#1099 form

Explore tagged Tumblr posts

Text

Don't Miss Dasher Tax Secrets: How to File Your DoorDash Taxes and 1099 Form to Keep More of Your Earnings

Don’t Miss Dasher Tax Secrets: How to File Your DoorDash Taxes and 1099 Form to Keep More of Your Earnings As a DoorDash driver, also known as a “Dasher,” you’re considered an independent contractor rather than an employee. This means your tax situation is different than that of a traditional employee. Understanding how to record your charges accurately, maximizing your derivations, and…

#1099 Form#1099 form for DoorDash drivers#1099 NEC#1099-NEC and 1099-K DoorDash#Door Dash Driver Guide#Door Dash Earnings#Door DashTax Savings#DoorDash tax guide 2023#DoorDash Taxes#DoorDash taxes 2023#File Your Taxes#Filing taxes as a DoorDash driver#Gig Economy Taxes#How to file DoorDash taxes#income tax#Independent Contractor Taxes#Maximize DoorDash tax refund#Self Employed Taxes#Self-employed DoorDash taxes#tax advice#Tax and Finance#Tax and Finance Career#Tax Deductions#Tax deductions for DoorDash drivers#tax filing#Tax Filing Tips#Tax Planning#Tax Season 2023#tax tips#Tax tips for DoorDash drivers

0 notes

Text

The Ultimate List of Form 1099 Tax Compliance Rewards

"The Ultimate List of Form 1099 Tax Compliance Rewards" is pivotal for businesses and individuals navigating U.S. tax requirements. Form 1099 serves to report various types of income, including payments to freelancers, interest, dividends, and more. Understanding IRS guidelines ensures compliance, averting penalties and fostering trust with contractors. 1099 filing isn’t an easy task. It does require calculation and a more bit of time consuming. But, no worries, this 60-minute session on Form 1099 will pick the most-common questions and attempt to answer them, while also leaving time for discussion and even more “live” questions from the audience.

0 notes

Text

What is Form W-9? An Overview and Purpose

Is your business involved in hiring gig workers, independent contractors, or freelancers? Then you most probably might come across Form W-9. In case you are someone new to business or still unaware of the Form W-9 and wonder what exactly it is used for? Who needs to file this form? Then this blog is for you. Here in this blog, we will be answering all of your questions regarding Form W-9 and more. So let's begin with one of the most obvious questions. What is Form W-9? IRS Form W-9 is also called “Request for Taxpayer Identification Number and Certification” As the name suggests, this form is used by employers to obtain taxpayer identification information from the vendor for tax purposes. Businesses use the information in the W-9 to prepare 1099 forms for the vendors at the year-end. Key Takeaway Backup withholding If the vendor is subject to backup withholding, you are required to withhold 24% of the income tax from the vendor's paycheck and remit it to the IRS. You may also need to withhold taxes and remit the backup withholding taxes to the IRS under the following conditions.

If the IRS says the report TIN (Vendor) is incorrect

If the vendor does not provide TIN in their Form W-9

The vendor did not certify their TIN

IRS tells the Vendor is subject to back withholding

Who is required to complete Form W-9?

Generally, businesses that pay vendors or independent contractors require Form W-9 from the vendor to complete Form 1099. However, there are some special conditions banks and other financial institutes request Form W-9 as follows

When you open a new account with them

To report the interest income, distribution, and real estate transactions.

Cancelation of debt

Acquires or abandonment of property

How do I fill out Form W-9?

Form W-9 is a single-page form that requires the following piece of information from the vendor.

Box 1: Enter the full legal name as it appears on their tax return.

Box 2: Enter the DBA (Doing Business As) name or disregarded entity name. Box 3: Select the type of business entity according to federal tax classification

Box 4: Enter the exemption code that applies to you if you are exempt from backup withholding.

Box 5: Enter the address it can be your business address or home address. Make sure that the address entered must match the address in your tax return.

Box 6: Enter the Tax Identification Number (TIN). If you are an individual, enter your Social Security Number (SSN), and if you are a business, enter your EIN.

Box 7: The account number field is an option and only applies if you need to send account information. When is Form W-9 due?

Like Form W-4, there is no specific deadline to request Form W-9 Online. It is typically sent to the vendor upon the hiring date. Although there is no specific deadline to report, employees should submit it as soon as they receive it. Failure to file Form 1099 to submit a W-9 or report incorrect information may result in penalties of $50. How to Request Form W-9?As the business owner, you will receive Form W-9 from your independent contractor or vendor. To request Form W-9, you can download the printable copy of Form W-9 from the IRS website and send it to your vendor, or you can opt for any e-file provider service to request Form W-9 online. If you are looking for a reliable e-file provider to request Form W-9 online, TaxBandits is here to help you.

TaxBandits offer a comprehensive filing solution right from requesting Form W-9 to e-filing Form 1099 to IRS and everything in between. TaxBandits bulk upload option enables you to send W-9 requests to multiple vendors and store either information in the secure database. You can use this information to file Form 1099 and stay compliant with the IRS. Visit TaxBandits to learn more.

0 notes

Text

Permanent Fund Dividend – Tax Information

The Permanent Fund Dividend (PFD) is a program in the U.S. state of Alaska that distributes a portion of the state's oil revenues to eligible residents. The program was established in 1982 with the intention of sharing the state's wealth derived from its natural resources.

The amount of the Permanent Fund Dividend varies from year to year and is determined by the Alaska Permanent Fund Corporation (APFC). The APFC manages the Alaska Permanent Fund, which is a fund that invests a portion of the state's oil revenues. The dividend amount is calculated based on the fund's performance, and each eligible resident receives an equal share.

The eligibility requirements to receive the Permanent Fund Dividend typically include being an Alaska resident for a full calendar year and not being absent from the state for more than a specified number of days. Other requirements may also apply.

To get the most accurate and up-to-date information about the Permanent Fund Dividend program, including the dividend amount and eligibility requirements, it is recommended to visit the official website of the Alaska Permanent Fund Dividend Division or contact them directly.

#1099 form#dividend form#1099 div#1099 div form#1099 div online#1099 div filing#efile 1099 div#form 1099 online

0 notes

Text

Unga bunga these take 3 hrs to make

#Artfight#Art#Hollers into the sky I'M MAKING AAART#Glad I still got it#Also was on vacay for the first two weeks of AF so thats. Great#Is it update time? Sure here's a quick life update#So I work at this tiny mom and pop shop right. Because they were so small they liked to take advantage of their workers#Aka me and literally 2 other people ever. I've been here for a year lmao#I always knew they were suspicious but it really came to a head when they accused me of stealing money#Btw they issued me a 1099 (the wrong tax form) so they already stole from me#I talked to the bank and had the delightful experience of slapping their account across the face with my guilt free hands#Metaphorically unfortunately#I'm gonna quit this week. I'm tired of these people. The drama was fun tho#Let's see. Ah! I just passed 1 1/2 years of Sky the other day!#More than the game itself I've become engrossed in the modding community hahaha#It's the weirdest little cranny of a fandom I've seen for such a large project#It's basically ONLY passed via word of mouth. And there's all sorts of fun drama happening within the discord(s) too#Idk this is just so funny to watch. Might get banned sooner or later but oh well. I've spent hundreds#It's their loss 🤪 and mine. Mostly mine. But also their loss 🤪#.... You know. My blog is small enough that I could post some funny stuff that I don't dare post anywhere else#Hehehuhuhu I just might. I have a lot of videos#OH SPEAKING OF VIDEOS I'm thinking of cleaning up all my old vids and publishing em to youtube#Apparently I just never did that#May as well dust off the ol' tube of yube and my handful of subs#I'll just post the unfinished ones unlisted as well. Why not!#Till next time. Hopefully soon

60 notes

·

View notes

Text

doing my taxes moodboard

#i am very sad and very confused and my brain hurts a lot <3#where is my fucking 1099 form why did i not get it in the mail yet i wanna FILEEEEE#is this ??? all the info i need???????? from that form????#im trying to do it through a free program that's partnered with the irs freefile thing so hopefully that works out ;;;;;;#HHHHHHHHHH#taxes suck i hate america i wanna leave#shh ac

7 notes

·

View notes

Text

#IRS Form 1099-K delay#1099-K reporting requirements#Third-party payment reporting#2023 1099-K update#Form 1099-K postponement#$600 reporting threshold#Venmo and PayPal 1099-K#IRS tax form delays#American Rescue Plan 1099-K#Tax reporting for online payments

2 notes

·

View notes

Note

And for even more tax benefits Piarles will end up 10 kids☝🏼

SO true babe. you get it

#charles: the irs says you have to come in me so i get pregnant for our 1099 form :/#pierre: sigh. well here goes#sorry for not knowing anything about international tax law#ask reply#Anonymous

7 notes

·

View notes

Text

🚀 Crowdfunding can kickstart your project, but don't overlook the tax implications! Learn how to navigate the tax landscape of Kickstarter, Indiegogo, and more. 💰 #Crowdfunding #TaxTips

#Crowdsourced funding#crowdfunding tax implications#Kickstarter#Indiegogo#Form 1099-K#tax-efficient crowdfunding

2 notes

·

View notes

Note

i have a feeling dhar mann will get away with the treatment

He'll probably try to pay his way out of it, if the actors he fired don't file lawsuits against him first.

#tw dhar mann#dhar mann talk#dhar mann is a fraud#anti dhar mann#dhar mann fam dni#i have a feeling the irs might get involved but i'm not sure at this time#because from my understanding not giving his employees 1099 forms is subject to big fines for each one

4 notes

·

View notes

Text

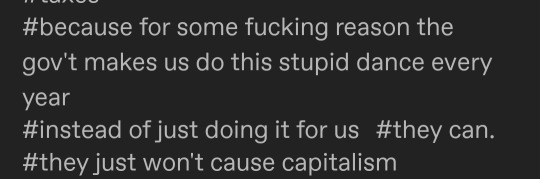

The fucking reason is the huge amount of money that Intuit and other tax prep companies throw at congresspeople specifically to prevent the streamlining of tax filing for the 95%.

So, yeah, it's not because anyone actually working at the IRS thinks it needs to happen (they have the info on hand already for 90+% of the country) - it's capitalism.

For people with anxiety about filing taxes, here’s what things that happen when you make a mistake on your tax return:

- it gets corrected

- you get a letter in the mail either asking for some additional information or a letter showing the adjustment

- you pay the amount (there’s options for payment plans too!) or get a refund

Things that do not happen

- you’re “in trouble”

- you are charged with fraud

- you go to jail

I know that most people are probably just joking/exaggerating when they say a mistake on their return means they get thrown in jail but when I worked with the public I always would encounter people who believed that would happen and they would be panicking about it. So I like to put this out there every year because if I can even prevent one person from feeling that way, it’s worth it

#taxes#fuck Intuit#fuck H&R Block#fuck Turbo Tax#(which is Intuit)#your employer already reports your W2 and 1099 to the IRS#your tax forms should fit on a postcard#(tho not literally for security reasons)#BTW Biden is pushing the IRS to make more free filing available

146K notes

·

View notes

Text

US Wyoming 1099 Forms Apostille Online

US Wyoming 1099 Forms Apostille Online If you need to use a Wyoming-issued 1099 tax form in another country, you may be required to obtain an apostille. An apostille certifies the authenticity of the document, making it valid for international use in countries that are part of the Hague Apostille Convention. While the process can be complicated and time-consuming, Hague Apostille Services offers…

0 notes

Text

Overview of Your 1099-DIV Tax Form

Owners of dividend-paying stocks or mutual funds can anticipate receiving Form 1099-DIV from their brokerage firm. Although some brokers deliver information to their investors more slowly than others, the majority of investors should already have it in their possession.

Although the Form 1099-DIV is rather simple, it is nevertheless crucial to understand how to use the information it provides and how to properly report it on your tax return. Here, we'll walk you through the 1099-DIV form box-by-box.

lateral boxes: identifying details

You can find information about the organization distributing the dividend and about yourself as the recipient of the payout along the left side of the form.

Observe that even if you actually earned dividend income from one or more stocks or funds you have within that account, your broker will be listed as the payer if you have a brokerage account. There is also room for an account number, as well as checkboxes for individuals who must comply with the Foreign Account Tax Compliance Act and those who have been informed that their tax identification number was erroneous.

Total ordinary dividends, Box 1a

The total of any stock dividends you receive, income distributions from mutual funds, and net short-term capital gains are all listed in the first box on the form. Remember that this sum consists of all eligible dividends shown in box 1b below.

Qualifying dividends, Box 1b

The percentage of your dividends that will be taxed at the qualified dividends' reduced rate is shown in Box 1b. The IRS instructs brokers to add dividends for which it is impractical to assess whether you have met the necessary holding period. This is based on the best information your broker possesses at the time. You'll need to perform a manual computation on your own if it turns out that you haven't.

Box 2a: Total distributions of capital gains

Distributions of long-term capital gains from funds are recorded in Box 2a. This amount encompasses all of the below-mentioned special cases and also receives a preferred tax rate.

Unrecaptured Section 1250 gain, Box 2b

Section 1250 of the Internal Revenue Code mandates that you recoup a portion of past depreciation at a specific tax rate if you sell real property that has been depreciated. How much of this type of revenue you have is shown in Box 2b.

Section 1202 gain, Box 2c

A preferential tax rate is available to investors in eligible small business stock under Internal Tax Code Section 1202. Any qualifying Section 1202 gains you have are shown in Box 2c.

Box 2d: Gain from collecting

The lowest capital gains tax rates, which are applicable to equities, funds, and the majority of investment assets, do not apply to taxes on long-term capital gains for collectibles.

Instead, a cap of 28% is in place. You will owe tax at the lower rate if your real tax rate is lower.

Box 3: Distributions other than dividends

Companies and mutual funds occasionally make payments that are referred to as capital return payments. Although these sums are not taxable, you must change your tax basis in order to declare the correct amount of gain when you sell the investment.

Federal income tax withheld in Box 4

This section will be marked if your broker withheld any federal income tax on your behalf. This sum should be considered a payment when determining your refund or tax liability.

Box 5: Investing costs

A few ventures that charge costs will incorporate them here. Most common assets just deduct costs from the sums they pay their financial backers, decreasing what appears in Box 1a and thusly not showing up as a different thing here.

Boxes 6 and 7: Unfamiliar expense paid and outside country or U.S. ownership

On the off chance that you own unfamiliar speculations on which you needed to pay duty to a far off country or U.S. ownership, how much expense and the name of the nation will be in these containers. For assets with pay and assessments from more than one unfamiliar nation, you'll normally see Different demonstrated. This is valuable data for you to use to assume the unfamiliar duty praise in the event that you're qualified.

Boxes 8 and 9: Money and noncash liquidation conveyances

On the off chance that an organization or asset sells, you could get a mix of money, stock, or different speculations. Money will be remembered for Box 8, and the worth of some other resources you get will appear in Box 9.

Boxes 10 and 11: Absolved interest profits and determined private action bond interest profits

Box 10 incorporates profits that aren't liable to burden since they address sums got in charge absolved interest . Confidential movement bonds are exceptional kinds of bonds that aren't dependent upon customary annual duty however can at times be dependent upon elective least assessment, and they're shown in Box 11.

Boxes 12 through 14: State charge data

You'll find state charge data in Boxes 12 through 14, including any state charge held back. Not all states observe the government guidelines for personal assessment on profits, so be prepared for any distinctions.

0 notes

Text

i can’t wait to make a fine delicious meal out of all my tax forms this shit is making me want to blow my brains ouuuuut

#status update#i have 6 different fucking income forms#3 w2s and 3 1099s and every autofile website hates me for the 1099s#i’ve put this info in so many times 😀 3 different websites that were like we file for free! uh ooooh i smell freelance work on you nvm#i’ve been at this for almost 4 hours i have a headache. and i still can’t submit anything

1 note

·

View note

Text

time to go to the gym and do cardio for an hour because I can't do my fucking taxes

#the docs#i nerd the 1099 form from my ira account#which i cant get bc the account is.blocked#they cant unblock my account until i send them my id worh proof of address#but they wont accept my car insurance bill#im gonna fucking fight someone i swear to god

0 notes

Text

so i worked for this company as a regular employee and i also did contract work for them, they have my w9 and sent me my w2 already, then after i receive my w2 i get an email from a company email with a first name i don’t recognize asking for my w9 so they can send me my 1099, but they already have at least 3 copies of my w9 cuz they kept making me fill it out over and over again while i worked there. and i also know for sure they have at least one bc they sent me my w2 already. is this a scam or is the company just extraordinarily disorganized with people who write emails in a scammerly fashion in their accounting department

#i also don’t have like a separate business or anything the contract work was just me my name that’s it#it was just sample knitting so there was no need for insurance or any kind of like official business stuff#it’s just me and my normal bank account cuz it’s less than $1000 and i wasn’t expecting it to pan out#and it didn’t lol#so both w9s would be identical. unless you’re supposed to fill out a diff form for 1099s in which case she’s asking me for the wrong form

1 note

·

View note