#Banking Crisis

Explore tagged Tumblr posts

Text

6 Lessons YOU Can Learn from the Silicon Valley Bank Crash

When news of the Silicon Valley Bank crash broke, I sighed deeply. Because sighing deeply is the age-appropriate version of a toddler pounding their fists on the floor screaming “I don’ wanna, I don’ wanna, I DON’ WANNA!” That’s always how I feel when I have to understand some complicated new brouhaha caused by oligarchs’ greed, when all I truly need in this life is more naptime.

Guys, don’t worry. Because I am a grown-up woman with finely tuned coping mechanisms, I worked through my tantrum and I did it! I understand what the hell happened to Silicon Valley Bank.

Paragon of intellectual generosity that I am, I’m going to explain it back to you.

If you want an in-depth, technical breakdown, this ain’t gonna be it. I’m going to focus on what this means for us plebs. That means skipping all the boring parts, creatively employing childish metaphors, recklessly speculating about its impact on the future of the economy, and oversimplifying absolutely everything.

Complex, dense financial topics explained by babies, for babies. That’s the Bitches Get Riches brand promise!

Keep reading.

If you liked this article, join our Patreon!

75 notes

·

View notes

Text

Angry depositors gathered in front of the Clarke Brothers Bank, an 80-year old private institution at 154 Nassau St., which closed as bankrupt, ca. 1929. Unprecedented withdrawals caused the crisis, and the payment of 100 cents on the dollar was promised to the skeptical depositors.

Photo: Bettmann Archive/Getty Images/Fine Art America

#vintage New York#1920s#bank run#bank closure#bankruptcy#bank failure#Great Depression#Great Depression causes#bank crisis#banking crisis#vintage NYC

22 notes

·

View notes

Text

Federal Reserve stuck between a rock and a hard place

#Federal Reserve#US Federal Reserve#Interest rate#High inflation#Biden inflation#Bidenflation#Banking crisis#Biden economy#Here comes the recession#2023 crash#Daily struggle

48 notes

·

View notes

Text

Gorrlax: The Merger

"...and here, on the 1-year anniversary of the mass acquisition of the final thirty-two banks country wide, JPMorgan Chase has put the finishing touch on their newest building on Wall Street by resurrecting what appears to be a demon monument that they boast is purely artistic sensationalism, while others warn that it is much, much more. Is it a glimpse into the dark truth of this organization, or simply creatively aggressive marketing and gaudy tastelessness? In a recent interview, Jamie Dimon, the company's top shareholder, spoke fondly of this ostentatious eye-sore, promising it to be a symbol of modern 'badassery,' as he put it, explaining it was simply meant to be 'bold and edgy'. 'It scored great with the under-forty crowd and, I have to say, we've already sold-out of the miniatures in the first presale. Gorrlax is the new 'golden bull!!, he responded with practiced zest that I, for one, wasn't entirely convinced by. The interview has, of course, gone viral, and whether the perceived terror in his voice and eyes is in fact real, or a figment of all our imaginations, remains to be decided. Some say that 'he's just old' and the shakiness of his voice and demeanor reflect his struggle with those long years he's lived on Earth. While others point to several different recent interviews to clearly point out the falsehoods to those claims. Nevertheless, it seems 'Gorrlax' is here to stay, as is this new superpower in financial infrastructure that has many die-hard American patriots finally tucking tale and fleeing the country. But is there anywhere on this planet outside of the influence of an institution this powerful? After all, the company has already positioned themselves to have their logo adorning the first civilian structures set to be colonized on Mars. With a reach spanning the cosmos, I'm afraid these expats are simply only delaying the inevitable. I'm Olivia Gutiérrez..." moving her hand from her long coat pocket, the past-her-prime star reporter revealed the small .22 caliber revolver she'd been keeping warm in her palm, "...and I don't want to be here anymore. God speed."

No one on the street even bothered to flinch at the shot. Olivia's blood and skull-matter hardly made it past Gorrlax's ankles and was removed in minutes with a single wipe from a cloth. Although the camera angle wasn't able to confirm it, several unrelated onlookers claimed to have seen the golden demon smile in that instant at its first taste of blood. And in the months since, hardly a day goes by without another lost soul quieting their existential torment at the feet of the fifty-foot monument. -cm

by AnomalousDesigns

#art#dark art#fantasy art#fantasy#digital art#demons#horror#horror art#demonic#demon worship#occult#macabre#creative writing#banking crisis#end the fed#social justice#midjorneyart#aiart#digital sculpture#sculpture#wall street#shrine#cyptocurrency#jamie dimon#political art#bitcoin

26 notes

·

View notes

Text

Government regulators seized and sold off First Republic Bank on Monday, making it the third bank to fail this year after Silicon Valley Bank and Signature Bank collapsed in March.

The three banks held a total of $532 billion in assets. That’s more than the $526 billion, when adjusted for inflation, held by the 25 banks that collapsed in 2008 at the height of the global financial crisis.

The implosion of Washington Mutual that year, as well as the investment banks Lehman Brothers and Bear Stearns, was followed by failures throughout the banking system. From 2008 to 2015, more than 500 federally insured banks failed.

Most were small or midsize regional banks and were absorbed into other institutions, a common outcome for banks that have been put under government control. Washington Mutual, which was heavily involved in risky mortgages and became the largest bank to fail in U.S. history, was sold to JPMorgan Chase.

In recent years, fewer banks have gone under, thanks in part to stricter regulations that were put in place in the wake of the financial crisis. Before Silicon Valley Bank, the last bank to fail was in late 2020, as the coronavirus was ravaging the country.

The collapse of Silicon Valley and Signature Bank in March led to fears of fallout for the broader industry. Higher interest rates have eroded the value of assets on banks’ balance sheets, stressing the financial system and making it harder for banks to pay back depositors if they decided to withdraw their money.

First Republic received a temporary $30 billion infusion from the nation’s biggest banks in March as a way to restore clients’ confidence. But customers pulled a staggering $102 billion in customer deposits over the first quarter of this year, according to the bank’s quarterly earnings report filed on Monday.

By the close of trading on Friday, the company’s stock price had dropped more than 75 percent this week.

Similar to Silicon Valley Bank, First Republic had many start-up industry clients, and many of its accounts held more than $250,000, the amount covered by federal insurance.

The regulations put in place for the nation’s biggest banks after the financial crisis include stringent capital requirements, which means they must have a certain amount of reserves for moments of crisis, as well as stipulations about how diversified their businesses must be.

But midsize banks like First Republic, Silicon Valley and Signature do not have the same regulatory oversight. In 2018, President Donald J. Trump signed a law that lessened scrutiny for many regional banks. Silicon Valley Bank’s chief executive, Greg Becker, was a strong supporter of the move. Among other things, the law changed requirements for the amount of cash that these banks had to keep on their balance sheets to protect against shocks.

In a review of the Fed’s oversight of Silicon Valley Bank released on Friday, Michael S. Barr, the central bank’s vice chair for supervision, said the Fed would “re-evaluate” its rules for banks that were similar in size to Silicon Valley Bank.

Mr. Barr called the bank’s failure a “textbook case of mismanagement.” But he faulted Fed supervisors, too, for not understanding the extent of the bank’s vulnerabilities, and for failing to take decisive action when they did identify problems.

He also noted the real threat of contagion from Silicon Valley Bank. “A firm’s distress may have systemic consequences through contagion — where concerns about one firm spread to other firms — even if the firm is not extremely large, highly connected to other financial counterparties, or involved in critical financial services,” he wrote.

4 notes

·

View notes

Link

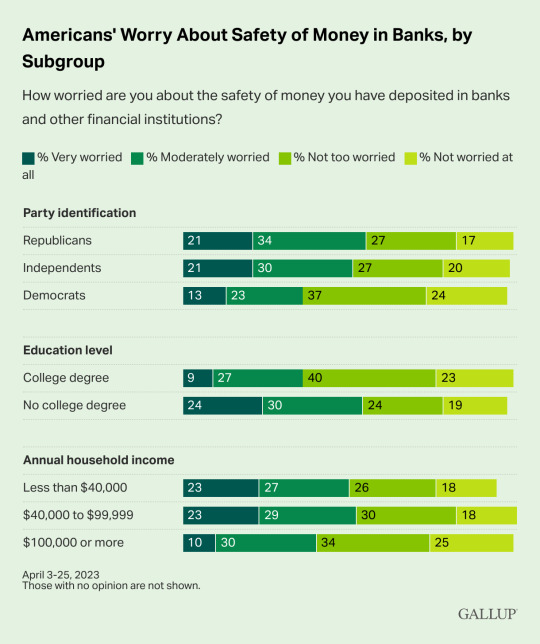

Nearly half of Americans say they're worried about the safety of the money they have in the bank. Yet most have their money in FDIC protected bank accounts — where it's safe.

6 notes

·

View notes

Text

IndusInd Bank's Derivatives Discrepancy: A Deep Dive into the ₹1,530 Crore Issue

IndusInd Bank, one of India’s leading private sector lenders, has recently reported an alarming discrepancy of ₹1,530 crore in its foreign exchange (forex) derivatives portfolio. This revelation, which constitutes approximately 2.35% of the bank’s net worth as of December 2024, has sent shockwaves across the financial markets. The issue, uncovered during an internal review, has not only resulted in a sharp decline in the bank’s stock price but has also raised questions about its risk management and governance practices.

#IndusInd Bank#forex derivatives#₹1#530 crore loss#banking crisis#RBI regulations#financial discrepancies#stock market impact#banking governance#risk management#investor strategy

0 notes

Text

Michael Douville & John Rubino: The World is about to change! Get Rich or Ignore at Your Peril!

The World is About to change! Pension Funds may not be able to honor their obligations.

Ecclesiastes 7:12 For the protection of wisdom is like the protection of money, and the advantage of knowledge is that wisdom preserves the life of him who has it. Proverbs 27:12 The prudent sees danger and hides himself, but the simple go on and suffer for it. John Rubino’s newsletter can be accessed at rubino.substack.com. John is an American thought leader, former Wall Street Analyst, and…

#2008#banking crisis#commercial real estate#commodities#copper#credit crunch#gfc#gold#housing bubble#housing market#housing market crash#Inventory myth#silent depression#silver#uranium

0 notes

Text

youtube

The Silent Giant: How Norinchukin Bank Entered the Fed's Elite Circle

0 notes

Text

Recipe for recession and a global liquidity crisis?

By Jim Rickards of Strategic Intelligence This past Monday, 10 banks were feeling the blues as Moody cut their credit ratings. The agency also placed six of the nation’s biggest lenders on review for potential downgrades. What’s going on? Moody’s is warning that the sector’s credit strength will likely be tested by funding risks and weaker profitability as demand for borrowing slows in…

View On WordPress

0 notes

Text

Bankers Smile

Here’s a song I wrote along with a video I (very cheaply) put together.Not the most professional of recordings but there never was any from my end in those days. This song is on my old Youtube channel. Please do consider showing your support for an underdog and subscribing to my NEW YOUTUBE CHANNEL at https://www.youtube.com/channel/UCzvkV8425oHt7jozbeOdMTQ Huge thanks for your support…

View On WordPress

#acoustic#banking crisis#banking scandal#guitarist#Music#original music#political#political song#singer#song

1 note

·

View note

Text

IMF Stresses Timely Debt Restructuring as Crucial for Sri Lanka's Economic Recovery

Timely debt restructuring is of utmost importance for Sri Lanka, as emphasized by the International Monetary Fund (IMF). The island nation is facing significant economic challenges, compounded by the ongoing COVID-19 pandemic. Sri Lanka's high debt burden and limited fiscal space necessitate swift action to restructure its debt in order to alleviate the financial strain and pave the way for sustainable economic recovery.

Sri Lanka's economy has been severely impacted by the pandemic, with declining revenues, reduced tourism, and disruptions in global trade. The country's external debt obligations have become increasingly burdensome, posing a threat to its long-term financial stability. The IMF recognizes the urgency of addressing this issue to prevent further deterioration of Sri Lanka's economic situation.

A timely debt restructuring plan would involve renegotiating terms with creditors, extending repayment periods, and possibly seeking debt relief. Such measures are essential to ease the immediate financial pressure on Sri Lanka, enabling the government to allocate resources towards crucial sectors such as healthcare, education, and infrastructure development. Additionally, debt restructuring would help restore investor confidence, attract foreign investment, and promote economic growth in the long run.

The IMF's support and guidance in navigating this challenging period are crucial for Sri Lanka. The international financial institution can provide valuable expertise and assistance in formulating an effective debt restructuring strategy. The IMF's involvement also signals to other global stakeholders that Sri Lanka is committed to implementing necessary reforms and regaining its economic stability.

However, debt restructuring alone is not a comprehensive solution. Sri Lanka must also address underlying structural issues within its economy to ensure sustained growth and stability. This includes implementing structural reforms to enhance competitiveness, promoting fiscal discipline, improving governance, and diversifying the economy to reduce reliance on a few sectors.

The government of Sri Lanka has taken steps towards fiscal consolidation and economic reforms, but further efforts are required to achieve long-term sustainability. It is imperative for policymakers to strike a balance between short-term measures to address the immediate crisis and long-term reforms that will lay the foundation for a resilient and robust economy.

The successful implementation of a debt restructuring plan will require strong political will, effective communication with creditors, and a commitment to transparency. It is crucial for all stakeholders, including the government, international financial institutions, and creditors, to work collaboratively and in good faith to find mutually beneficial solutions.

In conclusion, the IMF's recognition of the importance of timely debt restructuring for Sri Lanka highlights the critical nature of the country's economic challenges. Swift action is required to alleviate the burden of high debt and create a conducive environment for sustainable recovery. Through effective debt restructuring, coupled with comprehensive economic reforms, Sri Lanka can overcome its current difficulties and lay the foundation for a prosperous future. The cooperation and support of international financial institutions, along with the commitment of the Sri Lankan government, will be instrumental in achieving these goals and securing a brighter economic outlook for the nation.

0 notes

Text

#banking crisis#fiat currency#crypto#defi#freedom#liberty#libertarian#libertarianism#voluntaryism#financialfreedom#anarchocapitalism#privacy#thorchain#rune#thorchainrune

1 note

·

View note

Text

Root Causes of the US and Europe Banking Crisis

1 note

·

View note

Text

Banks don't go down 70% unless there's a systemic problem

With Bloomberg BNN anchor Jon Erlichman

Click Here for Video https://www.bnnbloomberg.ca/video/we-have-a-real-problem-banks-don-t-go-down-70-without-a-real-systemic-issue-strategist~2681378

View On WordPress

1 note

·

View note