#Airborne Telemetry SYSTEM

Explore tagged Tumblr posts

Link

The NASA Ames Science Directorate recognizes the outstanding contributions of (pictured left to right) Don Sullivan, Serena Trieu, Emmett Quigley, and Zara Mirmalek. Their commitment to the NASA mission represents the talent, camaraderie, and vision needed to explore this world and beyond. Earth Science Star: Don Sullivan Don Sullivan enables cutting-edge research in the Earth Science Division, serving as telemetry and communications lead for the Airborne Science Program. As Principal Investigator, Don led the highly successful and innovative STRATO long-duration balloon flight project in August 2024 with the United States Forest Service (USFS) that demonstrated last-mile connectivity and near real-time infrared imagery to a remote wildfire incident command station. Space Biosciences Star: Serena Trieu Serena Trieu conducts research in the Bioengineering Branch for projects that develop Earth-independent spaceflight instrumentation, especially for the International Space Station (ISS). She has excelled in coordinating the inventory for 21 spaceflight trash batches sent to Sierra Space, Inc., for ground-unit testing of the Trash Compaction Processing System (TCPS). Tapping into her innovative spirit and technical expertise, she developed a new method to prepare trash batches for the ISS without freezing. Space Science & Astrobiology Star: Emmett Quigley Emmett Quigley is a mechanical technician with the Astrophysics Branch who goes above and beyond to serve Ames. As a specialist in small precision manufacturing, Emmett has designed and built lab hardware, telescopes, and airborne instruments, as well as small satellites and instruments heading to the Moon and beyond. His collaborative disposition and dedication to problem solving have enabled delivery of numerous projects on behalf of the Space Science and Astrobiology Division and the Earth Science Division. Space Science & Astrobiology Star: Zara Mirmalek Zara Mirmalek is the Deputy Science Operations Lead for VIPER within the Space Science & Astrobiology Division and has been pivotal in the design and build efforts of the VIPER Mission Science Operations team and Mission Science Center. She has applied her expertise in science team social-technical interactions to recommend discussions, groupings, and timelines that enable the VIPER Science Team to advance pre-planning for VIPER surface operations.

0 notes

Text

Platform Segments: Trends in Ground-Based Telemetry Systems

The Aerospace and Defense Telemetry Market is integral to modern aerospace and defense operations, involving the collection and transmission of critical data such as position, speed, altitude, and system performance from various platforms like aircraft, missiles, satellites, and ground stations to monitoring and control facilities. This data is crucial for mission planning, execution, and analysis. As the complexity and sophistication of aerospace and defense operations increase, the demand for advanced telemetry solutions grows. These systems ensure real-time data transmission, enhancing the efficiency and safety of missions. The Aerospace and Defense Telemetry Industry is projected to grow from USD 1.4 Billion in 2022 to USD 2.0 Billion by 2027, at a CAGR of 6.9%.

Market Size and Growth Factors

The Aerospace and Defense Telemetry market is expanding significantly due to several growth factors:

Technological Advancements

The miniaturization of sensors, enhanced data processing capabilities, and robust communication systems drive the adoption of advanced telemetry solutions. These technological innovations enable precise, reliable, and efficient data collection and transmission, essential for the success of aerospace and defense missions.

Increasing Defense Budgets

Many countries are increasing their defense budgets to enhance their military capabilities. This increased funding leads to higher investments in sophisticated telemetry systems, crucial for modernizing defense infrastructure and improving operational effectiveness.

Rising Use of UAVs and Satellites

The growing deployment of unmanned aerial vehicles (UAVs) and satellites for surveillance, reconnaissance, and communication boosts the demand for advanced telemetry systems. These applications require precise and real-time data transmission that telemetry systems provide.

Modernization of Military Equipment

Nations are continuously upgrading their military equipment to stay ahead in defense technology. This modernization includes integrating advanced telemetry systems to enhance performance, interoperability, and reliability.

Expansion of Space Exploration

Increased space exploration activities by government agencies and private companies are driving the demand for robust telemetry solutions. These missions depend on telemetry for tracking and monitoring spacecraft, ensuring mission success and safety.

Get a Deeper Understanding of the Industry by Visiting: https://www.marketsandmarkets.com/Market-Reports/aerospace-defense-telemetry-market-27039415.html

Regulatory Mandates

Strict regulatory requirements for aerospace and defense operations necessitate the adoption of advanced telemetry systems. Compliance with these regulations ensures safety, reliability, and efficiency in defense operations.

Enhanced Cybersecurity Needs

The critical nature of defense data requires secure transmission methods. The growing focus on cybersecurity is driving the development of telemetry systems with advanced encryption and security features to protect sensitive information from cyber threats.

Market Trends and Dynamics

The market is experiencing significant growth across various segments, including platforms, applications, technologies, and components. Each segment presents unique opportunities and challenges.

Platform Segments

Ground: Ground-based telemetry systems are essential for monitoring and controlling aerospace and defense operations. These systems support ground stations, launch facilities, and control centers.

Airborne: Airborne telemetry systems are used in aircraft for real-time data collection and transmission. Increasing investments in modernizing air fleets and developing new aircraft are boosting this segment.

Marine: Telemetry systems for marine applications are crucial for naval operations, including submarines and surface ships. The expansion of naval capabilities drives growth in the marine segment.

Space: Space-based telemetry systems are critical for satellite operations, space exploration missions, and communication between space assets and ground stations. The surge in commercial space ventures and governmental space exploration initiatives is propelling this segment.

Weapons: Telemetry for weapons systems, including missiles and guided munitions, is vital for tracking, control, and performance analysis. The development of advanced weaponry enhances the growth of this segment.

UAVs (Unmanned Aerial Vehicles): UAV telemetry systems are rapidly expanding due to their increasing use in surveillance, reconnaissance, and combat operations. The demand for real-time data transmission in UAV operations drives this segment's growth.

Get Thorough Information in Our PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=27039415

Application Segments

Avionics: Telemetry in avionics ensures the proper functioning of aircraft systems by providing real-time data on various parameters. Advancements in avionics technology contribute to this segment's growth.

Air Vehicle Test: Telemetry systems are crucial for testing air vehicles, including performance evaluation and system validation. The continuous development and testing of new air vehicles are driving this segment.

Flight Test Instrumentation: Used during flight tests to gather data on aircraft performance, flight test instrumentation telemetry is essential for safety and design improvements, boosting growth in this segment.

Distributed Data Acquisition System: These systems collect data from various sensors distributed across platforms, enabling comprehensive monitoring and analysis. The increasing complexity of aerospace systems fuels growth in this segment.

Flight Termination System: Telemetry in flight termination systems is crucial for ensuring the safe termination of flights during tests or operations. Regulatory requirements and safety concerns drive this segment's growth.

Technology Segments

Wired Telemetry: Traditional wired telemetry systems are still in demand due to their reliability and accuracy in specific applications. The need for stable and interference-free data transmission supports this segment.

Wireless Telemetry: Wireless telemetry is rapidly growing due to advancements in wireless communication technologies and the need for flexible and mobile telemetry solutions. The rise of IoT in aerospace and defense further boosts this segment.

Component Segments

Receivers: Telemetry receivers are essential for capturing transmitted data. The development of advanced, high-sensitivity receivers contributes to this segment's growth.

Transmitters: Transmitters send data from sensors to receivers. The demand for high-power and miniaturized transmitters drives growth in this component segment.

Antennas: Antennas are critical for effective data transmission and reception. Innovations in antenna design and technology, including phased array and compact antennas, enhance this segment's growth.

Processors: Processors in telemetry systems handle data processing and analysis. The increasing complexity and volume of data in modern telemetry applications necessitate advanced processors, driving growth in this segment.

Discover All the Steps in Our Detailed Sample: https://www.marketsandmarkets.com/requestsampleNew.asp?id=27039415

Regional Growth

The Aerospace and Defense Telemetry market is expanding significantly across various regions, including North America, Europe, and Asia Pacific.

North America

North America, particularly the United States, leads in aerospace and defense telemetry technology. The region's focus on innovation and advanced R&D drives the market. The U.S. has one of the highest defense budgets globally, fueling investments in sophisticated telemetry systems. Robust space exploration activities, led by NASA and private companies like SpaceX, significantly contribute to the growth of the space-based telemetry segment. Major aerospace and defense companies such as Lockheed Martin, Boeing, and Raytheon Technologies are headquartered in North America, driving demand for advanced telemetry systems.

Europe

European countries are enhancing their military capabilities with higher defense budgets, boosting the demand for advanced telemetry systems. Europe has numerous collaborative defense initiatives, such as European Space Agency (ESA) projects and joint military programs like the Eurofighter Typhoon. These collaborations necessitate sophisticated telemetry systems for seamless integration and operation. Europe is also expanding its UAV capabilities and space exploration efforts. Investments in UAV technology and new space missions by countries like France, Germany, and the UK drive the need for reliable telemetry systems.

Asia Pacific

Countries like China, India, and Japan are significantly increasing their defense spending. This modernization of military equipment and enhancement of surveillance capabilities drive the demand for telemetry systems. The Asia Pacific region is witnessing rapid advancements in aerospace and defense technologies. Innovations in telemetry, supported by government R&D, boost market growth. China and India are expanding their space programs with ambitious satellite launches and lunar missions. These initiatives require robust telemetry systems for successful missions. The UAV market in Asia Pacific is expanding due to increasing applications in defense, agriculture, and surveillance.

Emerging Industry Trends

Several emerging trends are shaping the Aerospace and Defense Telemetry market:

Miniaturization of Antennas: Research and development efforts are focused on reducing the size and weight of antennas while increasing their power. Flexible hybrid electronics (FHE) technology is leading to the development of integrated antennas that are lightweight and can conform to various surfaces while maintaining operational integrity.

Integration of AI and Machine Learning: The use of artificial intelligence (AI) and machine learning (ML) in telemetry systems enhances data analysis, predictive maintenance, and autonomous decision-making, improving operational efficiency and mission success.

5G and Advanced Communication Technologies: The deployment of 5G and other advanced communication technologies enables faster, more reliable, and higher-capacity data transmission, crucial for real-time monitoring and control of aerospace and defense assets.

Development of Smart and Connected Defense Systems: The trend towards smart and connected defense systems, including the Internet of Military Things (IoMT), requires advanced telemetry for real-time data, enhanced situational awareness, and improved decision-making capabilities.

Market Opportunities

The market presents several opportunities for growth:

Increased Space Exploration and Commercial Space Ventures: The growing interest in space exploration and the rise of commercial space ventures create substantial demand for advanced telemetry systems.

Expansion of Unmanned Systems: The increasing use of unmanned systems, such as drones and unmanned ground vehicles (UGVs), in defense and surveillance applications presents new opportunities.

Cybersecurity Enhancements: As cybersecurity becomes a top priority for defense operations, there is a growing need for telemetry systems with advanced security features.

International Collaborations and Defense Alliances: International collaborations and defense alliances drive the need for interoperable telemetry systems, creating opportunities for companies to develop solutions that can seamlessly integrate with different nations' defense technologies and protocols.

Sustainability and Green Aerospace Initiatives: The push towards sustainable and green aerospace initiatives is leading to the development of energy-efficient and eco-friendly telemetry systems.

Aerospace and Defense Telemetry Market Company Shares

The Aerospace and Defense Telemetry Companies are dominated by globally established players such as L3harris Technologies (US), Honeywell International Inc (US), General Dynamics Corporation (US), Lockheed Martin (US), Maxar Technologies (US)

The Aerospace and Defense Telemetry market is experiencing significant growth driven by technological advancements, increasing defense budgets, rising use of UAVs and satellites, modernization of military equipment, expansion of space exploration, regulatory mandates, and enhanced cybersecurity needs. The market's diverse segments, including platforms, applications, technologies, and components, present unique opportunities and challenges. Regional growth in North America, Europe, and Asia Pacific highlights the dynamic nature of the market. Emerging trends and opportunities, such as miniaturization of antennas, integration of AI and ML, deployment of 5G, and development of smart defense systems, are shaping the future of the Aerospace and Defense Telemetry market. As the industry continues to evolve, the demand for advanced telemetry solutions will remain crucial for ensuring the efficiency, safety, and success of aerospace and defense operations.

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we formally transformed into one of America's best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, and facilitates analysis of interconnections through applications, helping clients look at the entire ecosystem and understand the revenue shifts in their industry.

To learn more, visit www.MarketsandMarkets���.com or follow us on Twitter, LinkedIn and Facebook.

Contact: Mr. Rohan Salgarkar MarketsandMarkets™ INC.

630 Dundee Road Suite 430 Northbrook, IL 60062 USA: +1-888-600-6441

Email: [email protected]

#Aerospace and Defense Telemetry#Aerospace and Defense Telemetry Market#Aerospace and Defense Telemetry Industry#Global Aerospace and Defense Telemetry Market#Aerospace and Defense Telemetry Market Companies#Aerospace and Defense Telemetry Market Size#Aerospace and Defense Telemetry Market Share#Aerospace and Defense Telemetry Market Growth#Aerospace and Defense Telemetry Market Statistics

0 notes

Text

Airborne ISR Market Analysis

Airborne ISR Market by Solution (Systems, Software, Services), Platform (Military Aircraft, Military Helicopters, Unmanned Systems), End User (Defense, Homeland Security), Application, and Region (North America, Europe, Asia-Pacific, Middle East and Africa and South America)

Market Overview

The Airborne ISR market size is projected to reach a CAGR of 5.4% from 2021 to 2028.

Airborne ISR refers to Airborne Intelligence, Surveillance and Reconnaissance. An ISR is primarily used to detect potential risks, and help the decision makers to access the change and take decisions according. Airborne ISR serves the described function in fir air-based risks. It not just operates but also evaluate and manages the processing systems. It is widely used for militarily purpose.

With a requirement for modern warfare system along with the integration of AI and IoT in the sector and the increased need for better missile detection systems are some of the factors that have supported long-term expansion for Airborne ISR Market.

COVID-19 had a negative effect on the market, due to the supply chain disruption and logistic disruption.

Get a Sample Copy of the Report: https://www.delvens.com/get-free-sample/airborne-ISR-market-trends-forecast-till-2028

Regional Analysis

North America is the most rapidly growing market and offers a huge opportunity for the industry, whose growth is driven by the increased R&D activities along with the surged demand for precision and accurate ISR system.

Competitive Landscape

Key Players

BAE Systems plc

L-3 Technologies Inc.

Lockheed Martin Corporation

Northrop Grumman Corporation

UTC Aerospace Systems

The Boeing Co.

General Dynamics Corporation

Raytheon Company

Rockwell Collins Inc.

Thales S.A.

Make an Inquiry Before Buying: https://www.delvens.com/Inquire-before-buying/airborne-ISR-market-trends-forecast-till-2028

Recent Developments

In July 2021, BAE Systems was awarded a contract from the US Army for the delivery of the next-generation 2-Color Advanced Warning System (2CAWS).

Reasons to Acquire

Increase your understanding of the market for identifying the best and suitable strategies and decisions on the basis of sales or revenue fluctuations in terms of volume and value, distribution chain analysis, market trends and factors

Gain authentic and granular data access for Airborne ISR Market so as to understand the trends and the factors involved behind changing market situations

Qualitative and quantitative data utilization to discover arrays of future growth from the market trends of leaders to market visionaries and then recognize the significant areas to compete in the future

In-depth analysis of the changing trends of the market by visualizing the historic and forecast year growth patterns

Get the Direct Order for the Report at: https://www.delvens.com/checkout/airborne-ISR-market-trends-forecast-till-2028

Report Scope

Airborne ISR Market is segmented into Solution, Platform, End User, Application and region.

On the basis of Solution

Systems

Software

Services

On the basis of Platform

Military Aircraft

Military Helicopters

Unmanned Systems

On the basis of End-User

Defense

Homeland Security

On the basis of Region

Asia Pacific

North America

Europe

South America

Middle East & Africa

Read More Industry Related Reports:

The Airborne ISR Market report answers a number of crucial questions, including:

Which companies dominate the Airborne ISR Market?

What current trends will influence the market over the next few years?

What are the market's opportunities, obstacles, and driving forces?

What predictions for the future can help with strategic decision-making?

What advantages does market research offer businesses?

Which particular market segments should industry players focus on in order to take advantage of the most recent technical advancements?

What is the anticipated growth rate for the market economy globally?

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-8638-5055

0 notes

Text

Military Antenna Market Trends, Share, Scope and Forecast by 2030

The market study covers several perceptions of the market, with market dynamics, value chain, pricing analysis, competition analysis, regional and segmental growth comparison, and macro-economic and industry growth analysis, alongside segment-level projections in a comprehensive manner. Increasing technological advancements, growing need for modern battle equipment, rising demand for innovative communication systems, increasing security concern, modernization of the military equipment, rise in terrorist activities, attack prone border, increasing demand for high - frequency military aircraft are few of the factors driving the market. The marketS are combined with advanced applications like multifunctional radars, 3D drones, etc. which provide better surveillance for accurate target tracking. However, the high cost involved in the development of the device is one of the main challenges for the development of the market. The global market is segregated on the basis of Application as Electronic Warfare, Navigation, Telemetry, Communication, Surveillance, and SATCOM. Based on the Frequency band the market is segmented in Ultra-High Frequency, Super High Frequency, Extremely High Frequency, High Frequency, and Very High Frequency. Based on Platform the market is segmented in Ground, Marine, and Airborne. Based on Type, the market is segmented in Loop Antennas, Aperture Antennas, Travelling Wave Antennas, Dipole Antennas, Monopole Antennas, and Array Antennas.

The global market report provides geographical analysis covering regions, such as North America, Europe, Asia-Pacific, and the Rest of the World. The market for each region is further segmented for major countries including the U.S., Canada, Germany, the U.K., France, Italy, China, India, Japan, Brazil, South Africa, and others.

View Complete Report@ https://marketreportslibrary.com/report/ad0093/military-antenna-market

The global Military Antenna market has been segmented as below:

By Application

Electronic Warfare

Navigation

Telemetry

Communication

Surveillance

SATCOM

By Frequency band

Ultra-High Frequency

Super High Frequency

Extremely High Frequency

High Frequency

Very High Frequency

By Platform

Ground

Handheld Antennas

Body Worn Antennas

Unmanned Ground Vehicle (UGV) Antennas

Base Station Antennas

Vehicle Antennas

Manpack Antennas

Marine

Shipboard Antennas

Submarine Antennas

Unmanned Marine Vehicle (UMV) Antennas

Airborne

Aircraft Antennas

Unmanned Aerial Vehicle (UAV) Antennas

Missile Antennas

By Type

Loop Antennas

Aperture Antennas

Travelling Wave Antennas

Dipole Antennas

Monopole Antennas

Array Antennas

By Region

North America

Europe

Asia-Pacific

Rest of the World

By Company

Harris Corporation

Cobham plc

Comrod Communications AS

Terma A/S

RAMI

Mitsubishi Electric Corporation Maxar

Technologies Norsat International Inc.

Kymeta Corporation

Viasat Inc.

Ruag International Holding Ltd.

Lockheed Martin Corporation

Aselsan A.S.

Ball Corporation

Nd Satcom

Thales Group

Gilat Satellite Networks

Micro-Ant

Sat-Lite Technologies

Datapath, Inc.

Hanwha-Phasor

Viking Satcom Ltd.

Honeywell International Inc.

General Dynamics Corporation

The report covers the below scope:

Global market sizes from 2019 to 2025, along with CAGR for 2020-2025

Market size comparison for 2020 vs 2025, with actual data for 2020, estimates for 2021 and forecast from 2021 to 2025

Global market trends, covering a comprehensive range of consumer trends & manufacturer trends

Value chain analysis covering participants from raw material suppliers to the downstream buyer in the global market

Major market opportunities and challenges in forecast timeframe to be focused

Competitive landscape with analysis on competition pattern, portfolio comparisons, development trends and strategic management

Comprehensive company profiles of the key industry players

Request a Sample of this Report: @ https://marketreportslibrary.com/request/sample/ad0093/military-antenna-market

Explore other reports from ”Information and Communication, Technology ” sector @

Contact Us:

Avinash

Market Reports Library

1 note

·

View note

Text

0 notes

Text

Satellite Communication Equipments Market to Observe Strong Growth to Generate Massive Revenue in Coming Years

Advance Market Analytics released a new market study on Global Satellite Communication Equipments Market Research report which presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global Satellite Communication Equipments Forecast till 2027*.

A satellite is fundamentally an independent interchanges framework with the capacity to get signals from Earth and to retransmit those signals back with the utilization of a transponder, an incorporated collector and transmitter of radio signs. Satellite communication equipment is utilized for the transmission, molding, and gathering of satellite signals in overall media communications. General particulars incorporate item type, mounting style, and connector type or interface. Impedance is likewise a significant boundary to consider. As far as execution, satellite interchanges gear varies as far as recurrence, working voltage, yield force, and gain, return loss, working temperature, and working Humidity. Items with provisions like a controller, an incorporated warmth sink, and an inserted power supply are normally accessible.

Key Players included in the Research Coverage of Satellite Communication Equipments Market are:

General Dynamics Corporation (United States)

Cobham Plc (United Kingdom)

L3 Technologies (United States)

Viasat (United States)

Harris Corporation (United States)

Iridium Communications Inc. (United States)

Gilat Satellite Networks (Israel)

ASELSAN A.S. (Turkey)

Intellian Technologies, INC (South Korea)

Hughes Network Systems LLC (United States)

Campbell Scientific Inc. (United States)

What's Trending in Market: Increase access to satellite technology by private players

Growing demand for wide area network communication, cellular backhaul, Internet trucking, and television broadcasting

Challenges: Increase in research activities to develop miniature systems that can perform efficiently in complex environments

Opportunities: Increase in use of satellite antennas in automobiles in the developing countries

Developing technologically advanced equipment for various applications, including telecommunication, automotive, and Earth observation

Market Growth Drivers: Increasing need for uninterrupted communication in various industries

A growing fleet of autonomous and connected vehicles

The Global Satellite Communication Equipments Market segments and Market Data Break Down by Type (SATCOM Transmitter/Transponder, SATCOM Antenna, SATCOM Transceiver, SATCOM Receiver, SATCOM Modem/Router), Application (Portable SATCOM Equipment, Land Mobile SATCOM Equipment, Maritime SATCOM Equipment, Airborne SATCOM Equipment, Land Fixed SATCOM Equipment), By Technology (SATCOM VSAT, SATCOM Telemetry, SATCOM AIS, SATCOM-on-the-Move, SATCOM-on-the-Pause) To comprehend Global Satellite Communication Equipments market dynamics in the world mainly, the worldwide Satellite Communication Equipments market is analyzed across major global regions. AMA also provides customized specific regional and country-level reports for the following areas. • North America: United States, Canada, and Mexico. • South & Central America: Argentina, Chile, Colombia and Brazil. • Middle East & Africa: Saudi Arabia, United Arab Emirates, Israel, Turkey, Egypt and South Africa. • Europe: United Kingdom, France, Italy, Germany, Spain, Belgium, Netherlands and Russia. • Asia-Pacific: India, China, Japan, South Korea, Indonesia, Malaysia, Singapore, and Australia. Presented By

AMA Research & Media LLP

0 notes

Text

Ronnie Bell Following

McDonnell Douglas Phantom II QF-4B carrying an AQM-37 air-launched target drone over the Pacific Missile Test Center range Point Mugu State California (CA) Country

The Sea Range at Point Mugu, Calif., is DoD’s largest and most extensively instrumented over-water range that offers realistic, open-ocean and littoral operating environments. Located off the coast of Southern California just 60 miles northwest of Los Angeles, the Sea Range is uniquely situated with a highly instrumented coastline and off-shore islands; full-service military airfields; target and missile launch facilities; data collection and surveillance aircraft; and an experienced staff of technical personnel. The Sea Range consists of 36,000 square miles of controlled sea and airspace. Temporary expansion of the area is possible through coordination with local Navy facilities and the FAA. The range supports the test and evaluation of a wide variety of weapons, ships, aircraft and specialized systems for a broad spectrum of military, Homeland Defense, NASA, foreign ally, and private sector programs; from small-scale static tests to complex multi-participant, multi-target operations in dense electronic combat environments.

Instrumentation includes radar, telemetry, photo-optics and video, sea and air surveillance, voice communications, and data processing and displays. Time Space Position Information (TSPI), telemetry, communications and geophysics support is all available at the Sea Range. Overlapping instrumentation coverage is provided from sites at Point Mugu, Laguna Peak, San Nicolas Island, Santa Cruz Island, Vandenberg Air Force Base and Pillar Point. These ground-based assets are augmented by airborne instrumentation on NP-3D Orion aircraft to ensure effective data collection over the entire Sea Range. Dedicated high-speed data links enable real-time data transfer between Point Mugu and ranges and laboratories at China Lake, Vandenberg Air Force Base, and Edwards Air Force Base.

Aerial, seaborne and littoral targets are available through the Port Hueneme facility, which provides surface craft for seaborne targets; boats for aerial target recovery; and vessels to enforce security and safety zones.

Sea Range program support includes:

Small-scale static tests to complex multi-participant, multi-target operations in dense electronic combat environments

Coordinated air, surface, and submarine operations including carrier strike group exercises

Submarine, surface, and air-launched cruise weapons (ship and land attack)

Long-range, large hazard pattern weapons and experimental vehicle testing

ICBM, missile defence, and Polar-orbit satellite launch support

Littoral operations

Joint engagement zone scenarios

Multi-service, multinational test and evaluation and training exercises

High energy laser weapons testing

Via Flickr

7 notes

·

View notes

Text

FLIGHTLINE: 191- SAAB 37 VIGGEN ("BOLT" OR "TUFTED DUCK")

-A SAAB 37 Viggen in the '70s and '80s era splinter camouflage. | Photo: Swedish Air Force

FLIGHTLINE: 191- SAAB 37 VIGGEN ("BOLT" OR "TUFTED DUCK")

Designed to replace older fighters and attack aircraft in the Swedish Air Force, the Viggen served from the early 70s into the early 2000s.

Development of the Viggen began almost before the planes it was intended to replace, the SAAB 32 Lansen and 35 Draken, took their maiden flights, with the Swedish Air Force beginning work on requirements in 1955. Included were integration into the STRIL-60 electronic air defense system, supersonic speed at low level and Mach 2 performance at altitude, and the ability to land and take off from short, rough fields or even stretches of highway. The latter was further codified in Bas 60, a system of dispersal bases and alternate runways developed by the Swedish Air Force starting in 1958. In the event of war, individual squadrons would be dispersed to krigsflygbaser ("wartime air bases") which had been established ahead of time. Additionally, civilian air ports and specially built sections of the national highway system could also be used as alternatives. As a result, the new aircraft would need to be able to land and take off in 500 meters or less, and further requirements included a modest landing speed at low angles of attack in order to avoid damaging ad hoc runways.

SAAB began design work on a new aircraft between 1952 and 1957, examining and discarding over 100 concepts along the way. Aircraft with one or two engines, tailless delta wings, double deltas, canard designs, and VTOL aircraft incorporating lift jets were all conceived, but by 1963 the new plane, officially titled Aircraft System 37, had taken the form of a single engined aircraft with a double-delta wing mounted low and to the stern, with a large canard foreplane mounted high on the intakes. This configuration had been proven to give the best balance of performance at low and high altitude as well as the needed STOL capability and maneuverability expected of a front-line strike fighter. A defense treaty signed between Sweden and the United States in 1960 allowed access to US research and technology, which resulted in SAAB selecting a license built P&W turbofan to power the System 37. The following year, construction of the first prototype of what became the Viggen began.

DESIGN AND SPECIFICATIONS

-Orthograph of the J 37 Viggen. | Illustration: Kaboldy

The SAAB 37 was roughly the same size as the J 35 Draken, being 16.4m long, with a wingspan of 10.6m, and a height of 5.9m. Empty weight was 9,500kg, while max TO weight varied from 16,400kg to 17,000kg depending on the variant. Maximum speed was Mach 2.1 (2,231 kph) at 11,000 meters, while maximum altitude was 18,000 meters. Six fuel tanks within the aircraft provided a capacity of 5,000 liters of fuel, giving the Viggen a combat radius of 1,000km and a ferry range of 1,800km, while an auxiliary drop tank of 1,500l could also be added to further increase the range. Power was provided by a Volvo RM8A turbofan, a modified and license-built version of the P&W JT8D originally designed for the Boeing 727 and 737. Volvo modified the P&W engine design, with more robust materials going into the manufacture to withstand sustained flight at Mach 2, as well as the addition of an afterburner and thrust reverser, making it the first turbofan so equipped. The RM8A had a dry thrust of 65.6kN and with AB this increased to 115.6kN. As the 37 was designed to be both mechanically simple and easy to maintain, the inlets were D-shaped and without adjustable geometry ramps as on contemporary fighters like the F-4, instead only simple boundary layer splitter plates were incorporated. The thrust-reverser could be preset to engage once the nose gear strut compressed, an innovative feature. Electrical power was provided through a 60kVA generator, and in emergencies a ram-air turbine capable of generating 6kVA was automatically deployed.

The 37's airframe was composed of an aluminum honeycomb structure; a ring aft of the engine was fabricated from titanium for heat-resistance. In order to pull the Viggen into smaller hangars and hardened shelters, the vertical stabilizer cold be folded down via an actuator. The main landing gear, designed for short, rough fields as well as temporary landing strips or stretches of highway, had two wheels arranged in tandem; both wheels were fitted with anti-skid brakes.

-A Viggen being towed from a low-ceilinged hardened shelter. | Photo: Swedish Air Force

The Viggen used a sophisticated suite of avionics, including the Central Kalkylator 37 (CK37, "Central Calculator 37), the first airborne computer to utilize integrated circuits. This digital computer replaced the analogue machines used on earlier aircraft, such as the J 35, which had proven to be difficult to maintain as well as inaccurate in use. On later models of the Viggen, the CK37 was replaced by a license-built copy of the American CD107, which was more powerful. The Viggen used electronics countermeasure equipment developed by Satt Elektronik, including radar warning receivers in the wings and tail, as well as infrared warning receivers. Optionally, an optional Ericsson Erijammer pod and/or SAAB BOZ-100 chaff/flare pod could be added. All told, the SAAB 37 carried 600kg of avionics, a substantial load for single-seat, single engine fighter of the era. Depending on the variant, the Viggen was equipped with either the Ericsson PS 37 or PS 46 radar, both of which operated in the X-band. The PS 37 was capable of air-to-ground and air-to-air telemetry, search, track, terrain-avoidance and cartography, while the more advanced PS 46 had a look-down/shoot-down capacity in excess of 50km, and which could track two targets simultaneously.

The cockpit displays of the 37 included traditional "steam gauge" instruments, as well as a HUD and three CRT screen, which were used to display radar imagery, computer-generated maps, as well as flight and weapons information. During the late 1990s, these CRTs were replaced by LCD screens. The right side of the console panel had dedicated controls and indicators for weapons as well as navigation, oxygen, windshield de-fogging, IFF, and lighting. Situated on the left side were controls for the radar, as well as the landing gear handle, radio controls and the cabin pressure indicator.

-Cockpit of a AJSF 37 Viggen. | Photo: Per80

The pilot was seated on a Raketstol 37 ("Rocket chair 37"), designed for low-altitude, high-speed ejections, and was the last Saab-designed seat used. Once triggered, the entire ejection sequence was automated, including separation of the seat from the pilot. Manual triggers were included in case of malfunction. On twin-seat versions, the pilot in the front cockpit can trigger ejection for both seats.

VARIANTS AND WEAPONS

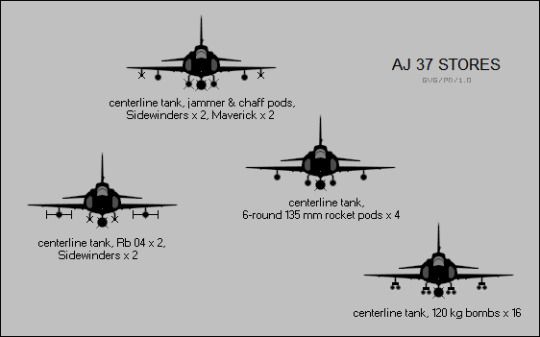

There were five variants of the Viggen, along with several upgrades and service-life extensions. The AJ 37 (Attack Jakt, "Strike Fighter") was the first to enter service, and was an attack variant with a secondary fighter mission. As such, the AJ's seven pylons could carry 7,000kg of stores, including unguided bombs and pods, such as the Bofors M70, for rockets, as well as the Rb04 anti-ship missile and the Rb05 air-to-surface missile (roughly equivalent to the American Bullpup). No cannon was fitted, though one or two pods could be carried, each of which housed a license-built Aden 30mm cannon and 150 rounds of ammunition. Finally, license-built copies of the AIM-9 Sidewinder, known as the Rb24, could be carried for self-defense. The Viggen was also cleared to carry AIM-4 Falcons, known as the Rb28 in Swedish service, but these were in the process of being phased out. The AJ 37's radar was not spec'd for BVR missiles. 109 AJ 37s were produced.

-Schematic of the AJ 37 carrying various loads. | Illustration: airvectors.com

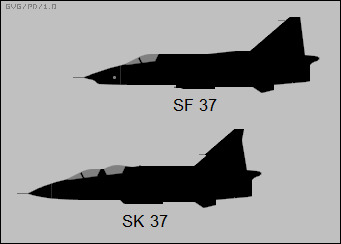

The second model was the SF 37 (Spanings Foto, "Photo Reconnaissance"), which was a modification of the AJ fuselage, with a new nose containing 7 cameras replacing the radar of the strike version. The camera fit included vertical and oblique cameras, as well as an infrared line scanner and data recording unit. Additional pods could be carried under the intakes, including a "Red Barron" night recon unit or a forward-looking long-range optical (LORP) pod. The SF 37 was fitted with radar-warning receivers and countermeasures pods, and could carry self-defense Sidewinders, but the plane lacked a radar, and was not fitted with a gunsight. 28 total SF 37s were completed.

-Orthograph of the SF 37 carrying drop-tanks and camera pods. | Illustration: wp.scn.ru

The third variant was the SH 37 (Spanings Havsoevervakning, "Coastal Surveillance & Reconnaissance") model, which was externally identical to the AJ 37, but the nose contained a new Ericsson PS-371/A radar, which was optimized for maritime surveillance. Like the SF 37, the SH could carry the Red Barron or LORP camera pods, but like the AJ it could also carry the Rb04 anti-ship missile, as well as the other offensive and defensive equipment of the strike version. 27 SH 37 aircraft were built between 1977 and 1979, and Flygvapnet reconnaissance squadrons operated a mix of the SF 37 and SH 37.

-Scale model of an SH 37, armed with Rb04 missiles. | Photo: trickyrich

A two-seat trainer variant was not initially ordered, but the Swedish Air Force reversed itself, and one of the prototypes was completed as a trainer, designated the Sk 37 (Skol, "School"). Based on the AJ 37 airframe, a second cockpit was grafted onto the fuselage, with part of a fuel tank being removed to make space. Two periscopes were added to the instructor's cockpit to improve his view. The tail fin was also modified, with a 10cm extension added to the top of the fin. The trainer version did not have a radar, and although stores could be fitted the the accurate delivery of bombs was somewhat compromised. Interestingly, the Sk retained the fairings for the radar warning gear, though the RWR equipment was not carried. 17 Sk 37s were produced.

-Schematic showing the difference in appearance of the SF and Sk 37 models. | Illustration: airvectors.com

The final production variant was the JA 37 (Jakt, "Fighter"), which saw a longer development as the Flygvapnet felt no rush to retire the J 35 Draken. The JA variant had the same tail extension as the Sk 37, and the fuselage was also stretched 10cm ahead of the wing to accommodate the more powerful RM8B engine, which had a maximum output of 125kN with afterburner. The interceptor had four elevator actuators versus the three present on the other models of Viggen, as the Flygvapnet saw the need for additional maneuverability, and the structure was reinforced to withstand higher stresses. In total, a JA 37 was approximately 400kg heavier than an AJ 37. The fighter carried different avionics than the other Viggen as well, including a PS-46/A radar, with look-down/shoot-down capacity and a range of 48km. The JA 37 also carried a more powerful central computer, the Garrett LD-5 digital air data computer (the same unit carried on the F-14 Tomcat), and one of the first digital flight-control systems. The fighter version was armed with a single Oerlikon KCA 30mm cannon, which had more range and punch than the Aden cannon carried by the AJ 37. The JA 37 had the same seven pylons as other models, with the center hardpoint being the only "wet" (capable of carrying a fuel tank) one. The other pylons could carry up to four Rb24 Sidewinders, as well as two Rb71 Skyflash semi-active radar homing (SARH) missiles. The JA 37 could carry the M70 rocket pods, with the gunsight being used for aiming, but the type was not capable of carrying the other bombs and missiles available to the AJ 37.

-Cutaway drawing of the JA 37, showing internal systems and armaments. | Illustration: SAAB

TESTING AND OPERATIONAL HISTORY

The first Viggen prototype was rolled out of the factory on 24 November 1966, with maiden flight occurring on 8 February 1967, the flight lasting 43 minutes. The second Viggen followed in flight on 21 September '67, and the third on 29 March 1968. By April 1969, all six of the single seat prototypes were flying in different trials for the forthcoming AJ 37 variant. The first aircraft was involved in a fatal accident on 31 May 1968 when the pilot dropped a flight checklist and in reaching for it triggered the ejection seat. Being an early model, it was not a true "zero-zero" seat, and the parachute did not open in time, killing test pilot Lennart Fryoe. The aircraft was repaired and returned to flight shortly thereafter. The fourth prototype was written off after leaving the runway and rolling over during a test on the thrust reverser on 7 May 1969, though the pilot was not seriously injured. That same month, the Viggen made its first public world-wide appearance at the Paris Air Show. On 5 April 1968, a production order for 175 Viggens, a mix of AJ, SF, SH and Sk variants, was placed, with the first production AJ 37 having its maiden flight on 23 February 1971 and delivery to the Flygvapnet in June of that year.

-Five of the Viggen prototypes lined up at the Linköping Testing Center in 1969. | Photo: SAAB

-Viggens under construction at SAAB's factory. In the background are J 35 Drakens for the Danish Air Force. | Photo: SAAB

The Skaraborg Air Force Wing became the first wing to receive the Viggen in 1971, with pilots completing a 450 hour course, first in the SAAB 105 trainer, then the J 32 Lansen before graduating to the Sk 37 tainer and finally the AJ 37. Dedicated simulators were also used, which was later cited as a major factor in pilot's ease of flying the new plane. Still, it took until October 1973 for the Wing to reach full effectiveness; by May 1974 two squadrons were fully operational with the third rapidly approaching complete status. The SH 37 maritime recon variant was officially introduced in 1975, followed in 1977 by the SF photo recon version. In September 1980 the JA 37 fighter model was added, with the Bråvalla Air Force Wing being the first to convert. By the mid-1980s, the Viggen was the Flygvapnet's primary air-defense platform, with the older Lansen relegated to target-tugs and electronics warfare, while the last J 35F wing converted in 1985.

-In order to maximize tactical flexibility, recon missions were often flown by an SH and an SF model, in this photo the SH is in the foreground and armed with a pair of Rb04 while the SF is in the background. | Photo: Flygvapnet

-A fully-loaded JA 37 on a test flight, armed with Sidewinders, Skyflash and cannon. | Photo: Flygvapnet

-Operationally the JA 37 flew in an air-superiority camo scheme of light and dark gray, while the other models sported the tri-color splinter scheme. | Photo: Paul Nann

The Viggen proved to be as easy to maintain as SAAB's engineers intended, with a team of five conscripts under the supervision of one chief mechanic able to keep a plane flying. Refueling and rearming a Viggen could be accomplished in as little as ten minutes, and an engine change could be completed in four hours. The 37 required 9 hours of front-line maintenance and 22 hours of depot level maintenance per flight hour, compared to the J 35, which required a total of 50 hours of maintenance per flight hour.

The effectiveness of the Viggen, as well as the Swedish air defense network as a whole, was demonstrated in the 1980s when, on several occasions. JA 37s tracked USAF SR-71 Blackbirds on their tracks into and out of Soviet airspace. Aided by the predicable course of the Blackbirds, and fed intercept data from ground controllers, the Viggen became the only aircraft acknowledged to have achieved radar lock-on of an SR-71, despite heavy jamming efforts by the American spy planes. These intercepts were kept classified well into the 2000s.

In the early 1990s, an upgrade program was started to modify the AJ, SF and SH variants to a single common configuration, known as the AJS 37. The modified Viggen would be a multi-role aircraft, and numerous upgrades were completed on the aircraft, including the addition of a new data bus and radar, which allowed the AJS 37s to carry AIM-120 AMRAAM missiles (license-built as the Rb99). The upgraded Viggen were also capable of carrying the Rb75, a license-built copy of the AGM-65 Maverick and the Rb15F, an upgrade of the Rb4 anti-ship missile. In all, 115 AJS 37 were completed, with maiden flight of the first converted aircraft occurring on 4 June 1996.

Ten Sk 37s, meanwhile, were converted to electronics warfare trainers between 1998 and 2000, which allowed the planes to act as aggressors during training exercises. This conversion was fairly involved, adding a new data bus, a GPS receiver and comprehensive reworking of the former instructor pilot's cockpit which included flat-panel displays, jammer controls and a separate radio for the electronics warfare officer. The Sk37 E Stoer ("Jammer") was also modified to carry a built-in radar jammer as well as external ECM and flare/chaff pods. The Stoer could also act operationally if the need arose.

The JA 37 fighters also received a series of upgrades in the 90s, including glass cockpit displays, new mission computers and data busses, improved ECM capabilities, a Synthetic Attitude Heading Reference System (SAHRS) to improve navigation, and an upgraded radar that allowed them to also carry the Rb99 AMRAAM missile.

-A JA 37D carrying 3 Rb99 and two Rb24, along with an electronics warfare pod, during an intercept mission. | Photo: Flygvapnet

Despite these upgrades, the Viggens were rapidly approaching the end of their service lives, and in fact had received several extensions due to the protracted development and production of the JAS 39 Grippen that was to take their place. These issues were finally sorted out in the early 2000s, and the final JA 37D was retired from Swedish service in 2005, while the Sk 37E held on until 2007. There were no export operators of the Viggen, despite the proposed 37X variant for Norway in the late 60s, and an attempt in 1975 to sell the 37E model to NATO as a replacement for the F-104 Starfighter.

SURVIVORS

Two Viggen, an AJS and an Sk, are registered to the Swedish Air Force Historic Flight association and are maintained in flight-worthy condition, registered as SE-DXN and SE-DXO respectively. Nearly two dozen Viggen, in part or in whole, are on display in Sweden and across Europe.

-SE-DXN on its inaugural flight after restoration. | Photo: Ragnhild & Neil Crawford

-An AJS 37, in a commemorative red paint scheme, at the Swedish Air Force Museum, Malmslätt. | Photo: Mangan2002

#airplane#airplanes#aircraft#Aviation#avgeek#saab#saab viggen#ja 37 viggen#aj 37 viggen#ajs 37 viggen#saab 37 viggen#swedish air force#sweden#svenska flygvapnet

44 notes

·

View notes

Text

1.14.22 Headlines

WORLD NEWS

Ukraine: Russia to blame for hack, says Kyiv (BBC)

“The Ukrainian government has accused Russia of being behind Friday's cyber-attack on dozens of official websites. About 70 government websites were temporarily down, in the largest such attack on Ukraine in four years. Before the sites went offline, a message appeared warning Ukrainians to "prepare for the worst". Access to most of the sites was restored within hours. The US and Nato condemned the attack and have offered support to Ukraine. Russia has not commented on the hack.”

Hong Kong: Transit flights from over 150 countries banned (AP)

“Hong Kong International Airport said it will ban transit passengers from 150 countries and territories starting Sunday, tightening stringent travel controls in an effort to stem the spread of the highly contagious omicron variant. Authorities also said Friday they will extend social distancing restrictions, including a ban on dining in after 6 p.m., by another two weeks over the Lunar New Year holidays to Feb. 3.”

Australia: Novak Djokovic to be detained on Saturday after visa cancelled (BBC)

“Novak Djokovic is set to be detained on Saturday after Australia cancelled his visa for a second time, in a row over his right to remain in the country unvaccinated. The decision on "health and good order" grounds means he faces deportation and a three-year visa ban. Djokovic's lawyers called the decision "patently irrational" and will appeal. The men's tennis number one is still scheduled to play in the Australian Open in Melbourne on Monday.”

US NEWS

Covid: US Supreme Court halts Covid-19 vaccine rule for US businesses (AP)

“The Supreme Court has stopped a major push by the Biden administration to boost the nation’s COVID-19 vaccination rate, a requirement that employees at large businesses get a vaccine or test regularly and wear a mask on the job. At the same time, the court is allowing the administration to proceed with a vaccine mandate for most health care workers in the U.S. The court’s orders Thursday came during a spike in coronavirus cases caused by the omicron variant.”

North Korea: Early warning systems first suggested missile could hit US (CNN)

“In the minutes after North Korea launched a ballistic missile around 7:30 a.m. local time on Tuesday, the US command responsible for protecting the American homeland from airborne threats raced to determine whether the missile might be capable of striking the United States -- and for a moment, took steps as if it was. Initial telemetry readings -- which can be inaccurate and are often discarded as more data becomes available -- suggested that the missile could pose a threat as far away as the Aleutian Islands off Alaska or the California coast, two sources familiar with the matter told CNN.”

Russia: US official says Russia prepping pretext for Ukraine invasion (AP)

“The Biden administration has determined a Russian effort is underway to create a pretext for its troops to potentially further invade Ukraine, and Moscow has already prepositioned operatives to conduct “a false-flag operation” in eastern Ukraine, a U.S. official said Friday. The administration believes Russia is also laying the groundwork through a social media disinformation campaign by framing Ukraine as an aggressor that has been preparing an imminent attack against Russian forces in eastern Ukraine, according to the official, who spoke on condition of anonymity because the official wasn’t authorized to discuss sensitive intelligence on the record.”

#current events#news#ukraine#russia#cybersecurity#hong kong#covid#australia#novak djokovic#united states#us supreme court#vaccine mandate#north korea

3 notes

·

View notes

Text

Thunderbird XL (Part Three)

Title: Thunderbird XL

Sequel to Thunderbird X

Thunderbird X | Thunderbird XL Part One | Part Two | Part Three

Author: Gumnut

Feb – 11 Mar 2020

Fandom: Thunderbirds Are Go 2015/ Thunderbirds TOS

Rating: Teen

Summary: “I’ve got you, son.”

Word count: 1572

Spoilers & warnings: SPOILERS FOR SEASON 3 EPISODE 25 & EPISODE 26

Timeline: Episode Tag, written episode

Author’s note: Sequel to Thunderbird X. so much is asking to be written about the last episode of the series. This one just happened and in a way I didn’t plan. Many thanks to the Thundernerds on Tumblr for all their support and especially @scribbles97 for the readthrough.

I’m having the strongest feeling that ‘Need’ might be the sequel to this, so it is probably a good idea for me to actually finish it. Also, for some reason, I was drawn to it today. So we have Part Three.

Disclaimer: Mine? You’ve got to be kidding. Money? Don’t have any, don’t bother.

-o-o-o-

Hate wasn’t really a word for what he felt for Gaat. Pity was closer, but considering Jeff was a man who had been stuck alone for eight years, that was saying something.

When Brains entered and Gaat was flung across the room to be caught by Gordon and Alan, Jeff had a moment to greet his old friend, the man who had managed to save him yet again.

And still be completely socially awkward about it.

He could only love him for it.

Scott grabbed Gaat from Alan, stepping between his little brother and the pest who had hurt them so much, and he and Gordon rough housed the criminal below decks.

That left Jeff with Virgil, Alan and Brains.

“That was some pretty hot shot flying there, Allie.”

His youngest son flushed a little red, his hand going to the back of his neck. “Aww, thanks, Dad.”

An awkward silence fell after that. Virgil shifted to a work station off to the right. His hand hitting his comms. “Thunderbird Five, cockpit is secure, what is our flight status?”

“Eos is running a damage report. The EMP did have some impact and we will need to make some repairs.”

“Point me where you need me.”

“FAB.”

Virgil looked over to his fellow engineer who was on the opposite side of the cockpit, running his own assessments. “Brains?”

“J-John is c-correct. I also want to r-run a s-systems check. T-to m-make sure there is n-no sabotage.”

Jeff’s stomach tightened. Gaat had been alone for who knew how long and when foiled, he could have done anything out of spite.

“Brains, timeframe?”

He was aware of his two boys and Brains both suddenly staring at him.

“I am unsure, M-Mr Tracy.”

“Keep me apprised.”

“FAB.”

“Dad, you should be resting.” Virgil appeared beside him, a gloved hand gently touching his arm.

“I am. There is no gravity in space, Virgil.”

“Dad-“

“Virgil, I need you in the aft computer core. I’m reading a series of faulty processors and I have some concerns about the air circulation system in the secondary life support hub.” John’s voice demanded immediate attention.

Virgil hit his comms. “FAB, John. I’m on it.” He turned to his little brother. “Alan.” An indrawn breath, worried eyes cast over Jeff. “Look after Dad.”

“Sure.” His youngest son propelled himself closer.

Virgil’s fingers brushed across Jeff’s forearm as he pushed himself towards the exit.

Brains muttered to himself absently at his console, but that awkward silence returned.

A glance at Alan and he caught his son’s profile. As the young man turned towards the front of the cockpit, Jeff was struck at the contrast yet again between the child he had left behind and the man who had flown this ship all the way out here.

“Dad, I should probably give you a quick orientation for safety’s sake.”

Jeff nodded once and there followed a very professional systems report. Within five minutes he knew the location of all the main controls, the functions of each of the stations, and he was pretty sure that he could give a good go at piloting the craft himself.

Not that he had any intention of trying.

But it was reassuring to hear familiar terms and watch his son, ever so confident, speak the language of astronaut.

He had been eleven when Jeff left on that rescue. All starry eyed and rocket obsessed. And now…

A competent young man flying rockets into the unknown.

He had so many questions.

But they would have to wait as Scott burst back into the room. His comms were lit up. “Eos, yes, thank you for your assistance, and no, I have no intentions of letting anyone shoot you with an EMP ever again.”

“Good!” That high-pitched voice again. “John is on his way down to the cockpit. We are showing green on all systems except those Virgil is currently attending to. Thunderbird Five is prepared for the jump, deflectors are at one hundred percent. Navigational data is being prepared.”

“Thank you, Eos. Couldn’t do this without you.” The frown on Scott’s brow got just that little bit deeper.

Gordon floated in behind his older brother, a frown equally severe on his face. It looked alien on those features as he turned to Jeff. “The Hood’s stowed in his ‘cabin’. Rope and all.” There was some satisfaction at that announcement. “We will now return to our scheduled inflight entertainment. Due to the lack of a movie, MAX will be providing juggling for your amusement.” The robot on the ceiling squawked. That was MAX?! “Alan will be providing the rollercoaster effects.” A hand up to Gordon’s face as he shifted to a not-quite whisper in an aside to Jeff. “He really has been playing far too many video games.”

“Hey!”

“Yes, Dad, you may have to curb his screen time when we get home.”

The youngest turned back from the helm. “Fine, Gordon. I’m sure Dad will love to hear about Corfu while I’m not playing those games.” The glare in those blue eyes was furious.

“Woah, Allie! Hold on the big guns, it was a joke.” Gordon reacted enough to float backwards.

Jeff held up a hand. “Boys?”

Two pairs of eyes darted at him. Alan pointed at his brother. “He started it.”

Jeff stared at them both and was suddenly struck at the familiarity. His boys were bigger, yes, but they were still his boys.

He opened his arms. “C’mere.”

Neither hesitated and he once again was able to wrap himself around dreams-become-reality. He kissed two golden heads.

Scott floated into his vision, a small smile on his face.

Jeff had to squeeze his eyes shut for just a moment before he let his two youngest go.

His eldest’s voice was gentle. “Alan, we need pre-flight. Gordon, Eos is about to relay navigational data for your approval.”

Chorus of two. “FAB.” And his two boys moved.

Scott approached Jeff. “Dad, we have a seat for you.” He reached down into the centre hub of the cockpit, just behind the two forward seats and unfolded a chair. It clicked solidly into place as if it had always been there.

“S-Scott, I can f-find no trace of sabotage.” Brains’ hands were dancing over his controls. “Eos, have you c-completed the d-data and programming checks?”

“I have, Hiram. There is no sign of interference of any kind. I find it highly doubtful that the criminal would sabotage his only way back to Earth.”

John sailed in through the rear hatch. “Eos, we’ve spoken about human idiocy, particularly regarding the Hood.” His middle boy smiled gently at him as he passed smoothly to his place in the cockpit.

“Oh, I thought you were joking.”

Those turquoise eyes that had kept Jeff company for all those long years, blinked. “What gave you that idea?”

“The illogic of it all. Why would the Hood be so stupid? Also, you swore in six different languages at the time.”

Another blink and a darted glance at his father. “Well, I wasn’t joking. The Hood is an idiot.”

Jeff couldn’t help himself. “Only six?”

John’s eyes widened just a little. “I was distracted trying to keep Thunderbird Two airborne.”

“What?”

Said Thunderbird’s pilot chose that moment to return. “John, processors replaced and the air circulation system is patched. I wouldn’t give it long, but it should survive enough to get us home.” A nudge off the ceiling and Virgil was once again beside him. “We should get you strapped in, Dad. The ride out here was rough.”

Scott’s hand landed on his brother’s shoulder and squeezed as he turned back to the helm where Alan was taking his seat.

That left Jeff to Virgil again, who gently urged him into the chair and buckled him in.

He stared at his boy as he let him do the simple task. It wasn’t as if Jeff was incapable of strapping himself in, it was just…

“Virgil?” He tipped his head down, trying to catch those worried eyes.

His son continued to fiddle with the belt, not acknowledging him at all.

“I’m going to be okay.”

At that Virgil did look up and the love in his son’s eyes pierced his heart. “I know, Dad.”

It was said with such finality, such determination…come whatever, Virgil was going to make sure he was okay.

Jeff opened his mouth to respond, but he didn’t have a chance as Scott began launch preparations and Virgil spun himself away to his station.

Jeff followed him with his eyes, his heart thudding in his chest.

God, it was hard to believe this was all happening.

Lucy, our boys.

Our boys!

“Alright.” Scott’s accent always made itself known when in command. That at least hadn’t changed. “Go / no go for launch.” He turned towards John. “Telemetry?”

“Go.”

To Gordon. “Navigation?”

Again with that serious expression on the aquanaut’s face. “Go.”

To Virgil. “Airframe?”

“Go.”

To Brains. “Propulsion?”

“Go!”

To Alan. “Helm?”

“Go!”

“Then let’s go home!” His eldest turned around to Jeff. “Wanna count us down?” Those blue eyes flashed.

There was no question. “I was hoping you would ask.”

With a heart so tied into his family and the wonders they were capable of, he counted down from five, each number thrown into fate’s face as he took that last step home.

And the ultimate in defiance.

“Thunderbirds are go!”

Alan moved.

The ship blinked.

-o-o-o-

End Part Three.

#thunderbirds are go#thunderbirds#thunderbirds fanfiction#Jeff Tracy#Virgil Tracy#Scott Tracy#Alan Tracy#John Tracy#Gordon Tracy#Eos#episode tag#tag spoilers#tagspoilers

51 notes

·

View notes

Text

Military Antenna market Size, 2020 Industry Share and Global Demand | 2027 Forecast by Fortune Business Insights™

The global military antenna market size is projected to reach USD 5.78 billion by the end of 2027. The rising military budget allocations will create several growth opportunities for the companies operating in the market. According to a report published by Fortune Business Insights, titled “Military Antenna Market Size, Share & Industry Analysis, By Frequency (High, Ultra-High, Super High, and Extremely High Frequency), By Type (Dipole, Aperture, Travelling Wave, Loop, and Array Antenna), By Platform (Airborne, Marine, and Ground), By Application (Communication, Surveillance, SATCOM, Electronic Warfare, and Telemetry), and Regional Forecast, 2020-2027,” the market was worth USD 4.89 billion in 2019 and will exhibit a CAGR of 8.61% during the forecast period, 2020-2027.

Coronavirus Outbreak has Compelled Several Countries to Prioritize Healthcare Budgets over Defense

The recent coronavirus outbreak has created a sense of panic across the world. Due to the rapid spread of the disease, governments across several countries have decided to allocate more budgets to the healthcare sector than the defense sector. The constant research and development activities to minimize the spread of the disease as well as development efficient treatment options, has influenced this decision. As a result, the reductions in budget allocations for military and defense applications will have an adverse effect on the growth of the military antenna market in the coming years.

Military antennas are used in several communication applications in the military and defense sector. A military antenna system is used to convert radio frequency waves into alternating current and vice versa for receiving and transmission process. The massive investments in the development and deployment of efficient military antennas are consequential to the degree of sensitivity and risks involved with the communication in this sector. Accounting to this, the military organizations of several countries across the world are looking to collaborate with tech-companies. It is observed that company mergers and collaborations are an increasing trend among major companies across the world. The increasing number of company collaborations will subsequently affect the growth of the overall market in the coming years. Additionally, the rising awareness regarding the importance of integrating high-quality products and devices in military applications will bode well for market growth.

Request a Sample Report: https://www.fortunebusinessinsights.com/industry-reports/military-antenna-market-101824

Increasing Number of Company Mergers and Acquisitions will Aid Growth

The report encompasses several factors that have contributed to the growth of the market in recent years. Among all factors, the increasing number of company mergers and acquisitions has made the highest impact on the growth of the overall market in recent years. Accounting to the massive investments in technological intervention by several companies, defense organizations are looking to collaborate with these tech companies. In May 2020, Raytheon Technologies announced that it has bagged a contract from the US Navy for development and assembly of planar antennas. Through this contract, the company will assemble planar array antennas as well as develop spare parts for the same. The company will also provide assistance for engineering related issues; a factor that will come under the repair and maintenance part. This collaboration will not just help the company generate huge revenue, but will also have a direct impact on the growth of the global market.

North America Likely to Emerge Dominant; Increasing Defense Expenditure will Provide Impetus to Market Growth

The report analyses the latest market trends across five major regions, including North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa. Among all regions, the market in North America is projected to emerge dominant in the coming years. The rising defense budget allocations, especially in the United States, have made a positive impact on the growth of the regional market. Additionally, the presence of several large scale tech-companies involved in manufacturing of military antennas will constitute an increase in the overall market size. As of 2019, the market in North America was worth USD 1.84 billion and this value will rise considerably in the coming years. The market in Asia Pacific will derive growth from the rising defense spending by leading countries such as India and China.

List of companies profiled in the report:

Antcom Corporation (California, the U.S.)

Cobham PLC (Wimborne Minster, The U.K)

Comrod Communication AS (Stavanger, Norway)

Eylex Pty Ltd. (New South Wales, Australia)

Hascall-Denke (Florida, The U.S.)

L3Harris Technologies Ltd. (Florida, The U.S.)

Lockheed Martin Corporation (Maryland, The U.S.)

MTI Wireless Edge Ltd. (Israel)

Raytheon Technologies (Connecticut, The U.S.)

Rohde & Schwarz GmbH & Co KG (Munich, Germany)

Terma A/S (Aarhus Municipality, Denmark)

Other Players

This Report Answers the Following Questions:

What are the plastic compounding market trends?

How many growth drivers and barriers will the market possess?

Which organizations are set to remain on top in the market?

What are the strategies adopted by industry giants to strengthen their position?

Which segment is set to dominate the market during the forthcoming years?

To get the short-term and long-term impact of COVID-19 on this Market, Visit: https://www.fortunebusinessinsights.com/industry-reports/military-antenna-market-101824

Military Antenna Market report Focus on:

Extensive product offerings

Customer research services

Robust research methodology

Comprehensive reports

Latest technological developments

Value chain analysis

Potential Market opportunities

Growth dynamics

Quality assurance

Post-sales support

Regular report updates

Reasons to Purchase this Report:

Comprehensive analysis of the market growth drivers, obstacles, opportunities, and other related challenges.

Tracks the developments, such as new product launches, agreements, mergers and acquisitions, geographical expansions, and joint ventures.

Identifies market restraints and boosters.

Identifies all the possible segments present in the market to aid organizations in strategic business planning.

Key Questions Answered:

Why Choose Fortune Business Insights?

What are the key demands and trends shaping the market?

What are the key opportunities in the market?

What are the key companies operating in the market?

Which company accounted for the highest market share?

What is the market size and growth rate of the global and regional market by various segments?

What is the market size and growth rate of the market for selective countries?

Which region or sub-segment is expected to drive the market in the forecast period?

What Factors are estimated to drive and restrain the market growth

Industry Developments:

May 2020 –Isotropic Systems announced that it has bagged a contract for evaluation & development of antenna by the U.S. Defense Innovation Unit. Through this contract, the company will focus on the delivery of low-profile, affordable, high performance, and customizable antenna to support multiple links over multiple bands of satellite capacity, including S, C, Ka, Ku, X, and Q-band connectivity.

Get your Customized Research Report: https://www.fortunebusinessinsights.com/enquiry/customization/military-antenna-market-101824

About Us:

Fortune Business Insights™ offers expert corporate analysis and accurate data, helping organizations of all sizes make timely decisions. We tailor innovative solutions for our clients, assisting them address challenges distinct to their businesses. Our goal is to empower our clients with holistic market intelligence, giving a granular overview of the market they are operating in.

Our reports contain a unique mix of tangible insights and qualitative analysis to help companies achieve sustainable growth. Our team of experienced analysts and consultants use industry-leading research tools and techniques to compile comprehensive market studies, interspersed with relevant data.

At Fortune Business Insights™, we aim at highlighting the most lucrative growth opportunities for our clients. We therefore offer recommendations, making it easier for them to navigate through technological and market-related changes. Our consulting services are designed to help organizations identify hidden opportunities and understand prevailing competitive challenges.

About Us:

Fortune Business Insights™ offers expert corporate analysis and accurate data, helping organizations of all sizes make timely decisions. We tailor innovative solutions for our clients, assisting them to address challenges distinct to their businesses. Our goal is to empower our clients with holistic market intelligence, giving a granular overview of the market they are operating in.

Our reports contain a unique mix of tangible insights and qualitative analysis to help companies achieve sustainable growth. Our team of experienced analysts and consultants use industry-leading research tools and techniques to compile comprehensive market studies, interspersed with relevant data.

At Fortune Business Insights™, we aim at highlighting the most lucrative growth opportunities for our clients. We, therefore, offer recommendations, making it easier for them to navigate through technological and market-related changes. Our consulting services are designed to help organizations identify hidden opportunities and understand prevailing competitive challenges.

Contact Us: Fortune Business Insights™ Pvt. Ltd. 308, Supreme Headquarters, Survey No. 36, Baner, Pune-Bangalore Highway, Pune - 411045, Maharashtra, India. Phone: US: +1 424 253 0390 UK: +44 2071 939123 APAC: +91 744 740 1245 Email: [email protected] Fortune Business Insights™ LinkedIn | Twitter | Blogs

Read Press Release: https://www.fortunebusinessinsights.com/press-release/military-antenna-market-9465

1 note

·

View note

Photo