#BaseChain

Explore tagged Tumblr posts

Text

Working on the Damned Doggie NFT Collection. I will soon mint a few at a time on Rarible.com. What would be a good floor price? All are 1/1. Comments?

1 note

·

View note

Text

Introducing BakerySwap: A Game-Changing Multi-Chain DeFi and NFT Platform

Discover the revolutionary world of BakerySwap, a cutting-edge multi-chain platform that is set to transform the DeFi and NFT landscape. With its strategic incorporation with Base Chain, BakerySwap is poised to unleash a wave of innovative services, including an advanced AMM exchange, a Launchpad for budding projects, and a groundbreaking NFTSwap platform. Join us on this exciting journey as we explore the seamless trading experience, liquidity provision, and unparalleled opportunities that BakerySwap brings to the crypto community. Embrace the future of DeFi and NFTs with BakerySwap today!

BakerySwap Expands Horizons with Base Chain Incorporation

BakerySwap, a prominent player in the cryptocurrency space, is gearing up for a major milestone in its journey by incorporating with multiple chains. Their first strategic move involves backing the Base Chain, a secure and cost-effective Ethereum Layer 2 solution created by Coinbase, designed to onboard a large number of users on-chain.

The Base Chain Advantage for BakerySwap

Integrating with the Base Chain opens up new horizons for BakerySwap, enabling the expansion of its services and community outreach. The upcoming launch will feature a cutting-edge AMM exchange, a dynamic Launchpad, and a groundbreaking NFTSwap platform, all built on the Base Chain.

BakerySwap AMM Exchange: Empowering Seamless Trading

The BakerySwap AMM exchange on Base Chain promises users a seamless and reliable trading experience. With a strong focus on liquidity provision, users will have the opportunity to earn a share of trading fees, fostering the growth of DeFi within the platform. Base Chain Launchpad: Nurturing Innovation As part of the incorporation, BakerySwap's Launchpad on Base Chain will serve as an innovation hub for aspiring projects. Developers and innovators will find a secure and conducive platform to launch their projects, allowing users to invest in them at an early stage. Bakery NFTSwap: A Paradigm Shift in NFT Trading Bakery NFTSwap, an innovative platform, is poised to revolutionize NFT trading. Simplifying the process, NFTs will be mapped with tokens, and trading can take place seamlessly on the AMM exchange. Unwavering Enthusiasm for Innovation BakerySwap's commitment to innovation doesn't stop here. The team is dedicated to introducing additional cutting-edge services and functionalities to the Base Chain. This effort will significantly enhance the NFT and DeFi landscape, providing users with exciting new opportunities.

Conclusion

BakerySwap's decision to incorporate with the Base Chain is a testament to its vision and ambition. The upcoming AMM exchange, Launchpad, and NFTSwap platform are set to redefine DeFi and NFT trading, making it more accessible and user-friendly than ever before. With BakerySwap's commitment to continuous innovation, the future looks promising for both the platform and its community. For more articles visit: Cryptotechnews24 Source: cryptonewsz.com

Related Posts

Read the full article

#AMMexchange#BakerySwap#BaseChain#CryptoNews#Defi#Launchpad#liquidity#multi-chainincorporation#NFTtrading#NFTSwap

0 notes

Text

We are EVERYWHERE!! build and deploy #dApps on #Avalanche #Polygon #BaseChain with @zbyte_io The perfect no-code platform to build from scratch accessible to EVERYONE 😎what are you waiting for go build now at http://https.zbyte.io 📷

#dapp development company#dapp development services#blockchain#bitcoin#ethereum#defi#digitalcurrency#solana#web3#blockchain technology

2 notes

·

View notes

Text

Ready to embrace #IamGasless?

Join Numa Network to go #Gasless and stand a chance to win $5000 in $UFT Rewards!

Experience @numa_chain Network on the @Basechain - easily sponsor fees across multiple wallets with just one gas-token wallet!

❎Don't forget to RT,

❎Follow UniLend Finance and participate here: 👇 https://gleam.io/9UWbR/numa-network-mainnet-launch-win-5000-in-uft-rewards.

Begin now at https://app.numa.network/.

For a quick start, check out the guide here: https://bit.ly/3V3DrN8.

Hurry now, the campaign is LIVE until 24th December, 11:59 PM UTC!

1 note

·

View note

Text

LOOM: un token Proof-of-Stake utilizzato per proteggere la rete principale di Loom Network, chiamata Basechain.

bonus.bitget.com/BK6NT

0 notes

Photo

Pandora signature clasp rose gold bangle bracelet snake chain$49.7 , in charmsilvers.com #pandora#bangle#bracelet#signature#clasp#gold#rosegold#snakechain#teendy#jewelry#fashion#bracelet#hot#new#popular#bracelet#basechain https://www.instagram.com/p/BpeB1xHA2Mt/?utm_source=ig_tumblr_share&igshid=2mo4pqmltm9x

#pandora#bangle#bracelet#signature#clasp#gold#rosegold#snakechain#teendy#jewelry#fashion#hot#new#popular#basechain

0 notes

Text

December 14, 2018 Week in Ethereum News

News and Links

Layer 1

[Eth 2] Danny Ryan’s state of the spec

[Eth 2] Latest Eth 2 implementers call. Agenda to follow along.

[Eth 2] What’s New in Eth2

[Eth 2] Latest Prysmatic dev update

[Eth 2] Lighthouse dev update

[Eth 2] Coindesk profiles the teams building Eth2

[ewasm] Latest Ewasm call.

[1 -> 2] When stable, the beacon chain to finalize the POW chain

[Eth1] State Rent proposal update

[Eth1] How types of contracts would handle contract state-root-plus-witness architecture

NEAR: Unsolved problems in blockchain sharding

Boneh, Bünz, Fisch: Batching Techniques for Accumulators for stateless chains

Justin Drake Ethereum 3.0 tweet

Layer 2

Storj is planning to use Raiden for its payments. Raiden v0.19

Building MixEth as a state channel dapp with Counterfactual

Celer’s team to play their state channel Gomoku game for real Eth

gas payment abstraction in layer 2

prime numbers to transactions instead of coins?

should fraudulent exit bonds be partially burned?

Demo snark for Plasma Cash and Cashflow history compaction

SKALE releases architecture of their sidechain network

Stuff for developers

Ethereum on ARM. Constantinople-ready images

registry-builder: A modular approach to building TCRs from LevelK

7 uses cases with 3box.js

Gnosis Apollo to create your own prediction market interface or tournament

Schedule your token transfers on MyCrypto using Ethereum Alarm Clock

BudgetBox from Colony. Binary choices turned into budget percentages, and can be done onchain. Github

web3j v4.1 for Android

You can now integrate Gitcoin’s Kudos into your app. Gitcoin also hit 500k in issues.

A quick Austin Griffith tutorial on Commit/Reveal

Matt Tyndall’s counterfactual loan repayment for Dharma

Linkdrops: let people send crypto embedded in URLs without gas/wallets

Panoramix decompiler using symbolic execution instead of static analysis

Streamr’s cold chain monitoring tutorial

Dennis Peterson: Spam protection with probabilistic payments and cheap doublespending protection

How to debug with Tenderly and Truffle

A teaser for Harvey fuzzer from ConsenSys Diligence

Automated Eth code exploiter and similar how to scan and steal ETH

Hard fork enabled client releases

Geth v1.8.20 - hard fork enabled, Puppeth improvements, etc

Parity Ethereum 2.2.5-beta and Parity Ethereum 2.1.10-stable hardfork enabled

Trinity v0.1.0-alpha.20 Constantinople support and genesis file support

Ecosystem

Opera releases native Eth wallet and dapp browser for Android. Download. Slick and well worth checking out.

How I learned Solidity basics for free as a noob dev

Uncle rate keeps falling. Time to start nudging up the gaslimit?

Monetary policy chart of historic and future Ether issuance

All the impressive ETHSingapore submissions and winners. Some of Josh Stark’s favorites.

A comparison of ETHSanFrancisco and EOS SF hackathons

Ethereum product management interviews. Also, video of Eth PMs call

Alethio’s EthStats block explorer

Ecosystem job listings

Web3Foundation, Validity Labs and Status working on Whisper alternative

Live on mainnet

OriginTrail: data exchange in supply chains protocol

Enterprise

Quorum v2.2.0

Cheddar suggests Facebook wants to do its own basechain and is recruiting

Why Enterprise Ethereum is way more than DLT

See OriginTrail above

Governance and Standards

ProgPOW testnet block explorer

A quick case study on Aragon’s AGP1 proposal

Evolution of a security token standard

ERC1643: Document Management Standard

ERC1644: Controller Token Operation Standard

ERC1666: Decentralized Autonomous Zero-identity Protocol

ERC1613: Gas stations network

Application layer

Cellarius first anthology released. Free to MetaMask users.

Golem’s Graphene-ng demo part2

XYO Network to launch satellite named EtherX on SpaceX’s Falcon9 in next few months

Data auditing and repair with Storj

The Fluidity stack to allow liquid secondary markets

Vitalik tweetstorm on non-financial apps

Onchain mutual insurance to return insurance to its origin: communities sharing risk

p2p loan offers on Bloqboard using Dharma

Ujo Portal out of beta and in version1.

KyberNetwork’s monthly update - new reserves, wBTC updated

Liquality offers crosschain swap of testnet Eth for Bitcoin. You can also get a good price buying Eth with Summa’s crosschain swap

GnosisSafe users can pay gas fees in OWL.

Maker proposal to reduce stability fee from 2.5% to 0.5%. Vote Dec 17

Augur’s controversial US House elections market has been reported as Republican. This is obviously nonsense because no one would have bet on that market and it makes no sense to encourage wordsmith trickery. This is a huge test of Augur and will be interesting to watch. Also, v1.8.4 out with new node endpoint. And a nice Augur 2018 review from Guesser

Interviews, Podcasts, Videos, Talks

All Devcon4 videos and photos

Arthur Falls uploads some Joe Lubin Devcon3 video footage

Video: a Wolfram language platform for Ethereum

Zero Knowledge ETHSingapore episode

Open Block Explorers community call

Blockchain Insider with Vitalik Buterin

Grid+ Alex Miller and Karl Kreder on Hashing It Out

Prysmatic’s Preston Van Loon and Raul Jordan on Into the Ether

Andrew Keys talks ConsenSys2.0 with Laura Shin

Tokens / Business / Regulation

Chris Burniske argues Ether and Bitcoin prices are undervalued based on fundamentals

4 eras of blockchain computing: degrees of composability from Jesse Walden

CFTC requests input. EthHub and Brooklyn Project are both crowd sourcing responses

Basecoin/Basis quits after raising ~130m and returns money to its VCs, blaming the SEC. I feel there may be more to come with this story.

MythX (formerly Mythril) decides against its announced token

Don’t think there was any doubt, but Coinbase is listing tokens. 30 assets up for consideration

Bonding curve intuition and parameterization

Harberger taxes in action on r/ethtrader banners

Simon de la Rouviere: Desire paths and recommendation markets

General

Zero-Knowledge Proofs Starter Pack

Support starving Venezuelans by buying NFT Christmas cards through Giveth. Easy onboarding for your non-crypto friends.

Results of Bounties Network paying local to participate in Manila Bay beach cleanup. Some interesting UX lessons.

Terra-Bridge: Transfer between Ethereum and Bitcoin protocol

CMEGroup puts up an Intro to Ether course

Zilliqa testnet v3 is live and in feature freeze ahead of January mainnet release. It also got an AWS case study

Boerse Stuttgart and SolarisBank say in next 6 months they’ll launch crypto trading platform in Europe

The state of Surveillance Capitalism is dire: your apps are tracking your location and selling it. It’s very easy to figure out who you are from your location. Bring on web3!

Dates of Note

Upcoming dates of note (new in bold):

Dec 17 - vote to reduce Maker stability fee

Jan 10 - Mobi Grand Challenge hackathon ends

Jan ~15 - Constantinople hard fork at block 7080000

Jan 29-30 - AraCon (Berlin)

Feb 7-8 - Melonport’s M1 conf (Zug)

Feb 15-17 - ETHDenver hackathon (ETHGlobal) next hacker application round closes December 31st

Feb 23-25 - EthAustin hackathon (EthUniversal)

Mar 4 - Ethereum Magicians (Paris)

Mar 5-7 - EthCC (Paris)

Mar 27 - Infura end of legacy key support (Jan 23 begins Project ID prioritization)

Apr 19-21 - ETHCapetown

If you appreciate this newsletter, thank ConsenSys

This newsletter is made possible by ConsenSys.

I own Week In Ethereum. Editorial control has always been 100% me. If you're unhappy with editorial decisions or anything that I have written in this issue, feel free to tweet at me.

Housekeeping and random Twitter banhammers

One of my best friends launched Stoop, an Android/iOS newsletter reader. It uses a dedicated email and clean design experience to keep your information diet healthy. If you subscribe to newsletters, you will like it.

Link: http://www.weekinethereum.com/post/181120057303/december-14-2018-week-in-ethereum-news

I’m sure that I missed things for this newsletter due to Twitter’s banhammer last week. Sorry! Plenty of folks in Ethereum got random Twitter banhammers this week. :(

If you’re wondering “why didn’t my post make it into Week in Ethereum?”

Did you get forwarded this newsletter? Sign up to receive the weekly email

1 note

·

View note

Text

Working on the Damned Doggies NFT Collection. I will soon mint a few at a time on Rarible.com. What would be a good floor price? All are 1/1. Comments?

1 note

·

View note

Text

Deploy Your First Smart Contract on Loom Network Using Remix

Introduction to Loom Network:

Loom Network is a platform to help the Ethereum scale. Loom Network provides a Layer 2 solution that uses Ethereum as it’s the base layer. Using Ethereum as a base layer means base chain assets like ERC20 & ERC721 tokens can have security guarantees of the Ethereum.

The loom is the perfect solution for building scalable applications with almost no transaction cost and very less amount of time for transaction confirmation.

If you don’t know more about the Loom Network and are curious to know, then you can check this handy guide where you can get more ideas about the Loom Network.

Without wasting time, let’s go through the process of deploying smart contracts on the Loom Basechain.

How to Deploy Smart Contract on Loom Chain:

It’s easy to deploy smart contracts on the loom.

Steps to deploy Smart Contract on Loom:

Integrate Remix with Loom

Writing your Smart Contract

Deploy Smart Contract on Loom from Remix IDE.

It’s that simple! Isn’t it?

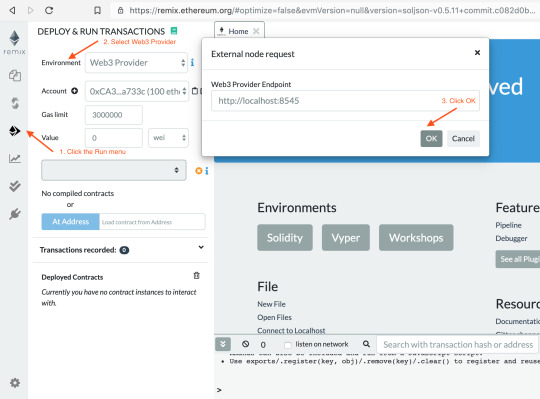

Step 1: Integrate Remix IDE with Loom

To integrate Remix with loom it requires services that proxies JSON RPC call to Loom. For that, Loom had built a small JSON RPC Proxy. So, here we will install and configure it with the Remix IDE to deploy our smart contract on Loom.

Prerequisites to install JSON RPC Proxy:

Node.js 10 or higher(recommended v10.15.3)

Yarn

Git client

1. Clone the JSON RPC Proxy repository:

Open a terminal, cd into your project directory and execute below command:

git clone https://github.com/loomnetwork/loom-provider-json-rpc-proxy

2. Install Dependencies and Build the Proxy:

For that run below command,

cd loom-provider-json-rpc-proxy/ && yarn install && yarn build

3. Configure the Proxy:

You need to configure a proxy to connect to Loom Testnet or Loom Basechain. For that, you need to set the following environment variables,PORT: port on which proxy listens for incoming requests. The default port is 8080. CHAIN_ID: Network Id you want to connect to. default for Mainnet & extdev-plasma-us1 for Testnet. By default, it will connect to Loom Mainnet. CHAIN_ENDPOINT: the address of the endpoint. The default value is wss://plasma.dappchains.com.Run below command to run proxy against Loom Testnet.

PORT=8545 CHAIN_ENDPOINT="wss://extdev-plasma-us1.dappchains.com" CHAIN_ID="extdev-plasma-us1" node .

Run below command to run proxy against Loom Basechain. Make sure deploying smart contracts on Loom Mainnet isn’t free. To deploy a smart contract on Loom Mainnet you need to whitelist your address, which will cost you around 1400 Loom per year ATM.

node .

Step 2: Writing your Smart Contract

Here is our Smart Contract example. It is a very simple smart contract that stores string messages and retrieve it from smart contracts. This is just for demo purposes. You can also use your smart contract code.

pragma solidity ^0.4.25;

contract HelloWorld {

// Define variable message of type string

string message;

// Write function to change the value of variable message

function postMessage(string value) public {

message = value;

}

// Read function to fetch variable message

function getMessage() public view returns (string){

return message;

}

}

Step 3: Deploy Smart Contract on Loom

First of all, we need to configure Remix to use Loom JSON RPC Proxy. For that open Remix Editor. Click on the Run menu and then select the Environment as Web3 Provider.

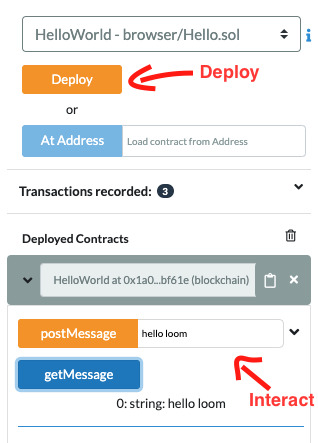

Now you are good to deploy our solidity Smart Contract to Loom Network. Paste below smart contract code into Remix. Select the appropriate compiler version and compile a smart contract by clicking the Compile button.

After compiling a smart contract you can deploy your smart contract by just clicking the Deploy button.

Conclusion:

Cheers. You just deployed your first smart contract code on the Loom network. I hope from now onwards you can deploy smart contracts on the Loom Network. If you have any confusion feel free to comment below.

Stay tuned with Yudiz Solutions!

0 notes

Text

We are EVERYWHERE!! build and deploy #dApps on #Avalanche #Polygon #BaseChain with @zbyte_io The perfect no-code platform to build from scratch accessible to EVERYONE 😎 what are you waiting for go build now at http://https.zbyte.io 🚀

#dapp development company#dapp development services#blockchain#ethereum#bitcoin#solana#blockchain technology#defi#digitalcurrency#web3

1 note

·

View note

Text

Annotated edition of May 17 Week in Ethereum News

As noted last week, I’ve started to think of this as the “Eth holder, but doesn’t work in the industry” edition, so we kick it off with the high-level things I’d read beyond just what you can read. So, for example, Gnosis/OpenEthereum is picking up the Parity client, but you can see that without me highlighting it.

So here’s my highlight of high-level things for Eth holders.

Some interesting findings in ConsenSys’s eth2 staking survey

Visa patent shows they are building on Ethereum

Building on ethtrader’s DONUT, Reddit unveils community points for r/fortniteBR and r/cryptocurrency subreddits. At the moment, 9000 wallets created for fortnite and just 2100 for r/cryptocurrency. Currently on Rinkeby testnet with plans to move to mainnet.

JPMorganChase decides to bank Coinbase and Gemini

ErisX launches ETH futures, physically delivered, monthly and quarterly contracts

dydx’s BTC/USDC perpetual with 10x leverage is open to the public

This BTC/USDC perpetual matters because the crypto market has been overtaken by YOLO gambling on centralized exchanges that probably trade against you as they know liquidation points and no one else does. Not a surprise, dydx’s founder says this is already the #1 most traded DeFi. Centralized exchanges get hacked all the time - not your keys not your crypto. DeFi is an improvement.

We finally have Eth futures! And they’re physically delivered, which is good. Though physical delivery requirements can lead to strange consequences (eg,negative price of oil last month!), it keeps traders honest and moors the price to the actual asset.

JPMorganChase finally banking some crypto clients is an important step for the space.

Reddit is testing letting subreddits govern themselves and pay for things using an Eth token. Very cool

Visa patented their method of digitizing dollars on Eth at the same time that their chairman said at a conference that “digital currencies could be additive to the payments ecosystem” and that they “supported” them.

In September 2018, the same Visa chairman said that “[blockchain] isn’t really at its core, for us, a good technology.”

It’s interesting that even as the crypto market continued to wane, Visa realized they needed to try to get ahead of the curve. Crypto isn’t dead.

Eth1

Geth v1.9.14 – unindex and save disk space

OpenEthereum v3. Formerly the Parity client. Support for eth/64, breaking database changes to save disk space. Deprecating light client, auto updater, and private transactions

cross-client consensus tests v7

Latest core devs call. Beiko’s notes from the call, largely around EIPs for next hard fork, eg: 2315 (evm subroutines), 2537 (precompile for curve in eth2), 2046 (reduce gas for static calls to precompiles) and 2565 (repricing the 198 precompile)

EVM+384 bit arithmetic as an alternative to EIP2537’s precompile

Discussion of a second method for resource accounting alongside gas: oil from Suhabe Bugrara, separately formulated as karma from Martin Swende. Or a counterproposal from Vitalik: per account gas limits

The case for Eth-collateralized tokenized gas at the protocol level

So the first real release of the fka Parity client. Very cool, client diversity is important and to my knowledge there are no large scale miners running anything but the Go and Rust clients, so this is important.

What’s up with the “second method of resource accounting alongside gas?” The idea is that stateless Eth will need a substantially different gas schedule for block witnesses, yet we don’t want to break existing contracts. We want backward compatibility without overly complicating the dev experience. Not an easy problem, hence the debate about the best way to do it.

Meanwhile there’s a bit of a debate about some of what goes into the next hard fork. Relatively normal stuff, some folks think we should stop doing all these precompiles (eg, bit arithmetic proposal), others think we should only do the general precompile EIP

Eth2

Latest what’s new in eth2, featuring Ben’s thoughts on timelines

Latest eth2 implementer call. Notes from Ben and Mamy, targeting June for the multi-client testnet

Schlesi testnet: Teku is fully participating and Nimbus is almost fully syncing, though there was a chain split this weekend

Proof of custody through occasional checks and slashing

Stethoscope: networking test suite

Idea from Justin Drake on putting price feed oracles in eth2 via validators, and a counter-proposal from Vitalik Buterin

The Schlesi testnet went down, but overall it has been quite stable. Nothing terribly unexpected for a testnet, and Lodestar will soon be the 5th client to join up. Slow and steady progress.

Price feed oracles got quite a bit of pushback, I think some of this is because stablecoins are having their second renaissance - something I’ll touch on later.

Proof of custody (ie, that you as a validator hold the data you say you do) through a Truebit-like game: to prevent lazy attestations, the protocol will guarantee false things, and if validators don’t point it out, then they get slashed.

Layer2

What are the true finality guarantees of state channels? Depends on liveness of layer 1 chain

We often say that state channels offer “instant finality” but this is a bit of a shorthand to say that it offers “instant finality” assuming that the underlying basechain has “liveness” (which is just blockchain-speak for “is producing blocks”)

This newsletter is made possible by Trail of Bits!

Trail of Bits recently reported and fixed 12 security issues in projects across Ethereum, some of them critical. Read more about what they were and how they found them in Bug Hunting with Crytic.

Stuff for developers

Solidity v0.6.8, some important bugfixes

Using immutables in Solidity v0.6.xx

Austin Griffith tutorial: build smart contract wallet with social recovery using React

If you haven’t watched Austin’s wtf is eth.build video, you should. It’s under 3 minutes, funny, and informative.

Running the Incubed light client with Python

OpenZeppelin Contracts v3, but modified to be safe for upgrades

Mainnet testing with your own node using Brownie

headlong: ABI v2 and RLP for the JVM

EthPM v3 – spec for v3 of Eth package manager is in last call

12 bugs found by Trail of Bits’ Crytic tool using 90+ detectors

Verifiable randomness on-chain using the Chainlink VRF

Austin’s eth.build explainer vid is great. Truly recommended - as a community we should be trying to get this in front of many devs as possible.

How long until someone wins a hackathon with eth.build + oneclickdapp or dapphero? Seems possible.

Chainlink VRF seems quite cool; PoolTogether is already integrating it.

Ecosystem

Tornado.cash finished the largest trusted setup ceremony to date, operator soon to be set to null

Some interesting findings in ConsenSys’s eth2 staking survey

A guide to building with MACI – an anti-collusion demo using SNARKs

And Tornado did burn the admin keys between then and now.

Enterprise

Visa patent shows they are building on Ethereum

Where to use the Baseline protocol: sharing business process automation with counterparties

Brave releases Mjolnir tool for easy deploying and benchmarking permissioned Eth chains

Brave is going to move their token to a separate chain, presumably with a bridge. Doesn’t seem like terrible news to me, if you have a small amount of BAT, you don’t need a strong censorship-resistance guarantee.

Application layer

Building on ethtrader’s DONUT, Reddit unveils community points for r/fortniteBR and r/cryptocurrency subreddits. At the moment, 9000 wallets created for fortnite and just 2100 for r/cryptocurrency. Currently on Rinkeby testnet with plans to move to mainnet.

Dfinity’s first Swiss employee Robert Lauko now working on Liquity stablecoin, low collateralization with algorithmic liquidation via stability pool

“Augur v2 core contracts are finalized and in a code-freeze state, and the trading UI is undergoing performance testing”

Aave changes its interest rate model. Inflection point in the curve now 8% and 90% usage.

Kyber hit 1 billion USD worth of trades

Brave at 14m MAU/5m DAU

Sai successfully shut down on May 12 and now is redeemable for ETH

Hasu: the future of cryptomoney is central banking. An analysis of Maker’s options and decisions

Utah County (Provo) in Utah offering marriage licenses certified with the hash on Eth mainnet

dydx’s BTC/USDC perpetual with 10x leverage is open to the public, and compares centralized and decentralized perpetual markets

Lots of cool stuff, some of which touched on above. Utah County is not the first local government to do something like this, but as far as I could tell, it was new. That must have been a hard sale with the crypto hope at a relative nadir. Amusingly their site was not https (not that I should judge, I’ve been lazy about that myself, usually do to my cheapness in finding hosts...ahem Tumblr)

Brave growth keeps going. It really is a superior product, it always surprises me that there are some in crypto who doesn’t use it.

One interesting trend is that we’re having a bit of a renaissance in projects trying to compete with Maker. Of course Synthetix has had quite a bit of success, though previous rounds contained some laughable attempts (Basecoin). Stablecoins have a large design space with lots of risks to tradeoff. I think the new wave of stablecoin designs has some interesting ideas. I think there’s plenty of space for more people to be successful, though I think plenty of folks are underrrating how hard it will be to compete with Maker.

Overall this felt like a good week for the app layer section, and my usual arbitrary “how much is DeFi? metric comes in at 6/10

Tokens/Business/Regulation

ErisX launches ETH futures, physically delivered, monthly and quarterly contracts

Now ~2300 WBTC on Eth versus 900 BTC on Lightning

RAC’s $TAPE launched on Zora and went from $20 to $1000. $TAPE is a token redeemable for a special edition cassette of RAC’s latest album. Interesting new model for artists to capture value

I guess “days, not weeks” dies as an Ethereum meme? Or maybe it’s like wooks and TwoWeeks, and it will live forever.

(if you don’t catch the reference, there before Eth shipped in july 2015, there was 18 months of Bitcoiners claiming that it was vaporware that was impossible and would never ship, and the eternal answer was always that the ship date was “two weeks” away....which became “two wooks” because the internet is wonderfully weird).

Meanwhile BTC keeps migrating to ETH, as the Bitcoin chain is too limited and fundamentally unsustainable so if you want to do anything with your orange memecoin, then you have to use Ethereum.

Loved seeing RAC’s $TAPE do well. While critics say this is gimmicky and perhaps not replicable, I actually tend to think the opposite. Many artists have huge fans who would pay insane amounts - artists have never done a great job at giving their fans new experiences and capturing value.

General

JPMorganChase decides to bank Coinbase and Gemini

Wired’s story on MalwareTech/Marcus Hutchins, from stopping WannaCry to FBI arrest

the main idea in HALO snark construction

Open cryptography problems: improving stealth addresses and ideal vector commitment

I love how the general section is such a mismash of the deepest crypto things and then human interest stories like about Marcus Hutchins. The Wired writer bought his story - I tend to think it’s probably slightly more complicated

I’ve been trying to figure out what to do with the calendar. I’m not excited about virtual conferences and VR. But maybe some of you are?

That’s all for this week in the annotated edition. If you made it this far, would you tweet about it or RT this? https://www.evanvanness.com/post/618575234233204736/annotated-edition-of-may-17-week-in-ethereum-news

Housekeeping

Follow me on Twitter @evan_van_ness to get the annotated edition of this newsletter, usually forthcoming in a day or so, as well as a real-time source of Eth news.

Did you get forwarded this newsletter? Sign up to receive it weekly

Permalink: https://weekinethereumnews.com/week-in-ethereum-news-may-17-2020/

Dates of Note

Upcoming dates of note (new/changes in bold):

May 18 – Book of Swarm launch

May 22-31 – Ethereum Madrid public health virtual hackathon

May 26 – last day to apply for Ethereum India fellowship

May 29-June 16 – SOSHackathon

June 17 – EthBarcelona R&D workshop

0 notes

Text

LOOM: A Proof-of-Stake token that is used to secure Loom Network's mainnet, called Basechain.

bonus.bitget.com/BK6NT

0 notes

Photo

RT @loomnetwork: Boom 💥 The first exchange to be built on Loom Basechain 🙌 https://t.co/WNpGYaptMn by 27aume on November 02, 2019 at 02:24PM

0 notes

Text

Blockchain Interoperability Solutions

The majority of interoperability solutions up till recently were mainly focused on chain interoperability across public blockchains, thereby using crypto-directed tools like sidechains (or relay chain), notary schemes and timed hash-locks. The focus however has increasingly shifted towards solutions for interoperability between private networks and/or between private networks and public blockchains.

One way to solve interoperability is to use a separate blockchain as a bridge to facilitate cross-communication. Essentially, this is a third blockchain that sits in the middle of the two blockchains and maintains a cryptographically secured timestamped ledger of the transactional and messaging activity between the two. Interoperability tools that are used range from hub and spoke, decentralised finance (DeFi) and general purpose bridges.

Another way to facilitate interoperability between systems is with off-chain or middleware systems. This so-called non-blockchain interoperability approach uses tools including atomic swaps, oracles and state channels.

Blockchain Interoperability projects

A growing number of interoperability projects have entered the scene to try to bridge the gap between the various blockchains. Their aim is to facilitate interaction between networks and ensure the concept of decentralisation is fully realised. Depended on the interoperability solutions these can be used for activities like decentralised asset exchange and decentralised message exchange. Interesting projects are Chainlink, Cosmos, Hybrix, Polkadot and Wanchain. Other examples include Aion, Ark, ICON, Transledger, and Overledger.

Chainlink

Chainlink is a decentralised oracle network, an interoperability solution to facilitate secure and trustless communication between all disparate blockchain systems. The resources mostly revolve around off-chain data to trigger smart contracts and settlement outputs like established payment systems and cloud backend. This standalone function is important for many blockchains that don’t have to interact with other blockchain protocols but do need access to externals inputs and outputs.

Chainlink nodes are able to format messaging and data from public APIs into a readable format for smart contracts. These nodes can connect to any API, whether it is a blockchain, enterprise system, Web API, or IoT device.

Chainlink is sometimes working in combination with other interoperability protocols. Chainlink has already announced partnerships with Polkadot and Ethereum to provide off-chain data to their networks. Wanchain is integrating with Chainlink to provide off-chain data to their on-chain smart contracts.

Cosmos

One of the most prominent interoperability solutions is Cosmos, very much focused on its Cosmos SDK platform. Cosmos aims to act as an ecosystem of blockchains that can scale and interoperate with each other. Cosmos is a smart contract platform that has prioritized interoperability as a critical component of their blockchain design. Their architecture is based on the so-called ‘hub-and-spoke’ system whereby a series of ‘spoke’ chains connect to a ‘central’ hub by means of inter-blockchain communication.

Cosmos is heavily reliant on validators to provide interoperability. It makes use of the so—called Byzantine fault tolerant (BFT) consensus algorithm and uses both member chains and Peg-Zones for existing chains to improve the overall ecosystem. Their end goal is to create an ‘internet of blockchains’ – a network of blockchains that can communicate with one another in a decentralised way.

The implementation of the IBC (Inter Blockchain Communication) protocol is scheduled for this year 2020. Cosmos will use the IBC protocol to allow communication between a central hub and the chains linked to the network, also called Zones. It will first only concern the interoperability of chains built on top of Cosmos SDK platform.

Hybrix

Hybrix is an open-source cross-chain solution aimed to make it easier to make cross-chain transactions, and also increase the level of ease for developers who want to offer multi-chain platforms. For that purpose Hybrix is developing an “HY” token. Each token represents an identical block of a chain and can be used to reconcile data across the entire crypto complex. Tokens form as bridges that allow transactions to be conducted on either a single chain or multi-ledger systems. Since Hybrix utilizes existing languages to build its protocol and interface, there’s no need to acquire new coding languages to use its system. Hybrix has amplified its capacity to adapt 27 major blockchains and more than 400 tokens.

Polkadot

Another project is Polkadot, which facilitates transactions and data exchange, aiming to promote interoperability between blockchains. It uses the DPoS algorithm and employs required validators which can lead to a certain degree of centralization .

The concept at Polkadot is quite similar to that of Cosmos. It allows communication between the relay chain and the parachains of Polkadot’s network. By using Parachains and Bridgechains, this approach enables to transfer both value and data. Additionally, scalability will be taken to a whole new level by running multiple parallel chains. This is a bit different from other projects which are looking to bridge the gap between blockchains as well.

The launch of their mainnet is planned for this year (2020). As for interoperability, there are no precise timelines regarding their protocols for chains implementation.

Wanchain

The Wanchain network allows interoperability between very heterogeneous blockchains like Bitcoin, Ethereum and EOS. Wanchain aims to link and facilitate communication between the different blockchains as much as possible.

Wanchain is already functional and allows communication and exchange of value and data between public and private blockchains through storeman nodes and the T-Bridge framework. The storeman node system combines two cryptographic concepts that ensure security and confidentiality of network transactions: secure multi-party computation and “Shamir’s secret sharing”.

The Wanchain project recently announced the integration of EOS blockchain and the implementation of the T-bridge framework. Wanchain’ s next challenge is to fully decentralise its network. This is planned to be finalised in 2022.

Other interoperability offerings

And there are many more interoperability projects including Aion, which is working towards integrating artificial intelligence in its consensus model. Or Ark which uses Smartbridge to link existing chains, and will also allow for the transfer of both data and value. And the Loom Network, which uses its DPoS blockchain Basechain to connect and transfer value among several blockchains, including Bitcoin, Ethereum, and Binance. A rather unknown but interesting player is Block Collider. Its proof-of-distance (PoD) consensus algorithm ensures that ledgers can operate with one another. It is also the only project that, in its current form, requires any validators.

https://www.finextra.com/blogposting/18972/blockchain-and-interoperability-key-to-mass-adoption

0 notes

Text

Working on the Damned Doggies NFT Collection. I will soon mint a few at a time on Rarible.com. What would be a good floor price? All are 1/1. Comments?

1 note

·

View note

Text

Liquid Bitcoin with Adam Back & Samson Mow - WBD224

Location: Zoom

Date: Friday 15th May

Project: Blockstream

Role: CEO & Chief Strategy Officer

Bitcoin: decentralised, permissionless, censorship-resistant and unconfiscatable. Unique properties which make it a unique form of money

For Bitcoin to keep growing, these features mustn't be compromised. However, scaling solutions for Bitcoin, may trade off some of these features for other benefits.

With the vast majority of the community in agreement that block sizes must remain small to maximise decentralisation, Bitcoin is best scaled using layered solutions. The Liquid Network, like the Lightning Network, is a layer two solution that, by sacrificing some aspects of decentralisation and censorship resistance, can improve speed and scalability.

Liquid is a project spearheaded by Blockstream and is aimed at traders, exchanges and market makers to offer faster and more confidential transactions than the Bitcoin basechain. It also adds the ability to build tokens on the network.

In this interview, I talk to Adam Back and Samson Mow Blockstream's CEO & Chief Strategy Officer. We discuss The Liquid Network, the tradeoffs between Liquid and the basechain, how it differs from Lightning network and tokenised securities.

from Money 101 https://letstalkbitcoin.com/blog/post/liquid-bitcoin-adam-back-samson-mow via http://www.rssmix.com/

0 notes