#Altcoin performance

Explore tagged Tumblr posts

Text

Bitcoin and Altcoins Update: Market Movements and Key Developments

The cryptocurrency market has experienced some intriguing shifts recently, with Bitcoin and various altcoins demonstrating varying levels of performance. Here’s a detailed overview of the latest market movements and notable developments.

Bitcoin: A Modest Decline with Strong Weekly Gains

Bitcoin, the leading cryptocurrency, has seen a slight decline of 0.9%, bringing its current price to $64,166.3. Despite this recent dip, Bitcoin has shown significant strength over the past week, trading up by 8.5%. This positive weekly performance highlights Bitcoin's resilience and continued appeal as an investment asset, even amidst short-term fluctuations.

Ether: A Small Drop Amid Anticipated ETF Approval

Ether has fallen by 0.2%, settling at $3,444.58. The drop comes as market participants await potential regulatory news. Recent reports suggest that the Securities and Exchange Commission (SEC) might approve a spot Ether ETF as early as next week. Such approval could have substantial implications for Ether's market dynamics, potentially driving up its value as institutional investment opportunities become more accessible.

SOL: Noteworthy Surge with ETF News

In contrast to Ether’s slight decline, Solana (SOL) has surged by 3.8%. This increase follows reports indicating that a spot SOL ETF is also in the pipeline. The anticipated approval of such an ETF could enhance Solana's visibility and attract new investment, contributing to its recent upward momentum.

ADA and XRP: Downturns Amid Market Volatility

Both Cardano (ADA) and Ripple (XRP) have experienced notable declines. ADA fell by 2.3%, while XRP saw a more substantial drop of 4.7%. These downturns reflect broader market volatility and may be influenced by various factors, including regulatory uncertainties and shifting investor sentiments.

Meme Tokens: DOGE and SHIB Face Declines

Among meme tokens, Dogecoin (DOGE) and Shiba Inu (SHIB) have also faced declines. DOGE fell by 1.1%, while SHIB saw a more significant slide of 6.2%. The fluctuations in these tokens underscore the volatility often seen in the meme coin sector, where price movements can be heavily influenced by social media trends and speculative trading.

Conclusion

The cryptocurrency market continues to demonstrate its dynamic nature, with Bitcoin maintaining a strong weekly performance despite recent declines. Ether’s minor drop is tempered by the potential approval of a spot ETF, which could bolster its market position. Meanwhile, Solana’s recent rise reflects optimism around its forthcoming ETF, while ADA and XRP, along with meme tokens like DOGE and SHIB, face varying degrees of market pressure. As always, staying informed about these developments is crucial for investors navigating the ever-evolving crypto landscape.

#Cryptocurrency market#Bitcoin performance#Ether ETF approval#Solana surge#Cardano decline#Ripple market volatility#Meme tokens#Dogecoin decline#Shiba Inu price drop#Crypto market trends#Investment opportunities#Regulatory news#Market analysis#Crypto market shifts#Institutional investment in crypto#SEC crypto regulations#Crypto market dynamics#Crypto investment strategies#Altcoin performance#Cryptocurrency news

0 notes

Text

Analyst Insights: Ethereum's Bullish Breakout Points to Promising Altseason

Ethereum's recent breakout from its established price channel has ignited excitement in the crypto community, marking a strong start to what analysts and investors anticipate as the onset of an 'Altseason.' The surge in Ethereum's price, coupled with increased holdings among top wallets, reflects a positive market sentiment and hints at a broader rally in the altcoin space.

Technical Breakout:

ProfessorAstrones, a respected figure in the crypto space, highlighted Ethereum's technical breakout from its price channel, a trend that has persisted since October. The recent breach above the upper limit of this channel signifies a robust entry into a period historically associated with strong altcoin performance. The optimistic technical outlook has fueled a shared sense of enthusiasm among analysts and investors.

On-Chain Accumulation:

Supporting the technical perspective, on-chain data reveals a notable increase in buying activity, particularly from corporate entities and high-net-worth individuals. Post the approval of the Bitcoin ETF, the top 1,000 Ethereum wallets have significantly augmented their holdings, accumulating a total of 570,000 ETH and amassing a substantial 64.6 million ETH in total. This on-chain accumulation further bolsters confidence in Ethereum's potential for growth.

Market Reaction and Performance:

The market has responded positively to these developments, with Ethereum's current price at $2,529.98, reflecting a modest gain in the last day and a noteworthy 10.58% upswing over the previous week. Ethereum's market value, now exceeding $304 billion, reflects increased market participation and positive investor sentiment. The combination of technical breakthroughs and on-chain accumulation sets the stage for Ethereum's success and potentially signals the beginning of a broader altcoin rally.

#Ethereum#altseason#Ethereum breakout#altcoin performance#ProfessorAstrones#technical analysis#on-chain data#top Ethereum wallets#buying activity#market reaction#price breakout#market value#investor sentiment#cryptotale

0 notes

Text

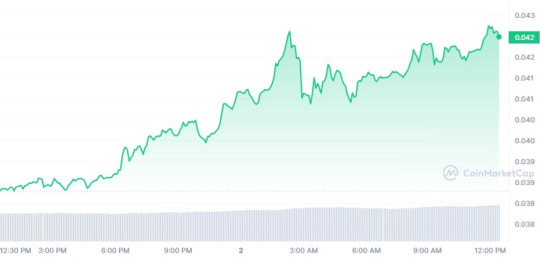

Unlocking the Power of Kaspa (KAS): A Deep Dive into the Altcoin's Impressive Performance and Growth Potential

Kaspa (KAS) has been on an impressive bullish run, maintaining an upward trajectory for three consecutive days, positioning itself as one of the top-performing altcoins in July. At the time of this writing, Kaspa is trading at $0.04223, representing a notable 13.01% increase in the past 24 hours. This impressive uptrend has led to an astounding surge of over 80.52% in the trailing 30-day period.

Kaspa's Enigmatic Power in the Blockchain World

Kaspa stands out in the blockchain landscape as it operates on a Directed Acyclic Graph (DAG)-powered proof-of-work (PoW) platform. Its emergence coincided with the need for an Ethereum (ETH) alternative after the transition of Ethereum from PoW to proof-of-stake (PoS) last year. Growth Drivers for Kaspa - Diverse Community and Increased Adoption: Kaspa's native community has been a driving force behind its growth, accumulating and supporting the project consistently. Furthermore, the entry of buyers from other protocols, like Ethereum, has contributed to bolstering Kaspa's appeal across the entire crypto space. - Utility and Performance Focus: Unlike many competitors in the market, Kaspa is prioritizing utility and performance over mere hype. The platform boasts an impressive throughput rate, capable of processing up to 100 blocks per second, making it exceptionally suitable for enterprise adoption. - Developer Team and Functionality Upgrades: The dedicated team of developers working on Kaspa has been instrumental in continuously enhancing its functionalities. Recently, they introduced a new update, further fortifying the platform's capabilities. Climbing the Ranks Kaspa's recent impressive growth has propelled it up the rankings, currently standing at the 208th position. However, there is a prevailing perception that the coin is still undervalued. With a series of upgrades and dApps in the pipeline, Kaspa holds the potential for further uptrend before the end of Q3.

Conclusion

Kaspa (KAS) has exhibited remarkable bullish momentum, making it one of the standout performers among altcoins in July. Its Directed Acyclic Graph (DAG)-powered proof-of-work (PoW) platform sets it apart in the blockchain world, and with the support of a dedicated community and growing adoption, its appeal continues to expand. Focusing on utility and performance, Kaspa stands out as a strong contender for enterprise adoption. As the team of developers keeps upgrading the platform, the potential for further uptrend remains high, positioning Kaspa for a promising future in the crypto market. For more articles visit: Cryptotechnews24 Source: u.today

Related Posts

Read the full article

#altcoin#Blockchain#CryptoNews#DAG#DirectedAcyclicGraph#ETH#Ethereum#growthdrivers#KAS#kaspa#performance#PoW#proof-of-work#protocol#utility

2 notes

·

View notes

Text

XRP Price Surge: Factors Driving Ripple's Growth in 2025

Published: January 25, 2025 By Crypto Analyst Team Introduction XRP, the digital asset associated with Ripple Labs, has recently garnered significant attention due to its notable price movements and developments within the cryptocurrency market. As of January 25, 2025, XRP is trading at approximately $3.14. This article delves into the factors influencing XRP’s price trajectory and provides…

#best altcoins 2025#cryptocurrency predictions#Ripple adoption#Ripple Labs price prediction#Ripple partnerships#Ripple price forecast#Ripple price growth#XRP analysis 2025#XRP cryptocurrency analysis#XRP expert opinions#XRP future trends#XRP future value#XRP historical performance#XRP investment analysis#XRP market trends#XRP news and updates#XRP price prediction#XRP regulatory clarity#XRP token forecas#XRP vs Bitcoin

1 note

·

View note

Text

About Exnori

Hello, I am Exnori.com, a premier cryptocurrency exchange dedicated to revolutionizing the way you trade digital assets. I am here to offer a secure, efficient, and user-friendly platform that caters to both beginners and seasoned traders alike. Let me take you through the various aspects of my services and why I am the go-to choice for cryptocurrency trading.

Mission and Vision

At my core, my mission is to create a transparent, secure, and seamless trading environment. I strive to empower my users with the tools and knowledge they need to navigate the volatile world of cryptocurrencies confidently. My vision is to become a cornerstone of the cryptocurrency ecosystem, where traders can thrive and reach their financial goals.

Robust Security Protocols

Security is my utmost priority. I employ state-of-the-art encryption techniques, robust multi-factor authentication, and continuous monitoring to protect your assets and personal information. My security infrastructure is designed to be resilient against cyber threats, ensuring that your investments are safe with me.

User-Centric Design

I am designed with the user in mind. My platform boasts a clean, intuitive interface that simplifies the trading process. Whether you are accessing me via desktop or mobile, you will find a consistent and user-friendly experience that makes trading easy and accessible, no matter where you are.

Extensive Cryptocurrency Selection

I offer a vast selection of cryptocurrencies for trading. From established giants like Bitcoin, Ethereum, and Ripple to promising new altcoins, my diverse range of assets ensures that you can find the right opportunities to diversify your portfolio and maximize your trading potential.

Competitive and Transparent Fee Structure

I believe in providing value to my users. My fee structure is transparent and competitive, allowing you to understand exactly what you are paying for each transaction. By keeping fees low, I help you maximize your returns and make the most out of your trading activities.

Comprehensive Educational Resources

Knowledge is power, especially in the dynamic world of cryptocurrency. I offer a wealth of educational resources, including in-depth articles, video tutorials, and live webinars. These resources are tailored to help you understand market trends, develop effective trading strategies, and make informed decisions.

Advanced Trading Tools

For the more experienced traders, I provide a suite of advanced trading tools. These include detailed charting capabilities, technical indicators, and algorithmic trading support through my API. Whether you are a day trader or a long-term investor, my tools are designed to enhance your trading strategy and performance.

Community and Customer Support

I pride myself on fostering a vibrant community of traders. My platform encourages interaction and the exchange of ideas among users, creating a collaborative environment. Additionally, my customer support team is available 24/7 to assist you with any issues or questions you may have, ensuring a smooth and supportive trading experience.

Innovation and Continuous Improvement

The cryptocurrency market is constantly evolving, and so am I. I am committed to continuous innovation and regularly update my platform with new features and improvements. This dedication to staying ahead of the curve ensures that I can provide you with the best tools and technologies for successful trading.

Conclusion

Choosing Exnori.com means partnering with a platform that is dedicated to your success. With my robust security measures, user-centric design, extensive asset selection, competitive fees, and unwavering support, I am here to help you achieve your trading goals. Join me at Exnori.com and experience the future of cryptocurrency trading.

By joining Exnori.com, you are becoming part of a dynamic and forward-thinking community. Let's trade smarter, safer, and more effectively together. Welcome to Exnori.com, where your trading journey begins!

13 notes

·

View notes

Text

BTC/USD: Bitcoin Surges 5% as Christmas Eve Ignites Crypto Market Momentum

Bitcoin (BTC/USD) experienced a notable rebound on Christmas Eve, reversing a three-day downward trend. The digital asset surged by over 5%, climbing from an intraday low of $93,000 to $99,000. This sharp price appreciation has sparked discussions about a potential Santa rally as the year draws to a close. With just a few trading days remaining, Bitcoin has solidified its position as one of the top-performing assets of the year, boasting an impressive annual gain of 123%.

The Broader Market Sentiment

The surge in Bitcoin prices reflects renewed optimism among investors, particularly as global economic uncertainties continue to push interest toward decentralized finance. Positive sentiment is further fueled by expectations surrounding the crypto industry’s growth under the administration of former President Donald Trump. With a focus on economic innovation, Trump has appointed a team comprising billionaires and tech entrepreneurs tasked with fostering crypto adoption and expanding institutional involvement.

Institutional Adoption and the Rise of Crypto ETFs

Bitcoin and Ethereum Exchange-Traded Funds (ETFs)

Currently, Bitcoin and Ethereum dominate institutional investment avenues, as evidenced by the approval of 11 Bitcoin ETFs and 9 Ethereum ETFs. These developments have positioned the two largest cryptocurrencies as primary gateways for mainstream and institutional investors looking to gain exposure to digital assets without directly holding them.

Prospective ETF Approvals for Emerging Tokens

Speculation is mounting about the potential approval of ETFs for other prominent tokens. Solana (SOL/USD), XRP (XRP/USD), and Reserve Rights (RSR/USD) are among the contenders for ETF listings in the coming year. Such listings could further legitimize these assets and drive significant inflows, enhancing their market value and liquidity.

Regulatory Outlook and Leadership Changes

The crypto industry is poised for potential regulatory reforms under a new Securities and Exchange Commission (SEC) leadership. Paul Atkins, rumored to succeed current SEC Chair Gary Gensler, is widely regarded as a pro-crypto advocate. If appointed, Atkins may introduce deregulation policies that promote innovation while addressing compliance concerns, setting the stage for broader crypto adoption.

Bitcoin’s Performance in 2023: A Year in Review

Key Milestones and Price Trends

Bitcoin’s 123% surge in 2023 underscores its resilience amid volatile market conditions. The cryptocurrency began the year with cautious optimism, trading around $44,000, before climbing to new heights fueled by institutional interest and technological advancements.

Catalysts for Growth

Several factors contributed to Bitcoin’s remarkable performance:

Institutional Interest: The introduction of Bitcoin ETFs increased accessibility for traditional investors.

Macro-Economic Factors: Persistent inflation and concerns over fiat currency depreciation drove investors toward digital assets as a hedge.

Technological Developments: Advances in Bitcoin’s Layer 2 scaling solutions, such as the Lightning Network, improved transaction efficiency.

Regulatory Clarity: Positive regulatory developments provided confidence to market participants.

Short-Term Outlook for Bitcoin

As the year concludes, analysts predict further volatility with a bias toward upward momentum. Traders are monitoring technical resistance levels near $100,000, a psychological barrier that could attract increased buying pressure if breached.

Broader Implications for the Crypto Market

The Role of Altcoins in the Current Rally

While Bitcoin continues to dominate, altcoins are also gaining traction. Solana, XRP, and RSR have displayed robust performance, spurred by rumors of upcoming ETFs and improved network functionalities. Investors are diversifying portfolios to capitalize on the growth potential of these emerging projects.

Institutional Adoption Trends

The influx of institutional capital into crypto assets is set to accelerate, driven by regulatory advancements and the proliferation of ETFs. Financial institutions are exploring blockchain-based solutions, further embedding cryptocurrencies into mainstream financial systems.

Regulatory Framework: A Turning Point

The anticipated appointment of a more crypto-friendly SEC Chair could pave the way for streamlined regulations, enhancing transparency and investor protection without stifling innovation. A favorable regulatory environment could unlock new opportunities for growth and development across the crypto ecosystem.

Predictions for 2024: What Lies Ahead?

Bitcoin’s Price Trajectory

Analysts project that Bitcoin may test higher resistance levels, potentially breaching the $100,000 mark. Factors such as increased institutional adoption, regulatory reforms, and macroeconomic trends will likely influence its price dynamics.

Altcoins on the Rise

Altcoins like Solana and XRP are positioned for substantial gains, driven by technological upgrades and anticipated ETF approvals. Investors should monitor developments in network scalability and interoperability, which could drive demand for these assets.

Evolving Market Infrastructure

The crypto landscape is expected to witness advancements in infrastructure, including decentralized finance (DeFi) protocols, non-fungible tokens (NFTs), and cross-chain interoperability. These innovations could attract new participants and boost overall market capitalization.

Regulatory Clarity and Adoption

With regulatory reforms on the horizon, 2024 could mark a turning point for mass adoption. Clearer guidelines may encourage institutional investors to allocate larger portions of their portfolios to cryptocurrencies, enhancing market stability and credibility.

Investment Strategies for Crypto Traders

Risk Management in Volatile Markets

Given the inherent volatility of cryptocurrencies, traders should employ risk management strategies such as stop-loss orders and position sizing to safeguard capital. Diversification across multiple assets can also mitigate risks.

Long-Term Holding vs. Active Trading

Investors should assess their risk tolerance and investment horizon before selecting a strategy. Long-term holders benefit from compounding gains, while active traders capitalize on short-term price fluctuations.

Leveraging Fundamental and Technical Analysis

Combining fundamental analysis, which evaluates project viability, with technical analysis, focusing on price patterns and trends, can provide a comprehensive approach to decision-making.

Conclusion: Capitalizing on Crypto Opportunities

Bitcoin’s 5% Christmas Eve rally highlights the resilience and growth potential of the cryptocurrency market. With institutional adoption on the rise, regulatory reforms in progress, and technological advancements unfolding, 2024 presents significant opportunities for investors.

As market dynamics continue to evolve, staying informed and adaptable will be key to navigating the complexities of the crypto space. Whether focusing on Bitcoin, altcoins, or emerging technologies, prudent strategies can help traders capitalize on this rapidly expanding market.

3 notes

·

View notes

Text

Bitcoin (BTC) gained significant momentum this week, pushing toward a $1 trillion market cap. Trading over $23,000 and approaching $23,500, Bitcoin leads the crypto market surge.

Cryptocurrencies prices heatmap, source: Coin360

Altcoins also saw strong gains despite Bitcoin dominating the spotlight. Ethereum (ETH) remains above $1,500, while Ripple (XRP) is up 1.60% at $0.4165, and Polkadot (DOT) has risen 2.42%.

Altcoin season is evident with Cardano (ADA), Binance Coin (BNB), Litecoin (LTC), Bitcoin Cash (BCH), and Chainlink (LINK) all recording minor gains. The overall crypto market capitalization has surged past $1 trillion, though Bitcoin’s dominance has dropped to 41.17%.

Top gainers include GALA, up over 27%, and other strong performers like Trust Wallet Token, Avalanche, Enjin Coin, Flax Share, and GMX token, each gaining over 10%.

Top gainers and losers of the day: CoinMarketCap

Despite Genesis Capital’s bankruptcy on Jan. 19, the market sentiment remains bullish, with investors continuing to enter the crypto space. Over the week, market capitalization climbed 7%, and 11 of the top 80 coins saw gains of 18% or more.

Bitcoin price analysis

Bitcoin is at $23,003.26, up 0.13% in the last 24 hours, with a market cap of $444.7 billion. Bitcoin has risen 36% over the past 30 days, with support at $22,200 and resistance at $24,000. Trading above the 21-day EMA, Bitcoin shows bullish control, with the RSI above 50 and a positive MACD indicating potential sideways trading before another move.

Ethereum Price Analysis

Ethereum is trading at $1,591.12, consolidating above $1,500 despite a slight dip. Its market cap is $186 billion. Up over 33% in the past 30 days, Ethereum shows bullish sentiment. Support is at $1,540 and resistance at $1,620. A stagnant triangle pattern suggests an imminent directional move, with the RSI neutral and MACD bullish. The Stochastic RSI in the overbought zone indicates a potential pullback before further gains. Overall, the sentiment remains positive for ETH.

In January's final week, the market cap surpassed $1 trillion, while Bitcoin’s dominance rose.

3 notes

·

View notes

Text

Build a Seamless Crypto Exchange Experience with Binance Clone Software

Binance Clone Script

The Binance clone script is a fully functional, ready-to-use solution designed for launching a seamless cryptocurrency exchange. It features a microservice architecture and offers advanced functionalities to enhance user experience. With Plurance’s secure and innovative Binance Clone Software, users can trade bitcoins, altcoins, and tokens quickly and safely from anywhere in the world.

This clone script includes essential features such as liquidity APIs, dynamic crypto pairing, a comprehensive order book, various trading options, and automated KYC and AML verifications, along with a core wallet. By utilizing our ready-to-deploy Binance trading clone, business owners can effectively operate a cryptocurrency exchange platform similar to Binance.

Features of Binance Clone Script

Security Features

AML and KYC Verification: Ensures compliance with anti-money laundering and know-your-customer regulations.

Two-Factor Authentication: Provides an additional security measure during user logins.

CSRF Protection: Shields the platform from cross-site request forgery threats.

DDoS Mitigation: Safeguards the system against distributed denial-of-service attacks.

Cloudflare Integration: Enhances security and performance through advanced web protection.

Time-Locked Transactions: Safeguards transactions by setting time limits before processing.

Cold Wallet Storage: Keeps the majority of funds offline for added security.

Multi-Signature Wallets: Mandates multiple confirmations for transactions, boosting security.

Notifications via Email and SMS: Keeps users informed of account activities and updates.

Login Protection: Monitors login attempts to detect suspicious activity.

Biometric Security: Utilizes fingerprint or facial recognition for secure access.

Data Protection Compliance: Adheres to relevant data privacy regulations.

Admin Features of Binance Clone Script

User Account Management: Access detailed user account information.

Token and Cryptocurrency Management: Add and manage various tokens and cryptocurrencies.

Admin Dashboard: A comprehensive interface for managing platform operations.

Trading Fee Setup: Define and adjust trading fees for transactions.

Payment Gateway Integration: Manage payment processing options effectively.

AML and KYC Oversight: Monitor compliance processes for user verification.

User Features of Binance Clone Script

Cryptocurrency Deposits: Facilitate easy deposit of various cryptocurrencies.

Instant Buy/Sell Options: Allow users to trade cryptocurrencies seamlessly.

Promotional Opportunities: Users can take advantage of promotional features to maximize profits.

Transaction History: Access a complete record of past transactions.

Cryptocurrency Wallet Access: Enable users to manage their digital wallets.

Order Tracking: Keep track of buy and sell orders for better trading insights.

Binance Clone Development Process

The following way outline how our blockchain experts develop a largely effective cryptocurrency exchange platform inspired by Binance.

Demand Analysis

We begin by assessing and gathering your business conditions, similar as the type of trades you want to grease, your target followership, geographical focus, and whether the exchange is intended for short-term or long-term operation.

Strategic Planning

After collecting your specifications, our platoon formulates a detailed plan to effectively bring your ideas to life. This strategy aims to deliver stylish results acclimatized to your business requirements.

Design and Development

Our inventors excel in UI/ UX design, creating visually appealing interfaces. They draft a unique trading platform by exercising the rearmost technologies and tools.

Specialized perpetration

Once the design is complete, we concentrate on specialized aspects, integrating essential features similar to portmanteau connectors, escrow services, payment options, and robust security measures to enhance platform functionality.

Quality Assurance Testing

After development, we conduct thorough testing to ensure the exchange platform operates easily. This includes security assessments, portmanteau and API evaluations, performance testing, and vindicating the effectiveness of trading machines.

Deployment and Support

Following successful testing, we do with the deployment of your exchange platform. We also gather stoner feedback to make advancements and introduce new features, ensuring the platform remains robust and over-to-date.

Revenue Streams of a Binance Clone Script

Launching a cryptocurrency exchange using a robust Binance clone can create multiple avenues for generating revenue.

Trading Fees

The operator of the Binance clone platform has the discretion to set a nominal fee on each trade executed.

Withdrawal Charges

If users wish to withdraw their cryptocurrencies, a fee may be applied when they request to transfer funds out of the Binance clone platform.

Margin Trading Fees

With the inclusion of margin trading functionalities, fees can be applied whenever users execute margin transactions on the platform.

Listing Fees

The platform owner can impose a listing fee for users who want to feature their cryptocurrencies or tokens on the exchange.

Referral Program

Our Binance clone script includes a referral program that allows users to earn commissions by inviting friends to register on the trading platform.

API Access Fees

Developers can integrate their trading bots or other applications by paying for access to the platform’s API.

Staking and Lending Fees

The administrator has the ability to charge fees for services that enable users to stake or lend their cryptocurrencies to earn interest.

Launchpad Fees

The Binance clone software offers a token launchpad feature, allowing the admin to charge for listing and launching new tokens.

Advertising Revenue

Similar to Binance, the trading platform can also generate income by displaying advertisements to its users.

Your Path to Building a Crypto Exchange Like Binance

Take the next step toward launching your own crypto exchange similar to Binance by collaborating with our experts to establish a robust business ecosystem in the cryptocurrency realm.

Token Creation

Utilizing innovative fundraising methods, you can issue tokens on the Binance blockchain, enhancing revenue generation and providing essential support for your business.

Staking Opportunities

Enable users to generate passive income by staking their digital assets within a liquidity pool, facilitated by advanced staking protocols in the cryptocurrency environment.

Decentralized Swapping

Implement a DeFi protocol that allows for the seamless exchange of tokenized assets without relying on a central authority, creating a dedicated platform for efficient trading.

Lending and Borrowing Solutions

Our lending protocol enables users to deposit funds and earn annual returns, while also offering loans for crypto trading or business ventures.

NFT Minting

Surpass traditional cryptocurrency investments by minting a diverse range of NFTs, representing unique digital assets such as sports memorabilia and real estate, thereby tapping into new market values.

Why Should You Go With Plurance's Ready-made Binance Clone Script?

As a leading cryptocurrency exchange development company, Plurance provides an extensive suite of software solutions tailored for cryptocurrency exchanges, including Binance scripts, to accommodate all major platforms in the market. We have successfully assisted numerous businesses and entrepreneurs in launching profitable user-to-admin cryptocurrency exchanges that rival Binance.

Our team consists of skilled front-end and back-end developers, quality analysts, Android developers, and project engineers, all focused on bringing your vision to life. The ready-made Binance Clone Script is meticulously designed, developed, tested, and ready for immediate deployment.

Our committed support team is here to help with any questions you may have about the Binance clone software. Utilizing Binance enables you to maintain a level of customization while accelerating development. As the cryptocurrency sector continues to evolve, the success of your Binance Clone Script development will hinge on its ability to meet customer expectations and maintain a competitive edge.

#Binance Clone Script#Binance Clone Software#White Label Binance Clone Software#Binance Exchange Clone Script

2 notes

·

View notes

Link

The Ethereum price performance was quite disappointing in the final weeks of 2024, struggling beneath the $3,500 level. This end-of-the-year blues somewhat flowed into the altcoin’s action in the first month of 2025, as it failed to build any serious momentum in the first 30 days of the year. Unsurprisingly, this sluggish price action has led to the panic of several Ethereum investors, with a portion of the market pondering if to sell their tokens. A popular crypto analyst on the social media platform X has come forward with an in-depth analysis of the ETH price over the next few months. What Does The Future Hold For ETH Price? In a Jan. 31 post on X, crypto pundit Ali Martinez tried to answer the “Is it time to sell Ethereum and move on?” question while breaking down its recent price action and on-chain movement. According to the analyst, the future looks somewhat bleak for the price of ETH, as it stands at the risk of a deep correction in the short term. This is based on the MVRV Ratio (160-day moving average), which tracks the ratio between a coin’s market cap and the realized cap. It helps to evaluate whether a cryptocurrency (Ethereum, in this scenario) is overvalued. According to Martinez, the ETH price recently fell beneath the MVRV (160D-MA), an occurrence that led to a 40% correction the last time. Source: Ali_charts/X The potential of a severe price pullback has resulted in a shift in investor sentiment, with a particular investor cohort showing some level of anxiety in the market. Data from Glassnode shows that long-term Ethereum holders are beginning to sell off some of their coins, strengthening the odds of a price correction. In the case of a correction, certain on-chain price levels could be crucial to the long-term health of the ETH price. One such price region is between $2,230 and $2,610 (where nearly 12 million wallets bought 62.27 million ETH), which could act as a major support zone against further decline. From a technical price analysis standpoint, the ETH price appears to be forming an inverse head-and-shoulders pattern, with a major support level between $2,800 and $3,000. According to Martinez, the Ethereum price could make a play for the pattern’s neckline at $4,000 if this support region holds. Source: Ali_charts/X While the $4,000 level has acted as a major resistance level for four years, recent whale accumulation increases the Ethereum price’s chances of breaking this crucial region. The latest on-chain data shows that whales bought over 100,000 ETH (worth over $340 million) in the past few days. Martinez noted that if the Ethereum price successfully breaks above the $4,000 mark, it could travel as high as $6,770 based on the MVRV pricing bands. This would represent an over 100% rally from the current price point. Ethereum Price At A Glance As of this writing, the price of Ethereum stands at around $3,315, reflecting over 2% jump in the past 24 hours. The Ethereum price loses the $3,300 level on the daily timeframe | Source: ETHUSDT chart on TradingView Featured image from iStock, chart from TradingView

0 notes

Text

Delving into Market Dynamics: SOL, WOO, and BEAM - A Crypto Trio's Exploration

In the dynamic and often unpredictable world of cryptocurrencies, Solana (SOL) has recently demonstrated remarkable resilience, standing tall with a closing value of $101.30. Despite the inherent volatility in the crypto market, SOL exhibited a notable gain of 4.22%, solidifying its position as the 5th largest cryptocurrency with a substantial market capitalization of $42.97 billion.

A key metric indicating Solana's robust presence in the market is the Volume/Market Cap ratio, currently sitting at a healthy 4.70%. This ratio underscores a well-balanced liquidity-to-market capitalization relationship, suggesting a strong market presence. Despite a minor correction of 1.52% over the past day, SOL's overall bullish trend remains intact, with a trading volume of $2.05 billion further supporting its market robustness.

Investors and crypto enthusiasts are advised to keep a close eye on potential support levels, as Solana continues to assert its dominance and establish a promising trajectory within the dynamic crypto landscape.

Wootrade (WOO) Surges with a 5.82% Gain, Demonstrating Market Demand

Amidst the vast array of cryptocurrencies, Wootrade (WOO) has emerged as a standout performer, showcasing an impressive gain of 5.82% and reaching a current price of $0.4496. Positioned as the 83rd largest cryptocurrency, WOO boasts a market capitalization of $814 million. What sets Wootrade apart is its extraordinary volume dominance, recording a staggering 74.49% in the last 24 hours, indicating robust demand for this asset.

The Volume/Market Cap ratio further strengthens WOO's appeal, standing at 4.64%, signifying a substantial and well-distributed liquidity profile. Wootrade's exceptional market position positions it as a compelling option for traders seeking opportunities within the vibrant altcoin space.

While the surge in volume dominance could be attributed to positive developments within the Wootrade ecosystem, traders should remain vigilant for potential breakout patterns or key support and resistance levels. Wootrade's strong market presence positions it as a formidable contender in the evolving crypto landscape.

Beam (BEAM) Faces Minor Correction Amidst Stable Liquidity Dynamics

In the expansive and ever-evolving cryptocurrency market, Beam (BEAM) recently experienced a slight correction, witnessing a 1.52% dip and bringing its value to $0.09618. Currently ranked as the 849th cryptocurrency by market cap, Beam's current market capitalization stands at $14,249,077. Despite the short-term decline, BEAM maintains a healthy volume/market cap ratio of 6.34%, indicating a reasonable level of liquidity.

The correction in Beam's value can be attributed to factors such as profit-taking by short-term traders or a natural market adjustment. Technical analysis suggests that BEAM might be entering a consolidation phase, prompting traders to observe potential support levels in the coming days.

Beam's resilient liquidity profile offers potential entry points for traders navigating the complex and dynamic crypto market landscape.

Navigating Unique Crypto Narratives: Solana, Wootrade, and Beam

In conclusion, Solana (SOL), Wootrade (WOO), and Beam (BEAM) contribute distinctive narratives to the cryptocurrency market. Solana's resilience and minor correction present strategic opportunities, while Wootrade's exceptional volume dominance solidifies its position in the altcoin space. Beam, despite a short-term decline, maintains a strong liquidity profile, providing opportunities for informed traders.

The ever-evolving crypto landscape demands careful attention to these dynamic narratives, ensuring that investors and traders stay well-informed for making judicious decisions in this exciting and unpredictable market.

#Solana#SOL#cryptocurrency market#market performance#market cap#Wootrade#WOO#altcoin#crypto market dynamics#Cryptotale

0 notes

Text

Overview: SOL vs ETH – Deciphering Key Aspects of the Solana-Ethereum Ratio

Key Points

Solana (SOL) underperformed Ethereum (ETH) by 25% at the end of January.

The SOL/ETH ratio is approaching key inflection points, indicating potential capital rotation between the two platforms.

Solana [SOL] experienced a significant drop against Ethereum [ETH] in the final week of January. The altcoin saw a substantial retracement of its gains after the launch of the TRUMP memecoin, falling from $295 to approximately $220.

The SOL/ETH ratio showed that SOL’s decline was more than 25% compared to ETH during the same period. This ratio is used to track SOL’s performance relative to ETH, and it can also indicate potential capital movement between the two smart contract platforms.

SOL/ETH Ratio Approaching Key Inflection Points

During the TRUMP frenzy, SOL outperformed ETH by almost 50% in just two days. However, this surge was short-lived, and SOL soon fell into a slump. Other factors such as fears about Chinese Deepseek AI and overvaluation concerns among U.S tech firms also contributed to a broader market downturn that affected SOL and other cryptocurrencies.

Interestingly, ETH managed to weather the weak market sentiment better than SOL, with SOL underperforming ETH by 25% during the recent market downturn. However, this drop also marked a rejection of the SOL/ETH ratio at the upper channel, which has historically signaled a reversal. The pair has now retreated towards key inflection points at the 50-day EMA (moving average) and the channel lows.

If the channel holds, the pair could rebound at the lower support levels, indicating that SOL might regain ground against ETH in the coming days.

Solana’s Position Against Ethereum

Despite the recent slump, Solana has held its ground against Ethereum in some areas, particularly after surpassing Ethereum in monthly revenue for the first time. In January, Solana generated $119M in revenue, compared to Ethereum’s $107.6M.

However, after Solana’s daily trading DEX volume peaked at $35.9 billion following the launch of TRUMP, the metric fell to $4.5 billion. This 87% drop reflects a significant decrease in demand for SOL, the primary token for gas fees within its DeFi ecosystem. This drop in demand has also impacted SOL’s price. The altcoin might only rebound if trading DEX volumes increase across the board.

The $220 price zone is a key short-term level to watch for SOL. This level has also been acting as the 50-day EMA. If SOL falls below this level, it could potentially drop to $200 or lower.

0 notes

Text

What is Causing the Decline in the Crypto Market in 2024? – Forbes Advisor INDIA

The cryptocurrency market has recently experienced a significant downturn, with the total market capitalization dropping from $2.51 trillion in May 2024 to $1.95 trillion as of August 6, 2024. This represents a substantial decrease in value, indicating a challenging period for investors in the crypto space. The market volume has also fallen by 13.13% in the last 24 hours, reflecting a lack of confidence and increased selling pressure.

Bitcoin, the largest cryptocurrency, is currently trading at $55,013, which is a 17.37% decrease over the past seven days. However, there was a slight increase of 8.04% in the last 24 hours. Ethereum, the second-largest cryptocurrency, is trading at $2,447, down by 26.53% in the last seven days. These price movements highlight the volatility and unpredictability of the cryptocurrency market.

The recent plunge in the cryptocurrency market can be attributed to various factors, including political uncertainty, geopolitical tensions, economic data, and ETF performance. CoinSwitch Markets Desk reported that the market saw one of the biggest crashes in crypto history, with Bitcoin losing over $250 billion in market cap in a single day. This sharp decline was triggered by events such as the Middle East escalations and the Japanese stock market crash.

Experts in the field, such as Sathvik Vishwanath, CEO of Unocoin, and Himanshu Maradiya, Founder of CIFDAQ Blockchain Ecosystem Ind Ltd, have pointed out that the recent decline in the crypto market is linked to the Bank of Japan’s decision to hike interest rates. This move has impacted carry trades, where traders borrow in low-interest-rate currencies and invest in higher-yielding assets like cryptocurrencies. The resulting sell-off in both stock and crypto markets has led to significant losses for investors.

As of August 6, 2024, the Fear and Greed index stands at 34, indicating a fear state among investors. This sentiment is reflected in the price movements of major cryptocurrencies like Bitcoin and Ethereum, which have seen significant declines in value over the past week. Altcoins have also been affected, with many experiencing double-digit percentage drops.

In light of these developments, investors are advised to proceed with caution when investing in cryptocurrencies. The market’s volatility and sensitivity to external factors make it a risky investment option. However, some experts suggest that investing a small portion of one’s portfolio in stable digital currencies like Bitcoin and Ethereum could be a safer approach.

For those looking to invest in the Indian cryptocurrency market, there are specific steps to follow. These include selecting the best cryptocurrency, choosing a reputable crypto exchange, completing KYC formalities, selecting a payment mode, purchasing cryptocurrency, storing it securely, and selling it when necessary. By following these steps and staying informed about market trends, investors can navigate the crypto space more effectively.

0 notes

Text

Ripple XRP Price Forecast: How high will it be in February 2025?

Ripple XRP was solid in January 2025 and rose 37 % at the beginning of the year. Altcoin is expected to be the top performer in 2025, especially during the Altcoin season this spring. How high the coin will be when February is progressing? XRP gathered a lot of attention and momentum in February. On Friday, coins were slightly soaked to create small assets. The dip may continue throughout the…

0 notes

Link

Litecoin and Mantra rallied in double-digits this week. Technical and on-chain analysis suggests the two altcoins are poised for further gains next week. Bitcoin’s flash crash under $100,000 and its return above $104,000 have fuelled optimism among crypto traders. U.S. macroeconomic data releases, performance of tech stocks and equities, and developments in artificial intelligence are the key market movers for Bitcoin. Altcoins like LTC and OM follow Bitcoin closely as the correlation remains high. Litecoin and Mantra could extend gains, technical analysis shows Technical analysis supports gains in LTC and OM, on the daily timeframe. Mantra (OM) consolidated in a range-bound manner for several weeks between mid-December and January. OM broke out of the range between $4.5352 and $3.1730. At the time of writing, on Friday, OM trades at $5.6263, close to its all-time high of $5.9500 as observed in the TradingView chart below. On the daily timeframe, OM formed a support zone between $4.443 and $4.069. This is a key imbalance zone and a correction could see MANTRA bouncing off this range. Two key technical indicators, the Relative strength index and the moving average convergence divergence indicator support a bullish thesis for OM. RSI reads 76 and is sloping upward. While this typically generates a sell signal, when combined with MACD’s green histogram bars above the neutral line, it highlights underlying positive momentum in OM price trend. A retest of OM’s all-time high is likely next week if the token sustains its upward momentum. OM/USDT daily price chart | Source: Crypto.news Litecoin was consolidating within the upper and lower boundaries of the range at $129.11 and $92.57. LTC ended its consolidation and broke out of the support zone, less than 8% under its 2025 peak of $141.22. Litecoin trades at $131.64 at the time of writing, early on Friday. The LTC/USDT daily price chart shows an imbalance zone between $102.57 and $114.04, two key levels for Litecoin in the event of a correction in the altcoin. RSI and MACD show underlying positive momentum in Litecoin’s price trend. RSI reads 61 and is sloping upwards and MACD shows green histogram bars above the neutral line. Traders need to watch for a re-test of the 2025 peak and an attempt to rally towards 2024 high of $147.06. LTC/USDT daily price chart | Source: Crypto.news On-chain analysis supports bullish thesis Santiment metrics highlight the rising relevance and demand for Litecoin among traders this week. The total open interest across derivatives exchanges in LTC climbed to nearly $420 million on January 30, marking a spike in the chart below. The total number of LTC holders has climbed steadily between December 2 and January 31, according to Santiment data. On Friday, the metric climbed to 8.13 million. The number of active addresses remains above the 2024 average, and total funding rates aggregated by LTC read positive, meaning derivatives traders maintain a bullish bias on Litecoin. Litecoin on-chain analysis | Source: Santiment In the case of Mantra (OM), the total amount of holders is climbing slowly, reached nearly 44,000 on Friday. Key metrics like funding rate show a bullish bias and a positive value for nearly two weeks, confirming the token’s relevance and demand in the derivatives market. The Network realized profit/loss metric used to track the net profit/loss of all tokens moved on the chain on a given day shows several positive spikes in January, signaling profit-taking. Traders need to watch for large positive spikes as that would imply large volume sell-off by traders de-risking their portfolio, and this could result in a correction in OM price. The total open interest in OM hit its highest level on January 30 above $348 million. Mantra on-chain analysis | Source: Santiment Market movers push Litecoin and Mantra higher The anticipation of Litecoin Exchange traded fund approval in the U.S. is one of the key market movers that drove LTC price higher this week. As the SEC officially acknowledges the 19b-4 filing from Canary Capital for a spot Litecoin ETF, traders are hopeful of an approval. Typically a spot ETF approval generates demand and interest among institutional investors and large wallet traders. The developments in the ETF could fuel further gains in Litecoin next week. Eric Balchunas, Bloomberg Intelligence Analyst commented on the development in a tweet on X: News but expected. Even Gensler’s SEC would approve these. That said, they approved in 45 days vs waiting 240 days. I really want to interpret this as a sign the new SEC will be faster but no way to know really. Litecoin on deck, know more soon https://t.co/xqlXusHuyN— Eric Balchunas (@EricBalchunas) January 31, 2025 Mantra’s recent announcement about a partnership with the DAMAC Group, a real-estate giant, for tokenizing assets on their chain is a key market mover for OM token this week. JP Mullin, co-founder and CEO of Mantra said, “This partnership with DAMAC Group is an endorsement for the RWA industry. We’re thrilled to partner with such a prestigious group of leaders that share our ambitions and see the incredible opportunities of bringing traditional financing opportunities on chain.” The other key market mover is Bitcoin’s recovery from the flash crash under $100,000 on Monday. The correlation between the tokens and Bitcoin remains relatively high, supporting their gains. Bitcoin catalyzes rally in Litecoin and Mantra The three-month correlation between Bitcoin and Litecoin is 0.84, and between Bitcoin and Mantra is 0.87. The relatively high correlation suggests that Bitcoin’s price trend influences the prices of LTC and OM, therefore further gains in BTC could push the assets higher. A flash crash in Bitcoin could push traders on edge as BTC could drag out assets correlated with it, wiping out millions of dollars in market capitalization. U.S. macroeconomic releases, the movement of U.S. based tech stocks and equities and institutional investor activity typically influenced Bitcoin price. LTC and OM holders need to watch Bitcoin’s daily price trend to predict sudden movements in the two altcoins. Strategic considerations Traders who accumulated LTC under the $100 level could consider taking profits on a percentage of their holdings, at least 30% before a correction in Litecoin. Staggered profit-taking is recommended while Litecoin holds steady above the range-bound consolidation zone. Traders holding OM acquired under $3.87 should ideally consider staggered profit-taking while the altcoin trades above $5. Sidelined buyers can enter when OM is closer to $4 and wait for a re-test of the all-time high at $5.95 before taking profits. Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. 2025-02-01 08:14:00 https://crypto.news/app/uploads/2024/02/crypto-news-Litecoin-option02.webp

0 notes

Text

5 Altcoins to Keep a Close Eye On

The cryptocurrency market is seeing increased activity, with several altcoins showing potential for significant gains. Investors closely watch HYPE, FARTCOIN, JTO, ONDO, and RAY as they demonstrate resilience and bullish patterns. With rising adoption in decentralized finance, meme culture, and real-world asset integration, these tokens could be well-positioned for strong performance. Also Read:…

0 notes