#*getting* the prescription was what I always viewed as the last real hurdle when i imagined pulling this particular trigger

Explore tagged Tumblr posts

Text

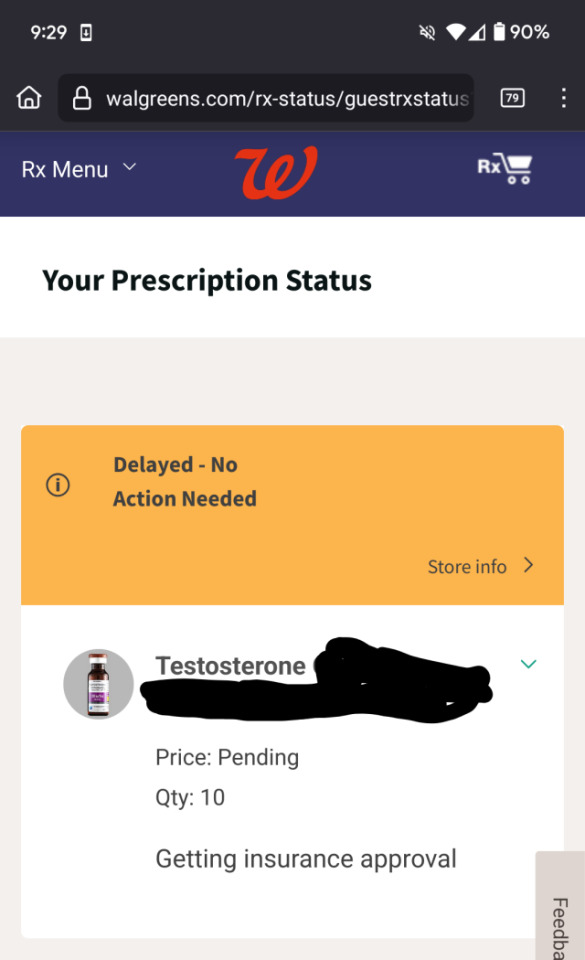

current status: foaming at the goddamn mouth

#ineffablefool original post#not good omens#I'm actually not upset just annoyed because if i reeeeally had to i could afford the out-of-pocket cost#so this is just an unnecessary delay not a stop-everything roadblock#*getting* the prescription was what I always viewed as the last real hurdle when i imagined pulling this particular trigger#now I'm basically just waiting for a package to arrive except i have to go across town for it and it's technically already physically there#and I am not planning to pay extra for Metaphorical Rush Shipping#ineffablefool does a gender

9 notes

·

View notes

Text

Reasonable Expectations

“You’ve got to be careful if you don’t know where you’re going, ’cause you might not get there.” ~ Yogi Berra

At the heart of Ben Graham’s teachings lies his advice that the intelligent investor must never forecast the future exclusively by extrapolating the past.

Unfortunately, that’s exactly the mistake that stock market experts and investors have made innumerable times in the past. Some go even further. Since stocks had “always” beaten bonds over any period of at least 30 years, stocks must be less risky than bonds or even cash in the bank. And if you can eliminate all the risk of owning stocks simply by hanging on to them long enough, then why quibble over how much you pay for them in the first place?

In India, it’s easy to find a forecaster who argues that stocks have returned an annual average of around 18% over the past 30 years and thus that’s what investors can easily expect in the future. But what if I tell you that the average annual return for the BSE-Sensex has been just around 10% over the past 25 years (since the peak of Harshad Mehta bull run)?

Of course, this is just one number and you may accuse me of being selective in my choice to prove a point. But that’s what I am up to – prove a point, that when you do not pay heed to the price you are paying for stocks because you have unreasonable expectations for the future, you are bound to get disappointed.

Just pick out any fund manager or analyst and ask him – “Is the stock market riskier today than two years ago simply because prices are higher?” The answer would be – no. But the answer is ‘yes’. It always has been. It always will be.

As you can see from the table below, BSE-Sensex’s 3-year CAGR return over the past 22 years, when the starting P/E was above 20x (9 times in last 22 years), has averaged just around 2%. And we are almost at around 23x level now.

Of course, despite its several downturns and crashes, the Sensex and the broader stock market has moved up over the long run, it pays to remember what Lord Keynes said – “The market can stay irrational longer than you can stay solvent.”

Higher They Go, Harder They Fall Jason Zweig writes in his commentary on Chapter 3 of The Intelligent Investor…

As the enduring antidote to bull-market baloney, Graham urges the intelligent investor to ask some simple, skeptical questions. Why should the future returns of stocks always be the same as their past returns? When every investor comes to believe that stocks are guaranteed to make money in the long run, won’t the market end up being wildly overpriced? And once that happens, how can future returns possibly be high?

Graham’s answers, as always, are rooted in logic and common sense. The value of any investment is, and always must be, a function of the price you pay for it.

Since the profits that companies can earn are finite, the price that investors should be willing to pay for stocks must also be finite.

Think of it this way: Michael Jordan may well have been the greatest basketball player of all time, and he pulled fans into Chicago Stadium like a giant electromagnet. The Chicago Bulls got a bargain by paying Jordan up to $34 million a year to bounce a big leather ball around a wooden floor. But that does not mean the Bulls would have been justified paying him $340 million, or $3.4 billion, or $34 billion, per season.

Focusing on the market’s recent returns when they have been rosy, warns Graham, will lead to “a quite illogical and dangerous conclusion that equally marvelous results could be expected for common stocks in the future.”

The Math of Reasonable Expectations The stock market’s performance depends on three factors –

Real growth (the rise of companies’ earnings and dividends)

Inflationary growth (the general rise in prices throughout the economy)

Speculative growth/decline (any increase or decrease in the investing public’s appetite for stocks)

In the long run, the yearly growth in corporate earnings per share in India – including inflationary growth – has averaged around 14-15%. Then, the dividend yield on stocks has been around 2%. So, in the long run, a defensive investor can reasonably expect stocks to average around 16-17% annual return – assuming you buy quality businesses at reasonable prices. And then, above-average investment skill and a lot of good luck can help you earn around 20%.

Now, remember that while the incremental return of 3% seems meagre considering the better investment skill you may bring on table, over a 20-year period, it can create a 66% outperformance (as compared to a 17% CAGR return), and over a 25-year period, an 88% difference.

Anyways, here’s another take on what you must reasonably expect to earn from the stock market in the long run (this comes from Prof. Sanjay Bakshi’s reply to a comment on this post; emphasis is mine) –

In a world where interest rates are 10% if you can find long-term opportunities that will give you 18% you should be more than satisfied. That’s how I look at it. If someone else finds a 25% opportunity and I don’t invest in it, it doesn’t bother me. Being envious is a bad idea in investing and in life. That’s a big lesson for every student of Charlie Munger.

Your hurdle rate should naturally be anchored to passive, relatively effortless fixed income returns. In a world where AAA bond yields jump to 16%, then an expected return of 18% in equities will be a bit silly, no? Therefore, you have to have an adjustable aspirational level and then go around looking for opportunities that will meet your aspirations.

If you can’t find them, then you must lower your expectations. If you want happiness in investing and in life, having an adjustable aspirational level is important.

Voltaire said, “The perfect is the enemy of the good.” This saying is especially applicable to investing, where insisting on participating only when conditions are perfect – like buying at the bottom in the expectation of great return – that can cause you to miss out on a lot. Perfection in investing is generally unobtainable, and the best one can hope for is to make a lot of good investments – that are expected to make reasonable long-term returns – and exclude the bad ones.

Have Reasonable Expectations Ben Franklin said –

Blessed is he that expects nothing, for he shall never be disappointed.

In other words, if we don’t hope for much, reality often beats our expectations. If we always expect the best or have unreal expectations, we are often disappointed. We feel worse and make bad judgments. Expect adversity. We encounter adversity in whatever we choose to do in life.

Charlie Munger gives his iron prescription for life –

Whenever you think that some situation or some person is ruining your life, it is actually you who are ruining your life … Feeling like a victim is a perfectly disastrous way to go through life. If you just take the attitude that however bad it is in any way, it’s always your fault and you just fix it as best you can – the so-called “iron prescription” – I think that really works.

When bad things happen, ask: What else does this mean? See life’s obstacles as temporary setbacks, not disasters. Mark Twain says: “[Our] race, in its poverty, has unquestionably one really effective weapon – laughter … Against the assault of laughter nothing can stand.”

And here’s Jason Zweig in The Intelligent Investor…

The only thing you can be confident of while forecasting future stock returns is that you will probably turn out to be wrong. The only indisputable truth that the past teaches us is that the future will always surprise us — always!

And the corollary to that law of financial history is that the markets will most brutally surprise the very people who are most certain that their views about the future are right. Staying humble about your forecasting powers, as Graham did, will keep you from risking too much on a view of the future that may well turn out to be wrong.

So, by all means, you should lower your expectations — but take care not to depress your spirit. For the intelligent investor, hope always springs eternal, because it should. In the financial markets, the worse the future looks, the better it usually turns out to be. A cynic once told G. K. Chesterton, the British novelist and essayist, “Blessed is he who expecteth nothing, for he shall not be disappointed.” Chesterton’s rejoinder? “Blessed is he who expecteth nothing, for he shall enjoy everything.”

To sum up, recognize your limits and be reasonable with your expectations. How well do you know what you don’t know? Don’t let your ego determine what you should do.

Munger says –

It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent. There must be some wisdom in the old saying: ‘It’s the strong swimmers who drown.’

The post Reasonable Expectations appeared first on Safal Niveshak.

Reasonable Expectations published first on http://ift.tt/2ljLF4B

0 notes