#Asset Finance Broker

Explore tagged Tumblr posts

Text

What Are The Key Benefits Of Using a Mortgage Broker?

A professional asset finance broker assists businesses and individuals in securing financing for the purchase or lease of assets, such as vehicles, machinery, property, and equipment. The broker serves as a bridge between clients and lenders, providing expert advice, access to a range of financing options, and customised solutions that align with the client's financial needs and objectives.

Key Responsibilities

Assess Client Needs: Understand the financial requirements and goals of clients.

Market Knowledge: Stay informed about lenders, products, and terms in the asset finance market.

Sourcing Finance: Identify appropriate financing options from a network of lenders.

Negotiation: Negotiate terms and interest rates to secure the best possible deal for the client.

Documentation: Assist clients with application forms and ensure compliance with regulations.

Customer Support: Offer ongoing support, including refinancing options and assistance with any issues.

Now that you have a good idea about the responsibilities of the finance broker, the next thing that you need to know is the benefits of hiring them. To get a good idea, you must go through the points explained below.

Benefits of Using an Asset Finance Broker

Time-Saving: The professionals will complete the negotiation process for you. In this way, they will save time.

Expertise: They have deep knowledge and are renowned for offering tailored solutions.

Cost Effective: You can trust them to provide cost-effective service without compromising quality.

Thus, by hiring professionals for home loans for self employed, you can be sure of getting the best result. To find them, you don't have to make a hard effort. You can do online research, get some good references from your friends and family, visit the company's website, and ask questions to clear your doubts. You should hire the one whom you can trust and who is ready to offer a warranty for the service.

1 note

·

View note

Text

0 notes

Text

Global Capital Finance for Business Growth

QI Capital has a team of seasoned Capital Investment Advisers here working globally. Our Private Investment Pool are seeking new partners in diverse industry sectors who are in need of long term Capital Investments of any size, for Business Growth, M&A or Refinance. We also offer an independent negotiated commission to consultants/brokers for any successful partnership referral. Contact us Today for a Free Evaluation.

Tel/Fax: +6568094050

Email: [email protected]

Website: www.qicapitalpte.com

#Private Capital#Capital Investments#Business loans#Loan for business#Mergers and Acquisition Finance#Business bounce back loans#Asset Finance#Business Asset finance#Asset finance brokers#Construction asset finance#Commercial and asset finance#Mining Loans and Finance#Commercial Finance

0 notes

Text

Why Choose an Experienced Mortgage Broker for Your Financial Needs

Expert Guidance from an Experienced Mortgage Broker

Navigating the complex world of mortgages can be daunting, but with an experienced mortgage broker by your side, you gain a wealth of knowledge and expertise. Our team is dedicated to simplifying the process for you, ensuring you make informed decisions that best suit your financial situation. We understand the intricacies of the mortgage landscape, and our experience allows us to provide tailored solutions that meet your unique needs.

Maximizing Your Investment with a Self Managed Super Fund Loan

If you're considering a self managed super fund loan, our expertise can be invaluable. These loans can be an excellent way to leverage your retirement savings for property investment, but they come with specific rules and regulations that can be complex to navigate. Our experienced brokers have a deep understanding of these regulations and can guide you through the process, ensuring compliance and optimizing your investment strategy. We are committed to helping you make the most of your super fund.

Flexible Financing Solutions with Asset Finance

When it comes to asset finance, our team offers flexible solutions tailored to your business needs. Whether you're looking to finance new equipment, vehicles, or other assets, we can help you find the best financing options available. Our deep understanding of the asset finance market enables us to provide competitive rates and terms, ensuring your business has the resources it needs to grow and succeed. We work closely with you to understand your goals and provide financing solutions that align with your strategic objectives.

Personalized Service from Local Mortgage Brokers

As local mortgage brokers, we pride ourselves on offering personalized service to our community. We understand the local market and have established relationships with a network of lenders, giving us the ability to find the best mortgage products for our clients. Our local presence means we are readily available to meet with you, discuss your needs, and provide ongoing support throughout the life of your loan. We are committed to building lasting relationships with our clients and supporting our community.

Why Choose Us?

Experience: Our extensive experience in the mortgage industry ensures you receive expert advice and guidance.

Personalized Service: We take the time to understand your unique financial situation and provide customized solutions.

Local Knowledge: As local brokers, we have a deep understanding of the market and strong relationships with lenders.

Comprehensive Support: From initial consultation to loan settlement and beyond, we are with you every step of the way.

Competitive Rates: Our network of lenders allows us to secure the best rates and terms for your needs.

Choosing us as your experienced mortgage broker means partnering with a team dedicated to your financial success. Whether you're looking for a self managed super fund loan, asset finance, or personalized service from local mortgage brokers, we are here to help you achieve your goals. Contact us today to learn more about how we can assist you with your financial needs.

1 note

·

View note

Text

Unveiling the Magic of Asset Finance Providers: Your Key to Financial Prosperity

youtube

In the ever-evolving world of finance, asset finance provider are the magicians who can turn your financial dreams into reality. They possess the power to unlock the potential of your assets and help you achieve your financial goals. In this article, we'll explore the realm of asset finance providers, why they matter, and how they can be the wizards of your financial success.

The Art of Asset Finance

Think of your assets as the tools in your financial toolbox. Whether it's machinery for your business, a vehicle for your personal use, or even real estate – your assets hold the key to financial growth. Asset finance is the art of leveraging these assets to secure financing and drive your financial aspirations forward.

The Benefits of Asset Finance

Before we dive deeper into the world of asset finance providers, let's understand why asset finance is such a valuable tool:

1. Efficient Capital Utilization: Asset finance is like a master chef making the most of every ingredient in a recipe. It allows you to utilize your assets without tying up your capital, keeping your financial resources available for other critical needs.

2. Accelerated Growth: Just as a turbocharger enhances an engine's performance, asset finance can turbocharge your business growth by providing the necessary funds for expansion, equipment upgrades, or fleet expansion.

3. Risk Management: Asset finance providers can help you navigate the treacherous waters of asset depreciation and technological obsolescence. It's like having a financial compass that keeps you on the right path.

4. Tax Benefits: Asset finance can offer potential tax advantages by allowing you to deduct lease payments as operating expenses. It's like finding hidden treasure in your financial statement.

5. Customized Solutions: Asset finance providers offer tailored solutions that fit your unique business or personal financial objectives. It's like having a bespoke suit made to measure, ensuring the perfect fit.

The Search for the Right Asset Finance Provider

Now that you grasp the significance of asset finance, the next step is to find the ideal asset finance provider for your needs. Here's how to go about it:

1. Define Your Goals

Begin by setting clear financial goals. Are you looking to expand your business, upgrade equipment, or acquire a new vehicle? Having a clear vision will help you identify the most suitable asset finance provider.

2. Research Online

The digital age has made it easier than ever to find asset finance providers. A quick online search, such as "asset finance provider near me," can reveal a list of potential partners. Explore their websites, read reviews, and get a feel for their services.

3. Seek Recommendations

Don't hesitate to tap into your network. Friends, colleagues, and business associates may have valuable recommendations based on their own experiences. It's like getting advice from fellow travelers who have explored the same path.

4. Verify Credentials

Ensure that the asset finance provider you consider is reputable and holds the necessary licenses and accreditations. This is like checking a doctor's qualifications before entrusting them with your health.

5. Consultation and Assessment

Contact potential asset finance providers and arrange consultations. These consultations are like job interviews for your financial partner. Ask about their experience, approach, and the solutions they can offer to help you achieve your goals.

6. References and Case Studies

Request references and case studies from previous clients. It's like reading customer reviews before making an important purchase. Hearing about successful partnerships can give you confidence in your decision.

The Wizardry of Asset Finance Providers

While some may consider navigating asset finance on their own, working with an asset finance provider has numerous advantages:

Expertise: Asset finance providers are like financial wizards who possess a deep understanding of asset evaluation, market trends, and financing structures.

Access to Resources: Just as a magician has a collection of props, asset finance providers have access to a wide range of financial tools and resources, making them versatile and adaptable.

Time and Efficiency: Managing asset finance can be complex and time-consuming. Asset finance providers free you from the intricacies, allowing you to focus on your core business or personal pursuits.

Risk Management: Asset finance providers have the skills to mitigate risks and navigate asset value fluctuations, much like seasoned sailors chart their course through unpredictable waters.

Customization: Asset finance providers tailor solutions to your specific needs and objectives, just like a skilled artist creates a masterpiece that reflects your vision.

Conclusion: Turning Dreams into Reality

In the vast landscape of finance, asset finance providers are like the enchanters who can turn your financial dreams into reality. Whether you're a business owner looking to expand your operations or an individual aiming to acquire a valuable asset, the right asset finance provider can be the magician who pulls success out of the hat. So, when you think about unlocking the potential of your assets and achieving your financial goals, remember that an experienced asset finance provider is just a call or click away, ready to work their magic and make your financial aspirations a reality.

#commercial and asset finance#asset finance providers#assets finance company#asset based lenders uk#asset finance brokers uk#asset finance companies#asset finance lenders#Youtube

1 note

·

View note

Text

Brighton's Financial Oasis: Diving into Asset Finance and Beyond

Located along Western Australia's picturesque coastline, Brighton is a town known for its stunning beaches, welcoming community, and thriving real estate market. For residents and businesses in this vibrant coastal community, the quest for financial solutions often leads to the exploration of asset finance and beyond. In this article, we'll dive deep into the world of asset finance and the broader financial landscape in Brighton, uncovering how Melba Broker can be your trusted partner in navigating this financial oasis.

The Financial Landscape of Brighton

Brighton's financial landscape is as diverse and dynamic as its real estate market. It encompasses a broad spectrum of financial needs, from residential mortgages to business loans and everything in between. The town's unique blend of lifestyle and commerce creates a rich tapestry of financial opportunities.

Real Estate Investment

Brighton's thriving property market offers opportunities for real estate investment. From beachfront properties to suburban homes, investors explore the potential to grow their wealth by entering this market.

Business Growth

Local businesses in Brighton also seek financial solutions to expand and prosper. Whether it's funding for a new venture, equipment financing, or working capital, these enterprises contribute to the community's economic vitality.

Personal Financing

Individuals, both residents and newcomers, require financial solutions for personal needs, from buying a first home to financing education, travel, or other life goals.

Asset Finance: Navigating Business Growth

Asset finance plays a pivotal role in Brighton's financial landscape, especially for local businesses. It provides a pathway for enterprises to acquire essential assets such as machinery, vehicles, technology, and equipment. With asset finance, businesses can access these assets without making substantial upfront payments, preserving their cash flow and capital for other needs.

Types of Asset Finance

Asset finance is a versatile tool, offering various options to suit different business requirements. The most common types include:

Equipment Leasing: Businesses can lease equipment and machinery, making regular payments over the lease term.

Hire Purchase: This arrangement allows businesses to make regular payments with the option to purchase the asset at the end of the term.

Asset Refinancing: Existing assets can be used as collateral to secure financing for new assets or other financial needs.

Advantages of Asset Finance

Asset finance provides businesses in Brighton with several advantages:

Preservation of Capital: By not requiring large upfront payments, asset finance allows businesses to keep their capital available for operations, expansion, and unforeseen expenses.

Improved Cash Flow: Regular, predictable payments make managing cash flow and budgeting easier.

Tax Benefits: Depending on the structure of the agreement, businesses may benefit from tax deductions on lease payments or interest.

Melba Broker: Your Financial Navigator

Navigating the financial landscape in Brighton, whether for real estate investment, business growth, or personal financing, can be a complex journey. That's where Melba Broker comes in. As a trusted name in sustainable homeownership and financial solutions, we are your partner in exploring the financial oasis of Brighton.

A Multifaceted Approach

Melba Broker takes a multifaceted approach to financial solutions, serving the diverse needs of individuals and businesses alike. Our services encompass:

Residential Mortgages: Whether you're a first-time homebuyer or looking to refinance, we offer customised mortgage solutions.

Business Financing: We assist local businesses in accessing capital for growth, equipment financing, and working capital.

Asset Finance: Our asset finance options are tailored to your specific requirements, helping businesses acquire the assets they need to thrive.

Sustainability: As a leading solar company, we promote clean, renewable energy solutions that contribute to both ecological and financial sustainability.

Expert Guidance

Navigating the world of finance can be challenging. Melba Broker's team of expert advisors is well-versed in the local market and maintains extensive networks with lenders. With their guidance, you can save time and ensure you receive the best financial terms available.

Conclusion

Brighton, with its pristine beaches and vibrant community, is a financial oasis offering a wide range of opportunities and needs. Whether you're a resident seeking a first home, a business owner looking to grow, or an investor eyeing real estate, Melba Broker is your partner in navigating this dynamic financial landscape. We're here to help you thrive in Brighton's financial oasis, from asset finance to residential mortgages and sustainability solutions.

Contact Melba Broker today and dive into the wealth of financial opportunities that Brighton has to offer. Together, we can explore the financial oasis, making your dreams and financial goals a reality in this coastal paradise.

0 notes

Text

Thrive Broking

Address: Somerset Drive, Thornton, NSW, 2322 Country:- Australia Main Phone:- 61 421 195 741 & 0421 195 741 Additional Phone:- (02) 4049 4441 Business Email :- [email protected] (mailto:[email protected]) Website:- thrivebroking.com.au (http://thrivebroking.com.au/) We are specialists for business, equipment & personal finance solutions across Australia. Our mission is to help you obtain the funding you need to thrive, We'll Put in the Hard Work In pursuit of excellence, Thrive Broking embraces the virtue of hard work to find the best solutions for your financial growth and prosperity, Lender Negotiation On Your Behalf Our expert team at Thrive Broking excels in lender negotiation, securing optimal terms and rates for your financing needs, ensuring your borrowing experience is seamless and advantageous, 24/7 Communication We at Thrive Broking offer waking hours support, available when you need us and keeping you informed every step of the way and afterwards. Services:- National Service Provider, Equipment & Vehicle Finance, Marine Finance & Insurance (Boat & Jetski), Caravan, Camper & Motor Home Finance & Insurance ,Motorbike Finance , Insurance , Commercial Business, Business Cash flow, Working Capital, Invoice Finance, Business Acquisition, Chattel Mortgage Machinery & Equipment ALL INDUSTRY for MOST worthwhile purposes , Purchase New or Used, Dealership, Private sale, or Auction Insurance & Car Search Services available.

#Loan#Car loans#Business loans#Caravan loan#Motorbike loan#Working capital loan#Cashflow loans#Personal loans#Business lending#Business car loan#Truck loan#Low doc loan#Debt consolidation loan#Boat loan#Loan broker#Equipment finance#Machinery finance#Farm machinery finance#Asset finance#Business finance#Personal finance#Car financing#Commercial finance#Trade finance#Vehicle finance#Truck finance#Excavator finance#Marine finance#Jet ski finance#Farm finance

1 note

·

View note

Text

Personal Loan for dubai

Asset Alliance |Financing Broker Dubai

Asset Alliance has a professional team with expertise in finance, mortgage and loan brokers in Dubai.

Financing Broker,personal loan,Personal Loan,SMEs Business Loan,POS Loan ,Mortgage ,Business bank, account,Credit Card,Buy out Loan,Debt Consolidation, Car/ Auto Loan,Bank guarantee & Trade Finace Dubai.

#Asset Alliance#financing broker#loan brokers#home loan brokers#brokers finance#mortgage loan brokers#house loan broker#be a loan broker#financial mortgage broker#home finance brokers#Personal Loan#SMEs Business Loan#POS Loan#Mortgage#Business bank account#Credit Card#Buy out Loan#Debt Consolidation#Car/ Auto Loan#Bank guarantee & Trade Finace

0 notes

Text

Find The Best And Right Investment Loans Near Me

Are you looking for a reliable lender who will offer the best deal possible for your home loan? Then look no further than LS Finance Broking. We are one of the best mortgage brokers, and with our extensive knowledge in the industry and vast network of financial partners, we will get you the best deal possible. We will always research the best arrangement for our clients and get them the most affordable loan possible. Do not hesitate to contact us for more information about investment loans near me.

#home loans south east melbourne#mortgage lenders bass coast#asset finance melbourne#first home buyer melbourne#first home buyers loan victoria#investment loans near me#investment property loans melbourne#machinery finance melbourne#mobile brokers melbourne#mortgage lenders near me#refinancing victoria

1 note

·

View note

Text

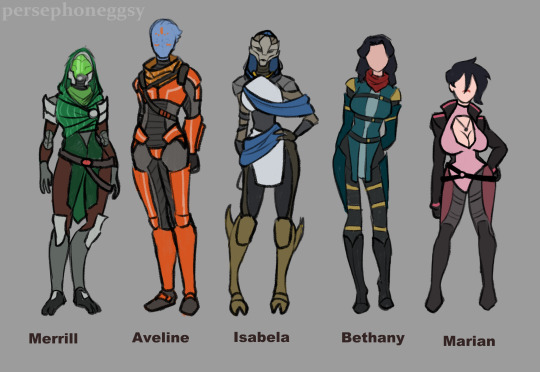

so i did this a while back, finally remembered it, and now i'm posting it

Mass Effect x Dragon Age AU

I did one of these already, sort of, for ME: Andromeda, but this one is set in the Milky Way.

Elaborations below:

Merrill is a quarian who was exiled from the Migrant Fleet. She's looking for a way not to destroy the geth, but to bring them back under quarian control, thinking they're too valuable a resource to just get rid of. Unfortunately, this made many quarians view her as dangerous, and she was exiled for the crime of experimental geth research. Making Merrill a quarian was the first choice I did for this AU, I think it fits really well.

Aveline is an asari. I'd considered krogan or turian, or simply keeping her human, but in the end I went with asari mostly because Aveline always struck me as condescending in the same way many asari are, lol. She's a commando who later moved to the Citadel to join C-SEC.

Isabela is a turian. She's a barefaced turian, meaning she has no association to a colony. Instead of following the typical turian tradition of proudly serving in the Hierarchy's military, Isabela instead ran off to become a space pirate, specializing in smuggling. She frequents the bars around Omega and has earned herself a fearsome reputation among the mercenaries.

Bethany remains a human; she grew up on a colony world with her siblings, and had a relatively peaceful childhood, despite the Alliance constantly badgering her parents to send her and her older sister to their biotic training program.

Marian, also a human, eventually ran away from home to become a mercenary. She resented her father for forbidding her and her siblings from joining the Alliance - not because she was particularly patriotic, but she felt like her father's grudge against the Alliance prevented her and her siblings from receiving the best training possible. Her powerful biotics made her both an asset and a target, and she soon caught the eye of a certain Council Spectre...

Fenris is a drell. He was raised under the Compact, an agreement between the drell and the hanar, and his purpose was to become a bodyguard... And then his training group was attacked by batarian slavers and he was taken captive. For many years, Fenris suffered under the batarians' rule, until he finally managed to escape. Unwilling to return home, he instead roams the galaxy, taking out as many batarian slaving operations as he can.

Anders is a human who escaped from a biotic testing facility run by Cerberus. Though this left him with a grudge against Cerberus, he also hates the Alliance, whom he sees as no better and will also use biotic children as weapons. He dreams of establishing a safe haven for biotics, and is willing to go to increasingly drastic measures to see that dream become a reality.

Varric is a volus. Unlike his business-minded brother, Varric does not spend his days negotiating trade agreements or doing finance consultations. Spending his days at the Afterlife bar on Omega, he's an information broker, and a pretty damn good one at that. With his specially crafted weapon Bianca, he's not too bad in a fight, either.

Carver, much like his older sister, left home to seek out his own path, and ended up joining the Alliance against his parents' wishes. He thrived in the military, quickly climbing the ranks due to his strength and competency. He's being primed for N7 training under the wathcful eye of Spectre Sebastian Vael.

Sebastian is a human, and a Council Spectre (I'm imagining this AU as a sort of nebulous period where humanity isn't as looked down upon as they were at the start of ME1, and there are a fair number of human Spectres running around). A wild child in his youth, his parents sent him to the Alliance to straighten him out, and to their relief, it worked like a charm. He specializes in covert missions and favors sniper rifles and tech powers.

#my art#mass effect au#mass effect x dragon age au#sebhawke#yeah it's technically sebhawke bc of course sebastian and marian are going to kiss have you even met me#marian regina hawke#sebastian vael#i'm not tagging everyone lol#lowkey i was worried about posting this in case Weirdos(tm) saw it and grilled me about my choices but y'know#life is for living etc etc#and yeah a lot of them are obviously based on existing ME characters and backstories but I still like this

192 notes

·

View notes

Text

In finance, a contract for difference (CFD) is a financial agreement between two parties, commonly referred to as the "buyer" and the "seller." The contract stipulates that the buyer will pay the seller the difference between the current value of an asset and its value at the time the contract was initiated. If the asset's price increases from the opening to the closing of the contract, the seller compensates the buyer for the increase, which constitutes the buyer's profit. Conversely, if the asset's price decreases, the buyer compensates the seller, resulting in a profit for the seller.

Developed in Britain in 1974 as a way to leverage gold, modern CFDs have been trading widely since the early 1990s. CFDs were originally developed as a type of equity swap that was traded on margin. The invention of the CFD is widely credited to Brian Keelan and Jon Wood, both of UBS Warburg, on their Trafalgar House deal in the early 1990s.

It remains common for hedge funds and other asset managers to use CFDs as an alternative to physical holdings (or physical short selling) for UK listed equities, with similar risk and leverage profiles. A hedge fund's prime broker will act as the counterparty to CFD, and will often hedge its own risk under the CFD (or its net risk under all CFDs held by its clients, long and short) by trading physical shares on the exchange. Trades by the prime broker for its own account, for hedging purposes, will be exempt from UK stamp duty.[citation needed]

16 notes

·

View notes

Text

Capital socially binds, represses and harnesses the material available for production including labour power before it engages it. The social category of control as such and the power platforms attendant upon the actual or ideological standing of the working classes precede the formation of prices. Making the Arab working classes more insecure, more vulnerable in the forms of their political organisation, means more profits accruing to central capital--in one facet of this one may envisage that the power-setting influences prices. The pittance spent in money form on control or destabilisation, whether it is the financing of Islamic fundamentalism or the US aid to Egypt, generates value for capital by the degree to which prices of Third World resources fall below value or, more significantly, the degree to which capital exercises control over value-forming processes. By tearing apart old ways of maintaining a living, inflating the ranks of the unemployed and driving people into poverty, capital inexpensively re-engages in production non-money assets (human beings) that had been disengaged by mass unemployment. (Of course, the same measures apply to all other resources-since to the imperialist, Arab working-class people are one more commodity to be devalued). Moreover, the images of dying Arab children, the cause of whose misery is assigned to cultural and identity politics, by 'demonstrating' that Arabs are culturally and nationally inferior, boost racism-laced nationalisms in the centre. Absurd scarcity and lifeboat theories bringing the Third World poor to First World safe havens acquire momentum and ideologically bear the weight of capitalist dynamics. The function of these campaigns is to conceal the fact that wars and their consequences in famines and chronic hunger are necessary to reproduce the ideological tools of capital. Deaths in Third World wars, famines and hunger are advertisements for imperialism (Avramidis 2005).

More often than not, diplomatic means of resolving conflicts are doomed to fail in the AW. None worked in the past unless the peace terms exacted more of a human toll than war. Egypt after the Camp David Accords is a case in point: after thirty years of growth, one out of three of its children is malnourished (IRIN 2010). That the empire will not take yes for an answer is not haphazard; war is necessary to circuitously reproduce the international division of labour attendant on accumulation by militarisation. Thus, despite the embargo on Iraq acting as a slow-motion WMD and the capitulation of its leadership, Iraq had to be invaded to crush even its remaining traces of sovereignty (Gordon 2010). Those on the Left who argue that the differences in wages across the globe are primarily derived from degrees of technological advancement, relative to differences in productivity (relative surplus value), forget that productivity in an integrated world is indivisible and that criminally wasted lives have gone into what is being produced. Accumulation and productivity do not start in the factories of the West; they begin in the Congo and Iraq. The concept of socially necessary labour and the reproduction of labour power presumes that wages are not exclusively determined by biological factors but by historical and sociological ones (Emmanuel 1972). The formation of value is an integrated historical process, in which all social moments participate in the realisation of the commodity, and not a statistical exercise accounting for distorted or power-brokered prices. The politics of imperialist aggression grapple with the growing rift between the US-led capital's bloated share of private appropriation and the redistribution of value to a complex global production structure (the shares of other imperialists). In the age of financialisation, this rift is magnified by the fetish incarnate in the dollar-based price system. The more acute the contradictions, the more developing nations have to be stripped of their security before they are deprived of political will and national resources.

Wars trace the outer limits of encroachment in the accumulation process. They are entwined with expansion by commodity realisation-- that is, the process by which commodities are brought to market and sold to realise their value. Wars also pre-empt revolutionary consciousness because they delink progressive reforms from their intermediation in revolution. In view of labour's abundance, those who perish in war reduce the number of labourers by so little relative to the huge total (an insignificant reduction of the labour-power commodity) such that they reduce the value of those remaining alive. When central-nation working classes are estranged from their own humanity (the alienated majority vote for the war machine) and under the incessant barrage of scaremongering associated with 'terrorism' and alleged resource scarcity, their initial attitude of compassion for and solidarity with Third World dead or skeletally starved people transmutes into its opposite--- deepening nationalisms and other identity forms to the benefit of capital. It is this ideological input of war distorting revolutionary consciousness that lays the ground for new wars. That wars are justified by fabricated information time and again is not a series of gaffes or mistakes; it is, as often said, a systemic calculus of mass crimc. Just as wars contribute to the reproduction of social conditions under capitalism, so also they buttress the ideology of capital, which must be continuously reproduced and is never separate from the expropriation of Arab formations. The epitome of war-making ideology was justifying what is utterly unjustifiable under the Charter of the United Nations--launching a war to protect 'a way of life'. During the ideological and media whip-up for the Second Gulf War, the distortion of humanist consciousness became so profound that some ideologues went so far as to quote Hegel's philosophy out of context in a manner that resembled the language of Mein Kampf.

Ali Kadri, Arab Development Denied: Dynamics of Accumulation by Wars of Encroachment

7 notes

·

View notes

Text

Global Business Loans for Business Growth

QI Capital has a team of seasoned Capital Investment Advisers here working globally. Our Private Investment Pool are seeking new partners in diverse industry sectors who are in need of long term Capital Investments of any size, for Business Growth, M&A or Refinance. We also offer an independent negotiated commission to consultants/brokers for any successful partnership referral. Contact us Today for a Free Evaluation.

Tel/Fax: +6568094050

Email: [email protected]

Website: www.qicapitalpte.com

#Private Capital#Capital Investments#Business loans#Loan for business#Mergers and Acquisition Finance#Business bounce back loans#Asset Finance#Business Asset finance#Asset finance brokers#Construction asset finance#Commercial and asset finance#Mining Loans and Finance#Commercial Finance

0 notes

Text

Japan announced one of its largest aid packages to Ukraine to the tune of $3.09 billion (471.9 billion yen). The fund is merely part of the G7 scheme to use frozen Russian assets to finance the war. In total, the G7 is prepared to redistribute $50 billion in Russian assets to Ukraine.

This plan will pass through the World Bank and the Japan International Cooperation Agency (JICA). The Japanese government has said it plans to oversee how Ukraine spends these funds, insisting that the aid is simply for human aid rather than military purposes.

No nation has been able to determine how Ukraine is using the endless aid they’re supplied. Portions are funneled back into the military-industrial complex and paid out to the very nations supplying aid. Everyone acts on the invisible hand in their own best interest. None of these aid packages were meant to be a handout, and Ukraine would suffer the repercussions. It is ridiculous to say that individual nations are contributing when they are using frozen Russian funds. The majority of these funds were ceased from private Russian citizens and companies who have committed no crime other than being Russian.

They stipulate this by saying they will only loan Ukraine money made on the profits of holding these assets. The risk will be shared among the G7 nations, and this risk is substantial, for Ukraine will no longer exist as a nation when this is over based on our computer models. Zelensky is too busy stuffing his pockets to care about his people or the future. He is banking on NATO invading Russia and extinguishing it as a country so he can then seize all the assets of Russia for Ukraine.

These nations are teetering on the edge by using these assets as collateral. Putin could confiscate ALL assets held by Western countries and private/public corporations under these new economic warfare tactics that completely violate international law. Zelensky has been demanding the full $300 billion in confiscated Russian assets as no sum will ever be enough for his bottomless pockets.

These funds are yet another reason why the war cannot simply end. Russia will demand that these funds be reinstated. Trump could be sworn into office and attempt to broker a deal with Putin, but all the other nations in the G7 will be against him. The US has already provided Ukraine $20 billion in Russian assets through the World Bank who would not likely reimburse a single nation’s “contributions.”

Will the G7 attempt to do the same to China when tensions in Taiwan heat up? No one seems to understand the consequences of these lowly actions, which have not prevented Russia from waging war or looking for alternative trade partners. One day, they will look back on these actions as an epic mistake, as there is no longer respect for international law; the rules no longer apply.

3 notes

·

View notes

Text

How Tobi and STON.fi Are Redefining the Future of Crypto Trading

When it comes to cryptocurrency, there’s one thing we can all agree on: the space is dynamic and constantly evolving. Yet, for many people, navigating this world can feel like being dropped into a bustling foreign market with no map, no guide, and no understanding of the language. That’s where innovation truly shines—not in making things more complex but in simplifying the experience for everyone, regardless of their level of expertise.

Let me introduce you to Tobi and STON.fi—two incredible tools that, together, are redefining what it means to trade crypto. Whether you're a seasoned trader or just starting out, the integration of these platforms offers a seamless, intuitive, and powerful way to interact with the blockchain space.

Understanding Tobi: Your Crypto Concierge

Think of Tobi as your personal assistant for cryptocurrency—a smart, AI-powered bot that operates 24/7 to make trading easier. Available on Telegram, Tobi does everything from helping users swap tokens across different networks to providing access to an integrated non-custodial wallet. In simpler terms, it’s like having a financial advisor who not only offers guidance but also does the heavy lifting for you.

Here’s an analogy: imagine you’re trying to build a bookshelf. Without the right tools, it’s frustrating, time-consuming, and you’re likely to give up halfway through. But if someone hands you pre-measured planks, the exact screws, and a clear guide on how to assemble it, suddenly the task becomes manageable. That’s exactly what Tobi does for crypto trading—it takes something complex and makes it straightforward.

STON.fi: The Engine Behind the Efficiency

Now, let’s talk about STON.fi, the decentralized exchange (DEX) powering Tobi’s ability to execute trades on the TON Blockchain. STON.fi isn’t just another DEX; it’s built on a foundation of speed, scalability, and cost efficiency. By integrating STON.fi, Tobi users gain access to seamless token swaps on the TON network—an ecosystem known for its reliability and innovative approach to blockchain technology.

Think of STON.fi as the highway system in a modern city. Without it, you’d be stuck taking backroads, dealing with unnecessary delays, and paying tolls at every turn. But with STON.fi, transactions are like cruising on a toll-free expressway—fast, efficient, and affordable.

---

Why This Integration Matters

To appreciate why this collaboration is such a big deal, it helps to step back and look at the broader picture of traditional finance versus decentralized finance.

In the traditional financial world, most of us are bound by intermediaries—banks, brokers, and centralized platforms. While these systems offer convenience, they often come at a high cost: transaction fees, delays, and, most importantly, a lack of control over your own assets.

Decentralized finance (DeFi) flips the script. Imagine having direct access to all your finances without needing a middleman. It’s like growing your own vegetables instead of buying them from a supermarket—you cut out the extra costs and gain full control. By using STON.fi’s DEX capabilities, Tobi empowers you to trade directly on the blockchain, ensuring that you’re always in charge of your assets.

Making Crypto Accessible for Everyone

One of the things I love most about this integration is how it levels the playing field. For too long, crypto trading has been dominated by those with deep technical knowledge and expensive resources. Tobi and STON.fi are changing that by making the process intuitive and user-friendly.

Here’s an example: imagine teaching someone to drive. Without proper guidance, it’s overwhelming. But if you sit with them, explain the basics, and provide a car with easy-to-use controls, they gain confidence quickly. Tobi acts as that guide, breaking down the complexities of trading into simple, actionable steps.

The Benefits: Why You Should Care

So, what does this mean for you as a trader? Let’s break it down:

1. Speed and Efficiency

Timing is everything in crypto. Missing a trade by a few seconds can mean losing out on a significant opportunity. With STON.fi’s integration, trades are executed in real time, ensuring you’re always ahead of the curve.

2. Cost Savings

Every transaction on a traditional exchange comes with fees that eat into your profits. STON.fi minimizes these costs, so more of your money stays in your pocket. Think of it like shopping at a wholesale market instead of paying retail prices—better deals with less overhead.

3. Security and Control

With a non-custodial wallet integrated into Tobi, you’re always in control of your assets. It’s the difference between keeping your money in a safe at home versus trusting someone else to hold it for you.

4. Accessibility

Whether you’re a beginner or an expert, Tobi’s intuitive interface makes crypto trading accessible to everyone. No jargon, no unnecessary steps—just a seamless experience.

A Vision for the Future

What excites me most about this collaboration isn’t just what it offers today but what it represents for the future. STON.fi isn’t just a tool; it’s part of a growing ecosystem on the TON Blockchain, working alongside projects like Tonkeeper, Punk City, and Tap Fantasy to create a thriving, interconnected community.

Imagine a marketplace where every participant adds value to the system. Developers use STON.fi’s SDK to build new applications, traders gain access to advanced tools, and the ecosystem as a whole grows stronger. It’s like a symphony where each instrument contributes to a harmonious performance.

Final Thoughts

The integration of Tobi and STON.fi isn’t just about making trading easier—it’s about empowering individuals to take full control of their financial journey. Whether you’re here to explore, invest, or build, this collaboration is your gateway to the future of decentralized finance.

Cryptocurrency can feel like uncharted territory, but with the right tools and guidance, it becomes a land of opportunity. Tobi and STON.fi are here to guide you every step of the way, ensuring that you’re not just a participant but a leader in this financial revolution.

So, are you ready to take the first step? Let’s redefine what’s possible together.

All links; https://linktr.ee/ston.fi

4 notes

·

View notes

Text

Eligible Uses for SBA 504 Loans!

SBA 504 loans are primarily used for purchasing or refinancing fixed assets, which makes them perfect for:

Commercial real estate purchases – Whether a business is looking to buy a new office building, warehouse, or retail space, the SBA 504 loan can help finance the purchase with favorable terms.

Large equipment purchases – Manufacturing companies, construction firms, or businesses in other capital-intensive industries can use SBA 504 loans to finance major equipment purchases.

Renovations or improvements – Business owners can also use SBA 504 loans to improve or expand their existing properties, allowing for further growth and increased operational efficiency.

Debt Refinances or cash out refinances

Borrowers can refinance high rate or maturing debt, and can also get cash out for eligible business expenses (EBE).

Who is Eligible for an SBA 504 Loan?

To be eligible for an SBA 504 loan, a business must meet certain criteria:

It must operate as a for-profit business.

It must meet SBA size requirements (the vast majority of businesses do).

The loan must be used for qualifying purposes such as commercial real estate, equipment purchases, or improvements.

Conclusion

For loan brokers and lending professionals, the SBA 504 loan program is an excellent option to recommend to your clients, especially those looking to expand their businesses with large fixed asset purchases. The program's long-term, fixed-rate financing, low down payments, and structured partnership between the SBA, CDCs, and private lenders make it a win-win for both borrowers and lenders. If you're not already offering SBA 504 loans, now is the time to consider incorporating them into your service offerings. By doing so, you can help your clients secure the financing they need to grow while positioning yourself as a valuable and knowledgeable partner in their success.

#SBALoans#SmallBusiness#BusinessFinancing#CommercialRealEstate#Entrepreneurship#EquipmentFinancing#BusinessGrowth#LoanBrokers#FinanceTips#DebtRefinance

2 notes

·

View notes