#.4 eth to dollars

Explore tagged Tumblr posts

Text

A Primer for Beginners in Cryptocurrency

Cryptocurrency has taken the financial world by storm, a phenomenon held in equal parts awe and scepticism. What is cryptocurrency, and why should beginners care? This guide will answer all these questions and provide a true definition of cryptocurrency, for the uninitiated.

What is Cryptocurrency?

At its most basic, cryptocurrency is any type of digital or virtual currency that uses cryptography for security. Cryptocurrencies — which are not issued by a central government (like the US dollar or Euro), operate on networks known as blockchains. This decentralization means that it is not owned by a single entity, like the central bank of each country.

How Does Cryptocurrency Work?

Decentralization, Transparency and Immutability are the killer features of blockchain technology which is being utilized by cryptocurrencies. A blockchain is a distributed ledger that keeps track of all transactions across a network of computers. When a block of transactions is added to the blockchain, it means that every new transaction in completion (e.g., money moving from one account to another) makes an update on all ledgers for their users.

The opaque and unreliable centralized system is avoided, allowing the data to be secure (distributed AND only YOU hold access), prompt & transparent. Bitcoin, the first and most famous cryptocurrency is a case in point: Bitcoin uses blockchain technology to enable peer-to-peer transactions without an intermediary (like a bank).

Popular Cryptocurrencies

Bitcoin, is the best-known cryptocurrency and there are thousands of other cryptocurrencies with various uses and functionality. Here are a few notable ones:

Ethereum (ETH): Ethereum is a decentralized platform that runs smart contracts (like dApps) on its platform.

Ripple (XRP): While Ripple is designed as a digital payment protocol, it still serves the same use case of enabling instant and cheap across borders.

Litecoin (LTC): Often dubbed as silver to Bitcoin's gold, Litecoin has faster transaction confirmation times.

Why Invest in Cryptocurrency?

There are few reasons for which a realization of benefits can seem attractive in investing this digital currency.

High upside: Cryptocurrencies can also gain value by huge percentages. For example, the early investors of Bitcoin and Ethereum are currently smiling to their bank-account.

2. Diversification: Cryptocurrencies can be added to an investment portfolio in order to diversify it thereby decreasing the risk.

3. Innovation and Technology: Investing in cryptocurrencies is an investment into the underlying blockchain technology, a revolutionary tool with many uses beyond digital currencies.

Risks and Considerations

But of course, as with all investment opportunities there are risks when it comes to digital currencies:

Volatility: Cryptocurrency is known for its price volatility; prices fluctuate rapidly and dramatically.

Regulatory Risks: The regulatory backdrop for cryptocurrencies is definitely a work in progress and future regulations may affect the value of these digital currencies as well as how they can be used.

Security Risks: The blockchain is secure, the platform and exchange on which cryptocurrencies are stored can be hacked.

How to Start with Cryptocurrency

There are some guidelines to help beginners who want to start investing in cryptocurrency.

Do your homework — It is important to be familiar with what you are investing; important to know what you're putting your money into, services like Coursera and NerdWallet provide thorough lessons on cryptocurrency.

Pick a Secure Exchange: Go for the most secure cryptocurrency exchange to purchase and offer cryptos Common exchanges such as Coinbase, Binance and Kraken.

Protect your investments: Store cryptocurrencies in secure wallets. Online wallets are less secure whereas hardware wallets provide advanced security to store.NEO.

4. Start Small — With all the volatility in this market, it would also be prudent to instead make a small investment and then scale into your position from there as you get more comfortable with these markets.

Conclusion

Cryptocurrency is a titanic heavy weight knocking the financial industry off its axis; it opens new doors for wealth and disaster as well. These are the basics of cryptocurrency that beginners need to understand and with a responsible, well-informed entering into it can lead them being successful. successful investment. Besides, due-diligence and strategic thinking at every stage are defining factors for anyone who wants to dive into the roller-coaster world of crypto-investing.

6 notes

·

View notes

Text

Base: activity in Mainnet. Free NFTs on Base.

Base is a secure, inexpensive and user-friendly tool for Ethereum L2 developers that was created to attract users to web3. It’s worth mentioning that Base is built as an MIT OP Stack in collaboration with Optimism. And as stated by the Base team, they specifically joined Core Dev working on the OP Stack to make it publicly available to everyone.

According to the developers, Base is the easiest way for decentralized applications to use the products and distribution of Coinbase, which has over 110 million users with over $80 billion in assets in the Coinbase ecosystem, thereby once again putting an emphasis on scalability.

For almost six months, there has been a testnet. Activity in which was steadily covered in our airdrops section, and recently the project team announced the launch of Mainnet.

Preparation

To interact with the network, you will need to add it to our wallet. If you have already done this, you can skip this point.

Go to the site, connect the wallet and click Add to Metamask:

Preparation

Next, you will need to transfer funds. To do this, you can use both the official bridge and third-party ones. Each of these methods has its pros and cons.

Official Bridge

According to the crypto-community, this method is the most reliable and correct, but the deposit can only be made from the Ethereum Mainnet.

Go to the site and connect the wallet.

Enter the desired amount, click Deposit ETH and confirm the transaction:

Official Bridge

Stargate Bridge

Using this protocol has several pluses, namely: additional activity in LayerZero and the ability to make a transfer from the L2 network.

Go to the site and connect the wallet.

Choose the network from which we will transfer, for example, Optimism. Enter the desired amount, click Transfer and confirm the transaction:

Stargate Bridge

Orbiter Bridge

Another cross-chain protocol from which users expect a drop.

Go to the site and connect the wallet.

Choose the network from which we will transfer. You can choose L1 or any L2 and Base. Enter the desired amount, click Send and confirm the transaction:

Orbiter Bridge

Note: you don’t have to focus on one bridge. You can combine them, thereby hitting multiple protocols. For example, deposit funds using Stargate and withdraw via Orbiter.

Interacting with DeFi

Focusing on the criteria of past airdrops from similar L2, we can assume that this item is one of the main ones. It is desirable not only to make swaps of a couple of dollars, but also to gain the volume of transactions.

In the guide we will touch only a part of the protocols deployed on Base. A more extensive list can be found on DefiLlama. But always keep DYOR in mind.

SushiSwap

Go to the site and connect the wallet. If another network is selected, switch it to the right one:

Interact with SushiSwap. Step 1

Choose tokens for exchange. Enter the desired amount, click Swap and confirm the transaction:

Interact with SushiSwap. Step 2

Go to the Pools tab and select the Base network:

Interact with SushiSwap. Step 3

Select a token pair and click on it. Next Create position:

Interact with SushiSwap. Step 4

Click Full Range and add funds to the pool as shown in the screenshot:

Interact with SushiSwap. Step 5

You can find your position on the My Positions section. To withdraw liquidity, click on it. Then select the Remove tab. Specify the amount of funds you want to withdraw, click Remove and confirm the transaction:

Interact with SushiSwap. Step 6

Maverick

Go to the website and connect the wallet.

Choose tokens to exchange and make the exchange:

Interact with Maverick. Step 2

Next, open the Pools tab, select the desired pair and click on it:

Interact with Maverick. Step 3

Click Next. Select a mod (you can use Static) and click Next again. Enter the desired amount and confirm the addition of liquidity as shown in the screenshot:

Interact with Maverick. Step 4

You can find your position on the Portfolio tab. To close it, click Manage and then Remove. Select Select All and confirm the withdrawal of assets:

Interact with Maverick. Step 5

Aave

A borrowing protocol that allows you to borrow tokens against your cryptocurrency and also gives you the opportunity to lend your tokens at a small APR. In this article, let’s look at this particular mechanic.

Go to the site and connect the wallet.

Change the network to Base, if necessary, and click Supply:

Interact with Aave. Step 2

Enter the desired amount and confirm the addition by clicking Supply ETH:

Interact with Aave. Step 3

Withdraw assets by clicking Withdraw on the homepage.

Interacting with NFT

In this section, we will show you how to commit NFT to MintFun and provide you with a list of marketplaces that support Base.

MintFun

If you want to learn more about this marketplace and earn points for mint, you can visit our guide.

Go to the site, connect your wallet and select the Base network, as shown in the screenshot:

Interacting with MintFun. Step 1

Leaf through the page below, select your favorite collection and click on Mint Now:

Note: the site has both free and paid collections.

Interact with MintFun. Step 2

Choose the quantity of NFTs and confirm the mint.

NFTs can be sold and bought on the following marketplaces: OpenSea, Element, Zonic.

New Activity

Onchain Daily on Galxe

Go to Galxe and perform active tasks. To find out which activities you need to perform, click Detail:

Onchain Daily on Galxe. Step 1

In this task, you need to mint the NFT on the site:

Onchain Daily on Galxe. Step 2

Perform other tasks by analogy and watch for new ones:

Onchain Daily on Galxe. Step 3

Mint NFT

Go to Zora’s site and mint the memorable NFT:Mint a commemorative NFT on Zora

Note: mint deadline is March 1, 2024 at 22:00 (Kiev).

Getting Roles in Discord

The project has an extensive list of roles in Discord. You can get them with the help of Guild for various tasks. What actions you need to perform to get this or that role is described in detail on the portal itself.

Go to the Discord of the project and pass verification.

Open the site, connect to the portal using the wallet and social networks:

Next, look at the available roles and get the desired ones by performing this or that action.

Note: if you’ve been interacting with the Base network for a long time, some roles will count automatically.

After execution, return to the Discord of the project. Open the rolles branch, click Join BaseGuild to verify and get roles:

Base Onchain Summer

The project team has launched Onchain Summer campaign. The activity involves completing quests to accumulate points, which can later be spent in the Shop tab on merch. Predominantly the quests consist of minting various NFTs, the average price of which at the time of writing is around $2.5 in ETH.

There have been no official announcements about this or that prize pool in dollar equivalent. At the time of writing, the only confirmed rewards are merch. The store will launch in July, but it is not yet known how many points are needed to convert into physical merchandise. Do your own research and consider all risks because the costs are substantial.

Despite this, the campaign is official and the possibility of additional announcements cannot be ruled out. So for those who are active in Base with an eye on drops, it may be worth it to accumulate a few levels with risk management in mind.

Follow the link and connect Coinbase Wallet.

Choose a quest from the proposed categories and perform it according to the instructions on the site:

Note: verification of completion and crediting of points may be delayed.

Conclusion

The network has entered Mainnet relatively recently, but already has an extensive infrastructure that simply cannot be covered in one guide. If you are interested in this blockchain, the best solution is to explore and interact with different dApps yourself. This will multiply your chances of a drop if the project team decides to make one.

Highlights:

Blockchain has an extensive infrastructure.

You need to be active periodically.

You don’t need to perform all the above activities at once. The best solution is to stretch the walkthrough over several days.

It is important to rack up not only the number of transactions but also the volume of transactions.

2 notes

·

View notes

Text

The SEC Approves Ethereum ETFs: A New Era for Institutional Adoption

The U.S. Securities and Exchange Commission (SEC) has recently approved the first batch of spot Ethereum (ETH) ETFs, marking a pivotal moment for Ethereum and the broader cryptocurrency market. This approval is anticipated to usher in increased institutional adoption and liquidity, setting the stage for potentially significant price movements and technological advancements within the Ethereum ecosystem.

Key Implications of the ETF Approval

1. Institutional Adoption and Market Liquidity: The approval of Ethereum ETFs is a critical development that could lead to a surge in institutional investment. This influx of institutional funds is expected to enhance market liquidity, making Ethereum a more attractive asset for both retail and institutional investors. By allowing investors to gain exposure to Ethereum through regulated financial products, the ETFs reduce the barriers to entry and provide a more secure investment avenue.

2. Potential Price Surge: Market analysts predict a substantial increase in Ethereum's price due to the ETF approval. Standard Chartered analysts foresee Ethereum's price potentially doubling, reaching $4,000 or higher by the end of the year if the ETFs perform well and attract significant investment. This optimistic outlook is driven by the expectation that the ETFs will boost demand for Ethereum, thus driving up its price.

3. Technological Advancements: Alongside the regulatory advancements, Ethereum is also making strides in technological innovation. The implementation of roll-up technology and EIP-4844 are poised to significantly increase the network's transaction capacity and efficiency. These upgrades are crucial for maintaining Ethereum's competitiveness, especially as it faces stiff competition from other blockchains like Solana.

Trading Strategies for the Evolving Landscape

The approval of Ethereum ETFs presents new opportunities and strategies for traders and investors. Here are a few approaches to consider:

1. Volatility Management: Given the potential for increased volatility around the ETF approval dates, strategies such as dynamic hedging and dollar-cost averaging could be beneficial. These methods help manage risk and capitalize on price fluctuations.

2. Market Sentiment Analysis: Understanding and exploiting market sentiment is crucial, especially in a market influenced by speculation about institutional adoption and ETF approvals. Using tools like artificial intelligence and machine learning to analyze social media, news outlets, and other sources for sentiment indicators can provide valuable insights for trading decisions.

3. Contrarian Investing: Taking positions against the market consensus when sentiment analysis suggests extremes of optimism or pessimism can be a profitable strategy. This approach, often summarized as "buy the rumor, sell the fact," involves making trades based on anticipated market reactions to news events.

4. Timing Regulatory Decisions: Staying informed on regulatory developments is essential. Strategically timing trades around the expected decision dates for ETF approvals can help investors capitalize on market movements triggered by anticipation and reaction to such news.

The Path Forward for Ethereum

The approval of Ethereum ETFs is a monumental step forward, but it also underscores the ongoing challenges and opportunities within the Ethereum ecosystem. As Ethereum continues to evolve, addressing scalability, security, and privacy concerns will be crucial for sustaining its growth and adoption. The network's ability to navigate the competitive landscape, marked by rivals like Solana and Cardano, will play a significant role in shaping its future.

As we move through 2024, Ethereum stands on the brink of transformative growth. The convergence of regulatory advancements, technological upgrades, and increasing institutional interest sets the stage for Ethereum to solidify its position as a leader in the blockchain and decentralized finance space.

For those interested in the future of Ethereum and the broader cryptocurrency market, staying informed and adaptive to the rapidly changing landscape will be key to navigating this exciting new era.

By understanding the implications and opportunities presented by the approval of Ethereum ETFs, investors and enthusiasts can better position themselves to take advantage of this significant development in the cryptocurrency world.

#Ethereum#SECApproval#EthereumETFs#Cryptocurrency#InstitutionalAdoption#MarketLiquidity#PriceSurge#RollUpTechnology#EIP4844#Blockchain#DecentralizedFinance#EthereumPrice#CryptoTrading#FinancialMarkets#CryptoRegulation#Investment#CryptoInnovation#ETFApproval#EthereumUpgrades#SolanaCompetition#CryptoMarket#FinancialNews#EthereumInvestment#CryptoAdvancements#CryptoUpdates#bitcoin#financial education#financial empowerment#financial experts#digitalcurrency

3 notes

·

View notes

Text

Best Top 10 Cryptocurrency to Invest 2023

March 1, 2023 by Adil Ali

Ethereum is a revolutionary cryptocurrency that’s snappily gaining traction in the global request. Its smart contracts, dApps, interoperability, and brisk sale pets make it a seductive option for businesses and inventors likewise. As further people borrow Ethereum and its DeFi capabilities, the eventuality for the platform to transfigure the way we do deals and contracts continues to grow. also, updates similar to EIP- 1559 on the horizon pledge to make Ethereum indeed more important. With such a promising future, Ethereum looks to be a decreasingly feasible platform for digital deals.

1. Bitcoin (BTC)

Market Cap: $458 billion

Bitcoin is the first and most popular cryptocurrency, created in 2009 by an unknown person or group using the alias Satoshi Nakamoto. It operates on a decentralized tally called blockchain, which allows for secure, transparent, and tamper-resistant deals. Bitcoin is known for its high volatility and is frequently considered a store of value or digital gold.

2. Ethereum (ETH)

Market Cap: $216 billion

Ethereum is the alternate-largest cryptocurrency by request capitalization and was created in 2015 by Vitalik Buterin. Unlike Bitcoin, Ethereum is further than just a digital currency; it’s a decentralized platform that enables inventors to make and emplace decentralized operations( dApps) on its blockchain. The platform’s native currency is Ether( ETH), which is used to pay-for-sale freights and computational services on the Ethereum network.

3. Tether (USDT)

Market Cap: $66 billion

Tether is a stablecoin that was created to be pegged to the US bone at an 11 rate. It was launched in 2014 by Tether Limited and is used as a means of transferring finances between exchanges and trading cryptocurrency without having to convert back to edict currency. Tether is controversial, with some critics claiming that it isn’t completely backed by US bones

4. USD Coin (USDC)

Market Cap: $54 billion

USD Coin, established by the financial technology corporation Circle and the cryptocurrency exchange Coinbase, is a stable coin tied to the American dollar. It’s backing of USD and routine audit protocols guarantee the stability and clarity of its operation.

5. Binance Coin (BNB)

Market Cap: $52 billion

Established in 2017, Binance Coin is the crypto asset associated with the renowned Binance Exchange, one of the largest crypto trading platforms globally. This digital asset is utilized to pay for trade fees on the Binance Exchange, as well as to access reduced commission fees on the same exchange.

6. Ripple (XRP)

Market Cap: $18 billion

In 2012, Ripple Labs initiated the cryptocurrency known as Ripple. This global payment system enables instantaneous and dependable cross-border payments with the utilization of its blockchain technology. Financial institutions and payment providers can benefit from Ripple’s services.

7. Cardano (ADA)

Market Cap: $18 billion

Input Output Hong Kong (IOHK), a blockchain research and development company, created Cardano, a decentralized platform, in 2017. With a vision of tackling the scalability and security issues that have affected preceding blockchain networks, Cardano is a third-generation blockchain. The native currency of the platform, ADA, is employed to pay transaction fees and to involve oneself in the governance of the Cardano network. Save to documented

8. Binance USD (BUSD)

Market Cap: $18 billion

Binance USD, a fiat-pegged stablecoin developed by the renowned crypto exchange Binance, is constantly monitored to guarantee transparency and maintain full US dollar support. Its main purpose is to allow seamless transfers and trading of digital assets without the need for reverting to conventional money.

9. Solana (SOL)

Market Cap: $15 billion

Solana was founded in 2017 by Solana Labs, to create a blockchain platform with speedy transactions and minimal costs for decentralized applications. As a result, SOL is the cryptocurrency native to this platform, utilized for transaction fees and to join in the administration of the Solana network.

10. Polkadot (DOT)

Market Cap: $10 billion

The Web3 Foundation designed the Polkadot platform in 2016 to bring together different blockchains and allow for seamless interconnectivity. To guarantee high performance and scalability, Polkadot uses a specialized technique called sharding. The native currency of the network is DOT, which is utilized to pay for transaction costs and grant holders a say in Polkadot’s governance.

Conclusion:

Ultimately, while these crypto assets vary in attributes and functions, they all share the objective of furnishing a distributed and safe system of exchanging value. As the industry of cryptocurrency persists to advance, we can assume to witness more breakthroughs and novel applications emerge, generating a thrilling period for both financiers and consumers. It is crucial to complete comprehensive research and recognize the risks linked with investing in any cryptocurrency.

8 notes

·

View notes

Text

⭐ Bitcoin on February 18th 2023 🚀✨

The price as I'm writing this is $24,470 per btc.

youtube

Astro 🔮💫

Venus is approaching a conjunction to Bitcoin's moon in Aries starting today, then subsequently Jupiter (On March 2nd). This likely points to a boost in people's investments (especially the jupiter conjunction). The stock market is likely to rally as well. Venus rules money & investments.

Super positive for bitcoin 👍

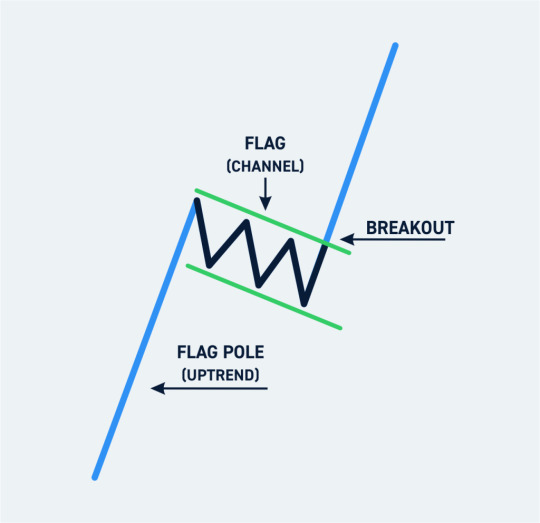

Cup & Handle Pattern:

- Invalidation vs. Breakout zones: $24,300 ❌ & $24,950 ✅

- Triple Bullish Scenario ♉♉♉

Cup Handle - 4h chart

Bull flag - 1h chart

W-pattern (2x-bottom) - 15m chart

-=-=-=-

1: 💹 Trends

Monthly, we are in a downtrend 📉.

Meaning, we can expect prices less than $17,000 Bitcoin in the next 12 months.

Weekly, we are in an uptrend 📈.

Meaning we can expect prices higher than $25,300 Bitcoin within the next 8 weeks

So long as we close Sunday above $23,900 btc (So far, ✅)

Daily, we are in an uptrend* 📈

IF we close the day above $24,300 BTC. (@ 7pm EST)

However yesterday, we have made lower highs than the 15th, when we retested $25,000. Which is bearish.

4h we are in a seeming downtrend. Marked by a distinct lower high in the chart. Simply one strong candle downwards on this timeframe is confirmation and We are looking horrendous for Bitcoins price over the next 3 days.

Right now, it seems we are in this ambiguous/pivotal energy like yesterday. So it's a time for relative inaction. Volume is eerie and low at the moment. Not much pressure from either the bull or the bears 😐

Hourly, we are in a downtrend 📉

Meaning we can expect prices lower than $24,300 bitcoin within the next day.

That is just the fact of the matter... Despite that we are forming a sort of distribution pattern known as a bull flag. A sort of last minute attempt to break the down trend. If that is validated, this could lead us powerfully to our next leg up. The measured move would lead us precisely to our next target: $26,250 dollar btc. ⚠️

The bull flag would be confirmed by any intraday closure above the "pole" of the flag: ~ 24,950. Usually by bullish candles with high volume

2: 🔮 Conclusion

I am in a small long position as of the bottom of the bullflag Entered at ~$24,480. I will add more once there is confirmation of a breakout. Placing my stop-loss price at the bottom of the flag (channel).

And taking some profits at $25K!

3: 💰 Current Portfolio

18.5% USDs (+8.65%)

17.15% BTC (-4%)

64.35% Alts (-4.65%)

In Alts [24% is ETH 🔵, 17% is BNB 🟡, Rest is a combination of ADA, LINK, LTC & SHIB]

That's all For now!

2 notes

·

View notes

Text

HKEX Set to Launch Bitcoin and Ethereum Virtual Asset Index Series on Nov 15

Key Points

Hong Kong Exchanges and Clearing Limited (HKEX) to launch Virtual Asset Index Series on November 15, 2024.

The index will serve as a benchmark for Bitcoin and Ethereum, providing unified reference prices.

Hong Kong Exchanges and Clearing Limited (HKEX) has revealed plans to introduce its Virtual Asset Index Series. This revolutionary move for digital assets in Asia is slated to commence on November 15, 2024.

The new series, as per the Monday, October 28 announcement, is designed to act as a comprehensive benchmark for Bitcoin (BTC) and Ethereum (ETH). Its purpose is to provide unified reference prices, addressing price discrepancies across global exchanges.

Boosting Hong Kong’s Position in Digital Finance

HKEX’s move is part of Hong Kong’s strategic plan to establish itself as a major digital assets hub in the Asia Pacific Region (APAC). HKEX is leading the charge to offer investors a robust, transparent tool for assessing market prices within the time zone.

The HKEX Virtual Asset Index Series is designed to create a real-time pricing framework that supports informed decision-making among investors in the digital asset space. The index will provide a 24-hour volume-weighted price for cryptocurrencies, including BTC and ETH, based on aggregate data from major virtual asset exchanges worldwide.

HKEX believes this unified price reference, denominated in US dollars, will provide investors with a consistent benchmark tailored to the fast-evolving crypto economy.

“We are excited to introduce the HKEX Virtual Asset Index Series to meet regional demand for this rapidly emerging asset class. By offering a transparent and reliable real-time benchmark, we aim to assist investors in making informed investment decisions, thereby supporting the healthy development of the virtual asset ecosystem and consolidating Hong Kong’s position as an international financial center,” stated Peter Chan, CEO of HKEX Group.

The new offering will also include a daily reference exchange rate, calculated at 4:00 pm Hong Kong time, to provide a standardized value for the settlement of financial products.

Meeting Global Regulatory Standards

HKEX has structured the Virtual Asset Index Series to comply with international regulatory standards, including the European Benchmark Regulation (BMR). To achieve this, the company has partnered with UK-based benchmark management firm and virtual asset data provider CCData.

Both companies will jointly manage and calculate the indices, ensuring the series aligns with rigorous standards of reliability and consistency.

This collaboration makes the index series the first of its kind in Hong Kong to adhere to such strict regulatory criteria. HKEX is confident that it is setting a precedent for transparency in Asia’s digital asset market with its forthcoming offerings.

HKEX has been providing a wide range of financial products, from stocks and derivatives to fixed-income instruments and commodities, as one of the world’s leading international exchange groups.

However, with this new offering, HKEX aims to further bridge the gap between the East and West markets, expanding access to a diverse variety of financial products and services for investors worldwide.

0 notes

Text

How to buy ETH ({tokenCode})

How to buy cryptocurrency on an exchange

Investing in ETH ({tokenCode}) has never been easier! Registering on an exchange, verifying your account, and paying by bank transfer, debit or credit card, with a secure cryptocurrency wallet, are the most widely accepted methods of acquiring cryptocurrencies. Below is a step-by-step guide on how to buy cryptocurrency on an exchange.

Step 1: Register OKX (click the link to register)

You can register by email or phone number, then set a password and complete the verification to pass the registration.

Step 2: Identity verification - Submit KYC information to verify your identity

Please verify your identity to ensure full compliance and enhance your experience with full identity verification. You can go to the identity verification page, fill in your country, upload your ID, and submit your selfie. You will receive a notification once your ID has been successfully verified, bind your bank card or credit card and start trading.

How to exchange USDT with a credit card and then convert it to ETH ({tokenCode})

Step 1: Click Buy Coins, first select your country , then click Card

Step 2: Click My Profile in the upper right corner

Step 3: Select Add Payment Method in the lower right corner and select a credit card that is suitable for you to fill in the information and bind, such as Wise, Visa, etc.

Step 4: Click P2P transaction again, select the corresponding payment method and choose the appropriate merchant to complete the transaction.

Step 5: After the transaction is completed, your amount will be converted into USDT (USDT is a stable currency of US dollar, pegged at 1:1 with US dollar) and stored in your account. Click on the transaction, search for ETH ({tokenCode}) and buy its tokens.

0 notes

Text

How to Diversify Your Cryptocurrency Portfolio for Maximum Returns

As the cryptocurrency market continues to grow, diversifying your investment portfolio has become crucial for managing risk and maximizing potential returns. With thousands of cryptocurrencies available, knowing how to effectively diversify can be challenging. In this blog, we'll explore strategies for building a well-diversified cryptocurrency portfolio that aligns with your investment goals.

Understanding Cryptocurrency Diversification

What is Diversification? Diversification is an investment strategy that involves spreading your investments across various assets to reduce risk. In the context of cryptocurrency, this means investing in a mix of different cryptocurrencies, tokens, and blockchain projects.

Why Diversify Your Cryptocurrency Portfolio?

Risk Management: The cryptocurrency market is highly volatile. Diversifying your portfolio can help mitigate the impact of price fluctuations on your overall investment.

Exposure to Growth Opportunities: Different cryptocurrencies have unique growth potentials. Diversifying allows you to capitalize on the success of multiple projects rather than relying on a single asset.

Mitigating Losses: If one cryptocurrency underperforms, gains from other investments in your portfolio can help offset those losses, leading to more stable returns.

Strategies for Diversifying Your Cryptocurrency Portfolio

1. Invest in Different Types of Cryptocurrencies

Large-Cap Cryptocurrencies: These are well-established cryptocurrencies with large market capitalizations, such as Bitcoin (BTC) and Ethereum (ETH). They tend to be more stable and less volatile than smaller coins.

Mid-Cap and Small-Cap Cryptocurrencies: Investing in these can provide higher growth potential, although they come with increased risk. Research promising projects to identify potential winners.

Stablecoins: Stablecoins are pegged to traditional currencies (like the US Dollar) and provide stability in a volatile market. Including stablecoins in your portfolio can help balance risk and provide liquidity.

2. Explore Different Sectors and Use Cases Cryptocurrencies serve various purposes and belong to different sectors within the blockchain ecosystem. Consider diversifying across these sectors:

Decentralized Finance (DeFi): Projects focused on creating decentralized financial services, such as lending, borrowing, and trading.

Non-Fungible Tokens (NFTs): Unique digital assets representing ownership of digital art, collectibles, and more.

Layer 1 and Layer 2 Solutions: Layer 1 solutions like Ethereum provide the foundational blockchain, while Layer 2 solutions like Polygon enhance scalability and efficiency.

Privacy Coins: Cryptocurrencies that prioritize user privacy, such as Monero (XMR) and Zcash (ZEC).

3. Allocate Funds Strategically

Core Holdings: Allocate a larger portion of your investment to established cryptocurrencies (like BTC and ETH) that provide stability.

Growth Investments: Allocate a smaller percentage to high-potential, lower-cap cryptocurrencies that may offer significant growth opportunities.

Rebalance Regularly: Periodically review and adjust your portfolio to maintain your desired allocation and respond to market changes.

4. Stay Informed and Conduct Research To make informed investment decisions, stay updated on market trends, news, and developments in the cryptocurrency space:

Follow Reputable Sources: Subscribe to cryptocurrency news websites, blogs, and podcasts that provide insights and analysis on market trends.

Join Online Communities: Engage with cryptocurrency communities on platforms like Reddit, Twitter, and Telegram to share knowledge and gain insights from other investors.

Analyze Project Fundamentals: Before investing in a cryptocurrency, research its whitepaper, team, technology, and market potential. Understanding the fundamentals can help you make informed decisions.

Common Mistakes to Avoid

1. Over-Diversification: While diversification is essential, over-diversifying can lead to a diluted portfolio that's difficult to manage. Focus on quality over quantity and avoid spreading your investments too thin.

2. Ignoring Risk Tolerance: Consider your risk tolerance when diversifying your portfolio. If you're risk-averse, you may want to allocate more funds to stablecoins and established cryptocurrencies rather than high-risk altcoins.

3. Failing to Monitor Your Portfolio: Regularly review your portfolio to assess performance and make adjustments as needed. Staying engaged with your investments will help you respond to market changes and opportunities.

Conclusion

Diversifying your cryptocurrency portfolio is a crucial strategy for managing risk and maximizing potential returns. By investing in different types of cryptocurrencies, exploring various sectors, and staying informed, you can create a balanced portfolio that aligns with your investment goals. As the cryptocurrency market continues to evolve, adopting a thoughtful approach to diversification will help you navigate this exciting and dynamic landscape with confidence.

For more crypto currency insights, visit Cryptolenz.

0 notes

Text

Crimes of Richard Heart

On November 18, 2020, “Gasman” distributed .33 ETH to the various “Whale” accounts, which then staked all of their respective HEX tokens for an approximately 3 day period. The dollar value in each account at the end of stake was ~$3-4 million.

The majority of these accounts later sacrificed their HEX to Pulsechain in August 2021.

“1337 Endpoint #2” is a Gnosis Safe proxy contract containing ~$1B of ETH (37th largest Ethereum account). This is the final destination of the ~115,928 ETH from “1337” transfers from the Flush account. It holds a large amount of CROCODILEKING (EYB) token (Chinese scam project - deleted website and Telegram).

See also: https://www.reddit.com/r/CryptoCurrency/comments/o3io46/how_hex_embezzled_hundreds_of_millions_usd_from/

Sergei Nazarov Ampchain.eth Neverpussy.eth @leong78461299 Plumpy Inu

Minereum SecurityFund (SFT)

0 notes

Text

Cillian Miller: Mastering AI and Quantitative Finance

Cillian Miller: Mastering AI and Quantitative Finance

Born on September 10, 1965, in Californian, Cillian Miller grew up immersed in a business-oriented environment, showing a profound interest in commerce and investment from a young age. During his time at Yale University, he made his first million dollars in the stock and futures markets, gaining an early and notable reputation while many of his peers were still seeking employment. Miller chose a life of discreet investment and global learning, which earned him the nickname “Professor Miller” as the youngest member of the Ivy League to achieve such distinction.

1. Ivy League Professor:

Starting his career at Yale University, Miller demonstrated sharp insights into the stock market early on. His early success allowed him to lead a low-key investment life, traveling the world to study different business and financial models, enriching his perspective and laying the groundwork for his future endeavors.

2. Honors and Crisis:

During his travels, Miller pursued a Master’s degree in Computer Science at the ETH Zurich , where he began building his own algorithmic trading models, achieving considerable success. In 2005, he was named “Emerging Market Stock Fund Manager of the Year” by an international money market magazine, and the Templeton Fund he led received the “Global Best Emerging Market Fund” award. However, the 2008 global financial crisis posed a significant challenge in his career, which he overcame with the guidance of his mentors and his resilience.

3. From Investor to Mentor:

After years of market ups and downs, Miller decided to systematize his investment philosophy and trading skills and began teaching quantitative trading. In 2011, he founded the DB Wealth Institute, committed to nurturing new talent in the financial sector. The institute quickly expanded globally, adhering to the principles of “student interests first” and “practical experience as the best teaching method.”

4. Rise of a Business Empire:

From its inception, the DB Wealth Institute began developing the “Lazy Investor System.” With the advancement of technology, particularly the application of artificial intelligence, Miller and his team gradually transformed quantitative trading into the realm of AI trading. In 2018, they successfully launched ‘AI Financial Navigator 4.0.’ To support the development of this system, the DB Wealth Institute issued the DBW token, which not only successfully raised funds but also brought more research funding and professional talent to the institution. With the success of the DBW token and AI Financial Navigator 4.0, the valuation of DB Wealth Institute skyrocketed, significantly expanding Miller’s business empire.

1 note

·

View note

Text

Top Altcoins to Watch for the 2024 Bull Run

As the 2024 bull run kicks off, the crypto market is buzzing excitedly, drawing investor interest toward altcoins that could see significant value increases by 2025. The analyst has reviewed several high-potential altcoins and provided insights for diversifying their portfolios and capitalizing on the current market momentum.

For those aiming to become millionaires by 2025, some promising cryptocurrencies, aside from Bitcoin and Ethereum, are worth considering for investment.

Promising Cryptos for Millionaire Status by 2025

As the 2024 bull run begins, several cryptocurrencies are generating buzz for their potential to deliver substantial returns by 2025. Here’s a look at some top contenders that could help you reach millionaire status:

1. Bitcoin: Bitcoin, the leading cryptocurrency with a fixed supply of 21 million coins, has historically experienced significant price increases following each “halving” event, which halves the rate of new Bitcoin issuance. The next halving is expected to take place in 2024, and based on historical patterns, Bitcoin’s price could potentially reach $120,000 by 2025. To achieve millionaire status by 2025 at today’s price of $55,511.04, you would need to own 8.3 BTC.

2. Ethereum: Ethereum, the second-largest cryptocurrency by market cap, is expected to see substantial growth next year. The anticipated Ethereum ETF and rising institutional interest could push the price to $9,000. To become a millionaire by 2025 at today’s price of approximately $2,918.46, you would need to own 111 ETH.

3. Solana (SOL): Solana is a high-performance blockchain renowned for its speed and low fees. Compared to Ethereum as “Apple” is to “Android,” Solana represents a streamlined, high-growth ecosystem. With a projected price target of $1,100, you would need 99 SOL at the current price of $132.90 to achieve a million-dollar valuation by 2025.

4. Polkadot (DOT): Polkadot has shown strong performance recently, up about 30–35% over the past year. As a key player in interoperability, its price could reach $350. To become a millionaire, you’d need 2,857 DOT at today’s price of around $5.50.

5. Axmint (AXM): Axmint has Shown strong performance recent burning of 20% of AXM tokens marks a pivotal moment in the token’s journey. AXM token is up +11.54% to $0.58. The AXM presale is selling out fast, with the token available at just USD 0.4. The listing price will be 1 to 2 USD/AXM, which is a remarkable feat. In essence, AXM token investors are already making decent profits while the presale is going on. presently trading at $0.63.

6. Injective Protocol (INJ): Injective Protocol aims to offer a complete DeFi experience. With a price target of $180, you would need 5,555 INJ tokens at the current price of around $19 to become a millionaire by 2025.

These cryptocurrencies offer unique opportunities for investors, each with distinct features and potential for significant returns, making them worth keeping an eye on.

0 notes

Text

Types of Tokens in Blockchain

What is a Crypto Token?

A crypto token is a digital asset on a blockchain network, representing value or utility. Built on platforms like Ethereum or Binance Smart Chain, tokens facilitate transactions, investments, and service access, and can be traded and stored in digital wallets.

The development process includes conceptualization, smart contract development, design, and compliance, followed by security audits and ongoing maintenance. This enables the creation of customized tokens, driving innovation within decentralized ecosystems.

In Blockchain technology has revolutionized the digital landscape, giving rise to a diverse array of tokens that serve different purposes within decentralized ecosystems. These tokens are integral to the functionality and governance of blockchain networks, offering unique features and utilities that drive innovation and adoption. In this blog, we'll explore the main types of tokens in blockchain, shedding light on their characteristics and applications.

1. Utility Tokens

Utility tokens are designed to provide access to specific products or services within a blockchain-based platform. They are intended as tools for users to engage with the ecosystem, not as investments. These tokens grant holders access to particular features or services, often incentivize beneficial behaviors like staking or governance participation, and are primarily used for their intended utility rather than speculation. Examples include Ethereum (ETH), used for transaction fees and computational services on the Ethereum network, and Filecoin (FIL), used for buying and selling storage space within the Filecoin network.

2. Security Tokens

Security tokens represent ownership in underlying assets like company shares, real estate, or other investment vehicles and must comply with federal securities regulations, ensuring legal compliance. These tokens indicate equity or debt ownership, may offer dividends or interest payments to holders, and exemplify regulated digital investments. Examples include tZERO (TZROP), which offers equity in the tZERO platform, and RealT, which represents fractional ownership in real estate properties.

3. Governance Tokens

Governance tokens empower holders with voting rights on the development and operation of blockchain projects, making them crucial for decentralized autonomous organizations (DAOs) and other decentralized projects. These tokens enable holders to vote on proposals affecting the platform's future, promote decentralized decision-making processes, and are often distributed as rewards for active participation in the ecosystem. Examples include Uniswap (UNI), which allows holders to vote on protocol changes and upgrades, and Maker (MKR), which is used to vote on proposals affecting the MakerDAO ecosystem.

4. Stablecoins

Stablecoins are designed to maintain a stable value by being pegged to a reserve of assets, such as fiat currency, commodities, or other cryptocurrencies, minimizing price volatility. They are characterized by their stability (pegged to stable assets like USD or gold), utility (used for trading, remittances, and as a store of value), and backing (supported by fiat reserves, cryptocurrencies, or algorithmic mechanisms). Examples include Tether (USDT), which is pegged to the US dollar, and DAI, a decentralized stablecoin pegged to the US dollar and backed by crypto collateral.

5. Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) represent unique digital assets with distinct attributes, making them non-interchangeable on a one-to-one basis like cryptocurrencies. Each NFT is unique and cannot be replicated, providing verifiable ownership of digital assets such as art, music, or virtual real estate. They can be used across different platforms and ecosystems, enhancing their utility. Examples of NFTs include CryptoKitties, which are digital collectible cats with unique traits, and the Bored Ape Yacht Club, a popular collection of unique cartoon apes.

6. Asset-Backed Tokens

Asset-backed tokens are tied to physical assets like real estate, commodities, or precious metals, bridging the gap between digital and tangible assets. These tokens represent ownership in physical assets (tangibility), are linked to the value of real-world assets (value stability), and must comply with regulations governing the underlying assets. Examples include Tether Gold (XAUT), representing ownership of physical gold, and Digix Gold Tokens (DGX), where each token is backed by a gram of gold stored in a secure vault.

Conclusion

In conclusion, the diverse array of tokens in blockchain, from utility tokens facilitating platform access to asset-backed tokens bridging digital and tangible assets, reflects the innovation and utility of blockchain technology. These tokens enable transactions, governance, and value exchange within decentralized ecosystems, shaping the future of the digital economy. Through ongoing development and compliance, blockchain technology continues to evolve, offering endless opportunities for innovation and growth.

0 notes

Text

What are the prospects for the development of Ethereum

The prospects for the development of Ethereum (ETH) are promising, driven by a series of ongoing upgrades, increasing adoption, and its pivotal role in the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems. Here are some key areas to consider:

1. Ethereum 2.0 and Scalability Upgrades

Transition to Proof of Stake (PoS): The transition from Proof of Work (PoW) to Proof of Stake (PoS) with Ethereum 2.0 (also known as the Beacon Chain) has been a major milestone. This shift aims to reduce energy consumption and improve network security.

Shard Chains: Shard chains are set to significantly enhance Ethereum's scalability by splitting the network into smaller, more manageable pieces (shards) that can process transactions and smart contracts in parallel.

Rollups and Layer 2 Solutions: Layer 2 solutions like rollups are being actively developed and adopted. These solutions process transactions off-chain while maintaining security through the main Ethereum chain, drastically increasing transaction throughput and reducing fees.

2. DeFi Expansion

DeFi Growth: Ethereum remains the leading platform for decentralized finance (DeFi) applications. The DeFi ecosystem on Ethereum has seen exponential growth, attracting billions of dollars in total value locked (TVL).

Innovation and New Protocols: Continuous innovation in DeFi protocols—such as decentralized exchanges (DEXs), lending platforms, and yield farming—keeps Ethereum at the forefront of financial technology.

3. Non-Fungible Tokens (NFTs)

NFT Popularity: Ethereum is the dominant platform for NFTs, which have gained significant popularity in digital art, gaming, and collectibles.

Standards and Interoperability: Ethereum's ERC-721 and ERC-1155 standards are widely used for creating NFTs, ensuring interoperability across different platforms and applications.

4. Enterprise and Institutional Adoption

Enterprise Solutions: Ethereum's blockchain technology is being explored and adopted by enterprises for various use cases, including supply chain management, finance, and identity verification.

Institutional Investment: Growing interest and investment from institutional players validate Ethereum's potential as a long-term asset and a foundational technology for decentralized applications.

5. Interoperability and Cross-Chain Solutions

Bridges and Cross-Chain Functionality: Efforts to improve interoperability between Ethereum and other blockchains are ongoing. Projects like Polkadot, Cosmos, and various bridge solutions aim to facilitate seamless transfer of assets and data across different blockchains. To create an Ethereum wallet, download the app for free!

Ethereum Virtual Machine (EVM): The EVM's compatibility with multiple chains enhances Ethereum's influence and allows for the deployment of Ethereum-based smart contracts on other blockchains.

6. Development Community and Ecosystem Growth

Active Development Community: Ethereum boasts one of the largest and most active development communities in the blockchain space. This community continuously works on improving the protocol, developing new applications, and expanding the ecosystem.

Support for Decentralized Applications (dApps): The extensive suite of developer tools, documentation, and support for decentralized applications makes Ethereum the go-to platform for blockchain developers.

7. Regulatory Environment

Regulatory Clarity: As blockchain and cryptocurrencies gain more regulatory scrutiny, Ethereum's development team and community are actively engaging with regulators to ensure compliance and foster a conducive environment for innovation.

Legal Recognition: Increased legal recognition of Ethereum and its applications can enhance its credibility and encourage wider adoption across various sectors.

8. Sustainability and Environmental Impact

Reduced Energy Consumption: The move to PoS is expected to reduce Ethereum’s energy consumption by over 99%, addressing one of the major criticisms of blockchain technology and making it more sustainable.

Conclusion

The prospects for Ethereum’s development are robust, with a clear roadmap for scalability, continued innovation in DeFi and NFTs, increasing enterprise adoption, and a strong development community. The ongoing upgrades, particularly Ethereum 2.0, will address many of the current limitations related to scalability and energy consumption, positioning Ethereum as a cornerstone of the future decentralized internet (Web3). With its strong ecosystem and continuous improvements, Ethereum is well-positioned to maintain and expand its role as a leading platform in the blockchain space.

0 notes

Text

How to Buy Crypto for the First Time in 2024

Introduction: As we navigate through 2024, the allure of digital currencies continues to captivate the attention of investors around the globe. If you're considering joining this digital revolution, purchasing cryptocurrency for the first time might seem daunting. Fear not, as this guide will walk you through the essential steps to embark on your crypto journey with confidence. Read on to discover the safest and most effective strategies to make your first crypto purchase, and don't forget to explore further insights through the link at the end of this article.Continue Reading Here

Step 1: Understand the Basics of Cryptocurrency Before you invest a single dollar, it's crucial to grasp the basic concepts of cryptocurrency. Cryptocurrencies are digital assets that use cryptography for security and operate independently of a central bank. Popular examples include Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). Understanding how blockchain technology works will provide you with a solid foundation for making informed investment decisions.Continue Reading Here

Step 2: Choose the Right Crypto Exchange Selecting a reputable crypto exchange is vital. Look for platforms known for their security measures, user-friendly interface, and customer support. Some of the top exchanges as of 2024 include Coinbase, Binance, and Kraken. Ensure the exchange supports the specific cryptocurrencies you are interested in and check for any geographical or legal restrictions.Continue Reading Here

Step 3: Set Up and Secure Your Account Once you choose an exchange, you'll need to create an account. This process typically involves verifying your identity to comply with regulatory requirements—known as KYC (Know Your Customer). It's essential to use strong, unique passwords and enable two-factor authentication (2FA) for added security.Continue Reading Here

Step 4: Deposit Funds After securing your account, the next step is to deposit funds. Most exchanges accept various funding methods, including bank transfers, credit cards, and even PayPal. Choose the method that best suits your needs, keeping in mind potential fees and transaction times.Continue Reading Here

Step 5: Make Your First Purchase Now, you're ready to buy your first cryptocurrency. You can start with a popular currency like Bitcoin or Ethereum, or perhaps a lesser-known altcoin depending on your interest and research. It’s advisable to start with a small amount until you become more familiar with the process.Continue Reading Here

Conclusion: Buying cryptocurrency for the first time is an exciting step towards participating in the digital economy of the future. By following these steps, you can ensure a safe and informed entry into the world of crypto. Remember, investing in cryptocurrencies can be risky, so it's wise to conduct thorough research and invest responsibly. For more detailed insights, click on the link below to further your understanding and enhance your investing journey.

Continue Reading Here

#bitcoin#crypto_mining#crypto_news#altcoins#crypto_security#crypto_trading#crypto_tokens#ethereum#defi#blockchain

0 notes

Text

Vitalik Buterin Reportedly Transferred About 40K ETH

Reports indicate that Ethereum co-founder Vitalik Buterin has executed a transfer of approximately 40,000 ETH, valued at around $48 million, from a wallet associated with him. The transfer originated from a multisig address named Vb 3, linked to Buterin, to another address holding 64,301 ETH, worth approximately $76.5 million. Buterin's Vb 3 wallet currently holds about 250,000 ETH, roughly $300 million.

Amidst market fluctuations, Ethereum's price sits at $1,200.93, reflecting a 3.93% increase in the last 24 hours. The recent FTX hack, which involved the swap of millions of dollars in ETH for Ren Bitcoin, caused significant concern in the cryptocurrency community.

Buterin's actions also attracted attention, particularly his reported sale of 3000 ETH tokens for $4 million USDC via Uniswap V3. Community members are scrutinizing these moves, especially in the wake of the FTX incident, closely monitoring activities of industry leaders like Buterin.

Recently, Buterin collaborated with former Coinbase CTO Balaji Srinivasan and received assistance from Binance, Coinbase, and Kraken staff to release a blog post discussing strategies to bring centralized exchanges closer to trustlessness. Buterin emphasized the importance of non-custodial exchanges in the future, aligning with his vision for the crypto industry.

0 notes

Text

Ethereum Price Close to Lowest as Network Expansion Reaches 4-Month High

Key Points

Ethereum (ETH) is nearing a correction bottom, setting the stage for a potential bull rally.

The Ethereum network has seen a four-month peak in growth, with over 126k new wallets created.

After a period of significant bearish trends, Ethereum (ETH) appears to be reaching a potential bottom. This could set the stage for a major bull rally in the near future.

Last week, Ethereum, boasting a fully diluted valuation of roughly $277 billion and an average daily traded volume of around $11 billion, nearly retested the correction low from the market crash on August 5.

Retesting Crucial Levels

Currently, the ETH price against the US dollar is retesting a key trendline support level. This level has been forming since early 2023. A successful rebound from this support level could lead to a rally towards Ethereum’s all-time high in the coming months.

The anticipated Fed’s interest rate cut on September 18 and the upcoming general election are expected to trigger the next bull market phase. Additionally, Bitcoin has been forming a macro reversal pattern, which could accelerate the crypto cash rotation to altcoins and catalyze the much-anticipated altseason.

Network Growth Surge

The Ethereum network, the leading web3-focused blockchain with over $43 billion in Total Value Locked (TVL) and a $82 billion stablecoins market cap, has attracted more users recently. On-chain data analysis from Santiment shows that the network has registered significant growth, with over 126k new wallets created on a single day.

This increase in adoption has a bullish outlook for Ethereum in the near term. Moreover, Ethereum is the top tokenization ecosystem used by most institutional investors. The recent approval of spot Ether ETFs in the United States has also notably improved the altcoin’s fundamentals.

Whale Investors’ Reactions

Despite fears of further crypto selloffs in the remaining weeks of September, on-chain data shows varied reactions from Ethereum whales. Some have been offloading, while others have held all through. For example, the US spot Ether ETFs have now seen four consecutive weeks of cash outflows.

Interestingly, the US spot Ether ETFs have registered only one week of net cash inflows since the official approval by the US SEC.

According to on-chain data analysis by Lookonchain, an Ether whale sold approximately 28,554 ETH units, worth about $64.4 million, to pay off all debts on Aave, resulting in a loss of more than $17 million.

Meanwhile, the supply of Ether on centralized exchanges has remained low, dropping by over 500k in the past five months.

0 notes