#0.5 ethereum to usd

Explore tagged Tumblr posts

Text

Top 10 crypto payment gateway companies

The future of payments is here, and it's decentralized, secure, and—dare we say—cooler than your average credit card swipe. Whether you're a merchant looking to accept crypto or a consumer eager to spend your digital assets, these top 10 crypto payment gateways are leading the charge in 2025. Let's dive in!

1. Pearl Lemon Crypto

With over 9 years in the digital space, Pearl Lemon Crypto isn't just another crypto firm; it's a seasoned veteran in marketing, lead generation, and web development. Think of them as your personal GPS in the vast crypto universe—guiding you to profitable investments while avoiding the black holes. Whether you're a newbie or a seasoned investor, they've got strategies tailored to your needs. Plus, their approach is as refreshing as a cold drink on a hot day.

2. NOWPayments

NOWPayments is the Swiss Army knife of crypto payment gateways, supporting over 300 cryptocurrencies. With a transaction fee as low as 0.5%, it's perfect for businesses looking to accept a wide range of digital assets without breaking the bank. Plus, their non-custodial nature means you stay in control of your funds.

3. CoinGate

CoinGate has been around since 2014, offering support for over 70 cryptocurrencies and seamless integration with platforms like Shopify and WooCommerce. With a 1% transaction fee and robust API, it's a solid choice for e-commerce businesses looking to dip their toes into crypto payments.

4. BitPay

BitPay is the OG of crypto payment gateways, handling transactions since 2011. Supporting major cryptocurrencies like Bitcoin and Ethereum, it offers instant crypto-to-fiat conversion and integrates with platforms like Shopify and WooCommerce. With a flat 1% transaction fee, it's a reliable choice for businesses of all sizes.

5. Cryptomus

Cryptomus is a newer player in the game but packs a punch with support for 15 cryptocurrencies and a 2% transaction fee. It offers crypto-to-fiat settlements and multi-currency wallets, making it ideal for e-commerce and gaming industries.

6. CoinPayments

CoinPayments boasts support for over 1,300 cryptocurrencies, making it one of the most versatile gateways out there. With a 0.5% settlement fee and integrations with platforms like WooCommerce and Magento, it's a go-to for businesses looking to accept a wide variety of digital assets.

7. SpicePay

SpicePay offers a straightforward solution for accepting Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. With a 2% transaction fee and support for USD and EUR settlements, it's a simple choice for businesses just starting to explore crypto payments.

8. CoinsBank

CoinsBank provides a comprehensive crypto payment solution with support for major cryptocurrencies and fiat settlements in USD, EUR, and GBP. With a 0.5% transaction fee, it's suitable for businesses looking for a full-service platform.

9. Flexa

Flexa enables instant and secure cryptocurrency payments at the point of sale, supporting assets like Bitcoin, Ethereum, and Dogecoin. With a flat 1.5% fee per transaction, it's perfect for physical retail locations looking to accept crypto payments.

10. Crypto.com

Crypto.com Pay offers a rewards-based payment system with cashback perks for customers using crypto payments. Supporting major digital assets and offering flexible withdrawal options, it's a great choice for both online and offline merchants.

Final Thoughts

Choosing the right crypto payment gateway is like picking the perfect playlist for your road trip—it's all about the vibe and the journey. Whether you're a merchant looking to accept a wide range of cryptocurrencies or a consumer eager to spend your digital assets, these top 10 gateways offer the tools and features to make your crypto experience smooth and enjoyable. So, buckle up and enjoy the ride!

0 notes

Text

Crypto Trading Platforms: Unlocking the Future of Digital Finance

The cryptocurrency market has experienced exponential growth over the past decade, with digital currencies like Bitcoin, Ethereum, and countless altcoins revolutionizing the world of finance. As interest in crypto continues to grow, the demand for reliable and accessible crypto trading platforms has skyrocketed. These platforms allow individuals to buy, sell, and trade digital assets with ease and efficiency.

In this article, we’ll explore what crypto trading platforms are, how they work, and how to select the best one for your needs.

What Are Crypto Trading Platforms?

A crypto trading platform is an online service that acts as a marketplace for cryptocurrency buyers and sellers. These platforms enable individuals to exchange cryptocurrencies or convert them into traditional fiat currencies like USD, EUR, or GBP. Crypto platforms provide traders with access to digital assets, including popular coins like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and even lesser-known altcoins.

Crypto trading platforms generally offer users a variety of features, including real-time market data, charts, secure wallets for storing assets, and the ability to execute trades. Depending on the platform, there may be advanced features such as margin trading, futures contracts, and staking options.

How Do Crypto Trading Platforms Work?

Crypto trading platforms operate as intermediaries, connecting buyers and sellers of cryptocurrencies. The process is fairly simple and follows these general steps:

Account Creation: To begin trading, you’ll need to create an account on the platform of your choice. This typically involves providing personal information and verifying your identity (via KYC—Know Your Customer) to comply with regulations.

Depositing Funds: Once your account is set up, you can fund it using either fiat currency (such as USD, EUR) or another cryptocurrency. Platforms may support various payment methods like bank transfers, credit cards, PayPal, or cryptocurrency deposits.

Placing Orders: Once your account is funded, you can place buy or sell orders. There are different types of orders:

Market Orders: These are executed immediately at the current market price.

Limit Orders: You can set a specific price at which you want to buy or sell. The order will only execute when the market hits your target price.

Stop-Loss Orders: These are used to limit losses by automatically selling a crypto asset when it reaches a certain price.

Executing Trades: When a match is found between your buy and sell orders, the transaction is executed, and the crypto or fiat currency is transferred to the respective wallets.

Withdrawing Funds: After a trade, you can withdraw your funds to an external wallet or bank account. Some platforms may charge withdrawal fees depending on the method you choose.

Essential Features of Crypto Trading Platforms

Not all crypto trading platforms are created equal. When selecting a platform, there are key features that should be considered to ensure a seamless and secure trading experience:

1. Security

Cryptocurrency is a valuable and often volatile asset, so security is paramount. Look for platforms that offer:

Two-Factor Authentication (2FA) to add an extra layer of security when logging in or performing transactions.

Cold Storage for a majority of assets, which HashKey Exchange involves keeping funds in offline wallets that are less vulnerable to hacks.

Encryption to protect personal and financial information from being compromised.

It’s also important to check if the platform is regulated in your region, as this ensures that it adheres to necessary financial laws, offering a layer of protection for users.

2. Fees

Crypto trading platforms charge various fees that can eat into your profits. These fees typically include:

Trading Fees: A percentage of each trade, which can range from 0.1% to 0.5% depending on the platform.

Deposit and Withdrawal Fees: Platforms may charge fees when you deposit or withdraw funds, especially when converting between crypto and fiat currencies.

Conversion Fees: Some platforms charge a fee when you exchange one cryptocurrency for another.

It’s important to review the fee structure before committing to a platform to ensure that it aligns with your trading strategy and goals.

3. Liquidity

Liquidity refers to how quickly and easily you can buy or sell a cryptocurrency without affecting its market price. A platform with high liquidity ensures that there are enough buyers and sellers, making it easier to execute trades without causing significant price fluctuations.

Platforms with good liquidity are generally better for traders who make frequent transactions, as they can get in and out of positions with minimal slippage (the difference between the expected price and the executed price).

4. User Experience

For beginners, a platform’s user interface and ease of use are critical. The platform should be intuitive, with easy navigation and clear instructions. Many platforms also offer demo accounts or educational resources to help you get started. For more experienced traders, advanced charting tools, order types, and additional features are essential.

A clean and easy-to-use interface can make a significant difference, especially for those just starting out in crypto trading.

5. Supported Cryptocurrencies

Not all platforms offer the same cryptocurrencies. While major coins like Bitcoin, Ethereum, and Litecoin are widely available, you may also be interested in altcoins and newer tokens. Check if the platform supports the coins you're interested in trading.

Some platforms specialize in niche or emerging cryptocurrencies, while others may only support the most popular ones. If you want access to a wide range of assets, choose a platform that offers extensive coin selection.

6. Mobile Access

If you're always on the go, consider a platform that offers a mobile app with features similar to the desktop version. A good mobile app will allow you to trade, track prices, and manage your portfolio at any time, making it convenient to stay connected to the market.

7. Customer Support

Responsive and knowledgeable customer support is essential, particularly for beginners who may have questions about how the platform works. Look for platforms that offer 24/7 support through live chat, email, or phone. Additionally, platforms with a robust FAQ section, guides, and video tutorials can be especially helpful.

Top Crypto Trading Platforms

There are several popular platforms catering to different types of traders. Here are some of the most widely used:

Binance: Binance is one of the largest and most widely used platforms globally, offering a wide variety of cryptocurrencies, advanced trading features, and low fees. It’s suitable for both beginners and experienced traders.

Coinbase: Known for its simplicity, Coinbase is ideal for those who are new to crypto trading. It’s beginner-friendly, offers a clean interface, and provides educational resources to help users understand the crypto market.

Kraken: Kraken is a well-established platform that offers a wide range of cryptocurrencies, competitive fees, and advanced features. It’s known for its strong security measures and excellent customer service.

Gemini: Based in the U.S., Gemini is a highly regulated platform that emphasizes security and user-friendly features. It supports a wide range of cryptocurrencies and offers useful tools for traders.

KuCoin: KuCoin is known for its vast selection of cryptocurrencies, competitive fees, and advanced trading options such as futures and margin trading. It caters to experienced traders looking for more sophisticated features.

Why Use Crypto Trading Platforms?

Using a crypto trading platform offers several advantages, including:

Global Access: The cryptocurrency market operates 24/7, and platforms allow you to trade from anywhere in the world.

Security: Reputable platforms offer robust security measures to protect your funds.

Liquidity: High liquidity ensures quick execution of orders at favorable prices.

User-Friendly Tools: Many platforms provide real-time charts, portfolio management tools, and educational resources to help traders make informed decisions.

How to Choose the Right Crypto Trading Platform

Selecting the right platform depends on your trading needs and experience level. For beginners, user-friendly platforms like Coinbase or Gemini are excellent choices, while advanced traders might prefer platforms like Binance or Kraken that offer more features and lower fees.

When evaluating a platform, consider its security features, fees, cryptocurrency selection, and liquidity. You should also ensure that it offers the trading tools and resources that align with your goals.

Crypto trading platforms are essential tools for anyone know more looking to participate in the growing world of cryptocurrency. With the right platform, you can access a wide variety of digital assets, make secure trades, and stay on top of market trends. Whether you’re a beginner or an experienced trader, the right platform can help you achieve your trading goals and explore the exciting potential of the digital finance revolution.

The crypto world is constantly evolving, so staying informed and adapting your strategy is key to success. Happy trading!

0 notes

Text

Following subdued U.S. PCE inflation data, the crypto market remains flat. Bitcoin has dropped by 0.50%, and Ethereum is down over 1%. Bitcoin's price analysis is neutral, reflecting broader market stagnation despite the economic data release.

Bitcoin, the largest cryptocurrency by market cap, remains stable near Wednesday’s level. As of now, BTC/USD is at $22,893, down 0.51% for the day, with a 24-hour trading volume of $23,013,105,309, a 30% decline according to CoinMarketCap.

Crypto markets faced resistance on Friday, mirroring mixed reactions in equity markets post-economic data. The Dow is flat, while the S&P 500 and Nasdaq 100 are down nearly 0.5% as investors process the softer data and earnings reports.

Technically, Bitcoin consolidates at higher levels, trading within a range. Despite a 30% rise from early 2023 lows of $16,360, momentum has stalled this week. Multiple Doji candlesticks near $23K indicate consolidation. Momentum oscillators in the overbought zone, with the Relative Strength Index (14) at 75 and receding MACD bullish momentum, suggest a possible price correction, with support around $22K.

A close above the daily high could resume the uptrend towards $24K. Conversely, the Bitcoin options market shows bullish sentiment. QCP Capital's tweet notes a sudden shift towards bullishness, with BTC risk reversals holding positive for multiple tenors.

#cryptotrading#cryptotrends#cryptocurrencies#bitcoin halving#bitcoin#bitcoin price#bitcoin etf#blockchaintechnology

0 notes

Text

What happened: On Wednesday a total of 1,695.49 Ether ETH/USD worth $2,589,907, based on the current value of Ethereum at time of publication ($1,527.53), was burned from Ethereum transactions. Burning is when a coin or token is sent to an unusable wallet to remove it from circulation. Why it matters: On August 5th, 2021, the Ethereum blockchain implemented an important upgrade known as EIP-1159. This Ethereum improvement proposal changed the fee model drastically. Now each transaction includes a variable base fee that adjusts according to the current demand for block space. This base fee is burned, or permanently removed from circulation, lowering the supply of Ether forever. See Also: How to Buy Ethereum & When Will Ethereum 2.0 Launch Ethereum is currently issuing new Ether at a rate of 4% per year, although this is expected to decrease to around 0.5-1% as a part of the Ethereum 2.0 upgrade. Once this occurs, many speculate that the burn rate of Ether will be greater than the token's issuance, causing ETH to become a deflationary currency. The net annualized issuance rate for Ether yesterday was 1.15%. Data provided by Glassnode

0 notes

Text

State of Decentralized Finance Remains Lackluster, Value Locked in Defi Slid 67% in 6 Months – Defi Bitcoin News

State of Decentralized Finance Remains Lackluster, Value Locked in Defi Slid 67% in 6 Months – Defi Bitcoin News

During the last 125 days or roughly four months, the total value locked (TVL) in decentralized finance (defi) has been range bound within the $50 billion to $65 billion region. The TVL in defi has shed significant value during the past six months as it dropped from $161 billion on April 1, down more than 67% lower to today’s $51.72 billion. TVL Dropped More Than 67% in 6 Months, Defi Market…

View On WordPress

#0.01 ethereum#0.05 ethereum#0.08 ethereum to usd#0.1 ethereum#0.1 ethereum to inr#0.1 ethereum to naira#0.2 ethereum to usd#0.25 ethereum to usd#0.3 ethereum to usd#0.5 ethereum to usd#1 ethereum to usd#100 ethereum to usd#1070 hashrate ethereum#1080 hashrate ethereum#1080 ti hashrate ethereum#1559 ethereum#1660 hashrate ethereum#1660 super hashrate ethereum#1660 ti hashrate ethereum#2 ethereum to usd#2.0 ethereum#2016 ethereum price#2021 ethereum price prediction#2022 ethereum price#2022 ethereum price prediction#2025 ethereum price prediction#2030 ethereum price#2060 hashrate ethereum#30 rates ethereum#3060 hashrate ethereum

0 notes

Text

Steps To Send Eth From Coinbase To Metamask

Introduction

Coinbase is a popular cryptocurrency exchange that many people use to buy and sell Ethereum. However, if you're using it to send Ethereum from one wallet to another, there are some steps that need to be taken before your funds can be sent. This article will explain how you can do just that!

Copy your *Metamask* ETH wallet address

You need to copy the Metamask ETH wallet address that you see in the top right corner of your wallet. This is a long string of numbers and letters, and it's case sensitive!

Now, go back to Coinbase and enter this copied address into the Amount field.

Get your Ethereum address ready to be used

You will need to get your Metamask ETH address ready.

Go to metamask.io and create an account by clicking on the "register" button at the top of their website. After filling out some basic information, click on "import" where you can then select "private key". Paste your private key into the box and click "load".

Go to Coinbase and feel free to go back to the homepage

To send eth from Coinbase to Metamask, you will need to go to Coinbase and feel free to go back to the homepage at www.coinbase.com

Click on the "Send" button at the top of your screen. From here, copy your ETH wallet address by clicking on it and then pressing Ctrl + C or ⌘ + C on Macs (or Control+C for PC).

You can now paste this into Metamask's settings page under "Advanced," where it says "Copy Address."

Enter the amount of ETH you would like to send, or click "Max" if you'd like to send all of your funds. (Note that there is a $10 minimum).

You are now ready to send your ETH.

You will be prompted to enter the amount you would like to send, or click "Max" if you'd like to send all of your funds. (Note that there is a $10 minimum).

The amount of ETH you are sending will be displayed on the next screen along with its price in USD and in Metamask's native token (which is MKR). Once you have entered the correct figures, confirm them by clicking “Send” and wait for confirmation from Coinbase before proceeding with any other steps listed below!

You will now be prompted to send! Make sure to double check all information before sending. This is just a simple step but it is extremely important as misclicks can lead to loss of funds. If it all looks good, click "Send".

Oops! Click Regenerate Content below to try generating this section again.

Your transaction has been sent! Now all you have to do is wait for it to arrive in Metamask

You should now see a confirmation of the transaction on Coinbase and Metamask, as well as on Etherscan. This means that your transaction has been sent! Now all you have to do is wait for it to arrive in Metamask.

If you want to speed up the process, there are several ways:

Paying a small fee (0.5 - 2%) will help your transaction get processed more quickly by miners. This can be done by clicking “Send” from within any wallet at https://www.coinbase.com/mywallet/ and choosing from one of these options: 1) Send Withdrawal; 2) Withdrawal; 3) Receive Payments; 4) Buy Bitcoin or Ethereum with PayPal / Credit Card etc... -> This option allows users who want faster processing times but still want their coins back quickly out there looking for work!" *"

Here are some steps for sending your Ether from Coinbase to Metamask wallet:

Copy your metamask eth wallet address from the website and open it in a separate tab of your browser. Don't forget to save the information on paper or in an audio file so that you can easily find it later!

Go back to Coinbase website, which can be done by clicking on this link: https://www.coinbase.com (you will be redirected). Click on "Sign Up" button on top menu bar, fill out all required fields with valid data (such as name, email address etc.). After completing registration process successfully click "Continue". Now you should see two buttons below "Sign Up": "Receive" and "Send". Click on either one of them - depending how much money is needed by users who want buy/sell crypto-currencies; because sending process has different fees depending upon what type of transaction is being made at any given moment."

Conclusion

As you can see, it's quite easy to send your Ether from Coinbase to Metamask. There are some other useful resources that will help you get started with the process as well. If you're new to cryptocurrency or simply want more information about how it works, I recommend reading up on this post by Coindesk! They've done a good job explaining how sending money between wallets works without getting too technical. Good luck on your journey towards becoming a full-fledged crypto enthusiast.

2 notes

·

View notes

Text

https://ether-away.com/?boss=E1AA3D4B6FCCBEDE get free Ethereum Dollar Registered Bonus 0.5 USD $$$$2000 Your wallet so Click on the link below.

1 note

·

View note

Text

"CRYPTOCOMMISSION" THIS IS BETTER THAN INVESTING IN SHAREMARKET

This is better than share market and you can earn in many way in this digital currency.

Here’s something special for you regarding cryptocurrency

Click here

These are some best cryptocurrency for your commission

If you invest in little bit good currency you will definetly get something than sharemarket

1. Binance – Best Cryptocurrency Exchange Overall

2. Kraken – Best Customer Service

3. Coinbase – Best Platform for Bitcoin Buyers and Beginners

4. eToro – Crypto and Forex in One Place

5. Bisq – Best Decentralized Platform

6. Coinmama – Good Brokerage Service for Bitcoin

7. Bittrex – Best For Security

8. Gemini – Best For Traders From the United States

Describing all above currencies.

1. Binance – Best Cryptocurrency Exchange Overall

This platform is based in Malta, even though it has branches in different parts of the world. It is a perfect option for beginners and experts alike. Not only that, but the platform has around 200 coins in total, ranging from the usual ones like Bitcoin to their native coin known as Binance Coin.

Binance Pros

Secure Asset Fund for Users (SAFU)

Native Binance Coin (BNB)

Approximately 200 cryptocurrencies to trade

0.1 percent flat trading fees

Binance Cons

US residents must use Binance.us which has only 80 cryptocurrencies available

Potential issues with ID verification

Slow-to-respond customer service

Binance offers a range of services such as margin trading, futures trading, and a lot more. Their fee remains at 0.1 percent on most transactions, but they also have a credit card brokerage service for more convenient purchases and sale of cryptocurrencies (at higher fees).

Security might not be something to worry about when using this platform, thanks to their system known as Secure Asset Fund for Users (SAFU), ensuring users from theft of funds. On the downside, however, this platform’s 2FA and ID verification processes can take quite a while to set up.

2. Kraken – Best Customer Service

This cryptocurrency platform takes pride in offering amazingly fast bank withdrawals, being available in most parts of the world, and charging low fees. The fees are between 0 and 0.36 percent, which is dependent on your type of trading as well as your trading volume for the last 30 days – you will enjoy lower fees if you trade more.

Kraken Pros

Wonderful customer support

Available worldwide

Strong reputation

Fast bank withdrawals

Considerably low transaction fees

Kraken Cons

Some bugs and issues

Not the largest selection of altcoins

This platform also facilitates discreet trading through its dark pool feature, which is another reason it is quite popular. You will, however, note that the user experience is not the best in the market if compared to other platforms. The platform’s UI needs a little bit of tweaking to make it more user-friendly.

3. Coinbase – Best Platform for Bitcoin Buyers and Beginners

Coinbase is, hands-down, one of the best platforms for Bitcoin exchanges online. It is used by lots of beginners who are trying to get their hands on digital currency. For this reason, it is a common platform for those looking to make both deposits and withdrawals of the most popular coin in the market – Bitcoin.

Coinbase Pros

Intuitive UI for beginners and experts alike

Best place for Bitcoin purchase

30 million users worldwide

Accepts debit cards, credit cards, and wire transfer

Coinbase Cons

Sluggish customer support

Rather extensive monitoring of trades

Fees are a little bit on the higher side

In addition to facilitating fast deposits and lots of payment methods, this platform has a UI that is almost perfect and easy to understand. Here, you can trade the most popular cryptos, including Litecoin, Bitcoin, Ethereum, and others.

Having been founded in 2012 and accruing a total of over 30 million active users currently, this platform is truly popular for a good reason.

One of the slight downsides of the platform is transaction fees that are somewhat higher compared to the best platforms for crypto exchange. The fees here are in the form of a 0.5 percent premium, after which you have to pay a slight fee depending on the amount that you trade.

Well, you may say that such are the fees that you pay to enjoy a well-designed UI as well as get your services from a popular crypto trading platform.

Is There a Difference Between Coinbase and Coinbase Pro?

There, indeed, is a slight difference between Coinbase Pro and Coinbase. Formerly known as GDAX, Coinbase Pro is a separate app that is meant for expert crypto investors. It is also more geo-restricted compared to the normal Coinbase app.

4. eToro – Crypto and Forex in One Place

If you are a fan of both the worlds of forex and crypto, then eToro should be your go-to platform. This might be the best platform yet for traders interested in having their fingers in many pies. The platform can be used from both its web or mobile platform.

eToro Pros

Choose between web and mobile platforms

Has been in operation since 2007

Can be used for both crypto and forex

Supports up to 94 cryptocurrency pairs

eToro Cons

Not a crypto-specific site

Supports only 14 crypto coins

It is also good to keep in mind that eToro has a dedicated crypto wallet app that utilizes multisig authorization for added security when investing with other parties. Having been established in 2007, eToro has done a great job in building a recognizable reputation for itself.

The only downside is the fact that they support a mere 14 crypto coins, even though it is a catalog of the most popular coins.

5. Bisq – Best Decentralized Platform

This is a decentralized crypto exchange platform. As such, its servers spread out all over the world, which makes it almost resistant to attacks. In that light, this is one of the best platforms for the purchase of different types of cryptocurrency in terms of security.

Bisq Pros

Brilliant security

Open-source code

Usable in the United States

No ID required

Bisq Cons

Does not allow the use of credit cards for deposits

What is more? The platform’s source code is discussed openly on GitHub and Slack, which makes it all transparent. One thing to keep in mind about the platform is that you will be charged 0.001 BTC and some extra mining fees for transactions, regardless of whether you are selling or buying.

The main downside is that the service only allows wire transfers for deposits. Also, after Litecoin and Bitcoin, the rest of the cryptocurrency is negligible.

6. Coinmama – Good Brokerage Service for Bitcoin

This is simply not a cryptocurrency exchange platform; rather, it is a brokerage service. What this means is that you can use the service to purchase your preferred Crypto coins from them rather than from other users.

Coinmama Pros

Live pricing in EUR and USD

Buy up to 10 different cryptocurrencies

Amazing customer service

Buy Bitcoin without a hassle

Coinmama Cons

No mobile app

2.9-3.9 percent trading fees

You will need a European bank to sell BTC

The main benefit of transacting that way is that you are sure of faster and safer transactions. You, however, might want to be aware of the 2.9–3.9 percent fees. On the positive side, you can purchase up to 10 different crypto coins from this platform and still get to enjoy a considerably competitive rate.

Their customer service is an outstanding one, too. Overall, however, the platform’s system seems to be more favorable to European users and might as such not be the best platform for US users.

7. Bittrex – Best For Security

This platform came into existence in 2013 in Seattle, courtesy of computer security experts who were former employees of Blackberry and Microsoft. This is one of the best, if not the best, cryptocurrency exchange platform in terms of security. It is worth noting that they have never experienced a security breach, which is not typical in the world of cryptocurrency.

Bittrex Pros

Attractive trading volumes

Top-notch security

Lots of currency pairs

US laws-compliant

Bittrex Cons

Does not offer the best customer service

No leveraged margin trading

This platform works with a flat 0.25 percent trading fee, which is somehow okay in terms of the pricing. Bittrex is available on a worldwide basis, even though some of the advanced features that it offers, such as margin trading, are not.

Also, all withdrawals and deposits are supposed to be via wire transfer, which is not something that everyone will find pleasurable.

Nonetheless, that does not take away the fact that this platform is one of the most secure. The owners believe in it so much that they offer full insurance on 80-90 percent of the user funds should there be an unlikely event of a breach.

8. Gemini – Best For Traders From the United States

This platform was founded in the year 2015 by the twins who sued Zuckerberg for allegedly stealing the Facebook idea. Gemini is, without a doubt, a platform that is highly respected in the United States. It is renowned for having considerably low fees and strict trading security.

Gemini Pros

USD accounts insured

Easy-to-use platform

Strong security

0-1 percent fee, which is quite affordable to most

Gemini Cons

Personal data required

ID required when signing up

Has had a software crash in the past

In addition to the fact that Gemini specializes in Ethereum and Bitcoin, it is also quite easy to use, making it a good choice for the new, inexperienced user. However, users have to keep in mind that their ID and personal data are necessary when signing up. For this reason, it may not be the best option for those looking to protect their identity.

Hope you like these blog, Thank You so much for reading.

click to get regarding cryptocurrency

2 notes

·

View notes

Text

4 Best Exchanges To Buy Dogecoin in Lebanon (2021

This simple guide for beginners will take you safely and step by step through the process of buying Doge coin. By following these steps, you will own your first Doge coin today! How exciting!

What is dogecoin?

Dogecoin is a cryptocurrency that started out as a joke in 2013. It is a satirical tribute to bitcoin, designed to only serve to generate a few laughs.

It got its name from an internet meme centered around the image of a Shiba Inu dog with bad spelling habits, hence "doge" instead of "dog». How to buy doge coins?

Dogecoin can be purchased with a credit card on cryptocurrency exchanges such as Bittrex Global GmbH and Pay ward Inc.'s Kraken, as well as on trading platforms such as popular brokerage firm Robin hood Markets Inc.

In February, the diverse group said it had added doge coin to its crypto-trading app as demand increased due to what chief executive Nigel Green called the “Elon effect”. Online brokerage firm We bull Financial LLC added doge coin to its We bull Crypto platform in April. In addition, eToro said on May 3 that it had added doge coin to its list of proposed assets.

The Gemini cryptocurrency exchange followed, announcing in May that deposits and exchanges were available for dogecoin.

How does Dogecoin work?

Like all cryptocurrencies, Dogecoin works by tracking the movement of coins on a publicly visible blockchain. This means that Doge changes hands between users without the need for a centralized intermediary such as a bank.

When it comes to the details of how Doge works, the coin is similar to Luckycoin and Litecoin in that it uses scrypt technology to verify transactions on its blockchain. This is a simpler function than the SHA-256 algorithm used by Bitcoin and means mining on the Doge Network uses less power.

If you're feeling a little lost and aren't 100% sure what words like 'mining' mean, take our free courses on the cryptocurrency you use to familiarize yourself with the basics of mining.

Binance

Binance is one of the largest platforms in the world. The big advantage is that it is very easy to buy Dogecoin on Binance. As with normal currency trading, you pay a small commission on every trade you wait and Binance has great rates. Once you have purchased Dogecoin, you can choose to keep your coins online or send to a hardware wallet if it is available for your coins.

Coinbase

In the crypto world and on exchanges like Binance, you cannot buy every cryptocurrency directly with FIAT currency. For this, they created stable coins like Tether USDT.

These stablecoins are cryptocurrencies that you can buy to later exchange for the currency you want to buy. The name stable-coin comes from the USD because the price of these coins simply uses the price of the USD. Before purchasing your favorite coin, it is a good idea to research which coins are associated with the coin you want to purchase. For example, some coins only pair with Bitcoin and Ethereum, others also pair with stablecoins.

Benefits of using stablecoins As some cryptocurrencies can be volatile, stablecoins are often pegged to the USD. Therefore, their price remains very similar, which will reduce the risk while exchanging fiat currency for other cryptocurrencies and vice versa.

CEX

One of the biggest names in the cryptocurrency trading space; CEX allows users to trade hundreds of different cryptocurrencies, including Dogecoin. You can open an account now.

Capital - By offering a more user-friendly interface than the biggest crypto exchanges, Capital allows you to trade a variety of cryptocurrencies for Doge quickly, easily and anonymously.

Bitfinex

Bitfinex now stores 99.5% of its customers' funds in cold rooms. Only 0.5% of the funds are held in hot wallets to provide the necessary liquidity for the exchange. The cold storage system is geographically located and uses a multisig function. Merchants are now required to go through a two-level authentication process for their login and withdrawals. The first level of security is the two-factor authentication (2FA) layer. The second layer of security is Universal Factor 2 (U2F), which uses a physical security key.

For security measures, Bitfinex uses several sofas of security measures for different areas of its website. In terms of fund security, 95% of client funds are kept in a cold room. Data is now kept on a new, more secure server with an expanded security team to oversee server security. In addition, Hacktivist Security regularly tests the security.

You know enough about dogeCoin now. We hope that this article will meet your expectations. When it comes to us, we trust Centurion Invest

Check the latest news about crypto in this article.

1 note

·

View note

Text

Rise Protocol

Rise Protocol — The next-gen hybrid rebase token

$RISE #ieo #blockchain #dot #bounty #defi #Rise #RiseProtocol #RebaseToken #FrictionlessYield #Rebases #DynamicPeg #blackhole #AutoLiquidity #AutoRewards.

Buy the RISE token

Rise Protocol is a fully compliant ERC20 token on the Ethereum network which can be purchased on Uniswap Exchange starting on February 11th, 2021 20:00 UTC.

Buy RISE at 16.40 USD

What is the Rise Protocol about ?

The world’s most advanced synthetic rebase token, Rise Protocol combines revolutionary tokenomics and features with the best and latest decentralized finance (DeFi) technology. Smart contract has already passed audits by CTDSec (professional auditing firm) and Shappy from WarOnRugs.

KEY FEATURES:

1. Rebase token.

If price of RISE is above peg price at 20:00 UTC, supply of RISE will increase and everyone will automatically receive additional RISE tokens into their wallet. If the price of RISE is 5% below the peg price for 3 consecutive days at 20:00 UTC, supply of RISE will decrease.

2. Dynamic peg.

Initially pegged to 0.01 ETH, RISE has the revolutionary ability to peg to any asset, class of assets, or calculated metric in the future based on investor/market sentiment.

3. Frictionless yield.

A portion of each and every transaction (except buys) is instantly distributed to all holders.

4. Auto-liquidity generation.

A portion of each and every sell is permanently locked into liquidity.

5. Auto-distribution of liquidity provider rewards.

A portion of each and every sell is automatically distributed to liquidity providers.

6. “Supermassive Black Hole”.

Publicly viewable burn address that accrues RISE through several mechanisms, scaling exponentially over time to provide incredibly powerful deflationary effects.

“Sustainable, Adaptable, Fair, and Secure”: these are the four tenets that Rise Protocol was built upon. Every aspect of the token, presale, smart contract, etc. was created with these core values in mind.

Many other DeFi projects sacrifice one or more of these values, which creates scenarios like ridiculously unfair advantages for early private investors, or generating short lived and temporary hype, or creating a rigid contract that has no ability to adapt or change to the ever evolving crypto market, or a contract that is subject to exploits.

How does Rise address these issues in DeFi?

1. Sustainable:

● Powerful and unique “Supermassive Black Hole” deflationary concept that accrues and burns tokens through various different methods. Effects scale exponentially over time.

● Auto-liquidity generation that permanently locks a portion of each transaction into liquidity, creating an ever increasing sell floor.

● Initial rebase lag of 5. This means that if the price of RISE at time of rebase is 100% over the target price, we will receive a rebase for 20% (100% divided by 5).

● “Supply adjustment” that will increase the price of RISE, but decrease the supply if the market price is below 5% of target price for 3 consecutive days during the rebase time.

2. Adaptable:

● Rise has the revolutionary ability to peg to any asset, calculated metric, or asset class. Initially pegged to Ethereum for its importance in DeFi and for ease of understanding, this peg can be altered in the future through governance based on investor/market sentiment.

● The smart contract was coded so that every parameter can be adjusted in the future through governance. Things like sales tax, transaction tax, burn percentage, liquidity provider rewards, rebase lag, etc. all have the ability to be adjusted. This gives RISE the ability to constantly adapt and change based on market conditions.

3. Fair:

● Presale price will be 0.01 ETH, same as the Uniswap launch price.

● Seed investors acquired Rise at 10% below launch price. However, 80% will be vested over the course of 1 month.

● Unique smart contract feature allows us to enable Uniswap trading after liquidity has been added and presale tokens distributed. This will give everyone a fair playing ground once trading begins.

● Maximum transaction size of 500 Rise for the first hour after Uniswap trading is enabled, preventing bot sniping and creating a fair environment for regular traders/investors.

● Buy and sell tax helps prevent coordinated price manipulation. A portion of this tax is distributed instantly through frictionless yield to all holders based on holdings.

4. Secure:

● The Rise contract has passed audits by CTDSec (a professional smart contract auditing firm) and by Shappy from WarOnRugs (highly respected owner of a community aimed at preventing rug pulls and scams in the crypto-sphere).

● No need to transfer your tokens to a staking contract address in order to earn rewards! Frictionless yield allows you to hold your tokens in your own wallet for utmost security. You can watch as your balance grows with each and every transaction.

● If you choose to provide liquidity, you will be rewarded through auto-distribution of liquidity rewards. Again, no need to send your LP tokens to a separate staking contract, simply hold your LP tokens in your own wallet and watch as their value increase over time.

● Initial team provided liquidity will be locked before Uniswap trading is enabled.

TOKEN DISTRIBUTION:

● Initial total supply ��� 100,000 RISE

● Presale – 37,500 RISE

● Initial Uniswap Liquidity – 30,000 RISE

● Seed investors (vested over 1 month) – 25,000 RISE

● Team funds (vested over 2 months) – 5,000 RISE

● Development & Marketing – 2,500 RISE

PRESALE DETAILS:

Price: 1 ETH = 100 RISE

Whitelist registration will open on February 4th, 2021 20:00 UTC.

Whitelist link will be posted on our official Twitter and Telegram channels.

You must complete all tasks on the whitelist registration form in order to be accepted into the whitelist! The team will be reviewing every application to validate. The whitelist will close once 375 ETH have been pledged.

Make sure to register for the whitelist to guarantee an allocation in the presale! A public presale will not occur if all 375 ETH is pledged, and all whitelisted wallets contribute their pledged amounts.

● Minimum pledge = 0.5 ETH, Maximum pledge = 4 ETH

Presale will take place across 2 rounds starting on February 7th, 2021 20:00 UTC, with the first round dedicated to those on the whitelist.

● Round 1

(20:00 UTC – 21:00 UTC) – Whitelisted wallets only.

Whitelisted wallets will have 1 hour starting on February 7th, 2021 20:00 UTC to send in their pledges. Once the contribution period ends, transactions and wallets will be validated to ensure wallet addresses and contributed amount matches the whitelist. Any unclaimed RISE from the whitelist will then be available in a first come first served public presale.

● Round 2

(22:00 UTC) – Public presale.

Any unclaimed RISE from the whitelist allocations will be made available to a public presale on a first come first served basis.

LAUNCH DATE/TIME:

RISE will launch on Uniswap and trading will be enabled on February 11th, 2021 20:00 UTC.

Rise Protocol Roadmap

The idea and concept

November 2020 – the project idea is born. Plans are drawn up and smart contracts are created.

Beta testing

December 2020 – Extensive testing on Ropsten testnet to ensure everything down to the smallest detail works as designed.

Token presale

January 2021 – Seed investors sale followed by a presale in February 2021 with 37500 Rise on offer.

Code audit and go live

February 2021 – Professional code audit and launch of Rise Protocol on Uniswap.

Q2 enhancements

Q2 2021 – New partnership announced to create additional transactions, generating more tokens for holders of Rise, utilizing frictionless yield. Launch of the governance platform.

Q3 enhancements

Q3 2021 – Implement Chainlink Price Oracles to further enhance the adaptable and dynamic peg function. Further enhance the rebase dashboard to pull in additional feeds.

Rise Protocol Team

Shuaps – Technical Lead, Project Management & Strategy

PBL00 – Branding, Strategy & Development

Jamie – Development, Auditing & Strategy

Andy – Website, Social Media & Community Manager

Radinho – Website, Social Media & Community Manager

CJ – Marketing

CryptKeep3r – Website, Social Media & Community Manager

PartnersHolder Finance

Holder Finance aims to become the best store of value token on the Ethereum network with a very low supply of only 1000 tokens being released over 10 years. Holderswap is the main product, a competitor to Uniswap and Sushiswap as a Decentralized Exchange that provides rewards for holders of the HFi token.

Official Resources:

Website: https://riseprotocol.io

Litepaper: https://riseprotocol.io/rise_litepaper

Twitter: https://twitter.com/RiseProtocol

Medium: https://medium.com/@riseprotocolofficial

Reddit: https://www.reddit.com/user/riseprotocolofficial

Discord: https://discord.com

Telegram: https://t.me/RiseProtocolOfficial

AUTHOR:

Bitcointalk Username: Manuel Akanji

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2954998

2 notes

·

View notes

Link

Asian shares hovered just below a record high on Friday as mixed U.S. economic data caused some investors to show restraint after a global stock market rally pushed many bourses to dizzying heights. The Shanghai composite is up 1.43% at 3,655.08. Overall, the Singapore MSCI up 0.35% at 333.95. Over in Hong Kong, the Hang Seng Index down 0.01% to 30,134. In Japan, the Nikkei 225 up 0.14% at 29,460, while the Topix index is up 0.55% at 1932.5. South Korea’s Kospi up 0.52% to 3100.58. Australia S&P/ASX 200 down 0.63% at 6806.7.

European equities Thursday closing. The DAX futures contract in Germany traded 0.77% up at 14040.91, CAC 40 futures down 0.02% at 5669.8 and the UK 100 futures contract in the U.K. up 0.07% at 6,528.7.

In U.S. on Wall Street, the Dow Jones Industrial Average closed 0.02% down at 31430.7 the S&P 500 up 0.17% to 3916.4 and the Nasdaq 100 up 0.58% at 13734.3, NYSE closes at 15297.08 up 0.15%.

In the Forex market, GBPUSD down 0.13% at 1.37971. The USDJPY up 0.10% at 104.84. The USDCHF up 0.05% at 0.89034. EURUSD flat at 1.21277, EUR/GBP up 0.15% at 0.87894. The USD/CNY down 0.05% at 6.4542, at the time of writing.

In the commodity market U.S. Gold futures down 0.15% at $1,822.51. Elsewhere, Silver futures up 0.46% to $27.08 per ounce, Platinum down 0.88% at $1223.14 per ounce, and Palladium up 0.19% to $2,356.0.

Crude Oil down on Friday; Brent crude oil down 0.25% to $60.69 barrel while U.S. West Texas Intermediate (CLc1) is down 0.35% at $57.52.

In the Cryptocurrency Markets, BTCUSD at 47107.62 down 1.82%, Ethereum at 1752.46 down 2.00%, Litecoin at 181.39 down 1.44%, at the time of writing.

TOP STOCKS TO WATCH OUT TODAY:

MICRON Tech. up 5.015% at $86.48, KRAFT HEINZ Co. up 4.869% at $35.54, WESTERN DIGITAL up 5.903% to $63.955, PEPSI Co. Inc. down 1.983% to $134.97, NIKE Inc. up 0.758% to $143.54, NVIDIA. Corp. up 3.295% at $610.03.

Economic news:

US: A slower-than-expected vaccine rollout and the rise of coronavirus variants may make attaining herd immunity against COVID-19 difficult, but that should not stop the economy from rebounding, according to a U.S. central banker Thursday.

“I don’t think the economy requires herd immunity,” Richmond Federal Reserve Bank President Thomas Barkin told Reuters Thursday. “Consumers who get vaccines, who have money in their pockets…are going to be free to spend,” he said.

Analysts have long predicted economic activity will pick up as more people are vaccinated, but hopes for a quick path to a fully immunized populace have faded amid vaccine shortages and other roadblocks. President Joe Biden said earlier this week it will be “challenging” for the economy to reach herd immunity by summer’s end. Barkin’s remarks signal a growing understanding that an economic rebound and an ongoing pandemic are not mutually exclusive realities.

Eurozone: The euro zone economy is in double-dip recession amid lockdown restrictions due to a resurgence in coronavirus cases, according to a Reuters poll of economists, who said the risks to their already weak outlook was skewed more to the downside.

Given delays to the European Union’s vaccine roll-out and concerns about new coronavirus variants supporting current lockdowns, stalled economic activity and rising unemployment pose a serious threat to any expected recovery.

Only last month the economy was predicted to make a sharp recovery and grow 0.6% this quarter after shrinking 0.7% in Q4.

Important Data: UK GDP (QoQ) (Q4) today at 2:00 this time estimated 0.5%, previously which was 16.0%. UK Manufacturing Production (MoM) (Dec) today at 2:00 this time estimated 0.5%, previously which was 0.7%. RUSSIA Interest Rate Decision (Feb) today at 5:30 previously which was 4.25%. US Federal Budget today at 14:00 previously which was at -430.0B.

Read Full Report Click Here Crypto Technical Analysis

#technical analysis#CAPITAL STREET FX#GBPUSD Technical Analysis#EURUSD Technical Analysis#EURSEK Technical Analysis#CHFJPY Technical Analysis#NIKKEI 225 Technical Analysis#WTI CRUDE OIL Technical Analysis#\#GOLD Technical Analysis#BTCUSD Technical Analysis

1 note

·

View note

Text

Tutoriel Bitmex

Bonjour et bienvenue sur ce tuto consacré à BitMEX, un exchange apparu en 2014 permettant un accès facile au margin-trading. Ici vous apprendrez tout ce qu'il faut savoir sur cet exchange qui fait parler de lui. Bonne lecture.

* INDICE

1. BitMEX, trader le Bitcoin avec des leviers 2. Frais BiTMEX 3. Fonctionnement des leviers et des liquidations 4. S’inscrire sur BitMEX 5. Sécuriser son compte (2FA) 6. Faire un dépôt sur BitMEX 7. Interface du site 8. Ouvrir et gérer une position sur BitMEX 9. Faire un retrait sur BitMEX 10. Parrainage BitMEX

1. BitMEX, trader le Bitcoin avec des leviers

BitMEX (Bitcoin Mercantile Exchange) est devenu le premier site de margin-trading de crypto-monnaie de par son volume échangé (près de 40% !). Il a été fondé aux Seychelles par HDR Global Trading Limited. Il a ensuite connu un succès retentissant en raison de sa facilité d'accès, de ses effets de leviers impressionnants (pouvant atteindre x100) et de ses produits dérivés (contrats). Vous ne traderez pas directement les cryptos sur ce site mais des produits dérivés. Cela permet une plus grande flexibilité, à la fois juridique et économique.

Possédant aujourd'hui ses bureaux à Hong-Kong, la plateforme a su s'imposer comme alternative accessible à BitFinex. Ce dernier ne proposant qu'un levier maximum de x3.3 et un dépôt minimum de 10.000 USD. Cinq langues sont disponibles sur le site : anglais, russe, chinois, japonais et coréen.

L'ergonomie est discutable pour un nouvel arrivant. Pour autant, vous trouverez facilement toute les informations nécessaires et même bien plus. BitMEX peut se vanter d'être une plateforme complète.

Ajoutons que le site possède une bonne réputation. Il n'a jamais été piraté.

Vous pourrez y trouver 8 crypto-monnaies : Bitcoin, Cardano, Bitcoin Cash, EOS, Ethereum, Litecoin, Tron et Ripple. Les leviers sont différents en fonction des devises : jusqu'à x100 sur le BTC, x50 pour ETH, x33.3 pour LTC et x20 pour les autres. Tout les échanges fonctionnent en contrats. Il faut compter 1 USD pour les perpetual swaps (BTC et ETH) ou 1 coin/token pour tout le reste.

Il n'est possible de déposer que des BTC sur BitMEX. Pas de fiat. Et aucune autre crypto-monnaie n'est acceptée !

BitMEX propose des produits dérivés, des contrats futures (possédant des dates d'expiration, la position se ferme automatiquement à ce moment), des perpetual swaps et des options binaires (équivalents à des paris). De base, vous utiliserez un perpetual swap sur la paire XBT/USD. Il s'agit d'un contrat d'échanges de flux financiers (de BTC dans notre cas) qui n'a pas de date d'expiration. Une position peut y rester ouverte indéfiniment si vous payez les frais toute les huit heures, d'où le "perpetual".

💡 Le symbole de Bitcoin peut varier en fonction des sites. Si BTC est employé la plupart du temps, il arrive que le symbole XBT le soit également.

Ainsi, Bitcoin = BTC = XBT.

→ Visitez BitMEX !

BitMEX vous propose également de faire vos armes sur une version d'essai, un testnet, que vous trouverez ici.

Vous pourrez trader avec un compte virtuel. Une bonne idée pour vous faire la main avant de plonger dans le grand bain. Cette version virtuelle est identique en tout point à la version réelle. Mais vous trouverez deux paires en plus : une paire BTC/YEN (Japon) et une paire BTC/WON (Corée).

Notez que les comptes/marchés du testnet et celui du site officiel ne sont pas liés. Vous pourrez différencier les deux versions à la couleur du logo :

(Vert pour la version Virtuelle, Rouge pour la version Réelle)

⚠ Attention : Il est déconseillé pour un débutant de s'essayer aux leviers et surtout de dépasser le levier 10. En plus d'être un marché très volatile, les biais psychologiques de chacun se retrouvent accentués par ce multiplicateur. Vos petites erreurs deviendront problématiques. N'augmentez pas le levier pour récupérer vos pertes ou pour décupler vos gains précédents. Tout comme au casino, c'est le meilleur moyen de tout perdre. Nous recommandons de débuter avec un faible capital et un levier faible.

2. Frais BiTMEX

Maker et Taker

Pour trader sur cette plate-forme il est important de connaître les notions de Maker et de Taker.

BitMEX applique des frais différents selon si vous passez un ordre Limit (Maker) ou un ordre Market (Taker).

Si l'ordre d'un Maker aboutit il est en partie rémunéré par le Taker qui devra payer des frais en plus à BitMEX.

Pour un Perpetual Swap, les frais sont de -0.025% en Maker et de 0.075% pour un Taker.Sur les Futures elles sont de -0.05% en Maker et 0.25% en Taker.

Ceux-ci sont prélevés à l'ouverture de la position mais aussi à la fermeture.

Vous l'aurez compris, essayez d'être un Maker dès que possible. Passez des ordres Limit afin de ne pas avoir de frais à payer.

D'autant plus si vous utilisez de gros leviers. Les frais concernent la position totale, pas seulement votre apport !

Funding

Si vous effectuez un Funding sur un Perpetual Swap vous devrez payer toutes les huit heures des frais de financement. Ces frais sont fonction de votre orientation et de la taille de votre position totale.

Dans le cas d'un Funding Rate positif, les positions long devront payer le pourcentage pour maintenir leur position ouverte là où les positions short seront rémunérées. C'est dans ces situations là que vous pourrez entendre "les longs payent les shorts". L'inverse est aussi vrai. Si le Funding Rate est en négatif, cela implique que les positions short payent les positions long.

En général, le Funding Rate est positif en tendance haussière et négatif en tendance baissière. Les suiveurs de tendance paieront donc des frais qui seront attribués aux spéculateurs contre-tendance.

Le Funding pose un problème. Etant obligé de payer des frais proportionnels à la taille de votre position, vous ne pouvez que difficilement tenir des leviers élevés sur la durée, votre position se faisant grignoter jour après jour par ce prélèvement.

En utilisant notre lien d'affiliation vous économiserez 10% sur les frais à payer pendant vos six premiers mois sur BitMEX.

→ BitMEX - 10% de réduction sur les frais !

3. Fonctionnement des leviers et des liquidations

Vous avez peut-être déjà entendu parler de BitMEX pour ses fameuses cascades de liquidations et son volume démentiel. Et bien les deux sont liés, il est important de connaître le fonctionnement de la plate-forme avant de l'utiliser. Je vais vous présenter comment cela tout fonctionne

Leviers

Un levier en finance est synonyme de multiplicateur .Il s'agit d'un prêt que vous fait l'exchange pour augmenter la taille de vos positions. En levier, vos gains comme vos pertes seront X fois plus importants. BitMEX peut vous prêter jusqu'à 100x votre mise de départ. Mais vous vous doutez bien qu'ils ne font cela ni gratuitement ni de façon risquée. Lorsque l'argent prêté entre dans une zone de danger vous subirez ce que l'on appelle une liquidation.

Liquidations

La liquidation fonctionne sur un principe simple. L'échange étant enclin à vous prêter de l'argent, il lui serait inacceptable d'en perdre via cette opération. C'est pourquoi il n'autorisera votre position à se retrouver en perte que jusqu'à l'équivalent de votre apport.

Je m'explique via un exemple : si vous avez mis 1.000€ et demandez un levier 5x vous vous retrouverez à jouer avec 5.000€. Si votre position atteint les -1.000€ (de pertes), les prochaines pertes se feront sur le prêt qui vous a été accordé. Mais l'exchange ne tolère pas cela, il fermera donc votre position et ressortira sans aucune perte. Vous par contre, vous aurez été liquidé et vous aurez tout perdu.

Sur BitMEX il est impossible d'avoir un solde négative. Ne vous inquiétez pas, vous ne serez jamais endetté vis à vis de l'exchange.

Il est facile de connaître son pourcentage autorisé de perte. Divisez 100 par le levier choisi, dans le cas du levier 5 cela revient à 100/5=20 soit -20% autorisé.

Le prix d'activation de la liquidation ne correspond pas au calcul que vous pourriez en faire. En effet, afin de se protéger du slippage (glissement du prix entre le moment où l'ordre au marché est passé et son activation retardée dû à un volume unilatéral qui explose) lors des cascades de liquidations, BitMEX active la liquidation de votre position avant que vous ne soyez réellement liquidé. Ceci implique que la plateforme va automatiquement clôturer la position en question et prendre ce qu'il reste, c'est la Maintenance Margin.

Raison de plus d'éviter les leviers élevés, en effet la Maintenance Margin correspond à un pourcentage de votre position totale, levier inclus ! Si vous vous trouvez en levier 50x vous ne serez pas liquidé en étant à -2% de votre position mais plutôt aux alentours de -1.5%. En levier x100 vous serez liquidé vers -0.5% au lieu de -1% !

Mark Price

Les utilisateurs sont autorisés à multiplier par 100 leur capital. Un problème se pose alors. Le prix peut se montrer extrêmement volatile.

Vous aurez l'occasion d'apercevoir des mouvements de prix dépassants largement les autres exchanges. Cela peut être causé par des manipulations, des manques de liquidités ou des phases de FOMO trop importantes.

Afin d'éviter des liquidations inutiles, BitMEX a choisi de placer leur activation non pas sur le Last Price (prix du dernier échange ayant eu lieu) mais sur un indice externe, le Mark Price.

Celui-ci est basé sur l'Index Price (prix de l'actif en question sur d'autres exchanges) à quoi s'additionne des frais de financement.

Le Mark Price est visible de base sous forme de ligne dans la fenêtre qui affiche les cours.

Les cascades de liquidations

Un autre problème se pose dans ce système aux leviers faciles. Lorsqu'une position d'achat arrive à liquidation, BitMEX oblige la position à faire une vente au marché pour récupérer sa part (ou un achat au marché pour un short liquidé). Dans une situation avec des leviers élevés faciles d'accès, ces rachats peuvent faire baisser le prix de quelques points, ce qui peut entraîner une autre liquidation pour un autre utilisateur. Celui-ci est alors contraint de faire une vente au marché, qui fait rebaisser le prix, qui entraîne d'autres liquidations... vous avez compris.

BitMEX est régulièrement sujet à ce genre de problématiques. Vous pourrez observer le cours exploser à la hausse comme à la baisse. Non pas par une pression des spéculateurs mais parfois simplement par des liquidations qui se suivent les une les autres. Une cascade de liquidations en quelque sorte.

Dans ces moment là, la plateforme est prise d'assaut par les spéculateurs qui tentent à tout prix de sortir de leurs positions ou d'entrer dans le mouvement par FOMO. Les serveurs de BitMEX sont saturés et il vous sera difficile de placer un ordre. Dans ce type de situation, il arrive que le prix saute votre Stop Limit si vous en aviez placer un (à cause du slippage). C'est pourquoi il est recommandé de toujours placer des Stop Market, même si cela implique de devoir payer des frais.

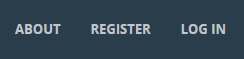

4. S’inscrire sur BitMEX

Commencez par vous rendre sur : BitMEX

→ Ouvrez un compte sur BitMEX

Cliquez sur Register en haut à droite de l'écran.

Complétez les champs qui s'affichent et cliquez sur "I accept the Terms of Service".

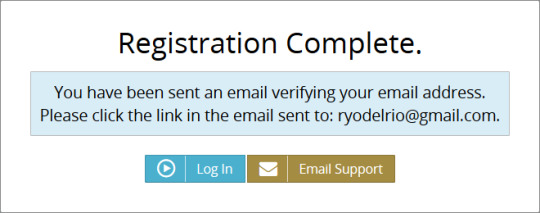

Vous allez recevoir un e-mail sur l'adresse que vous avez indiqué pour créer votre compte. Vous n'avez plus qu'à le valider sur votre boîte mail.

💡 Si vous ne recevez pas l'e-mail, pensez à vérifier vos spams (courriers indésirables) !

Bien joué votre compte est créé Avant de l'approvisionner en bitcoins, il est nécessaire de le sécuriser !

5. Sécuriser son compte (2FA)

Quel est le principe du double facteur ? (2 Factor Authentification)

Ajouter une couche de sécurité en plus de votre mot de passe. Au lieu de vous connecter à votre compte uniquement grâce au mot de passe, la connexion nécessitera deux facteurs : le mot de passe en premier lieu, puis un code unique et temporaire généré par une application sur votre smartphone. Vous n'êtes pas sans savoir que les mots de passes ne sont pas imparables. Etant donné que vous avez une partie de votre capital stockée sur votre compte, il est très important de configurer votre 2FA.

L'application la plus utilisée est Google Authentificator. Vous la trouverez sur iOS et Android. Un smartphone ou une tablette est donc nécessaire.

(Logo de l’application Google Authenticator)

L'application est installée ? Parfait. Maintenant configurons la pour votre compte BitMEX.

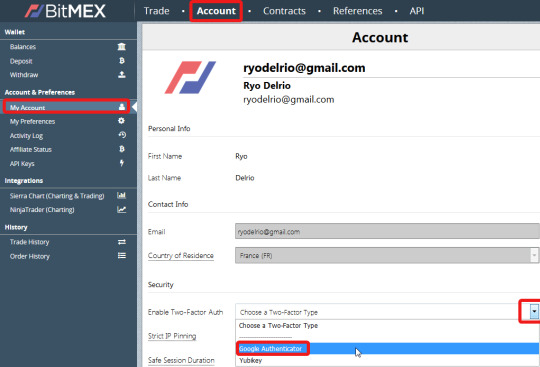

En premier lieu, cliquez sur Account en haut de l'écran. Dans le volet de gauche, cliquez sur My Account. Enfin, sous Security, sélectionnez Google Authentificator dans le menu déroulant.

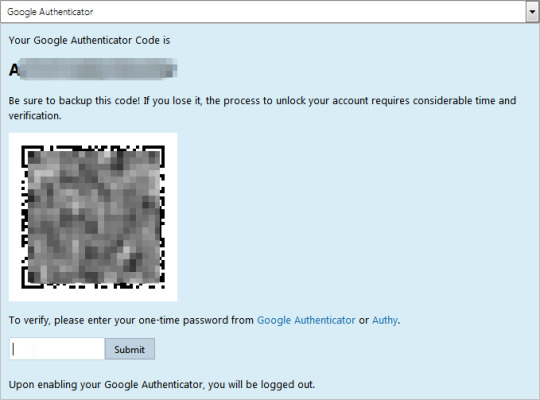

⚠️ Notez bien le code qui s'affiche et gardez-le précieusement en lieu sûr. Ce code secret vous sera nécessaire pour accéder à votre compte si vous perdez votre smartphone et donc votre accès à Google Authenticator.

Vous pouvez maintenant ouvrir votre application Google Authenticator et cliquer sur le petit ➕ afin de scanner le QR code de BitMEX. Voilà, votre code 2FA (double authentification) apparaît désormais sur votre application. Vous devez renseigner le code 2FA que vous affiche votre application dans la case prévue à cet effet puis cliquer sur Submit pour finaliser l’activation.

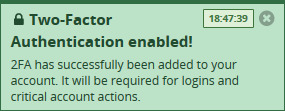

Félicitations 🎉 Votre compte est désormais sécurisé avec la double authentification. Le code généré par l’application vous sera demandé à chaque tentative de connexion à votre compte BitMEX.

Nous pouvons déjà passer à l'étape suivante qui est de créditer votre compte avec du BTC.

💡 BitMEX vous indique que votre code 2FA est erroné quand vous essayez de vous connecter à votre compte ? Vérifiez que votre téléphone soit à l’heure ! Si ce n'est pas le cas, le code affiché ne sera pas le bon et vous ne pourrez pas vous connecter.

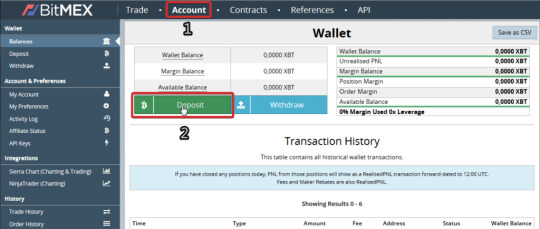

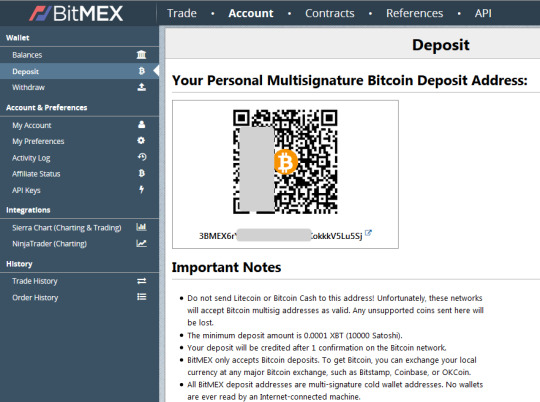

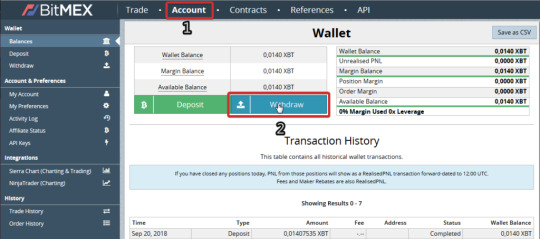

6. Faire un dépôt sur BitMEX

Sur BitMEX il est impossible d'acheter de cryptos par CB ou virement bancaire. Vous devez déjà posséder des BTC afin de les envoyer sur la plate-forme.

Si vous n'en possédez pas encore il vous sera nécessaire d'en acheter sur une plate-forme le permettant. Nous vous conseillons d'utiliser Coinbase ou Kraken.

Après vous être connecté, cliquez sur Account puis sur Deposit.

Vous devez alors envoyer vos BTC en copiant l'adresse qui s'affiche ou en scannant le QR code.

⚠ Important : Ne déposez que des BTC sur cette adresse !

Le dépôt minimum est de 0.0001 BTC (soit 10000 satoshis).

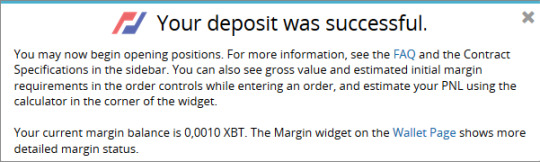

Il ne vous reste plus qu'à patienter jusqu'à la réception de vos bitcoins. Vous recevrez une notification par mail "Deposit Confirmed" lorsque ce sera fait ainsi qu'un message sur BitMEX comme ci-dessous.

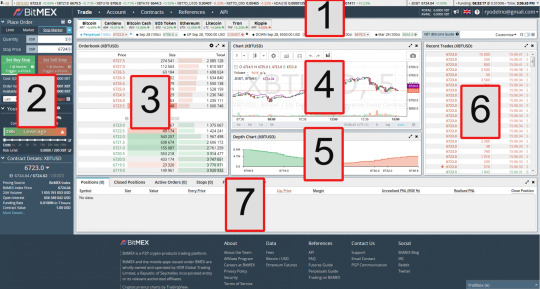

7. Interface du site

L'interface du site peut vous paraître complexe de prime abord. Ne vous en faites pas. Je vais tout vous expliquer dans la suite det article.

① Barre d'onglets

Sur la zone blanche tout en haut :

Vous avez un résumé des prix et des évolutions de prix sur 24h des différents contrats proposés par BitMEX. En passant la souris sur All vous pouvez choisir ce que vous souhaitez afficher dans cette ligne. En cliquant sur le contrat vous y serez redirigé.

Plus à droite vous avez .BXBT. Il s'agit de l'index de prix de la crypto sur laquelle vous êtes (XBT dans notre cas, qui représente le bitcoin sur BitMEX). C'est le principal composant du Mark Price, prix qui sera utilisé pour activer les liquidations.

Tout à droite vous trouverez Funding suivi d'un compteur et d'un pourcentage. C'est la durée avant que des frais ne soient prélevés sur vos positions ouvertes ainsi que le pourcentage appliqué aux positions long. Notez que sur un contrat future il sera affiché Settlement suivi de la date d'expiration du contrat (fermeture automatique de la position).

En dessous de cette zone blanche vous trouverez les 5 principaux onglets du site :

Trade vous emmenant sur la page principale, celle pour pouvoir trader.

Account pour un accès aux retraits, dépôts et historique de votre compte.

Contract vous donnant toutes les informations possibles sur les contrats du site.

References pour trouver divers guides et informations.

API qui vous permet de configurer un accès à votre compte depuis un tiers (à éviter pour un débutant)

Liste des cryptos :

Vous trouverez ici un accès aux différentes crypto-monnaies proposées par BitMEX. Il est recommandé de rester sur le Bitcoin, actif ayant le plus de liquidité et donc le plus de fluidité.

Sous chacune des cryptomonnaies vous trouverez les contrats qui lui sont relatifs : les Perpetual Swaps (sans limite de temps mais soumis au Funding), Contrats Futures (à échéance) et Options Binaires (Bitcoin uniquement et sans leviers). Il est recommandé de rester sur celui le plus à gauche. Il s'agit de celui le plus utilisé et donc du plus liquide. Il est le plus proche des prix réels.

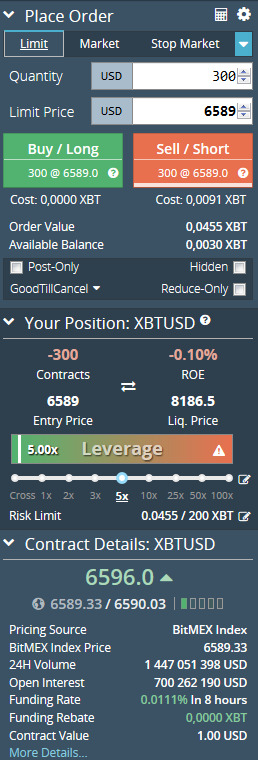

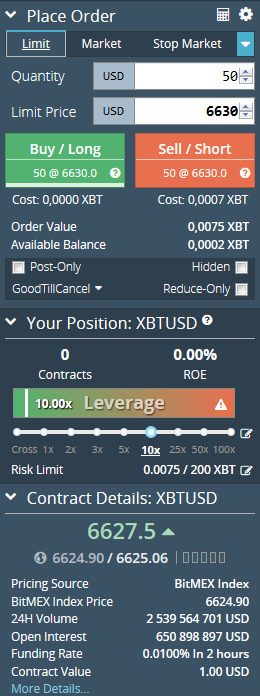

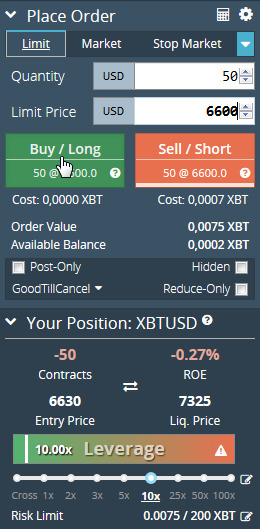

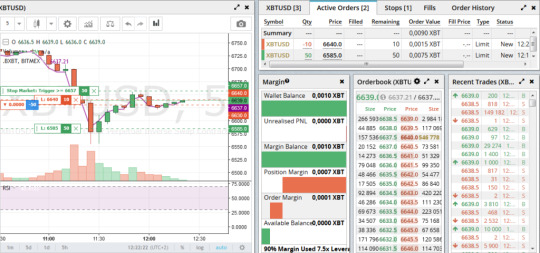

② Fenêtre de passage d'ordre

Place Order :

C'est ici que vous pourrez créer un ordre pour un achat ou une vente.

En plus des leviers, Bitmex vous permet de short (prendre une vente à découvert) et de mettre des stop loss.

Vous trouvez 3 options en haut de la fenêtre : Limit, Market et Stop Market. Vous trouverez également d'autres types d'ordres en cliquant sur la flèche bleue. Il n'est pas nécessaire de les utiliser, vous pouvez tout à fait vous satisfaire des trois ordres principaux. Le premier permet de poser un ordre à un prix fixe. Le deuxième d'acheter au meilleur prix instantanément. Le dernier de déclencher un buy/sell market si la valeur du contrat dépasse une limite définie, à la hausse ou à la baisse.

⚠ Pensez à toujours placer un Stop Market par mesure de sécurité.

Juste au dessus de Stop Market se trouve une calculatrice. Elle vous permettra de calculer votre ratio gain/perte, trouver un prix correspondant à un pourcentage et surtout de connaître à l'avance votre prix de liquidation.

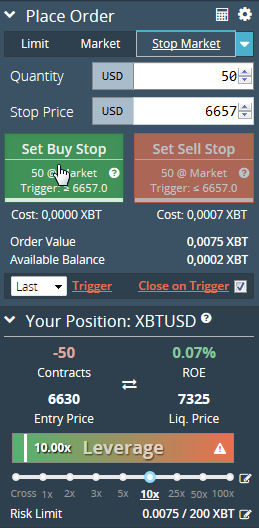

La zone Quantity ne représente pas forcément la valeur d'un coin mais la valeur inscrite tout en bas de la fenêtre dans Contract Value. Pour XBTUSD cela représente 1$.

La zone Cost est très importante, elle indique combien de XBT la position va vous coûter. Order Value représente le "Cost" multiplié par le levier.

Dans cet exemple, Cost dépasse Available Balance. Je ne peux donc pas placer cet ordre car je n'ai pas assez de XBT disponible.

Je ne détaillerai pas les 4 options (que l'on retrouve en dessous de Available Balance) dans cet article.

Your position :

Votre nombre de contrats s'affiche ainsi que votre retour sur investissement immédiat.

Au milieu de la fenêtre vous trouverez la zone Leverage. C'est là que vous pourrez choisir un multiplicateur sur votre position. Il peut aller de 1 à 100 sur XBT et vous pouvez le customiser en cliquant à droite de 100x.

⚠ Ne laissez pas le curseur sur Cross. Cela signifie que la position en cours est autorisée à piocher dans votre portefeuille jusqu'à le vider pour ne pas être liquidée. Cela sous entend que vous pourriez perdre tout le solde de votre compte sur un seul mauvais trade. Restez toujours en Isolated Margin. Autre point crucial, n'abusez pas des leviers. Un levier 10x est largement suffisant pour bénéficier des avantages de BitMEX.

Contract details :

Dans la zone la plus en bas, vous trouverez les détails sur le contrat : prix, Index Price, volume échangé, et surtout les frais à payer et la valeur d'un contrat.

Les frais affichés concernent les positions long. Si ce nombre est positif, les longs devront payer des frais et les shorts seront rémunérés.

Si Funding Rate passe en négatif, les rôles seront inversés.

Vous pourrez observer 5 cases à droite du Mark Price. Il s'agit de votre ordre dans la liste des liquidations automatiques dans le cas où BitMEX se retrouve en manque de liquidité. Pas de quoi paniquer, cela ne risque pas d'arriver avant un bon moment, BitMEX étant largement en gain.

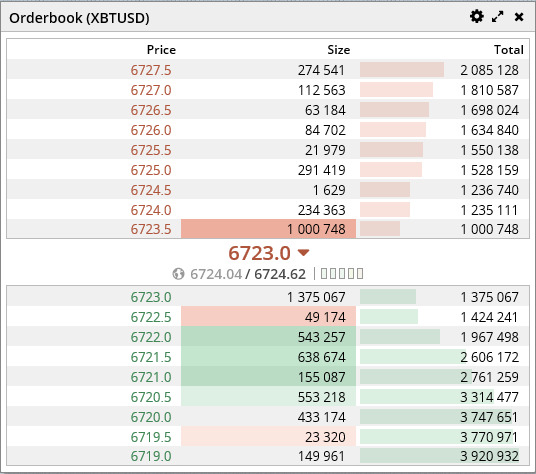

③ Order book

Il est des plus classiques. L'order book permet d'afficher les différents ordres en attente sur le marché : ordres d'achats et ordres de ventes avec la quantité et le prix. Ne vous y fier pas trop, l'order book est souvent utilisé pour influencer les spéculateurs. Il est par exemple commun d'y voir apparaître des walls pour faire croire aux investisseurs qu'il y a de fortes pressions sur les prix.

En cliquant sur la roue crantée en haut à droite vous trouverez deux options utiles. Tout d'abord vous avez la possibilité de grouper les ordres afin de rendre l'order book plus lisible. Autre option intéressante, vous pouvez cliquer sur Alert on liquidation pour être notifié lors des liquidations de vos compères, pratique pour ne pas rater les mouvements de panique.

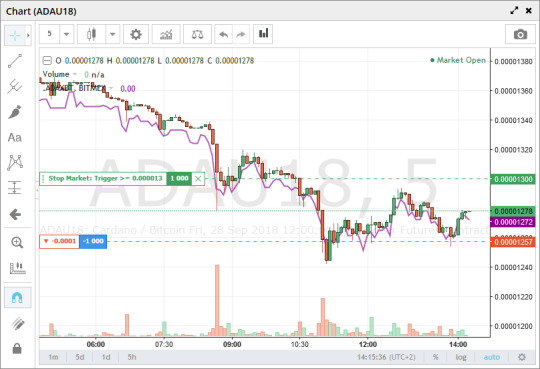

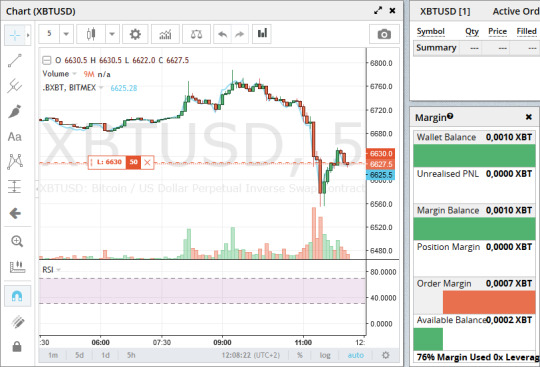

④ Chart

Ici du grand classique. Vous trouverez un affichage des prix en bougies (configuré de base en Unité de Temps 5 minutes) utilisable comme sur TradingView.

Le graphique affiche vos points d'entrée ainsi que vos ordres, limit comme stop. Très pratique pour se représenter visuellement sa gestion du risque.

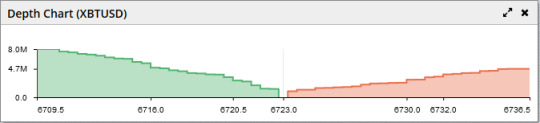

⑤ Depth Chart

Affiche une représentation visuelle de l'order book. Un ordre fait monter la courbe selon la quantité de contrats qu'il représente.

⑥ Recent Trades

Vous permet de voir les derniers échanges ayant eu lieu sur le contrat actuel. Utile pour respérer des mouvements de panique et voir si les achats au marché se font à la hausse ou à la baisse.

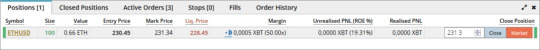

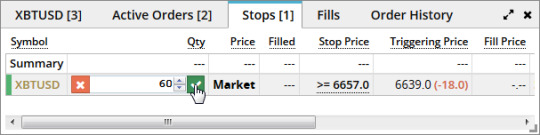

⑦ Positions

Vous affiche un récapitulatif de vos positions : positions ouvertes, positions fermées, ordres en cours, stop loss, ordres ayant abouti, historique de vos ordres.

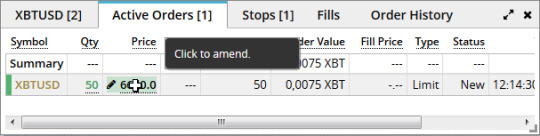

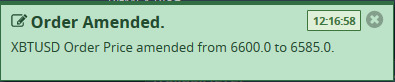

A savoir que dans les onglets Active Orders et Stops vous pouvez cliquer sur la quantité de contrats ou sur le prix de déclenchement pour le modifier facilement sans avoir à supprimer l’ordre puis le recréer.

Autre atout, vous pouvez cliquer sur le +฿ pour ajouter une partie de votre portefeuille à vos positions. Cela aura pour effet d'éloigner le prix de liquidation.

Lorsqu'une position est ouverte, elle affiche vos gains/pertes en se basant sur le Mark Price. Si vous passez la souris dessus, vous pourrez voir vos gains/pertes si vous vendez immédiatement en market.

Dans l'affichage avancé, la fenêtre Positions se divise en deux fenêtres (Positions et Open Orders).

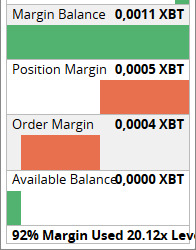

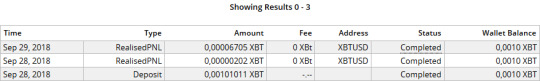

Une fenêtre très utile : Margin

Margin vous permet d'avoir un visuel complet et en direct de votre portefeuille. Élément indispensable pour prendre en main BitMEX facilement.

Pour y avoir accès vous pouvez cliquer sur l'onglet Account. Ou alors (ce que je recommande) cliquer sur le bouton à droite de Customize, tout en haut à droite de l'écran pour passer en affichage avancé.

Ceci fait, vous pouvez alors réagencer chaque fenêtre de BitMEX, les agrandir, les écraser, les déplacer, de manière à avoir l'expérience la plus ergonomique possible du site. Vous pouvez cliquer sur Customize pour sélectionner quelles fenêtres vous voulez faire apparaître ou disparaître. Veillez à ce que les options Price chart, Open orders, Positions et Margin soient cochées.

💡 Sur BitMEX votre portefeuille se compte en XBT (BTC) et non pas en dollars

Voici comment se décompose cette fenêtre :

Wallet Balance : Vous indique votre solde, votre portefeuille, sans compter les variations des positions ouvertes.

Unrealised PNL : Vous renseigne sur les résultats en cours sur vos positions ouvertes (PNL = Profit aNd Loss, gains et pertes). S'additionnera à Wallet Balance lors de la fermeture des positions.

Margin Balance : Accumulation des deux lignes précédentes. C'est la valeur actuelle de votre portefeuille, la somme qui peut être perdue avant une liquidation totale. Elle se décompose dans les trois lignes en-dessous.

Position Margin : Correspond à vos positions ouvertes.

Order Margin : Correspond à vos ordres en attente.

Available Balance : La part de votre compte encore disponible pour ouvrir des positions et placer des ordres.

Margin Used : Ici vous trouverez une information très utile, le pourcentage de votre portefeuille utilisé, cela compte les positions ouvertes comme les ordres posés.

💡 Choisissez de préférence un mot de passe long, complexe et dédié uniquement à BitMEX. Évitez de prendre un risque inutile concernant la sécurité informatique, surtout quand votre argent est en jeu.

8. Ouvrir et gérer une position sur BitMEX

Vous venez de créer, sécuriser et remplir votre compte. Il est maintenant temps de s'intéresser à la prise et à la gestion d'une position avec un exemple.

Pour commencer, assurez-vous d'être sur la page principale de BitMEX : Trade.

Afin d'ouvrir une position, rendez-vous dans la fenêtre de passage d'ordre, à gauche de l'écran.

Placez vous en Limit. Entrez le nombre de contrats que vous souhaitez trader et à quel prix vous les voulez. Le prix d'un contrat est indiqué en bas dans Contract Value, ici il est de 1 dollar.

Placez le levier que vous voulez utiliser et assurez-vous que la ligne Cost soit inférieure à la ligne Available Balance. Sur l'image ci-dessus ce n'est pas le cas, vous pouvez alors diminuer la quantité de contrats, augmenter le levier ou supprimer des ordres en attente afin d'avoir les XBT nécessaires.

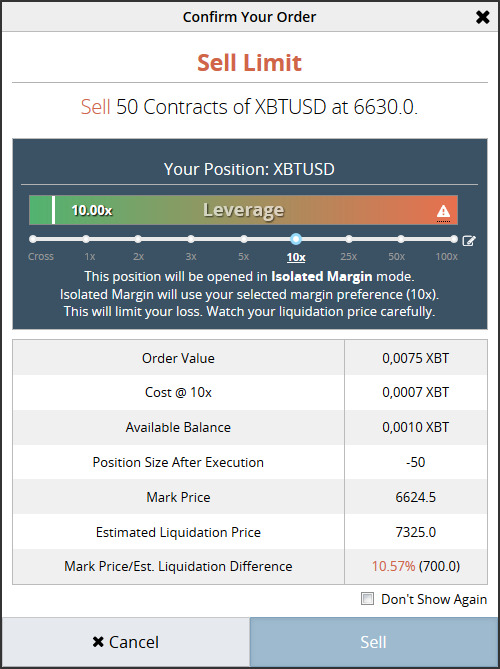

Dans mon exemple je veux prendre une position short de 50 contrats à 6630 en levier 10x.

En cliquant sur Short apparaît une fenêtre récapitulative de l'ordre. Vérifiez bien qu'elle vous convient. Elle vous renseigne également sur le prix où votre position sera liquidée.

Ceci fait, vous distinguerez qu'une ligne apparaît sur le Chart là où se trouve votre ordre et que dans la fenêtre Margin une partie de la Available Balance s'est déplacée dans Order Margin. Vous pouvez annuler l'ordre tout simplement en cliquant sur la croix de la ligne le représentant dans la fenêtre Chart.

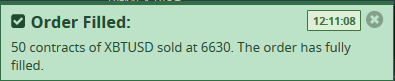

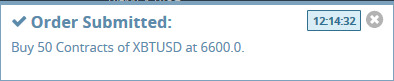

Lorsque le prix atteindra votre ordre vous verrez apparaître une pop-up verte caractéristique d'un ordre complété.

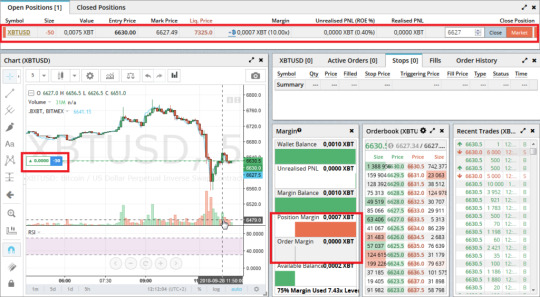

Ceci fait, vous pourrez distinguer quelques différences. Dans Margin, l'Order Margin s'est déplacé dans Position Margin. La ligne dans le Chart ne peut plus être annulée et une position est apparue dans la fenêtre Open Positions.

L'ordre étant placé, je dois maintenant m'occuper de mon Stop Loss.

Retournez dans la fenêtre de passage d'ordre et cliquez sur l'onglet Stop Market. Placez un ordre équivalent au nombre de contrats que contient votre position ouverte (50 dans l'exemple) et le prix auquel vous souhaitez déclencher le Stop. Vous pouvez alors cliquer pour placer le stop. Assurez-vous qu'il va à l'encontre de votre position (étant en short nous plaçons donc un buy afin de faire un rachat de notre position en cas de danger).

💡 Placez toujours un Stop Loss sur vos positions. Cela est déjà très important sur les exchanges classiques mais devient indispensable avec l'utilisation de leviers. Placez le Stop une fois que votre ordre a été complété. Si vous le placez avant il est possible que le prix aille à sa rencontre avant de déclencher votre Limit, vous mettant dans une situation problématique...

Maintenant que nous sommes protégés d'un retournement malencontreux des cours, il est temps de placer son Take Profit. Pour cela un Limit Buy suffira car nous souhaitons racheter nos contrats. Ici, j'ouvre un ordre d'achat de 50 contrats si le prix atteint 6600.