#Bribery UAE

Explore tagged Tumblr posts

Text

🔅ISRAEL REALTIME - Connecting the World to Israel in Realtime

🔻HEZBOLLAH SUICIDE DRONES x2 rounds at Sdeh Meron, Hurfeish, Zivon and surrounds, then Beit Jann, Har Chalutz, Harashim.

🔻HEZBOLLAH ANTI-TANK MISSILE fired at the Ramim Ridge IDF post.

▪️YET MORE HOSTAGE / CEASEFIRE LEAKS.. Senior Hamas official: "Biden's statements about the cessation of fighting in Gaza are premature and do not correspond to the situation on the ground. There are still big gaps that need to be addressed before a ceasefire."

Qatar - Spokesman of the Ministry of Foreign Affairs: "There is no agreement between Hamas and Israel on any of the main issues related to the ceasefire in the Gaza Strip. We are optimistic in light of the continuation of the dialogue between the parties, but there is no special development that can be announced.”

Reuters from a source in Hamas: “Biden's statements about the cessation of fighting in Gaza are too early. There are big gaps that need to be bridged before a ceasefire.”

▪️ELECTION NEWS.. So far: the lowest voter turnout in local elections in Israel, at 26% as of 15:00 vs. 33% in 2018.

Election bribery case in Beit Shemesh, 6 arrested for offering payment (NIS 100-500) for either the identity card with which to vote for them, or for them to vote for a particular candidate and party. Instructions for distraction and ballot stuffing were also found.

Election fight in Moshav Zrahia (near Kiryat Malachi), as two campaign managers of rival council candidates ran into each other at a polling station. Both arrested plus one more.

Election stabbing in Kabul (northern Arab Israeli town), ‘violent incident with stabbing’ a the polling station.

Election fight in Aror (north Negev Israeli Bedouin town), fight and gunshot near polling station between two sides of an extended family.

As of 15:30 p.m.: The police have dealt with a number of election incidents as a result of which 8 were arrested and 35 cases were opened for crimes of electoral integrity, threats and violence.

▪️LEBANON.. attack waves by the IDF Air Force throughout the day.

▪️GAZA.. The IDF says it struck a Hamas command center and a launcher used to carry out a rocket fire from the Gaza Strip on southern Israel yesterday morning, within several hours of the attack.

▪️NEW HEZBOLLAH WEAPON? A commander in Hezbollah's "Armored Corps" told (Arab news) Al-Mayadeen: The new” thermobaric" missile is capable of destroying houses and killing everyone inside.

▪️AID.. Egypt with the UAE and Jordan, in cooperation with Israel, air dropped aid on Rafah today after yesterday’s air-drop miss by Jordan (landed in the sea). Overnight 40 aid trucks entered through the Rafah crossing to be delivered to the residents of the northern Gaza Strip, if they were not looted by Hamas or Rafah refugees en route.

▪️THOUSANDS GATHERED IN NEW YORK’S TIME SQUARE FOR THE HOSTAGES.. https://youtube.com/shorts/4_irVQ-hiDo?si=p-Da0HI5yfXnliu5

16 notes

·

View notes

Text

What is the punishment for bribery and corruption in Dubai?

Bribery and corruption are serious offenses in Dubai and are subject to strict penalties under the UAE’s legal system. The country has implemented a robust framework to combat these crimes, ensuring that individuals who engage in such illegal activities face significant consequences. This is crucial for maintaining public trust and fostering a transparent business environment. Under the UAE…

0 notes

Text

The Role of Forensic Auditing Services in Fraud Prevention

Introduction

In today’s complex business environment, fraud prevention has become a critical concern for organizations across the globe. With the rising cases of financial misconduct, the role of forensic auditing services has gained significant importance. These specialized services help identify and investigate fraud and play a crucial role in preventing it. In the UAE, particularly in cities like Dubai, the demand for forensic auditors and forensic audit services has sharply increased, reflecting the need for robust financial oversight.

What is Forensic Auditing?

Forensic auditing is a specialized field that involves the examination of an organization’s financial records to detect and investigate any fraudulent activities. Unlike traditional auditing, which primarily focuses on ensuring that financial statements are accurate and comply with accounting standards, forensic auditing delves deeper into the financial data to uncover any irregularities that may indicate fraud.

Forensic auditors are trained to identify suspicious transactions, analyze financial patterns, and provide detailed reports that can be used in legal proceedings. This makes forensic auditing a powerful tool in the fight against financial crime.

The Role of Forensic Auditors in Fraud Prevention

Forensic auditors play a pivotal role in fraud prevention by adopting both proactive and reactive approaches. Proactively, they help organizations identify vulnerabilities in their financial systems and implement controls to mitigate risks. Reactively, they conduct thorough investigations when fraud is suspected, providing critical evidence that can lead to legal action against the perpetrators.

By continuously monitoring compliance with regulations and internal policies, forensic auditors ensure that any potential issues are identified and addressed before they escalate into full-blown fraud cases.

Common Types of Fraud in Organizations

Fraud can take many forms, and forensic auditors must be well-versed in identifying the most common types. These include:

Financial Statement Fraud: Manipulating financial statements to present a misleading picture of the company’s financial health.

Asset Misappropriation: Theft or misuse of an organization’s assets, such as cash, inventory, or intellectual property.

Corruption and Bribery: Engaging in unethical practices, such as offering or accepting bribes, to influence business decisions.

Understanding these different types of fraud is essential for forensic auditors to develop effective strategies for prevention and detection.

How Forensic Audit Firms in UAE Operate

The regulatory environment in the UAE is stringent, with a strong emphasis on transparency and accountability. Forensic audit firms in UAE operate within this framework, offering specialized services tailored to the unique needs of businesses in the region.

These firms work closely with organizations to integrate forensic auditing into their corporate governance structures, ensuring that financial oversight is robust and effective. By leveraging their expertise, forensic audit firms in UAE help businesses navigate the complexities of local regulations while safeguarding against fraud.

Importance of Forensic Auditors in Dubai

Dubai’s rapid economic growth has made it a hub for international business, but it has also increased the risk of financial crime. The demand for forensic auditors in Dubai has risen as companies seek to protect their assets and reputation in a competitive market.

Forensic auditors in Dubai face unique challenges, such as dealing with cross-border transactions and diverse regulatory environments. However, these challenges also present opportunities for auditors to develop innovative solutions that enhance fraud prevention.

Tools and Techniques Used in Forensic Auditing

Forensic auditors rely on a variety of tools and techniques to detect and investigate fraud. Some of the most commonly used methods include:

Data Analysis and Digital Forensics: Analyzing large volumes of financial data to identify anomalies and patterns indicative of fraud.

Interviewing and Interrogation Techniques: Conducting interviews with key personnel to gather information and uncover inconsistencies in their statements.

Document Examination and Review: Scrutinizing financial documents for signs of tampering or misrepresentation.

These tools and techniques enable forensic auditors to conduct thorough investigations and provide actionable insights to their clients.

Collaboration with Legal Professionals

Forensic auditors often collaborate with legal professionals to ensure that their findings can be effectively used in court. This collaboration involves preparing detailed reports, presenting evidence, and providing expert testimony during legal proceedings.

By working closely with lawyers, forensic auditors help build strong cases against fraudsters, increasing the likelihood of successful prosecution.

Forensic Audit Services in UAE: A Growing Industry

The demand for forensic audit services in UAE has been on the rise, driven by the need for greater financial transparency and accountability. Key players in the industry are continually expanding their service offerings to meet the evolving needs of businesses in the region.

As the market for forensic audit services grows, so do the opportunities for firms to innovate and enhance their capabilities. This trend is expected to continue, with forensic auditing becoming an integral part of corporate governance in the UAE.

How Forensic Auditing Supports Corporate Governance

Forensic auditing plays a crucial role in supporting corporate governance by enhancing transparency and accountability within organizations. Forensic auditors help companies build stronger internal controls by identifying and addressing potential risks and improving their overall risk management strategies.

This, in turn, boosts investor confidence, as stakeholders are assured that the company is committed to maintaining the highest standards of financial integrity.

Choosing the Right Forensic Audit Firm

Selecting the right forensic audit firm in UAE is a critical decision for any organization. Key criteria to consider include the firm’s experience, expertise, and reputation in the industry. It’s also important to evaluate their approach to confidentiality and ethics, as these are essential elements of a successful forensic audit.

By choosing the right partner, businesses can ensure that their forensic auditing needs are met with the highest level of professionalism and effectiveness.

The Benefits of Regular Forensic Audits

Conducting regular forensic audits offers several long-term benefits, including enhanced fraud prevention, improved financial oversight, and increased confidence among stakeholders. While the cost of forensic auditing may be a concern for some companies, the benefits far outweigh the expenses, particularly when considering the potential financial and reputational damage caused by fraud.

Case studies have shown that organizations that invest in regular forensic audits are better equipped to prevent and detect fraud, leading to more sustainable business operations.

Challenges Faced by Forensic Auditors

Forensic auditors face several challenges in their work, including the complexities of detecting sophisticated fraud schemes and navigating the legal and regulatory landscape. Additionally, managing client expectations can be difficult, as clients often expect quick results, even in cases that require extensive investigation.

Despite these challenges, forensic auditors remain dedicated to their mission of protecting businesses from financial crime, continually adapting their strategies to stay ahead of emerging threats.

Conclusion

The role of forensic auditing services in fraud prevention cannot be overstated. By providing specialized expertise in detecting and investigating fraud, forensic auditors play a vital role in safeguarding the financial integrity of organizations. As the demand for these services continues to grow in the UAE, particularly in Dubai, businesses must recognize the value of forensic auditing in protecting their assets and reputation.

Investing in forensic auditing is not just a cost, but a crucial step towards building a robust and resilient business that can withstand the challenges of today’s complex financial landscape.

FAQs

1. What is the difference between forensic auditing and internal auditing? Forensic auditing focuses on detecting and investigating fraud, while internal auditing is concerned with ensuring that a company’s financial statements are accurate and comply with accounting standards.

2. How do forensic auditors detect fraud? Forensic auditors use a combination of data analysis, digital forensics, and investigative techniques to identify suspicious transactions and uncover evidence of fraud.

3. Why is forensic auditing important in the UAE? Forensic auditing is essential in the UAE due to the stringent regulatory environment and the need for businesses to maintain transparency and accountability in their financial operations.

4. How often should a company conduct a forensic audit? The frequency of forensic audits depends on the size and complexity of the organization, but many experts recommend conducting them annually or whenever there is a suspicion of fraud.

5. What qualifications should a forensic auditor have? Forensic auditors typically have a background in accounting or finance, along with specialized training in forensic auditing techniques and certification from recognized professional bodies.

#audit firms in dubai#auditing companies in dubai#accounting services#Auditing firm in UAE#Auditing services in UAE#Auditors in Dubai#Forensic Audit firm in UAE

0 notes

Text

#iso certification in UAE#ISO Standard in UAE#ISO Certification in United arab emirates#iso 37001 certification in UAE#siscertifications#iso certification#sis certifications

0 notes

Text

ISO 37001 Certification in UAE necessities:

ISO 37001 Certification in UAE necessities:

ISO 37001 Certification in UAE importance of adhering to worldwide necessities can not be overstated in the current worldwide enterprise corporation business enterprise business environment. Among those, the ISO 37001 Consultants in UAE is a pivotal diploma in stopping bribery and fostering a lifestyle of transparency and integrity. For businesses within the UAE, carrying out ISO 37001 Certification in UAE now complements credibility and aligns with the dominion’s power of thought to preserve moral corporation practices. This blog delves into the intricacies of ISO 37001 Consultants in UAE, its blessings, and the steps to advantage of it in the UAE.

What is ISO 37001?

ISO 37001:2016 is a worldwide fashion designed to help groups be positioned to impact and keep an effective anti-bribery management tool (ABMS). It offers a framework for stopping, detecting, and responding to bribery, whether or not, and consists of public, private, or non-income sectors. The desired covers several styles of corruption, which embody direct and oblique, whether or not the act is completed through the monetary enterprise corporation itself, its employees, or its organization buddies.

Why ISO 37001 Certification Bodies in UAE?

The UAE is a hub for global change and business enterprise corporations, attracting groups from spherical locations. With this influx, the danger of bribery and corruption can increase, posing significant threats to the moral landscape of the business company, business employer enterprise, employer, and business enterprise surroundings. Here’s why ISO 37001 Certification Bodiesis in UAE essential:

Enhancing Corporate Reputation: Certification signs and signs and symptoms and signs and symptoms to stakeholders, together with customers, clients, and companions, that the organization commercial business enterprise company is devoted to moral practices and has sturdy measures to combat bribery.

Legal Compliance: It lets businesses look at country-wide and global anti-bribery criminal recommendations, decreasing the risk of criminal effects and reputational damage.

Risk Management: Implementing an ABMS lets in recognize and mitigate bribery dangers, thereby deterring the economic organization from capability financial losses and operational disruptions.

Competitive Advantage: Certified groups are frequently preferred partners for groups and governments prioritizing moral requirements and corporation governance.

Cultural Transformation: It fosters integrity and transparency within the commercial enterprise organization, commercial enterprise employer, and business enterprise employer, encouraging employees to stick to ethical practices.

Stages to Achieve ISO 37001 Consultants in UAE:

Understanding the Requirements: Familiarize yourself with the ISO 37001 Certification Bodiesis in UAE. This consists of an extensive evaluation of the documentation and know-how of the scope of the certification.

Gap Analysis: Conduct a gap assessment to discover current-day strategies and controls in the desire to the ones required with the valuable aid of ISO 37001 Consultants in UAE. This will spotlight areas searching for improvement.

Developing an ABMS: Design and locate into impact an anti-bribery manipulation device tailor-made to your commercial enterprise enterprise enterprise organization’s specific goals. This needs to embody pointers, strategies, and controls to save you, come upon, and respond to bribery.

Movement and Attention: Educate workers and stakeholders about the ABMS, stressing the importance of compliance and their roles in preventing bribery.

Interior Audit: Perform an interior audit to ensure the ABMS is completed and functioning. Address any diagnosed deficiencies.

Selecting a Certification Body: Choose an established certification frame for the outdoor audit. Ensure they have experience with ISO 37001 certification.

External Audit: The certification frame will conduct an intensive audit of your ABMS. This consists of reviewing documentation, conducting interviews, and assessing the implementation’s effectiveness.

Certification: Upon a successful very last touch of the audit, the certification body will hassle the ISO 37001 certificates. Regular surveillance audits can be finished to ensure ongoing compliance.

Challenges and Solutions in ISO 37001 Auditors in UAE:

While the direction to certification is easy, groups can also face traumatic conditions along with resistance to alternatives, proper resource allocation, and maintaining ongoing compliance. Here are a few answers:

Change Management: Engage, manage, and communicate the benefits of ISO 37001 Auditors in UAE to foster a way of life that embraces moral practices.

Resource Allocation: Invest in essential assets, including employees and generation, to guide the ABMS.

Continuous Improvement: Regularly evaluate and update the ABMS to cope with developing bribery dangers and changes inside the regulatory surroundings.

Conclusion:

Achieving ISO 37001 Auditors in UAE is a strategic circulate that underscores a power of mind to ethical commercial enterprise corporation practices. It now enhances an organization’s recognition and competitiveness and guarantees compliance with criminal requirements. By following a primarily based technique to enforcing and retaining an ABMS, agencies can efficaciously mitigate bribery risks and contribute to an apparent and clean business commercial enterprise organization’s surroundings inside the UAE. As the UAE continues to expand as a worldwide industrial company business enterprise agency organization hub, ISO 37001 Auditors in UAE will play an essential role in keeping its reputation for integrity and moral behavior.

Why Factocert for ISO 37001 Certification in UAE?

We provide the best ISO consultants Who are knowledgeable and provide the best solution. And to know how to get ISO certification. Kindly reach us at [email protected]. Work according to ISO standards and help organizations implement ISO certification in India with proper documentation.

For more information, visit ISO 37001 Certification in UAE.

Related links:

ISO 21001 Certification in UAE

ISO 27701 Certification in UAE

ISO 26000 Certification in UAE

ISO 20000-1 Certification in UAE

ISO 50001 Certification in UAE

Related Article:

How can I get ISO 14001 Certification For a Food Supply Business?

0 notes

Text

Steps to Hire ISO 37001 Consultants in Philippines

ISO 37001 Certification in Philippines. With an international focus on anti-bribery management systems (ABMS), companies around the globe, including those in Philippines, are looking for ways to combat unethical actions. Being a signatory of the United Nations Convention against Corruption, the Philippines aligns its laws to global standards. It includes the adoption of ISO 37001 Certification in Philippines, a framework that guides businesses in establishing a strong ABMS. Skilled consultants are required to help organizations achieve this certification, and the role they play is essential. They ensure compliance and promote business ethics and transparency, ISO 37001 Certification in Philippines.

Value of ISO 37001 Auditors in Philippines

ABMS relies on ISO 37001 Certification in Philippines to monitor its effectiveness. To ensure compliance, independent auditors assess the systems. Qualiified auditors in Philippines provide several benefits:

1. Compliance: Auditors thoroughly assess ABMS, helping businesses correct non-compliant practices.

2. Risk Reduction: Continuous audits identify bribery and corruption risks to protect the reputation and finances of a company, ISO 37001 Auditors in Philippines.

3. Constant Improvements: Auditors recommend enhancements, ensuring the management system remains efficient and effective, ISO 37001 Certification in Philippines.

4. Third-Party Assessment: Accredited third-party audits confirm dedication to ethical practices, promoting trust, ISO 37001 Auditors in Philippines.

ISO 37001 Certification Providers in Manila

Manila houses various validation bodies that offer ISO 37001 services. These include:

1. Bureau Veritas: Well-known for testing, inspection, and certification services. It also offers ISO 37001 Consultants in Philippines services across diverse industries.

2. Intertek: Specialists in ABMS, Intertek helps businesses in Manila get ISO 37001 certification.

3. TÜV Rheinland: Esteemed for its management system certification and ISO 37001 Certification in Philippines services.

4. SGS: SGS, a recognized inspection and certification agency, assists businesses in adopting effective ABMS.

Benefits of ISO 37001 Certification in Philippines

A certified ISO 37001 ABMS offers several advantages for Filipino companies:

1. Regulation Compliance: With the Philippines setting strict anti-corruption laws, ISO 37001 certification showcases dedication to legal adherence.

2. Gaining Trust: ISO 37001 certification enhances a company’s reputation and builds stakeholder trust.

3. Competitive advantage: An ISO 37001-certified ABMS gives an edge over competitors.

4. Gateway to Global Markets: ISO 37001 Certification can lead to global business opportunities and collaborations.

5. Better Corporate Management: ISO 37001 fosters transparency and ethical practices, leading to better business performance.

Why Choose Factocert for ISO 37001 Consulting in Philippines

Factocert distinguishes itself among various ISO 37001 consultants in Philippines. Why? 1. Expertise: Factocert has a well-rounded team that understands ISO 37001 well.

2. Wide-Ranging Services: Services like gap analysis, certification assistance, internal auditing, and more are offered.

3. Industry-Specific Solutions: Understanding the unique challenges of each industry, Factocert presents tailored solutions.

4. Client-Focused Approach: Factocert prioritizes client needs and offers customized solutions.

5. Track Record: Factocert’s success in guiding Filipino organizations to ISO 37001 certification speaks for itself, ISO 14001 Certification in UAE..

Why Should Philippine Companies have ISO 37001 Certification?

Getting ISO 37001 certification has many benefits:

1. Lower Bribery Risk: An effective ABMS significantly reduces corruption and bribery risks. 2. Increased Stakeholder Belief: ISO 37001 certification boosts stakeholder trust through ethical business practices.

3. Better Internal Systems: ISO 37001 certification promotes stronger internal controls and processes.

4. An Edge Over Competitors: ISO 37001-certified ABMS lends a competitive edge to businesses.

5. Global Opportunities: ISO 37001 certification opens up international markets and opportunities.

6. Improved Governance: ISO 37001 certification promotes ethical decision-making and transparency.

7. Legal Adherence: ISO 37001 certification showcases commitment to legal adherence and prevents reputational damage.

8. Employee Confidence: A culture of ethical behavior increases employee morale and productivity, ISO 9001 Certification in South Africa..

9. Risk Management: ISO 37001-ABMS helps identify potential hazards, enhancing risk management.

10. Showing Corporate Responsibility: ISO 37001 certification proves a company’s commitment to ethical business and contributes to a virtuous business environment in Philippines. ISO 37001 certification is highly recommended for any organization in the Philippines, and consultants like Factocert play a key role in achieving it, ISO 14001 Certification in Bangalore..

Why Factocert for ISO Certification in Philippines

We provide the best ISO consultants in Philippines, Who are very knowledgeable and provide the best solution. And to know how to get ISO certification in the . Kindly reach us at [email protected]. ISO Certification consultants work according to ISO standards and help organizations implement ISO certification in with proper documentation.

For more information visit: ISO 37001 Certification in Philippines.

Related Article: How to get ISO Consultants in Philippines

0 notes

Text

How to Get ISO Certification in UAE?

In UAE, ISO standards are widely used across various industry sectors like healthcare, manufacturing, energy, IT organizations, and more. The benefits of implementing ISO certifications will help you in terms of employee productivity, cost reductions, technology adoption, and more. The various ISO standards in an organization effectively optimize your business operation and improve the international quality standards in frequent business operations.

What is ISO certification in Dubai, UAE?

ISO certification is the quality process that ensures your organization strictly adheres to the ISO standard guidelines. This certification helps companies to standardize their business operations and deliver quality services or products. Moreover, it streamlines the business process and reduces operational costs. Above all, the ISO certification achieves business profitability by standardizing key operations. The International organization for Standardization or ISO was established earlier in the year 1947 in Switzerland. The organization governs the certification standards and standardizes the quality of services or products. The ISO issues specific guidelines and manuals across various industry sectors.

How to apply for ISO certification in UAE?

ISO certification is preferred by most of the companies in UAE. Companies consider ISO certification to maintain their product or service quality consistently. Moreover, it’s globally accepted and improves customer satisfaction.

To get your ISO certification, you have to go through various stages. However, ISO consultants like Flybiz can help you go through the certification process effortlessly.

The certification process starts with,

STEP 1 – Gap analysis

Initially, understand the scenario of ISO standards by analyzing each clause. Then analyze the system whether it has any defects or shortcomings. In this stage, you can get help from our ISO consultants in UAE.

STEP 2 – Implementation

In this stage, you have to prepare the records, documents, and policies. With the help of auditors, perform internal auditing and management review to understand practical realities and gaps. If you find any improper records, then correct it to confirm error-free implementation.

STEP 3 – Certification

Fill up the application form provided by the certification body. As a next step, invite auditors from the ISO certification body for audit and certification. Finally, your management system is ISO certified.

What are the popular ISO certifications in UAE?

· ISO 14001 certification

ISO 14001 denotes a healthy environment. To get this certification, you have to implement an environmental management system that allows positive I interaction of your business activities with the environment.

· ISO 9001 certification

To get this ISO 9001 certification, you have to implement international practices and establish a quality management system in the organization. This ISO certification ensures the high quality of your products and services.

· ISO 45001 certification

To get ISO 45001 certification, you need a safe workplace. This certification implements effective occupational health and safety management in the organization ensuring the well-being of your workers.

· ISO 22000 certification

This certification is extremely important for businesses in the food sector because it certifies the quality and safety of prepared food. Any organization in the food supply chain should hold this certification in Dubai. Moreover, it can be used by manufacturers, producers, distributors, storage facilities, retailers, or even restaurant owners to ensure food safety.

· ISO 37001 certification

This certification denotes the Anti-bribery management system published by ISO to curb the illegal practices of bribery. The ISO standard formulates a monitoring system to address bribery and fight against it. Bribery can be destructive both internally as well as externally. Therefore, with ISO 37001 certification Dubai can mitigate bribe-related risks.

· ISO 22301 certification

This certification denotes the social security of BCMS or business continuity management system. ISO 22301 allows the smooth and efficient running of your business operations. Any immediate risk, natural calamity, or any other factors may interrupt the continuity of your business. Having this certification, will help you anticipate the risk and cover all aspects of business continuity.

· ISO 21001 certification

This certification facilitates the educational sector. With ISO 21001, the educational organization management system will effectively satisfy the need of learners and ensure conformity.

· ISO 17025 certification

This certification allows global recognition standards for testing and calibration laboratories. ISO 17025 is the most important certification required for all types of laboratories, research centers, and universities. The certification claims the technical competency and technical requirements that enable a calibration or testing laboratory. ISO 17025 certification will help to showcase that your procedures are regulated by standard protocols and enhance the prominence of your organization.

· ISO 27001 certification

In today’s digital world, securing your data has become more important. Any data breach or loss can create a huge impact on your privacy and security. With ISO 27001certification, the organizations can implement the best security management system and prevent data misuse.

How do ISO certifications help your business in Dubai?

· Increase your business productivity

· Improve your business performance

· Improve the effect of core processes

· Valid ISO certifications improve the quality of your services and products

· Analyze the risk and take necessary actions

· Find new business opportunities

· Reduce the errors and risk

· More satisfied customers

Why should you choose Flybiz for ISO certification in Dubai, UAE?

Flybiz provides ISO certification in UAE for all major standards and industry sectors. Being an expert ISO consultant in UAE, we are specialized in providing specific ISO standards. Flybiz is a certified team maintaining high-quality standards in our operations, client relationships, and project delivery. We act as a single-window solution for ISO certification in Dubai.

The reasons to choose us

· We work to certify all types of organizations regardless of their size, type, and processes.

· When you choose us, you get the certifications directly without the help of a middleman.

· While taking up a project, we focus on every client with utmost importance.

· We utilize the right resources to certify the organizations.

· We treat our clients equally.

Our ISO consultants will transform your business into globally recognized brand providing high-quality services or products. We ensure reasonable certification solutions and grow your business value world-wide.

Connect with our expert team to know more about ISO certification in UAE.

1. What is ISO Certification?

Answer: ISO Certification is a seal of approval from an external body that a company complies with one of the internationally recognized ISO management systems. ISO stands for the International Organization for Standardization, which develops and publishes standards for a wide range of industries to ensure the quality, safety, efficiency, and interoperability of products and services. Common certifications include ISO 9001 for quality management, ISO 14001 for environmental management, and ISO 27001 for information security management.

2. Why is ISO Certification important?

Answer: ISO Certification is important because it:

Enhances credibility and reputation: Demonstrates a company’s commitment to quality, safety, and efficiency.

Improves customer satisfaction: Ensures products and services meet customer expectations.

Facilitates market access: Many markets require ISO Certification as a precondition for entry.

Increases efficiency and cost savings: Streamlines processes and reduces waste.

Provides a competitive advantage: Differentiates a company from competitors who may not be certified.

3. How can my organization become ISO Certified?

Answer: To become ISO Certified, your organization should:

Select the appropriate ISO standard: Choose the standard relevant to your industry and needs.

Develop and implement a management system: Align your processes with the requirements of the chosen ISO standard.

Conduct internal audits: Regularly review your processes to ensure compliance.

Choose a certification body: Select an accredited certification body to conduct an external audit.

Undergo an external audit: The certification body will audit your processes and systems.

Receive certification: If the audit is successful, you will receive your ISO Certification.

4. How long does it take to obtain ISO Certification?

Answer: The time required to obtain ISO Certification varies depending on the size and complexity of the organization, the specific ISO standard, and the current state of the organization’s processes and systems. Generally, it can take anywhere from 6 months to 2 years. The process includes planning, implementing the necessary changes, conducting internal audits, and undergoing the external certification audit.

5. What are the costs associated with ISO Certification?

Answer: The costs of ISO Certification can vary widely based on several factors including the size of the organization, the complexity of its processes, the specific ISO standard, and the certification body chosen. Costs typically include:

Initial assessment and gap analysis: Identifying areas needing improvement.

Implementation costs: Resources and time spent aligning processes with ISO standards.

Internal audit costs: Conducting internal reviews.

Certification body fees: Costs for the external audit and certification.

Ongoing costs: Maintaining the certification through continuous improvement and periodic re-audits.

0 notes

Text

HOW UAE ISO 37001 Certification Protects ACMS?

ISO 37001 Certification in UAE to keep ACMS and battle dishonesty is the most integral factor that can be completed to preserve morale and inspire honest competition. Corruption no longer solely makes humans much less possible to consider in institutions, however it additionally hurts social and financial growth. Anti-corruption administration structures (ACMS) are being used by means of greater and greater agencies globally to limit dangers and guard their reputation. There are many models, however ISO 37001 stands out as a considerable fashion that offers clear guidelines on how to put anti-bribery measures into motion that work. Transparency and duty are crucial for long-term increase in the United Arab Emirates (UAE), and ISO 37001 Certification is fundamental to preserving humans from being corrupt.

Understanding ISO 37001 Certification:

The International Organization for Standardization (ISO) created ISO 37001 as a world fashionable way to assist corporations combat bribery and promote sincere enterprise practices. It lets businesses set up anti-bribery administration equipment that are proper for their size, type, and degree of complexity. The popular lays out rules, policies, procedures, and controls agencies can use to efficiently stop, identify, and deal with bribery and corruption risks.

Why ISO 37001 Certification Is Important in UAE:

As a centre for global change and investment, UAE is aware of how necessary it is to preserve the commercial enterprise world trustworthy and corruption-free. Corruption makes it more difficult for the U.S. to get overseas funding, stops new thoughts from happening, and slows monetary growth. Because of this, corporations in UAE choose to get ISO 37001 Certification to exhibit they are committed to actually doing commercial enterprise and enhancing their photography in UAE and round the world.

Maintaining ACMS with ISO 37001 Certification in UAE:

UAE's ACMS can be stored secure in a number of approaches with ISO 37001 Certification:

Risk Assessment and Mitigation: ISO 37001 Certification in UAE stresses the significance of thorough hazard assessments to locate bribery and corruption dangers special to the organisation's operations and business. By discovering feasible vulnerable spots, corporations can put into effect centred controls and mitigation techniques that will efficiently give up bribery and corruption.

Strong Policies and Procedures: The fashionable says that corporations need to set up clear insurance policies and methods in opposition to fraud that align with legal guidelines and rules. These policies provide an explanation for what type of behaviour is k and no longer okay, who is accountable for what and how to record and seem to be into viable bribery or corruption. Companies in UAE can construct a subculture of honesty and compliance at some stage in their operations via inserting in location sturdy insurance policies and processes.

Due Diligence Processes: ISO 37001 Certification in UAE stresses how vital it is to do historical past exams on enterprise partners, sellers, and different 1/3 events to see how trustworthy they are and discover any viable bribery or corruption risks. Companies can decrease their probabilities of involvement in unlawful things to do besides realising it through cautiously screening and monitoring the humans they do commercial enterprise with. This is specially essential in UAE, the place groups frequently work collectively with other corporations from different nations in an extensive variety of fields.

Training and Awareness: ISO 37001 stresses how vital it is to provide personnel at all degrees of an organisation education and consciousness programs. These applications train people about the dangers of bribery and corruption, the company's anti-bribery insurance policies and processes, and how they can assist quit and discover bribery. By encouraging a way of life of expertise and responsibility, organisations can supply their people the equipment to spot and document questionable behaviour.

Continuous Improvement: ISO 37001 Certification encourages a attitude of regular enhancement by way of making organisations check, evaluate, and enhance their anti-bribery administration structures regularly. Through administration reviews, inside checks, and comments systems, agencies can discover locations to enhance their ACMS and make it greater and stronger over time. This looping manner ensures the organisation stays on the pinnacle of altering bribery and corruption risks.

Why Choose factocert for ISO 37001 Certification in UAE?

Are you searching for ISO 37001 Certification in UAE? Factocert is a giant ISO 37001 Certification Bodies in UAE, imparting ISO 37001 Consultants in UAE and with places of work in Dubai, Abu Dhabi, Sharjah, Ajman, Al Ain Umm al-Qaiwain, Fujairah, and different necessary cities.We supply a range of ISO Standards at discounted prices, such as ISO 27001, ISO 37001, ISO 45001, ISO 13485, Halal, ISO 17025, ISO 14001, ISO 22000, and others. For in addition information, please go to www.factocert.com or contact us at [email protected]

Conclusion:

ISO 37001 Certification in UAE is extensive for defending anti-corruption administration structures due to the fact it offers corporations an entire sketch for combat bribery and corruption. By following the standard's standards and standards, groups can decrease risks, open their operations, and maintain their integrity. As the UAE continues to push for openness and duty in business, ISO 37001 Certification is a precious device for agencies that prefer to exhibit they care about doing enterprise and decreasing corruption risks.For More records go to : ISO 37001 Certification in UAE

Related Links :

CE Mark Certification in UAE ISO 21001 Certification in UAE ISO 22301 Certification in UAE ISO 27701 Certification in UAE ISO 26000 Certification in UAE ISO 20000-1 Certification in UAE ISO 50001 Certification in UAE

0 notes

Text

How to get ISO 37001 Certification In UAE

ISO 37001 Certification In UAE:

ISO 37001 Certification In UAE stands as a testament to a company's dedication to combatting bribery and selling moral enterprise practices. In the United Arab Emirates (UAE), where transparency and integrity are pivotal, acquiring ISO 37001 certification In UAE is a strategic move for businesses aiming to foster a corruption-loose environment. The certification technique involves attracting ISO 37001 specialists and auditors, expertise fees, meeting stringent requirements, and following particular methods.

ISO 37001 Consultants In UAE:

ISO 37001 Consultants In UAE experts within the UAE are professionals well-versed in anti-bribery management systems. These experts offer professional steerage to businesses searching for ISO 37001 certification, aiding them in setting up and imposing effective anti-bribery measures. Their position encompasses assessing current approaches, identifying vulnerabilities to bribery, and recommending techniques to mitigate dangers. These specialists collaborate intently with companies, imparting tailored solutions aligned with the UAE's felony framework and worldwide standards. Their knowledge covers diverse components, inclusive of danger tests, coverage improvement, training applications, and ongoing help to ensure non-stop compliance with ISO 37001 necessities.

ISO 37001 Auditors In UAE:

ISO 37001 Auditors in UAE are liable for evaluating a company's anti-bribery control gadget impartially. These auditors possess substantial expertise in anti-bribery pleasant practices, neighborhood regulations, and worldwide requirements. They conduct thorough assessments and audits to ascertain compliance with ISO 37001 necessities. Auditors observe a dependent method, inspecting regulations, techniques, controls, and documentation related to anti-bribery efforts in the agency. Their objective critiques assist businesses in picking out weaknesses, rectifying non-conformities, and reinforcing their anti-bribery control structures. Choosing ready and certified ISO 37001 Auditors I UAE is crucial for a a success certification system.

Cost of ISO 37001 Certification In UAE:

The cost of obtaining ISO 37001 certification in UAE varies based on several factors. The length of the organization, the complexity of operations, existing anti-bribery measures, and the extent of compliance readiness substantially affect the overall price. Engaging ISO 37001 consultants In UAE, conducting education packages, imposing vital modifications, and presenting process audits make contributions to the charges incurred at some stage in the certification technique. While the preliminary funding for ISO 37001 certification In UAE may also appear sizable, it signifies a dedication to moral commercial enterprise practices and allows the protection of the business enterprise against the dangers associated with bribery. The long-term blessings, consisting of stronger popularity, reduced criminal liabilities, and extended stakeholder acceptance as true, outweigh the preliminary prices.

Requirements for ISO 37001 Certification In UAE:

ISO 37001 certification calls for groups to set up, implement, keep, and continually improve an anti-bribery management device. Key requirements encompass: Leadership Commitment: Demonstrating commitment from top management to prevent bribery and foster a tradition of ethical conduct. Risk Assessment: Conduct thorough chance assessments to discover and mitigate bribery dangers throughout the company's operations. Policies and Procedures: Developing and implementing anti-bribery guidelines, strategies, and controls tailored to the agency's desires. Training and Awareness: Providing comprehensive schooling programs to employees, making sure they understand the anti-bribery policies and their roles in compliance.

Procedure for ISO 37001 Certification In UAE:

The method for acquiring ISO 37001 certification in the UAE includes several degrees: Gap Analysis: Conduct a detailed evaluation to pick out gaps between the present anti-bribery measures and ISO 37001 necessities. Implementation: Implementing necessary changes and improvements in rules, methods, and controls to deal with recognized gaps. Training and Communication: Conducting training programs and speaking anti-bribery guidelines and procedures throughout the corporation. Audit and Certification: Undergoing an audit conducted via permitted ISO 37001 auditors to evaluate compliance. Upon successful finishing touch, the corporation is presented with ISO 37001 certification.

Conclusion:

In conclusion, ISO 37001 certification inside the UAE signifies an organization's commitment to ethical practices and serves as a proactive step toward stopping bribery dangers. Engaging with experienced ISO 37001 specialists and auditors, information about the expenses, assembly stringent necessities, and following the structured method are critical factors for a hit certification adventure.

Why Factocert for ISO 37001 Certification in UAE

We provide the best ISO 37001 consultants in UAE, Who are very knowledgeable and provide the best solution. And to know how to get ISO 37001 certification in the . Kindly reach us at https://factocert.com/contact-us/. ISO 37001 Certification consultants work according to ISO 37001 standards and help organizations implement ISO 37001 certification in with proper documentation.

for more information visit: ISO 37001 Certification In UAE

RELATED LINKS:

ISO 37001 Certification In UAE

ISO 21001 Certification In UAE

ISO 27001 Certification In UAE

0 notes

Text

CBI to send judicial requests to U.K., UAE, S. Korea in bribery case against lobbyist Sanjay Bhandari http://dlvr.it/Srg7B1

0 notes

Text

Forensic Audit Services in Dubai UAE

Dubai, the thriving economic hub of the United Arab Emirates (UAE), has established itself as a global center for business and finance. In such a dynamic and competitive environment, maintaining financial integrity and combating fraud are critical for businesses operating in the region. This is where forensic audit services play a pivotal role. Forensic audits go beyond traditional financial audits, employing specialized techniques to uncover fraud, financial irregularities, and misconduct. We will delve into the realm of forensic audit services in Dubai, exploring their significance, the key procedures involved, and the invaluable benefits they provide to businesses, regulators, and investors alike. Join us as we unveil the world of forensic audit services in Dubai. Were transparency and accountability reign supreme.

What are Forensic Audit Services in Dubai:

Forensic audit services refer to specialized investigations conducted by professionals with expertise in accounting, auditing, and law. These services are primarily focused on examining financial records, transactions, and other relevant data to detect and uncover fraud, financial irregularities, and misconduct within an organization. Forensic audits go beyond the scope of regular financial audits by employing various forensic techniques, such as data analysis, interviews, and examination of supporting documents.

The objective of forensic audit services is to gather evidence, analyze it meticulously, and present findings that can be used in legal proceedings, internal investigations, or regulatory actions. These audits are typically carried out in response to suspicions or allegations of fraudulent activities, including embezzlement, money laundering, asset misappropriation, bribery, or financial statement fraud.

Forensic auditors in UAE employ a combination of accounting knowledge, investigative skills, and legal understanding to meticulously examine financial records, identify irregularities, trace financial flows, reconstruct transactions, and assess the impact of fraudulent activities. Their goal is to uncover the truth, provide an accurate account of the financial situation, and support decision-making processes related to legal actions, risk mitigation, and regulatory compliance.

Forensic audit services are essential in protecting the interests of stakeholders, ensuring financial transparency, and maintaining the integrity of business operations. By uncovering fraud and financial irregularities, these services contribute to preventing future misconduct, enhancing corporate governance, and safeguarding the reputation of organizations.

Key Objectives of Forensic Audit Services in Dubai:

The key objectives of forensic audit services in Dubai are as follows:

Uncovering Fraud and Financial Irregularities:

Forensic audits aim to detect and investigate fraudulent activities, including embezzlement, asset misappropriation, bribery, corruption, and financial statement fraud. By thoroughly examining financial records, transactions, and supporting documents, forensic auditors seek to identify irregularities and fraudulent patterns.

Identifying Misconduct and Non-Compliance:

Forensic audit services extend beyond fraud detection and delve into identifying instances of misconduct and non-compliance with laws, regulations, and internal policies. This includes uncovering instances of conflicts of interest, breaches of fiduciary duty, insider trading, money laundering, and other unethical practices.

Preserving Evidence for Legal Proceedings:

One of the primary objectives of forensic audits is to gather and preserve evidence that can be used in legal proceedings. Forensic auditors in Dubai adhere to strict protocols to ensure the integrity and admissibility of the collected evidence. The evidence uncovered during the forensic audit can be crucial in supporting legal actions, such as civil litigation or criminal prosecutions.

Enhancing Corporate Governance and Accountability:

Forensic audit services play a vital role in promoting good corporate governance practices and ensuring accountability within organizations. By conducting thorough investigations, forensic auditors help identify weaknesses in internal controls and governance structures, recommend improvements, and contribute to maintaining transparency and integrity in business operations.

Safeguarding Stakeholder Interests:

Forensic audits protect the interests of stakeholders, including shareholders, investors, employees, and creditors. By identifying and addressing financial irregularities, fraud, and misconduct, forensic audit services help mitigate risks and prevent further harm to stakeholders. This, in turn, enhances trust and confidence in the organization and its financial reporting.

The objectives of forensic audit services in Dubai are aligned with maintaining financial integrity, preventing fraud, and upholding the reputation of businesses in the region. These services contribute to the overall economic stability and growth by ensuring transparency, accountability, and adherence to legal and regulatory requirements.

Scope of Forensic Audit Services in Dubai:

The scope of forensic audit services in Dubai encompasses various aspects related to detecting and investigating financial irregularities, fraud, and misconduct. Here are key elements within the scope of forensic audit services in Dubai:

Fraud Detection and Investigation:

Forensic auditors in Dubai are equipped to uncover different types of fraud, including embezzlement, asset misappropriation, financial statement fraud, bribery, corruption, and money laundering. They employ specialized techniques to identify red flags, anomalies, and patterns that may indicate fraudulent activities within financial records and transactions.

Financial Irregularities and Misconduct:

Forensic audit services extend beyond fraud detection and cover a wide range of financial irregularities and misconduct. This includes investigating instances of non-compliance with laws, regulations, and internal policies, conflicts of interest, insider trading, fraudulent reporting, and other unethical practices.

Compliance and Regulatory Framework:

Forensic audits in Dubai are conducted within the legal and regulatory framework established by the UAE. Forensic auditors ensure compliance with local laws, regulations, and reporting requirements while conducting investigations. They are knowledgeable about the specific legal provisions relevant to forensic audits in Dubai.

Industry and Sector Expertise:

Forensic audit services cater to various industries and sectors in Dubai, including banking and finance, construction, real estate, healthcare, energy, and more. Forensic auditors possess industry-specific knowledge and expertise to effectively understand the unique risks and challenges within each sector.

Data Analysis and Examination:

Forensic auditors utilize advanced data analysis tools and techniques to examine large volumes of financial data, identify patterns, anomalies, and trends, and detect potentially fraudulent activities. They have expertise in handling financial data from various sources, including electronic records, documents, and digital transactions.

Digital Forensics:

With the increasing prevalence of digital transactions and the use of technology in financial processes, forensic audits in Dubai often involve digital forensics. Forensic auditors are skilled in investigating digital evidence, analyzing computer systems, recovering deleted or hidden data, and tracing digital transactions to uncover potential fraud or financial misconduct.

Reporting and Documentation:

Forensic audits generate comprehensive reports documenting the findings, analysis, and evidence collected during the investigation. These reports are prepared in a manner that is clear, concise, and suitable for legal and regulatory purposes. They serve as a critical resource for legal proceedings, internal investigations, and decision-making processes.

By encompassing these elements, forensic audit services in Dubai provide a comprehensive approach to uncovering financial irregularities, combating fraud, ensuring compliance, and maintaining financial integrity within organizations operating in the region.

Benefits of Forensic Audit Services in Dubai:

Forensic audit services in Dubai offer several key benefits to businesses operating in the region:

Fraud Detection and Prevention:

Forensic audits are designed to uncover fraudulent activities, such as embezzlement, financial misstatements, bribery, and corruption. By thoroughly examining financial records and transactions, forensic auditors can detect and prevent fraud, minimizing financial losses and protecting the organization's assets.

Enhanced Financial Integrity:

Engaging in forensic audits promotes financial integrity by ensuring accurate and reliable financial reporting. By examining the organization's financial systems, controls, and processes, forensic auditors can identify weaknesses and recommend improvements, thereby reducing the risk of financial irregularities and enhancing overall transparency.

Compliance with Regulatory Requirements:

Forensic audit services assist organizations in complying with the legal and regulatory framework in Dubai. Forensic auditors possess in-depth knowledge of local regulations and reporting requirements, ensuring that businesses operate within the prescribed guidelines and maintain compliance with applicable laws.

Risk Mitigation and Internal Control Enhancement:

Through forensic audits, organizations can identify vulnerabilities and weaknesses in their internal control systems. By addressing these shortcomings, businesses can strengthen their control environment, mitigate risks, and prevent future instances of fraud or misconduct.

Legal and Disciplinary Actions:

Forensic audits generate comprehensive reports and provide strong evidence that can be used in legal proceedings or disciplinary actions. These reports serve as valuable resources, supporting organizations in taking appropriate legal action against wrongdoers and aiding in the resolution of disputes, thereby protecting the organization's interests.

Protection of Stakeholder Interests:

Forensic audits safeguard the interests of stakeholders, including shareholders, investors, and employees. By uncovering fraud, financial irregularities, or misconduct, forensic auditors help protect stakeholders' investments, maintain shareholder confidence, and ensure the organization's overall financial well-being.

Reputation Management:

Engaging in forensic audits demonstrates a commitment to transparency, ethical practices, and maintaining a strong reputation. By proactively addressing potential financial misconduct, organizations can preserve their reputation, build trust among customers, investors, and the public, and differentiate themselves in the competitive business landscape.

Forensic audit services in Dubai offer a range of benefits, including fraud detection and prevention, enhanced financial integrity, compliance with regulations, risk mitigation, legal support, stakeholder protection, and reputation management. By availing of these services, organizations can bolster their financial security, promote transparency, and ensure the sustainability and growth of their businesses in Dubai.

Why Choose MASAR:

MASAR is a top choice for forensic audit services in UAE for several reasons. With their expert team of forensic auditors and extensive experience, they possess the necessary expertise to uncover financial irregularities and fraud effectively. They have a strong understanding of UAE laws and regulations, ensuring compliance throughout the audit process. MASAR utilizes advanced forensic techniques and tools, delivering comprehensive and actionable insights. Their client-centric approach, commitment to confidentiality, and reputation for integrity make them a trusted partner for organizations seeking reliable forensic audit services in the UAE.

Conclusions:

Forensic audit services play a crucial role in Dubai, UAE, in ensuring financial integrity, transparency, and accountability within organizations. By engaging in forensic audits, businesses can effectively detect and prevent fraud, identify misconduct, and enhance corporate governance practices. The scope of forensic audit services in Dubai covers various aspects, including fraud detection, compliance, industry expertise, data analysis, and digital forensics. Engaging a reputable firm like MASAR for forensic audit services in the UAE brings several benefits, such as expert knowledge, advanced techniques, compliance with local laws, confidentiality, and a client-centric approach. Overall, forensic audit services contribute to maintaining a trustworthy business environment, protecting stakeholder interests, and fostering sustainable growth in Dubai, UAE.

0 notes

Text

Can a lawyer help if I’m accused of bribery in Dubai?

If you’re accused of bribery in Dubai, it’s crucial to seek legal representation. Criminal offenses like bribery are taken very seriously in the UAE, and a conviction can lead to severe penalties, including lengthy prison sentences and hefty fines. This is where experienced criminal lawyers in Dubai can play a critical role in protecting your rights and defending your case. Bribery is considered…

0 notes

Link

Subsequent to economic stagnation of 2008, UAE assumed proactive measures to indict individuals who violated Federal Penal Code’s anti-bribery legislation

2 notes

·

View notes

Text

Pluralist, your daily link-dose: 22 Feb 2020

Today’s links

Tax Justice Network publishes a new global Financial Secrecy Index: US and UK, neck-and-neck

What Marc Davis lifted from the Addams Family while designing the Haunted Mansion: Amateurs plagiarize, artists steal

ICANN should demand to see the secret financial docs in the .ORG selloff: at least it’s an Ethos

Wells Fargo will pay $3b for 2 million acts of fraud: they shoulda got the corporate death penalty

This day in history: 2019, 2015, 2010

Colophon: Recent publications, current writing projects, upcoming appearances, current reading

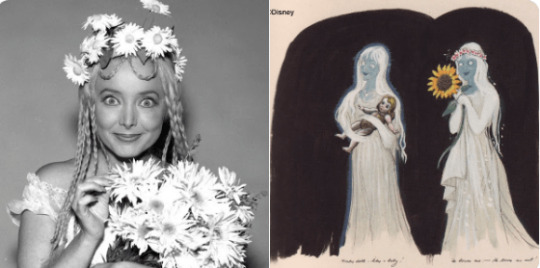

Tax Justice Network publishes a new global Financial Secrecy Index (permalink)

The Tax Justice Network just published its latest Financial Secrecy Index, the leading empirical index of global financial secrecy policies. The US continues to make a dismal showing, as does the UK (factoring in overseas territories).

https://fsi.taxjustice.net/en/

Both Holland and Switzerland backslid this year.

Important to remember that “bad governance” scandals in poor countries (like the multibillion-dollar Angolaleaks scandal) involve rich financial secrecy havens as laundries for looted national treasure.

https://www.theguardian.com/world/2020/jan/19/isabel-dos-santos-revealed-africa-richest-woman-2bn-empire-luanda-leaks-angola

As Tax Justice breaks it down: “The secrecy world creates a criminogenic hothouse for multiple evils including fraud, tax cheating, escape from financial regulations, embezzlement, insider dealing, bribery, money laundering, and plenty more. It provides multiple ways for insiders to extract wealth at the expense of societies, creating political impunity and undermining the healthy ‘no taxation without representation’ bargain that has underpinned the growth of accountable modern nation states. Many poorer countries, deprived of tax and haemorrhaging capital into secrecy jurisdictions, rely on foreign aid handouts.”

Talk about getting you coming and going! First we make bank helping your corrupt leaders rob you blind, then we loan you money so you can keep the lights on and get fat on the interest (and force you to sell off your looted, ailing state industries as “economic reforms”).

The Taxcast, which is the Network’s podcast, has a great special edition in which the index’s key researchers explain their work. It’s always a good day when a new Taxcast drops.

https://www.taxjustice.net/2020/02/20/financial-secrecy-index-who-are-the-worlds-worst-offenders-the-tax-justice-network-podcast-special-february-2020/

What Marc Davis lifted from the Addams Family while designing the Haunted Mansion (permalink)

It’s always a good day — a GREAT day — when the Long Forgotten Haunted Mansion blog does a new post, but today’s post, on the influence of the Addams Family TV show on Mansion co-designer Mark Davis? ::Chef’s Kiss::

https://longforgottenhauntedmansion.blogspot.com/2020/02/the-addams-family-and-marc-davis.html

It’s clear that Davis was using Addams’s comics as reference, but, as Long Forgotten shows, the Davis sketches and concepts are straight up lifted from the TV show: “Amateurs plagiarize, artists steal.”

Some of these lifts are indisputable.

“Finally, it’s possible that Davis took a further cue from the insanely long sweater Morticia is knitting in ‘Fester’s Punctured Romance’ (Oct 2, 1964), but in this case I wouldn’t insist upon it.”

Likewise, from the TV show, “Bruno” the white bear rug that periodically bites people was obviously the inspiration for this Davis sketch for the Mansion. Long Forgotten is less certain about “Ophelia,” but I think it’s pretty clear where Davis was getting his ideas from here.

Davis was an unabashed plunderer and we are all better for it! “We’ve seen many other examples of Marc Davis taking ideas from here, there, and anywhere he could find them, but not many other examples of multiple inspiration from a single source.”

ICANN should demand to see the secret financial docs in the .ORG selloff (permalink)

ISOC — the nonprofit set up to oversee the .ORG registry — decided to sell off this asset (which they were given for free, along with $5M to cover setup expenses) to a mysterious private equity fund called Ethos Capital.

Some of Ethos’s backers are known (Republican billionaire families like the Romneys and the Perots) but much of its financing remains in the shadows. We do know that ICANN employees who help tee up the sale now work for Ethos, in a corrupt bit of self-dealing.

The deal was quietly announced and looked like a lock, but then public interest groups rose up to demand an explanation. Not only could Ethos expose nonprofits to unlimited rate-hikes (thanks to ICANN’s changes to its rules), they could do much, much worse.

If a .ORG registrant dropped its domain, Ethos could sell access to misdirected emails and domain lookups – so if you watchdog private equity funds and get destroyed by vexation litigation, Ethos could sell your bouncing email to the billionaires who crushed you.

More simply, Ethos could sell the kind of censorship-as-a-service it currently sells through its other registry, Donuts, which charges “processing fees” to corrupt governments and bullying corporations who want to censor the web by claiming libel or copyright infringement.

Ethos offered ISOC $1.135b for the sale, but $360m of that will come from a loan that .ORG will have to pay back, a millstone around its neck, dragging it down. Debt-loading healthy business as a means of bleeding them dry is a tried-and-true PE tactic – it’s what did in Toys R Us, Sears, and many other firms. The PE barons get a fortune, everyone else gets screwed.

The interest on .ORG’s loan will suck up $24m/year — TWO THIRDS of the free money that .ORG generates. .ORG is a crazily profitable nonprofit – it charges dollars to provide a service that costs fractional pennies, after all. In response to getting slapped around by some Members of Congress, the Pennsylvania AG, and millions of netizens, Ethos has made a promise to limit prices increases…for a while. And they say that they’ll be kept honest by the nonbinding recommendations of an “advisory council” whose members Ethos will appoint and who will serve at Ethos’s pleasure.

In a letter to ICANN, EFF and Americans for Financial Reform have called for transparency on the financing behind the sale: “hidden costs, loan servicing fees, and inducements to insiders.”

https://www.eff.org/press/releases/eff-seeks-disclosure-secret-financing-details-behind-11-billion-org-sale-asks-ftc

Wells Fargo will pay $3b for 2 million acts of fraud (permalink)

Wells Fargo stole from at least two million of its customers, pressuring its low-level employees to open fake accounts in their names, firing employees who refused (refuseniks were also added to industry-wide blacklists created to track crooked bankers). These fake accounts ran up fees for bank customers, including penalties, etc. In some cases, the damage to the victims’ credit ratings was so severe that they were turned down for jobs, unable to get house loans or leases, etc.

The execs who oversaw these frauds had plenty of red flags, including their own board members asking why the fuck their spouses had been sent mysterious Wells Fargo credit cards they’d never signed up for. Though these execs paid fines, they got to keep MILLIONS from this fraud (which was only one of dozens of grifts Wells Fargo engaged in this century, including stealing from small businesses, homeowners, military personnel, car borrowers, etc). Some of them may never work in banking again, but they’re all millionaires for life.

Now, Wells Fargo has settled with the DoJ for $3b, admitting wrongdoing and submitting to several years of oversight. That’s a good start, but it’s a bad finish.

https://www.bbc.com/news/business-51594117

The largest bank in America was, for DECADES, a criminal enterprise, preying on Americans of every description. It should no longer exist. It should be broken into constituent pieces, under new management. There would be enormous collateral damage from this (just as the family of a murderer suffers when he is made to face the consequences of his crimes). But what about the collateral damage to everyone who is savaged by a similarly criminal bank in the future, emboldened by Wells Fargo’s impunity?

Wells Fargo is paying a fine, but will have NO criminal charges filed against it.

https://newsroom.wf.com/press-release/corporate-and-financial/wells-fargo-reaches-settlements-resolve-outstanding-doj-and

If you or I stole from TWO MILLION people, we would not be permitted to pay a fine and walk away.

“I’ll believe corporations are people when the government gives one the death penalty.”

This day in history (permalink)

#15yrsago: Kottke goes full-time https://kottke.org/05/02/kottke-micropatron

#15yrsago: New Zealand’s regulator publishes occupational safety guide for sex workers: https://web.archive.org/web/20050909001954/http://www.osh.dol.govt.nz/order/catalogue/pdf/sexindustry.pdf

#10yrsago: Principal who spied on child through webcam mistook a Mike n Ike candy for drugs: https://reason.com/2010/02/20/lower-pervian-school-district/

#10yrsago: School where principal spied on students through their webcams had mandatory laptop policies, treated jailbreaking as an expellable offense https://web.archive.org/web/20100726204521/https://strydehax.blogspot.com/2010/02/spy-at-harrington-high.html

#10yrsago: Parents file lawsuit against principal who spied on students through webcams: https://abcnews.go.com/GMA/Parenting/pennsylvania-school-webcam-students-spying/story?id=9905488

#1yrago: Cybermercenary firm with ties to the UAE want the capability to break Firefox encryption https://www.eff.org/deeplinks/2019/02/cyber-mercenary-groups-shouldnt-be-trusted-your-browser-or-anywhere-else

#1yrago: Fraudulent anti-Net Neutrality comments to the FCC traced back to elite DC lobbying firm https://gizmodo.com/how-an-investigation-of-fake-fcc-comments-snared-a-prom-1832788658

Colophon (permalink)

Today’s top sources: Naked Capitalism (https://nakedcapitalism.com/).

Hugo nominators! My story “Unauthorized Bread” is eligible in the Novella category and you can read it free on Ars Technica: https://arstechnica.com/gaming/2020/01/unauthorized-bread-a-near-future-tale-of-refugees-and-sinister-iot-appliances/

Upcoming appearances:

The Future of the Future: The Ethics and Implications of AI, UC Irvine, Feb 22: https://www.humanities.uci.edu/SOH/calendar/event_details.php?eid=8263

Canada Reads Kelowna: March 5, 6PM, Kelowna Library, 1380 Ellis Street, with CBC’s Sarah Penton https://www.eventbrite.ca/e/cbc-radio-presents-in-conversation-with-cory-doctorow-tickets-96154415445

Currently writing: I just finished a short story, “The Canadian Miracle,” for MIT Tech Review. It’s a story set in the world of my next novel, “The Lost Cause,” a post-GND novel about truth and reconciliation. I’m getting geared up to start work on the novel now, though the timing is going to depend on another pending commission (I’ve been solicited by an NGO) to write a short story set in the world’s prehistory.

Currently reading: I finished Andrea Bernstein’s “American Oligarchs” this week; it’s a magnificent history of the Kushner and Trump families, showing how they cheated, stole and lied their way into power. I’m getting really into Anna Weiner’s memoir about tech, “Uncanny Valley.” I just loaded Matt Stoller’s “Goliath” onto my underwater MP3 player and I’m listening to it as I swim laps.

Latest podcast: Persuasion, Adaptation, and the Arms Race for Your Attention: https://craphound.com/podcast/2020/02/10/persuasion-adaptation-and-the-arms-race-for-your-attention/

Upcoming books: “Poesy the Monster Slayer” (Jul 2020), a picture book about monsters, bedtime, gender, and kicking ass. Pre-order here: https://us.macmillan.com/books/9781626723627?utm_source=socialmedia&utm_medium=socialpost&utm_term=na-poesycorypreorder&utm_content=na-preorder-buynow&utm_campaign=9781626723627

(we’re having a launch for it in Burbank on July 11 at Dark Delicacies and you can get me AND Poesy to sign it and Dark Del will ship it to the monster kids in your life in time for the release date).

“Attack Surface”: The third Little Brother book, Oct 20, 2020.

“Little Brother/Homeland”: A reissue omnibus edition with a very special, s00per s33kr1t intro.

17 notes

·

View notes

Link

News Roundup 10/16/19

By Kyle Anzalone

Catalonia

Spain is seeking to extradite the former Catalan president from Belgium. The Spanish government made two previous requests that were rejected by Belgium. Spain is looking to extradite the president because he held an independence referendum for Catalonia. [Link]

Afghanistan

The UN reports 85 civilians were killed in last month’s election. [Link]

A truck bomb killed at least three people in Afghanistan. [Link]

Turkey Invades Syria

The US announces it has withdrawn from Manbij. [Link]

Italy bans weapons sales to Turkey. [Link]

Turkey’s leader Erdogan says he will never declare a ceasefire in northeastern Syria, and he is not concerned about US sanctions on Turkey. [Link]

A senior Pentagon official says that US soldiers assisted Russia in moving through dangerous areas outside of Manbij as the US soldiers were leaving the area. [Link] The Syrian Army took over several bases that were abandoned during the US withdraw. [Link]

Senator Graham said the US must remain in Syria so 200 Israeli troops can stay in Syria to combat Iran. [Link]

Middle East

Two US officials say the US carried out a cyberattack against Iran after Saudi oil facilities were attacked on September 14th. [Link]

Daniel Larison explains the Yemeni government policy of charging duties at the Port of Aden before ships can dock at the Port of Hodeidah has increased fuel prices by 100%. Larison says this will likely make the cholera outbreak worse. Over 600,000 Yemeni have contracted cholera in 2019. [Link]

Saudi forces have taken control over Aden after UAE forces withdrew. [Link]

Africa

Ten Kenyan police were killed when their vehicle struck a homemade bomb near the Somali border. Al-Shabaab is believed to be behind the attack. [Link]

Trash is piling up in the streets of Tripoli as the ongoing battle on the outskirts of the city is preventing trash removal. [Link]

Airstrikes by Haftar’s forces in Libya killed three young girls. [Link]

The US sanctions two South Sudanese businessmen. [Link]

Read More

41 notes

·

View notes

Text

The Philippines is where ISO 37001 Certification has grown greatly in importance.

ISO 37001 Certification in Philippines. It’s a good guideline for getting an Anti-Bribery Management System (ABMS). This global rule helps businesses stop, spot, and react to bribery. This shows they value of honest business methods that obey anti-bribery rules, ISO 37001 Auditors in Philippines.

ISO 37001 Auditors have a big role in getting the certification.

They make sure Philippine businesses stick to the standard’s needs, ISO 37001 Auditors in Philippines.

Here’s why these auditors matter:

1. Fairness and Independence: These auditors offer a free and fair judgement of a company’s ABMS to make sure it follows the standard.

2. Knowledge and Background: Auditors are {ABMS and ISO 37001 experts. This lets them give advice and insights, ISO 37001 Auditors in Philippines.

3. Guaranteed Compliance: The auditors assist Philippine firms to conform to anti-bribery laws and rules. This lowers the chance of breaking the law and fines later.

4. Ongoing Improvement: Auditors point out how to better the ABMS as you go. In Manila, the Philippine capital, there are different bodies that give the ISO 37001 certification in Philippines.

These include:

1. Philippine Accreditation Board (PAB): The group that manages all Philippines certification, guaranteeing skillfulness and fairness, ISO 37001 Auditors in Philippines.

2. TUV Rheinland Philippines Inc: A worldwide expert in certification with loads of ISO 37001 know-how.

3. SGS Philippines In.: A world-class inspection, verification and certification group that provides ISO 37001 Certification in Philippine range of services.

Many reasons make the ISO 37001 Certification in Philippines: