#Bittensor

Explore tagged Tumblr posts

Text

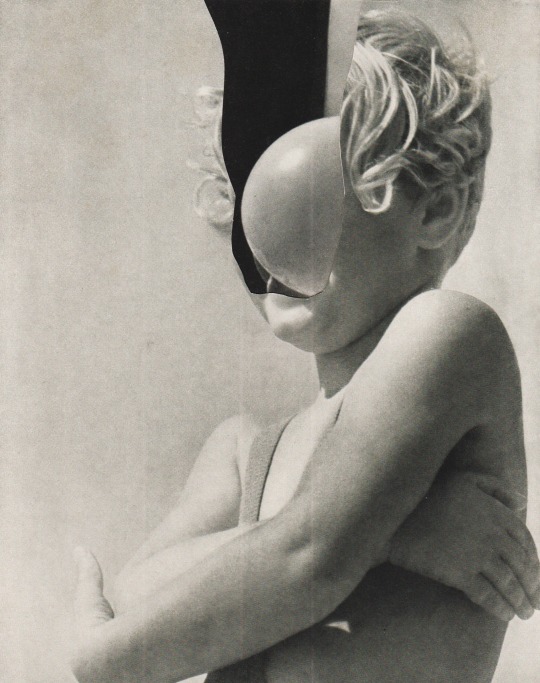

Tao - Handmade collage 2023

#mesineto#hugo barros#handmade collage#artists on tumblr#collage art#collage#art#lisboa#surrealism#black and white#Kid a#Bittensor#Tao

75 notes

·

View notes

Text

youtube

2 notes

·

View notes

Text

🚀 Bittensor (TAO): Decentralized AI Meets Market Challenges 🤖💡 📉 Sentiment: Bearish, with $3.9M in exchange deposits signaling sell-offs. Long-to-short ratio at 0.9084 shows cautious trader outlook. 📊 Key Levels: Resistance: $624, $1,050 Support: $361.1, $213.6 💡 TAO is in a retracement phase but holds recovery potential. Breaking $624 could target $1,050, driving innovation in decentralized AI.

0 notes

Text

🚀 Bittensor (TAO): Decentralized AI Meets Market Challenges 🤖💡

🚀 Bittensor (TAO): Decentralized AI Meets Market Challenges 🤖💡 📉 Sentiment: Bearish, with $3.9M in exchange deposits signaling sell-offs. Long-to-short ratio at 0.9084 shows cautious trader outlook. 📊 Key Levels: Resistance: $624, $1,050 Support: $361.1, $213.6 💡 TAO is in a retracement phase but holds recovery potential. Breaking $624 could target $1,050, driving innovation in decentralized AI.

https://www.cifdaq.com

0 notes

Text

www.cifdaq.com

0 notes

Text

youtube

0 notes

Text

5 Reasons to Invest in TAO Tokens Today

🚀 Revolutionize AI with BitTensor & TAO Token! 🔥

💡 What if you could shape the future of AI? BitTensor offers an open-source, decentralized platform where you can create, share, and monetize AI models. No central gatekeepers—just innovation driven by a global community. 🌎

✨ Powering this new AI economy? The TAO token 🪙: ⚙️ Incentives for contributions (data, computing power, AI models) 🛒 Seamless transactions within the AI marketplace 🎮 Governance through community voting 📈 Growth Potential as the demand for decentralized AI surges

🎯 Ready to buy TAO? Easily convert ETH to TAO on @rocketxexchange and store it securely with Talisman Wallet, Tensor Wallet, or Nova Wallet.

💼 Why invest in TAO? Limited supply (21M tokens) + increasing AI adoption = 🚀 potential for long-term value!

🔗 Get started now with BitTensor and explore the frontier where AI meets blockchain.

#AI #Blockchain #Crypto #TAOToken #BitTensor #InvestSmart

Click here for complete guide:

#crypto#cryptocurreny trading#crypto community#cryptocurrency#cryptocurency news#coinbase#ethereum#usdt#crypto market#bitcoin#binance#defi#tao#bittensor

0 notes

Text

Nvidia's Surge Propels Top AI Altcoins: Fetch.ai, SingularityNET, and Bittensor

As June progressed, the cryptocurrency market underwent a notable correction. Bitcoin dipped to a monthly low of $64,000, influencing major altcoins to follow a similar downward trend. However, AI-related cryptocurrencies experienced a resurgence. This renewed interest appears to be linked to Nvidia, the AI chip-making giant, which recently achieved the status of the world’s most valuable company…

View On WordPress

0 notes

Text

Assessing the Longevity of Bullish Trends in New Crypto Tokens: In-Depth Analysis and Outlook

KaikoData, a leading provider of cryptocurrency market data, has reported a substantial surge in weekly spot volume, reaching an impressive $8 billion for new crypto tokens. This revelation underscores the presence of a mini-bull rally that has been gaining momentum since early 2023. The data, derived from Kaiko Asset Liquidity Metrics and covering the period from February 2023 to January 2024, focuses on tokens traded on centralized cryptocurrency exchanges (CEX).

The graph, portraying weekly trading value on the y-axis, reveals a notable upward trend, with tokens like TAO, APT, and DYM color-coded for easy identification. Although the initial months displayed lower volumes, the market dynamics shifted, leading to a remarkable surge in spot volume.

Of particular interest are spikes in trading activity, with November 2023 standing out as a period of intense market activity. TAO and SUI tokens witnessed substantial volume increases towards the end of this period, while APT maintained a consistent presence. The week-over-week variability, a hallmark of the volatile cryptocurrency market, further accentuates the dynamic nature of the market.

The performance of these newly launched tokens is not only evident in trading volumes but also in recent price increases. Bittensor, for instance, experienced a surge, reaching a price of $619.01 with a 24-hour trading volume of $27,583,663—a 2.44% increase indicating strong investor interest.

Aptos and Dymension also demonstrated resilience and growth, with prices at $9.27 and $7.33, respectively, accompanied by significant trading volumes. The slight but consistent increases in these tokens signal a steady demand and growing popularity within the trading community.

Sui, with a price jump to $1.71 and a 24-hour trading volume of $329,650,057, marked a 2.47% rise. This activity underscores the optimism surrounding its future in the market, highlighting the token's ability to attract attention and investment.

Kaiko's comprehensive analysis, enriched with the latest trading prices, provides valuable insights into the performance of newly launched tokens. This data contributes significantly to understanding broader market trends and investor behavior, indicating a potentially fertile ground for future crypto ventures.

0 notes

Text

Unveiling the Forces: What's Behind the Rally of Bittensor, Helium, and Solana in the Altcoin Arena?

In a week that witnessed significant market movements, Bittensor, Helium, and Solana have emerged as standout performers, eclipsing Bitcoin's performance and highlighting a discernible shift in trader focus. Santiment's data reveals a remarkable 70% surge for Bittensor, accompanied by a 37% increase for Helium and a 25% jump for Solana. These altcoins have played a pivotal role in propelling the total market cap of digital assets to a noteworthy $2.452 trillion, marking a 6.82% increase and reflecting bullish sentiments among investors.

Despite the positive momentum, the last 24 hours have seen a dip in Bittensor, Helium, and Solana prices, signaling the inherent volatility of the crypto market. Bittensor has seen an 8.13% increase, reaching $448.94, while Helium and Solana have experienced slight declines of 4.12% and 0.97%, with current prices at $7.57 and $101.28, respectively. Bitcoin, at $42,998.46, has also exhibited a 1.00% decrease in the past day.

The report emphasizes a noteworthy trend among traders, as social volume for Bitcoin decreases while interest in altcoins rises. This trend signifies a shift towards more speculative and potentially lucrative crypto investments. As Bittensor, Helium, and Solana lead a strong crypto rebound, investors are reminded of the unpredictable nature of the market. Staying informed and exercising caution remain crucial in navigating the dynamic and evolving crypto landscape

0 notes

Text

Standard Chartered'in SOL fiyat tahmini: Solana yüzde 400, Bittensor fiyatı çift haneli kazanç bekleniyor!

Ekim ayının ikinci haftasında karışık seyreden Solana fiyatı haftanın son işlem gününde iyimser bir seyir izledi. Özellikle Standard Chartered’in açıklamaları ile Solana fiyatına dair yatırımcı iyimserliği yükseldi. Finans şirketi, ABD seçimlerinin Solana fiyatını nasıl etkileyeceğini ele alırken Trump’ın kazanması hâlinde altcoinin fiyatında yüzde 400 artış beklediğini açıkladı. ABD seçimlerinde…

0 notes

Text

🚀 Bittensor (TAO): Decentralized AI Meets Market Challenges 🤖 📉 Sentiment: Bearish, with $3.9M in exchange deposits signaling sell-offs. Long-to-short ratio at 0.9084 shows cautious trader outlook.

📊 Key Levels: Resistance: $624, $1,050 Support: $361.1, $213.6

💡 TAO is in a retracement phase but holds recovery potential. Breaking $624 could target $1,050, driving innovation in decentralized AI.

www.cifdaq.com

0 notes

Text

🚀 Bittensor (TAO): Decentralized AI Meets Market Challenges 🤖💡 📉 Sentiment: Bearish, with $3.9M in exchange deposits signaling sell-offs. Long-to-short ratio at 0.9084 shows cautious trader outlook. 📊 Key Levels: Resistance: $624, $1,050 Support: $361.1, $213.6 💡 TAO is in a retracement phase but holds recovery potential. Breaking $624 could target $1,050, driving innovation in decentralized AI.

#CIFDAQ

0 notes

Text

🚀 Bittensor (TAO): Decentralized AI Meets Market Challenges 🤖💡 📉 Sentiment: Bearish, with $3.9M in exchange deposits signaling sell-offs. Long-to-short ratio at 0.9084 shows cautious trader outlook. 📊 Key Levels: Resistance: $624, $1,050 Support: $361.1, $213.6 💡 TAO is in a retracement phase but holds recovery potential. Breaking $624 could target $1,050, driving innovation in decentralized AI.

0 notes

Text

[ad_1] By Anjali Sharma NEW YORK – Crypto Almanac 2024, released by CIFDAQ on Monday stated that an AI-based blockchain ecosystem has unveiled an in-depth analysis of the dynamic digital assets market. According to Crypto Almanac 2024, the year 2025 for the crypto world is expected to be a year of consolidation, innovation, and strategic growth. It said the tokenization market is forecasted to grow into a $10–16 trillion sector by 2030, with early adoption of tokenized treasuries, commodities, and securities paving the way for mainstream trading platforms. Regulatory sandboxes in jurisdictions like Singapore and Hong Kong are expected to accelerate this trend. It said payment giants such as PayPal, Visa, and Stripe are integrating blockchain technology to streamline cross-border transactions and treasury operations. This is expected to drive stable coin adoption, with volumes rivaling major payment networks. The broader regulatory reforms, including the launch of new ETFs for assets like Solana and XRP, will encourage institutional participation while fostering compliant DeFi platforms. It highlighted that in 2024, memecoins like Dogecoin (+253%) and Shiba Inu (+110%) led the market in speculative growth, reflecting strong community engagement. AI Integration and DePIN Projects gained traction, with Fetch.ai (+92%) and Bittensor (+70%) demonstrating the increasing role of AI in blockchain automation. Gaming and Metaverse Tokens such as BEAM (+64%) and GALA (+17%) continued to thrive, fueled by play-to-earn models and virtual world innovations, it said. On the global parameter, US approved Bitcoin ETFs in February, attracting over 1 million BTC in inflows, surpassing gold ETFs’ six-year achievements. Ethereum ETFs debuted in July, broadening altcoin adoption and solidifying Ethereum’s role in institutional finance. The UAE eliminated crypto taxes in October, fostering industry growth and innovation. The post Crypto Almanac predicts consolidation, innovation & strategic growth in 2025 appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes