#0x crypto reddit

Explore tagged Tumblr posts

Text

Axmint-How to Update BEP20 USDT Address in your Profile?

AXMachine project is an ecosystem of essential Blockchain and crypto products that are developed, deployed and tokenized by AXM coin. This is considered a revolutionary workspace for all sorts of beginners, investors, traders, enthusiasts, and developers occupying tangible tools, GAS, and interested in learning/exploring smart contracts with the hidden benefits of blockchain space.

The marketplace presents the asset cluster with Binance Smart Chain protocols to make the AXM token usage a big-used cryptocurrency with numerous unlocked benefits. So, now you can get, withdraw, and update the BEP20 USDT address in your profile for future usage and implementation of maximum resources.

FYI, BEP20 Tokens represent a token standard operating on the Binance Smart Chain which is quite similar to ERC20 tokens that are issued and implemented on the Ethereum blockchain. Whereas, Tether (USDT) is one of the most widely used liquidated stablecoins that supports 15 different blockchains like Ethereum, Tron, and Solana. Updating Tether (USDT) to your wallet needs to be done with a process based on the specific network where tokens will be held.

Using USDT of the BEP20 potential enables users to tap into Tether’s multi-billion liquidity occupied on the BNB Smart Chain. Hence, you might find it quite useful in case you are looking to use USDT for various decentralised finance use cases including decentralised exchanges (DEXs) or other trading protocols. If you want to explore the DeFi landscape in terms of USDT, it is recommended that you use a standalone crypto software wallet such as MetaMask or Trust Wallet that can easily connect and offer countless services in the BNB Smart Chain ecosystem.

How to Update BEP20 USDT Address?

The statement to this question entirely depends on the type of platform or service you wish to use for updating your BEP20 USDT address. You have many accessible platforms with several procedures/requirements to sturdy your profile details:

If you are using the exchange platform to deposit USDT or update the address to the BNB Smart Chain network, go to the Deposit Crypto option and tap on “BNB Smart Chain” as the destination network. Then, copy the deposit address and use it as your BEP20 USDT address.

If you are using the Trust Wallet to search for the BEP20 address. Check out the BNB Smart Chain token placed in your wallet and choose the “Receive” option. Then, copy the address and further use it as your BEP20 USDT address.

To update your BEP20 USDT address at your AXM profile, log in to your AXM account, navigate to the Profile section and tap on the “Edit” option next to the Wallet Address field. Now, feed in the BEP20 USDT address [a hexadecimal string that starts with 0x] in the text box which can be found on your BSC-compatible wallet like Trust or MetaMask wallet. Once you enter the address, click on the “Save” option to confirm your changes and then you will successfully update your BEP20 USDT address at your AXM profile. You can also this user address to receive/send USDT BEP20 tokens on any of the BNB Smart Chain networks.

There are countless ways to do the same, in case you are searching for other suggestions, please drop your query in the comment box. If you have any other questions, please feel free to reach out on our social media channels.

Website: https://www.axmint.io/

Twitter: https://twitter.com/AxmintDefi

Telegram: https://t.me/AxMintChat

Medium: https://medium.com/@Axmintdefi/

Reddit: https://www.reddit.com/user/Axmint

0 notes

Text

Axmint-How to Update BEP20 USDT Address in your Profile?

AXMachine project is an ecosystem of essential Blockchain and crypto products that are developed, deployed and tokenized by AXM coin. This is considered a revolutionary workspace for all sorts of beginners, investors, traders, enthusiasts, and developers occupying tangible tools, GAS, and interested in learning/exploring smart contracts with the hidden benefits of blockchain space.

The marketplace presents the asset cluster with Binance Smart Chain protocols to make the AXM token usage a big-used cryptocurrency with numerous unlocked benefits. So, now you can get, withdraw, and update the BEP20 USDT address in your profile for future usage and implementation of maximum resources.

FYI, BEP20 Tokens represent a token standard operating on the Binance Smart Chain which is quite similar to ERC20 tokens that are issued and implemented on the Ethereum blockchain. Whereas, Tether (USDT) is one of the most widely used liquidated stablecoins that supports 15 different blockchains like Ethereum, Tron, and Solana. Updating Tether (USDT) to your wallet needs to be done with a process based on the specific network where tokens will be held.

Using USDT of the BEP20 potential enables users to tap into Tether’s multi-billion liquidity occupied on the BNB Smart Chain. Hence, you might find it quite useful in case you are looking to use USDT for various decentralised finance use cases including decentralised exchanges (DEXs) or other trading protocols. If you want to explore the DeFi landscape in terms of USDT, it is recommended that you use a standalone crypto software wallet such as MetaMask or Trust Wallet that can easily connect and offer countless services in the BNB Smart Chain ecosystem.

How to Update BEP20 USDT Address?

The statement to this question entirely depends on the type of platform or service you wish to use for updating your BEP20 USDT address. You have many accessible platforms with several procedures/requirements to sturdy your profile details:

If you are using the exchange platform to deposit USDT or update the address to the BNB Smart Chain network, go to the Deposit Crypto option and tap on “BNB Smart Chain” as the destination network. Then, copy the deposit address and use it as your BEP20 USDT address.

If you are using the Trust Wallet to search for the BEP20 address. Check out the BNB Smart Chain token placed in your wallet and choose the “Receive” option. Then, copy the address and further use it as your BEP20 USDT address.

To update your BEP20 USDT address at your AXM profile, log in to your AXM account, navigate to the Profile section and tap on the “Edit” option next to the Wallet Address field. Now, feed in the BEP20 USDT address [a hexadecimal string that starts with 0x] in the text box which can be found on your BSC-compatible wallet like Trust or MetaMask wallet. Once you enter the address, click on the “Save” option to confirm your changes and then you will successfully update your BEP20 USDT address at your AXM profile. You can also this user address to receive/send USDT BEP20 tokens on any of the BNB Smart Chain networks.

There are countless ways to do the same, in case you are searching for other suggestions, please drop your query in the comment box. If you have any other questions, please feel free to reach out on our social media channels.

website: https://www.axmint.io/

Twitter: https://twitter.com/AxMachine

Telegram: https://t.me/AxMintChat

Reddit: https://www.reddit.com/user/AxMachineDeFI

0 notes

Text

January 25, 2019

News and Links

Layer 1

[eth1] state rent proposal 2

[eth1] selfish mining in Ethereum academic paper. Per Casey Detrio, EIP100 changed the threshold to 27%. But since ETC doesn’t have EIP100, it’s just 5 or 10%.

[eth2] a long AMA from the Eth2 research team

[eth2] yeeth Eth2 client in Swift

[eth2] What’s new in eth2 includes Ben’s take on future of the PoW chain

[eth2] notes from last eth2 implementer call

[eth2] Vitalik’s security design rationale

[eth2] More Vitalik: Eth2 and Casper CBC video talk

[eth2] Collin Myers takes a look at the proposed economics for validators

Layer 2

Raiden on progress towards Ithaca release, which will include pathfinding and fee earning as well as monitoring. More from Loredana on building CryptoBotWars on Raiden

Magmo update: about to release their paper on Nitro, their protocol for a virtual state channel network

The case for Ethereum scaling through layer 2 solutions

Optimistic off-chain data availability from Aragon

Starkware on a layer 2 design fundamental: validity proofs vs fraud proofs. Also: its decentralized exchange using STARKs planned for testnet at end of q1.

Stuff for developers

Solidity v0.5.3

web3j v4.1.1

Web3.js v1.0.0-beta.38

Waffle v2 of its testing suite (uses ethers.js)

Celer Network’s proto3 to solidity library generator for onchain/offchain, cross-language data structures. Celer’s SDK

ERC20 meta transaction wrapper contract

“dumb contracts” that store data in the event logs

ETL pipline on AWS for security token analytics

Interacting with Ethereum using web3.py and Jupyter notebooks

Tutorial on using Embark

Tutorial: using OpenLaw agreements with dapps

OpenBazaar’s escrow framework

Etherisc opensources the code for their Generic Insurance Framework

Austin Griffith’s latest iteration of Burner Wallet sales

Deploying a front end with IPFS and Piñata SDK

Video tutorial of Slither static analyzer

Overview of formal verification projects in Ethereum

zkPoker with SNARks - explore iden3’s circom circuit

Ecosystem

Lots of charts on the bomb historically and present

Gnosis Safe is now available on iOS

A big thing in the community was r/ethtrader’s DONUT tokens. Started by Reddit as “community points” to experiment in ethtrader upvotes, the donuts can be used to buy the banner, vote in polls, and get badges. So a Reddit <> Eth token bridge was created, and DONUT traded on Uniswap. But some people preferred donuts to be used for subreddit governance, so the experiment is currently paused. That’s my take, here’s Will Warren’s take.

Decentralizing project management with the Ethereum Cat Herders

ENS permanent registrar proposals

Client releases

The Mantis client written in Scala now supports ETH and will stop supporting ETC

Enterprise

Hyperledger Fabric founder John Wolpert on why Ethereum is winning in enterprise blockchain

Levi’s jeans, Harvard SHINE and ConsenSys announce a workers well being pilot program at a factory in Mexico

Tokenizing a roomba to charge it

Correctness analysis of Istanbul BFT. Suggests it isn’t and can be improved.

Governance and Standards

Notes from last all core devs call

A postmortem on the Constantinople postponement

SNT community voting dapp v0.1 - quadratic voting system

EIP1712: disallow deployment of unused opcodes

EIP1715: Generalized Version Bits Voting for Consensus Soft and Hard Forks

ERC1723: Cryptography engine standard

ERC1724: confidential token standard

EIP1717: Defuse the bomb and lower mining reward to 1 ether

Application layer

Augur leaderboard. And Crystalball.be stats. Augur v1.10 released

Lots of action in Augur frontends: Veil buys Predictions.global, Guesser to launch Jan 29, and BlitzPredict.

A fiat-backed Korean Won is live on AirSwap

Adventureum - “a text-based, crowd-sourced, decentralised choose-your-own adventure game”

PlasmaBears is live using LoomNetwork

Kyber’s automated price reserve - a simpler though less flexible option for liquidity providers. Also, Kyber’s long-term objectives

Interviews, Podcasts, Videos, Talks

Trail of Bits and ChainSecurity discuss 1283 on Hashing It Out

Videos from Trail of Bits’ Empire Hacking

Scott Lewis and Bryant Eisenbach give the case for Ethereum on a Bitcoin podcast

Philipp Angele talk on Livepeer’s shared economies for video infrastructure

Tarun Chitra on PoS statistical modeling on Zero Knowledge

Gnosis’ Martin Köppelmann on Into the Ether

Martin Köppelmann and Matan Field on Epicenter

Tokens / Business / Regulation

If you don’t have a background in finance, MyCrypto’s learning about supplying and borrowing with Compound will be a good read.

A nice look at the original NFT: CryptoPunk

NFT License 2.0 to define what is permitted with NFT and associated art

IDEO on what NFT collectibles should learn from legacy collectibles.

Matthew Vernon is selling tokens representing 1 hour of design consulting

Caitlin Long tweetstorm about Wyoming’s crypto-friendly legislation

Crypto exchanges don’t need a money transmitter license in Pennsylvania

General

Samsung to have key store in their Galaxy S10. Pictures show Eth confirmed.

Zilliqa to launch its mainnet this week, much like Ethereum launched with Frontier

NEAR’s private testnet launches at event in SF on the 29th

Polkadot upgrades to PoC3 using GRANDPA consensus algo

Looks like Protonmail wants to build on Ethereum

Messari says Ripple drastically overstates their supply to prop up their market cap

Sia’s David Vorick on proof of work attacks

a zero knowledge and SNARKs primer

Infoworld when the Mac launched 35 years ago: do we really need this?

Have a co-branded credit card in the US? Amazon (or whoever) probably gets to see your transaction history, which means they’re probably selling it too.

Dates of Note

Upcoming dates of note (new in bold):

Jan 29-30 - AraCon (Berlin)

Jan 30 - Feb 1 - Stanford Blockchain Conference

Jan 31 - GörliCon (Berlin)

Jan 31 - Maker to remove OasisDEX and Oasis.direct frontends

Feb 2 - Eth2 workshop (Stanford)

Feb 7-8 - Melonport’s M1 conf (Zug)

Feb 7 - 0x and Coinlist virtual hackathon ends

Feb 14 - Eth Magicians (Denver)

Feb 15-17 - ETHDenver hackathon (ETHGlobal)

Feb 27 - Constantinople (block 7280000)

Mar 4 - Ethereum Magicians (Paris)

Mar 5-7 - EthCC (Paris)

Mar 8-10 - ETHParis (ETHGlobal)

Mar 8-10 - EthUToronto

Mar 22 - Zero Knowledge Summit 0x03 (Berlin)

Mar 27 - Infura end of legacy key support

April 8-14 - Edcon hackathon and conference (Sydney)

Apr 19-21 - ETHCapetown (ETHGlobal)

May 10-11 - Ethereal (NYC)

May 17 - Deadline to accept proposals for Instanbul upgrade fork

If you appreciate this newsletter, thank ConsenSys

This newsletter is made possible by ConsenSys.

I own Week In Ethereum. Editorial control has always been 100% me.

If you're unhappy with editorial decisions or anything that I have written in this issue, feel free to tweet at me.

Housekeeping

Archive on the web if you’re linking to it: http://www.weekinethereum.com/post/182313356313/january-25-2019

Cent link for the night view: https://beta.cent.co/+3bv4ka

https link: Substack

Follow me on Twitter, because most of what is linked here gets tweeted first: @evan_van_ness

If you’re wondering “why didn’t my post make it into Week in Ethereum?”

Did you get forwarded this newsletter? Sign up to receive the weekly email

2 notes

·

View notes

Text

Coindesk vs The Wall Street Journal and other Crypto talk with Jason Yanowitz

youtube

Leaving traditional finance in favor of cryptocurrency, Jason Yanowitz knew he couldn’t work in any other sector ever again. As the co-founder of Blockworks, Yanowitz has not only played a pivotal role in developing media in the crypto space for growing institutional interest, but he has also helped build Melker’s podcast to what it is today. He believes that not only is crypto an improvement on traditional finance, but it is offering the first chance in history for retail investors to front-run institutions’ slow arrival to the crypto space.

In this episode, Melker and Yanowitz discuss a range of topics including:

A Bitcoin super cycle Learning from Reddit and Twitter “This time is different” Coinbase becoming a top 5 company VanEck’s Bitcoin ETF Coindesk vs The Wall Street Journal 2017’s frenzy Crypto’s infrastructure Regret minimization framework Short Squeezes and Melvin Capital Front running institutions

—

VOYAGER

This episode is brought to you by Voyager, your new favorite crypto broker. Trade crypto fast and commission-free the easy way. Earn up to 9.5% interest on top coins with no lockups and no limits. Go to https://www.investvoyager.com/ and download the Voyager app and use code “SCOTT25” to get $25 in free Bitcoin when you create your account.

—

Mina Protocol

Mina is the world’s lightest blockchain, powered by participants. Rather than apply brute computing force, Mina uses advanced cryptography and recursive zk-SNARKs to ensure a super-light and constant sized chain, that allows participants to quickly sync and verify the network. The team behind Mina is backed by VCs such as Coinbase Ventures, and Mina’s adversarial testnet was the largest public testnet outside of ETH 2.0. To get involved ahead of Mina’s mainnet, visit https://minaprotocol.com/wolf

—

Matcha 0x

Matcha is the easiest way to trade in DeFi. Matcha enables traders to seamlessly swap tokens using 20+ aggregated liquidity sources that deliver better prices than going to a centralized exchange or Uniswap. Connect your wallet and start today at https://matcha.xyz/wolf

—

Join the Wolf Den newsletter:

►►https://www.getrevue.co/profile/TheWolfDen/members

—

If you enjoyed this conversation, share it with your colleagues & friends, rate, review, and subscribe. This podcast is presented by Blockworks. For exclusive content and events that provide insights into the crypto and blockchain space, visit them at: https://www.blockworks.co

The post Coindesk vs The Wall Street Journal and other Crypto talk with Jason Yanowitz appeared first on BLOCKPATHS.

source https://blockpaths.com/commentaries/coindesk-vs-the-wall-street-journal-and-other-crypto-talk-with-jason-yanowitz/

0 notes

Photo

It’s ‘Dorsey’s Node’ as Bitcoin Marches Higher, DOGE Chokes

Bitcoin (BTC) was higher early Friday, pushing toward $38,000, around the highest levels in about three weeks.

The news overnight was mixed, with an Australian central bank official telling lawmakers in the country that bitcoin is “not a payment instrument and it’s not even really money,” while Twitter and Square (SQ) CEO Jack Dorsey tweeted that he had set up his own bitcoin node.

Key price levels: “Should we go higher, we’ll be eyeing the $40,035 mark as the next resistance,” Matt Blom, head of sales and trading for the cryptocurrency exchange firm EQUOS, wrote early Friday in an emailed note. “Should we edge back down, the $34,855 mark will be the level to watch.”

Related: Arcane Crypto Lists on Nasdaq First North After Reverse Takeover

DeFi to the moon: CoinDesk’s Omkar Godbole reported Friday that some investors “look to be temporarily shifting focus away from bitcoin and toward crypto tokens associated with decentralized finance,” such as Compound’s COMP token and Aave’s AAVE. (Read more about this in Bitcoin Watch and Token Watch, below.)

And dogecoin (DOGE)? The price of the token, symbolized by the dog breed Shiba Inu, was down 16% on Friday, after a brief rally late Thursday. The post below was representative of the flavor of the chatter on Reddit:

Market Moves: Bank of England takes baby step toward negative interest rates

The Bank of England has asked British banks to prepare for negative interest rates within six months, opening the possibility the U.K. central bank could eventually join counterparts in Europe and Japan in pursuing ultra-loose monetary policy.

Only an option, we swear: Officials were quick to note the central bank wasn’t signaling an intention to actually push borrowing rates below zero – just that option might be needed at some point. The main bank rate is currently set at 0.1%.

Story continues

Related: China’s BSN Onboards EY for Ethereum Compliance Tools

“The BOE wants to have its cake and eat it, too: recognize that negative interest rates as a possible tool, which may help keep rates down without delivering what would appear to be a disruptive move,” Marc Chandler, a former head currency strategist for foreign-exchange giants Brown Brothers Harriman and HSBC, wrote Thursday on SeekingAlpha.

Negative interest rates have always been a head-scratcher, given the prospect that borrowers in the country may at some point find themselves getting to take out loans, rather than forking over interest payments to their lenders. Or that savers might end up paying banks to hold their money, instead of receiving income on deposits.

Bitcoin’s validation? The announcement – made via a published letter that was sent to bankers, with a subsequent news conference held by Bank of England Governor Andrew Bailey – offers the latest validation of the economic scenario many bitcoin bulls are betting on: that despite the ongoing rollout of coronavirus vaccines, the world’s monetary authorities aren’t likely to stop stoking global financial markets with easy money anytime soon.

More money printing: Economists are reading the tea leaves and coming to the conclusion the Bank of England may also opt to increase its £895 billion (US$1.3 trillion) target for asset purchases, a form of stimulus pioneered by the U.S. Federal Reserve in which central banks essentially pump new money into financial markets. Pantheon, the forecasting firm, predicted Thursday the U.K. central bank will increase the target by £50 billion later this year.

The Federal Reserve, for what it’s worth, is currently buying $120 billion of assets a month, and Chair Jerome Powell has said there’s no need to cut interest rates to negative levels; currently, the key U.S. short-term rate is set at just above zero. But pressure might build on the Fed to experiment with more unconventional monetary policies if the world’s other major central banks keep moving in that direction.

Bitcoin Watch

The path of least resistance for bitcoin appears to be to the upside, writes CoinDesk’s Omkar Godbole, as demand continues to outstrip supply.

The cryptocurrency has broken out of a descending channel on the daily chart, indicating scope for a re-test of record highs above $41,900, Godbole wrote Friday. The market focus may shift back to bitcoin if the cryptocurrency charts a quick move upwards. (See chart above.)

Stimulus plan moves forward: The U.S. Senate narrowly voted early Friday to adopt a budget blueprint for President Joe Biden’s $1.9 billion coronavirus relief package, a legislative track that’s being closely watched by bitcoin bulls betting the cryptocurrency can serve as an inflation hedge during an era of outsize government and monetary stimulus.

Dollar strength: The U.S. dollar is on track for its strongest weekly gain since October on investor optimism for a faster economic recovery. The greenback’s strength makes bitcoin’s 14% gain since Sunday look more impressive because the cryptocurrency’s price is denominated in dollars.

Token Watch

DEFI TOKENS MOON: In the past 24 hours, DeFi-linked tokens such as COMP, AAVE, KNC and ZRX leapt to fresh all-time highs. Compound’s governance token COMP clocked a new record of $500, taking the month-to-date gain to above 40%. Oracle provider Chainlink’s LINK token is also benefitting from the broad-based rally across DeFi. AAVE, the token of the DeFi lending protocol Aave, rose 21% to a record. ZRX, from the Ethereum-based decentralized exchange 0x, is up 60% in the past 24 hours.

ETHER GAS PRICE FALLOUT: Japan cryptocurrency exchange Liquid temporarily halted ether (ETH) withdrawals as gas fees hit new highs.

COMPOUND VS. AAVE: Aave has a “fighting chance” to the take the crown from Compound as “DeFi’s most popular lending protocol,” according to The Defiant.

Celebrity Watch

Who ISN’T investing in crypto these days? LL Cool J, the Queens, N.Y.-born rapper and entrepreneur, is among a glitzy roster of limited partners backing North Island Ventures’ newly revealed $72 million fund, CoinDesk’s Zack Seward reported Thursday. Paul Tudor Jones II, the legendary hedge fund manager who last year was among the first big institutional investors to espouse bitcoin as an inflation hedge, is also involved. North Island Ventures is chaired by Glenn Hutchins, a co-founder of the technology-investment firm Silver Lake and until recently a board member of the Federal Reserve Bank of New York.

Jack Dorsey has set up his own bitcoin node. The Twitter and Square CEO, who has used his posts to promote the cryptocurrency, shared an image Friday “showing the node in the action of synchronizing with the bitcoin blockchain,” CoinDesk’s Tanzeel Akhtar reported. In the latest post he wrote simply, “Running #bitcoin.”

What Else

$90M hedge fund deceit: Cryptocurrency hedge fund founder Stefan Qin pleaded guilty in New York Thursday to deceiving investors out of more than $90 million. According to a press release from the U.S. Department of Justice on Thursday, Qin, a 24-year-old Australian national and founder of Virgil Capital, had been charged with a single count of securities fraud in Manhattan’s federal court.

Arcane stock goes live: Shares in the Norwegian cryptocurrency analysis firm Arcane Crypto started trading Friday under the ticker ARCANE on Nasdaq First North Growth Market, after completion of reverse takeover. According to this, the stock has a market capitalization of about 1.7 billion Swedish krona ($200 million).

Move over, GameStop: Brokerage firms report boom in online bond trading, including corporate debt and mortgage-backed securities.

Was anything wrong with the GameStop saga, or just markets being markets?

U.S. Securities and Exchange Commission investigators are combing social-media and message-board posts for signs that fraud played a role in the recent GameStop (GME) stock-price pump, Bloomberg News reported. Regulators in Massachusetts are also looking into the case.

Prosecutors reaching: The story shows how pressed the official overseers of traditional markets are to bring a solid case over the move, which appeared to be coordinated by retail stock traders on the Reddit forum r/WallStreetBets. The basic defense is that they were just sharing their opinions publicly, perhaps less suspicious than the type of private information sharing and insider access that’s prized on Wall Street.

What’s the big deal? Cryptocurrency analysts have noted the similarities between the GameStop saga and the type of anything-goes trading that happens every day in 24-hours-a-day, seven-days-a-week, international digital-asset markets, where no single exchange or country dominates the action and regulations seem to be constantly catching up to the industry’s fast-evolving growth. Coordination on social media? Check. Triple-digit percentage moves? Check. A sometimes complete lack of news to explain price pumps or price dumps? Check.

So it’s perhaps not surprising some crypto-industry executives are using the opportunity to tee off on everything that’s wrong with the traditional financial system. Or maybe what’s wrong with believing there’s a right way to think about a trade and a wrong way.

William Quigley, co-founder of WorldWide Asset eXchange, a decentralized video-game and entertainment network, said in emailed comments Thursday that “at its core, investing all about convincing someone else of the merits of buying a stock or other asset – or the opposite.”

Even in traditional markets, there are all sorts of reasons for getting in and out of the market – including “programmatic trading that pays no heed at all to underlying fundamentals.”

“The notion that WallStreetBets is somehow illegitimate because it is encouraging going long GME without solid fundamentals to back it up there is irrelevant,” Quigley said.

The “pure speculation” in dogecoin recently is no different, he added.

Dogecoin, for those who haven’t followed the thread, is a “meme token,” symbolized by the Japanese dog breed Shina Inu, was launched in 2013 as a joke. Elon Musk, the electric-vehicle and private-spaceflight entrepreneur who’s reportedly the world’s richest man, likes to tweet about it. People are talking about it on the Reddit forum r/SatoshiStreetBets.

“It has no fundamental value drivers,” Quigley said. “People buy dogecoin for one reason: pure speculation. They hope other people will buy it and pay a higher price.”

Quigley is giving his opinion. Just like the commenters on Reddit and Warren Buffett on CNBC when he talks about the virtues of his conglomerate Berkshire Hathaway’s investments in railroads and Coca-Cola.

Related Stories

0 notes

Text

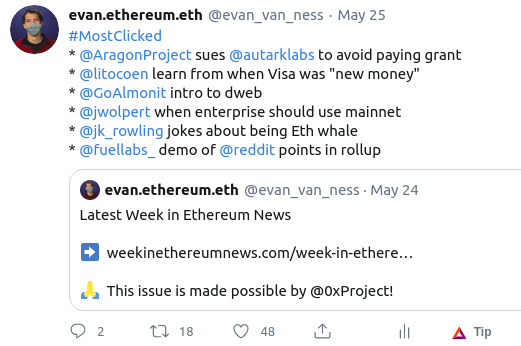

Annotations for the latest Week in Eth News

I tweeted this week:

Feels like an accurate reflection of the broader week in the Ethereum ecosystem. Just take a look at the most clicked:

“Yield farming” is the idea of figuring out how to leverage up to get the most yield, where part of the yield is usually a native token for the platform/protocol. (Please do so very cautiously...if you get leveraged up, you’re juicing returns but taking large risk of losses).

With Compound, this meant various “trades,” which changed through the week. First people were lending (and resupplying) Tether, because that had the highest rates. Then the trade switched to BAT because some whale figured out (the advantages of scale!) that it wouldn’t be hard to drive BAT rates up even higher than Tether (USDT) and all the sudden an insane amount of BAT moved to Compound. I kid you not: at the moment there is about $250m USD worth of BAT in Compound - though only 6% of supply as it gets circulated through a few times

Leveraged up? Be careful! If BAT price doubles, how many people would get liquidated?

Hint: it’s those of you who are over 50% on the borrow limit you can see from your account page on the Compound UI. Looking at exchanges, the order books are rather thin - how much would it cost a liquidator to drive all the BAT price up 2x compared to how much it could make liquidating? Or what if Brave announces a big partnership? Crypto is an adversarial environment (ahem, look at all those YouTubers with huge followings trying to sell you on the latest pump of some worthless token)

These order books are thinner than normal because....so much BAT got sucked into Compound from the exchange’s order books. So the price is now easier to push higher.

Meanwhile, Balancer started its “liquidity mining” (same thing as yield farming) before Compound, but just released its token today. And now it’s trading at $15 last I looked, or 1.5 billion USD fully diluted market cap.

Signs of a bull market? Feels like it to me.

These aren’t the only liquidity mining opportunities - and you’ll see a bunch more people do it now that this is what is bringing in users.

Back to Compound, it got listed on Coinbase Pro today and the price actually fell, as all the people who had “farmed” it got liquid, plus presumably some others as well. However, it eventually held (at time of writing) at about $280. (that’s a 2.8b USD fully diluted valuation). It had been at $380 and looking at the orderbook when it opened, it appeared that the first trade (for a tiny amount) happened at $440. We’ll see what happens when Coinbase opens it to retail.

The DeFi narrative is strong. Seems clear that there is some demand for folks wanting to own a bit of what might be the next big financial platforms.

-------

The final thing I always call out in my intro is high-level things I suggest Eth holders might read:

Matter Labs’ ZK Sync rollup is live – tiny transaction fees, withdrawals to Eth mainnet in 15 mins, 300 transactions per second (with 2000 tps coming)

Reddit announces scaling competition to move Reddit’s community points to mainnet

It seems the mysterious and massive transaction fees were from a hacked korean ponzi called GoodCycle. Various miners have handled differently: Ethermine (already paid out). Sparkpool (said it would pay out but then victim identified, unclear to me if yet resolved). f2pool (said they’d return to new address)

ETH disrupting SWIFT: why fintech VCs are missing DeFi

As always, reverse order:

Looking at ETH as a distruptor for SWIFT is a pretty interesting lens. I’ve always rolled my eyes a little at “fintech” because it seems like playing fast with regulations and then if you get a certain scale hiring lawyers and lobbyists to hopefully make your issues go away. This article argues that the real innovation is further down in the financial “stack” - Ethereum taking the place of antiquated SWIFT.

Personally I don’t think the massive mistake/hack transaction fees are a big deal, but it seems to be something that the crypto clickbait jumps on. It’s not a danger to any normal user. Just check the transaction fee before sending.

Reddit wants to put its Community Points on Eth mainnet, likely through a rollup or sidechain. Very neat - it does feel like their deadline is just a little ambitious for rollups which might make them use a sidechain, which would be a bit of a shame if they can get better trust assumptions from a rollup by waiting an extra month or two.

And speaking of rollups, ZkSync is live. Fast, cheap transfers with the data onchain and the execution offchain. Woot!

Eth1

Trinity v0.1.0-alpha.36 (Python client) – BeamSync improvements, metrics tracking (influxDB/Grafana), partial eth/65 support

Updated Eth on ARM images. Geth fast syncs a full node in 40 hours on 8GB Raspberry Pi4

Miners began bumping up the gas limit (12m now), which sparked some polemics about the tradeoff between state growth versus user fees. Higher gas limit resulted in safelow gas fees in the teens for the first time in weeks.

Speaking of yield farming ruling the week, the gas prices are back to 30 gwei despite the fact that that throughput went up 20%. My strong suspicion is that this has a lot to do with yield farming.

For the record, the max transactions per second of Ethereum right now is about 44 transactions per second. It’s an easy calc to do (12m divided by 13.1 block time divided by 21000 gas per simple eth transfer).

Of course that doesn’t include rollups, who put their data onchain to the point where they are arguably layer 1.5.

Personally I think we should make this gas limit increase “temporary” when gas prices go back down.

Eth2

Prysmatic (Go) client update – stable Onyx testnet, 80% validators community run, RAM usage optimizations

Nimbus (Nim) client update – up to spec, 10-50x processing speedup, splitting node and validator clients

SigmaPrime’s update on their Eth2 fuzzer – found some Prysmatic bugs, fuzzing Lodestar (Javascript client), Lighthouse ENR crate bug, dockerizing the fuzzer so the community can run it

Jonny Rhea’s Packetology posts (one and two) on identifying validators

Attack nets – a testnet specifically for attacks

When Sigma Prime’s fuzzer is dockerized, does “are you fuzzing any eth2 clients” become the cool new question that Eth folks ask each other, instead of “are you running any testnets?”

There’s not much more to say otherwise. This is the final slog to getting the eth2 chain launched. The final tinkering, the testnets, thinking about validator privacy and cost of attack, an attack net for white hats.

Layer2

Matter Labs’ ZK Sync rollup is live – tiny transaction fees, withdrawals to Eth mainnet in 15 mins, 300 transactions per second (with 2000 tps coming)

Minimally viable rollback in Validium/Volition

The flipside to high gas prices is layer2. It’s hard to get people to excited about layer2 when you can get onchain transactions done in a couple minutes at 1 gwei. At 30 gwei, people get more excited about layer2, and stuff is working.

Network effects are real: layer2 also becomes much better to use the more people who are using it. So there is a silver lining to higher gas prices, because it provides the incentive to push people to superior alternatives. Obviously a really fast and cheap ETH/token transfer rollup is increasingly more valuable the more people are using it.

Crypto

a GKR inside a snark to speed up SNARK proving 200x

Attacking the Diogenes setup ceremony for Eth2’s VDF

Isogenies VDFs: delay encryption

Kate polynomial commitments explainer from Dankrad Feist

Reputable List Curation from Decentralized Voting Crites, Maller, Meiklejohn and Mercer paper for construction of private TCR voting

Debut of the “crypto” section. It seemed like it was getting lost in the general.

Placement (compared to other sections) was rather random. Categorization can be somewhat arbitrary, that’s something the newsletter will hopefully constantly evolve.

This newsletter is made possible thanks to Matcha by 0x!

0x is excited to sponsor Week in Ethereum News and invite readers to try out our new DEX!

Sign up here to get early access to Matcha, your new home for fast, secure token trading.

Stuff for developers

Waffle v3 with ethers v5 support

WalletConnect v1 release, now with mobile linking

ethers-rs, a port of ethers to Rust

Solidity v0.6.10. error codes and bugfix for externally calling a function that returns variables with calldata location.

Inheritance in Solidity v0.6

Sorting without comparison in Solidity

Create dynamic NFTs using oracles

Deploying with libraries on Remix IDE

Wyre’s WalletPasses allow push notifications for dapps

Bunch of neat stuff in here. I’ve said it before, ethers is increasingly the thing that people use, even while most of the eth tutorials are still using web3js.

Code security

OpenZeppelin found a bug that affected 61 Argent wallets

Bancor bug: public method allowed anyone to drain user balances. Amusingly, the white hat draining got frontrun

DeFiSaver exchange vulnerability. They white hat drained it and also got frontrun.

Database of audit reports

Check out this newsletter’s weekly job listings below the general section

A special security section to break up the “stuff for devs” since it was a little big.

The whole “white hat drainers” get frontrun theme was...well, I used the word amusing in the newsletter, but I don’t think that’s quite the right word.

Ecosystem

Reddit announces scaling competition to move Reddit’s community points to mainnet

It seems the mysterious and massive transaction fees were from a hacked korean ponzi called GoodCycle. Various miners have handled differently: Ethermine (already paid out). Sparkpool (said it would pay out but then victim identified, unclear to me if yet resolved). f2pool (said they’d return to new address)

By default, Geth will no longer accept transaction fees over 1 eth

3box on demystifying the many facets of digital identity

The death (and web3 rebirth?) of privacy

Ethereum Foundation invests in Unicef’s CryptoFund startups

Unicef’s press release didn’t mention the Ethereum Foundation (and barely mentioned Ethereum! strange) but in fact EF did provide the capital. Very strange that Unicef barely mentioned Ethereum.

And yes, I still love a good privacy essay. I’m not a privacy nut, but I do think people should have the right to at least know when our every online action action is being surveiled.

Enterprise

WEF, IADB and Colombian government project to reduce corruption in procurement

EY launches crypto tax reporting app

EY continues to push things for enterprise, and dealing with taxes is presumably just one more hurdle that they’re knocking down. Of course many enterprises also still refuse to own crypto (even on a centralized exchange), so I remain curious as to whether

the anti-corruption procurement project in Colombia suffers a similar problem: to be actually used, the Colombian government requires secret bids. So they either have to change the law to try it, or they have to integrate...something like EY’s Nightfall

DAOs and Standards

EIP2733: Transaction package

Anonymous voting using MACI and BrightID

Arguably the anonymous voting using MACI could’ve been in the crypto section, but it felt slightly more applicable here.

Application layer

$COMP was distributed and liquidity mining (“yield farming”) blew up. Compound passed Maker for #1 on DeFiPulse, and $COMP has had a fully diluted market cap over $3.5 billion

Uniswap v2 passes v1 in liquidity

Streamr’s data unions framework is live for anyone to create their own

5m KNC burned milestone

Yield farming on steroids from Synthetix, Ren, and Curve

A yield farming for normies (and the risks!) tweetstorms from Tony Sheng

this artwork is always on sale, v2 with 100% per year tax instead of 5%

My weekly what fraction of applayer section is DeFi: 5/7.

I was somewhat surprised Uniswap v2 took over this quickly. I suppose that’s a data point for “the power of frontends.”

Tokens/Business/Regulation

ETH disrupting SWIFT: why fintech VCs are missing DeFi

Nick Tomaino on the economics of Eth2

Personal token vote on Alex Masmej’s life decisons

Liechtenstein company tokenizes 1.1m USD collectable Ferrari

Opyn: hedging with calls

It does seem like the economics of Eth2 are still vastly underrated by “crypto” at large. In my view that largely reflects the skepticism that Eth2 ever launches, as Silicon Valley went very skeptical on ETH 2 years ago when they pivoted away from FFG.

New tokens from protocols valued in the billions and tokenized Ferraris. It’s starting to feel like the true beginnings of a bull market.

No general section this week; I was surprised as you, but lately the general section had been dominated by cryptography and that got its own section.

That’s it for the annotations!

Please RT this on Twitter if you enjoyed it:

https://twitter.com/evan_van_ness/status/1275551414350237702

Job Listings

Synthetix: Deep Solidity engineer, 2+ years exp & US/EU friendly timezone

Chainlink: Product Manager for Blockchain Integrations and Lead Test Engineer

0x is hiring full-stack, back-end, front-end engineers + 1 data scientist

Celer Network: Android developer

Trail of Bits is looking for masters of low-level security. Apply here.

Want your job listing here? $250 per line (~75 character limit including spaces), payable in ETH/DAI/USDC to evan.ethereum.eth. Questions? thecryptonewspodcast -at-gmail

Housekeeping

Follow me on Twitter @evan_van_ness to get the annotated edition of this newsletter on Monday or Tuesday. Plus I tweet most of what makes it into the newsletter.

Did you get forwarded this newsletter? Sign up to receive it weekly

Permalink: https://weekinethereumnews.com/week-in-ethereum-news-june-21-2020/

Dates of Note

Upcoming dates of note (new/changes in bold):

June 24 – EIP1559 call

June 25 – Eth2 call

June 26 – Core devs call

June 29 – Swarm first public event

July 3 – Gitcoin matching grants ends (here’s my grant)

July 6-Aug 6 – HackFS Filecoin/IPFS and Ethereum hackathon

July 20 – Fork the World MetaCartel hackathon

Aug 2 – ENS grace period begins to end

Oct 2-Oct 30 – EthOnline hackathon

0 notes

Photo

New Post has been published on http://cryptonewsuniverse.com/free-cryptocurrency-complete-guide-to-earning-free-crypto/

Free Cryptocurrency: Complete Guide to Earning Free Crypto

Free Cryptocurrency: Complete Guide to Earning Free Crypto

This article will cover the main methods that can be leveraged in order to obtain free crypto coins & tokens

The last couple of years have marked an increase in the overall public awareness of cryptocurrencies worldwide.

In return, a larger number of people have expressed their interest in purchasing or earning digital currencies. While buying your favorite coin via an exchange is likely the easiest way to enter the cryptocurrency market, this industry is full of surprises – therefore a noticeable amount of coin can be earned for free. As such, this article will cover the main methods that can be leveraged in order to obtain free crypto. Do keep in mind that most of these methods require a bit of effort, since nothing is ever truly free. However, these methods do not entail having to work a fulltime job, nor do they imply any monetary investment from your part.

Free Crypto from Coinbase Earn

Coinbase is largely seen as one of the most popular digital currency exchanges, especially in the United States. While the platform facilitates the purchase and sale of crypto, it also offers its users the opportunity to earn several coins, including but not limited to Orchid, Tezos, Dai, EOS, Stellar, Zcash, Basic Attention Token and Ox.Free crypto at Coinbase Earn.

For example, at the moment you can earn the following cryptos for free:

Orchid: users can earn up to $52 OXT by completing a free course meant to teach you the basics of this privacy-focused coin;

Tezos: completing a course on Tezos and learning about its openness, safety or upgradability will earn you $6 XTZ;

Dai: a similar course-based offer is available for Dai as well, thus granting course participants $20 DAI;

EOS: you can earn up to $50 EOS by completing a course on this coin, and learning more about its goal of facilitating the development of blockchain-based apps;

Stellar Lumens: the completion of a quick course on how Stellar connects payment systems, banks and individuals will earn you $50 XLM;

Zcash: this coin is known for its privacy-focused philosophy – course completion will grant you an undisclosed amount of ZEC tokens;

Basic Attention Token: $8-worth of BAT can be earned by reading on BAT’s vision of fixing the web;

0x: last but not least, educating yourself on OX’s token-based idea of the future web will award you several ZRX tokens.

Do keep in mind that there is a catch to these courses. You must be the holder of a Coinbase exchange account, where all tokens will be credited.

Earning Free Crypto via Airdrops

Airdrops are one of the simplest and most effective methods of earning extra cryptocurrency, especially in the form of newly-announced tokens. The idea behind airdrops is quite simple – innovative and newly-launched projects choose to hold airdrops as an effective marketing strategy, meant to pique the interest of the cryptocurrency community. Participating in an airdrop is bound to be quite simple. It entails owning an active Ethereum wallet that is ERC-20 compatible, an email address, Telegram account, and in some cases, a Twitter account. Once these criteria are met, you will have to look for Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and token-based start-ups that have announced an upcoming airdrop.

Most of these platforms will require you to sign-up, by entering your ERC-20 address and email. For marketing purposes, some airdrops may require you to follow them on Twitter, or join the Telegram chat group. This ensures that you’re kept in the loop and quickly become aware of news concerning the token. Recently, KYC&AML regulations have made it mandatory for numerous airdrops to request identifying details. This is due to the money laundering potential associated with these events. Therefore, if you’re keen on protecting your online privacy, airdrops might not be the best choice for you. Recently, numerous wallet providers such as Blockchain.com have started sponsoring airdrops.In other words, you are announced whenever a partner start-up is holding an airdrop of their new tokens, and can earn the tokens directly in your wallet. Similarly, there are numerous websites which scour the web looking for new airdrop events. Following will help ensure that you will be one of the first people to know about upcoming airdrops.

Leveraging Bounties for Free Coin

Bounties are quite similar to airdrops, in the sense that they represent free coins given away by crypto project developers. There’s one key difference, however – bounties generally imply that you do some type of work in exchange for the coin. With this in mind, here are the main types of bounties, alongside a quick description for each:

Bug bounties

Bug bounty campaigns are generally well-paid, yet they are only relevant to people who hold development skills. Programmers throughout the world actively attempt to crack the code of online platforms, while also testing for potential bugs. As such, crypto and blockchain-based companies may hold bounty campaigns, where developers analyse platform functionality and report any bugs. Over the last couple of years, there have been numerous instances in which white-hat hackers discovered vulnerabilities or significant bugs in web platforms. In return for this service, and based on the severity of the vulnerability discovered, companies can offer tens of thousands of dollars as compensation.

Signature campaigns

This marketing strategy is often implemented on forums such as Bitcointalk. In exchange for a monthly bounty, forum users add a specific signature, thus indirectly promoting the products and services of a crypto company. Most businesses holding signature campaigns require forum users to have a higher membership level, which can be obtained through frequent high-quality posts. In return for buying the signature space, companies offer a monthly bounty in tokens.

Translations

Crypto start-ups are always interested in having their content translated into multiple languages. Since many start-ups run on a limited budget, a good method to go about this is to launch a translation bounty. Here, native users translate specific portions of text, in exchange for a number of tokens.

Social media, images, blog posts and video bounties

Last but not least, we also have other promotional bounties. Some companies may ask you to write and post a positive article on their services, whereas others may require you to edit videos, share posts on social media, or create promotional images. Based on these aspects, bounties do, in fact, represent a method of earning free tokens, yet they imply actual work. Luckily, the work is generally quite easy (apart from bug bounties), and can be completed rather quickly.

The Earning Potential of Affiliate Marketing and Referrals

At this point in time, most experts define affiliate marketing as the process associated with promoting products and services of various companies, in exchange for a commission on each sale. A recent research study concluded that US-based affiliate spending may reach $6.8 billion by the end of 2020. As such, affiliate marketing represents a significant revenue stream for numerous companies, especially those which operate in the online ecosystem. Therefore, it only makes sense that numerous crypto and blockchain-related businesses have launched their very own affiliate marketing campaigns. Getting involved is bound to be simple – in most instances, you need an account, and a personalized link, which can be shared across the web.

Any service or product that is purchased using your affiliate link or referral code will be credited with a percentage of the sale. Affiliate marketing can earn you free cryptocurrency as long as you are active online. This implies sharing the link as part of valuable content on a variety of platforms, such as crypto discussion forums, Reddit, YouTube, Facebook, Twitter, Instagram, or your personal blog. The possibilities are endless. Your success depends directly on the size of your audience and your overall online reach. However, this means that actual work needs to be carried out in order to get this free crypto. On the other hand, once your links are live, affiliate marketing becomes a lucrative source of passive income, which can be leveraged for a prolonged period of time.

To put things into perspective, here are several crypto-related affiliate campaigns:

Coinbase: if new users sign up using your personalized affiliate link, you are eligible to obtain 50% of the fees charged by the exchange platform for all transactions;

TREZOR: this platform offers 10% of net sales carried out by users who have signed up using your referral;

Ledger: this affiliate program promises to credit 12% – 15% of all sales;

LocalBitcoins: you can expect to earn 20% of the trading fee associated with each transaction that is carried out by referred users;

Binance: this exchange platform offers 20%-40% commissions on transaction fees.

Do keep in mind the fact that these conditions may be modified unilaterally by the website. Therefore, it is always recommended that you carry out your due diligence, and carefully research the affiliate marketing conditions associated with each of the examples given above. Additionally, note that this list isn’t exhaustive – in fact, there are hundreds of crypto-related affiliate opportunities on the market at this moment. It certainly isn’t unusual for affiliate marketing to become a main income stream, especially if done right. People have reported earning hundreds of thousands of dollars monthly using affiliate marketing strategies. Given the fact that we are referring to the digital currency market, your income potential is further increased by crypto price volatility. However, this entails that you treat it as a fulltime job until enough of your links are published on the web.

Other Free Crypto Offers

A quick search will likely unveil numerous other free cryptocurrency sources. Here are a few examples that we consider relevant:

Crypto.com

This crypto debit card company has launched a cash-back system that allows users to earn tokens on each purchase you make. Values vary between 1% and 5%, yet users can also expect several offers on third-party platforms such as Netflix, Spotify, Expedia or Airbnb;

Celsius Network

This lending platform allows users to deposit cryptocurrency, and earn an interest as other users borrow it. It advertises itself as a safe method of earning passive income by using your existing coins;

Wirex

Yet another digital currency card company, Wirex advertises a 0.5% bitcoin-based cashback scheme on all purchases made via the card.

Cryptocurrency gambling

Cryptocurrency gambling can also act as a method for earning free coins, yet extra care should be practiced if you decide to wager your coins. Do keep in mind that most casinos offer crypto faucets, which give out an amount of free coin every time they are clicked on (they are programmed against abuse, however, and serve as a method of encouraging users to keep on playing). If you do decide to try your luck at a casino, make sure that you choose a platform that relies on a provably-fair protocol. Otherwise, you may expose yourself to rigged games that are bound to steal your hard-earned crypto.

Keep an Eye Out for Scams

Over the last couple of years, the popularity of the cryptocurrency market has increased exponentially. The rise in public awareness was mostly fuelled by intense volatility, and record-breaking prices. With this in mind, the market is still seen as a way to get rich quickly. While there is significant money-making potential in crypto, this perception has led to the appearance of numerous scams, meant to fraud people out of their money. Whenever dealing in crypto, there are two aspects worth keeping in mind: if an offer sounds too good to be true, it probably is. Also, you should never risk more than you can afford to lose. Cybersecurity practices dictate that it’s best to always carry out in-depth research on any platform or service that you decide to use. Similarly, you should never give out your personal details or private keys to third parties. Protection against scams and other forms of fraudulent activity is basically non-existent, whereas transactions are irreversible, therefore due diligence is essential.

The Bottom Line

Based on everything that has been highlighted in this guide, most people are only a few clicks away from earning free cryptocurrency. There are hundreds, if not thousands of offers that you can take advantage of, while most imply an insignificant amount of work. On the other hand, those who are serious about creating a crypto-based income stream will be happy to know that affiliate marketing and bug bounty hunting are highly-lucrative passive income streams.

Article Produced By Daniel Dob

Daniel Dob is a freelance writer, trader, and digital currency journalist, with over 7 years of writing experience. His main niches are cryptocurrencies, business, fintech, internet marketing, and finance. When he's not writing, you can find him reading, traveling, or taking one of his hobbies to the next level.

https://blockonomi.com/free-cryptocurrency/

0 notes

Text

Bitcoin Cash Scaling Benchmarks, Brewdog, and Rising Transaction Volume

Over the last week, there’s been lots of going on within the Bitcoin Cash (BCH) environment with companies implementing BCH support, new applications, and various announcements. While Bitcoin Cash supporters keep bolstering adoption, development and community projects have continued to flourish.

Also Read: Over 22,000 Traders Have Now Signed up to Local.Bitcoin.com

The Bitcoin Cash (BCH) ecosystem has seen a lot of action throughout the first two quarters of 2019. This week is not much different as there’s been an abundance of developments within the space. BCH markets are holding steady today and much like the rest of the cryptoconomy there’s been some consolidation. At the time of writing, bitcoin cash commands the fifth largest market valuation and each coin has been hovering between $405-420. BCH is the sixth most traded coin on Saturday, July 6. The decentralized digital asset has around $1.4 billion worth of global trade volume and a market cap of around $7.2 billion.

The First Exchange-Traded Product Tracking the Performance of Bitcoin Cash

This week the fintech firm Amun AG announced that it had listed the first Bitcoin Cash exchange-traded product (ETP) on the Switzerland-based principal stock exchange Six. According to the announcement, Amun’s BCH ETP is fully collateralized and the product is denominated in USD. On the Six trading exchange, the ETP’s ticker will be called ABCH and the BCH community seemed excited about the announcement. “This is huge,” one person commented on the Reddit forum r/btc. “Now there is a new option to invest in bitcoin cash (BCH) with an exchange-traded product in one of the most advanced markets in the world,” explained the Twitter account @Bitcoin on Friday.

Bitcoin Cash Can Now Be Used to Invest in Scottish Craft Beer Company Brewdog

On Thursday, Scottish craft beer brewery Brewdog revealed that the public can invest in the company using multiple denominations of crypto. Brewdog’s crowdfunding project, “Equity for Punks,” now accepts bitcoin core (BTC), bitcoin cash (BCH), omisego (OMG), qtum (QTUM), augur (REP), 0x (ZRX), bitcoin SV (BSV), ether (ETH), litecoin (LTC), and ripple (XRP). Essentially Equity for Punks allows investors to purchase a stake in the company and allows them to become shareholders. According to Brewdog, there were 114,000 investors before they opened up the crowdfunding to cryptocurrency users.

“You can now become a card-carrying Brewdog Equity Punk using cryptocurrency,” explained the company’s announcement. “This is the natural next step for us as a business. James and Martin started Brewdog to be an alternative to the status quo; to challenge perceptions and revolutionise their industry — The developers, miners, and users of cryptocurrency are exactly the same.”

Handlekrypto Launches in Sweden

The sister company of Keys4coins, a startup called Handlekrypto, has launched in Sweden. Now residents from Sweden can visit Handlekrypto.se to purchase BCH in seconds with SEK using a bank card or Swish. There is no registration required and visitors looking to purchase BCH can verify themselves instantly with a BankID.

https://t.co/P1sm0akuqc launches in Sweden! Purchase Bitcoin #BTC, Bitcoin Cash #BCH and Ethereum #ETH in seconds from Sweden with BankID and pay in SEK with bank card or Swish

— HandleKrypto (@HandleKrypto) June 30, 2019

At the moment Handlekrypto provides bitcoin cash (BCH), bitcoin core (BTC) and ethereum (ETH). The website also has a cryptocurrency conversion application that allows users to swap between hundreds of digital assets. The Handlekrypto service has a website for international visitors, the UK, Norway, and the latest in Sweden.

3,000 Transactions Per Second in BCH Benchmark Stress Test

Software developer and miner Jonathan Toomim published a video on July 2 which shows how he built a benchmark to measure the performance of the Bitcoin Cash reference client Bitcoin ABC. Toomim’s test generated 672,000 transactions and mined them into blocks in roughly a nine-minute time frame. The results equate to more than 3,000 BCH transactions per second on his desktop computer. Toomim is well known for his Xthinner project and the developer said he plans to work on Xthinner so it can “propagate blocks before performing full transaction validation (and after only doing data integrity/merkle root+PoW checks).” “Testing block propagation was the original motivation for building this test apparatus,” Toomim explained. The software engineer continued:

I also intend to set up a networked version of this test with four 40-core computers, using the Linux netem module to inject artificial latency and packet loss. Again, this is primarily and initially to be used as a testbed for optimizing block propagation.

youtube

Dementia Society of America Now Accepts Bitcoin Cash

On July 4 the Dementia Society of America revealed they now accept cryptocurrency donations. The organization is a nonprofit that provides individuals and families impacted by dementia with education, local resources, and life enrichment. “We recognize caregivers and innovators, and raise hope by supporting relevant research to discover cures, causes, and meaningful interventions,” explains the Dementia Society’s website.

Dementia Society of America Begins Accepting Five Cryptocurrencies https://t.co/VxCUdwZC2P

— Dementia Society (@DementiaOrg) July 4, 2019

Now the charitable organization accepts donations in bitcoin core (BTC), ethereum (ETH), litecoin (LTC), bitcoin cash (BCH) and Circle’s USD stablecoin (USDC). Founder and Volunteer President Kevin Jameson explained that he wants the “crypto community to know that we support innovative mediums of exchange.” Jameson stated:

More than 2,000 years ago, we traded salt and gold for our labors – as we were worth our weight in it – today, its bits and bytes, and since our Society’s origins just over 5 years ago, we’ve understood that there is always lasting value to human kindness, no matter the currency.

Bitcoin Cash Network Becomes the Second Most Valuable Chain

On July 2 the founder of Ryan Research, Peter Ryan, explained in a recent research analysis hosted on Coinspice.io that Bitcoin Cash recently became the second most valuable chain according to transaction volume or the total amount of value transacted through the blockchain. “While Bitcoin Cash might be fifth by market cap, its transaction volume is now 2nd,” explained Ryan’s analysis. “Around mid-May, that volume started to really take off and exceeded $2 billion per day — Other notable cryptocurrencies like ETH, LTC, and XRP are well below these new milestones.”

In fact over the last six months when comparing bitcoin core (BTC) and bitcoin cash (BCH) transaction volume there’s been a slight downturn, but in April both networks showed positive growth. After that, however, BCH began to outpace BTC in growth drastically, Ryan detailed. The researcher added:

In May, BCH saw 185% month-over-month growth in transaction volume while BTC only grew by 56%. BCH came close to a third of the volume of BTC in May only to settle in July at about a quarter.

Local US Government in Ohio Plans to Use SLP Token to Incentivize Positive Behavior

This week BCH supporters heard about the local government of Dublin, Ohio planning to use a Simple Ledger Protocol (SLP) token for a citywide reward system. On July 1, the CEO of the BCH implementation Bitcoin Verde revealed the news and explained the SLP token will be used throughout the city. Green told news.Bitcoin.com that the token’s goal is to provide three functions in Dublin: digital identity, electronic polling system, and a token of value.

For the past 6+ mo we have been working on a project for @DublinOhio

The project's goal was to provide 3 functions for people of #DublinOhio

1. A digital identity 2. An electronic polling system 3. A token of value

You can read more about it here: https://t.co/Qndks63lLw

— Software Verde (@SoftwareVerde) July 1, 2019

“The Dublin token is intended to be a reward and barter system for Dublin’s citizens — to incentivize positive behavior,” explained the Bitcoin Verde founder, who also told the BCH community that the team “investigated other blockchain and token implementations, but ultimately decided Bitcoin Cash’s scaling solution to be superior than other alternatives, and viewed the thriving developer community to be an important pillar to the platform’s longevity.”

Twitch.tv Acceptance, Brave Browser, and Tipbitcoin.cash

There’s been so much happening within the Bitcoin Cash ecosystem and BCH supporters have been discussing the variety of developments fervently. The latest live streaming Bitcoin Cash tipping platform Tipbitcoin.cash has been seeing a lot of action on the Twitch.tv platform. Moreover, Twitch.tv re-added the ability to pay for services and items on the website using bitcoin cash (BCH) or bitcoin core (BTC) through Bitpay. In another exciting development, Brendan Eich, the CEO of the Brave browser, revealed on Twitter that BCH will soon be supported. “BCH and other funding choices coming to Brave [version] 0.68,” Eich declared. With BCH enthusiasts, developers and companies pushing for quality crypto services and mainstream adoption, the latest slew of announcements should augment their optimism.

What do you think about all the developments within the Bitcoin Cash ecosystem? Let us know what you think in the comments section below.

Disclaimer: This editorial is intended for informational purposes only. Readers should do their own due diligence before taking any actions related to the mentioned companies or any of their affiliates or services. Bitcoin.com or the author is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Image credits: Shutterstock, Ryan Research, Handlekrypto, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Bitcoin Cash Scaling Benchmarks, Brewdog, and Rising Transaction Volume appeared first on Bitcoin News.

READ MORE http://bit.ly/2YGOBIK

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

0 notes

Link

February 12, 2019 6:55 PM

0x community governance, ProgPoW signaling, and Constantinople FUD.

Your daily distillation of crypto news for Tuesday, February 12, 2019:

0x Pursues Community Governance

The 0x team has drafted a 0x Improvement Proposal, ZEIP23, to add "the ability to trade arbitrary bundles of ERC20 and ERC721 tokens" using the 0x protocol. If approved, this functionality would be included via an EDCC (aka smart contract) called MultiAssetProxy.

Because the MultiAssetProxy integration would require a "hot upgrade" to 0x's contracts, CEO and co-founder Will Warren noted that community oversight would be needed to make the change. Therefore, there will be a vote period beginning Monday, February 18, during which ZRX token holders can approve or reject ZEIP23.

Warren added that the vote will represent 0x's "first exercise in community governance" and, as such, encourages community members "to take the process seriously." The 0x team's first goal is to establish ZEIP communication guidelines so that the community is fully informed prior to voting on a proposal such as ZEIP23.

As a step toward establishing better communication, 0x is hosting a reddit AMA today starting at 11 a.m. PST. Community members can use the forum to ask the team about ZEIP23 and the voting process.

ProgPoW: Yea or Nay?

Following up on the core devs' decision to solicit feedback from the mining community regarding ProgPoW, Parity's Afri Schoedon tweeted today that Ethereum miners and pool operators should "add PPYE to your node's extra-data field to signal for #ProgPoW or PPNO to oppose it." Further, ETH holders and investors can vote for ProgPoW with their coins. "We [Ethereum Cat Herders] are trying to gather as many signals as possible," Schoedon continued.

When the core devs decided to allow miners to vote using the extraData field, ProgPoW proponent Kristy-Leigh Minehan said, delighted, "This is exactly what mining was meant for – one GPU, one vote."

Constantinople Shade

A February 12 Trustnodes article reports that another Constantinople bug has been found – this time with the Create2 feature – and goes on to question whether the hard fork will be delayed again as a result. This article has elicited frenzied discussion from the Ethereum reddit community.

Some redditors have suggested a Parity conspiracy, arguing that "an entity who has been so obviously compromised" like Parity should not lead Ethereum development. Others have dismissed the FUD, calling the article's claims "stupid" and "delusional."

Despite what the peanut gallery has opined, Schoedon himself told Trustnodes that Constantinople would, in fact, not be delayed because of the reported bug.

Dani is a full-time writer for ETHNews. He received his bachelor's degree in English writing from the University of Nevada, Reno, where he also studied journalism and queer theory. In his free time, he writes poetry, plays the piano, and fangirls over fictional characters. He lives with his partner, three dogs, and two cats in the middle of nowhere, Nevada.

ETHNews is committed to its Editorial Policy

Like what you read? Follow us on Twitter @ETHNews_ to receive the latest 0x, community governance or other Ethereum technology news.

window.fbAsyncInit = function() { FB.init({ appId : '1761887554082917', xfbml : true, version : 'v2.7' }); }; (function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_US/sdk.js"; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk'));

0 notes

Text

New Bitcoin [BTC], Ethereum, Litecoin, Bitcoin Cash trading pairs announced on CoinField

CoinField, a popular Canadian cryptocurrency exchange, has added another feather in its cap with the latest announcement stating that 18 new fiat trading pairs will be added on the platform on January 11. The roster includes trading pairs pegged to popular fiat currencies such as the United States dollar [USD], Canadian dollar [CAD], British Pound [GBP], the Euro [EUR] and the Japanese Yen [JPY].

The cryptocurrencies that will be included as part of the trading pairs are Bitcoin [BTC], Ethereum [ETH], Stellar Lumens [XLM], Bitcoin Cash [BCH], Litecoin [LTC], Digibyte [DGB], Basic Attention Token [BAT], ZCash [ZEC] and 0x [ZRX].

The exchange also gave its word on the deposit holds by stating that a user can whitelist their account by uploading a proof of address and making at least 3 deposit history with the alternative of a wire transfer that has no hold. The allocation of the trading pairs are as follows:

USD: DGB, ZRX, BCH, DASH, ZEC & BAT

CAD: DGB, ZRX, BCH, DASH & ZEC

GBP: BTC, ETH, XLM, LTC & DGB

EUR: DGB

JPY: BTC

Post the announcement, users flocked to CoinField’s twitter handles to voice their opinion. One Twitter user, Pucksterpete had said:

“How about enabling or finding a bank to accept your EUR SEPA option. Still not active, very disappointing L”

To this CoinField replied:

“Hi

, SEPA is going to be activated in this month. In the meanwhile you may use our bank wire transfer option which is fairly quick. 1-3 days max. – Thank you!”

CoinField had also made the news recently when XRP based trading pairs were confirmed on the platform. This also included an XRP based Stellar Lumens trading pair XLM/XRP. The XLM/XRP trading pair was stated to be available alongside six other direct fiat pairings. The news had excited users of the cryptocurrencies as expressed by Lapinette, a Twitter user had stated:

“Really good Job ! I’m not Canadian but I’m an XRP holder so I’m so proud of you ! I really hope than other as @binance @BittrexExchange @Bitstamp @eToro … will follow your exemple !”

TinCryp, a Reddit user also voiced his opinion by saying:

” This sort of development is what the crypto space needs right now. Shoutout to CoinField for making this happen, some real progress this.”

The post New Bitcoin [BTC], Ethereum, Litecoin, Bitcoin Cash trading pairs announced on CoinField appeared first on AMBCrypto.

[Telegram Channel | Original Article ]

0 notes

Text

August 17, 2018

News and Links

Protocol

Latest core devs call. Lane’s notes.

[Casper] Vitalik Buterin’s 75 tweets on the history and current plans of Casper

[Casper] Latest Casper standup

[Casper] Censorship detectors via 99% fault tolerant consensus

[Casper] Casper FFG and light clients. Vitalik listed the major challenges of light client protocol design and compared with old Casper FFG, this post explored how to optimize the times on BLS verifications for beacon chain light clients.

[Eth 2.0] Eth2.0 Implementers call

[Eth 2.0] VDF explainer

[Plasma] OmiseGO’s comprehensive Plasma update (with notes from last Plasma call)

[Plasma] Enabling Fast Withdrawals for Faulty Plasma Chains

[Plasma] Challenge Bond Pricing Concerns

[Plasma] Batch auctions on Plasma

[Plasma] Plasma bridge between chains

[STARKs] BarryWhiteHat: babyjubjub ecc

[State channels] Channels Can Enforce Contracts Beyond Intermediary Lockup Time

Stuff for developers

List of opcodes and gas prices. Kelvin Fichter adopted Danny Ryan’s list

eth-mutants: mutation testing tool from Federico Bond

Cryptofin’s array utilities library for Solidity

Austin Griffith on his Clevis and Dapparatus dapp dev tools

Runtime Verification: Formal verification of ERC20 tokens

Loredana’s new video tour of Pipeline visual IDE. Github code

New and comprehensive Infura documentation

A list of tools to get data out of the Ethereumchain

Getting deep into the EVM. Reminds me of Howard Yeah’s EVM series.

Zeppelin: deconstructing a Soliditycontract, part 1 and part 2

OpenZeppelin v1.12

Client Releases

Trinity third major alpha release- faster sync

Scala/Akka v0.1

Ecosystem

Maker and Wyre announce compliant fiat <> Dai onramp in 30+ countries, so now it will be easy to acquire the best store of value in crypto. An AMA with Maker and Wyre

ETH India recap from Lendroid. Check out the EthIndia submissions, lots of ambitious projects as well as devs new to Solidity. ENS Hackathon recap

ECF and EthPrize team up to fund EthWorks to implement Avsa’s universal logins

Luke Duncan: Harberger taxes for a middle ground between copyleft and permissive licenses

CryptoKitties filed for a Nifty trademark, which is messed up. Perhaps this means Nifty will win out in the nifty vs nfty nomenclature wars.

Governance and Standards

Harbour <> Aragon bridge for Harbour voting in Aragon orgs.

Secret voting with Enigma

ERC1329: Inalienable Reputation Token

ERC1319: Smart Contract Package Registry Interface

ERC1328: WalletConnect Standard URI Format

ERC1327: Extendable Atomic Swaps

Project Updates

Brave plans to release an in-browser ETH wallet running a geth light client. Also, they’ll add Reddit and Twitter tipping.

Toshi rebrands as Coinbase Wallet

Columbia Journalism Review profiles Civil

Aragon Q2 dev update

0x monthly dev update

100 pages on local electricity market regulations to guide Grid+ domestic expansion

Gnosis on getting to 100% decentralized exchanges

Augur hit 1000 markets

Raiden v0.5 testnet breaking change release

Ocean Protocol v0.1 testnet release

Loom Network’s Zombie Battleground is in private alpha

Interviews, Podcasts, Videos, Talks

Howard Wu talks snarks and libsnark on Zero Knowledge

Joseph Lubin 11 min BloombergTV interview

Cheddar’s 5 min profile of ConsenSys

Matt Condon’s intro to blockchain talk

Podcast interview of EEA Executive Director Ron Resnick

Ryan Selkis on Epicenter

Origin Protocol’s Stan James on Hashing It Out

Vitalik’s transaction fee economics talk from TechCrunchZug

30 mins of Brian Armstrong with Emily Chang

General

ZCash 2.0 released, should activate Oct 28 on 2 year anniversary

Dan Boneh’s Cryptography II Coursera class starting in September

Fascinating story of Indian politicians and Bitconnect. Ignore the fake news title.

Foreshadow: “how speculative execution can be exploited for reading the contents of SGX-protected memory as well as extracting the machine’s private attestation key”

Dates of Note

Upcoming dates of note:

August 19 - deadline to submit Devcon4 talk/workshop/discussion

August 22 - Maker DAO ‘Foundation Proposal’ vote

August 24-26 - Loom hackathon (Oslo, Norway)

September 6 - Security unconference (Berlin)

September 7-9 - ETHBerlin hackathon

September 7-9 - WyoHackathon (Wyoming)

September 8 - Ethereum Industry Summit (Hong Kong)

September 21-23 — EthAtlanta