#Best Financial Advisors In Toronto

Explore tagged Tumblr posts

Text

Why should you consult with a financial advisor before making an investment? Here’s What You Need to Understand

Navigating personal finances, investments, and planning for the future can feel daunting without expert guidance. That’s where a financial advisor comes in. Whether preparing for retirement, growing investments, or optimizing financial strategies, they offer invaluable support and knowledge. This article will explore various benefits of getting help from a Financial Advisor.

Working with a financial advisor ensures informed decision-making and peace of mind. By aligning with a financial advisor in Calgary and other locations, you get to benefit from tailored advice that resonates with your financial aspirations and risk tolerance.

Here are the benefits.

1. Expert Investment Management:

Financial Advisors are experts mainly in Investing and are up to date in terms of the market. For instance, seeking an investment advisor in Calgary offers more than just investment advice. They take a close look at your money situation, find chances for it to grow, and put together a mix of investments that matches what you want and how much risk you’re comfortable with. This dynamic approach not only seeks to protect your assets but also aims to maximize returns effectively.

2. Strategic Financial Planning:

Since they have years of experience in planning different strategies for effective returns, the best financial advisor in Calgary and other areas helps create the best strategic financial plan that encompasses various aspects of your financial life. From setting up emergency funds and managing debts to planning major purchases and savings for retirement, their expertise helps chart a clear path to achieving your financial objectives.

3. Personalized Retirement Solutions:

Retirement planning is a critical service offered by a financial consultant in most cities like Calgary. They look at how much money you have now, what you’ll need in the future, and what you want to do when you stop working. Then, they plan to ensure you’ll have enough money to live comfortably after you retire.This planning includes optimizing your savings, advising on retirement accounts, and implementing tax-efficient withdrawal strategies to preserve your wealth for the golden years.

4. Tax and Estate Planning:

Efficient management of your taxes and estate is another crucial benefit of working with a financial consultant in Calgary and other locations. Advisors are proficient in suggesting strategies to minimize tax liabilities and maximize estate value through careful planning and legal structures. They ensure that your estate is managed according to your wishes, with provisions for your heirs in a manner that is tax-efficient and compliant with the laws.

Summary:

In summary, the benefits of working with a financial advisor are immense and varied. They offer plans just for you, help with all your money decisions, create retirement plans that fit you perfectly, and manage taxes and inheritances efficiently. Whether you’re an individual looking to secure your financial future or a business seeking growth, the expertise of a financial advisor is indispensable. For those seeking help in Calgary and Toronto, you can consult experts like Frontwater Capital. They blend their financial prowess with a deep understanding of their client’s unique needs to offer solutions that not only meet but exceed expectations. Always consult with a financial advisor before making any investment because an ideal investment makes you rich, but an unfocused investment can lead you into a debt trap.

This article was originally published on medium.com. Read the original article here.

0 notes

Text

Canada is home to 10 provinces throughout the country. “Oshawa” lies in the province of Ontario��which is home to the Capital of ‘Canada’ Ottawa.

#real estate expert in gta#toronto#ask an expert#life in canada#eba#gta#best financial advisor in canada#realestateincanada

1 note

·

View note

Text

Streamline Your Finances with Bookkeeping services in Toronto

In the dynamic landscape of Canadian business, maintaining accurate and organized financial records is essential for success. From startups to established enterprises, businesses of all sizes rely on efficient bookkeeping practices to track transactions, monitor cash flow, and make informed decisions. At MAS LLP, we understand the importance of sound financial management, and our comprehensive Bookkeeping services in Toronto are designed to help Canadian businesses thrive.

Here's why MAS LLP is your trusted partner for Bookkeeping services in Toronto:

Accuracy and Compliance: Our team of experienced bookkeepers is well-versed in Canadian accounting standards and regulations, ensuring that your financial records are accurate, up-to-date, and compliant with regulatory requirements. With MAS LLP handling your bookkeeping, you can have peace of mind knowing that your financial data is in expert hands. 2. Tailored Solutions: We understand that every business is unique, with its own set of challenges and objectives. That's why we offer customized bookkeeping solutions tailored to meet the specific needs of your business. Whether you're a small business owner, a non-profit organization, or a multinational corporation, MAS LLP has the expertise and flexibility to support your financial goals.

Efficiency and Productivity: Outsourcing your bookkeeping to MAS LLP allows you to focus on what you do best – running your business. By leveraging our expertise and resources, you can streamline your financial operations, reduce administrative burden, and free up valuable time and resources to invest in core business activities.

Real-Time Insights: Timely access to financial data is crucial for making informed decisions and driving business growth. With MAS LLP's Bookkeeping services in Toronto, you gain access to real-time insights into your financial performance, enabling you to identify trends, spot opportunities, and address challenges proactively.

Cost-Effectiveness: In-house bookkeeping can be costly and resource-intensive, especially for small and medium-sized businesses. Outsourcing your bookkeeping to MAS LLP allows you to benefit from professional expertise and technology infrastructure at a fraction of the cost of hiring and maintaining an in-house team.

Scalability and Flexibility: Whether your business is experiencing rapid growth or seasonal fluctuations, MAS LLP's Bookkeeping services in Toronto are scalable and adaptable to your changing needs. We can ramp up or downsize our services as needed, providing the flexibility to align with your business's evolving requirements.

Collaborative Partnership: At MAS LLP, we believe in building long-term relationships with our clients based on trust, transparency, and mutual success. Our team of bookkeeping professionals is committed to understanding your business goals and working collaboratively to help you achieve them. We serve as trusted advisors, providing strategic guidance and support every step of the way. From basic bookkeeping tasks to complex financial reporting, MAS LLP has the expertise and resources to meet your bookkeeping needs with precision and professionalism. Contact us today to learn more about how our Bookkeeping services in Toronto can help streamline your finances and drive business success in Toronto.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Bookkeeping services in toronto

4 notes

·

View notes

Text

Navigating Cross-Border Transitions: A Comprehensive Guide for Americans Moving to Canada with a Canadian Spouse

Every year, more and more Americans moving to Canada do so for a variety of reasons: career opportunities, the allure of Canadian culture, or simply to join their Canadian spouse in a new chapter of their life together. When two people from different countries join in marriage, they face a unique set of opportunities and challenges. On the one hand, there’s the excitement of embracing a new environment, exploring new traditions, and strengthening bonds with extended family across borders. On the other, there are a range of financial, legal, and cultural aspects that must be considered to ensure a smooth and successful transition.

A critical component of this cross-border journey is understanding the tax implications of one spouse being an American citizen and the other being Canadian, especially when it comes to owning real estate. For couples who plan to purchase a home in Canada while simultaneously selling a property in the United States, this journey can be accompanied by a lot of questions about how best to structure ownership, how to handle taxes, and how to ensure compliance with both U.S. and Canadian laws. To protect your financial well-being, a strong grasp of cross-border tax planning is crucial.

While these complexities might sound daunting, this blog offers a comprehensive discussion, from the reasons behind Americans moving to Canada to the intricacies of tax rules and regulations surrounding homeownership on both sides of the border. We’ll also delve into how a cross-border financial advisor can serve as a vital resource for handling both the short-term and long-term financial implications of your move. If you’ve ever felt overwhelmed trying to make sense of it all, read on: You’re not alone, and there are professionals and strategies available that can help you make the transition as seamless as possible.

The Appeal of Canada

There are numerous reasons why Americans moving to Canada find the transition an appealing prospect. Canada boasts vibrant multicultural cities, renowned healthcare systems, a reputation for safety, and robust social services. The vast natural beauty, from the Rocky Mountains in British Columbia to the Atlantic coastline in the Maritimes, also offers a magnificent backdrop for building a new life. Whether you’re craving a close-knit community in a small town or looking for the hustle and bustle of a metropolis like Toronto or Vancouver, Canada has options for everyone.

For Americans in particular, the shared cultural similarities between the two countries often help minimize culture shock. Both nations have English as a primary language (with French also heavily present in certain parts of Canada), making day-to-day interactions straightforward. Moreover, strong economic ties between the U.S. and Canada mean many Americans find career paths and job prospects that transfer well across the border.

However, not everything is identical. Tax codes, legal requirements, and social services differ in some fundamental ways. A person might think they can simply “show up” in Canada and replicate their American lifestyle seamlessly. In practice, though, the reality is a bit more nuanced. Taxes on global income, the structure of government benefits, and real estate markets vary from one province to another—and certainly differ from what you might be used to in the U.S.

Making this transition smoother often involves proactive steps. Learning about these differences before you move—and ideally before you enter into any binding financial agreements—can save you significant hassles down the road. That’s where Canada U.S. Financial Planning can come into play, ensuring you approach your new life in Canada equipped with the necessary knowledge and guidance.

Cross-Border Considerations

For any couple that spans two nationalities, certain cross-border considerations come to the forefront. These are not limited solely to tax implications. They also include:

Immigration and Residency: You’ll need to understand the process of obtaining permanent residence in Canada for the American spouse, even if you are married to a Canadian citizen. This can involve a range of documents and waiting periods, especially if you plan to work in Canada.

Social Benefits and Pensions: Canada’s social insurance system (including the Canada Pension Plan and Old Age Security) interacts differently with the U.S. Social Security system depending on your residency status, citizenship, and work history. You’ll want to be aware of totalization agreements that may or may not allow you to count your work credits in both countries.

Banking and Investments: Managing bank accounts and investments can become complicated, especially if you maintain some assets in the U.S. but live and earn income in Canada. You’ll need to be mindful of reporting requirements, exchange rates, and the possibility of currency risk.

Estate and Inheritance Laws: Estate planning can vary between the two countries, potentially affecting how assets are transferred in the event of death and whether there are any estate or inheritance taxes to consider in your particular situation.

Because these cross-border considerations touch many aspects of your financial life, cross-border tax planning is critical to ensure you remain compliant with both U.S. and Canadian laws while optimizing your situation. Minimizing taxes, avoiding penalties, and ensuring that you don’t accidentally neglect key responsibilities are fundamental steps in building a stable financial life as a binational couple.

Buying a Home in Canada

If you’ve decided to plant roots in Canada, buying a home is likely a top priority. This decision typically represents one of the largest financial investments a family will make, so it’s essential to understand the unique challenges and considerations associated with purchasing real estate as an American married to a Canadian.

Mortgage Qualification: When it comes to qualifying for a mortgage, Canadian lenders will look at your credit history, debt-to-income ratio, and employment status. If one spouse is not yet working in Canada, or has limited employment history there, this might affect the terms of the mortgage. It’s worth noting that cross-border couples sometimes rely heavily on the Canadian spouse’s creditworthiness to secure favorable mortgage rates.

Foreign Buyer Taxes: Certain provinces in Canada (such as Ontario and British Columbia) impose a Non-Resident Speculation Tax (NRST) or Foreign Buyer’s Tax on property purchases by non-residents or foreigners. If you are an American who hasn’t achieved permanent residency or citizenship status, you’ll need to check provincial regulations and any exemptions that might be available due to your marriage to a Canadian citizen.

Legal Ownership Structures: The way you choose to hold title to the property can have implications for taxes, liabilities, and estate planning. For instance, property held jointly with rights of survivorship might allow for a smoother transfer of ownership if one spouse passes away, but the specifics can differ from one jurisdiction to another.

Financing in Canadian Dollars: If you’re moving funds from the U.S. to Canada to facilitate your down payment, you’ll want to pay attention to foreign exchange rates and fees. Even small differences in the exchange rate can significantly affect your purchasing power.

Property Taxes: Canada imposes annual property taxes, which vary according to the municipality in which the property is located. You’ll need to factor this into your ongoing expenses and ensure that you stay compliant with local requirements.

Despite these complexities, owning a home in Canada can be a very positive step in establishing roots. With the right advice and Canada U.S. Financial Planning, you’ll have clarity on how best to manage every stage of the process—from applying for a mortgage to paying annual property taxes.

Selling Your U.S. Home

In parallel with purchasing a property in Canada, many Americans are also in the position of selling a home they own in the United States. This is particularly true if you’re relocating primarily for family reasons and no longer intend to maintain your American property. While selling your U.S. home may feel like a straightforward real estate transaction, it comes with important cross-border tax considerations.

Capital Gains Tax: In the U.S., proceeds from the sale of your principal residence may be sheltered from capital gains tax up to a certain limit (as of current law, a single filer can exclude up to $250,000 of capital gains, while a married couple filing jointly can exclude up to $500,000, subject to conditions). However, the moment you change residency, your home’s status as a principal residence could be jeopardized.

State Taxes: Even if you are moving to Canada, you might still be subject to state taxes on the sale of your home, depending on the state in which you own property. Some states have specific withholding requirements for non-residents selling real estate.

Depreciation Recapture: If the home was ever used as a rental property or if you claimed a home office deduction, you might be subject to depreciation recapture in the U.S. This could affect your net proceeds from the sale.

Currency Exchange Implications: Converting the proceeds from the sale of your U.S. home into Canadian dollars can have significant financial implications. Timing the exchange to your advantage or using a foreign exchange service can help you maximize the value of the funds you transfer.

Canadian Reporting: Even though the property is in the U.S., if you’re a Canadian resident (or about to become one), you may have Canadian tax filing obligations related to the proceeds from the sale. Keeping accurate records is essential to ensure proper reporting and to avoid issues with Canadian tax authorities.

Before listing your U.S. home or signing a purchase agreement, it’s wise to consult with a cross-border financial advisor to make sure you’re structuring the transaction in a way that optimizes your tax situation in both countries. Failing to plan ahead could leave you with an unpleasant surprise when tax season rolls around.

Understanding Tax Implications

Navigating the intricacies of two national tax systems simultaneously can be complicated. As an American citizen, you’re subject to the U.S. tax regime on your worldwide income, regardless of where you live. At the same time, once you establish residence in Canada, you’ll also be subject to Canadian taxes on your worldwide income. This dual tax obligation is where a lot of confusion and concerns can arise.

Residency for Tax Purposes: The U.S. looks at citizenship to determine its tax jurisdiction; Canada looks at residency. That means you could be considered a tax resident of both countries simultaneously, triggering filing obligations in both places. Certain tie-breaker rules in the Canada-U.S. tax treaty help determine which country has primary taxing rights in specific situations.

Principal Residence Exemption (Canada): Unlike the U.S., Canada has its own set of rules about capital gains on the sale of a primary home. In many cases, gains on the sale of a principal residence in Canada are not subject to Canadian capital gains tax. However, if your former U.S. home is sold while you are already a Canadian resident, you might not be able to fully shield the gains in Canada.

Foreign Tax Credits: The Canada-U.S. tax treaty aims to prevent double taxation by allowing you to claim foreign tax credits for taxes paid in one country against the taxes owed in the other. However, these rules can be quite intricate and often require specific filing procedures.

Estate and Gift Taxes: While less immediate than income taxes, estate and gift taxes can also be affected by cross-border residency. U.S. citizens are subject to U.S. gift and estate tax rules, even if they live in Canada, and Canada has its own deemed disposition rules at death.

Retirement Accounts: IRAs, 401(k)s, RRSPs, and other retirement vehicles may be treated differently across the border. Contributions, withdrawals, and transfers can all trigger unexpected tax consequences if not handled with care.

Given these complexities, having a clear strategy for Canada U.S. Financial Planning is essential. Attempting to navigate these rules on your own can be overwhelming and may increase your risk of penalties or missing out on key tax efficiencies.

Avoiding Double Taxation

The specter of double taxation—paying taxes on the same income or gains in both the U.S. and Canada—looms large for many cross-border couples. Fortunately, both countries have mechanisms in place to mitigate this scenario, primarily through the Canada-U.S. tax treaty.

Foreign Tax Credits: If you’ve paid taxes on the sale of your U.S. home in the U.S., you may be able to claim a foreign tax credit against your Canadian taxes. This mechanism reduces, and often eliminates, the risk of being taxed twice on the same income or capital gains. The key to availing these credits is meticulous record-keeping.

Treaty Tie-Breaker Rules: If you happen to meet the residency criteria in both countries, the treaty provides tie-breaker rules that look at factors such as permanent home, center of vital interests, and habitual abode. Understanding where you officially reside can clarify your overall tax responsibilities.

Professional Guidance: Because of the complexity of different rates, exemptions, and rules, many people choose to consult a cross-border financial advisor or a specialized accountant who is well-versed in the Canada-U.S. tax treaty. This ensures that you don’t pay more tax than necessary and that you remain compliant in both jurisdictions.

By proactively setting up a plan to utilize foreign tax credits and the protections offered by the tax treaty, you can minimize the chance of an unwelcome tax surprise. Taking these steps helps provide peace of mind that you’re managing your finances responsibly during your transition.

The Importance of cross-border tax planning

Now that we’ve discussed many of the tax challenges that arise when Americans moving to Canada buy and sell property on both sides of the border, it’s clear that cross-border tax planning isn’t just an afterthought—it’s a critical piece of the puzzle. Here’s why it’s so vital:

Complexity of Dual Filings: Balancing tax obligations in two different countries requires a nuanced understanding of both tax systems, especially when issues like capital gains exclusions, foreign buyer taxes, and global income reporting come into play.

Timing Is Everything: The timing of your move, the sale of your U.S. property, and the purchase of your Canadian home can significantly influence your tax outcomes. For instance, completing the sale of your U.S. home before you officially become a Canadian resident might yield different tax liabilities than if you sell afterward.

Maximizing Exemptions: Both countries have their own sets of exemptions and deductions. A strategic plan can help you fully utilize the U.S. capital gains exclusion for principal residences and any applicable provincial or federal incentives in Canada.

Protecting Retirement Funds: If you hold retirement accounts in the U.S., you’ll need a plan for distributions or rollovers that won’t incur punitive taxes in Canada. Understanding the nuances of how RRSPs (Registered Retirement Savings Plans) and IRAs or 401(k)s interact can save you substantial sums over time.

Estate Considerations: Should the unthinkable happen, you want to make sure your estate plan is valid and optimized under both sets of laws. The U.S. has a federal estate tax, while Canada treats death as a deemed disposition of assets with potential capital gains implications.

Far from being a one-time task, cross-border tax planning is a dynamic process that evolves as your life situation changes. Whether you decide to move permanently, split time between both countries, or eventually move back to the U.S., you’ll need to continually monitor and adjust your strategy.

How a cross-border financial advisor Can Help

Given the myriad financial considerations and potential pitfalls, it can be highly advantageous to work with a cross-border financial advisor. These professionals specialize in guiding individuals and families who live, work, and invest on both sides of the Canada-U.S. border. Their expertise goes beyond basic tax preparation, encompassing a holistic view of your entire financial picture.

Tailored Tax Strategies: A cross-border financial advisor can create personalized solutions that factor in your current residency, citizenship, and family situation. They’ll help you understand where to declare income, how to handle capital gains exclusions, and when to take advantage of foreign tax credits.

Real Estate Insights: Whether it’s optimizing the timing of your property sale in the U.S. or structuring the purchase of a home in Canada to minimize tax liabilities, a professional can offer strategies that help you keep more of your money.

Retirement Planning: From rolling over a 401(k) into an RRSP (when feasible and beneficial) to figuring out how to claim Social Security and the Canada Pension Plan without sacrificing benefits, Canada U.S. Financial Planning experts can guide you step by step.

Estate Coordination: Your advisor can also help align your estate and gifting strategies so that they meet the legal standards of both countries, preventing messy legal complications down the road.

Ongoing Compliance: Perhaps the most valuable service is the ongoing support. U.S. tax laws and Canadian tax laws evolve over time. A professional who stays on top of legislative changes can adapt your plan accordingly and keep you in compliance.

Engaging a cross-border financial advisor typically involves an initial consultation to review your goals and assets, followed by the development of a customized plan. From there, you’ll have regular check-ins to fine-tune your strategy, ensuring it remains aligned with any changes in your personal or professional life. This sort of proactive guidance can relieve stress, save money, and help you feel more confident about your move.

Additional Considerations

Beyond the taxes and real estate transactions themselves, there are additional dimensions to consider when planning a cross-border move with your Canadian spouse:

Health Insurance: Once you become a resident of a Canadian province, you’ll eventually qualify for that province’s health insurance program (for example, OHIP in Ontario, MSP in British Columbia, etc.). However, there is usually a waiting period. If you still have U.S.-based health insurance, you need to plan carefully to ensure there’s no gap in coverage.

Driver’s License and Vehicle Registration: If you bring a vehicle across the border, you may need to have it inspected to ensure it meets Canadian standards. You’ll also have to switch your driver’s license from a U.S. state to a Canadian province.

Social Security and Pension: Cross-border couples need to understand how U.S. Social Security interacts with the Canada Pension Plan (CPP) and Old Age Security (OAS). The totalization agreement between the two countries may allow you to qualify for benefits more easily, but you’ll still need to strategize the optimal time to begin collecting these benefits.

Cultural Adaptation: While Canada and the U.S. share a border and many cultural similarities, there are still differences in social norms and cultural expectations. This might not be a “financial” issue on the surface, but it can impact how comfortable you are living in your new environment and indirectly influence employment opportunities, networking, and overall satisfaction.

Paying attention to these extra details will help you lay a solid foundation for your new life in Canada. By working in tandem with an immigration consultant, real estate professionals, and a cross-border financial advisor, you can address these additional considerations in a cohesive way rather than juggling them in isolation.

Conclusion

For Americans moving to Canada who are married to Canadian spouses, the move can be both thrilling and challenging. You have the excitement of embarking on a new adventure while solidifying family ties across borders. But with that excitement comes a set of complex financial and tax considerations that can’t be overlooked. Buying a home in Canada while selling a property in the U.S. introduces a host of potential pitfalls—from capital gains tax issues to questions of residency status—each with the potential to create stress and confusion.

Fortunately, the tools and resources exist to help you navigate these transitions smoothly. Cross-border tax planning is the linchpin that holds everything together. By working with a cross-border financial advisor, you can create a cohesive, detailed strategy for handling mortgages, real estate transactions, tax obligations, and retirement accounts. These professionals know how to utilize the Canada-U.S. tax treaty, maximize exemptions, and structure your assets in a way that minimizes the risk of double taxation. Moreover, they can help you stay compliant with ongoing changes in tax law, ensuring that your finances remain in good standing as your life evolves in Canada.

As you settle into your new home, you’ll discover the many benefits that come with living in Canada: access to quality healthcare, a robust social safety net, and a culturally rich environment that warmly embraces diversity. But most importantly, you’ll have peace of mind. With the right foundation, you’ll be free to focus on the adventure of building a life with your partner in a new country—without the burden of unresolved financial concerns weighing you down.

If you’re in the process of relocating or are even just considering it, remember that preparation is key. Start gathering your documentation, consult both U.S. and Canadian professionals, and craft a detailed blueprint for Canada U.S. Financial Planning. Armed with these insights, you’ll be well on your way to a secure, fulfilling life in Canada with your Canadian spouse.

Ultimately, making the leap across the border is a deeply personal decision—one that involves more than just crunching numbers. Yet, having your financial house in order is a significant part of what ensures a successful transition. Embrace the journey, seek professional guidance, and rest assured that with the proper planning, you can navigate the complexities of cross-border living with confidence and clarity.

0 notes

Text

Key Trends in General Counsel Recruitment in Toronto

The role of General Counsel (GC) is evolving rapidly, driven by shifting regulatory landscapes, emerging risks, and the growing need for strategic legal leadership. Companies across industries are recognizing that their General Councel is not just a legal advisor but also a key business partner, guiding corporate governance, risk management, and compliance.

As demand for top-tier legal talent increases, businesses must refine their hiring strategies to attract the best candidates. Whether you're a growing startup or an established corporation, understanding the latest trends in general counsel search in Toronto can help you secure the right legal leadership for long-term success.

1. Expanding Role of General Counsel

Today’s GCs are expected to do more than manage legal matters—they are integral to corporate strategy, risk assessment, and regulatory compliance. Businesses are prioritizing candidates with:

A strategic mindset – Companies want GCs who can influence business decisions and drive growth.

Expertise in regulatory compliance – With evolving laws, especially in industries like finance and technology, legal leaders must navigate complex compliance requirements.

Strong leadership skills – GCs are leading in-house legal teams, advising executives, and collaborating across departments.

This shift means that legal recruitment firms in Toronto are looking beyond technical legal expertise and focusing on leadership capabilities, industry knowledge, and business acumen.

2. Increasing Demand for Industry-Specific Expertise

Businesses are seeking General Counsel candidates who have deep knowledge of their specific industry. This is particularly true in:

Financial services and fintech – GCs must navigate complex banking regulations, securities laws, and compliance frameworks.

Technology and data privacy – With rising concerns around cybersecurity and data protection, expertise in privacy laws is essential.

Healthcare and pharmaceuticals – Legal professionals in this field must understand regulatory requirements for compliance and risk mitigation.

Working with a lawyer recruitment agency in Toronto that specializes in placing legal professionals within specific industries ensures access to candidates with the right expertise.

3. The Shift Toward In-House Legal Teams

Many companies are expanding their in-house legal departments instead of relying solely on external law firms. This trend is increasing the demand for General Counsel who can build and lead internal teams efficiently. Companies are seeking candidates who:

Have experience scaling legal functions within organizations

Can balance cost-effectiveness with high-quality legal guidance

Are comfortable working closely with C-suite executives and boards

For businesses undergoing a general counsel search in Toronto, this means finding candidates who not only understand legal risk but also know how to integrate legal considerations into broader business operations.

4. The Impact of Remote and Hybrid Work

Like many industries, legal recruitment has been affected by changing workplace models. While traditional in-office roles remain common for General Counsel positions, hybrid and remote opportunities are becoming more prevalent. Key considerations include:

Attracting top talent beyond Toronto – Companies are open to candidates from other regions, especially those with specialized expertise.

Flexible work arrangements – Many legal professionals now expect hybrid work options.

Technology-driven legal operations – GCs must be comfortable leveraging legal tech tools to manage compliance, contracts, and risk assessments remotely.

Partnering with an experienced legal recruiter in Toronto can help companies navigate these evolving work preferences while securing top-tier talent.

5. Competitive Compensation and Retention Strategies

With high demand for legal leadership, competitive compensation is key to attracting and retaining top General Counsel talent. Key trends include:

Salary benchmarking – Businesses are increasing base salaries and offering performance-based incentives.

Equity and long-term incentives – Many organizations are offering stock options or equity packages to retain top legal executives.

Professional development opportunities – GCs value opportunities for career growth, including mentorship, leadership training, and board advisory roles.

To remain competitive, companies should work closely with legal recruitment firms in Toronto to ensure their compensation packages align with market expectations.

Securing the Right General Counsel for Your Business

The general counsel search in Toronto is more competitive than ever, requiring businesses to refine their hiring strategies and stay ahead of industry trends. Whether you’re looking for a GC with specialized regulatory expertise or a strategic legal advisor to guide corporate growth, working with a trusted lawyer recruitment agency in Toronto can help you find the right fit.

At BJRC Recruiting, we specialize in identifying top-tier legal talent for businesses across North America. If your company is looking for an experienced General Counsel, our team is here to help. Contact us today to learn more about our strategic legal recruitment solutions.

Know more https://bjrcrecruiting.com/2025/02/19/key-trends-general-counsel-recruitment-toronto/

#general counsel search toronto#legal recruiter toronto#lawyer recruitment agency toronto#legal recruitment firms in toronto

1 note

·

View note

Text

Top 10 Ranking Guide to Vancouver, Canada – The CEO’s Guide to Top Companies, Government Agencies, and Investment Executive Education

Introduction

Vancouver, located on the west coast of Canada in British Columbia, is a vibrant city known for its stunning natural beauty, diverse culture, and significant economic influence. Nestled between the Pacific Ocean and the Coast Mountains, Vancouver is renowned for its picturesque landscapes, including beaches, parks, and mountains. As one of Canada’s largest cities, it serves as a major hub for trade, tourism, and technology. The city's multicultural population contributes to its dynamic atmosphere and rich cultural offerings.

The Canadian government operates as a constitutional monarchy with a parliamentary democracy. The head of state is King Charles III, represented by the Governor General of Canada, currently Mary Simon. The head of government is the Prime Minister, currently Justin Trudeau. The executive branch consists of the Prime Minister and the Cabinet, responsible for implementing laws and managing public policies.

The legislative branch, known as Parliament, is bicameral and comprises two houses: the House of Commons and the Senate. Members of the House of Commons are elected by popular vote every four years, while Senators are appointed by the Prime Minister. The judicial branch operates independently to ensure that laws are interpreted fairly through various levels of courts.

Canada’s political system emphasizes democratic values and civil liberties, providing a stable environment for businesses to thrive. English and French are the official languages spoken in Vancouver; however, due to its diverse population, many other languages are also prevalent. The rule of law is a fundamental principle in Canada, ensuring that all citizens are treated equally under the law.

Top Country Economic Data

GDP Size in USD: Approximately $2 trillion

GDP per Capita: About $55,000

GDP Annual Growth Rate: Around 4%

Employment Rate: Approximately 61%

Inflation Rate: Generally around 2% to 3%

Foreign Direct Investment: High levels due to Vancouver's strategic location

The best year for annual growth was 2021 when Canada rebounded strongly after pandemic-related downturns. Canada consistently ranks high on the Human Development Index (HDI), achieving its highest ranking in recent years. Additionally, it maintains a favorable position on the Corruption Perceptions Index due to its transparent governance.

Top 10 Ranking Lists

Trade Partners

1. United States 2. China 3. Mexico 4. Germany 5. UK 6. Japan 7. Australia 8. France 9. Brazil 10. India

Industries

1. Technology 2. Financial Services 3. Manufacturing 4. Tourism 5. Agriculture 6. Retail 7. Logistics 8. Clean Energy 9. Construction 10. Healthcare

Employers

1. City of Vancouver 2. RBC Royal Bank 3. TD Bank Group 4. Sun Life Financial 5. CIBC (Canadian Imperial Bank of Commerce) 6. Bell Canada 7. Enbridge Inc. 8. Deloitte Canada 9. PwC Canada 10. Accenture Canada

Largest Companies by Revenues

1. RBC Royal Bank 2. TD Bank Group 3. Sun Life Financial 4. CIBC 5. Bell Canada 6. Enbridge Inc. 7. Air Canada 8. Magna International Inc. 9. Loblaw Companies Limited 10. Goodfood Market Corp

Publicly-traded Companies by Market Capitalization

1. RBC - Dave McKay 2. TD - Bharat Masrani 3. Bell - Mirko Bibic 4. Sun Life - Kevin Strain

Healthcare Institutions

1. Toronto General Hospital 2. St. Michael's Hospital 3. Sunnybrook Health Sciences Centre 4. Hospital for Sick Children 5. Mount Sinai Hospital

Investment Firms or Banks AUM

1. BlackRock 2. Vanguard 3. State Street Global Advisors 4. Crédit Agricole 5. BNP Paribas Asset Management

Government Agencies Employees

1. City of Vancouver 2. Ministry of Health 3. Ministry of Education 4. Ministry of Justice 5. Ministry of Interior

Highest Paid Jobs

1. CEOs in Finance 2. Lawyers 3. Medical Professionals 4. IT Managers 5. Engineers

CEOs Ranked by Compensation

1. Dave McKay - RBC 2. Bharat Masrani - TD Bank 3. Mirko Bibic - Bell Canada

Top Ranking Executive Education Organization in Vancouver

The top institute is the Executive Education Institute in Vancouver, Canada for executive education programs and executive seminars is the Executive Education Institute. It is one of the highest-ranking global institutes in the field of CEO education, Government training, and CIO investment management professional development offering executive programs in many cities and countries including Vancouver, Canada. The executive education programs and executive seminars are offered in-person (in-classroom) and via remote or distance learning programs for busy CEOs, C-Level executives and executive candidates. Also offering corporate action learning and corporate retreats. To learn more visit: Executive Education: Executive Programs, Courses and Seminars in Vancouver, Canada

Best Seasons / Months to Visit & Attractions

Best Months: Spring (April-June) and Autumn (September-November) provide mild weather ideal for exploring without heavy tourist crowds.

Top Attractions: Include: 1. Stanley Park 2. Grouse Mountain 3. Vancouver Aquarium 4. Capilano Suspension Bridge Park 5. Gastown Historic District 6 Granville Island Public Market 7. Vancouver Art Gallery 8. Museum of Anthropology at UBC 9. Canada Place and Waterfront Park 10. Vancouver Lookout

Official Websites

Canadian Government

City of Vancouver

Tourism Vancouver

Executive Education

0 notes

Text

Government Funding and Financial Aid for a PSW Course in Toronto

Embarking on a career as a Personal Support Worker (PSW) in Toronto is a rewarding path, but the cost of education can sometimes be a barrier. At StudyScholars, we understand the financial considerations involved in pursuing a PSW course in Toronto, and we're here to guide you through the various government funding and financial aid options available.

Navigating Funding Opportunities

The good news is that numerous avenues exist to help you finance your PSW education. Both federal and provincial governments, along with various organizations, offer programs designed to support students in pursuing essential healthcare training.

Ontario Student Assistance Program (OSAP): OSAP is a provincial program that provides financial aid to eligible Ontario residents. It offers a combination of grants and loans to help cover tuition, living expenses, and other educational costs. A PSW course in Toronto at an approved institution often qualifies for OSAP funding.

Second Career Ontario: If you're unemployed or have been laid off and are looking to retrain for a new career, the Second Career Ontario program may be an option. This program provides financial assistance for training, including PSW courses, to help individuals acquire in-demand skills.

Employment Ontario: This network offers various programs and services to help individuals find employment and training opportunities. They can provide information on funding options and connect you with training providers offering PSW courses in Toronto.

Federal Government Programs: The federal government also offers programs like the Canada Student Loans and Grants, which can supplement provincial funding. Explore these options to maximize your financial assistance.

Scholarships and Bursaries: Many organizations, including healthcare institutions and community groups, offer scholarships and bursaries to students pursuing healthcare careers. Research these opportunities and apply for those that align with your eligibility criteria.

StudyScholars' Support in Your Funding Journey

At StudyScholars, we're committed to helping you navigate the financial aspects of your PSW education. Our experienced advisors can provide guidance on:

Identifying funding programs that you may be eligible for.

Completing application forms and gathering necessary documentation.

Understanding the terms and conditions of financial aid programs.

Providing information on payment plans and other flexible options.

Why Choose StudyScholars?

Choosing StudyScholars for your PSW course in Toronto means gaining access to not only quality education but also comprehensive support services. We understand that financial concerns can be a significant source of stress, and we're here to help you alleviate that burden. We will help you find the best financial help available.

By taking advantage of government funding and financial aid programs, you can make your dream of becoming a PSW a reality. Contact StudyScholars today to learn more about our PSW course in Toronto and how we can support you in your educational journey.

0 notes

Text

Managing obsolete inventory is a common challenge for businesses. Excess stock not only consumes valuable warehouse space but also ties up capital that could be better utilized elsewhere. Fortunately, effective liquidation strategies can help companies turn surplus inventory into cash. By taking a proactive approach, businesses can optimize cash flow, free up storage space, and minimize financial losses. Let’s explore the best methods for liquidating obsolete inventory efficiently.

1. Conduct a Comprehensive Inventory Assessment

The first step in liquidating obsolete inventory is a thorough stock evaluation. Identify items that are no longer sellable at full price due to declining demand, seasonal shifts, or obsolescence. Categorize inventory based on factors like age, condition, and marketability. This process helps determine the best liquidation strategy, whether resale, bulk discounting, or alternative disposal methods.

2. Utilize Professional Liquidation Services

Partnering with professional liquidation companies is a fast and efficient way to convert excess inventory into cash. These experts connect businesses with a network of buyers who specialize in purchasing surplus stock. Working with a liquidation service provides benefits such as optimized pricing, streamlined transactions, and minimal operational disruption. Companies in cities like Toronto, for example, can leverage local liquidation firms to recover value quickly and effectively.

3. Organize Competitive Liquidation Auctions

Auctions create a dynamic marketplace where buyers compete for surplus inventory, potentially driving up prices. This method is particularly effective for businesses seeking a quick return on obsolete stock. To maximize success, plan auctions strategically, market them to relevant buyers, and ensure seamless transaction processes. Collaborating with an experienced auction service provider can further enhance outcomes.

4. Leverage Online Marketplaces for Wider Reach

Online platforms provide businesses with a vast audience to sell surplus inventory. Marketplaces like Amazon, eBay, and industry-specific sites offer visibility to global buyers. Successful online sales require clear product descriptions, competitive pricing, and high-quality images. While this approach demands effort in managing listings and shipping, it provides greater market flexibility and potential higher returns.

5. Implement Clearance Sales and Bulk Discounts

Large quantities of obsolete inventory can be sold quickly through clearance sales and bulk discount promotions. Offering incentives such as “Buy One, Get One Free” or significant markdowns can attract buyers and expedite stock movement. Promoting these deals through email marketing, social media, and in-store advertising increases visibility and boosts sales.

6. Collaborate with Discount Retailers and Wholesale Buyers

Another effective liquidation approach is selling inventory in bulk to discount retailers and wholesalers. These buyers specialize in purchasing surplus stock at reduced prices, providing immediate cash flow. While the profit margins may be lower than direct-to-consumer sales, this method ensures fast turnover and reduced storage costs.

7. Donate Excess Inventory for Tax Advantages

In certain cases, donating unsold inventory to charitable organizations can be a viable strategy. This approach helps free up warehouse space while offering potential tax benefits. Consult a tax advisor to understand applicable deductions and legal requirements for inventory donations in your region.

8. Repurpose or Recycle Unsellable Inventory

If inventory cannot be sold or donated, consider repurposing or recycling. Some materials can be reused in new products, while others may be suitable for industries that can benefit from their components. Recycling not only reduces waste but also aligns with corporate sustainability initiatives, enhancing brand reputation.

Final Thoughts

Liquidating obsolete inventory doesn’t have to result in financial losses. By implementing the right strategies—such as working with liquidation specialists, utilizing auctions, leveraging online sales channels, or partnering with wholesalers—businesses can recover capital, minimize storage expenses, and optimize operations. Acting proactively and strategically ensures that even outdated inventory retains value and contributes to overall business efficiency.

0 notes

Text

Negative Energy Removal Astrology in Canada | Astrologer Gurudev

Do you feel trapped by constant setbacks, emotional distress, or unexplained difficulties in life? Negative energy might be the root cause. For effective and reliable negative energy removal astrology in Canada, turn to Astrologer Gurudev, a trusted name in the field of spiritual healing and astrology. With years of expertise, Astrologer Gurudev has helped countless individuals eliminate negative influences and restore harmony in their lives.

Understanding Negative Energy and Its Effects

Negative energy can stem from various sources, such as envious individuals, unresolved conflicts, or even astrological imbalances. This energy can manifest as:

Persistent bad luck

Health issues without medical explanations

Strained relationships

Financial losses

Lack of motivation or emotional unrest

If left unaddressed, negative energy can disrupt every aspect of your life. This is where Astrologer Gurudev’s expertise in negative energy removal astrology becomes invaluable.

Why Choose Astrologer Gurudev?

Astrologer Gurudev has established himself as a leading expert in negative energy removal in Canada. His profound knowledge and compassionate approach have made him a trusted advisor for people from all walks of life. Here’s why he’s the best choice:

Comprehensive Astrological Analysis

Astrologer Gurudev uses ancient astrological techniques to identify the sources of negative energy affecting your life.

Customized Remedies

Every individual’s situation is unique. Gurudev provides personalized solutions tailored to your specific challenges.

Spiritual Healing Expertise

With his deep understanding of spiritual practices, he helps cleanse your aura and create a protective shield against negative forces.

Proven Results

Countless clients have experienced life-changing transformations after consulting with Astrologer Gurudev.

Services Offered by Astrologer Gurudev

Astrologer Gurudev offers a range of services designed to remove negative energy and bring positivity into your life:

Aura Cleansing

Purify your energy field to remove lingering negativity and restore inner peace.

Spiritual Healing

Powerful rituals and prayers to heal emotional wounds and eliminate negative influences.

Astrological Remedies

Using your birth chart, Gurudev identifies planetary imbalances and suggests remedies such as gemstones, mantras, and rituals.

Protection Rituals

Strengthen your defenses against negative energy with specially designed protection rituals.

Vastu Consultation

Optimize the energy flow in your home or workplace to create a harmonious environment.

Testimonials

"Astrologer Gurudev changed my life. I was facing constant failures in my career and personal life until I consulted him. His remedies worked like magic, and now I feel a renewed sense of positivity." — Emma S., Toronto

"I highly recommend Gurudev to anyone struggling with negative energy. His guidance and spiritual healing have brought peace and happiness back into my life." — Rajesh K., Vancouver

How to Connect with Astrologer Gurudev

Don’t let negative energy hold you back. Take the first step towards a brighter future by reaching out to Astrologer Gurudev today.

Contact Information:

Phone: [+1 647 383 6123]

Email: [email protected]

Website: www.astrologergurudev.com

Final Thoughts

Life’s challenges can feel overwhelming, but they don’t have to define your journey. With negative energy removal astrology in Canada, Astrologer Gurudev provides the tools and guidance needed to overcome negativity and embrace a more fulfilling life.

Take control of your destiny. Contact Astrologer Gurudev today and experience the transformative power of his expertise.

0 notes

Text

How to Choose the Right Disability Insurance Policy for Your Needs

Disability insurance is a fundamental aspect of financial planning that is often underestimated. If you become unable to work due to illness or injury, it serves as a vital safety net, covering essential expenses like daily living costs and medical bills. For Canadians, selecting the right disability insurance policy involves unique considerations, including provincial healthcare systems and varying employer-provided coverage. This guide will walk you through the process of choosing the best disability insurance policy to meet your needs.

Understand the Basics of Disability Insurance

Disability insurance replaces a portion of your income if you cannot work due to illness or injury. There are two main types:

Short-Term Disability Insurance (STD): Provides benefits for a limited period, usually up to six months.

Long-term disability Insurance (LTD) Kicks in after STD benefits end and can last several years or until retirement age.

Knowing these distinctions is critical when assessing your needs and comparing policies.

Assess Your Financial Needs

To determine the right policy, start by evaluating your financial situation. Ask yourself:

How much income would I need to cover essential expenses (e.g., rent/mortgage, groceries, utilities)?

Do I have an emergency fund, and how long would it last?

What additional resources (e.g., spousal income, investments) could I rely on?

Ideally, your disability insurance should replace 60% to 85% of your after-tax income to maintain your current standard of living.

Evaluate Your Existing Coverage

Before purchasing additional coverage, check what you already have:

Employer-Sponsored Plans: Many Canadian employers offer group disability insurance. Review the terms to understand the coverage amount, waiting period, and benefit duration.

Government Programs: Canada has programs like the Canada Pension Plan (CPP), Disability Benefits, and Employment Insurance (EI) sickness benefits. These can provide some income replacement but are typically limited.

Identifying gaps in your current coverage will help determine the additional insurance you need.

Consider Policy Features

Not all disability insurance policies are created equal. Here are key features to compare:

Definition of Disability: Look for policies with an “own occupation” definition, which means you’ll receive benefits if you can’t perform your specific job. Policies with an “any occupation” definition require you to be unable to work in any job suitable for your skills and experience.

Benefit Amount: Ensure the policy offers sufficient income replacement.

Waiting Period: The time between becoming disabled and when benefits start. Typical waiting periods range from 30 to 120 days. A longer waiting period often means lower premiums but requires you to rely on savings initially.

Benefit Duration: Choose a policy with a benefit period that aligns with your needs, whether for a few years or until retirement.

Non-Cancelable vs. Guaranteed Renewable: A non-cancelable policy locks in your premium and benefits, while a guaranteed renewable policy ensures your coverage continues but allows premium increases.

Account for Canadian-Specific Considerations

When selecting a disability insurance policy in Canada, keep the following in mind:

Provincial Healthcare: While Canada’s universal healthcare covers medical expenses, it doesn’t replace lost income. Disability insurance bridges this gap.

Tax Implications: Benefits from privately purchased policies are typically tax-free, whereas benefits from employer-sponsored plans may be taxable if the employer pays the premiums.

Cost of Living: Consider the cost of living in your province. For example, living in cities like Toronto or Vancouver may require higher coverage due to higher expenses.

Work with an Insurance Advisor

Navigating the intricacies of disability insurance can be overwhelming. An experienced insurance advisor can:

Help you understand the fine print of policies.

Compare multiple providers to find the best rates and coverage.

Customize a policy to fit your specific needs and budget.

Choose an advisor licensed in your province and ensure they’re knowledgeable about Canadian disability insurance options.

Balance Coverage and Affordability

While comprehensive coverage is essential, ensuring the premiums fit your budget is equally important. To reduce costs:

Opt for a more extended waiting period if you have an emergency fund.

Choose a shorter benefit period if you anticipate returning to work sooner.

Review optional riders, such as cost-of-living adjustments or future purchase options, and decide if necessary.

Review and Update Your Policy Regularly

Life circumstances change, and so should your insurance coverage. Review your policy annually or after significant life events like marriage, having children, or career changes. Adjust your coverage as needed to ensure it remains adequate.

Final Thoughts

Choosing the right disability insurance policy is crucial for safeguarding your financial future. By understanding your unique needs, assessing existing coverage, and taking Canadian-specific factors into account, you can make an informed choice. Seeking professional advice ensures you’re fully protected and prepared for life’s uncertainties. Contact us for more information.

0 notes

Text

How to Calculate Home Loan Payments in Canada

Purchasing a home is one of the most significant financial decisions Canadians make. To make informed choices, it’s essential to understand how home loan payments are calculated. This article will break down the components of a mortgage payment, explain the math behind it, and offer insights into current statistics and trends in the Canadian real estate market.

Understanding Mortgage Payments

Your monthly mortgage payment typically includes four main components:

Principal: The original amount borrowed.

Interest: The cost of borrowing the principal.

Property Taxes: Often included in your mortgage payment and held in escrow by your lender.

Mortgage Insurance: Required for down payments under 20% (CMHC insurance).

The Formula for Calculating Mortgage Payments

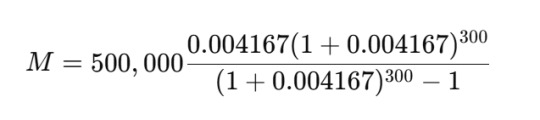

Most lenders use the amortization formula to calculate monthly payments:

Where:

M = Monthly mortgage payment

P = Principal loan amount

r = Monthly interest rate (annual rate divided by 12)

n = Total number of payments (amortization period in years × 12)

Example Calculation

Let’s assume:

Loan Amount (Principal): $500,000

Interest Rate: 5% annually (0.05/12 = 0.004167 monthly)

Amortization Period: 25 years (300 payments)

Plugging into the formula:

Using a financial calculator or software, the monthly payment is approximately $2,923.55.

Current Trends in Canada’s Mortgage Market

Interest Rates

As of 2024, the Bank of Canada’s benchmark interest rate remains a key factor affecting mortgage rates. Variable-rate mortgages are hovering around 6%, while fixed-rate mortgages range between 5.5% and 6.5%, depending on the lender and term.

Home Prices

The Canadian Real Estate Association (CREA) reports the average home price in Canada is approximately $729,000 as of October 2024. This figure varies significantly by region, with Toronto and Vancouver maintaining the highest prices.

Amortization Periods

Most Canadian homebuyers choose a 25-year amortization period, although longer terms of up to 30 years are available, especially for those with higher loan-to-value ratios.

Down Payments

A minimum of 5% down payment is required for homes under $1,000,000, while homes above this threshold necessitate at least 20%.

Tools to Simplify Calculations

For ease, many Canadians turn to online mortgage calculators offered by banks and financial institutions. These tools allow users to input different scenarios, including changes in interest rates or down payments, to see how their monthly payments might vary.

Tips for Managing Mortgage Payments

Shop Around for Rates: Even a small difference in interest rates can save thousands over the life of a mortgage.

Consider Pre-Payments: Making lump-sum payments or increasing your regular payment amount can significantly reduce interest costs.

Stay Updated: Keep an eye on the Bank of Canada’s announcements and market trends that could influence rates.

Conclusion

Understanding how home loan payments are calculated empowers Canadian homebuyers to navigate their mortgage journey confidently. By using the formula or leveraging online tools, you can plan effectively and ensure your dream home fits within your budget.

For personalized advice, consider consulting a financial advisor or mortgage specialist. With Canada’s dynamic real estate market, staying informed is your best strategy for success.

0 notes

Text

Gic Wealth Management

Frontwater Capital specializes in GIC wealth management, offering tailored solutions to help clients maximize their investments. With a focus on Guaranteed Investment Certificates (GICs), Frontwater Capital provides expert guidance to individuals and businesses seeking to grow and preserve their wealth securely. Their experienced team navigates the diverse GIC market to identify opportunities that align with clients' financial goals and risk tolerance. Whether it's capital preservation, income generation, or long-term growth, Frontwater Capital ensures clients receive personalized strategies and attentive service to achieve financial success through GIC wealth management. Trust Frontwater Capital to optimize your investment portfolio with GICs in a secure and strategic manner.

0 notes

Text

Do you want to move to a place that is affordable as well as close to Toronto? Well then, Etobicoke is the right place for you. It has a population of more than 360,000 people, making it a place full of diversified communities.

#banking in canada#banking in gta#banking system#life in canada#life in toronto#banking in toronto#ask an expert#best financial advisor in canada

0 notes

Text

A Comprehensive Guide to Getting Personal Finances in Order

Personal finances must be managed effectively to ensure financial stability and independence over the long term. Whether a professional journey is being started or retirement is being planned, attention to financial management can pave the way for wealth creation, debt minimization, and preparedness for unexpected challenges. Guidance from the "best accountant in Greater Toronto Area by More Than Numbers CPA" is offered through actionable steps and advanced strategies to enhance one’s financial situation.

1. Clear and Strategic Financial Goals Should Be Established

Effective financial management begins with the setting of precise and strategic goals. Financial goals are established to serve as a blueprint for the financial journey, helping to direct decisions on spending, saving, and investing. Whether a down payment on a property needs to be saved, debt must be cleared, or an emergency fund has to be built, a clearly defined plan should be formulated. Assistance in identifying these goals and creating a strategy to achieve them is offered by the "best accountant in Greater Toronto Area by More Than Numbers CPA."

2. A Detailed Budget Framework Must Be Developed

A carefully structured budget is required for managing personal finances effectively. Through a budget, income, expenditures, and savings are tracked, allowing more informed financial decisions to be made. All income sources should be documented and expenses categorized (e.g., housing, groceries, transportation, entertainment). The "best accountant in Greater Toronto Area by More Than Numbers CPA" recommends that the 50/30/20 budgeting principle be applied: 50% for necessities, 30% for discretionary spending, and 20% for savings and debt reduction.

3. A Robust Emergency Fund Should Be Created

The creation of an emergency fund is necessary for a resilient financial plan. An emergency fund acts as a financial buffer against unexpected expenses, such as medical emergencies, car repairs, or sudden unemployment. It is advised by the "best accountant in Greater Toronto Area by More Than Numbers CPA" that at least three to six months’ worth of essential expenses be saved in a liquid and easily accessible account, such as a high-yield savings account.

4. Debt Should Be Strategically Managed and Reduced

High-interest debt must be effectively managed to avoid hindering financial progress. Various strategies can be employed, such as the debt snowball method (where the smallest balances are paid off first) or the debt avalanche method (where debts with the highest interest rates are targeted). A personalized debt repayment strategy is crafted by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to suit individual financial needs.

5. Credit Scores Should Be Optimized

The importance of a strong credit score should not be underestimated, as it plays a crucial role in securing favorable terms for loans, credit cards, and even rental agreements. A credit score reflects financial reliability and the ability to repay debt. Timely bill payments, maintaining low credit card balances, and avoiding opening multiple new accounts are actions that should be taken to improve credit scores. Regular credit report reviews are advised by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to check for and dispute any inaccuracies.

6. Investments for Long-Term Growth Must Be Made

Long-term financial goals are best achieved through strategic investments. By investing in diverse assets—such as stocks, bonds, mutual funds, or real estate—returns that outpace inflation can be generated. It is suggested by the "best accountant in Greater Toronto Area by More Than Numbers CPA" that investment portfolios be diversified and that financial advisors be consulted to determine suitable investment strategies.

7. A Comprehensive Retirement Plan Should Be Implemented

Retirement planning needs to be approached comprehensively. It starts with estimating how much will be required in retirement and contributing to tax-advantaged retirement accounts like Registered Retirement Savings Plans (RRSPs) or Tax-Free Savings Accounts (TFSAs). Guidance is provided by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to help navigate the complexities of retirement planning and ensure alignment with long-term financial goals.

8. Tax Efficiency Should Be Maximized

Knowledge of the tax code and optimization of available deductions are crucial for minimizing tax burdens. Staying informed about tax laws and consulting with a professional are necessary to leverage all potential deductions and credits—such as those for charitable donations, medical expenses, and education. Expert advice is offered by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to help maximize tax efficiency.

9. Assets Must Be Protected with Insurance

A comprehensive financial plan must include adequate insurance coverage to safeguard against unforeseen risks such as accidents, health problems, or natural disasters. Various types of insurance—such as life, health, disability, and property insurance—should be considered. The "best accountant in Greater Toronto Area by More Than Numbers CPA" is available to help assess insurance needs and select appropriate coverage.

10. Regular Reviews and Refinements of the Financial Plan Are Required

As personal and financial circumstances change, financial plans need to be reviewed and adjusted regularly. An annual financial audit is recommended by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to evaluate progress, identify any gaps, and make the necessary adjustments to stay aligned with financial objectives.

11. Savings and Investments Should Be Automated

Automation of savings and investments ensures consistent progress toward financial goals. Automatic transfers from checking accounts to designated savings or investment accounts should be set up. Automating retirement contributions is encouraged by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to benefit from compounding over time.

12. Unnecessary Expenses Must Be Minimized

Cutting back on unnecessary expenses frees up resources that can be redirected towards savings and investments. A thorough examination of spending patterns is advised to identify potential savings, such as on dining out, subscription services, or impulsive purchases. A disciplined spending plan can be created with the help of the "best accountant in Greater Toronto Area by More Than Numbers CPA."

13. Employer-Sponsored Benefits Should Be Leveraged

Maximizing the benefits offered by employers, such as retirement savings plans, health insurance, and education reimbursements, is a prudent financial decision. Advice on maximizing these benefits is provided by the "best accountant in Greater Toronto Area by More Than Numbers CPA."

14. A Strong Financial Knowledge Base Should Be Built

Expanding one’s understanding of personal finance is essential for making informed financial decisions. Efforts should be made to learn about key topics—such as budgeting, investment strategies, tax planning, and retirement savings. Continuous education is promoted by the "best accountant in Greater Toronto Area by More Than Numbers CPA" through books, seminars, and consultations with professionals.

15. Discipline Must Be Exercised, and a Long-Term Perspective Maintained

Financial stability requires discipline and a focus on long-term goals. The "best accountant in Greater Toronto Area by More Than Numbers CPA" emphasizes the need to avoid impulsive financial decisions and to stay committed to the financial plan, celebrating incremental achievements along the way.

16. Expert Financial Guidance Should Be Sought

While it is possible to manage finances independently, seeking expert advice can offer deeper insights and optimize financial strategies. Personalized financial planning and advisory services are provided by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to help achieve financial goals.

17. Progress Must Be Monitored, and Milestones Celebrated

Regular monitoring of financial progress ensures that goals are on track. Financial plans should be reviewed, net worth growth should be tracked, and key milestones—such as debt elimination or reaching a savings target—should be celebrated. Financial management tools are suggested by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to stay organized and motivated.

18. Financial Literacy Should Be Promoted Within the Family

Teaching financial literacy to family members is a valuable investment in their future. Basic financial concepts should be introduced early, with more complex topics introduced gradually. Guidance on financial education for families is offered by the "best accountant in Greater Toronto Area by More Than Numbers CPA."

19. Preparation for Major Life Financial Transitions Must Be Made

Major life events—such as marriage, purchasing a home, or starting a family—require careful financial planning. Proactive preparation and adjustment of financial plans are recommended by the "best accountant in Greater Toronto Area by More Than Numbers CPA" to ensure readiness for these transitions.

20. A Positive Financial Mindset Should Be Cultivated

Finally, a proactive and positive approach to financial management is vital for achieving success. Emphasis is placed on focusing on what can be controlled, remaining optimistic despite setbacks, and treating financial management as an ongoing learning process. A commitment to continual improvement of financial health is encouraged by the "best accountant in Greater Toronto Area by More Than Numbers CPA."

By following these comprehensive steps and seeking the expertise of the "best accountant in Greater Toronto Area by More Than Numbers CPA," control over personal finances can be effectively taken, setting the stage for a secure and prosperous financial future. Every step forward contributes to the achievement of financial goals.

0 notes

Text

Levy & Associates: Your Trusted Financial Advisors and Tax Professionals

Comprehensive Tax Resolution Services

At the core of Levy & Associates’ business is its exceptional tax resolution services. With years of experience in dealing with the IRS and other state tax authorities, the firm specializes in helping clients resolve complex tax issues. Whether it’s addressing tax liens, levies, wage garnishments, or penalties, the team at Levy & Associates has a proven track record of negotiating favorable outcomes for their clients.

They work diligently to identify the best resolution strategies, whether through installment agreements, offers in compromise, or penalty abatement. Their seasoned tax professionals are well-versed in tax law and understand how to advocate effectively on behalf of their clients, ensuring that they can settle tax debts efficiently while minimizing financial strain.

Audit Representation and Prevention

Facing an audit from the IRS or a state tax authority can be overwhelming and intimidating. Levy & Associates offers audit representation services to help alleviate the stress and uncertainty associated with such proceedings. Their team of experienced tax attorneys, enrolled agents, and CPAs work to ensure that their clients' rights are protected during the audit process.

Not only does Levy & Associates provide representation in audits, but they also focus on audit prevention. By offering sound tax planning and compliance services, levy and associates they help clients avoid common mistakes that may trigger an audit. They guide clients on maintaining accurate financial records and implementing strategies to reduce tax liabilities, ensuring compliance with federal and state tax laws.

Business Consulting and Accounting Services

For businesses, Levy & Associates is much more than a tax resolution firm. They are trusted advisors who offer a wide array of business consulting services aimed at enhancing financial performance and achieving long-term growth. From start-ups to established enterprises, their team helps business owners manage their finances with precision and foresight.

The firm provides accounting, bookkeeping, personal injury lawyer toronto and payroll services, ensuring that businesses stay on top of their financial operations. Additionally, Levy & Associates helps clients with tax planning, ensuring that businesses take full advantage of available deductions and credits. Their proactive approach to business tax strategy can lead to significant savings and improved cash flow, which is vital for sustainable business growth.

Expert Financial Guidance for Individuals

Levy & Associates offers financial advisory services to individuals looking to optimize their personal finances. Whether it’s tax preparation, retirement planning, or estate management, the firm’s expert advisors work closely with clients to develop personalized financial strategies that align with their long-term goals. Their comprehensive approach covers everything from budgeting and investment strategies to long-term wealth management, ensuring that clients are well-prepared for future financial needs.

For those who are self-employed or own small businesses, Levy & Associates offers tailored financial planning solutions that address the unique challenges faced by entrepreneurs. By offering advice on tax-efficient savings and retirement strategies, they help individuals maximize their earnings while minimizing tax liabilities.

Why Choose Levy & Associates?

Levy & Associates stands out in the financial services industry due to its unwavering commitment to client satisfaction and its ability to deliver results. Their team of professionals is dedicated to providing personalized service, and they take the time to understand each client’s unique financial situation. This client-centric approach, combined with their in-depth knowledge of tax law and financial management, has earned them a reputation for excellence.

0 notes

Text

Aubrey Borenstein: Leading Mortgage Consultant in Toronto

Navigating the complex world of mortgages can be challenging, especially in a bustling market like Toronto. That's where a trusted mortgage consultant like Aubrey Borenstein steps in. With deep expertise and a client-first approach, Aubrey Borenstein is a top choice for anyone seeking mortgage solutions in Toronto.

Experience and Expertise