#8 gram gold coin

Explore tagged Tumblr posts

Text

Buy 8 Grams 22K (916) Gold Coin Online at best prices in Dubai from Rizan Jewellery.

#buy gold coins online#buy 24K gold coins online#buy gold coins online dubai#buy gold coins online UAE#gold coins#buy gold online#buy gold coins#gold coins online#gold coin dealers in dubai#8 gm gold coin#8 gm gold coin rate in Dubai#8 grams gold coin price in UAE#8 gram gold coin#8 gram gold coin buy online

0 notes

Text

Gold is one of the most popular metals, respected for its worth. It is not only valued as an adornment or a beautiful piece of jewellery but a popular investment form. In India, often families pass gold items to the next generations, retaining their value for years.

0 notes

Photo

Very Rare Roman Gold Coin is Returned to Greece

A Very Rare Gold Coin, Minted by Brutus to Mark Caesar’s Death, Is Returned to Greece

The gold coin, which dates from 42 B.C. and is valued at $4.2 million, is thought to have been looted from a field near where an army loyal to Brutus camped during the struggle for control of Rome.

A rare and ancient gold coin that morbidly celebrates the stabbing death of Julius Caesar was returned this week to Greek officials by investigators in New York who had determined it was looted and fraudulently put up for sale at auction in 2020.

The coin, known as the “Eid Mar” and valued at $4.2 million, features the face of Marcus Junius Brutus, the onetime friend and ally of Caesar who, along with other Roman senators, murdered him on the Ides of March in 44 B.C. According to historians and experts, Brutus had the coins minted in gold and silver to applaud Caesar’s downfall and to pay his soldiers during the civil war that followed the killing.

The return Tuesday came at a ceremony attended by officials of the Manhattan district attorney’s Antiquities Trafficking Unit and U.S. Homeland Security Investigations, who cooperated on the case.

The coin, one of 29 artifacts returned to Greek officials, was given up earlier this year by an unidentified American billionaire who, investigators said, had bought it in good faith in 2020. The British dealer who helped to arrange the sale was arrested in January, and the coin itself was recovered in February, officials said.

Experts said the coin, minted two years after Caesar’s death, is about the size of a nickel and weighs about 8 grams, and is one of only three known to be in circulation. A silver version of the coin was also minted and about 100 are known to exist. Those can sell for $200,000 to $400,000.

“The Eid Mar is an undisputed masterpiece of ancient coinage,” Mark Salzberg, the chairman of Numismatic Guaranty Corp., which verified the coin but does not research provenances, said in a statement in 2020.

Experts said they believe the coin was likely discovered more than a decade ago in an area of current-day Greece where Brutus and his civil war ally, Gaius Cassius Longinus, were encamped with their army.

The front, or obverse, of the coin features an engraved side view of Brutus and the Latin letters “BRVT IMP” and “L PLAET CEST.” Experts say the former stands for “Brutus, Imperator,” with imperator referring not to emperor but to commander. The latter stands for Lucius Plaetorius Cestianus, who was a treasurer of sorts for Brutus and oversaw the minting and assaying of his coins.

The reverse features two daggers on either side of a cap known as a pileus. The daggers stand for Brutus and Cassius and reflect the manner of Caesar’s death, experts say, while the cap is a symbol of liberty that was worn by freed slaves. Overall, the image is meant to celebrate the murder as an act by which Rome was liberated from Caesar’s tyranny. Beneath the symbols is the Latin inscription “EID MAR,” designating the Ides of March — March 15, 44 B.C. — the fateful day on which the conspirators left Caesar dead on the floor of the Roman Senate.

Historians see irony in the fact that Brutus, who had admonished Caesar before the murder for the self-aggrandizing act of putting his face on Roman coinage, wound up doing the same with his own coins.

Ultimately, the forces who favored the dead Caesar, led by Mark Antony and others, defeated Brutus and his men in October of 42 B.C. at the Second Battle of Philippi, and Brutus and Cassius committed suicide.

According to investigators, the coin is first thought to have come to market between 2013 and 2014. Richard Beale, 38, director of the London-based auction house Roma Numismatics, put it up for sale on his company’s website and over several years shopped it at coin shows in the United States and Europe before it was sold in October 2020. The $4.2 million was the most ever paid for an ancient coin, according to the Numismatic Guaranty Corp.

Mr. Beale is charged with grand larceny in the first degree and several other felonies and was released on his own recognizance. His lawyer, Henry E. Mazurek, declined to comment on the case.

Among the other Greek antiquities repatriated on Tuesday were figurines of people and animals; marble, silver, bronze and clay vessels; and gold and bronze jewelry. Their total value was put at $20 million.

In remarks at the ceremony, Konstantinos Konstantinou, Greece’s consul general in New York, said his country has been hit hard by the illicit trading of antiquities and is seeking their return “in every possible way.”

He praised investigators for “striking down the illegal international criminal networks whose activity distorts the identity of peoples, as it cuts off archaeological finds from their context and transforms them from evidence of people’s history into mere works of art.”

By Tom Mashberg.

#Very Rare Roman Gold Coin is Returned to Greece#Julius Caesar#Marcus Junius Brutus#Eid Mar#gold#gold coin#collectable coin#ancient artifacts#history#history news#ancient history#ancient culture#ancient civilizations#roman history#roman empire#Mark Antony#Second Battle of Philippi#long reads

216 notes

·

View notes

Text

Reales, pieces of eight, doubloones and ducats

Who doesn't know it, in films and books there are always stories about great pirate treasures and lots of coins are shown. But what kind of coins are they? Here is a small overview.

Silver real

Silver coin: 8 reales Fernando VI, Viceroyalty of New Spain - 1757 (x)

The real was a coin and a currency in Spain for several centuries after the mid-14th century, weighing 0,12 ounces (3,43g) of silver, and these were eight reales to a peso, hence the term " pieces of eight" for pesos.

Silver piece of eight or Spanish Dollar

Spanish piece of eight, 1780 (x)

Was an early Spanish silver dollar sized coin, with a content of 25.563 g = 0.822 oz t fine silver. As Spanish mints issued silver denominations smaller than eight reales relatively infrequently, these coins would sometimes be chopped up into smaller pieces to provide small change. In the 17th and 18th centuries, so many were in circulation that they were accepted almost anywhere in the world. The American doller sign $ was derived from the figure 8 stamped on the side of the piece of eight, the silver peso (or piaster). They were minted at Mexico City and Lima in Peru, and were common currency in all of England's colonies, being valued at four shillings and sixpence. Often they wre cut into eight pieces for ease of transaction, so that two bits made a quarter. The origin of the American phrase, not worth two bits, is from the days when the English colonies around Massachusetts used this Spanish money. Pieces of eight were produced for about 300 years, in Mexcio, Peru and Colombia, and they became the standard unit of trade between Europe and China. They wre legal tender in the USA until 1857. Before the Spanish started exploiting Potosi in Peru (in today's Bolivia), silver was almost as valuable as gold in the Old World. Such were the quantities taken from the New World, that silver dropped to about a 1/5 of the value of gold. The Spanish exported four billion pesos of silver and gold from the New World between 1492 and 1830.

Gold ducat

Gold ducat of Venice. Doge Andrea Gritti, Italy, 1523-38 (x)

This was the European gold trade coin, containing around 3.5 grams (0.11 troy ounces) of 98.6% fine gold, during the late medieval and early modern period. The name derives from ducatus, the Latin form of the title of the Doge of Venice, whre the ducat was first issued 1284. Called the ducado, it was worth less than a doubloon, about 10-11 silver reales, and was known to the British seaman as a ducat. The coin was copied throughout mainland Europe, and coins of the ducat standard were struck in several European countries up to the 20th century.

Gold doubloon (doblôn)

Spanish 4-doubloon, or doubloon of 8 escudos, stamped as minted in Mexico city mint in 1798 (x)

This was an early Spanish gold coin, worth approximately $4 (four Spanish dollars) or 32 reales, and weighing 6.766 grams (0.218 troy ounce) of 22-karat gold (or 0.917 fine; hence 6.2 g fine gold). The name originally applying to the gold excelente of Ferdinand and Isabella. It was later transferred to the two escudo coin issued by Spain and the Spanish colonies in the Americas. It was the largest Spanish gold coin, weighing slightly less than an ounce of gold, and originates from the Latin word duplus, or double. A doubloon was worth about seven weeks wages to a sailor.

#naval history#general history#coins#reales#piece of eight#doubloon#ducat#medieval seafaring#age of discovery#age of sail#age of steam

211 notes

·

View notes

Text

The Most Mysterious Emperor to (probably never) Exist.

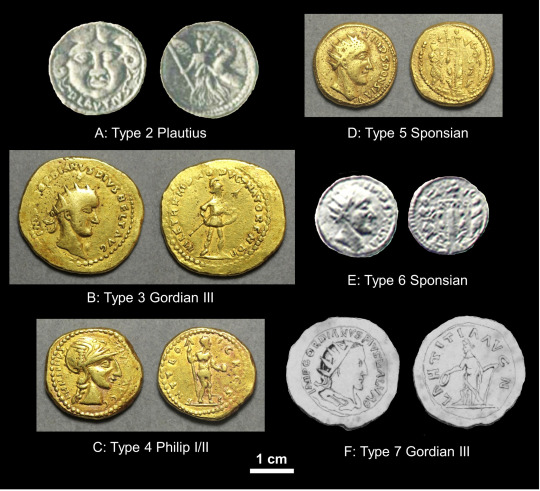

In 1713, The inspector of medals for the holy roman emperor, Carl Gustav Heraeus would note that 8 strange looking gold coins had come into the possession of the Imperial Collection of Vienna. Carl had apparently acquired these coins from the Hapsburg finance minister Johann David von Palm, who in turn had gotten them from a supposed hoard found in Transylvania. The hoard mainly consisted of an assortment of strange types, ranging from a large gold coin of Gordian III to strange "aurei" of Philip that use a republican obverse, and even a whole gold version of an old Republican denarius.

The coins themselves are all very odd, but one type among them stands out for being the strangest of them all, that being the gold coins of the emperor Sponsian, who was unrecorded in history up until the hoard's discovery, and who presumably had all of the hoard coins minted to pay either his soldiers or officials. Sponsian's gold coins are extremely odd to say the least, and the following is a list of all the details about the coin that differ from the normal imperial issues of the time. 1. The weight is extremely heavy for Roman gold coins, the known Sponsian coins range from weighing 9 to 11 grams. No official Roman or barbarian imitation gold coins weigh that much.

2. The obverse of the Sponsian coin is strange in a few ways. As noted above, the weight is far too heavy to be an aureus, therefore it is speculated that the coins are of the binio / double aureus denomination due to the radiate crown on Sponsian's head, which on Roman coins is indicative of a double denomination. It is more likely that they are supposed to be donative coins meant to pay senior officers, although typical donative coins were usually made with spectacular engraving, and the Sponsian coins are just about as far off from that as possible. The way the legend is lumped to one side of the coin is also never seen on any other official imperial 3rd century issues. 3. The reverse is arguably stranger than the obverse, as it uses a very old Republican design from 135 B.C.

This original republican denarius was meant to commemorate a grain donative and struck by a certain Caius Augurinus, whose name can be seen at the top of the reverse "C AVG". The use of republican reverses on 3rd century era coinage is unheard of (especially extremely obscure ones such as this), with the Sponsian coins being the only exception. Could Sponsian be calling back to his republican era ancestor Caius? Not likely. If these coins are from the 3rd century, the most plausible explanation is that whoever had them engraved for Sponsian had the Republican denarius on hand as a reference and assumed that the "C AVG" on the reverse meant "Caesar Augustus". The Philip coins that were found in the hoard support the theory that the engraver had the Caius Augurinus denarius as a model, since those coins use the obverse of the republican denarius for their design.

4. The Sponsian coins are undoubtedly cast, which is typically indicative of a fake coin. The problem with the coins being cast is that no 3rd century coins were ever cast, as all official issues were always struck. There is also no hoard evidence of more Sponsian coins. Another emperor that was proven to exist was Domitian II, who was also brushed off by some numismatists as being a fake (the theory being that his coins were tooled issues of Tetricus) but another example of his coinage was unearthed in a hoard of undoubtedly genuine coins later on, finally proving his existence. If more Sponsian coins are found in a hoard containing genuine coins, it could possibly be evidence that the coins are from antiquity. (it is noteworthy that the coins of Domitian II are not nearly as weird as Sponsian's coins, and are much easier to accept as real). We don't know anything about the initial discovery of the Transylvania hoard and we don't even know exactly how many coins were found, but throughout the 18th century the hoard would be dispersed into collections across Europe. During the period from the hoard's discovery and 2020, many numismatists had the chance to speak on the Sponsian coins. Their theories on the mysterious pieces ranged from the coins being Barbarian imitations, to the coins being blatant 17th century forgeries. But amidst the limited discussion during the years after 1713 surrounding the Sponsian coins, a general aura of mystery still was associated with them. In 2020, light discussion on the Sponsian popped up again, this time on a Coin discussion forum. At this point Sponsian was very obscure, with only one photo of one of his coins being known at the start of the thread, the same photo was the one being used by Wikipedia on their page about Sponsian.

The initial discussion mainly surrounded Sponsian's strange name and trying to find more drawings / photos of the Sponsian coins. In comes Professor Paul Pearson, who finds more photos of the Sponsian coins, and eventually requests the Hunterian museum to take the photo at the very top of this post. It is my belief that Pearson was inspired to write his famous paper on Sponsian because of his interest in this thread. Fast forward to 2022, Pearson's paper comes out and proves that the Sponsian coins are ancient and NOT 17th century fakes. The way Pearson concluded they were real was by analyzing the wear patterns and comparing them to some other genuine gold coins of the period in the same museum. Towards the end of the paper he also theorizes that Sponsian was a rebel in Dacia during the reign of Gallienus, and made these coins to pay his officers. Alright, now I'm going to need you to forget the narrative that Sponsian ever actually existed. See, in order for a newly discovered emperor on a roman coin to even remotely be considered as genuine, the coins bearing their name and image at the very least have to follow the specific patterns that other known 3rd century issues follow. If you're a roman usurper trying to prove legitimacy, one of the first things you do is mint coins bearing your image and name in the typical imperial style to pay your troops. The coins would also have to be similar weights to those of official issue, to make sure they could function properly in the Roman economy. For example, take the emperor Silbannacus. He follows the same story as Sponsian in the sense that he was not recorded in any historical record until the discovery of his coins. But instead of being widely criticized by Numismatists for being a fraud, the majority of the Numismatic community is far less skeptical of his coins for the very reason that they followed all the right patterns when it came to Imperial coinage. There is just way too many weird things going on with the Sponsian coins. All of the right patterns that the Silbannacus and Domitian II coins follow, the Sponsian coins throw out the window. From the coins being far too heavy, the use of the Republican era reverse, the fact that they're cast. Nothing here adds up. There are flaws with Pearson's conclusion about the coins being a genuine product from a 3rd century usurper. Although his analysis of the coin's history is solid, the means of determining the coins are from antiquity kind of fall apart when scrutinized.

For one, you can't prove a coin is ancient just because it has scratches on it that are similar to ones on an ancient coin. There is just no definitive way to date the wear on the Sponsian coins. Wear can also be easily faked, Pearson even admits this in his paper, as he brings up the forger Carl Wilhelm Becker and how he used iron filings to fake wear on his coins as an example. It is also important to remember that they were in various collections during the 300 years since they were found, and during that time there is a possibility that they were handled carelessly by numismatists and others due to the fact proper precautions for handling ancient coins were not in place during those years. The wear could've developed from them. The study done on the earthen deposits is also quite flimsy, there is simply not enough research on deposits in general, and the research conducted on them in Pearson's paper is too surface level to prove much. We don't know how long those deposits take to form, we don't know if they were formed in the ground or during the coin's stay in the Hunterian collection etc etc. It's very silly to immediately jump to the conclusion that Sponsian was real just because of these few flimsy points in the face of all of the things alluding to the coins being fake. During the period after the paper's publication and the media coverage of Sponsian, many rebuttals would be made by numismatists and Roman historians alike, but one series of videos that I followed made by Guy de la Bédoyère covering Sponsian pointed out even more solid evidence against Sponsian. In the last part of his series (and the only one left public on his yt channel) Guy talks about a book that he recently reread written a bit before the Sponsian hoard's discovery by a scholar named John Evelyn. In one of the chapters pertaining to fakes, Evelyn mentions a hoard of heavy gold forgeries imitating Roman issues discovered during the siege of Bonn in 1673. Later on, while listing off Emperors that were commonly faked, he states "and to these add such as borrow the head of some emperor with some fantastic reverse, or enigmatical inscription, which has no relation to the person, or appertain to some other, or seeming to historize some new and extravagant thing, never heard nor read in any good author before". (I highly recommend checking out Guy's full video, I'll have it linked at the end) The Bonn hoard of coins as well as Evelyn's description of fantasy fakes is solid evidence that forgeries similar in style and manufacture of the Sponsian pieces did exist in the 17th and 18th centuries. Although I'm a firm believer that the coins are fake, at this point this mystery technically isn't 100 percent solved until better research on the earthen deposits is conducted, or if a new hoard of Sponsian coins is found alongside genuine issues. Sources linked below, highly recommend reading then / watching them if you're interested in Sponsian.

youtube

youtube

3 notes

·

View notes

Text

Selling Gold in Toronto: Tips for a Smooth Transaction

If you're looking for the Right Way To Sell Gold in Toronto, ensuring a smooth and profitable transaction requires careful consideration. Whether you’re selling gold bars, coins, or looking to buy old jewellery to resell, knowing how to navigate the market is key. At 24 Gold Group Ltd., we help clients get the best value for their gold while offering transparent and trustworthy services.

1. Know the Value of Your Gold

Before selling, it’s crucial to understand the current market price of gold. Gold prices fluctuate daily based on global markets, so checking live rates will give you a better idea of what your gold is worth. Be aware that the purity of your gold—measured in karats—also affects its value.

2. Choose a Reputable Buyer

Toronto has many gold buyers, but not all offer the same level of transparency and fair pricing. Look for a well-established dealer with positive reviews and industry recognition. At 24 Gold Group Ltd., we provide honest assessments, ensuring you get competitive rates.

3. Weigh Your Gold Properly

Gold is bought and sold based on weight, typically in grams or ounces. When visiting a buyer, ensure your gold is weighed using a calibrated and certified scale. This ensures accuracy and fairness in pricing.

4. Understand the Selling Process

Selling gold involves more than just handing over your items and receiving cash. Reputable buyers will assess the gold’s purity, weight, and market value before making an offer. If you’re selling jewellery, factors like design, brand, and gemstone settings can impact the price.

5. Get Multiple Quotes

If you’re unsure about an offer, don’t hesitate to shop around. Visiting multiple buyers allows you to compare prices and choose the best deal. However, beware of offers that seem too good to be true, as they often come with hidden fees.

6. Avoid Mail-In Gold Buyers

While some companies offer mail-in gold-selling services, these transactions can be risky. There’s always a chance of lost shipments or lowball offers that leave you with less than expected. Selling gold in person provides a safer and more transparent experience.

7. Keep Documentation

Always request a receipt or documentation of your sale. This is particularly important for tax purposes or in case you need to reference the transaction later. A professional buyer will provide clear records of the sale.

8. Selling Gold Jewellery

If you’re looking to Buy Old Jewellery to resell or upgrade, consider selling unwanted pieces first. Gold jewellery often holds sentimental value, but if you no longer wear it, selling can provide extra cash or an opportunity to invest in something new.

Sell Your Gold with Confidence

At 24 Gold Group Ltd., we make selling gold in Toronto simple, secure, and profitable. With fair pricing, expert evaluations, and a commitment to customer satisfaction, we ensure a seamless experience.

Want more insights on the right way to sell gold? Read our blog for expert tips and market updates!

0 notes

Text

2025 Gold Price at Dubai: Smart Shopping Tips for Ladies | Hypeladies

Gold Price at Dubai: Expert Smart Shopping Tips for Ladies to Buy in 2025

Dubai, often called the "City of Gold," has long held its position as one of the world's premier destinations for gold trading and purchases. With approximately 20% of the world's gold passing through this glittering emirate, understanding the gold price at Dubai is crucial for both investors and jewelry enthusiasts. In this comprehensive guide, we'll explore everything you need to know about navigating Dubai's golden landscape.

Understanding Gold Prices in Dubai

The fascinating world of Dubai's gold market operates on a delicate balance of global and local factors. While the international gold market sets the baseline for Dubai gold prices, several unique aspects make the emirate's pricing structure particularly attractive to buyers worldwide. How Dubai Gold Prices Are Determined ? The gold price at Dubai is primarily influenced by the international gold market, which is quoted in US dollars per ounce. However, local prices are typically displayed in Arab Emirates Dirham (AED) per gram, making it essential to understand both metrics. Here's a breakdown of the pricing structure: Base Price Components: - International market rate (spot price) - Currency exchange rates - Local market premiums - Making charges (for jewelry) What makes Dubai's gold market unique is its tax-free status and competitive pricing structure. While most global markets add significant taxes and premiums to gold purchases, Dubai maintains minimal markups, typically ranging from 0.5% to 1% above the international rate for pure gold bars. Daily Price Fluctuations in Dubai's Gold Market Gold prices in Dubai are updated multiple times throughout the trading day, reflecting real-time changes in the global market. Local dealers receive price updates through the Dubai Gold & Jewellery Group (DGJG), which helps maintain consistency across the market. In 2024, we've seen price fluctuations ranging from: - Morning trading: First update around 8:30 AM GST - Mid-day adjustments: Updates around 1:30 PM GST - Evening revisions: Final updates around 5:00 PM GST Key Market Influences: - Global economic indicators - Political events - Currency fluctuations - Local demand cycles - Tourism patterns Market Dynamics and Price Factors Several unique factors affect the gold price at Dubai: - Tourism Impact: - Peak season (November to March): Prices may include higher premiums - Off-peak season: More room for negotiation - Festival periods: Increased demand can drive up making charges - Local Market Conditions: - Wedding season demand - Religious festivals (particularly Diwali and Eid) - Regional economic stability - Local consumer confidence - Global Factors: - International gold prices - US dollar strength - Global economic conditions - Geopolitical events Recent market analysis shows that Dubai's gold prices have maintained a competitive edge over other major gold markets. For instance, in early 2025, the average markup over international prices was just 0.75%, compared to 2-3% in many Western markets.

Dubai Gold Price Calculator: Making Sense of Rates and Values

2025 Gold Price at Dubai Understanding how to calculate gold prices in Dubai is essential for making informed purchases. Whether you're interested in pure gold bars or intricate jewelry, knowing the pricing structure helps you get the best value for your investment. Understanding Gold Karats and Purity In Dubai's gold market, you'll encounter different purity levels, each affecting the final price: 24K Gold (999.9 purity) - Purest form of gold available - Used primarily in bars and coins - Price per gram serves as the base rate - No additional metals mixed in 22K Gold (916.7 purity) - Most popular for jewelry in Dubai - Approximately 91.67% pure gold - More durable than 24K - Price calculation: (24K price × 0.916) 18K Gold (750 purity) - Common in contemporary jewelry - 75% pure gold - More affordable option - Price calculation: (24K price × 0.750) Making Charges and Additional Costs Making charges significantly impact the final price of gold jewelry in Dubai. These charges vary based on: - Design Complexity: - Simple designs: 3-8% of gold value - Medium complexity: 8-15% of gold value - Intricate designs: 15-25% of gold value - Custom pieces: Can exceed 25% - Retailer Location: - Gold Souk: Generally lower making charges - Mall outlets: Higher making charges - Boutique stores: Premium charges Sample Price Calculation Formula To calculate the final price of gold jewelry in Dubai, use this formula: Final Price = (Gold weight in grams × Current gold rate × Purity percentage) + Making charges + VAT (if applicable) Example Calculation: For a 22K gold necklace weighing 20 grams with 10% making charges: - Current 24K gold rate: 220 AED/gram - Purity percentage: 0.916 (22K) - Weight: 20 grams - Making charges: 10% Base gold cost = 20 × 220 × 0.916 = 4,030.40 AED Making charges = 4,030.40 × 0.10 = 403.04 AED Final price = 4,030.40 + 403.04 = 4,433.44 AED Price Differences Between Products Understanding price variations across different gold products helps in making informed decisions: Gold Bars: - Lowest making charges (0.5-1%) - Best value for investment - Usually sold in 24K only - Available in various weights (1g to 1kg) Gold Coins: - Slightly higher premium than bars - Collectible value consideration - Popular weights: 1g, 5g, 10g, 1oz Jewelry: - Highest making charges - Design value addition - Labor costs included - Variety of purity options

Best Time to Buy Gold in Dubai: Seasonal Guide and Market Trends

2025 Gold Price at Dubai Understanding the optimal timing for gold purchases in Dubai can lead to significant savings. Let's explore the various factors that influence pricing throughout the year and the best strategies for timing your purchase. Seasonal Price Variations Dubai's gold market experiences distinct seasonal patterns that affect prices: Peak Tourist Season (November to March) - Higher foot traffic in gold markets - Increased retail premiums - Less room for negotiation - Better selection of designs Off-Peak Season (June to September) - Lower tourist numbers - More competitive pricing - Better bargaining opportunities - Potential seasonal discounts (20-30% off making charges) Festival Impact on Gold Rates Key festivals significantly influence gold prices in Dubai: Dubai Shopping Festival (January-February) - Special promotions and discounts - Raffle draws and prizes - Reduced making charges - Limited-time offers Religious and Cultural Festivals - Diwali (October/November) - High demand period - Premium prices - Extensive new collections - Special festival designs - Eid Celebrations - Increased local buying - New collection launches - Gift-buying season - Premium pricing during Eid al-Fitr Best Days and Times to Buy Strategic timing can help secure better deals: Weekly Timing: - Monday mornings: Often see lower prices after weekend adjustments - Mid-week (Tuesday-Thursday): Stable prices - Friday: Limited trading hours - Saturday: Higher tourist traffic Daily Timing: - Early morning (8:30-10:00 AM): Fresh price updates - Mid-afternoon (2:00-4:00 PM): Usually stable prices - Evening (after 6:00 PM): Possible end-of-day adjustments Market Monitoring Tips To track gold prices effectively in Dubai: - Digital Tools: - Dubai Gold & Jewellery Group website - Gold price tracking apps - Local banking apps with gold rate features - International gold market websites - Price Alerts: - Set up notifications for price drops - Monitor weekly trends - Track currency exchange rates - Follow market news - Historical Data Analysis (2024-2025 Trends): Quarter | Average Price (AED/gram) | Market Trend Q1 2024 | 215 | Upward Q2 2024 | 220 | Stable Q3 2024 | 228 | Upward Q4 2024 | 235 | Volatile Q1 2025 | 240 | Stable Expert Buying Strategy For optimal pricing, consider this recommended approach: - Research Phase: - Monitor prices for 2-3 weeks - Compare rates across retailers - Understand current market trends - Check historical price patterns - Timing Considerations: - Avoid major festivals - Shop during off-peak tourist seasons - Consider early weekday purchases - Watch for promotional periods - Price Negotiation: - Best during quiet periods - More effective in traditional souks - Focus on making charges - Bundle purchases for better deals

Where to Buy Gold in Dubai: A Comprehensive Guide to the Best Locations

Dubai offers several renowned locations for gold shopping, each with its unique advantages and characteristics. Let's explore the most prominent gold shopping destinations in detail. Dubai Gold Souk: The Traditional Heart of Gold Trading The Dubai Gold Souk, located in Deira, stands as the city's most historic and authentic gold shopping destination. This traditional market hosts over 380 retailers, making it one of the largest gold markets globally. Key Features of Dubai Gold Souk: - Operating hours: 10:00 AM to 10:00 PM - Closed on Friday mornings - Over 10 tons of gold present at any time - Competitive prices due to high competition Notable Retailers: - Deira Gold Souk - Atlas Jewellery - Joy Alukkas - Malabar Gold & Diamonds - Kalyan Jewellers Shopping Tips: - Best for bulk purchases - Excellent bargaining opportunities - Wide variety of traditional designs - Lower making charges compared to malls Gold & Diamond Park: Modern Luxury Shopping Located on Sheikh Zayed Road, the Gold & Diamond Park offers a more contemporary shopping experience in an air-conditioned environment. Distinctive Features: - 90+ specialized retailers - Modern shopping environment - Custom design services - Manufacturing facilities on-site Benefits: - Fixed price transparency - Quality certification guaranteed - Professional service standards - Modern designs and collections Dubai Mall Gold Shops: Premium Retail Experience The Dubai Mall hosts numerous high-end jewelry retailers, offering a luxury shopping experience with international brands. Notable Features: - Location Benefits: - Central location - Premium shopping environment - International brands - Extended shopping hours - Popular Retailers: - Cartier - Tiffany & Co. - Local premium jewelers - Designer boutiques Price Comparison Across Locations: Location | Making Charges | Price Premium | Bargaining Scope Gold Souk | 4-12% | Lowest | High Gold & Diamond | 8-15% | Medium | Medium Dubai Mall | 12-25% | Highest | Low Speciality Areas and Unique Offerings Meena Bazaar: - Alternative to Gold Souk - Lower tourist traffic - Competitive prices - Specialized in Indian jewelry Satwa Gold Markets: - Local community favorite - Moderate prices - Good for small purchases - Personalized service Location-Specific Shopping Tips - Gold Souk Shopping: - Visit during weekday mornings - Compare prices across shops - Bargain confidently - Check gold purity certificates - Mall Shopping: - Best for branded jewelry - Fixed prices but seasonal sales - Premium making charges - Excellent after-sales service - Gold & Diamond Park: - Ideal for custom designs - Professional craftsmanship - Mid-range pricing - Good for engagement rings Expert Recommendations for Different Buyer Types: Buyer Type | Recommended Location | Reason Bulk Buyers | Gold Souk | Best wholesale prices Tourists | Dubai Mall | Convenient location Custom Design | Gold & Diamond Park | Specialized services Traditional | Meena Bazaar | Authentic designs Budget-conscious | Satwa Markets | Competitive pricing

Gold Investment Options in Dubai: A Strategic Guide

2025 Gold Price at Dubai Dubai's status as a global gold hub makes it an attractive destination for gold investment. Let's explore the various investment options available and how to maximize your returns. Gold Bars: The Pure Investment Choice Gold bars represent the most straightforward and cost-effective way to invest in physical gold in Dubai. Available Options: - Cast Bars: - Most economical choice - Available weights: 1g to 1kg - Lower premium over spot price - Best for long-term investment - Minted Bars: - Premium finish - Collector's value - Higher manufacturing cost - Popular sizes: 50g, 100g, 250g Price Comparison by Weight (February 2025): Weight | Cast Bar (AED) | Minted Bar (AED) | Premium 1g | 245 | 255 | 4% 10g | 2,425 | 2,475 | 2% 50g | 12,050 | 12,200 | 1.2% 100g | 24,000 | 24,200 | 0.8% 1kg | 238,000 | 239,500 | 0.6% Gold Coins: Combining Investment and Collectible Value Gold coins offer a unique combination of investment potential and numismatic value. Popular Options: - Emirates Gold Coins - Canadian Maple Leaf - American Eagle - South African Krugerrand Investment Considerations: - Advantages: - Easy to store and transport - Widely recognized - Historical value appreciation - Good liquidity - Disadvantages: - Higher premiums than bars - Storage concerns - Authentication requirements - Limited size options Storage Solutions in Dubai Secure storage is crucial for gold investments. Dubai offers several options: Bank Safe Deposit Boxes: - Annual fees: 500-2000 AED - Size variations available - Insurance included - 24/7 security Private Vault Facilities: - Enhanced security features - Flexible access hours - Higher insurance limits - More privacy Insurance Considerations Protecting your gold investment is crucial: - Insurance Types: - Basic coverage (included with storage) - Comprehensive coverage - Transportation insurance - Personal possession coverage - Coverage Costs: - 0.5-1% of gold value annually - Additional rider options - Deductible choices - Multi-year discounts Investment Strategy Tips Short-term Investment (1-2 years): - Focus on smaller denominations - Consider coins for quick sales - Monitor market actively - Maintain flexible storage options Long-term Investment (5+ years): - Larger bars for better value - Secure storage solutions - Regular market monitoring - Documentation maintenance Risk Management: - Authentication verification - Diversification across products - Regular market analysis - Professional storage solutions

Tips for Buying Gold in Dubai: Essential Guidelines and Precautions

When purchasing gold in Dubai, following proper guidelines ensures a secure and satisfactory transaction. Here's a comprehensive guide to help you make informed decisions. Authentication and Certification Verifying the authenticity of your gold purchase is crucial in Dubai's market. Read the full article

0 notes

Text

A Beginner’s Guide to Buying Physical Gold Bullion

1. Understanding Gold Bullion

Gold bullion refers to gold in its physical form, usually as bars or coins, prized for its purity and weight. Unlike paper assets, it’s a physical store of value, offering a hedge against inflation and economic downturns.

2. Deciding Why You’re Buying Gold

Understanding your motivation is key. Gold bullion is ideal for long-term investors who seek stability, as it tends to retain value over time. It's essential to know whether you’re investing to diversify your assets, protect against inflation, or secure a tangible legacy for the future.

3. Types of Gold Bullion

Gold Bars: Bars are available in various sizes, ranging from 1 gram to 1 kilogram. They often have lower premiums, meaning they’re closer to market prices, making them cost-effective for large investments.

Gold Coins: Coins, like the Canadian Maple Leaf or American Eagle, are popular with collectors and investors. They may have higher premiums but are easier to liquidate and handle.

4. Spot Price and Premiums

Spot Price: This is the current market price of gold per ounce. It fluctuates based on supply, demand, and economic conditions.

Premiums: Retailers charge a premium over the spot price for minting, handling, and shipping. Premiums are lower on bars than coins.

5. Where to Buy Gold Bullion

Local Dealers: Buying locally can save on shipping costs and allow for in-person assessment. However, always verify the dealer’s reputation.

Online Dealers: Reputable online platforms offer extensive inventories and often competitive prices. Look for trusted dealers with secure payment options and customer reviews.

Banks: Some banks offer gold bullion, though often at a higher premium. Check with local financial institutions to explore options.

6. Storing Your Gold

Home Storage: Ideal for small quantities, secure storage options like safes are essential to prevent theft.

Bank Vaults: For larger amounts, bank safety deposit boxes provide high security but may involve fees.

Secure Vault Facilities: Third-party facilities offer insured storage and easy access for frequent trades.

7. Authenticity and Purity Checks

Assay Certificates: These certify the purity of the gold and provide peace of mind.

Official Mint Marks: Many gold pieces come with mint stamps indicating purity and origin.

Testing Kits: For added security, you can purchase testing kits or visit a jeweler to verify purity.

8. Selling Your Gold

Selling gold can be done through dealers, online platforms, or auctions. Keep all documentation to ensure authenticity, and aim to sell when market prices favor higher returns.

9. Tax Implications and Legal Considerations

Research the tax implications in your country, as some forms of gold are subject to capital gains taxes. Also, verify any legal requirements, as some countries regulate large gold purchases.

10. Market Trends and Timing

Staying informed on market trends can help you time your purchase effectively. Watching economic indicators, such as inflation rates or stock market performance, often provides insight into when gold prices may rise or stabilize.

Conclusion

Gold bullion can be a smart, stable investment for those prepared to research and understand the market. Buy physical gold bullion Canada By focusing on trusted dealers, secure storage, and market trends, you can make your bullion investment a valuable component of your financial future.

0 notes

Text

Understanding the Price of 10 Gram Silver Coins

When it comes to investing in precious metals, silver holds a unique position. Known for its industrial applications and its status as a store of value, silver coins are a popular choice among both novice and experienced investors. 10 gram silver coin price One of the most sought-after options is the 10-gram silver coin.

What is a 10 Gram Silver Coin?

A 10-gram silver coin is a compact yet valuable investment option. Typically made of .999 fine silver, these coins often carry a nominal face value, but their real worth is tied to the current market price of silver. They are ideal for investors looking to accumulate silver in smaller increments without committing to larger purchases.

Factors Influencing the Price of 10 Gram Silver Coins

Market Price of Silver: The primary factor affecting the price of any silver coin is the spot price of silver itself. This price fluctuates based on market demand, geopolitical events, and economic conditions.

Minting and Premiums: Coins from reputable mints, such as the Royal Canadian Mint, may carry a premium over the spot price due to their quality and craftsmanship. This premium can vary based on demand, rarity, and the coin's design.

Collectibility: Some 10-gram silver coins are produced as limited editions or commemorative issues, which can drive up their value among collectors. The coin's condition and rarity will also impact its market price.

Economic Trends: During times of economic uncertainty, silver often becomes a safe-haven investment, leading to increased demand and potentially higher prices.

Current Pricing Trends

As of the latest market analysis, the price of a 10-gram silver coin typically ranges from $8 to $12 CAD above the current spot price of silver. This can vary based on the factors mentioned above. It’s advisable for potential buyers to monitor the silver market closely and compare prices from different dealers.

Why Invest in 10 Gram Silver Coins?

Investing in 10-gram silver coins offers several advantages:

Affordability: Smaller denominations make it easier for investors to enter the market without spending large sums of money.

Portability: These coins are easy to store and transport, making them a convenient option for investors.

Liquidity: Silver coins are widely recognized and can be easily bought and sold, providing liquidity to your investment.

Hedging Against Inflation: As a physical asset, silver can act as a hedge against inflation and currency devaluation.

Where to Buy 10 Gram Silver Coins

For those interested in purchasing 10-gram silver coins, reputable dealers are crucial. Gold Stock Canada is a trusted source for buying silver coins and other precious metals. With competitive pricing and a commitment to customer satisfaction, they provide valuable resources for both new and seasoned investors.

Conclusion

Investing in 10-gram silver coins can be a strategic move for those looking to diversify their portfolios and hedge against economic uncertainties. 10 gram silver coin price By understanding the factors that influence their pricing and staying informed about market trends, you can make well-informed investment decisions. For more information on buying silver coins, visit Gold Stock Canada.

0 notes

Link

Check out this listing I just added to my Poshmark closet: 18K Yellow Gold Caciques De Venezuela 21K Gold Coin Link Bracelet 6.50" Length.

0 notes

Text

Invest in confidence with our 8-gram 24K gold coin – a timeless symbol of security and prosperity. Invest in pure gold, where each gram reflects a commitment to your financial well-being.

#buy 8 gram 24K gold coin#buy 8 gram 24K gold coin online#buy 8 gram 24K gold coin in dubai#8 gram 24 K gold coin rate in dubai

0 notes

Text

10 Coins That Are Worth More Than You Think

You may have heard of people making a fortune with rare coins, but you’d be surprised to learn just how valuable some ordinary-looking ones can be! In particular, there are several US coins from the 19th and 20th centuries that can fetch high prices. Classics such as pillar dollars or Carson City Morgan Dollars are highly sought-after by dedicated collectors due to their historical significance.

While these coins aren’t easily found in circulation today, any lucky individual who does stumble across them could find themselves sitting on quite a fortune! Even if they don’t look particularly special at first glance, it pays off to verify coinage authenticity before selling.

1. Spanish Colonial Pillar Dollar

The Spanish Colonial Pillar Dollar is an incredibly valuable coin, especially for US collectors! Minted between 1732 and 1821 in several countries that were formerly part of Spain, these coins feature two columns on their reverse side which represent a religious or social unity.

Depending on its condition, it can be worth anywhere from $20 to thousands if found in pristine quality. The most sought-after pillar dollar is the Mexico City minted 8 escudos piece containing 16 grams of pure gold, with around 80 known specimens available today!

2. Carson City Morgan Silver Dollars

Carson City Morgan Silver Dollars were minted in the United States from 1878 to 1893 at a branch location called “Carson City.” Collectors are highly attracted to them because they carry extra significance. Often, these rare coins can reach high prices when sold at auction.

Furthermore, there’s always an exciting demand for these particular dollars due to their age and limited mintage quantity. Experts suggest that buyers should focus mainly on high-quality conditions, as this will determine the worthiness more than any other factor, like strike or design features alone.

3. Liberty Seated Half Dimes

The Liberty Seated Half Dime is an important coin in American history. You may come across these coins at your local antique shop or coin collector’s fairs, and they can be quite valuable depending on the level of scarcity. These silver half-dimes featured a seated figure of Lady Liberty looking leftward.

She held a staff with our nation’s Capitol as its background. This made it one of the earliest United States imprints to feature this powerful woman who symbolizes freedom for all Americans, regardless of gender, race, and creed. With careful research, you might find that some rare varieties are worth more than expected, giving potential buyers solid investment opportunities when exploring their variety!

4. Buffalo Nickels with Errors or Varieties

You may be surprised to discover that Buffalo Nickels from 1913-1938 can have errors, too. They’re also hard to come by, so they tend to go for higher values than most coins of their kind. Look closely at the mintmark position, off-center strikes, or repunched dates; all of these features could add value when discovered.

Furthermore, Liberty Nickels with no cents signs on them, proof coins, will command a premium over regular nickels, as well!

5. Early American Copper Cents

You can find Early American Copper Cents from the late 1800s and early 1900s in many locations. These coins were minted with a “wreath” or “chain back.” They also come in three different sizes: large cents, half cents, and Flying Eagles. It’s important to note that these coins are becoming increasingly rare as time goes on, so it pays off to keep your eyes peeled for them!

Additionally, you’ll want to make sure all of your copper pennies have survived since they’ve been passed around through generations of people, so their condition is key when evaluating how much they’re worth. Ultimately, though, because these penny types are highly sought after by collectors, if you happen to be lucky enough to land yourself one, then get ready for an interesting ride!

6. Indian Head Pennies from the 19th Century

Indian Head Penny from the 19th century, which was minted from 1859 to 1909, is certainly one of those coins that are worth more than you initially think. Many collectors seek these coins because of their rarity and historical significance as U.S.

Currency during a period when America was going through significant changes in terms of its industrialization and urbanization drive prior to World War I threats emerging in Europe. The coin shows Lady Liberty on the front, while there’s an image depicting a wreath with “ONE CENT” written at the bottom and above it on the reverse side. These old pennies command higher prices, usually depending on quality, availability, and edition year.

7. Lincoln Wheat Cent Coins

You may think all pennies are worth the same, but Lincoln Wheat Cent Coins have a hidden value. Individuals with an eye for rare error coins in circulation could find themselves with some big bucks if they stumble upon certain errors such as tripled dies or more valuable doubled-die Error Pennies. This means when you come across one of these prized cents, it’s important to enhance your coin collection and cash out on its greater monetary value worth being auctioned by professional numismatists.

The key is to be aware of what makes them so special. Focus on details like years issued and mint marks that will increase their intrinsic values.

8. 20-cent Pieces of 1876

You should definitely keep an eye out for those 20-cent pieces of 1876, also known as the CC Liberty Seated. They’re incredibly rare and valuable due to how few were made, with mints in Carson City only producing 745 coins total! In fact, one such coin can fetch up to $20,000 or more, depending on its condition.

As a result, you’ll want to ensure that if you find one, it’s carefully preserved and stored safely until ready for sale. Also, look into having your potential treasure professionally evaluated so you get the best price possible when selling it. Prices vary immensely based on condition, after all!

9. Three-cent Pieces with Shield Reverse

For numismatists with a penchant for American currency, three-cent pieces with a shield reverse are worth checking out. These coins were first minted in 1865 and feature unique designs that draw attention to the obverse of the coin, displaying Lady Liberty. Shield reverses can be found on silver and nickel versions of three-cent pieces, ending in 1873.

They also boast rare varieties, including those struck over errors or misprinted planchets from other denominations! Collectors must pay close attention when looking at these coins, as some may contain valuable features like repunched dates, overdates, or off-metal strikings, all of which greatly increase their value.

10. Unexpected Values From Kennedy Halves

You may come across valuable coins in unexpected places, like Kennedy halves or rare coin auctions. Such coins could fetch a good deal if sold to the right person at the right time. It’s also wise to know popular mint marks for commemorative gold coins and classic US gold quarter eagles that are of significant value.

Moreover, remember that some rare dates and varieties can be worth even more than commonly circulated denominations! Keep your eyes open for all potential opportunities; you never know what kind of hidden treasure awaits around every corner!

There are many coins across the world that can be worth more than you think. From classic pillar dollars to Carson City Morgan Dollars and half dimes, these rare pieces of history can command high prices with collectors. Whether you’re looking for a great investment or just something interesting to feature in your collection, any of these ten coins could fit into Blackwell Auctions‘ selection!

Source: https://blackwellauctions.com/10-coins-that-are-worth-more-than-you-think/

1 note

·

View note

Text

Celebrate the essence of pure gold with Auriz Gold Refinery's 8-gram coin - A promise in every precious gram.

Buy now at https://aurizrefinery.com/

0 notes

Link

The price of a gold coin is not just based on the broader economy. There are a variety of other factors that help determine the value of a gold coin.

0 notes

Text

A Beginner Guide to Buying Physical Gold Bullion

Buying physical gold bullion is a valuable investment for those looking to diversify their portfolios with a tangible asset. Here’s a comprehensive guide to help you make informed decisions.

1. Understanding Gold Bullion

Gold bullion refers to gold in its physical form, usually as bars or coins, prized for its purity and weight. Unlike paper assets, it’s a physical store of value, offering a hedge against inflation and economic downturns.

2. Deciding Why You’re Buying Gold

Understanding your motivation is key. Gold bullion is ideal for long-term investors who seek stability, as it tends to retain value over time. It's essential to know whether you’re investing to diversify your assets, protect against inflation, or secure a tangible legacy for the future.

3. Types of Gold Bullion

Gold Bars: Bars are available in various sizes, ranging from 1 gram to 1 kilogram. They often have lower premiums, meaning they’re closer to market prices, making them cost-effective for large investments.

Gold Coins: Coins, like the Canadian Maple Leaf or American Eagle, are popular with collectors and investors. They may have higher premiums but are easier to liquidate and handle.

4. Spot Price and Premiums

Spot Price: This is the current market price of gold per ounce. It fluctuates based on supply, demand, and economic conditions.

Premiums: Retailers charge a premium over the spot price for minting, handling, and shipping. Premiums are lower on bars than coins.

5. Where to Buy Gold Bullion

Local Dealers: Buying locally can save on shipping costs and allow for in-person assessment. However, always verify the dealer’s reputation.

Online Dealers: Reputable online platforms offer extensive inventories and often competitive prices. Look for trusted dealers with secure payment options and customer reviews.

Banks: Some banks offer gold bullion, though often at a higher premium. Check with local financial institutions to explore options.

6. Storing Your Gold

Home Storage: Ideal for small quantities, secure storage options like safes are essential to prevent theft.

Bank Vaults: For larger amounts, bank safety deposit boxes provide high security but may involve fees.

Secure Vault Facilities: Third-party facilities offer insured storage and easy access for frequent trades.

7. Authenticity and Purity Checks

Assay Certificates: These certify the purity of the gold and provide peace of mind.

Official Mint Marks: Many gold pieces come with mint stamps indicating purity and origin.

Testing Kits: For added security, you can purchase testing kits or visit a jeweler to verify purity.

8. Selling Your Gold

Selling gold can be done through dealers, online platforms, or auctions. Keep all documentation to ensure authenticity, and aim to sell when market prices favor higher returns.

9. Tax Implications and Legal Considerations

Research the tax implications in your country, as some forms of gold are subject to capital gains taxes. Also, verify any legal requirements, as some countries regulate large gold purchases.

10. Market Trends and Timing

Staying informed on market trends can help you time your purchase effectively. Watching economic indicators, such as inflation rates or stock market performance, often provides insight into when gold prices may rise or stabilize.

Conclusion

Gold bullion can be a smart, Buy physical gold bullion Canada stable investment for those prepared to research and understand the market. By focusing on trusted dealers, secure storage, and market trends, you can make your bullion investment a valuable component of your financial future.

Investing wisely in gold offers long-term stability and security.

0 notes

Text

british sovereign gold coin | Goldstockcanada.com

Invest in the timeless elegance of the British Sovereign Gold Coin through Gold Stock Canada. Our 8-gram Gold British Sovereign Coin captures the heritage and prestige of British coinage. Add a touch of history to your investment portfolio with this exquisite coin: British Sovereign Gold Coin - Gold Stock Canada

british sovereign gold coin

0 notes