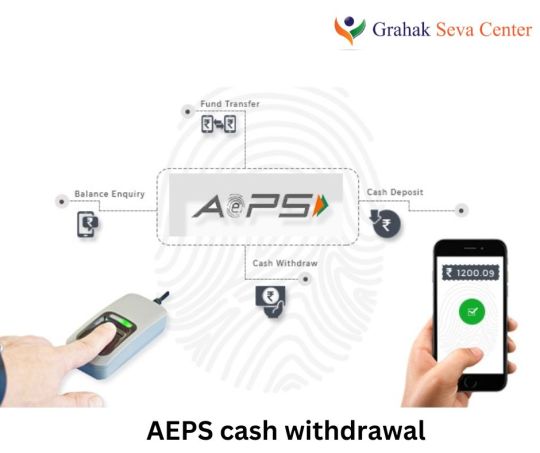

#AEPS cash withdrawal

Text

Requirements For AePS Transactions

AePS (Aadhaar Enabled Payment System) does not require a smartphone, documents, or payment cards. To use AePS, customers only need to link their Aadhaar card to their bank account. The system captures the following information:

Aadhaar Number

Biometric Fingerprint Identification

Name or Bank Issuer Identification Number (IIN)

If the full Aadhaar number is not remembered, the last four digits will suffice. A Business Correspondent with an AePS machine or Micro ATM in assisted mode can perform transactions for the customer.

#Aeps#aeps debit facility#AEPS Cash Withdrawal#Best AEPS Services Provider company#aeps service#aeps registration#aeps portal#aadhaar pay

0 notes

Text

How to Grow Your Kirana Store’s Earnings Today?

In today’s rapidly evolving retail landscape, Kirana stores are presented with exciting opportunities to enhance their earnings and customer reach. Leveraging innovative solutions like AEPS cash withdrawal, Bharat Bill Payment Service, and online DTH recharge can transform your Kirana store into a one-stop shop for a diverse range of services. In this blog, we’ll explore these key features and guide you on how to grow your Kirana store’s earnings today!

#aeps cash withdrawal#what is aeps cash withdrawal#aadhaar enabled payment system#Bharat bill payment service for retailers#online DTH recharge#Retailer Mobile recharge portal#domestic money transfer in India

0 notes

Text

Aeps Cash Withdrawal Software

Are you thinking to start your own brand Aeps cash withdrawal business as an admin and looking for best Aeps cash withdrawal software then this is no 1.

Yes, I am talking about Ezulix Software, A leading Aeps Software Provider, Offering best standard b2b Aeps admin panel with all bank cash withdrawal services and advanced features.

For more details visit the link now.

#aeps cash withdrawal#aeps software provider#aeps software company#aeps software development#aeps cash withdrawal software

0 notes

Text

AEPS cash withdrawal

AEPS, or Aadhaar Enabled Payment System, is a financial inclusion initiative in India that allows people to make basic banking transactions using their Aadhaar number and fingerprint authentication. One of the services offered under AEPS is "AEPS cash withdrawal," which enables individuals to withdraw cash from their bank accounts without the need for a traditional ATM card or debit card.

0 notes

Text

Highlighted Points of Aadhaar Withdrawal?

AEPS or Aadhaar Enabled Payment System is a payment service that uses Aadhaar card details for authentication and enables transactions through Aadhaar-linked bank accounts. AEPS cash withdrawal is a service provided by banks where customers can withdraw cash using their Aadhaar card and biometric authentication. Some key points about AEPS cash withdrawal are:

AEPS cash withdrawal is a secure and convenient way to withdraw cash without the need for a physical debit card or PIN.

To avail of AEPS cash withdrawal services, customers need to link their Aadhaar card to their bank account.

The biometric authentication is done through fingerprint recognition or iris scan, which ensures secure and accurate identification of the customer.

AEPS cash withdrawal can be availed at any AEPS-enabled bank branch or business correspondent (BC) outlet.

The maximum amount that can be withdrawn through AEPS cash withdrawal is Rs.10,000 per transaction.

AEPS cash withdrawal charges are usually lower than charges for using an ATM or visiting a bank branch.

AEPS cash withdrawal can be used by anyone who has an Aadhaar card and a linked bank account, making it a useful service for people who do not have access to traditional banking facilities.

Overall, AEPS cash withdrawal is a convenient and secure way for customers to withdraw cash using their Aadhaar card and biometric authentication.

If you are looking for the best AEPS service provider company in India to start your own AEPS business, you can choose Ezulix software as the No 1 AEPS company in India.

#aeps cash withdrawal#aeps cash withdrawal meaning#aeps cash withdrawal limit#aeps service#aeps service provider#aeps company

1 note

·

View note

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below

*Adhaar Address Update

*Adhaar download

*Adaar PVC card apply

*Adhaar Update History

*Adhaar Card Slot Booking

*Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services

* New Pan Card Apply

*Pan card Corrections

*Instant Pan card

*Minor Pan Card

*Duplicate Pan Card

4.Micro& Mini ATM Services

*Cash withdrawal

*Fund transfer

*Cash Deposit

*Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines:

1.Adhaar card photo

2.Pan Card photo

3.Phone number

4.Email Id

5.Live Location to be shared

6.2-4 Sec video Recording by holding adhaar /pan

7.Any other person reference contact number and ID proof

8.bank passbook photo

9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339

Note : Registration fees non Refundable

2 notes

·

View notes

Text

𝔻𝕚𝕘𝕚𝕥𝕆ℕ 𝑴𝒖𝒍𝒕𝒊 𝑺𝒆𝒓𝒗𝒊𝒄𝒆𝒔 welcomes you. It is a Common Service Center (CSC). We offers Bank Accounts Opening, Money Transfer, Cash Withdrawal, Cash Deposit, Micro ATM, Aadhaar ATM (AEPS), Taxation (ITR, TDS, GST etc.), Loan (Two Wheeler, Four Wheeler, Gold etc.) All Insurances [General (Two Wheeler, Private Car, Commercial Car, Bus, Truck), Life, Health, Miscellaneous etc.], MV Tax Payment, Transport (Vahan) Department Services, Driving Licence, Voter ID Card, Pan Card (New/Correction), Ayushman Card, Indian Passport Registration, Aadhaar Demographic Update, EPF Withdrawal/Settlement/Transfer/Claims, NPS (National Pension System) Registration, Electricity Bill Payment, Flight Booking, Railway Ticket Booking, Bus Booking, Landline Bill, Postpaid Mobile Bill, FASTag Recharge, DTH Recharge, Prepaid Mobile Recharge, PVC cards, Scan, Print, Xerox, Lamination, Passport Size Photo, Internet, Online Works etc.

CONTACT:

DIGITON Multi Services

Sila, Silabori Road, PO/PS Changsari,

Inside Brahmaputra Industrial Park,

Guwahati, 781101, Kamrup, Assam.

0361-2911329

Location:

DIGITON Multi Services

https://maps.app.goo.gl/UhgamMiuaci19gAcA

#digiton#digitonms#digitonmultiservices#guwahati#assam#northeast#india#digital#csc#online#services#technology#books & libraries

4 notes

·

View notes

Text

Exploring the 5 Benefits of AEPS Service

In the ever-evolving landscape of financial technology, AEPS (Aadhaar-enabled Payment System) services stand out as a transformative tool, particularly in the realm of digital transactions. Developed by the National Payments Corporation of India (NPCI), AEPS leverages Aadhaar, India's biometric identification system, to facilitate secure and efficient financial transactions. As fintech software continues to integrate with various financial systems, AEPS services offer unique advantages that can significantly enhance financial accessibility and security. Here, we explore five key benefits of AEPS services, illustrating their impact and relevance in today’s financial ecosystem.

1. Enhanced Accessibility and Inclusion

One of the foremost benefits of AEPS services is their role in enhancing financial inclusion. In India, where a significant portion of the population resides in rural or semi-urban areas with limited access to traditional banking infrastructure, AEPS services provide a vital solution. By enabling transactions using just an Aadhaar number and biometric authentication, AEPS eliminates the need for physical bank branches, which are often scarce in remote locations.

Fintech software plays a crucial role in this process, integrating AEPS services into mobile and digital platforms that extend financial services to underserved populations. This accessibility ensures that individuals who previously had limited or no access to banking services can now perform essential transactions, such as cash withdrawals, balance inquiries, and fund transfers, with ease.

2. Improved Security and Fraud Prevention

Security is a paramount concern in financial transactions, and AEPS services address this with robust measures. AEPS relies on Aadhaar biometric authentication, which requires users to provide their fingerprints or iris scans to authorize transactions. This biometric security ensures that only the rightful account holder can complete transactions, significantly reducing the risk of fraud.

The integration of AEPS services with fintech software enhances security further by employing encryption protocols for data transmission. This ensures that sensitive information is protected against unauthorized access and cyber threats. By combining biometric verification with advanced encryption, AEPS services offer a secure and reliable alternative to traditional transaction methods.

3. Cost-Effective Transactions

AEPS services provide a cost-effective solution for both users and financial institutions. For users, especially those in rural areas, the cost of accessing traditional banking services can be prohibitive. AEPS minimizes these costs by enabling transactions through biometric authentication, reducing the need for physical infrastructure and related expenses.

From a financial institution’s perspective, integrating AEPS services with fintech software streamlines transaction processes and reduces operational costs. Banks and financial service providers can leverage AEPS to lower the expenses associated with maintaining extensive branch networks and handling cash. This cost efficiency benefits both institutions and users, making financial transactions more affordable.

4. Seamless Integration with Fintech Solutions

The integration of AEPS services with fintech software provides a seamless user experience and enhances the functionality of digital financial platforms. Fintech software developers have increasingly incorporated AEPS capabilities into their solutions, allowing users to access AEPS services through various digital interfaces, including mobile apps and web platforms.

This seamless integration means that users can perform AEPS transactions alongside other financial activities, such as bill payments and online shopping, within a single application. The convenience of accessing multiple financial services through a unified platform enhances user satisfaction and drives greater adoption of digital financial solutions.

5. Real-Time Transaction Processing

AEPS services offer the advantage of real-time transaction processing, a critical feature in today’s fast-paced financial environment. Unlike traditional banking methods, which may involve delays in transaction settlement, AEPS ensures that transactions are processed instantaneously.

This real-time processing capability is particularly beneficial for users who need to complete transactions quickly, whether for personal or business purposes. Fintech software that integrates AEPS services enables users to conduct transactions, check balances, and transfer funds in real-time, enhancing the overall efficiency of financial operations.

Conclusion

AEPS services represent a significant advancement in the realm of financial technology, offering numerous benefits that address the needs of diverse user groups. By enhancing accessibility, improving security, providing cost-effective solutions, integrating seamlessly with fintech software, and enabling real-time transaction processing, AEPS services have established themselves as a pivotal component of modern financial systems.

As fintech software continues to evolve, the integration of AEPS services will likely expand, further enhancing their utility and reach. For both users and financial institutions, AEPS offers a secure, accessible, and efficient means of conducting financial transactions, contributing to the broader goal of financial inclusion and digital empowerment. Whether in urban centers or remote villages, AEPS services are paving the way for a more inclusive and technologically advanced financial future.

1 note

·

View note

Text

AePS Cash Withdrawal

AePS cash withdrawal is a revolutionary service that simplifies accessing cash from your bank account. Using the Aadhaar Enabled Payment System, you can withdraw money without needing a debit card or ATM. Simply visit an AePS-enabled banking outlet, provide your Aadhaar number, and authenticate the transaction with your fingerprint. This secure method ensures that only you can access your funds, making aeps cash withdrawal both convenient and safe. It is especially beneficial for those in rural areas with limited banking infrastructure, providing them with easy access to their money anytime, anywhere.

0 notes

Text

Eko API Integration: Revolutionizing Money Transfer and AePS Services

In the rapidly evolving landscape of financial technology, the need for seamless, secure, and efficient digital transaction solutions has never been more crucial. Eko, a leading fintech platform in India, has emerged as a pivotal player, offering a suite of APIs that empower businesses to integrate money transfer services and Aadhaar-enabled Payment Systems (AePS) directly into their applications. This article explores the role of an Eko API Integration Developer and the transformative potential of integrating these services.

Eko API Integration for Money Transfer and AePS:-

Understanding Eko’s API Ecosystem

Eko's platform is designed to bridge the gap between traditional banking services and the burgeoning demand for digital financial solutions. The Eko's APIs provide a versatile toolkit for developers aiming to offer domestic money transfers (DMT), bill payments, and AePS functionalities. Eko’s API services are crucial in a market like India, where financial inclusion remains a significant challenge.

1. Money Transfer API

Eko’s Money Transfer API is at the heart of its offering, allowing developers to integrate domestic remittance services into their applications. Eko API supports a range of transactions, from peer-to-peer (P2P) transfers to more complex transactions involving multiple parties.

Key features include:

Ease of Integration: With detailed documentation and robust SDKs, developers can quickly integrate money transfer capabilities into web or mobile applications.

Security: The API is designed with stringent security protocols, ensuring that every transaction is encrypted and compliant with regulatory standards.

Flexibility: Support for various transaction modes, such as IMPS, NEFT, and RTGS, makes it adaptable to different user needs.

2. Aadhaar-enabled Payment System (AePS) API

AePS is a crucial service in India, enabling financial transactions through Aadhaar authentication. Eko’s AePS API allows developers to offer essential banking services like cash withdrawal, balance inquiry, and mini statements via Aadhaar.

Key features include:

Biometric Authentication: AePS transactions require Aadhaar-linked biometric verification, which the API handles efficiently, ensuring a smooth user experience.

Comprehensive Documentation: Developers have access to extensive documentation that simplifies the integration process.

Real-Time Transactions: The API supports real-time transactions, ensuring that users can access their funds instantly.

The Role of an Eko API Integration Developer

An Eko API Integration Developer plays a pivotal role in bringing these financial services to life within a business’s digital ecosystem. Here’s a closer look at the responsibilities and skills required for this role:

1. Expertise in API Integration

At the core of this role is the ability to integrate Eko’s APIs into various platforms seamlessly. This requires:

Proficiency in Programming: Developers need to be well-versed in programming languages such as Python, Java, Node.js, or PHP, which are commonly used for API integration.

Understanding of RESTful APIs: Since Eko's APIs follow RESTful principles, a deep understanding of how these APIs work, including methods like GET, POST, PUT, and DELETE, is essential.

Authentication Management: Managing API keys and handling OAuth or other authentication methods is crucial for secure API integration.

2. Developing a Robust User Experience

While the backend integration is critical, ensuring a seamless and intuitive user experience is equally important. This involves:

UI/UX Collaboration: Working closely with UI/UX designers to ensure that the integration feels natural within the application.

Error Handling: Implementing robust error handling to manage transaction failures, network issues, or authentication errors smoothly.

3. Ensuring Compliance and Security

Financial services integration comes with significant compliance and security responsibilities:

Data Security: The developer must ensure that all data, especially sensitive information like Aadhaar numbers, is encrypted and securely transmitted.

Regulatory Compliance: Adhering to local and international financial regulations is a must, particularly with services like AePS, which are heavily regulated.

Benefits of Integrating Eko’s APIs

For businesses, the integration of Eko’s APIs offers several advantages:

1. Expanding Service Offerings

Businesses can offer a broader range of services, from instant money transfers to banking services via AePS, making them more competitive in the fintech space.

2. Enhancing Customer Convenience

With services like real-time money transfers and biometric authentication for AePS, customers can enjoy a seamless and secure transaction experience.

3. Driving Financial Inclusion

By leveraging AePS, businesses can reach underserved populations, offering banking services to those who may not have access to traditional banking infrastructure.

Conclusion

The integration of Eko’s APIs for money transfer and AePS is a game-changer for businesses looking to provide comprehensive financial services. For developers, mastering these integrations is not just about enhancing their technical skills but also about contributing to the larger goal of financial inclusion in India. As fintech continues to evolve, the role of an Eko API Integration Developer will only become more critical, driving innovation and expanding access to essential financial services across the country.

Contact Details: –

Mobile: – +91 9711090237

E-mail:- [email protected]

#Eko API Integration Developer#integration of Eko’s APIs for money transfer and AePS#money transfer and AePS#Eko API Integration#API Integration

0 notes

Text

👍 Omega Softwares Revolutionizes Rural Banking with AEPS Portal! 🌟

💸 Cash Withdrawal

💰 Fund Transfer

📊 Balance Enquiry

🏧 Micro ATM

📱 UPI Payment—all at your fingertips!

🌍 AEPS Portal empowers rural communities with convenient and accessible banking solutions. 🏡

⏰ Head to our website, https://www.omega-sys.com/ or comment below to chat about how Omega Softwares can help YOU! 💬

#payment#software#technology#fintech#information technology#finance#development#services#custom software development

0 notes

Text

Unlock Hassle-Free Cash Withdrawals with SoulPay's AEPS Service!

Experience the future of cash withdrawals with SoulPay's AEPS Cash Withdrawal Service! Say goodbye to long ATM lines and cash shortages. Our secure and convenient service allows you to access cash instantly, 24/7, using your Aadhaar card and biometric authentication. Join the SoulPay revolution today and enjoy a new level of convenience and security.

🚀 Visit our nearest outlet and enjoy hassle-free cash withdrawals now! 🚀

Read more on

0 notes

Text

Ezulix AePS Software - Why No 1 In Fintech Industry?

AePS software is a b2b fintech solution that offer all basic banking services served by multiple banks.

Ezulix Software is a leading AePS software development company in India that offers fully featured AePS software with all bank services.

By using AePS b2b software, anyone can start b2b fintech company as an admin and can create unlimited members.

By offering multiple banking services like cash withdrawal, aeps money transfer, balance enquiry, mini statement etc, admin can earn profit.

Ezulix offers highest AePS commission to admin in India with lifetime free technical support.

for more details about AePS business software, you can visit on given link.

#aeps software#best aeps software#aeps software provider#aeps software developer#aeps software company#aeps software commission#aeps software business

2 notes

·

View notes

Text

UPIADDA: Elevating Financial Inclusion with AEPS Payment Gateway Feature

The AEPS feature of UPIADDA payment gateway brings banking services to the fingertips of every Indian, particularly those residing in rural and remote areas. With AEPS, users can conduct a variety of financial transactions, including balance inquiry, cash withdrawal, fund transfer, and more, using only their Aadhaar number and fingerprint authentication. This eliminates the need for traditional banking infrastructure like ATMs and bank branches, making banking services more accessible and convenient.

One of the key advantages of AEPS is its interoperability across different banks and financial institutions, ensuring that users can access their accounts and perform transactions regardless of their bank's affiliation. This promotes financial inclusion by providing banking services to underserved communities who may not have easy access to traditional banking channels.

Additionally, AEPS transactions are highly secure, utilizing biometric authentication to verify the identity of users. This significantly reduces the risk of fraud and unauthorized access to accounts, enhancing trust and confidence in digital financial services.

For merchants and business owners, the AEPS feature opens up new opportunities for accepting digital payments, even in remote areas where card-based or online payment systems may not be feasible. By integrating AEPS into their payment ecosystem, businesses can cater to a wider customer base and streamline their payment processes.

Overall, the AEPS feature of UPIADDA payment gateway represents a significant step towards realizing the vision of a digitally inclusive India. By leveraging Aadhaar-based authentication and biometric technology, UPIADDA is empowering individuals and businesses to participate in the digital economy, driving financial inclusion and economic growth across the country.

0 notes

Text

Experience Seamless Banking: AEPS Feature with Nyrapay

Unlock the convenience of banking anytime, anywhere with Nyrapay's cutting-edge AEPS (Aadhaar Enabled Payment System) feature. Seamlessly integrate Aadhaar authentication into your financial transactions, enabling secure and hassle-free banking services for individuals across the nation.

Nyrapay's AEPS feature revolutionizes the traditional banking experience by leveraging Aadhaar authentication to provide secure and convenient banking services to users. This innovative solution eliminates the need for physical bank branches and ATMs, allowing users to access essential financial services anytime, anywhere, even in remote areas where banking infrastructure is limited.

With Nyrapay's AEPS feature, users can perform a wide range of banking transactions using their Aadhaar number and biometric authentication. This includes cash withdrawals, balance inquiries, fund transfers, and more, all with the utmost security and reliability. By integrating Aadhaar authentication directly into the payment process, Nyrapay ensures that transactions are secure and tamper-proof, reducing the risk of fraud and unauthorized access.

The AEPS feature also enhances financial inclusion by providing banking services to underserved populations who may not have access to traditional banking channels. This includes rural communities, low-income individuals, and migrant workers who may face challenges in accessing traditional banking services. By leveraging Aadhaar authentication, Nyrapay ensures that these individuals can participate fully in the digital economy and access essential financial services without barriers.

Overall, Nyrapay's AEPS feature represents a significant step forward in the digitization of banking services in India. By harnessing the power of Aadhaar authentication, Nyrapay empowers users with greater convenience, security, and accessibility in their financial transactions, ultimately contributing to the vision of a digitally inclusive society.

0 notes

Text

Seamless Banking with Nabpower: Introducing Our AEPS Feature for Easy Financial Transactions

Nabpower's AEPS (Aadhaar Enabled Payment System) feature revolutionizes the way individuals interact with banking services. By leveraging Aadhaar, India's biometric identity system, this innovative solution brings banking convenience to the fingertips of every citizen. With AEPS, users can access a wide range of banking services without the need for a physical bank branch. Whether you're in a bustling city or a remote village, Nabpower ensures that banking services are accessible to all.

One of the key benefits of Nabpower's AEPS feature is its inclusivity. It caters to individuals from all walks of life, including those who may not have access to traditional banking infrastructure. By using Aadhaar authentication, users can securely perform transactions such as cash withdrawals, balance inquiries, fund transfers, and more, using only their biometric information.

Security is paramount in the digital age, and Nabpower's AEPS feature prioritizes the protection of users financial information. With Aadhaar authentication, transactions are encrypted and authenticated using biometric data, ensuring that each transaction is secure and tamper-proof.

Furthermore, Nabpower's AEPS feature promotes financial inclusion by bridging the gap between urban and rural areas. In remote regions where traditional banking services are scarce, AEPS provides a lifeline, enabling individuals to access banking services conveniently and securely.

In summary, Nabpower's AEPS feature is a game-changer in the world of digital banking. It empowers individuals with the freedom to bank anytime, anywhere, using only their Aadhaar credentials. With its focus on inclusivity, security, and accessibility, Nabpower is paving the way for a more inclusive and digitally empowered society.

0 notes