#Form 2290 Online Filing

Explore tagged Tumblr posts

Text

Form 2290 Penalties and Fees: What To Look Forward To

This is very important Form for any person who drives heavy vehicles on public highways as it is related to the Heavy Vehicle Use Tax (HVUT). Nevertheless, incorrect or late filing of these forms can attract severe penalties and fees. One must have a good knowledge of these effects in order to avoid unnecessary expenses and complications

As a result, amounts due from delayed submission could snowball into considerable sums. More often than not, the Internal Revenue Service (IRS) levies fines for not filing the 2290 form by its due date which usually falls on the last day of the month that succeeds the month when you started using your vehicle(s). A penalty of up to 4.5 % per month can accumulate if you fail to meet this deadline up to five months, this also mounts up greatly. Furthermore, $100 is imposed as a minimum fine just in case the tax remains unpaid after it becomes overdue.

Furthermore, interest rates are applied on unpaid taxes besides late filing penalties. The interest rate is equal to federal short term rate plus 3% and starts accruing from the date when return was due until such time as tax is fully paid back. This may significantly increase your liability especially if payment is seriously delayed. For an individual to avoid this kinds of fines including interests there’s need to promptly file his/her Form 2290 and ensure that all taxes have been paid in full. Consistently checking IRS updates while employing digital methods helps simplify everything while minimizing any chances for errors

0 notes

Photo

Tax2290.com is the perfect online form 2290 e-filing service provider to report form 2290 taxes online. Register for free and e-file your truck taxes now! https://blog.tax2290.com/everything-you-need-to-know-about-e-filing-form-2290-online-at-tax2290-com/

0 notes

Text

Underst

Renewing your IRS Form 2290 is crucial for truck owners with vehicles weighing 55,000 pounds or more. The process is simple, especially when using eForm2290.com.

You can start by registering, adding your business details, and providing vehicle information. You'll choose your filing type, add the necessary details, and review everything before submitting. Payment options include Electronic Funds Withdrawal (EFW), EFTPS, debit/credit card, or check/money order. After filing, you’ll receive your stamped Schedule 1 via email. It’s important to renew by August 31 each year to avoid penalties, which can be significant.

eForm2290.com offers timely reminders and 24/7 customer support to ensure you never miss a deadline and can file your HVUT return easily and accurately.

0 notes

Text

E-file form 2290 online and get schedule in minutes Visit our website - www.simpletrucktax.com

#efileform2290#taxi service#truckinglife#truck#truckers#taxfilinghelp#form2290#form2290online#custom truck#2290online

0 notes

Text

Step-by-Step Guide to E-Filing Form 2290 with a Trusted Provider

You are a truck driver; you know that to keep your rigs moving without any kind of violation, the form 2290 needs to be made. Be assured that doing it online through form 2290 e-filing is not too tough or stressful if you're doing it with a trustworthy filing provider. Just follow this step-by-step procedure to help you file your Form 2290 Online with ease via electronic means, assisted by a trusted filing provider. Step 1: Select a Reliable E-Filing Company First, select a reputable and authentic seller for the e-filing of Form 2290. The company you want to select should be an IRS-authorized company; besides this, it must have positive reviews from thousands of truckers. That way, your filing process would be safe and soundless. Second Step: Creating An Account Then you are guided to their website for a registration process where they require you to provide them with some personal details such as your name, email address, and EIN number. Then, they will keep this information confidential and monitor your filing status. Add Truck Information Once you create your account, you are required to fill in as much information regarding your truck(s) as possible. Information includes; Vehicle Identification Number, gross weight of your vehicle, and date that has brought it to public highways during a tax period. Step 4: Review Your Form Ensure all details given are cross-checked prior to uploading. Check if truck detail contains EIN are correctly added. In fact, even some legitimate providers also allow error-checking capability and thus reduce the likelihood of most often encountered errors. Step 5: HVUT Payment You are supposed to pay the HVUT depending on the amount of how much your vehicle has consumed, in terms of its weight or mileage. There is always more than one way that reliable e-filing service providers give a person to pay HVUT, that include credit cards or direct transfers to banks. Step 6: File and Get Your Signed Schedule 1 Once you fill it out and pay for, you will submit your application. You get an instant process of e-filing through a valid filing service that will forward to you a signed Schedule 1 with proof of filing your tax. This will be conveyed to you via email in minutes. Step 7: Safe Custody of your Documents The copy of it must be kept in your record, so you will have easy access when receiving your schedule 1, especially for your vehicle's re-registration. Conclusion Use E-file Form 2290 with a professional e-file service provider- fast, easy, and stress-free. No more paper filing headaches. Pay your tax on time, so your truck hits the road without a hitch. Happy Trucking!

0 notes

Text

Empowering Logistics Companies | Form 2290

Welcome to the 2024 Key Tax Deadline and Strategies Season!

As we approach January 29th, the begin of the e-filing season, it’s time to center on proficient and stress-free assess filing.

We are committed to directing you through this prepare, guaranteeing a smooth involvement. Our group is here to oversee your monetary obligations with mastery and care, making assess recording direct and worry-free.

Forms to Anticipate by the Conclusion of January or the Starting of February Form W-2G: For detailing betting winnings. Form 1099-C: For announcing obligation of $600 or more canceled by certain monetary substances counting monetary teach, credit unions, and government government agencies. Form 1099-DIV: For announcing profits and selling distributions. Form 1099-G: For announcing certain government installments, counting unemployment recompense and state and nearby charge discounts of $10 or more.

Form 1099-INT: For detailing intrigued, counting intrigued on conveyor certificates of deposit. Form 1099-K: For announcing installments gotten from a third-party settlement entity. Form 1099-LS: For detailing reportable approach deals of life insurance. Form 1099-LTC: For announcing long-term care and quickened passing benefits. Form 1099-MISC: For detailing eminence installments of $10 or more, lease or other commerce installments of $600 or more, prizes and grants of $600 or more, edit protections continues of $600 or more, angling pontoon continues, restorative and wellbeing care installments of $600 or more.

Form 1099-NEC: For announcing nonemployee compensation. Form 1099-OID: For announcing unique issue discount. Form 1099-PATR: For announcing assessable disseminations gotten from cooperatives. Form 1099-Q: For detailing conveyances from 529 plans and Coverdell ESAs. Form 1099-QA: For detailing disseminations from ABLE accounts. Form 1099-R: For detailing conveyances from retirement or profit-sharing plans, IRAs, SEPs, or protections contracts. Form 1099-SA: For announcing conveyances from HSAs, Toxophilite MSAs, or Medicare Advantage MSAs. Form 1098: For announcing $600 or more of contract interest. Form 1098-E: For detailing $600 or more of understudy advance interest. Form 1098-MA: For announcing contract help payments. Form 1098-T: For announcing qualified educational cost and expenses. Form 8300: For announcing exchanges of more than $10,000 in cash (counting computerized resources such as virtual cash, cryptocurrency, or other advanced tokens speaking to value).

Form 8308: For detailing trades of a organization intrigued in 2023 that included unrealized receivables or significantly acknowledged stock items. Form 5498: For announcing IRA commitments, counting conventional, Roth, SEPs, and SIMPLEs, and giving the December 31, 2023, reasonable advertise esteem of the account and required least dispersion (RMD) if applicable. For proficient handling of your assess return, it is fundamental that we accumulate all essential data. It would be ideal if you fill out the brief Admissions Sheet.

Your precise reactions on the Admissions Sheet will empower us to give you with the best conceivable benefit and guarantee compliance with charge regulations. Convenient Arrangements and Custom fitted Assistance: Tax Deadline Understanding the complexities of assess season, G&S Bookkeeping offers helpful arrangements for record accommodation.

If you’re in the Rancho Cucamonga range, feel free to drop off your printed material at our office. Alternatively, secure online transfers are accessible. Our objective is to make your assess due date encounter as consistent as conceivable. For organizations with financial year plans, we give custom-made bolster to help in recognizing and assembly particular assess due date, guaranteeing prompt compliance. Conclusion: Set out on a Smooth Charge Journey: As the charge season unfurls, let us at G&S Bookkeeping ease your travel. With our mastery and personalized approach, we’re committed to guaranteeing a smooth and effective charge recording involvement for you.

Ready to begin? Provide us a call, and take the to begin with step towards a worry-free charge season.

0 notes

Text

Important Updates of Form 2290 and the Best Online Form 2290 Filing Service from Truck2290.com

Staying updated with Form 2290 changes and choosing the right filing service are crucial for truck owners and operators. Truck2290.com offers a seamless, efficient, and reliable solution for all your filing needs. With its user-friendly interface, robust support, and comprehensive resources, Truck2290.com stands out as the best choice for online Form 2290 filing.

#Form2290#TaxGuide#Truck2290#IRS#form2290irs#taxform2290#form2290online#form2290duedate#2290instructions

0 notes

Text

How Do I Get a Copy of My Paid 2290?

"If you need a copy of your paid Form 2290, follow these steps:

Log into your IRS account: If you filed electronically, you could access your account online. Request a Copy: You can request a copy by calling the IRS directly or by using their online services. Check Your Records: If you filed by mail, keep copies of all forms and receipts."

#IRSForm2290#TaxDocuments#HeavyVehicleUseTax#PaidForm2290#Truck2290#2290CopyRequest#TruckTax#TaxFiling#EfileTax

0 notes

Photo

Pro-rated form 2290 truck taxes for February used heavy vehicles and trucks are due on March 31, 2023. E-file form 2290 and stay ahead of the deadline at Tax2290.com! More Visit at: https://blog.tax2290.com/tax2290-com-is-the-convenient-platform-to-e-file-form-2290-online/

#Tax2290.com#form 2290#efile form 2290#e-file form 2290 online#form 2290 truck taxes#schedule 1 copy#prorated tax

0 notes

Text

File Form 2290 Online and Get Your Schedule 1 in Minutes

Fast & Secure 2290 Filing

The Cheapest 2290 e-Filing for Heavy Vehicles

IRS Authorized e-File Provider for Form 2290

Instant IRS Confirmation of Successful Filing

File now -www.simpletrucktax.com

#custom truck#efileform2290#form2290#taxi service#form2290online#truck#truckinglife#truckers#taxfilinghelp#2290online

0 notes

Text

How to E-file Form 2290 Without Breaking the Bank

Being the owner of a trucking company, most of the time, these things give an irritating feeling to do taxes, especially with something like Heavy Vehicle Use Tax (HVUT). However, you will be surprised to know that you can file Form 2290 electronically and pay it without burning too much of a hole in your pocket. Here is a step-by-step guide on how to do it effectively and save money. 1. What is Form 2290? It is a tax form truckers must file to the IRS if their vehicle exceeds 55,000 pounds. You will be required to file this form to the IRS yearly and helps funds for road maintenance. 2. Why File Form 2290 Online? E-filing of Form 2290 online is quick, convenient, and sometime cheaper than mailing it. You can do it from anywhere, at any time, and get your quick confirmation from the IRS. Also, you will not fear delays with postal services. 3. How to E-file Without Breaking the Bank Here is how to e-file Form 2290 without breaking the bank: Compare E-file Providers: There are many Form 2290 online services. Some are cheaper than others. Check their prices and see if they have deals on them. Watch for Discounts: Some e-file providers give discounts during tax season and/or first filers. Look for these types of savings to shave some more off. Use Free Trials or Low-cost Providers: Some providers allow you to try their service free or at low cost, especially if you file for only one truck. 4. How to E-file Form 2290 Online There is a simple step-by-step guide on how to e-file: Select an E-file Provider: Choose a reliable and affordable provider to file Form 2290 online. Sign up and input your information- including the information relating to the vehicle (in this case, your truck) and your Employer Identification Number. Form 2290 Filing: You can prepare your Form 2290 online. The website will automatically forward it to the IRS. Schedule 1: Once your form is processed, you'll receive Schedule 1, which becomes proof of payment. 5. Why Affordable E-filing Matters An independent trucker works tough to run a business, and every dollar saved helps. An economical way of e-filing Form 2290 online saves precious money while aiding you to stay compliant with the IRS. The lesser amount spent on filing means the more amount you can invest in your business or truck maintenance. Conclusion E-filing the Form 2290 online is not only simple but also inexpensive if you choose the right provider. And following the above makes it quite possible to file your taxes without breaking the bank, and that's what you do best: drive!

0 notes

Text

What is Form 2290 Tax and How Does it Work?

Understanding Form 2290 Tax and its significance in the world of taxation, Form 2290 holds a significant place. This form, also known as the Heavy Highway Vehicle Use Tax Return, is an essential component of the United States tax system. It plays a crucial role in ensuring that heavy vehicles operating on public highways contribute their fair share to infrastructure development and maintenance.

Form 2290 tax serves as a means for the Internal Revenue Service (IRS) to collect taxes from owners of heavy vehicles with a gross weight of 55,000 pounds or more. These taxes are imposed on vehicles that are used primarily for transportation purposes and have an estimated annual mileage exceeding 5,000 miles.

The importance of Form 2290 tax lies in its contribution towards funding vital highway construction, repairs, and upgrades programs. The revenue generated from this tax is utilized to improve road safety measures, enhance transportation infrastructure, and support various initiatives aimed at maintaining efficient roadway systems throughout the country.

It is worth noting that compliance with Form 2290 tax requirements is not only an obligation but also beneficial for vehicle owners. By fulfilling their tax responsibilities through timely submission of this form and payment of applicable taxes, individuals and businesses can avoid penalties imposed by the IRS.

Who Needs to File Form 2290?

Form 2290 is a crucial document that needs to be filed by certain individuals and businesses. It is primarily used to report and pay the Heavy Highway Vehicle Use Tax (HVUT). The HVUT applies to vehicles with a gross weight of 55,000 pounds or more and is operated on public highways. So, who needs to file Form 2290?

Generally, anyone who owns a heavy vehicle that falls under the aforementioned weight criteria must file this form. This includes trucking companies, owner-operators, and even agricultural businesses that use heavy vehicles for farming purposes. It's important to note that there are specific deadlines for filing Form 2290.

For most vehicles, the deadline falls on August 31st of each year. However, if you purchase a new vehicle during the tax period, you will need to file within the month following the first use of the vehicle. Filing Form 2290 is not only a legal requirement but also ensures that you stay in compliance with IRS regulations.

Failure to file or pay the HVUT can result in penalties and interest charges. To simplify the process of filing Form 2290, many individuals and businesses choose to utilize online services or software programs specifically eform2290.com designed for this purpose. This tool streamlines the filing process and provide assistance in calculating taxes owed based on vehicle weight and usage.

In conclusion, if you own or operate a heavy vehicle meeting the weight criteria outlined by IRS regulations, it is essential to file Form 2290 in a timely manner. Doing so will keep you compliant with tax laws while avoiding any unnecessary penalties or fees.

0 notes

Text

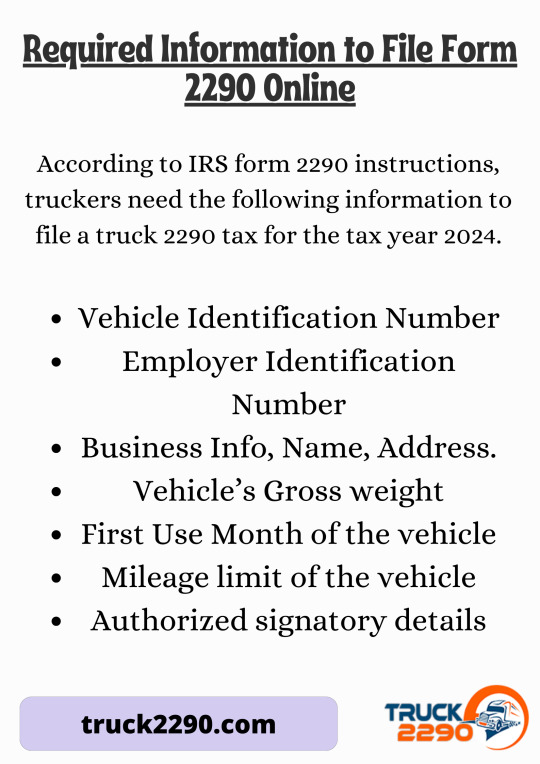

Required Information to File Form 2290 Online

Filing a 2290 tax form for the 2024 tax year is easy with Truck2290. Here, you will get assistance such as accurate tax calculations, free VIN correction, accessibility from anywhere, the ability to upload multiple VINs at once, and you will receive the instant schedule 1 proof in minutes.

0 notes

Text

0 notes

Photo

Form 2290 Filing Deadline is September 3rd for 2019-20 tax year. File Form 2290 before 2290 Deadline to avoid 2290 Tax penalties. Contact us: 316-869-0948

1 note

·

View note