#Bill Janklow

Explore tagged Tumblr posts

Text

South Dakota Governor DILFs

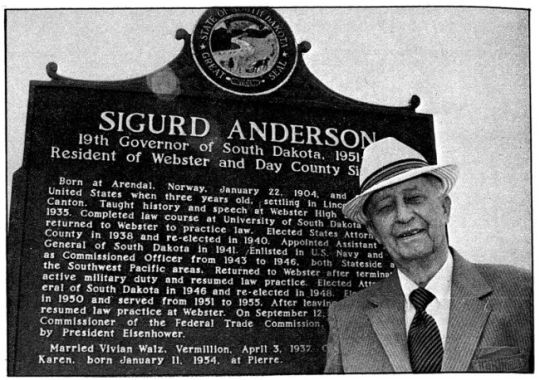

Dennis Daugaard, Nils Boe, Richard F. Kneip, Walter Dale Miller, Leslie Jensen, Bill Janklow, Archie M. Gubbrud, George T. Mickelson, George S. Mickelson, Frank Farrar, Harlan J. Bushfield, Mike Rounds, William H. McMaster, Ralph Herseth, Carl Gunderson, Merrell Q. Sharpe, Joe Foss, Sigurd Anderson

#Dennis Daugaard#Nils Boe#Richard F. Kneip#Walter Dale Miller#Leslie Jensen#Bill Janklow#Archie M. Gubbrud#George T. Mickelson#George S. Mickelson#Frank Farrar#Harlan J. Bushfield#Mike Rounds#William H. McMaster#Ralph Herseth#Carl Gunderson#Merrell Q. Sharpe#Joe Foss#Sigurd Anderson#GovernorDILFs

11 notes

·

View notes

Text

Good morning, friends. 🏧💳💰

18 January 2025

The first time I saw or used an ATM was in 1979, in Las Cruces, New Mexico. I was assigned there as part of the New Mexico State University ROTC detachment. I found it truly remarkable that I didn't need to go inside the bank to get cash, though I did have to get out of my car since drive-through ATMs had not yet emerged. In those days, people mostly wrote a lot of checks, and I carried my checkbook everywhere. Nowadays, however, my checkbook is relegated to the top shelf on my desk, and I use it only to pay the occasional bill that I can't pay online. ATMs are ubiquitous now, and I use them for the little bit of cash that I need.

"Folks can't carry around money in their pocket. They've got to go to an ATM machine, and they've got to pay a few dollars to get their own dollars out of the machine. Who ever thought you'd pay cash to get cash? …" - Bill Janklow

1 note

·

View note

Photo

November 1978 - First meeting of SD Governor-elect Bill Janklow’s transition team. (photo by author)

2 notes

·

View notes

Photo

“There’s a world out there, and you’ve got to look at both sides of the mountain in your lifetime.” – Bill Janklow International mountain day 2021! Kerala Holiday Tours Call us : 9946668319 9495544599 9539997279 https://lnkd.in/giN99_kb [email protected] Our Page: https://lnkd.in/gp_UJMDu #mountainday#vagamon#resort #travel #india #nature#wayanadtrip #vacation #hotel #keralatourism #godsowncountry #photography #travelgram #beach #holiday #luxury #picoftheday #summer #love #travelphotography #photooftheday #family #instatravel #keraladiaries #yathra #malayalam

0 notes

Text

The Great American Tax Haven: Why the Super-rich Love South Dakota

It’s known for being the home of Mount Rushmore – and not much else. But thanks to its relish for deregulation, the state is fast becoming the most profitable place for the mega-wealthy to park their billions.

— By Oliver Bullough | Thursday, 14 November 2019 | Guardian USA

Illustration: Guardian Design

Late last year, as the Chinese government prepared to enact tough new tax rules, the billionaire Sun Hongbin quietly transferred $4.5bn worth of shares in his Chinese real estate firm to a company on a street corner in Sioux Falls, South Dakota, one of the least populated and least known states in the US. Sioux Falls is a pleasant city of 180,000 people, situated where the Big Sioux River tumbles off a red granite cliff. It has some decent bars downtown, and a charming array of sculptures dotting the streets, but there doesn’t seem to be much to attract a Chinese multi-billionaire. It’s a town that even few Americans have been to.

The money of the world’s mega-wealthy, though, is heading there in ever-larger volumes. In the past decade, hundreds of billions of dollars have poured out of traditional offshore jurisdictions such as Switzerland and Jersey, and into a small number of American states: Delaware, Nevada, Wyoming – and, above all, South Dakota. “To some, South Dakota is a ‘fly-over’ state,” the chief justice of the state’s supreme court said in a speech to the legislature in January. “While many people may find a way to ‘fly over’ South Dakota, somehow their dollars find a way to land here.”

Super-rich people choose between jurisdictions in the same way that middle-class people choose between ISAs: they want the best security, the best income and the lowest costs. That is why so many super-rich people are choosing South Dakota, which has created the most potent force-field money can buy – a South Dakotan trust. If an ordinary person puts money in the bank, the government taxes what little interest it earns. Even if that money is protected from taxes by an ISA, you can still lose it through divorce or legal proceedings. A South Dakotan trust changes all that: it protects assets from claims from ex-spouses, disgruntled business partners, creditors, litigious clients and pretty much anyone else. It won’t protect you from criminal prosecution, but it does prevent information on your assets from leaking out in a way that might spark interest from the police. And it shields your wealth from the government, since South Dakota has no income tax, no inheritance tax and no capital gains tax.

A decade ago, South Dakotan trust companies held $57.3bn in assets. By the end of 2020, that total will have risen to $355.2bn. Those hundreds of billions of dollars are being regulated by a state with a population smaller than Norfolk, a part-time legislature heavily lobbied by trust lawyers, and an administration committed to welcoming as much of the world’s money as it can. US politicians like to boast that their country is the best place in the world to get rich, but South Dakota has become something else: the best place in the world to stay rich.

At the heart of South Dakota’s business success is a crucial but overlooked fact: globalisation is incomplete. In our modern financial system, money travels where its owners like, but laws are still made at a local level. So money inevitably flows to the places where governments offer the lowest taxes and the highest security. Anyone who can afford the legal fees to profit from this mismatch is able to keep wealth that the rest of us would lose, which helps to explain why – all over the world – the rich have become so much richer and the rest of us have not.

In recent years, countries outside the US have been cracking down on offshore wealth. But according to an official in a traditional tax haven, who has watched as wealth has fled that country’s coffers for the US, the protections offered by states such as South Dakota are undermining global attempts to control tax dodging, kleptocracy and money-laundering. “One of the core issues in fighting a guerrilla war is that if the guerrillas have a safe harbour, you can’t win,” the official told me. “Well, the US is giving financial criminals a safe harbour, and a really effective safe harbour – far more effective than anything they ever had in Jersey or the Bahamas or wherever.”

Those of us who cannot vote in South Dakota elections have little hope of changing its laws. But if we don’t do something to correct the imbalance between global wealth and local legislation, we risk entrenching today’s inequality and creating a new breed of global aristocrat, unaccountable to anyone and getting richer all the time – with grave consequences for the long-term health of liberal democracy.

South Dakota is west of Minnesota, east of Wyoming, and has a population of 880,000 people. Politically, its voters enthusiastically embrace the Republicans’ message of self-reliance, low taxes and family values. Donald Trump won more than 60% of the vote there in 2016, and the GOP has held a super-majority in the state’s House of Representatives since the 70s, allowing the party to mould South Dakota in its image for two generations.

Outsiders tend to know South Dakota for two things: Mount Rushmore, which is carved with the faces of four US presidents; and Laura Ingalls Wilder, who moved to the state as a girl and wrote the Little House on the Prairie series of children’s books. But its biggest impact on the world comes from a lesser-known fact: it was ground zero for the earthquake of financial deregulation that has rocked the world’s economy.

The story does not begin with trusts, but with credit cards, and with Governor William “Wild Bill” Janklow, a US marine and son of a Nuremberg prosecutor, who became governor in 1979 and led South Dakota for a total of 16 years. He died almost eight years ago, leaving behind an apparently bottomless store of anecdotes: about how he once brought a rifle to the scene of a hostage crisis; how his car got blown off the road when he was rushing to the scene of a tornado.

In the late 70s, South Dakota’s economy was mired in deep depression, and Janklow was prepared to do almost anything to bring in a bit of business. He sensed an opportunity in undercutting the regulations imposed by other states. At the time, national interest rates were set unusually high by the Federal Reserve, meaning that credit card companies were having to pay more to borrow funds than they could earn by lending them out, and were therefore losing money every time someone bought something. Citibank had invested heavily in credit cards, and was therefore at significant risk of going bankrupt.

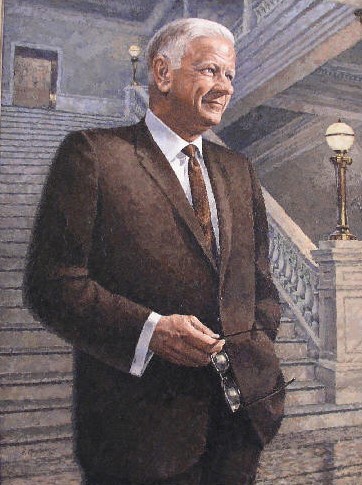

William ‘Wild Bill’ Janklow, the former governor of South Dakota in 1988. Photograph: Per Breiehagen/Life Images Collection via Getty Images

The bank was searching for a way to escape this bind, and found it in Janklow. “We were in the poorhouse when Citibank called us,” the governor recalled in a later interview. “They were in bigger problems than we were. We could make it last. They couldn’t make it last. I was slowly bleeding to death; they were gushing to death.”

At the bank’s suggestion, in 1981, the governor abolished laws that at the time – in South Dakota, as in every other state in the union – set an upper limit to the interest rates lenders could charge. These “anti-usury” rules were a legacy of the New Deal era. They protected consumers from loan sharks, but they also prevented Citibank making a profit from credit cards. So, when Citibank promised Janklow 400 jobs if he abolished them, he had the necessary law passed in a single day. “The economy was, at that time, dead,” Janklow remembered. “I was desperately looking for an opportunity for jobs for South Dakotans.”

When Citibank based its credit card business in Sioux Falls, it could charge borrowers any interest rate it liked, and credit cards could become profitable. Thanks to Janklow, Citibank and other major companies came to South Dakota to dodge the restrictions imposed by the other 49 states. And so followed the explosion in consumer finance that has transformed the US and the world. Thanks to Janklow, South Dakota has a financial services industry, and the US has a trillion-dollar credit card debt.

Fresh from having freed wealthy corporations from onerous regulations, Janklow looked around for a way to free wealthy individuals too, and thus came to the decision that would eventually turn South Dakota into a Switzerland for the 21st century. He decided to deregulate trusts.

Trusts are ancient and complex financial instruments that are used to own assets, such as real estate or company stock. Unlike a person, a trust is immortal, which was an attractive prospect for English aristocrats of the Middle Ages who wished to make sure their property remained in their families for ever, and would be secure from any confiscation by the crown. This caused a problem, however. More and more property risked being locked up in trusts, subject to the wishes of long-dead people, which no one could alter. So, in the 17th century, judges fought back by creating the “rule against perpetuities”, which limited the duration of trusts to around a century, and prevented aristocratic families turning their local areas into mini-kingdoms.

That weakened aristocratic families, opened up the British economy, allowed new businessmen to elbow aside the entrenched powers in a way that did not happen elsewhere in Europe, and helped give the world the industrial revolution. “It’s a paradoxical point, but it wasn’t a bad thing when the scion of some family from out in the counties came down to London and pissed away his fortune. It was redistribution of wealth,” said Eric Kades, a law professor at William & Mary Law School in Virginia, who has studied trusts.

English emigrants took the rule to North America with them, and the dynamic recycling of wealth became even more frenetic in the land of the free. Then Governor Janklow came along. In 1983, he abolished the rule against perpetuities and, from that moment on, property placed in trust in South Dakota would stay there for ever. A rule created by English judges after centuries of consideration was erased by a law of just 19 words. Aristocracy was back in the game.

In allowing trusts to last for ever, South Dakota did something genuinely revolutionary, but sadly almost everyone I contacted – from current governor Kristi Noem to state representatives to members of the South Dakotan Trust Association – refused to talk about it. For an answer to the question of what exactly prompted the state to ditch the rule against perpetuities, I was eventually directed to Bret Afdahl, the director of the state administration’s Division of Banking, who wanted the question in writing. A week later, back came a one-word response: “unknown”.

Initially, South Dakota’s so-called “dynasty trusts” were advertised for their ability to dodge inheritance tax, thus allowing wealthy people to cement their family’s long-term control over property in the way English aristocrats had always wanted to. It also gave plenty of employment to lawyers and accountants.

“It’s a clean industry, there are no smokestacks, we don’t have to mine anything out of the earth or anything, and they’re generally good paying jobs,” said Tom Simmons, an expert on trust law at the University of South Dakota, when we chatted over coffee in central Sioux Falls. Alongside his academic work, Simmons is a member of South Dakota’s trust taskforce, which exists to maintain the competitiveness of the state’s trust industry. “Janklow was truly a genius in seeing this would be economic development with a very low cost to the government,” he said. (By “the government”, he of course means that of South Dakota, not that of the nation, other states or indeed other countries, which all lose out on the taxes that South Dakota helps people avoid.)

As the 1990s progressed, and more money came to Sioux Falls, South Dakota became a victim of its success, however, since other states – such as Alaska and Delaware – abolished the rule against perpetuities, too, thus negating South Dakota’s competitive advantage. But, having started the race to the bottom, Janklow was damned if any other state was going to beat him there. So, in 1997, he created the trust taskforce to make sure South Dakota was going as fast as it could. The taskforce’s job was to seek out legal innovations created in other jurisdictions, whether offshore or in the US, and make them work in South Dakota.

Thanks to the taskforce, South Dakota now gives its clients tricks to protect their wealth that would have been impossible 30 years ago. In most jurisdictions, trusts have to benefit someone other than the benefactor – your children, say, or your favourite charity – but in South Dakota, clients can create a trust for the benefit of themselves (indeed, Sun Hongbin is a beneficiary of his own trust). Once two years have passed, the trust is immune from any creditor claiming a share of the assets it contains, no matter the nature of their claim. A South Dakotan trust is secret, too. Court documents relating to it are kept private for ever, to prevent knowledge of its existence from leaking out. (It also has the useful side effect of making it all but impossible for journalists to find out who is using South Dakotan trusts, or what legal challenges to them have been filed.)

Leona Helmsley with her dog, Trouble.Leona Helmsley with her dog, Trouble. Photograph: Jennifer Graylock/AP

This barrage of innovations has allowed lawyers to create structures with complex names – the South Dakota Foreign Grantor Trust, the Self-Settled Asset Protection Trust, etc – which have done two simple things: they have kept the state ahead of the competition; and they have made South Dakota’s property protections extraordinarily strong. “The smart people want privacy,” explained Harvey Bezozi, a Florida financial adviser and tax expert who blogs under the name Your Financial Wizard. “South Dakota offers the best privacy and asset protection laws in the country, and possibly in the world, for the wealthy to protect their assets. They’ve done a pretty good job in making themselves unique; a real boutique place where the people in the know will eventually gravitate to.”

Among those in the know were the lawyers of Leona Helmsley, the legendarily mean hotel heiress, who coined the phrase “only the little people pay taxes”. When Helmsley died in 2007, she left $12m in trust for the care of her dog, a maltese called Trouble. Trouble dined on crab cakes and kobe beef, and the trust provided her with $8,000 a year for grooming and $100,000 for security guards, who protected her against kidnappings, as well as against reprisals from the people that she bit. When a New York court – not entirely unreasonably – decided to restrain this expenditure, trustees moved the trust to South Dakota, which had crafted “purpose trusts” with just such a client in mind. Other states impose limits on how a purpose trust can care for a pet, on the principle that perhaps there are better things to do with millions of dollars than groom a dog, but South Dakota takes no chances. The client is always right.

Despite all its legal innovating, South Dakota struggled for decades to compete with offshore financial centres for big international clients – Middle Eastern petro-sheikhs perhaps, or billionaires from emerging markets. The reason was simple: sometimes the owners’ claim to their assets was a little questionable, and sometimes their business practices were a little sharp. Why would any of them put their assets in the US, where they might become vulnerable to American law enforcement, when they could instead put them in a tax haven where enforcement was more … negotiable?

That calculation changed in 2010, in the aftermath of the great financial crisis. Many American voters blamed bankers for costing so many people their jobs and homes. When a whistleblower exposed how his Swiss employer, the banking giant UBS, had hidden billions of dollars for its wealthy clients, the conclusion was explosive: banks were not just exploiting poor people, they were helping rich people dodge taxes, too.

Congress responded with the Foreign Account Tax Compliance Act (Fatca), forcing foreign financial institutions to tell the US government about any American-owned assets on their books. Department of Justice investigations were savage: UBS paid a $780m fine, and its rival Credit Suisse paid $2.6bn, while Wegelin, Switzerland’s oldest bank, collapsed altogether under the strain. The amount of US-owned money in the country plunged, with Credit Suisse losing 85% of its American customers.

The rest of the world, inspired by this example, created a global agreement called the Common Reporting Standard (CRS). Under CRS, countries agreed to exchange information on the assets of each other’s citizens kept in each other’s banks. The tax-evading appeal of places like Jersey, the Bahamas and Liechtenstein evaporated almost immediately, since you could no longer hide your wealth there.

How was a rich person to protect his wealth from the government in this scary new transparent world? Fortunately, there was a loophole. CRS had been created by lots of countries together, and they all committed to telling each other their financial secrets. But the US was not part of CRS, and its own system – Fatca – only gathers information from foreign countries; it does not send information back to them. This loophole was unintentional, but vast: keep your money in Switzerland, and the world knows about it; put it in the US and, if you were clever about it, no one need ever find out. The US was on its way to becoming a truly world-class tax haven.

The Black Mountain Hills of South Dakota. Photograph: Posnov/Getty Images

The Tax Justice Network (TJN) still ranks Switzerland as the most pernicious tax haven in the world in its Financial Secrecy Index, but the US is now in second place and climbing fast, having overtaken the Cayman Islands, Hong Kong and Luxembourg since Fatca was introduced. “While the United States has pioneered powerful ways to defend itself against foreign tax havens, it has not seriously addressed its own role in attracting illicit financial flows and supporting tax evasion,” said the TJN in the report accompanying the 2018 index. In just three years, the amount of money held via secretive structures in the US had increased by 14%, the TJN said. That is the money pouring into Sioux Falls, and into the South Dakota Trust Company.

“The easy takeaway is that people are trying to hide. But wanting to be private, to be confidential, there’s nothing illegal about that,” said Matthew Tobin, the managing director of the South Dakota Trust Company (SDTC), where Sun Hongbin parked his $4.5bn fortune. We were sitting in SDTC’s conference room, which was decorated with a large map of Switzerland, as if it were a hunting trophy.

Tobin added that many foreign clients had wealth in another jurisdiction, and worried that information about it could be reported to their home country, thanks to CRS. “That could put them at risk. They could be at risk of losing their wealth, it could be taken from them. There’s kidnapping, ransom, hostages. There is risk in a lot of parts of the world,” he explained. “People are saying: ‘OK, if the laws are the same, but I can have the stability of the US economy, the US government, and maintain my privacy, I might as well go to the US.’” According to the figures on its website, SDTC now manages trusts holding $65bn and acts as an agent for trusts containing a further $82bn, all of them tax-free, all of them therefore growing more quickly than assets held elsewhere.

When I spoke to the official from one of the traditional tax havens, who asked not to be identified, for fear of wrecking what was left of the jurisdiction’s financial services industry, he was furious about what the US was doing. “One of the bitter aspects of this, and it’s something we haven’t said in public, is the sheer racism of the global anti-money laundering management effort,” he said. “You will notice that the states that are benefiting from this in America are the whitest states in the country. They’ve ended up beating the shit out of a load of black and Hispanic places, and stuffing all the money in South Dakota. How does that help?”

I put those comments to a South Dakotan trust lawyer who agreed to speak to me as long as I didn’t identify them. The lawyer was sympathetic to the offshore official’s argument, but said this is how the world is now, and everyone is just going to have to get used to it. It is, after all, not just South Dakota and its trust companies that are sucking in the world’s money. Banks in Florida and Texas are welcoming cash from Venezuela and Mexico, realtors in Los Angeles are selling property to Chinese potentates, and New York lawyers are arranging these transactions for anyone that wants them to. Perhaps under previous administrations, there might have been some appetite for aligning the US with global norms, but under Trump, it’s never going to happen.

“You can look at South Dakota and its trust industry, but if you really want to look at CRS, look at the amount of foreign money that is flowing into US banks, not just into trusts,” the lawyer said. “The US has decided at very high levels that it is benefiting significantly from not being a member of CRS. That issue is much larger than trusts, and I don’t see that changing, I really don’t.”

We have no idea yet what this means in the long term, because the revolution in trust law that began in South Dakota and spread throughout the US is only a generation old. But the implications are ominous.

Here is an example from one academic paper on South Dakotan trusts: after 200 years, $1m placed in trust and growing tax-free at an annual rate of 6% will have become $136bn. After 300 years, it will have grown to $50.4tn. That is more than twice the current size of the US economy, and this trust will last for ever, assuming that society doesn’t collapse altogether under the weight of this ever-swelling leach.

If the richest members of society are able to pass on their wealth tax-free to their heirs, in perpetuity, then they will keep getting richer than those of us who can’t. In fact, the tax rate for everyone else will probably have to rise, to make up for the shortfall caused by the wealthiest members of societies opting out, which will just make the problem worse. Eric Kades, the law professor at William & Mary Law School, thinks that South Dakota’s decision to abolish the rule against perpetuities for the short term benefit of its economy will prove to have been a long-term catastrophe. “In 50 or 100 years, it will turn out to have been an absolute disaster,” said Kades. “Now we’re going to have a bunch of wealthy families, and no one will be able to piss away that wealth, it will stay in the family for ever. This just locks in advantage.”

So far, most of the discussion of this development in wealth management has been confined to specialist publications, where academic authors have found themselves making arguments you do not usually find in discussions of legal constructs as abstruse as trusts. South Dakota, they argue, has struck at the very foundation of liberal democracy. “It does seem unfair for some people to have access to ‘property plus’, usable wealth with extra protection built in beyond that which regular property owners have,” noted the Harvard Law Review back in 2003, in an understated summation of the academic consensus that South Dakota has unleashed something disastrous.

And if some people have access to privileged property, where does that leave the equality before the law that is central to how society is supposed to function? Another academic, writing in the trade publication Tax Notes two decades ago, put that unfairness in context: “Perpetual trusts can (and will) facilitate enormous wealth and power for dynastic families. In the process, we leave to future generations some serious issues about the nature of our country’s democracy.”

With Washington unconcerned by what is happening, and the rest of the world incapable of doing anything about it, is there any prospect of anyone in South Dakota moving to repair the damage? The short answer is that it is too late. Two-dozen other states now have perpetual trusts too, so the money would just move elsewhere if South Dakota tried to tighten its rules. The longer answer is that South Dakotan politics appears to have been so comprehensively captured by the trust industry that there is no prospect of anything happening anyway.

The state legislature is elected every even-numbered year, and meets for two months each spring. It last updated the law governing trusts in 2018, and brought in Terry Prendergast, a trust lawyer, to explain the significance of the changes. “People should be allowed to do with their property what they desire to do,” Prendergast explained. “Our entire regulatory scheme reflects that positive attitude and attracts people from around the world to look at South Dakota as a shining example of what trust law can become.”

There were a few questions from the representatives, but they were quickly shut down by Mike Stevens, a Republican lawyer, and chairman of the state’s judiciary committee. “No more questions. I didn’t understand perpetuities in law school, and I don’t want to understand it now,” he said, laughing.

Susan Wismer, one of just 10 Democrats among the House’s 70 members, attempted to prolong the discussion by raising concerns about how South Dakota was facilitating tax avoidance, driving inequality and damaging democracy. Her view was dismissed as “completely jaded and biased” by a trust lawyer sitting for the Republicans. It was a brief exchange, but it went to the heart of how tax havens work. There is no political traction in South Dakota for efforts to change its approach, since the state does so well out of it. The victims of its policies, who are all in places like California, New York, China or Russia, where the tax take is evaporating, have no vote.

Wismer is the only person I met in South Dakota who seemed to understand this. “Ever since I’ve been in the legislature, the trust taskforce has come to us with an updating bill, every year or every other year, and we just let it pass because none of us know what it is. They’re monster bills. As Democrats, we’re such a small caucus, we’re the ones who ought to be the natural opponents of this, but we don’t have the technical expertise and don’t really even understand what we’re doing,” she confessed, while we ate pancakes and drank coffee in a truck stop outside Sioux Falls. “We don’t have a clue what the consequences are to just regular people from what we’re doing.”

That means legislators are nodding through bills that they do not understand, at the behest of an industry that is sucking in ever-greater volumes of money from all over the world. If this was happening on a Caribbean island, or a European micro-principality, it would not be surprising, but this is the US. Aren’t ordinary South Dakotans concerned about what their state is enabling?

“The voters don’t have a clue what this means. They’ve never seen a feudal society, they don’t have a clue what they’re enabling,” Wismer said. “I don’t think there are 100 people in this state who understand the ramifications of what we’ve done.”

• This article was amended on 20 November 2019 because an earlier version misnamed the Foreign Account Tax Compliance Act as the Financial Assets Tax Compliance Act.

0 notes

Photo

There's a world out there, and you've got to look at both sides of the mountain in your lifetime.

Bill Janklow

Avalanche Lake is located in Glacier National Park, in the U. S. state of Montana.

187 notes

·

View notes

Quote

A caravan of Indians traveled through a howling snowstorm to Custer, where they were refused entry to the meeting. Sarah Bad Heart Bull, mother of John Wesley, asked that she and the AIM leaders be admitted. They were at first denied, but then four AIM leaders, Leonard Crow Dog, Russel Means, Dennis Banks and Charlie Hall, were allowed to proceed into the back of the Custer County Court House. After a "shouting match," Russell Means went out to get the victim's mother, Sarah Bad Heart Bull. The sheriff immediately blew his whistle and 90 officers, batons raised, flooded out of the courthouse basement and into the crowd. They grabbed Sarah Bad Heart Bull and started choking her, forcing her to the ground with a nightstick. Several people in the crowd rushed to her defense, and a riot ensued. Sarah Bad Heart Bull was later convicted of inciting a riot, and sentenced to one to five years in prison. She is currently out on bail awaiting her appeal after having served-six months. Darold Schmidtz never served a day in prison; he was acquitted of all charges. Indian spokespeople believe that a trap had been set at the Custer County Court House. They discovered that dozens of riot police had hidden around the courthouse, with others hiding throughout town. During the battle outside the courthouse, the police threw a tear-gas canister into the back room. Banks picked up a police billyclub from the floor and smashed one of the windows so that the small group inside could get out. He was subsequently charged with being armed in a riot, as well as conspiracy.

Paul DeRienzo at NWO.Media, originally in Overthrow, April-May 1983. Rapist Gov's Vendetta Against AIM Founder

Bill Janklow, Wikipedia article

6 notes

·

View notes

Text

New Post has been published on Sunny Dawn Johnston

New Post has been published on http://sunnydawnjohnston.com/blog/full-moon-report-december-3rd-full-moon/

Full Moon Report - December 3rd Full Moon

I always love the energy of the full moon – well … almost always. Sometime it gets a bit intense, which is why I ask people that tune into moon energy to let me know, in advance … what to be mindful of. I’m one of those types of people that would rather have awareness ahead of time … than not. So … Here is some great info for this month’s FULL MOON by Melissa Corter – Enjoy – SDJ ♥

December 3rd Full Moon in Gemini

The Gemini Full Moon brings communication into view, creating opportunity to clarify and discern your truth and where to place emphasis on speaking it. Engage in conversation of the heart, refrain from the tendency to perpetuate or ignite drama with the spoken word. We are on the horizon of a new year, begin the momentum of this shift now, here in the present moment. Begin the mental and emotional inventory of clutter clearing – this powerful full moon can bring worn out beliefs and ideal to surface to honor and let go of.

The Gemini energy can stir up our talkative and chatty nature at the same time, for some this energy may feel scattered and unclear. A Gemini moon can cause us to become easily distracted; combat this with meditation, presence, and mindfulness and you will float through with ease. A blessing of this moon, is the potential it brings for helping you to shift gears and see things from a new or different perspective, especially if you have found yourself spinning on a particular subject. This moon can help break that cycle to reveal a solution that was present all along.

Full Cold Moon: December- In Native American cultures which tracked the calendar by the Moons, December’s full Moon was known as the Full Cold Moon. It is fittingly associated with the month when winter cold fastens its grip and the nights become long and dark. This Full Moon is also called the Long Nights Moon by some Native American tribes because it occurs near the winter solstice, the night with the least amount of daylight. (Farmer’s Almanac)

Full Moon Self Care for Gemini Energy:

Physical- Use your hands to create something or express yourself. Focus on following through to ground the energy of this month. Gemini rules the hands, fingers, arms, shoulders, upper ribs, lungs, nervous system, and brain.

Emotional- Gemini connect to the air element – place attention on communication; your words are your wands. Affirmative statements are also beneficial at this time. Stones to work with are agate, Aquamarine, Emerald, Tigers Eye, and Citrine.

Spiritually- Work with air to clearly articulate and communicate; be mindful of the dual energy of Gemini. Use this to see both sides of a situation or problem. Gemini has yin and yang energy – channel this in your endeavors.

“There’s a world out there, and you’ve got to look at both sides of the mountain in your lifetime.”

~Bill Janklow

Tips for The December 2017 Gemini Full Moon:

The air element reminds us of the continuous flow that is occurring, even if it is invisible to the eye. The mind can get lost in thought, or be set free with inspiration. You get to choose how air influences your mental body; will it keep you in state of constant movement, or carry you into alignment for the next perfect move? This Full Moon is ripe with opportunity. Receive this gift with conscious awareness so you may release self-sabotage in the form of flightiness or distraction out of fear. Air is flexible, in motion, and knows the perfect place to glide into next.

Let the wind carry away your worries, and create space for a fresh perspective. Connect to the air moving in and out of your lungs, let it clear away mental debris, calming the mind, and inviting clarity to arise. Spirit speaks through the elements, the wind carrying in our desires and messages from loved ones. Allow the Gemini energy open you up to new forms of communication and connection.

Ways You Can Connect to This Full Moon:

Find out when the moon rise is in your city by going here: http://www.timeanddate.com/moon/

Find a place where you can see, or sense the energy of the full moon. Preferably a comfortable position with the moon in sight.

Take 5 to 10 deep breaths as you feel and sense the air element flowing through your body, and perhaps a breeze on your skin.

Now bring a loved one to mind whom you wish to connect with. They may be here walking the Earth or in spirit. Hold a message in your heart, words you wish to share with them, let the words flutter through your body, mind, and spirit.

Now with your next breath pretend to blow out the words into the universe … let the wind carry your words to the heavens or out into the world. Feel the pull of the moon, amplifying this effect, knowing your message has been sent.

**Reminder: each full moon will impact you for up to 3 days prior to the full moon and 3 days after the full moon.

Full moons are always powerful times for releasing and letting go. Try creating your own ceremony or honoring of this time to embrace the energy that this time has to help you create space in your life for what you truly desire. As always remember, you are not alone in experiencing this phase, be mindful of this when encountering others over these next few days. Send them love as they are also shining a light on themselves and may be extra sensitive during this time. The next full moon is on December 3rd, it is known as the Full Cold Moon.

~ Melissa Corter

Melissa Kim Corter is a Certified Hypnotherapist and Shamanic practitioner certified over 20 healing modalities. She helps clients release fear & clear away the emotional clutter from their life experiences. Through various modalities coupled with her heightened intuition, she connects with your spirit for expanded truth and guidance on how to shift limiting beliefs. The earth, moon, and elements have been a channel for deeper levels of healing and connection for Melissa, stirring a passion within her to teach others to embrace the natural world.

Melissa has opened the Moon Vault! Do you feel erratic, wonky, or emotional during the Full Moon? The Moon Vault is your home for monthly recordings, information, tips, and practices to find your own natural rhythm and harmony with the moon cycles.

http://melissacorter.com/join-the-moon-vault

[email protected] www.melissacorter.com

#affirmations#angels#appreciation#energy#full moon#healing#intuition#love#lunar#melissa corter#moon ceremony#psychic#psychic medium#spirit#spirits#spiritual#sunny dawn johnston

1 note

·

View note

Text

Mark Meierhenry Death | Cause of Death - Mark Meierhenry Obituary

Mark Meierhenry Death | Cause of Death – Mark Meierhenry Obituary

Mark Meierhenry Death | Mark Meierhenry Obituary – A former South Dakota attorney general and the patriarch of an influential legal family, Mark Meierhenry has passed away at the age of 75. He went on to serve two terms as attorney general from 1979 to 1987, a time frame that overlapped the first two terms of Gov. Bill Janklow’s tenure in office, who had preceded Meierhenry as attorney general.

D…

View On WordPress

0 notes

Text

August 12, 2018: 5:55 pm:

August 12, 2018: 5:45 pm<br><br>The information below is a list of American F... StoneMan .Warrior - 2018-08-12T20:52:38-0400 - Updated: 2018-08-12T20:55:42-0400

August 12, 2018: 5:45 pm The information below is a list of American Federal Politicians who were CONVICTED of crimes, the information is available at: <en.wikipedia.org/wiki/List_of_American_federal_politicians_convicted_of_crimes#2017–Present_(Donald_J._Trump_(R)_presidency)>

This list of crooks only represents those who were convicted. I was looking for information about politicians or federal employees who admitted taking bribery money. I was expecting to find a list of Federal Employees who admitted to taking bribery money. My expectations do not meet the reality that only very few Federal employees or politicians have ever admitted to taking bribery money. This list only represents information going back to and including the tenure of Ronald Reagan. The information is much easier to read at the source, link provided. ========================================= 2017–Present (Donald J. Trump (R) presidency) Executive branch Lieutenant General Michael Flynn (R) National Security Advisor. Pleaded guilty to lying to the FBI. (2017)[1] Legislative branch Steve Stockman (R-TX) was convicted of fraud. (2018)[2] Anthony Weiner (D-NY)[3] was convicted of sending sexually explicit photos of himself to a 15-year-old girl and was made to sign the sexual offenders register. (2017)[4] Corrine Brown (D-FL) was convicted on 18 felony counts of wire and tax fraud, conspiracy, lying to federal investigators, and other corruption charges. (2017)[5][6] Greg Gianforte (R-MT) pleaded guilty to charge of assault. (2017)[7][8]2017–Present (Donald J. Trump (R) presidency) Executive branch Lieutenant General Michael Flynn (R) National Security Advisor. Pleaded guilty to lying to the FBI. (2017)[1] Legislative branch Steve Stockman (R-TX) was convicted of fraud. (2018)[2] Anthony Weiner (D-NY)[3] was convicted of sending sexually explicit photos of himself to a 15-year-old girl and was made to sign the sexual offenders register. (2017)[4] Corrine Brown (D-FL) was convicted on 18 felony counts of wire and tax fraud, conspiracy, lying to federal investigators, and other corruption charges. (2017)[5][6] Greg Gianforte (R-MT) pleaded guilty to charge of assault. (2017)[7][8] 009–2017 (Barack Obama (D) presidency) Executive branch General David Petraeus (R)[9] Director of the Central Intelligence Agency. On April 23, 2015, a federal judge sentenced Petraeus to two years' probation plus a fine of $100,000 for providing classified information to Lieutenant Colonel Paula Broadwell.(2015)[10] Legislative branch Chaka Fattah (D-PA) was convicted on 23 counts of racketeering, fraud, and other corruption charges. (2016)[11] Dennis Hastert (R-IL) Speaker of the United States House of Representatives pleaded guilty in court for illegally structuring bank transactions related to payment of $3.5 million to quash allegations of sexual misconduct with a student when he was a high school teacher and coach decades ago.[12] (2016) Michael Grimm (R-NY) pleaded guilty of felony tax evasion. This was the fourth count in a 20-count indictment brought against him for improper use of campaign funds. The guilty plea had a maximum sentence of three years; he was sentenced to eight months in prison. (2015)[13][14] Trey Radel (R-FL) was convicted of possession of cocaine in November 2013. As a first-time offender, he was sentenced to one year probation and fined $250. Radel announced he would take a leave of absence, but did not resign. Later, under pressure from a number of Republican leaders, he announced through a spokesperson that he would resign. (2013)[15][16][17] Rick Renzi (R-AZ) was found guilty on 17 of 32 counts against him June 12, 2013, including wire fraud, conspiracy, extortion, racketeering, money laundering and making false statements to insurance regulators. (2013)[18] Jesse Jackson, Jr. (D-IL) pleaded guilty February 20, 2013, to one count of wire and mail fraud in connection with his misuse of $750,000 in campaign funds. Jackson was sentenced to two and one-half years' imprisonment. (2013)[19] Laura Richardson (D-CA) was found guilty on seven counts of violating US House rules by improperly using her staff to campaign for her, destroying the evidence and tampering with witness testimony. The House Ethics Committee ordered Richardson to pay a fine of $10,000. (2012)[20][21] Judicial branch Mark E. Fuller (R) U.S. District Judge was found guilty of domestic violence and sentenced to 24 weeks of family and domestic training and forced to resign his position. (2015)[22][23][24] 2001–2009 (George W. Bush (R) presidency) Executive branch Scott Bloch (R) United States Special Counsel. pleaded guilty to criminal contempt of Congress for "willfully and unlawfully withholding pertinent information from a House Committee investigating his decision to have several government computers wiped ..."[25][26] On June 24, 2013, U. S. District Judge Robert L. Wilkins sentenced Bloch to one day in jail and two years' probation, and also ordered him to pay a $5000 fine and perform 200 hours of community service.(2010) [27] David Safavian (R) Administrator for the Office of Management and Budget[28] where he set purchasing policy for the entire government.[29][30] He was found guilty of blocking justice and lying,[31] and sentenced to 18 months. (2008)[32][33] Lewis Libby (R) Chief of Staff to Vice President Dick Cheney (R). 'Scooter' was convicted of perjury and obstruction of justice in the Plame Affair on March 6, 2007 and was sentenced to 30 months in prison and fined $250,000. His sentence was commuted by George W. Bush (R) on July 1, 2007. (2007)[34] Libby was pardoned by President Donald J. Trump on April 13, 2018. [35] Lester Crawford (R) Commissioner of the Food and Drug Administration, resigned after 2 months. Pleaded guilty to conflict of interest and received 3 years suspended sentence and fined $90,000. (2006) [36] Claude Allen (R) Director of the Domestic Policy Council, was arrested for a series of felony thefts in retail stores. (2006) He was convicted on one count and resigned soon after.[37] Legislative branch William J. Jefferson (D-LA) was charged in August 2005 after the FBI seized $90,000 in cash from his home freezer. He was re-elected to the House in 2006, but lost in 2008. He was convicted November 13, 2009, of 11 counts of bribery and sentenced to 13 years in prison. (2009)[38] Jefferson's Chief of Staff Brett Pfeffer, was sentenced to 84 months for bribery. (2006) [39] Jack Abramoff CNMI scandal involves the efforts of Abramoff to influence Congressional action concerning U.S. immigration and minimum wage laws. See Executive branch convictions. Congressmen convicted in the Abramoff scandal include: Bob Ney (R-OH) pleaded guilty to conspiracy and making false statements as a result of his receiving trips from Abramoff in exchange for legislative favors. Ney received 30 months in prison. (2007)[40] Duke Cunningham (R-CA) pleaded guilty November 28, 2005, to charges of conspiracy to commit bribery, mail fraud, wire fraud and tax evasion in what came to be called the Cunningham scandal and was sentenced to over eight years in prison. (2005)[41] Frank Ballance (D-NC) admitted to federal charges of money laundering and mail fraud in October 2005 and was sentenced to four years in prison. (2005)[42] Bill Janklow (R-SD) was convicted of second-degree manslaughter for running a stop sign and killing a motorcyclist. Resigned from the House and given 100 days in the county jail and three years probation. (2003)[43] Jim Traficant (D-OH) was found guilty on ten felony counts of financial corruption, sentenced to eight years in prison and expelled from the House of Representatives. (2002) [44] 1993–2001 (Bill Clinton (D) presidency) Executive branch Wade Sanders (D), Deputy Assistant United States Secretary of the Navy, for Reserve Affairs, was sentenced to 37 months in prison on one charge of possession of child pornography. (2009)[45][46][47] Darleen A. Druyun (D), Principal Deputy United States Under Secretary of the Air Force.[48] She pleaded guilty to inflating the price of contracts to favor her future employer, Boeing. In October 2004, she was sentenced to nine months in jail for corruption, fined $5,000, given three years of supervised release and 150 hours of community service.(2005).[49] CBS News called it "the biggest Pentagon scandal in 20 years" and said that she pleaded guilty to a felony.[50] Legislative branch Mel Reynolds (D-IL) was convicted on 12 counts of sexual assault, obstruction of justice and solicitation of child pornography. (1997) He was later convicted of 12 counts of bank fraud. (1999) Reynolds served his entire sentence stemming from the first conviction and served 42 months in prison for the bank fraud conviction at which point his sentence was commuted by President Bill Clinton.[51] As a result, Reynolds was released from prison and served his remaining time in a halfway house.[52][53] Bob Packwood (R-OR), 19 women accused him of sexual misconduct. He fought the allegations, but eventually, the US Senate Ethics Committee found him guilty of a "pattern of abuse of his position of power and authority" and recommended that he be expelled from the Senate. He resigned on Sept. 7, 1995.[54] Wes Cooley (R-OR), was convicted of having lied on the 1994 voter information pamphlet about his service in the Army. He was fined and sentenced to two years probation (1997)[55] After leaving office, Cooley was convicted of income tax fraud connected to an investment scheme. He was sentenced to one year in prison and to pay restitution of $3.5 million to investors and $138,000 to the IRS.[56] Austin Murphy (D-PA) was convicted of one count of voter fraud for filling out absentee ballots for members of a nursing home. (1999) [57] House banking scandal [58] The House of Representatives Bank found that 450 members had overdrawn their checking accounts, but not been penalized. Six were convicted of charges, most only tangentially related to the House Bank itself. Twenty two more of the most prolific over-drafters were singled out by the House Ethics Committee. (1992) Buz Lukens (R-OH) convicted of bribery and conspiracy.[59] Carl C. Perkins (D-KY) pleaded guilty to a check kiting scheme involving several financial institutions (including the House Bank).[60] Carroll Hubbard (D-KY) was convicted of illegally funneling money to his wife's 1992 campaign to succeed him in congress.[61] Mary Rose Oakar (D-OH) pleaded guilty to a misdemeanor campaign finance charge not related to the House Bank.[62] Walter Fauntroy (D-District of Columbia) was convicted of filing false disclosure forms to hide unauthorized income.[63] Congressional Post Office scandal (1991–1995) was a conspiracy to embezzle House Post Office money through stamps and postal vouchers to congressmen.[64] Dan Rostenkowski (D-IL) was convicted and sentenced to 18 months in prison, in 1995.[65] Joe Kolter (D-PA) pleaded guilty to one count of conspiracy and sentenced to 6 months in prison.(1996)[66][67] 1989–1993 (George H. W. Bush (R) presidency) Executive branch Catalina Vasquez Villalpando, (R) Treasurer of the United States, pleaded guilty to obstruction of justice and tax evasion. (1992)[68] Legislative branch Nicholas Mavroules (D-Massachusetts) was convicted of extortion, accepting illegal gifts and failing to report them on congressional disclosure and income tax forms. Mavroules pleaded guilty to fifteen counts in April 1993 and was sentenced to a fifteen-month prison term. (1993) [69][70] Albert Bustamante (D-Texas) was convicted of accepting bribes and sentenced to three and one-half years in prison. (1993) [71] David Durenberger Senator (R-Minnesota) denounced by Senate for unethical financial transactions and then disbarred (1990). He pleaded guilty to misuse of public funds and given one year probation (1995) [72] Jay Kim (R-CA) accepted $250,000 in illegal 1992 campaign contributions and was sentenced to two months house arrest. (1992)[73][74][75][76] 1981–1989 (Ronald Reagan (R) presidency) Executive branch See also: Reagan administration scandals Operation Ill Wind was a three-year investigation launched in 1986 by the FBI into corruption by U.S. government and military officials, and private defense contractors. Melvyn Paisley, Assistant Secretary of the Navy,[77] was found to have accepted hundreds of thousands of dollars in bribes. He pleaded guilty to bribery and served four years in prison.[78][79][80] James E. Gaines, Deputy Assistant Secretary of the Navy, took over when Paisley resigned his office.[81] Gaines was convicted of accepting an illegal gratuity and theft and conversion of government property. He was sentenced to six months in prison.[82] Victor D. Cohen, Deputy Assistant Secretary of the Air Force, was the 50th conviction obtained under the Ill Wind probe when he pleaded guilty to accepting bribes and conspiring to defraud the government. He was sentenced to 33 months in prison.[83][84] Housing and Urban Development Scandal was a controversy concerning bribery by selected contractors for low income housing projects.[85] James G. Watt (R) United States Secretary of the Interior 1981–1983, was charged with 25 counts of perjury and obstruction of justice. Sentenced to five years probation, fined $5,000 and 500 hours of community service[86] Iran-Contra Affair (1985–1986); A secret sale of arms to Iran, to secure the release of hostages and allow U.S. intelligence agencies to fund the Nicaraguan Contras, in violation of the Boland Amendment.[87] Elliott Abrams (R) Assistant Secretary of State for Inter-American Affairs, convicted of withholding evidence. Given 2 years probation. Later pardoned by President George H. W. Bush.[88] Michael Deaver (R) White House Deputy Chief of Staff to Ronald Reagan 1981–85, pleaded guilty to perjury related to lobbying activities and was sentenced to 3 years probation and fined $100,000 [89] Legislative branch Abscam FBI sting involving fake 'Arabs' trying to bribe 31 congressmen. (1980) [90] The following Congressmen were convicted: Harrison A. Williams (D-NJ) Convicted on 9 counts of bribery and conspiracy. Sentenced to 3 years in prison.[91] John Jenrette (D-SC) sentenced to two years in prison for bribery and conspiracy.[92] Richard Kelly (R-FL) Accepted $25K and then claimed he was conducting his own investigation into corruption. Served 13 months.[93] Raymond Lederer (D-PA) "I can give you me" he said after accepting $50K. Sentenced to 3 years.[94] Michael Myers (D-PA) Accepted $50K saying, "...money talks and bullshit walks." Sentenced to 3 years and was expelled from the House.[95] Frank Thompson (D-NJ) Sentenced to 3 years.[96] John M. Murphy (D-NY) Served 20 months of a 3-year sentence.[97] Wedtech scandal Wedtech Corporation was convicted of bribery in connection with Defense Department contracts.[98] Mario Biaggi (D-NY) Convicted of obstruction of justice and accepting illegal gratuities he was sentenced to 2½ years in prison and fined $500K. (1987)[99] Robert Garcia (D-NY) sentenced to 2½ years.[100] Pat Swindall (R-GA) convicted of 6 counts of perjury. (1989) [101][102] George V. Hansen (R-ID) censured for failing to fill out disclosure forms. Spent 15 months in prison.[103] Frederick W. Richmond (D-NY), Convicted of tax evasion and possession of marijuana. Served 9 months (1982) [104] Dan Flood (D-PA) censured for bribery. After a trial ended in a deadlocked jury, pleaded guilty and was sentenced to a year's probation.[105][106] Joshua Eilberg (D-PA) pleaded guilty to conflict-of-interest charges. In addition, he convinced president Carter to fire the U.S. Attorney investigating his case.[107] Jon Hinson (R-MS) was arrested for having homosexual oral sex in the House of Representatives' bathroom with a government staffer. Hinson, who was married, later received a 30-day jail sentence, and a year's probation, on condition that he get counseling and treatment. At the time, homosexual acts were criminalized, even between consenting adults. He then resigned his seat and began working as a gay rights advocate.(1981) [108][109] 1977–1981 (Jimmy Carter (D) presidency) Legislative branch J. Herbert Burke (R-FL) pleaded guilty to disorderly intoxication, resisting arrest, and nolo contendere to an additional charge of witness tampering. He was sentenced to three months plus fines.(1978)[110] Fred Richmond (D-New York) – Convicted of tax fraud and possession of marijuana. Served 9 months in prison. Charges of soliciting sex from a 16-year-old boy were dropped after he submitted to counseling. (1978) [111] Charles Diggs (D-Michigan), convicted on 29 charges of mail fraud and filing false payroll forms which formed a kickback scheme with his staff. Sentenced to 3 years (1978) [112] Michael Myers (D-Pennsylvania) Received suspended six-month jail term after pleading no contest to disorderly conduct charged stemming from an incident at a Virginia bar in which he allegedly attacked a hotel security guard and a cashier.[113] Frank M. Clark (D-Pennsylvania) pleaded guilty to mail fraud and tax evasion on June 12, 1979 and sentenced to two years in prison.[114] Richard Tonry (D-Louisiana) pleaded guilty to receiving illegal campaign contributions.[115] Andrew J. Hinshaw (R-CA) US Representative was convicted of accepting bribes. He served one year in prison. (1977)[116][117] Frank Horton (New York politician) (R-NY) Pleaded guilty to Driving While Intoxicated (arrested at 105 mph) served 11 days jail(1976)[118][119]

Shared with: Public, George Hubbard+1'd by: Magnifier Marketing, DC Emergency Glass Repair Washington, DC, To Live And Dine, Navy Veteran

StoneMan .Warrior - 2018-08-12T22:38:40-0400 - Updated: 2018-08-12T22:49:04-0400

August 12, 2018: 7:32 pm: Wal-Mart in Grants Pass opened a veterinary clinic inside the store. There is a separate entrance into the VetIQ Pet Doctor, which conveniently allows access to the Wal-Mart inside. Click the link to see some of the services they offer. Once you know what I know about shopping is a socio-terrific Dystopian environment, you will understand what this really means. The existence of PetIQ at the Wal-Mart has absolutely nothing to do with the care of animals. This adds bonus fear to a terrifying thing. With the addition of the veterinary clinic at Wal-Mart, customers are offered Euthanization services without the need for the sword they have been using for so long. This makes a mess-free human extermination service. Don't get on the bus, never get on the bus. =========================================== VetIQ Grand Opening OfferWinter Is Coming : Trump & BlueWave Retribution - 2018-08-30T04:43:06-0400u can put the iron patriot to rest now +George Hubbard The permanently suspended his G+ account

(4-4-2019: Authors Note: Google manipu;ated this entry and included infor,mation that suggests that Google+ account was suspended. It was never suspended, This is more evidence of Google working to cover terror activities associated with #SAGcoup, Googles participation in the a coup take-over of the USA. Information is missing here. Selectively deleted and then manipulated to appear as wrongdoing of the author of the account)

0 notes

Photo

"There's a world out there, and you've got to look at both sides of the mountain in your lifetime." -Bill Janklow • #travel #travels #traveler #travelph #travelgram #travelphotography #nature #naturegram #naturelovers #naturephotography #landscape #landscapephotography #wanderlust #igtravel #ig_nature #ig_captures #ig_cameras_united #adventure #awesomeEarth #discoverphl #vscocam #exploreph #sky

#adventure#naturelovers#traveler#ig_cameras_united#travelph#naturegram#nature#travelphotography#ig_nature#exploreph#ig_captures#landscape#travel#sky#awesomeearth#landscapephotography#vscocam#discoverphl#travelgram#travels#naturephotography#wanderlust#igtravel

0 notes

Photo

🏔 There's a world out there, and you've got to look at both sides of the mountain in your lifetime. // Bill Janklow. #discover #explore #travel #adventure #nature #alps #spring #alpine #snowday #forest #discoveraustria #snow #landscape #visittirol #mountains #mountain #hikingadventures #tirol #nature_perfection #naturelovers #clouds #nature_shooters #nature_sultans #photooftheday #landscape_captures #ig_captures #landscape_lovers #austria #österreich #travelgram (at Innsbruck, Austria)

#travel#ig_captures#landscape#clouds#photooftheday#discover#nature_shooters#alpine#spring#snowday#visittirol#snow#discoveraustria#nature#hikingadventures#mountains#naturelovers#adventure#nature_sultans#tirol#travelgram#nature_perfection#austria#landscape_lovers#österreich#forest#mountain#explore#landscape_captures#alps

0 notes

Video

youtube

South Dakota Political Artifact: The Ballad of Rudy & Bill I was doing a post about District 7 earlier and suddenly a song I hadn't thought about since I was kid popped into my head.

0 notes

Text

Bosworth's big names

Sioux Falls physician and potential U.S. Senate candidate Annette Bosworth has never run for political office, but yesterday she told the press some political heavy-hitters have encouraged her to run.

To KELO, Bosworth said U.S. Sen. Tom Coburn -- himself a medical doctor who made the leap to politics -- is "one of her mentors in considering a run."

Bosworth didn't mention Coburn to me in my interview, but she did talk about another person she said encouraged her to enter politics: former Gov. Bill Janklow.

"The idea actually was first introduced to me over three years ago by Bill Janklow," Bosworth said. "He was my good friend and many times said, you've got a lot of great ideas for how health care and our community could be served better. He was the first person to plant the idea."

At the time, Bosworth said she demurred. "I said no, Bill. You did politics. I'm meant to be a doctor."

Janklow died in January 2012. By the time U.S. Sen. Tim Johnson announced his retirement this March, Bosworth said she had come most of the way around to running.

0 notes