#Beginner's guide to mutual funds

Explore tagged Tumblr posts

Text

A Beginner's Guide to Mutual Funds: Exploring Types, Risks, and Returns

A Beginner's Guide to Mutual Funds: Exploring Types, Risks, and Returns

Dive into the world of mutual fund investments with our comprehensive beginner's guide. Explore mutual fund types, risks, returns, and comparisons with other investments. Make confident investment choices to pave the way for your financial growth.

Read more >>

#understanding-mutual-funds#Beginner's guide to mutual funds#Mutual fund investment basics#Types of mutual funds explained#Mutual fund risk and return#Mutual fund vs other investments

0 notes

Text

A Beginner's Guide to Investing in Mutual Funds-by managingfinance.in

Mutual funds are one of the most popular investment options for beginner investors. They offer a diversified portfolio of stocks, bonds, and other securities, making them a great option for those who want to invest in the stock market but don’t have the time or expertise to pick individual stocks. If you’re new to investing and looking to get started with mutual funds, here’s a beginner’s guide…

View On WordPress

0 notes

Text

Why Mutual Funds Are Better Than Stocks: A Comprehensive Guide

“Why Mutual Funds Are Better Than Stocks”

In recent years, investment has become a hot topic as more people look for ways to grow their wealth. While stocks have been a popular choice for many, mutual funds have been gaining ground as a better alternative for long-term investment. In this comprehensive guide, we’ll explore the reasons why mutual funds are better than stocks and help you make an informed decision about your investment strategy.

#mutual funds#mutual funds for beginners#investing in mutual funds#best mutual funds#mutual funds india#how to invest in mutual funds#mutual funds investment#stocks vs mutual funds#mutual funds vs stocks#invest in mutual funds#mutual funds tips#top mutual funds#equity mutual funds#mutual fund#mutual funds guide#mutual fund investment#what is mutual funds in hindi#index mutual funds#mutual funds in hindi#best mutual funds in 2022

0 notes

Text

A Comprehensive Guide to the Top ETFs for 2023, Featuring Low Expense Ratios and High Performance

If you're looking to invest in the best ETFs for 2023, look no further than this comprehensive guide. Featuring seven top-performing ETFs with low expense ratios, this guide is perfect for both beginners and experienced investors.

The featured ETFs include the Vanguard Total Stock Market ETF (VTI), iShares Edge MSCI USA Quality Factor ETF (QUAL), Vanguard Value ETF (VTV), iShares Russell 2000 ETF (IWM), Vanguard Dividend Appreciation ETF (VIG), iShares 20+ Year Treasury Bond ETF (TLT), and the Vanguard Real Estate ETF (VNQ). Each ETF is discussed in detail, including its ticker symbol, expense ratio, and 1-year return.

This guide also includes an FAQ section that answers common questions about ETFs, such as whether they're a good way to invest, whether they're good for beginners, and whether they pay dividends.

With this guide, you'll be well-equipped to make informed investment decisions and choose the best ETFs for your portfolio. Whether you're just starting out or looking to diversify your investments, these top-performing ETFs will surely provide long-term success. So, what are you waiting for? Start investing in the best ETFs for 2023 today!

Click Here To Read The Full Article

#investing for beginners#stock market#a beginner's guide to the stock market pdf#etf#mutual fund#financial news

1 note

·

View note

Text

Beginner's Guide to Mutual Fund | Bajaj Finserv Asset Managment

Embark on your mutual fund investment journey with confidence by using Bajaj Mutual Fund's beginner's guide, which provides comprehensive information to help you get started. Visit now to learn more.

1 note

·

View note

Note

I have a friend in the midwest who's looking for a political org and i was wondering if you could you offer some advice. Are there qualities you would look for in an org that would make you feel like, okay, these are people I can work with?

Yea! I think there’s a ton of variation and it depends on what kinds of work they like to do or want to learn to do. I’d be happy to talk to them directly about their city.

As a materialist, I sort of think any group or org can be worth trying—doing so gives you a sense of the conditions and things to learn, and helps you follow where people are, which is the best way to learn about a new place you live. Always join stuff, you can always stop going if you don’t like it, never try to start something from scratch until you’ve been going to stuff for a long time (unless that something is a union in your workplace :p). Your friend should just trust their instincts but be open to learning from others, honor their time/energy/boundaries, and watch out for red flag orgs that don’t respect boundaries and don’t allow members to vocalize concerns or bring ideas to the table. I think that’s the key line.

For me personally, I am only interested in deep involvement with democratically organized groups that are not primarily concerned with providing service to people who are mostly non members. I definitely respect and work with these kinds of orgs all the time, but it’s not where my organizing energy goes — I am not a mutual aid person, but your friend might be! Examples of groups locally that I like and work with and would trust as a model are food not bombs style mutual aid as well as some urban farm style stuff (some of which can be soooo fashy but some i like here!), syringe access and harm reduction, eviction defense and other anti carceral rapid response. I do work with abortion funds and infinitely recommend anybody who can stomach it do the same (they can reach out to me for info on their local funds). I’ve been doing stuff around parent/childcare/repro and I would strongly advise to tread carefully there given the entrenchment of socially conservative religious actors. Just stay vigilant and research. Antifascist style orgs are also very interesting, frustrating, messy, frequently dangerous, occasionally surprisingly fascist, and presently useful—look into them but be thoughtful.

Questions to ask, many of which especially apply to mutual aid style groups: is there a leadership structure, and if so, how do leaders become leaders? Is there a board of directors? Who is on it? Do we have money, and if so, where does it come from, who decides how we use it, and what is its legal status? Who decides what work we do and how? Do I as a participant have a vote, the potential to run for leadership, or the right to propose work or organizational ideas? How does this group conceptualize the relationship between me, the community at large, the people we focus on, and people in other places? What other orgs do they seem to be connected to? Is anyone paid staff, and if so, what are their working conditions and how do they relate to the non paid staff? What does this org have on paper, online, etc.? What kind of safety or security norms do they have? Do they have a procedure for handling violence or just mundane conflict between participants? How are everyday decisions handled? None of my judgments relate to an assessment of the people themselves, per se—which is NOT to say I don’t make those judgements lol.

Many different responses to the above are valid depending on the work, and not having clear answers doesn’t mean that an org is bad, especially if it’s open to development. Having said that, again, I only organize with groups that give me a vote. And I think everyone should consider that guide.

My pitch for joining DSA if you have a chapter is that it has the best answers to the above compared to anyone else. It has the most things you can do as a beginner, the widest variety, and the best opportunities to grow yourself as an organizer, and it’s the biggest leftist organization in blah blah you’ve heard it. I strongly recommend not getting too involved with small communist leftist factionalist orgs (I won’t name them here), but there are a million exceptions, especially in cities like Chicago and Minneapolis with long deep weird histories. And no need to hate on them, either. If some communist league seems to be really doing something and not uhhh openly trafficking people or something lol, go off. (Where I live this is the case on campus!) The other exception is the IWW. It’s always fine to join the IWW, especially for labor, and there really are a handful of cities where the IWW is effective and the place to do rank and file labor work (and mostly those are in the midwest!) In many more cases the IWW is a sad little thing but it’s our duty to be nice to them.

In conclusion “make you feel like you wanna work with them” is complicated—I’m a hater, and do not enjoy the company of most of these people, or in fact even the masses in general. You have to find your own balance, which requires pushing yourself out of your comfort zone for a little while, and see how the org reacts. But ultimately, you don’t need to want to work with the people—you need an org that is productive and moves by creating conditions for people to work together regardless of whether they like each other. Fundamental premise of socialism and communism specifically, and it’s what sets us apart from tendencies on the right and common versions of certain tendencies on the left whomst I won’t name. My #1 advice is always to avoid any group whose mission is based on affinity and friendship between its members. (But if you make friends with them, go off)

23 notes

·

View notes

Text

An Overview of Different Financial Instruments in Global Trading

Introduction Entering global trading can be both exciting and complex. To help you navigate, this guide explores various financial instruments, assisting you in finding the best trading platform and making informed investment decisions. 1. Stocks Buying stocks means owning a share of a company. Stock prices fluctuate with company performance and market trends. Stocks are ideal for long-term investments, especially for those aiming to become the best forex trader. 2. Bonds Bonds are loans given to companies or governments, repaid with interest. Bonds are generally safer than stocks but offer lower returns. 3. Forex (Foreign Exchange Market) The forex market deals with currency trading and is the largest financial market globally. It operates 24/7, providing high liquidity. Forex trading involves buying one currency while selling another, requiring a good grasp of market trends and currency pairs to excel as the best forex trader. 4. Commodities Commodities include raw materials like gold, oil, and agricultural products. Trading commodities can diversify your investment portfolio. Their prices are affected by supply and demand, political events, and natural factors. 5. Mutual Funds Mutual funds collect money from numerous investors to invest in a diversified portfolio of stocks, bonds, or other assets. Managed by professionals, they are ideal for beginners, offering a hassle-free investment approach. 6. ETFs (Exchange-Traded Funds) ETFs are similar to mutual funds but trade like stocks. They offer a diversified investment portfolio with the flexibility of stock trading. ETFs can cover various assets, including stocks, bonds, and commodities. 7. Options Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price before a set date. They can be used for hedging or speculative purposes, presenting high rewards but also high risks. Conclusion Grasping the different financial instruments available in global trading is vital for making smart investment choices. Whether you're interested in stocks, bonds, forex, or commodities, selecting the best trading platform and strategy will set you on the path to success. Begin with the basics, continue learning, and discover the best investment opportunities tailored to your goals.

4 notes

·

View notes

Text

Beginners guide to Financial Planning

Introduction

It is the process of managing your own and your household personal finances, or it is the most valuable point you will have to understand about the data that advice how a single manage his/her personal finance. It Include Financial planning which one person makes over time. That means you establish goals and benchmarks and track your progress. With that said, now let's pretty much get into the basics of how to kick-start your financial journey.

1. What is Financial Planning?

The purpose of financial planning is to assess your financial status, identify the goals you would like to achieve, and come up with a way in which these goals can be possible. This includes budgeting, saving, investing, and managing debt/loans to maintain financial security and well-being as well as planning for life events.

2. Setting Financial Goals

Set clear, achievable goals:

Short-term (rough guideline: build a 3-6 month emergency fund or pay off > 7% interest debt

– Medium Term: Save for a down payment or large expenditure

Long-term — for retirement or your child's education.

3. Understanding Your Finances

Understand your finances by:

Net worth (Assets – Liabilities)- Tracking income and expenses

- Evaluating debt.

4. Creating a Budget

A budget is how you spend your income on expenses, saving, and investments.

- List income sources.

So, the things you got to do are: — Expense characterization (fixed and variable)

- Set spending limits.

- Regularly review and adjust.

5. Building an Emergency Fund

Have three to six months living expenses set aside in a liquid account for medical problems or loss of job.

6. Managing Debt

Reduce debt by:

Focusing on high interest debt

- Consolidating debt.

- Creating a repayment plan.

7. Investing for the Future

Invest to grow wealth:

Stocks- high returns, risk also higher.

– Bonds: Consistent income, lower risk.

Diversified portfolio — mutual funds

Real estate: rental income and appreciation

8. Retirement Planning

Redefining goal retirement savings with retire Expense

401(k) — Employer-sponsored plans

– IRA (Individual Retirement Accounts)

Pension plans:

Steady income after retirement.

9. Insurance and Risk Management

Protect assets with:

— Health/Life/Disability/Property Insurance

10. Reviewing Your Financial Plan

Be sure to revise and fine-tune your plan over time to reflect the goals you are working towards.

Conclusion

Financial planning gives you clear control over your financial future. Establish goals, financial plan, manage debt and invest in interest of stability and wealth creation. Persevere and be able to adapt.

#economy#investing#entrepreneur#investment#startup#insurance#retirement#retireearly#finance#personal finance#debt#debt recovery#debt relief#debt consolidation#income

4 notes

·

View notes

Text

Mutual Funds Made Easy: A Guide to Beginners.

What is a Mutual Fund?

Hey buddy, Mutual funds are a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The mutual fund is managed by a professional fund manager who makes investment decisions on behalf of the investors, to maximize returns while minimizing risk.

Types of Mutual Funds

There are several types of mutual funds, including equity funds, fixed-income funds, balanced funds, index funds, and specialty funds. Equity funds invest in stocks, fixed-income funds invest in bonds, and balanced funds invest in a mix of stocks and bonds. Index funds are designed to track a specific market index, such as the S&P 500, while specialty funds focus on a particular sector or industry.

Benefits of investing in mutual funds

Mutual funds offer several benefits, including diversification, professional management, convenience, and flexibility. Diversification is important because it helps reduce the risk of losses by spreading investments across many different assets. Professional management ensures that your money is invested by a trained and experienced professional. Mutual funds are also convenient because they can be purchased and sold through a brokerage account or financial advisor. Additionally, they offer a high level of flexibility, allowing you to buy or sell shares at any time.

Risks of investing in mutual funds

All investments come with some level of risk, and mutual funds are no exception. The value of mutual funds can fluctuate based on changes in the financial markets, and past performance is not always an indicator of future performance. Additionally, mutual funds charge fees and expenses, which can eat into your returns over time.

Choosing a mutual fund

When choosing a mutual fund, it’s important to consider your investment goals, risk tolerance, and investment time horizon. You should also research the fund’s fees and expenses, as well as its historical performance. Finally, consider working with a financial advisor who can help you choose the right mutual funds for your portfolio.

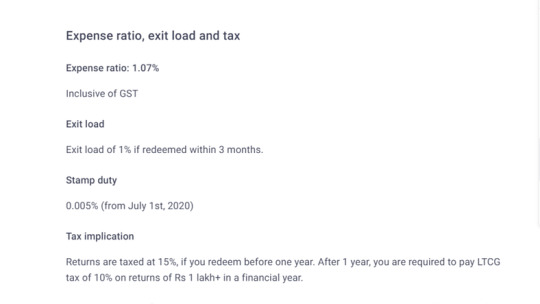

I will give two tips on checking to choose a mutual fund before investing first one is

Performance History: Look at the fund’s past performance over a period of time, preferably five to ten years. While past performance is not an indicator of future returns, it can give you an idea of how the fund has performed during different market conditions. You can check easily on grow app or whatever app you like it.

Expense Ratio: The expense ratio represents the cost of managing the fund and is deducted from your returns. Look for funds with a lower expense ratio, as high fees can eat into your returns over time.

I will show pictures of higher expense ratios and lower expense ratios.

Monitoring your mutual fund

After you invest in a mutual fund, it’s important to monitor your investment regularly to ensure that it continues to meet your investment goals. This may involve reviewing the fund’s performance, fees, and expenses, as well as rebalancing your portfolio periodically to maintain a diversified mix of investments.

Remember, mutual funds can be a great way to invest in the stock market and other assets without having to choose individual stocks or assets yourself. However, it’s important to do your research and carefully consider the risks and potential rewards before investing.

Hope you enjoy and like this blog post. Later on, I will post a full detailed blog on Mutual funds. Make sure to share with your friends and comment with your opinions and subscribe.

Disclaimer:

The information provided on this blog is for educational and informational purposes only and should not be considered financial advice. I am not a certified financial advisor and do not hold any professional licenses in the finance industry. Any financial decisions you make based on the information provided on this blog are at your own risk. Please consult with a certified financial advisor before making any significant financial decisions.

2 notes

·

View notes

Text

Investing in Stocks 101: A Beginner's Guide to Building Wealth with Confidence

I. Introduction to Investing in Stock

Investing in stocks can be a powerful tool for building long-term wealth. By acquiring ownership in companies through stock ownership, individuals can participate in the profits and growth of these businesses. This comprehensive guide aims to provide beginners with a solid foundation to navigate the complex world of stock investing, enabling them to make informed decisions with confidence.

Understanding the Basics of Investing in Stocks

Before diving into the intricacies of stock investing, it is crucial to grasp the basic concept of stocks. Stocks, also known as shares or equities, represent a portion of ownership in a company. When individuals purchase stocks, they become shareholders in that company, which entitles them to a share of its profits and assets.

Why Investing in Stocks is Essential for Wealth Building

Investing in stocks offers numerous advantages for wealth building. Unlike traditional savings accounts, stocks have the potential to generate substantial returns over the long term. Additionally, investing in stocks allows individuals to diversify their portfolios and participate in the growth of different industries and sectors. By harnessing the power of compounding returns, investors can exponentially increase their wealth over time.

II. Getting Started in Stock Investing

Embarking on a journey of stock investing requires careful planning and consideration. Before delving into the world of stocks, beginners should lay a strong foundation by following these steps:

Setting Financial Goals and Time Horizon

Determining financial goals is paramount in creating a roadmap for successful investing. Whether the objective is saving for retirement, buying a home, or funding education, setting clear goals helps investors tailor their investment strategies accordingly. Additionally, identifying the time horizon, or the length of time an investor plans to stay invested, plays a crucial role in selecting suitable investment options.

Assessing Risk Tolerance and Investment Options

Understanding personal risk tolerance is vital when considering investment options. Risk tolerance refers to an individual's willingness and ability to withstand fluctuations in investment values. It is essential to strike a balance between risk and potential returns to align investment choices with personal comfort levels. Furthermore, investors should explore different investment vehicles such as stocks, bonds, and mutual funds to diversify their portfolios and manage risk effectively.

Building a Solid Foundation: Budgeting and Emergency Funds

Before entering the world of stock investing, it is imperative to establish a solid financial foundation. Implementing a budgeting system enables individuals to monitor their income, expenses, and savings. By creating a clear picture of their financial health, investors can allocate funds for stock investments without compromising their overall financial stability. Additionally, building emergency funds safeguards against unforeseen circumstances, ensuring the availability of funds for emergencies rather than withdrawing invested capital prematurely.

III. Demystifying the Stock Market

The stock market can be an intimidating concept for beginners. However, gaining a fundamental understanding of its key aspects can help demystify the process of stock investing.

Exploring the Stock Market: Definitions, Exchanges, and Indexes

The stock market refers to the platform where investors can buy and sell stocks. It is an organized marketplace where buyers and sellers meet to trade shares of publicly listed companies. Stock exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ, facilitate these transactions. Indexes, such as the S&P 500 and Dow Jones Industrial Average, track the performance of specific groups of stocks, enabling investors to gauge overall market trends.

How Stock Prices are Determined

Stock prices are determined by supply and demand dynamics in the stock market. When there is high demand for a particular stock, its price tends to rise, while low demand leads to price declines. Various factors, such as company performance, economic conditions, and investor sentiment, contribute to the fluctuations in stock prices.

Key Players in the Stock Market: Brokers, Investors, and Analysts

Several key players participate in the stock market, each with distinct roles and responsibilities. Brokers act as intermediaries between investors and the stock exchange, facilitating the buying and selling of stocks. Investors, who can be individuals or institutions, purchase and own stocks based on their investment objectives. Analysts play a pivotal role by analysing companies, industries, and economic factors to provide insights and recommendations to investors.

IV. Different Types of Stocks

Understanding the different types of stocks available in the market is essential for investors seeking to diversify their portfolios effectively.

Common Stocks vs. Preferred Stocks: Understanding the Differences

Common stocks and preferred stocks are the two primary types of stocks available to investors. Common stocks represent ownership in a company and provide individuals with voting rights in corporate matters. Preferred stocks, on the other hand, typically do not carry voting rights but offer higher priority for dividends and liquidation proceeds.

Growth Stocks, Value Stocks, and Dividend Stocks: Choosing Investments

Within the stock market, investors can select from various categories of stocks based on their investment objectives and strategies. Growth stocks are shares of companies with high growth potential but may not necessarily pay dividends. Value stocks, on the other hand, are stocks that are considered undervalued compared to their intrinsic worth. Dividend stocks are shares of companies that regularly distribute a portion of their profits to shareholders in the form of dividends.

V. Fundamental Analysis: Evaluating Stocks

Fundamental analysis plays a crucial role in evaluating the financial health and performance of companies, enabling investors to make informed decisions about their investments.

Introduction to Fundamental Analysis

Fundamental analysis focuses on assessing the underlying factors that drive a company's financial performance and stock value. By analyzing financial statements, economic factors, and industry trends, investors can gauge the intrinsic value of a stock.

Examining Financial Statements: Balance Sheets, Income Statements, and Cash Flow

Financial statements provide a comprehensive view of a company's financial health. The balance sheet showcases a company's assets, liabilities, and shareholders' equity. The income statement presents the company's revenues, expenses, and profits or losses. The cash flow statement illustrates the movement of cash into and out of the company, providing insights into its liquidity.

Key Financial Ratios for Stock Analysis

Financial ratios offer valuable insights into a company's financial health and performance. Ratios, such as price-to-earnings (P/E), return on equity (ROE), and debt-to-equity (D/E), can help investors assess a company's profitability, efficiency, and financial leverage.

VI. Technical Analysis: Analysing Stock Price Patterns

Technical analysis complements fundamental analysis by examining stock price patterns, trends, and indicators to predict future price movements.

Introduction to Technical Analysis

Technical analysis revolves around the belief that historical price and volume data can provide insights into future price movements. It involves studying stock charts, trend lines, and technical indicators to identify patterns that can guide investment decisions.

Understanding Stock Charts, Trends, and Patterns

Stock charts display the historical price movements of stocks over different time frames. Trend lines help identify the direction and strength of a stock's price movement. Various chart patterns, such as head and shoulders, double bottoms, and triangles, indicate potential reversals or continuations in stock prices.

Utilising Technical Indicators for Decision Making

Technical indicators, such as moving averages, relative strength index (RSI), and MACD (moving average convergence divergence), provide additional insights into stock price movements. These indicators help investors identify overbought or oversold conditions, as well as potential trend reversals, aiding in strategic decision-making.

VII. Building a Diversified Stock Portfolio

Diversification is a principle that mitigates risk by spreading investments across various stocks, sectors, and industries.

The Importance of Diversification

Diversifying a stock portfolio protects investors against the risk of holding a concentrated position. By investing in stocks across different industries and sectors, individuals can reduce the impact of negative events affecting a specific company or sector.

Choosing Stocks across Different Industries and Sectors

When building a diversified stock portfolio, it is crucial to allocate investments across various industries and sectors. This strategy ensures exposure to different economic cycles, reducing the potential vulnerability of the portfolio to specific events or industry downturns.

Allocating Portfolio Weightings and Risk Management

Determining the allocation of investments within a portfolio requires careful consideration. By diversifying holdings based on risk tolerance, investment goals, and time horizon, investors can achieve an optimal balance between risk and return.

VIII. Investing Strategies for Long-term Growth

Investing in stocks for long-term growth involves adopting specific strategies that capitalize on compounding returns and market cycles.

Buy and Hold Strategy: Investing for the Long Run

The buy and hold strategy entails purchasing stocks with the intention of holding them for an extended period, often years or even decades. This approach relies on the long-term growth potential of well-established companies and minimises the impacts of short-term market fluctuations.

Dollar-Cost Averaging: Regular Investing Regardless of Market Conditions

Dollar-cost averaging involves investing a fixed amount of money regularly, regardless of market conditions. This strategy allows investors to buy more shares when prices are low and fewer shares when prices are high, potentially reducing the overall average cost of investments.

Understanding Market Cycles and the Role of Patience

Markets experience cycles of expansion, consolidation, and contraction. Recognizing these cycles and maintaining patience are integral to long-term investment success. By avoiding knee-jerk reactions to short-term market movements, investors can harness the power of compounding returns over time.

IX. Performing Due Diligence: Researching and Selecting Stocks

Researching and selecting stocks requires thorough due diligence to make informed investment decisions.

Identifying Sources of Investment Information

Accurate and reliable information is crucial when researching stocks. Investors can access various sources of information, such as financial news websites, company annual reports, SEC filings, and industry reports, to gather insights and make informed decisions.

Evaluating Company Fundamentals and Industry Performance

Analysing a company's fundamentals, including revenue growth, profitability, competitive advantages, and management, helps assess its potential for long-term success. Additionally, understanding industry trends, competition, and market dynamics provides a broader context for evaluating a company's performance.

Selecting Stocks for Your Portfolio

The process of stock selection involves filtering potential investments based on established criteria, such as financial strength, growth prospects, and valuation. By carefully evaluating stocks, investors can assemble a portfolio that aligns with their investment goals and risk tolerance.

X. The Art of Buying and Selling Stocks

Executing buy and sell orders requires understanding various types of stock orders and maintaining a disciplined approach.

Placing Stock Orders: Market Orders, Limit Orders, and Stop Orders

Investors can place different types of orders to buy or sell stocks. Market orders execute immediately at the prevailing market price, while limit orders allow investors to specify the desired price at which to buy or sell. Stop orders are triggered when the stock reaches a specific price, aiming to limit losses or secure gains.

Timing the Market vs. Time in the Market

Timing the market, or attempting to buy stocks at the lowest price and sell at the highest, is extremely challenging and often unsuccessful. Instead, the time spent in the market is a more reliable strategy, allowing investors to benefit from the long-term upward trend of the stock market.

Emotional Pitfalls to Avoid

Emotions can significantly impact investment decisions. Fear and greed often lead to irrational behaviour, such as panic selling during market downturns or chasing speculative investments during market euphoria. Avoiding emotional pitfalls and maintaining a disciplined approach based on the investment plan is key to long-term success.

XI. Managing and Monitoring Your Stock Portfolio

Regularly managing and monitoring a stock portfolio ensures it remains aligned with evolving financial goals and market conditions.

Regular Portfolio Review and Rebalancing

Periodic portfolio reviews are essential to evaluate the performance of individual stocks and the overall portfolio. Rebalancing involves adjusting the portfolio's weightings to maintain the desired allocation and risk level.

Tracking Performance and Monitoring News

Monitoring the performance of individual stocks and the broader market is crucial for making informed decisions. Additionally, staying abreast of relevant news, such as company announcements, industry developments, and economic indicators, allows investors to react to potential opportunities or threats in a timely manner.

Tax Considerations and Investment Record-Keeping

Investors should be mindful of tax implications related to their stock investments. It is important to keep accurate records of transactions and consult with a tax professional to maximize tax efficiency. Maintaining proper documentation also facilitates overall investment record-keeping and simplifies the tax filing process.

XII. Potential Risks and Mitigation Strategies

Investing in stocks involves inherent risks. By understanding them and implementing appropriate mitigation strategies, investors can safeguard their portfolios.

Understanding Volatility and Market Fluctuations

Volatility refers to the degree of variation in stock prices over time. Market fluctuations can be driven by a wide range of factors, including economic events, geopolitical risks, and investor sentiment. Investors should be prepared for the occasional turbulence and remain focused on long-term objectives.

Assessing Systematic and Unsystematic Risks

Systematic risks, also known as market risks, affect the overall stock market and cannot be diversified away. Unsystematic risks, on the other hand, impact specific companies or sectors and can be mitigated through diversification. By diversifying across industries and sectors, investors can mitigate unsystematic risks while accepting the broader market risks.

Hedging and Protective Measures

Hedging involves employing strategies to offset potential losses in a portfolio. Options, futures, and exchange-traded funds (ETFs) are common hedging instruments. Protective measures, such as utilising stop-loss orders or setting trailing stops, enable investors to limit potential downside risks.

XIII. Investing in Stocks for Retirement

Stocks play a crucial role in retirement planning, providing long-term growth potential and income generation.

The Role of Stocks in Retirement Planning

Incorporating stocks in retirement investment portfolios can help counteract the effects of inflation and generate long-term growth. As stocks historically outperform other investment options over extended periods, they play a vital role in ensuring adequate retirement savings.

Considerations for Different Retirement Ages

The appropriate allocation to stocks within a retirement portfolio varies depending on an individual's age and risk tolerance. Younger individuals may have a higher allocation to equities due to their longer time horizon, while older individuals may opt for a more conservative allocation.

Balancing Risk and Income in Retirement Investment Portfolios

Retirees often seek a balance between risk and income in their investment portfolios. This involves diversifying holdings to mitigate potential volatility while considering income-generating assets, such as dividend-paying stocks, to meet ongoing financial needs.

XIV. Investing in Stocks for Specific Goals

Beyond retirement planning, stocks can be utilised to achieve various financial objectives.

Investing for Education: College Funds and 529 Plans

Investors can leverage stocks through college funds, such as 529 plans, to save for their children's education. By starting investments early and adopting a long-term perspective, individuals can potentially accumulate substantial funds for educational expenses.

Investing for a Home Purchase or Down Payment

Stock investments can serve as a means to save for a home purchase or down payment. Aligning investment strategies with the desired time frame and risk tolerance allows individuals to accumulate funds for this significant financial milestone.

Stocks as Passive Income: Dividend Investing

Dividend investing involves selecting stocks that regularly distribute a portion of their profits as dividends. By building a portfolio centred around dividend-paying stocks, investors can generate passive income and

3 notes

·

View notes

Text

A Beginner's Guide to the Stock Market: Demystifying the Basics

Introduction:

Welcome to the exciting world of the stock market! Investing in stocks can be a rewarding venture, but for beginners, it can also be overwhelming. This blog post aims to provide you with a solid foundation and demystify the basics of the stock market, so you can embark on your investment journey with confidence.

What is the Stock Market?

The stock market is a platform where individuals and institutions buy and sell shares of publicly traded companies. It serves as a marketplace for investors to trade stocks and other securities.

Understanding Stocks:

Stocks represent ownership in a company. When you purchase shares of a company's stock, you become a partial owner of that company and may have the right to vote on certain matters and receive dividends.

Types of Stocks:

There are different types of stocks, including common stocks and preferred stocks. Common stocks offer voting rights and the potential for capital appreciation, while preferred stocks provide fixed dividends but limited voting rights.

Setting Investment Goals:

Before diving into the stock market, it's crucial to establish your investment goals. Determine your risk tolerance, time horizon, and financial objectives. This will help shape your investment strategy.

Conducting Research:

Thorough research is essential before investing in stocks. Analyze company financials, industry trends, and market conditions. Utilize fundamental analysis to assess a company's performance and technical analysis to study price patterns.

Diversification:

Diversification is a key principle to mitigate risk. Spread your investments across various sectors, industries, and even geographic locations. This helps reduce the impact of individual stock volatility on your overall portfolio.

Investment Vehicles:

There are different ways to invest in stocks, such as individual stock picking, mutual funds, and exchange-traded funds (ETFs). Mutual funds pool money from multiple investors to invest in a diversified portfolio, while ETFs are passively managed funds that track specific indices.

Risk Management:

Understand that investing in the stock market involves risks. Educate yourself on risk management techniques such as setting stop-loss orders, understanding market volatility, and staying informed about your investments.

Long-Term Approach:

Stock market investing is best suited for the long term. Avoid making hasty decisions based on short-term market fluctuations. Adopt a patient approach and focus on the underlying fundamentals of the companies you invest in.

Learn from Mistakes:

Investing is a continuous learning process. Embrace the fact that mistakes may happen, but use them as opportunities to learn and refine your investment strategy. Seek knowledge from experienced investors and financial resources.

Conclusion:

As a beginner in the stock market, remember that education and patience are your allies. By understanding the fundamentals, conducting research, diversifying your portfolio, and managing risks, you can embark on a successful investment journey. Stay disciplined, stay informed, and enjoy the rewards of long-term investing in the dynamic world of the stock market.

#beginners#stock management#stockmarket#passiveseinkommen#income#financial markets and investing#investment#maximum#bitcoin news#bitcoin

3 notes

·

View notes

Text

A Beginner's Guide to Building a Strong Mutual Fund Portfolio

Building a mutual fund portfolio can help you accumulate wealth. With so many mutual fund options in India, beginners can feel overwhelmed. You can create a portfolio that meets your financial goals with careful planning and discipline. Starting with a SIP calculator to calculate your monthly investment to reach your goals is easy. This guide explains how to build a solid mutual fund portfolio.

1. Understanding Different Types of Mutual Funds

Understanding mutual fund types is the first step in portfolio building. Equity, debt, and hybrid mutual funds exist. Equity funds invest in stocks and offer higher returns but higher risk, making them good for long-term goals. Debt funds invest in bonds and are safer but yield lower returns. Hybrid funds balance equity and debt for moderate risk-takers.

Consider your risk tolerance, investment horizon, and financial goals when choosing funds. ABSL Mutual Fund, for instance, offers aggressive growth equity and stable income debt funds to diversify and manage risk.

2. Start Small with SIPs

Beginners can invest in mutual funds with a Systematic Investment Plan (SIP). SIPs let you invest a set amount monthly in mutual funds. This disciplined approach encourages saving and ensures consistent investing, even in volatile markets. SIPs benefit from compounding, which can boost investment growth.

SIP investing also provides the advantage of rupee cost averaging. This means you buy more fund units when markets are low and fewer units when markets are high, averaging your cost per unit. This mitigates market fluctuations in your portfolio.

3. Diversify Across Asset Classes

Mutual fund risk is reduced by diversification. Avoid investing only in equity or debt funds. Diversifying across asset classes reduces risk and boosts returns.

If you're young and risk-tolerant, you may invest more in equity funds. For stability, you may want to include more debt funds if you're nearing retirement. Adding asset classes strengthens your portfolio against market volatility.

4. Keep an Eye on Costs and Performance

Mutual funds come with costs, such as the expense ratio, which is the fee charged by the fund house to manage the fund. Over time, these costs can eat into your returns, so it is crucial to compare the expense ratios of different funds. Always opt for funds with competitive costs without compromising on performance.

In addition to costs, regularly monitor the performance of the funds in your portfolio. While short-term performance may fluctuate, long-term underperformance may indicate that it is time to switch to a better-performing fund.

5. Stay Focused on Long-Term Goals

Investing in mutual funds requires patience and a long-term perspective. While it is tempting to chase after short-term gains, the true power of mutual funds is realised when you stay invested over the long term. Equity funds, especially, may experience volatility in the short term but have historically provided significant growth over longer periods.

0 notes

Text

How Stock Market Training Can Transform Your Investing Success

Investing in the stock market has the potential to generate significant returns. However, a lack of knowledge can turn a promising journey into a challenging one. To transform your investing success, stock market training is invaluable. Through structured courses, you can gain the skills and strategies needed to maximize your returns and minimize risks. Here’s how stock market training, especially with Index and Stock Trading Academy, can make a transformative difference in your investing journey.

Target Audience

Who is This Blog For?

This blog is tailored to:

⦁ Beginner Investors: Newcomers looking to understand stock market basics and make informed investment choices.

⦁ Intermediate Traders: Those with some experience who want to advance their skills in options trading, technical analysis, and strategic investment.

⦁ Young Professionals and Students: Individuals in cities like Delhi, Mumbai, Bangalore, and Chennai who are eager to achieve financial literacy.

⦁ Professionals and Entrepreneurs: People interested in diversifying their financial portfolios and maximizing returns.

Purpose/Goal

This blog aims to highlight the advantages of stock market training and why enrolling in courses from Index and Stock Trading Academy can equip you with the necessary skills to succeed in the Indian stock market. Keywords like stock market courses, share market trading, Indian stock market, and options trading will help optimize for search engines, so readers can easily find this guide to transform their investing approach.

Blog Structure

Introduction: Why Investing Success Depends on Training

The stock market is full of potential, but without training, it can feel unpredictable. Lack of knowledge can lead to impulsive decisions, missed opportunities, and unnecessary risks. Training in stock market trading equips you with the right strategies, helping you make more confident and informed investment choices.

Target Audience: Who Can Benefit from Stock Market Training?

Stock market training provides unique advantages for individuals at different stages of their investment journey:

⦁ Beginners looking to understand the fundamentals and terminology of share market investing.

⦁ Experienced traders who need to refine their strategies with insights into options trading and technical analysis.

⦁ Young professionals and students in metro cities like Delhi, Mumbai, Bangalore, and Pune who want to build investment knowledge early in their careers.

How Stock Market Training Can Transform Your Investing Success

1. Build a Strong Foundation in Stock Market Basics

Training programs like those at Index and Stock Trading Academy cover essential stock market concepts, demystifying terms like equities, shares, mutual funds, and options trading. By mastering the basics, you’ll feel more confident and better equipped to make informed investment decisions.

2. Enhance Your Market Analysis Skills

Knowing how to analyze the stock market is key to understanding market trends and potential investments. Stock market training teaches both fundamental and technical analysis techniques. You’ll learn how to assess a company’s financial health, interpret price patterns, and gauge market sentiment, giving you an edge in predicting potential stock movements.

3. Develop Strategic Investment Skills

In stock market courses, you’ll explore various investment strategies, including long-term investing, swing trading, and intraday trading. With a clear understanding of these approaches, you’ll be able to create strategies that align with your financial goals, risk tolerance, and investment horizon.

4. Learn About Risk Management

Effective investing isn’t just about maximizing returns — it’s also about minimizing risks. Stock market training emphasizes risk management strategies, teaching you how to assess risks, protect your investments, and set stop-loss levels. This knowledge is invaluable, especially for managing downturns in the Indian stock market.

5. Boost Your Confidence and Decision-Making Abilities

Making informed decisions in the stock market requires confidence. By equipping you with the right tools and knowledge, stock market courses boost your confidence and help you trust your strategies, whether investing in the share market or trading options.

6. Network with Industry Experts and Fellow Learners

In stock market classes, you’ll connect with instructors and fellow students who share a passion for the market. At Index and Stock Trading Academy, students benefit from learning with industry experts who provide valuable insights and networking opportunities, helping you grow both personally and professionally.

7. Access to Advanced Tools and Resources

Institutes like Index and Stock Trading Academy provide access to advanced resources, including real-time market data, trading simulators, and expert analysis reports. These resources help you track and analyze the Indian stock market, aiding your investment decisions.

8. Gain Practical Experience Through Real-Life Case Studies

Professional stock market courses incorporate real-life case studies and live trading sessions, allowing you to apply theoretical knowledge practically. This hands-on experience is invaluable for learning to adapt and refine your strategies.

9. Stay Updated on Market Trends and Regulations

The stock market is constantly evolving, with new trends, technology, and regulations. Stock market training keeps you updated, ensuring you’re aware of changes in market policies, trends in the Indian stock market, and how these impact your investments.

10. Prepare for Long-Term Financial Growth

With comprehensive stock market training, you develop the skills needed to grow your wealth over time. Courses help you understand the importance of diversification, planning, and disciplined investing, setting you up for long-term financial success.

Major Indian Cities Offering Professional Stock Market Training

India has several cities where you can find quality stock market training:

⦁ Delhi: Offers numerous courses covering everything from basics to advanced options trading.

⦁ Mumbai: Known as India’s financial hub, Mumbai provides access to some of the best stock market training resources.

⦁ Bangalore: A prime city for technology-driven stock market education.

⦁ Chennai: A growing hub for investment training and stock market awareness.

⦁ Pune: Known for its practical and in-depth courses on stock market fundamentals.

Conclusion: Invest in Your Knowledge for Lasting Success

Investing in the stock market is rewarding, but only when done right. Stock market training is the key to navigating this complex landscape with confidence. Index and Stock Trading Academy offers some of the best stock market courses designed to transform your investing success through a combination of foundational knowledge, practical skills, and advanced strategies.

Call-to-Action (CTA): Take the First Step Toward Investment Success

Ready to transform your stock market journey? Start by enrolling in a professional stock market course with Index and Stock Trading Academy and equip yourself with the skills to invest confidently. Follow us on social media to stay updated on courses and market insights!

0 notes

Text

Dhan App Referral Code [ASAR14] - Unlock a Bonus of Up to ₹250!

Are you interested in trading but feel overwhelmed by the complexity of traditional platforms? Look no further! The Dhan App is here to simplify your trading experience, making it accessible and enjoyable for both beginners and experienced traders alike. Plus, by using the exclusive referral code [ASAR14], you can earn a bonus of up to ₹250 just for signing up! Let’s explore how you can make the most of this opportunity and why the Dhan App should be your go-to choice for trading and investing.

Why Dhan App Stands Out

Dhan App is a cutting-edge trading platform that brings together a range of features designed to meet the needs of modern investors. One of its most significant advantages is its user-friendly interface, which allows you to navigate the stock market with ease. Whether you’re trading in equities, derivatives, or commodities, Dhan provides you with the tools you need to make informed decisions quickly.

Additionally, Dhan App offers various educational resources to help you learn the ropes of trading. From video tutorials to webinars, you’ll find valuable information at your fingertips. This emphasis on education empowers users to develop their trading skills and strategies over time.

How to Sign Up and Claim Your Bonus

Getting started with Dhan App is a breeze, especially when you use the referral code [ASAR14]. Here’s a step-by-step guide on how to sign up and claim your bonus:

Download the Dhan App: Head over to the Google Play Store or Apple App Store and search for "Dhan App." Download and install the app on your device.

Create an Account: Open the app and follow the prompts to register. When you reach the referral code section, enter [ASAR14] to ensure you qualify for the sign-up bonus.

Complete the KYC Process: Dhan App requires a quick Know Your Customer (KYC) process to verify your identity. This process is straightforward and typically involves submitting a few documents.

Receive Your Bonus: After successfully registering and completing your KYC, the app will credit your account with a bonus of up to ₹250. This bonus can be used to kickstart your trading journey!

Why Use the Dhan App Referral Code [ASAR14]?

Using the referral code [ASAR14] not only gives you a financial boost but also opens the door to several advantages that enhance your trading experience:

1. Initial Capital Boost: The bonus of up to ₹250 is a fantastic way to explore the app’s features without risking your own money initially. This is especially beneficial for new traders who may want to try out different strategies without committing significant funds.

2. Diverse Investment Options: With Dhan, you can trade a wide array of assets, including stocks, ETFs, mutual funds, and more. The bonus allows you to explore these options and find what works best for you.

3. Advanced Tools and Features: Dhan App is equipped with advanced trading tools such as real-time market analysis, technical charts, and customizable watchlists. With the bonus, you can experiment with these features and see how they can enhance your trading strategies.

4. Community and Support: By joining Dhan, you become part of a vibrant community of traders. You can connect with others, share insights, and learn from experienced investors. Plus, Dhan offers excellent customer support to assist you whenever needed.

How to Maximize Your Bonus

To get the most out of your bonus, consider the following tips:

Explore Educational Resources: Take advantage of Dhan’s educational materials to enhance your trading knowledge. The more you learn, the better equipped you’ll be to make informed decisions.

Start Small: Use the bonus to start trading in smaller amounts. This approach allows you to gain experience and confidence without risking too much capital.

Utilize Advanced Tools: Make the most of the trading tools available on the app. Analyze market trends, track your investments, and adjust your strategies based on performance.

Conclusion

In conclusion, the Dhan App is an excellent platform for anyone looking to start their trading journey. With its user-friendly interface, extensive educational resources, and the opportunity to earn a bonus of up to ₹250 using the referral code [ASAR14], there’s never been a better time to sign up. Take the leap today and unlock the potential of your trading skills with Dhan App. Don’t miss out on this incredible opportunity—download the app now, enter the referral code [ASAR14], and start your journey toward financial success!

0 notes

Text

Smart Money Moves: Your Fun Guide to Personal Finance and Investing Basics!

Ready to learn how to make your money grow? 🌱 This easy guide breaks down investing for beginners, covering stocks, ETFs, mutual funds, and simple tips for smart saving. Learn about the difference between Traditional and Roth IRAs, what REITs are, and how to start with crypto if you're curious. Perfect for teens just getting started, this guide makes personal finance fun, simple, and totally doable. Take your first step toward building a bright financial future—let’s dive in! 💰

1 note

·

View note

Text

Building Wealth Through Real Estate: A Beginner's Guide to Smart Investing

Real estate investing can be one of the most rewarding ways to grow wealth, but it can also feel overwhelming for beginners. With the proper knowledge and strategy, anyone can tap into the opportunities offered by the real estate market. This guide will walk you through the essentials of real estate investing, from different types of investments to tips on getting started and avoiding common pitfalls.

Why Invest in Real Estate?

Real estate offers a tangible asset that appreciates over time, providing both income and long-term growth. Unlike stocks or other financial investments, real estate allows investors to benefit from rental income, tax advantages, and market appreciation. Additionally, it offers diversification to your investment portfolio and serves as a hedge against inflation.

Types of Real Estate Investments

To succeed as a beginner, it's crucial to understand the variety of investment options available in the real estate market. Here are the most popular types:

Residential Properties

This includes single-family homes, apartments, and vacation rentals. Investors can buy these properties to rent them out to tenants or flip them for a profit after renovation.

Commercial Real Estate

Commercial properties such as office buildings, retail spaces, and warehouses are leased to businesses. These types of investments often offer higher returns but require more expertise and capital.

Real Estate Investment Trusts (REITs)

REITs allow investors to invest in real estate without purchasing property. They function like mutual funds, pooling money to buy and manage income-generating properties.

House Flipping

This strategy involves buying properties at a low price, renovating them, and selling them at a profit. While flipping can offer quick returns, it also involves high risk and costs.

Rental Properties

Investing in rental properties provides a steady cash flow. The goal is to generate passive income while the property's value appreciates over time.

Steps to Get Started in Real Estate Investing

Set Clear Goals

Before you dive into the market, determine what you want to achieve with your investment. Are you looking for short-term profits or long-term wealth building? Your goals will help you choose the right type of investment.

Educate Yourself

Attend seminars, read books, and explore online courses to learn about the local real estate market, investment strategies, and financial concepts.

Create a Budget and Secure Financing

Assess your current financial situation and determine how much you can invest. You may need to explore mortgage options, partner with investors, or tap into real estate crowdfunding platforms.

Research the Market

Look for areas with high rental demand, population growth, and potential for property value appreciation. A thorough market analysis will help you identify the best investment opportunities.

Start Small

If you're new to real estate investing, consider starting with smaller properties or REITs. These options are easier to manage and can provide valuable experience without the risk of a large-scale investment.

Hire Professionals

Work with a real estate agent, attorney, and accountant who specializes in real estate investments. These professionals can provide guidance and ensure that your transactions are legally sound.

Risks to Consider

While real estate can be profitable, it is not without its risks. Being aware of potential challenges will help you make informed decisions.

Market Fluctuations: Property values can decrease due to economic downturns or changes in the local market.

Vacancy Risk: Rental properties may experience periods without tenants, affecting your cash flow.

Unexpected Costs: Repairs, maintenance, and property management fees can add up quickly.

Illiquidity: Unlike stocks, real estate is not easily converted to cash. Selling a property can take time and may involve additional costs.

Tips for Long-Term Success

Think Long-Term

Real estate is not a get-rich-quick scheme. Successful investors adopt a long-term mindset and focus on building wealth over time through rental income and appreciation.

Keep Learning and Adapting

The real estate market is dynamic, with changing trends, regulations, and opportunities. Stay informed and be prepared to adapt your strategy as needed.

Network with Other Investors

Join local real estate investment groups or online communities to connect with experienced investors. Networking can provide insights, mentorship, and potential partnership opportunities.

Have a Backup Plan

Always have contingency plans for your investments. This might include setting aside funds for emergency repairs or planning for potential vacancies in rental properties.

Leverage Technology and Tools

Use property management software, online listings, and market analysis tools to streamline your investments and make informed decisions.

Real estate investing offers immense potential for building wealth, but it requires careful planning, patience, and ongoing learning. For beginners, the key is to start small, set clear goals, and gradually build your knowledge. With the right approach, real estate can become a cornerstone of your financial success. Whether you aim to flip properties, invest in REITs, or manage rental homes, the journey to becoming a successful real estate investor starts with taking the first step.

0 notes