#Blockchain in Healthcare Market forecast

Explore tagged Tumblr posts

Text

Transforming the Health Landscape: The Global Blockchain in Healthcare Market

The integration of blockchain technology into the healthcare sector is revolutionizing the way medical data is managed, shared, and secured. As the demand for transparent, efficient, and secure healthcare services grows, blockchain offers promising solutions to longstanding challenges.

Understanding Blockchain in Healthcare

Blockchain Technology is a decentralized digital ledger that records transactions across multiple computers in a way that ensures the security and transparency of data. In healthcare, blockchain can be used to manage patient records, track pharmaceuticals, ensure the integrity of clinical trials, and streamline administrative processes. The immutable nature of blockchain helps in preventing data breaches, ensuring data accuracy, and enhancing patient privacy.

According to BIS Research, the Global Blockchain in Healthcare Market was estimated to grow to a value of $5.61 billion by 2025, and still the market is showing a steep growth till 2030 witnessing a double-digit CAGR growth rate throughout the forecast period.

Key Market Dynamics

Several factors are driving the growth of the global blockchain in healthcare market:

Data Security and Privacy:

Need for robust data security and privacy solutions.

Healthcare data breaches are a growing concern.

Blockchain's secure, immutable nature protects sensitive patient information.

Interoperability and Data Sharing:

Facilitates seamless data sharing between healthcare providers and systems.

Overcomes current interoperability issues.

Leads to better patient outcomes by providing a comprehensive view of health history.

Supply Chain Transparency:

Tracks the entire lifecycle of drugs in the pharmaceutical industry.

Ensures the authenticity of medications.

Helps combat counterfeit drugs.

Efficient Administrative Processes:

Streamlines various administrative processes, such as billing and claims management.

Reduces fraud and administrative costs.

Support from Regulatory Bodies:

Increasing support from regulatory bodies and governments.

Initiatives by FDA and EMA to explore blockchain for drug traceability and clinical trials boost market growth.

Request for an updated Research Report on Global Blockchain in Healthcare Market Research.

Global Blockchain in Healthcare Industry Segmentation

Segmentation by Application:

Data Exchange and Interoperability

Supply Chain Management

Claims Adjudication and Billing Management

Clinical Trials and Research

Others

Segmentation by End-User:

Healthcare Providers

Pharmaceutical Companies

Payers

Others

Segmentation by Region:

North America

Europe

Asia-Pacific

Latin America and Middle East & Africa

Future Market Prospects

The future of the global blockchain in healthcare market looks promising, with several trends likely to shape its trajectory:

Integration with AI and IoT: The integration of blockchain with artificial intelligence (AI) and the Internet of Things (IoT) will enhance data analytics, predictive healthcare, and real-time monitoring.

Expansion of Use Cases: New use cases for blockchain in digital healthcare will emerge, including patient-centered care models, personalized medicine, and enhanced telemedicine services.

Focus on Patient-Centric Solutions: Blockchain will enable more patient-centric healthcare solutions, empowering patients with greater control over their health data and enhancing patient engagement.

Development of Regulatory Frameworks: The establishment of clear regulatory frameworks and industry standards will facilitate the widespread adoption of blockchain in healthcare.

Conclusion

The Global Blockchain in Healthcare Industry is poised for significant growth, driven by the need for enhanced data security, interoperability, supply chain transparency, and efficient administrative processes. By addressing challenges related to regulatory compliance, implementation costs, standardization, and scalability, and leveraging opportunities in technological advancements, investments, partnerships, and government initiatives, the potential of blockchain in healthcare can be fully realized. This technology promises to revolutionize healthcare delivery, enhancing efficiency, transparency, and patient outcomes, and setting new standards for the future of digital health.

#Blockchain in Healthcare Market#Blockchain in Healthcare Industry#Blockchain in Healthcare Market Report#Blockchain in Healthcare Market Research#Blockchain in Healthcare Market Forecast#Blockchain in Healthcare Market Analysis#Blockchain in Healthcare Market Growth#BIS Research#Healthcare

2 notes

·

View notes

Text

Blockchain in Healthcare Market to Hit $20976.96 Million by 2032

The global Blockchain in Healthcare Market was valued at USD 462.36 Million in 2024 and it is estimated to garner USD 20976.96 Million by 2032 with a registered CAGR of 61.1% during the forecast period 2024 to 2032.

Global Blockchain in Healthcare Market Research Report 2024, Growth Rate, Market Segmentation, Blockchain in Healthcare Market. It affords qualitative and quantitative insights in phrases of market size, destiny trends, and nearby outlook Blockchain in Healthcare Market. Contemporary possibilities projected to influence the destiny capability of the market are analyzed in the report. Additionally, the document affords special insights into the opposition in particular industries and diverse businesses. This document in addition examines and evaluates the contemporary outlook for the ever-evolving commercial enterprise area and the prevailing and future outcomes of the market.

Get Sample Copy of Report @ https://www.vantagemarketresearch.com/blockchain-in-healthcare-market-1223/request-sample

** Note: You Must Use A Corporate Email Address OR Business Details.

The Major Players Profiled in the Market Report are:-

IBM Corporation, Microsoft Corporation, Gem, Patientory Inc., Guardtime Federal, Hashed Health

Blockchain in Healthcare Market 2024 covers powerful research on global industry size, share, and growth which will allow clients to view possible requirements and forecasts. Opportunities and drivers are assembled after in-depth research by the expertise of the construction robot market. The Blockchain in Healthcare Market report provides an analysis of future development strategies, key players, competitive potential, and key challenges in the industry.

Global Blockchain in Healthcare Market Report 2024 reveals all critical factors related to diverse boom factors inclusive of contemporary trends and traits withinside the worldwide enterprise. It affords a complete review of the top manufacturers, present-day enterprise status, boom sectors, and commercial enterprise improvement plans for the destiny scope.

The Blockchain in Healthcare Market document objectives to offer nearby improvement to the market using elements inclusive of income revenue, destiny market boom rate. It gives special observation and analysis of key aspects with quite a few studies strategies consisting of frenzy and pestle evaluation, highlighting present-day market conditions. to be. Additionally, the document affords insightful records approximately the destiny techniques and opportunities of worldwide players.

You Can Buy This Report From Here: https://www.vantagemarketresearch.com/buy-now/blockchain-in-healthcare-market-1223/0

Global Blockchain in Healthcare Market, By Region

1) North America- (United States, Canada, Mexico, Cuba, Guatemala, Panama, Barbados, and many others)

2) Europe- (Germany, France, UK, Italy, Russia, Spain, Netherlands, Switzerland, Belgium, and many others)

3) the Asia Pacific- (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Vietnam, and many others)

4) the Middle East & Africa- (Turkey, Saudi Arabia, United Arab Emirates, South Africa, Israel, Egypt, Nigeria, and many others)

5) Latin America- (Brazil, Argentina, Colombia, Chile, Peru, and many others)

This Blockchain in Healthcare Market Research/analysis Report Contains Answers to your following Questions

What trends, challenges, and barriers will impact the development and sizing of the global market?

What is the Blockchain in Healthcare Market growth accelerator during the forecast period?

SWOT Analysis of key players along with its profile and Porter’s five forces analysis to supplement the same.

How much is the Blockchain in Healthcare Market industry worth in 2019? and estimated size by 2024?

How large is the Blockchain in Healthcare Market? How long will it keep growing and at what rate?

Which section or location will force the market and why?

What is the important thing current tendencies witnessed in the Blockchain in Healthcare Market?

Who are the top players in the market?

What and How many patents are filed by the leading players?

What is our Offering for a bright industry future?

The Research Objectives of this Report are to:-

Company, key regions/countries, merchandise and applications, historical records from 2018 to 2022, and global Blockchain in Healthcare Market till 2032. Study and analyze the market length (cost and volume).

To recognize the structure of Blockchain in Healthcare Market via way of means of figuring out its numerous subsegments.

Blockchain in Healthcare Market on the subject of the primary regions (with every essential country). Predict the cost and length of submarkets.

To examine the Blockchain in Healthcare Markets with appreciation to person boom trends, destiny prospects, and their contribution to the general market.

To examine aggressive trends consisting of expansions, contracts, new product launches, and acquisitions withinside the market.

Strategic profiling of key gamers and complete evaluation of growth strategies.

Read Full Research Report with [TOC] @ https://www.vantagemarketresearch.com/industry-report/blockchain-in-healthcare-market-1223

Reasons to Buy Market Report

The market record presents a qualitative and quantitative analysis of the market based on segmentation that includes each economic and non-economic element.

Blockchain in Healthcare Market through the region. The market evaluation highlights the consumption of products/services in areas and well-known shows elements influencing the market in every region.

Blockchain in Healthcare Market. It consists of an in-depth analysis of the market from specific views via Market Porter's Five Forces Analysis and provides insights into the market via the Value Chain.

The Blockchain in Healthcare Market file provides an outline of market fee (USD) information for every segment and sub-segment.

It consists of an in-depth analysis of the market from distinct views via a 5 forces analysis of the Blockchain in Healthcare Market and offers insights into the market through the fee chain.

Check Out More Reports

Global Sports Medicine Market: Report Forecast by 2032

Global Chemotherapy Devices Market: Report Forecast by 2032

Global Background Music Market: Report Forecast by 2032

Global Brain Health Supplements Market: Report Forecast by 2032

Global Virgin Coconut Oil Market: Report Forecast by 2032

#Blockchain in Healthcare Market#Blockchain in Healthcare Market 2024#Global Blockchain in Healthcare Market#Blockchain in Healthcare Market outlook#Blockchain in Healthcare Market Trend#Blockchain in Healthcare Market Size & Share#Blockchain in Healthcare Market Forecast#Blockchain in Healthcare Market Demand#Blockchain in Healthcare Market sales & price

0 notes

Text

#Blockchain in Healthcare Market#Blockchain in Healthcare Market size#Blockchain in Healthcare Market share#Blockchain in Healthcare Market trends#Blockchain in Healthcare Market analysis#Blockchain in Healthcare Market forecast

0 notes

Text

Healthcare IT Integration Market Size Expected to Reach USD 11.16 Billion by 2030

The global Healthcare IT Integration market size, which was valued at USD 4.38 billion in 2022, is anticipated to witness remarkable growth, reaching USD 11.16 billion by 2030. This projection reflects a robust Compound Annual Growth Rate (CAGR) of 12.4% over the forecast period spanning from 2023 to 2030.

The increasing demand for efficient healthcare delivery systems, coupled with the rising adoption of electronic health records (EHRs) and other digital solutions, is driving the growth of the Healthcare IT Integration market. Healthcare organizations worldwide are realizing the significance of integrating disparate systems and applications to streamline workflows, improve patient care, and enhance operational efficiency.

Key Market Segments:

The Healthcare IT Integration market is segmented by Products & Services type, End User, and Regions:

Products & Services Type:

Products: Interface Engines, Media Integration Software, Medical Device Integration Software, Other Integration Tools

Services: Support and Maintenance Services, Implementation and Integration Services (Training and Education Services, Consulting Services)

End User:

Hospitals

Clinics

Diagnostic Imaging Centers

Laboratories

Other End Users

Regions: The global market forecast covers various regions across the globe.

Market Outlook:

The increasing adoption of electronic health records (EHRs) and healthcare information exchange (HIE) solutions is propelling the demand for Healthcare IT Integration products and services. Interface engines and integration software play a pivotal role in connecting disparate systems within healthcare organizations, enabling seamless data exchange and interoperability.

Moreover, the emergence of advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain in healthcare is further driving the need for robust IT integration solutions. These technologies require seamless integration with existing healthcare IT infrastructure to harness their full potential in improving patient outcomes and optimizing healthcare processes.

As healthcare providers continue to prioritize interoperability and data exchange to support value-based care initiatives and enhance patient engagement, the demand for Healthcare IT Integration solutions is expected to witness significant growth in the coming years.

2 notes

·

View notes

Text

How IoT Security is Shaping the Future of Cyber Protection

IoT Security Market: Growth, Trends, and Future Outlook

Introduction

The Internet of Things (IoT) security market is witnessing significant growth as the adoption of connected devices continues to surge across industries. With billions of IoT devices in use globally, ensuring cybersecurity has become a top priority to protect data, prevent cyber threats, and comply with regulatory standards. As cyberattacks targeting IoT ecosystems increase, businesses and governments are investing heavily in IoT security solutions.

Market Overview

Current Market Size and Growth Trends

The global IoT security market was valued at USD 15.6 billion in 2023 and is projected to grow at a CAGR of 18.2% from 2024 to 2032, reaching approximately USD 60 billion by the end of the forecast period. This growth is fueled by factors such as rising cyber threats, stringent security regulations, and increasing deployment of IoT devices across industries.

Regional Market Insights

North America: The leading market, driven by strict cybersecurity regulations and high IoT adoption in industries like healthcare, finance, and smart cities.

Europe: Strong emphasis on data protection laws such as GDPR boosts demand for IoT security solutions.

Asia-Pacific: The fastest-growing region, led by rapid industrial IoT expansion and government initiatives in countries like China, Japan, and India.

Latin America & Middle East: Emerging markets showing gradual adoption due to increasing awareness and investment in cybersecurity.

Key Market Drivers

Rising Cyber Threats and Attacks: IoT devices are highly vulnerable, making robust security solutions a necessity.

Government Regulations and Compliance Requirements: Policies such as GDPR, CCPA, and NIST guidelines drive security adoption.

Proliferation of IoT Devices: The exponential rise in smart devices across industries fuels demand for security solutions.

Advancements in AI and Blockchain Security Solutions: Emerging technologies enhance real-time threat detection and authentication in IoT networks.

Leading Players in the IoT Security Market

Several major cybersecurity firms and technology providers dominate the market with innovative IoT security solutions:

Cisco Systems (USA) – A leader in network security and IoT protection solutions.

IBM Corporation (USA) – Provides AI-driven security analytics and cloud-based IoT security.

Symantec Corporation (USA) – Offers robust endpoint and IoT security solutions.

Palo Alto Networks (USA) – Specializes in firewall and next-gen IoT security platforms.

Trend Micro (Japan) – Focused on cloud security and industrial IoT protection.

Challenges and Roadblocks

Despite strong growth, the IoT security market faces several challenges:

High Implementation Costs: Security solutions can be expensive, especially for SMEs.

Lack of Standardization: Different IoT ecosystems require customized security frameworks, complicating implementation.

Limited Awareness Among End-Users: Many businesses underestimate the importance of IoT security.

Scalability Issues: Securing large-scale IoT deployments remains a significant challenge.

Future Outlook

The IoT security market is poised for significant advancements, with key trends shaping its evolution:

Integration of AI and Machine Learning for automated threat detection.

Adoption of Zero-Trust Security Models to enhance protection across IoT networks.

Blockchain-Based IoT Security for decentralized, tamper-proof data protection.

Rise of Quantum Cryptography to safeguard IoT communications against future cyber threats.

Conclusion

The IoT security market is growing rapidly as businesses and governments prioritize cybersecurity in an increasingly connected world. Companies investing in AI, blockchain, and next-generation security solutions will lead the industry’s evolution toward a safer IoT ecosystem.

Looking to stay ahead in the IoT security industry? Follow our blog for the latest market trends and insights!

0 notes

Text

CIFDAQ Introduces Innovative Blockchain Ecosystem in India

In an increasingly digital world, the role of blockchain technology cannot be understated. The decentralized, transparent, and immutable nature of blockchain has found applications in numerous fields, from finance to healthcare. However, as with any technology, blockchains have their limitations, especially when dealing with scalability and transaction throughput. Enter CIFDAQ, an innovative blockchain ecosystem that’s melding artificial intelligence (AI) with blockchain to revolutionize the space. In this article, we’ll explore CIFDAQ’s unique advantages, primarily its AI-powered features that range from swift transaction speeds to predictive market analysis.

Visit us for more details: linktr.ee/cifdaq

1. Blazing Fast Transaction Speeds

Traditional blockchains have often been criticized for their inability to handle large transaction volumes, which can lead to bottlenecks and slow processing times. CIFDAQ, with its AI-enhanced layer 1 blockchain, addresses this pain point head-on. The integration of AI algorithms optimizes the verification process, enabling CIFDAQ to handle a higher transaction throughput than its contemporaries. For users, this translates to faster, more efficient transactions without the dreaded wait times.

2. Smart Predictive Analysis

Predictive analytics is a game-changer in any industry, and the crypto world is no exception. CIFDAQ harnesses the power of AI to sift through vast amounts of blockchain data, identify patterns, and make accurate market predictions. Such predictive capabilities can give traders and investors a competitive edge by providing actionable insights about potential market movements, thus allowing for more informed decision-making.

3. Enhanced Security Protocols

AI doesn’t just boost CIFDAQ’s speed; it amplifies its security as well. By continuously monitoring transaction patterns, the AI systems can instantly detect any anomalies or potential security threats. This proactive approach ensures that any unusual activities are flagged and addressed in real-time, fortifying CIFDAQ against potential breaches.

4. Dynamic Fee Adjustments

One of the challenges in the crypto space is the fluctuating transaction fees. CIFDAQ’s AI algorithms continuously analyze network activity to adjust fees dynamically. This ensures that users are always charged a fair fee, proportional to the network’s current demand and activity.

5. Adaptive Scalability Solutions

The crypto world is continuously evolving, and any platform needs to adapt to changing demands. CIFDAQ’s AI-driven approach allows it to be incredibly flexible. Whether there’s a sudden surge in user activity or a new digital asset gaining traction, CIFDAQ can scale its resources accordingly to ensure uninterrupted, efficient service.

6. Future-Proofing the Ecosystem

The blend of AI and blockchain means that CIFDAQ isn’t just solving today’s problems — it’s preparing for tomorrow’s challenges. As AI technology advances, its integration within the CIFDAQ ecosystem will only become more refined, leading to even more enhanced features, better security, and unparalleled user experience.

CIFDAQ’s approach to blending artificial intelligence with blockchain technology is an exciting leap forward for the crypto world. From transaction speeds to predictive analysis, the advantages of an AI-powered ecosystem are evident. As CIFDAQ continues to evolve and refine its platform, it’s set to remain at the forefront of the next generation of blockchain innovation, offering users a secure, efficient, and forward-thinking environment for all their crypto needs.

cifdaq.com

Bitcoin and the Cryptocurrency Market: Trends and Forecasts

Hmmmmmmmm

January 30, 2025

modify

comment

changes and technological advancements, are shaping the future of the market. Experts predict significant growth and that Bitcoin may once again reach its all-time high.

Bitcoin and Cryptocurrency Market Trends in 2023

Bitcoin went through a turbulent phase in 2023, losing almost 65% of its market cap. The downturn was largely due to a series of unforeseen events, including the dramatic collapse of Terra Luna and the FTX exchange.

Of course, macroeconomic pressures and legal troubles of large exchanges like Binance were not without their impact. However, the cryptocurrency market showed resilience, and the price of Bitcoin saw promising growth in 2024.

Bitcoin and Cryptocurrency Market Trends in 2024

Be sure to read:

Therapeutic properties of tarragon; from strengthening the immune system to improving digestion + how to prepare

How to make Tabrizi meatballs with aromatic vegetables

The year 2024 started with significant momentum for Bitcoin and the cryptocurrency market, generating a lot of excitement among crypto supporters. But a significant rebound occurred when Bitcoin surpassed its previous record high of $69,170 on March 8, 2024, reaching $70,083.

Just a few days later, on March 14, BTC broke through this peak again, this time to $73,750. This increase increased its market cap to $1.44 trillion and helped the total cryptocurrency market cap reach $2.77 trillion.

Bitcoin’s recovery journey has had its ups and downs. After falling below the psychological threshold of $31,000, Bitcoin entered a bearish phase and often traded below $30,000 for most of last year. However, it recovered significantly in late spring, gaining 89.74% year-to-date. As of July 28, 2024, Bitcoin is trading at $68,000, bringing its global market cap to $2.53 trillion.

Bitcoin trend forecast in 2025

Bitcoin enthusiasts and the cryptocurrency market often make overly optimistic and sometimes unrealistic predictions about the future of their beloved currency, with some analysts predicting that the price of Bitcoin will reach $1,000,000 by 2025.

“The idea of Bitcoin reaching $1,000,000 by 2025 may seem very ambitious,” says Himanshu Maradia, founder and head of blockchain ecosystem CIFDAQ. “But several factors could make this scenario possible. The growing adoption of Bitcoin, the approval of Bitcoin ETFs in various countries, the weakening of traditional fiat currencies due to hyperinflation, and the increasing profitability for Bitcoin miners are all important drivers.”

Also, Standard Chartered Bank's recent revision and prediction of Bitcoin's price reaching $120,000 by the end of 2024 indicates increased confidence in BTC's potential.

As more investors and institutions look to Bitcoin as a hedge against inflation, the prospect of it reaching unprecedented heights is increasingly growing. If sovereign funds start investing in Bitcoin or its ETFs, the price of the currency could rise rapidly.

Conclusion

Since Bitcoin is a decentralized currency with a limited supply, its accumulation by large investors, or “Bitcoin whales,” can affect its price trend. Data shows that these investors are actively increasing their holdings, indicating a potential upward movement ahead for Bitcoin and the cryptocurrency market

Cifdaq.com

If you know, you know. 😉💎 Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Krunal Sheth Jay Hao Anil Vasu Ankur Garg Muthuswamy Iyer Shipra Anand Mishra #CIFDAQ #CIFD #BlockchainEcosystem #CryptoTrading #Web3Community

cifdaq.com

0 notes

Link

0 notes

Text

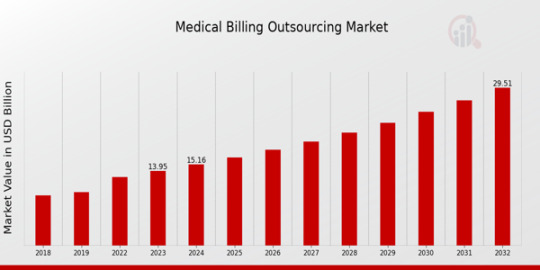

Global Medical Billing Market Size, Growth Outlook 2035

The medical billing market Size was valued at USD 15.88 billion in 2023 and is projected to grow from USD 17.76 Billion in 2024 to USD 32.79 billion by 2032

Summary

The global medical billing market is experiencing rapid expansion due to the increasing need for streamlined revenue cycle management (RCM) in healthcare. With the growing complexity of medical billing and coding procedures, hospitals, physician offices, and diagnostic centers are turning to automated and outsourced billing solutions to optimize their administrative and financial operations. The transition from traditional paper-based billing systems to cloud-based and AI-driven solutions has significantly improved efficiency, minimized billing errors, and enhanced reimbursement processes. Additionally, government initiatives promoting electronic health records (EHRs) and digital billing solutions are further accelerating market growth. However, the market faces challenges such as data security concerns, regulatory complexities, and the high cost of implementation. Despite these obstacles, advancements in AI, blockchain, and automation are expected to drive innovation in medical billing systems, ensuring sustained market growth.

Market Overview

Medical billing is a crucial component of healthcare administration, ensuring that healthcare providers receive payments for their services from insurance companies, patients, and government healthcare programs. The market has evolved significantly, integrating automated claim processing, real-time patient billing, and AI-powered coding assistance to reduce human errors and increase operational efficiency. With the increasing burden of medical debt and insurance reimbursement challenges, healthcare organizations are investing in robust billing solutions to optimize revenue cycles. The outsourcing of medical billing services is also gaining popularity, as third-party service providers offer cost-effective solutions while ensuring compliance with evolving healthcare regulations.

Market Size and Growth Analysis

The medical billing market Size was valued at USD 15.88 billion in 2023 and is projected to grow from USD 17.76 Billion in 2024 to USD 32.79 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 12.14% during the forecast period (2024 - 2032). The rise in healthcare expenditure, regulatory mandates for digital healthcare solutions, and increasing adoption of cloud-based billing platforms are key contributors to this growth.

Market Dynamics

Growth Drivers

The increasing complexity of medical billing and the need for efficient revenue cycle management solutions are primary drivers of market growth. The adoption of electronic health records (EHRs) and practice management software has streamlined billing processes, reducing administrative burdens on healthcare providers. Additionally, government regulations supporting healthcare digitization, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S., are encouraging hospitals and clinics to implement secure and compliant billing systems. The growing trend of outsourcing medical billing services is also driving market expansion, as healthcare organizations seek cost-effective and error-free billing solutions.

Challenges and Restraints

Despite the market's rapid growth, challenges such as data security risks, regulatory compliance complexities, and high initial investment costs pose significant hurdles. Medical billing systems must adhere to stringent regulations to ensure patient data privacy and avoid legal penalties. Moreover, the lack of skilled personnel and resistance to adopting new technologies in certain regions further restrains market growth.

Regional Analysis

The North American region dominates the global medical billing market, with the United States being the key contributor due to its advanced healthcare IT infrastructure and stringent regulatory mandates for digital billing. Europe follows closely, driven by government initiatives promoting digital healthcare solutions. Asia-Pacific is expected to witness the highest growth rate, with countries such as India, China, and Japan increasingly investing in healthcare IT and billing automation. The Middle East & Africa and Latin America are gradually adopting digital billing solutions, but infrastructure challenges continue to limit rapid expansion.

Market Segmentation

By Component:

Software – Includes cloud-based and AI-driven billing platforms

Services – Outsourced billing services and consulting

By Mode of Deployment:

Cloud-based solutions – Increasingly preferred due to scalability and cost-efficiency

On-premise solutions – Offers greater security and customization options

By End-User:

Hospitals & Healthcare Providers – Major adopters of automated billing software

Diagnostic Centers & Laboratories – Require streamlined claims processing solutions

Outsourced Billing Companies – Provide end-to-end revenue cycle management services

Key Market Players

Several companies are actively shaping the medical billing landscape, including:

Accenture (US)

AGS Health (India)

TCS (India),

Cognizant Technology Solutions (US)

Genpact (US)

GeBBS Healthcare (US)

INFINIT Healthcare

Recent Developments

The medical billing market has seen notable advancements in recent years, including the integration of AI-driven coding systems, blockchain-based secure billing solutions, and real-time claim adjudication technologies. Mergers and acquisitions among key market players have strengthened the industry, enhancing technological capabilities and service offerings. Governments worldwide are also introducing new policies for medical billing transparency, further shaping the market landscape.

Future Outlook and Opportunities

The future of the medical billing market looks promising, with ongoing innovations in AI, machine learning, and automation revolutionizing revenue cycle management. The adoption of predictive analytics in billing processes is expected to reduce claim denials and improve financial performance for healthcare providers. Additionally, as telehealth and remote patient monitoring services continue to rise, the demand for digital billing solutions will further expand. However, overcoming data security risks and regulatory challenges will be crucial to ensuring sustained growth in this evolving industry.

For more information, please visit @marketresearchfuture

#Global Medical Billing Market Size#Global Medical Billing Market Share#Global Medical Billing Market Growth#Global Medical Billing Market Analysis#Global Medical Billing Market Trends#Global Medical Billing Market Forecast#Global Medical Billing Market Segments

0 notes

Text

Why Experts Believe a Surge by 18,000%

Table of Contents

Why Early Investments in Emerging Cryptos Are Crucial

The Case for Lightchain AI’s Predicted 18,000% Growth

Looking Ahead: Lightchain AI’s Limitless Potential

The cryptocurrency market is a fast-paced, ever-changing landscape where identifying the "next big thing" can lead to life-changing returns for investors.

One project gaining serious attention is Lightchain AI (LCAI), with industry analysts forecasting an astonishing 18,000% increase in its value.

Having already raised $11.6 million during its presale at an introductory price of $0.00525, Lightchain AI is poised to disrupt the blockchain sector by seamlessly integrating artificial intelligence. This combination sets the stage for exponential innovation and growth.

Why Early Investments in Emerging Cryptos Are Crucial

Getting in on the ground floor of an emerging cryptocurrency can be one of the most financially rewarding strategies. History highlights the potential of early investments—take Ethereum as an example. Launched in 2015 at just $0.30 per token, it soared to thousands of dollars per token over the years, delivering returns of over 1,000,000%.

Why acting early matters:

Lower Costs: Early adopters can purchase tokens at significantly lower prices, maximizing potential future profits.

Exclusive Perks: Many early investors benefit from bonuses like airdrops, staking opportunities, and other incentives.

High Growth Potential: Emerging cryptos often experience meteoric rises as they gain market adoption and credibility.

That said, it’s critical to manage risk by thoroughly researching a project’s technology, team, and long-term vision. Diversifying your portfolio across several promising projects is another way to balance potential rewards with associated risks.

The Case for Lightchain AI’s Predicted 18,000% Growth

Lightchain AI is positioned to redefine blockchain innovation by embedding advanced artificial intelligence directly into its ecosystem. Its flagship feature, the Artificial Intelligence Virtual Machine (AIVM), allows complex AI computations to run seamlessly on the blockchain. This breakthrough opens up new possibilities for industries such as finance, healthcare, and logistics.

What sets Lightchain AI apart:

Unmatched Scalability and Speed: Built for high-performance operations, Lightchain AI delivers low-latency performance, enabling faster and more efficient decentralized applications.

Real-World Usability: Its AI-powered solutions are designed to address practical challenges, making it highly attractive across diverse industries.

Market Confidence: The successful presale, which raised $11.6 million, reflects strong belief in the project's vision and potential.

With a competitive starting price and the momentum of growing investor interest, Lightchain AI stands out as a compelling opportunity for both seasoned traders and newcomers to the crypto space.

Looking Ahead: Lightchain AI’s Limitless Potential

Experts are confident that Lightchain AI’s innovative platform, combined with its scalability and real-world applications, will cement its position as a game-changer in blockchain technology. This could drive the predicted 18,000% surge in value, making it a standout investment opportunity.

Thanks to its rapid fundraising success and accessible entry point, Lightchain AI has positioned itself as a catalyst for a new era of blockchain and AI integration. Among the sea of emerging crypto projects, Lightchain AI shines as a promising frontrunner with the potential to revolutionize the industry. For those seeking a high-growth investment, this is one to watch closely in 2025 and beyond.

Don’t Miss Out Join the Lightchain AI presale today and claim your stake in this groundbreaking project. Secure your place in a venture that could deliver exponential returns.

Visit the links below to learn more:

Lightchain AI Official Website

Disclaimer: This article is a sponsored piece for informational purposes only. It does not reflect the editorial views of the writer and should not be considered legal, tax, financial, or investment advice. Always conduct your own research before making any investment decisions.

0 notes

Text

Public Key Infrastructure (PKI) Industry Set for 15.6% CAGR Growth, Reaching USD 25.6 Billion by 2034 | Future Industry Insights Inc.

The global Public Key Infrastructure (PKI) industry is projected to witness substantial growth, driven by an escalating demand for secure digital transactions and communications. With a industry valuation of USD 5,200.0 million in 2023, the industry is expected to grow significantly, reaching USD 6,011.2 million by 2024. This robust growth trajectory reflects the increasing reliance of businesses across various sectors on secure cryptographic technologies to protect sensitive data. The industry is poised to expand at a compound annual growth rate (CAGR) of 15.6%, culminating in a forecasted size of USD 25,617.7 million by 2034.

The need for enhanced security protocols in the face of rising cyber threats, as well as stringent data protection regulations, is fueling the demand for PKI solutions. PKI serves as a foundational security architecture, offering encryption, authentication, and digital signature solutions to ensure the confidentiality and integrity of communications. Industries such as banking, financial services, insurance (BFSI), government and defense, healthcare, and retail are increasingly adopting PKI systems to safeguard their operations and customer interactions.

One of the primary trends shaping the future of the PKI industry is the ongoing shift toward cloud-based PKI solutions. With businesses seeking scalable, cost-effective, and flexible security solutions, cloud PKI is becoming a preferred option. This shift is particularly relevant in the context of digital transformation, where organizations are looking for solutions that align with their cloud-centric infrastructure. While cloud-based PKI is gaining traction, on-premises PKI hardware remains essential for industries that require stringent security measures, particularly those handling highly sensitive or classified data.

Request a Sample of this Report: https://www.futuremarketinsights.com/report-sample#5245502d47422d3135313031

Technological advancements in blockchain and the Internet of Things (IoT) are also driving the PKI industry. As these technologies continue to grow, the demand for robust PKI solutions to secure their digital transactions and communications is increasing. Hardware security modules (HSMs), which ensure secure key generation and storage, are seeing higher demand as they form a crucial component of PKI systems. Additionally, the rise of managed and professional PKI services is enabling organizations to efficiently implement, maintain, and audit their security infrastructures, further fueling industry growth.

What Factors are Propelling Public Key Infrastructure (PKI) Demand?

As digitalization develops across several industries, the need for a digital authentication strategy to safeguard organisational infrastructure grows. As a result, the public key infrastructure industry is expected to grow. The growing need to reduce authentication costs across a wide range of industries, including banking, healthcare, and e-commerce, is driving the usage of PKI solutions and, consequently, the expansion of the public key infrastructure market.

Companies rely on PKI to restrict data access and authenticate the identities of people, systems, and devices on a broad scale as they rely more on digital information and face more sophisticated assaults.

As businesses try to keep the lights on and the bottom line in control, security solutions will become more efficient. Security officers will be asked to do more with less resources. In 2022, greater focus will be placed on technology that enables enterprises to accomplish more with less, and automation will play a big part in security innovation. According to a recent study by DigiCert, around 91% of organizations are contemplating automating PKI certificate administration. AI and machine learning (ML) technologies will remain crucial in accelerating automation.

Key Takeaways from Industry Study:

The global PKI industry was valued at USD 5,200.0 million in 2023 and is estimated to reach USD 6,011.2 million in 2024.

The industry is expected to grow at a CAGR of 15.6%, reaching USD 25,617.7 million by 2034.

Cybersecurity threats and compliance requirements are driving the adoption of PKI solutions across multiple industries.

Cloud-based PKI solutions are gaining traction due to their scalability, flexibility, and cost-effectiveness.

On-premises PKI remains critical for sectors requiring the highest levels of security.

Blockchain and IoT advancements are increasing the demand for secure PKI solutions.

Managed and professional PKI services are in high demand as organizations seek effective implementation and auditing solutions.

North America remains a dominant region in PKI adoption, with increasing focus on securing critical infrastructure in sectors like government and financial services.

South Asia & Pacific are experiencing rapid growth in PKI adoption due to the digital transformation and heightened cybersecurity awareness.

Region-wise Analysis

Which Region is projected to Offer the Largest Opportunity for Public Key Infrastructure (PKI) Market?

North America is the most lucrative region with a double-digit projected growth. The increasing use of various cutting-edge technologies and solutions in developed nations such as the United States and Canada presents appealing opportunities for key players in the PKI market. Furthermore, the presence of multiple technological behemoths will drive up demand for public key infrastructure solutions and services.

Several companies are increasingly spending and collaborating to strengthen and secure their servers, boosting regional demand for PKI. For example, Entrust PKI services will be incorporated into Device Authority's KeyScaler IoT IAM platform, extending the current relationship for Hardware Security Module services to allow device trust, data trust, and IoT-scale automation. By connecting to Federal Information Processing (FIP) Compliant Entrust PKI and HSM services, one may execute PKI security operations such as device PKI authentication, onboarding, certificate creation, machine identity lifecycle management, and cryptographic activities. It will also use KeyScaler's pre-built service connectors and flexible connection architecture to integrate security operations into any cloud application or platform.

Furthermore, the rising internet penetration and high reliance of organizations on the internet, as well as associated solutions and services, will drive up demand for PKI in this area.

Industry's Prime Determinants of Trends, and Opportunities:

Several factors are driving the growth and shaping the trends within the PKI industry. These include:

Cybersecurity Threats: The growing sophistication of cyber threats is a key driver for PKI adoption. As organizations face increasing risks from data breaches and cyber-attacks, PKI systems provide robust encryption and authentication methods to secure communications and sensitive data.

Compliance Regulations: Stricter data protection regulations, such as the GDPR and CCPA, are pushing organizations to adopt PKI solutions to ensure compliance. These regulations often require businesses to encrypt sensitive customer information and verify identities, functions that are effectively addressed by PKI systems.

Cloud and IoT Integration: The rise of cloud computing and IoT technologies is creating a demand for scalable and secure PKI solutions. Cloud PKI solutions offer flexibility and cost-effectiveness, while IoT devices require robust security to prevent data breaches and unauthorized access.

Blockchain and Digital Transformation: As blockchain technology and digital transformation continue to evolve, the need for secure PKI solutions will remain strong. Blockchain's decentralized nature relies on PKI for digital signatures and secure transactions, further driving industry growth.

Key Companies & Industry Share Insights:

The Public Key Infrastructure industry is highly competitive, with several key players dominating the industry. These companies offer a wide range of PKI solutions, including hardware, software, and managed services, catering to diverse industries worldwide. Some of the major players in the industry include:

DigiCert, Inc.

Entrust

GlobalSign

Thales Group

Gemalto (now part of Thales)

Microsoft Corporation

Comodo Group, Inc.

These companies have significant industry shares due to their comprehensive offerings, strong brand recognition, and established customer bases. Their continued investment in research and development (R&D) ensures that they remain at the forefront of technological advancements in PKI solutions, particularly in areas like cloud PKI and hardware security modules.

Growth Drivers:

The PKI industry is primarily driven by the increasing need for data security across all sectors. The rise of digital payments, e-commerce, and remote work has amplified the demand for secure communications, creating substantial growth opportunities for PKI providers. Additionally, regulatory pressures and compliance requirements continue to drive the adoption of PKI solutions in sectors like banking, government, healthcare, and retail.

Technological advancements in IoT, blockchain, and cloud computing are also fueling the demand for PKI solutions. These innovations require secure encryption methods to protect data and ensure the integrity of digital transactions. As organizations continue to embrace these technologies, the need for PKI systems will only increase.

Regional Analysis of Public Key Infrastructure (PKI) Industry:

North America leads the global PKI industry, driven by the region's strong regulatory frameworks and the rapid pace of digital transformation in sectors such as government, finance, and healthcare. The increasing focus on securing critical infrastructure in these sectors is propelling the demand for PKI solutions.

Europe also shows significant growth due to stringent data protection laws, including the GDPR, which require organizations to implement encryption and secure communication protocols. As the region's digital landscape evolves, PKI adoption is expected to grow further.

Asia-Pacific is witnessing rapid growth, particularly in South Asia and the Pacific region, as digital economies expand, and cyber threats become more prevalent. Increased investments in secure digital infrastructure are driving the demand for PKI solutions, making this region a key growth area in the coming years.

Latin America and the Middle East & Africa are experiencing moderate growth, with increasing awareness of cybersecurity risks and a focus on regulatory compliance contributing to PKI adoption. However, these regions face challenges in terms of infrastructure and investment in cybersecurity, limiting the pace of industry expansion.

Public Key Infrastructure (PKI) Industry Segmentation

By Component:

In terms of component, the segment is divided into Public Key Infrastructure Hardware Security Modules (HSM), Public Key Infrastructure Solutions and Public Key Infrastructure Services.

By deployment:

In terms of deployment, the segment is segregated into cloud based and on premise.

By Enterprise size:

In terms of enterprise size, the segment is segregated into Small & Mid-Sized Enterprise and Large Enterprise.

By Vertical:

In terms of industry, the segment is segregated into BFSI, Government and Defense, IT and Telecom, Retail, Healthcare, Manufacturing and Other.

By Region:

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa.

0 notes

Text

Blockchain in Clinical Research: Market Growth Forecast to Hit $5.8B by 2034

Blockchain in Clinical Research Market is transforming the clinical trial landscape by enhancing data integrity, transparency, and security. This innovative approach addresses key challenges in clinical research, from secure patient data management to regulatory compliance, fostering trust and efficiency in drug development processes.

To Request Sample Report : https://www.globalinsightservices.com/request-sample/?id=GIS10894 &utm_source=SnehaPatil&utm_medium=Article

In 2023, the market achieved robust growth, processing 320 million metric tons of data. The data management segment commands 45% of the market, driven by the demand for secure and immutable records. Patient recruitment and retention solutions account for 30%, reflecting the critical need for efficient participant management, while supply chain and niche applications hold the remaining 25%.

North America leads the market, supported by advanced healthcare infrastructure and robust regulatory frameworks. Europe follows, with increased investment in digital health technologies and proactive data privacy regulations. The United States dominates globally due to its technological advancements and innovation-driven research landscape, while Germany stands out for its commitment to integrating cutting-edge technologies into clinical practices.

Market segmentation highlights public, private, consortium, and hybrid blockchain types; applications in patient recruitment, data sharing, and supply chain tracking; and deployment models such as cloud-based and on-premises solutions. Key players like IBM, Deloitte, and Accenture are at the forefront, driving innovation in blockchain platforms and methodologies.

Regulatory frameworks, such as the FDA’s digital health guidelines, shape market dynamics, ensuring compliance while boosting adoption. With a projected CAGR of 15% over the next decade, blockchain integration with AI and machine learning promises to streamline processes, enhance data security, and unlock new efficiencies in clinical research.

#BlockchainInHealthcare #ClinicalTrialsInnovation #DataSecurity #TransparencyInResearch #HealthTech #DigitalHealth #SmartContracts #R&DExcellence #PatientRecruitment #SupplyChainTransparency #ClinicalResearch #BlockchainApplications #AIinHealthcare #FutureOfMedicine #DataIntegrity

0 notes

Text

Cyber Security Market - Forecast(2025 - 2031)

The Cyber Security Market size is estimated to reach $360 Billion by 2030, growing at a CAGR of 9.5% during the forecast period 2024-2030.

The market is projected to grow significantly in the coming years, propelled by increased digital transformation, adoption of cloud computing, and expansion of IoT ecosystems. Key segments within the market include network security, endpoint security, application security, cloud security, and identity management. The demand for advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain to enhance threat detection and response is reshaping the industry landscape. Industries such as banking, financial services, and insurance (BFSI), healthcare, and retail are the largest adopters, prioritizing investments in cybersecurity to safeguard sensitive data.

0 notes

Text

CIFDAQ's AI-Powered Edge: Boosting Transaction Speeds and Predictive Analysis

In an increasingly digital world, the role of blockchain technology cannot be understated. The decentralized, transparent, and immutable nature of blockchain has found applications in numerous fields, from finance to healthcare. However, as with any technology, blockchains have their limitations, especially when dealing with scalability and transaction throughput. Enter CIFDAQ, an innovative blockchain ecosystem that’s melding artificial intelligence (AI) with blockchain to revolutionize the space. In this article, we’ll explore CIFDAQ’s unique advantages, primarily its AI-powered features that range from swift transaction speeds to predictive market analysis.

Visit us for more details: linktr.ee/cifdaq

1. Blazing Fast Transaction Speeds

Traditional blockchains have often been criticized for their inability to handle large transaction volumes, which can lead to bottlenecks and slow processing times. CIFDAQ, with its AI-enhanced layer 1 blockchain, addresses this pain point head-on. The integration of AI algorithms optimizes the verification process, enabling CIFDAQ to handle a higher transaction throughput than its contemporaries. For users, this translates to faster, more efficient transactions without the dreaded wait times.

2. Smart Predictive Analysis

Predictive analytics is a game-changer in any industry, and the crypto world is no exception. CIFDAQ harnesses the power of AI to sift through vast amounts of blockchain data, identify patterns, and make accurate market predictions. Such predictive capabilities can give traders and investors a competitive edge by providing actionable insights about potential market movements, thus allowing for more informed decision-making.

3. Enhanced Security Protocols

AI doesn’t just boost CIFDAQ’s speed; it amplifies its security as well. By continuously monitoring transaction patterns, the AI systems can instantly detect any anomalies or potential security threats. This proactive approach ensures that any unusual activities are flagged and addressed in real-time, fortifying CIFDAQ against potential breaches.

4. Dynamic Fee Adjustments

One of the challenges in the crypto space is the fluctuating transaction fees. CIFDAQ’s AI algorithms continuously analyze network activity to adjust fees dynamically. This ensures that users are always charged a fair fee, proportional to the network’s current demand and activity.

5. Adaptive Scalability Solutions

The crypto world is continuously evolving, and any platform needs to adapt to changing demands. CIFDAQ’s AI-driven approach allows it to be incredibly flexible. Whether there’s a sudden surge in user activity or a new digital asset gaining traction, CIFDAQ can scale its resources accordingly to ensure uninterrupted, efficient service.

6. Future-Proofing the Ecosystem

The blend of AI and blockchain means that CIFDAQ isn’t just solving today’s problems — it’s preparing for tomorrow’s challenges. As AI technology advances, its integration within the CIFDAQ ecosystem will only become more refined, leading to even more enhanced features, better security, and unparalleled user experience.

CIFDAQ’s approach to blending artificial intelligence with blockchain technology is an exciting leap forward for the crypto world. From transaction speeds to predictive analysis, the advantages of an AI-powered ecosystem are evident. As CIFDAQ continues to evolve and refine its platform, it’s set to remain at the forefront of the next generation of blockchain innovation, offering users a secure, efficient, and forward-thinking environment for all their crypto needs.

cifdaq.com

Bitcoin and the Cryptocurrency Market: Trends and Forecasts

Hmmmmmmmm

January 30, 2025

modify

comment

changes and technological advancements, are shaping the future of the market. Experts predict significant growth and that Bitcoin may once again reach its all-time high.

Bitcoin and Cryptocurrency Market Trends in 2023

Bitcoin went through a turbulent phase in 2023, losing almost 65% of its market cap. The downturn was largely due to a series of unforeseen events, including the dramatic collapse of Terra Luna and the FTX exchange.

Of course, macroeconomic pressures and legal troubles of large exchanges like Binance were not without their impact. However, the cryptocurrency market showed resilience, and the price of Bitcoin saw promising growth in 2024.

Bitcoin and Cryptocurrency Market Trends in 2024

Be sure to read:

Therapeutic properties of tarragon; from strengthening the immune system to improving digestion + how to prepare

How to make Tabrizi meatballs with aromatic vegetables

The year 2024 started with significant momentum for Bitcoin and the cryptocurrency market, generating a lot of excitement among crypto supporters. But a significant rebound occurred when Bitcoin surpassed its previous record high of $69,170 on March 8, 2024, reaching $70,083.

Just a few days later, on March 14, BTC broke through this peak again, this time to $73,750. This increase increased its market cap to $1.44 trillion and helped the total cryptocurrency market cap reach $2.77 trillion.

Bitcoin’s recovery journey has had its ups and downs. After falling below the psychological threshold of $31,000, Bitcoin entered a bearish phase and often traded below $30,000 for most of last year. However, it recovered significantly in late spring, gaining 89.74% year-to-date. As of July 28, 2024, Bitcoin is trading at $68,000, bringing its global market cap to $2.53 trillion.

Bitcoin trend forecast in 2025

Bitcoin enthusiasts and the cryptocurrency market often make overly optimistic and sometimes unrealistic predictions about the future of their beloved currency, with some analysts predicting that the price of Bitcoin will reach $1,000,000 by 2025.

“The idea of Bitcoin reaching $1,000,000 by 2025 may seem very ambitious,” says Himanshu Maradia, founder and head of blockchain ecosystem CIFDAQ. “But several factors could make this scenario possible. The growing adoption of Bitcoin, the approval of Bitcoin ETFs in various countries, the weakening of traditional fiat currencies due to hyperinflation, and the increasing profitability for Bitcoin miners are all important drivers.”

Also, Standard Chartered Bank's recent revision and prediction of Bitcoin's price reaching $120,000 by the end of 2024 indicates increased confidence in BTC's potential.

As more investors and institutions look to Bitcoin as a hedge against inflation, the prospect of it reaching unprecedented heights is increasingly growing. If sovereign funds start investing in Bitcoin or its ETFs, the price of the currency could rise rapidly.

Conclusion

Since Bitcoin is a decentralized currency with a limited supply, its accumulation by large investors, or “Bitcoin whales,” can affect its price trend. Data shows that these investors are actively increasing their holdings, indicating a potential upward movement ahead for Bitcoin and the cryptocurrency market

Cifdaq.com

If you know, you know. □□

Hmmmmmmmm

January 30, 2025

modify

comment

If you know, you know. 😉💎 Himanshu Maradiya Sheetal Maradiya Rahul Maradiya Krunal Sheth Jay Hao Anil Vasu Ankur Garg Muthuswamy Iyer Shipra Anand Mishra #CIFDAQ #CIFD #BlockchainEcosystem #CryptoTrading #Web3Community

cifdaq.com

1 note

·

View note

Link

0 notes

Text

Exploring Crowdfunding Market: Opportunities, Challenges, and Innovations

The global crowdfunding market size is expected to reach USD 5.53 billion by 2030, growing at a CAGR of 16.7% from 2023 to 2030, according to a new study conducted by Grand View Research, Inc. Growing demand for low-cost promotional tools, such as social media platforms for crowdfunding campaigns, is a major factor driving market growth. Furthermore, rising internet penetration has led to more accessibility of online crowdfunding platforms, which is further contributing to the growth of the crowdfunding market.

Numerous crowdfunding platform providers remain focused on launching niche areas such as serving black women. For instance, in May 2020, BuildHer, a crowdfunding platform for women, launched its service to support young women in Kenya with credited construction skills leading to greater financial prosperity and promoting gender equality within the construction industry. Such launches are expected to create lucrative growth opportunities for the market over the coming years.

An increasing number of startup companies globally has also led to a greater demand for crowdfunding platforms. For instance, in July 2022, India witnessed a rise of 15,400% number of startups which increased from 471 in 2016 to 72,993 as of June 2022. Startup companies raised funds to increase their market presence globally and invest more in research and development activities. Such a rise in the number of startup companies is expected to further drive market growth.

The COVID-19 outbreak played a vital role in driving the crowdfunding market growth over the forecast period. The number of donations through crowdfunding platforms increased during the pandemic for COVID care treatment, hospitalization, and oxygen relief campaigns. For instance, on Milaap, a crowdfunding platform, the number of donations for the COVID-19 pandemic increased from 325,000 in 2020 to 400,000 in 2021. Similarly, in 2021, through GoFundMe, a crowdfunding platform, more than 175,000 crowdfunding campaigns were established in the U.S. for the COVID-19 pandemic-related needs.

Gather more insights about the market drivers, restrains and growth of the Crowdfunding Market

Crowdfunding Market Report Highlights

• The equity-based crowdfunding segment is expected to witness rapid growth over the forecast period. The segment growth can be attributed to the growing popularity of equity crowdfunding platforms as it offers an equity share of the company to investors

• The technology segment is expected to witness significant growth over the forecast period. Growing demand for integrating innovative technologies such as blockchain, machine learning, and Artificial Intelligence (AI) into various digital platforms is expected to propel the growth of the segment

• North America dominated the regional market in 2022. The rising number of startup companies across the region is driving the growth of the regional market

Crowdfunding Market Segmentation

Grand View Research has segmented the global crowdfunding market based on type, application, and region:

Crowdfunding Type Outlook (Revenue, USD Million, 2017 - 2030)

• Equity-based Crowdfunding

• Debt-based Crowdfunding

• Others

Crowdfunding Application Outlook (Revenue, USD Million, 2017 - 2030)

• Food & Beverage

• Technology

• Media

• Real Estate

• Healthcare

• Others

Crowdfunding Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o U.K.

o Italy

o Spain

• Asia Pacific

o China

o India

o Japan

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East & Africa

Order a free sample PDF of the Crowdfunding Market Intelligence Study, published by Grand View Research.

#Crowdfunding Market#Crowdfunding Market Analysis#Crowdfunding Market Report#Crowdfunding Market Size#Crowdfunding Market Share

0 notes