#2024 Volkswagen sales growth

Explore tagged Tumblr posts

Text

Melissa Ryan at Ctrl Alt Right Delete:

On Saturday, February 15, I was standing outside a Tesla dealership in the heart of Seattle with a sign that said “BigBalls can lick Deez Nuts” and a photo of DOGE dipshit Edward “BigBalls” Coristine. As about 80 of us stood on the street chanting and yelling, an older couple stopped to compliment my sign. They were out for a walk after their breakfast and wondered what the fuss was about. I told them if they wanted to join us, they could hold my sign. To my surprise, they grabbed the sign and spent the next hour happily waving it at passing cars. The key to effective resistance is to make your opponent pay a price for their overreach—or at least instill fear that there might be a price to pay. Clearly, everyone involved in Trump 2.0 believes they can fuck around and will never have to find out. It’s up to us to change that. But how do regular people with limited resources extract a price from a rising fascist movement? The first answer is everything we can think of. No one who’s lived their whole life in the United States has ever faced something like this, and none of us knows for sure what’s going to derail the march toward fascism. In times like these, we should foster creative actions, not wag our fingers or tut-tut ideas.

But there is a very specific target that deserves special focus—Tesla Motors. Tesla is the basis of Elon Musk’s mystique and his wealth. His stake in the company is worth around $145 billion at today’s valuation—more than a third of his total net worth. Elon clearly isn’t scared about the legal consequences of his actions. Why should he be? The courts have never held him accountable in any meaningful way before, and now he’s protected by an increasingly authoritarian regime. But legal consequences aren’t the only cost an effective resistance can make opponents pay. The first thing you need to know is that Tesla Motors is a house of cards. As I write this, Tesla’s market cap stands at $1.12 trillion—about $400 billion more than Toyota, Honda, Ferrari, BMW, Mercedes-Benz, Porsche, Volkswagen, Ford, GM, Stellantis and Hyundai COMBINED. Tesla’s stock has been on a hype-fueled rocket ride since the start of the pandemic. But Wall Street investors hate uncertainty, and in the end, hype is no match for quarterly profits. Most of Tesla’s extreme valuation is based on the cockamamie idea that the company can continue growing at the rate it achieved early in the pandemic—and the mistaken belief that Tesla is a tech company, rather than a car company. But Tesla’s market dominance and opportunities for growth weren’t built to last. Only one in three Americans are open to buying EVs today, and there’s much more competition in the market than there was even 5 years ago. Chinese EV companies are eating Elon’s lunch. And far from the game changer Elon promised, the Cybertruck is looking more like an anchor around Tesla’s neck. Tesla sales are already tanking in Europe because of Musk’s tumbling reputation.

For the first time in a decade, Tesla reported fewer sales in 2024 than in 2023. Now, buyers in the U.S. are starting to price-in Elon’s ties to Trump and far-right movements around the world—and the potential social consequences of driving a car so closely associated with Musk’s personal brand. If that spreads, it could pop the hype bubble. Tesla insiders know it, and so do big Wall Street research firms.

Tesla, the crown jewel of Elon Musk’s empire, has become increasingly persona non grata among the left in the USA, and that is due to Musk’s turn to the far-right that began as early as the COVID pandemic and accelerating further in recent years.

22 notes

·

View notes

Text

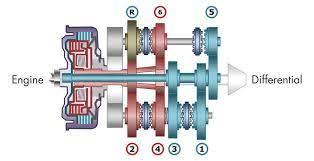

Dual Clutch Transmission Market To Witness the Highest Growth Globally in Coming Years

The report begins with an overview of the Dual Clutch Transmission Market 2025 Size and presents throughout its development. It provides a comprehensive analysis of all regional and key player segments providing closer insights into current market conditions and future market opportunities, along with drivers, trend segments, consumer behavior, price factors, and market performance and estimates. Forecast market information, SWOT analysis, Dual Clutch Transmission Market scenario, and feasibility study are the important aspects analyzed in this report.

The Dual Clutch Transmission Market is experiencing robust growth driven by the expanding globally. The Dual Clutch Transmission Market is poised for substantial growth as manufacturers across various industries embrace automation to enhance productivity, quality, and agility in their production processes. Dual Clutch Transmission Market leverage robotics, machine vision, and advanced control technologies to streamline assembly tasks, reduce labor costs, and minimize errors. With increasing demand for customized products, shorter product lifecycles, and labor shortages, there is a growing need for flexible and scalable automation solutions. As technology advances and automation becomes more accessible, the adoption of automated assembly systems is expected to accelerate, driving market growth and innovation in manufacturing.

The global dual clutch transmission market size was valued at USD 13.76 billion in 2023. The market is projected to grow from USD 14.68 billion in 2024 to USD 24.10 billion by 2032 at a CAGR of 6.4% during the forecast period. The Asia Pacific dominated the Dual Clutch Transmission Market Share with a share of 52.97 % in 2023

Get Sample PDF Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/108016

Key Strategies

Key strategies in the Dual Clutch Transmission Market revolve around optimizing production efficiency, quality, and flexibility. Integration of advanced robotics and machine vision technologies streamlines assembly processes, reducing cycle times and error rates. Customization options cater to diverse product requirements and manufacturing environments, ensuring solution scalability and adaptability. Collaboration with industry partners and automation experts fosters innovation and addresses evolving customer needs and market trends. Moreover, investment in employee training and skill development facilitates seamless integration and operation of Dual Clutch Transmission Market. By prioritizing these strategies, manufacturers can enhance competitiveness, accelerate time-to-market, and drive sustainable growth in the Dual Clutch Transmission Market.

Major Dual Clutch Transmission Market Manufacturers covered in the market report include:

Volkswagen AG (Germany)

Getrag (Magna International Inc.) (Germany)

BorgWarner Inc. (U.S.)

Schaeffler AG (Germany)

Aisin Seiki Co., Ltd. (Japan)

ZF Friedrichshafen AG (Germany)

Hyundai Dymos Inc. (South Korea)

Jatco Ltd. (Japan)

Daimler AG (Germany)

Eaton Corporation plc (Ireland)

The global economy gradually recovered and vehicle sales recorded a rebound, the demand for DCT systems picked up. Manufacturers are focusing on developing more efficient and cost-effective DCT systems to meet the growing demand for fuel-efficient vehicles.

Trends Analysis

The Dual Clutch Transmission Market is experiencing rapid expansion fueled by the manufacturing industry's pursuit of efficiency and productivity gains. Key trends include the adoption of collaborative robotics and advanced automation technologies to streamline assembly processes and reduce labor costs. With the rise of Industry 4.0 initiatives, manufacturers are investing in flexible and scalable Dual Clutch Transmission Market capable of handling diverse product portfolios. Moreover, advancements in machine vision and AI-driven quality control are enhancing production throughput and ensuring product consistency. The emphasis on sustainability and lean manufacturing principles is driving innovation in energy-efficient and eco-friendly Dual Clutch Transmission Market Solutions.

Regions Included in this Dual Clutch Transmission Market Report are as follows:

North America [U.S., Canada, Mexico]

Europe [Germany, UK, France, Italy, Rest of Europe]

Asia-Pacific [China, India, Japan, South Korea, Southeast Asia, Australia, Rest of Asia Pacific]

South America [Brazil, Argentina, Rest of Latin America]

Middle East & Africa [GCC, North Africa, South Africa, Rest of the Middle East and Africa]

Significant Features that are under offering and key highlights of the reports:

- Detailed overview of the Dual Clutch Transmission Market.

- Changing the Dual Clutch Transmission Market dynamics of the industry.

- In-depth market segmentation by Type, Application, etc.

- Historical, current, and projected Dual Clutch Transmission Market size in terms of volume and value.

- Recent industry trends and developments.

- Competitive landscape of the Dual Clutch Transmission Market.

- Strategies of key players and product offerings.

- Potential and niche segments/regions exhibiting promising growth.

Frequently Asked Questions (FAQs):

► What is the current market scenario?

► What was the historical demand scenario, and forecast outlook from 2025 to 2032?

► What are the key market dynamics influencing growth in the Global Dual Clutch Transmission Market?

► Who are the prominent players in the Global Dual Clutch Transmission Market?

► What is the consumer perspective in the Global Dual Clutch Transmission Market?

► What are the key demand-side and supply-side trends in the Global Dual Clutch Transmission Market?

► What are the largest and the fastest-growing geographies?

► Which segment dominated and which segment is expected to grow fastest?

► What was the COVID-19 impact on the Global Dual Clutch Transmission Market?

Table Of Contents:

1 Market Overview

1.1 Dual Clutch Transmission Market Introduction

1.2 Market Analysis by Type

1.3 Market Analysis by Applications

1.4 Market Analysis by Regions

1.4.1 North America (United States, Canada and Mexico)

1.4.1.1 United States Market States and Outlook

1.4.1.2 Canada Market States and Outlook

1.4.1.3 Mexico Market States and Outlook

1.4.2 Europe (Germany, France, UK, Russia and Italy)

1.4.2.1 Germany Market States and Outlook

1.4.2.2 France Market States and Outlook

1.4.2.3 UK Market States and Outlook

1.4.2.4 Russia Market States and Outlook

1.4.2.5 Italy Market States and Outlook

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

1.4.3.1 China Market States and Outlook

1.4.3.2 Japan Market States and Outlook

1.4.3.3 Korea Market States and Outlook

1.4.3.4 India Market States and Outlook

1.4.3.5 Southeast Asia Market States and Outlook

1.4.4 South America, Middle East and Africa

1.4.4.1 Brazil Market States and Outlook

1.4.4.2 Egypt Market States and Outlook

1.4.4.3 Saudi Arabia Market States and Outlook

1.4.4.4 South Africa Market States and Outlook

1.5 Market Dynamics

1.5.1 Market Opportunities

1.5.2 Market Risk

1.5.3 Market Driving Force

2 Manufacturers Profiles

Continued…

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. We tailor novel solutions for our clients, assisting them to address various challenges distinct to their businesses. Our aim is to empower them with holistic market intelligence, providing a granular overview of the market they are operating in.

Contact Us:

Fortune Business Insights™ Pvt. Ltd.

US:+18339092966

UK: +448085020280

APAC: +91 744 740 1245

0 notes

Text

Trump Tariffs to Impact 20% of US Car Sales, Raising Industry Concerns

The Trump administration's tariffs, impacting vehicles from trade partners like China, Mexico, and Canada, could affect nearly 20% of car sales in the US. In 2024, 2.9 million vehicles from these nations made up a significant portion of total car sales. Mexican factories saw a 13% growth, while Canadian exports declined. This trade disruption poses challenges for manufacturers, particularly Volkswagen, which heavily relies on Mexican-made vehicles, signaling potential shifts in the US automotive landscape.

#TrumpTariffs#CarSales#AutoIndustry#TradePolicy#USAutomotive#TariffImpact#GlobalTrade#VehicleImports#Manufacturing#EconomicPolicy

0 notes

Text

Rivian Moves Closer to Profitability but Warns of Potential Policy Challenges

Source: thebrakereport.com

Rivian’s aggressive cost-cutting measures have significantly improved its financial outlook, bringing it closer to profitability. However, the company remains cautious about 2025, citing potential challenges due to shifting government policies and economic uncertainties under the new Trump administration.

In its fourth-quarter and full-year 2024 financial report released on Thursday, Rivian announced plans to deliver between 46,000 and 51,000 electric vehicles (EVs) in 2025. The company acknowledged that potential changes in government regulations and a challenging demand environment could impact its performance.

Although Rivian Policy Change not to specify which policy changes could pose risks, Trump has expressed intentions to eliminate the $7,500 federal EV tax credit. Additionally, Vivek Ramaswamy, a known Trump ally, has advocated for revoking a $6.6 billion Department of Energy loan granted to Rivian for building a manufacturing plant in Georgia. This loan was finalized just days before Trump took office.

Rivian’s chief financial officer, Claire McDonough, emphasized the company’s commitment to collaborating with the new administration and the Department of Energy regarding its loan. She highlighted Rivian’s plan to create 7,500 manufacturing jobs at the Georgia plant, aligning with the administration’s focus on bringing jobs back to the US. However, McDonough acknowledged that Rivian Policy Change could face financial setbacks amounting to hundreds of millions of dollars due to tariffs, potential loss of EV tax credits, and other policy shifts.

CEO RJ Scaringe reinforced the importance of maintaining US leadership in electric vehicle technology, artificial intelligence, and software development. He stressed that Rivian’s investment in these areas is crucial for ensuring the country remains at the forefront of the global EV market.

Cost-Cutting Measures Drive Profit Growth

Throughout 2024, Rivian focused heavily on reducing expenses. The company implemented a 10% workforce reduction in February and introduced more cost-efficient versions of its flagship EVs—the R1T pickup and R1S SUV—in June. By modifying 600 parts in these models, Rivian successfully lowered manufacturing costs while also enhancing its electric architecture and software interface.

These cost-cutting strategies contributed to Rivian achieving a positive gross profit of $170 million in the final quarter of 2024, with $60 million of that coming from software and services. The company reported a revenue of $1.7 billion for the fourth quarter, reflecting a 32% increase compared to the same period in 2023. Vehicle sales accounted for approximately $1.5 billion, while an additional $299 million came from the sale of zero-emissions regulatory credits to other automakers. For the entire year, Rivian generated $325 million from regulatory credit sales.

Revenue from software and services is playing an increasingly vital role in Rivian’s financial strategy. The company earned $214 million from software in the fourth quarter alone, doubling its earnings from the same period in the previous year. In total, software and services contributed $484 million in revenue for 2024.

While Rivian’s core business remains EV manufacturing, its future growth is also tied to software, particularly through its joint venture with Volkswagen Group. The company’s software revenue stream includes earnings from charging subscriptions, repair and maintenance services, and software development initiatives tied to new vehicle electrical architecture.

Rivian Policy Change Integrates Generative AI for Cost Efficiency

In an effort to streamline customer service and reduce operational costs, Rivian has embraced generative AI. The company has developed an AI assistant integrated into its mobile app, which was rolled out in beta form for R1 customers in December.

The AI assistant, powered by both in-house AI infrastructure and third-party language models, is designed to automate various processes and minimize administrative overhead on non-repair tasks. It can assist customers by answering service-related questions, troubleshooting basic issues, collecting necessary information for vehicle maintenance, and providing general guidance on Rivian vehicles.

To ensure reliability and relevance, Rivian Policy Change has implemented guardrails to keep the AI assistant’s responses focused solely on Rivian-related queries. The company expects this technology to enhance customer experience while reducing service costs.

Rivian policy changes will play a critical role as the company pushes toward profitability, ensuring it can navigate potential challenges and maintain cost-cutting momentum. With a growing reliance on software revenue and AI-driven efficiencies, the company is positioning itself as not just an EV manufacturer but a technology-driven enterprise in the evolving automotive landscape.

0 notes

Text

Electric Vehicles 2024

Electric Vehicles 2024: Latest Models and Technological Advances

Electric Vehicles 2024, the electric vehicle (EV) industry has moved far forward. The 2024 electric vehicle landscape has become changed, leaving us enthralled about transport. EVs are becoming the go-to mode of transport for consumers as worries over climate change, progressively higher prices of fuels, and rapid technological advancements have had time to register the respective contributing components. Right from new models and battery technology advancements to the growth of electric vehicle charging networks, the electric vehicle overall landscape is changing incredibly rapidly. This article delves into what's coming up as regards the key events and trends regarding the electric vehicle undercurrent in 2024. 1. Best-Ever EV Sales 2024 will be a major year for electronic vehicles, as global sales are expected to soar to heights never reached before. The EV sales rate will go up to around 20% of the world's total sales across all vehicles from a mere 10% in 2020. Some of these additional factors fueling the growth are increased environmental awareness, government resources in incentive disbursement, and a wider choice of affordable electric models in the market. Automakers ranging from traditional giants to new entrants have started working more intensively on EVs. Tesla, Volkswagen, GM, and Ford are leading the charge, and even more than that, Chinese manufacturers such as BYD and NIO emerge quickly as market catchers in the battle going on internationally. Consumers have a stronger edge in this day and age because the competition is more: more competition makes the contests more intense, thereby expanding the variety in the end for the customer in terms of price, design, and features. 2. Innovation in Battery Technology Advanced battery technology will also play a major role. This is in keeping with the expectation of high achievement in this year 2024. Power-wise, it has remarkable batteries that beat the cost down and increase mileage as far as lifespan is concerned. Nowadays, solid-state batteries offer potentially greater energy density and faster charging times, commencing the entry into commercialization. The storage battery uses a solid electrolyte rather than a liquid electrolyte presented in traditional lithium-ion batteries. Having potential safety benefits, including lightness and low energy, solid-state batteries are still at the development stage and are expected to usher in a revolution in the EV industry in the years to come. There is a new aspect of improvement of LFP (lithium iron phosphate) battery technology because low cost, wider lifespan, and better safety make it highly popular with manufacturers. Manufacturers continue to apply LFP technology as a solution to making affordable electric vehicles without shortchanging the performance. Improved Charging Infrastructure One of the biggest hurdles to widespread EV adoption has been the lack of charging stations. However, in 2024, the charging infrastructure is growing rapidly, addressing one of the primary concerns for potential EV buyers. Governments worldwide are making significant investments in charging networks, and private companies are also increasing their efforts. Alongside the increase in charging stations, there is a heightened emphasis on fast-charging technology. Ultra-fast chargers that can add 200 miles of range in under 20 minutes are becoming more prevalent, making long-distance travel more practical for EV owners. Additionally, wireless and inductive charging systems are being investigated, which could offer even greater convenience for EV drivers in the future. Sustainability and Recycling Initiatives Sustainability is central to the electric vehicle revolution, and in 2024, there is a stronger focus on making the entire lifecycle of an EV more environmentally friendly. Automakers are striving to lower the carbon footprint associated with vehicle production, incorporating recycled materials into car manufacturing, and enhancing the energy efficiency of EVs. Another important aspect is the recycling of EV batteries. As more electric vehicles reach the end of their useful life, effective recycling will be essential for minimizing waste and recovering valuable materials such as lithium, cobalt, and nickel. Numerous companies are advancing efficient battery recycling methods, and the European Union has implemented new regulations to ensure that battery recycling becomes a standard practice in the industry. 5. Government Policies and Incentives Government policies are crucial in promoting the adoption of electric vehicles, and in 2024, many countries are providing financial incentives to make EVs more appealing to consumers. Tax credits, rebates, and lower registration fees remain popular forms of support for those purchasing electric vehicles. Moreover, stricter emissions regulations are compelling automakers to transition to electric drivetrains. Various cities and regions are implementing low-emission zones, allowing only EVs and other clean vehicles, which further encourages the shift towards electric mobility. In the U.S., the Biden administration’s commitment to electric vehicle adoption is clear through its proposed infrastructure investments aimed at establishing a nationwide network of EV charging stations. Meanwhile, China’s robust policies, including subsidies and incentives for EV buyers, are helping it retain its status as the largest EV market globally. 6. The Rise of EV Fleets and Shared Mobility Another trend gaining traction in 2024 is the increasing use of electric vehicles by fleets. Delivery companies, ride-hailing services, and car rental agencies are progressively transitioning to electric vehicles. Companies such as Amazon, UPS, and FedEx are making significant investments in EVs to lower their carbon footprints and reduce operational costs. In addition to fleet adoption, shared mobility services are also integrating more EVs into their offerings. Companies like Lyft, Uber, and various car-sharing services are providing electric options to customers in major urban areas, facilitating access to clean transportation without the need for vehicle ownership. 7. Electric Trucks and SUVs The electric vehicle revolution isn't just about compact sedans and hatchbacks anymore. In 2024, electric trucks and SUVs are gaining traction, with automakers rolling out a variety of options to meet the rising demand for these vehicles. Brands like Rivian, Ford, and Tesla have already launched electric pickups, while others such as Chevrolet and GMC are set to introduce their electric trucks shortly. Electric trucks come with numerous benefits, including reduced operating costs, quieter rides, and zero emissions. For businesses that depend on transportation, electric trucks can lead to substantial savings over time while also supporting sustainability initiatives. As electric trucks and SUVs continue to gain popularity, we can expect even more options in this segment in the coming years.

Conclusion

The Electric Vehicles 2024 market in is a vibrant and rapidly changing landscape, characterized by technological advancements, enhanced infrastructure, and growing acceptance among consumers and businesses alike. With improvements in battery technology, more convenient charging solutions, and ongoing government incentives, the future of electric mobility appears more promising than ever. Electric Vehicles 2024 is poised to be a crucial moment in the EV revolution, as electric vehicles become a fundamental part of the global automotive scene. Whether driven by environmental concerns, cost efficiency, or performance advantages, an increasing number of drivers are opting for electricity as their transportation choice. Looking ahead, the shift to electric vehicles is set to transform how we travel, contributing to a cleaner, greener, and more sustainable world. Read the full article

#BatteryTechnology#ElectricTrucks#Environmentallyfriendly#Incentives#Infrastructure#RecyclingInitiatives#SharedMobility#Technology#Volkswagen

0 notes

Text

Brazil sales of new vehicles grow 6% in January

In January, 171,200 units were licensed, representing a growth of 5.97% compared to the first month of 2024

The sale of new vehicles continues to rise at the beginning of this year. In January, 171,200 units were licensed, marking a growth of 5.97% compared to the first month of 2024. January is typically a weaker month for the sector, so industry leaders considered the results to be satisfactory.

“This is a period when family budgets are impacted by expenses such as IPVA [vehicle tax], school enrollments, and school supplies, in addition to being a time when many consumers go on vacation and end up postponing vehicle purchase decisions,” said Arcelio Junior, president of the National Federation of Vehicle Distribution (FENABRAVE), which represents dealerships and releases sector results based on traffic authority data.

The segment of cars and light commercial vehicles saw a 5.15% increase last month compared to the same month in 2024, totaling 159,800 units.

Fiat was the leading brand, with 21.49% of light vehicle sales in January. Volkswagen ranked second with 13.22%, followed by General Motors with 12.29%. Volkswagen’s Polo was the best-selling car.

Continue reading.

0 notes

Text

Hybrid Vehicles Market: Growth, Trends, and Future Outlook

Introduction

The hybrid vehicles market is witnessing rapid growth as governments worldwide push for sustainable mobility and consumers seek fuel-efficient alternatives. Hybrid vehicles, which combine internal combustion engines with electric propulsion, offer an optimal balance between performance and environmental benefits. With advancements in battery technology and increasing investments in green transportation, the demand for hybrid vehicles is on the rise.

Market Overview

Current Market Size and Growth Trends

The global hybrid vehicles market was valued at USD 290 billion in 2023 and is projected to grow at a CAGR of 12.1% from 2024 to 2032, reaching approximately USD 700 billion by the end of the forecast period. Key factors driving this growth include stringent emission regulations, improvements in hybrid powertrains, and increasing consumer awareness of eco-friendly transportation.

Regional Market Insights

North America: A leading market, driven by government incentives for hybrid and electric vehicles and a strong presence of automakers such as Tesla, Ford, and General Motors.

Europe: Growth is fueled by ambitious carbon neutrality targets, investments in charging infrastructure, and hybrid model expansions from major automakers like BMW, Volkswagen, and Renault.

Asia-Pacific: The fastest-growing region, with China, Japan, and South Korea leading in hybrid vehicle production and adoption.

Latin America & Middle East: Emerging markets showing gradual adoption due to fluctuating fuel prices and government-led green energy initiatives.

Key Market Drivers

Rising Fuel Prices and Energy Efficiency Demands: Consumers are seeking cost-effective and fuel-efficient alternatives to traditional gasoline vehicles.

Government Regulations and Incentives: Policies promoting lower emissions and tax benefits for hybrid car owners boost market growth.

Advancements in Battery Technology: Improved lithium-ion batteries enhance the efficiency and affordability of hybrid vehicles.

Consumer Shift Towards Sustainability: Increasing awareness of climate change is driving demand for environmentally friendly transportation solutions.

Leading Players in the Hybrid Vehicles Market

Several major automotive manufacturers are investing in hybrid vehicle technologies, competing for market leadership:

Toyota Motor Corporation (Japan) – A pioneer in hybrid technology, with models like the Toyota Prius leading global sales.

Honda Motor Company (Japan) – Strong presence in hybrid sedans and compact cars.

Ford Motor Company (USA) – Expanding its hybrid lineup, including the Ford Escape Hybrid and Maverick Hybrid.

BMW Group (Germany) – Focused on luxury hybrid models integrating advanced driving technologies.

Hyundai-Kia Motors (South Korea) – Investing heavily in hybrid and plug-in hybrid models for global markets.

Challenges and Roadblocks

Despite significant growth, the hybrid vehicles market faces several challenges:

High Initial Costs: Hybrid vehicles often come with a premium price tag compared to conventional cars.

Battery Supply Chain Constraints: Dependence on raw materials like lithium and cobalt can lead to production delays.

Limited Charging Infrastructure for Plug-in Hybrids: Inadequate public charging stations in some regions slow down hybrid adoption.

Competition from Fully Electric Vehicles (EVs): The rising popularity of EVs poses a threat to hybrid vehicle sales.

Future Outlook

The hybrid vehicles market is expected to expand with continuous technological innovations, increased government backing, and growing consumer adoption. Key future trends include:

Development of next-generation hybrid powertrains with enhanced efficiency.

Expansion of plug-in hybrid (PHEV) models across all vehicle segments.

Adoption of hydrogen fuel cell hybrid technology as an alternative to battery-electric vehicles.

Integration of AI and smart connectivity for optimized fuel efficiency and driving experience.

Conclusion

The hybrid vehicles market is on a strong growth trajectory, offering a crucial bridge between traditional combustion engines and fully electric vehicles. As governments and consumers prioritize sustainability, hybrid technology will continue playing a vital role in the future of mobility.

Looking to stay ahead in the hybrid vehicle industry? Follow our blog for the latest market trends and innovations!

0 notes

Text

Renault beats Stellantis in European car sales

According to the European Automobile Manufacturers’ Association (ACEA), new car sales in Europe grew by 0.9 per cent year-on-year in 2024.

This growth was fuelled by an increase in hybrid car registrations, which surpassed petrol car sales for the fourth consecutive month in December.

Particularly notable is the fact that in the final month of the year, the Renault Group overtook Stellantis in terms of market share for the first time in three years. Renault’s market share in December was 11.9 per cent, while Stellantis slipped to 11.6 per cent. This marked the first time Renault managed to surpass Stellantis since the latter was formed in January 2021.

In December 2024, sales in the European Union, the United Kingdom and the EFTA area rose by 4.1% year-on-year to a total of 1.1 million vehicles sold. Volkswagen’s sales increased by 4.9 per cent, while Renault posted an impressive 16.6 per cent growth. At the same time, Stellantis recorded a decline of 6.7 per cent.

Particular attention should be paid to the dynamics of electric car sales. Despite an overall increase in sales, registrations of battery electric vehicles (BEVs) fell by 10.2 per cent in December 2024. The share of sales of electrified vehicles, including hybrids and plug-in hybrids, was 57.7 per cent in December, up 4.4 per cent from a year earlier.

EU sales growth in December was 5.1%, with the largest increase in Spain at 28.8%. However, Germany and Italy recorded declines of 7.1% and 4.9% respectively.

These data show that the European automotive market continues to adapt to the new realities associated with the transition to electric vehicles and changing consumer preferences in favour of hybrid models. However, this transition is not without challenges, such as high production costs and increasing competition from Chinese carmakers.

Read more HERE

#world news#news#world politics#europe#european news#european union#eu politics#eu news#car#cars#renault#stellantis

0 notes

Text

Global Light Duty Vehicle Market Growth Dynamics, Trends, and Future Prospects to 2030

The Light Duty Vehicle market is expected to grow from USD 666.22 Billion in 2024 to USD 1075.55 Billion by 2030, at a CAGR of 8.31% during the forecast period.

The light-duty vehicle (LDV) market is a critical segment of the global automotive industry, encompassing passenger cars, vans, and small trucks with a gross vehicle weight rating (GVWR) of up to 8,500 pounds. The market has experienced steady growth due to rising urbanization, increasing disposable incomes, and evolving consumer preferences for fuel-efficient, compact, and environmentally friendly vehicles. The ongoing shift toward electrification and stringent emission regulations is reshaping the landscape, creating new opportunities for innovation and growth.

For More Insights into the Market, Request a Sample of this Report https://www.reportprime.com/enquiry/sample-report/19877

Market Growth Drivers

Electrification Trends: The increasing adoption of electric light-duty vehicles (e-LDVs) is one of the most significant drivers of market growth. Governments across the globe are incentivizing the production and adoption of electric vehicles (EVs) through subsidies, tax rebates, and the development of charging infrastructure. For instance, the International Energy Agency (IEA) reported that EV sales exceeded 10 million units globally in 2022, with a significant portion attributed to the LDV segment.

Stringent Emission Standards: Regulatory bodies are enforcing strict emission standards to combat climate change and reduce air pollution. Standards such as the European Union’s Euro 7 and the United States' Corporate Average Fuel Economy (CAFE) requirements are pushing automakers to invest in low-emission and zero-emission vehicle technologies. Hybrid, plug-in hybrid, and fully electric light-duty vehicles are gaining traction as a result.

Urbanization and Mobility Needs: The rapid pace of urbanization, particularly in emerging economies, is driving demand for light-duty vehicles due to their practicality, fuel efficiency, and affordability. Compact and mid-sized vehicles dominate urban markets, addressing the need for efficient transportation solutions in congested city environments.

Market Segmentations

By Type: Automatic Transmission, Manual Transmission, Continuous Variable Transmission

By Applications: Fuel Car, Electric Cars

Regional Analysis The light-duty vehicle market in North America is driven by strong consumer demand for pickup trucks and SUVs. Electrification is gaining momentum, with manufacturers like Tesla, Ford, and General Motors investing heavily in electric light-duty trucks and cars.Europe is at the forefront of the electric light-duty vehicle revolution, supported by stringent emission standards and government incentives. Countries like Norway, Germany, and the Netherlands are leading in EV penetration rates, with manufacturers like Volkswagen and Renault introducing a range of electric LDVs.

Get Full Access of This Premium Report https://www.reportprime.com/checkout?id=19877&price=3590

Competitive Landscape

The light-duty vehicle market is highly competitive, with key players focusing on innovation, electrification, and strategic partnerships to strengthen their market presence. Prominent players include Toyota Motor Corporation, Volkswagen AG, General Motors, Ford Motor Company, Tesla, Hyundai Motor Group, and Stellantis.

These companies are increasingly investing in R&D to develop fuel-efficient and electric LDVs. For example, Toyota is focusing on hybrid and hydrogen-powered vehicles, while Tesla continues to lead the EV market with its advanced electric car lineup.

Future Outlook

The global light-duty vehicle market is poised for substantial growth, driven by electrification, urbanization, and technological advancements. According to market forecasts, the LDV segment is expected to grow at a compound annual growth rate (CAGR) of approximately 6%-8% between 2024 and 2030, with electric and hybrid vehicles leading the charge.

0 notes

Text

Exploring the Future of Paint Protection Films: Market Trends and Innovations

The global paint protection film (PPF) market was valued at USD 499.7 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030. This growth is primarily driven by a shift in consumer preferences towards preserving the aesthetic and finish of their vehicles, as well as growing awareness about the importance of maintaining automobiles' external appearance.

Consumers are increasingly seeking products that provide long-lasting protection against scratches, chips, and other damage that can affect the vehicle's paint. Paint protection films offer an effective solution by acting as a clear, durable layer that safeguards the vehicle's paint from everyday wear and tear, such as rock chips, bird droppings, and UV damage. As the demand for maintaining vehicles in pristine condition rises, the market for paint protection films is expected to see steady growth.

In particular, the United States is one of the largest automotive markets in the world and is expected to be a major driver of the paint protection film market. The U.S. market is characterized by a high level of consumer interest in automotive customization and protection products. As more consumers recognize the value of paint protection films in maintaining the appearance of their vehicles, demand for these films is expected to grow significantly during the forecast period.

Regional Insights

Europe:

Europe held the largest revenue share of 31.6% of the paint protection film market in 2023, primarily due to its robust automotive sector. The automotive industry in Europe plays a significant role in the region's economy, contributing over 7% of the European Union’s GDP. The sector is highly integrated with other industries, including textiles, chemicals, steel, mobility, and repair services, alongside information and communication technology (ICT).

Europe is home to major automotive manufacturers such as Volkswagen AG, Stellantis NV, Renault Group, and Mercedes-Benz Group AG. Additionally, foreign automakers like Hyundai, Toyota, and Kia have established significant manufacturing operations within the region. Countries such as Germany, Italy, France, and Spain are key hubs for automotive production, while nations like the Czech Republic and Hungary are home to a large number of small- and medium-sized enterprises (SMEs) specializing in automotive components.

The demand for paint protection films (PPF) in Europe is driven by the strong automotive sector, which increasingly emphasizes vehicle customization, durability, and long-term value retention. The region’s well-established automotive industry, coupled with the growing interest in keeping vehicles in pristine condition, positions Europe as a dominant player in the global PPF market.

North America:

North America is projected to grow at a CAGR of 5.9% from 2024 to 2030. A significant contributor to this growth is the increasing adoption of electric vehicles (EVs), particularly in the U.S. States like California, New Jersey, Washington, and Louisiana offer various tax incentives such as rebates, tax exemptions, and credits to encourage the adoption of EVs. For example, California provides rebates for the purchase and use of plug-in hybrid electric vehicles (PHEVs) and other zero-emission vehicles, while New Jersey and Washington exempt sales and use taxes on EVs. These tax benefits are expected to stimulate the market for EVs, which, in turn, will increase the demand for paint protection films to safeguard the exteriors of these vehicles.

In addition to the automotive market, the growing aerospace and defense sector in North America is also anticipated to drive demand for paint protection films. Both the U.S. and Canada are mature automotive markets, with a high proportion of pre-owned vehicles in circulation, further boosting the demand for PPF. The increasing focus on vehicle protection and aesthetics, coupled with the rising popularity of thermoplastic polyurethane (TPU)-based PPF due to its superior scratch resistance and aesthetic appeal, will also play a significant role in expanding the market.

Browse through Grand View Research's Category Paints, Coatings & Printing Inks Industry Research Reports.

The Central and South America automotive wrap films market size was valued at USD 165.7 million in 2024 and is projected to register a CAGR of 3.8% from 2025 to 2030.

The global thermal insulation coating market sizewas estimated at USD 10.45 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030.

Key Companies & Market Share Insights

The paint protection film market is characterized by strong competition, with several key players holding substantial shares in the global market. Two prominent companies operating in this space are 3M and XPEL, Inc. Both companies are heavily involved in the production, distribution, and installation of paint protection films, leveraging their extensive product portfolios, global reach, and strong brand recognition to maintain a competitive edge.

3M Company:

3M is a diversified global corporation known for its innovative solutions across a wide range of industries, including safety and industrial, healthcare, transportation, and consumer goods. The company operates in multiple business divisions, and paint protection films are produced through its Safety & Industrial segment. 3M's Scotchgard brand is highly recognized in the market for providing high-quality automotive protection solutions.

3M’s Scotchgard Paint Protection Film Pro Series offers exceptional protection to automotive surfaces, helping shield vehicles from weathering, chips, and scratches. The product is designed for use in the automotive industry, protecting paint and enhancing the vehicle's aesthetic appeal. 3M's extensive product range also includes automotive films, electronics films, window films, and architectural finishes, allowing the company to cater to a broad spectrum of customer needs.

3M has an extensive global presence, with 89 manufacturing facilities located in 30 countries. This widespread network enables the company to efficiently serve its customers worldwide, offering high-quality products and services on a global scale.

Key Highlights of 3M:

Operates under the Scotchgard brand, offering advanced paint protection films.

Provides a range of protective films for automotive, electronics, windows, and architecture.

Strong global presence with��89 manufacturing facilities in 30 countries.

Known for its innovations in adhesives, sealants, and films across multiple industries.

XPEL:

XPEL, Inc. is a leading manufacturer, distributor, and installer of aftermarket automotive products, including paint protection films, window films, and flat glass films. The company operates primarily in the U.S., Canada, and the UK, where it provides complete paint protection film solutions directly to independent installers, car dealerships, and retail customers. XPEL is renowned for its comprehensive offerings, including not only paint protection films but also installation training, design software, marketing support, and lead generation services for its partners.

The company's product portfolio includes XPEL paint protection films, automotive window films, flat glass window films, and plotters used in the cutting and customization of films. XPEL operates six company-owned installation centers in the U.S. and one installation center each in the UK and the Netherlands. These centers cater to wholesale and retail customers and offer additional services such as custom installations and consultations.

In markets outside of the U.S., Canada, and the UK, XPEL distributes its products through a network of third-party distributors who work under contracts with the company to provide installation services and supply products in international markets.

Key Paint Protection Film Companies:

3M

XPEL Inc.

Schweitzer-Mauduit International, Inc.

Eastman Chemical Company

Avery Dennison Corporation

Saint-Gobain S.A.

RENOLIT SE

Ziebart International Corporation

Hexis S.A.S

Garware Hi-Tech Films Ltd.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

New Study: 2023-2030 Commercial Vehicles Market Trend and Forecast Report

Commercial Vehicles Industry Overview

The global commercial vehicles market size was estimated at USD 1.35 trillion in 2022 and is projected to register a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030.

Implementation of vehicle scrappage programs, aggressive investments in infrastructure development and rural development, and drafting of stringent regulatory norms for vehicle length and loading limits, among other parameters, are anticipated to fuel the growth. The resumption of mining activities in some parts of the world, which has triggered the demand for tippers, is also expected to drive growth.

Gather more insights about the market drivers, restrains and growth of the Commercial Vehicles Market

The rising levels of disposable income in both developing and developed countries and the continued infrastructure development are also projected to bode well for the growth of the market. The rise in awareness for environmentally sustainable transportation solutions has motivated commercial vehicle manufacturers to develop vehicles that reduce carbon emissions. Manufacturers are working on innovating vehicle design, reducing load factors & size, and customizing vehicles according to weight regulations.

Infrastructure conditions, driver technique, weather management, and national policy are additional influential factors considered by automakers for developing vehicles. Research & development for manufacturing such vehicles requires a significant investment. Thus, there is a requirement for policy action and investment initiatives to be taken by the government, private and public sectors. Such initiatives will support manufacturers in reducing operational & production costs.

Furthermore, the demand for small, medium-, and heavy commercial vehicles has increased for logistics and transportation purposes in association with e-commerce. The logistics market has shifted from just being a service provider to offering customer-centric solutions. Thus, the requirement for commercial vehicles has increased for transportation purposes. Supportive regulatory frameworks and additional incentives from governments have raised the demand for commercial electric vehicles. There has been an increase in electric buses and heavy-duty truck registrations in North America, Europe, and the Asia Pacific regions.

With the emerging economies in the Asia Pacific region, China dominates the overall electric bus and electric truck market. According to IEA, with more than 78k buses and 31k trucks registered, local policies of the Chinese government are a significant contributor to high sales of Electric Commercial Vehicles (ECVs). Thus, with the rapid increase in the adoption of electric vehicles, electric commercial vehicles are also expected to witness considerable traction over the forecast period.

While various factors contribute to the growth of the commercial vehicle market, COVID-19 has posed a severe challenge. Global lockdowns stalled all manufacturing and transportation activities. Disruption of the supply chain and economic slowdowns impacted several sectors such as automobile, transportation, and logistics. As the transportation and logistics sectors hold around 50% share in the market for commercial vehicles, less demand from this sector resulted in declining sales of commercial vehicles.

Browse through Grand View Research's Automotive & Transportation Industry Research Reports.

• The global mountain e-bikes market size was estimated at USD 7.52 billion in 2023 and is expected to grow at a CAGR of 9.4% from 2024 to 2030.

• The global automotive 3PL market size was estimated at USD 219.16 billion in 2023 and is projected to grow at a CAGR of 8.9% from 2024 to 2030.

Key Commercial Vehicles Company Insights

The key players that dominated the global market in 2022 include Tata Motors, Volkswagen AG, Ashok Leyland, AB Volvo, and General Motors. Most of these vendors are putting a strong emphasis on providing advanced products based on the latest technologies, as part of the efforts to enhance their respective product offerings in the market. The companies are also pursuing strategic initiatives, such as regional expansions as well as strategic acquisitions, mergers, partnerships, and collaborations, to cement their position in the market.

Organic growth remains a key strategy for most of the market incumbents. As such, market players are focusing on expanding their product offerings by developing and launching new and innovative products. For instance, in August 2022, Mahindra and Mahindra launched the New Jeeto Plus CNG, CharSau, which leads the segment in terms of range, mileage, maneuverability, and payload, leading to higher profits for inter- and intra-city applications. This last-mile transportation solution offers a range of stand-out features suitable for India's small and medium-scale business and trading needs. Some prominent players in the global commercial vehicles market include.

Ashok Leyland

Bosch Rexroth AG

Daimler

Volkswagen AG

Toyota Motor Corporation

Mahindra and Mahindra

TATA Motors

AB Volvo

Golden Dragon

General Motors

Order a free sample PDF of the Commercial Vehicles Market Intelligence Study, published by Grand View Research.

0 notes

Text

Automotive Market: Trends & Analysis

The global automotive market stands as one of the most significant sectors in the world, representing a cornerstone of the global economy. The market is dynamic, constantly evolving with technological advancements, changing consumer preferences, and regulatory shifts. As of 2024, the automotive industry is navigating through a transformative phase, influenced by the push toward sustainability, advancements in electric vehicles (EVs), and the integration of smart technologies. This blog provides an in-depth analysis of the automotive market, covering its size, growth, key players, prevailing trends, and challenges, culminating in a forward-looking conclusion.

Market Size, Share, and Growth

As of 2023, the global automotive market was valued at approximately USD 3.7 trillion, with projections indicating a steady growth trajectory, anticipated to reach USD 5 trillion by 2030. This growth is primarily driven by the increasing demand for electric vehicles (EVs), technological advancements, and the resurgence of the global economy post-pandemic.

In terms of market share, the automotive market is segmented into passenger vehicles, commercial vehicles, and electric vehicles (EVs). The passenger vehicle segment dominates, accounting for nearly 60% of the market share. However, the electric vehicle segment is witnessing the fastest growth, with a compound annual growth rate (CAGR) of 20% from 2024 to 2030. This surge in EV adoption is fueled by heightened environmental awareness, government incentives, and advancements in battery technology.

The commercial vehicle segment, while growing at a slower pace, remains crucial, particularly in emerging economies where infrastructure development is a priority. The Asia-Pacific region leads the market, contributing to over 40% of the global automotive sales, followed by North America and Europe.

Market Trends

Several key trends are shaping the future of the automotive industry, each contributing to the sector's evolution and expansion:

Electrification and the Rise of EVs: The transition from internal combustion engines (ICE) to electric vehicles is one of the most significant trends in the automotive industry. Governments across the globe are setting ambitious targets for reducing carbon emissions, leading to increased investments in EV infrastructure and incentives for EV adoption. Major automakers like Tesla, Toyota, and Volkswagen are at the forefront of this shift, introducing a range of electric models aimed at both the mass market and premium segments.

Autonomous Driving and Connected Vehicles: The development of autonomous vehicles (AVs) is progressing rapidly, with companies like Waymo, Tesla, and GM’s Cruise making significant strides in self-driving technology. In parallel, the integration of connected vehicle technologies is enhancing vehicle safety, efficiency, and user experience. The Internet of Things (IoT) enables real-time communication between vehicles, infrastructure, and other devices, paving the way for smarter, more efficient transportation systems.

Shared Mobility and Changing Ownership Models: The concept of vehicle ownership is evolving, with a growing trend toward shared mobility solutions. Ride-hailing services, car-sharing, and subscription models are gaining popularity, especially in urban areas. Companies like Uber, Lyft, and Zipcar are leading this shift, offering flexible alternatives to traditional car ownership, which is particularly appealing to younger, urban populations.

Sustainability and Green Technologies: The automotive industry is increasingly focused on sustainability, with a strong emphasis on reducing carbon footprints and utilizing green technologies. Beyond electrification, this includes the adoption of lightweight materials, improved fuel efficiency, and the development of hydrogen fuel cell vehicles. Automakers are also investing in circular economy practices, such as vehicle recycling and the use of renewable energy in manufacturing processes.

Digital Transformation and E-Commerce: The digitalization of the automotive industry is reshaping how vehicles are designed, manufactured, sold, and serviced. E-commerce platforms are playing a crucial role in the automotive retail space, with more consumers opting to purchase vehicles online. This trend is accelerated by the growing influence of digital marketing, virtual showrooms, and online customer support.

Key Market Players and Their Impact

The automotive market is dominated by a few key players, each with a significant share in the global market. These companies are instrumental in shaping industry trends and driving innovation.

Toyota Motor Corporation: Toyota remains the largest automaker globally, with a market share of approximately 10%. The company's strong emphasis on hybrid technology and its gradual transition to electric vehicles have solidified its leadership position. Toyota's global sales in 2023 exceeded 9.5 million units, with significant contributions from its best-selling models like the Corolla and the RAV4.

Volkswagen Group: Volkswagen holds a market share of around 8%, with a robust portfolio that includes brands like Audi, Porsche, and Bentley. The company is heavily invested in electrification, with plans to produce over 50 different electric models by 2025. Volkswagen's ID.4 and ID.3 models are gaining traction in key markets, including Europe and China.

Tesla, Inc.: Tesla continues to be a dominant force in the electric vehicle segment, with a market share of about 3% in the overall automotive market but a commanding 20% share in the global EV market. Tesla's Model 3 and Model Y are among the best-selling electric vehicles worldwide, and the company's focus on innovation and battery technology sets it apart from traditional automakers.

General Motors (GM): GM has a market share of approximately 6%, with a strong presence in North America and China. The company is transitioning toward an all-electric future, with plans to phase out internal combustion engines by 2035. GM's Chevrolet Bolt EV and the upcoming Hummer EV are key models in its electric vehicle lineup.

Hyundai-Kia Automotive Group: With a market share of around 7%, Hyundai-Kia is rapidly expanding its electric vehicle portfolio, aiming to launch 23 new EV models by 2025. The group's focus on hydrogen fuel cell technology, alongside traditional battery electric vehicles, positions it uniquely in the market.

Market Challenges

Despite its robust growth prospects, the automotive market faces several significant challenges:

Supply Chain Disruptions: The global semiconductor shortage has severely impacted automotive production, leading to delays and increased costs. The reliance on a complex, global supply chain makes the industry vulnerable to disruptions caused by geopolitical tensions, natural disasters, and pandemics.

Regulatory Hurdles: Stringent environmental regulations and safety standards vary significantly across regions, creating challenges for automakers in terms of compliance and cost management. The shift towards electric vehicles also requires substantial investments in infrastructure, which is progressing at different rates globally.

Technological Integration: The rapid pace of technological advancements presents a double-edged sword. While it drives innovation, it also requires significant R&D investments and poses challenges in integrating new technologies into existing platforms. Moreover, the race to develop autonomous vehicles is fraught with legal, ethical, and safety concerns that need to be addressed before widespread adoption can occur.

Consumer Adoption Barriers: While the demand for electric vehicles is growing, barriers such as high upfront costs, limited charging infrastructure, and range anxiety continue to hinder widespread adoption, particularly in developing markets. Additionally, the shift in ownership models, from traditional to shared mobility, requires a cultural change that may take time to materialize.

Conclusion

The automotive market is at a pivotal juncture, with the convergence of electrification, autonomous driving, and digitalization driving its transformation. The industry's future will be shaped by how well it navigates the challenges of supply chain disruptions, regulatory pressures, and technological integration. Key players like Toyota, Volkswagen, and Tesla are leading the charge, but the market remains highly competitive, with new entrants and evolving consumer preferences continually reshaping the landscape. As we look ahead, the shift towards sustainable and smart mobility solutions is set to redefine the automotive industry. Companies that can innovate and adapt to these changes will thrive, while those that resist will face increasing challenges. Ultimately, the automotive market's trajectory will be determined by its ability to balance growth with sustainability, ensuring that the industry continues to drive global economic progress while addressing the environmental and societal challenges of the 21st century.

#Automobile Market#Automobile Market Share#Automobile Market Size#Automobile Market Forecast#Automobile Market Report

0 notes

Text

Electric Car Market is Estimated to Witness High Growth Owing to Stringent Emission Norms

The electric car market comprises battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) that aim to reduce vehicular emissions. Electric cars provide environmental and economic benefits over conventional internal combustion engine vehicles as they produce zero direct emissions. The growing awareness regarding the environmental impact of gasoline and diesel cars is encouraging consumers to switch to electric vehicles. Stringent emission control regulations imposed by regulatory authorities across nations to curb air pollution have accelerated the adoption of electric cars. The Global electric car market is estimated to be valued at US$ 343.27 Bn in 2024 and is expected to exhibit a CAGR of 24% over the forecast period 2024 to 2031. Key Takeaways Key players operating in the electric car market are Tesla, Inc., Nissan Motor Corporation, BMW AG, Ford Motor Company, General Motors Company, Volkswagen AG, Hyundai Motor Company, Kia Corporation, Audi AG, Mercedes-Benz AG, BYD Company Limited, Rivian Automotive, Inc., Lucid Motors, Inc., Polestar Automotive Holding AB, and Volvo Cars. The key opportunities in the Electric Car Market Growth include rising investments by governments to develop charging infrastructure and provide purchase incentives. Additionally, evolving customer preferences toward electric vehicles over conventional vehicles due to growing environmental consciousness will drive market growth. Globally major automakers are focusing their efforts on expanding their electric vehicle portfolio and production capacities. For instance, Volkswagen plans to increase its global electric vehicle production to around 26 million units per year by 2030. BMW also aims to double its electric vehicle sales annually over the next few years. Market drivers Stringent emission norms imposed by governments: Stringent emission control regulations regarding carbon dioxide emissions from vehicles are encouraging automakers to shift toward electric vehicle production. This is a major market driver. Growing consumer awareness about environmental protection: Increasing environmental consciousness among consumers regarding pollution caused by gasoline and diesel cars is raising the Electric Car Companies for zero-emission electric vehicles.

PEST Analysis Political: The electric car market is experiencing supportive government policies and regulations across different regions and countries globally. Governments are introducing subsidies, tax rebates and other fiscal incentives to promote adoption of eco-friendly electric vehicles. Economic: Factors like fluctuating fuel prices and lower total cost of ownership compared to gasoline vehicles is positively impacting the electric car market. However, high initial purchase price of electric vehicles may pose a challenge for widespread adoption. Social: Increasing awareness about environmental pollution and impact of carbon emissions is driving social change. Many consumers are preferring electric vehicles to fulfill their social responsibility of adopting clean energy solutions. Technological: Continuous research & development is facilitating improvement in battery technologies like lithium-ion batteries. Advancements are resulting in higher driving range on a single charge and faster charging times. Software technologies are also enhancing driver experience through connectivity features. Geographical regions of concentration The electric car market in terms of value is majorly concentrated in the Asia Pacific and European regions currently. China dominates the Asia Pacific electric car market owing to supportive FDI policies and large domestic automobile industry. Presence of major OEMs and consumers' rising disposable income levels are factors behind Europe's prominence. Fastest growing region North America is anticipated to witness the fastest growth in the electric car market during the forecast period. Presence of early technology adopters and government measures promoting emission reductions are driving the regional market. The US market, in particular, will experience high demand fueled by strengthening charging infrastructure and production expansions by leading automakers.

Get more insights on Electric Car Market

Also read related article on Hypercar Market

Unlock More Insights—Explore the Report in the Language You Prefer

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

Alice Mutum is a seasoned senior content editor at Coherent Market Insights, leveraging extensive expertise gained from her previous role as a content writer. With seven years in content development, Alice masterfully employs SEO best practices and cutting-edge digital marketing strategies to craft high-ranking, impactful content. As an editor, she meticulously ensures flawless grammar and punctuation, precise data accuracy, and perfect alignment with audience needs in every research report. Alice's dedication to excellence and her strategic approach to content make her an invaluable asset in the world of market insights.

(LinkedIn: www.linkedin.com/in/alice-mutum-3b247b137 )

#Coherent Market Insights#Electric Car Market#Electric Car#EV#Electric Vehicle#Battery-Powered Car#ZeroEmission Vehicle#Electric Automobile#Green Vehicle#Sustainable Transportation#Ecofriendly Car

0 notes

Text

Global Electric Car Sales by Brand BYD, Volkswagen, Tesla And BMW

Tesla leads global electric car sales, followed by BYD and Volkswagen. These brands dominate the market with innovative EV models. Global Electric Car Sales by Brand: Electric vehicles (EVs) are rapidly transforming the automotive industry. Tesla remains at the forefront with its cutting-edge technology and widespread appeal. BYD, a Chinese giant, has swiftly gained traction, particularly in its home market. Volkswagen, a traditional automotive powerhouse, is investing heavily in EVs to catch up. These brands are pushing the boundaries of electric mobility, offering consumers a variety of options. The rise of EVs signifies a significant shift towards sustainable transportation. As technology evolves, more automakers are entering the EV space, intensifying competition and innovation. This trend highlights the growing demand for eco-friendly vehicles and the ongoing revolution in the automotive sector.

Global Plug-in Car Sales Hit 1.3 Million In May 2024

Electric cars are taking over the world. In May 2024, global plug-in car sales hit an impressive 1.3 million. This shows the growing shift towards cleaner and greener transportation. Let's dive into the details of these impressive numbers. Global Electric Car Sales By Brand Several brands lead the electric car market. These brands are pushing the boundaries of innovation and sustainability. Top Brands Leading Sales Here are the top brands that dominated the market: - Tesla: Known for its sleek designs and cutting-edge technology. - BYD: A Chinese brand making waves with affordable options. - Volkswagen: Combining traditional reliability with electric innovation. - BMW: Luxury meets sustainability in their electric models. Sales Figures By Region Different regions showed varying levels of enthusiasm for electric vehicles. Region Sales (in millions) North America 0.4 Europe 0.5 Asia 0.3 Other Regions 0.1 Factors Driving Sales Several factors contributed to the rise in sales: - Government incentives: Tax rebates and subsidies made electric cars more affordable. - Improved infrastructure: More charging stations increased convenience. - Environmental awareness: People chose electric cars to reduce their carbon footprint. - Technological advancements: Better battery life and performance drew more buyers. Future Projections Experts predict that electric car sales will continue to rise. The goal is to reach 2 million units per month by 2025. This growth shows the strong shift towards a sustainable future.

Top Brands Overview

Electric cars are transforming the automotive industry. With global sales increasing, knowing the top brands is essential. This section provides an overview of leading manufacturers in the electric vehicle (EV) market. Leading Manufacturers Several brands dominate the electric car market. These companies set trends and lead in innovation. Here are the top manufacturers: - Tesla - Known for high performance and range. Tesla is a pioneer in the electric car industry. - BYD - A Chinese automaker that offers affordable and efficient electric cars. - Volkswagen - This German giant is investing heavily in EV technology. - Nissan - Famous for the Nissan Leaf, one of the best-selling electric cars. - BMW - Combines luxury with electric innovation. Their i-series is popular worldwide. Below is a table showcasing the global sales figures for these top brands in 2022: Brand Global Sales (in units) Tesla 936,000 BYD 593,000 Volkswagen 452,900 Nissan 200,000 BMW 194,000 Tesla is leading the global electric car market. Their focus on innovation and performance sets them apart. BYD follows, providing affordable options for many. Volkswagen is rapidly expanding its EV lineup. Nissan and BMW continue to deliver reliable and stylish electric vehicles. These brands not only sell the most electric cars. They also invest heavily in research and development. This ensures continuous improvement in battery technology, range, and overall vehicle performance.

Brand Performance Analysis

The global electric car market is booming. Each year, more brands enter the race for dominance. Analyzing brand performance helps consumers and investors make informed decisions. This section delves into how different brands fare in the competitive landscape of electric cars. Market Share Statistics Understanding market share helps gauge a brand's dominance. Tesla leads the pack with a significant share. They hold about 21% of the global market. Here's a breakdown of market shares for top brands: - Tesla: 21% - BYD: 13% - Volkswagen: 11% - BMW: 6% - Nissan: 5% These figures highlight the competitive nature of the industry. Tesla's lead shows their strong brand loyalty and innovation. BYD and Volkswagen are catching up, showcasing their growing influence. The table below summarizes the market shares: Brand Market Share (%) Tesla 21 BYD 13 Volkswagen 11 BMW 6 Nissan 5 Sales Volume Comparison Sales volume is another critical metric. Tesla sold over 500,000 units last year. This number far exceeds other brands. BYD sold 300,000 units, showing their rapid growth. Here is a sales volume comparison: - Tesla: 500,000 units - BYD: 300,000 units - Volkswagen: 220,000 units - BMW: 150,000 units - Nissan: 120,000 units These numbers indicate Tesla's strong market presence. BYD's growth is noteworthy, showing their potential to challenge Tesla in the future. Volkswagen, BMW, and Nissan continue to hold significant market positions. The table below summarizes the sales volumes: Brand Sales Volume (Units) Tesla 500,000 BYD 300,000 Volkswagen 220,000 BMW 150,000 Nissan 120,000

Credit: www.counterpointresearch.com

Regional Sales Insights

The global electric car market is booming. Each region has its unique trends and leading brands. Understanding these regional sales insights helps identify market leaders and consumer preferences. Let's dive into the electric car sales by brand across North America, Europe, and Asia. North America In North America, Tesla dominates the electric car market. The brand's Model 3 and Model Y are top sellers. Consumers prefer Tesla for its innovation and extensive charging network. Other notable brands include: - Chevrolet with its Bolt EV - Ford with the Mustang Mach-E - Nissan with the Leaf A table summarizing the sales figures: Brand Model Units Sold (2022) Tesla Model 3 120,000 Chevrolet Bolt EV 40,000 Ford Mustang Mach-E 35,000 Nissan Leaf 30,000 The demand for electric cars is rising. Consumers are keen on reducing their carbon footprint. Tesla's dominance is driven by its technological edge and brand loyalty. Europe Europe sees a different trend. Volkswagen leads the electric car market. The ID.3 and ID.4 models are popular. European consumers value sustainability and local brands. Other leading brands are: - Renault with the Zoe - BMW with the i3 - Hyundai with the Kona Electric A table summarizing the sales figures: Brand Model Units Sold (2022) Volkswagen ID.3 75,000 Renault Zoe 50,000 BMW i3 45,000 Hyundai Kona Electric 40,000 Volkswagen's investment in electric mobility pays off. The brand's wide range of models caters to different needs and preferences. European consumers prefer compact and efficient models. Asia Asia is a dynamic market. BYD leads in electric car sales. The brand's extensive lineup includes the Han EV and Tang EV. Other prominent brands include: - Tesla with the Model 3 - Wuling with the Hongguang Mini EV - NIO with the ES6 A table summarizing the sales figures: Brand Model Units Sold (2022) BYD Han EV 100,000 Tesla Model 3 90,000 Wuling Hongguang Mini EV 80,000 NIO ES6 70,000 BYD's success is due to its affordable and diverse models. Asian consumers look for value and innovation. The market is growing rapidly, with local brands gaining traction.

Consumer Preferences

The world of electric cars is buzzing with excitement. Global electric car sales are at an all-time high, and consumer preferences are shifting towards greener alternatives. People want reliable, efficient, and stylish vehicles. Let's delve into the popular models and brand loyalty trends shaping the market. Popular Models Several electric car models stand out among consumers. These models are known for their performance, design, and range. Here are some of the top picks: - Tesla Model 3: This model is famous for its sleek design and impressive range of up to 353 miles. - Nissan Leaf: Known for its affordability, the Leaf offers a range of up to 150 miles. - Chevrolet Bolt EV: This car provides a range of 259 miles and a spacious interior. - Hyundai Kona Electric: Combining style with efficiency, the Kona offers a range of 258 miles. These models have garnered attention due to their features and performance. The table below highlights some key specifications: Model Range (miles) Starting Price Tesla Model 3 353 $39,990 Nissan Leaf 150 $31,620 Chevrolet Bolt EV 259 $36,500 Hyundai Kona Electric 258 $37,390 Tesla Model 3 leads the pack with its extended range and competitive pricing. Nissan Leaf is a favorite for budget-conscious consumers. Chevrolet Bolt EV and Hyundai Kona Electric offer a balance between price and range. Brand Loyalty Trends Brand loyalty plays a crucial role in the electric car market. Consumers tend to stick with brands they trust. Tesla has a significant following due to its innovative technology and strong brand image. Several factors influence brand loyalty: - Performance: Consumers prefer brands that deliver high performance and reliability. - Customer Service: Excellent customer service enhances brand loyalty. - Technology: Advanced features and cutting-edge technology attract loyal customers. - Environmental Impact: Brands with a strong commitment to sustainability win customer loyalty. Brands like Tesla, Nissan, and Chevrolet have successfully built loyal customer bases. Tesla's continuous innovation and commitment to quality keep customers coming back. Nissan's focus on affordability and reliability appeals to a broad audience. Chevrolet's balance of price, range, and features attracts a diverse customer base. Brand loyalty is also driven by community engagement. Tesla owners often participate in community events and online forums, fostering a sense of belonging. This community support further strengthens brand loyalty. In conclusion, popular models and brand loyalty trends shape consumer preferences in the electric car market. High performance, advanced technology, and strong brand commitment are key drivers of this loyalty.

Global Plug-in Electric Car Registrations – May 2024

Electric cars are changing the world. In May 2024, global plug-in electric car registrations reached new heights. Car brands are battling for the top spot. Let's dive into the numbers and see who's leading the race. In May 2024, global plug-in electric car sales hit record numbers. Consumers around the world are choosing electric over traditional cars. The data shows a significant rise in registrations compared to the previous year. Top Brands By Registrations The following table highlights the top brands by the number of plug-in electric car registrations in May 2024: Brand Registrations Market Share Tesla 150,000 25% BYD 120,000 20% Volkswagen 90,000 15% Nissan 60,000 10% Hyundai 50,000 8% Tesla Leads The Pack Tesla continues to lead the electric car market. With 150,000 registrations, it holds a strong 25% market share. Tesla's popularity is driven by its high performance and cutting-edge technology. Byd's Strong Performance BYD is not far behind. With 120,000 registrations, it has a 20% market share. BYD's extensive range of models appeals to a broad audience. Volkswagen's Steady Growth Volkswagen saw 90,000 registrations in May 2024. This gives it a solid 15% market share. Volkswagen's commitment to electric vehicles is paying off. Nissan And Hyundai's Contributions Nissan and Hyundai registered 60,000 and 50,000 cars respectively. Their combined market share is 18%. These brands continue to be favorites for many consumers.

Ranking In Model