#400G Optical Transceivers Market

Explore tagged Tumblr posts

Text

MTP/MPO Fiber Optic Cable: Types and Their Applications

With ever-greater bandwidths and network connections to deal with in data centers, traditional duplex fiber patch cords like LC fiber patch cords no longer meet the demands. To solve this issue, MTP/MPO fiber optic cable that houses more fibers in a multi-fiber MTP/MPO connector was introduced in the market as a practical solution for 40G/100G/400G high-density cabling in data centers. This article will introduce different MTP/MPO cable types and their applications.

What is MTP/MPO Cable?

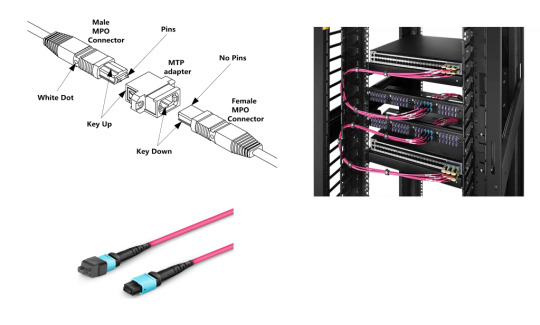

MPO (multi-fiber push-on) is the first generation of clip-clamping multi-core fiber optic connectors. MTP is an advanced version of MPO with the better mechanical and optical performance. They look similar and are fully compatible and interchangeable.

MTP/MPO cable consists of MTP/MPO connector and optical fiber. MTP/MPO connector has a female type (without pins) or a male type (with pins). MTP/MPO connector increases the fiber optic cable density and saves circuit card and rack space, which is well suited for current data center cabling and future network speed upgrades.

MTP/MPO Cable Types

MTP/MPO cable types are classified based on function, polarity, fiber count, fiber mode, and jacket rating.

By Function

Based on function, MPO/MTP cable type is divided into MTP/MPO trunk cable, MTP/MPO breakout cable, and MTP/MPO conversion cable.

MTP/MPO Trunk Cable

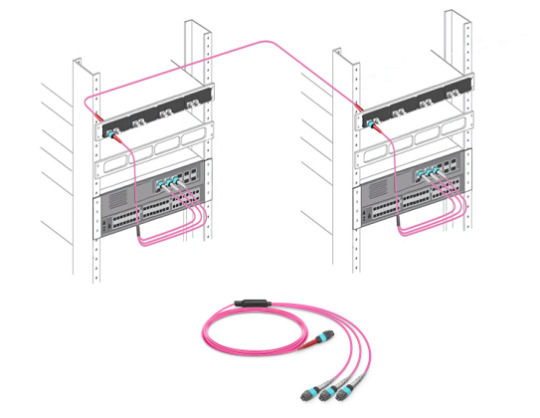

MTP/MPO trunk cable is terminated with an MTP/MPO connector (female/male) on both ends, which is available in 8-144 fiber counts for users’ choices. Typically, MTP/MPO trunk cable is ideal for creating a structured cabling system, including backbone and horizontal interconnections such as 40G-40G and 100G-100G direct connections.

2.MTP/MPO Breakout Cable

MTP/MPO breakout cable (aka. harness cable or fanout cable) is terminated with a female/male MTP/MPO connector on one end and 4/6/8/12 duplex LC/FC/SC/ST connectors on the other end, such as 8-fiber MTP/MPO to 4 LC harness cables and 12-fiber MTP/MPO to 6 LC harness cables. Typically, MTP/MPO breakout cable is ideal for short-range 10G-40G and 25G-100G direct connections or for connecting backbone assemblies to a rack system in the high-density backbone cabling.

3.MTP/MPO Conversion Cable

MTP/MPO conversion cable has the same fanout design as MTP/MPO breakout cable but is different in fiber counts and types. MTP/MPO conversion cable is terminated with MTP/MPO connectors on both ends. MTP/MPO conversion cable is available in 24-fiber to 2×12-fiber, 24-fiber to 3×8-fiber, and 2×12-fiber to 3×8-fiber types, and is ideal for 10G-40G, 40G-40G, 40G-100G, and 40G-120G connections, which eliminate fiber wasting and largely increase the flexibility of the MTP/MPO cabling system.

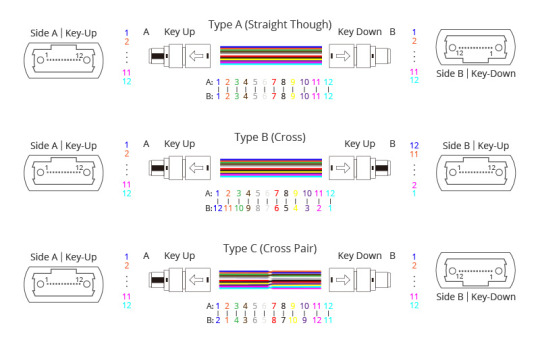

By Polarity

Polarity refers to the difference between the optical transmitters and receivers at both ends of the fiber link. Due to the special design of MTP/MPO connectors, polarity issues must be addressed in high-density MTP/MPO cabling systems. To guarantee the correct polarity of the optical path, the TIA 568 standard defines three connection methods, called Type A, Type B, and Type C. The cables of the three MTP/MPO connector types have different structures.

By Fiber Count

Based on fiber count, MTP/MPO cable type is divided into 8/12/16/24 fiber. The 8-fiber MTP/MPO cable can transmit the same data rate as 12-fiber, but with lower cost and insertion loss, making it a more cost-effective solution. 12-fiber MTP/MPO cable is the earliest developed and most commonly used solution in 10G-40G and 40G-100G connections. If it is used in 40G QSFP+ or 100G QSFP28 transceivers, 4 fibers will be idle, resulting in low fiber utilization.16-fiber MTP/MPO is designed for 800G QSFP-DD/OSFP DR8 and 800G OSFP XDR8 optics direct connection and supporting 800G transmission for hyperscale data center. 24-fiber fiber MTP/MPO cable is used to establish a 100GBASE-SR10 connection or 400G connection between CFP and CFP transceivers.

By Fiber Mode

Based on fiber mode, MTP/MPO cable includes single-mode (SM) and multi-mode (MM). SM MTP/MPO cable is suitable for long-distance transmissions, such as in metropolitan area networks (MANs) and passive optical networks PONs (PONs), with less modal dispersion, and it is available in OS2 type. While MM MTP/MPO cable is suitable for short-distance transmission, allowing 40 Git/s maximum transmission distance of 100m or 150m, and it is available in OM3/OM4 types.

By Jacket Rating

According to different fire rating requirements, the jackets of MTP/MPO cable types are divided into low smoke zero halogen (LSZH), optical fiber non-conductive plenum (OFNP), communications multipurpose cable plenum (CMP), etc. LSZH MTP/MPO cable is free of halogenated materials (toxic and corrosive during combustion), provides better protection for personnel and equipment in a fire, and is suitable for closed places. OFNP MTP/MPO cable contains no electrically conductive elements and is designed with the highest fire rating, which can be installed in ducts, plenums, and other spaces for building airflow. CMP MTP/MPO cable can restrict flame propagation and smoke exhaust rate during a fire, which is suitable for plenum spaces, where air circulation for heating and air conditioning systems are facilitated.

Conclusion

MTP/MPO cables provide stable transmission, high performance, high-density cabling for various environments, and prevent network bottlenecks, reduce network latency, and expand bandwidth and scalability for future network expansion. Sun Telecom provides total and customized solutions of fiber optic products to the global market. Contact us if you have any needs.

2 notes

·

View notes

Text

The Optical Transceiver Market is projected to grow from USD 10,055 million in 2024 to USD 26,166.87 million by 2032, at a compound annual growth rate (CAGR) of 12.70% during the forecast period. The optical transceiver market has seen significant growth in recent years, driven by rising data traffic, the expansion of communication networks, and the rapid adoption of cloud computing, 5G technology, and data centers. As a fundamental component in modern telecommunication systems, optical transceivers enable high-speed data transmission over optical fibers by converting electrical signals into optical signals and vice versa. These devices play a pivotal role in fiber-optic communication, supporting everything from data centers to enterprise networks and telecommunication providers.

Browse the full report at https://www.credenceresearch.com/report/optical-transceiver-market

Market Overview

An optical transceiver is a modular device that is both a transmitter and receiver of optical signals, allowing for bidirectional data communication. Typically, these devices are deployed in networking hardware like switches and routers to enable high-speed data transmission over fiber optic cables. With the shift towards high-bandwidth applications, optical transceivers have become indispensable for meeting the demand for greater network capacity and faster communication.

Key Growth Drivers

Several key factors are fueling the growth of the optical transceiver market:

1. Increasing Data Traffic: The exponential growth of internet users, the expansion of smart devices, and the rise of video streaming, online gaming, and other bandwidth-intensive applications are driving unprecedented demand for data transmission capacity. Optical transceivers offer the high-speed, long-distance transmission needed to keep pace with this growth.

2. Expansion of Data Centers: The rapid expansion of cloud computing services, coupled with the digital transformation of enterprises, has led to the proliferation of data centers globally. Optical transceivers are essential components in the architecture of these data centers, allowing them to handle massive volumes of data. As more businesses migrate to cloud platforms, demand for optical transceivers is set to rise.

3. 5G Rollout: The advent of 5G technology is revolutionizing mobile communication by providing faster speeds, lower latency, and higher data capacity. To support this, telecom networks require robust infrastructure capable of managing high-bandwidth, high-speed data transmission over long distances, which optical transceivers provide. With many countries accelerating their 5G rollout, the demand for optical transceivers is expected to grow substantially.

4. IoT and Smart Cities: The Internet of Things (IoT) and smart city initiatives are driving a surge in connected devices and the need for real-time data processing. Optical transceivers help manage the massive data flow generated by IoT devices, ensuring low-latency, high-speed transmission between devices and networks. This sector offers enormous potential for market expansion.

5. Advancements in Optical Technology: Technological advancements, such as the development of compact and energy-efficient optical transceivers, have lowered operational costs while improving performance. Innovations like 400G and 800G transceivers are enabling data centers to boost their transmission rates, making them ideal for supporting future high-capacity applications.

Regional Insights

North America and Asia-Pacific are the leading markets for optical transceivers. In North America, the presence of major cloud service providers, tech companies, and the rapid deployment of 5G networks are key drivers. Asia-Pacific, led by China, Japan, and South Korea, is witnessing rapid growth in telecommunications infrastructure, large-scale data center expansion, and government-backed smart city projects.

Challenges and Opportunities

Despite its growth, the optical transceiver market faces certain challenges. The high cost of installation and maintenance of optical communication networks can act as a deterrent to adoption. Additionally, the industry is experiencing supply chain constraints and shortages of critical components, which have been exacerbated by the global semiconductor crisis.

However, the market also presents numerous opportunities. The ongoing development of 5G networks, rising adoption of AI and machine learning, and increasing investments in smart infrastructure provide fertile ground for future growth. The shift towards 400G and 800G transceivers will open up new revenue streams for companies investing in cutting-edge technology.

Key Player Analysis:

Cisco Systems, Inc.

II-VI Incorporated

Lumentum Holdings Inc.

Finisar Corporation

Broadcom Inc.

Huawei Technologies Co., Ltd.

Intel Corporation

Ciena Corporation

Fujitsu Optical Components Ltd.

Infinera Corporation

Segmentations:

By Protocol

Ethernet

Fiber Channel

CWDM/DWDM

FTTx

Other Protocols

By Data Rate

Less than 10 Gbps

10 Gbps to 40 Gbps

100 Gbps

Greater than 100 Gbps

By Application

Data Center

Telecommunication

By Geography

North America

The U.S

Canada

Mexico

Europe

Germany

France

The U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of Middle East and Africa

Browse the full report at https://www.credenceresearch.com/report/optical-transceiver-market

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

Website: www.credenceresearch.com

0 notes

Text

Exploring Innovations in Optical Transceivers: A Deep Dive into Market Dynamics

Market Overview: Exploring Innovations in Optical Transceivers - A Deep Dive into Market Dynamics

The optical transceiver market has been experiencing substantial growth, driven by increasing data traffic and the need for faster, more efficient communication networks. Optical transceivers, which play a critical role in converting electrical signals to optical signals and vice versa, are indispensable in modern data transmission systems, including data centers, telecommunications, and cloud infrastructure.

Key Market Drivers:

5G Deployment: The global rollout of 5G technology has dramatically increased the demand for optical transceivers, as they are essential in supporting the high-speed, high-bandwidth communication required for 5G networks.

Data Center Expansion: The rise of hyperscale data centers and the growing reliance on cloud services are key drivers of the optical transceiver market. These facilities require advanced transceivers to manage the massive amounts of data being transferred and stored.

Increased Adoption of Fiber Optics: As businesses and consumers demand faster internet and reliable connectivity, the adoption of fiber optic communication is increasing globally. Optical transceivers are crucial in enabling high-speed, long-distance data transmission, particularly in enterprise and telecom sectors.

Innovations Shaping the Market:

Higher Data Rate Transceivers: The development of 400G and 800G transceivers is one of the most significant innovations, catering to the needs of data-hungry applications such as artificial intelligence (AI), machine learning (ML), and virtual reality (VR). These high-capacity transceivers are pivotal in scaling up data center networks.

Silicon Photonics: Innovations in silicon photonics technology are reducing the cost and energy consumption of optical transceivers while improving performance. This technology integrates optical components on a silicon chip, revolutionizing the design and efficiency of transceivers.

Wavelength-Division Multiplexing (WDM): WDM technology allows multiple data streams to be transmitted simultaneously over the same fiber optic cable, increasing the capacity and efficiency of communication networks. This advancement is crucial for high-density data center applications.

Market Challenges:

High Cost of Deployment: While optical transceivers offer substantial performance benefits, their deployment, especially in long-distance networks, can be expensive. This limits adoption in regions with budget constraints.

Technological Complexity: As transceiver technology becomes more advanced, integrating these devices into existing infrastructure becomes increasingly complex, requiring specialized expertise and robust systems for successful implementation.

Regional Insights:

North America remains the dominant region due to its well-established data center infrastructure and early adoption of 5G technology. Leading tech companies and cloud service providers continue to invest heavily in optical transceiver innovations.

Asia-Pacific is emerging as a high-growth market, driven by the rapid expansion of telecom networks in countries like China, Japan, and India. The region's growing internet user base and increasing mobile data traffic further fuel demand.

Future Outlook:

The optical transceiver market is poised for sustained growth as innovations in data rate capabilities, power efficiency, and miniaturization continue to advance. As 5G networks expand and data centers scale up their operations, the need for cutting-edge optical transceivers will become even more pronounced, driving further investment and development in this critical market.

The market is projected to grow at a CAGR of X% over the next five years, with key players like Finisar Corporation, Lumentum Holdings, and Broadcom Inc. leading the innovation race. As industry trends continue to evolve, optical transceivers will play a central role in shaping the future of global communication infrastructure.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence https://www.mordorintelligence.com/industry-reports/optical-transceiver-market

#Optical Transceiver Market#Optical Transceiver Market Size#Optical Transceiver Market Share#Optical Transceiver Market Analysis#Optical Transceiver Market Trends#Optical Transceiver Market Report#Optical Transceiver Market Research#Optical Transceiver Industry#Optical Transceiver Industry Report

0 notes

Text

United States Ethernet Optical Transceivers Market Overview By Share, Size, Industry Players, Revenue And Product Demand Till 2028

The United States Ethernet Optical Transceivers market is poised for significant growth over the next several years. According to recent market research, this sector is expected to achieve a compound annual growth rate (CAGR) of 26.22% during the period of 2023 to 2030. This forecasted expansion is fueled by a variety of factors, including the increased demand for high-speed data transmission, the ongoing evolution of communication networks, and the growing deployment of cloud computing and other advanced technologies.

In 2021, the market for Ethernet Optical Transceivers in the United States was valued at USD 1.78 billion, with a large portion of this demand stemming from data centers and enterprise networks. As the need for faster, more reliable data transmission continues to rise, the market for these transceivers is expected to expand significantly in the coming years.

The growth of the Ethernet Optical Transceivers market in the United States can be attributed to several key factors. One of the most important is the increasing demand for high-speed data transmission across a variety of industries, including healthcare, finance, and telecommunications. With the rise of cloud computing and other advanced technologies, organizations of all sizes are looking for ways to move data more quickly and efficiently than ever before.

Another key driver of growth in this market is the ongoing evolution of communication networks. As networks become more complex and interconnected, the demand for high-quality, high-performance transceivers continues to grow. In particular, the deployment of 5G networks is expected to drive demand for Ethernet Optical Transceivers, as these networks require fast and reliable data transmission to operate effectively.

Looking ahead, the future of the United States Ethernet Optical Transceivers market looks bright. As the demand for high-speed data transmission continues to rise, this sector is expected to expand significantly, with a projected market value of USD 13.66 billion by 2030. With ongoing innovation and development, the future of this market looks promising for both vendors and customers alike.

In terms of technology, the United States Ethernet Optical Transceivers market is experiencing a shift towards higher data transmission rates and more efficient use of bandwidth. For example, the market is seeing an increased demand for transceivers that support 400G and 800G transmission speeds, which can handle the growing volume of data generated by today's applications and services.

Moreover, the market for Ethernet Optical Transceivers in the United States is also driven by the need for higher levels of security and reliability in data transmission. As organizations increasingly rely on cloud computing and other advanced technologies to store and process sensitive data, they need to ensure that this data is transmitted securely and reliably. Ethernet Optical Transceivers can help to meet this need by providing secure and reliable data transmission, which is essential for maintaining the integrity of sensitive information.

In terms of market segmentation, the United States Ethernet Optical Transceivers market is categorized into various types, including SFP, SFP+, QSFP/QSFP+, CFP, and others. The SFP transceivers segment is expected to hold the largest share of the market during the forecast period, owing to their widespread use in data centers and enterprise networks.

Another key trend in the United States Ethernet Optical Transceivers market is the growing adoption of software-defined networking (SDN) and network function virtualization (NFV) technologies. These technologies enable organizations to manage and optimize their networks more effectively while reducing costs and improving performance. As the adoption of SDN and NFV technologies continues to grow, the demand for Ethernet Optical Transceivers that support these technologies is also expected to increase.

In conclusion, the United States Ethernet Optical Transceivers market is expected to grow significantly over the next several years, driven by the increasing demand for high-speed data transmission, the ongoing evolution of communication networks, and the growing adoption of advanced technologies like cloud computing, 5G, SDN, and NFV. With ongoing innovation and development, the future of this market looks promising for both vendors and customers alike.

0 notes

Text

The Trend Of Optical Transceiver Of 2020

With the advancement of China's 5G arranges and the improvement of China's residential optical module makers' innovative work abilities and creative capacity. This pattern extraordinarily builds the cost preferred position of Chinese optical module items, making China the optical modules essentially upgrade the aggressiveness of enterprises. It likewise invigorated outside correspondence hardware makers to expand the obtainment of optical module items in China. At a similar time, remote correspondence gear makers have bit by bit moved their generation and R&D bases to China as of late because of elements, for example, labor. This conduct has driven the interest in China's optical module advertise. So for this situation, what is the pattern of optical modules in 2020?

1. The development of 5G system advances the expanding interest for optical modules

5G organize as a fifth era portable correspondence arrange, the hypothetical pinnacle paces of up to many Gb every second, contrasted and the standard at this stage the most noteworthy transmission speed of 4G systems multiple times faster. In expansion, the blast of information traffic and quickened organization of 5G and the Internet of Things will further drive the interest for rapid optical modules, and the interest for optical modules as a center segment is immense. The majority of this implies we need a progressively optical module parts to construct the system foundation.

2. The ascent of the information market drives the interest for rapid optical modules.

At present, the stage utilizing cloud innovation will be experienced enough, for example, AI, video, web-based games, Internet of Things, portable Internet and different advancements will keep on driving the interest for IDC infrastructure. Third-party IDC administrators are required to introduce a quick development cycle. That implies the ascent of enormous information centers. And in the stream between exceptionally huge server farms, the customary administrator request can not fulfill this need at 25T. This will exploit the 960T of the Internet venture. This information is around multiple times that of the previous. It can augment effectiveness and handle the gigantic figuring needs of ventures.

In this way, rapid optical modules will turn out to be increasingly famous, particularly 40G and 100G optical transceivers, which will be generally utilized later on.

3. The development of the server farm will bring dangerous interest for optical modules and switches.

As indicated by the information, the optical module market keeps up a high development rate, in which 100G optical modules contribute over 60% of income.

Tests of 400G items have been displayed, and QSFP-DD is relied upon to turn into a standard item. It is normal that there will be little scale creation on the planet this year and huge scale application by 2022.

#OM3 Patch Cable#10G OM3 Fiber Cables#Buy 10G OM3 Fiber Cables#OM3 Patch Cable Online#PM Fiber Cables#Buy PM Fiber Cables

4 notes

·

View notes

Text

Research Report Explores 400G Optical Transceivers Market 2018

The 2016 study has 525 pages, 121 tables and figures. The vendors in the 400G optical transceivers industry have invested in high-quality technology and processes to develop leading edge broadband network capability a being implemented in the mega data centers.

400G optical transceivers market driving forces relate primarily to the implementation of networks within the mega data centers and the interconnects between the data centers.

Request Sample Report at https://www.wiseguyreports.com/sample-request/1637249-400g-optical-transceivers-market-shares-strategies-and-forecasts-worldwide-2017-to

Software as a Service (SaaS) is a primary offering.

Global adoption of the Internet

Driving rapid growth of the mega datacenter

Data centers support Internet applications

Online commerce

Streaming video

Social networking

Cloud services

Software as a Service (SaaS)

400G Transmitter / Transceivers

Leading vendors offer a broad product selection. They are positioned with innovative technology. Optical module manufacturers address the needs of all major networking equipment vendors worldwide. Leading vendors have taken a leading role in transforming the data communications and telecommunications equipment market.

The shift has been away from utilizing discrete optical components to leveraging the design and pay-asyougrow flexibility offered by pluggable modules. 400G Optical transceiver products are compliant with Ethernet, Fibre Channel, SONET/SDH/OTN and PON standards. They generally operate at data rates of 400 Gb/s and higher.

400G Transmitter / Transceivers are capable of distances ranging from very short reach within a datacenter to campus, access, metro, and long-haul reaches. They feature outstanding performance. Units work over extended voltage and temperature ranges. They are positioned to minimize jitter, electromagnetic interference (EMI) and power dissipation.

Mega Datacenter Online Commerce, Streaming Video, Social Networking, And Cloud Services are key to operations of mega data centers.

Global adoption of online commerce, streaming video, social networking, and cloud services such as Software as a Service (SaaS) is driving rapid growth of the mega datacenter. The storage and computing requirements supported by the datacenters present new challenges to connectivity within the datacenter in terms of bandwidth, transmission distance, power consumption, and cost.

The product portfolio offered by vendors for telecom and datacenter and cloud applications effectively addresses these requirements and challenges.

Covering data rates up to 400Gb/s in compact form factors, vendor products enable green field deployments and the upgrade of existing datacenters in a cost-effective manner. WAN telco applications Internet, enterprise augmented reality, and IoT Drive optical network adoption as the mega data centers are poised for significant growth to support trillion-dollar app markets. Global adoption of the Internet is driving rapid growth of the mega datacenter and the need for very high speed network transmission. Optical transceivers are used to upgrade telecommunications networks and launch very large mega data centers. The development of innovative products is essential to keeping and growing market share.

A 400G optical transceiver is a single, packaged device that works as a transmitter and receiver. An optical transceiver is used in an optical network to convert electrical signals to optical signals and optical signals to electrical signals. Optical transceivers are widely deployed in optical networking for broadband. Optical transceiver manufacturers test to ensure that their optical transceivers have compliance with the defined specifications. Testing of key optical parameters: transmitter optical power and receiver sensitivity is a big deal.

According to the research, “400G Optical transceiver markets are driven by the use of mega data centers that implement broadband networks in cloud computing environments. Video, Internet adoption, and tablets drive demand for broadband mega data centers. Markets are influenced by apps, augmented reality. IoT, the move to cloud computing and the adoption of smart phones by 9.5 billion people by 2020. Mega data centers that support online commerce, streaming video, social networking, and cloud services for every industry are expected to adopt 400G optical transceivers as a fundamental technology. Software as a Service (SaaS) is a primary offering that will leverage 400 G optical transceivers in the mega data center.”

High-speed serial transceivers form the backbone of networks. Communications, servers and many other electronic systems depend on high-speed serial transceivers. Global adoption of the Internet is driving rapid growth of the mega datacenter. Data centers support online commerce, streaming video, social networking, and cloud services.

Leading vendors offer a broad product selection. They are positioned with innovative technology. 400 G optical module manufacturers address the needs of major networking interconnect equipment vendors and companies building mega data centers. Leading vendors have taken a leading role in transforming the data communications and tele-communications equipment market.

The global 400 G optical transceiver market is expected to be at $22.6 billion in 2023 driven by the availability and cost effectiveness of 100 Gbps, and 400 Gbps devices. Next generation optical transceiver devices use less power, are less expensive, and are smarter and smaller. The adoption of widespread use of the 100 Gbps devices, followed by 400 Gbps devices and the vast increases in Internet traffic are core to helping manage change in the large mega data center and communications interconnect and infrastructure markets.

Companies Profiled

Selected Market Leaders

Finisar

Lumentum

Broadcom

Oclaro

Fujitsu

Source Photonics

Sumitomo

NeoPhotonics

NEC

Innolight Technology

Emcore

Accelink Technologies

Oplink Communications

NTT

Furukawa Electric

Market Participants

Acacia

ACON

Applied Optoelectronics

GigPeak

Huawei

Inphi

IPG Photonics

Nokia

Qorvo

Viavi Solutions

Xilinx

Key Topics

400G Optical Transceiver

Augmented Reality

Internet of Things (IoT)

Network Core

DWDM

Data rates 100 Gb/s

Data rates 400 Gb/s

Mega Data Center Optimized

Internet Protocol Traffic

Mobile Backhaul

Broadband Optical Sector

View Detailed Report at https://www.wiseguyreports.com/reports/1637249-400g-optical-transceivers-market-shares-strategies-and-forecasts-worldwide-2017-to

Table of Contents

1 400G Optical Transceiver Market Description and Market Dynamics

2 400G Optical Transceivers Market Shares and Market Forecasts

3 Optical Transceiver Product Description

4 400G Optical Transceiver Technology

5 Optical Transceiver Company Description

About Us:

Wise Guy Reports is part of the Wise Guy Research Consultants Pvt. Ltd. and offers premium progressive statistical surveying, market research reports, analysis & forecast data for industries and governments around the globe.

Contact Us:

NORAH TRENT

Ph: +1-646-845-9349 (US)

Ph: +44 208 133 9349 (UK)

#400G Optical Transceivers Market 2018#400G Optical Transceivers Market#400G Optical Transceivers Market Growth

0 notes

Text

Medically Prescribed Apps EUROPE Market Research Report 2021-2026

This report describes the global market size of Medically Prescribed Apps from 2016 to 2020 and its CAGR from 2016 to 2020, and also forecasts its market size to the end of 2026 and its CAGR from 2021 to 2026.

ALSO READ: http://www.marketwatch.com/story/medically-prescribed-apps-market-research-report-with-size-share-value-cagr-outlook-analysis-latest-updates-data-and-news-2020-2027-2021-07-16

For geography segment, regional supply, demand, major players, price is presented from 2016 to 2026. This report cover following regions: North America South America Asia & Pacific Europe MEA

The key countries for each regions are also included such as United States, China, Japan, India, Korea, ASEAN, Germany, France, UK, Italy, Spain, CIS, and Brazil etc.

ALSO READ: http://www.marketwatch.com/story/june-2021-report-on-global-pediatric-oral-electrolyte-market-overview-size-share-and-trends-2015-2026-2021-06-02

For competitor segment, the report include global key players of Medically Prescribed Apps as well as some small players. The information for each competitor include: Company Profile Business Information SWOT Analysis Revenue, Gross Margin and Market Share

Applications Segment: Diabetes Management Multi-Parameter Tracker Cardiac Monitoring Others

ALSO READ: http://www.marketwatch.com/story/june-2021-report-on-global-400g-optical-transceivers-industry-market-overview-size-share-and-trends-2021-2026-2021-06-03

Types Segment: Wellness Management Apps Diseases And Treatment Management Apps Women’s Health & Pregnancy Apps Diseases Specific Apps Others

Companies Covered: Pathfinder InnovationM Fueled Sourcebits Technologies WillowTree Y Media Labs OpenXcell ArcTouch Contus Intellectsoft Savvy Apps etc.

Please ask for sample pages for full companies list

Base Year: 2021 Historical Data: from 2016 to 2020 Forecast Data: from 2021 to 2026

Any special requirements about this report, please let us know and we can provide custom report.

ALSO READ: http://www.marketwatch.com/story/june-2021-report-on-global-health-safety-and-environmental-hse-services-market-overview-size-share-and-trends-2026-2021-06-03

Table of Contents

Chapter 1 Executive Summary Chapter 2 Abbreviation and Acronyms Chapter 3 Preface 3.1 Research Scope 3.2 Research Sources 3.2.1 Data Sources 3.2.2 Assumptions 3.3 Research Method Chapter Four Market Landscape 4.1 Market Overview 4.2 Classification/Types 4.3 Application/End Users Chapter 5 Market Trend Analysis 5.1 Introduction 5.2 Drivers 5.3 Restraints 5.4 Opportunities 5.5 Threats 5.6 Covid-19 Impact Chapter 6 Industry Chain Analysis 6.1 Upstream/Suppliers Analysis 6.2 Medically Prescribed Apps Analysis 6.2.1 Technology Analysis 6.2.2 Cost Analysis 6.2.3 Market Channel Analysis 6.3 Downstream Buyers/End Users Chapter 7 Latest Market Dynamics 7.1 Latest News 7.2 Merger and Acquisition 7.3 Planned/Future Project 7.4 Policy Dynamics Chapter 8 Historical and Forecast Medically Prescribed Apps Market in North America (2016-2026) 8.1 Medically Prescribed Apps Market Size 8.2 Medically Prescribed Apps Market by End Use 8.3 Competition by Players/Suppliers 8.4 Medically Prescribed Apps Market Size by Type 8.5 Key Countries Analysis 8.5.1 United States 8.5.2 Canada 8.5.3 Mexico Chapter 9 Historical and Forecast Medically Prescribed Apps Market in South America (2016-2026) 9.1 Medically Prescribed Apps Market Size 9.2 Medically Prescribed Apps Market by End Use 9.3 Competition by Players/Suppliers 9.4 Medically Prescribed Apps Market Size by Type 9.5 Key Countries Analysis 9.5.1 Brazil 9.5.2 Argentina 9.5.3 Chile 9.5.4 Peru

ALSO READ: http://www.marketwatch.com/story/june-2021-report-on-global-tennis-wear-sales-market-overview-size-share-and-trends-2021-2026-2021-06-03

Chapter 10 Historical and Forecast Medically Prescribed Apps Market in Asia & Pacific (2016-2026) 10.1 Medically Prescribed Apps Market Size 10.2 Medically Prescribed Apps Market by End Use 10.3 Competition by Players/Suppliers 10.4 Medically Prescribed Apps Market Size by Type 10.5 Key Countries Analysis 10.5.1 China 10.5.2 India 10.5.3 Japan 10.5.4 South Korea 10.5.5 Southest Asia 10.5.6 Australia Chapter 11 Historical and Forecast Medically Prescribed Apps Market in Europe (2016-2026) 11.1 Medically Prescribed Apps Market Size 11.2 Medically Prescribed Apps Market by End Use 11.3 Competition by Players/Suppliers 11.4 Medically Prescribed Apps Market Size by Type 11.5 Key Countries Analysis 11.5.1 Germany 11.5.2 France 11.5.3 United Kingdom 11.5.4 Italy 11.5.5 Spain 11.5.6 Belgium 11.5.7 Netherlands 11.5.8 Austria 11.5.9 Poland 11.5.10 Russia Chapter 12 Historical and Forecast Medically Prescribed Apps Market in MEA (2016-2026) 12.1 Medically Prescribed Apps Market Size 12.2 Medically Prescribed Apps Market by End Use 12.3 Competition by Players/Suppliers 12.4 Medically Prescribed Apps Market Size by Type 12.5 Key Countries Analysis 12.5.1 Egypt 12.5.2 Israel 12.5.3 South Africa 12.5.4 Gulf Cooperation Council Countries 12.5.5 Turkey Chapter 13 Summary For Global Medically Prescribed Apps Market (2016-2021) 13.1 Medically Prescribed Apps Market Size 13.2 Medically Prescribed Apps Market by End Use 13.3 Competition by Players/Suppliers 13.4 Medically Prescribed Apps Market Size by Type Chapter 14 Global Medically Prescribed Apps Market Forecast (2021-2026) 14.1 Medically Prescribed Apps Market Size Forecast 14.2 Medically Prescribed Apps Application Forecast 14.3 Competition by Players/Suppliers 14.4 Medically Prescribed Apps Type Forecast Chapter 15 Analysis of Global Key Vendors 15.1 Pathfinder 15.1.1 Company Profile 15.1.2 Main Business and Medically Prescribed Apps Information 15.1.3 SWOT Analysis of Pathfinder 15.1.4 Pathfinder Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.2 InnovationM 15.2.1 Company Profile 15.2.2 Main Business and Medically Prescribed Apps Information 15.2.3 SWOT Analysis of InnovationM 15.2.4 InnovationM Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.3 Fueled 15.3.1 Company Profile 15.3.2 Main Business and Medically Prescribed Apps Information 15.3.3 SWOT Analysis of Fueled 15.3.4 Fueled Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.4 Sourcebits Technologies 15.4.1 Company Profile 15.4.2 Main Business and Medically Prescribed Apps Information 15.4.3 SWOT Analysis of Sourcebits Technologies 15.4.4 Sourcebits Technologies Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.5 WillowTree 15.5.1 Company Profile 15.5.2 Main Business and Medically Prescribed Apps Information 15.5.3 SWOT Analysis of WillowTree 15.5.4 WillowTree Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.6 Y Media Labs 15.6.1 Company Profile 15.6.2 Main Business and Medically Prescribed Apps Information 15.6.3 SWOT Analysis of Y Media Labs 15.6.4 Y Media Labs Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.7 OpenXcell 15.7.1 Company Profile 15.7.2 Main Business and Medically Prescribed Apps Information 15.7.3 SWOT Analysis of OpenXcell 15.7.4 OpenXcell Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.8 ArcTouch 15.8.1 Company Profile 15.8.2 Main Business and Medically Prescribed Apps Information 15.8.3 SWOT Analysis of ArcTouch 15.8.4 ArcTouch Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.9 Contus 15.9.1 Company Profile 15.9.2 Main Business and Medically Prescribed Apps Information 15.9.3 SWOT Analysis of Contus 15.9.4 Contus Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.10 Intellectsoft 15.10.1 Company Profile 15.10.2 Main Business and Medically Prescribed Apps Information 15.10.3 SWOT Analysis of Intellectsoft 15.10.4 Intellectsoft Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) 15.11 Savvy Apps 15.11.1 Company Profile 15.11.2 Main Business and Medically Prescribed Apps Information 15.11.3 SWOT Analysis of Savvy Apps 15.11.4 Savvy Apps Medically Prescribed Apps Revenue, Gross Margin and Market Share (2016-2021) Please ask for sample pages for full companies list Tables and Figures Table Abbreviation and Acronyms Table Research Scope of Medically Prescribed Apps Report Table Data Sources of Medically Prescribed Apps Report Table Major Assumptions of Medically Prescribed Apps Report Figure Market Size Estimated Method Figure Major Forecasting Factors Figure Medically Prescribed Apps Picture Table Medically Prescribed Apps Classification Table Medically Prescribed Apps Applications Table Drivers of Medically Prescribed Apps Market Table Restraints of Medically Prescribed Apps Market Table Opportunities of Medically Prescribed Apps Market Table Threats of Medically Prescribed Apps Market Table Covid-19 Impact For Medically Prescribed Apps Market Table Raw Materials Suppliers Table Different Production Methods of Medically Prescribed Apps Table Cost Structure Analysis of Medically Prescribed Apps Table Key End Users Table Latest News of Medically Prescribed Apps Market Table Merger and Acquisition Table Planned/Future Project of Medically Prescribed Apps Market Table Policy of Medically Prescribed Apps Market Table 2016-2026 North America Medically Prescribed Apps Market Size Figure 2016-2026 North America Medically Prescribed Apps Market Size and CAGR Table 2016-2026 North America Medically Prescribed Apps Market Size by Application Table 2016-2021 North America Medically Prescribed Apps Key Players Revenue Table 2016-2021 North America Medically Prescribed Apps Key Players Market Share Table 2016-2026 North America Medically Prescribed Apps Market Size by Type Table 2016-2026 United States Medically Prescribed Apps Market Size

….CONTINUED

CONTACT DETAILS :

+44 203 500 2763

+1 62 825 80070

971 0503084105

0 notes

Text

Are 100G Optical Transceivers Outdated?

1. Introduction of optical transceiver

Optical module is a device for converting optical and electrical signals in optical communication system. Its basic structure includes: laser (TOSA) + driver circuit, detector (ROSA) + receiver circuit, multiplexer (MUX), demultiplexer (DEMUX), interface, auxiliary circuit and housing, etc. According to the application of different scenarios, different kinds of optical modules are derived. The specific scenarios are: inside data center, data center interconnection, metro network, core network, 5G Fronthaul, etc. Further classification can be obtained by elements such as package form, transmission rate, single-mode and multi-mode, plugging mode, operating temperature, and whether digital diagnostics are available.

Structure diagram of 100G optical module

Driven by technology upgrade, cost reduction and other factors, optical modules continue to be "high-speed, miniaturized and integrated". QSFP (Four Channel SFP Interface) series is increasingly popular in the market because of its high-speed, high-density, hot-pluggable and other characteristics. It is the main packaging form of data communication optical module. For 100G optical modules, CFP vs QSFP28, SR/LR mainly adopts QSFP28 package, while ER mostly adopts CFP4 package.

2. The standards of optical transceiver

The transmission distance of optical module is divided into short range (2km and below), medium range (2 - 40km), and long range (40km and above); at present, the short and medium range occupies the main market share in data communication optical module. There are two key standard organizations for optical modules, IEEE and MSA (Multi Source Agreement), which complement and learn from each other. The standards beginning with 100G are proposed by IEEE802.3. The following are the naming rules:

As shown in the figure, for example, in the name of 100GBASE-LR4, “LR” means long rage, i.e. 10Km, and “4” means four channels, i.e. 4*25G, combined together as a 100G optical module that can transmit 10Km. Since the introduction of 100G networks, IEEE, the Multi-Source Agreement (MSA) industry consortium and other organizations have developed several standards for 100G optical modules. Taking 100G optical modules as an example, IEEE has defined standards such as 100GBASE-SR4, 100GBASE-LR4, 100GBASE-SR10, etc. Multi-Source Protocol (MSA) has 100G PSM4, 100G QSFP28 ER4, 100G CLR4, 100G SWDM4, etc. Among the many standards, the PSM4 and CWDM4 standards developed by the Multi-Source Protocol (MSA) industry group are more suitable for the mainstream 100G QSFP28 optical modules in the market today.

3. IDC market and 100G optical module demand

Like a raging fire in the past few years, the concept of Internet + , Big Data and Cloud Computing has been booming. The IDC business revenue has been increasing continuously. At present, the optical module market is developing rapidly, and 100G optical modules applied in data centers are in short supply. 100G SR4 and 100G LR4 are the most commonly used 100G interface specifications defined by IEEE. However, for the internal interconnection scenario of large data centers, the distance supported by 100G SR4 is too short to meet all interconnection requirements, and the cost of 100G LR4 is too high. MSA has brought medium distance interconnection solutions to the market. PSM4 and CWDM4 are the products of this revolution.

DCN Connectivity Evolution example of large Internet company

CWDM4 vs. LR4

The 100G CWDM4 standard is designed for data center deployment of 2km 100G links, and the 100G CWDM4 optical module interface conforms to the duplex single-mode 2km 100G optical interface specification and can reach a transmission distance of 2km. 100G QSFP28 series optical modules are currently the most widely used in data centers. The 100GBASE LR4 capability fully covers CWDM4, but in the 2km transmission scenario, the CWDM4 solution is lower cost and more competitive. LR4 and CWDM4 are similar in principle in that they both multiplex four parallel 25G channels onto a single 100G fiber link via the optical device MUX as well as DEMUX. However, there are several differences between the two:

·LR4 uses more expensive optical MUX/DEMUX devices;

·LR4 uses a more expensive laser and consumes more power;

·LR4 requires an additional TEC (semiconductor thermoelectric cooler).

Based on the above three points, the optical module cost of 100G BASE LR4 standard is higher, so the 100G CWDM4 standard proposed by MSA is a good supplement to the gap caused by the high cost of 100G BASE LR4 within 2km.

PSM4 vs. CWDM4

In addition to CWDM4, PSM4 is also a medium distance transmission solution, so what are the advantages and disadvantages of PSM4 compared to CWDM4? The 100G PSM4 optical module is a single-mode parallel four-channel optical module, mainly suitable for 500m applications. The 100G PSM4 specification defines a point-to-point 100 Gbps link with eight single-mode fibers (four transmit and four receive), with each channel transmitting at 25 Gbps. Four identical wavelength and independent channels are used in each signal direction. Therefore, these two types of transceivers typically communicate over an 8-fiber MTP/MPO single-mode patch cable, and the QSFP28 PSM4 transmission distance is a maximum of 500m.

4. Summary

With the rapid development of data communication and telecommunication transmission technology, the information capacity of optical network increases sharply. The optical module with high bandwidth is a research and production hotspot in the field of optical communication. QSFP28 100G modules are not enough for meeting the current requirements. At present, China is in the historical opportunity period from 100G to 400G optical network. The advent of 5G era will bring tens of millions of optical modules. The optical module market will have a market share of more than 30 billion in the next few years.

At present, the application of data center is in the period of rapid development of 100G optical module. In 2010, 100G optical communication technology standard has been adopted in ITU-T (ITU), IEEE and OIF. The three standards organizations have successively stipulated 100G technical standards for 100G line side, user side and interworking. Subsequently, with the wide attention and promotion of global operators, all links of the industrial chain (optical modules, optical transmission equipment, router equipment and test instruments) have rapidly promoted the commercialization process of 100G.

0 notes

Text

Ethernet Controller Market is Estimated To Expand At a Healthy CAGR in The Upcoming Forecast 2025

The ethernet controller market is expected to register a CAGR of 6.1% during the forecast period 2020-2025. As Ethernet controller controls Ethernet communications, the trend towards industrial Ethernet physical layer (PHY) products to help manufacturers addressing key Industry 4.0 and smart factory communication challenges surrounding data integration, synchronization, edge connectivity, and system interoperability is highly being adopted. The ADIN1300, for example, is a low-power, single-port Ethernet transceiver designed for time-critical industrial Ethernet applications up to Gigabit speeds and designed to operate reliably in harsh industrial conditions over extended ambient temperature ranges. It is the latest technology developed for the company’s ADI Chronous portfolio of industrial Ethernet solutions. - Adoption of EtherCat for the real-time network for machine control drives the market. EtherCAT uses the implementation of on-board Ethernet controller integrated via Direct Memory Access (DMA), so no CPU capacity is required for the data transfer between the master device and the network providing higher orders of magnitude faster than Profibus, DeviceNet, and ModbusTCP. Automation equipment manufacturers can use EtherCAT on their own device implementations to improve performance and flexibility, while end-users and automation system designers can implement their own EtherCAT-compliant devices. Further, EtherCAT is part of several IEC Standards (61158, 61784, 61800), ISO 15745, and is also a SEMI standard (E54.20).

Click Here to Download Sample Report >> https://www.sdki.jp/sample-request-86056 - In April 2020, Renesas Electronics Corporation announced the RX72N Group and RX66N Group of 32-bit microcontrollers (MCUs), new additions to the RX Family that combines equipment control and networking function on a single chip with EtherCAT support.

- The adoption of USB Ethernet controllers drives the market. There are various protocols for Ethernet-style networking over USB. The main function of these protocols is to allow the application-independent exchange of data with USB devices, instead of specialized protocols such as video or MTP. Even though USB is not a physical Ethernet, the networking stacks of all major operating systems are set up to transport IEEE 802.3 frames.

- For instance, implementing the KL5KUSB121 10/100 Base-T USB-Ethernet controller provides highly integrated 16-bit RISC CPU, mask ROM, and RAM buffer coupled with serial, external memory, and SPORT interfaces. It easily converts USB to Ethernet. The chip's internal processor enables a remote network device interface specification that provides compatibility with next-generation operating systems and faster data transfers and is well suited for LAN, Home Area Network, cable modem, set-top boxes, or mobile networking applications.

- The impact of COVID-19 has provided the restraints to market growth. There is nearly an 80% chance for significant contraction in worldwide semiconductor revenues in 2020, which also affects the market of ethernet controllers due to the massive slowdown of the supply chain. A player such as Arista, Cisco, Juniper, and many others in the 400GbE ecosystem planned to demonstrate interoperability and the growing volume of 400GbE wares at OFC (Optical Fiber Communication Conference and Exhibition) 2020 and the major networking vendors working on 400GbE were reported some degree of 400G implementation, but the players have decided to manufacture in the first half of 2021, and currently, the production has been stopped. - Further, as the epidemic has caused the manufacturing industry to slow down, the requirement of EtherCAT in the industry is most vital as it provides real-time, deterministic, high performance, and open industrial Ethernet network protocol and can ensure the data transmission certainty and real-time. In April 2020, ASIX Electronics Corporation announced to supply EtherCAT Slave Controller SoC in China and other parts of the world, which caters to the significant assistance in the market growth. But overall, the growth is restrained due to negligible demand from all the sectors. Key Market Trends Gigabit Ethernet to Witness Growth in Data Centers - Data-intensive applications such as big data and cloud computing continue to grow at an accelerating rate. Multiple terabits of data travel to and from the data center each second. Moving such massive data around the data center requires a robust infrastructure that is capable of handling high bandwidth data delivery having high IP traffic to and from storage endpoints, servers, top-of-rack (TOR) switches, and core switches. This penetrates the demand of an ethernet controller, which connects devices using media access control (MAC) addresses. - Players such as Marvell Ethernet Network Adapters and Controllers are purpose-built to accelerate and simplify data center, PC and workstation networking. Marvell Ethernet controllers deliver Ethernet connectivity speeds ranging from NBASE-T for Workstations to data center-class 10/25/50/100GbE for high-volume software-defined datacenters. - Further, rising power consumption and costs related to continuous growth in data are bringing data centers to face the challenges of delivering greater storage bandwidth and capacity. To address such issues, in April 2020, Marvell’s MRVL QLogic Fibre Channel and FastLinQ Ethernet adapter solutions will now enable NVMe over Fabrics (NVMe-oF) technology in VMwarevSphere 7.0, displaying its continued efforts to strengthen its end-to-end Ethernet storage and bandwidth capabilities. - Further, with an increasing demand for networking speed and throughput performance within the data center and high-performance computing clusters, in April 2020, the newly rebranded Ethernet Technology Consortium has announced a new 800 Gigabit Ethernet technology for data center replacing the 400 Gigabit Ethernet. The 800 B base-R specification (or 800 GbE) will need new definitions for media access control (MAC) and physical coding sublayer (PCS). This further benefits hyperscale datacenter networks that span a large number of nodes and require multiple hops. - Furthermore, in April 2020, Tyan has officially announced its support for the new chips on selecting models of their Transport HX barebones servers, which are designed for high-performance computing and server data-driven workflows. It includes Transport HX TN83-B8251, TS75A-B8252, and the TS75-B8252, where on the motherboard, there is an Intel X550-AT2 dual 10 G Ethernet controller, with a dedicated Realtek IPMI Ethernet port, and an Aspeed AST2500 BMC. Each model has offered its own benefits for the server, data center, and high-frequency trading systems.

- Moreover, as the demand for public cloud services continues to grow, hyper-scale data centers and cloud providers increasingly rely on multicore SmartNIC solutions to offload infrastructure services and workloads to maximize server utilization. In March 2020, Broadcom Inc. announced that its Stingray adapter, the industry’s first 100G SmartNIC (integrated NetXtreme Ethernet Controller), is powering Baidu Cloud with unprecedented levels of performance. The Stingray adapter’s exceptional levels of integration, includes eight ARM A72 CPU cores running at 3GHz, 300G of memory bandwidth.

Click Here to Download Sample Report >> https://www.sdki.jp/sample-request-86056 North America Accounts for Significant Share - North America accounts for a significant share. With the increase in the development of technology along with the adoption of a high rate of consumer electronics such as gaming consoles, etc., the demand for the ethernet controller is growing in this region.

- For instance, in April 2020, Killer announced the Killer E3100 Ethernet controller is improving the internet performance by prioritizing gaming and rescuing up CPU power and PC memory. It reaches speeds up to 2.5Gbps and can combine with Killer Wi-Fi products to reach up to 4.9 Gbps of theoretical throughput. The Killer 3100 is available in systems from Acer and MSI, including the newly announced MSI Creator 17 and MSI GE66 Raider.

- Further, as the automotive industry increasingly adopts Ethernet in-vehicle networks for mainstream models, the number of related ports is expected to grow at a 62% annualized growth trajectory, from 53 million in 2018 to 367 million by 2022, according to Marvell Technology Group. Moreover, in September 2019, Marvell Technology Group completed the acquisition of Aquantia Corporation to expand the market in automotive solutions. - The acquisition of Aquantia complements Marvell’s portfolio of copper and optical, physical layer product offerings, and extends its position in the Multi-Gig 2.5G/5G/10G Ethernet segments. In particular, Aquantia’s innovative Multi-gig automotive PHYs, coupled with Marvell’s gigabit PHY and secure switch products, creates a broad range of high-speed in-car networking solutions. - Further, in November 2019, Astronics Ballard announced to embed an open architecture with a 64-bit processing foundation and Ethernet backbone across its next generation of NG avionics input/output (I/O) computers. Inside the next generation, boxes are simple converters capable of supporting Ethernet, MIL-STD-1553 and ARINC 429 among other data bus protocols, and the processing is capable of enabling advanced distributed control and mission computing on fighter jets, drones, and helicopters. - To support the instance, in January 2019, U.S. Air Force, Army, and Navy officials signed a memorandum agreeing that future acquisitions of new aircraft technologies will focus on using the Modular Open Systems Approach (MOSA). In addition to MOSA, the NG computers also meet the design requirements for DoD’s Open Mission Systems (OMS) standard. This enhances the demand for the market in this sector.

Competitive Landscape The ethernet controller market is fragmented in nature due to high competition. Despite the fragmentation, the market is largely tied by the regulatory requirements for establishment and operation. Further, with increasing innovation, acquisitions, and partnerships, the rivalry in the market tends to be increasing in the future. Key players are Intel Corporation and Broadcom Inc. Recent developments in the market are - - March 2020 - Ethernity Networks introduced its ENET-D, an add-on Ethernet Controller technology to its ACE-NIC100 SmartNIC that efficiently processes millions of data flows and offers performance acceleration for networking and security appliances. ENET-D is an Ethernet adapter and DMA (direct memory access) engine that eliminates the need for proprietary hardware on a network interface card. By fitting into various FPGAs and enabling customers to further avoid ASIC-based components, ENET-D advances complete disaggregation at the edge of the network. The dynamic nature of business environment in the current global economy is raising the need amongst business professionals to update themselves with current situations in the market. To cater such needs, Shibuya Data Count provides market research reports to various business professionals across different industry verticals, such as healthcare & pharmaceutical, IT & telecom, chemicals and advanced materials, consumer goods & food, energy & power, manufacturing & construction, industrial automation & equipment and agriculture & allied activities amongst others.

For more information, please contact:

Hina Miyazu

Shibuya Data Count Email: [email protected] Tel: + 81 3 45720790

0 notes

Text

400G CFP8 in the Data Center: Options For Your Optical Transceiver Module

The worldwide network traffic is expanding due to the rapid expansion of mobile Internet, cloud computing, big data, and other technologies. Major providers in the market have started to launch 400G and even 800G optical transceiver modules. So, do you know the 400G CFP8 optical transceiver module? This article will take you through what CFP8 optical transceiver module is, the types available in the market, its features and benefits, and where it is applicable to use this product.

What is a 400G CFP8 Optical Transceiver Module?

400G CFP8 (Eight Channel Form Factor Pluggable) optical transceiver module is designed for use in 400 Gigabit Ethernet interfaces over single-mode fiber (SMF). It is defined by CFP MSA CFP8 and supports eight channels (8x50G) with data rates of 400Gbps. It has a small size of 40 x 102 x 9.5 mm.

Types of 400G CFP8 Optical Transceiver Module

Generally speaking, there are four types of 400G CFP8 optical transceiver modules on the market— CFP8 FR8, CFP8 LR8, CFP SR16, and CFP DR4. The interfaces of the four CFP8 transceivers are generally specified to allow for 8 x 50Gb/s, 16 x 25Gb/s, and 4x100Gb/s modes, respectively.

Features and Benefits

16x25G electrical interface

Electrical and optical signaling is available using 50Gb/s or 25Gb/s components

Good thermal and cooling management due to a larger footprint

Low port density due to the large size of the CFP8 form factor

Requires a larger enclosure, around the size of a CFP2

Applications

400G CFP8 optical transceiver module is used in 400G Ethernet, data centers, telecommunications networks, cloud networks, enterprise networking, etc.

Conclusion

400G CFP8 optical transceiver module provides Ethernet users with a dense port and high-throughput solution. It has a compact size and low power consumption.

Sun Telecom specializes in providing one-stop total fiber optic solutions for all fiber optic application industries worldwide. We are devoted to not only meeting the need of customers but; also providing our customers with basic and in-depth knowledge about fiber optic products and solutions through articles. Contact us if you have any needs.

1 note

·

View note

Text

Thermal Solutions Designed for 400G Ethernet

As noted in a recent article from Electronic Design, the IEEE 802.3bs Ethernet Working Group published its standards for 400 Gigabit Ethernet in December and at the DesignCon conference in Santa Clara, Calif. at the end of January many of the connector companies, including industry leaders such as Molex and TE Connectivity, were already rushing to create hardware to meet the new standards.

“The 8-lane, Quad Small Form-factor Pluggable Double Density (QSFP-DD) form factor is one of four connectors that will target 400G Ethernet connections,” Technology Editor William Wong explained. “The others include OSFP, CFP8, and COBO. These new form factors are needed to handle the 25-Gb/s NRZ, 56-Gb/s PAM-4, or potentially 112-Gb/s PAM-4 signaling needed for 400G and beyond.”

Hardware specifications were also defined by the Quad Small Form-Factor Pluggable Double Density (QSFP-DD) Multi-Source Agreement (MSA) group in Sept. 2017. In addition to Molex and TE Connectivity, the 62 companies that were part of the QSFP-DD MSA included Broadcom, Cisco, Finisar, Juniper Networks, and more leaders in the communications and broadcast industries.

The report said, “QSFP-DD supports up to 400 Gb/s in aggregate over an 8 x 50 Gb/s electrical interface. The cage and connector designs provide backwards compatibility to QSFP28 modules which can be inserted into a QSFP-DD port and connected to 4 of the 8 electrical channels.” From a thermal standpoint, the group defined the operating case temperatures as 0-70°C for standard class, -5°C to 85°C for extended class and -40°C to 85°C for industrial class.

“For all power classes,” the report continued, “all module case and handle surfaces outside of the cage must comply with applicable Touch Temperature requirements.”

At DesignCon, Wong wrote, one of the biggest challenges that companies faced was how to optimize thermal management for these optical systems. This is nothing new for designers of optical transceivers, as increased density means increased heat, which can lead to performance and reliability issues.

As a recent article from Advanced Thermal Solutions, Inc. (ATS) exploring industry developments in cooling QSFP transceivers explained, “The performance and longevity of the transceiver lasers depend on the ambient temperature they operate in and the thermal characteristics of the packaging of these devices. The typical thermal management approach combines heat dissipating fins, e.g. heat sinks, and directed airflow.”

It added, “Designers can reduce thermal spreading losses by keeping the heat sources close to the thermal interface area and by increasing the thermal conductivity of the case materials.”

ATS engineers have been working with QSFP manufacturers to meet thermal needs. In a recent project, ATS engineers designed a new solution for cooling optical transceivers using a series of heat sinks in an optimized layout that took into consideration individual QSFP junction temperatures as well as the effect of airflow pushing heat onto downstream transceivers.

Test set-up of different heat sink designs on QSFP28 connector cages. Through testing, analytical modeling and computer simulations, ATS engineers optimized a design for cooling a series of QSFP. (Advanced Thermal Solutions, Inc.)

Analytical modeling and computer simulations “showed that having heat sinks with fewer fins upstream and heat sinks with more fins downstream provided a near isothermal relationship between the first and last QSFP, an important consideration for QSFP arrangements.” Overall, the innovative design showed a 30 percent improvement over QSFP heat sinks currently on the market. Using this design, there was less than a degree difference between the first QSFP in the series and the last.

“Minimizing the upstream QSFP heat sinks, which in turn minimizes the amount of preheat to the downstream QSFP and allows as much airflow to enter downstream QSFP,” the engineers remarked. “At the same time ensuring the upstream QSFP temperatures are equal to or just lower than the downstream QSFP. This keeps the downstream QSFP temperatures at a minimum, while also keeping the transceiver stack close to isothermal.”

In addition to junction temperature, ATS engineers factored in contact resistance, since QSFP transceivers require that no thermal interface material (TIM) is used. As the engineers explained, “The QSFP isn’t fixed in the cage; it can be hot swapped. After a few insertions and removals, it will gunk up the TIM.” Also, to increase the surface area, the heat sinks were extended beyond the edge of the cage and the base had to be thicker than originally planned to account for spreading resistance.

As 400G Ethernet technology continues to expand, more power is required, and transceiver-density is increasing, ATS is ready with thermal solutions to meet next-generation challenges for the QSFP market.

For more information about Advanced Thermal Solutions, Inc. (ATS) thermal management consulting and design services, visit https://www.qats.com/consulting or contact ATS at 781.769.2800 or [email protected].

0 notes

Text

Coherent Optical Equipment Market for New Business Developments Strategies with Competitive Analysis of Top Companies 2019-2027

According to a new market report titled Coherent Optical Equipment Market -Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 – 2026, published by Transparency Market Research the global coherent optical equipment market is expected to reach US$ 34,599.0 Mn by 2026, expanding at a CAGR of 9.1% from 2018 to 2026. According to the report, the global market is expected to continue to be influenced by a range of macroeconomic and industry-specific factors. North America is anticipated to continue to be at the forefront of global demand, with the market in the region expanding at a CAGR of 8.0% during the forecast period. Technical advancements, increased digitization, high internet penetration, and presence of a large number of optical equipment providers are anticipated to drive the coherent optical equipment market in North America.

Request a Sample – https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=62211

Rising Significance of High Speed Bandwidth and Technological Advancement across the World Driving the Global Coherent Optical Equipment Market

Increasing adoption of new IT solutions with modern consumer trends in different organizations, and IT modernization is expected to boost the coherent optical equipment market in the coming years. Moreover, growing internet penetration is expected to fuel the growth of the market in the near future.

Both North America and Europe are mature regions of the market, due to high awareness about coherent optical equipment among users and technological developments. However, the market in Asia Pacific is expected to expand at a robust pace during the forecast period. Rise in penetration of technology as well as significant investments in the optimal utilization of IT solutions across countries such as the U.S., U.K., Germany, France, China, India, and Brazil are anticipated to offer lucrative opportunities for coherent optical equipment providers in the near future.

Coherent Optical Equipment Market: Scope of the Report

Based on technology, the global coherent optical equipment market has been segmented into 100G, 200G, 400G+, and 400G ZR. The 100G segment held significant market share, followed by 200G and 400G+ technology segments in 2017. However, 400G+ segment is projected to witness significant growth in the coming years and is expected to hold prominent share of the market by the end of the forecast period. 200G and 400G+ technology are expected to see strong growth over the forecast period. The report includes analysis of the coherent optical equipment market by region, segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Request For Covid19 Impact Analysis Across Industries And Markets – https://www.transparencymarketresearch.com/sample/sample.php?flag=covid19&rep_id=62211

On the basis of equipment, the global coherent optical equipment market has been segmented into WDM (Wavelength-Division Multiplexer), modules/chips, test & measurement equipment, optical amplifiers, optical switches, and others. Others equipment segment includes optical fiber, optical splitters, fiber optic circulators, optical transceivers etc. WDM segment accounted for major market share in 2017 and is expected to retain its position over the forecast period. WDM segment is likely tobe driven by the demand for 100G+ coherent wavelengths. It is a highly popular equipment that aides in multiplexing of many optical fiber carrier signals into a single fiber optic cable by using different wavelengths of light. The biggest advantage of WDM is that it can carry multiple wavelengths in a single fiber cable. However, the optical switches segment is expected to expand significantly over the forecast period. Moreover, test & measurement equipment segment is projected to gain market share in the coming years as it helps to push the boundaries of high speed optical communication with a range of innovative, easy-to-use modular and customized solutions.

In terms of application, the networking segment occupied major market share in 2017 as it helps to provide broader bandwidth with increased transmission speeds, while the data center application segment is likely to expand significantly over the forecast period. Networking application is further bifurcated into Fiber-to-the-Building/Premises (FTTB/P) optical network and Fiber-to-the-Home (FTTH) optical network. The FTTB/FTTP optical network sub-segment is expected to maintain its leading position over the forecast period, due to the growing demand for high-speed networks at buildings or premises for accessing smart systems. The application of coherent optical equipment in data centers is expected to grow at a rapid pace over the forecast period due to mainstream adoption of cloud computing and the growing use of the Internet by smartphones and other connected devices.

By end-user, the market is segmented into service provider, public sector, and industries.Growing demand from internet service providers and telecom service providersforhigh data bandwidthis anticipated to drivegrowth ofthe global coherent optical equipment market in the coming years. Theservice provider sector is a prominent user of coherent optical equipment. This segment accounted for major market share in 2017 and is expected to hold its leading position over the forecast period. However, the market in the industries sector is projected to expand at a rapid pace in the near future.

North America held a prominent share of the coherent optical equipment marketin 2017.The market in the region is anticipated to expand at a CAGR of 8.0% during the forecast period. In 2017, the U.S. held a significant share in terms of revenue of the coherent optical equipment marketin North America,followed by Canada.However, the market in Asia Pacific and MEA is anticipated to expand at a significant CAGR in the coming years.

Customization of the Report: This report can be customized as per your needs for additional data or countries. – https://www.transparencymarketresearch.com/sample/sample.php?flag=CR&rep_id=62211

Global Coherent Optical Equipment Market: Competitive Dynamics

The research study includes profiles of leading companies operating in the global coherent optical equipment market. Profiles of market players provide details of company business overview, broad financial overview, business strategies, and recent developments. Some of the key players in the coherent optical equipment market profiled in the study are Ciena Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Nokia Corporation, Infinera Corporation, Fujitsu Limited, ECI Telecom Ltd. and ZTE Corporation among others.

Market Segmentation

Coherent Optical Equipment Market, by Technology

100G

200G

400G+

400G ZR

Coherent Optical Equipment Market, by Equipment

WDM (Wavelength-Division Multiplexer)

Modules/Chips

Test & Measurement Equipment

Optical Amplifiers

Optical Switches

Others (optical fiber, optical splitters, fiber optic circulators, optical transceivers)

Coherent Optical Equipment Market, by Application

Networking

Data Center

OEMs

Fiber-to-the-Building/Premises (FTTB/P) Optical Network

Fiber-to-the-Home (FTTH) Optical Network

Coherent Optical Equipment Market, by End-user

Service provider

Public Sector

Industries

Internet service provider

Telecom service provider

Aviation

Energy

Railways

In addition, the report provides analysis of the coherent optical equipment market with respect to the following geographic segments:

North America

Europe

Asia Pacific (APAC)

Middle East & Africa (MEA)

South America

U.S.

Canada

Rest of North America

U.K

Germany

France

Rest of Europe

India

China

Japan

Rest of Asia Pacific

GCC

South Africa

Rest of Middle East & Africa

Brazil

Rest of South America

About Us

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR’s experienced team of Analysts, Researchers, and Consultants, use proprietary data sources and various tools and techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact

90 State Street, Suite 700 Albany, NY 12207 Tel: +1-518-618-1030 USA – Canada Email: [email protected] Website: https://www.transparencymarketresearch.com/

0 notes

Text

How to Choose the Right Fiber Optic Transceiver

With the rapid development of optical communication, there are more and more fiber optic transceivers appearing in the market to meet users’ demand to achieve various transmission rates. With so many options available, maybe you are wondering what you should pay attention to during the purchase process. This post will concentrate on the things you should know before choosing an optical transceiver, including form factors, fiber mode, etc. and I hope it can be helpful.

Basics of Fiber Optic Transceiver

Fiber optic transceiver, also called optical module, is a device that uses fiber optical technology to send and receive data. It uses electronic components to condition and encodes/decode data into light pulses and then sends them to the other end as electrical signals. As a core component in optical communication, fiber optic transceiver is widely applied in LAN, FTTH, SDH/SONET, etc. With 5th Generation wireless systems (5G) being deployed these days, the demand for high-rate optical transceivers will be increasing, especially for 100G, 200G or even 400G optical transceiver. Anyway, it’s necessary for you, who are about to choose an optical transceiver, to consider the following points.

Eight Points for Choosing Transceiver

Form Factors

Since the first optical transceiver comes on the scene, it has been constantly updated to be smaller and supports a higher data rate. Some types such as GBIC and X2 have been superseded by the newer ones. The common types that are widely used currently are 1G SFP, 10G SFP+, 40GQSFP+, 100G QSFP28, and so on. As the multi-source agreement (MSA) defines the operating characteristics of different kinds of fiber optic transceivers, it’s necessary to make a comparison among them and then choose the right one.

Fiber Mode