#Best GST Registration Consultants

Text

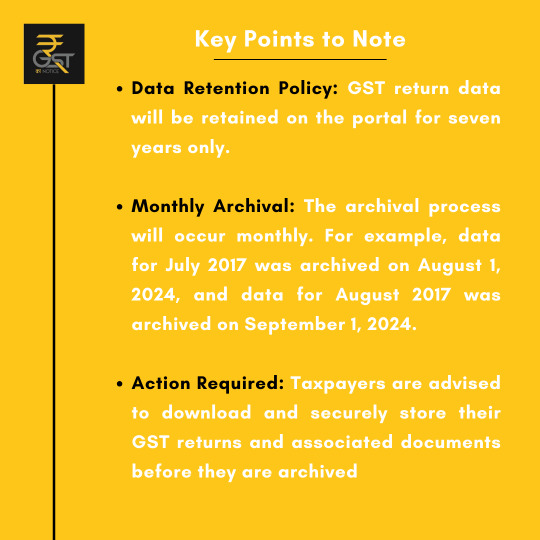

Archival of GST return data...

Find your information...

For more information visit- gstkanotice.com or DM GST ka Notice

#gst #gstkanotice #gstfact #gstupdates #gstreturn #gstregistration #gstcircular #gstn #gstcouncil #gstcouncilmeeting #gsthelp #gstassistance #cbic #icai #business #budget #finance

#best gst consultation in india#gst#gst consultation firm#corporate lawyer in india#gst experts in india#best gst services in india#best gst lawyers in india#best taxation law firm#gst help#gst india#gst assistance#gst registration#gstreturns#gstfiling#taxation#gst services#gstr1#gst services in india#gst updates

0 notes

Text

Ganesh Chaturthi Special: 50% OFF on Essential Services!

his Ganesh Chaturthi, we’re rolling out a Stunning 50% OFF on our most sought-after services! 🕉️✨ It’s the perfect time to take care of your financial and business needs while celebrating the festival of prosperity.

Grab the Deal on: 🔹 ITR Filing – Simplify your tax returns at half the price! 🔹 GST Registration – Get your business GST-ready with huge savings! 🔹 GST Filing – Ensure your GST filings are accurate and affordable! 🔹 Company Registration – Launch your dream business and save big!

⏳ Hurry, this offer is only available for the next 10 days! Don’t miss out on this golden opportunity to save and thrive.

📞 Act Fast – Contact Us Now! 👉 +91 97 11296343 , explore website know offer taxring.com

Celebrate Ganesh Chaturthi with joy and savings. Let’s make this festival the most prosperous one yet. Ganpati Bappa Morya! 🐘🌟

#GaneshChaturthi #MegaDiscount #CelebrateWithSavings #TaxServices #LimitedTimeOffer #ProsperityAwaits

#ganeshchaturthi#Ganesh chaturthi best offer#gst services#income tax return#consultant#company registration#accounting services#itr filing#income tax audit

0 notes

Text

What, Why and How Patent Registration Service in India Protects Your Ideas: A Guide by TaxDunia

In today’s rapidly evolving world, ideas are more valuable than ever. Whether you’re an entrepreneur with a groundbreaking invention, a tech innovator, or a creative professional, protecting your intellectual property is essential. Patent registration is one of the most effective ways to safeguard your ideas, ensuring that they remain your exclusive asset. At TaxDunia, we understand the complexities of patent registration and are here to guide you through the process. In this comprehensive blog, we’ll explore what patent registration is, why it’s crucial, and how the Patent Registration Service in India can protect your ideas.

What is a Patent?

A patent is a legal protection granted to an inventor for a new and useful invention. This protection gives the inventor exclusive rights to their creation, allowing them to prevent others from making, using, or selling the invention without permission. Patents are essential for safeguarding innovative ideas and encouraging technological advancements.

Here’s a simple breakdown of what a patent is and its significance:

· Legal Right: A patent provides the inventor with the sole right to exploit their invention. This means that only the patent holder can manufacture, use, or sell the patented invention.

· Types of Patents: There are several types of patents, including utility patents (for new and useful inventions or discoveries), design patents (for new, original, and ornamental designs), and plant patents (for new varieties of plants).

· Duration: Patents are usually granted for a limited period, typically 20 years from the date of filing for utility patents, after which the protection expires and the invention becomes public domain.

· Purpose: The primary purpose of a patent is to encourage innovation by offering inventors a temporary monopoly on their creations, providing them with a financial incentive to invest time and resources into developing new technologies.

What is Patent Registration?

A patent is a legal document granted by the government that gives an inventor exclusive rights to make, use, and sell their invention for a specified period. This means that once you have a patent, no one else can legally produce, use, or sell your invention without your permission. Patent registration is the process of securing these rights, ensuring that your invention is protected under the law.

Why Patent Registration is Important

Patent registration is crucial for several reasons:

Protection of Intellectual Property: By registering your patent, you secure your invention from being copied or used by others without your consent. This legal protection is vital in a competitive market where ideas can easily be stolen or replicated.

Monetary Benefits: A registered patent can be a significant financial asset. You can license your patent to other companies, sell it, or use it as collateral for loans. This opens up various avenues for generating revenue from your invention.

Encourages Innovation: Knowing that your ideas are protected encourages further innovation. Inventors are more likely to invest time and resources into developing new products when they know their work is legally safeguarded.

Establishes Market Position: A patent gives you a competitive edge by establishing your position in the market as the exclusive owner of your invention. This can enhance your brand’s reputation and attract investors.

How Patent Registration Works in India

The process of patent registration in India involves several steps, and it’s essential to follow each one carefully to ensure your patent is granted.

Step 1: Conduct a Patent Search

Before applying for a patent, it’s crucial to conduct a thorough patent search to ensure that your invention is unique and hasn’t already been patented by someone else. This step helps you avoid legal complications and potential rejections.

Step 2: Draft a Patent Application

Once you’ve confirmed that your invention is unique, the next step is to draft a patent application. This document should include a detailed description of your invention, how it works, and its potential applications. It’s advisable to seek help from the Top Income Tax Consultants like taxdunia which ensure your application is accurate and comprehensive.

Step 3: Submit the Patent Application

After drafting, the patent application is submitted to the Indian Patent Office. This can be done online or in person. Once submitted, your application will undergo a thorough examination by the patent office.

Step 4: Examination of the Patent Application

The Indian Patent Office will examine your application to ensure it meets all the legal requirements. This involves verifying that the invention is new, has a significant innovative feature, and can be practically applied in the industry. If any issues are found, you may be required to make amendments to your application.

Step 5: Publication of the Patent Application

If your application passes the examination, it will be published in the official patent journal. This allows others to view your patent application and raise any objections if they believe your invention infringes on their rights.

Step 6: Grant of Patent

If no objections are raised or if they are resolved, the patent office will grant your patent. You will then receive a patent certificate, giving you exclusive rights to your invention for 20 years.

The Importance of Patent Registration Services in India

Patent registration in India is a complex process that requires a deep understanding of legal and technical aspects. This is where professional Patent Registration Services in India come into play. These services are designed to assist inventors and companies in navigating the patent registration process smoothly and efficiently. Tax dunia plays as the best income tax advisors in India with their knowledge and skilled staff.

Expertise in Patent Law

Patent consultants are well-versed in Indian patent law and can provide invaluable guidance throughout the registration process. They make sure your application complies with all legal standards, lowering the chances of it being rejected.

Thorough Documentation

A crucial aspect of patent registration is the documentation. Patent consultants help in drafting detailed and precise patent applications that clearly describe your invention. This increases the chances of your patent being granted without complications.

Efficient Process Management

The patent registration process can be time-consuming, with several steps that need to be completed within specific deadlines. Patent consultants manage the entire process, ensuring that everything is done promptly and correctly.

Handling Legal Challenges

In some cases, your patent application may face objections or legal challenges. Patent consultants are equipped to handle these issues, representing your interests and ensuring that your rights are protected.

Why Choose TaxDunia for Patent Registration?

At TaxDunia, we take pride in being recognized as one of the Best Patent Consultants in India. Our team of experts is committed to helping you safeguard your intellectual property through efficient and reliable patent registration services. Here’s why choosing TaxDunia is the best decision for your patent needs:

Experienced Professionals

Our team is composed of highly qualified patent consultants with extensive experience in the field. We understand the complexities of patent law and are dedicated to providing you with top-notch service. Our expertise ensures that your patent application is handled with the utmost care and attention to detail, increasing the likelihood of successful registration.

Comprehensive Support

TaxDunia offers comprehensive support throughout the patent registration process. From conducting thorough patent searches to drafting and filing applications, our services cover every aspect of the process. We also provide assistance in managing legal challenges that may arise, ensuring that your rights are fully protected.

Client-Centric Approach

At TaxDunia, our clients are our top priority. We take the time to understand your unique needs and provide tailored solutions that align with your specific requirements. Our client-centric approach means that we work closely with you, offering personalized guidance and support at every step of the patent registration process.

Efficient Process

We understand the importance of time in securing your intellectual property rights. That’s why we have streamlined our patent registration process to ensure that your application is submitted and processed promptly. Our efficient approach minimizes delays, helping you secure your patent as quickly as possible.

The Role of TaxDunia in Online Patent Registration

TaxDunia also offers comprehensive online Patent Registration Services in India, making it convenient for you to protect your ideas from anywhere. Our online services and tax consultant services are designed to be user-friendly, efficient, and secure, ensuring that your patent application is handled with the utmost care.

Easy-to-Use Platform

Our intuitive online platform allows you to submit your patent application with ease. With clear instructions and support available at every step, you can navigate the process with minimal hassle.

Expert Assistance

Even with the convenience of online registration, expert guidance is essential. Our team of patent consultants is available to assist you throughout the online process, ensuring that your application is accurate and complete.

Secure Transactions

We prioritize the security of your intellectual property. Our online platform is equipped with advanced security measures, ensuring that your data is protected and your patent application is submitted safely.

The Benefits of Online Patent Registration in India

With the advent of digital technology, patent registration has become more accessible than ever. Online patent registration offers several benefits that make the process faster, more convenient, and cost-effective.

Convenience and Accessibility

Online registration allows you to submit your patent application from anywhere, at any time. This eliminates the need for physical visits to the patent office and simplifies the process for busy inventors and businesses.

Faster Processing

Online patent registration is often faster than traditional methods. The digital submission process streamlines the application, reducing the time it takes to review and approve your patent.

Cost-Effective

Online registration can be more cost-effective, as it reduces the need for physical paperwork and in-person consultations. This makes patent registration more affordable, particularly for startups and small businesses.

Conclusion

Patent registration is a vital step in protecting your ideas and ensuring that your hard work is rewarded. Whether you’re an individual inventor, a startup, or an established business, securing a patent can provide you with the legal protection and competitive advantage you need to succeed.

At TaxDunia, we are committed to helping you navigate the patent registration process with ease. As one of the Best Patent Consultants in India and best income tax consultant in india, we offer comprehensive services that cover every aspect of patent registration, from conducting patent searches to submitting applications and handling legal challenges. Our goal is to make patent registration as simple and stress-free as possible, so you can focus on what you do best — innovating and creating.

If you’re ready to protect your ideas and secure your future, contact TaxDunia today. Our expert team is here to guide you through the Patent Registration Service in India and ensure that your intellectual property is protected for years to come.

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#Patent Registration Service in India#Best Patent Consultants in India#online Patent Registration Services in India#income tax#itr filing#finance#tax consultants#itr filling#taxdunia#gst filling#gst return

0 notes

Text

In today’s dynamic business environment, compliance with tax regulations is crucial for the smooth operation of any enterprise. The Goods and Services Tax (GST) in India is one such regulation that businesses must adhere to. If you're looking for professional guidance and seamless GST registration services in Ghaziabad, Legalari is here to assist you. As experienced GST registration consultants, we offer comprehensive services to help you navigate the complexities of GST compliance.” GST registration consultant in Ghaziabad”

Understanding GST and Its Importance

The Goods and Services Tax (GST) is a single tax levied on the supply of goods and services from the manufacturer to the consumer. It is a multi-stage, destination-based tax that has replaced numerous indirect taxes in India. GST is categorized into three types:

CGST (Central Goods and Services Tax): Collected by the Central Government on intra-state sales.

SGST (State Goods and Services Tax): Collected by the State Government on intra-state sales.

IGST (Integrated Goods and Services Tax): Collected by the Central Government on inter-state sales.

Why GST Registration is Essential

GST registration is mandatory for businesses whose turnover exceeds the prescribed threshold limit. The threshold limit is Rs. 20 lakh for service providers and Rs. 40 lakh for suppliers of goods. Businesses involved in inter-state supply, e-commerce, or those opting for the voluntary registration for input tax credit benefits must also register for GST. Here are some key reasons why GST registration is important:” GST registration consultant in Ghaziabad”

Legal Compliance: Being GST compliant ensures that your business operates legally within the framework of the GST Act.

Input Tax Credit: Registered businesses can avail of the benefit of input tax credit, reducing their overall tax liability.

Competitive Advantage: GST registration provides your business with a competitive edge, enhancing credibility and trust among customers and suppliers.

Expansion Opportunities: GST compliance facilitates smooth business expansion and the possibility of entering new markets without legal hurdles.

Legalari: Your Trusted GST Registration Consultant in Ghaziabad

Legalari is a leading provider of GST registration and compliance services in Ghaziabad. Our team of experienced professionals is dedicated to helping businesses streamline their GST processes. Here’s how we can assist you:

Comprehensive GST Registration Services

Our GST registration services include:

Eligibility Assessment: We assess your business to determine if GST registration is mandatory or beneficial for you.

Document Preparation: Our experts assist in preparing and organizing the necessary documents required for GST registration.

Application Filing: We file your GST registration application accurately and efficiently, ensuring timely submission to avoid delays.

Follow-Up and Approval: Legalari monitors the application status and follows up with tax authorities to ensure swift approval.

GST Compliance: Post-registration, we provide ongoing support to ensure your business remains GST compliant, including filing returns and managing records.

Why Choose Legalari?

Expertise and Experience: Our team consists of experienced professionals who understand the intricacies of GST regulations and compliance.

Personalized Solutions: We provide customized solutions tailored to your business needs, ensuring a hassle-free registration process.

Transparent Pricing: Our services come with transparent pricing, without any hidden charges, offering value for money.

Client-Centric Approach: We prioritize our clients’ needs, offering reliable support and guidance at every step of the GST registration process.

Timely Delivery: Legalari ensures that your GST registration is completed within the stipulated time frame, minimizing any disruption to your business operations.

The GST Registration Process with Legalari

Getting your business registered under GST with Legalari is a simple and straightforward process. Here’s a step-by-step guide to our registration process:

Initial Consultation: We begin with a consultation to understand your business requirements and assess your eligibility for GST registration.

Document Collection: Legalari provides a checklist of required documents, including PAN card, proof of business registration, address proof, bank account details, and photographs of authorized signatories.

Application Preparation: Our experts prepare your GST registration application, ensuring all details are accurate and complete.

Submission and Follow-Up: We submit your application to the GST portal and monitor its progress, following up with authorities if necessary.

Approval and GSTIN Issuance: Once approved, your business receives a unique Goods and Services Tax Identification Number (GSTIN), signifying successful registration.

Post-Registration Support: We offer ongoing support to help you stay compliant with GST regulations, including filing GST returns and managing records.

Conclusion

Navigating the complexities of GST registration and compliance can be challenging for businesses. However, with Legalari by your side, you can focus on growing your business while we take care of your GST needs. As a trusted GST registration consultant in Ghaziabad, we are committed to providing efficient, reliable, and cost-effective services to our clients.

Contact Legalari today to ensure seamless GST registration and compliance for your business. Let us help you achieve peace of mind and focus on what you do best—running your business successfully.

0 notes

Text

Best Company Registration Consultants in Gurgaon

Gurugram is a city of Haryana and it is in northern India of New Delhi. Also, it’s known as a financial and technology hub in India. There are some famous and incredible monuments are in Gurugram i.e. The Kingdom of Dreams is a large complex for theatrical shows, Sheetala Mata Mandir is an orange-and-white-striped Hindu temple and there is a famous zoon that is Sultanpur National Park.

#vedkee associates#gst registration consultant#company registration consultant#gst consultant#Best Company Registration Consultants in Gurgaon

0 notes

Text

https://thetaxplanet.com/

Best CA Firms in Delhi

If you are looking for the Best CA Firms for advice on financial matters. The Tax Planet is one of the best chartered accountants and CA firms in Delhi, India. We are Experts in various areas like merger & acquisition, finance, auditing, international taxation, GST & Taxation, etc

#ca firm in delhi#chartered accountants in delhi#gst registration consultants in delhi#best gst consultant#accounting firm in delhi#best ca firms in delhi#gst consultant in delhi#accounting services in delhi

0 notes

Text

1 note

·

View note

Text

Company Formation by MASLLP: Your Partner in Starting a Business

Starting a company is an exciting venture, but the process can be complex and time-consuming. This is where professional guidance comes in handy. MASLLP offers expert company formation services, designed to streamline the process and ensure compliance with all legal requirements. Whether you are a local entrepreneur or an international business looking to establish a presence in India, MASLLP has the expertise to assist you at every step.

Why Choose MASLLP for Company Formation?

Expertise in Legal Procedures

MASLLP specializes in handling the intricate legal requirements involved in setting up a company. From filing necessary documents to obtaining essential licenses, MASLLP ensures that your business is established in compliance with India's regulatory framework.

Customized Solutions

Every business has unique needs, and MASLLP tailors its services to meet your specific goals. Whether you're forming a private limited company, a public limited company, or a limited liability partnership (LLP), MASLLP provides guidance based on your business model and objectives.

End-to-End Support

MASLLP offers comprehensive services from the initial consultation through to post-formation compliance. This includes drafting Memorandum of Association (MOA) and Articles of Association (AOA), securing digital signatures, and helping with PAN/TAN registration.

The Company Formation Process

Setting up a company in India requires a series of steps that MASLLP manages efficiently:

Choosing the Right Structure

The first step is determining the right business structure—Private Limited, LLP, or a One-Person Company (OPC). MASLLP provides advice on the best structure based on liability, tax, and regulatory requirements.

Name Approval

MASLLP assists in selecting a suitable name for your business and ensures it complies with the Ministry of Corporate Affairs (MCA) guidelines.

Incorporation Documentation

The legal team at MASLLP helps prepare and file all necessary documents, such as the Director Identification Number (DIN), Digital Signature Certificate (DSC), and incorporation forms with the MCA.

Post-Incorporation Compliance

Once your company is established, MASLLP ensures you meet all post-incorporation compliance requirements, such as obtaining necessary licenses, registering for Goods and Services Tax (GST), and maintaining statutory records.

Benefits of Company Formation with MASLLP

Time Efficiency: With MASLLP managing the paperwork, you can focus on growing your business rather than worrying about legal hurdles.

Compliance Assurance: Ensures that your company is set up in full compliance with Indian law.

Professional Expertise: MASLLP’s team of legal and financial experts guide you through every phase of company formation.

Conclusion

For entrepreneurs looking to establish a company in India, MASLLP offers a seamless, efficient, and expert-driven service. Their deep understanding of the legalities involved in company formation makes them the ideal partner for anyone looking to start a business. Whether you're a startup, an established business, or an international firm, MASLLP ensures your company formation process is smooth and compliant.

#accounting & bookkeeping services in india#businessregistration#audit#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

2 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants?

Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure

Filing the necessary paperwork with regulatory authorities

Complying with tax laws

Obtaining approvals and licenses

The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co.

As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory

Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company

Limited Liability Partnership (LLP)

One Person Company (OPC)

Public Limited Company

SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services

From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA)

Digital signature certificates (DSC)

Director Identification Number (DIN)

Filing with the Ministry of Corporate Affairs (MCA)

Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support

Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing

Annual financial statements

Regulatory audits

SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing

Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license

Import-export code (IEC)

Professional tax registration

Why SC Bhagat & Co. Stands Out

With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts.

Personalized Service: They tailor their services according to the specific needs of your business.

Quick Turnaround: Their efficient processes ensure timely incorporation and compliance.

Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs.

Conclusion

Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

The GoM proposes increasing GST for High Value Apparel...

Find your information...

For any assistance visit- gstkanotice.com or DM GST ka Notice

#gom #gommeeting #gstcouncil #gstcouncilmeeting #indirecttax #gstregistration #apparel #clothing #shopping #gstkanotice #gstnoticereply #gstnotice #gstn #finance #nirmalasitharaman #budget #finance

#best gst consultation in india#best gst lawyers in india#best gst services in india#best taxation law firm#gst#corporate lawyer in india#gst consultation firm#gst experts in india#gst help#gst india#gst assistance#gstreturns#gst registration#gstfiling#taxation#gst services#gst services in india#gstkanotice

0 notes

Text

best tax consultancy agency in Delhi NCR

2 notes

·

View notes

Text

Unlocking Success: TaxDunia Proven Strategies for Foreign Company

Foreign Company Registration is the process of legally establishing a business entity in a country different from where it was originally incorporated. For businesses looking to expand internationally, this process allows them to operate and conduct business in a new market while complying with local laws and regulations.

The registration involves several steps, including choosing the right business structure (such as a subsidiary, branch office, or representative office), submitting necessary documents, and meeting legal requirements specific to the host country. This may include obtaining a local business license, registering with tax authorities, and adhering to local labor and corporate laws.

Successful foreign company registration can open up new opportunities, facilitate market entry, and help businesses gain a competitive edge. It’s essential to seek local legal and financial advice to navigate the complexities of the registration process and ensure compliance with all regulations in the new market.

India’s diverse business landscape and evolving regulatory environment can present unique challenges for international enterprises looking to establish a foothold in this dynamic market. However, with the right guidance and strategic approach, foreign companies can navigate these waters and unlock tremendous growth opportunities. Whether you’re a multinational corporation or a small-to-medium-sized enterprise, our goal is to empower you with the knowledge and tools necessary to make informed decisions and achieve your business objectives in the Indian market.

Why Register a Foreign Company in India?

India’s rapidly growing economy, large consumer base, and pro-business policies have made it an increasingly attractive destination for foreign direct investment (FDI). By establishing a registered presence in India, foreign companies can:

1.Access a Vast and Diverse Market: With a population of over 1.3 billion and a rapidly expanding middle class, India offers unparalleled opportunities for businesses to reach a vast and diverse customer base.

2.Leverage Cost Advantages: India’s competitive labor costs, skilled workforce, and favorable manufacturing and service sector environments can provide significant cost advantages for foreign companies.

3.Capitalize on India’s Strategic Location: India’s strategic geographic location, well-developed transportation infrastructure, and proximity to other emerging markets make it an ideal hub for regional and global operations.

4.Benefit from Favorable Policies and Incentives: The Indian government has implemented various policies and incentives to attract foreign investment, including tax benefits, special economic zones, and streamlined regulatory processes.

5.Enhance Credibility and Visibility: Registering a foreign company in India can enhance the company’s credibility and visibility, making it more attractive to potential partners, customers, and investors.

Key Considerations for Foreign Company Registration in India

Before embarking on the foreign company registration in India, it’s crucial to consider the following key factors:

1.Legal Structure: Determine the appropriate legal structure for your foreign company in India, such as a wholly-owned subsidiary, joint venture, or liaison office.

2.Sector-Specific Regulations: Understand the specific regulations and requirements for your industry or sector, as some sectors may have additional compliance obligations.

3.Taxation and Accounting: Familiarize yourself with India’s complex tax system, including income tax, goods and services tax (GST), and other relevant regulations.

4.Repatriation of Profits: Understand the rules and procedures for repatriating profits from India to your home country.

5.Regulatory Approvals: Identify the necessary regulatory approvals and licenses required for your business operations in India.

6.Compliance and Reporting: Ensure that you have a robust system in place to maintain compliance with all applicable laws and regulations, including timely filing of returns and reports.

Step-by-Step Process for Foreign Company Registration in India

Navigating the foreign company registration process in India can be a complex and time-consuming endeavor. At TaxDunia, we have developed a structured approach to guide our clients through each step of the process:

1.Name Approval: Obtain approval for the proposed name of your foreign company from the Registrar of Companies (ROC).

2.Incorporation: Incorporate your foreign company in India as a private limited company or a wholly-owned subsidiary.

3.Regulatory Approvals: Obtain necessary approvals and licenses from relevant authorities, such as the Reserve Bank of India (RBI), the Ministry of Corporate Affairs (MCA), and industry-specific regulators.

4.Taxation and Compliance: Register your foreign company for various tax and compliance requirements, including income tax, GST, and labor laws.

5.Bank Account Establishment: Open a corporate bank account in India to facilitate business operations and financial transactions.

6.Ongoing Compliance: Maintain ongoing compliance with all applicable laws and regulations, including timely filing of returns, reports, and other required documents.

Throughout this process, our team of experts at TaxDunia will work closely with you to ensure a seamless and efficient registration experience.

Choosing the Right Income Tax Consultant in India

Navigating India’s complex tax landscape is a critical aspect of foreign company registration and operations. Engaging the services of a reliable and experienced income tax consultant can make all the difference in ensuring compliance, minimizing tax liabilities, and optimizing your company’s financial performance.

When selecting an income tax consultant in India, consider the following key factors:

1.Expertise and Experience: Look for a consultant with a proven track record of handling tax-related matters for foreign companies operating in India.

2.Regulatory Knowledge: Ensure that the consultant is well-versed in the latest tax laws, regulations, and compliance requirements.

3.Responsiveness and Communication: Choose a consultant who is responsive, communicative, and able to provide timely and accurate advice.

4.Service Offerings: Evaluate the consultant’s range of services, including tax planning, return filing, audit representation, and advisory support.

5.Reputation and Credentials: Check the consultant’s reputation, professional affiliations, and client testimonials to gauge their credibility.

Benefits of Working with the Best Income Tax Consultant in India

Engaging the services of the best income tax consultant in India, such as TaxDunia, can provide a multitude of benefits for foreign companies operating in the country:

1.Comprehensive Tax Expertise: Our team of seasoned tax professionals possesses in-depth knowledge of Indian tax laws, regulations, and best practices, ensuring that your company remains fully compliant.

2.Proactive Tax Planning: We work closely with you to develop customized tax planning strategies that minimize your tax liabilities and maximize your financial returns.

3.Streamlined Compliance: We handle all your tax-related compliance requirements, including timely filing of returns, managing audits, and representing you before tax authorities.

4.Cost Optimization: By leveraging our expertise and economies of scale, we can help you achieve significant cost savings on your tax-related expenses.

5.Reduced Risk: Our thorough understanding of the Indian tax landscape and our commitment to staying up-to-date with the latest changes in regulations help you avoid potential penalties and legal issues.

6.Improved Decision-Making: Our tax advisory services provide you with valuable insights and recommendations to support your strategic business decisions in India.

7.Enhanced Credibility: Working with a reputable and trusted income tax consultant like TaxDunia can enhance your company’s credibility and reputation in the Indian market.

At TaxDunia, we are committed to helping foreign companies navigate the complexities of registering and operating in India. Contact us today to learn more about our proven strategies and how we can support your success in the Indian market. Visit us at taxdunia.com to get started.

Conclusion: TaxDunia’s Expertise in Foreign Company Registration in India

At TaxDunia, we are committed to empowering foreign companies to unlock their full potential in the Indian market. Our deep understanding of the country’s regulatory environment, tax landscape, and best practices, coupled with our client-centric approach, make us the trusted partner of choice for businesses seeking to establish a successful presence in India.

Whether you’re a multinational corporation or a small-to-medium-sized enterprise, our team of experts is ready to guide you through every step of the foreign company registration process and beyond. From incorporating your business to optimizing your tax strategy and ensuring ongoing compliance, we will work with you every step of the way to tackle challenges, reduce risks, and make the most of the great opportunities available in the Indian market.

Take the first step towards your success in India. Contact https://www.taxdunia.com today to learn more about our proven strategies and how we can help you navigate the complex world of foreign company registration in India.

Other Link

Private Limited Company Registration

One Person Company Registration Service

Public Limited Company Registration Service

GST Return Filing Services

Trademark Registration service

#Foreign Company Registration in India#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#income tax#itr filling#itr filing#gst return#finance

0 notes

Text

Anisha Sharma & Associates - Where Expertise Meets Integrity in Business Services

Your trusted partner for all-encompassing financial and legal services at Anisha Sharma & Associates

In today’s competitive market, having a reliable partner for business and finance needs is crucial. Anisha Sharma & Associates offers a comprehensive suite of services tailored to meet the diverse needs of clients. With a focus on excellence and client satisfaction, they ensure that businesses can navigate the complexities of finance with ease.

1.Accounts

Maintaining accurate financial records is vital for any business. Anisha Sharma & Associates provides expert accounting services to help you manage your finances effectively, ensuring compliance and informed decision-making.

2.Audit

Regular audits are essential for transparency and trust. Their audit services assess financial health, identify discrepancies, and provide valuable insights to enhance operational efficiency.

3.Trademark Services

Protecting intellectual property is crucial in today's economy. The firm assists businesses in registering trademarks, safeguarding their brand identity, and ensuring legal compliance.

4.ROC (Registrar of Companies) Services Navigating the regulatory landscape can be complex. They offer expert guidance in fulfilling ROC compliance, ensuring that all statutory requirements are met without hassle.

5.License & Registration

Starting a business involves various licenses and registrations. Anisha Sharma & Associates simplifies this process, helping clients obtain necessary permits efficiently.

6.Loans

Whether for expansion or operational needs, securing loans is often essential. Their consultancy services assist in identifying the best financing options tailored to client needs.

7.Income Tax Services

Tax planning and compliance are critical for financial health. Their income tax services ensure clients meet obligations while maximizing deductions and credits.

8.GST Services

The Goods and Services Tax (GST) can be challenging to navigate. The firm provides comprehensive GST consultancy to ensure compliance and efficient tax management.

9.Consultancy

Strategic business consultancy is key to growth. Anisha Sharma & Associates offers tailored advice to help clients achieve their business goals effectively.

10.Insurance Services

Protecting assets and investments is vital. They offer guidance in selecting the right insurance products to mitigate risks and ensure business continuity.

11.Outsourcing Services

Focusing on core competencies is essential for growth. Their outsourcing solutions allow clients to delegate non-core functions efficiently.

12.DSC & Token Services

Digital Signatures are essential for e-governance. They assist clients in obtaining Digital Signature Certificates and tokens for seamless online transactions.

Specialized Services

1.Stock Broking & Advisory

With a keen eye on the market, their stock broking services provide clients with expert advice and investment strategies tailored to maximize returns.

2.Website & Digital Services

In the digital age, an online presence is crucial. They offer website development and digital marketing services to enhance visibility and engagement.

3.Real Estate Placement Consulting

Navigating the real estate market can be complex. Their consulting services provide valuable insights and assistance in property transactions.

4.IPF and ESI Services

Understanding and managing employee benefits is essential. They provide consultancy on Industrial Provident Fund (IPF) and Employee State Insurance (ESI) regulations.

5.Civil and Criminal Lawyer Services

Legal support is crucial for business operations. Their access to experienced civil and criminal lawyers ensures clients receive comprehensive legal guidance.

Conclusion

Choosing Anisha Sharma & Associates means partnering with a team dedicated to delivering excellence in business and finance. Their diverse range of core and specialized services ensures that every client receives tailored solutions to meet their unique needs. With a focus on trust, integrity, and client satisfaction, they stand out as a reliable partner in your business journey.

0 notes

Text

Is it Worth Salary Sacrificing an Electric Car?

As electric vehicles (EVs) become more popular in Australia, many are exploring the financial benefits of novated leases, especially when it comes to salary sacrificing an electric car. But is it truly worth it? Let's delve into the advantages and considerations of EV leasing, with a particular focus on the services offered by Carbon Leasing, a leading lease provider in Australia.

What is Salary Sacrificing?

Salary sacrificing, also known as salary packaging, is a financial arrangement where you agree to forgo part of your pre-tax salary in exchange for benefits of similar value. One popular benefit is a novated lease, which allows employees to lease a car using their pre-tax income, reducing their taxable income and potentially leading to significant tax savings.

The Benefits of Salary Sacrificing an Electric Car

Tax Savings

- Pre-Tax Payments: By using pre-tax income for lease payments, you reduce your taxable income, which can significantly lower your tax liabilities.

- GST Benefits: In many cases, the GST on the purchase price of the vehicle can be claimed by the employer, which is then passed on as a saving to the employee.

Cost Efficiency

- Bundled Costs: Novated leases typically bundle all car-related expenses (including registration, insurance, maintenance, and fuel) into one monthly payment, simplifying financial management.

- Lower Operational Costs: Electric vehicles generally have lower running costs compared to petrol or diesel vehicles, including lower fuel costs (electricity vs. fuel) and reduced maintenance costs due to fewer moving parts.

Environmental Benefits

- Reduced Emissions: Driving an electric vehicle significantly reduces your carbon footprint, contributing to a cleaner environment.

- Support for Green Technology: Salary sacrificing an electric car supports the adoption and development of green technologies.

Why Choose Carbon Leasing?

Carbon Leasing is a leading lease provider in Australia, specialising in EV leasing and salary packaging solutions.

Here’s why we stand out:

- Expertise in EV Leasing: Carbon Leasing offers tailored solutions for electric vehicle leasing in Australia, ensuring you get the best deal suited to your needs.

- Competitive Rates: They provide some of the most competitive rates in the market, ensuring you maximise your savings.

- Comprehensive Service: From initial consultations to lease agreements and vehicle delivery, Carbon Leasing offers a seamless and hassle-free experience.

Novated Leasing a Tesla with Carbon Leasing

One of the most popular choices for EV enthusiasts is Tesla. Tesla leasing through Carbon Leasing can be particularly advantageous due to the high residual value of Tesla vehicles, which can further reduce your lease payments.

- Flexible Lease Terms: Choose from a variety of lease terms to suit your financial situation and preferences.

- Online Free Calculator: Use Carbon Leasing’s online calculator to get an instant estimate of your monthly costs and potential savings.

Considerations and Potential Downsides

While there are numerous benefits to salary sacrificing an electric car, it’s also important to consider potential downsides. This is why choosing the right provider is so important. Some things to watch out for with other providers:

- Hard to read quotes – you should be able to understand how much you are paying for by simply looking at the quote.

- No interest rate – if the interest rate isn’t listed anywhere on the quote that is a massive red flag. If your interest rate is too good to be true, we can guarantee you it is. Those low interest rates are generally loaded with nasty fees.

- What is your brokerage and establishment fee? – be careful with how these are listed in your quote. They can be buried under a million-line items that are designed to confuse you.

- Check the maintenance packages – some providers will bundle expensive and unnecessary maintenance packages that will drive up the cost overall.

- Check for hidden charges in the amount financed

– we don’t make customers finance things they don’t need but other providers do. We also don’t try and sell you junk insurance buried into our quotes.

With Carbon Leasing, a top-notch lease provider, you can enjoy a seamless and cost-effective experience, making it easier than ever to drive an electric vehicle in Australia. Whether you’re considering Tesla leasing or exploring other EV options, salary packaging in Australia provides a practical and financially savvy route to driving a green, efficient vehicle.

1 note

·

View note

Text

Best Accounting Firm in Delhi

Need a quote for services like ITR refund, company formation, trademark registration, income tax, GST, ROC compliances, and more? Call us today!

#ca firm in delhi#chartered accountants in delhi#gst registration consultants in delhi#best gst consultant#accounting firm in delhi#best ca firms in delhi#gst consultant in delhi#accounting services in delhi

0 notes

Text

Business Setup in India by MAS LLP: Your Partner for Growth

Setting up a business in India is a lucrative opportunity due to its growing economy, diverse market, and skilled workforce. However, navigating the legal and regulatory framework can be challenging. That’s where MAS LLP steps in, offering expert assistance to help you establish your business smoothly and efficiently.

Why Choose MAS LLP for Business Setup in India?

MAS LLP is a leading consultancy that specializes in business formation and compliance services. With years of experience, MAS LLP has assisted numerous entrepreneurs and companies in setting up their businesses across India. Here’s why partnering with MAS LLP is a smart choice:

Comprehensive Services

MAS LLP provides a full suite of services, from company registration and legal compliance to tax advisory and financial consulting. Their team of experts ensures that every step of the business setup process is handled professionally.

Expert Knowledge of Indian Regulations

India's business environment is governed by complex laws and regulations, including the Companies Act, FDI norms, and various tax laws. MAS LLP has in-depth knowledge of these regulations, ensuring that your business complies with all legal requirements from the start.

Tailored Solutions for Different Business Structures

Whether you are looking to establish a private limited company, a partnership, an LLP, or a sole proprietorship, MAS LLP can help you choose the right structure based on your business goals and operational needs.

Steps to Setting Up a Business in India with MAS LLP

Business Structure Selection

Choosing the right business structure is crucial for long-term success. MAS LLP provides guidance on selecting the best structure, whether it's an LLP, private limited company, or branch office.

Company Registration

MAS LLP will help you with the process of registering your business with the Ministry of Corporate Affairs (MCA). This includes obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and filing the required documents for incorporation.

Tax Registration

Once your business is registered, MAS LLP assists in obtaining necessary tax registrations such as GST, PAN, and TAN, ensuring your company is compliant with India’s tax laws.

Legal Compliance

Keeping up with regulatory requirements is essential for any business. MAS LLP provides ongoing legal compliance support, including annual filings, audit reports, and statutory compliance.

Banking and Financial Setup

MAS LLP also assists with setting up business bank accounts, payment gateways, and financial structuring, helping you manage your financial operations efficiently.

Why Set Up a Business in India?

India is a growing economy with a young, dynamic workforce and a vibrant consumer market. By setting up your business here, you tap into a diverse and large customer base, benefit from government incentives for startups, and gain access to various sectors like IT, manufacturing, and retail.

Additionally, India offers excellent opportunities for foreign investors with simplified FDI policies. With MAS LLP by your side, you can navigate the challenges of setting up a business in India with ease and focus on what really matters—growing your business.

Conclusion

MAS LLP is your go-to partner for setting up a business in India. Their expertise in regulatory compliance, business formation, and financial consulting ensures that you can establish your business smoothly and start operating without any legal or financial hurdles.

Whether you are a local entrepreneur or a foreign investor, MAS LLP offers tailored solutions to meet your unique business needs. Get in touch with MAS LLP today and take the first step towards establishing a successful business in India!

6 notes

·

View notes