#28NorthGroup

Explore tagged Tumblr posts

Text

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

One major reason why we’re not heading toward a foreclosure crisis is the high level of equity homeowners have today. Unlike in the last housing bubble, where many homeowners owed more than their homes were worth, today’s homeowners have far more equity than debt.

That’s a big part of the reason why even though mortgage debt is at an all-time high, this isn’t 2008 all over again. As Bill McBride, Housing Analyst for Calculated Risk, explains:

“With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern . . .”

Today’s homeowners are in a much stronger position than ever before. So, let’s break it down and see why today’s mortgage debt isn’t anything to fear.

More Equity, Less Risk of Foreclosures

According to the St. Louis Fed, total homeowner equity is nearly triple the total mortgage debt today (see graph below):

High equity makes it less likely for homeowners to face foreclosure because they have more options. If someone struggles to make their mortgage payments, they could potentially sell their house and still come out ahead thanks to their built-up equity.

Even if home values were to dip, most homeowners would still have a comfortable cushion of equity. That’s a big contrast to the 2008 crisis, where many homeowners were underwater on their mortgages and had few options to avoid foreclosure.

Delinquency Rates Are Still Near Historic Lows

Another reassuring sign is that, according to the NY Fed, the number of mortgage payments that are more than 90 days late is still near historic lows (see graph below):

This is partly due to a variety of programs designed to help homeowners through temporary hardships. As Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA), says:

“. . . servicers are helping at-risk homeowners avoid foreclosures through loan workout options that can mitigate temporary distress.”

So, even if someone falls behind on their payments, there are support systems in place to help them avoid foreclosure.

Low Unemployment Helps Keep the Market Stable

One other important factor is today’s low unemployment rate. More people have stable jobs, which means they’re better able to afford their mortgage payments. As Archana Pradhan, Principal Economist at CoreLogic, explains:

“Low unemployment numbers have helped reduce the overall delinquency rate . . .”

During the last housing crisis, unemployment was much higher, which led to a wave of foreclosures. Today’s unemployment rate is very different (see graph below):

That stability in how many people are employed is one of the reasons the market doesn’t have the same risks as it did the last time.

There’s no need to worry about a wave of distressed sales like the one we saw in 2008. Most homeowners today are employed and have low-interest mortgages they can afford, so they’re able to make their payments. As McBride states:

“The bottom line is there will not be a huge wave of distressed sales as happened following the housing bubble.”

Bottom Line

While mortgage debt is high, rest assured the market isn’t on the brink of another crash. Instead, most homeowners are in a strong position. If you have questions or concerns, connect with a local real estate agent.

0 notes

Text

Debunking Scary Myths About Buying a Home

Some Highlights

There are a number of scary myths about homebuying in today’s market. Here’s what you need to know.

Prices are not expected to crash, it is possible to buy even with student loan debt, and there are programs that can help you save for a down payment.

Don’t let scary myths delay your homebuying plans. Connect with an agent so you have a pro to help you separate the facts from your fears.

0 notes

Text

What To Expect from Mortgage Rates and Home Prices in 2025

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices.

Whether you’re thinking of buying or selling, here’s a look at what the experts are saying and how it might impact your move.

Mortgage Rates Are Forecast To Come Down

One of the biggest factors likely affecting your plans is mortgage rates, and the forecast looks positive. After rising dramatically in recent years, experts project rates will ease slightly throughout the course of 2025 (see graph below):

While that decline won’t be a straight line down, the overall trend should continue over the next year. Expect a few bumps along the way, because the trajectory of rates will depend on new economic data and inflation numbers as they’re released. But don’t get too hung up on those blips and reactions from the market as they happen. Focus on the bigger picture.

Lower mortgage rates mean improving affordability. As rates come down, your monthly mortgage payment decreases, giving you more flexibility in what you can afford if you buy a home.

This shift will likely bring more buyers and sellers back into the market, though. As Charlie Dougherty, Director and Senior Economist at Wells Fargo, explains:

“Lower financing costs will likely boost demand by pulling affordability-crunched buyers off of the sidelines.”

As that happens, both inventory and competition among buyers will ramp back up. The takeaway? You can get ahead of that competition now. Lean on your agent to make sure you understand how the shifts in rates are impacting demand in your area.

Home Price Projections Show Modest Growth

While mortgage rates are expected to come down slightly, home prices are forecast to rise—but at a much more moderate pace than the market has seen in recent years.

Experts are saying home prices will grow by an average of about 2.5% nationally in 2025 (see graph below):

This is far more manageable than the rapid price increases of previous years, which saw double-digit percentage growth in some markets.

What’s behind this ongoing increase in prices? Again, it has to do with demand. As more buyers return to the market, demand will rise – but so will supply as sellers feel less rate-locked.

More buyers in markets with inventory that’s still below the norm will put upward pressure on prices. But with more homes likely to be listed, supply will help keep price growth in check. This means that while prices will rise, they’ll do so at a healthier, more sustainable pace.

Of course, these national trends may not reflect exactly what’s happening in your local market. Some areas might see faster price growth, while others could see slower gains. As Lance Lambert, Co-Founder of ResiClub, says:

“Even if the average national home price forecast for 2025 is correct, it’s possible that some regional housing markets could see mild home price declines, while some markets could still see elevated appreciation. That has been, after all, the case this year.”

Even the few markets that may see flat or slightly lower prices in 2025 have had so much appreciation in recent years – it may not have a big impact. That’s why it’s important to work with a local real estate expert who can give you a clear picture of what’s happening where you’re looking to buy or sell.

Bottom Line

With mortgage rates expected to ease and home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers.

If you have any questions about how these trends might impact your plans, connect with a local agent. That way you’ve got someone to help you navigate the market and make the most of the opportunities ahead.

0 notes

Text

The Biggest Mistakes Sellers Are Making Right Now

The housing market is going through a transition. Higher mortgage rates are causing more moderate buyer activity at the same time the supply of homes for sale is growing.

And if you aren’t working with an agent, you may not realize that. Here’s the downside. If you’re not informed, you can’t adjust your strategy or expectations to today’s market. And that can lead to a number of costly mistakes.

Here’s a look at some of the most common ones – and how an agent will help you avoid them when you sell.

1. Overpricing Your House

Many sellers set their asking price too high and that’s why there’s an uptick in homes with price reductions today. An unrealistic price will deter potential buyers, cause an appraisal issue, or lead to your house sitting on the market longer. An article from the National Association of Realtors (NAR)explains:

“Some sellers are pricing their homes higher than ever just because they can, but this may drive away serious buyers and result in unapproved appraisals . . .”

To avoid falling into this trap, partner with a pro. An agent uses recent sales of similar homes, the condition of your house, local market trends, and so much more to find the price that’ll attract more buyers and open the door for multiple offers and a faster sale.

2. Skipping the Small Stuff

You may try to skip important repairs, thinking you can pass the task on to your buyer. But visible issues (even if they’re small) can turn off potential buyers and result in lower offers or demands for concessions. As Money Talks News says:

“Home shoppers like to turn on lights, flush toilets and run the water. If these basic things don’t work, they may assume you’ve skipped other maintenance. Homes that appear neglected aren’t likely to fetch top price.”

If you want to get your house ready to sell, the best place to turn to for advice is your agent. They’ll be able to do a walk-through with you and point out anything you’ll need to tackle before the photographer comes in.

3. Not Looking at Things Objectively

Buyers today are feeling the pinch of high home prices and mortgage rates. With affordability that tight, they may come in with an offer that’s lower than you’d want to see – especially if you didn’t stage, price, or market the house well.

It’s important you don’t take this personally. Getting overly emotional can put the sale at risk. As an article from Ramsey Solutions says:

“Remember, a buyer’s offer is not a reflection of their opinion of your home or your housekeeping abilities. . . The sale of your home is strictly a business transaction. If they start out with a low offer, don’t take it personally and get emotional. Instead, channel that energy toward negotiating. Work with your agent and make a counteroffer.”

4. Being Unwilling To Negotiate

The supply of homes for sale has grown. That means buyers have more options, and with that comes more negotiation power. As a seller, you may see more buyers getting an inspection, requesting repairs, or asking for help with closing costs today. You need to be prepared to have those conversations. As U.S. News Real Estate explains:

“If you’ve received an offer for your house that isn’t quite what you’d hoped it would be, expect to negotiate . . . the only way to come to a successful deal is to make sure the buyer also feels like he or she benefits . . . consider offering to cover some of the buyer’s closing costs or agree to a credit for a minor repair the inspector found.”

An agent will walk you through what levers you may want to pull based on your own goals, budget, and timeframe.

5. Not Using a Real Estate Agent

Notice anything? For each of these mistakes, partnering with an agent helps prevent them from happening in the first place. That makes trying to sell your house without an agent’s help the biggest mistake of all.

Real estate agents have experience and expertise in pricing, marketing, negotiating, and more. That knowledge streamlines the selling process and usually results in drumming up more interest and ultimately can get you a higher final price.

Bottom Line

If you want to avoid making mistakes like these, you need to work with a real estate agent.

0 notes

Text

3 Graphs That Prove There Won’t Be A Housing Market Crash

There are a whole lot of people who think a housing crash is coming.

And who can blame them? From YouTube videos to social posts and media headlines…there’s so much noise about what’s ahead for the housing market.

Whether you realize it or not, this is negatively impacting your business, because this misconception is affecting your clients’ thoughts about the market, and ultimately, their decisions.

How Housing Crash Fears Impact Buyers and Sellers

On the one hand, you have people sitting on the sidelines waiting (and hoping for) home prices to drop. They want a crash to happen because they’re holding out for that deal of a lifetime. In fact, a survey found that 32% of people think it’s the only way they’ll be able to buy a home.

Then you have current homeowners. Maybe they’re thinking about selling, but worry they’ll take a loss if prices drop drastically. They don’t want to buy their next home at the top of the market to then have their investment go belly up.

If you’ve gotten this objection from even just one client or prospect, you have a chance to clear the air and prove your value as a housing market expert.

The Main Reason the Housing Market Won’t Crash

Let’s go back to your high school economics class. You’ll remember one of the first lessons it covered: supply and demand.

When supply is low and demand is high, prices go up. When it’s the reverse, they go down.

Looking at it from the lens of the housing market, we can apply the same rule. While inventory is on the rise, there are still too few homes for sale to meet demand.

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101,” said Mark Fleming, Chief Economist at First American.

Therefore, inventory, or rather a lack thereof, is the biggest reason we will not see a drastic drop in home prices.

But if that isn’t enough to convince your clients that a housing crash isn’t coming, showing them these three graphs should help too.

Why Today’s Market Is So Different from 2008

Even though there are more homes for sale now compared to last year, the overall supply is still pretty low. Nationally, we have about a third of the inventory we had in 2008. With fewer homes on the market, prices are unlikely to drop significantly.

A repeat of 2008 would require a lot more people selling their homes and not enough buyers, and that’s just not happening, especially since so many people are holding on to their homes right now due to their historically low mortgage rates.

There’s also been talk about all the new homes being built. While new houses make up a bigger slice of the market than usual, it’s nothing to worry about.

Builders aren’t overbuilding right now – they are just catching up from years of underbuilding since the last crash. So, even with more new homes available, the supply still isn’t meeting the demand.

Foreclosures and short sales aren’t flooding the market either. Thanks to tighter lending standards, we have more qualified buyers and fewer foreclosures. Even though foreclosures are up a bit, as expected, they’re still below normal levels.

This means we’re not seeing even close to the number of distressed properties that we did during the last crash.

And like the cherry on top of a sundae, we have this quote from Business Insider to drive this point home:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

So, with inventory levels low compared to demand, prices aren’t going to drop drastically. Even top industry economists and experts agree: this isn’t a bubble about to burst. We’re in a much more stable place than in 2008, and a market crash is unlikely.

0 notes

Text

The U.S. Commercial Real Estate Market: Trends, Insights, and Forecasts

The U.S. commercial real estate market has been undergoing significant transformations in 2024. One of the key recent developments is the decline in commercial foreclosures, which decreased by 14% in June 2024 compared to the previous month. Despite this positive shift, foreclosures are still up by 48% compared to the same period last year (2).

Key Factors Influencing the Market

Interest Rates and Lending Environment

Rising interest rates have posed challenges for commercial real estate investors, particularly since many rely on refinancing every few years. The cost of commercial real estate loans has increased, and obtaining these loans has become more difficult due to tightened lending standards by banks. This has resulted in a significant drop in commercial property sales volume, which fell by 53% year-over-year for properties valued at over $1 million in the first half of 2023 (1).

Sector Performance

Multifamily and Neighborhood Retail: These sectors have remained strong, benefiting from stable demand. Multifamily properties, in particular, continue to perform well with a vacancy rate holding steady around 5% throughout 2023 (3).

Industrial Real Estate: The industrial sector, especially cold storage, has shown resilience. However, there are signs of softening as the demand for inventory decreases. Despite this, long-term prospects remain positive with expected annual rent growth for warehouse and distribution properties (4).

Office Space: The office sector faces ongoing challenges, with a national vacancy rate reaching 19.2% in Q3 2023. The future of office buildings remains uncertain as central business districts evolve, potentially leading to the conversion of some office spaces into residential or data centers (3).

Retail: While traditional malls struggle, neighborhood retail centers in urban and suburban areas are performing well. Retail is expected to emerge as a strong sector in 2024, with steady performance and moderate rent growth (4).

Macroeconomic Influences

The broader economic environment, characterized by higher interest rates and geopolitical concerns, continues to impact the commercial real estate market. The Federal Reserve's stance on maintaining higher interest rates to control inflation suggests that the current rate environment will persist at least through the second half of 2024 (3).

Construction Costs and Insurance

The construction industry faces high costs due to inflation, labor shortages, and rising material prices. These factors have led to increased property insurance premiums, which saw average increases of 17% in the third quarter of 2023. Construction inflation is expected to continue through 2024, influencing both costs and insurance coverage (1).

Looking Ahead

The outlook for the U.S. commercial real estate market in 2024 is mixed. While certain sectors like multifamily and neighborhood retail remain strong, the office and industrial sectors face uncertainties. Investors and property owners should focus on optimizing liquidity, safeguarding against fraud, and exploring new financing approaches to navigate these challenges and capitalize on emerging opportunities.

References

1. CBIZ. (2024). Commercial Real Estate Trends to Track in 2024. Retrieved from www.cbiz.com

2. Florida Realtors. (2024). U.S. commercial foreclosures decreased in June. Retrieved from www.floridarealtors.org

3. JPMorgan Chase. (2024). 2024 Midyear Commercial Real Estate Outlook. Retrieved from www.jpmorgan.com

4. Moody's Analytics. (2024). Commercial Real Estate Trends. Retrieved from www.moodysanalytics.com

0 notes

Text

Analyzing the Current State of Florida's Housing Market: Separating Fact from Fiction

Recent headlines have sparked concerns about the stability of Florida's housing market, citing decreases in home sales and increases in active listings. However, these reports often lack depth and fail to provide the necessary context for understanding the situation accurately. In this article, we delve into the nuances of Florida's housing market, analyzing key trends and providing insights to set the record straight.

Understanding the Data:

Statement 1: Declining Home Sales

It's true that home sales in Florida have seen a decline in recent months. However, it's essential to view this trend within the broader context of seasonal fluctuations and historical data. Traditionally, the beginning of the year witnesses a dip in housing sales, attributed to factors such as the holiday season and slower market activity. Therefore, isolated observations of declining sales at the start of the year may not accurately reflect the overall health of the market.

Moreover, while recent years have shown record-breaking levels of home sales, particularly in 2021, it's crucial to recognize these as outliers rather than the norm. The unprecedented population growth and historically low interest rates during this period fueled a surge in housing demand, leading to inflated sales figures. As such, the current decline in sales could be interpreted as a natural correction rather than a sign of crisis.

Statement 2: Surge in Active Listings

The significant increase in active listings over the past year has raised concerns among observers. However, similar to the discussion on home sales, this trend must be evaluated in light of historical patterns and external factors. The initial decline in listings at the onset of the COVID-19 pandemic was followed by a rapid rise as market conditions stabilized.

It's essential to recognize that the current level of active listings has yet to reach pre-pandemic levels, indicating a replenishment of housing inventory rather than an oversupply. Restoring balance to the market by increasing inventory can contribute to long-term stability and affordability, countering the previous trend of soaring housing costs driven by supply shortages.

The apparent challenges facing Florida's housing market may not be as dire as some headlines suggest. While fluctuations in home sales and active listings warrant attention, they are part of a broader process of market adjustment and recalibration. Viewing these trends through the lens of historical context and economic fundamentals provides a more accurate perspective on the state of the housing market.

Sheridan Morby, senior research economist at the Florida Chamber Foundation, aptly describes the current situation as a transition to a "new normal." This characterization acknowledges the evolving dynamics of the housing market and emphasizes the importance of adaptability and informed analysis.

"Prices will remain firm and will not decline on a national level."

— Lawrence Yun, Chief Economist, National Association of Realtors

In conclusion, while challenges and uncertainties persist, Florida's housing market demonstrates resilience and adaptability in navigating evolving economic conditions. By embracing data-driven analysis and contextual understanding, stakeholders can contribute to a robust and thriving housing ecosystem that benefits residents and investors alike.

This article provides an in-depth analysis of Florida's housing market, examining key trends and dispelling misconceptions. It offers insights into the factors influencing market dynamics and emphasizes the importance of informed decision-making for stakeholders.

References:

Baltuch, K. (April 19, 2024). Is Florida’s Housing Market in Trouble? The Difference Between Headlines and Analysis. Florida Chamber Foundation. Retrieved from https://www.flchamber.com/is-floridas-housing-market-in-trouble-the-difference-between-headlines-and-analysis/

Rothstein, R., & Basile, C. (April 11, 2024). Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again? Forbes Advisor. Retrieved from https://www.forbes.com/advisor/mortgages/real-estate/housing-market-predictions/

Ostrowski, J. (April 21, 2024). Is the housing market going to crash? What the experts are saying. Bankrate. Retrieved from https://www.bankrate.com/real-estate/is-the-housing-market-about-to-crash

Carbonaro, G. (Mar 04, 2024). Florida's Housing Market Is in Trouble. Newsweek. Retrieved from https://www.newsweek.com/florida-housing-market-trouble-1874962

#MarketAnalysis hashtag#FloridaRealEstate hashtag#DataDrivenInsights#housingmarket#realestatemarket#realestate#28northgroup#realestateadvisor#home & lifestyle

0 notes

Text

6 Strategies to Save on Home Insurance Premiums

From wildfires to floods, the past few years have brought a historic number of devastating climate and weather events to the United States. In 2023 alone, there were 28 individual weather-related disasters that caused at least $1 billion in damages each.1

These events triggered a huge influx of home insurance claims, and analysts expect the increase in both catastrophes and claims to continue. Adding to the problem, construction labor and supply costs have risen, making it more expensive to repair affected homes. Consequently, home insurance rates have surged: In 2024, Bankrate reports, premiums are already up an average of 23%, following double-digit increases the previous year.2,3

In disaster-prone regions, the situation is even more challenging. Some insurers have pulled out of risky areas entirely, and many of those that still offer policies in high-risk areas have doubled or even tripled their premiums.4

For most homeowners, comprehensive home insurance coverage is crucial for financial security—but massive rate increases can turn a once-affordable home into a financial burden. They can also pose a serious challenge for sellers. A home insurance policy is typically required to get a mortgage, and, in some hard-hit regions, we’re seeing sales fall through or homes sit on the market because insurance policies are unattainable or too expensive.5,6

But don’t panic! While these broader trends may be out of your control, there’s still plenty you can do to save. Here are our top six strategies to slash insurance premiums while maintaining the protection you need.

SHOP AROUND

Getting multiple quotes is a smart move for many major purchases, including home insurance. We recommend reviewing at least three estimates before you commit to a policy. You can get quotes either by reaching out to insurers directly or by working with an independent insurance broker.7 You’ll need to provide detailed information about the property you’re insuring and your claims history.

Make sure you read policies carefully before you choose. Sometimes, a policy can look like a better deal at first glance but turn out to have important coverage gaps. Be sure to consider how much the policy will pay out to repair or replace your home and review caps on personal possession and liability claims. It’s also smart to read reviews from policyholders (Trustpilot is a good place to start) and ratings published by organizations like the Better Business Bureau and J.D. Power.

For help choosing the right policy, reach out to us for a list of trusted insurance professionals.

INCREASE YOUR DEDUCTIBLE

The size of your deductible—which is the amount you pay before your insurance coverage kicks in on a claim—is a major factor in your insurance cost.

A low deductible, such as $500, comes with higher premiums, while a higher deductible, like $2,500 or even $5,000, costs less on a monthly basis. In some cases, you may be able to customize your coverage further by designating a different deductible for certain kinds of claims, such as those caused by named storms or natural disasters.

If you are confident that you have enough in savings to cover that initial outlay if needed, choosing a higher deductible can help you save significantly over the long term. According to Nerdwallet, raising your deductible from $1,000 to $2,500, for example, could save you an average of 11% each year.8

BUNDLE MULTIPLE TYPES OF INSURANCE

Insurers want to get as much of your business as possible, so most offer significant discounts if you bundle your home and auto insurance, meaning that you package the two policies together. With some insurers, you can get even higher savings by bundling more than home and auto—RV, boat, jewelry, and life insurance are potential options to consider.

According to US News and World Report, insurers typically offer customers who bundle home and auto insurance 10-25% savings on monthly premiums.This approach also has other advantages: It cuts down on your paperwork, and in some cases—like if a storm damages both your home and car—you may be able to pay just one deductible instead of two when you file a claim.9

However, before you sign on the dotted line, remember strategy #1 and be sure to shop around. In some cases, bundling isn’t the cheaper option, and bundling deals vary between companies. It’s also critical to carefully check that the bundled coverage offers everything you need.

ASK ABOUT AVAILABLE DISCOUNTS

Did you know that being a nonsmoker might qualify you for a home insurance discount?8 Some insurers offer some surprising incentives for policyholders who pose a statistically lower risk of filing a claim. In the case of nonsmokers, that’s because of the decreased risk of a home fire.

Many carriers also offer discounts to military-affiliated families, homeowners in certain professions, such as teachers or engineers, or recent homebuyers. Sometimes, you can also save by opting for paperless billing or paying your premiums for a full year upfront.10

Since available discounts vary significantly between insurers, the best strategy is to simply ask a representative for the full list of available discounts so you can see what cost savings might be available to you.

AVOID MAKING SMALL CLAIMS

Worried that your premiums will rise significantly in the future? Try to avoid making a claim unless truly necessary. Many insurers offer discounted rates to policyholders who go a certain number of years without filing a claim, and filing multiple claims typically results in large increases.10 If you file too many, you may even risk non-renewal of your policy.11

Since the cost of even a small premium increase can add up significantly over time, if you have minor damage to your home—for example, if a few shingles blew off your roof in a windstorm—it may be a wiser long-term financial decision to pay out of pocket instead of filing a claim.

If the cost of the repair is less than your deductible, it never makes sense to file, and if it’s just slightly above your deductible, it’s also usually best to pay for the repairs yourself. Additionally, always be sure to review your policy before you make a claim. Even claims that are denied can count against you, so it’s not worth filing if the damage is clearly excluded from coverage.11

If you find yourself in this situation, feel free to reach out for a list of reasonably-priced professionals who can help with home repairs.

BE STRATEGIC ABOUT HOME IMPROVEMENTS

Insurance premiums alone may not be the deciding factor for a home improvement project, but it’s important to know how renovations could impact your rates—for better or worse.

For example, some upgrades and repairs can reduce your premiums by making your home safer or less prone to certain types of damage. These include:12

Upgrading your electrical system

Updating your plumbing

Installing a monitored security system

Adding a fire sprinkler system

Replacing the roof

On the other hand, some upgrades can raise premiums significantly, either because they increase the value of your home (and therefore the cost to replace it) or because they pose a hazard. These include:12

Installing a swimming pool or other water features

Building an extension or expanding your living space

Upgrading materials, like flooring or countertops

Adding a fireplace or woodstove

Whether or not your planned renovations are on either of these lists, it’s wise to inform your insurer about changes you make to your home—otherwise, you may risk gaps in coverage. And you’re always welcome to check with us before you begin any home improvement project to find out how it could impact the value and resale potential of your home.

BOTTOMLINE: Protect Your Investment Without Sacrificing Enjoyment of Your Home

Getting the coverage you need for financial security without overpaying can be a tricky balance, especially in today’s environment. But remember, while it’s important to find the best deal you can, home insurance isn’t an area to skimp on.

For advice on your specific risks and the type of coverage you need, we recommend consulting with a knowledgeable insurance professional. We’re happy to connect you with a trusted adviser in our network. And if you’re considering a home renovation, feel free to reach out for a free consultation on how it might affect your property value (and your premiums).

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, insurance, or tax advice. Consult the appropriate professionals for advice regarding your individual needs.

Sources:

Climate.gov - https://www.climate.gov/news-features/blogs/beyond-data/2023-historic-year-us-billion-dollar-weather-and-climate-disasters

Bankrate - https://www.bankrate.com/insurance/homeowners-insurance/homeowners-insurance-cost/

Policygenius - https://www.policygenius.com/homeowners-insurance/home-insurance-pricing-report-2023/

CNN - https://www.cnn.com/2023/09/20/business/insurance-price-increase-risk-climate-first-street-dg/index.html

BBC - https://www.bbc.com/news/business-66367224

US News - https://realestate.usnews.com/real-estate/articles/how-climate-change-could-impact-your-home-value

Nerdwallet - https://www.nerdwallet.com/article/insurance/how-to-shop-for-homeowners-insurance

Nerdwallet - https://www.nerdwallet.com/article/insurance/save-on-homeowners-insurance

US News and World Report - https://www.usnews.com/insurance/homeowners-insurance/how-to-bundle-home-and-auto-insurance

Marketwatch - https://www.marketwatch.com/guides/insurance-services/how-to-save-on-homeowners-insurance/

Bankrate - https://www.bankrate.com/insurance/homeowners-insurance/when-to-file-a-home-insurance-claim/#when

Bankrate - https://www.bankrate.com/insurance/homeowners-insurance/home-insurance-and-renovations/

0 notes

Text

Why Overpricing Your House Can Cost You

If you’re trying to sell your house, you may be looking at this spring season as the sweet spot – and you’re not wrong. We’re still in a seller’s market because there are so few homes for sale right now. And historically, this is the time of year when more buyers move, and competition ticks up. That makes this an exciting time to put up that for sale sign.

But while conditions are great for sellers like you, you’ll still want to be strategic when it comes time to set your asking price. That’s because pricing your house too high may actually cost you in the long run.

The Downside of Overpricing Your House

The asking price for your house sends a message to potential buyers. From the moment they see your listing, the price and the photos are what’s going to make the biggest first impression. And, if it’s priced too high, you may turn people away. As an article from U.S. News Real Estate says:

“Even in a hot market where there are more buyers than houses available for sale, buyers aren’t going to pay attention to a home with an inflated asking price.”

That’s because no homebuyer wants to pay more than they have to, especially not today. Many are already feeling the pinch on their budget due to ongoing home price appreciation and today’s mortgage rates. And if they think your house is overpriced, they may write it off without even stepping foot in the front door, or simply won’t make an offer if they think it’s priced too high.

If that happens, it’s going to take longer to sell. And ideally you don’t want to have to think about doing a price drop to try to re-ignite interest in your house. Why? Some buyers will see the price cut as a red flag and wonder why the price was reduced, or they’ll think something is wrong with the house the longer it sits. As an article from Forbes explains:

“It’s not only the price of an overpriced home that turns buyers off. There’s also another negative component that kicks in. . . . if your listing just sits there and accumulates days on the market, it will not be a good look. . . . buyers won’t necessarily ask anyone what’s wrong with the home. They’ll just assume that something is indeed wrong, and will skip over the property and view more recent listings.”

Your Agent’s Role in Setting the Right Price

Instead, pricing it at or just below current market value from the start is a much better strategy. So how do you find that ideal asking price? You lean on the pros. Only an agent has the expertise needed to research and figure out the current market value for your home.

They’ll factor in the condition of your house, any upgrades you’ve made, and what other houses like yours are selling for in your area. And they’ll use all of that information to find that target number. The right price will bring in more buyers and make it more likely you’ll see multiple offers too. Plus, when homes are priced right, they still tend to sell quickly.

Bottom Line

Even though you want to bring in top dollar when you sell, setting the asking price too high may deter buyers and slow down the sales process.

Connect with a local real estate advisor to find the right price for your house, so we can maximize your profit and still draw in eager buyers willing to make competitive offers.

#realestate#28northgroup#realestateadvisor#home & lifestyle#lifestyle#realestatemarket#housingmarket

0 notes

Text

The Island Issue

We are excited to welcome you to The Island Issue of GG Magazine. This new issue is all about the endless appeal of islands, featuring stories about individuals whose island lifestyles and enterprises never fail to inspire. From stunning boutique hotels and resorts to the vibrancy of cultures captured by world-renowned photographers, we welcome you to explore the stories that emulate the island dream.

In this issue, we meet serial entrepreneur Sir Richard Branson for the opening of his new boutique hotel “Son Bunyola” in Majorca. In an interview about dreams, pioneering spirit and the thirst for adventure, we learn the story behind his entrepreneurial spirit and “never-give-up” mentality. Following is a section exploring the work of legendary photographer Slim Aarons, who captured the glamorous lives of the upper class in the Mediterranean and the Caribbean, followed by a look inside the colorful Manhattan townhouse of John Demsey, former Group President of Estée Lauder, who was forced to start over in his mid-60s. Finally, discover the luxury resort known as the “Bawah Reserve” located in Indonesia, rewriting the definition of peace via seclusion.

Meeting Mr. Yes!

In the heart of Mallorca, a new chapter unfolds in the story of Sir Richard Branson, the intrepid founder of the Virgin Group and a connoisseur of adventure. With the unveiling of “Son Bunyola,” his latest venture, Branson beckons us into an extraordinary world where the narrative is as captivating as the landscape.

“Son Bunyola” stands as a beacon of luxury within the Tramuntana mountains, sprawling across a 520-hectare estate adorned with more than15,000 olive trees. Mallorca's essence is captured in every detail, from the meticulously selected décor to the furniture that echoes the island's soul, ensuring that the spirit of the Balearics pulsates through the veins of this majestic retreat. At its heart lies a 28-meter pool, born from ruins, symbolizing rebirth and the enduring allure of transformation.

Yet, it is Branson’s personal journey that imbues “Son Bunyola” with its unique allure. His journey, initially fueled by the pursuit of a lost love, ultimately led him to a different kind of passion—a love affair with Mallorca itself. While fate may not have granted him the romantic outcome he once sought, it gave him a profound appreciation for the island, its beauty, and its capacity to inspire.

Beyond the enchanting landscapes and luxurious amenities, “Son Bunyola” is a testament to Branson's life lessons—family, dedication, and the importance of patience. It embodies his belief that “The brave may not live forever, but the cautious do not live at all.”

For this article and more, you can get the full issue here. Enjoy your read.

0 notes

Text

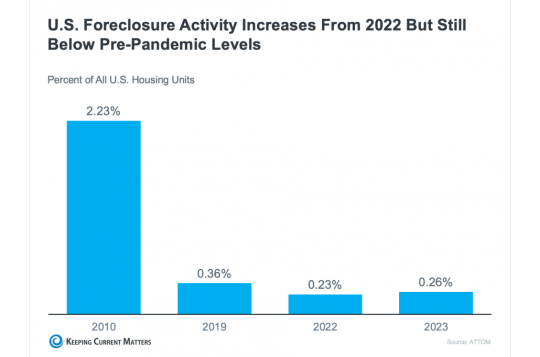

3 Graphs that Prove there is NO Foreclosure Crisis coming

Here’s the scoop: while the number of foreclosure filings might be inching up, we’re nowhere near a foreclosure crisis.

The market’s stable, buyer demand is strong, and homeowner equity is higher than ever.

Keep calm, carry on, and don’t get scared by any foreclosure headlines – that’s the message to share with your clients right now.

Because this news isn’t going away anytime soon. So, use the insights and visuals in this article to let them know why there’s no cause for alarm.

Foreclosures Have Increased, But Not By Much

During the Great Recession, millions of homes went into foreclosure. In 2010, there were almost 3 million foreclosure filings in this country.

In comparison, there were only about 357,000 last year.

The graph below shows the number of foreclosure filings going back to 2005 – before the housing crash.

The red bars are when there were over 1 million filings per year. You can see that not only are foreclosure numbers nowhere near where we were during the Great Recession, but they’re also still significantly lower than where they were before the pandemic.

As Rick Sharga, Founder and CEO of the CJ Patrick Company, explains:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

Now, let’s focus in on 2020 and 2021. Remember the foreclosure moratorium and forbearance programs during the pandemic? They were lifesavers for millions of homeowners, giving them a chance to bounce back during some seriously tough times.

When those programs wrapped up, it was inevitable that we’d see a bump in foreclosures. But here’s the key point: just because foreclosures are ticking up, it doesn’t mean there’s a crisis or a wave on the horizon.

Just take a look at the graph above to help put that into perspective. We’re still below pre-pandemic numbers and way below the height of the housing crash in 2010.

One of the biggest reasons why is that homeowners are sitting on tons of equity right now. That means that even if they hit challenging times, they have options to use that equity to sell and avoid foreclosure altogether.

This perspective helps people understand why the market today is so much different than back in 2008.

As for what’s happening right now, the graph below says it all. All foreclosure metrics are down. That means active foreclosure inventory, foreclosure sales, and foreclosure starts are lower than they were a year ago.

Therefore, those headlines blowing up your newsfeed are painting a pretty exaggerated picture. They’re cherry-picking recent numbers and comparing them to a time when foreclosures were at an all-time low.

It’s like comparing apples to oranges – not exactly fair, right?

Bottom Line

Headlines have been creeping their way into the news cycle again. They claim that foreclosures are on the rise. The reality, however, is a little more complex.

In the wake of inflation and what have been some tough years for housing affordability, some people want a crash to happen. They’re holding out for that deal of a lifetime.

On the other end of that, anything foreclosure related will immediately put homeowners on high alert. Who wants to sell their house and buy a new one that immediately drops in value?

These visuals and insights help put any fears at ease, letting consumers know there’s no foreclosure crisis on the horizon and therefore, no cause for alarm.

0 notes

Text

4 Tips To Make Your Strongest Offer on a Home

Are you thinking about buying a home soon? If so, you should know today’s market is competitive in many areas because the number of homes for sale is still low – and that’s leading to multiple-offer scenarios. And moving into the peak homebuying season this spring, this is only expected to ramp up more.

Remember these four tips to make your best offer.

1. Partner with a Real Estate Agent

Rely on a real estate agent who can support your goals. As PODS notes:

“Making an offer on a home without an agent is certainly possible, but having a pro by your side gives you a massive advantage in figuring out what to offer on a house.”

Agents are local market experts. They know what’s worked for other buyers in your area and what sellers may be looking for. That advice can be game changing when you’re deciding what offer to bring to the table.

2. Understand Your Budget

Knowing your numbers is even more important right now. The best way to understand your budget is to work with a lender so you can get pre-approved for a home loan. Doing so helps you be more financially confident and shows sellers you’re serious. That gives you a competitive edge. As Investopedia says:

“. . . sellers have an advantage because of intense buyer demand and a limited number of homes for sale; they may be less likely to consider offers without pre-approval letters.”

3. Make a Strong, but Fair Offer

It’s only natural to want the best deal you can get on a home, especially when affordability is tight. However, submitting an offer that’s too low does have some risks. You don’t want to make an offer that’ll be tossed out as soon as it’s received just to see if it sticks. As Realtor.com explains:

“. . . an offer price that’s significantly lower than the listing price, is often rejected by sellers who feel insulted . . . Most listing agents try to get their sellers to at least enter negotiations with buyers, to counteroffer with a number a little closer to the list price. However, if a seller is offended by a buyer or isn’t taking the buyer seriously, there’s not much you, or the real estate agent, can do.”

The expertise your agent brings to this part of the process will help you stay competitive and find a price that’s fair to you and the seller.

4. Trust Your Agent During Negotiations

After you submit your offer, the seller may decide to counter it. When negotiating, it’s smart to understand what matters to the seller. Once you do, being as flexible as you can on things like moving dates or the condition of the house can make your offer more attractive.

Your real estate agent is your partner in navigating these details. Trust them to lead you through negotiations and help you figure out the best plan. As an article from the National Association of Realtors (NAR) explains:

“There are many factors up for discussion in any real estate transaction—from price to repairs to possession date. A real estate professional who’s representing you will look at the transaction from your perspective, helping you negotiate a purchase agreement that meets your needs . . .”

Bottom Line

In today's competitive market, be sure to work with a local real estate agent to find you a home you love and craft a strong offer that stands out.

0 notes

Text

Why You May Want To Seriously Consider a Newly Built Home

Are you putting off your plans to sell because you’re worried you won’t be able to find a home you like when you move? If so, it may be time to consider a newly built home and the benefits that come with one. Here’s why.

Near-Record Percentage of New Home Inventory

Newly built homes are becoming an increasingly significant part of today’s housing inventory. According to the most recent report from the National Association of Home Builders (NAHB):

“Newly built homes available for sale accounted for 31% of total homes available for sale in November, compared to an approximate 12% historical average.”

That means the percentage of the total homes available to buy that are newly built is well over two times higher than the norm. And even more new homes are on the way.

Recent data from the Census shows there’s been an uptick in both housing starts (where builders break ground on more new homes) and housing completions (homes where construction just wrapped).

And while some people may worry builders are building too many homes, that isn’t a concern – if anything, the recent increase is really good news. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Even more home building will be needed with the housing shortage persisting in most markets . . . Another 30% rise in home construction can easily be absorbed in the marketplace . . .”

How This Helps You

Since the supply of existing homes for sale is still low right now, the increase of new-home construction can be a game changer because it gives you more options for your search.

Picture yourself in a home that’s new from the ground up: new appliances, fresh paint, fewer maintenance needs because everything is new, and so much more. Doesn’t that sound nice?

And it may be more within reach than you ever imagined. In addition, some builders are offering things like mortgage rate buy-downs for homebuyers right now. This can help offset today’s affordability challenges while also getting you into your dream home. In a recent article, Patrick Duffy, Senior Real Estate Economist at U.S. News, explains:

“Builders have been using mortgage interest rate buydowns for many years as a sales incentive whenever interest rates are relatively high, . . .Today more builders are offering rate buydowns for the entirety of the loan, allowing buyers to finance more home for the same payment amount.”

Just remember, the process of buying from a builder is different from buying from a home seller, so it’s important to partner with a trusted real estate advisor who knows the local market. They’ll be your go-to resource for coordinating with the builder, reviewing contracts, and more.

Bottom Line

If you’re trying to sell so you can make a move but you’re having a hard time finding a home you like, connect with a local real estate advisor to explore all of your options, including the newly built homes in our area.

0 notes

Text

Unlocking the Charms of Apopka: 10 Reasons Why This Hidden Gem Beckons You Home

Nestled in Northwest Orange County Florida, Apopka, beckons as a compelling destination for those in search of an idyllic home. With its enchanting blend of natural beauty, economic vibrancy, and close-knit community spirit, Apopka stands out as an appealing choice for individuals and families alike. In this comprehensive exploration, we delve into ten convincing reasons why Apopka might be the perfect place for you to call home.

Natural Oasis: Apopka, proudly acclaimed as the “Indoor Foliage Capital of the World,” invites residents to immerse themselves in the captivating landscapes that define the city. From the serene beauty of Wekiwa Springs State Park to the expansive shores of Lake Apopka, this natural oasis promises a daily retreat into Florida’s picturesque scenery.

Community Harmony: At the heart of Apopka lies a genuine sense of community, where neighbors effortlessly become friends. The city’s rich tapestry of local events, lively festivals, and communal gatherings fosters connections among residents, creating an environment where every newcomer is welcomed with open arms.

Economic Dynamism: Apopka’s strategic location and robust economy position it as a thriving hub for professionals and businesses. From the flourishing agriculture sector to cutting-edge developments in healthcare and technology, the city’s economic dynamism presents a myriad of opportunities for those seeking growth and prosperity.

Exemplary Education: Families with children find reassurance in Apopka’s unwavering commitment to education. The city is home to a diverse range of high-performing public and private schools, ensuring that every student receives a quality education that prepares them for a successful future.

Housing Diversity: Apopka’s housing market caters to a variety of preferences and budgets, offering a spectrum of options that include charming single-family homes, contemporary condominiums, and comfortable apartments. Whatever your lifestyle, Apopka has a home that suits your needs.

Access to Cultural Hub: A short drive from Orlando, Apopka seamlessly combines the tranquility of suburban living with the cultural richness of a metropolitan hub. Residents can enjoy the vibrant arts scene, world-class entertainment, and abundant employment opportunities while still relishing the peaceful ambiance of Apopka.

Top-Notch Healthcare: Apopka prioritizes the well-being of its residents through top-notch healthcare facilities. The city boasts advanced hospitals, clinics, and healthcare providers, ensuring that residents have access to quality medical care and wellness services.

Recreation Aplenty: Fitness enthusiasts rejoice in Apopka’s diverse recreational offerings, from well-maintained golf courses and state-of-the-art sports facilities to picturesque hiking and biking trails. The city provides ample opportunities for an active and health-conscious lifestyle.

Safety and Tranquility: Apopka consistently ranks as one of Florida’s safest cities, creating an ideal environment for families and individuals seeking peace of mind. The city’s unwavering commitment to public safety underscores its dedication to maintaining a high quality of life for its residents.

Business Opportunities: Apopka’s business-friendly environment fosters a hub of opportunities for entrepreneurs and professionals alike. Whether you’re looking to establish a new venture or expand an existing one, Apopka’s supportive ecosystem and entrepreneurial spirit make it an attractive destination for businesses of all sizes.

Apopka, unfolds as a dynamic and inviting community, where the allure of natural wonders, economic vitality, and a tight-knit community spirit converge seamlessly. Whether drawn by scenic landscapes, economic opportunities, or a family-friendly environment, Apopka promises a lifestyle that resonates with diverse preferences. Consider Apopka as your next home, and embrace the unparalleled lifestyle this Sunshine State gem has to offer.

1 note

·

View note

Text

Essential Tips for Hiring a Remodeling Contractor

Embarking on a home remodeling project is an exciting venture, but finding the right remodeling contractor is crucial to ensuring a successful outcome. With numerous options available, it's essential to approach the hiring process with diligence and care. To guide you through this important decision, we've compiled a list of invaluable tips for hiring a remodeling contractor.

Obtain Multiple Estimates:

Before making any decisions, seek at least three written estimates from different contractors. This not only provides you with a comprehensive understanding of the project's cost but also allows you to compare services and determine the most reasonable pricing.

Check References:

Go beyond the estimates and delve into the contractor's track record. Request and check references, and if possible, visit previous projects they have completed. This firsthand insight into their work quality and client satisfaction can be instrumental in making an informed decision.

Investigate Complaints:

Take the time to investigate the contractor's reputation by checking with local entities such as the Chamber of Commerce or Better Business Bureau for any complaints or disputes. A clean track record is a positive indicator of a contractor's reliability and professionalism.

Detailed Contracts:

Ensure that the contract is detailed and explicitly outlines the scope of work. Clearly define what is to be done and establish procedures for handling change orders. A comprehensive contract serves as a blueprint for the project and minimizes misunderstandings.

Minimal Down Payment:

Protect your investment by making the smallest down payment possible. This precautionary measure safeguards your finances in case the contractor fails to complete the job or encounters unforeseen challenges.

Verify Permits, Licenses, and Insurance:

Confirm that the contractor possesses the necessary permits, licenses, and insurance. This ensures that they comply with local regulations and have the coverage needed to address any potential issues during the project.

Timelines and Recourse:

Clearly stipulate in the contract when the work will be completed, and outline the recourse available if deadlines are not met. Familiarize yourself with your right to cancel a contract within three business days of signing it, should any concerns arise.

Subcontractor Involvement:

Clarify whether the contractor's employees will handle the entire job or if subcontractors will be involved. Understanding the dynamics of the workforce contributes to effective project management and coordination.

Indemnification for Code Compliance:

Secure an indemnification clause in the contract, holding the contractor responsible if the work fails to meet local building codes or regulations. This adds an extra layer of protection and accountability.

Cleanup and Damage Responsibility:

Specify in the contract that the contractor is responsible for cleaning up after the job and addressing any damages incurred during the remodeling process. This ensures a seamless transition to enjoying your newly renovated space.

Material Specifications:

Guarantee the use of materials that meet your specifications by clearly outlining them in the contract. This prevents any discrepancies and ensures that your vision for the project is realized.

Final Payment Satisfaction:

Hold off on making the final payment until you are completely satisfied with the completed work. This gives you the leverage to address any lingering issues or concerns before concluding the project.

Choosing the right remodeling contractor is a pivotal step in the success of your home improvement project. By adhering to these tips, you empower yourself to make informed decisions, mitigate risks, and ultimately transform your vision into a beautifully renovated reality.

#realestate#28northgroup#evcfl#realestateadvisor#home & lifestyle#lifestyle#realestatemarket#homerenovation#renovation#construction#home improvement

0 notes

Text

5 Reasons to Relocate Your Business to Apopka, Florida

Relocating a business is a significant decision that requires careful consideration and thorough analysis. Among the numerous factors that need to be weighed, the choice of location stands out as one of the most critical. When it comes to selecting an ideal destination, Apopka, Florida, offers numerous compelling reasons for businesses looking to make a strategic move. In this blog, we will explore five key factors that make Apopka an excellent choice for business relocation. From its access to transportation and logistics to its economic competitiveness, Apopka has a lot to offer.

1. Access to Transportation and Logistics: Apopka's strategic location in Central Florida positions it as a hub for transportation and logistics. The city is well-connected to major highways, such as Interstate 4, which offers quick access to key markets throughout the state. Additionally, Apopka's proximity to the Orlando International Airport, one of Florida's busiest airports, makes it an ideal location for businesses that rely on air travel for their logistics needs. The city's logistical advantages make it easier to import and export goods, streamline supply chains, and connect with customers and partners both within Florida and beyond. This accessibility to transportation and logistics can significantly boost a company's operational efficiency, reducing costs and enhancing market reach.

2. Economic Competitiveness: One of the most attractive aspects of Apopka for businesses is its economic competitiveness. The city has taken substantial steps to create a business-friendly environment. Florida, in general, boasts a favorable tax climate with no state income tax, making it an appealing destination for both small and large businesses. Apopka, specifically, has implemented measures to encourage economic growth, including financial incentives, streamlined permitting processes, and development assistance programs. These initiatives not only make it easier to establish and grow your business in Apopka but also promote a thriving entrepreneurial ecosystem.

3. Skilled Workforce: Apopka's strategic location in the Orlando metropolitan area provides access to a diverse and skilled workforce. The city is surrounded by a wealth of educational institutions and professional training centers, ensuring a consistent pool of talented professionals across various industries. Whether your business operates in technology, healthcare, manufacturing, or any other sector, you'll find the skilled labor you need to drive your company forward in Apopka.

4. Quality of Life: Apopka's quality of life is another significant factor that contributes to its attractiveness as a business relocation destination. The city offers a unique blend of urban amenities and natural beauty. Employees and their families can enjoy the many parks, recreational opportunities, and cultural attractions, all while benefiting from the convenience of nearby shopping and dining options. This combination of work and play makes Apopka an excellent place to live, work, and raise a family.

5. Proximity to Major Markets: Situated in the heart of Florida, Apopka is not only well-connected to the state's markets but also within reach of major markets across the southeastern United States. With access to major transportation corridors, your business can efficiently distribute products and services to a wide customer base, facilitating growth and expansion opportunities.

Conclusion: When contemplating a business relocation, the decision should be guided by a comprehensive evaluation of the potential benefits and opportunities offered by the chosen destination. Apopka, Florida, stands out as an excellent option due to its access to transportation and logistics, economic competitiveness, skilled workforce, quality of life, and proximity to major markets. Businesses looking for a strategic move will find Apopka to be an accommodating and prosperous environment to establish and grow their operations.

If you are considering relocating your business to a place where you can thrive, Apopka's combination of strategic advantages makes it a compelling choice worthy of your attention.

#BusinessRelocation#ApopkaOpportunities#StrategicMove#BusinessGrowth#FloridaBusiness#LogisticsHub#EconomicDevelopment#GrowApopka#28NorthGroup#PassportApopka

0 notes