#2 dollars less in pay and a half hour to an hour's more commute. well i dont know

Explore tagged Tumblr posts

Text

also... stuff like this is true: big development companies and banks bought up a huge amount of the empty housing (and because they can afford to keep the houses empty for years at a time, they can keep the prices high due to scarcity) so, in a bunch of places in california houses cost about a million dollars... per bedroom. I am not kidding i have found one bedroom houses for 1.5 million, and average 4 bedroom homes for 5 million. Prices have gone down a little since then but not enough.

So if you buy a 2 million dollar home (which is, at this point, a normal 3 bedroom if you're lucky) even if you pay for it all at once in cash and do not have a mortgage, the property taxes on that home come to about 40k per year. You'd have to spend my entire annual income on a house you've already paid off. For a normal family home.

So when you see like "hollywood so and so has a net worth of several million dollars" yeah, they are doing well, but also, they have to live where it's super expensive for work, and therefor are basically middle class. Quite comfortable, true, but not the enemy.

Like, look at this. This is a current listing i just found for a normal ass family home in the city i used to work in, and your mortgagge would cost you more than 20k per month, and your property taxes would be another 5,600 per month so you're talking 26k per month or over 300k each year just on a family home you could have 3 kids in. If one parent stays home with the kids the other would need an income of half a million dollars a year just to get by

somebody with a billion dollars could by 250 of these homes and park a $100k car in each of their driveways and they'd still have money left over.

And yeah, you can go three hours north and find homes for less, but you'd have to commute 5 hours round trip every day to anywhere you could get a good job, and your neighbors would be meth heads

So if you see somebody that makes, like, $500k a year, they could still be a normal middle class family struggling to save for retirement. They certainly aren't the people we're trying to sacrifice to poseiden

I need y’all to understand that every time that somebody who makes $10,000 a year thinks that somebody who makes $30,000 a year thinks that somebody who makes $50,000 a year thinks that somebody who makes $100,000 a year thinks that YES EVEN somebody who makes $150,000 a year is the real enemy

…a billionaire wins and we all lose.

And every time that somebody who makes $150,000 a year thinks that they’re better than somebody else who makes $100,000 a year thinks that they’re better than somebody else who makes $50,000 a year thinks that they’re better than somebody else who makes $30,000 a year thinks that they’re better than somebody else who makes $10,000 a year

…a billionaire wins and we all lose.

Privilege and comfort rises with income, obvi. It’s not all “the same.” But please zoom the fuck out and look at the whole picture. The WHOLE picture.

17K notes

·

View notes

Text

Note: I’m pretty sure I made this list last summer and since school finally over I figured I would reflect on these and see how well I did and how I could improve. Linked below is the original post that has all of the goals I will be talking about, but since I write them down here I’m sure you don’t need to read it to understand what I am talking about, but I put it there just in case. This is just a review of my goals from last year, I will create a separate post for my new goals for this summer and next year.

The Original Post

⊳ Money

Goal #1: Work towards saving more of your paychecks ✓

I did a good job of saving money, but I went back and forth as time went on. During the summer I would spend money at work during my breaks but I was making way more than I am currently during the school year. I would still spend money like I was when I was making more, but when I learned that I got better at budgeting my cash.

Now that I have a car and have a monthly bill for it as well as gas, I am getting better at saving the money I need for the said bill.

I plan on moving out within the year so I need to save up as much as I possibly can. I am moving out with two of my best friends, if all goes as planned, we will be splitting rent and bills between the three of us.

Goal #2: Put half of checking into a savings account on payday ✖ I did this for a while, but then I saw that it wasn’t really helping me as much as I thought it would. I would end up having like $6 in my checking account before payday comes so I didn’t see a point in just transferring $3 when I was going to get more of it, so what I did was estimate how much money I would need for the week and then put the rest in savings. If I knew I was going out or had bills to pay during that week, I would leave that money in the account. This proved to work way better for me than what I had originally planned to do.

What I ended up doing was creating a separate savings account for my new house/apartment so I had an emergency account and a moving out account. I would only use my emergency account for things like bills, unpredicted expenses, or big purchases such as a new laptop for school and blogging. But I keep it at $500, just in case I needed it. Right now it’s at like $450 since I needed to pay my car bill and I didn’t work much this week, but what I do is I rebuild it as fast as possible and hopefully, I do not need to take more money out of it.

When I am rebuilding my emergency fund, not as much or no money goes into my “moving out” account, so I am more motivated to save money so I can get both accounts back in order. I am going back to my old job this summer, since it is seasonal work, and I know I am going to be working close to 40 hours a week since I will be 18 they would work me as much as possible, which I like since it’s a job I love with wonderful coworkers. Not to mention we get so many gift cards it’s not even funny. We all love free money.

*Update: My family has encouraged me to stay home while I am studying at a college that I am commuting to. My father said he won’t charge me rent as long as he can afford to keep me at home and even if he does it won’t be more than $100 a month which he and I agreed on for a price. That account is now for saving up for a new car.

Goal #3: Have a spending limit when going out ✓

This goes along with what I was saying before about leaving money in my checking account if I have plans to spend it. I like planning my week out and so I tell my friends if they want to make plans they need to do it a few days in advance so I can see if I don’t have work or scheduled time to study, since I am the “nerd” if my group, all of my friends respect how I plan things.

They also respect when I tell them I don’t have money to go out. Sometimes I’d rather save my money than use it on movie tickets, of course with the occasional splurge here and there on a new pair of shoes or a delicious dinner. When times get like that, we all agree to do something else that is either really cheap or free, such as having a sleepover or going to the park.

Goal #4: Establish an “okay amount” to spend daily on coffee, breakfast, etc. ✖

I also did this for a little while, putting away $15 every check to get coffee in the morning before school. Since saving money is a learning experience, I’m messing up now rather than ten or twenty years from now. Doing this put be at risk for developing bad spending habits, $3-$4 a day adds up way faster than you think, the next thing you know you’re spending over $50 in a month for morning coffee runs. Now I’m not saying I never go to buy food and coffee before or after school, sometimes it’s great to treat yourself by doing so. Typically, I buy creamers and coffee grounds to make at home and sometimes I’ll buy a bundle of bananas to last me the week. I saw that not only did it save me money, it also saved me about a half hour in the morning. Meaning a half hour more of sleep.

While my coffee brews I walk my dog for a few minutes so she can go to the bathroom before everyone else in the house wakes up, and I start my car so it can run a bit before I leave. This is especially good since where I live the weather is unpredictable and it can frost over my windows at any time. If I catch this early enough I can defrost my windows before I go to school.

For about a month I would do something called “Fuck it Friday” where I bought coffee, snacks, whatever I wanted since I get paid every Friday. I saw that when I did this, I would just end up spending the amount I typically would in a whole week in one day, so I quickly stopped doing that and I plan on going back to making coffee at home. Goal #5: Add spare change to change dispenser in car ✖

I don’t use cash that often, which means I don’t really get change, but when I do have some lying around, it normally goes right into a bank I have in my room. When I have change in my car, I do tend to put it into the dispenser but then I’ll sometimes use it to give to the people asking for spare change or to buy a piece of candy at the store.

⊳ Languages

Goal #1: Take review notes of language material learned over the summer ✓

I did a really good job over the summer with posting a lot here, at least in my opinion, but when the school year started I posted a little less. In my first semester, I had a bit more time to post multiple times a week for multiple blogs, but when the second semester hit I began to prioritize my schooling over languages and blogs. I started to post at least once a week, but I noticed my language learning for Korean and Italian has gone down a lot because of it.

I take French in school so I practice it every day, and there are so many French posts I have drafted I’m in love. During the summer I worked more on Italian and Korean since my French was already way way way better, and I knew I would be taking it as a class during the school year. Goal #2: Listen to podcasts in the halls instead of music ✖

I really was going to do this, but right as summer ended I lost my apple headphones and I was not going to spend thirty dollars or so to get new ones, so I just didn’t have podcasts. I have my old phone, which is a Samsung, for music so I just used that with regular headphones.

Even when I got apple headphones from my dad’s fiancee, I still didn’t really listen to podcasts. I think it’s because I don’t want to start a new one or a new audio lesson if I am just walking three minutes to my next class. When I go back to my old job, however, that’ll change. It’s part of a program with my school for getting students into the workforce, so there is a bus that provides us with transport. I have a 45-minute ride there and an over 2-hour long ride back. No excuses to not listen to a podcast or two!

Goal #3: Mondly/Duolingo and Lingodeer during breakfast/as a part of your morning routine ✖

I used to be really good at doing these daily, but then I lost motivation. Even before I would never have a long streak, but I would just try to do it as often as possible to make up for it. There was a time where I didn’t even look at these apps for over a month, but I didn’t notice much of a change in my language comprehension. But I want to get back into it since I don’t have a lot of time now to sit down and do a couple of grammar lessons. Goal #4: Post weekly to studyblr/langblr for Italian and Korean review notes of what you studied over the summer. ✓

Again, I feel like I did a better job with this during the summer and my first semester of this year. I have several vocab lists saved just in case I don’t feel like studying but I need to do my weekly post. There are some times when I’ll be really motivated for no reason and just make like twelve vocab lists and I draft them for future use.

⊳ Health/Lifestyle

Goal # 1: Wake up at 6am ✓

Waking up early does not equal productivity, I learned that the hard way. I wake up that early for school, but during the weekends or on breaks I wake up normally at 8-9am if I don’t have to work that morning, which I rarely do since I work the night shift (typically around 1-12am I work).

Goal # 2: Go to bed at 10pm - 11pm ✖

If I am not working I go to bed at around 11pm at the latest, but there are some nights I get home at around 11:30 so I don’t sleep until 1-2am. This is usually weekends so I don’t have an issue since in my state it’s illegal to work minors after 10pm on a school night and 11pm on a weekend.

But now that I’m 18 and it’s summer, I can anticipate a lot of overnight shifts or longer hours! I’m not complaining, I’d rather work at night than in the daytime anyway.

Goal # 3: 5-minute workouts or 10-minute abs in the morning and evening or after school ✖ Hahaha, I never did this. I’m never gonna do this. Goal # 4: Floss more ✖ Not happening either, that’s too much man. It’s not that big in my life to floss, even if my dentist tells me to do it more. I have no cavities, no gum issues, so I’m good. Goal # 5: Take your medicines daily ✓ This I’ll admit, I need to do more. Sometimes I’ll go a few days without my meds, but it’s not important that I take them daily, since they are “as needed” medicines. I should take them at least every other day, but I am getting better at that. Goal # 6: Morning and Nightly Skin Care Routine ✓ I started off slow by only doing my routine in the morning and then occasionally going a nightly routine. My skin is really sensitive so this worked for me, putting on too much product would either make my skin too dry or too oily. If the weather is affecting my skin, I’ll add on an extra moisturizer if need be.

Basically, I only do a night time routine when I get home from work or school late and my face feels really gross. Since I shower at night I wash my face with a gentle cleanser in the shower. That’s usually it.

Goal # 7: Face mask while you study ✓ Doing facemasks too often also negatively affects my skin as well. I normally do one when I’m with my friends or when my skin really needs it.

Goal # 8: Drink more water ✖

Again, I need to do this way more often than I do. I think this is mainly because the water fountains at my school are utterly disgusting. I don’t know if it’s because our school is under construction, but it’s always been gross if I remember correctly.

⊳ School

Goal #1: SAT Fee Waiver ✓

THIS SAVES LIVES. At my school, if you have free or reduced lunch, you get fee waivers for all sorts of things. AP Exams, Applications, even SAT Exams. You only get two for the SAT so you need to use them wisely. Most students don’t even know that their school offers fee waivers that either cover costs completely or reduce the fee. Make sure you ask, it doesn’t do any harm!

Goal #2: October SAT ✓

I took the October SAT and got a 1050, which is way over than what the school I wish to go to is asking for. Then I retook the exam in June since I had one more waiver left, and I got a 1080. Now the college I want to go to has a 960 SAT Average and I needed at least a 500 on the Math and English portions to be exempt from the entrance exams.

Goal #3: Research application deadlines ✓ My school was a big help with this, especially since I’m starting at community college for my first two years. I’m accepted as a student and have already selected my classes, but there were some issues with my FASFA that I still need to resolve. Goal #4: Check scholarship board ✓ My school was also a big help with this as well, they print out all the available scholarships for that month, the criteria, AND the due dates! All I had to do was complete the applications, no fishing for free money.

Goal #5: Study at least 15 minutes a day ✓

I was strong with this with my first semester classes, since I enjoyed the work and had daily tasks I needed to do for one of the classes. When the second semester came, things changed. Most of my classes are easy, no homework and very little classwork that I got done early. All but AP Calc.

The way my teacher is, he doesn’t grade the problem sets he assigns. He’ll give us class participation points if we are working in class, but the problems are mainly for our own benefit. I don’t let myself not do the problems just because I won’t get a grade I’m struggling in that class now and I do all that I can to bring my grade up, but it’s not really doing much. If this is the only class I fail, then I’m glad it's AP Calculus AB and not English or something. I don’t need calc to graduate or to still obtain scholarships, it was an extra class I regret taking.

⊳ Misc.

Goal #1: Watch more Netflix when stressed ✓ I found that I’m not much of a TV or Show person unless it’s a really good show that I get hooked on. I’d much rather destress by having time to myself and browsing social media for hours. Goal #2: Take your time with everything ✓ This allowed me to get better with time management, taking things slow, thinking carefully, and making myself okay with the idea of rescheduling plans. Goal #3: Think before you speak/act ✓ Doing this made me do things I was glad I did and knew I would never do if I hadn’t thought it out. I became the friend who would do and say the things everyone else was afraid of. Goal #4: Try listening to others about their day ✓ This kind of went along with the goals #2 and #3 but this also worked out for me and I feel it made me somewhat of a better person??? Yea, just listen to people when they talk to you and ask them questions. Let them know you care about them, you don’t know how much it could raise their spirits. Goal #5: Attend Coalition meeting (every third Friday) ✖ As much as I wanted to, I could not attend meetings. I didn’t have an adult representative from my school to escort me and possibly other students, therefore I could not attend meetings.

~brianna

8 notes

·

View notes

Note

Honestly you're right about the way the wrong lessons were learnt about pokemon - when let's go was a commercial failure in nintendo terms, they thought "it must be because people love the mobile games!" not, you know, people DON'T like the mobile games enough for them to be replacing the mainline series' mechanics and full game efforts etc. Do they ever actually listen to their customers? Probably not. I could write a dissertation on companies losing the love for letting video games be games.

I think that’s a large component, but I do think there’s another component to it as well that’s a bit more bleak. I think mobile games absolutely are catching on as a competitor to console games. I think half the reason that the Switch is the new handheld console is specifically to compete with smartphones.

Like, when you think about it, console games are expensive for everyone. It’s several hundred dollars of expense, and about $60 per game, excluding any DLC or whatever they add in. That adds up quick. One game on a console requires $400 dollars, just to start. The main reason no one got Let’s Go, from what I heard, was “why would I drop all that money for a console, just to play Go in its original state with fewer Pokemon?” Which is fair. But that’s the big issue: cost.

By comparison, smartphone games are free to pick up. They don’t stay free, unless you don’t mind being completely unable to compete in the games, but you can, theoretically, get them completely free. On a system which costs like...hundreds to thousands of dollars depending on your pretention level, but consider: smartphones are unavoidable. A smartphone is largely considered necessary in society now. It’s your phone, an internet browser, able to connect to all sorts of different apps, and is now a separate gaming console in its own right.

So a consumer has a choice now. They can either (1) spend hundreds on a console that...pretty much just plays games, and occasionally has access to the internet but can’t compete with a PC due to the lack of like...anything significant a PC does, or (2) they can get a smartphone, which has all the same features of a console and then-some, but the games are less 40-hour time sinks and more pick up and play when you can, such as during your commute or when you have a little downtime between activities in your day. The choice is obvious. Getting the phone is an unavoidable expense that comes with games that are technically completely free, more features, and the games presented are better able to fit into the busy schedules of adult life.

So now we have the Switch, which is a handheld console, that’s adding a bunch of well-known indie games that are fairly short duration. Why? Competition. I think consoles are starting to realize that their main competition isn’t PCs anymore, it’s the smartphones. And smartphones are going to blow them out of the water. Sure, smartphones can’t render the same level of impressive RPG experience that a console can, but then, does it need to? How many people are still getting those console games, now that everyone comes with major extra expense with DLC, and run 40-60+ hours? Not to mention the cost to the company producing them. By comparison, smartphone games are about as cheap to produce as they come. You barely have to do shit for them to still make millions. On every side, the smartphones win. Hell, if you want to get really jaded: I barely own games for the Wii or WiiU. Maybe 3-5 games that are actually on the console. Most of the games for those systems are downloaded from virtual console, and I would say a good half of the WiiU games I own are remakes of older games. If we’re aiming to appeal to nostalgia, guess what: smartphones can emulate those older RPGs. So if consoles are going to largely try to appeal to nostalgia to draw in customers to their remake games that are still full price, guess what. Smartphones win again by having the ability to cheaply emulate the original version of the game.

Pokemon Company, and probably many other franchises, are definitely learning the wrong lessons, but the lesson isn’t which type of platform people like more. No one in the company cares. It’s about profit, and on that front, smartphone wins hands down. Rather, the lessons they’re not learning are about how to compete. What can the console games do different from smartphone games, and what draws in players? Well, as we should have been learning, consoles can definitely put on more of a spectacle with graphics and such, but that’s not exactly salvaging your problem. So what they need to be doing is paying attention to the purchasing decisions, and what draws people in, when they’re making these games. But who knows! Maybe that’s not a concern anymore. Maybe all of these constantly mistakes are just their way of transitioning everyone to accept that the main console games are no longer a focus or concern, and they just want to go into the mobile market that’s making them way more for way less effort.

3 notes

·

View notes

Text

Last summer I spent two weeks of my summer travelling around Sri Lanka whilst collaborating with hotels and restaurants across the country. I used the public transport system and local drivers to visit six different locations in my thirteen full days there, seeing everything from the Indian Ocean from Mirissa’s beaches to elephants in Yala National Park. In this post I’ll outline costs of food, commuting and excursions in Sri Lanka as well as giving a rough itinerary outline. Of course, everybody visits this incredible country for different reasons. I’m aware that some people may want to safari or surf for the duration of their stay, but for me I wanted to cram as much as possible into my very short visit and at as low a cost as possible.

For those intending on visiting Sri Lanka, there is a limit on how many Sri Lankan rupees you can take out of the country so you will be unable to purchase currency before your trip. If you’re taking cash to convert on arrival, be sure to use a large currency such as Pounds (for my fellow Scots, make sure it’s English notes – trust me!) or Dollars. Sri Lanka requires an e-visa from most visitors. Our visas took around 3 working days to be confirmed and emailed to us, so make sure to apply in plenty of time and to use an official source (local governments should have links to where visas are safe to purchase from). I have a full post on applying for East and South Asian visas on my site, which you can read by clicking here.

Processed with VSCO with c1 preset

Processed with VSCO with c1 preset

Processed with VSCO with f2 preset

Itinerary

As I’ve already indicated we visited a total of six locations whilst in Sri Lanka, however there were countless other towns and sights I would love to have seen so I’ll be sure to include them in this post, too.

Colombo, 3 nights: We started in Colombo, spending three nights in the heart of the city. Colombo has a great culinary scene and its skyline is transforming almost daily. The city is experiencing incredible growth but managed to retain all the charm I expected to find in Sri Lanka. You can see more photos from our time in Colombo as well as hotel and restaurant reviews by clicking here.

Mirissa, 3 nights: From Colombo we took a beautiful coastal train to Galle followed by a bus to Mirissa (more on getting around Sri Lanka later in this post) where we spent a further three nights. You can read my full review of our hotel, Seaworld Resort, by clicking here. Mirissa is perfect for surfing, being close to the stick fishermen and is roughly forty-five minutes for the much pricier town of Galle.

Yala, 2 nights: We took a tuk tuk from our hotel in Mirissa and drove across the Southern belt of the country which took close to three and a half hours. Yala is an incredible National Park with an endless list of wildlife. You can see photos from our safari by clicking here, and if anyone would like a review for our hotel then just let me know in the comments.

Ella, 2 nights: We travelled by bus from Yala to Ella by public bus. Although they’re pretty crowded and poorly ventilated, this drive in particular was one of the most beautiful we took during our visit. We climbed into the mountains to reach the small town of Ella, where you can visit the famous nine-arch bridge, mountainside waterfalls and climb Little Adam’s Peak. For more photographs of Ella and a full review of a suitable-for-any-budget hotel, click here.

Kandy, 2 nights: We took the world-renowned train journey from Ella to Kandy which took a few hours. Kandy was incredibly hectic, but I have to say I preferred it to Colombo. We stayed with the same chain as in Colombo, Clock Inn, and you can read my review for the hotel/hostel by clicking here.

Pinnawala, 2 nights: I’m aware this location may be slightly controversial to some, and I will admit that after seeing wild elephants on safari I would rather have not stayed at the Pinnawala Elephant Orphanage, but hotels and transfers to the airport were already paid for. However, our hotel had an incredible view of the river and we were able to get up close and personal with the elephants during their times in the water. Note that you’re unable to get to your hotel without paying a fee outside the hours of 10am and 4pm, so be sure to arrive before or after then to avoid time wasting.

Because of both time and budget constraints we weren’t able to make it to Sigiriya, Udawalawe National Park or to the Cameron Highlands. When I visit Sri Lanka again I’ll make a point of visitng all three for very different reasons. Udawalawe because of its dense elephant population, the Cameron Highlands because of their incredible beauty and Sigiriya to learn more about its history.

Costs

During this trip I was fortunate enough to receive a lot of my meals and accommodation for free, but I’ve done some research on costs of both as well as that of public transport and excursions to give a fully comprehensive guide to Sri Lanka.

Our flights from Manchester to Colombo (with a stopover in Muscat) cost approximately £360 return with Oman Air. As far as long haul flights go, this is more than reasonable and the same path for the rest of 2018 will cost you roughly the same. I always use Skyscanner.net to source flights and compare prices. Nine times out of ten I’ll book the flights through the airline’s own website, but sometimes the discounted rates are available only through Skyscanner. If you’d like to learn more about using the website for flights and hotels, you can read my guide here.

In terms of hotels, prices fluctuate slightly from region to region. For more remote areas such as Pinnawala and Yala, hotels have the ability to jack up the prices because of their monopoly across the area. Even so, for two people rooms can range from £12 per night to upwards of £100. In the larger cities like Colombo and Kandy, I would budget around £30 per night for a three-star hotel and £75 for a five-star. This is really where I start to plan the lengths of my trips, as accommodation is always the biggest outlay apart from flights.

Food can be as expensive or inexpensive as you desire. Around half of the nights we bought ramen noodles and cooked them with the kettle at our hotel which cost just £2 to feed us both. Others we went to local restaurants, and others to larger restaurants like Kaema Sutra and Ministry of Crab. Like the hotels, you really can adapt your meal plan to suit your budget. Realistically, I would budget around £20 per day per person for food, however it’s more than doable on £5 each.

Processed with VSCO with f2 preset

Getting Around

For getting around the country, you can either use private transfers, hire a car yourself or use public transportation. With the exception of our final trip to the airport which cost us an insane £40, we used public transport and tuk tuks for the entirety of our trip.

Upon our arrival in Colombo we used the local 187 bus to take us to Colombo Fort, costing 60 rupees (120 LKR = 1 GBP) each. This is significantly cheaper than taking a taxi, and means you get a higher-up view of the city while you maneouvre the winding market streets of the outskirts of the city. From the fort we took a taxi to our hotel which cost us 400 rupees. At no point in Colombo did we ever pay more than this to get from A to B, and everytime we boarded a tuk tuk we asked either the driver turn on the meter or give us a price upfront.

For thirteen days and for two people we spent around £100 getting around Sri Lanka. We took two trains, one from Colombo to Galle and another from Ella to Kandy. The former can cost 50p for third class tickes, £1 for second and £5 for first. The latter is a little pricier, but worth it compared to the cost of private transfer, at £2 each for a second class ticket.

Twice we used tuk tuks for length journey, the first being from Mirissa to Yala which cost us 4000 rupees and the second from Kandy to Pinnawala which cost us much less at 2000 rupees. Both of these journeys are possible by bus, but we wanted to cut down our travel time and be able to stop on the drive wherever we wished. Private transfers begin at roughly £40, so if you’re on a budget I strongly recommend investigating the public transport system and its limits before heading to Sri Lanka. For every country – Asian, European and North American – I’ve visited I always use Seat61 to determine routes, prices and timetables. Click here to view his site.

Processed with VSCO with f2 preset

Processed with VSCO with c1 preset

If you’ve made it all the way to the end, thanks for taking the time to read this post! This is a brand new style of post for me, so I’d really like to hear your feedback on my social channels or in the comments. If you’d like to subscribe for more content like this, sign up at www.caitlinjeanrussell.com/subscribe

Two Weeks in Sri Lanka – Costs, Itinerary and Getting Around Last summer I spent two weeks of my summer travelling around Sri Lanka whilst collaborating with hotels and restaurants across the country.

#asia#backpacking#budget#Budget Travel#Hotels#money#Public Transport#saving#south asia#southeast asia#sri lanka#Transport#travel#travel guide

1 note

·

View note

Text

Livingston Manor New York Cheap car insurance quotes zip 12758

"Livingston Manor New York Cheap car insurance quotes zip 12758

Livingston Manor New York Cheap car insurance quotes zip 12758

BEST ANSWER: Try this site where you can compare quotes: : http://freecarinsurance.xyz/index.html?src=tumblr

RELATED QUESTIONS:

Born abroad car insurance premiums higher?

I have been gathering quotes for car insurance online on confused and was delighted to see the price down at 615 for once as I have been getting car insurance every year since the age 18 and it has always been over 1000. However, just having a quick check over my details to make sure everything I had entered was correct and then I noticed I had ticked the resident from birth box. I was born in Spain as my mother went over there to work and then had me. I was born in 87 and she took me back home in 88 or 89 roughly. (She is a full British citizen born and raised in UK). As I have no contact with my father and I don't even remember being in Spain or nor can I even speak the language well, I feel fully British and also am regarded as a British citizen. My mum also registered me at a british consulate in april 88, just 6 months after I was born. So I put on the form that I became a resident in 1988. I then calculate the prices again and the insurance quotes shoot up with 955 being the cheapest and the rest going up to 1000. I then think back to all the years I have been paying the insurance and building up my no claims and being the perfect driver with no claims despite having to pay the shocking premiums that young people have to pay and this makes me absolutely livid that my insurance goes up by 340 to 400 based on the fact that I was born in Spain and spent 1 year of my life there and the rest of the 23 years as British Citizen raised here. I am just wondering if I could get away with just going ahead and saying that I was a resident from Birth as I have a baby on the way and really wish that my premiums were a reasonable ammount for once or I should go through it and just demand that they bring the premiums down to the 615 like originally quoted! It just makes me really annoyed that they can get away with this kind of stuff and I really don't like the fact that I am having to pay higher premiums just for the sake of it. Any advice on this?""

Car insurance Michigan?

Im 23 i will be trying to buy a car. I have the down payment but its the insurance that the dealers are scaring me with. One dealer told me it would be about 400 to start a policy. My question is do i havr to pay that whole 400 to get my car off the lot or will it be like half and then the other half later that month

Does anybody know of or know a way of finding an insurance company that insures car park operators?

I want to hire 50 car parking spaces from a major retail outlet in the UK with a view to renting these spaces to commuters /I will be sharing their car park with the retailers customers. Does anybody know of or know a way of finding an insurance company that insures car park operators?

What's the annual policy premium?

I have an amount of 623 dollars for annual policy premium for life insurance. Do I have to pay the amount?

Exactly how much does credit score affect auto insurance rates?

Can anyone tell me roughly what percentage my rate is gouged (oops, I mean 'increased') as a result of less than perfect credit? I have Progressive insurance if that helps. Thanks!""

Don't Have Insurance But My Dad Does. Can I Drive (with him) In His Car?

In other words, I'm from California and I don't have insurance nor a car. I have a Permit. The adult (with a license) has a car and insurance. Is it legal for me to drive his car (with him on passenger seat) even though my name is not on the insurance?""

Swinton Car Insurance ?? Any one used Swinton ?

I have always been insured with either Churchill or Direct Line. Been shopping around this time and Swinton have offered the best quote so far through Highway Insurance.,. Price includes Legal cover, High breakdown cover, courtesy Car ect,, Im just abit unsure what the service is like as I dont know anyone who uses them. Any one used them and what were your experiences? good or bad ? Many thanks in advance.""

Lowest insurance cars for 17 year old / first car?

i'm looking to buy my first car and wanna spend about 1000, does anyone know a good lads car around this price with comparatively low insurance for young drivers? thanks peoplee!""

What whole life insurance policy is best for a 24 year old?

I have a policy from New York Life, but 2 of my friends who are financial planners, say Mass Mutual would be better... there's a bunch of baloney I'm not understanding i.e. guaranteed benefits, crap about withdrawing money for retirement. Altogether, it doesn't seem like I am getting that much from death benefits with the amount I am putting in ($1K/year until pretty much I'm 65). I don't want to pay forever for this... where in my policy does it say when I can stop paying?""

Question About Car Insurance?

I have AAA. I have 3 vehicles, 2 in which my daughters are the drivers. One of my daughters has 2 points for prohibited turn, which raised my insurance rate. Is there anyway to get the points removed or remove her from the policy even though she would still drive?""

Where can i buy health insurance?

I'm have a low income and I'm looking for a right insurance coverage. I work as a part time job so my employer won't buy an insurance for me. Please if anyone knows any ...show more

""Is it possible to buy a car insurance without owning a car, and then use it for renting a car?""

I live in India and frequently travel to USA. And when I go rent a car, pay almost double the rental because I have to buy all the coverage. I was wondering if it is possible for me (or my company) to buy some sort of protection policy, using which I can rent the car and not have to buy insurance from them.""

About health insurance?

i don't have a health insurance and my job doesn't provide me one i had a car accident and i owe around 3,000 dollars on my own hospital visit i didn't injure another car if i get an insurance do you think they will pay for my health debts???""

How much car Insurance would I pay?

I have just got my first car as I'm 17. I got the VW Scirocco 2.0 Around how much insurance would I be paying? I am a very good driver as I have had lots of practise since I was about ten. It is modified with a nice body kit and has twin turbos. I didn't think about insurance before I bought big engine car for a first car. Any help and who does it cheap for teenagers?

Do you have to have proof of car insurance to get your car inspected in texas?

Just wanted to know if you have to have proof of car insurance in order to get your car inspected in the state of Texas?

What is the best place to get insurance from when just passed test (uk)?

What is the best place to get insurance from when just passed test (uk)?

Where can I get affordable health insurance?

I am a full time college student, and my school offers insurance, but it is expensive. I need basic health care to cover doctors visits, specialist visits, and x rays. The main reason I need coverage is that my back is messed up from a car accident about a year and a half ago and I can't take the pain anymore. I went to my states website and the insurance they offer is currently not accepting applications. I have looked at tons of sites online, but so far am having no luck. Any advice would be appreciated.""

Wich car will cost more?

wich car will cost more in insurance? im a 16 year old boy with a3.0. i dont need exact prices just wich costs more. 2004 mustang v6 or 2004 silverado 1500 access cab 5.3 litre v8. thank you

Motorcycle insurance?

Im a 20 soon to be 21 year old male who lives in the lower half of Michigan. I was wondering if any one knows about the cheapest or the best coverage and how much will that run me? I am about to buy a Honda CBR 600 if that makes any difference. Anyone with insurance experience any and all information will be greatly accepted also information on registration!!!! THANKS

What's the cheapest insurance company or booker they've come across?

The cheapest iv encountered is onlyyoungdrivers.com the next being RAC insurance a few hours quid more, followed by 4youngdrivers.co.uk that is myself being under 25. Also has anyone found it cheaper to ring the direct in attempt to get cheaper quote, iv stayed away from this as of yet because of the cost of calling.""

What does comprehensive car insurance cover?

I caused damaged to my own car, scraping it against a wall while driving out of a car park. The damage was done near the rear tyres and on my door and quotes I've received were all above the 900 range. My standard excess fees are $725, I was wondering if having comprehensive insurance (with AAMI Insurance) does that cover damage done to your OWN car? (I pay $2,500 annually for insurance) and there was no third party involvement, it was just a driving error. Would my insurance fix up my car even if it was entirely my fault?""

Is there a State Farm insurance branch in Texas?

Is there a State Farm insurance branch in Texas?

Best option for buying insurance for my 8 yr old child?

I am wanting to buy insurance for my child. He is no longer covered by his old plan and I want to get it ASAP. Without having company/ group coverage as an option I have been looking at EHealth online services. It can be a little confusing on just exactly which is the right deal. My child is never sick and has no existing issues, but with all the sport; I just don't want to be facing a broken leg and no insurance. I could some advise here. I have all but pulled the trigger on a package I found through Humana (I think) on the E health site but I just would like an nonbias opinion first. Thanks""

How much is registration/insurance for a 17 year old?

Does anyone know how much car insurance is in QLD australia for 6 monthda and a year for a 17 year old

Do (UK) car insurance companies need to know the car's registered address?

I am a student and thus spend most of my time away from home - I receive correspondence to my university address and my car is kept there most of the time. Essentially all the details ...show more

Livingston Manor New York Cheap car insurance quotes zip 12758

Livingston Manor New York Cheap car insurance quotes zip 12758

Where can I get affordable health insurance in Arkansas??

Where can I get affordable health insurance in Arkansas??

""I'm turning 16, and wanting to buy a car. How much is the Car insurance?""

Well, i'm turning 16 and when i'm 16 i'm going to buy a car. I saved enough money to buy myself a mitsubishi lancer or Eclipse base model. I live in Calgary, Alberta, Canada i want to know what is the cheapiest car insurance for me? on a monthly or yearly term.""

Mandating health insurance?

I heard that HIllary and Obama want to mandate health insurance. How is that going to solve anything? People can't afford it, like me. Health insurance should be like car insurance, people pay their own way and if they don't have it they pay for their repairs or don't get fixed.""

What is the best and the cheapest car insurance in ontario?

What is the best and the cheapest car insurance in ontario?

How much for an 18 years old car insurance?

I will be turning 18 in august, and i was just wondering how much my car insurance will be. I have to wait till august to get my license, My GPA is about 3.50gpa, I'm planning on buying a used scion tc. Can someone give me a estimate how much i have to pay for 6 month insurance?""

Car insurance?

I PLAN TO PURCHASE A USED CAR. THIS WILL BE MY FIRST CAR SO I DO NOT HAVE ANY CAR INSURANCE. I KNOW THAT I CAN NOT DRIVE THE CAR OFF THE LOT UNTIL I HAVE CAR INSURANCE. SO WHAT DO I DO? CAN I SIGN UP FOR CAR INSURANCE AT THE LOT? WHAT IS A GREAT CAR INSURANCE COMPANIES? ANY HELP YOU COULD GIVE ME WILL BE GREAT. THANK YOU SO MUCH :)

How much will Mirena IUD cost without insurance?

I go to a local clinic and My copay is %75 of the bill . How lovely right lol , How much would the Mirena cost ?? any ball park figures would be great thanks!""

Will my insurance company insure my car without the registration?

I'm buying a used car and picking it up and hour away from me. I don't have the bill of sale or registration but I need insurance on it to drive it home. Can they still insure it?

When i turn 21 can i change my car insurance details for cheaper car insurance?

so im 20 now and as we all know your insurance drops when you turn 21 basically im insured now but my policy doesnt run out for like 8 months when i turn 21 can i ring them up and say im now 21 can i change this detail to get cheaper car insurance whilst not cancelling the policy

How much is car insurance for a 17 year old?

I know it all depends, but I'm talking on average, I live in the Manchester area and I've heard it depends on your area aswell?""

Do I HAVE to pay for insurance if im not driving but have a license?

My mom is trying to tell me and my brother (who is 19 and I will be 18 in about a month which is when i will get my license) that we cant get a license unless we have money to buy insurance. I think its really f***ed up for a student who got a license and doesnt drive any vehicle has to pay for insurance. She says that once i get my license, the insurance company will force her to put me on her plan so i can be insured. I think its a load of sh*t. I have never heard of anyone being forced to have insurance when they dont drive. When i say dont drive i mean, when i get my license, i wont be driving until I get my own car. Please dont respond to my situation and how i should deal with it, just tell me if thats even possible for the insurance to do that.""

What will happen if my wife gets pregnant and we dont' have health insurance?

They can't refuse prenatal care can they? Would we have $40,000 in medical bills? What would happen? We aren't poor, we just have horrible insurance through both of our workplaces.""

If a health insurance company can't deny my pre-existing condition...?

Why should I buy insurance at all?

What is the best car insurance company out there today?

I'm gonna get a car soon and I'm having difficulty picking an exact car insurance company to insure my car so I just wanted to read others opinion on what car insurance they think is the best.....if availabe tell me the pros & cons....

How can I get the best quote for a car insurance in the UK?

I have just bought a car, but I haven't driven since I moved to London, 5 years ago. I am doing a research on-line to get the best quote, but they all seem to be a bit pricey. Does anybody know a telephone number in the UK where a person (rather than a machine!) can find the best deal? I am tired of websites such as moneysupermarket, as you end up having to contact companies individually... Any help would be greatly appreciated as I would like to bring the car home today!! Many thanks in advance!!""

What is the cheapest auto insurance for young drivers?

With your experiences with auto insurance, whats been the cheapest you've had or knew someone had. I'm 20 with a 2001 Mazda Protege LX 2.0L in NYS""

What is the cheapest auto insurance in general/in NM?

I feel like i'm paying too much for auto insurance (i have aaa) what other insurnce cold I get that will be the cheapest, I don't drive my car all that much, I just want the cheapses rather than nothing.""

How much does insurance cost for?

Hi! I'm a 16 year old male that lives in Kentucky, and i'm getting a truck soon, it would be my first vehicle. Its going to be a mid 90s or late 80s truck. I'm wanting to know how much insurance would cost on average? Any help would be greatly appreciated.""

How much would i pay for car insurance? Estimate?

I know that it depends on a lot of factors but can you estimate how much i would pay for car insurance on a monthly basis - I am 18 years old - will be driving either a 1999 or 2000 model - will be attending college after the summer - clear background - this will be my first car - I live in a very wired and exotic place called MARYLAND

Looking for a online site to get cheap car insurance quote from all carriers at once?

Looking for a online site to get cheap car insurance quote from all carriers at once?

Which is the best Home Loan insurance?

Hi, i have taken Home loan of Rs. 10 Lac from HDFC. and want to protect my loan through insurance. can any body tell me that , which is the best home loan insurance plan or policy. HDFC recommend to me its own HDFC ERGO for home loan. is it best for me or any ohter option to chosse me. Please advice. LK Sharma""

How much will my insurance and maintenance costs be affected by what type of car I get?

I'm about to be 18 and am planning on getting my first car soon. I've been driving for almost 3 years in my parents' cars but need my own for heading off to college and such. I don't know what type of car I want to get, but it's gotta be cheap, old and used, preferably up to $6,000-7,500 at the absolute max. The problem is that I've been really into cars for most of my life and would rather have something a little nicer to start, I mean within the same price range but for example a Mustang, Mitsubishi 3000GT, BMW 3- or 5-Series, etc., rather than the usual Civic or Camry (not that I'd mind one of them either). The problem is that I'm worried the insurance will be way more expensive. The latest quote my dad got was a few weeks ago and it was quite a bit lower than I expected, only like $560/yr., but that was with their old '93 Taurus GL. Will having a sports car or more high-end car affect it really dramatically or will it not make that big a difference as long as my driving record stays good? Also, how much more does it cost to maintain and repair a car like a used BMW than it does just a normal car like an Accord? I've always heard that European cars in particular can be temperamental and finicky if not maintained properly, so I'm just worried that I won't have the money and know-how to have and keep a car like that as my first car.""

What is full coverage auto insurance?

What counts as full coverage auto insurance in California? Thanks!

""Car accident, insurance rate?""

ive been driving 2 years, no tickets, no accidents....so tonight i got in an accident, rear ended a car....my fault,,,how much will my insurance go up? i have Allstate.""

What's the cheapest motorcycle insurance for a 17 year old owning a motorcycle and holding a Motorcycle L....?

Learner's permit and no DL in viriginia? Serious answers only please. I want to be the only person on the insurance.

Livingston Manor New York Cheap car insurance quotes zip 12758

Livingston Manor New York Cheap car insurance quotes zip 12758

Is it possible to get Mexican insurance (not tourist) for US plated car ?

I have a US plated car (calif plates) not currently registered in the US, Not currently insured in the US. I am in mexico on FM2. Car has been here for over 4 yrs with temp permit. Is it possible to get insurance in mexico? For tourist policy I have been told car must have current US registration and insurance, For mexican policy I have been told need to have mex plates. Anyone with US plates been able to get Mexican insurance (not tourist) for their currenlty unregistered un insured US vehicle in mexico? If so what is your insurance company. Thanks""

Has anyone ever had short term car insurance ?

how much is it ? i work alot in the summer so i only need a car for a month please help am new to this.

Is it Ok to buy insurance for me and let other people buy the car?

It is cheap to buy me insurance, so I am just wondering if I can buy the insurance and let other people to drive the car.""

What is the positive & negetive aspect of Term insurance?

Why insurance agent do not show interest towards term insurance. Why they insist on ULIP only.

Can I buy triple a auto insurance with a permit? California?

So due to curtain circumstances, I need to get my own auto insurance, the catch is that I only have a permit. what I wanted to know is if a major insurance company, like triple a, would cover me, if so would it cost more than a newly licensed person, and if not does anyone know a minor insurance company that would.""

Are Honda's usually expensive on insurance?

Also what are some good looking cars that arn't to bad with insurance (I know that it all depends but still) oh and we have geico, thanks!""

Why are insurance companies such bastards?

I could never figure out why people screw their insurance companies when they can. Well now I know. They are a bunch of ethic-less, principle-less bastards. So go for it, screw them when you can for all you can. You can be assured they will do it to you first wether you are honest or not.""

How much is the insurance for a '01 pontiac firebird?

i wanted t know how much the insurance is for a teen on a '01 firebird?

Car insurance for a 19 year old?

Ok about a few Weeks ago I was involved in a wreak, I had no license and was not under my parents insurance. Luckily i didn't go to jail cause I was rear ended. Now I'm attempting to get A drivers license after SO long I've been begging for one, The only thing that's held me back from getting one was my parents because they said i would be tagged on into the insurance, and that I had to go under another address. Now after the wreak they said I cant get one, because once the insurance finds out im driving, they'll automatically add me on, is this true? I want to get back on the road and walking is pretty bad knowing i have a car ive been paying for the [ast two years for. BTW I live in Texas and under state farm.""

What is the cheapest way to get car insurance?

i passed my driving test yesterday and am looking at buying my first car but no matter what car i go fo i always get quoted around 3500 but i just cant afford that. does anyone know of any companies that specialise in young or new drivers insurance? and i would prefer less than 2000 lol xx

Will my car insurance rates go up?

A year ago, I got into an accident that was my fault. My insurance rates went up. Recently they dropped but at school, I was pulling out of a parking space and I ran into another girl's car. Will my insurance rates go up if she put in a claim? If so, how much. Any thoughts? What should I do?""

How much is car insurance on a Nissan 350z?

How much is car insurance on a Nissan 350z?

Insurance same day proof?

i was pulled over on he 1-9-2008 the same day i received the insurance went to court thought it was done i recevied a paper from the bmv in ohio asked for my insurance sent it to them 2 weeks later was sent another letter insurance same day proof for my insurance company faxed that to them they faxed it back should i had insurance 1-9-2008-6-9-2008(changed insurance companies)my insurance company signed it i sent it to the bmv that apparently was not good now they on the paper which never asked for the time exactly and make and model of car shouldn't they just except what the insurance company sighned and gave them

""Can any one say best insurance site,which dealing with better travel insurance policies of different companies?

I want to know benefits of insurance policies of different companies before buy travel insurance policy

What is the least expensive color of car to insure?

I know red is the most expensive. I've heard that white is the least from one person and green is the least from another.

How much will my auto insurance cost?

Ok...so I'm looking at an old 73' Bug to possibly buy for college and all. Cost- of the car at least- is not a problem, as its $100, and I have $100. (Yes, it does have issues and looks horrible, but hey it runs and drives). So...that brings up insurance. There is NO way I can get in on my mom's insurance- she won't let me get a car so the only way is if I do all myself, and I'm 18 now and going to college in a few weeks, so a=Im looking at my options. I know as a male teenage driver its going to be high, but what is high? How much will good grades and all that help? Just, what would you recommend and how much could it end up costing? Thanks...""

Is Progressive Auto Insurance a good company?

I have several insurance quotes from State Farm and Allstate, and Progressive beats the price by almost half. But, when something looks to good to be true, it probably is. Is this good insurance? Are they good with claims?""

Do I need to declare to my insurance company If I change my alloy wheels.?

It currently has the factory 16 alloy wheels on but 2 of them are buckled. I don't want to buy new ones the same as this seems to be a common problem with ford fiesta alloys so was thinking of replacing them with the same size alloys of a different brand. Do I have to declare this to my insurance company?

What is the average insurance cost for a 2012 Chevy Cruze?

I will be turning 21 in June. No tickets or accidents on my record. What would the average monthly payment be for insurance?

How much would car Insurance be for a 16 year old girl?

I live in Michigan. Thank you :)

Nj motorcycle insurance?

im 23, male, have a pretty good car driving record (if that helps), but my credit isnt that good. how much (ball park) would it be in nj for motorcycle insurance. im planning on purchasing a bike in the next 8 months and wanna know how much i should expect to pay for insurance. i will get a quote, i just wanna know from you guys a rough estimate. thanks""

What do I need before I get car insurance besides license?

I have my license, and a car that I bought that is in my dad's name. He wants to transfer ownership to my name, inspection expired in 2007 (I haven't driven for about a year). First, do I need to have a car in my name to get insurance, or can I just get ins. with the car in my dad's name then transfer the title later? (with no ins. changes) 2nd, to get insurance do I need to pass inspection, or can I just get ins. first?""

How old dose a car/vehicle need to be for lower insurance?

I am 17 and i have been saving money for a brand new car and i started looking for one and i found the one i want and so i decided to get a quote on the insurance for it and the quote as around 350 and the car payment quote was 200 i thought that this is a little ridicules myself and i cant afford insurance that high... So i was just wondering how old a vehicle needs to be before the insurance is way lower than what it would be if it was brand new!

I need to find a good Car no older then lets say 1999! Thats good on Gas and low Insurance! Low Price $5000 <!

Hi my name is James. I am a college student and I am looking for a used car to get me through college and maybe Further! I am hoping to spend under $5000 Dollars. I need it to be able to have a lower insurance rate then lets say a sports car. I also need something thats has a very good fuel efficacy! I am a tall guy but can fit into any thing! So if any of you know of a car that looks almost good has good gas millage and is not too expensive on car insurance let me know! ASAP!!!!!! Oh and this car not one I want to buy online or privately. It is one I want to buy from a car dealer ship this is just to help me lock down my search!

Non-credit based car insurance?

i saw a commercial on tv about a car insurance company that bases your premium on your driving record, not your credit score. but i cant remember the name. anyone know? thanks!""

Livingston Manor New York Cheap car insurance quotes zip 12758

Livingston Manor New York Cheap car insurance quotes zip 12758

Can anybody Reccomend a good online insurance company for a Cagiva Mito 125?

I have been looking around for a low insurance rate for my Cagiva Mito 125 Motorbike, does any Mito owners know of a good insurer for that bike and how much did you pay?""

Do I buy car insurance before buying a car from a private party?

I'm buying a car this weekend from a private seller (we are just waiting for the duplicate title to come in the mail; she lost the original). Money won't be exchanged until ...show more

Where can i find cheap auto insurance?

I am 18, almost 19""

I just got a speeding ticket how much will insurance go up?

Im 18 i was speeding to get to school, 50 in 35... The ticket was worth 50 dollars, i pay 1200 a year for insurance and i was wondering how much it goes up, and my insurance company is farris insurance in Hickory NC, and my sister works there.""

What bike would be cheapest on insurance?

scooter?street+trail?chopper?crotchrocket? or anything?which bike out of all bikes street legal and able to achieve 50mph is the cheapest insurance wise

Do you think which is better for a 1984 corvette classic car insurance or regular car insurance?

I am planning on getting a 1984 corvette but the insurance for it is a little too high.i just found out about classic car insurance but i really don't know much about it.but for classic car insurance,am i limited to a certain number of things like how far i can drive my car,when i can drive,etc?will the insurance actually be less or more for classic car insurance?and what is the best classic car insurance company i should go with?""

How much would a Ford Puma cost to insure?

I'm 16, taking driving lessons soon after my birthday, and I'd love to get a Puma, I know insurance is a lot... But I thought that as it's a small, 2 door car, the price might drop a bit, if maybe the price is going to be quite high (Above average for a new driver) then please suggest some other cars that are cheap to insure :) But I would really like one of these x) Also considering fuel consumption and economy :) One of these - http://www.autotrader.co.uk/classified/advert/201228478314260/usedcars/postcode/bn72ph?logcode=kp :) Thanks very much""

Can I sue someone with auto insurance?

I live in Las Vegas and I was involved in a car accident in November. There were 6 cars involved and this process is being UNUSUALLY long. It is impossible to get in contact with one of the claimants so we can not settle for our car damages. Can I sue the individuals that were held respoinsible for the auto accident?

Can I get insurance myself at 17?

I'm 16 right now and I have been diagnosed with major depressive. My mom lost her insurance in May last year and I haven't been to a doctor since. My symptoms are getting worse and I attempted suicide a couple months ago (refused to see a doctor afterwards because I didn't want social services to get involved). I have a family history with depression and mood disorders and my condition is only getting worse. I tried to get insurance all summer and fall last year, but I couldn't qualify for medi cal (I live in california) because of my age supposedly and my old doctor refused to sign off on minors consent. I'm wondering if things will be different by the time I turn 17? Will I be more likely to be accepted by then? Is there anything else I can do that won't get my mom arrested and me put into the foster care system? I feel like the social workers have a gun pointed to my back right now.. if I say much more about my problems to them they'll take me, and my little brother. Also CPS is not an option I want nothing to do with them or foster care. I would rather continue on and die in my condition than go to the foster home in my area, I've met kids stuck in that system and continuing on without medical care seems better than living in that hell hole. And I certainly wouldn't wish that on my little brother.""

Is Medicaid consider as A health insurance?

Hello, I live in Texas and am going to college. My mom wants me to get health insurance stuffs fill out for college, so I have to pay less(? not sure if this is true). The website told me to to file my health insurance so they can take some of the health bill off the insurance.""

I reasonly got layied off need my wife is haven a baby need to know about insurance?

i got layied off from my job im a union worker in nyc and i have to work a certin amout of hours to keep my heath insurance going . my term ends in june my baby is do in july there for i will not be covered when the baby is do . does any one know what i can do for covrage i have aetna ? is there anyway i can extend my insurance ?

How does rbs insurance differentiate itself from it's competitors?

Hi, I'm filling out an internship form, and I'm stuck on this question.. Please help me! Thank you""

Minor car accident without insurance?

I caused a scratch. But I don't have insurance by that time. What am I supposed to do? Go to beg the old lady stop claim insurance company but solve that privately? But she already reported to insurance company. Can she withdraw the claim so we can solve privately? Any other choice?

How much will my car insurance go up?

I recently had an accident and my car was totaled, it was my fault, i did have full coverage so they did pay for my car and the other person, can someone give me an idea like a percentage or something that will help me determine how much more i will be paying, i am currently paying $95/month.""

Need Insurance?

I am buying a new car and have to get insurance. Any suggestions on good and cheap companies?

How many people lack health insurance?

If you lack health insurance, why? If you cannot afford it, what could people around you do to help you out?""

How much would car insurance cost for me?

Im seventeen. And female. The car is a black 94 Jetta standard (if that has anything to do with it) Im just confused about insurance. People are saying it would be very expensive but I turn 18 in a month should I wait until then? Also people say insurance is cheaper for girls. Is this true? And what insurance company is cheapest?

""How can i get insurance if my car cost 20,000?""

How can i get insurance if my car cost 20,000?""

Is a Pontiac Grand Am considered a sports car?

Want to know if it'll be a higher insurance cost..... Thanks. :3

What types of insurance are required in Minnesota?

I have a permit test in about an hour and I forgot what kinds of insurance are required in the state of Minnesota? There are 2 of them I think it's liability and no fault? Help please?

What is the cheapest auto insurance for 16 year old boy?

Thanks in advance

Whats the difference between insurance and bonded insurance on roofs?

i started my construction business and im looking for some good insurance, and im not too sure whats the difference between a regular construction business insurance and bonded insurance? any suggestions?""

Insurance Rates?

I'm a 17 year old male and I just got my 1st speeding ticket today and it was a 6 point ticket how much do you think my insurance rate will go up by

Do i need insurance to sell motobikes?

I am selling mini moto's and quad bikes online, do i need liability insurance to sell these?""

Do I need to pay for insurance when I have my temps in Ohio?

My mom has insurance on her car, but I wanted to know do I have to pay for separate insurance for me?""

Livingston Manor New York Cheap car insurance quotes zip 12758

Livingston Manor New York Cheap car insurance quotes zip 12758

https://www.linkedin.com/pulse/find-cheap-car-insurance-hayden-collier/"

1 note

·

View note

Text

New story in Business from Time: Millions of Americans Have Lost Jobs in the Pandemic — And Robots and AI Are Replacing Them Faster Than Ever

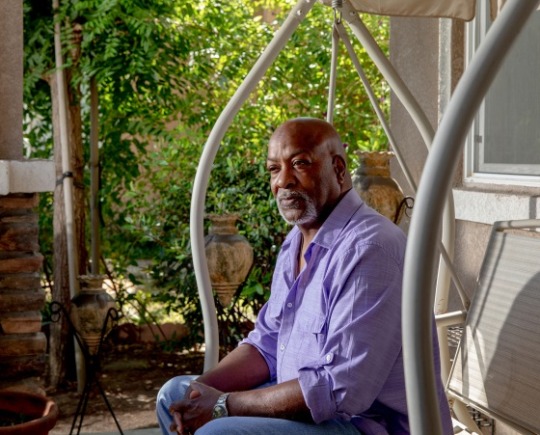

For 23 years, Larry Collins worked in a booth on the Carquinez Bridge in the San Francisco Bay Area, collecting tolls. The fare changed over time, from a few bucks to $6, but the basics of the job stayed the same: Collins would make change, answer questions, give directions and greet commuters. “Sometimes, you’re the first person that people see in the morning,” says Collins, “and that human interaction can spark a lot of conversation.”

But one day in mid-March, as confirmed cases of the coronavirus were skyrocketing, Collins’ supervisor called and told him not to come into work the next day. The tollbooths were closing to protect the health of drivers and of toll collectors. Going forward, drivers would pay bridge tolls automatically via FasTrak tags mounted on their windshields or would receive bills sent to the address linked to their license plate. Collins’ job was disappearing, as were the jobs of around 185 other toll collectors at bridges in Northern California, all to be replaced by technology.

Machines have made jobs obsolete for centuries. The spinning jenny replaced weavers, buttons displaced elevator operators, and the Internet drove travel agencies out of business. One study estimates that about 400,000 jobs were lost to automation in U.S. factories from 1990 to 2007. But the drive to replace humans with machinery is accelerating as companies struggle to avoid workplace infections of COVID-19 and to keep operating costs low. The U.S. shed around 40 million jobs at the peak of the pandemic, and while some have come back, some will never return. One group of economists estimates that 42% of the jobs lost are gone forever.

This replacement of humans with machines may pick up more speed in coming months as companies move from survival mode to figuring out how to operate while the pandemic drags on. Robots could replace as many as 2 million more workers in manufacturing alone by 2025, according to a recent paper by economists at MIT and Boston University. “This pandemic has created a very strong incentive to automate the work of human beings,” says Daniel Susskind, a fellow in economics at Balliol College, University of Oxford, and the author of A World Without Work: Technology, Automation and How We Should Respond. “Machines don’t fall ill, they don’t need to isolate to protect peers, they don’t need to take time off work.”

Cayce Clifford for TIMELarry Collins, at home in Lathrop, Calif., on July 31, was a bridge toll collector until COVID-19 led the state to automate the job to protect employees and drivers. “I just want to go back to what I was doing,” says Collins, whose job is among the millions that economists say could be lost forever as companies accelerate moves toward automation.

As with so much of the pandemic, this new wave of automation will be harder on people of color like Collins, who is Black, and on low-wage workers. Many Black and Latino Americans are cashiers, food-service employees and customer-service representatives, which are among the 15 jobs most threatened by automation, according to McKinsey. Even before the pandemic, the global consulting company estimated that automation could displace 132,000 Black workers in the U.S. by 2030.

The deployment of robots as a response to the coronavirus was rapid. They were suddenly cleaning floors at airports and taking people’s temperatures. Hospitals and universities deployed Sally, a salad-making robot created by tech company Chowbotics, to replace dining-hall employees; malls and stadiums bought Knightscope security-guard robots to patrol empty real estate; companies that manufacture in-demand supplies like hospital beds and cotton swabs turned to industrial robot supplier Yaskawa America to help increase production.

Companies closed call centers employing human customer-service agents and turned to chatbots created by technology company LivePerson or to AI platform Watson Assistant. “I really think this is a new normal��the pandemic accelerated what was going to happen anyway,” says Rob Thomas, senior vice president of cloud and data platform at IBM, which deploys Watson. Roughly 100 new clients started using the software from March to June.

In theory, automation and artificial intelligence should free humans from dangerous or boring tasks so they can take on more intellectually stimulating assignments, making companies more productive and raising worker wages. And in the past, technology was deployed piecemeal, giving employees time to transition into new roles. Those who lost jobs could seek retraining, perhaps using severance pay or unemployment benefits to find work in another field. This time the change was abrupt as employers, worried about COVID-19 or under sudden lockdown orders, rushed to replace workers with machines or software. There was no time to retrain. Companies worried about their bottom line cut workers loose instead, and these workers were left on their own to find ways of mastering new skills. They found few options.

In the past, the U.S. responded to technological change by investing in education. When automation fundamentally changed farm jobs in the late 1800s and the 1900s, states expanded access to public schools. Access to college expanded after World War II with the GI Bill, which sent 7.8 million veterans to school from 1944 to 1956. But since then, U.S. investment in education has stalled, putting the burden on workers to pay for it themselves. And the idea of education in the U.S. still focuses on college for young workers rather than on retraining employees. The country spends 0.1% of GDP to help workers navigate job transitions, less than half what it spent 30 years ago.

“The real automation problem isn’t so much a robot apocalypse,” says Mark Muro, a senior fellow at the Brookings Institution. “It is business as usual of people needing to get retraining, and they really can’t get it in an accessible, efficient, well-informed, data-driven way.”

This means that tens of thousands of Americans who lost jobs during the pandemic may be unemployed for years or, in Collins’ case, for good. Though he has access to retraining funding through his union contract, “I’m too old to think about doing some other job,” says Collins, who is 63 and planning on taking early retirement. “I just want to go back to what I was doing.”

Check into a hotel today, and a mechanical butler designed by robotics company Savioke might roll down the hall to deliver towels and toothbrushes. (“No tip required,” Savioke notes on its website.) Robots have been deployed during the pandemic to meet guests at their rooms with newly disinfected keys. A bricklaying robot can lay more than 3,000 bricks in an eight-hour shift, up to 10 times what a human can do. Robots can plant seeds and harvest crops, separate breastbones and carcasses in slaughterhouses, pack pallets of food in processing facilities.

That doesn’t mean they’re taking everyone’s jobs. For centuries, humans from weavers to mill workers have worried that advances in technology would create a world without work, and that’s never proved true. ATMs did not immediately decrease the number of bank tellers, for instance. They actually led to more teller jobs as consumers, lured by the convenience of cash machines, began visiting banks more often. Banks opened more branches and hired tellers to handle tasks that are beyond the capacity of ATMs. Without technological advancement, much of the American workforce would be toiling away on farms, which accounted for 31% of U.S. jobs in 1910 and now account for less than 1%.

But in the past, when automation eliminated jobs, companies created new ones to meet their needs. Manufacturers that were able to produce more goods using machines, for example, needed clerks to ship the goods and marketers to reach additional customers.

Now, as automation lets companies do more with fewer people, successful companies don’t need as many workers. The most valuable company in the U.S. in 1964, AT&T, had 758,611 employees; the most valuable company today, Apple, has around 137,000 employees. Though today’s big companies make billions of dollars, they share that income with fewer employees, and more of their profit goes to shareholders. “Look at the business model of Google, Facebook, Netflix. They’re not in the business of creating new tasks for humans,” says Daron Acemoglu, an MIT economist who studies automation and jobs.

The U.S. government incentivizes companies to automate, he says, by giving tax breaks for buying machinery and software. A business that pays a worker $100 pays $30 in taxes, but a business that spends $100 on equipment pays about $3 in taxes, he notes. The 2017 Tax Cuts and Jobs Act lowered taxes on purchases so much that “you can actually make money buying equipment,” Acemoglu says.

In addition, artificial intelligence is becoming more adept at jobs that once were the purview of humans, making it harder for humans to stay ahead of machines. JPMorgan says it now has AI reviewing commercial-loan agreements, completing in seconds what used to take 360,000 hours of lawyers’ time over the course of a year. In May, amid plunging advertising revenue, Microsoft laid off dozens of journalists at MSN and its Microsoft News service, replacing them with AI that can scan and process content. Radio group iHeartMedia has laid off dozens of DJs to take advantage of its investments in technology and AI. I got help transcribing interviews for this story using Otter.ai, an AI-based transcription service. A few years ago, I might have paid $1 a minute for humans to do the same thing.

These advances make AI an easy choice for companies scrambling to cope during the pandemic. Municipalities that had to close their recycling facilities, where humans worked in close quarters, are using AI-assisted robots to sort through tons of plastic, paper and glass. AMP Robotics, the company that makes these robots, says inquiries from potential customers increased at least fivefold from March to June. Last year, 35 recycling facilities used AMP Robotics, says AMP spokesman Chris Wirth; by the end of 2020, nearly 100 will.