#180B

Explore tagged Tumblr posts

Text

610 Datsun 180B

9 notes

·

View notes

Text

1960 Mercedes 180b

My tumblr-blogs: germancarssince1946 & frenchcarssince1946

1 note

·

View note

Text

Datsun 180B SSS Coupé, 1973. The 610 series 4th generation Bluebird was badged as a Datsun internationally but also for the Japanese market. The SSS model had twin-Hitachi carburetors for its 1,770cc L series 4 cylinder engine.

#Datsun#Datsun 180B SSS Coupé#Datsun Bluebird#Bluebird 610 series#4th generation#pillarless hardtop#hardtop coupé#1973#twin carburettor#1970s

202 notes

·

View notes

Text

1977 Datsun Bluebird 180 B SSS-Coupé

My tumblr-blogs:

www.tumblr.com/germancarssince1946 & www.tumblr.com/frenchcarssince1946 & www.tumblr.com/englishcarssince1946 & www.tumblr.com/italiancarssince1946 & www.tumblr.com/japanesecarssince1947 & www.tumblr.com/uscarssince1935

7 notes

·

View notes

Text

Sam Reid pulling in and pulling out

#sam reid#agatha christie's marple#austin a90 atlantic#the astronaut wives club#chevrolet corvette c1#bloom#mitsubishi triton mk#the hunting#jeep cherokee xj sport#the newsreader#datsun 180b#iwtv#interview with the vampire#rolls-royce phantom ii#prime suspect 1973#hillman hunter#standing up for sunny#porsche 718 boxster spyder

20 notes

·

View notes

Text

6th June

Whatever else you say we have outlived GOX 300 and our hairstyles

0 notes

Text

Insurance companies are making climate risk worse

Tomorrow (November 29), I'm at NYC's Strand Books with my novel The Lost Cause, a solarpunk tale of hope and danger that Rebecca Solnit called "completely delightful."

Conservatives may deride the "reality-based community" as a drag on progress and commercial expansion, but even the most noxious pump-and-dump capitalism is supposed to remain tethered to reality by two unbreakable fetters: auditing and insurance:

https://en.wikipedia.org/wiki/Reality-based_community

No matter how much you value profit over ethics or human thriving, you still need honest books – even if you never show those books to the taxman or the marks. Even an outright scammer needs to know what's coming in and what's going out so they don't get caught in a liquidity trap (that is, "broke"), or overleveraged ("broke," again) exposed to market changes (you guessed it: "broke").

Unfortunately for capitalism, auditing is on its deathbed. The market is sewn up by the wildly corrupt and conflicted Big Four accounting firms that are the very definition of too big to fail/too big to jail. They keep cooking books on behalf of management to the detriment of investors. These double-entry fabrications conceal rot in giant, structurally important firms until they implode spectacularly and suddenly, leaving workers, suppliers, customers and investors in a state of utter higgeldy-piggeldy:

https://pluralistic.net/2022/11/29/great-andersens-ghost/#mene-mene-bezzle

In helping corporations defraud institutional investors, auditors are facilitating mass scale millionaire-on-billionaire violence, and while that may seem like the kind of fight where you're happy to see either party lose, there are inevitably a lot of noncombatants in the blast radius. Since the Enron collapse, the entire accounting sector has turned to quicksand, which is a big deal, given that it's what industrial capitalism's foundations are anchored to. There's a reason my last novel was a thriller about forensic accounting and Big Tech:

https://us.macmillan.com/books/9781250865847/red-team-blues

But accounting isn't the only bedrock that's been reduced to slurry here in capitalism's end-times. The insurance sector is meant to be an unshakably rational enterprise, imposing discipline on the rest of the economy. Sure, your company can do something stupid and reckless, but the insurance bill will be stonking, sufficient to consume the expected additional profits.

But the crash of 2008 made it clear that the largest insurance companies in the world were capable of the same wishful thinking, motivated reasoning, and short-termism that they were supposed to prevent in every other business. Without AIG – one of the largest insurers in the world – there would have been no Great Financial Crisis. The company knowingly underwrote hundreds of billions of dollars in junk bonds dressed up as AAA debt, and required a $180b bailout.

Still, many of us have nursed an ember of hope that the insurance sector would spur Big Finance and its pocket governments into taking the climate emergency seriously. When rising seas and wildfires and zoonotic plagues and famines and rolling refugee crises make cities, businesses, and homes uninsurable risks, then insurers will stop writing policies and the doom will become undeniable. Money talks, bullshit walks.

But while insurers have begun to withdraw from the most climate-endangered places (or crank up premiums), the net effect is to decrease climate resilience and increase risk, creating a "climate risk doom loop" that Advait Arun lays out brilliantly for Phenomenal World:

https://www.phenomenalworld.org/analysis/the-doom-loop/

Part of the problem is political: as people move into high-risk areas (flood-prone coastal cities, fire-threatened urban-wildlife interfaces), politicians are pulling out all the stops to keep insurers from disinvesting in these high-risk zones. They're loosening insurance regs, subsidizing policies, and imposing "disaster risk fees" on everyone in the region.

But the insurance companies themselves are simply not responding aggressively enough to the rising risk. Climate risk is correlated, after all: when everyone in a region is at flood risk, then everyone will be making a claim on the insurance company when the waters come. The insurance trick of spreading risk only works if the risks to everyone in that spread aren't correlated.

Perversely, insurance companies are heavily invested in fossil fuel companies, these being reliable money-spinners where an insurer can park and grow your premiums, on the assumption that most of the people in the risk pool won't file claims at the same time. But those same fossil-fuel assets produce the very correlated risk that could bring down the whole system.

The system is in trouble. US claims from "natural disasters" are topping $100b/year – up from $4.6b in 2000. Home insurance premiums are up (21%!), but it's not enough, especially in drowning Florida and Texas (which is also both roasting and freezing):

https://grist.org/economics/as-climate-risks-mount-the-insurance-safety-net-is-collapsing/

Insurers who put premiums up to cover this new risk run into a paradox: the higher premiums get, the more risk-tolerant customers get. When flood insurance is cheap, lots of homeowners will stump up for it and create a big, uncorrelated risk-pool. When premiums skyrocket, the only people who buy flood policies are homeowners who are dead certain their house is gonna get flooded out and soon. Now you have a risk pool consisting solely of highly correlated, high risk homes. The technical term for this in the insurance trade is: "bad."

But it gets worse: people who decide not to buy policies as prices go up may be doing their own "motivated reasoning" and "mispricing their risk." That is, they may decide, "If I can't afford to move, and I can't afford to sell my house because it's in a flood-zone, and I can't afford insurance, I guess that means I'm going to live here and be uninsured and hope for the best."

This is also bad. The amount of uninsured losses from US climate disaster "dwarfs" insured losses:

https://www.reuters.com/business/environment/hurricanes-floods-bring-120-billion-insurance-losses-2022-2023-01-09/

Here's the doom-loop in a nutshell:

As carbon emissions continue to accumulate, more people are put at risk of climate disaster, while the damages from those disasters intensifies. Vulnerability will drive disinvestment, which in turn exacerbates vulnerability.

Also: the browner and poorer you are, the worse you have it: you are impacted "first and worst":

https://www.climaterealityproject.org/frontline-fenceline-communities

As Arun writes, "Tinkering with insurance markets will not solve their real issues—we must patch the gaping holes in the financial system itself." We have to end the loop that sees the poorest places least insured, and the loss of insurance leading to abandonment by people with money and agency, which zeroes out the budget for climate remediation and resiliency where it is most needed.

The insurance sector is part of the finance industry, and it is disinvesting in climate-endagered places and instead doubling down on its bets on fossil fuels. We can't rely on the insurance sector to discipline other industries by generating "price signals" about the true underlying climate risk. And insurance doesn't just invest in fossil fuels – they're also a major buyer of municipal and state bonds, which means they're part of the "bond vigilante" investors whose decisions constrain the ability of cities to raise and spend money for climate remediation.

When American cities, territories and regions can't float bonds, they historically get taken over and handed to an unelected "control board" who represents distant creditors, not citizens. This is especially true when the people who live in those places are Black or brown – think Puerto Rico or Detroit or Flint. These control board administrators make creditors whole by tearing the people apart.

This is the real doom loop: insurers pull out of poor places threatened by climate disasters. They invest in the fossil fuels that worsen those disasters. They join with bond vigilantes to force disinvestment from infrastructure maintenance and resiliency in those places. Then, the next climate disaster creates more uninsured losses. Lather, rinse, repeat.

Finance and insurance are betting heavily on climate risk modeling – not to avert this crisis, but to ensure that their finances remain intact though it. What's more, it won't work. As climate effects get bigger, they get less predictable – and harder to avoid. The point of insurance is spreading risk, not reducing it. We shouldn't and can't rely on insurance creating price-signals to reduce our climate risk.

But the climate doom-loop can be put in reverse – not by market spending, but by public spending. As Arun writes, we need to create "a global investment architecture that is safe for spending":

https://tanjasail.wordpress.com/2023/10/06/a-world-safe-for-spending/

Public investment in emissions reduction and resiliency can offset climate risk, by reducing future global warming and by making places better prepared to endure the weather and other events that are locked in by past emissions. A just transition will "loosen liquidity constraints on investment in communities made vulnerable by the financial system."

Austerity is a bad investment strategy. Failure to maintain and improve infrastructure doesn't just shift costs into the future, it increases those costs far in excess of any rational discount based on the time value of money. Public institutions should discipline markets, not the other way around. Don't give Wall Street a veto over our climate spending. A National Investment Authority could subordinate markets to human thriving:

https://democracyjournal.org/arguments/industrial-policy-requires-public-not-just-private-equity/

Insurance need not be pitted against human survival. Saving the cities and regions whose bonds are held by insurance companies is good for those companies: "Breaking the climate risk doom loop is the best disaster insurance policy money can buy."

I found Arun's work to be especially bracing because of the book I'm touring now, The Lost Cause, a solarpunk novel set in a world in which vast public investment is being made to address the climate emergency that is everywhere and all at once:

https://us.macmillan.com/books/9781250865939/the-lost-cause

There is something profoundly hopeful about the belief that we can do something about these foreseeable disasters – rather than remaining frozen in place until the disaster is upon us and it's too late. As Rebecca Solnit says, inhabiting this place in your imagination is "Completely delightful. Neither utopian nor dystopian, it portrays life in SoCal in a future woven from our successes (Green New Deal!), failures (climate chaos anyway), and unresolved conflicts (old MAGA dudes). I loved it."

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/28/re-re-reinsurance/#useless-price-signals

#pluralistic#doom loop#insurance#insuretech#climate#climate risk#climate emergency#the lost cause#market forces#risk management#price signals#control boards#decarbonization#bond vigilantes#climate resilience

266 notes

·

View notes

Text

Death Note Character List

source: https://mangadex.org/title/85b6f4e4-180b-43b0-a0ec-9a9de401aed0/death-note-digital-colored-comics

#halle lidner#stephen gevanni#anthony rester#nate river#death note#manga#light yagami#ryuk death note#touta matsuda#hideki ide#kanzo mogi#shuichi aizawa#misa amane#mello death note

12 notes

·

View notes

Text

Heavenly sake and for the bake of beloved's Jesus, there's reasons, and seasons, I'll see you Next year, oh just stay home and have your beer, Babe take a look in the mirror, it's you I'm sure, you kept love pure, that's a cure.

My mother says that at twenty-thirteen I was TEN YEARS OLD, your Datsun 180B was sold!

Go home Babe that's your stage.

19 notes

·

View notes

Text

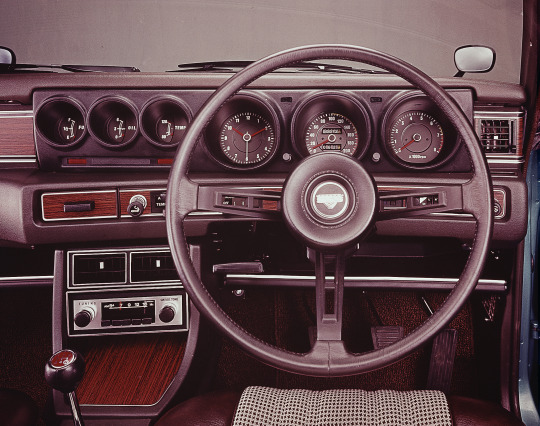

Datsun 180B / Datsun 610 / 610 Nissan Bluebird

9 notes

·

View notes

Text

2024 – 180b

censurée ?

je viens en effet de la poster mais elle n'est pas visible sur le fil principal

mais seulement dans mes archives

je la reposte donc

16 notes

·

View notes

Note

Ok but, what WOULD you do if you had 200BN dollars?

So I've been thinking about a lot this over the last two weeks. Initially, I wanted to come back with a spreadsheet that detailed every penny. The longer I let it sit, the more issues I remember.

I would love to fix the world, but even with all of the money in the world, one person can't do everything.

Obviously, I would take care of my friends and family first--pay off mortgages, student loans, etc. I'm not talking about buying new homes or Lamborghinis or anything, just getting everyone comfortable where they currently are.

I'd love to single-handedly dismantle capitalism, but that's not realistic. I would take about 10% of the money ($20B) to put toward my own specific interests--indigenous issues, water issues, homelessness, etc--which would include a significant amount of lobbying. Like it or hate it, lobbying moves mountains in US politics.

Where I live, we have a ton of empty strip malls that I'd like to rezone from commercial to residential and retrofit into apartments. They would go to low-income or no-income households, but without an income cap so no one's worrying about getting kicked out because they're above the income threshold. Housing is a right, not a privilege. Dignity is a right, not a privilege.

The ex-Christian in me wants to reverse-colonize the suburbs. I learned religion at the knee of teaching pastors and missionaries. Instead of introducing Jesus to villages in Africa, I want to introduce critical thinking to planned subdivisions. Get banned books in the hands of the children whose parents had them pulled. Explain what a land acknowledgment and colonization are.

The rest of the money ($180B) would go to scholarships and grants for meticulously verified nonprofits. I know there are bad actors, but most are good. There are amazing people running life-changing projects I can't even imagine.

I know I'm forgetting things, but this is the absolute most basic. If you ask me this question again two years from now, my answer may be different. My answer six years ago certainly would have been.

Your turn. How would you spend $200B?

#social discourse#asked and answered#good life shit#fuck bezos musk and zuckerberg with a saguaro cactus

3 notes

·

View notes

Text

Youtube's worth over $180B, how the fuck does the app still do that thing where it scrolls up when you hold the screen sometimes

1 note

·

View note

Text

1977 Datsun Bluebird 180 B Station Wagon

My tumblr-blogs:

www.tumblr.com/germancarssince1946 & www.tumblr.com/frenchcarssince1946 & www.tumblr.com/englishcarssince1946 & www.tumblr.com/italiancarssince1946 & www.tumblr.com/japanesecarssince1947 & www.tumblr.com/uscarssince1935

3 notes

·

View notes