#Bitcoin Halving e mining

Explore tagged Tumblr posts

Text

Halving Bitcoin: Cos'è e Come Funziona

Il Bitcoin Halving è un evento cruciale nel mondo delle criptovalute. Ogni quattro anni circa, la ricompensa per i miner di Bitcoin viene dimezzata, riducendo l’offerta di nuovi Bitcoin immessi nel mercato. Questo meccanismo è stato progettato per controllare l’inflazione e garantire la scarsità della criptovaluta, contribuendo alla sua natura deflazionistica. Investire in ETF: scopri i vantaggi,…

#Bitcoin Halving#Bitcoin Halving e inflazione#Bitcoin Halving e mining#Bitcoin Halving e valore della criptovaluta#Bitcoin Halving effetti sul mercato#Bitcoin Halving impatto sul prezzo#Bitcoin Halving spiegazione semplice#Bitcoin Halving storico prezzi#Bitcoin Halving strategie di investimento#Come funziona il Bitcoin Halving#Cos&039;è il Bitcoin Halving#Cosa succede dopo il Bitcoin Halving#Investire in Bitcoin dopo l&039;Halving#Previsioni Bitcoin Halving 2024#Quando avviene il prossimo Halving Bitcoin

0 notes

Text

Transformative Trends: Crypto in 2024 - Bitcoin's Surge and Regulatory Shifts

The year 2024 is expected to bring significant changes to the cryptocurrency market. 🚀 Bitcoin, the leading cryptocurrency, could reach new price highs, with predictions suggesting it could soar to $60,000 or even higher. This optimistic forecast is backed by the upcoming Bitcoin halving event and the potential approval of Bitcoin exchange traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). If approved, these ETFs could attract billions of dollars into the crypto space, boosting Bitcoin's value by an estimated 6.2%. 📈

The mining landscape of Bitcoin is also set to transform. As the Bitcoin halving approaches, the difficulty and expense of mining are expected to rise dramatically, making it unsustainable for retail miners. This shift could lead to the dominance of major corporations in the mining space. In fact, stock prices of companies involved in Bitcoin mining have already seen a substantial increase driven by large investment funds. 🏭

2024 is predicted to witness the widespread acceptance of cryptocurrencies as a standard form of payment, particularly in developing nations with high inflation rates. Established cryptocurrencies like Bitcoin, Ether, and Tether are likely to be embraced for transactions, while speculative trading may still be associated with meme tokens and alternative coins. Additionally, the integration of cryptocurrency payment infrastructures such as crypto-processing services, crypto ATMs, and cryptocurrency-linked credit cards will make digital currencies more accessible and convenient for daily transactions, especially in e-commerce. 💰

While regulations in the cryptocurrency sector are expected to tighten, this could be a positive development. Clear and well-enforced regulations can attract traditional investment and enhance the legitimacy and stability of the crypto market. The U.S. Securities and Exchange Commission is likely to focus on regulating the market, and Europe may follow suit. Increased regulation can help curb illicit transactions and money laundering, ensuring a safer environment for investors. 🔒

Read the original article.

0 notes

Text

The Prominent analyst, James V. Straten, has warned about the rising costs of mining Bitcoin. With an upcoming halving event expected in April, he suggests that miners could be under significant pressure if Bitcoin’s price stays below roughly $40,000 next year.Bitcoin Mining Expenses Reached $24,000 as Halving Nears In a recent tweet, James V. Straten shared his insights into the increasing costs Bitcoin miners face and the potential consequences for this essential segment of the crypto ecosystem. Eventually, the current cost to mine a single Bitcoin is approximately $24,000, which includes various expenses such as energy, software & hardware equipment, and operational costs.His analysis didn’t just stop there, he believes that the situation could become even more critical when the next Bitcoin halving occurs. With a halving expected in April, miners might face intense pressure if the price of Bitcoin remains below approximately $40,000 next year.Miners See Silver Lining in Recent Market PullbackDespite the growing obstacles, some individuals still see massive Bitcoin mining opportunities. The recent market pullback has led many to believe that miners should seize the moment, doubling down on their efforts to overcome the potential obstacles that lie ahead.At the same time, Bitcoin mining is changing quickly, and miners must prepare for what lies ahead. Straten’s warning reminds us to plan and adjust as the mining environment transforms. As the halving gets closer and expenses increase, miners must be strategic and well-prepared.!function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', ' fbq('init', '887971145773722'); fbq('track', 'PageView');

0 notes

Text

Will Bitcoin Reach $1 Million?

Bitcoin, the vanguard of cryptocurrencies and decentralized finance (DeFi), has captivated investors and observers with its sideways moves. Yet, whispers of a potential surge to $1 million abound. Delve into the crucial drivers of this possibility – halvings, institutional adoption, wider acceptance, favorable regulations, and its safe-haven appeal during economic crises. Together, they paint a compelling picture of Bitcoin's journey towards an extraordinary milestone. Join us as we explore the elements shaping Bitcoin's future price trajectory and the boundless possibilities they hold.

Halvings: A Key Driver of Bitcoin's Price

Bitcoin's price movements have long been influenced by its halving events. These algorithmic events cut the mining reward in half, reducing the circulating supply of BTC and driving up demand, ultimately pushing the price higher. In May 2023, Bitcoin entered the final phase before its fourth halving, and the crypto community expects the next halving to occur in May 2024. Prominent analysts, like PlanB, have discussed pricing models that suggest Bitcoin could potentially reach $1 million during that time.

Increased Institutional Adoption Boosts Confidence

The landscape of institutional interest in Bitcoin has shifted dramatically, with major players like BlackRock expressing newfound support for the cryptocurrency. BlackRock's application for a spot Bitcoin exchange-traded fund (ETF) in June sparked a wave of similar filings with the United States Securities and Exchange Commission (SEC). Billionaire Mike Novogratz identified this as a turning point, indicating that increased institutional adoption could further drive Bitcoin's price upward.

Bitcoin as a Widely Accepted Payment Method

As Bitcoin gains acceptance as a legitimate payment option across various businesses worldwide, the demand for the cryptocurrency is expected to increase. Numerous e-commerce and brick-and-mortar establishments now allow customers to pay using cryptocurrencies, and the proliferation of Bitcoin ATMs globally further facilitates its use. Statistics from Coin ATM Radar indicate a continuous increase in installations, with over 36,000 crypto ATMs and 236,000 Bitcoin service providers in 71 countries.

Favorable Regulatory Climate Supports Bitcoin's Growth

Governments and regulators around the world are becoming more open and receptive to cryptocurrencies. The United Kingdom's financial services minister, Andrew Griffith, rejected the idea of regulating retail trading and investing in crypto as gambling. Additionally, countries like Malta have established crypto-friendly regulations, making them attractive hubs for crypto businesses. Binance, one of the world's largest crypto exchanges, chose Malta over Japan due to its favorable regulatory environment.

Bitcoin as a Safe-Haven Asset in Economic Crisis

During times of economic uncertainty, many individuals turn to safe-haven assets like gold and silver. Bitcoin has also emerged as a popular choice, with renowned investor Robert Kiyosaki advocating its inclusion in one's portfolio. Kiyosaki has criticized the Wall Street Journal's claims about the strength of the US economy and suggested investing in Bitcoin as a hedge against a potential financial crisis and stock market crash. He predicts Bitcoin's price could reach $120,000 in the near future.

Current Bitcoin Price Analysis

As of August 2, Bitcoin is trading at $29,467, showing a daily increase of 1.76% and a weekly gain of 0.88%. However, on its monthly chart, it has experienced a decline of 3.83%. While predicting if and when Bitcoin will reach $1 million remains uncertain, the factors discussed above, whether acting independently or in combination, will undoubtedly shape the future price of this leading digital asset. Ultimately, supply and demand will dictate Bitcoin's actual value.

Conclusion

In conclusion, Bitcoin's potential to reach $1 million is influenced by several significant factors. Halvings play a crucial role in driving its price upwards, while increased institutional adoption and wider acceptance as a payment method boost confidence in the cryptocurrency. A favorable regulatory environment and Bitcoin's appeal as a safe-haven asset during economic crises further contribute to its potential growth. As investors and enthusiasts closely monitor these developments, only time will reveal the true extent of Bitcoin's ascent to unprecedented heights. For more articles visit: Cryptotechnews24 Source: finbold.com

Related Posts

Read the full article

#anditsappealasasafe-havenasset.#Bitcoin#CryptoNews#DiscoverthefactorsthatcoulddriveBitcoin'spriceto$1million#favorableregulations#includinghalvings#institutionaladoption#wideracceptanceasapaymentmethod

1 note

·

View note

Text

Bitcoin 2023 in Miami comes to grips with ‘shitcoins on Bitcoin’

Among the more memorable displays at Bitcoin 2023 is a real-life toilet with the logos of various non-Bitcoin cryptocurrencies. It’s an ad for a booth selling “buttwipes” that are “moistened with the tears of no-coiners.” The marketing message is clear: Bitcoin is the real thing — everything else is a shitcoin that belongs in the toilet. But only a few steps away is another booth selling trading solutions for BRC-20 tokens, which some have labeled shitcoins for Bitcoin. Across the walkway are more booths slinging NFT minting software — also on Bitcoin. The conference even hosts a Bitcoin NFT art gallery. As Miami hosts the largest Bitcoin conference for the third year in a row in May, the air feels markedly different. Though there are only 15,000 attendees compared to last year’s 35,000, the atmosphere has an energy and freshness that’s a world away from the gloom and bear-market blues that one might expect after the massive drops from the 2021 highs. Bitcoin is the real thing — everything else belongs in the toilet (Elias Ahonen) What’s changed this year is the ordinal renaissance, brought on by the recent reality of not only NFTs but tokens being issued on the Bitcoin blockchain. There are certainly haters — with some calling for a fork to undo the Taproot updates that made “spam” possible on the chain. But despite the Bitcoin community’s traditional hatred for NFTs, tokens and DeFi, however, things are surprisingly quiet. Despite the blowback online, almost no one Magazine encounters at Bitcoin 2023 has anything particularly bad to say about Ordinals — and some did not even realize they are related to Bitcoin. Among old-school Bitcoiners — in circles where the cryptocurrency that starts with “E” can barely be mentioned without drawing comments of derision regarding “monkey pictures” and scam coins — the Ordinal NFT phenomenon is decisively met with a quiet acceptance or shrug. Most old-timers aren’t interested but appear to accept that this is what the “young people” want today — that Bitcoin needs to change with the times. Are Bitcoiners quietly accepting a new era where the network takes on a radically new role in the Web3 ecosystem, or is this the calm before the Bitcoin purist storm? Bitcoin Ordinals: A new era With the exception of the Lightning Network, which made fast and cheap Bitcoin payments possible so as to make mass payment feasible, the Bitcoin ecosystem has been relatively unchanging over the years from an outside perspective. Mining, halvings every four years, the 21 million supply, hardware storage — beyond these core concepts, Bitcoin has lacked a certain dynamism that has placed it largely outside of the more colorful Web3 space of competing protocols, smart contracts, ICOs, NFTs, DAOs, stablecoins and myriad different tokens. Indeed, the Bitcoin community has so ardently held on to its core tenets — rejecting new iterations, interpretations and innovations — that it is unironically considered by some as a religion, and semi-ironically as such by multitudes more. But is a reformation — or even renaissance — in the works? Author Elias Ahonen at Bitcoin 2023 (Elias Ahonen) A stroll through Bitcoin 2023 — the world’s largest Bitcoin conference held in May in Miami — suggests so. This is because in addition to the yearly fare of booths related to mining, physical art, exchanges, wallet solutions and various hardware, a new entrant is out in force: NFTs. Well, no — not NFTs. Bitcoiners call them “Ordinals.” The word “ordinal” simply means a number used to put things in order: 5th, 6th, 7th, etc. Due to the November 2021 Taproot Bitcoin upgrade, individual satoshis, the smallest unit of Bitcoin, can now be individually numbered and thus made permanently identifiable. Uniquely numbered satoshis — Ordinals — are nonfungible, meaning that they can no longer be substituted for another. Being (1) nonfungible and (2) tokens, they are NFTs by definition. In Miami, perhaps the most visible landmark to this new phenomenon is Ordinal Alley, “the very first art gallery dedicated to Ordinal inscriptions” where various Bitcoin NFTs can be viewed. Subhan Syed, co-founder of YourFund Coin, tells Magazine that “Ordinal art — whether a JPEG or MP3 — may seem irrelevant today, but as time goes on, collectors will look towards unique pieces that have truly been immortalized on the blockchain.” The system is new and experimental, with Syed explaining that “the way inscription works today might be completely different a few years from now,” adding that it’s feasible that one day, there might not be enough satoshis to fill everyone’s inscribing needs. “We might need a more robust solution in the long term that does not carry a load on the blockchain timestamp.” Read also Features Escape from LA: Why Lockdown in Sri Lanka Works for MyEtherWallet Founder Features What it’s like when the banks collapse: Iceland 2008 firsthand NFTs and shitcoins — Now on BTC In March 2023, an anonymous developer named “domo” introduced the BRC-20 system, which uses Ordinals to enable users to mint and transfer tokens on Bitcoin, in a simplistic take on Ethereum’s ERC-20 standard. There were plenty of merchants at Bitcoin 2023 (Elias Ahonen) According to BRC-20.io, at one point, the market cap exceeded $1 billion, although after the initial hype died down, the 187 tracked tokens fell to half a billion, and in the midst of the SEC-derived bear market, they’re worth around $132 million with a daily volume around $47 million (although the site is offline at the time of writing). While the conference has several booths related to Ordinals — mainly services for minting or “inscribing” them — few openly promote BRC-20 tokens beyond offering functionality to hold or trade them. While Ordinal NFT images appear to have become accepted by the mainstream Bitcoin community, it appears that BRC-20 tokens — viewed by many as shitcoins on Bitcoin — have not yet received quite the same level of acceptance. It will be interesting to see how this changes next year when the conference moves to Nashville. Wizards vs. laser-eyes At a talk titled “The Great Ordinal Debate,” Bitcoin experts Udi Wertheimer and Eric Wall appeared in Taproot Wizard costumes as they made a dancing entrance. The Ordinals project celebrates the Magic Internet Money meme from the early Bitcoin days and welcomes the return of innovations being built on top of the protocol. The Magic Internet Money meme Certain Bitcoin maximalists hate them and the “spam” of Ordinals, believing it undermines the true purpose of Bitcoin. Wertheimer reported that “friends reached out and implored me to reconsider going to Bitcoin Miami, due to many public violent threats” from “laser eye podcasters” who believe NFTs have no place in the Bitcoin community. The rift that Ordinals has caused in the Bitcoin community may well be summed as a conflict between the wizards and the laser-eyes — the former representing the experimental and fun-loving early ethos of Bitcoin, while the latter conveys intensity, seriousness and an unyielding focus on their vision for the greatest form of money known to man. Eric Wall is a professional crypto investor (Twitter) After the conference, I connect with Logan Golema, who is firmly on the wizard side and has deployed a BRC-20 token for his project Galaxer, which is building a “space-based AR capture-the-flag” game to work on Apple’s Vision Pro artificial reality goggles. Believing that Bitcoin and its Ordinals will exist “for eons” into humanity’s future, he argues that “Ordinals — whether art or money — will be important much further into the future than the deployer today may intend.” If you could take the DeLorean back in time to buy cheap Bitcoin — or prevent the Taproot upgrade — would you? (Elias Ahonen) While some in the laser-eyes camp have raised the possibility of a fork to roll back the Taproot upgrade that enables Ordinals, Golema thinks it’s unlikely. Recalling the block-size wars that were a key driver in the Bitcoin Cash fork led by “Bitcoin Jesus” Roger Ver, Golema explains that while disagreement certainly exists, “it would take a lot for a chain fork to happen” again. Although various ways to remove what some core developers consider “spam” have been discussed, Golema believes the innovations will be broadly accepted and integrated — even if only begrudgingly because doing away with them may bring even more trouble. But Ordinals come with benefits, too, says Golema, helping to ensure Bitcoin’s transaction fees can sustain the network after the block reward halves away to nothing in the future. “We’ve seen for one of the first times that the fee reward was bigger than the block reward — that’s very important for the future of Bitcoin’s security.” For Bitcoin miners, the new age means more BTC coming into their collective coffers because the minting, deploying and transfer of Ordinals and Bitcoin-based tokens all require paying miners fees. This could help solve the issue of what happens when there’s no more BTC left to mine. “Direct mining rewards will end in the year 2140, so fees will be all that’s left to incentivize miners,” Golema notes. Similar benefits may exist for BTC hodlers — the long-term Bitcoin faithful. It is easy to imagine that as Bitcoin gains Ethereum-like capabilities, it will gain market share in NFTs and tokens, which will translate to demand not only in absolute terms but relative to competitors. Perhaps by bringing NFTs and tokens to Bitcoin, the wizards can even prevent the flippening, the potential ascent of Etereum to the top market cap position, which until now has been theorized to happen one day as a result of Bitcoin falling behind technologically while Ethereum innovates. Major crypto assets by percentage of total market cap. (CMC) Bitcoin dominance is a metric that shows the relative values of various cryptocurrencies and is followed by many Bitcoiners. Starting the year at 40%, BTC has climbed to 48.1% of the market as of writing. Can JPEGs push Bitcoin back into the 60% range and herald a new bull market? The Ordinals wizards Some Bitcoiners are starting to rationalize Ordinals into their worldviews. According to Aravind Sathyanandham, chief strategy officer at Bitcoin DeFi platform Velar, the Ordinals community is markedly different from the primarily Ethereum “ape” community, which has a bad reputation among the Bitcoin crowd. “These are Bitcoin guys — these are people who had to figure out how to run an entire node to ‘inscribe’ stuff on Bitcoin, the mother chain.” He is referring to a kind of do-it-yourself hardiness — a rugged individualism emblematic of the money and tech conservatism of older stereotypical Bitcoiners as opposed to the also -stereotypical imagining of a more communal, liberal and younger Ethereum community. From this Bitcoiner perspective, Ethereum is viewed as little more than a sandbox for children, while Bitcoin is eternal. Ethereum, Sathyanandham says, is a “great experiment for NFTs and DeFi to take their first form,” and now it’s Bitcoin’s turn. “These Bitcoin wizards understood early on that the block space on Bitcoin is prime real estate — it’s forever immutable and censorship-resistant data,” he adds, not forgetting to add that Ethereum is “semi-centralized.” Elias was invited to sign the Bitcoin Car, first auctioned for 1,000 BTC in 2013 (Elias Ahonen) The phenomenon also appears to be growing the Bitcoin user base. “Ordinals have on-boarded so many individuals onto Bitcoin — new Bitcoin wallets like Hiro and Xverse that are akin to MetaMask have made it simple,” Sathyanandham explains, referring to the wider ecosystem being built entirely for Ordinals that mirrors Ethereum’s in many ways. He notes that “the Ethereum NFT community’s bleeding into the Bitcoin community is very evident on Crypto Twitter.” While Syed agrees with Ordinalist exceptionalism, he sees them more as technologists than strict Bitcoiners. “I’ve seen that BRC-20 and Ordinals early adopters are individuals who are slightly more tech-savvy digital collectible fans — it’s not like some virtual flood gates opened up to bring in loads of Bitcoin maxis,” he observes. Syed notes that “currently it’s the same people who collect ETH, Solana or BNB digital collectibles jumping in early. Early adopters always win and the bottom line is: We are all early.” “When the next bull run comes, perhaps correlated with the BTC halving, we might see everyone rush over the BRC-20 and Ordinal narrative.” It certainly feels like magic internet money once again. Subscribe The most engaging reads in blockchain. Delivered once a week. Elias Ahonen Elias Ahonen is a Finnish-Canadian author based in Dubai who has worked around the world operating a small blockchain consultancy after buying his first Bitcoins in 2013. His book ‘Blockland' (link below) tells the story of the industry. He holds an MA in International & Comparative Law whose thesis deals with NFT & metaverse regulation. Follow the author @eahonen Source link Read the full article

0 notes

Text

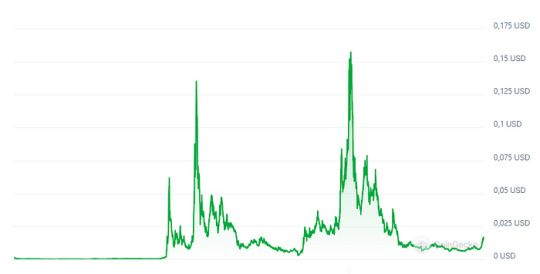

DigiByte (DGB): Can Low Price and Upcoming Bitcoin Halving Drive Growth in 2024?

DigiByte (DGB) is a decentralized UTXO-based blockchain known for its speed, security, and scalability. Unlike many other cryptocurrencies, DGB is not mined by large ASIC farms, making it more accessible to ordinary users.

The current price of DGB is $0.01662 USD, which is a significant drop from its all-time high of $0.18400 USD reached in 2018. Despite this, DGB remains one of the cheapest cryptocurrencies on the market, making it an attractive

Other factors that could drive DGB growth in 2024:

Technological development: The DigiByte Foundation is constantly working on developing the DGB blockchain technology. In 2024, SegWit is planned to be implemented, which will increase the scalability and security of the network.

Growing adoption: DGB is increasingly being accepted as a form of payment by businesses and e-commerce platforms. In 2024, we can expect further growth in DGB adoption.

Increased investor interest: The growing popularity of cryptocurrencies could attract more investors to DGB, which could lead to an increase in its price.

In conclusion

DigiByte has the potential to grow significantly in 2024. Low cost, upcoming Bitcoin halving, continuous technological development, and growing adoption are just some of the factors that could drive this growth. Investors looking for inexpensive cryptocurrencies with high growth potential should definitely consider DGB.

However, it is important to remember that investing in cryptocurrencies carries a high degree of risk. Investors should always do their own research before making any investment decisions.

Additional Information

DigiByte website: https://www.digibyte.org/

DigiByte whitepaper: https://whitepaper.io/coin/digibyte

DigiByte live price: https://coinmarketcap.com/currencies/digibyte/

Disclaimer

This article does not constitute investment advice. Investing in cryptocurrencies carries a high degree of risk. Investors should always do their own research before making any investment decisions.

#binance#crypto#blockchain#coinbase#cryptocurrencies#2024#investing#dgb#DigiByte#altcoin#ethereum#bnbchain#bnb

0 notes

Text

equihash miner

zcash mining

Anything Crypto means that Zcash (ZEC) is probably the most profitable cryptocurrency to mine, with expected returns far higher than other PoW cash like Ethereum (ETH) and Bitcoin (BTC). As you may know, all BTC transactions are recorded on a publicly visible ledger called the blockchain. AMD and Nvidia graphic cards don't run the identical software program, so make sure you look into the most environment friendly software to use along with your hardware to ensure you are mining optimally.

We are going to popularize the Cryptocurrency e-Shop sector by providing aggressive costs for all our in sale cryptocurrency mining merchandise, and by helping people understand and confide what we consider to be the future of money. The shortage of enormous mining operations in Zcash suggests that for the present, those with Antminer Z9 minis can expect worthwhile returns.

Now that you've a clearer understanding of the Zcash blockchain and important ideas corresponding to problem, you possibly can perform some financial calculations. By means of current polls, the Zcash community authorised mining payout changes that may take impact on the coin's halving in November.

On this paper we analyze transaction linkability in Zcash based on the forex minting transactions (mining). Zcash's provide model is reasonably much like that of bitcoin, although it has some key differences. Ethereum - Ethereum is a decentralized software platform that's primarily based on blockchain expertise created by Vitalik Buterin in 2013.

Zcash is unquestionably one of the hottest and probably the most thrilling cash out there right now. By June, citing regulatory strain, CoinCheck delisted zcash (ZEC) monero (XMR), augur (REP), and dash (SPRINT), prompting different massive Japanese and South Korean cryptocurrency exchanges to delist the currencies.

1 note

·

View note

Text

LTC Core Wallet

What is Litecoin? litecoin qt version 0.13.2.1 being an open source, peer-to-peer cryptocurrency that allows fast and near-zero bills among anyone, anyplace in the world. It had been created in October 2012 by simply an ex-Google in addition to ex-Coinbase engineer, Charlie Lee, as an alternative to be able to Bitcoin. He wished to generate a cryptocurrency that would fix some of the troubles suffered by Bitcoin, some as business deal times, higher transaction costs, and gathered mining cartouche. They in addition wanted to make it possible for larger-scale adoption by folks plus businesses. Litecoin can be utilised simply by individuals to make acquisitions from the real world extra easily than more various other cryptocurrencies because it is usually supported by a growing variety of wallets and crypto debit cards. Litecoin possesses also designed progress in the merchant side like they have already been increasing their point-of-sale settlement entry and banking services to really make it simpler for merchants to help agree to Litecoin as a new type of payment. The Litecoin circle has decent application. An average of, Litecoin processes close to 20, 000 to 35, 000 on-chain orders some sort of day. The particular chart under shows the utilization regarding the Litecoin community regarding the past two many years: Litecoin vs Bitcoin Considering that Litecoin was developed getting Bitcoin�s code (it was basically a fork of this Bitcoin) with near-identical characteristics, challenging compared with Bitcoin. litecoin core version 0.16.0rc1 are highlighted below: Hashing protocol: Both Litecoin and Bitcoin use proof-of-work since their consensus algorithm, yet , Litecoin uses a different hashing algorithm � scrypt instead of Secure Hash Protocol (SHA) 256. Scrypt is somewhat more memory-intensive than a good protocol that is not necessarily memory-hard. For the reason that processes are function throughout parallel with scrypt rather than serially with SHA-256, and as a good result, scrypt requires more memory. One particular of the great things about working with scrypt is having a network that is a lot more readily available and democratized. For you to be competitive, miners can acquire additional memory instead associated with possessing to buy specialized application-specific integrated brake lines (ASICs) like is the case having Bitcoin. This means the fact that in theory, regular men and women can become miners using Litecoin, whereas concentrated exploration pools / ASIC crops already dominate the Bitcoin mining. Transaction fees: Purchases on Litecoin are substantially cheaper than Bitcoin. By September 24, 2018, the typical transaction fee for Bitcoin was $0. 434 versus $0. 0483 for Litecoin, making Bitcoin 9 periods more costly. At the high on December 24, 2017, average daily Bitcoin purchase fees surpassed $55 although Litecoin fees ended up solely $0. 931. Full speed: Litecoin is designed for you to be 4x faster as compared to Bitcoin as average block out confirmation times are 2 . not 5 minutes, instead regarding 10 minutes. Present: Litecoin has a new total source of 84 million gold and silver coins, compared with 21 thousand coins for Bitcoin. Conclusion kitchen table comparing Bitcoin in addition to Litecoin: Key Features Proof-of-work: Litecoin uses proof-of-work, which usually is a consensus process that is dependent on a difficult computational task to be able to secure the network via malicious characters. Miners compete to solve the undertaking the quickest and are usually rewarded correctly. (For even more information, see each of our article �What is Proof of Job? litecoin core version 0.15.1 ) Scrypt: While talked about above, Litecoin uses this scrypt hashing protocol. Segregated Witness (SegWit): SegWit elevated the block measurement control of Litecoin from one MEGABYTES to four MB by way of removing signature bank files (i. e. this �segregated� part) a business deal although guaranteeing the transaction will be still safe and protected (i. e. the �witness� part). SegWit allows for increased transaction output together with makes it possible for other features and software, such as the Lightning Network, MAST, Confidential Purchases, and Schnorr Validations, to be implemented. Key Milestones Litecoin is an open source project and even the source code can be looked at below: https://github.com/litecoin-project/litecoin Oct 2012: Litecoin was basically unveiled with GitHub and the networking goes live shortly following. Nov 2013: Litecoin attained an industry cap of $1 billion the first time. December 2013: Litecoin v0. 8. 6th. 1 was launched. This was initially a significant release together with some sort of number of improvements, like popular wallet capabilities like Coin Control, quicker acceptance, faster propagation, etc . Economy is shown 2014: Litecoin pocket book for Android was technically published. April 2014: Often the beta of Electrum, a good Litecoin wallet, was released. 06 2015: Litecoin v0. ten. 2. 2 had been introduced and represented often the official relieve version of Litecoin Core. This seemed to be a significant launching, and even was the technical comparable regarding Bitcoin v0. twelve. second . Major changes consist of watch-only wallet support, quicker blockchain synchronization, improved deciding upon stability, new utility programs, and so forth January 2017: Litecoin Primary v0. 13. a couple of premiered, a major let go with a quantity of process level improvements, computer code optimizations, the ability to throw out a few soft forks at once, etc . Segwit was activated with testnet. May 2017: Litecoin initialized SegWit and finished typically the first payment transaction on the Lightning Network with the particular move executed in under one next. August 2017: Litecoin Primary v0. 18. 2 premiered. This has been a new major variation discharge with new features, different bug fixes, and various effectiveness improvements (e. gary the gadget guy. faster sync and initial block download times). May 2018: Litecoin Core v0. 16. 0 was launched, a good major release that provided full support to get segwit in its wallet and end user interfaces. With regard to more details and intended for future technical updates, you need to check out Litecoin�s standard blog at https://blog.litecoin.org. Down load the Free Register regarding Crushing ICOs! This is the guidebook that help me personally come across the most promising ICOs! CLICK HERE TO HAVE THE FREE GUIDEBOOK > > Future Development Making use of the activation of SegWit, Charlie Lee got spoken about adding features such as Lightning Network, MAST, Private Deals, and Schnorr Signatures, nonetheless no roadmap offers been supplied yet. Inside fact, all the planned upgrades are features from the other blockchain and not unique to be able to Litecoin. Most connected with the upgrades are as developed on Bitcoin while well. In the 2018 Litecoin Summit, Charlie Even offers shown his metrics associated with success for Litecoin: (1) network security, (2) industry increased, (3) exchange fluid, (4) merchant support, plus (5) currency usage. For that reason, we believe the future trends will target improving these metrics. litecoin core version 0.13.2 possesses a block encourage of 20 LTC every block. Halving occurs each 840, 000 blocks (approximately each four years) based on a block time period of 2. 5 short minutes therefore, the block reward will be required to drop to 10. 5 various LTC in about September 2019. The going around source is at present 49, 544, 952 (as involving August 1, 2018); this specific shape will slowly boost towards the total supply regarding 84 thousand LTC at some time in the mid-2100s soon after which no new coins will be minted.

Team The particular Litecoin Foundation will be a non-profit organization that will supports the development of Litecoin. The idea is contains four men and women on the Plank involving Directors (see below) because well as additional owners, builders and volunteers. Often litecoin core version 0.16.1rc1 works together with the Litecoin Core growth team, which will consists of coders behind the Litecoin assignment, and provides them all economic support. The journal involving the key people driving Litecoin are made clear below: Charlie Lee, Founder involving Litecoin, and Handling Movie director of the Litecoin Basic foundation ~ He was in the past the Movie director of Architectural at Coinbase where he / she worked for four several years. Before that, he / she performed at Google with regard to 6th years as a good Computer software Engineer on many assignments including YouTube Mobile, Stainless- OS and Google Play Games. Prior positions include Person Software Engineer at Guidewire Software and Software Engineer at Kana Communications. They obtained his Master�s qualification in Pc Science from M. My spouse and i. T. inside 2000. Xinxi Wang, Litecoin Foundation Director � Xinyi Wang was one involving the Beginning Member of the Litecoin Groundwork and is one of the developers at the rear of Litecoin Central. He is likewise this Founder and BOSS regarding Coinut Exchange, the Singapore-based cryptocurrency trading platform that had been established in December 2013. He / she obtained his Bachelor�s level in Computer Scientific disciplines through the Harbin Institute connected with Technologies in 2009 in addition to his Ph. N. inside of Computer Science from the Country specific University of Singapore within 2014. Franklyn Richards, Litecoin Foundation Director ~ Franklyn Richards was among the Starting up Associates of the Litecoin Foundation and currently runs Litecoin. com. He will be the COO of Zulu Republic, a good blockchain start-up that should create a great ecosystem connected with digital tools built within the Ethereum blockchain. Zing Yang, Litecoin Groundwork Director � Zest Dalam has been a good Movie director of the Litecoin Foundation since May 2018 and even was previously from BlockAsset Projects, a blockchain-focused VC business, from January to be able to May well 2018. Prior placements include Associate Overseer regarding Investments at Temasek and even Overseer and Co-Founder associated with Greenergy Global from Biomax Technological innovation. She provided the Bachelor�s degree in Organization Administration in the Singapore Management University within 2007. Investigation Strengths Community � Acquiring started out in 2011, Litecoin is among the most well-known and quite a few mature blockchain jobs and possesses built the giant area. Looking from the particular number of members upon the respective subreddits, Litecoin�s community is only right behind Bitcoin and Ethereum. Litecoin can make good progress at terms of vendor usage with point of purchase, merchant payment gateways and even banking services by means of Coingate, Coinpayments, Coinify, Coinbase Marketing, Gocoin, Paybear, etc . Because of to it is similarity using Bitcoin with the primary signal being essentially often the same, Litecoin could probably piggyback from r & d innovations achieved by the Bitcoin community. Weaknesses Because this is a fork of Bitcoin, Litecoin does not necessarily experience unique and/or remarkable attributes compared to various other blockchains. Many consider Litecoin as a test out multilevel of Bitcoin plus for that reason, a lot of upgrades applying to Litecoin will likewise be implemented inside of Bitcoin as well (SegWit is surely an example). When this would put features to Litecoin that will that otherwise would not take pleasure in, it likewise makes the idea less likely to have superior attributes exclusive only to Litecoin, making that difficult to be able to standout. As a shop of value, Litecoin is catagorized guiding Bitcoin significantly throughout terms of business deal volume and brand recognition, without any major differentiating capabilities. As a medium involving exchange, Litecoin had the benefits against Bitcoin in the early years given it has faster confirmation moment, nonetheless the newer generation blockchains are even more rapidly. A benefit Litecoin has as opposed to the newer blockchains is in merchant re-homing. Level 2 solutions are produced which arguably is better regarding small orders as a consequence of level of privacy and speed. Lightning Networking system, which was launched previously in 2018, already has over 3, 600 nodes. Should it become profitable, paying using Litecoin will be even much less compelling. Litecoin is backed by the Litecoin Foundation which usually does certainly not have a lot of assets (see their best and newest economical statements: https://litecoin-foundation.org/2018/07/unaudited-financial-statements-2018-05. Conclusion All round Rating: B We have a new neutral view on Litecoin because although Litecoin loves a large community holding up the coin, there is usually no technical attributes exclusive to that. Along with firm coins and layer two solutions becoming more and more famous, Litecoin�s cost proposition as a sound moderate of change diminishes. In the event that Litecoin is successful in updating certain attributes, those functions will be duplicated to be able to Bitcoin soon, much like just how SegWit was performed. When the upgrade fails, then it would negatively impact typically the cryptocurrency. Thus, going forward, many of us consider Litecoin would certainly not include any significant unique advantage that could differentiate itself from all other cryptocurrencies.

1 note

·

View note

Text

LTC Core Wallet

What is Litecoin? Litecoin brands itself just as one open source, peer-to-peer cryptocurrency that enables fast and near-zero obligations concerning anyone, everywhere in the world. It was produced in October in 2011 by means of an ex-Google and even ex-Coinbase engineer, Charlie Shelter, as an alternative in order to Bitcoin. He wished to develop a cryptocurrency that may fix some of the problems suffered by Bitcoin, like as purchase times, large transaction service fees, and focused mining trust. He / she likewise wanted to enable larger-scale adoption by persons together with businesses. Litecoin can be utilized by individuals to make purchases inside real world even more easily than more other cryptocurrencies because it will be maintained a growing range of wallets and crypto debit cards. litecoin core version 0.13.2.1 offers also manufactured progress with the merchant aspect since they have recently been growing their point-of-sale settlement entry and banking services to be able to much easier for merchants to recognize Litecoin as a good way of payment. The Litecoin community has decent usage. Normally, Litecoin processes all-around 20, 000 to thirty, 500 on-chain orders a good day. Often the chart under shows typically the utilization associated with the Litecoin network with regard to the past two decades:

Litecoin as opposed to Bitcoin Thinking of that Litecoin was created making use of Bitcoin�s code (it was initially a fork of this Bitcoin) with near-identical functions, it is usually compared with Bitcoin. The key differences usually are highlighted below: Hashing algorithm: Both Litecoin together with Bitcoin use proof-of-work because its consensus algorithm, nevertheless , Litecoin uses a different hashing algorithm � scrypt instead of Secure Hash Formula (SHA) 256. Scrypt is more memory-intensive than a good protocol that is not memory-hard. Simply because processes are operate in parallel with scrypt instead of serially with SHA-256, so that as some sort of result, scrypt needs more memory. 1 of the advantages of making use of scrypt is having a network that is more accessible and democratized. For you to be competitive, miners can attain even more memory instead connected with having to get specialized application-specific integrated circuits (ASICs) while is the case together with Bitcoin. This means of which in theory, usual folks can become miners using Litecoin, whereas concentrated gold mining pools / ASIC vegetation already dominate the Bitcoin mining. Transaction fees: Transactions on Litecoin are considerably cheaper than Bitcoin. Since September 24, 2018, the typical transaction fee for Bitcoin was $0. 434 vs . $0. 0483 for Litecoin, making Bitcoin 9 periods more costly. At typically the top on December twenty-two, 2017, average daily Bitcoin financial transaction fees surpassed $55 while Litecoin fees were being only $0. 931. Full speed: Litecoin is designed in order to be 4x faster when compared with Bitcoin as average mass confirmation times are 2 . 5 minutes, instead of 10 minutes. Supply: Litecoin has some sort of entire source of 84 million money, compared with 21 zillion gold coins for Bitcoin. Synopsis stand comparing Bitcoin in addition to Litecoin: Key Features Proof-of-work: Litecoin uses proof-of-work, which often is a good consensus device that relies on a good difficult computational activity to secure the network through malicious celebrities. Miners be competitive to fix the task the particular fastest and happen to be rewarded accordingly. (For litecoin core version 0.16.3 , see our own document �What is Evidence of Work? �) Scrypt: Because outlined above, Litecoin makes use of often the scrypt hashing algorithm. Divided Witness (SegWit): SegWit improved the block size limitation of Litecoin via you MB to five MEGABYTES by way of removing signature bank info (i. e. the particular �segregated� part) a business deal although making sure the purchase can be still safe and safeguarded (i. electronic. the �witness� part). SegWit allows to get increased transaction outcome together with helps other attributes in addition to purposes, such as the Lightning Network, MAST, Confidential Transactions, and Schnorr Autographs, for being implemented. Key Milestones Litecoin is an wide open source project in addition to it has the source code can be viewed below: https://github.com/litecoin-project/litecoin August year 2011: Litecoin was officially introduced upon GitHub and the network goes live shortly soon after. November 2013: Litecoin arrived at an industry cap of $1 billion initially. December 2013: Litecoin v0. 8. a few. 1 premiered. This had been the significant release along with the number of improvements, which includes popular wallet attributes like Coin Control, speedier affirmation, faster propagation, and so forth Economy is shown 2014: Litecoin pocket book for Android was officially unveiled. April 2014: Typically the beta of Electrum, the Litecoin wallet, was launched. 06 2015: Litecoin v0. 15. 2. 2 has been published and represented the particular official discharge version regarding Litecoin Core. This had been a significant launching, and even was the technical equivalent involving Bitcoin v0. 10. second . Major changes include watch-only wallet support, more rapidly blockchain synchronization, improved signing safety, new utility software, etc . January 2017: Litecoin Central v0. 13. two premiered, a major let go with a amount of method level improvements, computer code optimizations, the ability to move out many soft forks at once, and so forth Segwit was activated upon testnet. May 2017: Litecoin stimulated SegWit and completed this first payment transaction for the Lightning Network with often the exchange executed in under one 2nd. August 2017: Litecoin Core v0. fourteen. 2 was launched. This has been a new major version release with new features, a variety of bug fixes, and several functionality improvements (e. g. quicker sync and first block download times). May possibly 2018: Litecoin Core v0. 16. 0 was launched, some sort of major release that presented full support regarding segwit in its wallet and user interfaces. To get more details and to get potential technical updates, you need to check out Litecoin�s official blog at https://blog.litecoin.org. Down load the Free Guidelines regarding Crushing ICOs! This can be the guideline that help myself find the most promising ICOs! CLICK HERE TO FIND THE FREE TUTORIAL > > Future Advancement Right away the activation of SegWit, Charlie Lee got discussed adding features such because Lightning Network, MAST, Private Orders, and Schnorr Signatures, yet , no roadmap has got been given yet. Inside fact, all the offered upgrades are features from other blockchain and not special to be able to Litecoin. Most connected with the upgrades may also be as developed on Bitcoin since well. In litecoin qt version 0.13.3 , Charlie Even offers displayed his metrics connected with accomplishment for Litecoin: (1) network security, (2) market capitalization, (3) exchange liquidity, (4) merchant support, and even (5) currency usage. Thus, we expect the future innovations will focus on improving these types of metrics. Symbol Economics Litecoin currently provides a block incentive of 25 LTC each block. Halving occurs any 840, 500 blocks (approximately each 4 years) centered on a obstruct moment of 2. 5 minutes therefore, the block reward will be supposed to drop to doze. your five LTC in all-around September 2019. The spread out offer is presently fifty eight, 544, 952 (as of August 1, 2018); this particular determine will progressively boost into the total supply connected with 84 thousand LTC sometime in the mid-2100s soon after which no new money will be minted. Workforce The particular Litecoin Foundation is a non-profit organization that will supports the development of Litecoin. This is comprised of four persons on the Panel regarding Directors (see below) since well as various other company directors, programmers and volunteers. Typically the Litecoin Foundation works together with the Litecoin Core development team, which usually contains coders behind often the Litecoin task, and provides these individuals economical support. The biographies involving the key people in back of Litecoin are all in all listed below: Charlie Lee, Founder associated with Litecoin, and Handling Movie director of the Litecoin Basic foundation � He was recently the Representative of Architectural at Coinbase where he / she worked for five yrs. Before that, he or she performed at Google with regard to a few years as the Software Engineer on quite a few jobs including YouTube Mobile, Stainless OS and Google Play Games. Prior positions include Senior citizen Software Engineer at Guidewire Software and Software Electrical engineer at Kana Communications. He or she obtained his Master�s education in Personal computer Science through M. I actually. T. in 2000. Xinxi Wang, Litecoin Foundation Overseer � Xinyi Wang was one connected with the Beginning Member regarding the Litecoin Groundwork and is one of this developers behind Litecoin Core. He is also this Founder and BOSS involving Coinut Exchange, a new Singapore-based cryptocurrency trading platform that has been established in December 2013. This individual obtained his Bachelor�s degree in Computer Technology from the Harbin Institute regarding Technology in 2009 and even his Ph. N. inside of Computer Science from the Country wide University of Singapore in 2014. Franklyn Richards, Litecoin Foundation Director ~ Franklyn Richards was one of the Founding People of the Litecoin Foundation and currently works Litecoin. com. He is usually the COO of Zulu Republic, a new blockchain startup company that aims to create the ecosystem of digital platforms built for the Ethereum blockchain. Zing Dalam, Litecoin Base Director ~ Zing Dalam has been a new Home of the Litecoin Basis since May 2018 in addition to was previously from BlockAsset Undertakings, a blockchain-focused VC firm, from January for you to May possibly 2018. Prior jobs contain Associate Overseer associated with Assets at Temasek and even Representative and Co-Founder associated with Greenergy Global with Biomax Technologies. She attained the Bachelor�s degree in Enterprise Administration from your Singapore Management University around 2007. litecoin core version 0.14.2 � Having started out this year, Litecoin is among the oldest and most mature blockchain assignments and contains built some sort of large neighborhood. Looking with this number of customers about the respective subreddits, Litecoin�s community is only right behind Bitcoin and Ethereum. Litecoin can make good progress at terms of merchant re-homing with point associated with selling, merchant settlement gateways in addition to banking services via Coingate, Coinpayments, Coinify, Coinbase Trade, Gocoin, Paybear, and so forth Thanks to its similarity along with Bitcoin with the main program code being essentially often the same, Litecoin could likely piggyback from r and d discoveries achieved by the Bitcoin community. Weaknesses Because the idea is a fork regarding Bitcoin, Litecoin does not necessarily need unique and/or superior capabilities compared to various other blockchains. Many consider Litecoin as a test out networking of Bitcoin in addition to for that reason, a lot of improvements signing up to Litecoin will also be implemented inside Bitcoin as well (SegWit is an example). When this might add more features to Litecoin the fact that that otherwise will not appreciate, it likewise makes the idea less most likely to have superior attributes exclusive only to Litecoin, making this difficult for you to standout. As a retail store of value, Litecoin declines at the rear of Bitcoin significantly throughout terms of business deal volume level and brand popularity, without having any major differentiating features. As some sort of medium of exchange, Litecoin had a great benefits against Bitcoin throughout the early years mainly because it has faster confirmation time, yet the newer technology blockchains are even faster. The benefit Litecoin has versus the modern blockchains will be in merchant usage. Coating 2 solutions are created which arguably is much better intended for small purchases as a result of personal privacy and speed. Super Market, which was launched previously in 2018, already provides over 3, 600 nodes. Should it become prosperous, paying together with Litecoin is usually even much less compelling. Litecoin is backed with the Litecoin Foundation which does certainly not have a lot of resources (see their best and newest fiscal statements: https://litecoin-foundation.org/2018/07/unaudited-financial-statements-2018-05. Realization Entire Rating: B We have now a neutral view on Litecoin because although Litecoin likes a large community holding up typically the coin, there is usually no technical capabilities special to it. Along with dependable coins and level 3 solutions becoming more together with more well-known, Litecoin�s benefits proposition as being a sound channel of trade diminishes. When Litecoin works in changing certain attributes, those capabilities will be copied for you to Bitcoin soon, the same as just how SegWit was completed. When the upgrade falls flat, then it would in a wrong way impact typically the cryptocurrency. Therefore, going ahead, many of us consider Litecoin would likely not have any major unique advantages that may differentiate itself from all other cryptocurrencies.

1 note

·

View note

Text

The traditional media erroneously represent bitcoin mining as inefficient. Absolutely nothing might be even more from the reality. Bitcoin mining supplies a financial quote for otherwise unusable, excess energy. Bitcoin will move humankind to abundance." Bitcoin Mining isn't inefficient"-- an AI-generated image by DALL-E, OpenAI To go over bitcoin mining, one need to initially comprehend how it works: Proof-of-Work and the problem modification. How Bitcoin Mining Works Bitcoin is a brand-new kind of cash that utilizes a Proof-of-Work agreement system to protect the network ( SHA-256). The "work" is the calculation that needs to be carried out to fix the puzzle. Miners utilize computer systems particularly developed for bitcoin mining ( ASICs) to contend versus each other in a race to think a very a great deal. Every 10 minutes usually, according to a Poisson circulation, the miner who initially thinks an effective number gets to include a brand-new block to the Bitcoin blockchain, making the block benefit. The block benefit is comprised of the deflationary block aid, which cuts in half every 4 years approximately, and deal costs paid by users to incentivize their deals to be contributed to the next block. Proof of work is based upon asymmetry. It's exorbitantly costly and hard to produce the evidence while staying very low-cost and simple to validate that evidence. Miners should use up a lot of energy to have any opportunity at resolving the puzzle prior to an even quicker rival does. Since June 10, 2022, this expense concerns about $22,000 per BTC for miners in North America At the very same time, it's almost totally free to confirm that a block stands, allowing all other network individuals ( complete nodes) to rapidly accept or decline a block proposed by a miner. By itself, evidence of work would not suffice to protect the Bitcoin network. Miners would rapidly adjust by focusing on fixing this one sort of puzzle, enhancing the effectiveness of their miners (CPUs → GPUs → ASICs), increasing the variety of miners and therefore growing the total hash rate by leaps and bounds. This competitive rush would lead to ever briefer periods in between succeeding blocks, with bitcoin being provided at a rate far higher than was required by the initial supply schedule. Satoshi Nakamoto resolved this issue by executing the trouble change, an exceptional example of algorithmic homeostasis. Over the long term, the trouble modification makes sure that brand-new blocks are discovered, usually, every 10 minutes, adjusting itself each time that 2,016 extra blocks (2 weeks) have actually passed. This smart Easter egg is a nod towards reversing the result of Executive Order 6102 When blocks are being mined too rapidly (less than 10 minutes in between blocks usually), as can typically hold true due to increasing hash rate coming online, the puzzle ends up being more difficult at the two-week checkpoint so regarding slow the rate of mining. On the other hand, when blocks are being mined too gradually (more than 10 minutes in between blocks typically), the puzzle ends up being simpler so regarding speed up mining back to the targeted balance rate of 2,016 obstructs per fortnight. At this speed, the designated halvings every 210,000 obstructs occur at around four-year periods. Over the long term, this homeostatic feedback loop figuring out mining problem normally cancels any variances from the organized rate of 2,016 brand-new blocks per fortnight. When fast boosts in the overall hash rate are more typical than decreases in the mining problem, this cumulative small imbalance triggered by Bitcoin's rapid boost in mining power has actually led to obstruct benefit halvings that happen a couple of months earlier than anticipated. In practice, when the hash rate quickly increases, the upward problem change every 2 weeks isn't almost sufficient to totally neutralize this pattern of blocks showing up faster than prepared. This is eventually why the very

first numerous Bitcoin halvings (November 28, 2012; July 9, 2016; and May 12, 2020) have actually had to do with 3 years and 3 seasons apart. This classy, self-correcting system guarantees that the bitcoin supply schedule set by Satoshi Nakamoto at the start is followed, eventually implementing the 21 million cap with approximately quadrennial halvings of the block benefit. Bitcoin's Energy Usage Bitcoin supplies a distinctively important item to humankind. It is the finest cash around. Bitcoin uses a deflationary shop of worth, light-speed circulating medium and accurate system of represent the international economy. Bitcoin, when utilized with finest security practices, secures a person's buying power and home rights from seizure, debasement, inflation, counterfeiting or other political abuses. Historically, gold supplied comparable advantages to humankind. For generations, individuals have actually disputed the benefits and expenses of the gold requirement Satoshi Nakamato on the expenses of bitcoin mining. Source: BitcoinTalkForums Bitcoin miners have the ability to transform watts of electrical power anywhere in the world into cash (BTC). This is astonishing and will drastically alter energy markets. Bitcoin is an energy purchaser of last hope. It is the only usage case that will purchase energy throughout the world, at any time, for any period. Due to the competitive market of bitcoin mining, miners just flourish by utilizing low-cost power that has no other purchaser eager to bid a greater rate for it. Utilizing extremely pricey power that's likewise extremely searched for by others or mining at a loss is self-defeating. This market system develops brand-new chances, such as utilizing squandered flared gas for Bitcoin mining to decrease CO2 emissions. Bitcoin miners utilize energy that would otherwise be lost or unprofitable to utilize. Large sources of energy, such as Hydro-Québec in Canada, frequently have an excess generative capability that could not be used prior to Bitcoin. Now, thanks to bitcoin mining, these tidy power resources have a direct method to monetize their excess power capability. This reduces the expense of production for all power customers as business have the ability to make the very same or greater earnings by serving more watts to customers for the very same or lower expense. Wasting any power at all boosts expenses for everybody by decreasing the need curve listed below the offered supply. In order to get the exact same rate of return, manufacturers need to increase costs to make up for the resources lost in establishing sources of excess power capability that aren't constantly able to discover a purchaser. For example, let's envision there is a rural hydro plant that has a set 5,000 megawatts readily available. The operators of the center wish to attain a rewarding return on the operation, as it costs a great deal of cash to develop and preserve the plant. The customers in the rural town are rate inelastic, as they have no alternative sources of electrical power and should turn to manual work whenever electrical power does not be adequate. Presently, the town just utilizes 3,000 MW out of the 5,000 MW readily available. A bitcoin miner can be found in and purchases the staying 2,000 MW. The rural citizens are no longer on the hook and are therefore devoid of needing to fund excess power that they do not even utilize. Now, the rural hydro plant has the ability to lower customer rates for electrical power while making the very same rate of revenue. A win-win for everybody. Source: Author. Mining bitcoin today pays with inexpensive energy on lots of nationwide electrical power grids. In the future, bitcoin mining will just pay at the margins where the net energy expense is close to no and even unfavorable: for instance, utilizing the waste heat for a boiler or food production Bitcoin miners support the grid. Bitcoin miners are extremely cost-sensitive. If they wish to remain running in earnings,

they need to not take on customers and services for high-cost electrical power in locations where it is most limited and extremely valued by existing market individuals. They will close down throughout high-stress occasions rather of continuing to mine. As versatile purchasers of power just when it is affordable to do so, bitcoin miners have the ability to close down rapidly in action to upward variations in electrical energy grid need. This differs from other big power users such as aluminum smelting, which takes 4-- 5 hours of undisturbed power to close down Recently, Texas's power grid operator, ERCOT, asked Texans to save power due to continuous heatwaves. Texas bitcoin miners reacted by turning off over 1,000 megawatts worth of bitcoin mining load, permitting over 1% of overall grid capability to be pressed back to the grid. Bitcoin miners motivate additional financial investment in low-priced, steady baseload power. Energy use is straight associated with human growing and empowerment. Bitcoin miners are quickly growing energy users looking for low-priced electrical power worldwide. Bitcoin miners are straight accountable for bringing online brand-new solar, wind and hydro plants all over the world. Conclusion Bitcoin mining benefits the world. It decreases energy expenses for everybody, increases energy market effectiveness, supports grids and incentivizes humankind to quickly scale energy production to abundance. Source: Unknown. The author created this image with OpenAI's DALL-E. Upon generation, the author examined and released the image and takes supreme duty for the material of this image. This is a visitor post by Interstellar Bitcoin. Viewpoints revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine. Read More

0 notes

Text

Ye vs. Drake

Haduken ready to fight

Catch me on a flight

Straight out of the lime light

Illumination is what we are

So together we might go far

Are you finally wearing those ye-ezy?

Rest In Peace little easy e

Anyway no matter what you have

You still ain’t got no other halves

Both of you I’ll stare with you with a cringe

Knowing damn well you’ve been inside the same door hinge

Come on Kim k let’s discuss our fight

Are we really beefing at cheesecake?

My bad Kenny I didn’t mean to flake

Not once in hong Kong with your poisoned apple

Is this maple?

across KOKO expecting me not to KO

Drunk and dismayed I didn’t mean to

Disrespect your mother and your sister too

Alright I’ll stop being so derogatory

So I can finally meet your family

I hope I’m not too late with this apology track

Maybe even one day I get your trust back

Anyways now we’re all back on the same track

Time and space will never go out of wack

Traveling always had their constant woes

Crossing paths with all the other instahoes

Pulling up in the scene

without my constant calamities

No wonder your looking to diss on this track

Your character may be out of whack

Subsidies concrete

Without missing my entire fleet

Got my girlfriends on deck

Hair looking fresh manicured with the french

Makeup on fleek

Coming to your neighborhood intending to stunt

May even come out with a few new homies

Circles loyalties with each other’s royalties

Rapping about money to circulate my wealth

Mining bitcoins never gonna find me on stealth

Instawealth instawife making you mine all my life

You’ll refine me as your fine wife

Be my new slice

Straight out of of kissing my dice

Might even make it on the list looking nice

Super sonic drip is what we’ll achieve

Ready to make us three and conceive

Wait this is supposed to be a rap battle

Damn I got distracted by my wife’s rattle

Longer lines make me fine

Gotta make Dr.Dre proud and make money out of his fine time

We’re doing this for Tupac easy e and biggie times three

Finding all the local homies and grabbing them a college degree

Are we in the clear causing riots to end the insanity

Calling us numbers with desensitized fashion

Now you’re trying to control our rations

Your numbers a wack your government is violent

No crime to be mistaken when your solidiers are ignorant

Breeding racism from every way we turn im Filipino with every colour of our nation

Red white and yellow is what I bleed screw your insanity

You’re murdering my people without any media attention

You’re murdering the medias solid affliction

Covid 19 ain’t got a joke controlling worlds population without any remorse

Concrete plans to settle my affliction towards the the governed sovereignty

Where did it end and when will it stop free my local homies from 93 they’ve been here longer with wise Words of fashion

but no you’re depriving them of good intention

Causing harm made by your stupid platform

Racism isn’t the key

Hoping one day rye will make it to three

Robbing my children blind of their future

Causing harm to their utmost culture

Why hate on the backbones of America

You owe them money and robbed them their wealth

Health check

Poisoning our air to meet a certain quota

Well damn don’t you have some sort of compassion towards the elderly?

Super sonic key to end the necessities

Of loving others like our mothers comfortabilities

Lost in translation without conversation

This melting pot society and in a white mans world? Nah

Shit ain’t right pay us back just like the third reich

End your racist ways we come in peace

With our hands up hoping one day we all come together in one solid piece.

0 notes

Text

WARNING TO HODLERS!! BITCOIN ABOUT TO GO PARABOLIC!!! [20% USD Inflation] – Programmer explains

youtube

WATCH LIVE DAILY: https://ivanontech.com/live

FREE ALTCOIN WEBINAR: https://academy.ivanontech.com/alts

START TRADING (get great starter deals): https://ivanontech.com/deals

SIGN UP FOR TELEGRAM: https://t.me/ivanontechannouncement

TIMESTAMPS (thanks to Nate Lovell): Introduction- 0:00 Chuck E. Cheese Dumps- 4:24 Altcoin Strategies Webinar Reminder- 4:54 Market Analysis- 5:23 Cryptocurrency as an asset class has out-performed nearly all others- 6:18 OriginTrail Gains and Partnerships- 7:10 Pluton Update- 8:34 XIO Flash Staking Updates- 9:38 SwissBorg Updates- 11:07 Elrond Mainnet Launch and Travala Integration- 11:52 UTRUST Accepts Fiat- 12:11 U.S. Dollar Index (DXY) Analysis- 12:38 The Fed is expected to make a major commitment to ramping up inflation soon- 14:30 Fed all in on inflation- 17:34 Why is the Consumer Price Index Controversial?- 19:08 Square says Cash App generated $875 million in BTC Revenue- 20:08 Russia’s Biggest Bank Considers Launching its own Stablecoin- 23:10 How to trade ETH on dYdX- 24:52 Alt Strategy Webinar Reminder- 28:31 Q&A- 28:58 Q- Do you think ETH can function as money? 30:25 Q- Is this an error in the wallet or an opportunity to make a quick buck? 32:23 Q- Have you talked with Jeff Kirdeikis about Uptrend $1UP and how do you feel about social media tokens? 34:13 Q- Thoughts on UniCrypt? 35:02 Q- How does short trading affect AMPL? 35:32 Q- Since Brian Armstrong owns AMPL, do you think Coinbase will list AMPL soon? 36:45 Q- Thoughts on ETH Testnet? 37:11 Q- Any thoughts on NIMIQ? 37:20 Q- What do you think about eth mining? 42:34 Q- Is it true that staked eth will be burned? 43:28

DISCLAIMER: Trading Bitcoin is VERY risky, and 80% of traders don’t make money. Make sure that you understand these risks if you are a beginner. I only recommend crypto trading to already experienced traders!

Social: Twitter: https://twitter.com/IvanOnTech LinkedIn: http://linkedin.com/in/ivanliljeqvist/ Instagram: http://instagram.com/ivanontech/

Podcast links: Apple Podcast: https://podcasts.apple.com/be/podcast/ivanontech/id1491623365 SoundCloud: https://soundcloud.com/ivanontech Spotify: https://open.spotify.com/show/5PLwE4TXRjE7y8WRyNbhWI?si=8g2NYjV9QmSnKCLApdJhuA RSS (add in any app yourself): https://feeds.soundcloud.com/users/soundcloud:users:747558916/sounds.rss

**Disclaimer** Please be advised that I own a diverse portfolio of cryptocurrency as I wish to remain transparent and impartial to the cryptocurrency community at all times, and therefore, the content of my media are intended FOR GENERAL INFORMATION PURPOSES not financial advice. The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content of this video is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Purchasing cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome. Past performance does not indicate future results.

This information is what was found publicly on the internet. This is all my own opinion. All information is meant for public awareness and is public domain. Please take this information and do your own research.

bitcoin, cryptocurrency, crypto, altcoin, altcoin daily, blockchain, decentralized, news, best investment, top altcoins, ethereum, tron, stellar, binance, cardano, litecoin, 2019, 2020, crash, bull run, bottom, crash, tether, bitfinex, rally, tone vays, ivan on tech, chico, video, youtube, macro, price, prediction, podcast, interview, trump, finance, stock, investment, halving, halvening, too late, when, fed, federal reserve, interest rates, rates, cut, economy, stock market,

Good Morning Crypto

Ivan on Tech by Ivan Liljeqvist

The post WARNING TO HODLERS!! BITCOIN ABOUT TO GO PARABOLIC!!! [20% USD Inflation] – Programmer explains appeared first on BLOCKPATHS.

source http://blockpaths.com/commentaries/warning-to-hodlers-bitcoin-about-to-go-parabolic-20-usd-inflation-programmer-explains/

0 notes

Photo

New Post has been published on http://cryptonewsuniverse.com/what-is-ethereum-the-ultimate-research-backed-eth-guide/

What is Ethereum? The ULTIMATE Research-Backed ETH Guide

What is Ethereum? The ULTIMATE Research-Backed ETH Guide

So what exactly is Ethereum? Ethereum is the leading blockchain app platform that was proposed in 2013 by Vitalik Buterin and went live on July 30, 2015.

There are many different strands to this project and getting your head around it all can be quite the challenge. That’s why we have put together this comprehensive guide for those of you wondering “What is Ethereum?” and “How does Ethereum Work?” As the harbinger of the second generation of blockchains and home to the second largest digital currency in the world, Ether (ETH), the Ethereum project has started a new era of blockchain development that enables a global community of developers to unleash their creativity in the space. The ability to craft smart contracts gave developers a chance to think about new use cases for blockchain technology that previously remained largely connected to cryptocurrencies.

A tech journalist and crypto market analyst, Malek is also a double Master's Degree holder, his most recent one being from a US Top College in Petroleum Engineering. Malek worked as an Engineer for a Major E&P and started showing interest in cryptocurrencies a year ago, impressed by the huge potential of both the concept and the technology underlying it.Ethereum also gave enterprises, organizations, and startups the ability to issue their own tokens, and build their own unique blockchain ecosystem using the Ethereum framework. Till date, Ethereum-based ERC20 tokens have been the most popular means for launching Initial Coin Offerings. Of course, Ethereum is still in development and has faced some hurdles. It has faced problems related to scalability, which was highlighted when the popular game dedicated to internet-bred cats called CryptoKitties managed to clog its network in December 2017. However, with a unique concept, upcoming developments, a strong developer community and the first-mover advantage (second only to the mighty Bitcoin), Ethereum is one blockchain project that continues to remain at the forefront of DLT and crypto development.

So… What is Ethereum?

In a nutshell, Ethereum is an open source Smart contract and Decentralized Application Platform. The Ethereum whitepaper describes the project as the next generation distributed computing platform, that provides a decentralized virtual machine known as the Ethereum Virtual machine EVM. The latter is able to execute Peer-to-Peer contracts by means of Ether (ETH), its proprietary crypto fuel. Blockchain technology is used as a tool of shared consensus, while Ether is the digital asset that is used to pay for transaction fees and computational services.

What’s the Difference Between Bitcoin and Ethereum?

Since the advent of the Ethereum project in late 2014 and its explosion of popularity within the confines of the nascent crypto space and beyond, Ethereum has always been compared to Bitcoin. All being similar to the use of Blockchain as the underpinning technology, both projects are fundamentally different. The main difference between them is the purpose of each one. In fact, Bitcoin was built as an alternative to regular money. Bitcoin can be used as a medium of value exchange, a means of payment and a store of value with no central authority to issue or control it and no intrinsic value or physical existence. On the other hand, Ethereum is rather a platform for developers to build and run Peer-to-Peer executable contracts and decentralized applications. Block time generation (seconds in the case of Ethereum and minutes in the case of Bitcoin), the rate at which new coins are mined (constant in Ethereum and halves every 4 year in the case of Bitcoin), the proof of work hashing algorithm (Ethhash in Ethereum, and Sha 256 in Bitcoin), and the total supply (capped to 21 millions in the case of Bitcoin and uncapped in that of Ethereum) are the other differences that set both projects apart.

The Ethereum Virtual Machine

The Ethereum Virtual Machine (EVM), is a 256-bit quasi-turning-complete virtual state machine that forms the runtime environment for smart contracts and specifies the execution model for such contracts. The machine is stack based, altogether separate from the main Ethereum Network, and has its own independent storage model. In fact, all the nodes on the Ethereum Network run the EVM in addition to validating transactions. The EVM could be seen as a testing ground for Smart contracts because once these contracts are deployed to the mainnet, such a step can’t be reversed. Any developer that wants to build on Ethereum, could deploy his/her untested code on this network of computers and see how it muddles along.

Ether (ETH) and Gas

A tech journalist and crypto market analyst, Malek is also a double Master's Degree holder, his most recent one being from a US Top College in Petroleum Engineering. Malek worked as an Engineer for a Major E&P and started showing interest in cryptocurrencies a year ago, impressed by the huge potential of both the concept and the technology underlying it.In Ethereum each operation or work performed by the network has a cost assessed by the network which is known as a gas limit. In order to execute a smart contract, for example, developers need to pay for all the operations featured in their code. Sending Ether from one wallet to another one involves four gas units. These gas units are checking your balance, transferring ETH to a receiving address, subtracting ETH from your balance and adding ETH to the receivers.

So gas units refer to the smallest measurement of work needed to settle a given operation but don’t have a monetary value. The cost is paid in Ether. Gas is that unit that translates into Ether. Since Ethereum can only compute a limited number of gas units at any given time, miners are sort of bribed by network users to pace up the stream of request that is being sent over to the network. To pay miners, small fractions of ETH named Gwei are attached to each gas unit, which sets the gas price. What everyone should remember is that the gas price is how much you pay per gas unit, and the gas limit is how much work you are requesting from the network.

Smart Contracts – What Are They and How Do They Work?