#Automotive Leaf Spring Market Size

Explore tagged Tumblr posts

Text

Exploring the Growth of the Automotive Leaf Spring Market

Key Highlights

The automotive leaf spring market was valued at USD 5,992.1 million in 2023, and it will rise to USD 8,252.1 million, powering at a 4.8% compound annual growth rate, by 2030.

The growth of this industry is because of the increasing requirement for commercial vehicles, coupled with the rising need for comfort while traveling or driving in them. The development of the e-commerce industry globally is likely to boost the need for light commercial automobiles, which would, in sequence, drive the demand for leaf springs worldwide.

Various e-commerce websites as well as postal services utilize heavy-duty automobiles, which impacts the automotive leaf spring industry directly. Robust and reliable vehicles that are lightweight are required for logistics applications. Leaf springs are suitable for delivery trucks and vans due to their large capacity and strong construction.

Because of the strict emission rules, fuel efficiency is the major emphasis for vehicle manufacturers as customers demand greener as well as more fuel-efficient automobiles.

They are in continuous demand due to the increasing acceptance of pickup trucks and SUVs, which are known for their towing and off-road capacities. The improvements in technologies are making them more rugged, cost-effective, and lighter than other vehicles.

Market Analysis

The metal category led the industry in 2023, with approximately 70% share. Because of their great strength, metals can withstand the loads and strains that automobiles—particularly trucks and SUVs—place on their leaf springs. Thus, they are ideal for applications that need strength and durability.

The parabolic category accounted for the largest share in 2023, of 40%, primarily because its curved figure evenly distributes the weight. This leads to more comfortable as well as smoother rides.

Because of the strict fuel economy rules, the weight reduction ability of the parabolic type makes it ideal for automotive manufacturers.

The commercial vehicles category was the largest contributor to the industry in 2023, with approximately 75% share, because of the high demand for durability and ruggedness in them.

For commercial vehicles, their overall price is the main reduction that leaf springs provide, while delivering greater durability and strength with improved fuel efficiency.

The original equipment manufacturers (OEMs) category led the industry in 2023, with approximately 80% share. This is because automobile manufacturers generally purchase leaf springs and various other components in bulk.

Due to their ability to negotiate large discounts with leaf spring providers, their costs per unit are lower compared to those of aftermarket sellers.

APAC accounted for the largest share in the industry in 2023, of approximately 50%. Moreover, the regional industry will also advance at the fastest rate, of 5.3%, in the years to come. This is because of the surging adoption of commercial vehicles by e-commerce firms and the large volume of vehicles manufactured in the region.

Since vehicles comprising leaf springs are manufactured cheaply, this price-sensitive region outperforms other regions.

The industry is competitive because of greater off-road capacity, strict government guidelines, and various applications of leaf springs. Players normally perform better in price-sensitive regions, which expands the possibility of technological advancements in this industry.

Source: P&S Intelligence

#Automotive Leaf Spring Market Share#Automotive Leaf Spring Market Size#Automotive Leaf Spring Market Growth#Automotive Leaf Spring Market Applications#Automotive Leaf Spring Market Trends

1 note

·

View note

Link

0 notes

Text

The Top Reasons to Choose Ananka Group for High-Quality U Bolts

If you're looking for high-quality and reliable U Bolts, Ananka Group is one of the top U Bolts manufacturers in India. With decades of experience as well as cutting-edge technology and a dedication to excellence, Ananka Group ensures that its U Bolts meet the highest industry standards, providing robust and well-engineered solutions for a variety of uses.

What Are U Bolts?

U Bolts are fasteners with a specialization designed to look like letters like "U." Their unique design makes them able to fix poles, pipes as well as any other cylindrical items to a variety of frames or surfaces. They are used extensively in plumbing, construction automotive, marine, and construction applications because of their flexibility and long-lasting nature.

It is the U Bolt is a key component in a wide range of industries where a strong, durable fastening is needed. The curved design provides great strength and support, which makes them a crucial tool for many industries.

An Overview of U Bolts Specifications

In the Ananka Group, U Bolts are manufactured in many dimensions and specifications that satisfy the needs of various industries. Here are a few most commonly used specifications:

Size Variation The U Bolts made by Ananka Group are available in various sizes, from large to small diameters. This means that customers will get the best fit to their specific needs.

Thread types U Bolts are available in a variety of thread types, such as metric and imperial to satisfy the particular requirements of different industries and markets.

Optional Coatings: Ananka Group offers U Bolts with different types of coatings like zinc-plated, galvanized, or stainless steel for enhancing the durability and resistance to corrosion particularly in extreme environments.

Materials & Grades of U Bolts

The strength and endurance that comes from U Bolts are heavily dependent on the type of material employed. Ananka Group manufactures U Bolts with high-quality components, making sure U Bolts that are durable robust, durable, and immune to wear and corrosion. Here are the most frequently utilized materials used for U Bolts:

Carbon Steel: U Bolts made of carbon steel is well known for its strength and durability. They are ideal for use for applications that require high tension force.

The Stainless Steel U Bolts provide excellent resistance to corrosion and are ideal for outdoor and marine applications in which exposure to moisture and chemicals is very high.

Alloy Steel: Alloy steel U Bolts are superior for high-temperature applications. They provide strength and durability in extreme conditions.

Galvanized Steel Galvanized U Bolts are coated with a coating of zinc to stop rust from forming and make them ideal to be used in damp or harsh environments.

Ananka Group offers U Bolts in various grades to satisfy the particular demands for strength and durability of different industries. The grades are:

Grade 4.6

Grade 8.8

Grade A2-70 (stainless steel)

Grade A4-80 (stainless steel)

Applications of U Bolts

U Bolts are commonly employed in industries where high-end fastening is needed. Here are a few typical applications:

Piping Systems: U Bolts are used to keep pipes in place securely to stop them from bouncing or vibrating.

Automotive Industry: U Bolts are used in automobiles for securing leaf springs onto the axles. They provide stability and security.

Construction U Bolts are used in construction structures to hold poles, beams and other building substances.

Marine Industry: Due to their resistance against corrosion stainless steel U Bolts are utilized in vessels, boats and various marine structures.

Why Choose Ananka Group as Your U Bolt Manufacturer?

Finding the top U Bolt manufacturer is crucial to ensure the quality and durability of the bolts used to complete your job. Here are some reasons to consider why Ananka Group is the most suitable choice

Highest Quality: Ananka Group uses only the finest raw materials and imposes strict quality control procedures throughout the manufacturing process to ensure that every U Bolt meets international standards.

custom manufacturing If you require traditional U Bolts or customized solutions, Ananka Group offers flexible manufacturing options to meet your needs.

Price Competitive By using the latest manufacturing techniques, Ananka Group offers high-quality U Bolts at competitive prices without compromising quality.

Speedy Delivery With a solid distribution channel, Ananka Group ensures timely delivery of U Bolts across India and internationally.

expert support with a team of highly skilled professionals, Ananka Group offers excellent customer service, assisting customers to choose the appropriate U Bolts for their applications.

Conclusion

If you are in need of sturdy and reliable U Bolts to suit any purpose you can count on Ananka Group to supply. Being one of the most renowned U Bolts producers in India They offer the widest selection of high-quality U Bolts with different dimensions and materials to meet the various requirements of different industries. No matter if you're in construction or marine or automotive, Ananka Group has the experience and capability to supply you with the highest quality U Bolts in the market.

For more details about Our U Bolts and to place your order, please visit our Ananka Group website today!

When it comes to protecting your projects with stability and strength, selecting the best hardware is essential. Join Ananka Group, where quality meets technology within the realm of U bolts! No matter if you're in construction or manufacturing, or automotive choosing durable and reliable fasteners can make a huge difference. FAQ

What industries benefit from using U Bolts from Ananka Group?

Ananka Group’s U bolts are used in a variety of industries, including construction, automotive, agriculture, and manufacturing. Their high-quality U bolts provide the strength and durability needed for critical applications across these sectors.

What customization options are available for U Bolts?

Ananka Group offers a range of customization options, including different sizes, materials (like stainless steel, carbon steel, galvanized steel), and coatings. They also provide tailored solutions for specific project needs, ensuring that the U bolts meet your exact requirements.

How does Ananka Group ensure the quality of their U Bolts?

Ananka Group follows strict adherence to international quality standards throughout their production process. They use advanced technology for precision manufacturing and conduct thorough testing to ensure every U bolt meets rigorous specifications.

Are Ananka Group’s U Bolts suitable for outdoor or marine applications?

Yes, Ananka Group offers stainless steel and galvanized U bolts that provide excellent corrosion resistance, making them ideal for outdoor and marine environments where exposure to moisture and harsh conditions is common.

How competitive are the prices for U Bolts at Ananka Group?

Ananka Group offers competitive pricing for their high-quality U bolts. Despite their commitment to superior manufacturing and customization, they ensure affordability, making them an excellent choice for businesses operating within tight budgets.

How quickly can I expect my order of U Bolts to be delivered?

Ananka Group prioritizes timely delivery. Thanks to their efficient production processes and dedicated logistics team, they ensure that your U bolts are delivered as per schedule, helping you meet your project timelines without delays.

0 notes

Text

Automotive Suspension System Market To Witness the Highest Growth Globally in Coming Years

The report begins with an overview of the Automotive Suspension System Market and presents throughout its development. It provides a comprehensive analysis of all regional and key player segments providing closer insights into current market conditions and future market opportunities, along with drivers, trend segments, consumer behavior, price factors, and market performance and estimates. Forecast market information, SWOT analysis, Automotive Suspension System Market scenario, and feasibility study are the important aspects analyzed in this report.

The Automotive Suspension System Market is experiencing robust growth driven by the expanding globally. The Automotive Suspension System Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Automotive Suspension System Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. Automotive Suspension System Market Size, Share & Industry Analysis, By Suspension Type (Macpherson Strut, Multilink Suspension, Air Suspension), By System Type (Passive Suspension, Semi Active Suspension, Active Suspension), By Actuation Type (Hydraulically Actuated Suspension, Electronically Actuated Suspension), By Vehicle Type (Passenger Cars Light Commercial Vehicle) Others and Regional Forecast, 2021-2028

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/102029

Key Strategies

Key strategies in the Automotive Suspension System Market revolve around optimizing production efficiency, quality, and flexibility. Integration of advanced robotics and machine vision technologies streamlines assembly processes, reducing cycle times and error rates. Customization options cater to diverse product requirements and manufacturing environments, ensuring solution scalability and adaptability. Collaboration with industry partners and automation experts fosters innovation and addresses evolving customer needs and market trends. Moreover, investment in employee training and skill development facilitates seamless integration and operation of Automotive Suspension System Market. By prioritizing these strategies, manufacturers can enhance competitiveness, accelerate time-to-market, and drive sustainable growth in the Automotive Suspension System Market.

Major Automotive Suspension System Market Manufacturers covered in the market report include:

Some of the major companies that are present in the automotive suspension system market include ThyssenKrupp AG, ZF Friedrichshafen AG, Benteler International AG, KYB Corporation, Magneti Marelli S.P.A., Tenneco Inc, NHK Springs Co., Ltd. Mubea Fahrwerksfedern GmbH, Rassini and Mando Corp. among the other players.

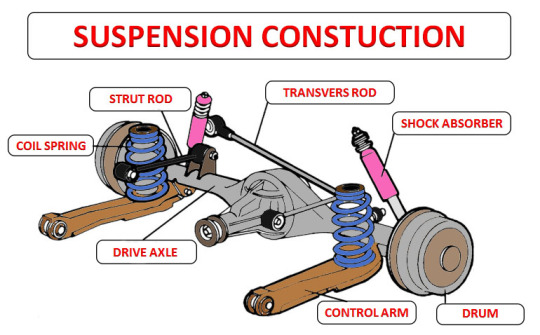

The suspension system includes shock absorbers, springs, control arm, absorbers, struts, and ball joints as their essential components. Spring is the most vital component of the suspension system as it absorbs the bumps while moving along the road and supports the vehicle. The different types of springs are used in the suspension system, such as coil spring, air spring, leaf spring, and torsion bars. The majority of passenger cars are equipped with light coil spring. The light commercial vehicles are deployed with coil and leaf spring, and heavy vehicles use leaf spring or air suspension.

Trends Analysis

The Automotive Suspension System Market is experiencing rapid expansion fueled by the manufacturing industry's pursuit of efficiency and productivity gains. Key trends include the adoption of collaborative robotics and advanced automation technologies to streamline assembly processes and reduce labor costs. With the rise of Industry 4.0 initiatives, manufacturers are investing in flexible and scalable Automotive Suspension System Market capable of handling diverse product portfolios. Moreover, advancements in machine vision and AI-driven quality control are enhancing production throughput and ensuring product consistency. The emphasis on sustainability and lean manufacturing principles is driving innovation in energy-efficient and eco-friendly Automotive Suspension System Market Solutions.

Regions Included in this Automotive Suspension System Market Report are as follows:

North America [U.S., Canada, Mexico]

Europe [Germany, UK, France, Italy, Rest of Europe]

Asia-Pacific [China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific]

South America [Brazil, Argentina, Rest of Latin America]

Middle East & Africa [GCC, North Africa, South Africa, Rest of the Middle East and Africa]

Significant Features that are under offering and key highlights of the reports:

- Detailed overview of the Automotive Suspension System Market.

- Changing the Automotive Suspension System Market dynamics of the industry.

- In-depth market segmentation by Type, Application, etc.

- Historical, current, and projected Automotive Suspension System Market size in terms of volume and value.

- Recent industry trends and developments.

- Competitive landscape of the Automotive Suspension System Market.

- Strategies of key players and product offerings.

- Potential and niche segments/regions exhibiting promising growth.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2024 to 2030?

► What are the key market dynamics influencing growth in the Global Automotive Suspension System Market?

► Who are the prominent players in the Global Automotive Suspension System Market?

► What is the consumer perspective in the Global Automotive Suspension System Market?

► What are the key demand-side and supply-side trends in the Global Automotive Suspension System Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Automotive Suspension System Market?

Table Of Contents:

1 Market Overview

1.1 Automotive Suspension System Market Introduction

1.2 Market Analysis by Type

1.3 Market Analysis by Applications

1.4 Market Analysis by Regions

1.4.1 North America (United States, Canada and Mexico)

1.4.1.1 United States Market States and Outlook

1.4.1.2 Canada Market States and Outlook

1.4.1.3 Mexico Market States and Outlook

1.4.2 Europe (Germany, France, UK, Russia and Italy)

1.4.2.1 Germany Market States and Outlook

1.4.2.2 France Market States and Outlook

1.4.2.3 UK Market States and Outlook

1.4.2.4 Russia Market States and Outlook

1.4.2.5 Italy Market States and Outlook

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

1.4.3.1 China Market States and Outlook

1.4.3.2 Japan Market States and Outlook

1.4.3.3 Korea Market States and Outlook

1.4.3.4 India Market States and Outlook

1.4.3.5 Southeast Asia Market States and Outlook

1.4.4 South America, Middle East and Africa

1.4.4.1 Brazil Market States and Outlook

1.4.4.2 Egypt Market States and Outlook

1.4.4.3 Saudi Arabia Market States and Outlook

1.4.4.4 South Africa Market States and Outlook

1.5 Market Dynamics

1.5.1 Market Opportunities

1.5.2 Market Risk

1.5.3 Market Driving Force

2 Manufacturers Profiles

Continued…

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

308, Supreme Headquarters,

Survey No. 36, Baner,

Pune-Bangalore Highway,

Pune - 411045, Maharashtra, India.

Phone:

US:+1 424 253 0390

UK: +44 2071 939123

APAC: +91 744 740 1245

#Automotive Suspension System Market#Automotive Suspension System Market Share#Automotive Suspension System Market Size#Automotive Suspension System Market Trends#Automotive Suspension System Market Growth#Automotive Suspension System Market outlook

0 notes

Text

Automotive Leaf Spring Market to Register Remarkable Growth by 2030

The novel offering by The Insight Partners on- “ Automotive Leaf Spring Market Industry Analysis| 2030” unfolds different prospects of the market. This market study provides an overview of the industry and later dives into details such as market size, shares, CAGR estimates, and revenue forecasts. The research is capable of providing a thorough understanding of key drivers and challenges ahead of…

View On WordPress

0 notes

Text

Automotive Suspension System Market Size, Share and Forecast to 2031

Automotive Suspension System Market Information:

The global Automotive Suspension System Market Report provides a complete analysis of the present situation and potential growth of the global Automotive Suspension System Market. This research report provides investors as well as companies that belong to the sector about market trends, drivers of growth, challenges, and opportunities. The purpose of this research is to offer readers valuable data they can use to assist with investment decisions in the Automotive Suspension System Market.

According to Straits Research the Automotive Suspension System Market will grow at a CAGR 5.56% during the forecast period.

Competitive Players

Some of the key players operating in the Automotive Suspension System market are

Continental AG

ZF Friedrichshafen AG

ThyssenKrupp AG

Mando Corporation

Tenneco Inc.

Marelli Corporation

Hitachi Astemo Ltd

BWI Group

Hyundai Mobis Co. Ltd

Sogefi SpA

KYB Corporation

LORD Corporation

Get Free Request Sample Report @ https://straitsresearch.com/report/automotive-suspension-system/request-sample

This research also provides a dashboard view of prominent Organization, highlighting their effective marketing tactics, market share and most recent advances in both historical and current settings.

Global Automotive Suspension System Market: Segmentation

By Component Type

Coil Spring

Leaf Spring

Air Spring

Shock Absorber

Other Components

By Type

Passive Suspension

Semi-active Suspension

Active Suspension

By Vehicle Type

Passenger Car

Commercial Vehicle

By Regions

North America

Europe

Asia-Pacific

Rest of the World

Stay ahead of the competition with our in-depth analysis of the market trends!

Buy Now @ https://straitsresearch.com/buy-now/automotive-suspension-system

Key Highlights

In order to explain Automotive Suspension System the following: introduction, product type and application, market overview, market analysis by countries, market opportunities, market risk, and market driving forces

The purpose of this study is to examine the manufacturers of Automotive Suspension System, including profile, primary business, and news, sales and price, revenue, and market share.

To provide an overview of the competitive landscape among the leading manufacturers in the world, including sales, revenue, and market share of Automotive Suspension System percent

Principal Motives Behind the Purchase:

To get deep analyses of the industry and to have a complete comprehension of the commercial landscape of the global market.

Analyse the production processes, key problems, and potential solutions in order to reduce the potential for future problems.

The goal of this study is to get an understanding of the most influential driving and restraining factors in the Automotive Suspension System industry as well as the influence that this market has on the worldwide market.

Gain an understanding of the market strategies that are now being used by the most successful firms in their respective fields.

In order to have an understanding of the market's future and potential.

Trending Report:

About Straits Research

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

Contact Us

Email: [email protected]

Address: 825 3rd Avenue, New York, NY, USA, 10022

Tel: +1 646 905 0080 , +44 203 695 0070

0 notes

Text

0 notes

Text

Automotive Suspension Systems Market Key Opportunity, Analysis, Growth, Trends 2032

The global automotive suspension systems market size is skyrocketing and is to be valued at US$ 62 Billion in 2022, forecast to grow at a stable CAGR of 4.36% to be valued at US$ 95 Billion from 2022 to 2032. Increasing urbanization, technical advances, and shift in purchasing habits are all contributing to the expansion of the automotive sector. Meticulous research and developments are assisting in updating the present automotive suspension systems in order to improve the ride quality and road holding capabilities of the vehicle.

Key Takeaways

Suspensions are vital for good ride quality and automobile handling control. A comfortable ride promotes convenience for passengers, prevents cargo damage, and decreases driver fatigue on extended voyages. Attributing to such crucial factors are resulting in surging sales of automotive suspension systems in the global market.

Since cars with firm suspension may result in better control of body motions and faster reflexes, it is increasingly becoming a crucial part of an automobile. Ambulances require improved vehicle suspension to minimize further damage to already unwell passengers. Such factors have increased the desire for greater driving comfort, which has benefited the worldwide automotive suspension systems market's development.

The SUV market has seen reasonable growth in recent years. Due to the cheap cost, small size, modern designs, and superior agility, the SUV & sub-compact SUV industry has seen significant expansion in nations such as the United States, China, India, and Mexico. The excessive use of multilink suspensions is witnessed in the market. The lower cost of multilink suspension and the simplicity of modification has expanded the use of multilink suspension in mid- to high-segment vehicles.

There is a multilink suspension seen in SUVs including Kia Sport, Volkswagen Tiguan, and Mahindra Scorpio. Throughout the projection period, the global automotive suspension systems market is predicted to increase at a pace of 4.36%. SUVs often have independent suspension at both the front and back wheels. As a result, the urge for independent suspension systems is growing.

At present, air suspensions are preferred more than leaf springs as it delivers optimum comfort and elegance to passengers. As a result, the growing demand for comfort and luxury is driving up demand for automotive suspension systems throughout the world.

For more insights: https://www.futuremarketinsights.com/reports/automotive-suspension-systems-market

The suspension system of an automobile consists of springs, structs, ball joints, shock absorbers, and control arms that help connect the vehicle to the wheel and allow relative motion between the two. The geometry and method used to design suspension are determined by the camber of the wheel, the castor of the hub, the toe of the vehicle, and the kingpin inclination of the control arms.

Suspensions are considered an important part of an automobile because it helps to keep the vehicle's tires in touch with the road during the trip, protecting the vehicle and reducing shocks along with protecting its cargo from damage or wear. In addition to that, it isolates the car from high-frequency vibrations caused by tire excitation.

Competitive Landscape

The Benteler Group, Continental AG, KYB Co., Ltd., Magneti Marelli S.p.A., Mando Corporation, Schaeffler AG, Tenneco Inc., TRW Automobile Holdings Corporation, WABCO Holdings Inc., ZF Friedrichshafen AG are some of the key companies profiled in the full version of the report.

There are various players in the market for automotive suspension systems. The automotive suspension systems industry is extremely competitive, with competitors vying to increase their market share. Product innovation and regional growth into new markets will be critical to the success of any automotive suspension systems industry participant.

Request a Sample of this Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-713

More Insights into the Automotive Suspension Systems Market

The Asia Pacific region is the largest manufacturer of automotive suspension systems. As per FMI reports, China is anticipated to maintain the dominant position in the automotive systems market during the projection period.

Owing to the surging demand for luxury vehicles, Asia Pacific becomes one of the leading manufacturers of fuel-efficient automobiles in the world. OEMs have begun to invest in and develop innovative automotive technology. Even though Japan and South Korea are technological leaders, India and China produce the most vehicles in the Asia Pacific.

Owing to the changing customer tastes, in recent years, have led to the rise in the per capita income of the middle-class population, and cost benefits for OEMs. Due to these factors, Asia Pacific has emerged as a center for automobile production in recent years.

0 notes

Text

Automotive Leaf Springs Market Expected to Reach More Than Moderate CAGR growth Forecast Period 2019-2025 | Top Vendors: Rassini, Hendrickson USA, L.L.C., Sogefi SpA

The Global Automotive Leaf Springs Market analysis 2020 offers a steady compound annual growth rate (CAGR) from 2019 to 2025 of 6.5%, which is the forecast period. Market Research Future estimates the figures and reveals that the market will witness high growth prospects in the coming years.

Top Impacting Factors

Automotive Leaf Springs Market size will witness a noticeable growth from the rising factors of medium and commercial vehicles and the production of light.

Top Companies:

Rassini (Mexico), Hendrickson USA, L.L.C. (US), Sogefi SpA (Italy), Jamna Auto Industries (India), Emco Industries (India), LITEFLEX (US), IFC Composite GmbH (Germany), NHK Springs Co. Ltd (Japan), Benteler-SGL (Austria), and OlgunCelik San. Tic. A. S (Turkey).

Get Free Sample Report @ https://www.marketresearchfuture.com/sample_request/8135

Major Highlights of TOC Covers:

Executive Summary

Key Business Trends

Regional Trends and Growth

Product Trends

End-use Trends

Definition and Forecast Parameters

More…

Contact Us

Market Research Future

+1 646 845 9312

Email: [email protected]

#Market Research Future#Automotive Leaf Springs#Automotive Leaf Springs Market#Automotive Leaf Springs Market Growth#Automotive Leaf Springs Market Share#Automotive Leaf Springs Market Size#Automotive Leaf Springs Market Trends#Automotive Leaf Springs Market Demand#Automotive Leaf Springs Market Forecast

0 notes

Link

0 notes

Link

The Automotive Leaf Springs Market is expected to witness sustained growth over the forecast period (2019-2023). The growth of the Automotive Leaf Springs market is driven as there is favourable growth in the industry is a major factor which will boost the Automotive Leaf Springs market.

#Automotive Leaf Springs#Automotive Leaf Springs Market#Automotive Leaf Springs Industry Analysis#Automotive Leaf Springs Market Size#Automotive Leaf Springs Market Share#Automotive Leaf Springs Market Trends#Automotive Leaf Springs Forecast#Automotive Leaf Springs Previous Data#Automotive Leaf Springs Vendors

0 notes

Text

Toyota Land Cruiser Customer's Guide

First manufacturing Toyota 4x4 energy, geared up with a B-series engine and also a three-speed transmission. Makes use of a grille with 9 upright slots, normally has no doors, has headlights installed behind steel guards on level fenders. Similar in look to early Jeeps, yet bigger. Assigned Land Cruiser name in 1954. 1951 - 1955

Land Cruiser (20 Collection).

Basic 20 Series car is an utility 4x4 outfitted with a soft or metal top.Land Cruiser BJ25s were outfitted with B-series engines,FJ25s with F-series engines.Both feature a grille with four horizontal slots between the headlights and use square, upright designing that means what the timeless FJ40 will certainly resemble.Readily available in several kinds,consisting of as a long wheelbase with a soft top (BJ28),fire truck (FJ24JA) and a hardtop with lengthy wheelbase (FJ28V).1955 - 1960.

Land Cruiser (40 Collection).

The timeless Land Cruiser 40 Series in its FJ40 kind,with its looks and also unified percentages.2 doors with a hard or soft top, folding windshield,F-series engine and two-speed transfer instance.The roofs of the hardtops are repainted white,and all hardtops had wrap-around rear windows. instead of straight grille slots,the grille contains a mesh aspect in between the two headlights.Square turn signals were placed atop each front fender.Available in numerous types,including a somewhat longer wheelbase permanent top (FJ45V) as well as a pick-up (FJ45).

Land Cruiser (55 Series).

A long-wheelbase four-door energy wagon with 40-Series running equipment. Designing remains really square-edged,but down-sloping front fenders with vestigial level tops somewhat integrated into the front clip. Square directional signal were placed atop the front fenders.Carburetor air intake grilles are high above,and also somewhat aft of, the front wheel wells.Hood is a lot more a flat panel than was the 40 Series hood.Grille includes horizontal ports between the fronts lights. The taillights are high-mounted as well as rectangle-shaped.The interior is much more complete and also incorporated than previously, with a cushioned dash top.1967 - 1979.

Land Cruiser (60 Series).

Land Cruiser wagon,the logical extension of the 55 Series,remains square for outstanding application of space however the sides are softer and also more rounded.The grille includes four horizontal bars as well as 5 horizontal slots.Fenders are completely incorporated into front clip.The front turn signals are incorporated right into the front fascia,immediately outboard of each headlight.Rear directional signal are rectangle-shaped and also upright,inset right into the body's sheet steel just over the rear bumper.The back door can be a single lift gateway,a solitary swing-out or a pair of swing-outs.Interior is currently styled,with an automotive-type dash.1980 -1989.

Land Cruiser (70 Collection).

Square-bodied Land Cruiser energy 4x4 two-door with steel doors as well as leading, inclined windscreen. The front-clip designing continues to be much like that of the 40 Series. The grille can be mesh or can include three horizontal bars.Both have three extra straight ports in a solitary line under the grille.Front turn signals are square with triangular white lens aspects underneath,as well as are fastened to the vertical edge of the front clip above the fenders and just outboard of each headlight.The top can be hard or soft.The doors are hard,with roll-up home windows.Taillights are long, upright rectangular shapes inset reduced right into the back bodywork.Rear doors are paired swing-outs.Windscreens of some armed forces versions will fold up atop hood. Available in several kinds,including a pickup (FJ75P) and a four-door,long wheelbase energy wagon (FJ77HV).1984 -present.

Land Cruiser (80 Collection).

Land Cruiser wagon with upright,rounded designing.Hood has a wide power lump, front fenders reveal character lines that mean the 55 Collection 'front fenders as well as stream the length of the car's body.Front fenders are fully incorporated right into the front clip and have sheet metal flares.Turn signals are thin,straight systems installed just below headlights. Grille is egg-crate mesh in between rectangular fronts lights. Back doors can be either swing-out side-openers or a tailgate/lift gate mix.Taillights are vertical rectangular shapes inset into the bodywork simply over the rear bumper.The interior is currently very contemporary,tending toward high-end, with a control panel inset under a curved brow in very early (broad) as well as late (much less large) styles. Springs are currently coils,as opposed to leafs,at each corner.1990 - 1997.

Land Cruiser (90 Series).

Called the Prado and developed from the 70 Series,the very first Land Cruiser to utilize independent front suspension.Was not marketed in the U.S.in this iteration.90 Series is somewhat smaller sized than 60 Collection and 80 Series,as well as offered with 2 or 4 doors.Grille is made up of 11 vertical bars in between styled headlamps,with additional air conditioning slots below the grille,in the bumper.1993 - 2001.

Land Cruiser (100 Collection).

Land Cruiser wagon with a high greenhouse, independent front suspension and 4.7 L V8. Some variations sold outside the U.S. get a solid front axle (101 Series). Power lump on large,flat hood much less obvious than formerly; front fenders reveal unique sheet-metal flare. Grille contains three horizontal bars in between incorporated and styled headlamps. An extra narrow straight air conditioning consumption is located listed below the grille, in the front bumper. A bump strip runs size of body below belt-line. Noticable flare around back wheel wells. Back door is a lift-gate. Taillights are huge ribbed systems that are partially built right into the lift gate and also twist around the rear edges of the vehicle to be noticeable from the side as well as from the rear. The dashboard is very modern with a cockpit console under its very own eyebrow and with HVAC as well as sound controls, as well as several Air Conditioning vents, in a different central panel. 100 Collection is offered just as a four-door. 1998 - 2007.

Land Cruiser (120 Series).

In 2002 the Land Cruiser Prado was revised as 120 Collection Prado,or in some markets, just the Land Cruiser.Seen in the United States as the Lexus GX 470.Body has 60 percent extra torsional strength as well as extremely advanced electronic grip controls for enhanced off-as well as on-road efficiency,lower noise and also far better quality. Center of mass was reduced, making sure far better stability.Along with a Torsen limited-slip main differential,Energetic Grip Control and also Vehicle Security Control offer superior movement on practically any kind of surface.2002 - Present.

FJ Cruiser (120 Collection).

Toyota's 2007 FJ Cruiser uses the 120 Collection frameworks layout created in 2002 as well as more enhanced in 2005 for this application.Optimization consists of increased fuel-tank clearance,32-inch tires and even more suspension articulation than on various other versions of the 120 Series.It includes a wide,flat hood with rounded sides as well as a mesh grille between two round white headlights,per FJ40.Flat,upright windshield, roof covering,wrap-around back home windows,brief front/rear overhangs,angular wheel openings,off-center back license plate,all per FJ40. 2006 as a 2007 version.

Land Cruiser (200 Collection).

A high-end 4x4 with fine-tuned, upright bodywork as well as styling for excellent area usage.A broad,flat hood contains character lines,as well as moves right into the beltline as well as into the horizontal,four-slatted grille - a theme that echoes the 60 Collection Used Toyota Land Cruiser For Sale In Europe - and also unitized straight headlights.Fender bulges and a three-dimensional rocker mark the vehicle's side facet,and a rear liftgate which contains part of the 200 Collection' taillights notes the back.Integrated bumper covers coincide shade as the bodywork.Power is provided by 3UR-FE 5.7 L DOHC engine as well as a six-speed automatic transmission.The full time four-wheel drive system includes an advanced traction-control system as well as a two-speed transfer case with a Torsen center differential with locking function.Inside includes three rows of seats with locations for eight guests.Instruments are included under a control panel eyebrow and also HEATING AND COOLING,sound and also offered navigation controls lie in a center binnacle.200 Collection readily available just as a four-door.2007 to present.

1 note

·

View note

Text

A Brief History of the Mazda Cosmo – Everything You Need To Know

The Mazda Cosmo – An Introduction

The Mazda Cosmo was born in the midst of the maelstrom of the 1960’s, the era of the Space Race between the Soviet Union, the United States, Britain, and the other democratic allies. In a sense the two rival political, economic and social systems were in direct and not particularly friendly competition with each other, and one of the areas in which that competition could be indulged in without actually getting into a nuclear war was the “Race for Space”.

It was in this environment of a hunger for technological advancement and prestige being given to those who made great strides in science and technology that a small Japanese car maker named Mazda were looking for a way to raise their company image and to thus raise their market share. Japan’s motorcycle and car makers, like Honda, were at that time making dramatic advances into the western world so Mazda’s leadership could see that if Soichiro Honda could do it then so could they.

Just as Honda had redefined what a motorcycle could be with their CB750, Mazda wanted to achieve a similar result with a motor car and realized that a good way to do that would be to pioneer newer technologies that other car makers hadn’t embraced. What technology could that be? It needed to be technology that would get people excited and interested, but it would need to be technology that would work with the existing fuel and maintenance infrastructure that mainstream conventional cars used.

The technology that jumped out as an obvious choice was the new Wankel rotary engine.

The Decision to use the Wankel Rotary Engine

The Wankel rotary engine had been first conceived in the years prior to 1951 by Felix Heinrich Wankel and he had made his first running prototype and tested it on February 1st, 1957. A number of companies purchased licenses to develop and use Wankel’s design, among them German car maker NSU and Japan’s Mazda.

Both NSU and Mazda would present cars powered by Wankel engines in 1967 but not before significant development work had been undertaken. The Wankel engine was new technology and had some major bugs that needed to be worked out before the engine could be used in a mass-produced production car. Mazda were more successful in achieving this than the Comotor joint venture between NSU and French car maker Citroën.

youtube

The major technical problem that needed to be solved in getting the Wankel engine into a usable state was the problem of “chatter marks” in the rotary engine’s housing caused by the rotor’s apex seals vibrating and impacting on the housing. It was Mazda’s engineers who came up with a decent solution to this problem initially by using hollow cast iron apex shields.

The prototype engine based on that solution was the 798cc (48.7 cu. in.) twin rotor L8A and it was used in two Mazda Cosmo prototypes in 1963. This solution was then further improved on by the use of aluminum/carbon apex seals. Legend has it that an engineer was inspired to try this when one day he was looking at the tip of his pencil and the thought struck him that carbon could be effectively used in the seals. This was then used in the next generation engine, the 982cc (60 cu. in.) twin rotor L10A, which was fitted in the car that was first shown to the public.

Mazda Cosmo Series I (1967-1968)

With work progressing on refining and debugging the radical Wankel rotary engine Mazda’s design staff got to work on the creation of a suitable vehicle with which to generate public interest both in the company and in their new rotary engine. In order to get the full attention of the automotive press one of the safest strategies is to create an exciting sports car.

British car maker Jaguar had demonstrated this both with their post-war Jaguar XK120, a car whose success came as a surprise for the company with orders flooding in to the extent that they had to actually put it into production – something that they had not originally intended to do.

Jaguar had repeated that success in 1961 when they showed their new E-Type which was so admired that even Enzo Ferrari described it as the “most beautiful car ever made”. Likewise American car maker Chevrolet had gained much admiration for their Corvette sports car and rival Ford had done likewise with their Mustang. So Mazda’s leadership could see that a sports car would be a relatively safe concept to roll the dice on.

The next question was how should the car look? Appearance and aesthetics are a make or break item when presenting a new car to a buying public. What was wanted was a car that would be beautiful like the E-Type, attractive to Americans like the Thunderbird, and reminiscent of a spaceship. The resulting car that emerged from the Mazda design studio featured a front end styling inspired by the E-Type, a rear end inspired by the Thunderbird, it was painted white just like a spaceship, and it was named “Cosmo” to capture the public imagination in the midst of the Space Race.

The Mazda Cosmo concept car was first shown at the 1964 Tokyo Motor Show and it garnered plenty of interest, no doubt there were eager people with check books in hand looking to make a Mazda Cosmo sized hole in their bank balances.

Mazda knew that although they had a working engine they still had development and extensive testing to do before they could risk releasing the car for public sale. The check books would need to go back into their pockets and the Cosmo money would have to remain in their bank accounts earning boring interest.

Mazda began thorough testing of the Mazda Cosmo pre-production cars in January 1965. There were 80 of these cars made and they were fitted with the 0810 version of the L10A engine. The engine rotor housing was made of sand cast aluminum which was chromed. Then the sides of the rotor housing were sprayed with molten carbon steel for added strength.

The rotors of these engines were cast iron while the eccentric shafts were chrome-molybdenum steel. This engine was fitted with a conventional Hitachi four barrel carburetor with a slightly unconventional twin ignition distributors and dual spark plugs in the combustion chambers.

The bodywork and suspension of the Mazda Cosmo was kept conventional with the body being a steel unibody, front suspension being fully independent with the tried and proven double “A�� arms with coils springs, tubular shock absorbers, and an anti-roll bar.

Rear suspension featured leaf springs and a De Dion tube. Brakes were 10″ (284mm) discs at the front and 7.9″ (201mm) drums at the back, wheels were 14″. Brakes were not servo assisted, which was a common arrangement at that time and many sports car drivers preferred it because it gave a better feel than the power brakes commonly available at the time. The gearbox was an all synchromesh four speed manual and these Mazda gearboxes were very positive and smooth to use.

With its 982cc twin rotor engine producing 109hp @ 7,000rpm and 96lb/ft of torque the Series I Cosmo could do a standing to 60mph in 8.2 seconds, standing quarter mile in 16.4 seconds, and had a top speed of 115 mph (185 km/hr).

The car had a wheelbase of 86.6″ (2,200mm), an overall length of 163″ (4,140mm), and width of 62.8″ (1,595mm). Kerb weight was 2072lb (940kg).

With testing satisfactorily completed the Mazda Cosmo went into regular production on May 30th, 1967, so after an almost three year wait those who had waited were at last able to buy their car and Mazda was able to welcome all those nice crisp banknotes into company coffers.

The year following the car’s going on sale Mazda were confident enough in the car’s reliability to put it to the test in a very public way. Although the 24 Hours Le Mans is one of the most challenging motorsport events on earth Mazda decided to go one better and enter the 84 hour Marathon de la Route at Germany’s difficult Nürburgring circuit. Mazda entered two modestly modified cars in a field of fifty eight. The engines of the two competition cars were tuned up to 128hp, which was a modest increase over the road going model’s standard, to help ensure their reliability, and they were fitted with a side and peripheral port switching intake system, which featured a butterfly valve which would switch from the side to the peripheral port as the engine’s rpm increased.

The cars both performed well holding on to fourth and fifth places throughout most of the race. When one car did fail it was not the engine, but the axle that failed in the 82nd hour. The other car went on to take fourth place. This was a most satisfactory result and proved that the efforts invested into the research and development, and the extensive testing, had all paid off. Mazda were content with that single excursion into motor sport competition and did not attempt a full program.

Production of the Series I cars was just 343 and ended in June 1968.

Mazda Cosmo Series II (1968-1972)

The Series II Cosmo took over from the Series I in July 1968. This model was fitted with an updated engine, the L10B 0813, which produced 128hp and torque of 103lb/ft. With the more powerful engine the standing quarter mile time went down to 15.8 seconds and the top speed was a little north of 120 mph (193 km/hr).

The Series II was fitted with servo assisted brakes and a five speed manual gearbox. The wheelbase of the Series II was increased by 15″ bringing it up to 101.6″ both to provide additional room and also to improve the car’s ride qualities. These Series II cars had a very comfortable ride quality, not harsh as many sports cars tend to be but very much inclined towards long distance comfort.

The Series I and Series II cars were all hand assembled as a limited production model so build quality was kept high: these were “halo” cars intended to gain positive publicity for Mazda and so great effort went into them. They were in direct competition with Toyota’s 2000GT and they needed to meet at least the same quality standards.

Production of the Series II cars was 1,176 and ended in 1972.

The Series I and II Mazda Cosmo achieved everything Mazda had hoped for. The company’s cars became famous in part because of the halo effect of the Mazda Cosmo and the company were able to become a world leader in Wankel engine technology.

Sensibly Mazda marketed both Wankel engined cars and conventional engined cars in the same body styles so customers could choose either Wankel rotary performance or conventional car performance. The Mazda 929 of the 1970’s was an example. One disadvantage of the Wankel engine was that it gave poorer fuel consumption than a conventional engine.

In some markets this was made up for because a Wankel is significantly lower in its engine capacity for a given power and torque levels than a conventional four stroke engine. This placed the rotary engine car in a less expensive licensing category in markets such as Japan, which was a significant cost offset.

Mazda Cosmo AP/CD (1975-1981)

With the phasing out of the hand-built original Mazda Cosmo Series I and II Mazda decided to shed the space age image and build a Wankel engined car that looked more American in style. By 1975 the Space Race was pretty much over and cars like the Jaguar E-Type and 1960’s Ford Thunderbird were starting to look dated in the eyes of some.

The new car to wear the Cosmo name was not in any way derived from the original but instead was a new production car with a Wankel engine. The model was called the “AP” (Anti-Pollution) model in Japan and was the first car to pass Japan’s new 1976 exhaust emissions regulations. The AP received strong advertising and sold more than 20,000 units in the first 6 months of production.

Within three months of going on sale the car won Motor Fan Magazine’s “Car of the Year” award. In 1977 a model with a vinyl covered landau roof was also introduced: this was called the Cosmo L. In export markets this car was designated the Cosmo CD.

The export version of this model was marketed as the Mazda RX-5 and often sold in parallel with a piston engined identical model the Mazda 121. (Note: that model name would later be re-used for a sub-compact Mazda car).

The Mazda AP was made with two different Wankel engines; the AP/CD22 was fitted with an 1,146cc twin rotor type 12A engine, and the AP/CD23 was fitted with the 1,308cc 13B twin rotor engine. Two piston engine models were sold in parallel with the Wankel engine models; the Cosmo 1800 was fitted with a 1,769 cc inline four cylinder SOHC gasoline engine and the Cosmo 2000 was fitted with 1,970 cc SOHC four cylinder.

This model was built in two series just like the original Cosmo: the AP/CD Series I were made from 1975-1978 and the Series II from 1979-1981. The CD Series I cars were exported to the US and other markets but sales were poor so the Series II cars were made for Japan’s domestic market only where they remained popular.

The car was equipped with front independent suspension and a five link suspension at the rear. Brakes were servo assisted discs all around.

Mazda Series HB (1981-1989)

When the Cosmo AP was phased out it was replaced by the Series HB which was also sold in export markets as the Mazda 929 (Note: This would be the second export model to bear this name as a previous 1970’s car had also been called the “Mazda 929″).

The HB Cosmo was sold in both sedan and two door coupé versions and was offered with Wankel engine options, gasoline piston engine options, and a diesel piston engine option. By this stage Mazda had invested a great deal of research and development into the Wankel engine such that the engine had become quite sophisticated.

There were three rotary engine options; The 1.1 liter 12A-6PI (6PI=”six-port induction”), the turbocharged 12A Turbo, and the interesting 1.3 liter 13B-RESI. The 13B-RESI used “Rotary Engine Super Injection” in which the engine used Helmholtz Resonance created by the opening and closing of the intake ports in a two-level intake box to effectively provide positive intake port pressure in synchronization with the intake cycle. The 13B-RESI engine used Bosch L-Jetronic fuel injection and was only available with an automatic transmission.

The Mazda Cosmo fitted with the Wankel 12A Turbo was the fastest production car in Japan until it lost that crown to the Nissan R30 Skyline RS. Not only had the turbocharged rotary engine contributed to this but also the car’s aerodynamics: it boasted a drag coefficient of just 0.32.

The piston engine’s used for the HB Cosmo were a 1.8 liter SOHC four cylinder, two different 2.0 liter SOHC four cylinder, and a 2.2 liter four cylinder diesel.

Eunos Cosmo: Series JC (1990-1996)

The last car to wear the “Cosmo” name was Mazda’s Eunos Cosmo of the Series JC. Eunos was Mazda’s luxury brand name similar to Toyota’s Lexus. The Eunos Cosmo was a superb successor to the original Mazda Cosmo and outstripped even the Cosmo Rotary Turbo which was itself a fabulously exciting car.

The Eunos Cosmo was made with two engine options: The smaller engine was the twin turbocharged 13B-RE which featured twin 654cc rotors giving total capacity of 1,308cc. This engine was fitted with a Hitachi HT-15 primary turbocharger and a smaller HT-10 secondary. Engine power was 235hp.

The larger engine was the triple rotor 20B-REW. This was the first triple rotor production car engine in the world, and the first to be fitted with twin sequential turbochargers. The rotors of this engine were the same capacity as the 13B-RE; i.e. 654cc, and with three of these rotors the engine capacity became 1,962cc. This engine was mated to an electronically controlled four speed automatic transmission and produced 300hp. Torque was 280lb/ft torque @ 1,800rpm: suffice to say its performance was nicely adequate.

The Eunos Cosmo was made as a 1990’s cutting edge technology luxury vehicle and boasted a built in GPS navigation system, and the Palmnet serial data communication system for ECU-to-ECAT operation. Not content with that the car was fitted with what we would nowadays regard as an “old school” CRT touch screen for control of the climate control system, mobile phone, GPS, TV, radio and CD player.

The Eunos Cosmo marked a return by Mazda to an expensive limited production sports coupé and it was never exported but only made for the Japanese market. In Japan it was speed limited to 180km/hr 118.8mph) but if that speed limiter was disabled it could reach 255km/hr (158.4mph).

Mazda sold just 8,875 Eunos Cosmos with about 60% of those cars being fitted with the twin rotor 13B-RE engine and 40% being fitted with the triple rotor 20B-REW. It was an expensive automobile and after production ended in September 1995 Mazda did not make another vehicle in the same price bracket again.

Conclusion

The Mazda Cosmo Series I and II were the ice-breaker vehicles that not only looked space age, back when a space age looking car was a fashionable thing, but they broke completely new technological ground.

The Mazda Cosmo was the car that helped make Mazda a household name and so it was the foundation on which the company built their public identity. Mazda not only made a success of the Cosmo but they also developed and made a success of the Wankel rotary engine technology: something that looked impossibly difficult back in the 1960’s and indeed something that the NSU and Citroën Comotor joint venture had much less success with.

Thanks to Mazda and that first Cosmo, and then its Cosmo named successors and others such as the RX-8, Wankel engine had its time in the sun. It did not replace piston engines as perhaps Mazda had hoped that it would, but it became a viable alternative until emissions restrictions killed it off. Rumours now abound that new apex seal technology is going to bring the Wankel back into production, and it’s believed that Mazda is still developing rotaries in secret.

Photo Credits: Mazda, Bonhams, RM Sotheby’s

The post A Brief History of the Mazda Cosmo – Everything You Need To Know appeared first on Silodrome.

source https://silodrome.com/history-mazda-cosmo/

3 notes

·

View notes

Text

Europe Automotive Leaf Spring Suspension Market Analysis, Report 2022-2028

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, expects Europe Automotive Leaf Spring Suspension Market size to grow at a CAGR of 6.1% during the forecast period between 2022 and 2028. Rising disposable income and economic prosperity among Europeans, expanding industrial activities, and commercial businesses all contribute to increasing supply of light, medium, and heavy commercial vehicles. This, in turn, is expected to drive the Europe automotive leaf spring suspension market. Strict emission norms are compelling manufacturers to adopt modern technologies, such as automotive leaf spring suspension systems, which aid in the reduction of emissions from automobiles. A rising demand for luxury cars and sports utility vehicles (SUVs) are also boosting the growth of Europe automotive leaf spring suspension market. However, rising substitutes for automotive leaf spring suspension systems are anticipated to hamper the overall market growth during the forecast period.

Europe Automotive Leaf Spring Suspension Market – Overview

A leaf spring is a type of suspension spring formed of leaves that is typically found in wheeled vehicles. It is a semi-elliptical arm composed of one or more leaves that are either steel or other material strips that flex when under pressure but revert to their original form when not in use. Leaf springs are positioned between the wheels and the body of the vehicle. As it travels over a bump, the wheel elevates and deflects the spring, storing energy in the spring. The elasticity of the spring causes it to bounce when released, expanding the stored energy.

The expansion of Europe automotive leaf spring suspension market can be ascribed to a rising demand for commercial and passenger automobiles. Europe automotive leaf spring suspension market is divided into three sections: type, vehicle type, and geography. The type segment is split into two types: multi-leaf springs and mono-leaf springs. Because of advantages, such as improved ride quality and load carrying capability, the multi-leaf springs are more popular than mono-leaf springs.

Request for Sample Report @ https://www.blueweaveconsulting.com/report/europe-automotive-leaf-spring-suspension-market/report-sample

Europe Automotive Leaf Spring Suspension Market – By Vehicle Type

Based on the vehicle type, Europe automotive leaf spring suspension market has segments: Light Commercial Vehicle (LCV), Medium Commercial Vehicle (MCV), and Heavy Commercial Vehicle (HCV) segments. Among these, the HCV segment held the highest market share in 2021 and is expected to continue its dominance in the coming years. The increased heavy transportation and logistics activities in the business sector around Europe are driving the demand for HCVs across the region. As compared to LCVs, which require both leaf spring and coil spring suspension depending on the loading conditions, automotive leafy spring suspensions are preferred among HCVs, such as trucks and buses. As a result, an increasing use of leaf springs in HCVs that aid in heavy loading operations is expected to drive the segment growth during the forecast period.

Impact of COVID-19 on Europe Automotive Leaf Spring Suspension Market

COVID-19 pandemic had a significant impact on Europe automotive leaf spring suspension market. Vehicle production in the region ceased due to reduced transportation and logistics operations and supply chain interruptions, and the region's experienced substantial impact on the deployment of automotive leaf spring suspension. Furthermore, major European countries, such as Germany, Italy, and Spain, took drastic steps, including travel restrictions, to prevent the spread of novel coronavirus. They also hold a sizable portion of the automobile leaf spring suspension market, as Europe has the stringent road safety requirements. Sales of various passenger cars and automobile production in European countries declined dramatically in 2020, and businesses required time to stabilize their operations. However, with the increased focus on new features and technology, the manufacturers can attract potential clients and expand their footprints in emerging markets. This aspect is projected to boost the Europe automotive leaf spring suspension market. In addition, post the relaxation of COVID-19 related restrictions, such as loosening of the transportation, travel and logistics restrictions, in Europe, the market is expected to grow at a high rate during the period in analysis.

Competitive Landscape

Major players operating in Europe automotive leaf spring suspension market include Hendrickson Commercial Vehicle Systems, Sogefi SpA, Olgun Celik A.S., HŽP a.s., Frauenthal Holding, IFC Composite GmbH, Owen Springs, Paddington Motor Springs, Jones Springs, Coil-Springs, Rossendale Road Springs, Lamina Suspension, and GME Springs. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product development.

About Us

BlueWeave Consulting provides comprehensive Market Intelligence (MI) Solutions to businesses regarding various products and services online and offline. We offer all-inclusive market research reports by analyzing both qualitative and quantitative data to boost the performance of your business solutions. BWC has built its reputation from the scratch by delivering quality inputs and nourishing long-lasting relationships with its clients. We are one of the promising digital MI solutions companies providing agile assistance to make your business endeavors successful.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Automotive Leaf Spring After Market Study 2022: An Emerging Hint of Business Opportunity and Trend Forecast to 2027

Stratview Research, a global market research firm announces the release of the report titled – Automotive Leaf Spring After Market which provides an in-depth analysis of the market dynamics, current and emerging trends, industry forecast, and competitive landscape.

Request a Free Sample here:

According to this report, the global Automotive Leaf Spring After Market is estimated to growth at a healthy CAGR of 5% by 2027.

Market Segments Analysis

The market researchers have studied the Automotive Leaf Spring After Market minutely for better understanding. The report consists of segment-wise details to assist the users in making suitable decisions for better growth opportunities. Below is the short piece of information -

Key Players

• Dongfeng Motor Suspension Spring Co., Ltd.

• Emco Industries

• FAW Group Corporation

• Hendrickson International

• Jamna Auto Industries

• NHK Springs Co., Ltd.

• Rassini

Growth drivers and Market Value:

This report, from Stratview Research, studies the Automotive Leaf spring aftermarket value and growth drivers over the trend period of 2019-24. According to the report -

Leaf spring is one of the oldest suspension components and is still being preferred in most of the LCVs and MHCVs. The automotive industry has witnessed a remarkable transition in the leaf spring technology, material, style, design, etc. over a period of time. There are countless styles of leaf-spring suspension available worldwide featuring different mounting points, shapes, and sizes. Leaf spring has to be replaced frequently, generally in 9-12 months, due to the damages like sag, break, and crack, caused by several factors including uneven road and excess load on the vehicle.

Segment Analysis:

Based on by Vehicle Type:

The leaf spring aftermarket is segmented based on the vehicle type as Passenger Car, LCV, M&HCV, and Other Vehicles. M&HCV is expected to remain the growth engine of the aftermarket during the forecast period owing to a higher penetration of leaf springs in the segment. Also, there is a frequent replacement of leaf springs in M&HCV due to higher loads carried by the vehicle.

Based on Regional:

In terms of region, Asia-Pacific is expected to remain the largest leaf spring aftermarket with an impressive CAGR during the forecast period. An increased vehicle production and growing fleet size would drive the demand for leaf springs in the region over the next five years. China and India are the growth engines of the Asia-Pacific’s aftermarket for leaf springs.

Know more about the report, click here

What else are available in this report?

The answer lies in the TOC and other details. Take a sneak-peek into the TOCs of this report.

Report Scope

Report Objectives

Research Methodology

Market Segmentation

Secondary Research

Primary Research

Breakdown of Primary Interviews by Region, Designation, and Value Chain

Data Analysis and Triangulation

Custom Research:

Stratview research delivers custom research services across the sectors. In case of any custom research requirements, please send your inquiry to [email protected]. Or connect with our experts at +1-313-307-4176.

About Us Stratview Research is a global market research firm, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with insightful market data to aid strategic decision making. These exclusive reports are the result of exclusive research methodology and are available for key industries such as chemicals, composites, advanced materials, technology, renewable energy, and more.

0 notes