#Aadhaar verification API

Explore tagged Tumblr posts

Text

Get Fintech API, Banking API, Travel API & Verification API

Are you looking for API solution to integrate into your software system to get addon services then this is for you?

Ezulix software is a leading fintech & banking API provider company in India. We provider you end-to-end fintech & banking API solution for your business.

Along with this, we facilitate you travel and verification APIs to support your business,

For more details visit our website or request a free live demo.

#fintech api#banking api#travel api#verification api#aeps api#bbps api#dmt api#pan verification api#aadhaar verification api#payout api#bus booking api#flight booking api#hotel booking api

3 notes

·

View notes

Text

Why Every Fintech Needs Aadhaar Verification API for Secure Transactions

In the rapidly evolving world of fintech, security and trust are paramount. As digital transactions become the norm, financial technology companies must prioritise secure and reliable verification methods to protect user data. One such initiative that has become mandatory in India is the Aadhaar verification API. This article explores why every fintech company should integrate Aadhaar verification APIs to ensure secure transactions and customer trust.

What is the Aadhaar Verification API?

The Aadhaar Verification API is an online service provided by the Unique Identification Authority of India (UIDAI). This allows businesses to instantly check their customers’ Aadhaar numbers. This screening process ensures that the information provided by the user is accurate and true, thus reducing the risk of fraud. APIs are an essential tool for fintech companies, enabling them to authenticate users quickly and securely.

Role Of Aadhaar In Digital Transactions

Aadhaar, the world’s largest biometric identification system, is playing a key role in digitizing the Indian economy. With over 1.3 billion Aadhaar cards issued, it has become a standard way of identifying various industries, including banks, telecommunications and government welfare schemes The Aadhaar verification API uses this huge database to track users, which is verified in real-time, making digital communications safer and more efficient.

Why Fintech Companies need Aadhaar Verification API

i]. Enhanced Security

Security is a key concern for fintech companies, and Aadhaar verification APIs provide additional security. By checking a user’s Aadhaar number, companies can ensure that the person is who they claim to be, thereby reducing the risk of theft fraud, and deception This is especially important for the economy's internal communication, which is critical.

ii]. Compliance With Legal Requirements

Fintech companies in India have to adhere to stringent regulations laid down by the Reserve Bank of India (RBI) and other regulatory bodies. These laws often require businesses to verify their customers’ identity before providing services. The Aadhaar Verification API simplifies this process, enabling businesses to seamlessly meet compliance requirements.

iii]. Speed and Efficiency

In the fast-paced world of fintech, time is of the essence. The Aadhaar verification API enables instant verification of users, reducing the time for new customers to come on board. This speed and efficiency not only improve customer experience but also give FinTech companies a competitive advantage.

iv]. Cost-Effective Solution

Manual verification can be time-consuming and expensive. The integration of the Aadhaar verification API enables fintech companies to automate the verification process, reducing operational costs. This cost-effective solution is particularly beneficial for startups and small businesses that operate on tight budgets.

v]. To Build Customer Confidence

Trust is key to the success of any fintech company. The use of the Aadhaar Verification API enables businesses to demonstrate their commitment to protect customer data. If users know they are verifying identity through a secure and reliable system, they are more likely to trust the company with their finances.

How the Aadhaar Verification API works

The Aadhaar Verification API works through a simple yet effective process. When a user enters their Aadhaar number, the API sends a request to UIDAI’s database to verify the details. The API can perform different types of verification, e.g.

i]. Verification Of Aadhaar Number

This checks if the Aadhaar number provided by the user is valid.

ii]. Population Certification

This ensures that the user’s demographics, like name, address, and date of birth, are compared with the Aadhaar database.

iii]. Biometric verification

In some cases, the API may require biometric data to authenticate the user, such as fingerprints or iris scans.

iv]. One-Time Password (OTP) verification

The API can also verify users through the OTP sent to the mobile number linked to the Aadhaar. This adds an extra layer of security, ensuring that only the Aadhaar holder can complete the verification process.

Integration of Aadhaar Verification API on Fintech Platforms

The integration of the Aadhaar verification API into a fintech platform is fairly straightforward. Most fintech platforms use APIs to integrate services and services, and can also include Aadhaar verification. Here are the basic details of the integration process.

i]. Api Integration

The fintech company should integrate the Aadhaar verification API into its platform. This involves adding the necessary code to connect the platform with UIDAI’s servers.

ii]. User-Interface Design

A user interface (UI) must be designed to collect the necessary basic information from the user. This includes fields for Aadhaar number, OTP and biometric data if required.

iii]. Testing

Before going live, the integration should be thoroughly tested to ensure a seamless and secure operation. This testing phase is critical to identifying and fixing any potential problems.

iv]. Initiation And Maintenance

Once the integration is complete and tested, the platform can go live. Ongoing monitoring is necessary to ensure that the verification system is safe and effective.

Future Of Aadhaar verification In Fintech

As the fintech industry grows, the need for secure verification systems like Aadhaar verification will only increase. With the government’s push for Digital India, more businesses are expected to integrate Aadhaar verification in the coming years. This will not only enhance security but also improve access to financial services for the unbanked population.

Moreover, technological advancements like artificial intelligence and blockchain can further enhance Aadhaar verification capabilities, making Aadhaar verification stronger and more secure. Fintech companies that embrace these innovations early will stand in a better position to market.

Conclusion

Aadhaar verification API is an important tool for fintech companies operating in India. It provides improved security, compliance with regulatory requirements, speed, efficiency, and cost reduction. Most importantly, it helps build customer trust, which is critical to the long-term success of any fintech business. As digital connectivity increases, fintech companies need to prioritize security measures such as Aadhaar verification to protect user data in order to stay ahead of the competition.

0 notes

Text

Aadhaar verification API is vital for any business, financial institutions or entity in determining the credibility of their customers. Aadhar card is the universal identification in India for any citizen. Signzy’s Online Aadhaar Verification Resource will help you verify your customers, swift and safe. Issued by the Government of India, Aadhaar cards contain information about your Full Name, Address, Mobile Number, and other data that could be used to verify an individual.

0 notes

Text

What is Aadhar Verification API: Simplifying Identity Verification

Introduction

In today's digital age, identity verification has become an essential aspect of many online services. One such verification method widely used in India is the Aadhar Verification API. This article will delve into the concept of Aadhar Verification API, its benefits, use cases, and the importance it holds in streamlining the verification process.

What is the Aadhar Verification API?

Aadhar Verification API refers to the Application Programming Interface that enables businesses and organizations to verify the authenticity of an individual's Aadhar card details through an automated process. Aadhar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI) to residents of India. The API allows seamless integration of Aadhar verification into various applications, making the verification process quick, secure, and reliable.

For more information regarding Aadhar Verification API visit https://surepass.io/

Understanding the Working of Aadhar Verification API

The Aadhar Verification API functions by connecting to the UIDAI database and retrieving the necessary information for verification. When an individual's Aadhar details are entered into the system, the API sends a request to the UIDAI servers, which then validate the information provided. The UIDAI server responds to the API with the verification status, allowing businesses to make informed decisions based on the authenticity of the Aadhar details.

Benefits of Aadhar Verification API

1. Enhanced Efficiency and Speed

With the Aadhar Verification API, businesses can automate the verification process, eliminating the need for manual verification. This leads to increased efficiency and faster onboarding of customers or users. By reducing the time and effort required for verification, organizations can provide a seamless user experience.

2. Accuracy and Reliability

The Aadhar Verification API directly connects with the UIDAI database, ensuring accurate and reliable verification results. The API leverages the comprehensive information stored by UIDAI to validate the identity of individuals, reducing the chances of fraudulent activities.

3. Cost-Effectiveness

Implementing the Aadhar Verification API can significantly reduce costs associated with manual verification methods. By automating the process, organizations can streamline their operations, minimize errors, and save resources that would otherwise be spent on manual verification efforts.

4. Compliance with Regulations

In India, Aadhar verification is a mandatory requirement for several services, including financial transactions, government schemes, and e-KYC processes. Integrating the Aadhar Verification API ensures compliance with regulatory standards and strengthens the security and trust of the verification process.

Use Cases of Aadhar Verification API

The Aadhar Verification API finds application across various sectors and industries. Let's explore some of the prominent use cases:

1. Financial Institutions

Banks, insurance companies, and other financial institutions can leverage the Aadhar Verification API to authenticate the identity of customers during account opening, loan applications, and other financial transactions. This ensures that the institution complies with KYC (Know Your Customer) norms and mitigates the risk of identity theft and fraud.

2. Telecommunication Services

Telecom service providers can integrate the Aadhar Verification API to verify the identity of subscribers. This helps in preventing misuse of services and ensures that only legitimate users gain access to mobile connections.

3. Online Service Providers

E-commerce platforms, online marketplaces, and other digital service providers can incorporate the Aadhar Verification API to verify the identity of users. This helps in creating a secure environment, preventing fraudulent activities, and enhancing trust among users.

4. Government Agencies

Government agencies can utilize the Aadhar Verification API for various services, such as disbursing benefits under social welfare schemes, issuing government documents, and conducting identity verification for citizen services. The API streamlines the verification process, reducing paperwork and ensuring efficient service delivery.

Conclusion

The Aadhar Verification API simplifies the identity verification process by leveraging the power of technology and the UIDAI database. It offers numerous benefits such as efficiency, accuracy, cost-effectiveness, and compliance with regulations. By incorporating the Aadhar Verification API into their workflows, businesses and organizations can establish a secure and reliable verification process, enhancing trust and improving the overall user experience.

0 notes

Text

Unlocking The Power Of Aadhaar Verification API For Your Business

How can Aadhaar verification API help your business? Aadhaar is the world’s largest biometric ID system, and its power lies in the fact that it is a unique identifier. It enables businesses to quickly, easily and accurately identify individuals by their demographic and biometric data. Because of its power and accuracy, an Aadhaar Verification API can be a great tool to help you streamline your processes while also helping ensure customer security. In this blog post, we will explore the benefits of an Aadhaar Verification API and how it can help take your business to the next level.

What is Aadhaar verification API?

The Aadhaar verification API is a set of tools that allows businesses to verify the identity of their customers using the Aadhaar number. The API can be used to validate customer identity, check customer details, and verify customer biometrics. The API is available to all businesses registered with the UIDAI.

The Aadhaar verification API is a simple and efficient way to verify the identity of your customers. It is easy to use and can be integrated into your existing systems. The API uses the latest security standards and is constantly updated with new features.

The Aadhaar verification API is an essential tool for businesses operating in India. It helps businesses comply with KYC norms and prevents fraud. The API is also useful for businesses that need to verify the identity of their employees or contractors.

How can businesses use Aadhaar verification API?

Aadhaar verification API can be used by businesses to verify the identity of their customers and employees. By using this API, businesses can ensure that they are dealing with genuine people and not fake identities. This is especially important for businesses that deal with sensitive information or transactions.

Using the Aadhaar verification API is simple and easy. All you need is the person’s Aadhaar number and their biometric data. The API will then verify the identity of the person and return a response indicating whether the person is who they claim to be.

The benefits of using this API for businesses are numerous. It helps businesses to build trust with their customers and employees. It also helps them to avoid fraud and scams. Additionally, it can help businesses save time and money by streamlining their processes.

What are the benefits of using Aadhaar verification API?

There are many benefits of using Aadhaar verification API for your business. It is a fast and convenient way to verify the identity of your customers. It also allows you to track and monitor customer activity. Additionally, using Aadhaar verification API can help to prevent fraud and improve customer service.

How to get started with using Aadhaar verification API?

If you're looking to use Aadhaar verification API for your business, there are a few things you need to know to get started. First, you'll need to sign up for an account with UIDAI, the organization responsible for issuing and managing Aadhaar numbers. Once you have an account, you can generate an API key which will allow you to access the API. Finally, you'll need to register your business with UIDAI in order to use the API.

Once you have an account and API key, you can start using the Aadhaar verification API. The first step is to send a request to UIDAI's servers with your unique API key. This request will include information about the individual whose Aadhaar number you wish to verify. If the individual has consented to sharing their data, UIDAI will return a response that includes their name, date of birth, gender, and address. You can then use this information to verify the individual's identity.

The Aadhaar verification API is a powerful tool that can help streamline your business operations. By taking advantage of this technology, you can simplify your customer onboarding process and ensure that only genuine individuals are accessing your services.

Conclusion

Aadhaar verification API has the potential to revolutionize the authentication and identity verification process for your business. It is an enterprise-ready solution that can be integrated with any existing system in no time, enabling you to validate customer identities quickly and accurately. With a robust security framework and compliance with data protection standards, Aadhaar verification API is one of the most secure solutions available today. Moreover, by leveraging this cost-effective technology you can easily streamline your customer onboarding process while ensuring data privacy at every step of the way.

0 notes

Text

Integrate Aadhaar Card Verification into Your Flutter App with Setu

This guide walks you through integrating Aadhaar card verification using Setu's OKYC API in Flutter.

0 notes

Text

Aadhaar Verification: Fast, Secure, and Reliable for KYC Compliance

Verifying identities has become essential for many businesses. OnGrid’s Aadhaar verification solution offers a seamless, secure, and efficient way to authenticate individuals in just a few clicks.

Why OnGrid's Aadhaar Verification Stands Out:

Quick and Easy Verification: No more waiting for days to confirm Aadhaar details. OnGrid’s technology allows you to verify identities in minutes, making your processes faster and smoother.

Effortless Integration: Our APIs are designed for easy integration into your current systems. Whether you’re a startup or a large organization, you’ll find it simple to add Aadhaar verification without any hassle.

Go Paperless: Forget the piles of paperwork and endless manual tasks. OnGrid’s digital process allows you to verify identities with just a few clicks, streamlining your operations and reducing the workload.

Top-notch Security: Security is at the core of everything we do. OnGrid uses industry-leading protection to keep your data safe and secure, ensuring that all verification processes comply with relevant regulations.

Why Choose OnGrid for Aadhaar Verification?

Accurate and Reliable: Aadhaar verification offers one of the most accurate ways to verify identity, helping to reduce the risk of fraud and errors.

Compliance Ready: With Aadhaar verification, your business stays compliant with government regulations, making it ideal for industries that require mandatory identity checks.

Boost Operational Efficiency: Our quick and efficient process helps reduce administrative time and cost, allowing you to focus on other key business operations.

Data Protection at Its Best: We take data privacy seriously, ensuring that all personal information is secured and only accessible by authorized personnel.

Experience fast, secure, and paperless Aadhaar verification with OnGrid. Simplify your verification processes and enhance customer trust with our reliable solution.

Ready to upgrade your identity verification process? Reach out to us today and see how OnGrid can make a difference.

#AadhaarVerification#DigitalVerification#SecureVerification#IdentityVerification#KYCCompliance#PaperlessVerification#OnGridSolutions#DataSecurity#RegTech#SeamlessVerification

0 notes

Text

Understanding the Aadhaar Enabled Payment System (AEPS) API: A Comprehensive Guide

In the rapidly evolving landscape of digital payments, the Aadhaar Enabled Payment System (AEPS) has emerged as a revolutionary solution in India. By leveraging the unique identification provided by Aadhaar, AEPS facilitates secure and seamless transactions. This blog will delve into the details of the AEPS API, its functionalities, benefits, and how it’s transforming the way we conduct financial transactions.

What is AEPS?

AEPS is a payment service developed by the National Payments Corporation of India (NPCI) that allows users to make transactions using their Aadhaar number and biometric authentication. It aims to provide basic banking services to people, especially in rural and semi-urban areas, where access to traditional banking services is limited.

Key Features of AEPS

Biometric Authentication: Transactions are verified using fingerprints, ensuring security and reducing fraud.

Interoperability: AEPS enables transactions across different banks, making it a versatile solution.

Inclusive Financial Services: It promotes financial inclusion by enabling unbanked individuals to participate in the digital economy.

AEPS API: An Overview

The AEPS API allows businesses and developers to integrate AEPS functionalities into their applications and platforms. This integration enables users to perform a variety of banking transactions seamlessly.

Core Functionalities of AEPS API

Balance Inquiry: Users can check their bank account balance using their Aadhaar number.

Cash Withdrawal: AEPS allows users to withdraw cash from their bank accounts through micro-ATMs using biometric authentication.

Cash Deposit: Users can deposit cash into their bank accounts using AEPS-enabled devices.

Fund Transfer: The API supports fund transfers between bank accounts through Aadhaar-based authentication.

How AEPS API Works

User Authentication: The user provides their Aadhaar number and biometric data (fingerprint).

Transaction Request: The request is sent to the AEPS server, which verifies the information against the UIDAI (Unique Identification Authority of India) database.

Bank Verification: Once authenticated, the request is sent to the user’s bank for processing.

Transaction Completion: Upon successful verification, the transaction is executed, and the user receives a confirmation.

Benefits of AEPS API

Enhanced Security: Biometric authentication significantly reduces the risk of identity theft and fraud.

Cost-Effective: Businesses can reduce costs associated with cash handling and branch operations.

Accessibility: AEPS promotes financial inclusion by providing access to banking services for unbanked populations.

Scalability: The API can be easily integrated into existing platforms, allowing businesses to scale their operations effortlessly.

Use Cases of AEPS API

Microfinance Institutions: Facilitating easy withdrawals and deposits for clients in remote areas.

E-commerce Platforms: Allowing customers to pay using their Aadhaar-linked bank accounts.

Retailers and Merchants: Enabling small businesses to accept payments directly from customers' bank accounts.

Conclusion

The Aadhaar Enabled Payment System API is a game-changer in the digital payments landscape, making transactions more accessible, secure, and efficient. By integrating AEPS into their platforms, businesses can offer enhanced services to their customers while contributing to the broader goal of financial inclusion in India. As the adoption of digital payments continues to grow, AEPS will play a pivotal role in shaping the future of financial transactions.

Whether you’re a developer, a business owner, or a tech enthusiast, understanding the AEPS API can help you navigate the evolving world of digital payments and leverage its potential for your needs.

#Aadhaar Enabled Payment System Api#Aeps Cash Withdrawal Api#Aeps Balance Enquiry Api#Aadhaar Based Cash Withdrawal Api

0 notes

Text

Aadhaar eSign API is a digital signature solution that simplifies the signing process by replacing physical signatures with electronic ones. It offers a secure and convenient way to sign documents using OTP or biometric authentication. The API supports various document types, verification methods, and deployment models, making it a versatile tool for businesses of all sizes.

0 notes

Text

Eko API Integration: Revolutionizing Money Transfer and AePS Services

In the rapidly evolving landscape of financial technology, the need for seamless, secure, and efficient digital transaction solutions has never been more crucial. Eko, a leading fintech platform in India, has emerged as a pivotal player, offering a suite of APIs that empower businesses to integrate money transfer services and Aadhaar-enabled Payment Systems (AePS) directly into their applications. This article explores the role of an Eko API Integration Developer and the transformative potential of integrating these services.

Eko API Integration for Money Transfer and AePS:-

Understanding Eko’s API Ecosystem

Eko's platform is designed to bridge the gap between traditional banking services and the burgeoning demand for digital financial solutions. The Eko's APIs provide a versatile toolkit for developers aiming to offer domestic money transfers (DMT), bill payments, and AePS functionalities. Eko’s API services are crucial in a market like India, where financial inclusion remains a significant challenge.

1. Money Transfer API

Eko’s Money Transfer API is at the heart of its offering, allowing developers to integrate domestic remittance services into their applications. Eko API supports a range of transactions, from peer-to-peer (P2P) transfers to more complex transactions involving multiple parties.

Key features include:

Ease of Integration: With detailed documentation and robust SDKs, developers can quickly integrate money transfer capabilities into web or mobile applications.

Security: The API is designed with stringent security protocols, ensuring that every transaction is encrypted and compliant with regulatory standards.

Flexibility: Support for various transaction modes, such as IMPS, NEFT, and RTGS, makes it adaptable to different user needs.

2. Aadhaar-enabled Payment System (AePS) API

AePS is a crucial service in India, enabling financial transactions through Aadhaar authentication. Eko’s AePS API allows developers to offer essential banking services like cash withdrawal, balance inquiry, and mini statements via Aadhaar.

Key features include:

Biometric Authentication: AePS transactions require Aadhaar-linked biometric verification, which the API handles efficiently, ensuring a smooth user experience.

Comprehensive Documentation: Developers have access to extensive documentation that simplifies the integration process.

Real-Time Transactions: The API supports real-time transactions, ensuring that users can access their funds instantly.

The Role of an Eko API Integration Developer

An Eko API Integration Developer plays a pivotal role in bringing these financial services to life within a business’s digital ecosystem. Here’s a closer look at the responsibilities and skills required for this role:

1. Expertise in API Integration

At the core of this role is the ability to integrate Eko’s APIs into various platforms seamlessly. This requires:

Proficiency in Programming: Developers need to be well-versed in programming languages such as Python, Java, Node.js, or PHP, which are commonly used for API integration.

Understanding of RESTful APIs: Since Eko's APIs follow RESTful principles, a deep understanding of how these APIs work, including methods like GET, POST, PUT, and DELETE, is essential.

Authentication Management: Managing API keys and handling OAuth or other authentication methods is crucial for secure API integration.

2. Developing a Robust User Experience

While the backend integration is critical, ensuring a seamless and intuitive user experience is equally important. This involves:

UI/UX Collaboration: Working closely with UI/UX designers to ensure that the integration feels natural within the application.

Error Handling: Implementing robust error handling to manage transaction failures, network issues, or authentication errors smoothly.

3. Ensuring Compliance and Security

Financial services integration comes with significant compliance and security responsibilities:

Data Security: The developer must ensure that all data, especially sensitive information like Aadhaar numbers, is encrypted and securely transmitted.

Regulatory Compliance: Adhering to local and international financial regulations is a must, particularly with services like AePS, which are heavily regulated.

Benefits of Integrating Eko’s APIs

For businesses, the integration of Eko’s APIs offers several advantages:

1. Expanding Service Offerings

Businesses can offer a broader range of services, from instant money transfers to banking services via AePS, making them more competitive in the fintech space.

2. Enhancing Customer Convenience

With services like real-time money transfers and biometric authentication for AePS, customers can enjoy a seamless and secure transaction experience.

3. Driving Financial Inclusion

By leveraging AePS, businesses can reach underserved populations, offering banking services to those who may not have access to traditional banking infrastructure.

Conclusion

The integration of Eko’s APIs for money transfer and AePS is a game-changer for businesses looking to provide comprehensive financial services. For developers, mastering these integrations is not just about enhancing their technical skills but also about contributing to the larger goal of financial inclusion in India. As fintech continues to evolve, the role of an Eko API Integration Developer will only become more critical, driving innovation and expanding access to essential financial services across the country.

Contact Details: –

Mobile: – +91 9711090237

E-mail:- [email protected]

#Eko API Integration Developer#integration of Eko’s APIs for money transfer and AePS#money transfer and AePS#Eko API Integration#API Integration

0 notes

Text

Aadhaar Masking API: Balancing security & privacy in identity verification. Learn how it empowers users & fosters trust in a digital world.

#aadhar masking#aadhar masking solution#aadhar masking api#aadharcard#aadhar download#habilelabs#ethics first#crmsoftware#softwaredeveloper

0 notes

Text

Aadhaar Verification API for Seamless User Onboarding

Aadhaar verification is a process commonly used in India to confirm the identity of individuals. The Aadhaar Verification API plays a crucial role in enabling seamless user onboarding by allowing businesses and service providers to verify the authenticity of users using their Aadhaar details. Here's an overview of how the Aadhaar Verification API can be utilized for this purpose:

1. Integration:

To initiate seamless user onboarding, businesses need to integrate the Aadhaar Verification API into their onboarding system. This integration is typically done through secure APIs provided by the Unique Identification Authority of India (UIDAI), which manages the Aadhaar database.

2. User Input:

During the onboarding process, users are prompted to enter their Aadhaar number and other relevant details. This information is then sent securely to the Aadhaar Verification API for validation.

3. OTP (One-Time Password) Verification:

To enhance security, the Aadhaar Verification process often includes an OTP sent to the mobile number registered with the Aadhaar database. Users need to enter this OTP to confirm their identity.

4. Biometric Authentication (Optional):

For additional security, some applications and services might choose to implement biometric authentication, such as fingerprint or iris scans. This step can be integrated into the Aadhaar Verification process to further ensure the identity of the user.

5. Response Handling:

Once the user submits their Aadhaar details and completes the necessary verification steps, the Aadhaar Verification API returns a response indicating whether the provided details are valid. This response is then used to determine whether the user can proceed with the onboarding process.

6. Compliance with Regulations:

It is crucial for businesses to ensure that their use of the Aadhaar Verification API complies with relevant regulations and privacy laws. Understanding and adhering to legal requirements helps build trust with users and avoids potential legal issues.

7. User Consent:

Respecting user privacy is paramount. Businesses should obtain explicit consent from users before accessing their Aadhaar information. Clearly communicate how the Aadhaar data will be used and assure users that their information will be handled securely.

8. Error Handling:

Implement robust error-handling mechanisms to manage situations where the Aadhaar Verification API may not provide a successful response. Clear error messages and instructions can help users troubleshoot any issues they encounter during the onboarding process.

By incorporating these steps into the onboarding workflow, businesses can leverage the Aadhaar Verification API to streamline the user registration process while maintaining the highest standards of security and compliance. This approach not only ensures a smooth onboarding experience for users but also helps in building trust and credibility for the business or service provider.

The significance of Aadhaar verification in user onboarding

Aadhaar verification holds significant importance in user onboarding for several reasons:

Unique Identification:

Aadhaar serves as a unique identification number for individuals in India. By incorporating Aadhaar verification in user onboarding, businesses can ensure that each user has a distinct identity, reducing the risk of duplicate or fraudulent accounts.

Enhanced Security:

Aadhaar verification adds an extra layer of security to the onboarding process. By validating users through their Aadhaar details, businesses can mitigate the risk of identity theft and unauthorized access.

Streamlined Onboarding:

The use of Aadhaar verification streamlines the onboarding process. Users can quickly and accurately provide their identity information, reducing the time and effort required for manual verification processes.

Reduced Fraud and Impersonation:

Aadhaar verification helps in combating fraud and impersonation. Verifying the identity of users through Aadhaar minimizes the chances of malicious actors creating fake accounts or assuming false identities.

Government Compliance:

Aadhaar is a government-issued identification, and integrating its verification ensures compliance with regulatory requirements. Businesses can align their onboarding processes with government standards, fostering a sense of trust and legitimacy.

Accuracy in User Data:

Aadhaar verification ensures the accuracy of user-provided information. Inaccurate or falsified details can be a challenge in various industries, but Aadhaar helps in verifying and maintaining the integrity of user data.

Facilitation of Financial Transactions:

For businesses in the financial sector, Aadhaar verification is crucial. It enables secure and reliable customer identification, making it easier to facilitate financial transactions and comply with Know Your Customer (KYC) regulations.

Digital Inclusion:

Aadhaar verification facilitates digital inclusion by providing a standardized and widely accepted method for verifying identities. This is particularly relevant in a digital era where online services and transactions are becoming increasingly prevalent.

Efficient Government Services:

Integration of Aadhaar verification in user onboarding enhances the efficiency of government services. It allows citizens to access various government programs and services more conveniently, promoting a digital and efficient governance system.

Trust and Credibility:

Incorporating Aadhaar verification builds trust and credibility with users. When individuals know that a business or service provider is taking steps to verify their identity through a government-backed system, it instills confidence in the legitimacy of the platform.

In summary, Aadhaar verification plays a pivotal role in user onboarding by providing a secure, efficient, and government-compliant method for verifying the identity of individuals. It not only enhances the overall security of digital platforms but also contributes to the establishment of a trustworthy and credible relationship between users and businesses.

Why choose an API for Aadhaar verification?

Choosing an API for Aadhaar verification offers several advantages, making the entire process more seamless and efficient. Here are some reasons why businesses opt for an API-driven approach for Aadhaar verification:

Real-Time Verification:

Aadhaar verification APIs provide real-time validation, allowing businesses to instantly confirm the authenticity of user-provided Aadhaar details. This quick response time is crucial for delivering a seamless onboarding experience.

Automation and Efficiency:

APIs enable automation of the verification process, reducing the need for manual intervention. This not only accelerates the onboarding process but also minimizes the likelihood of human errors associated with manual data entry and validation.

Scalability:

APIs are scalable and can handle a large volume of verification requests simultaneously. This scalability is essential for businesses experiencing varying levels of user onboarding activity, ensuring that the verification process remains efficient during periods of high demand.

Integration with Existing Systems:

Aadhaar verification APIs can be easily integrated into existing software systems, whether it's a mobile app, web application, or backend infrastructure. This integration allows businesses to leverage Aadhaar verification without overhauling their entire onboarding infrastructure.

Security Standards:

APIs designed for Aadhaar verification adhere to security standards and protocols, ensuring the secure transmission of sensitive information. This is crucial for maintaining the confidentiality and integrity of user data during the verification process.

Cost-Efficiency:

Implementing an Aadhaar verification API eliminates the need for businesses to develop and maintain their own verification systems. This can result in cost savings, as businesses can leverage the infrastructure and expertise of the API provider.

Regulatory Compliance:

Aadhaar verification APIs are designed to comply with government regulations and standards. By using a reputable API, businesses can ensure that their onboarding processes align with legal requirements, minimizing the risk of non-compliance.

User Experience:

APIs contribute to a smoother and more user-friendly experience. The real-time nature of API-driven verification ensures that users receive prompt feedback during the onboarding process, enhancing overall satisfaction.

Reliability and Uptime:

Reputable Aadhaar verification APIs are designed to be highly reliable, with minimal downtime. This reliability is crucial for businesses, especially those that operate in sectors where continuous service availability is essential.

Enhanced Fraud Prevention:

API-driven Aadhaar verification often includes additional security features, such as OTP verification and biometric authentication. These features contribute to enhanced fraud prevention, safeguarding businesses and users against unauthorized access and identity theft and fraud.

In summary, choosing an API for Aadhaar verification offers businesses a reliable, scalable, and secure solution for streamlining the user onboarding process. It aligns with modern development practices, enhances efficiency, and ensures compliance with regulatory standards.

Key features and benefits of Aadhaar Verification API

The Aadhaar Verification API comes with key features and benefits that make it a valuable tool for businesses looking to streamline user onboarding and enhance the security of their platforms. Here are some of the key features and benefits:

Key Features:

Real-Time Verification:

The API provides real-time verification of Aadhaar details, allowing businesses to promptly confirm the authenticity of user-provided information.

OTP (One-Time Password) Integration:

Many Aadhaar Verification APIs incorporate OTP-based verification, adding an extra layer of security to the process. Users receive a one-time password on their registered mobile number, ensuring that they have physical access to the linked device.

Biometric Authentication (Optional):

Some Aadhaar Verification APIs support biometric authentication, such as fingerprint or iris scans, providing an additional level of identity confirmation.

Scalability:

The API is designed to handle a scalable and large volume of verification requests, making it suitable for businesses with varying levels of user onboarding activity.

Easy Integration:

Aadhaar Verification APIs are designed for easy integration into existing systems, whether they are web applications, mobile apps, or backend infrastructure.

Compliance with Standards:

The API is built to comply with government standards and regulations, ensuring that businesses using the service align with legal requirements.

Secure Transmission:

Aadhaar Verification APIs employ secure transmission protocols to safeguard the confidentiality and integrity of user data during the verification process.

Error Handling and Reporting:

Robust error-handling mechanisms are often a part of Aadhaar Verification APIs, providing clear feedback and instructions to users in case of verification failures or errors.

User Consent Management:

The API may include features for managing user consent, ensuring that businesses obtain explicit permission before accessing and verifying Aadhaar information.

Benefits:

Enhanced Security:

Aadhaar Verification APIs contribute to enhanced security by verifying user identities through government-issued Aadhaar details, reducing the risk of fraudulent activities.

Efficiency in Onboarding:

The real-time nature of the API speeds up the onboarding process, allowing businesses to quickly validate user identities and facilitate a smoother registration experience.

Cost-Efficiency:

By leveraging an Aadhaar Verification API, businesses can save on development and maintenance costs associated with building their own verification systems.

Legal Compliance:

Businesses using Aadhaar Verification APIs can ensure compliance with government regulations and standards, avoiding legal complications related to user data verification.

Trust Building:

The use of Aadhaar Verification adds credibility to the onboarding process, building trust with users who appreciate the commitment to secure and reliable identity verification.

Fraud Prevention:

OTP and biometric features in the API contribute to robust fraud prevention, protecting businesses and users from unauthorized access and identity theft.

User-Friendly Experience:

The API enhances the overall user experience by providing quick and secure identity verification, reducing the friction associated with manual onboarding processes.

In summary, the Aadhaar Verification API offers a range of features and benefits that contribute to secure, efficient, and compliant user onboarding processes for businesses. It aligns with modern development practices and supports the establishment of trust between businesses and their users.

0 notes

Text

How Instantpay Aadhaar Verification API Works: A Comprehensive Guide

Aadhaar verification has become a cornerstone of identity verification processes in India and is integral to numerous administrative and financial transactions. With over a billion people enrolled, the Aadhaar system is the world's most extensive biometric ID system. This guide provides a detailed understanding of Aadhaar verification, its benefits, and the verification process, focusing on how the system works.

What is Aadhaar?

Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI). Introduced in 2009, Aadhaar is designed to provide a single, robust, and easily verifiable identity document for residents of India.

Need for Aadhaar Verification

Aadhaar verification, also known as Aadhaar authentication, involves validating an individual’s identity using their Aadhaar number. This process is crucial for ensuring that services, subsidies, and benefits reach the correct recipients, thereby reducing fraud and enhancing security across various sectors such as banking, telecom, and government services.

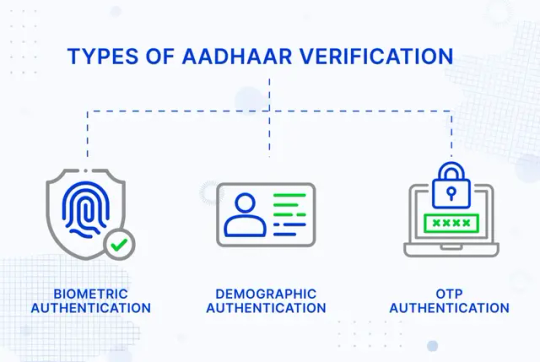

Types of Aadhaar Verification

1. Biometric Authentication

To verify identity, biometric authentication uses an individual’s unique physical characteristics, such as fingerprints, iris scans, or facial recognition. This method is highly secure as these biometric traits are unique to each individual and difficult to replicate.

Process:

The individual provides their Aadhaar number.

Biometric data (fingerprints, iris scans, or facial images) is captured using a biometric device.

The captured data is sent to UIDAI for verification against the stored biometric data.

UIDAI responds with a "Yes" or "No" indicating whether the biometrics match the Aadhaar number provided.

2. Demographic Authentication

Demographic authentication verifies an individual's identity using basic demographic information such as name, address, date of birth, and gender. This method is often used in conjunction with biometric authentication to enhance security.

Process:

The individual provides their Aadhaar number along with demographic information.

This information is sent to UIDAI to be verified against the data stored in the UIDAI database.

UIDAI responds with a "Yes" or "No" indicating whether the demographic details match the Aadhaar number provided.

3. OTP Authentication

One-Time Password (OTP) authentication involves sending a unique code to the individual’s mobile number registered with Aadhaar. This method adds an extra layer of security to the verification process.

Process:

The individual provides their Aadhaar number.

An OTP is sent to their registered mobile number.

The individual enters the OTP to complete the verification process.

UIDAI verifies the OTP and responds with a "Yes" or "No".

Learn More:

Everything You Need To Know About Aadhaar Verification

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

Identity Verification - How to Check PAN Aadhaar Linking Status with API

Aadhaar Verification Using API

What is an API?

An Application Programming Interface (API) is a set of protocols and tools that enable different software applications to communicate and interact with each other. APIs allow systems to share data and functionalities seamlessly, facilitating integration and automation. In the context of Aadhaar verification, APIs serve as a bridge between an organization's application and the UIDAI's Aadhaar database. This connection allows real-time verification of an individual's identity by cross-referencing the provided Aadhaar number and associated data with the UIDAI's records.

How are APIs used?

APIs can be used in numerous ways to enhance various processes across different industries. For instance, an API can retrieve essential information from a database, such as names and addresses, based on specific input criteria. On the other hand, more advanced APIs can provide comprehensive details, including biometrics or transaction histories, using multi-factor authentication methods like OTPs. These APIs ensure secure, quick, and reliable data exchange, making them invaluable tools for banking, telecommunications, healthcare, and e-commerce sectors. By integrating APIs, organisations can streamline operations, improve user experience, and maintain high security and efficiency standards.

Critical Key Terms in APIs

1. Request

The request is the message sent by the client to the server to perform an action (like retrieving or sending data)

2. Response

The response is the message sent back from the server to the client, indicating the result of the request.

3. API Endpoint

A specific URL where the API can access a resource or perform an action.

Example: Aadhaar Verification API

4. API HTTP Methods

Defines the type of operation the client wants to perform:

GET: Retrieve data.

POST: Create new data.

PUT: Update existing data.

DELETE: Remove data.

5. Header

Part of the request and response carries additional information such as content type, authentication tokens, and other metadata.

6. Parameters

Data is sent with the request to specify details or modify the request.

7. Authentication

Methods to verify the client's identity, make the request, and ensure they have the correct permissions. Standard methods include API keys, tokens, and Auth.

What is a REST API or RESTful?

A REST API (Representational State Transfer API) is a web service architecture that uses standard HTTP methods (GET, POST, PUT, DELETE) to interact with URL-identified resources. REST APIs are stateless, meaning each request contains all the information needed for processing. They are known for their simplicity, scalability, and flexibility in handling various data types.

What is API Testing and How Do We Test It?

API testing ensures APIs meet functionality, reliability, performance, and security expectations. Key methods include:

1. Unit Testing: Testing individual endpoints.

2. Integration Testing: Ensuring multiple API calls work together.

3. Performance Testing: Checking response times and load handling.

4. Security Testing: Protecting against unauthorised access.

What is an API Key and Why is it Important?

An API key is a unique identifier used to authenticate a client requesting an API. It ensures only authorised users can access resources, helps track usage, manage quotas, and prevent abuse.

What is Web API and Why is it Beneficial?

A Web API is an API accessed via the web using HTTP protocols. It allows different applications to communicate and exchange data over the internet. Benefits include:

1. Integration: Seamlessly connects systems and applications.

2. Accessibility: Accessible from any internet-connected device.

3. Scalability: Handles increasing loads and user demands.

4. Reusability: Leverages existing functionalities without rebuilding.

What is API Integration?

API integration connects different applications and systems via APIs, enabling them to share data and work together. It automates processes, improves data accuracy, and enhances functionality, creating efficient and scalable digital ecosystems.

Aadhaar Verification APIs on Instantpay

Instantpay offers seamless integration of Aadhaar verification through its APIs, making the verification process efficient and secure for businesses.

1. Aadhaar Demographics API

The Aadhaar Demographics API provides basic demographic information using only the Aadhaar number as input. This API is useful for simple identity verification where detailed information is not required.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar Demographics API endpoint with the Aadhaar number.

Processing: UIDAI processes the request and retrieves demographic details.

Response: The API returns a JSON response containing the demographic information (e.g., name, address, date of birth, gender).

2. Aadhaar offline e-KYC API

The Aadhaar offline e-KYC API provides comprehensive details but requires both the Aadhaar number and an OTP sent to the Aadhaar-linked mobile number. This ensures thorough verification for services needing extensive identity details.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar OKYC API endpoint with the Aadhaar number.

OTP Generation: UIDAI sends an OTP to the registered mobile number.

OTP Verification: The client system captures the OTP and sends it back to the API.

Processing: UIDAI processes the request, fetching both demographic and biometric details.

Response: The API returns a detailed JSON response containing all relevant information (e.g., name, address, date of birth, gender, photograph).

Step-by-Step Guide to Aadhaar Verification on the Instantpay Dashboard

Step 1: Log in to the Instantpay Dashboard and Navigate to Verification Suite. (If this isn't visible, please get in touch with [email protected] to enable it.)

Step 2: Click on the Verify Data Tab

Step 3: Choose Aadhaar Demographic API

Step 4: Download and fill template for Bulk Verification

Or If you want to try out the API click the button below

Step 5: Enter the Aadhaar Number you want to Verify

Step 6: Enter your iPin for authentication

Step 7: Congratulations, you have successfully retrieved the Aadhaar Demographic Data

Step 8: You can view and download the bulk verification files by clicking on the “Download” Button

Who Can Use Aadhaar Verification APIs?

Aadhaar Verification APIs can be utilised by a various organisations and sectors to streamline their identity verification processes. These APIs provide a reliable and secure way to verify the identities of individuals, ensuring that only genuine people can access services and benefits. Here are five examples of entities that can benefit from using Aadhaar Verification APIs:

1. Banks and Financial Institutions

Banks and financial institutions can use Aadhaar Verification APIs to verify customers' identities during account opening, loan applications, and other financial transactions. This ensures compliance with KYC (Know Your Customer) regulations and helps prevent identity fraud.

Example A bank uses the Aadhaar Offline EKYC API to verify the identity of a new customer applying for a savings account. The customer provides their Aadhaar number and OTP, allowing the bank to quickly and securely verify their details and open the account.

2. Telecom Companies

Telecom companies can utilise Aadhaar Verification APIs to authenticate customers when new SIM cards or mobile connections are issued.This process helps prevent fraudulent activities and ensures that mobile connections are issued to legitimate users.

Example: A telecom company uses the Aadhaar Demographics API to verify a customer's identity when they apply for a new SIM card. By entering their Aadhaar number, the company can instantly retrieve and verify the customer's demographic information.

3. Government Agencies

Government agencies can use Aadhaar Verification APIs to authenticate beneficiaries of various schemes and services. This ensures that subsidies and benefits are disbursed to the right individuals, reducing the risk of fraud and providing efficient service delivery.

Example

A government welfare department uses the Aadhaar Verification API to verify the identity of individuals applying for a social welfare scheme. This helps ensure that only eligible beneficiaries receive the benefits.

4. E-commerce Platforms

E-commerce platforms can leverage Aadhaar Verification APIs to verify the identities of sellers and buyers, enhancing trust and security in online transactions. This helps prevent fraudulent activities and builds trust among users.

Example

An e-commerce platform uses the Aadhaar Demographics API to verify the identity of a new seller registering. This ensures that only legitimate sellers can list their products, improving the platform's credibility.

5. Educational Institutions

Educational institutions can use Aadhaar Verification APIs to verify students' identities during admissions and examinations. This helps maintain the integrity of the admission process and ensures that only eligible students are enrolled and assessed.

Example

A university uses the Aadhaar offline - KYC API to verify the identity of applicants during the admission process. Using the Aadhaar number and OTP, the university can authenticate the students' details and ensure that only genuine applicants are admitted.

These examples illustrate the versatility and utility of Aadhaar Verification APIs by Instantpay across various sectors. By integrating these APIs, organisations can enhance security, improve efficiency, and ensure that services and benefits are delivered to the right individuals.

Conclusion

By focusing on how Aadhaar verification works and its implementation through APIs, this guide aims to provide a comprehensive understanding of the process and its significance in various sectors. For detailed API documentation, visit Instantpay Developer Portal, and for further assistance, contact support at [email protected].

0 notes

Text

Empowering Businesses with IDSign's Advanced KYC Solutions in India

In today's rapidly digitalizing world, the need for robust and reliable Know Your Customer (KYC) services has never been more critical. IDSign stands at the forefront, offering a comprehensive suite of offline kyc services in india, ensuring secure and seamless identity verification processes for businesses and individuals alike.

A Spectrum of KYC Services

IDSign's portfolio includes a wide range of services, each tailored to meet the unique needs of various clients. The company’s e kyc services in india have revolutionized the way businesses conduct customer onboarding, providing a swift and efficient method to verify identities electronically. These electronic kyc services in india eliminate the need for physical documentation, streamlining the entire verification process.

Specialized PAN and Aadhaar KYC Services

IDSign excels in providing pan e kyc services in india, a crucial service for businesses and financial institutions that require quick and accurate PAN verification. Additionally, the company is renowned as one of the leading e kyc solution providers in india, offering cutting-edge solutions that integrate seamlessly with existing systems.

The Aadhaar-based services provided by IDSign are particularly noteworthy. With aadhaar e kyc online services in india, users can complete their KYC process swiftly, leveraging the extensive Aadhaar database. This service is complemented by ekyc service providers in india like IDSign, who ensure that the process is not only fast but also highly secure.

Offline KYC Services for Businesses

For businesses seeking offline kyc api for businesses in india, IDSign offers robust APIs that can be integrated into existing workflows, enabling companies to conduct offline KYC without hassle. The aadhaar paperless offline kyc verification in india provided by IDSign ensures that businesses can verify their customers' identities without needing physical Aadhaar cards, thereby enhancing efficiency and security.

IDSign’s aadhaar paperless offline e kyc services in india are designed to meet the highest standards of security and compliance, ensuring that businesses can conduct KYC processes confidently and in accordance with regulatory requirements.

Focus on Hyderabad

IDSign has a significant presence in Hyderabad, a city rapidly becoming a hub for technological innovation. The company offers a comprehensive range of offline kyc services in hyderabad, catering to the city's growing business and financial sectors. The e kyc services in hyderabad provided by IDSign ensure that businesses in the region can access state-of-the-art electronic KYC solutions.

The electronic kyc services in hyderabad are particularly beneficial for startups and SMEs looking to streamline their customer onboarding processes. IDSign's pan e kyc services in hyderabad offer quick and reliable PAN verification, crucial for financial transactions and compliance.

As one of the leading e kyc solution providers in hyderabad, IDSign leverages advanced technology to provide seamless integration and high-security standards. The company's aadhaar e kyc online services in hyderabad are designed to offer quick and secure verification processes, ensuring that businesses can operate efficiently.

Supporting Hyderabad's Businesses

For businesses in Hyderabad, IDSign’s offline kyc api for businesses in hyderabad offers a reliable solution for integrating offline KYC processes. This API enables businesses to verify identities without needing continuous internet access, a crucial feature for areas with limited connectivity. The aadhaar paperless offline kyc verification in hyderabad ensures that businesses can conduct KYC processes without requiring physical documents, enhancing both speed and security.

IDSign also provides aadhaar paperless offline e kyc services in hyderabad, ensuring that businesses in the city can leverage the benefits of Aadhaar-based verification without the need for physical documentation. This service is particularly useful for financial institutions and other regulated entities that require stringent KYC processes.

Conclusion:

IDSign is leading the charge in revolutionizing identity verification processes in India. With a comprehensive range of offline kyc services in india and specialized offerings in Hyderabad, the company is well-positioned to meet the growing demand for secure and efficient KYC solutions. Whether through e kyc services in india or offline kyc api for businesses in india, IDSign ensures that businesses and individuals can navigate the complexities of identity verification with ease and confidence.

0 notes

Text

Unveiling the Power of a Background Verification Company: Ensuring Workforce Integrity

A background verification company plays a crucial role in today’s hiring landscape, providing essential services and APIs that help businesses make informed hiring decisions. By conducting comprehensive background checks, these companies validate the credentials and histories of potential employees, ensuring that businesses hire qualified and trustworthy individuals.

What does a Background Verification Company Do?

A background verification company performs extensive checks on various aspects of a candidate’s history. These include:

Employment History Verification

Educational Qualifications Verification

Criminal Record Checks

Identity Verification

Credit History Checks

These checks are vital in mitigating risks associated with hiring, such as fraud and unqualified candidates, thereby safeguarding the company's interests.

APIs Provided by SprintVerify:

SprintVerify, as a leading background verification company, offers a suite of advanced APIs to streamline and enhance the verification process:

Aadhaar Verification

PAN Verification

Email Authentication Solutions

EPFO without OTP

Mobile to UAN

PAN to UAN

Aadhaar to UAN

ITR Details Get

These APIs are designed to integrate seamlessly with your existing systems, providing reliable and accurate data to facilitate efficient background checks.

Benefits of Using SprintVerify’s Background Verification API:

Enhanced Hiring Efficiency: Automate verification processes to save time and resources.

Improved Candidate Trust: Ensure the authenticity of credentials and build a reliable workforce.

Risk Mitigation: Minimize the risk of hiring unqualified or fraudulent candidates.

Regulatory Compliance: Ensure adherence to industry standards and legal requirements.

Cost Efficiency: Reduce the costs associated with manual verification processes.

Key Features of SprintVerify’s Background Verification API:

Comprehensive Data Verification: Extensive checks covering criminal records, education, and employment history.

Real-Time Updates: Access the most current and accurate information.

User-Friendly Dashboard: An intuitive interface for managing and reviewing verification results efficiently.

Scalability: Suitable for businesses of all sizes, adapting to various verification needs.

Secure Data Handling: Robust encryption and compliance with data protection regulations to ensure data security.

Conclusion

Partnering with a background verification company like SprintVerify provides businesses with the tools needed to conduct thorough and accurate background checks. Our advanced APIs offer unparalleled efficiency, accuracy, and security, empowering your HR team to make informed hiring decisions. By leveraging SprintVerify's services, you can build a reliable and trustworthy workforce, ensuring your business thrives in today’s competitive market. Trust SprintVerify to be your go-to solution for all your background verification needs.

0 notes