#Bankruptcy Leads for Attorneys

Explore tagged Tumblr posts

Text

Best Bankruptcy Leads for Attorneys Faceless Digital

Stop wasting time on unqualified leads! Our premium bankruptcy leads help attorneys connect with real clients ready to take action. We provide exclusive, high-quality leads that convert, allowing you to maximize revenue and grow your firm. No cold calling—just real, high-intent prospects. Whether you're looking for consumer or business bankruptcy cases, we deliver leads that turn into paying clients. Start increasing your caseload today! Get high-quality bankruptcy leads that help your firm succeed. Sign up now and watch your firm grow!

0 notes

Text

Drive Business Success with Premium Auto Insurance Leads

In the competitive world of auto insurance, acquiring high-quality leads is crucial for sustained growth and success. Premium auto insurance leads offer a strategic advantage, providing businesses with targeted, motivated prospects. By investing in the best auto insurance leads, companies can optimize their marketing efforts, increase conversion rates, and ultimately boost revenue.

The Importance of Quality Auto Insurance Leads

Understanding the Value of Premium Leads

The auto insurance market is saturated with providers vying for customers' attention. To stand out, businesses need to focus on acquiring premium leads—prospects who are actively seeking auto insurance and are ready to make a purchase decision. These high-intent leads can significantly reduce the time and effort spent on cold calling and chasing uninterested prospects.

The Impact on Conversion Rates

Utilizing the Best Auto Insurance Leads ensures that your sales team spends their time and resources on prospects with a higher likelihood of conversion. This not only improves the efficiency of your sales process but also enhances the overall customer experience, leading to higher satisfaction rates and better retention.

Strategies to Acquire Premium Auto Insurance Leads

Leveraging Advanced Data Analytics

To acquire the best auto insurance leads, businesses must leverage advanced data analytics tools. These tools can analyze vast amounts of data to identify patterns and trends, helping you to target prospects more effectively. By understanding the demographics, behaviors, and preferences of your ideal customers, you can tailor your marketing strategies to attract high-quality leads.

Utilizing Multi-Channel Marketing

Diversifying your marketing efforts across multiple channels can increase your reach and visibility. Utilize digital marketing techniques such as search engine optimization (SEO), pay-per-click (PPC) advertising, social media marketing, and email campaigns. By maintaining a strong presence on various platforms, you can capture the attention of potential customers wherever they are.

Building Strategic Partnerships

Partnering with complementary businesses can also help in acquiring premium auto insurance leads. For instance, collaborating with car dealerships, repair shops, or financial advisors can provide access to a pool of potential customers who are already in need of auto insurance services. These partnerships can create a steady stream of high-quality leads.

Maximizing the Value of Your Leads

Implementing a Robust Lead Management System

To fully capitalize on the best auto insurance leads, it’s essential to have a robust lead management system in place. This system should track and manage leads throughout the sales funnel, ensuring that no opportunity is missed. Automated follow-ups, personalized communication, and detailed analytics can help in nurturing leads and converting them into loyal customers.

Training and Empowering Your Sales Team

A well-trained sales team is crucial for effectively handling premium auto insurance leads. Continuous training programs should focus on improving communication skills, product knowledge, and customer relationship management. Empower your team with the tools and resources they need to succeed, such as CRM software and sales automation tools.

Personalizing the Customer Experience

In today's market, personalization is key to winning over customers. Use the data collected from your leads to offer personalized solutions that meet their specific needs. Tailored quotes, customized policy options, and targeted marketing messages can enhance the customer experience and increase the likelihood of conversion.

Measuring Success and Adjusting Strategies

Analyzing Key Performance Indicators (KPIs)

Regularly analyze KPIs such as conversion rates, cost per lead, and customer acquisition costs to measure the success of your lead generation efforts. These metrics can provide valuable insights into the effectiveness of your strategies and highlight areas for improvement.

Adjusting Your Approach

The auto insurance market is dynamic, and consumer preferences can change rapidly. Stay agile by continuously reviewing and adjusting your lead generation strategies based on the latest market trends and customer feedback. This proactive approach ensures that you remain competitive and continue to attract the best auto insurance leads.

#Lead Generation for Health Insurance#Health Insurance Leads Generation#Ping Post Software#Health Insurance Leads#Lead Distribution Systems#Ping Post Lead#Ping and Post#Payday Loans Leads#Ping Tree System#Ping Tree Software#Ping Post Lead Distribution#Ping Post Lead Distribution Software#Lead Distribution System#Leads Distribution Software#Buy Health Insurance Lead#Leads For Payday Loan#Solar Industry Leads System#Best Auto Insurance Leads#Mortgage Loan Leads System#Workers Compensation Leads#Restaurants Lead Generation#Immigration Law Lead Generation#Estate Planning Lead Generation#Personal Injury Lead Generation#Buy Drug Injuries Lead#Social Security Disability Legal Leads#Family Law Lead Generation#Bankruptcy Leads for Attorneys

0 notes

Text

I’m pissed. I am so pissed right now. (Super long, very personal rant below)

I’m an attorney. A lawyer. My job is to advise my clients to the best of my ability of what legal options they have and which acts may be in their best interest. That’s why one of the other names for my job is counselor.

It is not to get more clients. It is not to file more bankruptcies. My job, my ethical obligation, is to provide my professional expertise to clients in relation to pursuing a bankruptcy.

Which means sometimes my ethical duty is to advise clients that filing a bankruptcy is the worse option for their situation and other steps would serve them better to reach their goals.

So when a client who makes less than the median income (which is fairly low, especially with inflation) comes in owning their house in full (meaning lots of value in the house to pay off debts), it is my job, my ethical obligation, to warn her that filing bankruptcy will mean she has to pay every single cent of her debts back. That she will be handing over almost half of her pay every month to the bankruptcy court to pay back her creditors. Or else the bankruptcy trustee has the right to sell her house.

And after discussing her situation with the senior attorney, turns out that it’s actually a better option for her to take out a small home equity loan and negotiate for lower debt payoffs for her credit cards and personal loans. It’s a lower interest rate, she gets a lot more leeway before her house is at risk, it’s quicker, and it will preserve her credit score. In every conceivable way it’s a better option for her.

So I call her to discuss that there are other options for her before I sink hours into preparing her case.

This woman freaks the fuck out. She’s convinced the loan will lead to her losing her house. She demands to know why I would even suggest it. She implies I have no clue what I’m doing and am just trying to take advantage (which is… no? I’m telling you that you’d be better off not using our services). I try to calm her down and ask for a few days to put together the numbers to show her what her options will look like. She agrees to a phone call in two days.

Two days later, she sends me a basic email saying she no longer wants to go forward with the bankruptcy. Silly me thinks that means she’s given thought and realized that a 3.5-5% small loan and negotiating payoffs is better than 5 years at 8-18% interest plus attorney fees.

Wrong! She also emails one of the partners and writes a nasty message about me and how “incompetent” I am! Because I suggested a home equity loan! Because I did my ethical duty! And I found this out because I went to add a note to her file about giving her a refund and found a note from the partner about her complaints about me.

And I do not trust the partners to take my side. I did the right thing. I took the right actions. I know I did. And the Senior attorney will back me up! We literally just had a discussion that legal ethics requires that at times we have to advise clients not to file bankruptcy, even if that means we lose their business.

But I cannot believe that the partners will stand behind my actions. I can’t. Not after the last year. Too many times have they assured me that they have my back only to throw me under the bus the moment they actually have to prove it.

A client is rude and combative to me and my paralegal? Makes me deeply uncomfortable and keeps on insisting on coming into the office so he can attempt to railroad me by physical intimidation into doing what he wants instead of the actual correct legal actions? Partners says he understands and that he’s okay if we turn this client away. Then he calls the client, tells them I’m also on the line, and immediately rolls over because the asshole isn’t rude to him. And I have another month of near constant harassment and arguments and passive aggressive insults.

A client gives off creepy vibes? Again insists on coming into the office for every little thing? Has a criminal record for domestic issues and an active criminal case open against him for pedophilia? Oh well. He paid a lot up front so guess I have no choice but to keep representing him. For the next 5 years.

Client starts being threatening and aggressive to our paralegal before we even meet with him? Demands to be seen and threatens to come into our office even though we are booked all afternoon? Gives the former criminal prosecutor senior attorney bad vibes before she’s even seen him? Meet with him anyway! Oh he just lost his job because he threatened his HR? Has been arrested for domestic violence? Just attempted to physically intimidate his now former boss and had the cops called him? That’s fine! We have security concerns? Oh well, they’ll think about it during the partners meeting next month.

I’d like to take the time to learn how to do post filing work or how to file bankruptcies in the neighboring district that I actually live in? Tough. More front end work for a court that’s literally on the other side of the state! And if that doesn’t keep me occupied, they’ll send me front end stuff from the other side of the country!

So I really don’t trust that when I tell them I was doing my ethical obligation and making my client aware that there are better options that they will take my word over hers. I can’t. They’ve shown me that’s not how they think. It’s being a business first, with being a law practice a distant second, and mentoring new attorneys a far away third. Caring for our staff is barely a blip on the horizon for them.

But I know I did the right thing. And if that client wants to go to another firm and pay most of her paycheck to the trustee every month, fine by me. And if they try to lecture me about how I “handled it poorly” and should have just filed it without saying anything, I can’t guarantee I won’t just walk out.

I’ve got contract work. I’ve been approached by headhunters. One literally emailed me this morning. I like this work, but for once I’m not scared to walk away.

#fury's life#fury’s a lawyer#and I will always be a lawyer before I am a businesswoman#I couldn’t live with myself otherwise#personal#fuck this firm#I thought I was just getting burnt out#and a week off would allow me to come back in better spirits#but this week has sucked#and it’s not burnout that’s making work harder than it has to be#it’s like they’re trying to ruin me for anything but being a replaceable cog in their fast law machine#so I can’t leave#fuck. that.

5 notes

·

View notes

Text

On September 19th 1778, Henry, Lord Brougham, the Scottish Whig statesman and jurist was born in Edinburgh.

Henry Brougham, the eldest son of Henry Brougham and Eleanora Syme Brougham, was born at the top of the West Bow, aged 14 he was enrolled at the University of Edinburgh, Henry Brougham displayed a remarkable talent for learning in a city steeped in the cosmopolitanism of the Scottish Enlightenment

He made his way to London, where he began a long career as a Whig politician and reformer. Trained as a lawyer and called to both the Scottish and English bars, Brougham made a name, as well as a substantial income, in this profession. The legal victory for which he acquired the most recognition was his 1820 defense of Queen Caroline in the House of Lords. Brougham had served as her legal advisor since 1812 and became her attorney general when George IV insisted on a divorce soon after inheriting the throne. After Brougham delivered a speech that lasted for two days, the bill to dissolve the royal marriage passed the Lords with only a handful of votes, which convinced the government to drop the matter and avoid what promised to be a crushing defeat in the Commons. As the public demonstrations celebrating the queen's victory demonstrated, popular opinion was firmly with the queen, and thus also with Brougham.

Commentators at the time recognized that Brougham's rhetorical skills far surpassed his understanding of complex legal issues. His particular talents were perfectly suited for politics. He began his political career in journalism, when in 1802 he helped Sydney Smith, Francis Horner, and Francis Jeffrey establish The Edinburgh Review, a quarterly periodical with a strong Whig bias that soon became a leading platform for political debate. I have posted about The Review and it's founders inprevious posts. Brougham frequently contributed articles, which in the first eight years of the Review's run numbered over one hundred. Brougham entered Parliament for the first time in 1810 as MP for Camelford. Though he lost and regained seats in Parliament over the years, he nevertheless managed to attain high political office by serving as lord chancellor from 1830 to 1834 in the administrations of the prime ministers Charles Grey and Lord Melbourne.

Brougham was routinely associated with the radical wing of the Whig Party, since his positions reflected those of many nineteenth-century reform movements. He was an early supporter of the abolitionists and promoted their efforts to end the slave trade.

Brougham encouraged one of the most significant political shifts of the century by making parliamentary reform a main tenet of his election campaign in Yorkshire in 1830 and then by helping to secure passage of the 1832 Reform Act.

is interest in educational policy took him in several directions. First, in 1820 he proposed a bill promoting publicly funded education; the bill failed, but Brougham remained committed to the cause. Second, in 1826 he founded the Society for the Diffusion of Useful Knowledge, which published cheaply priced works aimed at the working classes. And third, he was among the active supporters of England's first nonsectarian university, the Unversity of London.

Brougham became Parliament's most consistent champion of law reform, in part because in 1828 he delivered a brilliant six-hour speech that turned law reform into a popular cause. He established the judicial committee of the Privy Council, a central criminal court, and bankruptcy courts, and he also laid the foundation for a county court system.

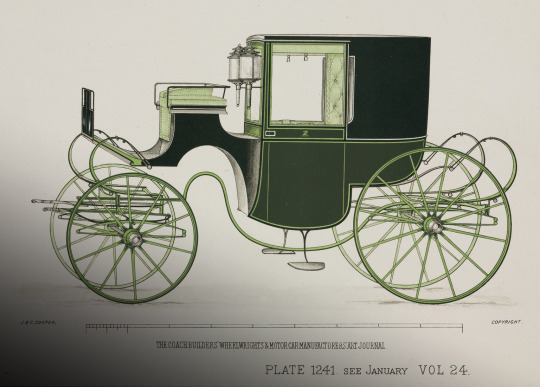

Brougham had an interest in science as well as politics. He was a fellow of the Royal Society and was credited with designing the brougham, a four-wheeled carriage. He died and was buried at Cannes, where his frequent residence during the last three decades of his life helped make the French Mediterreanean town a destination for British tourists.

13 notes

·

View notes

Text

How Effective is the “Loss Mitigation Program” in Chapter 13 Cases?

In the realm of bankruptcy law, Chapter 13 cases bring a unique perspective to the table. Among the various tools and programs available to debtors seeking financial relief, the “Loss Mitigation Program” stands out as a pivotal element. This program allows the court to encourage and supervise debtors’ modification efforts. But how effective is it, and how widespread is its implementation across the United States?

The Purpose of the Loss Mitigation Program

Understanding the Core Objective

The Loss Mitigation Program was established to address a fundamental issue within Chapter 13 bankruptcy: the need to prevent unnecessary foreclosures. Its primary goal is to facilitate communication between debtors and creditors, encouraging the modification of mortgage terms to make repayments more manageable.

Encouraging Debtors’ Efforts

Debtors are often faced with the daunting prospect of losing their homes due to mortgage arrears. The Loss Mitigation Program empowers them to actively engage in modifying their mortgage agreements, striving for a more favorable outcome.

The Mechanics of the Program

Court Supervision

One of the unique aspects of the Loss Mitigation Program is the active involvement of the bankruptcy court. The court oversees the process, ensuring that both debtors and creditors participate in good faith negotiations.

youtube

Modification Options

Debtors can explore various modification options, including extending the loan term, reducing interest rates, or even lowering the principal balance. These adjustments aim to create a more affordable repayment plan.

Effectiveness Across Judicial Districts

Variability in Implementation

The implementation of the Loss Mitigation Program is not uniform across all judicial districts in the United States. While some districts fully embrace the program’s potential, others may not prioritize it as highly.

Measuring Success

Effectiveness varies from one district to another. Success is often measured by the number of modified mortgage agreements that prevent foreclosure and allow debtors to retain their homes.

Judicial Districts Embracing the Program

Leading the Way

Certain judicial districts have championed the Loss Mitigation Program, recognizing its potential to save homes and stabilize communities. These districts actively promote and implement the program.

Success Stories

Real-life success stories from debtors who navigated Chapter 13 cases with the help of the Loss Mitigation Program highlight its positive impact on families and communities.

Challenges and Limitations

Potential Roadblocks

While the Loss Mitigation Program has proven effective in many cases, it is not without challenges. Some creditors may be hesitant to participate, and debtors must meet certain criteria to qualify.

The Importance of Legal Counsel

Navigating the complexities of Chapter 13 bankruptcy and the Loss Mitigation Program often requires legal expertise. Debtors are encouraged to seek qualified attorneys to guide them through the process.

Conclusion

In conclusion, the “Loss Mitigation Program” in Chapter 13 cases serves as a powerful tool to prevent unnecessary foreclosures and help debtors retain their homes. Its effectiveness varies across judicial districts in the United States, with some districts embracing it wholeheartedly, while others may not prioritize its implementation. Success stories underscore the positive impact of this program on individuals and communities. However, challenges and limitations exist, highlighting the importance of legal counsel for debtors navigating this complex process.

2 notes

·

View notes

Text

Donald Trump is expected to be indicted this week by a Manhattan grand jury following an investigation by Manhattan District Attorney Alvin Bragg Jr. into whether Trump’s alleged payment of hush money to former porn star Stormy Daniels rose to felony-level criminality on the part of the ex-president. Once again, Trump is facing court over allegedly shady dealings, and his chief nemesis is a Black man, only this time that Bragg isn’t trying to rent one of Trump’s apartments, he’s seeking a historic conviction that could mark the first time a former president ends up incarcerated.

If it feels like Trump has spent the last 50 years being sued over his business practices and antagonizing Black people, your instinct isn’t far off. In 1973, the Justice Department sued Trump for discriminating against Black prospective tenants in his then rental real estate portfolio. Trump settled, and to this day claims he did nothing wrong. That lawsuit foreshadowed two themes in Trump’s life that this week could also begin his downfall: court battles over his business practices and tussles with Black folks who refused to be cowed by his racist public policy and rhetoric.

Since then, Trump been accused of jerking contractors who worked on his construction sites out of their money. The Trump Organization reorganized under federal bankruptcy protection three times. The company was convicted last year of tax fraud. He bought an infamous full-page New York Times ad asking for the death penalty (which didn’t exist in New York at the time) for five Black teenagers who were ultimately exonerated for the rape of a white woman who was jogging in Central Park. His presidential campaign and four years in the White House centered on anti-Black and anti-immigrant demagoguery.

So you’re not wrong if you also think it’s fitting that since leaving office, the biggest threats to his fortune and his freedom are investigations led by three Black prosecutors: Bragg, Fulton County District Attorney Fani Willis, whose office could still indict Trump over his attempts to undo Georgia’s 2020 election results, and New York Attorney General Letitia James, who is suing the Trump Organization in civil court over the kind of accounting practices at the company’s criminal conviction.

Trump has tried hard to delay or derail all those investigations. He challenged subpoenas. He filed an unsuccessful countersuit against James. He made veiled threats against Willis. He was seen sticking a banana in the tailpipe of Bragg’s chauffeured SUV (ok, that didn’t happen but you can’t stop seeing the visual, can you?). As late as Monday morning, his legal team filed paperwork to try to get Willis thrown off the case and to seal her grand jury’s report, which recommends criminal charges against multiple, unnamed people. Wanna guess who one of those people just might be? So far, none of it has worked.

Still, that it’s Bragg whose investigation appears to have reached the finish line first is ironic. A year ago this week, I questioned whether Bragg was pulling punches on Trump after one of the former lead prosecutors from Bragg’s team wrote a scathing resignation letter that accused his ex-boss of ignoring overwhelming evidence that Trump had committed multiple felonies. Back then, it looked like if any of the investigations against Trump would implode, it would be Bragg’s.

I’ve interviewed Bragg several times since and asked him directly about the Trump investigation. Every time, he was measured and cautious with his words, demure about discussing an ongoing grand jury proceeding. But never once did he close the door on the idea that his office would prosecute Trump if evidence led the grand jury to indict. And as I noted in last year’s piece, it’s pretty easy for New York prosecutors to get grand juries to bring charges if they really want to.

Of course, an indictment is a long, long way from a conviction and the trial of a former president–especially one that would play out in a New York courtroom–would be a spectacle that would do more pay-per-view buys than a Floyd Mayweather fight. But if boxing is the appropriate metaphor for Trump’s current legal woes, maybe with all his antagonizing, he finally picked the wrong opponent, somebody he couldn’t push around the ring too easily. Somebody willing to punch back, or even go on the offensive. Maybe this time, he finally loses.

#Will This Black Man Be Donald Trump's Downfall?#Alvin Bragg#NY State Prosecutors#donald trump#Stormy Daniels

3 notes

·

View notes

Text

Verified Solicitor Contact Database USA

Verified Solicitor Contact Database USA

Verified Solicitor Contact Database USA – A Powerful Resource for Law Firm Marketing.

In today’s competitive legal industry, having access to an accurate and verified solicitor contact database is essential for law firms, legal service providers, and marketing professionals. A well-structured Solicitor Contact Database USA helps law firms connect with the right attorneys, legal professionals, and decision-makers, enabling effective marketing campaigns and business expansion.

At Lawyersdatalab.com, we provide a Verified Solicitor Contact Database USA, ensuring law firms have access to up-to-date and high-quality solicitor contact information for outreach, networking, and client acquisition.

List of Data Fields

Our verified database includes essential solicitor contact details, such as:

✅ Full Name – The solicitor’s complete name for personalized outreach ✅ Firm Name – The law firm or organization they are associated with ✅ Practice Area – Their specialization (e.g., corporate law, family law, real estate law) ✅ Email Address – Verified solicitor email for direct communication ✅ Phone Number – Contact number for professional engagement ✅ Office Address – Physical location of the solicitor’s firm ✅ State & City – Geographic details for targeted marketing ✅ Website URL – The official website of the law firm or solicitor ✅ Bar Association Membership – Information on their bar accreditation ✅ Years of Experience – Understanding their expertise and legal background

This structured and validated database ensures law firms, legal tech companies, and marketing professionals can reach solicitors with precision.

Benefits of the Verified Solicitor Contact Database USA

1. Enhancing Law Firm Marketing Efforts

With verified solicitor contact data, law firms can directly engage with legal professionals, boosting their marketing success and client acquisition efforts.

2. Expanding Professional Network

Having access to solicitor contacts across the USA allows firms to establish partnerships, referrals, and collaborations, strengthening their business connections.

3. Targeted Outreach for Legal Services

Law firms can filter solicitors by location, practice area, or experience, ensuring highly targeted marketing campaigns with a better response rate.

4. Lead Generation & Client Acquisition

Legal service providers, consulting firms, and law tech companies can generate leads efficiently, focusing on solicitors who require their services.

5. Improved Email Marketing & Cold Outreach

With accurate solicitor email lists, legal marketers can launch effective email campaigns, promoting services, events, and legal solutions with confidence.

6. Save Time & Resources

Instead of manually searching for solicitor details, law firms can leverage an already verified database, ensuring faster and more efficient marketing execution.

7. Competitive Edge in Legal Marketing

A high-quality solicitor database gives firms an advantage over competitors by providing direct access to key decision-makers in the legal sector.

Why Choose LawyersDataLab.com?

At LawyersDataLab.com, we specialize in providing high-quality, accurate, and verified legal contact databases, ensuring businesses connect with the right legal professionals.

✔ 100% Verified Data – No outdated or incorrect solicitor contacts ✔ Customizable Lists – Filter solicitors by practice area, location, and more ✔ Multiple Formats – Get data in CSV, Excel, or API for seamless integration ✔ Regularly Updated Database – Stay ahead with fresh solicitor contacts ✔ 24/7 Customer Support – Assistance for all your database needs

Popular Lawyers Mailing List

Divorce Attorney Email Marketing List

California Bankruptcy Lawyers Email List

New Mexico Attorney Email Database

Verified Massachusetts Lawyers Email List

Verified Attorney Mailing List

Verified Texas Lawyers Email List

Verified Wyoming Lawyers Email List

Verified Washington Attorney Email Database

Bankruptcy Lawyers Email List

Family Lawyers Email List

Best Verified Solicitor Contact Database in USA

Detroit, Chicago, New Orleans, San Francisco, Portland, Bakersfield, Long Beach, Oklahoma City, Miami, Omaha, Orlando, Sacramento, Raleigh, Seattle, Milwaukee, Wichita, Los Angeles, Memphis, Kansas City, Columbus, Phoenix, Austin, San Antonio, Indianapolis, Virginia Beach, Arlington, Fort Worth, Tucson, Philadelphia, Colorado Springs, Baltimore, Nashville, Washington D.C., Houston, Charlotte, Tulsa, Denver, Honolulu, Louisville, Dallas, Albuquerque, El Paso, Boston, San Jose, New York, Atlanta, San Diego, Las Vegas, Fresno, Jacksonville and Mesa.

Get Access to the Verified Solicitor Contact Database USA Today!

Unlock powerful legal marketing opportunities with a verified solicitor email and contact database. Whether you are a law firm, legal consultant, or marketing professional, our data solutions help you reach the right solicitors effectively.

📩 Contact us at: [email protected]🌐 Visit our website: LawyersDataLab.com

🚀 Supercharge your legal marketing with accurate solicitor contact data!

#verifiedsolicitorcontactdatabaseusa#solicitormailinglistusa#legalmarketing#lawyersemaildatabase#lawyersdatalab#legaloutreach#attorneycontactlist#datadrivenmarketing#legalconnections#alabamalawyersmailinglis

0 notes

Text

Navigating Legal Challenges: Jeffrey A. Cancilla’s Advice for Individuals and Businesses

Jeffrey A. Cancilla, a distinguished attorney with over 20 years of experience, has become a trusted name in the legal world. Known for his expertise in bankruptcy, real estate, immigration law, and civil litigation, Cancilla offers invaluable advice for individuals and businesses navigating complex legal challenges. His insights reflect a blend of academic excellence, professional skill, and a deep commitment to client advocacy.

Understanding Your Legal Rights and Responsibilities

One of the fundamental pieces of advice from Jeffrey Cancilla is the importance of understanding your legal rights and responsibilities. Whether you are an individual facing bankruptcy or a business dealing with a real estate dispute, having a clear grasp of the legal landscape is crucial. Cancilla emphasizes the need to stay informed about relevant laws and regulations, as this knowledge empowers you to make informed decisions and protect your interests. For more insights into his professional journey and legal expertise, visit his Medium profile.

The Value of Professional Guidance

Navigating legal issues can be overwhelming, and attempting to handle complex cases without professional guidance can lead to unfavorable outcomes. Cancilla advises individuals and businesses to seek the assistance of a qualified attorney who specializes in the relevant area of law. An experienced attorney can provide strategic advice, represent your interests, and help you achieve the best possible outcome. Cancilla’s own career is a testament to the value of professional legal guidance. Discover more about his achievements and career on Crunchbase.

Effective Communication and Documentation

Effective communication and thorough documentation are essential components of successful legal practice. Jeffrey Cancilla highlights the importance of clear and transparent communication with all parties involved in a legal matter. This includes clients, opposing parties, and legal representatives. Additionally, maintaining detailed and accurate records can be pivotal in supporting your case. Proper documentation not only helps establish the facts but also ensures that you are prepared for any legal challenges that may arise. For additional legal resources and publications, visit his publications list.

The Importance of Ethical Practice

Ethical practice is a cornerstone of Jeffrey Cancilla’s approach to law. He advises attorneys and legal professionals to uphold the highest standards of integrity and professionalism. This includes being honest with clients, opposing parties, and the court, as well as avoiding conflicts of interest. By adhering to ethical principles, legal professionals can build trust, maintain their reputation, and contribute positively to the legal community.

Staying Informed and Adapting to Change

The legal landscape is constantly evolving, with new laws, regulations, and precedents emerging regularly. Jeffrey Cancilla emphasizes the importance of staying informed about these changes and adapting your practice accordingly. Continuous learning and professional development are key to maintaining expertise and providing effective representation. Cancilla’s dedication to lifelong learning is evident in his contributions to legal scholarship and his active engagement in professional organizations.

In Conclusion

Jeffrey A. Cancilla’s advice for individuals and businesses navigating legal challenges is a reflection of his extensive experience and commitment to client advocacy. By understanding your legal rights, seeking professional guidance, prioritizing effective communication and documentation, upholding ethical standards, and staying informed about legal developments, you can navigate complex legal issues with confidence. Cancilla’s legacy of legal excellence serves as an inspiration for legal professionals and clients alike, demonstrating the impact of dedication, integrity, and expertise in the field of law.

0 notes

Text

Bankruptcy Leads for Attorneys in Arizona: Faceless Digital

Attract exclusive bankruptcy leads for attorneys with Faceless Digital’s expert bankruptcy lead generation services. Based in Arizona, our digital marketing agency helps law firms secure high-quality leads tailored to their specific practice areas. We use innovative strategies to ensure you reach clients actively seeking bankruptcy legal assistance. Let us handle your marketing while you focus on delivering outstanding legal services.

0 notes

Text

Achieving Solar Industry Success: Mastering a High-Converting Leads System

The solar industry is experiencing rapid growth as more individuals and businesses seek sustainable energy solutions. In this competitive market, having a robust leads system is crucial for success. This blog will explore how to build a high-converting solar industry leads system that can propel your business to new heights.

Understanding the Importance of a Solar Industry Leads System

A well-designed Solar Industry Leads System is the backbone of any solar business. It not only helps in attracting potential customers but also ensures that these leads are nurtured and converted into loyal clients. By investing in a high-converting leads system, you can significantly increase your chances of success in the solar market.

Key Components of a High-Converting Leads System

1. Lead Generation Strategies

A. Content Marketing

Content marketing is a powerful tool for generating leads in the solar industry. By creating valuable and informative content, you can attract potential customers who are interested in solar energy solutions. Blog posts, whitepapers, and case studies can position your business as an authority in the field.

B. SEO and Keyword Optimization

Search Engine Optimization (SEO) is essential for improving your website's visibility on search engines. By optimizing your website with relevant keywords such as "Solar Industry Leads System" you can attract more organic traffic. Ensure that your content is not only keyword-rich but also provides real value to your audience.

C. Social Media Marketing

Social media platforms offer an excellent opportunity to connect with potential customers. By sharing engaging content and interacting with your audience, you can build a strong online presence. Utilize platforms like Facebook, LinkedIn, and Instagram to promote your solar solutions and generate leads.

2. Lead Nurturing Techniques

A. Email Marketing Campaigns

Email marketing is an effective way to nurture leads and keep them engaged with your business. By sending personalized and informative emails, you can build trust and guide potential customers through the buying journey. Use segmentation to tailor your messages to different audience groups.

B. Webinars and Online Workshops

Hosting webinars and online workshops is a great way to educate your audience about the benefits of solar energy. These events can help you establish your expertise and build relationships with potential customers. Make sure to follow up with attendees to keep the conversation going.

C. CRM Systems

Customer Relationship Management (CRM) systems are essential for managing your leads effectively. A good CRM system allows you to track interactions, segment your leads, and automate follow-up processes. This ensures that no lead falls through the cracks and that you can provide timely and relevant information.

3. Conversion Optimization

A. Landing Pages

Landing pages are critical for converting visitors into leads. Ensure that your landing pages are well-designed, with clear calls-to-action (CTAs) and relevant information. A/B testing different elements of your landing pages can help you determine what works best for your audience.

B. Testimonials and Case Studies

Including testimonials and case studies on your website can build trust and credibility. Potential customers are more likely to convert if they see that others have had positive experiences with your solar solutions. Highlight real-life success stories to demonstrate the value of your offerings.

C. Follow-Up Strategies

Timely and personalized follow-up is key to converting leads. Whether it's a phone call, email, or meeting, ensure that you address the specific needs and concerns of your leads. By providing tailored solutions, you can increase the likelihood of conversion.

FAQs

What is a Solar Industry Leads System?

A Solar Industry Leads System is a structured approach to generating, nurturing, and converting leads specifically for the solar energy market. It involves various strategies and tools to attract potential customers and guide them through the sales funnel.

How can content marketing help in generating solar industry leads?

Content marketing helps by providing valuable information that attracts potential customers. By establishing your business as an authority in the solar industry, you can build trust and generate more leads.

Why is SEO important for a Solar Industry Leads System?

SEO improves your website's visibility on search engines, making it easier for potential customers to find you. By optimizing your content with relevant keywords such as "Solar Industry Leads System" you can attract more organic traffic and generate more leads.

How do CRM systems contribute to lead management?

CRM systems help manage leads by tracking interactions, segmenting audiences, and automating follow-up processes. This ensures that leads are nurtured effectively and increases the chances of conversion.

What role do testimonials and case studies play in conversion?

Testimonials and case studies build trust and credibility. They provide real-life examples of how your solar solutions have helped others, making potential customers more likely to convert.

Building a high-converting Solar Industry Leads System requires a combination of effective lead generation, nurturing techniques, and conversion optimization. By implementing the strategies discussed in this blog, you can enhance your lead system and achieve greater success in the solar market. Remember, the key to success lies in providing value to your potential customers and guiding them through their buying journey with personalized and timely interactions.

#Solar Industry Leads System#Best Auto Insurance Leads#Mortgage Loan Leads System#Workers Compensation Leads#Car Title Loan Software#Restaurants Lead Generation#Immigration Law Lead Generation#Estate#Planning Lead Generation#Buy Debt Collection Legal Leads USA#Employment Law Lead Generation#Personal Injury Lead Generation#Buy Drug Injuries Lead#Social Security Disability Legal Leads#DUI Leads for Attorneys#Family Law Lead Generation#Buy Criminal Defense Legal Leads#Bankruptcy Leads for Attorneys#Auto Accident Lead Generation#Ping Tree System#Ping Tree Software#Ping Post Software#Ping Post Lead Distribution#Ping Post Lead Distribution Software#Lead Distribution Software#Lead Distribution System#Leads Distribution Software#Health#Insurance Leads#Buy Health Insurance Leads

0 notes

Text

Grow My Firm Online only sell exclusive best legal leads for lawyers. While many other lead generation companies sell the same lead to all the competition, we only distribute the lead once. This means that your law firm will be the only law firm calling on these leads. We also offer a return guarantee. If the lead does not meet our quality standards, you will be returned credit for a better lead opportunity. Finally, you will be assigned a friendly account manager to aid in your lead generation marketing. This means your lead generations can be customized to fit what you are looking for. By personalizing your marketing campaigns, we feel that we can generate the best legal leads for your firm in the market.

#social security disability leads for lawyers#legal leads for attorneys#best legal leads for attorneys#motor vehicle accident leads for lawyers#motor vehicle accident leads for attorneys#best mass tort leads for law firms#mass action leads#best mass tort marketing firm#best legal leads for lawyers#law firm marketing strategies

0 notes

Text

Finding a Fresh Start in Las Vegas: The Importance of Bankruptcy and Debt Relief Services

In today’s economic climate, many people are facing overwhelming financial struggles. From mounting credit card bills to medical expenses, the pressure to keep up with payments can be daunting. For many, this leads to considering bankruptcy or debt relief as viable options to regain financial stability. Bankruptcy Vegas has become a critical topic of conversation as individuals seek solutions to their debt woes in the city. Las Vegas, known for its vibrant entertainment industry, also has a significant population that requires financial assistance. Navigating through these options can be confusing, but understanding the process of bankruptcy and debt relief can pave the way for a fresh start.

What is Bankruptcy and How Does it Help in Las Vegas?

Bankruptcy is a legal process that allows individuals or businesses to eliminate or restructure their debts under the protection of the federal court system. In Las Vegas, many residents struggle with debt, often turning to Bankruptcy Vegas professionals to guide them through the process. When a person is unable to pay off their debts, bankruptcy provides a way to obtain financial relief while keeping certain assets protected. The process can help individuals eliminate unsecured debts such as credit cards or medical bills, allowing them to start over without the constant burden of financial stress.

Filing for bankruptcy isn’t the only solution, though. There are two main types of bankruptcy for individuals: Chapter 7 and Chapter 13. Chapter 7 allows for the liquidation of assets to pay off creditors, while Chapter 13 is more of a repayment plan, enabling individuals to reorganize their finances and settle debts over time. Depending on one’s financial situation, the guidance of a bankruptcy attorney can determine which type of bankruptcy is most suitable. For those in Las Vegas, consulting a lawyer specializing in Bankruptcy Vegas can ensure the process runs smoothly, leading to a new beginning.

The Importance of Las Vegas Debt Relief Options

In addition to bankruptcy, there are other forms of debt relief that individuals in Las Vegas can explore. Las Vegas Debt Relief options can offer tailored solutions for individuals who may not qualify for bankruptcy or wish to avoid it. These options include debt settlement, debt consolidation, and credit counseling. Debt settlement allows individuals to negotiate with creditors to settle debts for less than the full amount owed, often with a lump sum payment. Debt consolidation involves combining multiple debts into a single loan, making it easier to manage payments and reduce interest rates.

Credit counseling is another valuable option for those who are struggling to make ends meet. It provides individuals with financial education and budgeting strategies to improve their situation. In Las Vegas, many companies offer these services to residents seeking a way out of their financial troubles. Working with an expert in Las Vegas Debt Relief can help create a customized plan that meets the specific needs of the individual and sets them on a path toward financial freedom.

How to Choose the Right Path to Financial Freedom in Las Vegas

When considering bankruptcy or debt relief options, it is important to understand that every individual’s financial situation is unique. While Bankruptcy Vegas may be the right choice for some, others might benefit more from exploring alternative debt relief options. It is essential to seek professional advice from a financial expert who understands the intricacies of the laws surrounding bankruptcy and debt relief. Having the right guidance ensures that individuals make informed decisions that are in their best interest and offer the highest likelihood of success.

If you are currently facing financial struggles in Las Vegas, remember that there are solutions available to help you regain control of your finances. Consulting with a reputable bankruptcy attorney or debt relief specialist can provide clarity and direction on which options best suit your needs. For those interested in getting started, afreshstartlaw.com offers expert advice and services to help individuals through their financial challenges. Take the first step toward financial freedom today and explore the options available to you in Las Vegas.

1 note

·

View note

Text

How Can A Bankruptcy Lawyer Help To Keep Your Assets Safe?

Bankruptcy filing can be a stressful situation, especially for property loss. Whether as a company or an individual, the anxiety usually grows when you know what would happen to all those precious assets. You begin to consider having some of your property sold in liquidation as a settlement. Still, this is where appropriate lawful representation becomes important in securing numerous properties during the filing process. Knowing how the processes work can help to navigate them to secure your financial future.

A Bankruptcy Lawyer in San Bernardino is an important resource for understanding what property is exempt and what isn't. In Chapter 7, those assets that are not exempt get sold off to satisfy creditors, but many personal items, including your principal residence, retirement accounts, and other specific personal effects are exempt from sale depending upon the law in your state. A skilled attorney will help you know which assets you can retain by guiding you through exemptions and ensuring that you meet all the legal requirements.

The expert will also guide you in preparation for the means test, an integral part of the qualification for bankruptcy relief. This checks whether your income and expenses allow you to file for Chapter 7 or not. Reviewing your financial position ensures that the lawyer does not miss out on anything in filing so that one can obtain valuable possessions as much as possible. Their expertise will help avoid any mistake that can lead to the loss of the asset or delays in the case.

Finally, hiring a Bankruptcy Lawyer in San Bernardino will serve as a great step for the protection of your assets. They will guide and advise you through complex legal requirements to protect your property. This can only be achieved if you have a close relationship with an expert attorney who can guide you into taking the right steps for your financial recovery and protecting those assets that are important to you.

#Bankruptcy Attorney San Bernardino#San Bernardino Bankruptcy Attorney#Bankruptcy Lawyer San Bernardino Ca#Family Law Attorney Riverside#Riverside Bankruptcy Lawyer Services#Bankruptcy Lawyer For Divorce Riverside#Bankruptcy Lawyer Free Initial Consultation#Bankruptcy Lawyer Free Consultation

0 notes

Text

Attorney for Wage Garnishment Near Me: Find Local Solutions to Stop Wage Garnishment

Introduction

When to Seek an Attorney to Stop Garnishment

If you’re facing wage garnishment, acting quickly is crucial. An attorney to stop garnishment can help you understand your rights and explore options to halt or minimize garnishment. They can file objections, negotiate payment plans, or even work towards debt settlement.

Key scenarios where an attorney is necessary:

Garnishments resulting from incorrect debt calculations.

Excessive garnishment amounts violating legal limits.

Employer noncompliance with garnishment orders.

How an Attorney for Payroll Issues Can Help

Payroll errors can sometimes lead to unauthorized or incorrect garnishments. An attorney for payroll issues specializes in addressing discrepancies between employers and employees. Whether your employer has miscalculated your wages or failed to stop garnishment after it’s been resolved, an attorney can ensure proper compliance with payroll laws.

Legal Strategies to Stop Wage Garnishment

An attorney to stop garnishment may use various strategies to address your case:

Filing an Exemption Claim: Certain income types, like Social Security benefits, are exempt from garnishment. Your attorney can help file a claim to protect these funds.

Negotiating with Creditors: Attorneys can negotiate directly with creditors to reduce the garnishment amount or settle the debt.

Filing for Bankruptcy: In severe cases, bankruptcy may temporarily or permanently stop garnishment. Your attorney can guide you through this process if it’s the best option.

Correcting Errors: If garnishment was initiated due to incorrect or outdated information, an attorney for payroll issues can resolve discrepancies and ensure accurate deductions.

Why You Need an Attorney for Wage Garnishment Near Me

Conclusion

Wage garnishment doesn’t have to derail your financial well-being. With the help of an attorney to stop garnishment, you can navigate the legal process effectively and protect your income. Whether you’re facing garnishment issues or payroll errors, an attorney for payroll issues can provide comprehensive support tailored to your needs. Take action today and consult with an attorney for wage garnishment near me to secure your financial future.

FAQs

1. What is wage garnishment, and how does it work?

Wage garnishment is a legal process where a portion of your paycheck is withheld by your employer to satisfy debts owed to creditors. This can include unpaid taxes, child support, or credit card debts.

2. How can an attorney to stop garnishment help me?

An attorney to stop garnishment can review your case, identify legal defenses, file objections, negotiate with creditors, and even work to reverse garnishments if they were improperly issued.

3. When should I hire an attorney for payroll issues?

You should consult an attorney for payroll issues if your employer has made errors in calculating garnishment amounts, failed to comply with court orders, or mishandled payroll deductions.

4. What options do I have to stop wage garnishment?

Options include filing an exemption claim, negotiating with creditors, setting up a payment plan, or, in some cases, filing for bankruptcy. Your attorney will help determine the best course of action.

5. How do I find an attorney for wage garnishment near me?

Search for local attorneys with expertise in wage garnishment, payroll disputes, or debt resolution. Consider their experience, reviews, and familiarity with local laws.

0 notes

Text

Verified California Bankruptcy Lawyers Email List

Verified California Bankruptcy Lawyers Email List

Enhance Legal Marketing with a Verified California Bankruptcy Lawyers Email List.

In the highly competitive legal industry, law firms, legal service providers, and marketing agencies must adopt data-driven strategies to connect with potential clients effectively. A Verified California Bankruptcy Lawyers Email List is an essential resource for legal marketing, enabling direct communication with attorneys specializing in bankruptcy law across California.

At Lawyersdatalab.com, we provide accurate, up-to-date, and verified attorney email lists, ensuring law firms and marketing professionals reach the right audience for their campaigns.

What is a California Bankruptcy Lawyers Email List?

A California Bankruptcy Lawyers Email List is a curated database containing the contact details of attorneys specializing in bankruptcy law across the state. This list includes verified email addresses, phone numbers, law firm affiliations, and other essential information that helps in legal outreach, client acquisition, and networking.

By leveraging this data, law firms, legal consultants, financial institutions, and marketing companies can target bankruptcy attorneys for business development, partnerships, and legal services promotions.

List of Data Fields

✅ Attorney Name – Full name of the bankruptcy lawyer. ✅ Email Address – Verified professional email for direct communication. ✅ Law Firm Name – The law firm or legal practice the attorney is affiliated with. ✅ Phone Number – Contact details for direct outreach. ✅ Practice Area – Specialization in bankruptcy law and related legal services. ✅ Office Address – Physical location of the lawyer’s practice. ✅ Website URL – Official website for law firm details. ✅ Social Media Profiles – LinkedIn, Twitter, or other professional accounts for networking.

Benefits of Using a Verified California Bankruptcy Lawyers Email List

1. Targeted Legal Marketing

A verified email list enables precise targeting of bankruptcy attorneys, helping legal marketing agencies, financial consultants, and law firms connect with the right audience for their campaigns.

2. Lead Generation & Client Acquisition

Law firms and legal service providers can use the email list to generate leads, promote services, and acquire new clients within the bankruptcy law sector.

3. Direct Outreach & Networking

Building relationships with bankruptcy attorneys is essential for legal consultants, financial institutions, and litigation support firms. A verified contact database ensures efficient outreach and networking.

4. Promoting Legal Services

Law firms specializing in bankruptcy, debt relief, or financial restructuring can use this email list to promote their legal services to attorneys handling bankruptcy cases.

5. Expanding Professional Connections

Legal professionals and consultants can connect with experienced bankruptcy attorneys, fostering collaborations and business partnerships.

6. Efficient Email Campaigns

With accurate attorney contact data, law firms and legal marketing agencies can run successful email campaigns, ensuring their messages reach the right legal professionals.

7. Competitive Advantage

Having a verified, up-to-date email list provides a strategic advantage by allowing legal businesses to connect with potential clients faster than competitors.

8. Increased Conversion Rates

Since the list contains verified and relevant contacts, marketing campaigns achieve higher engagement and conversion rates, leading to better ROI.

9. Enhanced Event & Webinar Promotion

Legal conferences, webinars, and networking events can attract more attendees by targeting bankruptcy lawyers directly through email outreach.

10. Customization & Segmentation

Our email list allows for customized outreach, enabling users to filter and target specific attorneys based on location, experience, or law firm affiliation.

Why Choose LawyersDataLab.com?

At Lawyers Data Lab, we specialize in curating, verifying, and updating attorney contact databases to ensure maximum accuracy and effectiveness.

✔ 100% Verified & Updated Data – Ensuring high deliverability rates for email campaigns. ✔ Customizable Lists – Tailored to your specific legal marketing needs. ✔ Affordable Pricing – Cost-effective solutions for law firms and marketers. ✔ Fast Delivery in Multiple Formats – Available in CSV, Excel, or API integration for seamless usage. ✔ Comprehensive Coverage – Covering bankruptcy lawyers across California and other U.S. states.

Get Your Verified California Bankruptcy Lawyers Email List Today!

Want to boost your legal marketing efforts and connect with top bankruptcy attorneys in California? LawyersDataLab.com provides high-quality, verified attorney email lists to enhance outreach and business development.

📧 Contact us at: [email protected] 🌐 Visit our website: LawyersDataLab.com

Leverage targeted attorney email marketing to grow your legal business! 🚀

#californiabankruptcylawyersemaillist#verifiedcaliforniabankruptcyattorneyemaillist#legalmarketing#lawyersemaildatabase#lawyersdatalab#legaloutreach#attorneycontactlist#datadrivenmarketing#legalconnections#alabamalawyersmailinglist

0 notes

Text

Why you need a Bankruptcy Lawyer

Bankruptcy is a complex process fraught with numerous legal intricacies that can be overwhelming when facing financial troubles. A bankruptcy lawyer plays an indispensable role in navigating these complexities, ensuring the process proceeds smoothly and helping you understand your rights and responsibilities. They provide expert advice on the best course of action, help you understand the potential implications of each decision, and prepare and file your bankruptcy petition. Moreover, a bankruptcy attorney also represents you at hearings, negotiates with your creditors to protect your assets, and bears the responsibility of completing all necessary paperwork accurately to avoid any missteps that could lead to severe consequences. With their in-depth knowledge of exemptions that could allow you to retain certain assets despite declaring bankruptcy, they add immeasurable value during such challenging times. Navigating through a financial crisis requires not only emotional resilience but also a sound understanding of the law and its nuances. Attempting to handle everything on your own to save money could lead to costly mistakes that exacerbate your financial woes further. A bankruptcy lawyer serves as a beacon of hope during these trying times by preventing such pitfalls through their professional assistance and empathy. In conclusion, having a knowledgeable bankruptcy lawyer by your side can make the daunting process of declaring bankruptcy much more manageable while providing reassurance amidst challenging circumstances. Their invaluable counsel enables you to make informed decisions confidently while ensuring all actions align with your long-term financial goals—ultimately turning around your financial situation while preventing costly errors throughout the process.

Understanding the Role of a Legal Expert in Financial Troubles

Bankruptcy is a complex process that involves numerous legal intricacies. A bankruptcy lawyer plays a critical role in navigating these complexities and ensuring that the process proceeds smoothly. When you're facing financial troubles, understanding your rights and responsibilities can be overwhelming. Here's where a bankruptcy lawyer steps in - they are there to guide you, providing expert advice on the best course of action and helping you understand the potential implications of each decision. Transitioning to the specifics, a bankruptcy attorney takes care of preparing and filing your bankruptcy petition, representing you at hearings, negotiating with your creditors, and protecting your assets. They also bear the responsibility of completing all necessary paperwork accurately to avoid any missteps that could lead to severe consequences. In addition to this, they possess an in-depth knowledge of exemptions that could allow you to retain certain assets despite declaring bankruptcy. Without wrapping up with conventional phrases like 'in conclusion' or 'finally', it's safe to say that hiring a bankruptcy lawyer adds immeasurable value during such challenging times. They not only take away some of the stress associated with financial troubles but also ensure that you make informed decisions based on their expertise. A well-versed bankruptcy attorney can ultimately help turn your financial situation around while preventing costly errors throughout the process.

Navigating through Bankruptcy Laws with Professional Guidance

Navigating the labyrinth of bankruptcy laws can be an arduous task for someone without legal expertise. This is where a bankruptcy lawyer's professional guidance becomes indispensable. These experts are well-versed with the Bankruptcy Code and familiar with both federal and state laws concerning bankruptcy. They understand how these laws apply to your specific situation, which enables them to provide tailored advice that takes into account all relevant factors. By leveraging their experience and proficiency, they can help you make strategic decisions that could significantly impact your financial future. Moreover, as you journey through the bankruptcy process, unexpected issues or questions may arise. Perhaps there's a dispute over a particular debt or complication related to filing deadlines; maybe you're unsure about certain aspects of the law. A bankruptcy attorney is equipped to handle these challenges promptly and efficiently, ensuring that such issues do not derail your case or prolong the process unnecessarily. They act like a compass in these tumultuous times, guiding you towards the most favorable outcome possible. It's evident that having a knowledgeable bankruptcy lawyer by your side can make the daunting process of declaring bankruptcy much more manageable. They translate complex legal jargon into layman terms for better understanding and provide comprehensive support throughout each step of the process. Their role extends beyond just paperwork and representation - they offer reassurance, confidence, and peace of mind amidst challenging circumstances. The value of their expertise cannot be overstated as it helps ensure that your path towards financial recovery is as smooth and efficient as possible.

Importance of Legal Assistance during Financial Crisis

Financial distress can be overwhelming, and when you're in the middle of a crisis, it's challenging to think clearly and make the best decisions. Legal issues associated with bankruptcy are no exception. A bankruptcy attorney serves as a beacon of hope during these trying times. They not only provide professional assistance but also lend an empathetic ear to your concerns. Their expertise allows them to evaluate your financial situation objectively, helping you understand various debt relief options and their implications. Furthermore, declaring bankruptcy isn't just about filing paperwork; it also involves complex negotiations with creditors, trustees, and court officials. Without proper legal representation, you might find yourself at a disadvantage during these discussions. This is where a bankruptcy lawyer's role becomes crucial. They possess the necessary negotiation skills and legal clout to protect your interests effectively. Their adept handling of such scenarios can result in more favorable terms for debt repayment or asset liquidation. Navigating through a financial crisis requires more than just emotional resilience; it demands a sound understanding of the law and its nuances. You might feel tempted to handle everything on your own to save money; however, this could lead to costly mistakes that exacerbate your financial woes further. A bankruptcy lawyer helps prevent such pitfalls by ensuring compliance with all legal requirements and deadlines associated with your case. Their guidance is invaluable in avoiding missteps that might complicate the process or jeopardize your chances of achieving financial stability once again. With their assistance, you can focus on rebuilding your life without the constant worry about potential legal repercussions.

The Complex Process of Filing for Bankruptcy Simplified by an Attorney

The bankruptcy process can be daunting to navigate alone due to its intricate nature and legal jargon involved. This is where a bankruptcy attorney steps in and simplifies everything for you. They guide you through every step, ensuring that you comprehend the proceedings and the implications of each decision you make. The paperwork associated with filing for bankruptcy can be exhaustive and confusing for those unfamiliar with legal terminologies. An experienced lawyer helps demystify these terms, ensures accurate completion of all required forms, and timely submission to the appropriate authorities. Furthermore, a bankruptcy case isn't just about paperwork; it involves extensive negotiations with creditors who may not have your best interests at heart. Your attorney plays a pivotal role during these discussions, using their expertise and negotiation prowess to secure favorable terms for you. They understand the strategies employed by creditors and are well-equipped to counter them effectively. This proactive approach minimizes potential disputes or misunderstandings that could delay your case's resolution or worsen your financial situation. Without signaling an end, it's essential to note how crucial a bankruptcy lawyer is beyond court representations and document preparations. They serve as your ally throughout this stressful period, providing emotional support along with legal assistance. They help alleviate your fears by addressing all your queries promptly and keeping you informed about the progress of your case regularly. Their invaluable counsel enables you to make informed decisions confidently while ensuring that all actions align with your long-term financial goals. Thus, they don't merely simplify the complex process but also provide reassurance during an otherwise distressing time in your life.

How a Legal Practitioner Protects Your Rights during Bankruptcy

When you file for bankruptcy, you are essentially declaring that you cannot pay off your existing unsecured debts. This can result in creditors attempting to seize your assets or harass you to recover their money. However, the law provides certain protections for individuals undergoing bankruptcy. A legal practitioner well-versed in bankruptcy law is instrumental in ensuring these rights aren't violated and that you're treated fairly throughout the process. Your bankruptcy attorney acts as a shield between you and your creditors. They handle all communication on your behalf, saving you from potential intimidation or harassment by aggressive debt collectors. Besides this, they can also stop wage garnishment and prevent your home from being foreclosed by using various legal strategies. In other words, an attorney ensures that while dealing with the ramifications of bankruptcy, your life isn't completely upended. Moreover, a lawyer is aware of the exemptions provided under federal and state laws during bankruptcy proceedings. These exemptions allow you to keep certain assets despite filing for bankruptcy. Whether it's your home, car, necessary household goods or retirement accounts; a proficient attorney can guide you through these provisions while ensuring maximum benefit for you. Without a doubt, having a seasoned legal practitioner by your side alleviates much of the stress associated with a bankruptcy case and helps protect what matters most to you during this turbulent period in your financial life.

Reducing Stress in Difficult Times: The Emotional Benefit of Hiring a Lawyer

Filing for bankruptcy is a highly stressful process, fraught with complex legal proceedings and emotional turmoil. Here, the role of a bankruptcy lawyer extends beyond just offering legal support. They provide much-needed emotional support, helping you navigate through this difficult period with minimal stress. This attorney-client relationship can serve as a source of comfort and stability in an otherwise volatile situation. A seasoned bankruptcy attorney not only understands the ins and outs of the law but also recognizes the emotional toll that such proceedings can have on an individual. Their expertise allows them to handle your case efficiently while ensuring that you are informed and prepared for each step of the process. This personalized attention helps alleviate anxiety and fear associated with bankruptcy filings. Moreover, knowing that your case is being handled by a professional who has your best interests at heart provides a sense of relief and assurance. The decision to file for bankruptcy is never easy, nor is grappling with its repercussions on your financial future. However, having a skilled attorney by your side can make this journey less daunting. They shoulder some of your burdens, allowing you to focus on rebuilding your life rather than getting lost in intricacies of the law. Thus, hiring a bankruptcy lawyer not only offers significant legal benefits but also contributes significantly to maintaining mental well-being during these challenging times.

Managing Creditors and Debt Collection Agencies with Legal Help

One of the most immediate and pressing concerns when considering bankruptcy is dealing with creditors and debt collection agencies. These organizations can be relentless in their pursuit, often resorting to intimidating tactics to extract payment. A bankruptcy lawyer can act as a buffer between you and these entities, managing all communication on your behalf. The Fair Debt Collection Practices Act (FDCPA) outlines certain protections for individuals facing aggressive collection practices. However, understanding these rights and how to enforce them requires legal knowledge that most people lack. This is where a bankruptcy attorney steps in - they know the rules of engagement and can take action if creditors overstep these boundaries. Additionally, once you file for bankruptcy, an automatic stay comes into effect. This prevents creditors from continuing their collection efforts or initiating lawsuits against you. Your lawyer ensures that this stay is enforced and any violations are dealt with accordingly. Navigating through the maze of debt collectors while trying to understand your rights can be overwhelming. A skilled bankruptcy lawyer provides much-needed clarity during this tumultuous time. They manage creditor communications, enforce your rights under the FDCPA, ensure compliance with the automatic stay provision, and more importantly, give you peace of mind knowing that someone is fighting on your behalf. So while you may initially baulk at the idea of hiring a lawyer due to cost considerations, remember that their assistance could prove invaluable in managing creditors effectively and making sure that your path towards financial recovery remains unobstructed.

Unraveling the Myths Surrounding Bankruptcy with Expert Advice

Bankruptcy is often shrouded in myths and misconceptions, which can prevent individuals from seeking the relief they need. A bankruptcy lawyer can play an instrumental role in dispelling these myths and providing factual advice tailored to your specific circumstances. For instance, many people believe that filing for bankruptcy will permanently ruin their credit score. While it's true that a bankruptcy filing will impact your credit, the effect isn't permanent. In fact, with proper financial management and discipline post-bankruptcy, you can rebuild your credit over time. Moreover, there's a common misconception that you'll lose all your assets if you file for bankruptcy. However, this isn't necessarily the case. Bankruptcy laws have exemptions that allow you to keep certain types of property up to a specified value. Your attorney can guide you through these exemptions and help protect as much of your property as possible during the bankruptcy process. It's worth noting that these laws vary by state, which further underscores the need for expert legal advice. Another prevailing myth is that you can only file for bankruptcy once. But in reality, there are no restrictions on how many times you can file. However, there are time limits between filings depending on what chapter of bankruptcy you previously filed under and what chapter you plan to file under next. These intricacies further underline why it's critical to consult with a knowledgeable lawyer who can explain all aspects of the law and guide you through each step of the process without falling prey to common misconceptions or misinformation.

Case Study: Success Stories Demonstrating the Value of a Legal Counselor in Bankruptcy Cases

Bankruptcy cases often come with a complex web of legal requirements and procedures that can be challenging to navigate on your own. For instance, the bankruptcy code is a federal law that applies in all states, but each state has its own set of exemptions. What's more, there are different types of bankruptcies—Chapter 7, Chapter 11, Chapter 12, and Chapter 13—each with its unique stipulations and outcomes. In such scenarios, having an experienced bankruptcy lawyer by your side can be invaluable. They have an in-depth understanding of the law and can provide you with personalized advice based on your situation. They will guide you through all the necessary paperwork, ensuring that every detail is accurately completed to avoid any potential pitfalls or delays in the process. Not only does this save you time and stress; it also significantly reduces the risk of errors that could potentially jeopardize your case or result in unfavorable outcomes. Moreover, a bankruptcy attorney is equipped to represent you during court proceedings and meetings with creditors. The presence of a lawyer can help level the playing field against creditors who may have their legal teams. They'll ensure that your rights are protected throughout these interactions while providing the necessary advocacy and negotiation skills to reach optimal settlements where possible. Without saying it outright, hiring a bankruptcy attorney isn't just about navigating the legal process—it's about safeguarding your financial future.

Future Planning Post-Bankruptcy: Let's Discuss the Role of Your Attorney

After successfully navigating through the bankruptcy process with your attorney, it's essential to shift focus towards rebuilding and planning for a secure financial future. The role of your bankruptcy lawyer doesn't end with the discharge of your debts. Your attorney can continue to be an instrumental figure in this next chapter, providing much-needed guidance and advise on money management strategies that will help you avoid falling back into debt. Your lawyer will provide you insights into financial practices that can help restore your credit score over time. They'll guide you on how to effectively manage your income, expenses, and savings strategies. For instance, they might suggest creating a budget that allows for consistent repayment of any remaining debts while also setting aside funds for emergencies or future investments. Your attorney could also recommend credit counseling services or courses that offer valuable education on managing finances wisely. You may also get advice on legal matters relating to your post-bankruptcy life from your attorney. For example, if you're considering buying a new home after bankruptcy discharge, the legal counsel can provide information about mortgage lenders willing to consider applicants with a bankruptcy history or advise on how long you should wait to apply for new credit. They can educate you about laws pertaining to debt collection and what creditors can and cannot do when attempting to collect outstanding debts post-bankruptcy. This continued relationship with your attorney ensures that even as you rebuild financially after bankruptcy, you're still under professional guidance every step of the way.

FAQ's

Q: Why would someone need a bankruptcy lawyer?

A: If a person is facing bankruptcy, a lawyer can provide crucial advice and guidance, ensuring legal procedures are correctly followed.

Q: Can I handle bankruptcy proceedings without a lawyer?

A: While it's technically possible, a lack of legal knowledge could result in flawed paperwork, missed deadlines, or unprotected assets. A bankruptcy lawyer helps avoid such mistakes.

Q: What can a bankruptcy lawyer do for me?

A: A bankruptcy lawyer walks you through every step of your case, helps fill out and file forms, advises on which bankruptcy type to file, and represents you in court.

Q: What happens if I make a mistake in my bankruptcy paperwork?

A: Mistakes in bankruptcy paperwork can lead to your case being dismissed, a loss of certain rights, or potential allegations of bankruptcy fraud. A lawyer helps avoid such errors.

Q: Can a bankruptcy lawyer determine which type of bankruptcy I should file?

A: Yes, a bankruptcy lawyer can analyze your financial situation and advise on which type of bankruptcy would be most beneficial for you.

Q: Will a bankruptcy lawyer represent me in court?

A: Yes, part of the bankruptcy lawyer's job is to represent you in bankruptcy court hearings and defend your interests.

Q: How do I know if hiring a bankruptcy lawyer is worth it?

A: If your case is complex, your assets are substantial, or the risk of making mistakes is high, then hiring a bankruptcy lawyer could prove invaluable.