#Bitcoin Trading Guide

Explore tagged Tumblr posts

Text

Mastering the Art of Short-Term Crypto Trading

Short-Term Crypto Trading has rapidly gained popularity in recent years, with an increasing number of individuals seeking to capitalize on the volatility of digital assets. Short-term crypto trading, in particular, has emerged as a lucrative opportunity for traders looking to profit from price fluctuations over brief periods. However, navigating the fast-paced world of short-term trading requires a solid understanding of market dynamics, technical analysis, and risk management. In this beginner’s guide, we’ll delve into the essentials of mastering the art of short-term crypto trading.

Introduction to Short-Term Crypto Trading

Short-term trading involves buying and selling assets within a relatively short time frame, typically ranging from minutes to days. Unlike long-term investing, which focuses on the fundamental value of an asset over time, short-term trading relies on exploiting short-term price movements for profit. While short-term trading can offer quick returns, it also comes with higher levels of risk due to increased volatility.

Setting Up Your Trading Environment

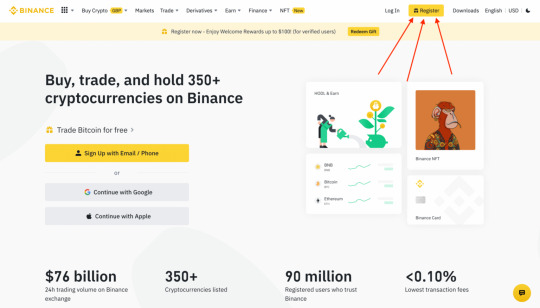

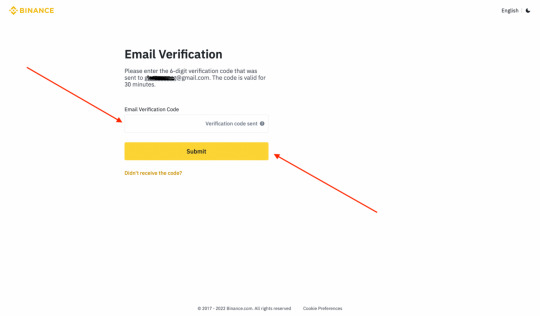

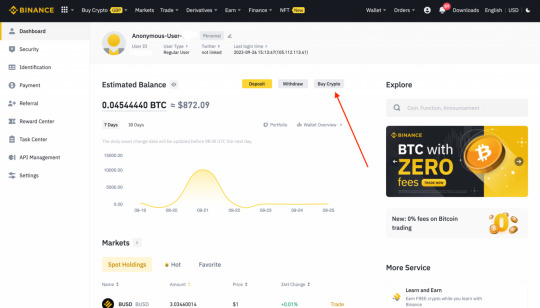

Before diving into short-term crypto trading, it’s crucial to establish a conducive trading environment. Start by choosing a reputable cryptocurrency exchange that offers a wide range of trading pairs and robust security features. Once you’ve selected an exchange, create a trading account and complete the necessary verification procedures. Additionally, familiarize yourself with the various trading tools and resources available, such as charting platforms, order types, and market analysis tools.

Understanding Market Analysis

Successful short-term trading requires a deep understanding of market analysis techniques. Technical analysis involves studying price charts and identifying patterns and indicators to predict future price movements. Fundamental analysis, on the other hand, focuses on evaluating the intrinsic value of an asset based on factors such as market demand, technology, and team expertise. Additionally, sentiment analysis involves gauging market sentiment through social media, news sentiment, and other indicators.

Developing a Trading Strategy

Having a well-defined trading strategy is essential for navigating the volatile crypto markets. Start by setting clear goals and objectives, such as profit targets and risk tolerance levels. Next, choose a trading style that aligns with your personality and risk appetite, whether it’s scalping, day trading, or swing trading. Implement robust risk management techniques, such as position sizing and diversification, to minimize potential losses.

Join our exclusive Four Candles Formula Master Class and unlock the secrets to profitable trading! Learn from industry experts and discover the strategies behind successful candlestick analysis. Don’t miss this opportunity to elevate your trading skills and achieve consistent results in the market. Enroll now to secure your spot and take the first step towards mastering the art of trading with confidence. ->See the course

Effective Entry and Exit Strategies

One of the keys to successful short-term trading is mastering entry and exit strategies. Identify optimal entry points based on your analysis of price patterns, support and resistance levels, and momentum indicators. Set stop-loss and take-profit levels to manage risk and lock in profits. Additionally, develop a clear plan for exiting trades, whether it’s based on predetermined targets or changing market conditions.

Managing Emotions and Psychology

Emotions play a significant role in short-term trading, often leading to impulsive decisions and irrational behavior. To succeed as a short-term trader, it’s essential to master your emotions and maintain a disciplined approach to trading. Avoid succumbing to fear and greed by sticking to your trading plan and avoiding emotional attachments to trades. Learn to accept both wins and losses as part of the trading process and focus on continuous improvement.

Continuous Learning and Adaptation

The cryptocurrency market is constantly evolving, with new trends, technologies, and regulations shaping its landscape. As a short-term trader, it’s crucial to stay informed and adapt to changing market conditions. Keep abreast of market trends and news that may impact your trading decisions. Moreover, leverage educational resources, such as online courses, webinars, and trading communities, to enhance your knowledge and skills.

Conclusion

Short-term crypto trading offers exciting opportunities for traders to capitalize on market volatility and generate profits within a short time frame. By mastering the art of short-term trading and developing a solid trading strategy, beginners can navigate the complexities of the crypto market with confidence. Remember to focus on continuous learning, risk management, and emotional discipline to succeed in the dynamic world of short-term crypto trading.

Join our exclusive Four Candles Formula Master Class and unlock the secrets to profitable trading! Learn from industry experts and discover the strategies behind successful candlestick analysis. Don’t miss this opportunity to elevate your trading skills and achieve consistent results in the market. Enroll now to secure your spot and take the first step towards mastering the art of trading with confidence. ->See the course

FAQs

Is short-term crypto trading suitable for beginners?

Short-term crypto trading can be challenging for beginners due to its fast-paced nature and higher risk levels. It’s essential to start with small investments and gradually build your skills and experience.

How much time do I need to dedicate to short-term trading?

The amount of time required for short-term trading depends on your trading style and strategy. Some traders may spend several hours a day analyzing markets and executing trades, while others may take a more passive approach.

What are some common mistakes to avoid in short-term crypto trading?

Common mistakes in short-term trading include overtrading, ignoring risk management principles, and letting emotions dictate trading decisions. It’s crucial to remain disciplined and stick to your trading plan.

Can I use automated trading bots for short-term crypto trading?

Automated trading bots can be useful tools for short-term trading, but they also come with risks. It’s essential to thoroughly research and test any trading bot before using it with real funds.

How can I stay updated on market trends and news relevant to short-term trading?

Stay informed by following reputable cryptocurrency news outlets, joining trading communities, and utilizing social media platforms to stay updated on market developments.

#Short Term Trading#Trading Guide#Bitcoin Trading Guide#Bitcoin Money#Trading Formula#binance#coinbase#earn money online#passive income#crypto news#crypto trading tools#ethereum

0 notes

Text

How to Set Up Your First Cryptocurrency Wallet

Entering the world of cryptocurrency is an exciting venture, offering the promise of financial independence, privacy, and a new way to engage with digital assets. However, before you can buy, sell, or trade any cryptocurrency, you need to know how to set up your first cryptocurrency wallet. This crucial step is the foundation for safely managing your digital currency, ensuring that your assets…

#Bitcoin#blockchain#blockchain security#crypto adoption#crypto beginners#crypto ecosystem#crypto education#crypto essentials#crypto guide#crypto investments#crypto management#crypto market#crypto privacy#crypto protection#crypto security#crypto setup#crypto storage#crypto tips#crypto tools#crypto trading#crypto transactions#crypto tutorial#crypto wallet#crypto world#cryptocurrency#decentralized finance#digital assets#digital currency#digital finance#digital money

0 notes

Text

10 Interesting Books About Bitcoin

Bitcoin, the pioneering cryptocurrency, has sparked a global financial revolution and inspired countless discussions about the future of money. Whether you’re a seasoned investor, a curious newcomer, or someone interested in the technological aspects of Bitcoin, there’s a wealth of literature available to deepen your understanding. Here are ten interesting books about Bitcoin that offer a…

View On WordPress

#Bitcoin#Bitcoin Adoption#Bitcoin Education#Bitcoin Guides#Bitcoin History#Bitcoin Investment#Bitcoin Market#Bitcoin Technology#Bitcoin Trading#Blockchain#Blockchain Applications#Blockchain Technology#Books About Bitcoin#Cryptoassets#Cryptocurrency#Digital Currency#Financial History#Investment Strategies#Technical Analysis

0 notes

Text

#P2p Trading#P2p Trading In India#P2p Platform In India#Guide To P2p Trading#Convert P2p To Inr#a2zcrypto#web3community#web3 development#bitcoin#web3 marketing#web3 technologies#web3 jobs#web3 social media#web3 gaming#web3 education

0 notes

Text

How to Make Money on Coinbase: A Simple Guide

Coinbase is a leading platform for buying, selling, and managing cryptocurrencies like Bitcoin and Ethereum. With millions of users worldwide, it’s a trusted choice for both beginners and experienced traders. Here’s how you can make money using Coinbase.

Why Use Coinbase?

Coinbase offers:

User-friendly interface: Ideal for newcomers.

Top-notch security: Advanced encryption and offline storage keep your assets safe.

Diverse earning methods: From trading to staking, there are plenty of ways to earn.

Ready to get started? Sign up on Coinbase now and explore all the earning opportunities.

Setting Up Your Coinbase Account

Sign up on Coinbase’s website and provide your details.

Verify your email by clicking the link sent to you.

Complete identity verification by uploading a valid ID.

Navigate the dashboard to track your portfolio, view live prices, and access the "Earn" section.

Ways to Make Money on Coinbase

1. Buying and Selling Cryptocurrencies

Start by buying popular cryptocurrencies like Bitcoin and Ethereum at a lower price and selling them when the price goes up. It’s the basic strategy for making profits through trading.

2. Staking for Passive Income

Staking allows you to earn rewards by holding certain cryptocurrencies. Coins like Ethereum and Algorand offer staking options on Coinbase. It’s a straightforward way to earn passive income.

Maximize your earnings—get started with Coinbase today and start staking your crypto.

3. Earning Interest

Coinbase lets you earn interest on some of your crypto holdings. Just hold these assets in your account, and watch your crypto grow over time.

Advanced Trading with Coinbase Pro

For those with more trading experience, Coinbase Pro provides lower fees and advanced trading tools. Learn how to trade efficiently using features like market charts, limit orders, and stop losses to enhance your profits.

Coinbase Earn: Learn and Earn

With Coinbase Earn, you can earn free cryptocurrency by learning about different projects. Watch educational videos and complete quizzes to receive crypto rewards—an easy way to diversify your holdings with no risk.

Coinbase Affiliate Program

Promote Coinbase using their affiliate program. Share your unique referral link (like this one: Earn commissions with Coinbase), and earn a commission when new users sign up and make their first trade. It’s a fantastic opportunity for bloggers, influencers, or anyone with an audience interested in crypto.

Want to boost your income? Join the Coinbase Affiliate Program now and start earning commissions.

Coinbase Referral Program

You can also invite friends to join Coinbase and both of you can earn bonuses when they complete a qualifying purchase. It’s a win-win situation that requires minimal effort.

Conclusion

Coinbase is an excellent platform for making money in the cryptocurrency world, offering various ways to earn through trading, staking, and affiliate marketing. Explore all its features to maximize your earnings.

Ready to dive in? Sign up today and start earning with Coinbase.

#coinbase#bitcoin#binance#ethereum#bitcoin news#crypto#crypto updates#blockchain#crypto news#make money on coinbase

504 notes

·

View notes

Text

bitcoin

pairing: chicken nuggets? I actually don't know

genre: NSFW (MDNI)

wc: ??

as you slowly gain consciousness in dark room tied to a chair. A tall, muscular man walks in and asks, "you're CaptainCrypto2817 arnt you?" realizing why you were here. about a week ago you were bragging on a Reddit thread that you made about 200k trading cryptocurrency. Was it true? ofc it fucking wasn't, you don't even know how to mine bitcoin. however, yeosang, you're handsome captor, thinking you have insider information about how to win big, opening his computer, pointing at the charts on the screen, looking at you

"either tell me what you know, or you're dead." slightly sweating you mumbled,

"I lied! I'm sorry I swear, I'll never do it again, I swear"

"you lied? to me? hmm... well you're gonna have to do something very special for me then, something very special..."

signalling for you to sit inbetween his thighs, by tapping on the ground with his leather shoes, you slowly crawling between them, keeping your head low,

“so, tell me why you lied?” you deciding not answer, his eyes rolling in response,

“Eyes up here liar”

pulling your face up, with an index finger to your chin. You looked at him with puppy eyes, trying to make him forgive you, but it all it did was make him want to dick you down

"I'm sorry I swear to go-"

“Prove it.” His face dropping “Make use of that tiny mouth of yours, to prove that you're sooooo sorry"

you quickly undid his belt, slid his pants and boxers off, and started to gently pump his cock as he staring down at you, god this was so humiliating, looking up at him as he finally got fully hard

your spit and his pre cum mixing, as you finally took him in your mouth, him taking a handful of your hair making you bob your head up and down.

“yeah, yeah, just like that”

continuing to guide you down his cock, forcing you to deepthroat him every once in a while,

“god... this proves lying little sluts give the best head hmm?” he groaned, looking at your tear stained cheeks, making him twitch in your mouth and buck into your mouth, finally cumming all over your face and into your gasping mouth, you quickly swallowed it as he stood up, pulling his underwear and pants up as he started walking on the room, stopping Infront of the small CCTV camera, tapping on the lens

"I'll definitely gonna watch this act again... see your soon, whore"

a/n: kicking my feet, I hope this was good

© yuyubeans 2024

#kang yeosang#yeosang#yeosang x y/n#yeosang x reader#yeosang x you#ateez yeosang#ateez scenarios#ateez mtl#ateez fanfiction#ateez atiny#ateez#ateez fluff#ateez hard hours#ateez reactions#ateez texts#areez smut

45 notes

·

View notes

Text

Can You Buy Crypto on Webull: A Complete Guide

#Cryptocurrency#Blockchain#Crypto Trading#Crypto News#Crypto Analysis#Bitcoin#Ethereum#Altcoins#DeFi (Decentralized Finance)#Crypto Investing#Crypto Education#Crypto Market Updates#Crypto Wallets#Crypto Security#ICO (Initial Coin Offering)#NFTs (Non-Fungible Tokens)#Crypto Regulations#Crypto Mining#Crypto Trends#Crypto Exchange Reviews

5 notes

·

View notes

Text

A Beginner's Guide to Cryptocurrency Sentiment Analysis for Maximizing Profits

Emotions are a natural aspect of existence, directing many of our decisions, whether as humans or in animals. These emotional choices don't always work out as planned, but they frequently have unanticipated consequences. Financial decisions that are driven by emotions can have serious repercussions, particularly in the cryptocurrency market. This blog examines the significance of sentiment research in cryptocurrency trading, demonstrating how monitoring public sentiments can provide traders with an advantage in a chaotic market.

Sentiment Analysis

Sentiment analysis is a computer approach for detecting and categorizing emotions and opinions conveyed in textual data. Using this method, one may parse text to ascertain if a message is positive, negative, or neutral.

Sentiment analysis helps in comprehending the views, attitudes, and responses of the public toward a range of subjects, goods, or occasions by examining and interpreting the emotional tone of written text. To obtain insights into consumer feelings and industry trends, it is commonly utilized in domains including financial analysis, social media monitoring, and market research.

Crypto-Related Sentiment Analysis

Sentiment research is essential for comprehending and forecasting market activity in the cryptocurrency space. This is how it's relevant:

News and Social Media Impact: Sentiment analysis monitors the voice of news stories, tweets, and forum comments to determine how the general population feels about cryptocurrency. This aids in determining the potential impact of current affairs and social media trends on market values.

Sentiment Indicators for the Market: Traders can discern bullish (positive) or bearish (negative) movements by assessing the general sentiment. An increase in favorable attitudes toward a cryptocurrency, for example, may portend an impending price increase.

Early Warning Signals: By examining abrupt alterations in public opinion or sentiment patterns, sentiment research can offer early alerts of impending market shifts or reversals.

Investor insights: By assessing the general sentiment of the market, traders and investors may make more informed judgments about their trading tactics.

How Sentiment Analysis Works in Crypto?

1. Data Sources for Sentiment Analysis

A. Social Media Platforms

These platforms provide a real-time gauge of popular sentiment. Sentiment research tools may detect trends early on and provide a clear picture of the market mood by examining posts, comments, and hashtags. Examples: Facebook, Twitter, Reddit.

B. News Sources:

Information about current affairs and events impacting the market may be found in reports and news articles. One approach to track how the public's perception of the present is evolving and how this is impacting market behavior is to keep an eye on the tone of news items. Websites featuring financial news and cryptocurrency news portals are two examples.

C. Community Conversations and Forums:

Forums and discussion boards can be used as a proxy for the community's atmosphere. They give a comprehensive examination of in-depth discussions and opinions from cryptocurrency enthusiasts, providing illuminating details on the overall mood of the market. The specialized Bitcoin forums CryptoCompare and Bitcointalk are two examples.

D. On-Chain Data for Market Trends:

On-chain data provides insight into the inner workings of the market. Sentiment research provides a more comprehensive understanding of market dynamics by revealing hidden trends and investor behaviors via the examination of transaction patterns and wallet movements. As an illustration: Blockchain data, transaction volumes, wallet activity.

2. Sentiment Indicators

A. Fear and Greed Index:

This index measures the amount of fear and greed in the market. It is a barometer of mood. It provides a quick glimpse into the psychology of the market by combining elements including volatility, market momentum, and emotion on social media. Severe anxiety or avarice frequently portends important shifts in the market.

B. Bullish/Bearish Sentiment Indicators:

These indicators measure the ratio of bullish (positive) to bearish (negative) sentiment. They provide hints for forecasting future price movements and market shifts and assist in determining whether the market is bought by optimism or burdened by pessimism.

Methods of Conducting Crypto Sentiment Analysis

Manual Sentiment Analysis: Hand-reading textual data from news articles, tweets, Reddit posts, and forums allows individuals to interpret sentiment, considering context and tone, providing nuanced understanding, and capturing subtleties that automated tools might miss.

Automated Sentiment Analysis: The tool uses Natural Language Processing and machine learning algorithms to analyze text data, categorize sentiment as positive, negative, or neutral, and is efficient, scalable, and consistent in applying sentiment rules.

Natural Language Processing (NLP): The AI branch enables interaction between computers and human language using Natural Language Processing (NLP) techniques to extract sentiment, identify patterns, and handle diverse linguistic styles, enhancing understanding.

Machine learning algorithms: Labeled datasets are used to train algorithms for sentiment classification, often using supervised learning techniques. These models can adapt and improve over time, delivering high accuracy with well-trained models.

Sentiment Analysis Tools and Platforms: Specialized software and platforms analyze sentiment data from various sources, providing dashboards and reports for market tracking. User-friendly interfaces and pre-built algorithms simplify sentiment analysis without technical expertise.

Is Sentiment Analysis the Key to Crypto Success?

Early Detection of Market Trends: Traders can predict market movements by using sentiment research to identify trends early on. Through the surveillance of public opinion on various platforms, traders may adopt calculated positions to optimize profits or minimize losses.

Enhanced Decision Making: Sentiment analysis enhances traditional analysis by providing insights into public opinion and behavior, adding a psychological dimension to market conditions. Combining sentiment with other methods allows traders to make informed decisions, with real-life case studies demonstrating its predictive power.

Risk Management: Sentiment analysis aids traders in avoiding emotional decisions influenced by hype or fear, enabling them to stay calm during market volatility, preventing impulsive actions that could lead to losses, as well as avoiding FOMO and other emotional trading pitfalls. Bottom Line

Let's take a look at Wagescoin (WGS), a cryptocurrency that rewards users for participating in activities and adding value to the network, to demonstrate how sentiment analysis may be used. Sentiment data about Wagescoin from social media, news, and forums may be analyzed to determine how people feel about the project as a whole, spot possible buy/sell opportunities, and make wise trading decisions.

Crypto sentiment research is a useful tool for identifying market trends and making sound trading decisions. Through the examination of public opinion on social media, news sites, and discussion boards, traders can learn more about the psychological factors influencing price fluctuations.

Sentiment analysis should not be used in isolation, even if it can supplement technical or fundamental research and offer early insights.

Traders should integrate sentiment insights with more comprehensive market data and research for the best outcomes. Sentiment research has the potential to improve strategic decision-making and aid in navigating the unstable cryptocurrency market when applied appropriately.

For More Info:

Website : https://wgscoin.com/

Telegram : https://t.me/wagescoin

TikTok : www.tiktok.com/@wagescoin

3 notes

·

View notes

Text

Crypto 101: Everything You Need to Know About Bitcoin and NFTs

Cryptocurrency and NFTs (Non-Fungible Tokens) have taken the world by storm, but for many, these concepts are still a mystery. Whether you're interested in investing, understanding blockchain technology, or simply curious about the digital revolution, this Crypto 101 guide breaks down everything you need to know about Bitcoin and NFTs—two of the most talked-about topics in the world of digital finance.

1. What is Bitcoin?

Bitcoin is the first decentralized digital currency created by an anonymous person (or group) known as Satoshi Nakamoto in 2009. Unlike traditional currencies issued by governments (like the US dollar or euro), Bitcoin operates on a peer-to-peer network and is not controlled by any central authority, such as a bank or government.

Key Features of Bitcoin:

Decentralized: Bitcoin transactions are verified by a network of computers (called "nodes") around the world, rather than a central bank.

Blockchain Technology: Bitcoin transactions are recorded on a public ledger called the blockchain, making it secure and transparent.

Limited Supply: There will only ever be 21 million bitcoins in existence, which helps create scarcity and can drive value.

Bitcoin can be used to buy goods and services, traded for other currencies, or held as an investment. Its value can fluctuate significantly, which has made it both an attractive investment and a high-risk asset.

2. How Does Bitcoin Work?

Bitcoin operates through blockchain technology, a decentralized system that records every transaction made with Bitcoin.

Mining: Bitcoin transactions are confirmed by miners, who use powerful computers to solve complex mathematical problems. Once a problem is solved, the miner adds the transaction to the blockchain, earning new bitcoins as a reward (this process is called "mining").

Wallets: To store Bitcoin, you need a crypto wallet, which is a software application that allows you to send, receive, and store your Bitcoin securely. Wallets use private and public keys—essentially digital passwords that protect your funds.

Security: Bitcoin transactions are secured using cryptography, which makes it difficult to counterfeit or reverse. Once a transaction is recorded on the blockchain, it is nearly impossible to alter.

3. What is an NFT?

NFTs (Non-Fungible Tokens) are unique digital assets stored on a blockchain. Unlike cryptocurrencies like Bitcoin or Ethereum (which are fungible, meaning each unit is identical), NFTs are non-fungible, meaning each one is distinct and cannot be replaced by another.

NFTs are used to represent ownership of digital art, music, videos, collectibles, and more. They have gained massive popularity in recent years, especially in the art world, where artists and creators can sell their work directly to buyers in digital form.

Key Features of NFTs:

Uniqueness: Each NFT has a unique digital signature that makes it one-of-a-kind. No two NFTs are exactly the same.

Ownership: When you purchase an NFT, you're purchasing a certificate of ownership for a specific digital asset. While the file itself (like a digital image) can be copied, the NFT proves that you own the original.

Smart Contracts: NFTs are often built on the Ethereum blockchain and use smart contracts—self-executing contracts with the terms directly written into the code. These smart contracts can include royalty payments to creators whenever the NFT is resold.

4. How Do NFTs Work?

NFTs are bought and sold on marketplaces like OpenSea, Rarible, and SuperRare. To buy an NFT, you'll need to set up a digital wallet and purchase cryptocurrency, usually Ethereum (ETH), as it’s the most widely used blockchain for NFTs.

Minting: This is the process of creating an NFT. When someone creates a digital piece of content (like art), they can "mint" it as an NFT on a blockchain, making it verifiably unique.

Buying & Selling: NFTs are bought and sold through auctions or fixed-price listings. When you buy an NFT, the ownership is transferred to your wallet.

Royalties: Many NFTs are programmed to pay creators royalties every time they are resold, providing a new revenue stream for artists and creators.

5. Why Are NFTs So Popular?

NFTs have exploded in popularity due to their ability to revolutionize the art, gaming, and entertainment industries. Here are a few reasons why NFTs are so attractive:

Digital Art Revolution: Artists now have a way to sell digital creations and ensure they retain ownership. Buyers can prove they own original works of art in the digital space.

Scarcity and Collectibility: NFTs provide a way to create digital scarcity, which makes items more collectible and valuable, much like rare trading cards or limited-edition merchandise.

Access & Community: NFTs often come with perks like access to exclusive content, events, or online communities, creating a sense of belonging and value for collectors.

6. Risks and Challenges of Bitcoin & NFTs

While both Bitcoin and NFTs offer exciting opportunities, they come with risks and challenges:

Bitcoin Risks:

Volatility: The value of Bitcoin can be highly volatile, meaning it can experience dramatic price swings in a short period.

Regulatory Uncertainty: Governments around the world are still figuring out how to regulate cryptocurrencies, which could impact their value and use.

Security: While Bitcoin transactions are secure, cryptocurrency exchanges and wallets can be vulnerable to hacking or fraud.

NFT Risks:

Speculation: Many NFT buyers are purchasing them as speculative investments, hoping to sell at a higher price later. This can create a bubble-like environment.

Environmental Impact: The energy consumption of the blockchain networks used to mint and trade NFTs (especially Ethereum) has raised concerns about their environmental footprint.

Value Uncertainty: Not all NFTs will hold their value over time, and some may become worthless if the market crashes or interest fades.

7. How to Get Started with Bitcoin & NFTs

For Bitcoin:Buy Bitcoin: You can buy Bitcoin on cryptocurrency exchanges like Coinbase, Binance, or Kraken using fiat currency (like USD).Store Bitcoin: Set up a digital wallet to securely store your Bitcoin. Popular wallets include Trust Wallet and Ledger.Start Small: If you're new to Bitcoin, consider starting with a small investment and learning about the technology as you go.

For NFTs:Set Up a Digital Wallet: You'll need a wallet that supports Ethereum (e.g., MetaMask or Coinbase Wallet).Purchase Ethereum: Buy Ethereum on an exchange like Coinbase or Gemini and transfer it to your wallet.Browse Marketplaces: Explore NFT marketplaces like OpenSea or Rarible to find NFTs you're interested in. Ensure you’re comfortable with the market and potential risks before making a purchase.

Conclusion: The Future of Crypto and NFTs

Bitcoin and NFTs are reshaping the digital landscape in 2024, providing new ways to invest, create, and interact with digital assets. Whether you’re drawn to Bitcoin’s potential as a digital store of value or intrigued by the world of NFTs and digital ownership, both offer unique opportunities in the evolving world of cryptocurrency.

Remember to approach both Bitcoin and NFTs with caution, do your research, and only invest what you can afford to lose. The crypto world is still relatively new, and its volatility makes it crucial to stay informed and educated.

Ready to dive into the world of Bitcoin and NFTs? Start by exploring, experimenting, and staying curious about the potential of this exciting digital frontier! Do You Know KVR?

Hashtags: #Crypto101 #Bitcoin #NFTs #Blockchain #Cryptocurrency #DigitalAssets #BitcoinInvesting #NFTCommunity #Ethereum #CryptoRevolution

#Crypto101#Bitcoin#NFTs#Blockchain#Cryptocurrency#DigitalAssets#BitcoinInvesting#NFTCommunity#Ethereum#CryptoRevolution

2 notes

·

View notes

Text

Complete Guide to Cash App Bitcoin (BTC) Withdrawal Limit

Bitcoin (BTC) trading has grown exponentially, with Cash App emerging as one of the most convenient and popular platforms to buy, sell, and withdraw BTC. However, for users dealing with high volumes of BTC, understanding Cash App’s Bitcoin withdrawal limits is essential for a smooth experience. This guide offers a deep dive into the BTC withdrawal limits on Cash App, how to manage these limits, and best practices to maximize your Cash App account for BTC transactions.

What is the Cash App Bitcoin (BTC) Withdrawal Limit?

Cash App imposes specific limits on Bitcoin withdrawals to ensure security and manage platform capacity effectively. For standard users, Cash App currently limits BTC withdrawals to $2,000 worth of Bitcoin per day and up to $5,000 per week. These limits may vary slightly depending on account status, identity verification level, and Cash App’s policies.

Why Does Cash App Have BTC Withdrawal Limits?

Withdrawal limits are a security measure. Cash App limits BTC transactions to protect accounts from unauthorized activities and minimize risks associated with high-frequency transactions. Users can benefit from enhanced security while still accessing the ability to buy, sell, and withdraw BTC within these set thresholds.

How to Check Your Cash App Bitcoin Withdrawal Limits

Cash App allows users to view their current BTC withdrawal limits within the app. follow these steps to access this information:

Open Cash App on your mobile device.

Navigate to the “Bitcoin” tab on the home screen.

Select “Withdraw Bitcoin” – you’ll see your daily and weekly withdrawal limits listed here.

These limits are standard for verified users, but Cash App may update these values periodically.

How to Increase Your Bitcoin Withdrawal Limits on Cash App

For users looking to increase Cash App BTC withdrawal capacity, Cash App offers a straightforward way to verify your account and access higher limits:

Verify Your Identity: Cash App requires you to complete identity verification for any increase in BTC limits. This process typically involves submitting a government-issued ID and a selfie.

Verify Your Bitcoin Address: Ensuring that the BTC address you use for withdrawals is confirmed and secure can help prevent potential issues and establish a trusted withdrawal pattern.

After completing these steps, Cash App reviews your information, and eligible users may see a significant increase in their BTC withdrawal limits.

Steps to Complete Cash App Identity Verification

Open Cash App and tap on your profile icon.

Select Personal Information and fill in the required fields.

Upload a government-issued ID and submit a real-time selfie.

Cash App usually processes these details within 24–48 hours.

Once verified, you should receive a confirmation message indicating any updates to your BTC withdrawal limit.

Understanding Cash App’s Verification Levels for BTC Withdrawals

Cash App’s BTC withdrawal limit varies by account status. Here’s a breakdown of limits based on Cash App’s verification levels:

Unverified Users: Limited access to BTC trading and capped at lower withdrawal limits.

Verified Users: Standard daily and weekly BTC withdrawal limits apply.

Enhanced Verification: Some high-frequency users or those with additional verification may be eligible for customized limits.

How to Withdraw Bitcoin on Cash App

To withdraw Bitcoin from Cash App to an external wallet:

Go to the Bitcoin tab within the app.

Select “Withdraw Bitcoin” and enter the amount you wish to transfer.

Input your BTC wallet address or scan a wallet QR code.

Review the details and confirm the withdrawal.

Bitcoin transfers can take from a few minutes up to an hour depending on network congestion. Cash App will provide a confirmation once the BTC is sent.

Are There Fees Associated with Cash App Bitcoin Withdrawals?

Yes, Cash App charges fees for Bitcoin withdrawals. These fees can vary based on network activity and market conditions. Cash App provides the fee estimate before completing the transaction. Users are encouraged to review fee rates during times of high network traffic as fees may temporarily increase.

How to Calculate Cash App BTC Withdrawal Fees

Fixed Transaction Fee: This is the fee Cash App charges on every BTC withdrawal transaction, regardless of the amount.

Variable Network Fee: This fee fluctuates based on blockchain network demand. High demand leads to higher fees.

Users can view the specific fee amount for each transaction in the app. If you’re aiming to save on fees, consider transferring during off-peak network hours.

BTC Withdrawal Limit FAQ

1. Can I Withdraw More Than My BTC Limit on Cash App?

Currently, Cash App does not allow withdrawals beyond the specified limit. To send larger amounts of BTC, you may need to split transactions over multiple days or weeks.

2. How Long Does it Take for BTC to Withdraw from Cash App?

Once a withdrawal request is made, Cash App processes BTC transactions quickly, usually within a few minutes to an hour. Processing time may increase during high-demand periods.

3. Are Cash App BTC Withdrawal Limits the Same for All Users?

No, BTC limits can vary based on user verification level. Verified users can enjoy higher limits, while unverified accounts have restricted BTC withdrawal capabilities.

4. Is There a Limit to the Number of BTC Withdrawals I Can Make on Cash App?

While there’s no limit on the number of withdrawals, the daily and weekly amount is capped. Users must adhere to these limits.

5. Can I Increase My BTC Withdrawal Limit Temporarily?

Currently, there’s no option to temporarily increase BTC withdrawal limits on Cash App. However, verification may unlock higher transaction thresholds over time.

Best Practices for Managing Cash App BTC Withdrawals

Managing BTC transactions on Cash App effectively can save you both time and money:

Plan BTC Withdrawals: Given the limits, plan large transactions in advance to avoid hitting the cap unexpectedly.

Check Fees: BTC fees can vary significantly. Be mindful of withdrawal costs, especially during times of high network activity.

Ensure Accurate Wallet Addresses: Always double-check the BTC wallet address you’re sending to. Mistakes can result in lost funds.

Stay Informed on Limit Changes: Cash App periodically updates its policies and may adjust withdrawal limits. Keeping up with these changes helps ensure smooth BTC transactions.

Conclusion

Navigating the Cash App Bitcoin withdrawal limit is straightforward when users understand the platform’s policies and limits. By verifying accounts and following best practices, users can maximize their experience on Cash App, enjoying secure and effective BTC transactions. For those needing larger capacities, enhancing account verification can unlock higher BTC withdrawal thresholds.

2 notes

·

View notes

Text

What Time Does the Weekly Bitcoin Withdrawal Limit Reset on Cash App?

Cryptocurrency has become increasingly accessible through platforms like Cash App, which allows users to buy, sell, and withdraw Bitcoin with ease. However, as convenient as Cash App is for handling Bitcoin transactions, it comes with specific limits, such as a maximum weekly withdrawal cap. These limits are crucial for ensuring account security and regulatory compliance, but they can also leave users wondering about the timing of their next available transaction.

One of the most common questions users have is when does Cash App weekly Bitcoin withdrawal limit reset?

This question is essential, especially for those who frequently transfer Bitcoin to external wallets—understanding how and when the withdrawal limits reset can help you plan your transactions better and avoid hitting your limit unexpectedly. In this comprehensive guide, we will dive deep into the details of the Cash App Bitcoin withdrawal limit reset, how the reset process works, and strategies to increase your withdrawal limit. We'll also answer some frequently asked questions about the withdrawal limits and provide actionable tips for managing them more efficiently.

Understanding the Cash App Bitcoin Withdrawal Limit

Before we discuss the specifics of the limit reset, it's essential to know how the Cash App Bitcoin withdrawal limits are structured. Cash App restricts how much Bitcoin users can withdraw over a specific time period to ensure the platform operates securely and complies with legal requirements.

What Is the Cash App Bitcoin Weekly Withdrawal Limit?

As of 2024, the Cash App Bitcoin weekly withdrawal limit is set at approximately $5,000 worth of Bitcoin. This limit applies to transactions involving withdrawals from your Cash App account to an external Bitcoin wallet. The limit is based on the value of Bitcoin at the time of the withdrawal, meaning fluctuations in Bitcoin's price could affect how much you can actually transfer within a week.

This weekly limit is significant for those who actively trade Bitcoin or need to move large amounts of cryptocurrency for investment purposes.

What Is the Cash App Bitcoin Daily Withdrawal Limit?

In addition to the weekly cap, there is also a daily Bitcoin withdrawal limit. The Cash App Bitcoin withdrawal limit per day is around $2,000 worth of Bitcoin. This means that even though you might still have some room within your weekly limit, you cannot exceed the daily cap. If you attempt to withdraw more than this limit in a single day, you'll need to wait until the limit resets before making another transaction.

When Does the Cash App Bitcoin Withdrawal Limit Reset?

Now, let's address the primary question: When will the Cash App Bitcoin withdrawal limit be reset?

Cash App Bitcoin Weekly Limit Reset

The weekly Bitcoin withdrawal limit on Cash App operates on a rolling 7-day basis. This means that the limit resets precisely seven days after each transaction. For instance, if you withdraw $1,000 worth of Bitcoin on a Monday, that $1,000 will be credited back to your available limit the following Monday. If you make another withdrawal of $2,000 on Wednesday, that amount will be available again the following Wednesday.

It's important to note that the weekly limit does not reset on a specific day of the week (e.g., Sunday or Monday). Instead, it resets precisely one week from the time you made each withdrawal.

How to Track Your Withdrawal Reset?

Due to this rolling system, tracking your available withdrawal amount and knowing when your limit will reset can be a bit tricky. Thankfully, the Cash App makes it relatively easy to monitor your withdrawals. In your Cash App account, you can view your transaction history and see how much Bitcoin you've withdrawn and how much of your limit remains. By checking this regularly, you can stay on top of when each part of your limit will reset.

How to Increase Your Cash App Bitcoin Withdrawal Limit

For some users, more than the default Cash App Bitcoin withdrawal limit might be required, especially for those who handle large amounts of cryptocurrency or need to move Bitcoin frequently. Fortunately, there are steps you can take to increase Cash App Bitcoin withdrawal limit:

Steps to Increase Your Cash App Bitcoin Withdrawal Limit

Complete Account Verification: The primary way to increase your withdrawal limit is by verifying your account. Cash App will ask for additional information, including your full name, date of birth, and the last four digits of your Social Security Number (SSN). This process helps the platform comply with regulatory requirements and ensures your account's security.

Provide Additional Information: In some cases, Cash App may request additional documents, such as a photo ID, to verify your identity further. This additional layer of verification can result in a higher Bitcoin withdrawal limit.

Request an Increase via Support: If your account is verified but you still need a higher limit, contacting Cash App support can be helpful. They may be able to offer advice or further assist you with raising your limit.

Keep in mind that there is no guarantee your limit will increase automatically, as approval is based on factors like account activity and Cash App's discretion.

Daily vs. Weekly Bitcoin Withdrawal Limits on Cash App

Understanding the difference between the daily and weekly limits is essential, especially if you're making multiple transactions in a short period.

Daily Limit: You can withdraw up to $2,000 worth of Bitcoin per day. Once you hit this cap, you must wait 24 hours from the time of the last transaction for the limit to reset.

Weekly Limit: The $5,000 weekly cap is on a rolling basis, so it's essential to track when each transaction was made to know when that portion of your limit will reset.

Troubleshooting: Why Is My Cash App Bitcoin Withdrawal Limit Not Resetting?

If you're expecting your Cash App Bitcoin withdrawal limit to reset, but it hasn't, there are a few things to consider:

Rolling Limit Confusion: Keep in mind that the limit resets precisely seven days after each transaction. If you're not seeing the reset, it could be that you're looking too early. For example, if you made a withdrawal at 8 p.m. last week, the limit will only reset at 8 p.m. this week.

Technical Issues: If you've waited for the appropriate time and your limit still hasn't reset, there may be a technical issue. In this case, you may need to contact Cash App support for assistance.

Exceeded Daily Limit: Remember that even if your weekly limit has reset, you still need to be mindful of the daily cap. If you've hit the daily $2,000 limit, you'll need to wait 24 hours before you can make another withdrawal.

FAQs: Cash App Bitcoin Withdrawal Limit Reset

1. When Does the Cash App Bitcoin Withdrawal Limit Reset?

The Cash App Bitcoin withdrawal limit resets on a rolling 7-day basis. This means that each transaction you make will reset seven days after the time of the original withdrawal.

2. When Does the Cash App Weekly Limit Reset?

The Cash App weekly limit reset individually for each transaction on a rolling basis, precisely seven days after each withdrawal.

3. Can I Increase My Cash App Bitcoin Withdrawal Limit?

Yes, you can request for a Cash App Bitcoin withdrawal limit increase by verifying your identity. This involves providing personal information and, in some cases, additional documents.

4. What Is the Cash App Bitcoin Daily Withdrawal Limit?

The daily Bitcoin withdrawal limit on Cash App is approximately $2,000 worth of Bitcoin per day.

5. What Happens If I Reach My Weekly Bitcoin Withdrawal Limit?

If you reach your weekly Bitcoin withdrawal limit, you'll need to wait for each transaction to reset seven days later before making additional withdrawals.

6. Why Is My Cash App Bitcoin Withdrawal Limit Not Resetting?

Your limit may still need to reset due to the rolling nature of the reset system. Each transaction will reset precisely seven days after it was made. If your limit isn't resetting as expected, contact Cash App support for further assistance.

Conclusion

Understanding the Cash App Bitcoin withdrawal limit reset process is vital for anyone who regularly handles cryptocurrency on the platform. The weekly limit operates on a rolling 7-day schedule, so it's essential to track your withdrawals carefully to know when each portion of your limit becomes available again. If you need a higher limit, verifying your account and requesting an increase can help.

By staying informed and keeping a close eye on your account activity, you can make the most of Cash App's Bitcoin features and avoid any interruptions to your cryptocurrency transactions.

#cash app bitcoin withdrawal limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin withdrawal limit#cash app bitcoin withdrawal pending#cash app bitcoin withdrawal not working

2 notes

·

View notes

Text

Understanding Cash App's Weekly Bitcoin Withdrawal Limits

In the world of cryptocurrency, convenience, and accessibility are key factors for users who wish to manage their digital assets efficiently. Cash App, a popular financial services platform, has quickly become one of the go-to apps for both sending money and buying Bitcoin. However, many users face a common question: What is the Cash App Bitcoin withdrawal limit?

Understanding these limits is essential for effectively managing your cryptocurrency. Whether you're trading Bitcoin regularly or just making occasional transactions, knowing the withdrawal restrictions can help avoid surprises. In this comprehensive guide, we'll explore the Cash App Bitcoin withdrawal limit, how it works, and tips to increase your withdrawal limit if necessary. We'll also address some common concerns, such as resetting your limit, troubleshooting withdrawal issues, and more. So, if you're wondering how much Bitcoin you can withdraw on Cash App weekly, keep reading!

Understanding the Cash App Bitcoin Withdrawal Limit

Like many other platforms that handle cryptocurrency transactions, Cash App has implemented specific withdrawal limits for Bitcoin to ensure both security and compliance with financial regulations. The Cash App Bitcoin withdrawal limit is an essential aspect for users to consider, especially those who regularly engage in cryptocurrency transactions.

What Is the Cash App Bitcoin Withdrawal Limit?

As of 2024, the Cash App Bitcoin weekly withdrawal limit is approximately $5,000 worth of Bitcoin. This limit applies to Bitcoin withdrawals to an external wallet and is calculated based on the value of Bitcoin at the time of the transaction. The weekly withdrawal limit is set to protect users and the platform from potential fraud or misuse of accounts.

This limit is critical for those who use Cash App as their primary means of buying and transferring Bitcoin. Suppose you're someone who needs to move larger amounts of Bitcoin for investments, trading, or other purposes. In that case, it's important to plan your withdrawals to ensure you stay within the limit.

Breaking Down the Bitcoin Withdrawal Limits on Cash App

Now that we've addressed the basics let's take a closer look at how Cash App's Bitcoin withdrawal limits work on a daily, weekly, and monthly basis.

1. Cash App Bitcoin Daily Withdrawal Limit

While the weekly limit is the most commonly discussed, it's also essential to understand how Cash App handles Bitcoin withdrawals on a daily basis. The Cash App Bitcoin daily limit typically allows up to $2,000 worth of Bitcoin per day. This means that if you need to make frequent withdrawals, you'll need to keep track of both the daily and weekly limits.

2. Cash App Bitcoin Weekly Withdrawal Limit

The weekly withdrawal limit for Bitcoin on Cash App is currently set at $5,000, as mentioned earlier. This limit applies to a rolling seven-day period, meaning that if you withdraw $2,000 worth of Bitcoin on a Monday, you would have $3,000 remaining in your weekly limit until the following Monday.

3. Cash App Bitcoin Monthly Withdrawal Limit

Although Cash App does not explicitly state a monthly Bitcoin withdrawal limit, the weekly and daily limits generally suffice for most users. However, if you are a high-volume trader or need to withdraw large amounts of Bitcoin regularly, you might hit these weekly and daily caps more frequently. In such cases, it is advisable to track your withdrawals closely.

How to Increase Your Cash App Bitcoin Withdrawal Limit?

If you find that the Cash App Bitcoin withdrawal limit is too restrictive for your needs, you might wonder if you can request a higher limit. Fortunately, the Cash App provides a way to request a higher withdrawal limit for Bitcoin.

How Can I Increase My Cash App Bitcoin Withdrawal Limit?

Increasing your Cash App Bitcoin withdrawal limit typically involves verifying your account. To do this, you'll need to provide additional personal information such as your full name, date of birth, and the last four digits of your Social Security Number. This process is designed to confirm your identity and ensure compliance with financial regulations.

Once your account is verified, you may see an increase in your withdrawal limits. Keep in mind that approval for higher limits is not guaranteed and may depend on factors such as your account activity, transaction history, and adherence to Cash App's terms of service.

Why Is My Cash App Bitcoin Withdrawal Limit Not Increasing?

If you've gone through the verification process and your Cash App Bitcoin withdrawal limit is not increasing, there could be several reasons for this:

Your account verification is still under review.

You've reached the maximum allowable limit based on your account activity.

There may be compliance issues that need to be resolved.

If you're having trouble increasing your withdrawal limit, it's advisable to contact Cash App support for further assistance.

Cash App Bitcoin Withdrawal Limit Reset: What You Need to Know?

Another critical aspect to consider is the Cash App Bitcoin withdrawal limit reset. Many users wonder when their withdrawal limit resets and how they can manage their withdrawals effectively.

When Does the Cash App Bitcoin Daily Limit Reset?

The Cash App Bitcoin daily limit resets every 24 hours, typically based on the time of your first transaction of the day. If you make a Bitcoin withdrawal at 2 p.m. on a Monday, your daily limit will reset 24 hours later, at 2 p.m. on Tuesday.

What Time Does the Cash App Bitcoin Weekly Limit Reset?

The weekly limit for Cash App Bitcoin withdrawals reset on a rolling basis. This means that your weekly limit will reset seven days after each transaction. For example, if you withdraw $2,000 worth of Bitcoin on a Thursday, that amount will be added back to your limit the following Thursday.

This rolling reset feature can sometimes make it challenging to track your available withdrawal amount, so it's essential to keep a close eye on your transaction history.

Common Issues: Cash App Bitcoin Withdrawal Not Working

Some users experience issues with withdrawing Bitcoin on the Cash App. If you find that your Cash App Bitcoin withdrawal is not working, it could be due to several reasons.

Why Is My Cash App Bitcoin Withdrawal Not Enabled?

If you see a message that your Cash App Bitcoin withdrawal is not enabled, it's usually because you still need to verify your account fully. In order to withdraw Bitcoin, the Cash App requires that your identity is verified to ensure compliance with regulatory standards.

FAQs: Cash App Bitcoin Withdrawal Limit

1. Can I Increase My Cash App Bitcoin Withdrawal Limit?

Yes, you can request an increase in your Bitcoin withdrawal limit by verifying your account with additional information. Approval depends on factors such as account activity and transaction history.

2. How Much Is the Cash App Bitcoin Withdrawal Limit?

As of 2024, the Cash App Bitcoin withdrawal limit is approximately $5,000 worth of Bitcoin per week and $2,000 worth of Bitcoin per day.

3. When Does the Cash App Bitcoin Daily Limit Reset?

The Cash App Bitcoin daily limit resets 24 hours after your first Bitcoin withdrawal of the day.

4. What Is the Cash App Bitcoin Weekly Limit Reset?

The weekly limit resets on a rolling basis, seven days after each transaction.

5. Why Is My Cash App Bitcoin Withdrawal Not Enabled?

Your Bitcoin withdrawal may not be enabled because your account has yet to be fully verified. Ensure that you've completed the account verification process to allow Bitcoin to withdraw.

Conclusion

Understanding the Cash App Bitcoin withdrawal limit is crucial for managing your cryptocurrency transactions effectively. Whether you're making frequent withdrawals or just transferring Bitcoin occasionally, knowing the daily and weekly limits can help you avoid any surprises. If the current limits don't suit your needs, there are steps you can take to request an increase. By staying informed and proactive, you can make the most of Cash App's Bitcoin features and enjoy a smooth crypto experience.

#cash app bitcoin withdrawal limit#cash app bitcoin withdrawal limit reset#increase cash app bitcoin withdrawal limit#cash app bitcoin withdrawal pending#cash app bitcoin withdrawal not working

2 notes

·

View notes

Text

Can Your Bitcoin Address Change on Cash App? Tips for Managing Your Wallet

As cryptocurrencies grow in popularity, platforms like Cash App have made it easier for everyday users to buy, sell, and send Bitcoin. Whether you’re new to crypto or a seasoned investor, you may have noticed that Cash App assigns you a unique Bitcoin wallet address. But what happens if you need a different address or wish to know whether a Cash App Bitcoin wallet address change is possible?

In this guide, we’ll take a deep dive into how the Cash App Bitcoin wallet works, whether you can change your Bitcoin address, and some essential tips for managing your Bitcoin transactions on the platform. We’ll also answer common questions about Bitcoin addresses on Cash App to help you understand how to keep your funds safe and transactions smooth.

Introduction: How Bitcoin Addresses Work on Cash App?

Cash App isn’t just a mobile payment app—it also offers crypto trading features, allowing users to send, receive, and store Bitcoin directly within the app. When you create a Bitcoin wallet on Cash App, the platform assigns a unique Bitcoin wallet address. This address acts like a digital identifier for your wallet, enabling other users or platforms to send Bitcoin to your account safely.

However, users often have questions about whether their Bitcoin address can be changed. Perhaps you are concerned about privacy, wondering if your wallet can have a new address to limit exposure of past transactions. Or maybe you want to reset the address for security reasons. This blog will explore how Bitcoin addresses on Cash App function and if you can request a Bitcoin wallet address change within the app.

Can I Change My Bitcoin Address on Cash App?

The answer to the question “Can I change my Bitcoin address on Cash App?” lies in how Bitcoin wallets are designed. Cash App automatically assigns a new Bitcoin address periodically for security reasons. So, the good news is that you don’t need to manually change your Bitcoin address because Cash App will provide new addresses on your behalf over time.

Bitcoin addresses on Cash App function similarly to how Bitcoin addresses work on most crypto platforms:

You can receive Bitcoin using the latest address assigned to your account.

Your previous Bitcoin addresses remain valid—so even if your address changes, funds sent to old addresses will still arrive in your wallet.

The platform may issue a new address whenever you perform certain activities, such as requesting a deposit address.

This dynamic address system ensures enhanced privacy for users by making it difficult for outsiders to trace a user’s entire transaction history based on one address.

How to View or Use Your Bitcoin Address on Cash App

If you’re using Cash App for Bitcoin transactions, it’s essential to know how to access your wallet address. Here’s how to find new Bitcoin wallet address on Cash App:

Open the Cash App on your phone.

Tap the Bitcoin (₿) icon at the bottom of the screen.

Select Deposit Bitcoin to display your current Bitcoin wallet address.

You’ll see both the alphanumeric address and a QR code that others can scan to send Bitcoin to your wallet.

This address can be used to receive Bitcoin from other wallets or platforms. Even though Cash App periodically updates your Bitcoin address, older addresses assigned to your account will still function for incoming transactions.

Why Does Cash App Change Bitcoin Addresses?

There are several reasons why Cash App assigns new Bitcoin addresses periodically. These changes are designed to enhance the security and privacy of your transactions:

Privacy Protection: Bitcoin addresses are public, meaning anyone can see all transactions associated with an address on the blockchain. By issuing new addresses periodically, Cash App helps prevent someone from easily tracking all your activity.

Security Enhancements: Using the same Bitcoin address repeatedly increases the chances of it being linked to fraudulent activities. Regular address changes lower these risks.

Compliance with Blockchain Standards: Bitcoin networks encourage wallet providers to use hierarchical deterministic (HD) wallets, which generate multiple addresses under a single wallet to enhance user security.

This automatic address update ensures that you don’t need to worry about changing your Bitcoin wallet address manually.

Can You Request a Specific Bitcoin Address Change?

Although Cash App generates new Bitcoin addresses regularly, there is no manual option for users to change the address on demand. The system is designed to automate this process, ensuring that each user’s account remains secure and compliant with blockchain standards.

If you have concerns about a previous Bitcoin address being compromised, you can still use the newest address generated by Cash App for future transactions. However, your old addresses will continue to receive Bitcoin without any issues.

Managing Multiple Bitcoin Transactions on Cash App

You don’t need to worry about managing different addresses yourself, as all Bitcoin received via old and new addresses will reflect in your Cash App Bitcoin balance. Here are some useful tips for seamless Bitcoin transactions on Cash App:

Use the latest Bitcoin address whenever requesting deposits from another wallet or exchange for added security.

Keep track of transaction confirmations on the Bitcoin blockchain to monitor the status of your incoming funds.

Make sure to verify the amount and recipient address before sending Bitcoin, as transactions on the blockchain are irreversible.

What Happens if You Share an Old Bitcoin Address?

If you’ve already shared an older Bitcoin address with someone, there’s no need to worry. Bitcoin sent to any valid address associated with your Cash App wallet will still arrive safely in your account.

Unlike some traditional payment systems, the blockchain ensures that all past addresses remain valid indefinitely, so even if your address changes, older ones will still work for receiving funds.

FAQ

Can I change my Bitcoin address on Cash App manually?

No, Cash App does not allow users to manually change their Bitcoin address. However, the platform periodically generates new addresses for your wallet to enhance security and privacy.

How often does Cash App change Bitcoin addresses?

There is no fixed schedule for Bitcoin address changes. Cash App issues new addresses automatically when needed, such as when you request a new deposit address.

Will my old Bitcoin address still work after a new one is assigned?

Yes, all old Bitcoin addresses linked to your Cash App wallet will remain valid and functional. Funds sent to any previous address will still arrive in your Bitcoin balance.

How do I find my Bitcoin wallet address on the Cash App?

To view Cash App Bitcoin wallet address, open the Cash App, tap the Bitcoin (₿) icon, and select Deposit Bitcoin. You’ll see your current address and QR code for deposits.

Why does the Cash App change Bitcoin addresses periodically?

Cash App updates Bitcoin addresses to protect user privacy, enhance security, and comply with blockchain best practices. Regular address changes prevent others from tracking your entire transaction history.

Can I have multiple Bitcoin addresses on Cash App?

Yes, Cash App assigns multiple addresses over time, but you don’t need to manage them separately. All addresses remain linked to your Bitcoin wallet and can receive funds.

#does cash app bitcoin address change#cash app bitcoin address change#how to change does cash app bitcoin address#how to get new cash app bitcoin address

2 notes

·

View notes

Text

Is it Legal to Buy Crypto in Bangladesh?

Cryptocurrencies have gained global traction in recent years, but their legal status varies significantly from one country to another. In Bangladesh, the question of legality regarding cryptocurrency is a topic of considerable debate and interest among enthusiasts and potential investors. This article will dive into the current legal framework for cryptocurrencies in Bangladesh, discuss the risks and benefits, and explore the future outlook for crypto in the country.

1. Understanding Cryptocurrency: A Brief Overview

Cryptocurrencies, such as Bitcoin and Ethereum, are digital or virtual forms of money that operate on blockchain technology. Unlike traditional currencies, cryptocurrencies are decentralized, meaning they are not controlled by any central authority, such as a government or bank. They offer various advantages, including lower transaction fees, faster transfers, and the potential for investment growth. However, the decentralized nature of cryptocurrencies also presents challenges regarding regulation and legal oversight.

Read More :

What is Staking in Cryptocurrency? A Beginner’s Guide

Top 10 Upcoming Cryptocurrency Trends in 2024

How to Avoid Common Cryptocurrency Scams

2. The Legal Status of Cryptocurrency Globally

Across the globe, cryptocurrency laws differ significantly, with countries adopting a range of approaches. For instance:

The United States has taken a generally positive stance, allowing crypto trading and taxation on profits.

Japan was one of the first countries to recognize Bitcoin as legal tender and has a well-developed regulatory framework for cryptocurrencies.

China, on the other hand, has implemented a complete ban on all crypto-related activities, including mining and trading.

The global stance on cryptocurrency often influences other countries, as governments assess both the risks and potential benefits associated with digital assets.

3. History of Cryptocurrency in Bangladesh

Government Stance and Regulations

In Bangladesh, the regulatory environment around cryptocurrency has historically been restrictive. The Bangladeshi government and the Bangladesh Bank have issued warnings and statements advising citizens against using or trading cryptocurrencies. As early as 2014, Bangladesh Bank declared that using Bitcoin or any other cryptocurrency was not only discouraged but could result in criminal prosecution.

Key Events and Milestones

Several events have shaped Bangladesh’s crypto landscape:

In 2014, the Bangladesh Bank issued a statement clarifying its position against Bitcoin, mentioning that using crypto could lead to fines or imprisonment.

Over the years, Bangladesh’s government has taken action against crypto traders, emphasizing the risks of money laundering and financing of terrorism.

Despite these restrictions, there remains a growing interest in crypto among Bangladeshis, many of whom continue to invest in and trade cryptocurrencies through various means.

4. Current Legal Framework in Bangladesh

Central Bank’s Role and Statements

The Bangladesh Bank is the primary financial regulatory authority in Bangladesh and has taken a strong stance against cryptocurrencies. According to the bank, cryptocurrencies are not recognized as legal tender, and the trading of these digital assets may violate existing anti-money laundering laws.

The Bank has cited concerns such as:

Risk of Fraud: The unregulated nature of crypto makes it susceptible to scams.

Money Laundering: Due to its anonymity, cryptocurrency transactions may facilitate illegal activities.

Anti-Money Laundering Laws

Bangladesh has stringent anti-money laundering (AML) and anti-terrorism financing (ATF) laws, which apply to all forms of financial transactions. The government has pointed out that cryptocurrency’s anonymous and decentralized nature poses risks in terms of enforcing these regulations.

5. Risks of Buying Cryptocurrency in Bangladesh

Legal Risks

Given the current legal framework, buying cryptocurrency in Bangladesh carries significant legal risks. Individuals caught trading or holding crypto could face penalties, including fines or jail time, as the government views it as a violation of foreign exchange laws and AML regulations.

Financial Risks

Even if legal risks are set aside, cryptocurrency trading comes with financial risks. The crypto market is highly volatile, meaning that values can fluctuate wildly. This unpredictability, coupled with the legal environment in Bangladesh, makes crypto investments particularly precarious for Bangladeshi citizens.

6. Potential Benefits of Cryptocurrency for Bangladesh

While the government has taken a cautious approach, there are several potential benefits that cryptocurrencies could bring to Bangladesh:

Financial Inclusion: With a large portion of Bangladesh’s population unbanked, crypto could provide an alternative means for people to store and transfer value.

Remittances: Crypto could make remittances faster and cheaper, benefiting the many Bangladeshi citizens who work abroad.

Blockchain Innovation: Embracing blockchain technology could foster innovation in various sectors, including supply chain management and digital identity verification.

7. How to Buy Cryptocurrency in Bangladesh (If It’s Legal)

For those interested in exploring cryptocurrency, it is crucial to stay informed about the legal context. However, if one were to proceed, the following steps outline how to do so:

Steps to Safely Purchase Crypto

Research Local Regulations: Before proceeding, consult the latest information on cryptocurrency laws in Bangladesh.

Choose a Reliable Exchange: International platforms like Binance or Coinbase are generally reputable, though accessibility may vary in Bangladesh.

Use a Secure Wallet: After purchasing crypto, transfer it to a secure wallet, such as a hardware wallet, for safekeeping.

Monitor Your Investments: Keep an eye on your portfolio and make informed decisions based on market trends.

Recommended Platforms

Since local exchanges are not available, Bangladeshi users typically access international platforms. These platforms often require additional steps for compliance, such as VPN usage or third-party wallets. However, it’s important to proceed with caution, as legal risks still apply.

8. The Future of Cryptocurrency in Bangladesh

While the current regulatory stance is restrictive, there is a possibility for change as global adoption of cryptocurrency continues. The government may consider the following trends:

Exploring Central Bank Digital Currencies (CBDCs): Some countries have explored CBDCs as a regulated alternative to cryptocurrencies, which could influence Bangladesh's approach.

Adopting Clearer Regulations: As more countries establish frameworks for crypto, Bangladesh may revisit its stance to accommodate blockchain technology’s benefits while minimizing risks.

9. Frequently Asked Questions (FAQs)

Q1: Is it illegal to own cryptocurrency in Bangladesh?

A: Yes, owning or trading cryptocurrency is currently considered illegal in Bangladesh, according to Bangladesh Bank regulations.

Q2: Can I use a VPN to access crypto exchanges?

A: While some users may use VPNs to access international exchanges, this is still legally risky, as it may violate Bangladeshi regulations.

Q3: Will Bangladesh legalize crypto in the future?

A: It’s uncertain. As crypto adoption grows globally, the Bangladeshi government may consider new regulatory approaches, but no official changes have been announced

2 notes

·

View notes

Text

What Exactly is Cryptocurrency? A Comprehensive Guide to Get You Started!

The term cryptocurrency has been gaining increasing attention over the past few years, capturing the interest of both investors and the general public. But what exactly is this emerging digital asset? How does it work, and what does it mean for someone new to the world of crypto? In this guide, we’ll walk you through the basics, from the core concepts to real-world applications, offering a complete insight into the rapidly evolving world of cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a digital asset built on blockchain technology. Unlike traditional currencies, it is not issued by central banks but is created and managed through decentralized technology. The key characteristics of blockchain are its openness, transparency, and immutability, which allow for secure transactions without the need for intermediaries like banks or other financial institutions.

Bitcoin (BTC), created in 2009, is the first and most well-known cryptocurrency. Its creator, Satoshi Nakamoto, aimed to leverage blockchain technology to build a new financial system that operates independently of traditional banking institutions. Since then, countless other cryptocurrencies have emerged, including Ethereum (ETH), Ripple (XRP), and many more.

Different cryptocurrencies have different design goals. Some are used for payments, others for executing smart contracts, while others are primarily investment or store-of-value tools. In essence, cryptocurrencies emerged to address issues in the traditional financial system, such as high transaction fees, long settlement times, and lack of transparency.

Cryptocurrency and Blockchain: The Relationship

To understand cryptocurrency, it’s essential to grasp the underlying technology — blockchain. Simply put, blockchain is a distributed ledger where all participants can view transaction records, but no one can arbitrarily alter them. Each time a transaction is completed, it’s added to a "block," and these blocks are linked in chronological order to form a chain — hence the name "blockchain." This setup ensures that every step of the transaction is traceable and nearly impossible to manipulate.

Another critical feature of blockchain is decentralization, meaning that no single entity controls the system, which, in theory, enhances its security and transparency. The reason cryptocurrencies are so popular is largely due to the independence that blockchain technology provides from traditional financial systems.

Beyond Payments: Cryptocurrency’s Other Use Cases

Although cryptocurrencies were initially designed as digital payment systems, their applications have grown exponentially over time. Here are a few common use cases:

Payment Systems: Cryptocurrencies like Bitcoin are widely used as global payment tools, especially in regions where traditional payment systems are inaccessible, such as countries with unstable political or economic conditions.

Smart Contracts and Decentralized Applications (DApps): Ethereum, beyond being a cryptocurrency, is also a platform for developing smart contracts — self-executing contracts that automatically enforce terms without human intervention. These contracts have broad applications across industries like law, finance, and logistics.

Decentralized Finance (DeFi): DeFi is one of the hottest trends in the crypto world. It aims to create a decentralized financial system where users can lend, borrow, trade, and earn interest on crypto assets without intermediaries like banks. DeFi is seen as more transparent and efficient compared to traditional banking systems.

NFTs and Digital Art: NFTs (Non-Fungible Tokens) are unique digital assets stored on the blockchain. Each NFT has a unique identifier, making it impossible to copy or divide, which has led to their popularity in digital art and collectibles markets.

How to Buy Cryptocurrency?

For beginners, the most common way to buy cryptocurrency is through a crypto exchange. These platforms provide a convenient interface for users to convert fiat money (like USD, EUR, or TWD) into cryptocurrency. Popular exchanges include Binance, Bitget,OKX,Gate·io, Kraken and Bybit. These platforms typically support various payment methods, including bank transfers, credit cards, and third-party payment systems.

Here’s a basic guide to purchasing cryptocurrency:

Create an Account: Choose an exchange and create an account. Most exchanges require identity verification to comply with KYC (Know Your Customer) regulations.

Deposit Funds: Once registered, you can deposit funds via bank transfer or another payment method.

Choose a Cryptocurrency and Place an Order: After depositing, you can select the cryptocurrency you want to purchase, set the quantity, and place an order. Most exchanges offer market orders (buying at the current price) or limit orders (setting a target price).

Transfer to a Wallet: Once your purchase is complete, it’s recommended to transfer your cryptocurrency to a private wallet for safekeeping. Wallets can be online, hardware, or paper-based.

Security Concerns Around Cryptocurrency

While blockchain technology itself is highly secure, cryptocurrency transactions still come with significant risks. Some of the most common include:

Market Volatility: The price of cryptocurrencies can fluctuate wildly in short periods, offering high returns but also posing substantial risks, especially for newcomers.

Scams and Hacking: Fraudulent schemes, like "rug pulls" (where project creators disappear with investors’ money), are common. Exchanges are also frequent targets for hackers, making it crucial to choose a reputable platform and store assets in a secure personal wallet.

Regulatory Risk: Cryptocurrency regulations vary widely across different countries. Some nations ban crypto trading, like China, while others, like the U.S., Singapore, and Hong Kong, are more open. Investors need to be aware of local regulations, especially regarding tax reporting and asset management.

The Future of Cryptocurrency: Opportunities and Challenges