#Anomalous Contiguous

Explore tagged Tumblr posts

Text

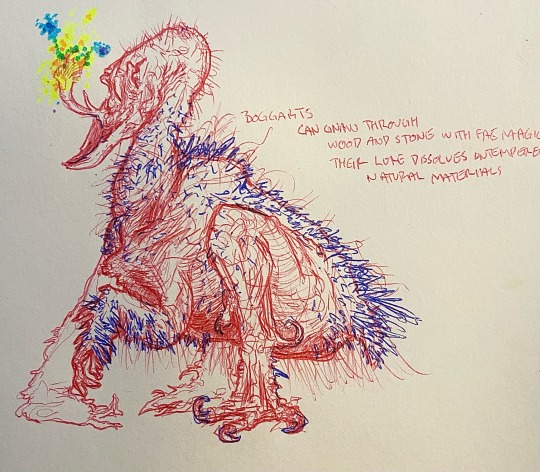

BOGGART

Boggarts are one of many Faerotten organisms produced by lifeforms on the primaterial plane being exposed to Abyssal rifts. With significant enough inundation, small avian lifeforms begin to lose their feathers and congregate near the bases of trees or large stones for shelter as the Abyssal Fae energies continue to poison their systems. Faerot reroutes normal life processes to produce grotesque deformities which, in turn, give rise to magnificent and wildly misunderstood anomalous powers.

Boggarts are an extreme nuisance. Along with creatures known as Hobs & Pixies, spawned from former woodland toads or frogs & bats respectively, these small Faerotten lifeforms make their homes in the walls and foundations of frontier homes where they feed off of psychic and emotional energy. When enough congregate together in a tight enough radius, clusters of Boggarts can impact the emotional wellbeing of a household to the point of ruin. Even homes built into the sides of mountains or those with solid stone foundations are not safe, as one of the Boggart’s abilities allows it to soften stone to the point of crumbling like dirt; Boggart warrens can run as far as the warrens of the average rabbit, with less organization & more overlapping passageways. These tunnels often collapse with passing drakes & other large wildlife, and can drastically exacerbate soil erosion.

Many small animals that dwell in woodlands are quickly crushed and twisted by the violent mutagenic powers of the Abyssal rifts which open in the lonely corners of Crodecca, where settlers and mystics alike shun the land. Overland expansion across the contiguous continent of Crodecca has forced citizens to come into contact with such beasts as Gouls, Beholders, Vampyrs, Hobs, Lunanthropes, Wyches, Boggarts, Pixies and the dreaded Skinhounds. A new chapter of pseudoclerics pioneering in anti-Fae inventions have become well known in the Deng region of Daidara & wide reaches of Doshov. These “Wychunters” are called warlocks by some in passing as their worship of a fallen saint of their faith has seemingly granted them keenness of sense for the Fae & their ilk far beyond clerics of the known faiths.

60 notes

·

View notes

Text

I’ve talked about being plural on here before, but I don’t think I’ve been terribly specific about it. I think the reason for this is that I think most peoples’ understanding of the phenomenon is constricted to knowledge about complex dissociative disorders, but to be clear that’s not what’s going on in me/us.

From what we have gleaned, our plurality stems from two places: a) a general breakdown of consciousness and contiguity of thought and b) an already-existing tendency to make sense of anomalous experiences through metaphor and storytelling. The result is a collection of more-or-less autonomous or quasi-autonomous “thought-loci” whereby subjective experience and cognition is allocated and rendered dialogic.

1 note

·

View note

Photo

Strawberry Valley, UT (No. 3)

The uplift of the range dates to the Laramide orogeny, about 70 to 50 million years ago, when compressive forces produced high-angle reverse faults on both the north and south sides of the present mountain range. The east-west orientation of the Uintas is anomalous compared to most of the ranges of the Rocky Mountains; it may relate to changing stress patterns and rotation of the Colorado Plateau. The Green River used to flow into the Mississippi River to the Gulf of Mexico, but changed to the Colorado River by going through the Uintas in ways not fully understood.

The high Uintas were extensively glaciated during the last ice age, and most of the large stream valleys on both the north and south sides of the range held long valley glaciers. However, despite reaching to over 13,500 feet (4,110 m) in elevation, the climate today is sufficiently dry that no glaciers survived even before the rapid current glacial retreat began in the middle nineteenth century. The Uintas are the most poleward mountain range in the world to reach over 13,000 feet (4,000 m) without modern glaciers, and are in fact the highest mountain range in the contiguous United States with no modern glaciers. Permafrost occurs at elevations above 10,000 feet (3,000 m) and at times forms large rock glaciers.

Between the summits and ridgelines are wide, level basins with around 500 small lakes. One of the most popular lakes is Mirror Lake because of its good fishing, scenic views, and easy road access.

Source: Wikipedia

#Strawberry Valley#Strawberry Lake#Strawberry Reservoir#Utah#USA#summer 2022#original photography#Rocky Mountains#Uintah County#Uinta Mountains#Uintah and Ouray Indian Reservation#Uinta National Forest#flora#meadow#blue sky#clouds#big sky country#travel#vacation#road trip#tourist attraction#nature#Western USA

5 notes

·

View notes

Text

In America June 14th equals flag day

and in Pennsylvania a federal holiday. "...I pledge allegiance to the flag of the United States of America. And to the republic for which it stands. One nation under god indivisible with liberty and justice for all...." Ever since setting foot in the classroom at Audubon Elementary School (circa mid ninety sixties) first thing in the morning witnessed all the students holding their right hand over their heart as a form of respect for Country and Flag and uttering the above words in quotation marks. Now as a grown adult (not quite three score years) since initially being inaugurated into my country tis of thee acquiescing without protestation the blood, sweat and tears signified courtesy stars and stripes, though now I feel squeamish blindly, fervently, obediently... uttering those thirty one words. Awareness about the bloody history delineating when "discovery" of forty eight contiguous states usurped by roving band of explorers since soured sentiment to experience native obligatory patriotism. Rather yours truly a passive activist exhibiting quiet riot mien as

rebellious nonestablishmentarian Pennsylvania doodling Yankee... dismissed as anomalous ill fête recognition came rather late in his life, yet he cannot craft literary endeavors at a fast enough rate to appease the sudden pleasantly unexpected spate of request, which hesitation on my part cannot wait. Pacifist bard of Perkiomen Valley regaled at Alpine Fellowship conclave regarding erosion of Democratic rights grave alarming usurpation of power - Republicans each and every one a nasty and brutish knave intent to pronounce decree sentencing every Homo sapien to pave (courtesy their lovely bones) back breaking laborious bloody path trumpeting, signaling and attesting slave versus master linkedin relationship essentially scuttling emancipation proclamation lifetime of human bondage forced to pledge flag of servitude amidst wreckage broken souls washed away courtesy totalitarian wave. Foreclosure on purported inalienable rights life, liberty and pursuit of happiness though hard won freedoms crimped foregone conclusion demanding fealty and loyalty to sovereignty therefore necessitates electorate to stage coup d'état and overthrow autocrat ideally thru peaceful modus operandi. Though aforementioned verses hypothetical, mine overactive imagination can easily envision governmental, née societal debacle witnessing yours truly, an extremely shy Norwegian bachelor wannabe gobbling up ample powder milk biscuits to acquire courage to protest (no matter the temperature seasonably cool today June fourteenth two thousand and twenty three) and stand firm against one unnamed political party aiming to upend voting rights, thus disenfranchising most economically vulnerable people (predominantly) persons of color to cast their vote for representation. Absolute zero chance for change unless even those risk averse (such as one garden variety wordsmith) to protest without resorting to violence and staking a claim to denounce opposition against exercising freedom for citizens to elect eligible candidate. I too would join aspiring bravehearts (each of us participants tightly grasping an amulet), not looking for fame nor fortune, only martyrdom and sainthood ha, nevertheless able, eager, and ready to risk life and limb in an effort to preserve (even at expense getting into a jam) principle figurative bulwark buttressing buzzfeeding land of milk and honey myth. Throughout American history many patriots as well as indigenous tribes bled, the latter viciously tracked down nsync with ominous dread, no matter how fast they fled taking refuge courtesy sympathetic and empathetic abolitionists, who silently motioned at (hiding) in hogshead. Outspoken voices helped spur Emancipation Proclamation and subsequent manumission diametrically opposed to bedrock attitudes, ideologies, prejudices... kept in check by scare tactics thus disallowing formerly shackled to experience full fledged freedom, whether enjoying opportunities

available to the leisure class or exploring inherent potential to amass learning and become financially successful, which suppression of free will, (within parameters of self expression - artistic, literary, musical et alia) gives credence to notion of white privilege automatic guilt linkedin with skin color. Each generation of oppressed, especially those who break the color barrier subjected with bigotry (ofttimes subtle mistreatment) challenging well earned freedom rightfully bequeathed from forebears labor. The ghosts of Africans, who suffered pre colonial rule (namely European exploitation) robbed of their national identity will forever haunt the offspring, whose forefathers/mothers brutally suffering desecrated haven housing rightful autochthonous men, women and children livingsocial within their own Lake Wobegone.

0 notes

Photo

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Item #: SCP-1824

Object Class: Keter

Special Containment Procedures: Early identification (prior to the Expansion State) of SCP-1824 remains a top priority in containment of the phenomenon. Personnel are to monitor the United States economy and investigate any localized significant recession.

A series of Foundation vehicles are to patrol the areas vulnerable to SCP-1824 and obtain comprehensive photographic data on every ground level exterior vertical surface therein. In addition, similar imaging programs utilized by online mapping agencies, as well as the FBI and NSA are to be tapped and added to the data pool. This information is to be processed by a graphic analysis program capable of isolating and identifying the designs congruent with SCP-1824.

Should SCP-1824 be discovered, the Foundation is to designate SCP-1824-1 as biologically or chemically contaminated, then evacuate all individuals that inhabit the area. Evacuated individuals are to be housed at Foundation-controlled temporary housing until the manifestation has ended. Should SCP-1824 enter the Expansion State and total evacuation has not yet been achieved, a gas vein explosion is to be emulated to expedite this process. Due to the highly public nature of SCP-1824, standard media blackout procedures are to be applied.

Description: SCP-1824 is a phenomenon manifesting as a graffiti design composed of red, black, and white spray-paint. SCP-1824 has thus far only made its initial appearance in urban environments with a population density of 14,000/km2 or higher in the contiguous United States. The graffiti always manifests on ground-level surfaces that are vertical or very nearly vertical. Designs produced by SCP-1824 are consistent in that they always feature a winged female humanoid, and possess a size of 1m x 1m or greater. Removing or obscuring the graffiti does not prevent or alter SCP-1824’s effects.

All individuals that reside within the effective range of SCP-1824 (this area is hereafter referred to as SCP-1824-1 and possesses an initial radius of roughly 50 meters) will demonstrate a pessimistic attitude towards the economy and their own financial situation. This effect will result inevitably in financial retention, and steadily worsen the economy of SCP-1824-1. Due to this, crime rates and the standard of living in said area will increase and decrease respectively.

After a period of approximately 45-47 days after SCP-1824’s initial appearance, the phenomenon will begin to increase the effective range of SCP-1824-1 by 2-3 meters every 24 hours (this has since been designated the “Expansion State”). This is marked by the appearance of additional graffiti of the same design in the extended area. This growth will continue until all available area with a population density of approximately 7,000/km2 or greater is affected. It does not appear that SCP-1824 can expand through areas with a population density lower than 7,000/km2, though once manifested, it will persist in SCP-1824-1 until the area is fully depopulated.

Each individual manifestation of SCP-1824 appears to abate only when SCP-1824-1 is completely devoid of human habitation. SCP-1824 has not been observed to generate multiple manifestations simultaneously, and occurrences are approximately 14-23 months apart.

Addendum [1824-001]: Additional Documentation

+ DOCUMENT-SCP-1824-P (CLEARANCE 4/1824 REQUIRED)

- DOCUMENT-SCP-1824-P (IDENTITY VERIFIED)

THE FOLLOWING FILE HAS BEEN EXPUNGED FROM FOUNDATION GENERAL RECORDS BY O5 MANDATE.

Item #: SCP-███

Object Class: Safe Neutralized

Special Containment Procedures: SCP-███ is currently housed in a standard humanoid containment cell at Site-19. Standard humanoid feeding regimens are to be maintained. SCP-███-1 is kept in a standard containment locker. Interaction with SCP-███ or SCP-███-1 requires the approval of a Level 3 or higher researcher.

SCP-███ is currently neutralized and does not require active containment protocols.

Description: Moved to Site-19 after being recovered from ███ ████ ████, ███ in 198█. SCP-███ is a Caucasian humanoid measuring 1.8 meters tall with a mass of 78kg. It appears to be roughly 56-59 years old, and possesses shoulder-length white hair. The entity is garbed in an assortment of damaged clothing and rags, mainly composed of cotton and leather. Its appearance demonstrates significant signs of labored living conditions, though this is typically in contrast with SCP-███’s disposition, which is pleasant and compassionate. SCP-███ will generally engage with Foundation staff without aggravation or annoyance, and is largely cooperative with staff directions. The entity often requests its release, though it does not proceed on this subject in an aggressive manner. SCP-███ does not display any anomalous properties when separated from SCP-███-1.

SCP-███-1 is an unmarked gray spray-paint can of unknown make and model. All attempts to open or breach the exterior of the object have failed; it is currently unclear whether or not it is indestructible. SCP-███-1 will not function properly if used by any individual other than SCP-███. If used by SCP-███, it will demonstrate an apparently unlimited capacity of spray-paint, which is produced in 3 known colors: red, black, and white. SCP-███ will use SCP-███-1 to create designs featuring winged female humanoids, and will typically produce these designs on public vertical surfaces.

Should SCP-███ use SCP-███-1 to create such a design, an indeterminate area surrounding it (currently believed to have a radius of approximately 50 meters) will be subject to the entity’s primary anomalous effect. All individuals who reside in this area will experience unnaturally fortunate probabilities regarding finances. The exact mechanism of this anomaly remains poorly documented, though the subjects will consistently return positive results on all financial ventures or career opportunities. Obscuring or destroying the designs is confirmed to terminate the phenomenon.

Addendum [███-001]: Interview Log

Interviewer: Dr. Brian Anborough

Interviewed: SCP-███

Foreword: Third interview with entity.

SCP-███: Would you release me, please?

Dr. Anborough: I’m afraid I can’t do that.

SCP-███: Unfortunate.

Dr. Anborough: SCP-███, you have thus far declined all inquiries about your origin. Is there anything you would care to elaborate on?

SCP-█��█: Nothing that interesting.

Dr. Anborough: Not even a name?

SCP-███: Do you have one?

Dr. Anborough: Brian.

SCP-███: A nice name. A name is as much a person as the letters are that make it.

Dr. Anborough: What about a family?

SCP-███: …Yes, my mother.

Dr. Anborough: No siblings? Children?

SCP-███: No. You?

Dr. Anborough: A son.

SCP-███: That’s wonderful. How is he?

Dr. Anborough: He’s a [EXPLETIVE REDACTED] pain in the ass. Where is your mother?

SCP-███: …Above.

Dr. Anborough: Do you have anything else to add?

SCP-███: She is hurt. A lot. The world hurt her; she never owned more than just enough food to feed us. She was angry at the world for a very long time. But I asked her to forgive and she said she would do it…for me. She would do anything for me. She gave me it before she died so I could forgive in her place.

Dr. Anborough: It? SCP-███-1?

SCP-███: Yes.

Dr. Anborough: Forgive who?

SCP-███: Whom. Everyone.

Addendum [███-002]: Neutralization Log

On ██/██/198█ at 7:28 AM, SCP-███ was accidentally killed by Foundation personnel during a containment breach by SCP-███. Dr. Brian Anborough was killed during the same incident. Within 5 hours of its death, SCP-███’s body had disintegrated, leaving behind a patch of spray-paint similar to one of SCP-███-1’s designs. The image detailed a male winged humanoid with shoulder-length black hair. SCP-███-1 ceased to demonstrate anomalous properties after the incident and was destroyed. Reclassified to Neutralized.

14 notes

·

View notes

Text

Q1 2019: SMG Market Recap

Economic and Stock Market recap of the year thus far

Asignificant slowdown of the world economy may already be unfolding and 2019 is off to a tumultuous year. Investors had been running record/cycle low cash allocations including record level cash by Berkshire Hathaway’s $112 billion dollar war chest. Goldman Sachs recently raised it’s 12-month Gold forecast to $1,450/OZ signaling an expected move towards safe haven assets.

Our Smart Money Gains analysts compiled important economic data on the US and Canadian Economy as well as identifies 5 stocks that are well positioned to perform even during this uncertain market climate. We recommend looking into the resource and cannabis micro cap’s for big winners that offer asymmetric returns.

US Market Update

Wall Street was counting on a lot more momentum in March but that has been elusive as stocks posted consecutive losses at the start of March. Investors await further indications that a trade deal between China and the U.S. could be reached and are dealing with an environment where almost all financial assets are overbought.

The most recent Fed data showed that manufacturing activity has increased but that the tight labour market is making things tough for some companies. Fed Chair Jerome Powell showed some concern about the current debt levels: “It is widely agreed that federal government debt is on an unsustainable path,” and it could “contribute greatly to the longer-run health and vitality of the U.S. economy.”

The US stock market has never been this overvalued and is ripe for a substantial downturn.

The 5G Battle Continues

Huawei CFO Meng Wanzhou has filed a civil lawsuit in Canada, accusing authorities of illegally detaining her last year. According to Deloitte since 2015 China outspent the US by $24 billion in wireless communication infrastructure is planning $400 billion in 5G related investment over the next 5 years. It’s interesting to see if the protectionist policies of the US will help the stocks of big US players in the 5G space: AT&T (T), Verizon Communications (VZ) and network gear makers LM Ericsson (ERICY) and Nokia (NOK).

US household’s biggest decline in net worth since the financial crisis

Recent numbers from the Fed showed a 3.4% drop in household net worth. US Net worth dropped to $104.3 trillion in 2018, a decrease of $3.73 trillion.

Financial assets: $85 trillion

Real estate assets: $29.2 trillion

US Consumer Credit Hits Record High

America’s ongoing love affair with auto loans, student loans and credit cards has the country hitting a new all time high of $4.034 trillion.

US companies deployed more robots last year than ever before – as advanced machines capable of specialized tasks have come down in price and availability.

Canadian Market Update

One of the only positive development’s in the Canadian economy has been the highest recorded investment by China into the metals and minerals sector spiking to $3.7 billion in 2018 from $264 million a year earlier. Big blows where delivered by falling real estate prices, weaker oil prices and the crisis of confidence in the energy industry. The recent political turmoil has shook markets and investors are feeling the pressure amid a shrinking economy. Canada’s weak December GDP numbers are worrying investors in the country.

Canadian banks report their lowest median EPS growth since the global financial crisis

Over 80% of all non-financial stocks in Canada lost money on a free cash flow basis in the last 12 months

The SNC Lavalin Scandal Has Rocked the political climate

SNC Lavalin a major engineering and construction firm bribed the Libyan Dictator and his inner circle by over $50M to get $123M in contracts. The Justice Minister wanted to prosecute the company essentially pushing them out of Canada. Prime Minister Trudeau tried to convince her not to and allegedly obstructed justice trying to push for a slap on the wrist to preserve jobs ( and his upcoming election prospects ). The minister quit and exposed him and now people are wanting asking him to resign for being corrupt since he the Liberals did receive large lobbying cheques from SNC.The company’s stock is only down 25% on the news hitting a 5 year low.

One of Prime Minister Justin Trudeau’s most trusted ministers announced on Monday that she planned to resign following the testimony of the ex Justice Minister. Interesting enough SNC-Lavalin won a $660-million transit contract from Ottawa in a deal that was surely rushed to be approved before the legal battle with the government intensifies.

Enbridge Pipeline Expansion is derailed

In a major blow to the Canadian oil industry Enbridge Inc. announced that it is delaying the date when it expects its replacement Line 3 crude oil pipeline to expand. The oil glut has been a result of a lack of pipeline space, making it difficult to ship oil to refineries. Canada’s crude oil production cuts are unsustainable and crushing Canada’s energy industry.

Some hope for a repeal to the Energy sector crushing Bill C-69

Vancouver Home Sales Crash 33%

The Real Estate Board of Vancouver reported February results released this week showed that residential home sales plummeting 32.8% year-over-year and 42.5% below the 10-year average. These numbers should be concerning to Canadian banks as mortgage growth fell to just 3.1% year-over-year in December, the worst monthly reading since May 2001.

Cannabis One IPO

One of the most exciting developments in the Cannabis sector was the IPO of Cannabis One Holdings. The company commenced trading on the Canadian Securities Exchange on February 26,2019 under the ticker symbol CBIS. A move from the NEX Board gave $MOE-H shell holders a huge 500% gain.

Cannabis One is no has a $256.88 M market cap with 73,395,168 issued shares. The company focused on aggregating and optimizing popular cannabis brands throughout North America. Their claim to fame is a portfolio of award winning products as well as their retail footprint.

The company’s first move since going public was a three-year, multi-state territorial licensing and royalty agreement for the exclusive rights to produce, market, and distribute Cheech’s Private Stash (“CPS”) brand. CPS is represented by GLE Brands Inc. (“GLE”) and film star Cheech Marin, of the legendary comedy duo, Cheech and ChongTM.

5 Active Gainers to watch

RosCan Gold Corporation

Ticker: ROS.V

Change: +27%

Volume: 4.7MM

Company Overview

RosCan is a gold exploration company developing properties in West Africa. The company has 100% interest in six contiguous gold prospective permits, encompassing 271 sq. kilometres, in Mali, West Africa. A geochemical sampling identified several anomalous areas that warrant

Drilling and work on this property is in progress. The drill program returned very positive assay results and resulted in a potentially significant new gold discovery. The company’s property is very close to producing B2G gold mine.

What is causing the increased volume?

The stock surged on news of due to the news of the strong demand in their previously announced $2-million offering. Pursuant to the upsized deal terms, the company raised up to $3.3-million through an offering of up to 23,571,428 units of the company to be priced at 14 cents per unit.

The new drill program will increase the size of the deposit and will add massive value to the current 24M market cap. The discovery is north of $250m so this stock has a long way to go. The aggressive buying came from institutional investors generating the bulk of the volume so it could be possible that the news on the discovery was revealed to the professionals.

48North Cannabis Corp.

Ticker: NRTH.V

Change: +18%

Volume: 3.5M

Company Overview

48North Cannabis is a vertically integrated cannabis company focused on the health and wellness market through cultivation and extraction, as well as the creation of innovative, authentic brands for next-generation cannabis products. 48North is developing formulations and manufacturing capabilities for its own proprietary products, as well as positioning itself to contract manufacture similar products for third parties. 48North operates two indoor licensed cannabis production sites in Ontario with over 86,000 square feet of production capacity.

What is causing the increased volume?

The company signed an exclusive licensing agreement with U.S.-based Arbor Pacific Inc. to bring its premium brand, Avitas, to Canadian consumers.Avitas, available in over 500 stores in Washington, Oregon and Colorado, is one of the bestselling single-strain vaporizer cartridges in the United States. 48North will be the exclusive Canadian licensed producer of all present and future Avitas products.

Adamera Minerals Corp.

Ticker: ADZ.V

Change: +33%

Volume: 3.126M

Company Overview

Adamera Minerals is exploring for a stand-alone, high-grade gold deposit within hauling distance of an existing mill near Republic, Wash. This area has reportedly produced over six million ounces of high-grade gold. Adamera is the dominant regional explorer in the area.

What is causing the increased volume?

Earlier this year the company found significant gold values on their property. The hole confirms the presence of an emerging zone extending northward from previously intersected high-grade mineralization. The company is at an apparent inflection point right now and it appears the tide is turning as this stock was until recently trading at a historic low.

Painted Pony Energy Ltd.

Ticker: PONY.TO

Change: +20%

Volume: 2.761M

Company Overview

Painted Pony is a publicly-traded natural gas company based in Western Canada. The Corporation is primarily focused on the development of natural gas and natural gas liquids from the Montney formation in northeast British Columbia.

What is causing the increased volume?

The company announced record 19% Increase in Proved Developed Producing Reserves Delivering a 3.1 Times Recycle Ratio in their year end operating results.

As Alberta shifts from coal to gas demand is set to increase. Two companies operating coal plants in Alberta announced plans to convert significant coal capacity to natural gas by the end of next year making this company’s future prospects quite bright.

Cameo Cobalt Corp

Ticker: CRU.V

Change: +3.85%

Volume: 3.542M

Company Overview

Cameo Cobalt Corp. is a resource exploration company with projects in Canada and Chile. The company is now in two out of three historic cobalt producing regions in Chile and has projects in 3 provinces in Canada. Its flagship asset is a 456-hectare project in the Carrizal Alto region that is adjacent to a historical high-grade cobalt deposit.

What is causing the increased volume?

The company closed a significant acquisition of 1 of 2 molybdenum mines in Canada as well as a promising gold property in the Golden Triangle. What is getting investors excited is that their Max Mine molybdenum asset is fully permitted and has a built turn key mine complex and mill that has had a total investment of over $80 million in the last decade. Molly prices had a 61% increase over the past year and that means real nearterm feasibility of the Max Mine and Mill. Upward price movements have been major with a pre-market dark pool trade of 2MM shares likely coming from a large institutional investor getting in on the action.

0 notes

Text

Explorer on Target to Issue Upgraded Resource by Early Fall

Source: Streetwise Reports 07/20/2017

Southern Silver Exploration’s core drill program at Cerro Las Minitas in Durango, Mexico, is coming to an end and the company sees the potential for a substantial resource upgrade, say Robert Macdonald, Southern Silver’s VP for Exploration, and Jay Oness, VP for Investor Relations. In this interview with Streetwise Reports, they also discuss the recently acquired additional claims, the Oro project in New Mexico and the JV with Electrum.

The Gold Report: Thank you for joining us today. Southern Silver Exploration Corp. (SSV:TSX.V; SSVFF:OTCQB; SEG1:FSE) is nearing the end of its 2016-2017 core drill program at Cerro Las Minitas in Mexico. What has the drilling revealed?

Robert Macdonald: We are currently drilling two holes and will probably drill one or two more before the end of the program. The total meterage will be over 12,000 meters (12,000m) for the entire program that started late last fall. The focus of the program has been to test deeper targets that occurred beneath the currently known deposits, the Blind and the El Sol zones.

The current program was successful in delineating a significant mineralized zone beneath those deposits. This target now has an approximate strike length of 650m and a width of up to 350m. This is a significant addition to what we identified previously and will contribute to increasing the mineral resource, which we anticipate updating in early fall 2017.

The other significant aspect to the results that we have had to date has been some very encouraging grades and thicknesses. We previously announced 14m thick intervals of 288 grams per tonne (288 g/t) silver, 2% copper and 2% combined lead-zinc. We have other significant results coming from there, including 9m 600 g/t silver and 25% combined lead-zinc.

So, not only are we seeing some good thicknesses, we’re also seeing very extensive mineralized zones overall and some higher grades than what we had seen earlier in the program. It’s all very encouraging.

TGR: When do you anticipate getting the last results from this program?

RM: We expect to finish the program around the end of July. About three weeks after that should be the publication of the final results. And then, in relatively short order after that, we’d like to have an updated resource calculation. We have been feeding the data to the resource modeler, the same person who did the maiden resource back in March 2016. We’re trying to stay up to date on it, so hopefully it’ll be a relatively quick turnaround when we get the final results.

TGR: You recently acquired additional strategic mineral claims adjacent to the Cerro Las Minitas claims package. Can you tell us about these claims and what drilling you have planned for them?

RM: These are the Biznagas and Los Lenchos claims, which are contiguous to the southern and western boundaries of the Cerro Las Minitas claim block. This was an area that we were directed to by two very prominent prospect generators, Bud Hillemeyer and Perry Durning of La Cuesta International Inc., who have had tremendous success in Mexico over the last two or three decades. These were the explorers who identified Hecla Mining Co.’s (HL:NYSE) San Sebastian mine, which is located on the eastern boundary of our claims. They also identified Argonaut Gold Inc.’s (AR:TSX) San Agustin deposit, located 2530 kilometers (2530 km) to the northwest of our property. They identified other major deposits throughout Mexico, including Silver Standard Resources Inc.’s (SSO:TSX; SSRI:NASDAQ) Pitarrilla deposit and the Camino Rojo deposit. These two individuals have been the premier mine finders in Mexico over the last several decades.

We were on a recent property tour with Bud and Perry in January. They relayed that they had previously collected some anomalous samples to the south of our property and asked if we would be interested in seeing the data and working out an agreement with them. So, we did that.

The data show some anomalous silver arsenic and antimony values, which are fairly classic pathfinders for epithermal deposits. We went in and did more due diligence sampling. We confirmed some of those early results and staked the ground, approximately 100 square kilometers (100 sq km). We’ve started sampling it more intensely, mainly float sampling and grab samples on surface. We’ve now collected over 700 samples.

We have results from around 400 samples so far and have about 300 sample results pending and have identified some fairly significant anomalies over a 5 km-long trend. We’re seeing clusters of anomalous silver and gold mineralization, as well as the previously mentioned pathfinders of arsenic, antimony and mercury. These are important, as they are indicators of a vigorous epithermal-style mineralization active throughout this area. This might be similar to the aforementioned San Sebastian style of deposit, which is located to the east, or maybe more significantly, the Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE) gold-silver deposit, which is located around 15 km to the northwest of the Biznagas and Los Lenchos claims.

We’re pretty excited about that and are continuing to develop those targets through conducting high-density grab sampling to vector in to where we need to be. The plan is to do a drill program this fall. It would probably be a reverse circulation drill program that would do the initial testing on some of these targets.

TGR: Let’s switch over to New Mexico and the Oro project. Southern Silver recently announced the start of airborne Z-TEM survey and surface work. Would you tell us about that?

RM: The Oro project is the second property within our portfolio; Cerro Las Minitas is the flagship and more advanced while Oro is at a much earlier stage. It appears to be a large, Laramide-aged porphyry copper-molybdenum system similar to some of the major deposit types that occur throughout New Mexico and Arizona.

What’s striking about this particular property is a very large zone of quartz, sericite and pyrite alteration that can be traced on surface for about 6 sq km. This is a tremendously large alteration footprint and much larger than the footprints of some of the major mines in Arizona. So, it attracts a lot of attention.

On the margins of that, we also have a gold target that we like, which we call the Stock Pond gold target. This is potentially the classic zonation that one sees in these large, very robust porphyry systems. And the analogy that we look at is the Barneys Canyon and Melco gold deposits and their relation to the Bingham Canyon porphyry copper deposit in Utah: A big porphyry center and about 34 km outboard, bulk-tonnage, oxide gold deposits.

That’s what we think we’re seeing here on the Oro property, a big porphyry center that has yet to be fully tested and drilled out, and outboard from that, a shallow, oxide gold target that occurs on the outer fringes of the mineralizing system.

So we have two targets there. At the porphyry target, we’ve completed data compilation by a Ph.D. porphyry specialist out of the University of British Columbia. He has identified two main target areas from the surface geochemistry and the alteration on the property. We’ve started a 300-line km Z-TEM program over the property, which is in process and nearing completion. The idea is to generate another targeting criterion, deep-seeing geophysics, that can help resolve some porphyry targets on the larger property package. This we think would make it more amenable to getting a major involved to explore the property and put in the big bucks that are generally required to drill a porphyry target.

In the meantime, we think that we can add value to the company by doing relatively inexpensive exploration on the Stock Pond gold target. Here, in the fall of 2016, we completed a nine-hole program, which identified a 40m interval of 0.4 g/t gold in drilling on the eastern margin of our drill pattern. This included a 9m interval of 0.75 g/t gold. This hole is open to the east, north and south.

We are now in the final stages of permitting an additional nine holes targeting a 500m by 800m area to the east of that mineralized hole with the intent of testing for a good oxide gold, bulk-mineable target on the project. It’s relatively low cost. We’re looking at a $300,000 to $400,000 total budget for both the geophysics and the drilling on the Stock Pond target. We think that we can upgrade the targeting and the property and add value to the company with those efforts.

TGR: When do you expect to do this second drill part?

RM: We would anticipate the start of drilling in mid-September.

TGR: Could you tell us a little bit about your joint venture arrangement with Electrum Global Holdings L.P.?

RM: We started down the path with Electrum in the beginning of 2015. We are very pleased with how we’ve been able to advance the project together.

In early 2015, we announced a deal where Electrum would earn 60% interest in the Cerro Las Minitas project by spending $5 million over a four-year period. It has also come in and took an equity interest in Southern Silver as well. So, it’s supporting us both with efforts on the property as well as corporately.

Electrum has been very aggressive in pursuing the property and very aggressive in deploying its investment into making the resource bigger. It had four years to spend $5 million and has done it in two and a half. When we started with Electrum, internally we felt we had maybe a 56-million-tonne (56 Mt) deposit drilled and ready to do a resource model. With Electrum’s initial investment in the project, we ended up doubling our projection to 10.8 Mt. In this last round of drilling, we think we’re going to significantly add to our existing resource with the latest results that we’ve released.

So we’ve been nothing but happy with how things have progressed with Electrum. It is an aggressive explorer and, like us, it wants to see how big this project can be before we start making any sort of development decisions or doing the predevelopment work that’s necessary to bring things to a production decision.

We’re the operator, too. So Electrum is very happy with the way that we’re advancing the project. I think it’s a win-win for everybody.

Electrum is seeing the value of its investment in the project go up. Since it came onboard, the company has gone from $0.05 up to as high as $0.60, $0.65. We’re now sitting in the $0.350.40 range. Electrum is not only seeing that we are creating value in the property, but also seeing its investment in the company get more and more valuable as we continue to advance the project.

TGR: You’re in the process of doing a brokered private placement. Would you tell us about that?

Jay Oness: Rob and I had arranged for a number of meetings prior to the Prospectors & Developers Association of Canada’s annual meeting this year with the intent of introducing the company to the institutional side of the equation. We recognize, with us being in the joint venture situation with Electrum, that as we go forward, we’re now going to be required to put up our share of the funding, which would be 40%. We then began to look for a strategic partner or partners to support us as we go down that path. We had excellent meetings. We had a number of institutions give us positive feedback with the result that there were a couple that were interested in discussing acting as a lead agent for a $5 million financing.

That resulted in us entering into an agency agreement with Gravitas Financial. Since we began undertaking this financing, we’ve been able to close 50% of it through our president’s list and through the participation of Electrum maintaining its percentage of ownership corporately. We’re now in the process of introducing the company through Gravitas and the syndication. It is a $5 million unit offering, at $0.40 per unit with a full warrant for three years at $0.55. There’s no acceleration or any onerous clauses to the warrant side of the equation.

We look at this as being an excellent opportunity. The company’s last financing back in March/April of 2016 was done at $0.10. Obviously, all of our shareholders and investors in that offering have been very pleased. We’ve had a number of them come back into our market. A number of them exercised in warrants. We’ve been able to demonstrate that through our efforts on the ground and the kind of results that we continue to show and through an aggressive investor relations program, which entails exposure globally actually, we’re able to maintain a retail element to the market. Even during the doldrums of summer right now, we’re able to still maintain our offering price of $0.40.

I think that this financing will put us in a position with an institution or institutions that at some point may take a larger interest in us. But at the same time, it’s going to be a necessity as we anticipate our share price will hopefully climband I believe it will with continued exploration successto have these institutions continue to support us with what we anticipate to be a pretty aggressive exploration program leading into potential development studies and maybe a production decision sometime over the next two or three years.

TGR: Thanks for your insights.

Robert W.J. Macdonald is the vice president of exploration for Southern Silver Exploration. He is also the vice president of geological services for the Manex Resource Group of Companies, and in such capacity has been the Exploration Manager for several publicly listed companies including Homestake Resource Corporation (formerly Bravo Gold Corp.), Valterra Resource Corporation, Duncastle Gold Corp. and Fortune River Resource Corp. Macdonald has overseen the exploration of many projects throughout North America including the discovery and delineation of the high-grade 1.2 million ounce Homestake Ridge Au-Ag deposit in northern British Columbia and is currently advancing Southern Silver’s 10 million tonne Cerro Las Minitas Ag-Pb-Zn project, Durango State, Mexico. Macdonald graduated with a B.Sc. (Hons) from Memorial University of Newfoundland in 1990 and earned a MSc. from the University of British Columbia in 1999.

Read what other experts are saying about:

Southern Silver Exploration Corp.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure: 1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, securities of the following companies mentioned in this interview: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None. 2) Southern Silver Exploration Corp. is a sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Southern Silver Exploration Corp. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Robert MacDonald and Jay Oness and not of Streetwise Reports or its officers. 4) Robert MacDonald and Jay Oness: We were not paid by Streetwise Reports to participate in this interview. We had the opportunity to review the interview for accuracy as of the date of the interview and are responsible for the content of the interview. We own shares of the following companies mentioned in this interview: Southern Silver Exploration Corp. 5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent. 6) This interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

( Companies Mentioned: SSV:TSX.V; SSVFF:OTCQB; SEG1:FSE, )

from The Gold Report – Streetwise Exclusive Articles Full Text http://ift.tt/2udn3MC

from WordPress http://ift.tt/2tudpbk

0 notes

Text

Explorer on Target to Issue Upgraded Resource by Early Fall

Source: Streetwise Reports 07/20/2017

Southern Silver Exploration's core drill program at Cerro Las Minitas in Durango, Mexico, is coming to an end and the company sees the potential for a substantial resource upgrade, say Robert Macdonald, Southern Silver's VP for Exploration, and Jay Oness, VP for Investor Relations. In this interview with Streetwise Reports, they also discuss the recently acquired additional claims, the Oro project in New Mexico and the JV with Electrum.

The Gold Report: Thank you for joining us today. Southern Silver Exploration Corp. (SSV:TSX.V; SSVFF:OTCQB; SEG1:FSE) is nearing the end of its 2016-2017 core drill program at Cerro Las Minitas in Mexico. What has the drilling revealed?

Robert Macdonald: We are currently drilling two holes and will probably drill one or two more before the end of the program. The total meterage will be over 12,000 meters (12,000m) for the entire program that started late last fall. The focus of the program has been to test deeper targets that occurred beneath the currently known deposits, the Blind and the El Sol zones.

The current program was successful in delineating a significant mineralized zone beneath those deposits. This target now has an approximate strike length of 650m and a width of up to 350m. This is a significant addition to what we identified previously and will contribute to increasing the mineral resource, which we anticipate updating in early fall 2017.

The other significant aspect to the results that we have had to date has been some very encouraging grades and thicknesses. We previously announced 14m thick intervals of 288 grams per tonne (288 g/t) silver, 2% copper and 2% combined lead-zinc. We have other significant results coming from there, including 9m 600 g/t silver and 25% combined lead-zinc.

So, not only are we seeing some good thicknesses, we're also seeing very extensive mineralized zones overall and some higher grades than what we had seen earlier in the program. It's all very encouraging.

TGR: When do you anticipate getting the last results from this program?

RM: We expect to finish the program around the end of July. About three weeks after that should be the publication of the final results. And then, in relatively short order after that, we'd like to have an updated resource calculation. We have been feeding the data to the resource modeler, the same person who did the maiden resource back in March 2016. We're trying to stay up to date on it, so hopefully it'll be a relatively quick turnaround when we get the final results.

TGR: You recently acquired additional strategic mineral claims adjacent to the Cerro Las Minitas claims package. Can you tell us about these claims and what drilling you have planned for them?

RM: These are the Biznagas and Los Lenchos claims, which are contiguous to the southern and western boundaries of the Cerro Las Minitas claim block. This was an area that we were directed to by two very prominent prospect generators, Bud Hillemeyer and Perry Durning of La Cuesta International Inc., who have had tremendous success in Mexico over the last two or three decades. These were the explorers who identified Hecla Mining Co.'s (HL:NYSE) San Sebastian mine, which is located on the eastern boundary of our claims. They also identified Argonaut Gold Inc.'s (AR:TSX) San Agustin deposit, located 2530 kilometers (2530 km) to the northwest of our property. They identified other major deposits throughout Mexico, including Silver Standard Resources Inc.'s (SSO:TSX; SSRI:NASDAQ) Pitarrilla deposit and the Camino Rojo deposit. These two individuals have been the premier mine finders in Mexico over the last several decades.

We were on a recent property tour with Bud and Perry in January. They relayed that they had previously collected some anomalous samples to the south of our property and asked if we would be interested in seeing the data and working out an agreement with them. So, we did that.

The data show some anomalous silver arsenic and antimony values, which are fairly classic pathfinders for epithermal deposits. We went in and did more due diligence sampling. We confirmed some of those early results and staked the ground, approximately 100 square kilometers (100 sq km). We've started sampling it more intensely, mainly float sampling and grab samples on surface. We've now collected over 700 samples.

We have results from around 400 samples so far and have about 300 sample results pending and have identified some fairly significant anomalies over a 5 km-long trend. We're seeing clusters of anomalous silver and gold mineralization, as well as the previously mentioned pathfinders of arsenic, antimony and mercury. These are important, as they are indicators of a vigorous epithermal-style mineralization active throughout this area. This might be similar to the aforementioned San Sebastian style of deposit, which is located to the east, or maybe more significantly, the Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE) gold-silver deposit, which is located around 15 km to the northwest of the Biznagas and Los Lenchos claims.

We're pretty excited about that and are continuing to develop those targets through conducting high-density grab sampling to vector in to where we need to be. The plan is to do a drill program this fall. It would probably be a reverse circulation drill program that would do the initial testing on some of these targets.

TGR: Let's switch over to New Mexico and the Oro project. Southern Silver recently announced the start of airborne Z-TEM survey and surface work. Would you tell us about that?

RM: The Oro project is the second property within our portfolio; Cerro Las Minitas is the flagship and more advanced while Oro is at a much earlier stage. It appears to be a large, Laramide-aged porphyry copper-molybdenum system similar to some of the major deposit types that occur throughout New Mexico and Arizona.

What's striking about this particular property is a very large zone of quartz, sericite and pyrite alteration that can be traced on surface for about 6 sq km. This is a tremendously large alteration footprint and much larger than the footprints of some of the major mines in Arizona. So, it attracts a lot of attention.

On the margins of that, we also have a gold target that we like, which we call the Stock Pond gold target. This is potentially the classic zonation that one sees in these large, very robust porphyry systems. And the analogy that we look at is the Barneys Canyon and Melco gold deposits and their relation to the Bingham Canyon porphyry copper deposit in Utah: A big porphyry center and about 34 km outboard, bulk-tonnage, oxide gold deposits.

That's what we think we're seeing here on the Oro property, a big porphyry center that has yet to be fully tested and drilled out, and outboard from that, a shallow, oxide gold target that occurs on the outer fringes of the mineralizing system.

So we have two targets there. At the porphyry target, we've completed data compilation by a Ph.D. porphyry specialist out of the University of British Columbia. He has identified two main target areas from the surface geochemistry and the alteration on the property. We've started a 300-line km Z-TEM program over the property, which is in process and nearing completion. The idea is to generate another targeting criterion, deep-seeing geophysics, that can help resolve some porphyry targets on the larger property package. This we think would make it more amenable to getting a major involved to explore the property and put in the big bucks that are generally required to drill a porphyry target.

In the meantime, we think that we can add value to the company by doing relatively inexpensive exploration on the Stock Pond gold target. Here, in the fall of 2016, we completed a nine-hole program, which identified a 40m interval of 0.4 g/t gold in drilling on the eastern margin of our drill pattern. This included a 9m interval of 0.75 g/t gold. This hole is open to the east, north and south.

We are now in the final stages of permitting an additional nine holes targeting a 500m by 800m area to the east of that mineralized hole with the intent of testing for a good oxide gold, bulk-mineable target on the project. It's relatively low cost. We're looking at a $300,000 to $400,000 total budget for both the geophysics and the drilling on the Stock Pond target. We think that we can upgrade the targeting and the property and add value to the company with those efforts.

TGR: When do you expect to do this second drill part?

RM: We would anticipate the start of drilling in mid-September.

TGR: Could you tell us a little bit about your joint venture arrangement with Electrum Global Holdings L.P.?

RM: We started down the path with Electrum in the beginning of 2015. We are very pleased with how we've been able to advance the project together.

In early 2015, we announced a deal where Electrum would earn 60% interest in the Cerro Las Minitas project by spending $5 million over a four-year period. It has also come in and took an equity interest in Southern Silver as well. So, it's supporting us both with efforts on the property as well as corporately.

Electrum has been very aggressive in pursuing the property and very aggressive in deploying its investment into making the resource bigger. It had four years to spend $5 million and has done it in two and a half. When we started with Electrum, internally we felt we had maybe a 56-million-tonne (56 Mt) deposit drilled and ready to do a resource model. With Electrum's initial investment in the project, we ended up doubling our projection to 10.8 Mt. In this last round of drilling, we think we're going to significantly add to our existing resource with the latest results that we've released.

So we've been nothing but happy with how things have progressed with Electrum. It is an aggressive explorer and, like us, it wants to see how big this project can be before we start making any sort of development decisions or doing the predevelopment work that's necessary to bring things to a production decision.

We're the operator, too. So Electrum is very happy with the way that we're advancing the project. I think it's a win-win for everybody.

Electrum is seeing the value of its investment in the project go up. Since it came onboard, the company has gone from $0.05 up to as high as $0.60, $0.65. We're now sitting in the $0.350.40 range. Electrum is not only seeing that we are creating value in the property, but also seeing its investment in the company get more and more valuable as we continue to advance the project.

TGR: You're in the process of doing a brokered private placement. Would you tell us about that?

Jay Oness: Rob and I had arranged for a number of meetings prior to the Prospectors & Developers Association of Canada's annual meeting this year with the intent of introducing the company to the institutional side of the equation. We recognize, with us being in the joint venture situation with Electrum, that as we go forward, we're now going to be required to put up our share of the funding, which would be 40%. We then began to look for a strategic partner or partners to support us as we go down that path. We had excellent meetings. We had a number of institutions give us positive feedback with the result that there were a couple that were interested in discussing acting as a lead agent for a $5 million financing.

That resulted in us entering into an agency agreement with Gravitas Financial. Since we began undertaking this financing, we've been able to close 50% of it through our president's list and through the participation of Electrum maintaining its percentage of ownership corporately. We're now in the process of introducing the company through Gravitas and the syndication. It is a $5 million unit offering, at $0.40 per unit with a full warrant for three years at $0.55. There's no acceleration or any onerous clauses to the warrant side of the equation.

We look at this as being an excellent opportunity. The company's last financing back in March/April of 2016 was done at $0.10. Obviously, all of our shareholders and investors in that offering have been very pleased. We've had a number of them come back into our market. A number of them exercised in warrants. We've been able to demonstrate that through our efforts on the ground and the kind of results that we continue to show and through an aggressive investor relations program, which entails exposure globally actually, we're able to maintain a retail element to the market. Even during the doldrums of summer right now, we're able to still maintain our offering price of $0.40.

I think that this financing will put us in a position with an institution or institutions that at some point may take a larger interest in us. But at the same time, it's going to be a necessity as we anticipate our share price will hopefully climband I believe it will with continued exploration successto have these institutions continue to support us with what we anticipate to be a pretty aggressive exploration program leading into potential development studies and maybe a production decision sometime over the next two or three years.

TGR: Thanks for your insights.

Robert W.J. Macdonald is the vice president of exploration for Southern Silver Exploration. He is also the vice president of geological services for the Manex Resource Group of Companies, and in such capacity has been the Exploration Manager for several publicly listed companies including Homestake Resource Corporation (formerly Bravo Gold Corp.), Valterra Resource Corporation, Duncastle Gold Corp. and Fortune River Resource Corp. Macdonald has overseen the exploration of many projects throughout North America including the discovery and delineation of the high-grade 1.2 million ounce Homestake Ridge Au-Ag deposit in northern British Columbia and is currently advancing Southern Silver's 10 million tonne Cerro Las Minitas Ag-Pb-Zn project, Durango State, Mexico. Macdonald graduated with a B.Sc. (Hons) from Memorial University of Newfoundland in 1990 and earned a MSc. from the University of British Columbia in 1999.

Read what other experts are saying about:

Southern Silver Exploration Corp.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure: 1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, securities of the following companies mentioned in this interview: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None. 2) Southern Silver Exploration Corp. is a sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Southern Silver Exploration Corp. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Robert MacDonald and Jay Oness and not of Streetwise Reports or its officers. 4) Robert MacDonald and Jay Oness: We were not paid by Streetwise Reports to participate in this interview. We had the opportunity to review the interview for accuracy as of the date of the interview and are responsible for the content of the interview. We own shares of the following companies mentioned in this interview: Southern Silver Exploration Corp. 5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent. 6) This interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

( Companies Mentioned: SSV:TSX.V; SSVFF:OTCQB; SEG1:FSE, )

from https://www.streetwisereports.com/pub/na/17571

0 notes

Text

Headlines

Historical figures reassessed around globe after Floyd death (AP) The rapidly unfolding movement to pull down Confederate monuments around the U.S. in the wake of George Floyd’s death at the hands of police has extended to statues of slave traders, imperialists, conquerors and explorers around the world, including Christopher Columbus, Cecil Rhodes and Belgium’s King Leopold II. Protests and, in some cases, acts of vandalism have taken place in such cities as Boston; New York; Paris; Brussels; and Oxford, England, in an intense re-examination of racial injustices over the centuries. Scholars are divided over whether the campaign amounts to erasing history or updating it.

Masks required and fewer parties (allegedly): What college will look like this fall (Washington Post) Students who move into Virginia Tech’s residence halls for the fall term are on notice: They must wear face masks indoors except in their own bedrooms or bathrooms or when eating a meal. They also must follow a regimen of “physical distancing” from people and other measures to prevent the spread of the novel coronavirus. “We know there are new expectations to follow now, but to be together we need to work together for the safety of all in our campus community,” the public university states in a housing contract rewritten to meet the pandemic moment. Those who don’t sign it won’t get a bed on campus. Those who flout the rules face possible eviction. Welcome to the weird new reality of campus life under a public health crackdown. Many universities are warning students to expect a new normal. Parties will be minimal or nonexistent, if schools have their way. Seating at sports events will be limited, if spectators are allowed at all. Many lectures will be online. Food service will be grab-and-go. Foot traffic will be routed one way through specific exits and entrances. Coronavirus testing will be widespread, with quarantines expected for those who test positive. In many places, face-to-face instruction will end by Thanksgiving.

Trump authorizes sanctions targeting International Criminal Court (Washington Post) President Trump has signed an executive order authorizing new sanctions against prosecutors and officials of the International Criminal Court after the body approved investigations of alleged war crimes by U.S. service members and intelligence officers in Afghanistan. In an unprecedented display of administration firepower, the secretaries of state and defense, along with the attorney general and the national security adviser, jointly announced sanctions against officials of what they called a “corrupt” and “politically motivated” court manipulated by Russia and other U.S. adversaries. The announcement escalates a long-standing dispute with the Netherlands-based court, established 18 years ago under the Treaty of Rome. The United States has never ratified the treaty or recognized the court’s jurisdiction. The measures announced Thursday include economic sanctions against any ICC officials involved in efforts to investigate “allied personnel without that ally’s consent” and an extension to family members of visa restrictions already in effect against those officials.

New forecasts show potential for widespread, long-lasting heat for Lower 48 by late June (Washington Post) A period of punishing heat may envelop much of the Lower 48 and potentially extend to parts of Canada and Alaska. Soaring temperatures could swallow much of the contiguous United States toward the end of June, arriving just in time for calendar-year summer and potentially lingering for weeks. The above-average temperatures are part of a major pattern change that would bring anomalous warmth to some parts of the nation that have seen a cooler than average spring. Summer 2020 may go down in the books as much warmer than average for the United States or portions of the country—unsurprising considering the past five summers have been the top five hottest on record for the globe.

Experts: Police ‘woefully undertrained’ in use of force (AP) Seattle officers hold down a protester, and one repeatedly punches him in the face. In another run-in, officers handcuff a looting suspect on the ground, one pressing a knee into his neck—the same tactic used on George Floyd. The officers were captured on videos appearing to violate policies on how to use force just days after Floyd died at the hands of Minneapolis police, setting off nationwide protests. With calls for police reforms across the U.S., instructors and researchers say officers lack sufficient training on how and when to use force, leaving them unprepared to handle tense situations. Better training can’t fix all the issues facing the nation’s police departments, but experts believe it would have a big impact. “The skills are not taught well enough to be retained and now the officer is scrambling to find something that works,” said William Lewinski, executive director at Minnesota-based Force Science Institute, which provides research, training and consulting to law enforcement agencies.

Venezuelan migrants make long trek back home (AP) A couple pushing their 6-month-old twins in a stroller. A family with their life’s belongings stuffed into one large cloth sack. Young boys and girls sleeping beneath makeshift tents, their mouths covered with face masks. These are some of the thousands of Venezuelans who fled their homeland hoping for a brighter future abroad and are now trying to get back home. A severe economic downturn caused by the coronavirus pandemic has dashed the dreams of countless Venezuelans who fled their crisis-torn country in what had been one of the largest mass migrations anywhere in recent years. Colombia migration authorities estimate nearly 75,000 have made the journey back, traveling tiring miles by foot and bus. Many are arriving at the border crossing in the city of Cucuta only to find they will have to wait longer: Authorities in Venezuela allow only a few hundred to enter and just on three days a week.

British economy battered (Reuters) The UK economy shrank by a quarter in the March-April period as entire sectors were shuttered by the coronavirus lockdown. “This is catastrophic, literally on a scale never seen before in history,” Paul Johnson, director of the Institute for Fiscal Studies think tank, said. “The real issue is what happens next.”

Nepal’s map irks India (Foreign Policy) Nepal’s parliament is due to vote over the weekend on a new map of its border with India. The new map would extend Nepal’s territory into India, a move New Delhi rejects as a “unilateral act.” Nepal’s Prime Minister K.P. Sharma Oli said he has tried to broker talks with India over the land dispute. “We have told [India] that we want to resolve this through diplomatic talks … And the solution is that our land should be returned to us,” Oli said.

North Korea says “never again” to Trump-Kim meetings (Foreign Policy) On the two-year anniversary of the first meeting between President Trump and North Korean leader Kim Jong Un, Pyongyang seems in no mood to pursue closer ties, according to a statement by Foreign Minister Ri Son Gwon. “Never again will we provide the U.S. chief executive with another package to be used for achievements without receiving any returns,” Ri said. The statement called for a change of direction in U.S. policy and pointed out what North Korea believes is U.S. hypocrisy. “The U.S. professes to be an advocate for improved relations with the DPRK, but in fact, it is hell-bent on only exacerbating the situation,” Ri added.

Hong Kong’s increasing divide portends a tumultuous future (AP) Protesters in Hong Kong got its government to withdraw extradition legislation last year, but now they’re getting a more dreaded national security law. And the message from Beijing is: Protest is futile. One year ago Friday, protesters took over streets and blocked the legislature, preventing lawmakers from starting debate on the extradition bill. Thousand of rounds of tear gas later, the movement has been quieted—in part by the coronavirus—but the anger has only grown. In its wake, the polarization has deepened between the city’s disenchanted youth and its government. And the resolve of the central government in Beijing to crack down on dissent, as evidenced by the coming national security law for the territory, has hardened. “Emotions are running high because these young protesters see no future,” said Willy Lam, a commentator and adjunct professor at the Chinese University of Hong Kong. “They know they can’t change the mind of (Chinese President) Xi Jinping.” The divide signals an uneasy and possibly tumultuous future for the semi-autonomous territory, which is part of China yet has its own laws and greater freedoms than the mainland under a “one-country, two systems” framework that is supposed to guarantee it a high level of autonomy until 2047.

Lebanese central bank to inject dollars as currency tumbles (AP) Lebanon’s money changers said the country’s central bank agreed Friday to inject fresh dollars into the market to prop up the national currency following a night of protests spurred by the dramatic plunging of the Lebanese pound. The protests, which degenerated into attacks on several bank branches, and the tumbling of the currency prompted an emergency Cabinet meeting Friday. Despite previous efforts to control the currency depreciation, the Lebanese pound sold for more than 6,000 to the dollar Thursday on the black market, down from 4,000 in recent days. The pound had maintained a fixed rate of 1,500 to the dollar for nearly 30 years.

Saudis consider cancelling the hajj pilgrimage (Financial Times) Saudi Arabia is considering cancelling the hajj pilgrimage season for the first time since the kingdom was founded in 1932, after cases of coronavirus in the country topped 100,000. “The issue has been carefully studied and different scenarios are being considered. An official decision will be made within one week,” a senior official from Saudi Arabia’s hajj and umrah ministry told the Financial Times. The annual ritual held in late July is one of the largest religious gatherings in the world, attracting about 2 million people to the kingdom every year.

0 notes

Text

Section 14 of the IBC: Discontinuance of Arbitral Proceedings

[Ashish Rana is an Advocate on Record in Supreme Court of India. The author thanks Shatakshi Singh for assistance]

The Insolvency and Bankruptcy Code, 2016 (IBC) has been enacted by the Parliament with a view to codify the existing framework of insolvency and bankruptcy which comprised of scattered provisions and mechanisms under the different legislation. Section 14 of the IBC provides for the declaration of the moratorium prohibiting coercive steps including the institutions of the suits or continuation of pending suits or proceedings against the corporate debtor, transferring or disposing off the assets of the corporate debtor, actions to foreclose or enforce security and the recovery of property in possession of the corporate debtor.

Last year, the Supreme Court, while delivering a judgment in the matter of Alchemist Asset Reconstruction Company Limited v. M/s Hotel Gaudavan Private Limited, has held that arbitration proceedings cannot be instituted or continued against the corporate debtor during the period of moratorium declared under section 14 of the IBC. Section 14 (1)(a) provides:

“(1) Subject to provisions of sub-sections (2) and (3), on the insolvency commencement date, the Adjudicating Authority shall by order declare moratorium for prohibiting all of the following, namely:—

(a) the institution of suits or continuation of pending suits or proceedings against the corporate debtor including execution of any judgment, decree or order in any court of law, tribunal, arbitration panel or other authority;”

However, we argue that section 14(1)(a), when read holistically keeping in the view the scheme of Code, suggests that the word ‘proceedings’ does not include ‘arbitration proceedings’. Therefore, arbitration proceedings can be instituted and continued during the period of moratorium. However, the award passed in such arbitration proceedings cannot be executed.

The meaning of a word is to be judged by the company it keeps. Hence the term ‘’proceedings’ under section 14(1)(a) should be read in context, i.e., in conjunction with the term “suits”. We argue that the term ‘proceedings’ should be taken only in the context of proceedings in relation to a suit (governed by the Code of Civil Procedure, 1908). As the post proceeds, we will examine the way the term ‘proceedings’ have been referred and used in different contexts:

(a) Section 5(6) of the IBC, while defining the term “dispute,” includes a suit or “arbitration proceedings”. The use of the word “arbitration proceedings” signifies the fact that the legislature is conscious that ‘arbitration proceedings’ have to be considered separately than proceedings in relation to a suit.

(b) Section 8(2) of the IBC uses the word “arbitration proceedings” and ‘suit’ together, thereby acknowledging the distinction between the two.