#BOMBAY STOCK EXCHANGE

Explore tagged Tumblr posts

Text

Stock Profit Calculator

If you buy or sell stocks in Stock Market, this app will calculate everything

#New York Stock Exchange#NYSE#Nasdaq#Japan Exchange Group#JPX#London Stock Exchange#LSE#Shanghai Stock Exchange#SSE#Hong Kong Stock Exchange#SEHK) Euronext#Toronto Stock Exchange#TSX#Shenzhen Stock Exchange#SZSE#Bombay Stock Exchange#BSE#National Stock Exchange#NSE#Deutsche Börse#FRA#SIX Swiss Exchange#Korea Exchange#KRX#Copenhagen Stock Exchange#Stockholm Stock Exchange#Helsinki Stock Exchange#Tallinn Stock Exchange#Riga Stock Exchang#Vilnius Stock Exchange

0 notes

Text

Infosys Share Price Today Highlights, 25 Sep, 2024: Infosys shares settles 0.17% lower

On September 24, 2024, Infosys shares closed at Rs 1897.8, after reaching an intraday high of Rs 1910.0 and a low of Rs 1871.05. The company's market capitalization stood at Rs 7879.94 crore. Over the past year, the stock hit a 52-week high of Rs 1975.05 and a low of Rs 1352.0. The trading volume on the Bombay Stock Exchange for that day was 114,447 shares.

#Infosys share price#Intraday high#Intraday low#Market capitalization#Trading volume#Bombay Stock Exchange

0 notes

Text

The Bombay Stock Exchange (BSE) is one of the oldest and most prestigious stock exchanges in Asia. It established a robust framework for trading in securities for Indian investors. Over the years, BSE has implemented numerous measures and adopted various technologies aimed at enhancing investor confidence and ensuring a transparent, efficient, and trustworthy marketplace. In this blog, we will delve into the seven ways in which BSE enhances investor confidence and builds trust in the Indian stock market.

0 notes

Text

For beginners, choosing between the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) is a crucial decision. Both exchanges are well-established, but which one best aligns with a new trader’s needs? This blog explores key differences, including liquidity, trading volumes, and transaction costs, to help beginners make an informed choice.

0 notes

Text

#bombay stock exchange#stock#career#education#saviorsglobalfoundation#saviorsfoundation#school#igcse board#igcse school

0 notes

Text

Bombay Stock Exchange and the Gibbous Moon

0 notes

Text

#BSE के चीफ इनफॉर्मेशन सिक्योरिटी ऑफिसर ने दिया इस्तीफा#BSE#SHARE MARKET NEWS#STOCK MARKET#BOMBAY STOCK EXCHANGE#BSE MANAGEMENT#share market news today#stock market news in hindi

0 notes

Text

Best Private University In Uttar Pradesh

Teerthanker Mahaveer University is the best private university in Uttar Pradesh and is well known for its Jain philosophy. The university is dedicated to Lord Mahaveer’s ideals of Right Philosophy, Right Knowledge, and Right Conduct in all spheres of action and aspires to be recognized as a premier destination of excellence in providing quality education, research, and consultancy services to society and nation. The University believes that the growth of the nation is only possible when both industry and academia work hand-in-hand. To make this possible, the university has formed alliances with several recognised multinational corporations and ensures the training of its students on the latest technologies used in the industry. TMU has collaborated with IBM, i-Nurture, NIVIDIA, BOSCH , Bombay Stock Exchange, Safeducate, Future Group and TCS-ION so that students can learn practically while pursuing their degrees at the best university.

#bestprivateuniversityinuttarpradesh#Teerthankermahaveeruniversity#ibm#bombay stock exchange#bosch#careergoals#career#student life

1 note

·

View note

Text

Top 10 Stock Market Research, Analysis Websites in India

In order to make wise investment decisions, stock analysis entails assessing and interpreting a variety of factors pertaining to a company’s stock. Evaluating the possible benefits and drawbacks of owning a specific stock is the aim. It’s crucial to remember that stock analysis calls for a blend of qualitative and quantitative evaluations. Depending on their investing objectives and risk…

View On WordPress

#analysis technical#bombay stock exchange site#bombay stock exchange website#bse stock exchange website#fundamental of analysis#national stock exchange web site#national stock exchange website#ongc stock price today#top stock research

0 notes

Text

How To Read- JAPANESE CANDLESTICK CHART

View On WordPress

#BSE (Bombay Stock Exchange#candle#Equity Market#Foreign Institutional Investors (FIIs)#Indian Stock Market#patterns#sharemarket#stocks

0 notes

Text

mfs be throwing gang signs in the exam hall, the way they portray numbers through fingers you'll feel you're in bombay stock exchange

3 notes

·

View notes

Text

Different Financial Instruments

Different Financial Instruments in India The financial market in India provides a wide variety of products to suit different risk tolerances and investment requirements. Making wise investing selections requires having a thorough understanding of these instruments. Here, we examine a few of the most important financial products that are offered in India.

Stocks Ownership in a corporation is represented by stocks, or equity. Purchasing shares of a firm permits you to participate in its development and earnings as an owner. On stock markets such as the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), stocks are exchanged. Although they have a large amount of market risk, they provide huge profits. Prior to making an investment in stocks, investors should perform extensive research.

Bonds Bonds are fixed-income securities that governments, businesses, and local governments issue to raise money. At maturity, they repay the principle amount together with monthly interest payments. Although they sometimes yield less returns than stocks, bonds are seen to be safer. For conservative investors seeking consistent income, they are perfect.

Mutual Funds Mutual funds invest in a diverse portfolio of stocks, bonds, and other assets by pooling the money of several individuals. Professional fund managers oversee them. By providing diversity, mutual funds help individual investors take on less risk. They are available in several varieties, including debt, equity, and hybrid funds, to accommodate varying risk tolerances and investment objectives.

Fixed Deposits (FDs) Fixed deposits are one of the most popular investment options in India. They offer a fixed interest rate for a specified tenure, providing assured returns. FDs are considered very safe, especially when deposited in reputable banks. They are suitable for risk-averse investors seeking guaranteed returns.

Derivatives Financial contracts known as derivatives derive their value from underlying assets such as stocks, bonds, or indexes. Derivatives that are frequently used are swaps, options, and futures. They are employed in price movement speculation and risk hedging. Since they can be complicated, derivatives are usually only advised for seasoned investors.

Instruments for Foreign Exchange Currency trading is a part of foreign exchange instruments. Businesses and investors use them to speculate on currency changes or as a hedge against currency risk. Forex trading is extremely risky and necessitates a solid grasp of world economic issues.

Cash and Cash Equivalents These include instruments like treasury bills, commercial papers, and certificates of deposit. They are highly liquid and can be quickly converted into cash. Cash equivalents are low-risk investments, suitable for short-term needs or as a part of a diversified portfolio

Goods and Services Investing in commodities such as crude oil, silver, and gold is an additional choice. Direct commodity trading is also possible, as is commodity futures trading. They diversify an investment portfolio and act as a buffer against inflation. In summary The financial market in India provides a vast range of instruments to suit varying risk appetites and investment requirements. Investors have a wide range of alternatives, from secure and steady fixed deposits to high-risk, high-reward stocks. Making wise investing selections requires having a thorough understanding of these instruments, as well as the risks and rewards associated with each. There is a financial product in India to meet your demands, regardless of whether you are an aggressive investor wanting large profits or a conservative investor seeking safety.

2 notes

·

View notes

Text

Bombay Stock Exchange (BSE) is the oldest stock exchange in Asia and the tenth oldest globally. Established in 1875, it was recognised by the Indian government in 1957 under the Securities Contract Regulation Act. This recognition solidified its legitimacy and attracted more investors and traders. The BSE is located in Mumbai, India, and lists more than 5000 companies, establishing a solid financial ecosystem for the development of the Indian stock market. BSE plays a cardinal role in providing Indian companies with an efficient platform to raise investment capital. It is also famous for its electronic trading system, which provides fast and efficient trade execution. This blog offers insights into the workings, operations, and functions of the BSE.

0 notes

Text

Praveg Share Price Target 2025 2026 2027 to 2030 Prediction

One of the listed companies on stock exchanges is praveg share price target 2027 which has good performance there. The company's only listing on the Bombay Stock Exchange (BSE) rather than the National Stock Exchange (NSE) has resulted in a decline in the demand for its equities; yet, there is still a reasonable amount of interest in the shares on the stock exchanges.

The company's share prices are fairly priced, which eventually pushes these shares into the overvalued range. Additionally, estimates for the pricing of the various upcoming years are being created. These are only ballpark estimates for share prices, though; they could vary in the future. The Praveg Share Price Prediction 2025 comprises a few anticipated values for the various years that precede it. Following this, another prediction—the Praveg Share Price Prediction 2030—is made, taking into account the company's historical and current performance.

The corporation uses the expected values to establish the pricing it wants to sell at. The company has met its target pricing in the past years; for example, it has already met Praveg target share price for 2024 at the beginning of the year, which is Praveg. Following that, a second goal, the Praveg Share Price Target 2025, might be reached by the end of the year due to the shares' expected quick increase. Praveg's share price objective for 2025 is regarded as one of the company's most important goals because stock exchange traders and investors closely follow it.

Praveg Ltd Share Price Insights:-

The current market prices of the shares of praveg share price target 2029 are 919.80INR; this is fluctuating and gets influenced easily.

The Share prices of Praveg Ltd had recently seen a reduction of 1.17 percent in the prices as compared to the previous prices on the stock exchanges.

According to the current prices on the stock exchanges; the share prices of Praveg ltd ranges from 915.00INR to 945.00INR.

The highest share price of Praveg ltd being recorded in the last one year is 1300.00INR whereas the lowest price being recorded in the last one year is 450.00INR.

As per the current share prices on the stock exchanges, the share prices of Praveg ltd falls in the overvalued category, however the overvalued percentage is yet to be determined.

Praveg Share Price Target 2024 Months Target Prices

January942.61

February957.84

March960.60

April986.85

May987.54

June1010.16

July1013.50

August1044.49

September1099.73

October1103.43

November1142.79

December1143.98

Conclusion:-

An organization called Praveg Ltd. is listed on stock exchanges; it does well there, as seen by rising share prices and a track record of hitting all of its goals. The company has been exceeding a number of goals ahead of schedule, which is a strong indication of its explosive rise on the stock exchanges. By year's end, the previous year's goal, the Praveg Share Price Target 2027, may also be accomplished.

It has been determined that the company is profitable because it has made enough money. Currently not listed on any national stock markets, the company will be listed there if its steady improvement in stock exchange performance continues with praveg share price target 2026 . Revenue growth and profitability growth for the organization are also anticipated.

2 notes

·

View notes

Text

poetry month: day 03

“Hiraeth, Old Bombay” by Imtiaz Dharker

I would have taken you to the Naz Café if it had not shut down. I would have taken you to the Naz Café for the best view and the worst food in town.

We would have drunk flat beer and cream soda and sweated on plastic chairs at the Naz Café. We would have looked down over the dusty trees at cars creeping along Marine Drive, round the bay to Eros Cinema and the Talk of the Town.

We would have held hands in the Naz Café over sticky rings on the table-top, knee locked on knee at the Naz Café, while we admired the distant Stock Exchange, Taj Mahal Hotel, Sassoon Dock, Gateway.

We would have nursed a drink at the Naz Café and you would have stolen a kiss from me. We would have lingered in the Naz Cafe till the day slid off the map into the Arabian sea.

I would have taken you to Bombay if its name had not slid into the sea. I would have taken you to the place called Bombay if it were still there and if you were still here, I would have taken you to the Naz café.

4 notes

·

View notes

Photo

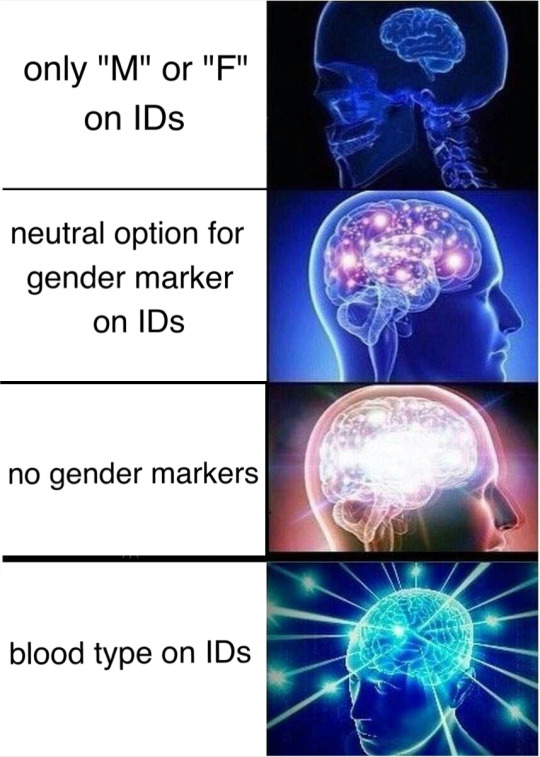

(sorry for rambling i just love talking about blood)

I MEAN i agree with the “no gender on ID” but having blood type is kinda useless and/or dangerous. even if youre a cop or a firefighter (at least here they have nametags with their ABO) if youre bleeding and it CANT wait 40 mins or so youre GONNA get an Oneg, im not about to trust a tag with a test i didnt do myself (its like 15 min to find out someones ABO).

Ive had patients with abo tags and it was wrong twice, ive had pregnant ppl on their third child who just found out they should have gotten RhoGAM bc their first test said they were Opos and just showed the results at the next pregnancies and the drs accepted it as true but when their kid needed an exchange transfusion we found out the person was actually Oneg and that almost killed the kid

the uncertainty makes the transfusion safer, imo

BUT of course, it could point out that the person who drew the blood took it from the wrong person, it could happen specially if there are multiple patients with the same name, or if the nurse isnt affiliated with the bloodbank (at least here our own techs draw the blood, but not all places are the same)

having a blood history would be useful to speed things up if you need like, 4 bags (its not really wise to waste Onegs, so we would send only the first one, maybe two depending on the bleeding), but i trust only other bloodbanks info for that, if i have access, and the following bags do NOT get distributed without the proper tests (to get an Oneg the Dr is aware of the risks of a transfusion without the tests and has to sign a term, they understand the risk but understand that the situation asks for as little time as possible)

tho! it could also be good if the person has a history of conditions like sickle cell anemia, some blood cancers, or if they in a transplant list! these people need Very Special blood and just matching their abo isnt ideal, we have over 40 subgroups of blood, the ABO is a separate (and certainly the deadliest) system we prioritize but if an O donor is a perfect match for a B+ patient theyre FOR SURE getting that O and we are marking that donor to invite to donate in case theyre needed

the one other situation i can think of is if theyre a bombay (hh) phenotype. It happens because the A and B antigens are always connected to a H antigen, but hh people dont have the H (and therefore, dont have A or B, so in OUR tests they would show up as O!) They can only receive from other hh, and theyre very rare depending on where you are >:0 So, in an emergency, if we dont have a history of the patient, we would give them Oneg and that would be very very dangerous, we are literally being misled with our tests bc they dont point out the lack of H. Because theyre so rare, we cant stock up on hh blood :( , so here the rare donors are marked as well and if we know they CANNOT get a transfusion bc of that, we advocate for alternate approaches (a little like JWs) at least until we can get in contact with those donors but other than that they could live their entire lives without knowing they have such a rare bloodtype :0

of course, im talking about my own experience, i work mainly with syckle cell and cancer patients and they regularly need transfusions, hh phenotype is something i never actually met at work, so it WOULD be useful to have these things on an ID as much as it would be to have a tattoo of drugs youre allergic to (the answer is very! very useful)

but yea, much safer to give Oneg at first than to trust a piece of paper. Donate if you can! Each donation can save up to 4 lives and we are so very grateful for our donors!

(also dont be discouraged if youre AB, only other AB can receive your red blood cells but we use the plasma for babies bc you have no A nor B antibodies, how cool is that! (THE ANSWER IS VERY COOL))

Sorry for rambling i just really like blood lol

this started as a joke but then i started actually thinking about it and now im really annoyed that IDs have this one letter that doesnt mean anything for cis people and is a huge pain in the ass for trans people when we could instead have literally lifesaving information so emergency medical services could just check ur wallet to see which blood to give you so you dont die or whatever But No

#fucking love blood#also im not sure if ambulances can have blood? i assume they shake a lot bc of the speed that would not be good for the bags#also would they have the correct temperature to stock it? like a little frigde only for blood?#oh i just realized emergency medical services could also mean Hospitals not just ambulances SORRY#i think this is the first time i wrote such a long post on tumblr and it was to show in a huge NERD but at least it was on the nerd website#also just for the bit: put gender. abo. mbti. sun moon and rising signs and the 4 humours. maybe kinlist if youre feeling naughty#(imagine a nurse refusing to help you bc you both kin dave strider)#Oh! forgot to mention we actually try to give afab ppl CEK neg blood bc it could impact pregnancies badly if they get antibodies for these#but thats not legally required (bc of stock. we cant garantee we're gonna have a CEK- bag bc not all blood gets phenotyped)

111K notes

·

View notes