#2290 truck tax due date

Text

🚚📝 Trucker's Guide to Hassle-Free 2290 Form Filing! 📝🚚

Are you a hardworking trucker looking for a smoother way to handle your 2290 Form filing? Well, look no further! Truck2290 is here to provide you with an easy and interactive online filing service that will save you time, effort, and the headaches that often come with tax season.

1. Say Goodbye to Tedious Paperwork! 📑

Gone are the days of drowning in mountains of paperwork. With Truck2290's online filing service, you can complete your 2290 Form in just a few simple steps. Say farewell to long hours of filling out forms manually, and say hello to a user-friendly digital solution.

2. File Anywhere, Anytime! 🌐🕒

As a trucker, you're always on the move, and we understand that. That's why Truck2290's platform is accessible 24/7 from any device with an internet connection. No more waiting in line at the IRS office or rushing to find a computer. File your 2290 Form wherever and whenever you please!

3. Prompt and Precise Filing! ⏰✅

Late filing can lead to penalties, and inaccuracies can cause unnecessary complications. Our platform ensures that your 2290 Form is filed promptly and accurately, saving you from potential penalties and worries. Rest easy, knowing your tax responsibilities are well taken care of.

4. Professional Support at Your Fingertips! 💼📞

Got a question or need assistance? Our friendly support team is just a call or click away! Truck2290 is committed to providing you with the support you need throughout the filing process. Whether you have a query about the form or need help with any technical issues, we've got your back!

5. Secure and Confidential! 🔒🤐

We understand the importance of safeguarding your sensitive information. Rest assured that your data is handled with utmost security and confidentiality. Our platform employs state-of-the-art encryption and security measures to protect your privacy.

6. Convenient Payment Options! 💳💵

We know how important it is to have flexible payment options. That's why Truck2290 offers multiple payment methods, making it easy for you to complete your tax filing without any unnecessary hassle.

7. Stay Updated and Informed! 📢📊

Taxes can be complex, and regulations may change. But don't worry, we've got you covered. Truck2290 keeps you informed about any updates or changes that may affect your tax filing, ensuring you stay compliant with the latest regulations.

So, dear truckers, make your life easier and stress-free by choosing Truck2290 for your 2290 Form filing needs. Let us handle the paperwork while you hit the road with confidence! 🚛💨

Visit our website now (www.truck2290.com) and experience the convenience of hassle-free 2290 Form filing. Join thousands of satisfied truckers who have already made the switch to Truck2290!

0 notes

Photo

Tomorrow is the last date to report pro-rated form 2290 HVUT for December used heavy vehicles. E-file pro-rated form 2290 at Tax2290.com and get your schedule 1 copy now! More Visit at: https://blog.tax2290.com/tomorrow-is-the-last-date-to-e-file-pro-rated-form-2290-taxes-for-december-used-vehicles/

#Tax2290#Form 2290#Form 2290 Prorated Tax#Prorated Tax Deadline is Tomorrow#Form 2290 Partial Period Tax#Form 2290 pro-rated truck taxes#2290 prorated tax due date#December 2022 is due on January 31st 2023

0 notes

Text

MEET YOUR AUGUST 31ST FORM 2290 DEADLINE WITH ADVANCED FEATURES FROM EXPRESSTRUCKTAX

MEET YOUR AUGUST 31ST FORM 2290 DEADLINE WITH ADVANCED FEATURES FROM EXPRESSTRUCKTAX

The Form 2290 due date is fast approaching. File now at expresstrucktax.com to take advantage of the easy-to-use Form 2290 e-filing solution

ROCK HILL, SOUTH CAROLINA, UNITED STATES, August 19, 2022 /EINPresswire.com/ — August 31st is a very important deadline for drivers in the trucking industry. This is because that is the deadline to file Form 2290, an IRS tax form for the Heavy Vehicle Use…

View On WordPress

0 notes

Photo

The new tax season, TY 2022-2023, has already started at the beginning of July 2022 as usual, and it is going to last till the end of June 2023. Truckers and trucking taxpayers must report their Highway Heavy Vehicle Use Tax (HVUT) for the whole tax period in advance around the beginning of the tax period. As per the IRS regulations, the last date to file and pay the form 2290 truck tax for this tax period, TY 2022-2023, is August 31, 2022. So, truckers should file their form 2290 tax returns to the IRS on or before the last date and get the IRS stamped schedule 1 copy to operate their trucking business on the public highways smoothly. Truckers and trucking taxpayers should remember that form 2290 HVUT due doesn’t fall on the due date of the vehicle’s registration. Form 2290 HVUT is absolutely necessary to register your new vehicle or renew your existing vehicle registration on its due date. So, tuckers should report form 2290 HVUT for every tax season before the deadlines, which is irrelevant to the heavy vehicle’s registration due date. @pay2290 @thinktradeinc @tax2290 @irs2290 @irs2290 @2290efile @2290tax @bigwheels2290 @trucktax2290 @trucktax2290

#2290 for 2022#heavy truck tax form 2290 for 2022#hvut form 2290 for 2022#tax 2290 for 2022 is due now#form 2290 for the 2022 is due#renew form 2290 online for 2022

0 notes

Text

e-File 2290 Form Online with the IRS

Every year, truckers, owner operators and trucking companies file form 2290 for using the American highways. Vehicles that weigh 55,000 pounds or more and have crossed 5,000 miles in a given tax period must file form 2290 and pay the Heavy Highway Vehicle Use Tax or the HVUT tax.

It is important to file your HVUT tax as you will receive an IRS watermarked Schedule 1 which acts as a proof of tax payment. Without the Schedule 1, users cannot update their vehicle registration and tags at the DMV.

When is the due date to e-file 2290 form?

There are mainly two scenarios that determine when you should start filing your form 2290 online. In the below section you can find the scenarios that determine the due date for filing your form 2290 online.

1.If you have been using your heavy vehicle continuously over the years:

In such scenarios, the due date for filing your form 2290 is August 31st of every year. The tax filing season begins on 1st of July 2021 and ends on the 30th of June 2022.

2.If you have recently purchased a truck or started using your truck recently. New trucks are registered every day in the US. If a truck is purchased in any month other than July, the user needs to file form 2290 and pay the HVUT tax within 30 days of the vehicle’s first use month. The

According Form 2290 IRS instructions, the due date for the newly used truck would be the last day of the month following the month of first use. For example, if you started using your heavy vehicle on the 1st of February then the due date will be on the 31st of March. Filing your form 2290 before the due date will ensure zero penalties for your truck.

0 notes

Photo

IRS Tax Form 2290 - Due for 2021 - August 31 Deadline

When is Form 2290 Due? The Form 2290 #HVUT returns are due in July 2021 through June 2022, has to be reported and paid between July 1 and August 31. 2290eFiling is the best way to report and pay, to receive the IRS stamped Schedule 1 instantly.

#Truck tax form 2290 for 2021#hvut tax 2290 for 2021#tax 2290 electronic filing#form 2290 due date for 2021#August 31 due date for Tax 2290

0 notes

Text

HVUT Form 2290 electronic filing from your Apple device!

HVUT Form 2290 electronic filing from your Apple device is easy and fast! Dowmload it at https://apps.apple.com/us/app/tax2290-efile/id1475769017?ls=1 #2290eFiling through Tax2290 Mobile App can save 10% on the efile fee, apply code IOS2290 to save yourself!

Tax2290 Mobile App powered by TaxExcise.com, a product of ThinkTrade Inc. TaxExcise.com is the 1st ever IRS Authorized e-file provider for the Federal Heavy Vehicle Use Tax returns. The most experienced e-file provider and top rated by The American Truckers and Owner Operators. Also the 1st company to launch a smart mobile app to e-File 2290 taxes.

Tax2290 is the best app to e-File your Federal…

View On WordPress

#2290 due date#2290 due dates#2290 e file#2290 efile#2290 electronic filing#2290 form online#2290 iOD app#2290 ipad app#2290 iPhone app#2290 Mobile App#2290 online#2290 tax efile on iphone#2290 tax online#2290 truck tax online#free iOS 2290 mobile app#Heavy vehicle use tax#iOS tax 2290 mobile app#iOs tax2290 app#ipad 2290 tax app#iphone 2290 tax app#IRS form 2290#IRS form 2290 and Schedule-1#IRS form 2290 efile#IRS Form 2290 Online Filing#IRS tax form 2290#mobile app for 2290 efile#tax 2290 mobile app

0 notes

Text

All About Form 2290

Form 2290 is an IRS tax levied on the truck owners. This is an annual tax collected by the IRS. Trucks that weigh 55,000 pounds or more and used for 5,000 miles or more are subjected to this tax. The tax money is used for the construction and maintenance of highways in the US.

File Form 2290 From your State

You can file IRS HVUT from anywhere. To make the filling simple and easier, you can file the IRS HVUT with IRS-authorized e-file service providers. eForm2290 is an IRS-authorized e-file service provider with more than a decade experience.

Form 2290 Due Date

The IRS HVUT due date for the first used vehicles is the last day of the month following the first used month. For example, if you have used your vehicle for the first time in the month of October, then 30th November is the last day to file HVUT. To know more about IRS HVUT due date, please visit the official IRS site.

Form 2290 – Reasons for Rejection

There are several reasons for IRS HVUT rejection, like:

Mismatched EIN number

Missing signature

RTN rejection

Duplicate VIN or form 2290

Form 2290 Correction

Committing errors when filing IRS HVUT is common. If there are any errors that occurred during filing of IRS HVUT, you can correct it. Before submitting your form, please review it. This will help you avoid mistakes when filing IRS HVUT tax.

Most common errors that are made while filling IRS HVUT are:

Entering incorrect VIN

Typo errors

Filling in the wrong taxable gross weight

To correct these errors, you can use the IRS HVUT Amendment. Using this, you can fix any errors on IRS HVUT.

Form 2290 Amendment

For IRS HVUT, amendment implies any change to be made on the already submitted form 2290. You must pay the additional tax for the amended returns electronically.

The change or amends can be:

A change in the taxable gross weight of the vehicle

Exceeded mileage usage of suspended vehicles.

When you file 2290 amendments with eForm2290, we will expedite your form 2290 returns. Once IRS accepts the amendment, you will receive your stamped Schedule 1 copy.

Filing with eForm2290

When filing IRS HVUT with eForm2290, you just have to follow a simple process. We have made the process simpler, easier and secure. So that you can rest assured about your tax filings when you are behind the wheels. Use our IRS HVUT coupon to save on our processing fees.

1 note

·

View note

Text

How Heavy Highway Use Tax is calculated?

Who's necessary to cover HVUT or Heavy Highway Use Tax?The Transport sector features a remarkable growth in the actual last couple of years. Annually a lot of new businesses enter in this industry. But they need to know of the taxes they have to cover once these people start operating. The hauling company utilizing heavy vehicles ought to comprehend in details regarding HVUT or heavy highway use tax. Heavy Highway Use Tax can be a central tax attained upon heavy vehicles at a licensed significant weight equal to as well as exceeding fityfive, Thousand pounds and works about open public highways. The absolute maximum HVUT about the cars exceeding 75,000 pounds is $550 annually. Annually Bureau of Cars (BMV) demands the repayment receipt or HVUT. The tax length of Heavy Highway Use Tax starts on July 1 along with ends on June 30 next year. For more information regarding ny highway use tax return, check out this eTrucks Tax Calculator Program.

The gross taxable weight with the vehicle is the summation of:

The real unloaded weight of the actual vehicle fully outfitted of support.

The actual unloaded fat of any trailers or semitrailers fully equipped about services customarily utilized in combination with the car, and.

The weight from the optimum load often carried on the vehicle and any trailers and semitrailers often utilized with the car.

Who's necessary to cover HVUT or Heavy Highway Use Tax?

You want to pay out Heavy Highway Use Tax in case your business fulfils the below criteria's.

The highway motor vehicle is authorised in your own title.

The gross weight of the automobile is 55,000 pounds or higher.

It can be predicted to exceed the mileage over 5000 miles (7500 miles for Agricultural & Logging vehicles).

In case your company has ideas not to exceed the 5000 kilometres (7500 miles for Agricultural & Logging vehicles).

Then the vehicle can be designated as Tax hanging vehicle. You do not need to cover the taxes but need to file for this anyhow.

There are several teams which are exempted the particular HVUT comprise:

The Federal Government.

State or local authorities, including the District of Columbia.

Local or State governments, including the District of Columbia.

Mass transportation authorities.

Nonprofit volunteer fire departments, ambulance associations or rescue squads.

Indian tribal governments (for vehicles used in essential tribal government functions).

You Have to Have the next information to file your current HVUT

Vehicle Identification Number (VIN) of each vehicle over 55,000 pounds.

Employer Identification Number (EIN)

The taxable gross weight of each vehicle

Penalties for not filing Heavy Highway Use Tax.

Should you miss to document HVUT returns or perhaps pay taxes within the specified deadline, the IRS may possibly impose penalties or even fines on you. HVUT penalties may also be charged on you if there is any fraudulent throughout filing tax returns. These kinds of sentences are going to be incorporated in the interest charged on the overdue repayment. If you have any valid reason for late payment, after that fines for past due filing of Heavy Highway Use Tax may not levy on you. Regarding completing after the due date, an individual need to attach the proof postpone to be able to get a reduction.

That's why It gets essential intended for each trucking company to submit Heavy Highway Use Tax sort 2290 punctually. Not merely it saves you through charges but also helps One to become authenticated within the company. To handle your own business with no interference, File the taxes on time along with following every principle associated with the industry.

1 note

·

View note

Text

How Heavy Highway Use Tax Is Important?

Knowing the fact about is heavy highway vehicle tax is quite crucial. A better understanding will help you to find out its importance. It also encourages you to submit a heavy highway tax. You get to enjoy the benefits of paying this tax when you know where it goes. This is an essential fee that they need to pay. This tax is collected from all of the truckers. This is important for companies to transport their products. This is a essential fee for the truckers. This tax is used for the keeping highways and roads in a fantastic condition. What else if the businesses forget to pay the tax on time? It will cost a huge penalty in their side. Weight distance tax should be calculated on the basis of different states laws, rates of fuel on various states, etc.. Heavy vehicle use taxes are calculated based on its own load.

The Heavy Vehicle Use Tax is filed to the IRS by using Form 2290. The burden of the taxable freight should be calculated here. Truckers need to pay the sum annually. They operate before they have to take collection based on various actions. The initial bill for tax due amount based on the return plus any interest and penalties. At the least, an additional bill ought to be sent by the IRS as a reminder. Interest and penalties will continue to add on until the complete due amount is paid. Ranging from applying for last tax year’s refund to tax because of seizing assets and property, the IRS takes steps. IRS usually takes measures based on the previous year’s tax return because of property seizing or strength seizing. One ought to cover the heavy highway use tax prior than the due date of tax payment without balance keeping. If a trucker failed to pay the complete tax at one time, they need to contact the IRS.

If you don’t admit that maintain a copy of the bill and any tax returns, cancelled checks, other records. It will help the IRS to understand why your bill is wrong. IRS may understand the problem with your tax with such documents. You can visit the local IRS office for a solution. Should you describe or admit your problem previously, IRS will take action on the matter. If you’re facing bankruptcy or other financial problems, notify it previously to the IRS. You can call them or can visit their offices for discussion. You can discuss them to keep it to stop. Making tax report and paying tax on right time is troublesome of lots of the trucking companies. They use the Weight distance tax software to make the job simple. This software can calculate and send the tax report punctually to IRS. With the help of this software, you can save time, money efforts and mistakes as taxes are paid properly and on time.

2 notes

·

View notes

Text

Due Date for IRS Form 2290 for 2023–2024

My form 2290 is due when? The IRS form 2290 must be submitted by August 31 each year for heavy vehicles with a taxable gross weight of 55,000 pounds or more. Form 2290 for newly acquired vehicles must be submitted by the last day of the month after the month of first use.

Pay by October 31, 2023, if September 2023 is the first month used.

How soon must I submit my form 2290?

Pro Tip: Asking yourself when is 2290 payment is due shouldn't be left until the very last minute. To avoid late costs, prepare to file before the 2290 deadline. For instance, if your truck was used for the first time on a public road in July, you must file Form 2290 between July 1 and August 31.

For instance, Mark must register the truck in his name and submit a separate form 2290 reporting this new vehicle on or by December 31, 2023, for the tax year 2023–2024, if he buys a new taxable vehicle on November 3, 2023, and drives it home from the dealership on a public roadway. To prevent late fines, make sure you submit by the deadline of 2290.

Plan ahead and set notifications to e-file your taxes. When is 2290 Due? This should not be a question you leave until the last minute.

0 notes

Photo

Dear truckers! The last date to e-file form 2290 HVUT on a pro-rated basis for your December used heavy vehicles is January 31, 2023. As the deadline is just a week away, you must e-file form 2290 at Tax2290.com today!

#Tax2290#Form 2290#Form 2290 Prorated Tax#Form 2290 Partial Period Tax#Form 2290 pro-rated truck taxes#2290 prorated tax due date

0 notes

Photo

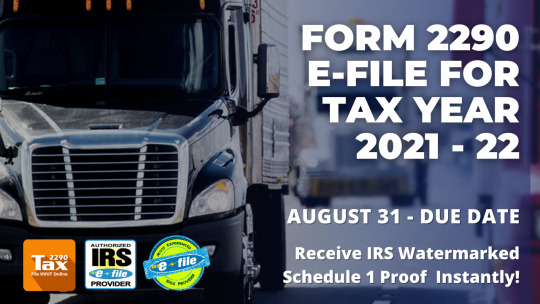

IRS Tax Form 2290 – Truck Tax Returns Due Date | Tax2290.com

Time to renew your heavy highway motor vehicle use tax using IRS Tax Form 2290 for the new tax filing period 2021 – 2022. E-filing is the fastest way to renew 2290 as you can receive Schedule-1 proof once IRS accepts your return.

@tax2290 it is easy and fast! Call us at 1-866-245-3918 or mail us at [email protected] for any suggestion and queries. Rest assured, our Tax Experts would never let you go wrong!

0 notes

Text

Best Way to e-File 2290 Form

Form 2290 is a federal tax reporting form. All heavy vehicle users using the American highways need to file form 2290 if it gauges 55,000 pounds or more on the weighing scale. You need to e-file 2290 form if you have used this vehicle for 5,000 miles or above. For agricultural vehicles, this limit extends to 7,500 miles.

You need to file your form 2290 before August 31st of every year. This is necessary to ensure that the IRS does not penalize you. The IRS monitors form 2290 submissions frivolously. Therefore you need to ensure that all your tax affairs are in order for a smooth on-road experience.

If your vehicle is pulled over by the highway patrol officer you need to provide the IRS schedule 1 copy, which is a proof of payment of your HVUT tax. You need to carry it in your vehicle at all times.

You should always file your form 2290 before the due date. Mostly, the due date for filing your form 2290 starts on July 1st and extends till June 30th of the next year. For vehicles purchased after July 1st, the due date to file form 2290 is the last day of the month following the month of first use.

What are Due Dates?

Due dates refer to the deadline by which you need to file your form 2290. It's very important that you file your form 2290 before the due date. Failure to do so will result in penalties.

The form 2290 filing season starts on July 1st and ends on June 30th of the next year. Users must file their form 2290 before the deadline, which is August 31st. For vehicles that were purchased after August, the user must file form 2290 on the last day of the month following the month of first use. For example, if you purchased your vehicle on October 1st, then the due date to file form 2290 is November 30th.

How Do I Calculate the Due Date?

If you have filed your form 2290 with an IRS authorised website previously, you will receive reminders about your next due date as the deadline approaches. For manual filers, the due date for filing form 2290 is within 30 days of purchasing your vehicle.

How Can I Get Support Regarding Form 2290?

Almost all e-filing service providers offer round the clock customer support. Customers can also make use of the Live chat feature to clarify doubts and file their form 2290 in a smooth and effortless manner.

0 notes

Text

FIRST USED HEAVY HIGHWAY VEHICLE ON USA HIGHWAYS NEEDS TO FILE IRS FORM 2290

As it is very important to File IRS Form 2290 Online and to Pay Heavy Vehicle Use Tax, everyone should know about the IRS Form 2290 Due Dates. Filers who file their Form 2290 within the 2290 Due Date are only filed smoothly with the IRS. If the truckers miss to File Form 2290 Online within the IRS Form 2290 Due Date then they may face the penalty. The IRS imposes interest and penalty along with tax if you fail to File IRS 2290 Online and to Pay Heavy Highway Vehicle Use Tax.

Filers can finish their Form 2290 Online Filing from the IRS Authorized Efile Provider. You can give the entire responsibility to the IRS Approved Efile Provider to File your Form 2290 Online. Or else, you can File Form 2290 Online by yourself. Annual Filing of IRS Form 2290 will starts from July 1st of the current year and ends on June 30th of the next year. The deadline of the IRS 2290 Online Filing is August 31st. Filers need to finish their IRS Form 2290 Online Filing and 2290 Highway Use Tax Payment within the time.

Form 2290 Due Date for New Heavy Vehicles

Without depending on the Tax year, the 2290 due date is different for new vehicles. The new vehicles which are running on public highways need to File IRS Form 2290 by the end of the next month. As per the IRS regulations and instructions, filers should File IRS Form 2290 by the end of the next month if they are new to run on public highways. For every first use of heavy vehicle running on USA, highways need to File 2290 Online Form and Pay Heavy Highway Vehicle Use Tax within the two months of due. If filers fail to File and Pay 2290 Online then one must need to Pay an extra charge which is a huge amount to pay an IRS.

Truckers who run their trucks on the public highways, fleet-owners, and also old and new truck operators need to File IRS 2290 Online Form and pay Heavy Highway Vehicle Use Tax. If the fleet-owners, filers who file Form 2290 Online annually, and also new and old truckers who starts running a new vehicle in the month of July then you need to File & Pay 2290 Highway Use Tax by the September month end. the filers need to File IRS 2290 Online by the September 30th if the filers start running their vehicle in the month of August.

Filing IRS Form 2290 Online

If the last day of September 30 falls on Saturday or Sunday then the filers can File 2290 Form Online on the next business day. truckers can File IRS Form 2290 Online by the IRS Authorized Efile provider with a small service charge. The Form 2290 Filing can process in two ways. Either you can File Form 2290 with paper and in an online. Filers can easily File IRS Form 2290 within the time without any late if they choose to File 2290 Online. Schedule 1 proof also immediately reach to the truckers with the IRS 2290 Online Filing.

IRS Authorized Efile Provider

Form 2290 Online Filing will take place within minutes and get IRS Stamped Schedule 1. Many tax experts will choose to File IRS Form 2290 Online for the easy and fast Form 2290 Filing. The HVUT 2290 Online Filing is the best method to File IRS 2290 Online and Pay Heavy Vehicle Use Tax to get IRS Authorized Schedule 1. File IRS Form 2290 Online from Form 2290 Filing for the best filing experience. You can call us to +1-316-869-0948 to File Form 2290 Online and Pay +1-316-869-0948 in an instant.

#IRS form 2290#Form 2290 Online Filing#File Form 2290#Form 2290 Online#E File Form 2290#IRS Tax Form 2290#Form 2290#2290 Due Date#2290 HVUT#2290 Tax#Tax Form 2290 E File

0 notes

Link

IRS form 2290 is a federal tax imposed on heavy vehicles like trucks. If you own a heavy vehicle that weighs 55,000 pounds or more and used for 5,000 miles or more, then it’s subjected to this tax. The tax amount is used for the construction and maintenance of highways in the United States.

File Form 2290 From Anywhere

Filing IRS HVUT is simple, easier and safer. To facilitate easy filing, IRS has authorized e-file service providers, like eForm2290. eForm2290 is an IRS-authorized e-file service provider with over 10 years of experience in the market. File with us and receive your Schedule 1 copy in a few minutes after IRS acceptance.

Form 2290 Due Date

The IRS HVUT deadline for the first used vehicles is the last day of the month following the first used month. For example, if your truck was used for the first time in the month of May, then 30th June is the last day to file IRS HVUT. To know more about IRS HVUT due date, please visit the official IRS site.

0 notes