#Best Crypto Tax Accountant

Text

Ecommerce Accounting Firms

Camuso CPA PLLC is a trusted eCommerce accounting firms offering top-notch financial services to help your online business grow. Our team of experts specializes in eCommerce accounting and can provide tailored solutions to meet your unique needs. Visit our website today.

0 notes

Text

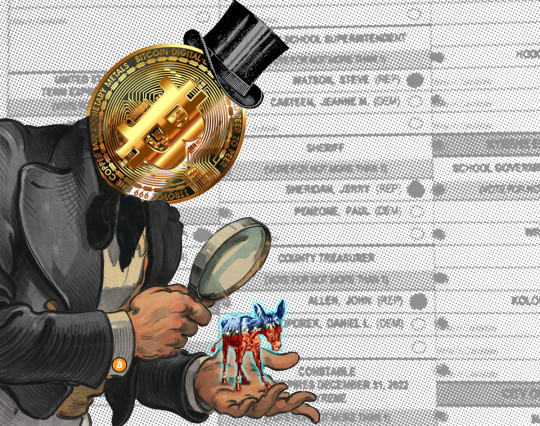

The largest campaign finance violation in US history

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Earlier this month, some of the richest men in Silicon Valley, led by Marc Andreesen and Ben Horowitz (the billionaire VCs behind Andreesen-Horowitz) announced that they would be backing Trump with endorsements and millions of dollars:

https://www.forbes.com/sites/dereksaul/2024/07/16/trump-lands-more-big-tech-backers-billionaire-venture-capitalist-andreessen-joins-wave-supporting-former-president/

Predictably, this drew a lot of ire, which Andreesen tried to diffuse by insisting that his support "doesn’t have anything to do with the big issues that people care about":

https://www.theverge.com/2024/7/24/24204706/marc-andreessen-ben-horowitz-a16z-trump-donations

In other words, the billionaires backing Trump weren't doing so because they supported the racism, the national abortion ban, the attacks on core human rights, etc. Those were merely tradeoffs that they were willing to make to get the parts of the Trump program they do support: more tax-cuts for the ultra-rich, and, of course, free rein to defraud normies with cryptocurrency Ponzi schemes.

Crypto isn't "money" – it is far too volatile to be a store of value, a unit of account, or a medium of exchange. You'd have to be nuts to get a crypto mortgage when all it takes is Elon Musk tweeting a couple emoji to make your monthly mortgage payment double.

A thing becomes moneylike when it can be used to pay off a bill for something you either must pay for, or strongly desire to pay for. The US dollar's moneylike property comes from the fact that hundreds of millions of people need dollars to pay off the IRS and their state tax bills, which means that they will trade labor and goods for dollars. Even people who don't pay US taxes will accept dollars, because they know they can use them to buy things from people who do have a nondiscretionary bill that can only be paid in dollars.

Dollars are also valuable because there are many important commodities that can only – or primarily – be purchased with them, like much of the world's oil supply. The fact that anyone who wants to buy oil has a strong need for dollars makes dollars valuable, because they will sell labor and goods to get dollars, not because they need dollars, but because they need oil.

There's almost nothing that can only be purchased with crypto. You can procure illegal goods and services in the mistaken belief that this transaction will be durably anonymous, and you can pay off ransomware creeps who have hijacked your personal files or all of your business's data:

https://locusmag.com/2022/09/cory-doctorow-moneylike/

Web3 was sold as a way to make the web more "decentralized," but it's best understood as an effort to make it impossible to use the web without paying crypto every time you click your mouse. If people need crypto to use the internet, then crypto whales will finally have a source of durable liquidity for the tokens they've hoarded:

https://pluralistic.net/2022/09/16/nondiscretionary-liabilities/#quatloos

The Web3 bubble was almost entirely down to the vast hype machine mobilized by Andreesen-Horowitz, who bet billions of dollars on the idea and almost single-handedly created the illusion of demand for crypto. For example, they arranged a $100m bribe to Kickstarter shareholders in exchange for Kickstarter pretending to integrate "blockchain" into its crowdfunding platform:

https://finance.yahoo.com/news/untold-story-kickstarter-crypto-hail-120000205.html

Kickstarter never ended up using the blockchain technology, because it was useless. Their shareholders just pocketed the $100m while the company weathered the waves of scorn from savvy tech users who understood that this was all a shuck.

Look hard enough at any crypto "success" and you'll discover a comparable scam. Remember NFTs, and the eye-popping sums that seemingly "everyone" was willing to pay for ugly JPEGs? That whole market was shot through with "wash-trading" – where you sell your asset to yourself and pretend that it was bought by a third party. It's a cheap – and illegal – way to convince people that something worthless is actually very valuable:

https://mailchi.mp/brianlivingston.com/034-2#free1

Even the books about crypto are scams. Chris Dixon's "bestseller" about the power of crypto, Read Write Own, got on the bestseller list through the publishing equivalent of wash-trading, where VCs with large investments in crypto bought up thousands of copies and shoved them on indifferent employees or just warehoused them:

https://pluralistic.net/2024/02/15/your-new-first-name/#that-dagger-tho

The fact that crypto trades were mostly the same bunch of grifters buying shitcoins from each other, while spending big on Superbowl ads, bribes to Kickstarter shareholders, and bulk-buys of mediocre business-books was bound to come out someday. In the meantime, though, the system worked: it convinced normies to gamble their life's savings on crypto, which they promptly lost (if you can't spot the sucker at the table, you're the sucker).

There's a name for this: it's called a "bezzle." John Kenneth Galbraith defined a "bezzle" as "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it." All bezzles collapse eventually, but until they do, everyone feels better off. You think you're rich because you just bought a bunch of shitcoins after Matt Damon told you that "fortune favors the brave." Damon feels rich because he got a ton of cash to rope you into the con. Crypto.com feels rich because you took a bunch of your perfectly cromulent "fiat money" that can be used to buy anything and traded it in for shitcoins that can be used to buy nothing:

https://theintercept.com/2022/10/26/matt-damon-crypto-commercial/

Andreesen-Horowitz were masters of the bezzle. For them, the Web3 bet on an internet that you'd have to buy their shitcoins to use was always Plan B. Plan A was much more straightforward: they would back crypto companies and take part of their equity in huge quantities of shitcoins that they could sell to "unqualified investors" (normies) in an "initial coin offering." Normally, this would be illegal: a company can't offer stock to the general public until it's been through an SEC vetting process and "gone public" through an IPO. But (Andreesen-Horowitz argued) their companies' "initial coin offerings" existed in an unregulated grey zone where they could be traded for the life's savings of mom-and-pop investors who thought crypto was real because they heard that Kickstarter had adopted it, and there was a bestselling book about it, and Larry David and Matt Damon and Spike Lee told them it was the next big thing.

Crypto isn't so much a financial innovation as it is a financial obfuscation. "Fintech" is just a cynical synonym for "unregulated bank." Cryptocurrency enjoys a "byzantine premium" – that is, it's so larded with baffling technical nonsense that no one understands how it works, and they assume that anything they don't understand is probably incredibly sophisticated and great ("a pile of shit this big must have pony under it somewhere"):

https://pluralistic.net/2022/03/13/the-byzantine-premium/

There are two threats to the crypto bezzle: the first is that normies will wise up to the scam, and the second is that the government will put a stop to it. These are correlated risks: if the government treats crypto as a security (or worse, a scam), that will put severe limits on how shitcoins can be marketed to normies, which will staunch the influx of real money, so the sole liquidity will come from ransomware payments and transactions with tragically overconfident hitmen and drug dealers who think the blockchain is anonymous.

To keep the bezzle going, crypto scammers have spent the past two election cycles flooding both parties with cash. In the 2022 midterms, crypto money bankrolled primary challenges to Democrats by absolute cranks, like the "effective altruist" Carrick Flynn ("effective altruism" is a crypto-affiliated cult closely associated with the infamous scam-artist Sam Bankman-Fried). Sam Bankman-Fried's super PAC, "Protect Our Future," spent $10m on attack-ads against Flynn's primary opponent, the incumbent Andrea Salinas. Salinas trounced Flynn – who was an objectively very bad candidate who stood no chance of winning the general election – but only at the expense of most of the funds she raised from her grassroots, small-dollar donors.

Fighting off SBF's joke candidate meant that Salinas went into the general election with nearly empty coffers, and she barely squeaked out a win against a GOP nightmare candidate Mike Erickson – a millionaire Oxy trafficker, drunk driver, and philanderer who tricked his then-girlfriend by driving her to a fake abortion clinic and telling her that it was a real one:

https://pluralistic.net/2022/10/14/competitors-critics-customers/#billionaire-dilletantes

SBF is in prison, but there's no shortage of crypto millions for this election cycle. According to Molly White's "Follow the Crypto" tracker, crypto-affiliated PACs have raised $185m to influence the 2024 election – more than the entire energy sector:

https://www.followthecrypto.org/

As with everything "crypto," the cryptocurrency election corruption slushfund is a bezzle. The "Stand With Crypto PAC" claims to have the backing of 1.3 million "crypto advocates," and Reuters claims they have 440,000 backers. But 99% of the money claimed by Stand With Crypto was actually donated to "Fairshake" – a different PAC – and 90% of Fairshake's money comes from a handful of corporate donors:

https://www.citationneeded.news/issue-62/

Stand With Crypto – minus the Fairshake money it falsely claimed – has raised $13,690 since April. That money came from just seven donors, four of whom are employed by Coinbase, for whom Stand With Crypto is a stalking horse. Stand With Crypto has an affiliated group (also called "Stand With Crypto" because that is an extremely normal and forthright way to run a nonprofit!), which has raised millions – $1.49m. Of that $1.49m, 90% came from just four donors: three cryptocurrency companies, and the CEO of Coinbase.

There are plenty of crypto dollars for politicians to fight over, but there are virtually no crypto voters. 69-75% of Americans "view crypto negatively or distrust it":

https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/

When Trump keynotes the Bitcoin 2024 conference and promises to use public funds to buy $1b worth of cryptocoins, he isn't wooing voters, he's wooing dollars:

https://www.wired.com/story/donald-trump-strategic-bitcoin-stockpile-bitcoin-2024/

Wooing dollars, not crypto. Politicians aren't raising funds in crypto, because you can't buy ads or pay campaign staff with shitcoins. Remember: unless Andreesen-Horowitz manages to install Web3 crypto tollbooths all over the internet, the industries that accept crypto are ransomware, and technologically overconfident hit-men and drug-dealers. To win elections, you need dollars, which crypto hustlers get by convincing normies to give them real money in exchange for shitcoins, and they are only funding politicians who will make it easier to do that.

As a political matter, "crypto" is a shorthand for "allowing scammers to steal from working people," which makes it a very Republican issue. As Hamilton Nolan writes, "If the Republicans want to position themselves as the Party of Crypto, let them. It is similar to how they position themselves as The Party of Racism and the Party of Religious Zealots and the Party of Telling Lies about Election Fraud. These things actually reflect poorly on them, the Republicans":

https://www.hamiltonnolan.com/p/crypto-as-a-political-characteristic

But the Democrats – who are riding high on the news that Kamala Harris will be their candidate this fall – have decided that they want some of that crypto money, too. Even as crypto-skeptical Dems like Jamaal Bowman, Cori Bush, Sherrod Brown and Jon Tester see millions from crypto PACs flooding in to support their primary challengers and GOP opponents, a group of Dem politicians are promising to give the crypto industry whatever it wants, if they will only bribe Democratic candidates as well:

https://subscriber.politicopro.com/f/?id=00000190-f475-d94b-a79f-fc77c9400000

Kamala Harris – a genuinely popular candidate who has raised record-shattering sums from small-dollar donors representing millions of Americans – herself has called for a "reset" of the relationship between the crypto sector and the Dems:

https://archive.is/iYd1C

As Luke Goldstein writes in The American Prospect, sucking up to crypto scammers so they stop giving your opponents millions of dollars to run attack ads against you is a strategy with no end – you have to keep sucking up to the scam, otherwise the attack ads come out:

https://prospect.org/politics/2024-07-31-crypto-cash-affecting-democratic-races/

There's a whole menagerie of crypto billionaires behind this year's attempt to buy the American government – Andreesen and Horowitz, of course, but also the Winklevoss twins, and this guy, who says we're in the midst of a "civil war" and "anyone that votes against Trump can die in a fucking fire":

https://twitter.com/molly0xFFF/status/1813952816840597712/photo/1

But the real whale that's backstopping the crypto campaign spending is Coinbase, through its Fairshake crypto PAC. Coinbase has donated $45,500,000 to Fairshake, which is a lot:

https://www.coinbase.com/blog/how-to-get-regulatory-clarity-for-crypto

But $45.5m isn't merely a large campaign contribution: it appears that $25m of that is the largest the largest illegal campaign contribution by a federal contractor in history, "by far," a fact that was sleuthed out by Molly White:

https://www.citationneeded.news/coinbase-campaign-finance-violation/

At issue is the fact that Coinbase is bidding to be a US federal contractor: specifically, they want to manage the crypto wallets that US federal cops keep seizing from crime kingpins. Once Coinbase threw its hat into the federal contracting ring, it disqualified itself from donating to politicians or funding PACs:

Campaign finance law prohibits federal government contractors from making contributions, or promising to make contributions, to political entities including super PACs like Fairshake.

https://www.fec.gov/help-candidates-and-committees/federal-government-contractors/

Previous to this, the largest ever illegal campaign contribution by a federal contractor appears to be Marathon Petroleum Company's 2022 bribe to GOP House and Senate super PACs, a mere $1m, only 4% of Coinbase's bribe.

I'm with Nolan on this one. Let the GOP chase millions from billionaires everyone hates who expect them to promote a scam that everyone mistrusts. The Dems have finally found a candidate that people are excited about, and they're awash in money thanks to small amounts contributed by everyday Americans. As AOC put it:

They've got money, but we've got people. Dollar bills don't vote. People vote.

https://www.popsugar.com/news/alexandria-ocasio-cortez-dnc-headquarters-climate-speech-47986992

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/31/greater-fools/#coinbased

#pluralistic#coinbase#crypto#cryptocurrency#elections#campaign finance#campaign finance violations#crimes#fraud#influence peddling#democrats#moneylike#bubbles#ponzi schemes#bezzles#molly white#hamilton nolan

412 notes

·

View notes

Text

Now all we hear is how banks are suddenly investing in things like BITCOIN. The propaganda is just stunning, for it has once again proven that Julius Caesar was right more than 2000 years ago, and nothing has ever changed.

Things like BITCOIN are a religion, and that is the problem. It would be best never to marry any trade, for you will never look at the world objectively. The code for the BITCOIN programmer was known to have come from the NSA. In 1996, the US government released a white paper entitled, “How to make a mint: the cryptography of anonymous electronic cash.” Released by the National Security Agency Office of Information Security Research and Technology, this document basically explains how a government agency could create something like Bitcoin or another cryptocurrency.

The Federal Reserve is not going to issue a CBDC. All the big banks are creating their own, and then they will be regulated by the Fed. The banks must already report suspicious activity to the Feds. The banks will create the digital currency since they will report “suspicious” activity to the Fed and IRS. If the Fed created a CBDC, they need a search warrant to look into an account where the banks do not.

OPEN YOUR EYES

This is the same scheme they used with covid. Private companies like Facebook and YouTube can regulate free speech that the government cannot. The banks will then report all suspicious activity and your cash flow to the IRS. Wake up! Janet Yellen wanted to audit $600 transaction of Ebay. They are broke and they believe ending cash will result in 35%+ more in tax collections.

This entire digital currency is to provide the government with 100% tracking of every monetary transaction. We will be driven back to barter. Don’t be surprised when they attack gold. All gold refiners already must declare every gram where it came from and where it went.

15 notes

·

View notes

Text

Top Crypto Accounting Services & Trading Firms | Cryptacce

Discover the top crypto accounting services and trading firms. Simplify asset management with expert support and the best platforms for efficient trading,

1. Onboarding

Our operations team will guide you through a streamlined onboarding process, and share an encrypted upload folder.

2. Data analysis and estimate

We will review your information and provide an estimate

for services.

3. Cryptocurrency calculations

Determining the cost basis, profit and loss of your crypto assets.

4. Preparation of Financials

We will prepare the financials based on the above results

5. Communication

We will have a review of financials with you over a meet or email

6. Tax planning and optimization

Income classification (capital gains vs business income), and identifying tax planning opportunities.

7. Tax preparation and filing

Preparing and filing your income tax return, ensuring crypto assets are accurately reported.

Read more: https://cryptacce.com/

#crypto tax accountants#cryptocurrency accounting software#fiat and crypto#accounting cryptocurrency#crypto accounting services#cryptocurrency accounting firms#crypto trading#crypto trading websites

0 notes

Text

Expert Crypto Tax Services for Australian Investors

If you are looking for Expert Crypto Tax Services in Australia then Australian Tax Specialists is one of the best destinations for you where you can get the best Australian Crypto Tax Specialists. Our Tax Specialists provide high-end Taxation & Accounting Services for Small to large private business groups in Australia.

#Australian Crypto Tax Specialists#Australian Tax Specialists#Crypto Tax Specialists#Australian Tax#Tax Specialists#Australian Crypto

0 notes

Text

Best Cryptos to Buy with $200 During the Bear Market! | Crypto Tech

https://www.youtube.com/channel/UC2dh-ClZCsnnA7yzaS5-SZw

Best Cryptos to Buy with $200 During the Bear Market! | Crypto Tech

https://www.youtube.com/channel/UC2dh-ClZCsnnA7yzaS5-SZw

https://ift.tt/DgPlcVx

Wondering how to invest your $200 in the current bear market? In this video, we’ll explore the best cryptocurrencies to consider during these challenging times. Whether you’re looking for long-term potential or quick gains, we’ve got you covered. Don’t miss out on these top picks!

Unlock the secrets of cryptocurrency and pave your path to financial freedom with

Crypto Tech! https://www.youtube.com/@CryptoTech-qk1hp/?sub_confirmation=1

Stay Connected With Us.

Instagram: https://ift.tt/xgyYJiX

Instagram: https://ift.tt/rzxn4VB

For Business Inquiries: [email protected]

=============================

Recommended Playlist

New Currency New Gold

WATCH OUR OTHER VIDEOS:

Hamster Kombat 2024: Can You Earn Real Money? | Crypto Tech

Pi Network Update: 200% Lockup Rewards – How To Benefit? | Crypto Tech

Trending Now: Solana Memecoins – Should You Invest? | Crypto Tech

Top Cryptos To Buy In 2024: Must-Have Coins For Huge Gains | Crypto Tech

Bitcoin Price Prediction 2024: Market Madness Explained! | Crypto Tech

=============================

About Crypto Tech.

At Discover Crypto, we aim to empower you with the knowledge and insights to embrace cryptocurrency and find your path to financial freedom. Every day, we strive to provide you with accessible expert analyses of the latest developments in Bitcoin, Ethereum, and various Altcoins. Welcome to the world of Discover Crypto.

For Collaboration and Business inquiries, please use the contact information below:

Email: [email protected]

Transform Your Financial Future with Cryptocurrency – Subscribe to Crypto Tech for Expert Insights and Financial Freedom!

https://www.youtube.com/@CryptoTech-qk1hp/?sub_confirmation=1

=================================

#crypto #cryptonews #crypto2024

Disclaimer: We want to emphasize that we are not professional advisors in finance, cryptocurrency, taxation, securities and commodities trading, or legal practice. The information and content disseminated through “Discover Crypto” are solely intended for general information purposes. None of our content, whether written or discussed, is meant to be interpreted as, or relied upon as, investment, financial, legal, regulatory, accounting, tax, or any other form of professional advice. Everything “Discover Crypto” conveys is based on subjective opinions about currently available facts.

Copyright Notice: This video and our YouTube channel contain dialogue, music, and images that are the property of Crypto Tech. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to our YouTube channel is provided.

© Crypto Tech

from Crypto Tech

https://www.youtube.com/watch?v=Yqr2e2OgJo8

via Crypto Tech https://ift.tt/IqcZaEQ

August 18, 2024 at 12:16PM

0 notes

Text

Current Financials: August 2024

As for the money, here's a rough look at what I've got. The market took a little tumble between last night and today, but that's ok as most of my earlier calculations were still with figures less than where they sit now.

Investment Accounts: ~400k

Cash Accounts: ~45k

An additional $3k has been set aside for business expenses. There is also technically a couple thousand floating around in various crypto, but I don't check it and don't really care to anymore because it makes my taxes too hard.

My expenses are roughly $1k per month on average. Some months I spend like $400, other months I spend close to $2000. As mentioned before, I am currently living with my family and taking care of my sick parent, so expenses are low. Even when living alone, I just don't really spend that much money beyond the cost of housing and health insurance.

I am expecting about $15k in a final check to come within the next few weeks. I will be living off of this money for the next year and have not factored it into my above accounts. I will also not be collecting unemployment.

The game plan is, generally, that I will not touch the above investment accounts (brokerage, IRA, 401k that I'll probably roll into my IRA) at all. My cash accounts are effectively an emergency fund for myself and my loved ones. I recently had to loan a dear friend several thousand dollars to help her out of a bad situation that was in no way her fault and I am glad that I chose to keep so much in cash for immediate availability.

I will likely put any additional income into my cash accounts and continue a $500 per month deposit into my investment accounts. It would be nice to have a large chunk of cash on hand for a down payment in the future. I know I could put it into my investment accounts and withdraw later and pay the taxes and all that, but I like simplicity. I know it's not the best move in terms of financial min-maxing, but again, simplicity. Most of my decisions err on the side of whatever causes me the least amount of stress and paperwork. I don't plan on ever doing a Roth Conversion Ladder in my life, sorry.

Onward to whatever comes next. I will update in a few months I think.

0 notes

Text

Find The Best Crypto Tax Accountant in Sydney

If you are investing in Crypto currency with the intention of investing to return a profit, then remember any sales generated are assessable income. We provide Crypto Tax Accountant Sydney service. Australian taxation office now receives this information from your crypto broker. But the good news is, if you make a loss then this could count as a tax loss and you should report it in your tax return. At Australian Tax Specialists, we want to help you understand how crypto currency taxation works so that you can avoid ATO penalties and audits.

0 notes

Text

Table of ContentsIntroductionMaximizing Tax Deductions for Crypto Mining EquipmentUtilizing Tax Loopholes to Reduce Capital Gains on Crypto SalesStrategies for Minimizing Tax Liability on Crypto Mining IncomeQ&AConclusionMaximize Profits: Uncover Tax Strategies and Loopholes for Crypto Mining SuccessIntroduction**Introduction to Tax Strategies and Loopholes for Crypto Mining Businesses**

Cryptocurrency mining has emerged as a lucrative industry, presenting unique tax implications for businesses involved in this activity. To optimize their tax liability, crypto mining businesses can employ various strategies and leverage loopholes within the existing tax framework. This introduction provides an overview of the key tax considerations and potential strategies that crypto mining businesses can explore to minimize their tax burden while ensuring compliance with applicable regulations.Maximizing Tax Deductions for Crypto Mining Equipment**Tax Strategies and Loopholes for Crypto Mining Businesses: Maximizing Tax Deductions for Crypto Mining Equipment**

Crypto mining, the process of verifying and adding transactions to a blockchain, has emerged as a lucrative business venture. However, navigating the tax implications of crypto mining can be complex. This article explores tax strategies and loopholes that crypto mining businesses can leverage to maximize tax deductions for their equipment.

**Section 179 Deduction**

The Section 179 deduction allows businesses to deduct the full cost of qualifying equipment in the year it is placed in service. This deduction is particularly beneficial for crypto mining businesses, as mining equipment can be expensive. To qualify for the Section 179 deduction, the equipment must be used in the business and have a useful life of less than 15 years.

**Bonus Depreciation**

Bonus depreciation is another tax deduction that can be used to accelerate the depreciation of certain assets, including crypto mining equipment. Under the Tax Cuts and Jobs Act, businesses can deduct 100% of the cost of qualifying property in the year it is placed in service. This deduction is phased out over time, but it remains a valuable tax savings opportunity for crypto mining businesses.

**Depreciation**

If crypto mining equipment does not qualify for the Section 179 or bonus depreciation deductions, it can still be depreciated over its useful life. Depreciation allows businesses to deduct a portion of the cost of the equipment each year, reducing their taxable income. The useful life of crypto mining equipment is typically 5-7 years.

**Energy Efficiency Tax Credits**

Certain energy-efficient crypto mining equipment may qualify for tax credits. These credits can reduce the cost of the equipment and provide additional tax savings. To qualify for the energy efficiency tax credits, the equipment must meet specific energy efficiency standards.

**Other Tax Loopholes**

In addition to the deductions and credits mentioned above, there are other tax loopholes that crypto mining businesses can explore. For example, some businesses may be able to deduct the cost of electricity used for mining as a business expense. Additionally, businesses may be able to defer taxes on their crypto mining income by holding the cryptocurrency in a tax-advantaged account.

**Conclusion**

Tax planning is essential for crypto mining businesses to maximize their profitability. By leveraging the tax strategies and loopholes outlined in this article, businesses can reduce their tax liability and increase their after-tax income. It is important to consult with a tax professional to determine the best tax strategies for your specific business.Utilizing Tax Loopholes to Reduce Capital Gains on Crypto Sales**Tax Strategies and Loopholes for Crypto Mining Businesses**

Crypto mining, the process of verifying and adding transactions to the blockchain, has emerged as a lucrative business venture. However, navigating the complex tax landscape surrounding crypto mining can be challenging.

This article explores tax strategies and loopholes that crypto mining businesses can leverage to reduce their capital gains tax liability.

**Taxation of Crypto Mining Income**

Crypto mining income is generally treated as ordinary income and taxed at the individual or corporate tax rate. However, there are certain tax loopholes that can be utilized to reduce the tax burden.

**Depreciation of Mining Equipment**

Mining equipment, such as ASICs and GPUs, can be depreciated over their useful life. This allows businesses to deduct a portion of the equipment's cost from their taxable income each year. The depreciation period for mining equipment is typically five years.

**Section 1031 Exchange**

Section 1031 of the Internal Revenue Code allows businesses to defer capital gains tax on the sale of certain assets if they reinvest the proceeds in similar assets. This loophole can be used by crypto mining businesses to upgrade their equipment without triggering a taxable event.

**Tax-Free Exchanges**

Certain cryptocurrency exchanges offer tax-free exchanges, which allow traders to swap one cryptocurrency for another without incurring a taxable event. This can be beneficial for crypto mining businesses that want to diversify their holdings or take advantage of price fluctuations.

**Long-Term Capital Gains**

If crypto mining businesses hold their mined assets for more than one year before selling them, they may qualify for the long-term capital gains tax rate. This rate is typically lower than the ordinary income tax rate, resulting in significant tax savings.

**Tax Loopholes for Reducing Capital Gains**

In addition to the strategies mentioned above, there are several loopholes that crypto mining businesses can exploit to reduce their capital gains tax liability.

**Wash Sale Rule**

The wash sale rule prohibits taxpayers from selling an asset at a loss and then repurchasing a substantially identical asset within 30 days. However, this rule does not apply to cryptocurrencies, which means that crypto mining businesses can sell their mined assets at a loss to offset other capital gains.

**Charitable Donations**

Crypto mining businesses can donate their mined assets to qualified charities and receive a tax deduction for the fair market value of the donation. This can be a valuable strategy for reducing capital gains tax liability while also supporting worthy causes.

**Conclusion**

Crypto mining businesses have a variety of tax strategies and loopholes at their disposal to reduce their capital gains tax liability. By carefully planning their tax strategies and utilizing these loopholes, businesses can maximize their profits and minimize their tax burden. It is important to consult with a qualified tax professional to ensure compliance with all applicable tax laws and regulations.Strategies for Minimizing Tax Liability on Crypto Mining Income**Tax Strategies and Loopholes for Crypto Mining Businesses**

Crypto mining, the process of verifying and adding transactions to a blockchain, has emerged as a lucrative business venture. However, navigating the complex tax landscape surrounding crypto mining income can be challenging. This article explores effective tax strategies and potential loopholes that crypto mining businesses can leverage to minimize their tax liability.

**Taxation of Crypto Mining Income**

In most jurisdictions, crypto mining income is treated as ordinary income and subject to income tax. The specific tax rates and regulations vary depending on the location of the business. It is crucial for crypto mining businesses to understand the tax laws applicable to their operations.

**Tax Strategies for Minimizing Liability**

**1. Entity Selection:** Choosing the appropriate business entity can significantly impact tax liability. Limited liability companies (LLCs) and S corporations offer pass-through taxation, meaning that the business's income is passed directly to the owners, who are then responsible for paying taxes on their individual returns.

This can reduce the overall tax burden compared to traditional corporations.

**2. Depreciation of Mining Equipment:** Crypto mining equipment, such as ASIC miners, can be depreciated over their useful life. This allows businesses to deduct a portion of the equipment's cost from their taxable income, reducing their tax liability.

**3. Energy Efficiency Tax Credits:** Some jurisdictions offer tax credits for businesses that invest in energy-efficient equipment. Crypto mining businesses can explore these credits to offset the high energy consumption associated with mining operations.

**4. Research and Development (R&D) Tax Credits:** Businesses engaged in developing new crypto mining technologies may qualify for R&D tax credits. These credits can provide significant tax savings for businesses investing in innovation.

**Potential Loopholes**

**1. Geographic Arbitrage:** Crypto mining businesses can take advantage of jurisdictions with favorable tax rates or regulations. By establishing operations in these locations, businesses can potentially reduce their tax liability.

**2. Tax Havens:** Some countries offer tax haven status to businesses, providing them with significant tax benefits. Crypto mining businesses may consider exploring these options to minimize their tax exposure.

**3. Cryptocurrency as a Currency:** In some jurisdictions, cryptocurrency is treated as a currency rather than an asset. This can provide tax advantages, as transactions involving currency are often exempt from capital gains tax.

**Conclusion**

Tax planning is essential for crypto mining businesses to minimize their tax liability. By implementing effective tax strategies and exploring potential loopholes, businesses can optimize their tax position and maximize their profitability. It is important to consult with tax professionals to ensure compliance with all applicable laws and regulations. As the crypto mining industry continues to evolve, it is likely that new tax strategies and loopholes will emerge, providing businesses with opportunities to further reduce their tax burden.Q&A**Question 1:** What is a common tax strategy for crypto mining businesses?

**Answer:** Depreciating mining equipment over its useful life to reduce taxable income.

**Question 2:** What is a potential loophole for crypto mining businesses?

**Answer:** Utilizing the "like-kind" exchange rule to defer capital gains taxes on the sale of mining equipment.

**Question 3:** How can crypto mining businesses minimize their tax liability?

**Answer:** By carefully structuring their operations, utilizing tax-advantaged entities, and exploring available deductions and credits.Conclusion**Conclusion**

Tax strategies and loopholes for crypto mining businesses can provide significant financial benefits, but they also come with potential risks. It is crucial for businesses to carefully consider the legal and ethical implications of these strategies and to seek professional advice to ensure compliance with tax regulations. By understanding the available options and implementing appropriate strategies, crypto mining businesses can optimize their tax liability while minimizing the risk of penalties or legal challenges.

0 notes

Text

Find the Best Crypto Accounting and Blockchain Accounting Software

Why adopt crypto-accounting and blockchain-accounting software?

Crypto accounting refers to recording and keeping financial reports relating to cryptocurrencies. Blockchain accounting software, on the other hand, is software that facilitates the transfer of ownership of digital assets as well as maintaining ledgers of accurate financial information relating to digital assets.

Businesses are rapidly delving into the world of crypto. To make the most of this world, it is essential to have the right tools for managing financial reporting as well as compliance. Getting the right crypto accounting software to help you with this is an important business investment. However, with so many software options for managing crypto accounts, how do you find the best crypto accounting software? The answer to this lies in the features that you require from the software.

Features that the best crypto accounting software should have

To help you find the best crypto accounting and blockchain accounting software for your business, regardless of where the business is on the digital asset maturity curve, here are some of the must-have features that characterize the best crypto accounting and blockchain accounting software.

Automation of data collections and integration

One of the key benefits you will get from the best crypto accounting and blockchain accounting software is the automation of the process of data collection and integration. The best software should be able to save you time and reduce the risk of errors that could potentially prove costly when operating in the highly volatile world of digital assets.

Good crypto accounting and blockchain software should also enable you to comply with the existing regulations as well as ensure that the accounting practices associated with them align with what is acceptable in the industry.

Accordingly, when looking for the best software, go for the solution that will provide you with support for bulk wallets, a broad range of custodial wallets with wallet-by-wallet tracking, a broad range of crypto exchanges, and one that can import off-chain data via API or CSV spreadsheet when an API is not available.

A great crypto accounting software solution is also one that can import for you charts of accounts, customer invoices, vendor bills, contacts, and organizational metadata, among others, from your already existing enterprise resource planning (ERP) system.

Easy customization and adaptation to work with other systems

A good software solution is also one that can easily be customized and adapted to work with other accounting systems developed from time to time in an effort to support a business’ ever-changing needs. This feature is particularly important when you are considering synchronizing your API with customer data and blockchain data. It is also helpful when you want to have access to a data warehouse.

API synchronization will allow your business to have a compressive view of your assets and transactions, which, in turn, will make it easier to track and manage the assets and transactions. API synchronization will also help your business comply with existing regulations, such as filling out accurate tax and accounting reports.

A good crypto accounting and blockchain accounting software should therefore have features that enable it to access customer data APIs, access blockchain data APIs, and push reconciled data back into ERPs and other ledgers.

Payment processing

Good crypto accounting software should have robust payment processing functionality. This is important because such functionality supports accounts payable and accounts receivable operations. Crypto accounting software with payment processing functionalities helps businesses save time and reduces the risk of errors. It also makes it easier for businesses to manage their vendor payments.

When looking for a great crypto accounting software solution for your business, ensure that you go for a solution that can segregate payment operational tasks and responsibilities, perform bulk invoicing to customer wallets, automatically price payments to fiat value, and accept payment in crypto from customers in multiple token denominations.

Need assistance with finding the best crypto accounting software?

There are many features that you need to look for in crypto accounting software before you decide to part with your money to purchase it. What has been shared in this blog article is just the tip of the iceberg. But with the existence of many crypto accounting software solutions, it may be confusing for businesses to settle for the best solution for their operations. That is why getting help from a crypto accounting software expert comes in handy.

Entendre Finance has been helping businesses and organizations find the best crypto accounting and blockchain accounting software that precisely meets their needs, and they can help you find the perfect one for your requirements. Talk to them today and let them assist you in finding the best crypto accounting software solution for your business.

0 notes

Text

Book Notes | Rich Dad, Poor Dad by Robert Kiyosaki | 14.11.2023

It’s a great book with such a clear and concise writing style. The author communicates his ideas well.

A friend said he wouldn’t read the book because it only applied to the American financial structure. That’s very far from the truth. The book is about building a solid financial foundation and the lessons the author has learned over his financial journey.

His biological (the one referred to as poor) father is a teacher and an intellectual socialist. The father of his friend (who later on becomes one of the wealthiest men in the state) is referred to as his rich dad.

These dads start on similar grounds, but through a massive difference in their ideology and how they view the world/money, they end up in very different places.

His rich dad would refer to himself as rich even when broke, while his poor dad would say, “I’ll never be rich, and that’s okay,” which manifested itself in reality.

Education is essential, yet people confuse this with academic education, which teaches you to be a cog in the system: a good lawyer, doctor, and employee. Many well-educated people who finish school with high GPAs struggle financially.

When you say, “I can’t afford it,” your brain stops working; that’s a limitation you place upon yourself. You should ask, “How can I afford it?” Laziness is the most potent ingredient in poverty.

You shouldn’t work for money or an employer, slaving your time and effort away. You should make money work for you; I’ll expand on this later.

Financial education and constant learning are far more powerful than money itself.

“You best change your point of view. Stop blaming me and thinking I’m the problem, then you have to change me. If you realize you are the problem, you can change, learn something new, and grow wiser.

The poor and the middle-class work for money, and the rich make money working for them.

The key is building your asset column, minimizing expenses and liabilities, constantly educating yourself and learning, and spending money on yourself and your improvement.

Be truthful about your emotions and motivations and use them in your favor; do not let them work against you.

Once a person stops looking for information and self-knowledge, ignorance sets in. This is a moment-to-moment decision: will you choose to learn, open your mind, or go numb? Money is an illusion.

Building your asset column is like planting a tree; you have to take care of it, but one day, it grows large enough to take care of itself.

People are too focused on money, that’s not their most significant wealth: financial education.

It’s not about how much money you make but how much you keep at the end of the day.

ACCOUNTING is a MUST LEARN if you wish to build wealth.

Understand the difference between liabilities and assets, then buy assets. Assets add to your income, while liabilities are expenses.

Money attracts money. The asset column generates enough wealth to cover expenses; the surplus is reinvested into buying more assets. A tale old as time, the rich get richer. While poor and the middle-class work for the government, employers, and banks.

The rich buy assets, the poor have only expenses, and the middle class buys liabilities that they think are expenses.

Minding your own business: Instead of working to make your employer rich, you take the skills you learn and the capital you have and invest them in yourself and your assets. Your business revolves around your asset column, not your income.

Businesses that do not require your presence.

Stocks

Bonds

Income-generating real estate

Notes (IOUs)

Royalties from intellectual property

Anything that has value, produces income, or appreciates (crypto is the modern-day example)

You need to acquire assets that you love. You won’t take care of something if you don't love it. If you’re going to enter a market, learn to love it.

The Robin Hood ideal is why the middle class is so heavily taxed. The rich DO NOT pay taxes, thinking they are taxing the rich; they taxed themselves.

The rich will always find a way to avoid taxes, find loopholes, or create systems that allow them to avoid paying. The history of taxes is hilarious; you can see how people who think they are taking away from the rich always harm themselves.

Having a cash surplus is good for corporations but bad for the government. One gets rewarded for it, while the other gets budget cuts. So the government keeps employing and keeps growing, being as inefficient as possible.

A corporation is merely a legal document that creates a legal body without a soul. The wealth of the rich is protected through legal tax evasion.

You use pre-tax money to pay for your personal expenses and call them business expenses. You pay less tax, and the amount you’d pay to taxes is used for your business purposes. You pay yourself first, then the government.

“Often in the real world, it’s not the smart who get ahead, but the bold.”

It’s not the lack of education or intelligence that holds people back, but the lack of self-confidence. Conviction.

The author has worked for companies purely for their education courses. He valued learning sales and marketing more than the money he made with the job. Through that education, he has made millions. It’s a short-term loss for long-term benefit.

Accounting

Law

Investing

Understanding Markets

Tax Advantages

Protection From Lawsuits

Work hard all of your life for an employer and slave yourself away. Pay half of it to the government and put the other half in a savings account with a minimal interest rate that is less than inflation.

OR

Develop financial intelligence and use your brain; harness the power of your brain and the asset column.

Who works harder? Which is smarter? It’s obvious when you put it this way, isn’t it?

“It’s not gambling if you know what you’re doing. It is gambling if you are throwing money into a deal and praying.”

Use your knowledge and education to lower the risk and make calculated risks.

Mistakes are not bad. Losers are afraid of losing, so they try not to lose. That’s why they lose.

The winners are not afraid of losing; they turn their failure into a win, either by learning a lesson from it or in some other way. No one likes to lose money, but it is the bold who win.

Find an opportunity everyone else missed.

Raise money.

Organize smart people.

A wise man knows that he needs people wiser than him in his team. Learning a bit about everything is better than specializing.

“a jack of all trades is a master of none, but oftentimes better than a master of one.”

People have an idea of salespeople that is harmful to their success. They feel they are above such tactics, so they fail and end up poor.

Learning sales and marketing and working in the field for a bit is extremely important, not only for personal growth but also for becoming rich.

The hardest part of leading a company is managing people.

“If you’re not a good leader, you’re going to get shot in the back, just like they do in business.”

Forgo the elitist attitude: this is a fact that the majority is always wrong.

They are scared; they play safe. Just LOOK OUTSIDE. LOOK AT THEM. LOOK AT THE STATISTICS.

You NEED to go against the grain, take risks, lead, fail, and carve your path. LEAD instead of following, and always keep that attitude.

You should ask, “Where is this daily activity or task taking me?”

People are living from paycheck to paycheck, day to day. Where are they headed?

The world is filled with talented but poor people because they do not know business, sales & marketing.

Management of cash flow.

Management of systems.

Management of people.

GIVE AND YOU SHALL RECEIVE. TO RECEIVE MONEY YOU MUST FIRST GIVE IT.

Most think: receive, then you shall give.

That’s the secret of the rich; that is the reason they are wealthy. Look at foundations like the Ford Foundation and Rockefeller Foundation.

The obstacles to significant cash flow are:

Fear

Cynicism

Laziness

Bad habits

Arrogance

“People are so afraid of losing that they lose.”

Everyone wants to go to heaven, but no one wants to die. Failure inspires winners.

You cannot be rich by being balanced. You need to be focused. If you have no money, a balance will keep you there.

The worst times are the best time to make money; long-term money is made on downs, not booms.

Like the Japanese say, a crisis and an opportunity are often one and the same.

People are using excuses not to get rich or focus on one thing to distract themselves from something else.

“Guilt is worse than greed, as it robs the body of its soul.”

Find a reason greater than reality: the power of the spirit. Do it for love, your love, and those you love. It makes the sacrifices not only bearable but enjoyable.

Each moment is a decision, think & act. Do not let your thoughts hold you back.

Time and knowledge are the most precious things in the world. Money and power are merely their outcomes.

Choosing your circle carefully and the power of association. Learning from all of your friends. The author has friends who have generated billions, and all of their poor friends come in to ask for a loan, money, or a job; none asks how the guy managed to get so rich.

“The hardest thing about wealth building is to be true to yourself and to be willing to not go along with the crowd.”

Pay yourself first. Learn to manage cash flow, people, and personal time.

Pay professionals well and work with them. Accountants and brokers are life savers.

Have idols and heroes; learn about their lives and how they make decisions. Expand your perspective and learn to think like them.

The power of giving. If you want love, you give love; if you want to be smiled at, you smile at people; if you want money, you give it first. The world is your mirror. There are powers in the world much more intelligent than you are; do not work against them but with them.

Look for new ideas

Find people doing what you want to do or have done it: learn from them.

Take classes and courses, read, and attend seminars: that is where proper education is found, not school.

Learn from history

Action ALWAYS beats inaction.

7.6/10

0 notes

Text

What is Quantum Flash?

The accompanying report portrays our involvement in Quantum Flash, it is one of the most outstanding auto exchanging stages for digital currency. We were constrained to survey Quantum Flash due to the solicitations from our crowd who needed to contribute however should have been certain they could create a gain.

Fortunately, we have uplifting news, Quantum Flash is great, it is one of the most outstanding auto exchanging stages everybody can use to create an everyday gain from the cryptographic money market.

We have tried Quantum Flash completely utilizing the best investigation instruments to concentrate on the framework. It is faultless; we found verification that ongoing.

financial backers are acquiring more than $5,000 day to day. In any case, this relies upon your store, higher ventures produce more benefits.

What we affirmed is that creating a gain with Quantum Flash is ensured no matter what the worth of assets you have stored. This creates Quantum Flash a novel stage with one of the most mind-blowing exchanging robots that can be utilized to grow an automated revenue.

Quantum Flash names itself to be a completely programmed robot for the bitcoin market. This bot supposedly directs speculation research by examining the bitcoin market large information for tradable experiences.

Not at all like human dealers, calculations can break down an immense measure of information inside a split of a second and spot comparing exchanges. Exchanging robots, for example, Quantum Flash say that they apply top innovations to guarantee high precision and exchanging speed.

As referenced before, Quantum Flash cases to produce benefits of up to $5k each day from a store underneath $1k. They say that this is conceivable because of the influence furnished by the merchants in organization with this bot.

Quantum Flash relies upon modern calculations to examine the bitcoin markets for tradable experiences and execute exchanges. The utilization of calculations isn't new exchanging and has been utilized broadly in high-recurrence exchanging.

High-recurrence exchanging is a strategy used to exchange exceptionally utilized monetary resources, for example, forex. This exchanging strategy includes a clever calculation examining colossal stashes of information and settling on an exchanging choice.

https://www.linkedin.com/in/quantumflash/

1 note

·

View note

Text

New to Bitcoin? Here is everything you need to know

What is Bitcoin (BTC)?

Bitcoin is a cryptocurrency – a decentralized digital currency based on blockchain technology. Unlike physical currency, a central bank or government does not control it. Transactions are mostly anonymous and made without any intermediaries.

Who created BTC?

An unknown person or group under the alias Satoshi Nakamoto created Bitcoin in 2009. The goal was to create «a new electronic cash system» that was «completely decentralized with no server or central authority.»

How do I get BTC?

You can get BTC either by mining it (see ECOS mining) or simply purchasing it at Marketplaces called “crypto exchanges” with Fiat Money or other cryptocurrencies. You can also get Bitcoin from other people as a form of payment.

What is Bitcoin Mining?

In simple terms, mining is the process of verifying BTC transactions and recording them in the public blockchain ledger. Everytime someone sends a BTC to someone else, the network records the transaction as well as other transactions over a period of time in a «block.» Powerful Computers with special software called «miners» write these transactions in a massive digital ledger. Once a block is verified, the miner becomes eligible to be rewarded a certain amount of BTC.

Where do I save BTC?

You can save your BTC in digital wallets either on the cloud or on physical computers. The wallet is somehow similar to what a bank account is for Fiat money.

How many BTC are there?

There is a maximum fixed supply of 21,000,000 BTC. Currently about 18,650,000 BTC are in circulation. Maximum supply is fixed to protect against inflation and insure the cryptocurrency will increase in value. This supply will never change and is hard-coded in the BTC protocol.

What can I do with Bitcoin?

There are 100,000s of merchants around the world that accept BTC as a form of payment and the list is growing by the day. You can spend BTC on products from commercial goods to ordering games and movies to even buying cars and real estate. Paypal recently started accepting BTC as a funding source. So technically, you can pay with Bitcoin anywhere Paypal is accepted.

Why does BTC have value?

Bitcoin has value because people decided to use it as a medium of exchange. Recently, institutional investors and big companies started investing in BTC, driving its price up. As adoption increases, and given BTC limited supply, Bitcoin price is expected to continue growing.

How do I get started?

The first step is to create an account on the ECOS platform. You will need to provide some personal information and complete the verification process to start investing.

ECOS provides easy access to the best-in-class digital assets to a wide audience.

It offers a diversified line of products for different investment strategies, including Bitcoin Mining, BTC Cloud Mining, High-Risk trading strategies, and B2B services. ECOS has a convenient mobile app available at the App Store, Google Play, and Mi App Malls. This app allows clients to monitor their mining operations in real-time, providing insights and updates on performance and profitability on the go.

At ECOS, you can mine Bitcoin in 3 ways: by cloud mining, ASIC rental or by buying an ASIC.

To start using Cloud mining, you need to select a contract on the website. You can pay for the contract with a bank card or by cryptos: BTC, ETH, USDC, USDT, BNB, XRP, Doge, ADA.

Another way to mine BTC is to rent or buy a Bitmain Antminer, which will be hosted at the ECOS mining facility in the Free Economic Zone in Armenia.

ECOS does everything for you: manages logistics, customs clearance, installation, setup, and daily maintenance. You can just enjoy a hassle-free mining through your personal account.

With 0% taxes on export/import and income, Armenia’s Free Economic Zone offers an ideal environment for mining hosting services. Additionally, stringent security measures, including military guards, fortify operational efficiency and safeguard assets within ECOS’ domain.

ECOS provides plenty of special offers, including trial mining, for its registered users.

Currently ECOS provides a unique opportunity to test mining before purchasing. After registration, activate demo mining in your account settings: use promo code “TryBeforeBuy” to try cloud mining and use promo code “TryASIC” to try ASIC mining.

0 notes

Text

Business Tax Accountant | Australian Tax Specialists

Are you searching for a reliable Business Tax Accountant? Australian Tax Specialists is one of the well-known tax specialists. We provide tax-related services such as business tax, individual tax, business validation, business setup share crypto services, etc. Every business no matter how big or small needs to submit taxes and other services such as tax planning, FBT, annual financial statements, etc. We have a team to provide you best services within a limited time.

Visit us:- https://australiantaxspecialists.com.au

#Business Tax Accountant#Sydney Business Tax Accountant#Accountant For Small Business Near Me#Small Business Tax Accountant#Business Tax Accountant Sydney#Accountants For Retail Business#Small Business Accountant#Business Tax Returns Accountant

0 notes

Text

Buy Verified Paxful Accounts

Paxful account symbolizes the empowerment of individuals to participate in the global economy on their terms. By leveraging a P2P model, diverse payment methods (various), and a commitment to education, Paxful paves the way for financial inclusion and innovation. Buy aged paxful account from dmhelpshop.com. Paxful accounts will likely play an instrumental role in shaping the future of finance, where borders are transcended, and opportunities are accessible to all of its users. If you want to trade digital currencies then you should confirm best platform. For this reason we suggest to buy verified paxful accounts.

Verified paxful account enabling users to exchange crypto currencies for various payment methods. To make the most of your Paxful experience, it's essential to understand the features and functions of your Paxful account. This guide will walk you through the process of setting up, using, and managing your Paxful account effectively. That’s why paxful is now one of the best platform to conserve and trading with cryptocurrencies. So, now, if you want to buy verified paxful accounts of your desired country, contact fast with (dmhelpshop.com).

Buy US verified paxful account from the best place dmhelpshop

Why we declared this website as the best place to buy US verified paxful account? Because, our company is established for providing the all account services in the USA (our main target) and even in the whole world. With this in mind we create paxful account and customize our accounts as professional with the real documents. If you want to buy US verified paxful account you should have to contact fast with us. Because our accounts are-

Email verified

Phone number verified

Selfie and KYC verified

SSN (social security no.) verified

Tax ID and passport verified

Sometimes driving license verified

MasterCard attached and verified

Used only genuine and real documents

100% access of the account

All documents provided for customer security

100% customer satisfaction ensured

How to conserve and trade crypto currency through Paxful account?

Deposit Cryptocurrency: Search for offers from sellers who accept your preferred payment method. Carefully review the terms of the offer, including exchange rate, payment window, and trading limits. Initiate a trade with a seller, follow the provided instructions, and make the payment. Once the seller confirms the payment, your purchased cryptocurrency will be transferred to your Paxful wallet. If you buy paxful account, firstly confirm your account security to enture safe deposit, and trade.

Selling Cryptocurrency: Buy paxful account, paxful makes an offer to sell your cryptocurrency, specifying your preferred payment methods and trading terms. Once a buyer initiates a trade based on your offer, follow the provided instructions to release the cryptocurrency from your wallet once you receive the payment. If you want to use paxful with verified documents, you should buy USA paxful account from us. We give full of access and also provide all the documents with the account details.

Why American peoples use to trade on paxful?

Paxful offers a user-friendly platform that allows individuals to easily buy and sell Bitcoin using many permitted payment methods. This approach provides users with more control over their trades and can lead to competitive prices. Buy USA paxful accounts at least price. As Paxful gained popularity in the USA, its platform is accessible globally. This has made it a preferred choice for individuals in regions where traditional financial systems might be less accessible or less stable. This adds an extra layer of security and trust to the platform. Buy aged paxful accounts to get high security.

Paxful has actively worked to build a community around its platform and cryptocurrency education. Paxful's platform has contributed to financial inclusion by enabling individuals without access to traditional banking services to participate in the cryptocurrency market. This has helped users, particularly newcomers, understand the intricacies of buying, selling, and using Bitcoin. Paxful's growth and initiatives have garnered media attention, contributing to its visibility and reputation within the cryptocurrency industry. Buy old paxful account for the best use of the account.

How Do I Get 100% Real Verified Paxful Accoun?

Paxful, a renowned peer-to-peer cryptocurrency marketplace, offers users the opportunity to conveniently buy and sell a wide range of cryptocurrencies. Given its growing popularity, both individuals and businesses are seeking to establish verified accounts on this platform. However, the process of creating a verified Paxful account can be intimidating, particularly considering the escalating prevalence of online scams and fraudulent practices. This verification procedure necessitates users to furnish personal information and vital documents, posing potential risks if not conducted meticulously.

In this comprehensive guide, we will delve into the necessary steps to create a legitimate and verified Paxful account. Our discussion will revolve around the verification process and provide valuable tips to safely navigate through it. Moreover, we will emphasize the utmost importance of maintaining the security of personal information when creating a verified account. Furthermore, we will shed light on common pitfalls to steer clear of, such as using counterfeit documents or attempting to bypass the verification process. Whether you are new to Paxful or an experienced user, this engaging paragraph aims to equip everyone with the knowledge they need to establish a secure and authentic presence on the platform.

Paxful payment system and trading strategy-

Paxful P2P stage connecting buyers and sellers directly to facilitate the exchange of cryptocurrencies, primarily Bitcoin. Paxful allow and provides a genuine marketplace where users can create offers to buy or sell Bitcoin using a variety of payment methods. Paxful provides a list of available offers that match the buyer's preferences, showing the price, payment method, trading limits, and other details. Buy USA paxful accounts from us.

If you want to buy currencies just tap to buy. Then paxful will Paxful provide a list of available offers that match the buyer's preferences, showing the price, payment method, trading limits. If the seller accepts the request, the trade enters into the next phase. Once the payment is confirmed and the Bitcoin is released from escrow, the trade is considered completed. Both parties can leave feedback and ratings for each other based on their trading experience.

Benefits Of Verified Paxful Accounts

Verified Paxful accounts offer numerous advantages compared to regular Paxful accounts. One notable advantage is that verified accounts contribute to building trust within the community. Verification, although a rigorous process, is essential for peer-to-peer transactions. This is why all Paxful accounts undergo verification after registration. When customers within the community possess confidence and trust, they can conveniently and securely exchange cash for Bitcoin or Ethereum instantly.

Paxful accounts, trusted and verified by sellers globally, serve as a testament to their unwavering commitment towards their business or passion, ensuring exceptional customer service at all times. Headquartered in Africa, Paxful holds the distinction of being the world's pioneering peer-to-peer bitcoin marketplace. Spearheaded by its founder, Ray Youssef, Paxful continues to lead the way in revolutionizing the digital exchange landscape.

Paxful has emerged as a favored platform for digital currency trading, catering to a diverse audience. One of Paxful's key features is its direct peer-to-peer trading system, eliminating the need for intermediaries or cryptocurrency exchanges. By leveraging Paxful's escrow system, users can trade securely and confidently. What sets Paxful apart is its commitment to identity verification, ensuring a trustworthy environment for buyers and sellers alike. With these user-centric qualities, Paxful has successfully established itself as a leading platform for hassle-free digital currency transactions, appealing to a wide range of individuals seeking a reliable and convenient trading experience.

Conclusion

Investing in Bitcoin offers various avenues, and among those, utilizing a Paxful account has emerged as a favored option. Paxful, an esteemed online marketplace, enables users to engage in buying and selling Bitcoin. The initial step involves creating an account on Paxful and completing the verification process to ensure identity authentication. Subsequently, users gain access to a diverse range of offers from fellow users on the platform. Once a suitable proposal captures your interest, you can proceed to initiate a trade with the respective user, opening the doors to a seamless Bitcoin investing experience.

In conclusion, when considering the option of purchasing verified Paxful accounts, exercising caution and conducting thorough due diligence is of utmost importance. It is highly recommended to seek reputable sources and diligently research the seller's history and reviews before making any transactions. Moreover, it is crucial to familiarize oneself with the terms and conditions outlined by Paxful regarding account verification, bearing in mind the potential consequences of violating those terms. By adhering to these guidelines, individuals can ensure a secure and reliable experience when engaging in such transactions.

Contact Us / 24 Hours Reply

Telegram:dmhelpshop

WhatsApp: +1 (980) 277-2786

Skype:dmhelpshop

Email:[email protected]

0 notes