#AatmaNirbhar

Explore tagged Tumblr posts

Text

ATL App Development Module

Aiming to transform school students from app users to innovative app developers, NITI Aayog’s Atal Innovation Mission launched the ‘ATL App Development Module’ in collaboration with Indian homegrown startup Plezmo. It would hone the school students’ skills nationwide and transform them from App users to App makers in the times to come under AIM’s flagship Atal Tinkering Labs initiative. This is a…

View On WordPress

0 notes

Text

#Aatmanirbhar Bharat#AMCA#AMCA 5th Generation Stealth Fighter Updates#AMCA first flight by 2028#AMCA prototype by 2026#Indian Aerospace Industry#Indian Air Power#Indian Defence

0 notes

Text

Dr. Ranjan Kumar Mishra to Receive Aatmanirbhar Bharat Gaurav Award 2024

Dr. Ranjan Kumar Mishra, Dean of IT at Netaji Subhash University, Jamshedpur, will be honored with the Aatmanirbhar Bharat Gaurav Award 2024. Dr. Ranjan Kumar Mishra, the Dean of Information Technology at Netaji Subhash University, Jamshedpur, has been selected to receive the prestigious Aatmanirbhar Bharat Gaurav Award 2024. The award, presented by MS Global Entertainment, recognizes his…

#Aatmanirbhar Bharat Gaurav Award 2024#शिक्षा#Dr. Ranjan Kumar Mishra award#Dr. Ranjan Kumar Mishra recognition#education#education awards India#Inspiring Expert Educator award#IoT book author#IT education leader#Jamshedpur academic achievements#MS Global Entertainment awards#Netaji Subhash University Jamshedpur

0 notes

Text

Boost to Aatmanirbharta: Govt releases new list of 346 indigenous defence items

The Ministry of Defence has notified the fifth Positive Indigenisation List (PIL) consisting 346 defence items in a major boost to Aatmanirbharta in defence production.

The items include strategically important Line Replacement Units/Systems/Sub-Systems/Assemblies/Sub-Assemblies/Spares & Components and raw materials, with import substitution value worth Rs 1,048 crore, according to a Ministry of Defence statement issued on Monday.

Source: bhaskarlive.in

0 notes

Text

Call For Chapters: Sustainable Development Through Legal Innovation @ Submit By June 02, 2024

Call For Chapters: Sustainable Development Through Legal Innovation @ Submit By June 02, 2024 ABOUT THE BOOK This book shall embark on a comprehensive exploration of how legal frameworks can pave the way for India’s journey towards economic self-reliance, environmental sustainability, and inclusive growth. Through a nuanced analysis of key themes and sub-themes, this book offers insights into the…

View On WordPress

0 notes

Text

ES Ranganathan Celebrates ONGC's Maiden Oil Extraction from KG Block as a Crucial Step Towards Aatmanirbhar Bharat

ONGC used advanced technologies and creative methods to tap into the untapped potential of the KG Block, showing India's progress in research and development. This effort also highlights India's commitment to embracing modern technologies. ES Ranganathan explains that using advanced seismic imaging, drilling techniques, and reservoir management led to successful oil extraction. Challenges like the waxy nature of the crude were overcome with innovative 'Pipe in Pipe' technology—a first in India. This shows ONGC's dedication to advancing India's energy sector with cutting-edge solutions.

The successful extraction from the KG Block isn't just a technical win but also aligns with the Aatmanirbhar Bharat initiative. Ranganathan believes this achievement has significant economic benefits, like boosting the domestic oil and gas sector, reducing import dependency, and creating job opportunities in energy. ONGC's success supports the government's vision of self-reliance in various sectors, including energy.

This victory will have positive economic impacts, contributing to the nation's GDP. Ranganathan says job creation in the oil and gas sector will strengthen the workforce and support local communities. Increased domestic oil production enhances India's energy security, meeting the nation's growing energy needs. The successful development of the 'M' field in phase 2 of the project is expected to significantly increase India's oil output. ONGC's commitment to the 'Make in India' initiative is evident, with most fabrication works done locally. The KG-DWN-98/2 block, near Reliance Industries Ltd’s (RIL) gas field, adds value to ONGC's portfolio.

Read More

0 notes

Text

Get exclusive discounts on a wide range of Handloom, Clothing, and Jewellery brands. Shop now and save!

#handloom#voucher#Digital showroom#handicraft#clothing deals#discount#ONDC Network#vocal4local#aatmanirbhar bharat

0 notes

Text

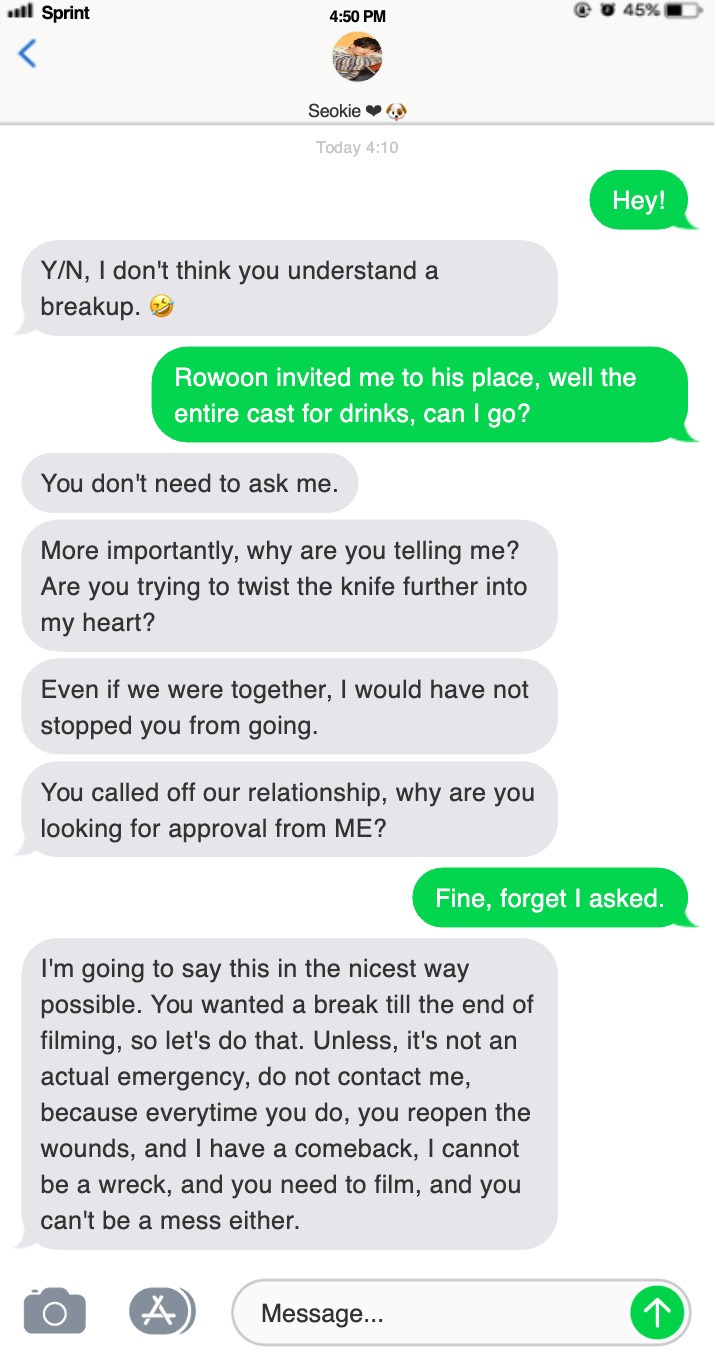

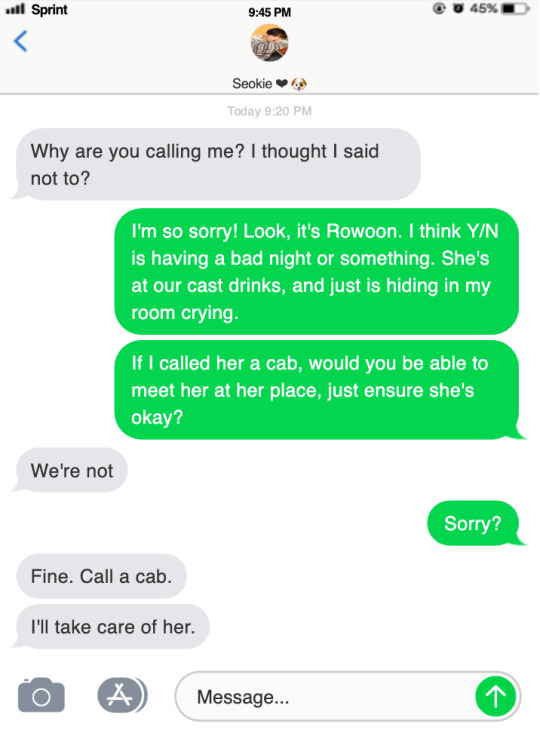

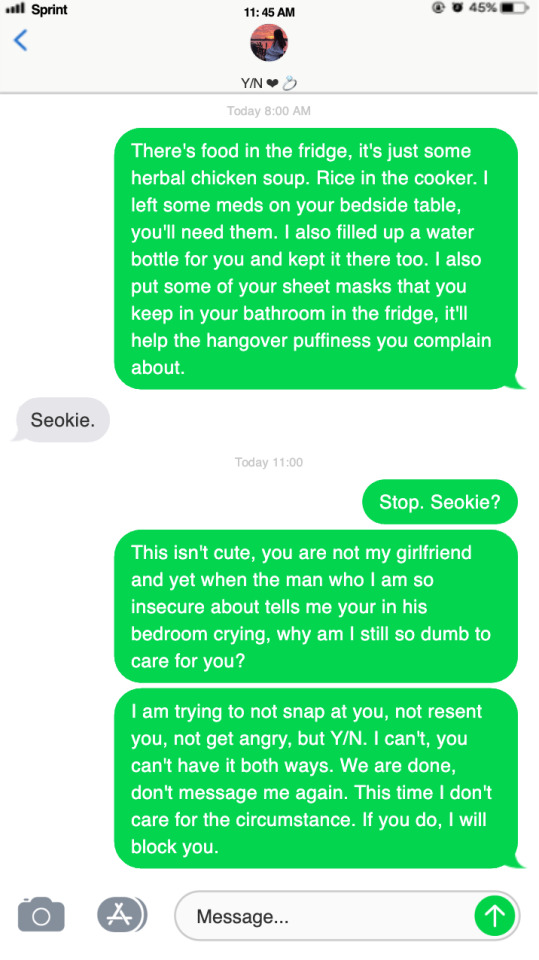

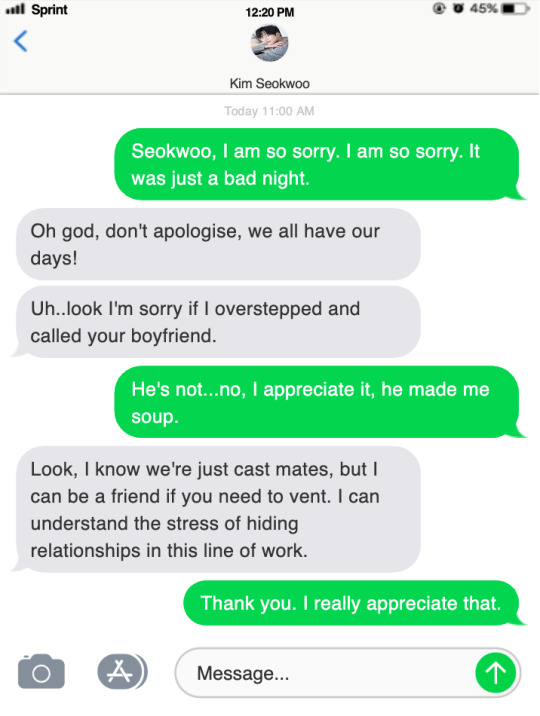

Doesn't justify his mean and aggressiveness 🤺

Better Than Me | Part 12: Drunk On You

Summary: You and Seokmin have been dating for a few years, but now you're the star of a new drama with your co-star Rowoon, which makes Seokmin insecure. Seokmin tries his best to be supportive and understanding, but sometimes it's too much, and you're both unsure if your relationship can survive the jealousy and fights.

Main Masterlist 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | Epilogue Taglist: @dkluvrsclub @wooahaeproductions @seokgyuu @stayinhellevator @aaniag @the-boy-meets-evil @hoeforhao @here4kpopfics @ressonancee @seungkwansphd @tomodachiii @shadowjellyfishfest @kyeomooniee @allmyl0ve17 @randomworker @gyuminusone @onlyseokmins @strawberryya @woozixo @meowmeowminnie @jeonghansshitester @gyuwoncheol @bitchlessdino @multi-kpop-fanfics @ohmygodwhyareallusernamestaken @imprettyweird @shuasunshine @carlesscat-thinklogic23 @gyuhanniescarat @miriamxsworld @sexygrass @joonsytip @k-drama-adict @noiceoofed @buffhoshi @huening-kawaii © wongyuseokie 2024. All rights reserved.

#its just showing how much toxic and mean he can be when such situation happens#even if they stay together#later when yn films again this whole drama will happen again#lets make yn aatmanirbhar 💪🏋♀️#im even ok with roo😉

116 notes

·

View notes

Text

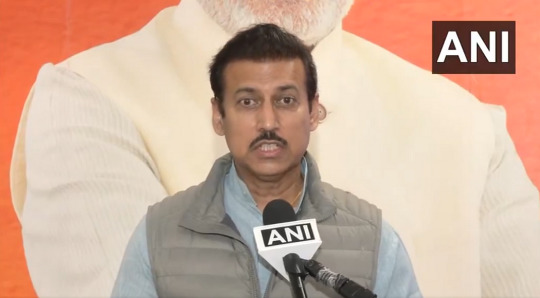

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

Hearty Welcome to the Nation’s Visionary Leader, Prime Minister Narendra Modi Ji: Col Rajyavardhan Rathore

Rajasthan, the land renowned for its unmatched valor, sacrifices, and bravery, takes immense pride in welcoming one of India’s most dynamic and visionary leaders, Prime Minister Narendra Modi Ji. Col Rajyavardhan Rathore, a celebrated leader and former Olympian, extended his heartfelt greetings and felicitations on this momentous occasion, highlighting the state’s enthusiasm and pride in hosting the Prime Minister.

A Historic Visit to the Land of Heroes

Prime Minister Narendra Modi’s visit to Rajasthan carries a deep significance, as it symbolizes his unwavering commitment to the development and prosperity of the nation and its states. Rajasthan, with its legacy of sacrifice and bravery, stands at the cusp of a new era of progress under his leadership.

Rajasthan’s Legacy of Bravery

The state’s history is adorned with tales of valiant warriors like Maharana Pratap and Rana Sanga.

Known as the “Land of Sacrifice,” Rajasthan embodies resilience and courage, making it a befitting host for the nation’s leader.

Symbol of National Unity and Progress

Prime Minister Modi’s leadership resonates deeply with the ethos of Rajasthan: strength, determination, and dedication to the nation’s progress.

Col Rajyavardhan Rathore: A Proud Host

As a prominent figure in Rajasthan, Col Rathore has always upheld the spirit of the state and worked tirelessly for its development. Welcoming the Prime Minister, he remarked: “It is an honor to host a leader who has transformed India’s vision into a global reality. Rajasthan, a land of heroes, is proud to welcome the nation’s leader who has instilled pride in every Indian.”

Key Highlights of the Visit

1. Inauguration of Developmental Projects

The Prime Minister’s visit includes the launch of several key initiatives aimed at boosting Rajasthan’s economy and infrastructure.

Infrastructure: New highways and smart city projects to improve connectivity and urbanization.

Water Resources: Key irrigation and drinking water schemes for arid regions.

2. Focus on Grassroots Empowerment

Rural Development: Announcements aimed at uplifting villages and enhancing rural livelihoods.

Youth and Women Empowerment: Programs to foster entrepreneurship and skill development.

3. Strengthening Rajasthan’s Role in India’s Growth

The state, with its vast potential in renewable energy, tourism, and agriculture, is set to play a pivotal role in the nation’s economic trajectory.

A Leader Who Inspires All

Prime Minister Modi’s visit is not just about inaugurating projects; it is a reflection of his connection with the people. His vision of a self-reliant India, or Aatmanirbhar Bharat, aligns with the aspirations of Rajasthan’s citizens.

Message of Unity and Progress

Col Rathore highlighted how Modi Ji’s leadership has brought people from diverse backgrounds together under one vision of development. Rajasthan, with its vibrant culture and industrious spirit, exemplifies this unity.

A Moment of Pride for Rajasthan

The Prime Minister’s visit to Rajasthan reaffirms the state’s critical role in India’s progress. With leaders like Col Rajyavardhan Rathore ensuring the success of such monumental occasions, Rajasthan stands poised to benefit from this renewed focus on growth and development.

As the land of bravery welcomes one of the bravest and most visionary leaders, it marks yet another chapter in Rajasthan’s journey toward excellence and prosperity.

3 notes

·

View notes

Text

[ad_1] By Anjali Sharma NEW YORK – India and Qatar on Tuesday are set to strengthen their economic and trade ties at the India-Qatar Joint Business Forum. The event took place on the sidelines of the visit of Sheikh Tamim bin Hamad Al Thani, the Amir of Qatar, to India from February 17-18. Commerce and Industry Minister Piyush Goyal and his Qatari counterpart Sheikh Faisal bin Thani bin Faisal Al Thani, took part in the meeting, according to an official statement issued on Monday. The joint business forum was organized by the Confederation of Indian Industry in collaboration with the Centre’s Department for Promotion of Industry and Internal Trade, which will convene top business leaders, policymakers, and industry stakeholders to explore investment opportunities, technological collaboration, and economic partnerships. The high-level Qatari delegation includes leading enterprises from energy, infrastructure, finance, technology, food security, logistics, advanced manufacturing, and innovation. The forum featured three panel discussions which include one on investment as a vehicle to build a long-term strategic partnership between India and Qatar, and a second on cooperating and leveraging competencies in the fields of logistics, advanced manufacturing, and food security. Another discussion will be held on promoting and strengthening cooperation in futuristic areas such as AI, innovation, and sustainability. These discussions will enable Indian and Qatari businesses to explore joint ventures, foreign direct investment, technology partnerships, and policy-driven collaborations. Representatives from both governments and leading industry players will contribute to shaping a forward-looking trade and investment framework. India and Qatar enjoy a robust economic partnership, with bilateral trade expanding across multiple sectors. Qatari firms have invested in India’s technology, infrastructure, and manufacturing sectors, while Indian companies have established a strong presence in Qatar. The forum will highlight strategic investment opportunities aligned with Make in India, Aatmanirbhar Bharat, and India’s infrastructure growth initiatives. Key areas for investment include logistics, warehousing, ports, airports, railways and highways, semiconductors, food security, tech and innovation, space, biosciences, banking and fintech, smart cities, pharmaceuticals, electric vehicles, and renewable energy. India-Qatar Startup Bridge is fostering innovation-driven partnerships in AI, fintech and deep tech, to strengthen bilateral economic cooperation. India emerging as a global hub for manufacturing, technology, and entrepreneurship, this forum serves as a crucial platform to enhance business-to-business (B2B) and government-to-business (G2B) engagements. It aims to deepen industry collaboration between Indian and Qatari businesses, facilitate foreign direct investment and joint ventures and promote technology transfer and innovation partnerships. The official statement added the forum works to strengthen trade through policy reforms and strategic agreements and underscored the shared vision of India and Qatar for long-term economic cooperation, reinforcing their commitment to fostering trade, investment, and innovation across key sectors. The post India-Qatar joint business forum boosts bilateral economic ties appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes

Text

India signs deal to arm Pinaka rockets with key munitions to boost army fire power

By N. C. Bipindra India’s Ministry of Defence (MoD) signed contracts with its state-run companies and a private sector firm to boost the firepower of its army’s Pinaka air defence rockets. An MoD statement on Feb. 6, 2025, said the deal, worth Rs 10,147 crore (~US$1.2 billion), will enhance the range of the Pinaka Multiple-Launch Rocket System (MLRS) to strike deep inside the enemy territory…

#Aatmanirbhar Bharat#Air Defence#Area Denial#Army#BEL#Bharat Electronics Limited#Defence#Defence Ministry#Defense#Economic Explosive Limited#EEL#Government of India#High Explosive#India#Indian Army#Indian Government#MIL#Military#Military Modernisation#Ministry of Defence#Missiles#MLRS#MoD#Modernisation#Multiple-Launch Rocket System#Munition#Munitions India Limited#Pinaka#rocket#Self-Reliant India

0 notes

Text

#Aatmanirbhar Bharat#Hindustan Aeronautics Limited#IAF Tejas Mk2#Indian Aerospace Industry#Indian Air Power#Indian Defence#Indian Defence Industry#Mishra Dhatu Nigam Limited MIDHANI

0 notes

Text

India's defence modernisation gets boost with Rs 10,147 crore rocket procurement deals

In an important move aimed at strengthening India’s defence capabilities and achieving the vision of ‘Aatmanirbhar Bharat,’ the Ministry of Defence (MoD) has signed contracts worth a total of Rs 10,147 crore with three prominent Indian companies: the Economic Explosives Ltd (EEL), Munitions India Ltd (MIL), and Bharat Electronics Ltd (BEL). The contracts aim to enhance the Indian Army’s…

0 notes

Text

[ad_1] GG News Bureau New Delhi, 3rd Feb. The Union Budget for 2025-26 showcases the government’s intensified commitment to the welfare and development of India’s tribal communities, who constitute 8.6% of the population. With over 10.45 crore Scheduled Tribe individuals residing across remote regions, the Union Budget significantly boosts the financial allocation for the Ministry of Tribal Affairs, reflecting a long-term vision for the upliftment of these communities. Unprecedented Budgetary Support for Tribal Welfare The budget allocation for Scheduled Tribes’ development has surged from ₹10,237.33 crore in 2024-25 to ₹14,925.81 crore in 2025-26, marking an impressive 45.79% increase. This signifies the government’s dedication to bridging gaps in infrastructure, education, healthcare, and economic opportunities for tribal populations. Significant milestones include: Eklavya Model Residential Schools (EMRS): ₹7,088.60 crore allocated, nearly doubling last year’s allocation of ₹4,748 crore to provide quality education in remote areas. Pradhan Mantri Jan Jatiya Vikas Mission: Budget raised to ₹380.40 crore, up from ₹152.32 crore, for fostering income-generating opportunities for tribal communities. Pradhan Mantri Adi Adarsh Gram Yojana (PMAAGY): A 163% increase, now at ₹335.97 crore, to improve infrastructure in tribal areas. Multi-Purpose Centers (MPC): Funding for PVTGs has doubled to ₹300 crore, strengthening socio-economic support for the most vulnerable tribal groups. Dharti Aaba Janjatiya Gram Utkarsh Abhiyan: A Game-Changer A landmark initiative, the Dharti Aaba Janjatiya Gram Utkarsh Abhiyan (DAJGUA), aims to address infrastructural deficits in 63,843 villages with a ₹79,156 crore budget outlay over five years. This game-changing program involves 17 ministries and 25 interventions, ensuring comprehensive development in critical areas such as health, education, and skill development. The allocation for DAJGUA under the Ministry of Tribal Affairs has increased fourfold, from ₹500 crore in 2024-25 to ₹2,000 crore in 2025-26, underlining the government’s resolve to improve tribal communities’ living standards. Leaders Applaud the Budget Union Minister for Tribal Affairs, Shri Jual Oram: “Under the visionary leadership of Prime Minister Shri Narendra Modi, this budget is dedicated to building an Aatmanirbhar Bharat. It prioritizes the holistic development of villages, youth, and women, while focusing on the upliftment of tribal communities.” Minister of State for Tribal Affairs, Shri Durga Das Uikey: “This budget reflects our commitment to tribal welfare with significant investments in education, livelihoods, and infrastructure, laying the foundation for a brighter future.” Secretary, Ministry of Tribal Affairs, Shri Vibhu Nayar: “The enhanced budget will empower us to implement transformative programs like PM-JANMAN and DAJGUA, creating sustainable impacts for tribal communities across India.” A Vision for Inclusive Growth The Union Budget 2025-26 stands as a testament to the government’s focus on transforming India into a Viksit Bharat, where tribal communities play a pivotal role in the nation’s progress. Through an integrated approach across various ministries, the government ensures that these communities benefit from inclusive growth, creating lasting change and sustainable empowerment. The post Union Budget 2025: Transforming Vision into Mission for Tribal Development appeared first on Global Governance News- Asia's First Bilingual News portal for Global News and Updates. [ad_2] Source link

0 notes

Text

Government Schemes Offering MSME Benefits in 2025

Micro, Small, and Medium Enterprises (MSMEs) are the spine of India's financial system, contributing extensively to employment, business output, and exports.

This article will let you know the Government Schemes benefits being offered for MSMEs in 2025.

Key Government Schemes for MSME Benefits in 2025 1. Pradhan Mantri Mudra Yojana (PMMY)

Provides collateral-loose loans up to ₹10 lakh to MSMEs. Classified into Shishu, Kishor, and Tarun categories based totally on investment needs. Helps small groups extend operations and enhance coin flow.

2. Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) Offers collateral-free credit score as much as ₹2 crore for MSMEs. Helps agencies steady loans with out the need for assets as safety. Encourages monetary institutions to lend to MSMEs with government-backed guarantees.

3. MSME Sustainable (ZED) Certification Scheme Promotes Zero Defect, Zero Effect (ZED) manufacturing. Helps MSMEs adopt strength-green, green, and high-quality-driven practices. Provides financial help for technology upgrades and certifications.

4. Udyam Assist Platform (UAP) for MSMEs Simplifies MSME registration and presents legit recognition. Enables organizations to get admission to numerous MSME Benefits, including precedence lending and tax exemptions.

5. Stand-Up India Scheme Aims at empowering ladies and SC/ST entrepreneurs. Provides loans between ₹10 lakh to ₹1 crore for setting up new companies. Encourages participation of underrepresented corporations in enterprise and industry.

6. Aatmanirbhar Bharat Rojgar Yojana (ABRY) Supports employment generation in MSMEs. Government contributes 12% of EPF (Employees’ Provident Fund) for new hires. Encourages MSMEs to amplify team of workers with out additional monetary pressure.

7. Production-Linked Incentive (PLI) Scheme for MSMEs Provides direct financial incentives for MSMEs in manufacturing sectors. Encourages manufacturing boom, innovation, and exports. Boosts home production and international competitiveness.

8. Market Access Initiatives (MAI) Scheme Helps MSMEs explore global markets. Provides monetary useful resource for participation in change galas, exhibitions, and advertising and marketing sports. Encourages MSME exports and overseas collaborations.

Conclusion The Indian government maintains to introduce and refine schemes to offer MSME Benefits and help small organizations in 2025. These schemes help MSMEs get admission to finance, develop abilities, enhance manufacturing strategies, and extend market reach.

0 notes