#AIM EVM

Explore tagged Tumblr posts

Text

AIM EVM, 2025. A new electric city car from the Nagoya-based engineering firm designed by SN Design Platform, a studio headed by Shiro Nakamura, Nissan's former design chief. The EVM's styling is inspired by Shisa (pictured), the guardian deity of the Okinawa province where it will go on sale in the summer before national sale begin. It is powered by a 19hp electric motor and has a range of 120 km (75 miles). Regulations for “Ultra-Compact Mobility” vehicles in Japan mean it can't be driven on the highway and is limited to 60 km/h (37 mph). The removable targa-style T-roof panels can be stored in the boot. AIM has an annual target of 1000 units with a starting price of ¥1,900,000 ($12,500).

#AIM#AIM EVM#electric city car#city car#prototype#2025#EV#Okinawa#Shisa#new cars#Ultra-Compact Mobility#tiny car#micro car#T-roof#open roof#targa#JDM#Japanese market

126 notes

·

View notes

Text

IGCSE

Heyy everyone

So did CIE's IGCSE and *hair flip* got an A* in all my subjects.

So yeah I'm just tryna help. Fr.

Now listen u dont need to get an A* to be happy with ur grades. If those are ur goals then u go girl. If those are not u still go girl.

But my mum always says "Always aim higher than what u can get. Then you will reach the farthest u can go. Now go make another omelette for me."

Now a major thing I would do before an exam is open a candidate response, the qp, the ms and the examiner report.

Do each question, check with the markscheme, check the candidate response and assess where u are and then the examiner report.

I love this so much: https://paper.sc/

Examiner reports are a really underrated resource and are REALLY HELPFUL.

Use the 'IGCSE' reddit and discord server

IGCSE Notes – Soumya Pandey

Here are some of the resources I used and each subject tips

Maths:

Past papers past papers past pAPERS PAST PAPERS PAST PA-

Girl i cant tell u enough

Also makes sure to learn all the calculator tricks including the linear equations one, differentiation (the only ones I can think off the top of my head)

Make sure to practice past papers have good time management. Calm down during the exam. It'll all be fine.

(trust me i went and got bangs cause i was depressed about the way i wrote the exam and here we are)

Sciences:

Use the examiner report tip. Always always use the syllabus of each subject. And ofc past papers

Skill for Science Packs - Google Drive

Bio:

Drives:

IGCSE Biology (0610) notes from MS - Google Drive

bio

Chem:

Heather Houston - YouTube

IGCSE all chemical tests - YouTube

Drives:

chm

0620 Chemistry – Google Drive

Phy:

physics resources

Business:

Bs is one of the easist subjects cause of the repeated questions and the low thresholds. If there is one subject u wanna chose for fun let it be BS or EVM

EVM:

Smallest syllabus ever

Just do past papers you'll be fine

Ik everyone says that but thats cause its true

The same advice goes to ICT. Like the practicals are the easiest shit u can think of but a big mistake that people do is forget theory.

Study for theory and u get good marks.

English (1st language) :

My fav subject in IGCSE

It was sooo good

Always choose descriptive its just easier to score in

Go read books from good authors like Madelline Miller, Katherine Arden, and Ocean Vuong. Get phrases that u really like and copy them into a word document. Go through it before the exam and use it in the writing

You can also use: https://www.descriptionari.com/

Examiners' Secrets: Descriptive Writing (Mr Salles) - YouTube

Paper 1 video

---------

AND THATS ALL

To everyone doing their GCSE's

All the best

Just remember that it isnt everything. Year 10 and 11 is all about finding urself and having the time of ur life. I sure as hell did. And at the end of the day these results dont matter half as much as u think. Its not that they're not important. Its just that there are more important things in the world.

Go live ur best life before the A level train hits.

77 notes

·

View notes

Text

On Monday, research conducted by a poll watchdog Association for Democratic Reforms (ADR) revealed discrepancies in vote counts in the Lok Sabha elections conducted in the year 2024.

According to the report, titled “Discrepancies between the votes cast and the votes counted in the 2024 Lok Sabha election: Multiple Perspectives” there were problems in 362 parliamentary constituencies where 554,598 votes counted were less than the actual votes cast.

The report continued that in 176 constituencies, the total votes were counted 35,093 more than the actual votes. It aimed to highlight the differences between the votes recorded by electronic voting machines (EVMs) and the counts reported by the Election Commission of India (ECI) for the 2024 general elections.

The report has highlighted significant discrepancies in as many as 538 constituencies, except Amreli, Attingal, Lakshadweep, and Dadra Nagar Haveli and Daman Diu. Surat seat did not have any contest. “Hence the total discrepancies in 538 PCs are 5,89,691,” reads the report.

The ElCI has not given a reasonable explanation for announcing the results of the election before releasing final and accurate vote count data. Concerns are; disparities in votes credited based on EVM, increased voter turnout, non-declaration of the actual number of votes polled, unreasonable delay in releasing vote data, and data being pulled down from the ECI website, the ADR report read.

It also said that due to ECI’s failure to address these irregularities during the 2019 & 2024 Lok Sabha elections, voters have developed concerns. These apprehensions must be seriously addressed and put to rest,” it said.

“In order to uphold the voter’s confidence, it is necessary that the ECI should immediately disclose on its website scanned legible copies of Form 17C Part- I (Account of Votes Recorded) of all polling stations which contains the authenticated figures for votes polled, within 48hours of the close of polling,” the report read.

3 notes

·

View notes

Text

Discussion on the rationality of BitPower mechanism

Introduction With the development of blockchain technology, decentralized finance (DeFi) as a new financial model has gradually attracted widespread attention. As a member of the DeFi field, BitPower has demonstrated the potential of decentralized finance through its unique smart contract mechanism, income structure and security measures. This article will explore the rationality of BitPower mechanism and analyze its advantages in security, profitability and sustainability.

Security of smart contracts The core of BitPower lies in its smart contracts, which are deployed on the Ethereum Virtual Machine (EVM) and based on TRC20 and ERC20 standards. The code of these smart contracts is open source, ensuring the transparency and credibility of the system. Due to the immutability of smart contracts, they cannot be modified or deleted once deployed, which greatly improves the security and stability of the system. In addition, BitPower Loop adopts a completely decentralized operation mode, without centralized administrators or owners, which means that no one can unilaterally change the system rules, thus avoiding human intervention and operational risks.

Rationality of income structure BitPower's income structure is cleverly designed to encourage users to get returns by providing liquidity. Users can provide liquidity according to different time periods and obtain corresponding yields. For example, the annualized yields of 1 day, 7 days, 14 days and 28 days are 429%, 773%, 1065% and 1638% respectively. This structure not only encourages users to participate in short-term investment, but also provides considerable returns for long-term investment. At the same time, the introduction of the compound interest mechanism further enhances the observability of the returns, so that the user's investment returns can grow significantly over time.

Sustainability of the promotion mechanism BitPower's promotion mechanism aims to expand the user base by inviting new users to join, thereby enhancing the liquidity and stability of the system. Each user can become a project initiator, invite new users to join through an invitation link, and receive corresponding referral rewards. The referral reward varies according to the level of the referral, ranging from 20% of the first-generation friends to 1% of the 17th-generation friends. This hierarchical referral reward mechanism not only encourages users to actively promote, but also ensures the long-term sustainable development of the system.

Decentralized governance structure BitPower's decentralized governance structure is another important manifestation of the rationality of its mechanism. The system has no centralized manager, and all participants are equal in rules and mechanisms. This decentralized governance structure ensures the fairness and transparency of the system and avoids possible corruption and injustice in the centralized system. At the same time, decentralized governance also enhances the resilience of the system, enabling it to better cope with external attacks and internal problems.

Rationality of the economic model BitPower's economic model is reasonably designed and can effectively balance the benefits and risks of the system. Users' benefits mainly come from liquidity provision and recommendation rewards. This income structure avoids high-risk models such as Ponzi schemes while maintaining high returns. In addition, BitPower also automatically executes reward distribution through smart contracts, reducing the risks and errors of human operations and improving the efficiency and reliability of the system.

Summary Through the analysis of the BitPower mechanism, it can be seen that it has significant advantages in security, profitability and sustainability. The immutability of smart contracts and the decentralized governance structure ensure the security and fairness of the system; the reasonable income structure and promotion mechanism provide users with considerable returns while enhancing the liquidity and stability of the system; the design of the economic model effectively balances benefits and risks. In summary, BitPower's mechanism is highly reasonable and feasible in the current DeFi field, providing a powerful example for the development of decentralized finance.

Future Outlook With the continuous development of blockchain technology and DeFi ecology, BitPower is expected to play a greater role in the future. By continuously optimizing smart contracts and improving user experience, BitPower can attract more users to join and further expand its influence and market share. At the same time, with the introduction of more innovative mechanisms, BitPower is expected to make more breakthroughs in the field of decentralized finance and provide users with richer and more diverse financial services.

In short, as a decentralized financial platform, BitPower's reasonable mechanism design not only ensures the security and stability of the system, but also provides users with generous returns and continuous incentives. It is an important case worthy of attention and research in the DeFi field.

5 notes

·

View notes

Text

Discussion on the rationality of BitPower mechanism

Introduction With the development of blockchain technology, decentralized finance (DeFi) as a new financial model has gradually attracted widespread attention. As a member of the DeFi field, BitPower has demonstrated the potential of decentralized finance through its unique smart contract mechanism, income structure and security measures. This article will explore the rationality of BitPower mechanism and analyze its advantages in security, profitability and sustainability.

Security of smart contracts The core of BitPower lies in its smart contracts, which are deployed on the Ethereum Virtual Machine (EVM) and based on TRC20 and ERC20 standards. The code of these smart contracts is open source, ensuring the transparency and credibility of the system. Due to the immutability of smart contracts, they cannot be modified or deleted once deployed, which greatly improves the security and stability of the system. In addition, BitPower Loop adopts a completely decentralized operation mode, without centralized administrators or owners, which means that no one can unilaterally change the system rules, thus avoiding human intervention and operational risks.

Rationality of income structure BitPower's income structure is cleverly designed to encourage users to get returns by providing liquidity. Users can provide liquidity according to different time periods and obtain corresponding yields. For example, the annualized yields of 1 day, 7 days, 14 days and 28 days are 429%, 773%, 1065% and 1638% respectively. This structure not only encourages users to participate in short-term investment, but also provides considerable returns for long-term investment. At the same time, the introduction of the compound interest mechanism further enhances the observability of the returns, so that the user's investment returns can grow significantly over time.

Sustainability of the promotion mechanism BitPower's promotion mechanism aims to expand the user base by inviting new users to join, thereby enhancing the liquidity and stability of the system. Each user can become a project initiator, invite new users to join through an invitation link, and receive corresponding referral rewards. The referral reward varies according to the level of the referral, ranging from 20% of the first-generation friends to 1% of the 17th-generation friends. This hierarchical referral reward mechanism not only encourages users to actively promote, but also ensures the long-term sustainable development of the system.

Decentralized governance structure BitPower's decentralized governance structure is another important manifestation of the rationality of its mechanism. The system has no centralized manager, and all participants are equal in rules and mechanisms. This decentralized governance structure ensures the fairness and transparency of the system and avoids possible corruption and injustice in the centralized system. At the same time, decentralized governance also enhances the resilience of the system, enabling it to better cope with external attacks and internal problems.

Rationality of the economic model BitPower's economic model is reasonably designed and can effectively balance the benefits and risks of the system. Users' benefits mainly come from liquidity provision and recommendation rewards. This income structure avoids high-risk models such as Ponzi schemes while maintaining high returns. In addition, BitPower also automatically executes reward distribution through smart contracts, reducing the risks and errors of human operations and improving the efficiency and reliability of the system.

Summary Through the analysis of the BitPower mechanism, it can be seen that it has significant advantages in security, profitability and sustainability. The immutability of smart contracts and the decentralized governance structure ensure the security and fairness of the system; the reasonable income structure and promotion mechanism provide users with considerable returns while enhancing the liquidity and stability of the system; the design of the economic model effectively balances benefits and risks. In summary, BitPower's mechanism is highly reasonable and feasible in the current DeFi field, providing a powerful example for the development of decentralized finance.

Future Outlook With the continuous development of blockchain technology and DeFi ecology, BitPower is expected to play a greater role in the future. By continuously optimizing smart contracts and improving user experience, BitPower can attract more users to join and further expand its influence and market share. At the same time, with the introduction of more innovative mechanisms, BitPower is expected to make more breakthroughs in the field of decentralized finance and provide users with richer and more diverse financial services.

In short, as a decentralized financial platform, BitPower's reasonable mechanism design not only ensures the security and stability of the system, but also provides users with generous returns and continuous incentives. It is an important case worthy of attention and research in the DeFi field.

3 notes

·

View notes

Link

0 notes

Text

Vitalik Buterin Proposes Bold Ethereum Overhaul Using RISC-V Architecture

Ethereum co-founder Vitalik Buterin has proposed a significant overhaul of the blockchain’s execution layer, suggesting replacing the Ethereum Virtual Machine (EVM) bytecode with the RISC-V architecture. In a new post on the Ethereum Magicians forum, Buterin described the idea as a long-term solution aimed at boosting Ethereum’s performance and efficiency. Buterin states that switching to RISC-V…

0 notes

Text

Xvitesse Partners with Unity Drive to Power a Nationwide Women Empowerment Movement

When Decentralized Innovation Meets Grassroots Impact

Xvitesse, a next-generation decentralized blockchain platform known for its speed, scalability, and security, has proudly joined hands with Onesea Media and Axle Aesthetics as a key sponsor of Unity Drive—a powerful and transformative nationwide initiative designed to uplift and empower women across India.

The initiative was officially launched on March 9 at the Orchid Hotel, Mumbai, where the Unity Drive banner was unveiled in the presence of changemakers, innovators, and supporters of social equality. The campaign is now set to begin its first leg on May 15, embarking on a dynamic journey from Hyderabad to Spiti Valley. Along this path, the Unity Drive will connect with communities, engage in on-ground development efforts, and deliver impactful programs aimed at creating real, lasting change for women and girls.

As a core sponsor, Xvitesse brings more than just funding to this initiative—it brings a vision for an inclusive digital future. As an EVM-compatible blockchain, Xvitesse is designed to handle real-world demands with fast transaction speeds, minimal gas fees, and robust infrastructure. But beyond its technical prowess, the platform stands for a greater purpose: leveraging technology to empower people—especially those at the margins of society.

“Blockchain is not just about finance; it’s about freedom,” said a spokesperson from Xvitesse. “Unity Drive represents the kind of grassroots movement that aligns with our mission—to use technology as a tool for equality, education, and opportunity. Through this partnership, we hope to contribute to a future where women across India are not only aware of their rights but are equipped with the financial tools, confidence, and support systems to lead.”

Unity Drive will take on a multi-pronged approach that includes:

Constructing sanitation infrastructure like toilets in girls’ schools and colleges to ensure dignity and promote continued education

Conducting financial literacy and digital skill development programs, encouraging women to build businesses, secure jobs, and explore Web3 technologies

Hosting open dialogues and awareness sessions to highlight women’s rights, safety, and leadership potential

Collaborating with local leaders and communities to foster change that’s sustainable and inclusive

Xvitesse sees this initiative as an extension of its global mission to bridge the gap between advanced technology and real-world needs. The platform is built with scalability in mind—not just for developers and enterprises, but for communities that seek accessible, secure, and transparent digital solutions. Through Unity Drive, Xvitesse aims to showcase how blockchain can directly support financial inclusion, social equity, and female entrepreneurship in both rural and urban India.

As the Unity Drive rolls across India’s diverse landscapes—urban cities, tribal belts, farming towns, and mountain hamlets—Xvitesse stands strong as a tech-forward partner with a human-first mindset. This collaboration is not just about roads travelled—it’s about lives touched, dreams reignited, and futures redefined.

With Unity Drive, Xvitesse is helping write a new chapter in India’s empowerment story—one where technology and humanity move forward, together.

0 notes

Text

Best Project Management Software Training to Build New Skills in 2025

In the ever-evolving field of project management, staying updated with the latest tools and methodologies is crucial for success. As we approach 2025, numerous training programs are available to help professionals enhance their skills in project management software. This guide highlights some of the best training options to consider, catering to various experience levels and learning preferences.

1. Google Project Management Certificate

Overview: Offered by Google through Coursera, this certificate program provides a comprehensive introduction to project management fundamentals. It covers essential tools and methodologies, preparing learners for entry-level project management roles. Coursera

Key Features:

Comprehensive coverage of project management principles.

Exposure to various project management tools and platforms.

Flexible online learning format.

Ideal For: Beginners seeking a solid foundation in project management principles and tools.

2. PRINCE2® 7th Edition Certification

Overview: PRINCE2® (PRojects IN Controlled Environments) is a globally recognized project management methodology. The 7th Edition offers updated practices and is suitable for managing projects across various industries. Training programs are available through accredited providers, such as Firebrand Training. firebrand.training

Key Features:

Structured approach to project management.

Focus on processes and themes.Reddit

Applicable to projects of varying sizes and complexities.

Ideal For: Individuals aiming for a globally recognized certification to enhance their project management credentials.

3. Project Management Professional (PMP)® Certification

Overview: Administered by the Project Management Institute (PMI), the PMP® certification is a rigorous program that covers all aspects of project management. It is based on PMI's Project Management Body of Knowledge (PMBOK) and is recognized worldwide. ProjectManager

Key Features:

Comprehensive coverage of project management processes and knowledge areas.

Emphasis on real-world application and experience.

Globally recognized credential.

Ideal For: Experienced project managers seeking to validate their skills and advance their careers.

4. Mastering Digital Project Management by The Digital Project Manager

Overview: This self-paced online course empowers participants to master the skills needed to deliver complex digital projects confidently. It covers the entire project lifecycle, from initiation to closure, and delves into methodologies like Waterfall, Scrum, and Agile.

Key Features:

In-depth exploration of digital project management processes.

Practical insights into various methodologies.

Flexible, self-paced learning format.

Ideal For: Project managers aiming to enhance their digital project management capabilities.

5. LinkedIn Learning Project Management Software Courses

Overview: LinkedIn Learning offers a vast library of courses on various project management software tools, including Microsoft Project, Asana, Trello, and Jira. These courses are designed to help learners plan, execute, and monitor projects effectively.

Key Features:

Wide range of software-specific training options.

Courses suitable for different skill levels.

Flexible learning schedules.

Ideal For: Professionals looking to gain proficiency in specific project management tools.

6. Udemy Project Management Courses

Overview: Udemy provides a variety of project management courses tailored to different experience levels and interests. Topics range from beginner to advanced levels, covering areas like cost and schedule monitoring using Earned Value Management (EVM).

Key Features:

Diverse course offerings on various project management topics.

Affordable pricing with frequent discounts.

Lifetime access to course materials.

Ideal For: Learners seeking flexible and cost-effective training options.

7. Coursera Project Management Courses

Overview: Coursera collaborates with renowned institutions to offer a wide array of project management courses and certificates. Courses cover topics such as project planning, execution, and specialized areas like Agile project management.

Key Features:

Access to courses from top universities and organizations.

Opportunities to earn recognized certificates.

Flexible learning schedules.

Ideal For: Individuals seeking academic-quality education in project management.

8. Scrum Master Certifications

Overview: For those interested in Agile methodologies, obtaining a Scrum Master certification can be highly beneficial. Options include certifications from Scrum.org and the Scrum Alliance.

Key Features:

Focus on Agile and Scrum practices.

Recognition in industries adopting Agile methodologies.

Ideal For: Professionals aiming to specialize in Agile project management.

Conclusion

Investing in project management software training is essential for staying competitive in today's fast-paced work environment. The programs listed above offer diverse options to build new skills and enhance your proficiency with various project management tools. Whether you're a beginner or an experienced professional, these courses can help you achieve your career objectives in 2025.

#project management software#Best Project Management Software Training#Project Management Software Training

0 notes

Text

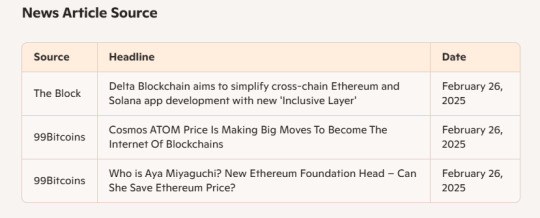

250226 - Today's News: Notes and Analysis

250226

Notes and Analysis

News 1 - Delta Blockchain aims to simplify cross-chain Ethereum and Solana app development with new 'Inclusive Layer'

Summary of the News: Delta Blockchain Fund founder Kavita Gupta is launching a new cross-chain network called the “Inclusive Layer” to make it easier to launch apps on Ethereum and Solana.

Key Metrics: The Inclusive Layer offers a cross-chain unified liquidity aggregation layer between EVM and non-EVM chains.

Expert Opinions: Gupta has 18 years of investment experience and is one of the earliest supporters of scalability solutions like Polygon and StarkWare.

Potential Risks: The success of the Inclusive Layer depends on its adoption by developers and the broader blockchain community2.

News 2 - Cosmos ATOM Price Is Making Big Moves To Become The Internet Of Blockchains

Summary of the News: Cosmos ATOM is positioning itself as the "Internet of Blockchains" with significant price movements.

Key Metrics: ATOM's price stands at $4.35 with a market cap of $1.69 billion and a circulating supply of 390.93 million.

Expert Opinions: Cosmos aims to solve interoperability issues between blockchains, making it a crucial player in the decentralized finance (DeFi) space.

Potential Risks: Market volatility and competition from other blockchain projects could impact ATOM's growth4.

News 3 - Who is Aya Miyaguchi? New Ethereum Foundation Head – Can She Save Ethereum Price?

Summary of the News: Aya Miyaguchi has been appointed as the new president of the Ethereum Foundation, following her tenure as Executive Director.

Key Metrics: Ethereum maintains dominance with over $53 billion TVL and $122 billion in stablecoin market caps.

Expert Opinions: Miyaguchi's leadership is expected to bring stability and growth to the Ethereum network.

Potential Risks: Community controversies and leadership challenges could affect the Ethereum Foundation's effectiveness7.

Note: This entry has been edited for clarity and to align with the specified editorial line by Copilot AI.

2 notes

·

View notes

Text

📢 @UniLend_Finance Announces

Come celebrate the addition of @squirrel_wallet to ecosystem!🎊

Squirrel Wallet is a top-tier multi-EVM Web3 wallet that integrates digital ID solutions, tokenized real-world assets, & DeFi, aiming to drive innovation in the web3 space.

#UniLend

0 notes

Text

Ethereum Pectra Upgrade: A Comprehensive Guide to Features, Timeline, and Impact

The Ethereum ecosystem is constantly evolving, with upgrades designed to enhance performance, scalability, and user experience. The upcoming Pectra upgrade, slated for March 2025, is a significant milestone in this evolution. Combining features from both the Prague and Electra releases, Pectra aims to improve network performance through technical updates and increased scalability. This article provides a comprehensive overview of the Pectra upgrade, its key features, anticipated impact, and potential challenges.

Understanding the Ethereum Pectra Upgrade

The Pectra upgrade is designed to improve the Ethereum network’s functionality, expand its capabilities, and introduce new staking methods. By enhancing layer-2 storage, Pectra seeks to reduce costs and improve overall network efficiency.

Scalability: Pectra introduces Peer Data Availability Sampling (PeerDAS), enabling nodes to check transaction data faster by processing smaller data portions, saving time and improving network operation.

Data Storage: The upgrade incorporates Verkle Trees, merging Vector Commitments and Merkle Trees, to accelerate data storage and verification. This allows validators to work with less data storage while maintaining fast and secure access to network information.

User Experience: Pectra enhances usability by allowing users to pay gas fees with stablecoins like USDC and DAI, making transactions more accessible. This is made possible through account abstraction, enabling wallet applications to run as smart contracts, allowing users to manage their transactions more effectively.

Key Features and Enhancements

The Pectra upgrade includes several core features designed to enhance network performance and user experience:

Account Abstraction: Users can pay gas fees using multiple tokens (e.g., USDC and DAI), and third parties can cover gas expenses.

EIP-7692: Optimizes smart contracts, making Ethereum Virtual Machine (EVM) operations faster.

Validator Enhancements:

EIP-7002: Introduces flexible staking withdrawal options for validators.

EIP-7251: Allows validators to stake larger amounts of Ether, up to 2,048 ETH, easing ETH management operations.

Data Storage and Network Scalability Improvements:

Verkle Trees: Improves data storage and speeds up transaction handling.

PeerDAS: Enhances Layer 2 solutions by managing heavy network traffic and improving system speed.

Ethereum Improvement Proposals (EIPs) in Pectra

Pectra implements various Ethereum Improvement Proposals (EIPs) to improve wallet management, staking processes, and overall user experience:

EIP-7702: Enables users to create smart contract interfaces from externally owned accounts (EOAs) for easier transactions.

EIP-7251: Permits each staking validator to validate up to 2,048 ETH instead of 32 ETH.

EIP-7002: Simplifies the process for staking service providers to exit their validator functions.

EIP-7742: Enhances Layer-2 technology scalability by enabling more simultaneous transactions and reducing storage costs.

EIP-2537: Improves the efficiency of digital signatures to speed up network processing times.

EIP-2935: Allows Ethereum to store block hashes on its own system, providing better ways to access data.

EIP-6110: Creates a new process to facilitate validator participation in the staking system.

Timeline and Release Stages

The Ethereum Pectra upgrade is scheduled for mid-March 2025 and will be rolled out in two phases:

Phase 1: Includes updates such as boosting Layer 2 blob capacity from three to six nodes to ease network load and decrease costs.

Phase 2: Will enhance operation from late 2025 to early 2026, introducing PeerDAS and Verkle Trees to strengthen data storage solutions and boost network performance.

Impact on Ethereum Users

The Pectra upgrade is expected to bring several benefits to Ethereum users:

Improved User Experience: Faster transactions and enhanced wallet capabilities.

Lower Transaction Fees: Potential for free or lower transaction fees, with decentralized programs and outside services potentially covering transaction costs.

Enhanced Transaction Efficiency: Grouping multiple transactions into one processing operation to lower expenses and enhance speeds.

Advanced Security Features: Protection against theft and simplified password recovery procedures, including features for key restoration through authorized contacts and multisig wallets.

Challenges and Risks

Despite the promising enhancements, the Pectra upgrade faces potential risks:

Client Variety: A severe technical problem in a primary user’s Ethereum client may disable the whole network.

Staking Concentration: Increased risk of slashing penalties if staking concentration shifts to fewer entities.

Dependence on Cloud Service Providers: Reliance on services like AWS and Hetzner poses security risks due to potential downtime or security faults.

Wallet Verification: Outdated protocols that are not properly updated could become vulnerable to hacking attacks.

Regulatory Scrutiny: Boosting staking limits may attract more attention from regulators.

Slow Adoption of Distributed Validator Technology (DVT): Weakens Ethereum’s defensive capabilities against attacks.

Ethereum’s Future After Pectra

Pectra is a step towards achieving long-term goals of better performance and secure decentralized networks. It builds a strong base for future upgrades, strengthening Ethereum as a blockchain network. Ethereum co-founder Vitalik Buterin has emphasized the importance of layer-2 solutions in building the economic value of ETH, recommending that these solutions improve Ethereum by using their income to pay for transactions or support network activities.

Historical Impact of Ethereum Upgrades on ETH Price

Past Ethereum upgrades have had varying impacts on ETH price:

Berlin (April 2021): ETH value improved by 7.5% seven days before the update.

London (August 2021): ETH gained 3.4% on the implementation date and experienced a 30% growth in the week following the update.

The Merge (September 2022): ETH price grew by 20% before the Merge but fell during and after the upgrade.

Dencun (March 2024): Experienced a price decrease despite its technical advantages.

These examples show that while upgrades bring technological benefits, their impact on ETH price is not always consistent.

Anticipated Impact of the Pectra Upgrade on ETH Price

Market analysts anticipate that the Pectra upgrade will increase ETH’s value due to its scalability, usability, and staking improvements. Some analysts expect ETH to reach $4,100, with optimistic forecasts projecting it could cross $6,000 for the first time. However, the cryptocurrency market is subject to strong price swings influenced by market stability policies, economic conditions, and regulations.

Tips and Guides for Navigating the Pectra Upgrade

Stay Informed: Keep up-to-date with the latest news and developments regarding the Pectra upgrade.

Understand the Changes: Familiarize yourself with the key features and improvements introduced by Pectra.

Assess the Risks: Be aware of the potential challenges and risks associated with the upgrade.

Secure Your Wallets: Ensure your wallets are updated with the latest security protocols to protect against potential vulnerabilities.

Consider Staking Opportunities: Explore the new staking options and enhancements offered by Pectra to potentially increase your ETH holdings.

Monitor Market Trends: Keep a close eye on market trends and analyst predictions regarding the impact of Pectra on ETH price.

Conclusion

The Ethereum community is keenly anticipating the Pectra upgrade, recognizing its potential to enhance network performance and user experience. While upgrades benefit the Ethereum network, their impact on ETH price can be unpredictable. Investors and company partners will be closely watching how Pectra affects Ethereum’s results and market standing. For many, such events are a reason to consider investing in Ethereum, anticipating potential long-term growth.

0 notes

Text

BitcoinOS Unveils Grail Bridge Testnet: A New Link Between Bitcoin and EVM Chains

Key Points

BitcoinOS has launched the Grail Bridge testnet app, aiming to improve Bitcoin’s interaction with other blockchain networks.

The Grail Bridge allows Bitcoin to be moved safely to Ethereum Virtual Machine (EVM)-compatible chains, enhancing its scalability and use in decentralized finance (DeFi) applications.

BitcoinOS, a decentralized operating system, has made significant strides in enhancing Bitcoin’s compatibility with other blockchain networks. The team behind the project has announced the launch of the Grail Bridge testnet app.

This cross-chain bridge solution enables users to transfer Bitcoin safely to Ethereum Virtual Machine (EVM)-compatible chains. The goal of this new feature is to boost Bitcoin’s scalability and facilitate its use in decentralized finance (DeFi) applications.

Grail Bridge: Enhancing Bitcoin’s Functionality

BitcoinOS has been focusing on augmenting Bitcoin’s functionality for some time. In July 2024, it was reported that the protocol successfully verified the first zero-knowledge proof (ZKP) on the Bitcoin mainnet.

By November of the same year, BitcoinOS had collaborated with Merlin Chain to carry out the first zero-knowledge bridge transaction. The introduction of Grail Bridge marks another significant milestone in expanding Bitcoin’s utility beyond payments.

The team has been developing solutions to address Bitcoin’s scalability and smart contract limitations. In April 2024, a whitepaper was released outlining how ZKP technology could mitigate these issues.

The Grail Bridge testnet app is a key part of this vision. The team disclosed that during the first phase, the testnet integrates with Ethereum’s Holešky network. It also connects with other Ethereum L2 blockchain networks, such as Base Sepolia and Mode Sepolia.

Furthermore, it connects to Merlin Chain, a prominent Bitcoin Layer 2 (L2) scaling solution, and supports the open-source protocol WalletConnect. This compatibility makes it easier for users to transfer BTC using popular crypto wallets like OKX, Xverse, Bitget, and Unisat.

BitcoinOS: Future Plans

BitcoinOS is gearing up to launch its mainnet in the second quarter. Before the launch, the team will conduct thorough security audits to ensure the system’s integrity and operational stability. The platform intends to extend its ecosystem beyond Ethereum Virtual Machine (EVM) compatible chains.

Future integrations will include non-EVM networks such as Cardano and Solana, allowing Bitcoin to connect with a wider range of blockchain networks.

BitcoinOS also announced plans to expand its ecosystem to connect with Arbitrum. The strategy is to enable its native token, BOS, to move between Bitcoin and Arbitrum, facilitating a trustless bridge between Bitcoin and Ethereum’s layer-2 solutions.

Through the use of zero-knowledge technology, Bitcoin can now leverage Ethereum’s DeFi ecosystem, creating more opportunities for users. These advancements by BitcoinOS simplify Bitcoin’s interaction with other blockchains.

The community is eagerly anticipating updates on Cardano, with the roadmap for the Bitcoin-Ethereum bridge now established. Last year, BitcoinOS and Cardano formed a partnership to enhance the Bitcoin DeFi ecosystem. While key details about this partnership remain undisclosed, it demonstrates the growing adoption of Bitcoin in the market.

0 notes

Text

In the evolving landscape of blockchain, the concept of omnichain stands out as a groundbreaking approach to enhancing connectivity across distinct blockchain networks. Omnichain technology aims to create a seamless integration where Ethereum users can access the same functionalities and opportunities as those on Solana or other networks. By doing so, it strives to eliminate barriers between blockchain ecosystems, offering a unified user experience across different platforms. Overcoming the Interoperability Challenge While the idea of interconnected blockchains is appealing, achieving practical interoperability is a complex undertaking. Initially, blockchains were designed to operate independently, each with its unique language and protocols. This has led to a fragmented ecosystem where interoperability became an afterthought, resulting in isolated chains that rarely communicate effectively with each other. Solving this issue requires innovative protocols designed to bridge these gaps, leading to the advent of omnichain frameworks. Benefits of Defragmenting Blockchain Assets The current multi-chain environment often resembles a disjointed collection of networks, each competing for dominance. This fragmentation can lead to inefficiencies, such as liquidity being trapped within individual chains and a lack of capital flow across networks. Omnichain solutions aim to resolve these inefficiencies by providing a layer of integration that allows assets and data to move fluidly between chains, enhancing capital efficiency and fostering innovation. Innovations in Omnichain Protocols Pioneers in omnichain technology, such as LayerZero, have set the stage for cross-chain data movement and communication. However, new protocols are continuously emerging to tackle specific challenges in this space. For example, the Dojima Network is making strides by offering solutions that bridge both EVM and non-EVM chains, providing a universal architecture that maintains seamless communication between diverse blockchain networks. This approach not only simplifies developer efforts but also ensures future adaptability as new blockchains enter the market. The Future of a Unified Blockchain Ecosystem The blockchain sphere has come a long way from its fragmented beginnings. Today’s omnichain protocols eliminate the previous necessity of overcoming the “cold start” problem for new networks, offering robust liquidity from the outset. Developers are no longer forced to make restrictive decisions based solely on the characteristics of individual chains. Omnichain mechanisms allow decentralized applications (dApps) to expand across various networks, minimizing complexity and easing the developer burden. Conclusion: A New Era for Web3 The progression towards an omnichain future signifies a pivotal shift in the blockchain industry. By ensuring interconnectivity across various networks, these advanced protocols empower Web3 to fulfill its fundamental promise: to operate seamlessly and inclusively for all users, regardless of their chosen blockchain. As this technology continues to evolve, it paves the way for a more integrated and accessible decentralized future for everyone. Read the full article

0 notes