#Automotive Leaf Spring Market Share

Explore tagged Tumblr posts

Text

Exploring the Growth of the Automotive Leaf Spring Market

Key Highlights

The automotive leaf spring market was valued at USD 5,992.1 million in 2023, and it will rise to USD 8,252.1 million, powering at a 4.8% compound annual growth rate, by 2030.

The growth of this industry is because of the increasing requirement for commercial vehicles, coupled with the rising need for comfort while traveling or driving in them. The development of the e-commerce industry globally is likely to boost the need for light commercial automobiles, which would, in sequence, drive the demand for leaf springs worldwide.

Various e-commerce websites as well as postal services utilize heavy-duty automobiles, which impacts the automotive leaf spring industry directly. Robust and reliable vehicles that are lightweight are required for logistics applications. Leaf springs are suitable for delivery trucks and vans due to their large capacity and strong construction.

Because of the strict emission rules, fuel efficiency is the major emphasis for vehicle manufacturers as customers demand greener as well as more fuel-efficient automobiles.

They are in continuous demand due to the increasing acceptance of pickup trucks and SUVs, which are known for their towing and off-road capacities. The improvements in technologies are making them more rugged, cost-effective, and lighter than other vehicles.

Market Analysis

The metal category led the industry in 2023, with approximately 70% share. Because of their great strength, metals can withstand the loads and strains that automobiles—particularly trucks and SUVs—place on their leaf springs. Thus, they are ideal for applications that need strength and durability.

The parabolic category accounted for the largest share in 2023, of 40%, primarily because its curved figure evenly distributes the weight. This leads to more comfortable as well as smoother rides.

Because of the strict fuel economy rules, the weight reduction ability of the parabolic type makes it ideal for automotive manufacturers.

The commercial vehicles category was the largest contributor to the industry in 2023, with approximately 75% share, because of the high demand for durability and ruggedness in them.

For commercial vehicles, their overall price is the main reduction that leaf springs provide, while delivering greater durability and strength with improved fuel efficiency.

The original equipment manufacturers (OEMs) category led the industry in 2023, with approximately 80% share. This is because automobile manufacturers generally purchase leaf springs and various other components in bulk.

Due to their ability to negotiate large discounts with leaf spring providers, their costs per unit are lower compared to those of aftermarket sellers.

APAC accounted for the largest share in the industry in 2023, of approximately 50%. Moreover, the regional industry will also advance at the fastest rate, of 5.3%, in the years to come. This is because of the surging adoption of commercial vehicles by e-commerce firms and the large volume of vehicles manufactured in the region.

Since vehicles comprising leaf springs are manufactured cheaply, this price-sensitive region outperforms other regions.

The industry is competitive because of greater off-road capacity, strict government guidelines, and various applications of leaf springs. Players normally perform better in price-sensitive regions, which expands the possibility of technological advancements in this industry.

Source: P&S Intelligence

#Automotive Leaf Spring Market Share#Automotive Leaf Spring Market Size#Automotive Leaf Spring Market Growth#Automotive Leaf Spring Market Applications#Automotive Leaf Spring Market Trends

1 note

·

View note

Link

0 notes

Text

Automotive Suspension System Market To Witness the Highest Growth Globally in Coming Years

The report begins with an overview of the Automotive Suspension System Market and presents throughout its development. It provides a comprehensive analysis of all regional and key player segments providing closer insights into current market conditions and future market opportunities, along with drivers, trend segments, consumer behavior, price factors, and market performance and estimates. Forecast market information, SWOT analysis, Automotive Suspension System Market scenario, and feasibility study are the important aspects analyzed in this report.

The Automotive Suspension System Market is experiencing robust growth driven by the expanding globally. The Automotive Suspension System Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Automotive Suspension System Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing. Automotive Suspension System Market Size, Share & Industry Analysis, By Suspension Type (Macpherson Strut, Multilink Suspension, Air Suspension), By System Type (Passive Suspension, Semi Active Suspension, Active Suspension), By Actuation Type (Hydraulically Actuated Suspension, Electronically Actuated Suspension), By Vehicle Type (Passenger Cars Light Commercial Vehicle) Others and Regional Forecast, 2021-2028

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/102029

Key Strategies

Key strategies in the Automotive Suspension System Market revolve around optimizing production efficiency, quality, and flexibility. Integration of advanced robotics and machine vision technologies streamlines assembly processes, reducing cycle times and error rates. Customization options cater to diverse product requirements and manufacturing environments, ensuring solution scalability and adaptability. Collaboration with industry partners and automation experts fosters innovation and addresses evolving customer needs and market trends. Moreover, investment in employee training and skill development facilitates seamless integration and operation of Automotive Suspension System Market. By prioritizing these strategies, manufacturers can enhance competitiveness, accelerate time-to-market, and drive sustainable growth in the Automotive Suspension System Market.

Major Automotive Suspension System Market Manufacturers covered in the market report include:

Some of the major companies that are present in the automotive suspension system market include ThyssenKrupp AG, ZF Friedrichshafen AG, Benteler International AG, KYB Corporation, Magneti Marelli S.P.A., Tenneco Inc, NHK Springs Co., Ltd. Mubea Fahrwerksfedern GmbH, Rassini and Mando Corp. among the other players.

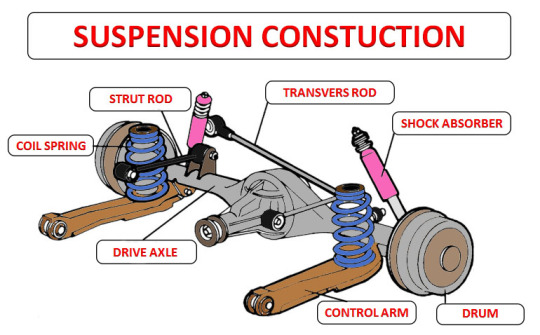

The suspension system includes shock absorbers, springs, control arm, absorbers, struts, and ball joints as their essential components. Spring is the most vital component of the suspension system as it absorbs the bumps while moving along the road and supports the vehicle. The different types of springs are used in the suspension system, such as coil spring, air spring, leaf spring, and torsion bars. The majority of passenger cars are equipped with light coil spring. The light commercial vehicles are deployed with coil and leaf spring, and heavy vehicles use leaf spring or air suspension.

Trends Analysis

The Automotive Suspension System Market is experiencing rapid expansion fueled by the manufacturing industry's pursuit of efficiency and productivity gains. Key trends include the adoption of collaborative robotics and advanced automation technologies to streamline assembly processes and reduce labor costs. With the rise of Industry 4.0 initiatives, manufacturers are investing in flexible and scalable Automotive Suspension System Market capable of handling diverse product portfolios. Moreover, advancements in machine vision and AI-driven quality control are enhancing production throughput and ensuring product consistency. The emphasis on sustainability and lean manufacturing principles is driving innovation in energy-efficient and eco-friendly Automotive Suspension System Market Solutions.

Regions Included in this Automotive Suspension System Market Report are as follows:

North America [U.S., Canada, Mexico]

Europe [Germany, UK, France, Italy, Rest of Europe]

Asia-Pacific [China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific]

South America [Brazil, Argentina, Rest of Latin America]

Middle East & Africa [GCC, North Africa, South Africa, Rest of the Middle East and Africa]

Significant Features that are under offering and key highlights of the reports:

- Detailed overview of the Automotive Suspension System Market.

- Changing the Automotive Suspension System Market dynamics of the industry.

- In-depth market segmentation by Type, Application, etc.

- Historical, current, and projected Automotive Suspension System Market size in terms of volume and value.

- Recent industry trends and developments.

- Competitive landscape of the Automotive Suspension System Market.

- Strategies of key players and product offerings.

- Potential and niche segments/regions exhibiting promising growth.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2024 to 2030?

► What are the key market dynamics influencing growth in the Global Automotive Suspension System Market?

► Who are the prominent players in the Global Automotive Suspension System Market?

► What is the consumer perspective in the Global Automotive Suspension System Market?

► What are the key demand-side and supply-side trends in the Global Automotive Suspension System Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Automotive Suspension System Market?

Table Of Contents:

1 Market Overview

1.1 Automotive Suspension System Market Introduction

1.2 Market Analysis by Type

1.3 Market Analysis by Applications

1.4 Market Analysis by Regions

1.4.1 North America (United States, Canada and Mexico)

1.4.1.1 United States Market States and Outlook

1.4.1.2 Canada Market States and Outlook

1.4.1.3 Mexico Market States and Outlook

1.4.2 Europe (Germany, France, UK, Russia and Italy)

1.4.2.1 Germany Market States and Outlook

1.4.2.2 France Market States and Outlook

1.4.2.3 UK Market States and Outlook

1.4.2.4 Russia Market States and Outlook

1.4.2.5 Italy Market States and Outlook

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

1.4.3.1 China Market States and Outlook

1.4.3.2 Japan Market States and Outlook

1.4.3.3 Korea Market States and Outlook

1.4.3.4 India Market States and Outlook

1.4.3.5 Southeast Asia Market States and Outlook

1.4.4 South America, Middle East and Africa

1.4.4.1 Brazil Market States and Outlook

1.4.4.2 Egypt Market States and Outlook

1.4.4.3 Saudi Arabia Market States and Outlook

1.4.4.4 South Africa Market States and Outlook

1.5 Market Dynamics

1.5.1 Market Opportunities

1.5.2 Market Risk

1.5.3 Market Driving Force

2 Manufacturers Profiles

Continued…

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

308, Supreme Headquarters,

Survey No. 36, Baner,

Pune-Bangalore Highway,

Pune - 411045, Maharashtra, India.

Phone:

US:+1 424 253 0390

UK: +44 2071 939123

APAC: +91 744 740 1245

#Automotive Suspension System Market#Automotive Suspension System Market Share#Automotive Suspension System Market Size#Automotive Suspension System Market Trends#Automotive Suspension System Market Growth#Automotive Suspension System Market outlook

0 notes

Text

Automotive Leaf Spring Market to Register Remarkable Growth by 2030

The novel offering by The Insight Partners on- “ Automotive Leaf Spring Market Industry Analysis| 2030” unfolds different prospects of the market. This market study provides an overview of the industry and later dives into details such as market size, shares, CAGR estimates, and revenue forecasts. The research is capable of providing a thorough understanding of key drivers and challenges ahead of…

View On WordPress

0 notes

Text

Automotive Suspension System Market Size, Share and Forecast to 2031

Automotive Suspension System Market Information:

The global Automotive Suspension System Market Report provides a complete analysis of the present situation and potential growth of the global Automotive Suspension System Market. This research report provides investors as well as companies that belong to the sector about market trends, drivers of growth, challenges, and opportunities. The purpose of this research is to offer readers valuable data they can use to assist with investment decisions in the Automotive Suspension System Market.

According to Straits Research the Automotive Suspension System Market will grow at a CAGR 5.56% during the forecast period.

Competitive Players

Some of the key players operating in the Automotive Suspension System market are

Continental AG

ZF Friedrichshafen AG

ThyssenKrupp AG

Mando Corporation

Tenneco Inc.

Marelli Corporation

Hitachi Astemo Ltd

BWI Group

Hyundai Mobis Co. Ltd

Sogefi SpA

KYB Corporation

LORD Corporation

Get Free Request Sample Report @ https://straitsresearch.com/report/automotive-suspension-system/request-sample

This research also provides a dashboard view of prominent Organization, highlighting their effective marketing tactics, market share and most recent advances in both historical and current settings.

Global Automotive Suspension System Market: Segmentation

By Component Type

Coil Spring

Leaf Spring

Air Spring

Shock Absorber

Other Components

By Type

Passive Suspension

Semi-active Suspension

Active Suspension

By Vehicle Type

Passenger Car

Commercial Vehicle

By Regions

North America

Europe

Asia-Pacific

Rest of the World

Stay ahead of the competition with our in-depth analysis of the market trends!

Buy Now @ https://straitsresearch.com/buy-now/automotive-suspension-system

Key Highlights

In order to explain Automotive Suspension System the following: introduction, product type and application, market overview, market analysis by countries, market opportunities, market risk, and market driving forces

The purpose of this study is to examine the manufacturers of Automotive Suspension System, including profile, primary business, and news, sales and price, revenue, and market share.

To provide an overview of the competitive landscape among the leading manufacturers in the world, including sales, revenue, and market share of Automotive Suspension System percent

Principal Motives Behind the Purchase:

To get deep analyses of the industry and to have a complete comprehension of the commercial landscape of the global market.

Analyse the production processes, key problems, and potential solutions in order to reduce the potential for future problems.

The goal of this study is to get an understanding of the most influential driving and restraining factors in the Automotive Suspension System industry as well as the influence that this market has on the worldwide market.

Gain an understanding of the market strategies that are now being used by the most successful firms in their respective fields.

In order to have an understanding of the market's future and potential.

Trending Report:

About Straits Research

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

Contact Us

Email: [email protected]

Address: 825 3rd Avenue, New York, NY, USA, 10022

Tel: +1 646 905 0080 , +44 203 695 0070

0 notes

Text

Automotive Suspension Systems Market Key Opportunity, Analysis, Growth, Trends 2032

The global automotive suspension systems market size is skyrocketing and is to be valued at US$ 62 Billion in 2022, forecast to grow at a stable CAGR of 4.36% to be valued at US$ 95 Billion from 2022 to 2032. Increasing urbanization, technical advances, and shift in purchasing habits are all contributing to the expansion of the automotive sector. Meticulous research and developments are assisting in updating the present automotive suspension systems in order to improve the ride quality and road holding capabilities of the vehicle.

Key Takeaways

Suspensions are vital for good ride quality and automobile handling control. A comfortable ride promotes convenience for passengers, prevents cargo damage, and decreases driver fatigue on extended voyages. Attributing to such crucial factors are resulting in surging sales of automotive suspension systems in the global market.

Since cars with firm suspension may result in better control of body motions and faster reflexes, it is increasingly becoming a crucial part of an automobile. Ambulances require improved vehicle suspension to minimize further damage to already unwell passengers. Such factors have increased the desire for greater driving comfort, which has benefited the worldwide automotive suspension systems market's development.

The SUV market has seen reasonable growth in recent years. Due to the cheap cost, small size, modern designs, and superior agility, the SUV & sub-compact SUV industry has seen significant expansion in nations such as the United States, China, India, and Mexico. The excessive use of multilink suspensions is witnessed in the market. The lower cost of multilink suspension and the simplicity of modification has expanded the use of multilink suspension in mid- to high-segment vehicles.

There is a multilink suspension seen in SUVs including Kia Sport, Volkswagen Tiguan, and Mahindra Scorpio. Throughout the projection period, the global automotive suspension systems market is predicted to increase at a pace of 4.36%. SUVs often have independent suspension at both the front and back wheels. As a result, the urge for independent suspension systems is growing.

At present, air suspensions are preferred more than leaf springs as it delivers optimum comfort and elegance to passengers. As a result, the growing demand for comfort and luxury is driving up demand for automotive suspension systems throughout the world.

For more insights: https://www.futuremarketinsights.com/reports/automotive-suspension-systems-market

The suspension system of an automobile consists of springs, structs, ball joints, shock absorbers, and control arms that help connect the vehicle to the wheel and allow relative motion between the two. The geometry and method used to design suspension are determined by the camber of the wheel, the castor of the hub, the toe of the vehicle, and the kingpin inclination of the control arms.

Suspensions are considered an important part of an automobile because it helps to keep the vehicle's tires in touch with the road during the trip, protecting the vehicle and reducing shocks along with protecting its cargo from damage or wear. In addition to that, it isolates the car from high-frequency vibrations caused by tire excitation.

Competitive Landscape

The Benteler Group, Continental AG, KYB Co., Ltd., Magneti Marelli S.p.A., Mando Corporation, Schaeffler AG, Tenneco Inc., TRW Automobile Holdings Corporation, WABCO Holdings Inc., ZF Friedrichshafen AG are some of the key companies profiled in the full version of the report.

There are various players in the market for automotive suspension systems. The automotive suspension systems industry is extremely competitive, with competitors vying to increase their market share. Product innovation and regional growth into new markets will be critical to the success of any automotive suspension systems industry participant.

Request a Sample of this Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-713

More Insights into the Automotive Suspension Systems Market

The Asia Pacific region is the largest manufacturer of automotive suspension systems. As per FMI reports, China is anticipated to maintain the dominant position in the automotive systems market during the projection period.

Owing to the surging demand for luxury vehicles, Asia Pacific becomes one of the leading manufacturers of fuel-efficient automobiles in the world. OEMs have begun to invest in and develop innovative automotive technology. Even though Japan and South Korea are technological leaders, India and China produce the most vehicles in the Asia Pacific.

Owing to the changing customer tastes, in recent years, have led to the rise in the per capita income of the middle-class population, and cost benefits for OEMs. Due to these factors, Asia Pacific has emerged as a center for automobile production in recent years.

0 notes

Text

Automotive Leaf Springs Market Expected to Reach More Than Moderate CAGR growth Forecast Period 2019-2025 | Top Vendors: Rassini, Hendrickson USA, L.L.C., Sogefi SpA

The Global Automotive Leaf Springs Market analysis 2020 offers a steady compound annual growth rate (CAGR) from 2019 to 2025 of 6.5%, which is the forecast period. Market Research Future estimates the figures and reveals that the market will witness high growth prospects in the coming years.

Top Impacting Factors

Automotive Leaf Springs Market size will witness a noticeable growth from the rising factors of medium and commercial vehicles and the production of light.

Top Companies:

Rassini (Mexico), Hendrickson USA, L.L.C. (US), Sogefi SpA (Italy), Jamna Auto Industries (India), Emco Industries (India), LITEFLEX (US), IFC Composite GmbH (Germany), NHK Springs Co. Ltd (Japan), Benteler-SGL (Austria), and OlgunCelik San. Tic. A. S (Turkey).

Get Free Sample Report @ https://www.marketresearchfuture.com/sample_request/8135

Major Highlights of TOC Covers:

Executive Summary

Key Business Trends

Regional Trends and Growth

Product Trends

End-use Trends

Definition and Forecast Parameters

More…

Contact Us

Market Research Future

+1 646 845 9312

Email: [email protected]

#Market Research Future#Automotive Leaf Springs#Automotive Leaf Springs Market#Automotive Leaf Springs Market Growth#Automotive Leaf Springs Market Share#Automotive Leaf Springs Market Size#Automotive Leaf Springs Market Trends#Automotive Leaf Springs Market Demand#Automotive Leaf Springs Market Forecast

0 notes

Text

1942-46 Willys-Overland Victory Car

"In 1942, Brooks Stevens delivered a lecture to the Society of Automotive Engineers in Detroit on the subject of America’s post-war car. In his opinion, which would for the most part be proven right, since virtually all resources were directed towards the war effort, the 1942 model-year cars would simply re-enter the market with minimal changes after hostilities ended, and any meaningful development of new cars would have to wait until later.

Stevens did, however, point out that the go-anywhere Jeep could be modified into a small, strong and inexpensive passenger car when the war was over. Moreover, such a car did not have to share the Jeep’s utilitarian looks. Representatives of the press were also present at this event, and a resulting article in the widely read Popular Mechanics magazine caught the eye of Willys-Overlands management. The company had been saved from bankruptcy by lucrative military contracts to build the Jeep for the war effort but realised that, once the war was over, it would need to diversify.

Willys-Overland was eager to discuss the matter in more detail with Stevens, so chief engineer Delmar G. (Barney) Roos invited the designer to their Toledo, Ohio headquarters. It was Stevens’ first chance to design a car to be made in significant numbers. He enthusiastically set to work and his proposal, although not exactly the epitome of elegant proportions, looked more modern than Willys-Overland’s pre-war cars. Stevens named it the ‘Victory Car’.

Because of a difference of opinion between Willys-Overland chairman Ward M. Canaday and chief executive Joseph Frazer, however, there would be a change in course. Canaday was in favour of the Jeep-based idea, but Frazer wanted to pick up where the old Willys Americar left off in 1942 and develop a new car on its base, with Studebakers highly successful 1939 Champion as an inspiration.

Brooks Stevens was instructed to design another new Willys-Overland car, named the 6-66. The result was a more grown-up looking vehicle with a front-end treatment reminiscent of the famous ‘coffin nose’ Cord 810/812. Stevens drew up several proposals, one of which was a convertible, but only the two-door sedan would make it to the prototype stage. The platform and engine were taken from the Americar so the wheelbase was identical at 104 foot and power came from a somewhat antiquated side-valve four-cylinder engine that churned out 66 bhp but was capable of delivering fuel economy in the 30mpg range.

The independent ‘Planadyne’ front suspension, the brainchild of Barney Roos, employed a single transverse leaf spring similar to Studebaker’s planar suspension, also engineered by Roos during his tenure there. Interestingly, the rear suspension was also to be independent, by means of swing axles. If the 6-66 had made it to production, it would have been the first American car with independent suspension on all four wheels.

During its developement, the 6-66 changed its name to 6-70 for undeclared reasons. Canaday continued to voice his distaste for the 6-70 and resolutely wanted to stick to Jeep-based models. By mid-1944, Frazer had had enough: he walked out, first to become CEO of Graham-Paige and, after that, to start his own car company together with Henry Kaiser. Although progressing as far as a completely functional and quite well detailed prototype, the 6-70 was stillborn and Willys-Overland would not re-enter the passenger car arena until 1952 with the Willys Aero."

source, source, source, source

MAMC: link, link, link, link

#Jeep#Willys MB#Victory Car#Willys 6-66#Willys 6-70#World War II#World War 2#WWII#WW2#History#my post

24 notes

·

View notes

Link

The Automotive Leaf Springs Market is expected to witness sustained growth over the forecast period (2019-2023). The growth of the Automotive Leaf Springs market is driven as there is favourable growth in the industry is a major factor which will boost the Automotive Leaf Springs market.

#Automotive Leaf Springs#Automotive Leaf Springs Market#Automotive Leaf Springs Industry Analysis#Automotive Leaf Springs Market Size#Automotive Leaf Springs Market Share#Automotive Leaf Springs Market Trends#Automotive Leaf Springs Forecast#Automotive Leaf Springs Previous Data#Automotive Leaf Springs Vendors

0 notes

Text

A Brief History of the Mazda Cosmo – Everything You Need To Know

The Mazda Cosmo – An Introduction

The Mazda Cosmo was born in the midst of the maelstrom of the 1960’s, the era of the Space Race between the Soviet Union, the United States, Britain, and the other democratic allies. In a sense the two rival political, economic and social systems were in direct and not particularly friendly competition with each other, and one of the areas in which that competition could be indulged in without actually getting into a nuclear war was the “Race for Space”.

It was in this environment of a hunger for technological advancement and prestige being given to those who made great strides in science and technology that a small Japanese car maker named Mazda were looking for a way to raise their company image and to thus raise their market share. Japan’s motorcycle and car makers, like Honda, were at that time making dramatic advances into the western world so Mazda’s leadership could see that if Soichiro Honda could do it then so could they.

Just as Honda had redefined what a motorcycle could be with their CB750, Mazda wanted to achieve a similar result with a motor car and realized that a good way to do that would be to pioneer newer technologies that other car makers hadn’t embraced. What technology could that be? It needed to be technology that would get people excited and interested, but it would need to be technology that would work with the existing fuel and maintenance infrastructure that mainstream conventional cars used.

The technology that jumped out as an obvious choice was the new Wankel rotary engine.

The Decision to use the Wankel Rotary Engine

The Wankel rotary engine had been first conceived in the years prior to 1951 by Felix Heinrich Wankel and he had made his first running prototype and tested it on February 1st, 1957. A number of companies purchased licenses to develop and use Wankel’s design, among them German car maker NSU and Japan’s Mazda.

Both NSU and Mazda would present cars powered by Wankel engines in 1967 but not before significant development work had been undertaken. The Wankel engine was new technology and had some major bugs that needed to be worked out before the engine could be used in a mass-produced production car. Mazda were more successful in achieving this than the Comotor joint venture between NSU and French car maker Citroën.

youtube

The major technical problem that needed to be solved in getting the Wankel engine into a usable state was the problem of “chatter marks” in the rotary engine’s housing caused by the rotor’s apex seals vibrating and impacting on the housing. It was Mazda’s engineers who came up with a decent solution to this problem initially by using hollow cast iron apex shields.

The prototype engine based on that solution was the 798cc (48.7 cu. in.) twin rotor L8A and it was used in two Mazda Cosmo prototypes in 1963. This solution was then further improved on by the use of aluminum/carbon apex seals. Legend has it that an engineer was inspired to try this when one day he was looking at the tip of his pencil and the thought struck him that carbon could be effectively used in the seals. This was then used in the next generation engine, the 982cc (60 cu. in.) twin rotor L10A, which was fitted in the car that was first shown to the public.

Mazda Cosmo Series I (1967-1968)

With work progressing on refining and debugging the radical Wankel rotary engine Mazda’s design staff got to work on the creation of a suitable vehicle with which to generate public interest both in the company and in their new rotary engine. In order to get the full attention of the automotive press one of the safest strategies is to create an exciting sports car.

British car maker Jaguar had demonstrated this both with their post-war Jaguar XK120, a car whose success came as a surprise for the company with orders flooding in to the extent that they had to actually put it into production – something that they had not originally intended to do.

Jaguar had repeated that success in 1961 when they showed their new E-Type which was so admired that even Enzo Ferrari described it as the “most beautiful car ever made”. Likewise American car maker Chevrolet had gained much admiration for their Corvette sports car and rival Ford had done likewise with their Mustang. So Mazda’s leadership could see that a sports car would be a relatively safe concept to roll the dice on.

The next question was how should the car look? Appearance and aesthetics are a make or break item when presenting a new car to a buying public. What was wanted was a car that would be beautiful like the E-Type, attractive to Americans like the Thunderbird, and reminiscent of a spaceship. The resulting car that emerged from the Mazda design studio featured a front end styling inspired by the E-Type, a rear end inspired by the Thunderbird, it was painted white just like a spaceship, and it was named “Cosmo” to capture the public imagination in the midst of the Space Race.

The Mazda Cosmo concept car was first shown at the 1964 Tokyo Motor Show and it garnered plenty of interest, no doubt there were eager people with check books in hand looking to make a Mazda Cosmo sized hole in their bank balances.

Mazda knew that although they had a working engine they still had development and extensive testing to do before they could risk releasing the car for public sale. The check books would need to go back into their pockets and the Cosmo money would have to remain in their bank accounts earning boring interest.

Mazda began thorough testing of the Mazda Cosmo pre-production cars in January 1965. There were 80 of these cars made and they were fitted with the 0810 version of the L10A engine. The engine rotor housing was made of sand cast aluminum which was chromed. Then the sides of the rotor housing were sprayed with molten carbon steel for added strength.

The rotors of these engines were cast iron while the eccentric shafts were chrome-molybdenum steel. This engine was fitted with a conventional Hitachi four barrel carburetor with a slightly unconventional twin ignition distributors and dual spark plugs in the combustion chambers.

The bodywork and suspension of the Mazda Cosmo was kept conventional with the body being a steel unibody, front suspension being fully independent with the tried and proven double “A” arms with coils springs, tubular shock absorbers, and an anti-roll bar.

Rear suspension featured leaf springs and a De Dion tube. Brakes were 10″ (284mm) discs at the front and 7.9″ (201mm) drums at the back, wheels were 14″. Brakes were not servo assisted, which was a common arrangement at that time and many sports car drivers preferred it because it gave a better feel than the power brakes commonly available at the time. The gearbox was an all synchromesh four speed manual and these Mazda gearboxes were very positive and smooth to use.

With its 982cc twin rotor engine producing 109hp @ 7,000rpm and 96lb/ft of torque the Series I Cosmo could do a standing to 60mph in 8.2 seconds, standing quarter mile in 16.4 seconds, and had a top speed of 115 mph (185 km/hr).

The car had a wheelbase of 86.6″ (2,200mm), an overall length of 163″ (4,140mm), and width of 62.8″ (1,595mm). Kerb weight was 2072lb (940kg).

With testing satisfactorily completed the Mazda Cosmo went into regular production on May 30th, 1967, so after an almost three year wait those who had waited were at last able to buy their car and Mazda was able to welcome all those nice crisp banknotes into company coffers.

The year following the car’s going on sale Mazda were confident enough in the car’s reliability to put it to the test in a very public way. Although the 24 Hours Le Mans is one of the most challenging motorsport events on earth Mazda decided to go one better and enter the 84 hour Marathon de la Route at Germany’s difficult Nürburgring circuit. Mazda entered two modestly modified cars in a field of fifty eight. The engines of the two competition cars were tuned up to 128hp, which was a modest increase over the road going model’s standard, to help ensure their reliability, and they were fitted with a side and peripheral port switching intake system, which featured a butterfly valve which would switch from the side to the peripheral port as the engine’s rpm increased.

The cars both performed well holding on to fourth and fifth places throughout most of the race. When one car did fail it was not the engine, but the axle that failed in the 82nd hour. The other car went on to take fourth place. This was a most satisfactory result and proved that the efforts invested into the research and development, and the extensive testing, had all paid off. Mazda were content with that single excursion into motor sport competition and did not attempt a full program.

Production of the Series I cars was just 343 and ended in June 1968.

Mazda Cosmo Series II (1968-1972)

The Series II Cosmo took over from the Series I in July 1968. This model was fitted with an updated engine, the L10B 0813, which produced 128hp and torque of 103lb/ft. With the more powerful engine the standing quarter mile time went down to 15.8 seconds and the top speed was a little north of 120 mph (193 km/hr).

The Series II was fitted with servo assisted brakes and a five speed manual gearbox. The wheelbase of the Series II was increased by 15″ bringing it up to 101.6″ both to provide additional room and also to improve the car’s ride qualities. These Series II cars had a very comfortable ride quality, not harsh as many sports cars tend to be but very much inclined towards long distance comfort.

The Series I and Series II cars were all hand assembled as a limited production model so build quality was kept high: these were “halo” cars intended to gain positive publicity for Mazda and so great effort went into them. They were in direct competition with Toyota’s 2000GT and they needed to meet at least the same quality standards.

Production of the Series II cars was 1,176 and ended in 1972.

The Series I and II Mazda Cosmo achieved everything Mazda had hoped for. The company’s cars became famous in part because of the halo effect of the Mazda Cosmo and the company were able to become a world leader in Wankel engine technology.

Sensibly Mazda marketed both Wankel engined cars and conventional engined cars in the same body styles so customers could choose either Wankel rotary performance or conventional car performance. The Mazda 929 of the 1970’s was an example. One disadvantage of the Wankel engine was that it gave poorer fuel consumption than a conventional engine.

In some markets this was made up for because a Wankel is significantly lower in its engine capacity for a given power and torque levels than a conventional four stroke engine. This placed the rotary engine car in a less expensive licensing category in markets such as Japan, which was a significant cost offset.

Mazda Cosmo AP/CD (1975-1981)

With the phasing out of the hand-built original Mazda Cosmo Series I and II Mazda decided to shed the space age image and build a Wankel engined car that looked more American in style. By 1975 the Space Race was pretty much over and cars like the Jaguar E-Type and 1960’s Ford Thunderbird were starting to look dated in the eyes of some.

The new car to wear the Cosmo name was not in any way derived from the original but instead was a new production car with a Wankel engine. The model was called the “AP” (Anti-Pollution) model in Japan and was the first car to pass Japan’s new 1976 exhaust emissions regulations. The AP received strong advertising and sold more than 20,000 units in the first 6 months of production.

Within three months of going on sale the car won Motor Fan Magazine’s “Car of the Year” award. In 1977 a model with a vinyl covered landau roof was also introduced: this was called the Cosmo L. In export markets this car was designated the Cosmo CD.

The export version of this model was marketed as the Mazda RX-5 and often sold in parallel with a piston engined identical model the Mazda 121. (Note: that model name would later be re-used for a sub-compact Mazda car).

The Mazda AP was made with two different Wankel engines; the AP/CD22 was fitted with an 1,146cc twin rotor type 12A engine, and the AP/CD23 was fitted with the 1,308cc 13B twin rotor engine. Two piston engine models were sold in parallel with the Wankel engine models; the Cosmo 1800 was fitted with a 1,769 cc inline four cylinder SOHC gasoline engine and the Cosmo 2000 was fitted with 1,970 cc SOHC four cylinder.

This model was built in two series just like the original Cosmo: the AP/CD Series I were made from 1975-1978 and the Series II from 1979-1981. The CD Series I cars were exported to the US and other markets but sales were poor so the Series II cars were made for Japan’s domestic market only where they remained popular.

The car was equipped with front independent suspension and a five link suspension at the rear. Brakes were servo assisted discs all around.

Mazda Series HB (1981-1989)

When the Cosmo AP was phased out it was replaced by the Series HB which was also sold in export markets as the Mazda 929 (Note: This would be the second export model to bear this name as a previous 1970’s car had also been called the “Mazda 929″).

The HB Cosmo was sold in both sedan and two door coupé versions and was offered with Wankel engine options, gasoline piston engine options, and a diesel piston engine option. By this stage Mazda had invested a great deal of research and development into the Wankel engine such that the engine had become quite sophisticated.

There were three rotary engine options; The 1.1 liter 12A-6PI (6PI=”six-port induction”), the turbocharged 12A Turbo, and the interesting 1.3 liter 13B-RESI. The 13B-RESI used “Rotary Engine Super Injection” in which the engine used Helmholtz Resonance created by the opening and closing of the intake ports in a two-level intake box to effectively provide positive intake port pressure in synchronization with the intake cycle. The 13B-RESI engine used Bosch L-Jetronic fuel injection and was only available with an automatic transmission.

The Mazda Cosmo fitted with the Wankel 12A Turbo was the fastest production car in Japan until it lost that crown to the Nissan R30 Skyline RS. Not only had the turbocharged rotary engine contributed to this but also the car’s aerodynamics: it boasted a drag coefficient of just 0.32.

The piston engine’s used for the HB Cosmo were a 1.8 liter SOHC four cylinder, two different 2.0 liter SOHC four cylinder, and a 2.2 liter four cylinder diesel.

Eunos Cosmo: Series JC (1990-1996)

The last car to wear the “Cosmo” name was Mazda’s Eunos Cosmo of the Series JC. Eunos was Mazda’s luxury brand name similar to Toyota’s Lexus. The Eunos Cosmo was a superb successor to the original Mazda Cosmo and outstripped even the Cosmo Rotary Turbo which was itself a fabulously exciting car.

The Eunos Cosmo was made with two engine options: The smaller engine was the twin turbocharged 13B-RE which featured twin 654cc rotors giving total capacity of 1,308cc. This engine was fitted with a Hitachi HT-15 primary turbocharger and a smaller HT-10 secondary. Engine power was 235hp.

The larger engine was the triple rotor 20B-REW. This was the first triple rotor production car engine in the world, and the first to be fitted with twin sequential turbochargers. The rotors of this engine were the same capacity as the 13B-RE; i.e. 654cc, and with three of these rotors the engine capacity became 1,962cc. This engine was mated to an electronically controlled four speed automatic transmission and produced 300hp. Torque was 280lb/ft torque @ 1,800rpm: suffice to say its performance was nicely adequate.

The Eunos Cosmo was made as a 1990’s cutting edge technology luxury vehicle and boasted a built in GPS navigation system, and the Palmnet serial data communication system for ECU-to-ECAT operation. Not content with that the car was fitted with what we would nowadays regard as an “old school” CRT touch screen for control of the climate control system, mobile phone, GPS, TV, radio and CD player.

The Eunos Cosmo marked a return by Mazda to an expensive limited production sports coupé and it was never exported but only made for the Japanese market. In Japan it was speed limited to 180km/hr 118.8mph) but if that speed limiter was disabled it could reach 255km/hr (158.4mph).

Mazda sold just 8,875 Eunos Cosmos with about 60% of those cars being fitted with the twin rotor 13B-RE engine and 40% being fitted with the triple rotor 20B-REW. It was an expensive automobile and after production ended in September 1995 Mazda did not make another vehicle in the same price bracket again.

Conclusion

The Mazda Cosmo Series I and II were the ice-breaker vehicles that not only looked space age, back when a space age looking car was a fashionable thing, but they broke completely new technological ground.

The Mazda Cosmo was the car that helped make Mazda a household name and so it was the foundation on which the company built their public identity. Mazda not only made a success of the Cosmo but they also developed and made a success of the Wankel rotary engine technology: something that looked impossibly difficult back in the 1960’s and indeed something that the NSU and Citroën Comotor joint venture had much less success with.

Thanks to Mazda and that first Cosmo, and then its Cosmo named successors and others such as the RX-8, Wankel engine had its time in the sun. It did not replace piston engines as perhaps Mazda had hoped that it would, but it became a viable alternative until emissions restrictions killed it off. Rumours now abound that new apex seal technology is going to bring the Wankel back into production, and it’s believed that Mazda is still developing rotaries in secret.

Photo Credits: Mazda, Bonhams, RM Sotheby’s

The post A Brief History of the Mazda Cosmo – Everything You Need To Know appeared first on Silodrome.

source https://silodrome.com/history-mazda-cosmo/

3 notes

·

View notes

Text

Europe Automotive Leaf Spring Suspension Market Analysis, Report 2022-2028

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, expects Europe Automotive Leaf Spring Suspension Market size to grow at a CAGR of 6.1% during the forecast period between 2022 and 2028. Rising disposable income and economic prosperity among Europeans, expanding industrial activities, and commercial businesses all contribute to increasing supply of light, medium, and heavy commercial vehicles. This, in turn, is expected to drive the Europe automotive leaf spring suspension market. Strict emission norms are compelling manufacturers to adopt modern technologies, such as automotive leaf spring suspension systems, which aid in the reduction of emissions from automobiles. A rising demand for luxury cars and sports utility vehicles (SUVs) are also boosting the growth of Europe automotive leaf spring suspension market. However, rising substitutes for automotive leaf spring suspension systems are anticipated to hamper the overall market growth during the forecast period.

Europe Automotive Leaf Spring Suspension Market – Overview

A leaf spring is a type of suspension spring formed of leaves that is typically found in wheeled vehicles. It is a semi-elliptical arm composed of one or more leaves that are either steel or other material strips that flex when under pressure but revert to their original form when not in use. Leaf springs are positioned between the wheels and the body of the vehicle. As it travels over a bump, the wheel elevates and deflects the spring, storing energy in the spring. The elasticity of the spring causes it to bounce when released, expanding the stored energy.

The expansion of Europe automotive leaf spring suspension market can be ascribed to a rising demand for commercial and passenger automobiles. Europe automotive leaf spring suspension market is divided into three sections: type, vehicle type, and geography. The type segment is split into two types: multi-leaf springs and mono-leaf springs. Because of advantages, such as improved ride quality and load carrying capability, the multi-leaf springs are more popular than mono-leaf springs.

Request for Sample Report @ https://www.blueweaveconsulting.com/report/europe-automotive-leaf-spring-suspension-market/report-sample

Europe Automotive Leaf Spring Suspension Market – By Vehicle Type

Based on the vehicle type, Europe automotive leaf spring suspension market has segments: Light Commercial Vehicle (LCV), Medium Commercial Vehicle (MCV), and Heavy Commercial Vehicle (HCV) segments. Among these, the HCV segment held the highest market share in 2021 and is expected to continue its dominance in the coming years. The increased heavy transportation and logistics activities in the business sector around Europe are driving the demand for HCVs across the region. As compared to LCVs, which require both leaf spring and coil spring suspension depending on the loading conditions, automotive leafy spring suspensions are preferred among HCVs, such as trucks and buses. As a result, an increasing use of leaf springs in HCVs that aid in heavy loading operations is expected to drive the segment growth during the forecast period.

Impact of COVID-19 on Europe Automotive Leaf Spring Suspension Market

COVID-19 pandemic had a significant impact on Europe automotive leaf spring suspension market. Vehicle production in the region ceased due to reduced transportation and logistics operations and supply chain interruptions, and the region's experienced substantial impact on the deployment of automotive leaf spring suspension. Furthermore, major European countries, such as Germany, Italy, and Spain, took drastic steps, including travel restrictions, to prevent the spread of novel coronavirus. They also hold a sizable portion of the automobile leaf spring suspension market, as Europe has the stringent road safety requirements. Sales of various passenger cars and automobile production in European countries declined dramatically in 2020, and businesses required time to stabilize their operations. However, with the increased focus on new features and technology, the manufacturers can attract potential clients and expand their footprints in emerging markets. This aspect is projected to boost the Europe automotive leaf spring suspension market. In addition, post the relaxation of COVID-19 related restrictions, such as loosening of the transportation, travel and logistics restrictions, in Europe, the market is expected to grow at a high rate during the period in analysis.

Competitive Landscape

Major players operating in Europe automotive leaf spring suspension market include Hendrickson Commercial Vehicle Systems, Sogefi SpA, Olgun Celik A.S., HŽP a.s., Frauenthal Holding, IFC Composite GmbH, Owen Springs, Paddington Motor Springs, Jones Springs, Coil-Springs, Rossendale Road Springs, Lamina Suspension, and GME Springs. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product development.

About Us

BlueWeave Consulting provides comprehensive Market Intelligence (MI) Solutions to businesses regarding various products and services online and offline. We offer all-inclusive market research reports by analyzing both qualitative and quantitative data to boost the performance of your business solutions. BWC has built its reputation from the scratch by delivering quality inputs and nourishing long-lasting relationships with its clients. We are one of the promising digital MI solutions companies providing agile assistance to make your business endeavors successful.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Link

0 notes

Text

Automotive Composite Leaf Springs Market Future Trends, Industry Size and Forecast to 2032

The Global Automotive Composite Leaf Spring Market was valued at US$ 71.6 Mn in 2021 and is expected to reach US$ 138 Mn by 2032, finds Future Market Insights (FMI) in a recent market survey. A new market research report by Future Market Insights on the Automotive Composite Leaf Spring Market includes a global industry analysis 2017–2021 and an opportunity assessment 2022–2032. As per the findings of the report, the Transversal installation of Composite Leaf Spring constitutes the bulk of the revenue that will be generated through this segment. It is projected that Transversal Type installation of composite will grow at 5.9% CAGR during the forecast period.

The United States to Command the Larger market share of Automotive Composite Leaf Spring throughout the Analysis Period

The United States will own 33.9% of the global Automotive Composite Leaf Spring Market. From 2017 through 2021, the CAGR is 6.7%. In the United States. The United States has the highest vehicle ownership per capita in the world and the automotive industry contributes about 3% of GDP. North America brought in US$31.7 Mn in revenue in 2022, up 7% from the previous year. In the following decade. In North America, continuous advancements in composite materials have helped to preserve competitiveness against traditional metals and plastics. These elements are propelling the market's revenue ahead.

“The introduction of new carbon fiber composites opens huge untapped segments of Automotive Leaf Spring Market. Their Commercialization in Light Commercial Vehicle segment can lead to a significant increase in revenue growth of Automotive Leaf Spring market” comments an analyst at Future Market Insights.

Automotive Composite Leaf Spring Market: Competition Insights

Currently, Composite Leaf Spring manufacturers are largely aiming at setting up manufacturing facilities, winning orders, and showcasing technology at exhibitions. The key companies operating in the flexible screen market include Benteler SGL, Hendrickson International, HyperCo, IFC Composite GmbH, LiteFlex, LLC, Mubea Fahrwerkstechnologien GmbH, ARC Suspension, FLEX-FORM, Heathcote Industrial Plastics, Hendrickson Holding LLC, KraussMaffei, Jamna Auto Industries Ltd, Standens, NHK Spring, Mitsubishi Steel, Owen Spring, Beijer Alma, Fangda, Dongfeng, Rassini International.

The key recent developments of flexible screens manufacturers are as follows:

In October 2019, Hendrickson has completed the acquisition of Dayton, Ohio-based Liteflex Composite Springs. Under the name Hendrickson Composites, the Company will operate as a branch of Hendrickson. Hendrickson's product folio is bolstered with more composite spring technology.

In Jun 2021, Rassini, a producer of suspension components for light commercial vehicles, has specified the use of an EPIKOTE epoxy resin system from Hexion Inc. for an innovative rear suspension system found in Ford Motor Co.’s new pickup truck model.

In Jan 2018, SGL Group with its joint venture with BENTELER Automotive, the complete takeover of BENTELER-SGL enables us to expand our serial productioncapabilities or components made from fiber-reinforced composites such as Leaf Spring.

In Jul 2021, Hexcel’s HexPly M901 prepreg system has been selected by Rassini, to speed up prototype and new product development cycles. The company aims to reduce overall time to market with the easy-to-process material that enables effective early-stage design screening and cost-effective production.

In Oct 2021, Under the UK government-funded research project, TUCANA, AOC AGwith Astar has developed a new sheet molding compound based on Daron polyurethane hybrid technology, that enables the production of chopped carbon fiber molded parts on an industrial scale with the mechanical performance of epoxy resin CF-SMC, and the manufacturing ease of unsaturated polyester resin and vinyl ester resin SMC.

More Insights Available

Future Market Insights, in its new offering, presents an unbiased analysis of the Automotive Composite Leaf Springs Market, presenting historical market data (2017-2021) and forecast statistics for the period of 2022-2032.

The study reveals extensive growth in Automotive Composite Leaf Springs Market in terms of Installation Type (Transversal and Longitudinal), By Process Type (High-Pressure Resin Transfer Molding Process, Prepreg Layup Process, Others), By Location Type (Front Leaf Spring, Rear Leaf Spring), By Vehicle Type (Passenger Car, Light Commercial Vehicle, Medium, and Heavy Duty Vehicles), across five regions (North America, Latin America, Europe, Asia Pacific and Middle East & Africa).

For More Info@ https://www.futuremarketinsights.com/reports/automotive-composite-leaf-springs-market

About Future Market Insights (FMI)

Future Market Insights, Inc. is an ESOMAR-certified business consulting & market research firm, a member of the Greater New York Chamber of Commerce and is headquartered in Delaware, USA. A recipient of Clutch Leaders Award 2022 on account of high client score (4.9/5), we have been collaborating with global enterprises in their business transformation journey and helping them deliver on their business ambitions. 80% of the largest Forbes 1000 enterprises are our clients. We serve global clients across all leading & niche market segments across all major industries.

0 notes

Text

Leaf spring isolator pads

#Leaf spring isolator pads how to

As with many first-year vehicles, not all the bugs had been worked out of the platform, and the Camaro had rear suspension problems. You can use the social sharing buttons to the left, or copy and paste the website link: īy 1967, Chevrolet had introduced the Camaro, and the Bow Tie group finally had a vehicle to compete for a share of the “pony” car market. SHARE THIS ARTICLE: Please feel free to share this post on Facebook / Twitter / Google+ or any automotive Forums or blogs you read. For a comprehensive guide on this entire subject you can visit this link: LEARN MORE ABOUT THIS BOOK HERE

#Leaf spring isolator pads how to

This Tech Tip is From the Full Book “ HOW TO RESTORE YOUR CAMARO 1967-1969“. There are a plethora of aftermarket as well as OEM multi-leaf spring upgrades that make performance far better than the original setup and do not adversely affect the value of a street-driven car. Safety is paramount when it comes to driving any car, and therefore the mono-leaf springs should be replaced unless you’re restoring the Camaro back to factory original equipment. Rather, the springs coil up and unload, causing severe wheel-hop and unsafe handling characteristics. The Camaro rear suspension is a weak point of the 19, as we’ll explain little later on, but suffice it to say that the original monoleaf rear springs and rear suspension setup does not provide adequate control and performance, particularly for a V-8-powered Camaro.

0 notes

Text

Automotive Suspension Systems Market Future Scenario, Key Insights, Top Companies 2031

The global automotive suspension systems market is skyrocketing and is to be valued at US$ 62 Billion in 2022, forecast to grow at a stable CAGR of 4.36% to be valued at US$ 95 Billion from 2022 to 2032.

Key Takeaways

Suspensions are vital for good ride quality and automobile handling control. A comfortable ride promotes convenience for passengers, prevents cargo damage, and decreases driver fatigue on extended voyages. Attributing to such crucial factors are resulting in surging sales of automotive suspension systems in the global market.

Since cars with firm suspension may result in better control of body motions and faster reflexes, it is increasingly becoming a crucial part of an automobile. Ambulances require improved vehicle suspension to minimize further damage to already unwell passengers. Such factors have increased the desire for greater driving comfort, which has benefited the worldwide automotive suspension systems market's development.

The SUV market has seen reasonable growth in recent years. Due to the cheap cost, small size, modern designs, and superior agility, the SUV & sub-compact SUV industry has seen significant expansion in nations such as the United States, China, India, and Mexico. The excessive use of multilink suspensions is witnessed in the market. The lower cost of multilink suspension and the simplicity of modification has expanded the use of multilink suspension in mid- to high-segment vehicles.

There is a multilink suspension seen in SUVs including Kia Sport, Volkswagen Tiguan, and Mahindra Scorpio. Throughout the projection period, the global automotive suspension systems market is predicted to increase at a pace of 4.36%. SUVs often have independent suspension at both the front and back wheels. As a result, the urge for independent suspension systems is growing.

At present, air suspensions are preferred more than leaf springs as it delivers optimum comfort and elegance to passengers. As a result, the growing demand for comfort and luxury is driving up demand for automotive suspension systems throughout the world.

Increasing urbanization, technical advances, and shift in purchasing habits are all contributing to the expansion of the automotive sector. Meticulous research and developments are assisting in updating the present automotive suspension systems in order to improve the ride quality and road holding capabilities of the vehicle.

The suspension system of an automobile consists of springs, structs, ball joints, shock absorbers, and control arms that help connect the vehicle to the wheel and allow relative motion between the two. The geometry and method used to design suspension are determined by the camber of the wheel, the castor of the hub, the toe of the vehicle, and the kingpin inclination of the control arms.

Suspensions are considered an important part of an automobile because it helps to keep the vehicle's tires in touch with the road during the trip, protecting the vehicle and reducing shocks along with protecting its cargo from damage or wear. In addition to that, it isolates the car from high-frequency vibrations caused by tire excitation.

Competitive Landscape

The Benteler Group, Continental AG, KYB Co., Ltd., Magneti Marelli S.p.A., Mando Corporation, Schaeffler AG, Tenneco Inc., TRW Automobile Holdings Corporation, WABCO Holdings Inc., ZF Friedrichshafen AG are some of the key companies profiled in the full version of the report.

There are various players in the market for automotive suspension systems. The automotive suspension systems industry is extremely competitive, with competitors vying to increase their market share. Product innovation and regional growth into new markets will be critical to the success of any automotive suspension systems industry participant.

For more information: https://www.futuremarketinsights.com/reports/automotive-suspension-systems-market

More Insights into the Automotive Suspension Systems Market

The Asia Pacific region is the largest manufacturer of automotive suspension systems. As per FMI reports, China is anticipated to maintain the dominant position in the automotive systems market during the projection period.

Owing to the surging demand for luxury vehicles, Asia Pacific becomes one of the leading manufacturers of fuel-efficient automobiles in the world. OEMs have begun to invest in and develop innovative automotive technology. Even though Japan and South Korea are technological leaders, India and China produce the most vehicles in the Asia Pacific.

Owing to the changing customer tastes, in recent years, have led to the rise in the per capita income of the middle-class population, and cost benefits for OEMs. Due to these factors, Asia Pacific has emerged as a center for automobile production in recent years.

Consumers in the region choose small and low-cost vehicles. Because of the simple availability of labor, safety standards, and government incentives for FDIs, the area has seen faster expansion than the developed markets of Europe and North America.

China was estimated to be the world's largest automobile market in 2020 and will continue to be the primary driver of regional sales in the Asia Pacific. Attributing to the country's impeccable vehicle penetration rates and its rapidly developing replacement market, China is leading the global market as its basic demand for new automobiles remains high.

As per FMI, the European market is showcasing lucrative growth opportunities as Germany and the U.K. have all seen rapid expansion in the automobile sector during the previous decade.

0 notes

Text

Spring Market: Scope, Share, Opportunity, Analysis, Status, Forecast to 2027

Spring Market Overview:

Impact of key players in domestic and localized markets, increased sales pockets, changes in market law, strategic market boom analysis, market size, market growth by category, niche and utility advantages, product approvals, new products Launches, regions and many squares measure everything that happened during this Global Spring Market place report was investigated.

Request For Free Sample: https://www.maximizemarketresearch.com/inquiry-before-buying/124371

Market Scope:

According to the forecast, the global Packaged Food market is rise at a stable rate between 2021 and 2027. The market is expected to grow considerably between 2021 and 2027 as a consequence of business participants` efforts. The development method is examined, moreover as value structures and development goals and objectives. Import/export consumption, offer and demand, cost, price, share, sales volume, revenue, and gross margins square measure all lined during this global Packaged Food marketing research. within the world Packaged Food market, this study appearance at every producer's producing sites, capacity, production, exfactory value, market value, sales revenue, and market share. The us, Canada, Mexico, Germany, France, UK, Russia, Italy, China, Japan, Korea, India, geographic area, Australia, and Brazil square measure among the countries concerned.

Segmentation:

Global Spring Market

Report CoverageDetails

Base Year:2020Forecast Period:2021-2027

Historical Data:2016 to 2020Market Size in 2020:US $ 12.5 Bn.

Forecast Period 2021 to 2027 CAGR:4.7 %Market Size in 2027:US $ 17.24 Bn.

Segments Covered:by Type• Helical Springs • Leaf Springs • Others

by End Use• Manufacturing • Automotive & Transportation • Agriculture • Construction • Others

by Vehicle Type• Passenger Cars • Commercial Vehicles • Electric Cars

Key Players:

• GALA GROUP • Ace Wire Spring and Form Co., Inc • Bal Seal Engineering, Inc • Barnes Group Inc. (Associated Spring) • CARL HAAS GmbH • EBSCO Spring Co • Frequential Holding AG • Hendrickson USA L.L.C • IFC Composite GmbH • Jamna Auto Industries Ltd • John Evans Sons Incorporated • Mubi Teleordering GmbH • Rossini SAB de CV • Sogeti Spa

Get more Report Details: https://www.maximizemarketresearch.com/market-report/spring-market/124371/

Regional Analysis:

The global Packaged Food market is divided into five regions: Europe, North America, Asia-Pacific, the Middle East and Africa, and Latin America. The Global Spring Market report offers a detailed analysis of the market's major geographies, as well as notable segments and sub-segments. In terms of market size, share, and volume, the study examines the current state of regional development. This global Packaged Food market report contains figures, geographies, and revenue, as well as an in-depth look at the business chain structure, opportunities, and industry news.

COVID-19 Impact Analysis on Spring Market:

The COVID19 pandemic can cause global market turmoil in three ways: directly impact production and demand, disrupt supply networks and markets, and bankrupt companies and financial institutions. The purpose of this study is to learn more about the current situation, the recession, and the impact of COVID 19 on the global Packaged Food market. The MMR regularly assesses the impact of the COVID 19 pandemic on different sectors and industries in all areas. The same information can be found in the Maximize Market Research (MMR) survey. It can be used to find out how COVID 19 has affected the decline and growth of the industry. In addition, the MMR report helps identify gaps in market supply and demand.

Key Questions answered in the Spring Market Report are:

Which product segment grabbed the largest share in the Packaged Food market?

How is the competitive scenario of the Packaged Food market?

Which are the key factors aiding the Packaged Food market growth?

Which region holds the maximum share in the Packaged Food market?

What will be the CAGR of the Packaged Food market during the forecast period?

Which application segment emerged as the leading segment in the Packaged Food market?

Which are the prominent players in the Packaged Food market?

What key trends are likely to emerge in the Packaged Food market in the coming years?

What will be the Packaged Food market size by 2027?

Which company held the largest share in the Packaged Food market?

About Us:Maximize Market Research provides B2B and B2C research on 12000 high growth emerging opportunities technologies as well as threats to the companies across the Healthcare, Pharmaceuticals, Electronics Communications, Internet of Things, Food and Beverages, Aerospace and Defence and other manufacturing sectors.

Contact Us:MAXIMIZE MARKET RESEARCH PVT. LTD.3rd Floor, Navale IT Park Phase 2,Pune Bangalore Highway,Narhe, Pune, Maharashtra 411041, India.Phone No.: +91 20 6630 3320

0 notes