#(the stats are basically nonsense so dont look too closely)

Explore tagged Tumblr posts

Text

➤ borderlands girls + choose your fighter

you can be a lover or a fighter, whatever you desire. life is like a runway and you're the designer. wings of a butterfly, eyes of a tiger. whatever you want, baby, choose your fighter!

#ocappreciation#queerocs#ochub#aib oc#alice in borderland oc#oc: kira nezuo#kira is so babygirl-coded#(the stats are basically nonsense so dont look too closely)

16 notes

·

View notes

Text

✧・゚: * ( park jiwon , cis female , she / her ) have you seen violet hwang around ? i hear the twenty-one year old is working as an art director . did you know they have 97 love alarm points ? if they ever want to be truly loved someday they should ease up on being temperamental & enigmatic . at least you can say they’re disarming & convivial, too. / love alarm blocked

hello ! im xan and ur watching d*sney channel ... just kidding we do NOT support big corporations who just wanna take ur money 😔 im 22 , from the est timezone ( even though my sleeping schedule ... does not reflect that sjbdwjkbdjdw ) & i go by she / her pronouns ! im gonna be honest this intro is gonna be completely winged so buckle up .... and meet violet 😋

━ ˙ ˖ ☆ quick stats + aesthetics !

full name: violet hwang.

nickname(s): vee, vivi.

zodiac: tba....

sexuality: bisexual.

birthplace: manhattan, new york.

current residence: toronto, canada.

aesthetics: maraschino cherries at the bottom of a glass, driving with the windows down at night, unanswered text messages, black nail polish, the sound of rain hitting the windowpane, kissing and not telling, smiles that don’t quite reach the eyes.

━ ˙ ˖ ☆ backstory !

was born and raised in nyc baby ! she’s a true city girl, grew up in lower manhattan ( the financial district if u wanna get specific ) to a family with lots of $$$$ thanks to her father’s position as a ceo of an investment bank located on wall street

life was pretty smooth until she was 17 and her father got arrested for embezzlement and fraud </3 it was actually a huge scandal for the investment bank he worked for because it was a whole group of higher ups who had been in on these crimes. basically a bunch of already rich men trying to get richer ... disgusting ik /:

her life changed pretty drastically after that ! the hwang name was all over the news, their family was pretty much disgraced by high society in nyc, not a very fun time for anyone but especially not for violet’s mom

after her dad got arrested violet was uhh high key furious with him for ruining their lives with his greed and she wanted nothing to do with him, but her mom couldnt let go. she was still defending him, spending the money they had left on lawyers which included the money the family had set aside for violet’s trust fund that she would have had access to once she was 18 </3

so her plans for college changed pretty drastically JSDBJWBDJW ( goodbye ivy league education ) she actually ended up getting into the university of toronto for visual studies on an academic scholarship

so she made the big move all on her own....moved into a tiny dorm...and vowed to reinvent herself. she didnt wanna be labeled as the daughter of a white collar criminal anymore so she just made it a point not to talk to much abt her past to anyone

her struggles as someone who grew up with $$$$ turning into a broke college student made for some embarrassing but funny moments <3 luckily though everyone else had their own struggles so no one found it suspicious JSBDJWBDJ

when love alarm launched three years ago, violet had just started college so it was really the Big thing anyone and everyone was talking about. since she’d never been a fan of other dating apps, she wasn’t gonna download it but her roommate at the time convinced her ! at first it was fun, just something she didnt take too seriously

fast forward to graduation and she’s snagged a job as an art director for a little local museum, doing freelance art directing on the side to help pay the bills. low and behold one day a photographer hires her to be the art director to a shoot they’re doing for a badge club member who was in a very high profile and public relationship at the time

violet ended up working with that photographer and badge club member a handful of times, enough for her to catch fee-🤢 catch feelin-🤢 i cant even say it .. she’d never rung anyone’s love alarm before, so of course her first time had to be with someone who was already taken </3 safe to say she ... freaked out

she was embarrassed above all else, but also heartbroken bc in her head like ... why would someone who literally is part of an exclusive club based on ppl ringing their love alarm care that she rung theirs ? she didnt think it’d be a big deal to them the way it was to her ( but also didn’t stick around long enough to find out jsxbsjbdjw )

when she was offered the block she didn’t hesitate to use it figuring it’s better if no one knows her romantic feelings ever again like that /: she’d delete the app but a part of her still likes knowing there are ppl out there who DO like her like that so ... Rip truly

━ ˙ ˖ ☆ personality + tidbits !

she comes across as ... kind of a bitch SDJBJWBJWBDW it’s truly not on purpose she just has a pretty serious resting expression most of the time ( so she looks mad or annoyed even when she isn’t ) and she’s pretty difficult to get to know ? not to mention the fact that no one has ever witnessed her ring someone’s love alarm .. so all that combined just makes it easy to assume she’s some sort of ice queen when that’s far from the truth /:

violet really isn’t one to open up too deep to people, but that’s got a lot to do with the past she’s kind of running away from ! so if you’re her friend most of the stuff you know about her is probably surface stuff, but when she’s close to someone she can make that fact hard to realize ? she just has a way with making the people in her life feel important so it’s easy not to be focused on how much you know about her

never bothers to correct the people that misjudge her. if you don’t like her, if you want to make up assumptions and rumors about her, go ahead like violet really won’t stop you which can sometimes make meeting new people difficult </3 if you’ve seen the dating class webdrama chuu was in she’s kinda like oh seyoung’s chara joowon 🤧

if she wants to, though, she’s pretty good at getting people to like her / trust her ! she does this a lot in professional situations, which is why she’s been doing so well as an art director so far despite being so young

she’s also very loyal to her friends ! if you can’t ask for extra sauces at mcdonald’s....if you can’t make a phone call to your credit card company explaining that a $3,000 charge to starbucks wasn’t you.....she’s your girl <3 since she’s relatively not bothered by the way people see her ( unless it has to do with her past ) she’s usually the one speaking up if someone she cares about can’t

after the ... incident ... JSDBWJDBWJ she’s really not a fan of the badge club and everything it stands for ): BUT she continues to do art directing work for a lot of the members when they do photoshoots, or instagram campaigns, or if they have a pop up shop, etc. it’s good money and she needs every penny considering she’s living without support from her family

cannot cook to save her life so she’s always eating out .. this really is why she’s taking those more high profile jobs she can’t budget .. but it’s better, safety wise at least, that she continues wasting her money on takeout aha <3

pretends she’s not a romantic and is all about the ~casual flings~ but really she’s just afraid of serious feelings and the idea of a serious relationship ... it’s the trauma 😔 constantly jokes shes gonna bring the tinder whore era back JWDBWJBDJW she is sick of this true love nonsense ! ( the irony of this url ahaha... )

she’s the most social after a few drinks, since drunk her isn’t burdened by a mind that overthinks literally everything the way she is sober. if you don’t supervise her though she can get pretty carried away and probably get into some kind of trouble so she’s definitely not the person you want to be in charge on a night out !

really wants a dog but doesn’t think she’s cut out to be a pet parent it feels just as scary as the idea of having an actual kid so ... BDWBDJW if you have a pet ? she’s gonna be living vicariously through you <3

━ ˙ ˖ ☆ wanted connections !

the photographer that hired her / introduced her to the badge club member she ended up having feelings for

the badge club remember she had / has feelings for because we love suffering 😈

old roommates from college !! maybe even the one that got her to download love alarm in the first place hehehe

also a current roommate / roommates because your girl can’t afford to live on her own <3

someone she’s confided in about her past ( maybe they judged her for it and had a falling out, or maybe they remain confidants )

an ex bf or gf she dated while she was in school ! she never rang their love alarm ( even though this was pre block ) so maybe that’s why things ended between them. or maybe they never rang each others and it was just a mutual thing where they both didn’t really have feelings for each other and tried to date anyway and it didn’t work. or perhaps they dated and when violet realized she was starting to have those feelings she dipped before she ever got a chance to ring their love alarm bc she didn’t want to be exposed like that and commitment is scary ):

spare best friend ? i’d use a knife emoji to show you how serious i am but i dont wanna scare anyone away aha .. i would just love a best friend plot 🥺

current flings / hookups or past flings / hookups ! i imagine most of them to not be serious but it would be kinda cool if there was someone she’s seeing now that she’s got the love alarm block that she’s actually falling for considering she’s never gonna be able to ring their love alarm hehehehe

people she art directs for !! i imagine she’s got a pretty long list of employers ( from badge club members to regular folk 🤧 ) so it would be cool to have people who hire her for stuff, or who collaborate with her for artistic endeavors since i’ve noticed we have a lot of artsy muses <3

ummm maybe an enemy. but where it’s like .. the hate isn’t even that deep it’s just like oh you dislike me ? well i dislike you FIRST 😠 and they insult each other and try and sabotage each other like five year olds fighting on the playground like it seems super serious to them but to everyone watching it’s like ... can you guys just get over it you dumb babies KSDBSDBWD like they could probably be good friends if they just .. stopped

and you’ve reached the end of this NOVEL of an intro post JDBJWBDJWBDW im literally so sorry i tried not to ramble but ..... its just who i am </3 please come shoot me a message to plot !!! you can use tumblr ims but im way more available / quicker to respond on discord so if u wanna add me there and plot u can find me at junhee mr. soft hands ʕ´• ᴥ•̥`ʔ#8172 i also did not check this post for typos so if u find one ... mind ur business 😭😭😭

#╰ ♡ . 𝒑𝒖𝒓𝒆 𝒐𝒇 𝒉𝒆𝒂𝒓𝒕 𝒅𝒖𝒎𝒃 𝒐𝒇 𝒂𝒔𝒔 ── ooc ! ┘#lovealarm.intro#HELPSDBWJD finally i finished.....im so sorry in advance this is . so long#also im going out in like 2 hours to eat so if im slow to respond to messages tonight u know whats going on <33333

7 notes

·

View notes

Note

i’m asking about your dragon age characters

molly i would KILL for u im ur personal hitman now

anyway i said my city now because the entire bioware writing team sucks shit xoxo and i’m so much smarter than all of them but also fully incapable of having a normal amount of ocs for anything (see: the time i made 20 rwby ocs in less than two weeks) so i have. five worldstates here r some assorted thoughts

uhhh so the worldstates r as follows

eira mahariel (two-handed berserk/champ spec), rhett hawke (two-handed berserk spec), alas lavellan (mage knight enchanter spec), romanced alistair/fenris/dorian respectively

shiv tabris (dual wield duelist/assassin spec), radella “rads” hawke (mage spirit healer spec), kat adaar (two-handed reaver spec), romanced morrigan/isabela/cassandra respectively because im a pc gamer and i think i should be able to date whatever video game woman i like because im infinitely better than cishet men

this world state said yeah i respect mens rights. mens rights to shut the fuck up

twins bronson (sword/shield reaver spec) & bryant cousland (archer ranger spec), carmine hawke (archer assassin spec), syracuse trevelyan (dual wield tempest spec), romanced zevran/anora/josephine/bull. if ur wondering how that works my city now and the warden, hawke and the inquisitor should all meet and so they do because i Said So

riva amell (mage arcane warrior/battlemage spec), graham “gray” hawke (mage force spec), hellathen “hela” lavellan (archer assassin spec); romanced cullen/anders and later blackwall because hawke only likes men who will break his heart. hela doesn’t have a romance because she’s literally 20. who let her lead the inquisition (me it was me). also it should be noted the version of cullen i have in my head only vaguely resembles actual cullen because i write better than dragon age writers ever could and i gave him an Actual Cohesive Narrative and he gets bullied relentlessly for being scrawnier than his mage boyfriend

malien “mal” surana (mage spirit healer/keeper spec), jules hawke (sword/shield reaver spec), ash adaar (mage rift spec), romanced leliana/merrill/krem because i should have been able to kiss krem and its a Crime that i am not allowed to

knight enchanter is a Very op specialization and by Very op i mean it makes a mage with their built-in low constitution stats able to solo the biggest baddest dragon in the game on nightmare mode in under five minutes so like. alas lavellan fist fights dragons for fun send tweet

i think lavellans should be able to hit ppl with bricks for all the shit they endure. thus solas gets pranked by mahariel and alas by which i mean they just tip buckets of water onto him from the rookery

kat might be my only competent inquisitor but she did also try to knock out the right hand of the divine and attempt to gap even tho there’s fucky magic burning up her hand so does she have a brain cell? you decide

also its fantasy land and i do what i want so kat has blue/gold sectoral heterochromia

gray “mage rights” hawke is best friends with fenris which surprises literally everyone. their friendship started because they got into a fist fight and then they were like okay i respect u now. hawke is like hey fenris give me ur sword i have a fun trick to show u [uses his sword as a foci to zap carver in the ass with lightning]

i am Always thinking abt like how cullen could have been one man anti-chantry propaganda machine if he hadn’t so blatantly been shoehorned into every game past origins so anyway bioware forgot about a wholeass moon i can write what i like. [holds up cullen by the scruff of his stupid armor] not only are you bisexual you are also a bottom

i also Hate the whole uwu mage haters get fixed by romancing a mage

unlocked secret dialogue option where my inquisitors verbally cuss out dorian’s dad instead of whatever sympathetic narrative the writers were going for cuz its bullshit.

riva is a showoff and a Menace about being as good as he is because he unabashedly loves being a mage and hes like oooh look at me im sexy i dont need to use my hands to cast magic because i’m just that good ;)) and you know what. hes right.

gray, on the other hand, does Not want to be mage. he wants to be a druffalo farmer and retire in the hinterlands and be left the fuck alone. unfortunately he is gay and has one brain cell and terrible, terrible taste in men. ribbed relentlessly for this by riva (altho does he have room to talk hes been hung up on cullen since he was like 13)

shiv is trans n kieran is the result of doing the dark ritual with her wife and he looks a Lot like shiv (dark skin pointed ears, shock-white hair) and morrigan always just Assumed she dyed it or did something magic with it so seeing their kid come out like that was a WEIRD time for her

leliana almost Murdered by cassandra in worldstate 5 because the warden is Actually There The Whole Time, but its been 10 years, mal’s cut off all her hair and gotten full facial tattoos and she’s like “no one will know its me its fine” and she’s right. she gets away with it. only cullen like, Knows, because he knew her before the blight but he doesnt have a death wish n he like. will Not piss her off

shes dalish by birth n she was stolen from her clan by templars and thus is vehemently anti-circle and anti-chantry in general

uhhh the vallaslin (elf face tattoos) of my 4 dalish characters are:

eira = ghilan’nain (chose em cuz shes rlly interested in the navigation aspect of the goddess)

alas = falon’din (god of the dead n he picked them because he’s Also the god of fortune and alas is like tee hee fun but also he can and will kill u if u fuck with him so yk its fitting)

hela = june (god of the craft bc she likes to Make things but june is also the god who taught the elves 2 hunt and hela is. a hunter.)

mal = elgar’nan (allfather/god of vengeance bc. she is Vengeful. she is Angry. but yk fucking with shem politics and fucking their divine is like. mal may have little a retribution. as a treat.) yes she has the full half-face solid colour tattoo she does NOT fuck around.

bronson and bryant r not genetically identical but they Look similar enough 2 anyone who doesn’t know them well enough 2 play spot the distance. anora and bronson think this is a super fun game to play, especially when nobles realize they’ve swapped out the king but they’re too nervous to say anything

eira mahariel has two hands. one is for holding hands with alistair and the other is for throttling elven gods, apparently. she’s killed one before so solas she’s coming for your bitch ass next. watch urself.

speaking of eira and alistair are married thru dalish tradition and humans don’t recognize it n alistair loves 2 re-propose to her with random things. he’ll just pick up like. a bit of cheese and be like “marry me ;)” and she’s like GASP but whatever will the chantry say!!!! all of their friends r sick of them

“vhenan if you love me bring me a sword” “you think i could do better than a sword made out of space rock?” “:)”

eira is my youngest hero at 18 at the start of her game and kat is my oldest at 32 at the start of her game.

none of my hawkes are under six foot. rhett is the tallest (6′8″) and rads is the shortest (6′2″).

syracuse trevelyan would have been the Perfect inquisitor if he were not a pretty boy himbo and a gay bastard who does Most Things just to spite his parents.

[corypheus pointing at syracuse’s visage in his crystal orb thingo] i want that twink obliterated

i love the companions from older games return thing i truly do so i make it a point for Every companion to return in inquisition so the gang rlly is all here because i am a Slutte for found family

i lie in my keep worldstates because i dont want to choose between hawke and alistair during here lies the abyss but i never make him king and every time i play inquisition and cole has the wicked grace line it makes me Scream. alistair baby im so sorry i did this to you but i didnt actually do this to you

yes this is my everyone lives au but like. all the time. i have never left hawke in the fade and i do not intend to.

fuck whatever nonsense about wardens not being able 2 have kids. by sheer divine power (me) anora and bryant have three daughters; eleanor, sabina & cecelia n both bronson and zevran make Excellent uncles because i think anora deserves good things because i’m tired of bioware being like women bad, actually,

so like most of the time i have the warden & hawke turning up after the move to skyhold n then staying on, with the exception of bryant, carmine & mal. mal is as mentioned previously just There the whole time with her girlfriend. bryant steps in as king of ferelden w/ interests in closing the big hole in the sky spewing demons in2 his kingdom yk. carmine shows up because she wants to help & she wants protection for bethany but she outright says she’d rather die than be inquisitor so cassandra is shit out of luck.

“CHANGE HER MIND VARRIC” “she once doubled down on insisting amaranth was a shade of blue because she didn’t want to admit to being wrong. no one’s changing her mind seeker”

alas is the middle child of eight and is thus very good with children and also bossing around people older than him. 2 of his older siblings come to the inquisition when stuff in wycome has been settled

i left ash with the basic canon background with Some variation (he grew up under the qun and left of his own free will when his magic was discovered n he realized he couldn’t take living as a saarebas

kat on the other hand was raised tal-vashoth and has bounced around basically all over thedas and leads her own merc company when the conclave blows up. she also speaks multiple languages. is there a language she doesn’t speak? probably not

just realized how long this got so im gonna like. stop my general rambling now but lmao yeah theres some basics. waves hands.

#sol.txt#sol.orig#long post#late night followers im SO sorry for this#but also like.#i love them so yall just have 2 cope w/ it#no thoughts head dragon age#peonydarling

4 notes

·

View notes

Text

nvm this is my essay length review this is just happening now i guess (read more with apologies to mobile users)

he was rattling off facts about 70s music...i just....like....are you shitting me???? why....ok....im

opening shots of him are just multiple close ups on ben c’s hands like.....im really gay ok

this man really said “try me, beyonce” and they want me to not think hes gay

hes gay

did i fucking mention the score had HARPSICHORD??? HARPSI FUCKING CHORD

ALL the visuals were stunning, the scenery was STUNNING, the sets were STUNNING, the locations were STUNNING, the effects especially were STUNNING- not just pretty or well shot but they ACTUALLY made things look COOL which is fucking AMAZING and more films need to do STAT???? i cant get over how cool the new york sanctum was, OR the scene where they make the fucking cathedral fold in on itself- A CATHEDRAL??? LITERALLY JUST FOR THE STYLE OF IT!!! AMAZING

ben was amazing did i mention? hes just so good like. he tried his best with the accent and it came out better at times than others but he was great and cute...i love him kdjfgsd god. im so glad this is the marvel movie he was in....all his outfits were cute too thanks

idk if this was just me paying extra attention because Ben but honestly i usually struggle to be able to follow plots in films, especially superhero ones with complicated stuff like this but i never once struggled to understand what was happening or why or what the plot was or the motivations etc etc etc??? which is frankly a miracle

in fact i definitely feel like i understood everyones motivations fairly well, even christine’s like of course her character arc was pitiful and women in films need to be treated better but at least it was cool how for most of the movie she was actually just chilling and ignoring stephen jksdghjdlfs good for her

did i mention it was fucking beautiful and ben was great???

soooo many shots specifically were amazing especially around that big window in the sanctum but ESPECIALLY stephen’s superhero reveal moment.....wow

i gotta watch it again shaking off the “its BEN its ben its ben it looks like sherlock?? its ben” glasses but like i feel like they did a job turning stephen from an asshole to a man with a greater purpose...like if i rewatched and focused in on that specifically i think they built it up really well idk

idk if i can speak to the pacing because i paused a lot but like it was almost 2 hours long and it felt Good and didnt feel like idk dragging at all? it felt like it had good punctuations of really cool big effects/fast loud scenes, good story carrying it, etc

the humor actually felt really good and not super forced like i really genuinely laughed and the timing/joviality of the characters was good omg

also the whitewashing thing was def an issue though there was a decent amt of diversity on screen- could have been more though as always

the fact that the main mechanism in this movie and this section of the universe is like magic is sooooo good because theres no over explanation of like, nonsense science or whatever? and they dont try too hard to explain it and ruin it and/or make it annoying they just Let It Be magic.....which is really nice? and also the glowing effects look really cool

THERE WAS A FUCKING GHOST FIGHT? A FIGHT ON THE ASTRAL PLANE??? THEIR SOULS BATTLED...GHSDJAKFGSHDG ><FL:?~?

i said this already but again, i fucking hate most action sequences in super hero movies and in marvel especially and these actually were INTERESTING and good and not just bash smash x100 like they usually are like these had drama and suspense and were dynamic and, again, interesting which is amazing

[spoiler] and again, i always hate the senseless destruction and destroyed buildings, THEY LITERALLY UN DESTROYED A CITY? THEY TURNED BACK TIME TO UN DESTROY IT......thats ALL ive ever wanted from a superhero movie !??!?!? im like crying

[spoilers] the het romance was like bad ofc for a lot of reasons but i liked that the big scenes it had didnt feel forced and didnt end with stephen and christine actually together at all like.....it didnt even show them kiss ever? thanks also let them both be gay now

[spoiler] the scenario by which he annoys the villain into submission (which is by far the best fucking thing) is basically the plot of the best and most amazing doctor who ep ive ever seen and which i think about constantly so uh thanks

[spoiler] i already said this but when he goes into the dark dimension and its like spocks journey into vger!!!!!!! WITH BLACKLIGHT COLORS??

[spoiler] okay so mads’ characters speech to stephen is truly amazing because theres actually some doubt sowed that feels genuine, like it really does sound nice and you really are left wondering about a lot of things especially about the ancient one- admittedly like when you look at the plot as a whole of course theres loads of questions like...why should we trust the ancient one? i wanna say also why did dormammu give in so easily but actually i really enjoyed the lighthearteness of that scene- but the point is when actually watching that scene it was really fucking engaging and didnt feel like it went to waste

[spoiler] ben doing the villains voice too- which i TOTALLY recognized immediately- was also amazing just as like... the hero playing the villain....the levels...

[spoiler] i really want mordo to like. not be evil and FRANKTLY they fucking set up a great line to call back to wrt stephen and mordo becoming a dynamic duo. please let that happen and also let them be gay together you monsters

10 notes

·

View notes

Text

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

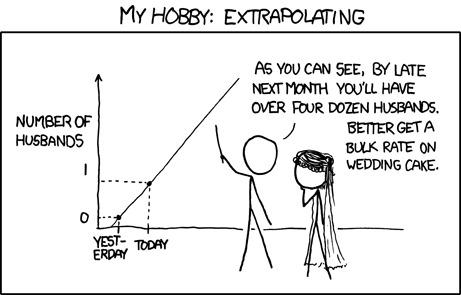

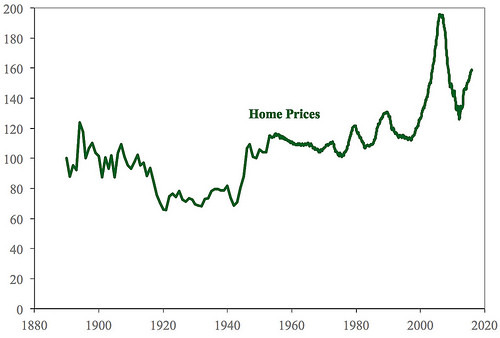

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

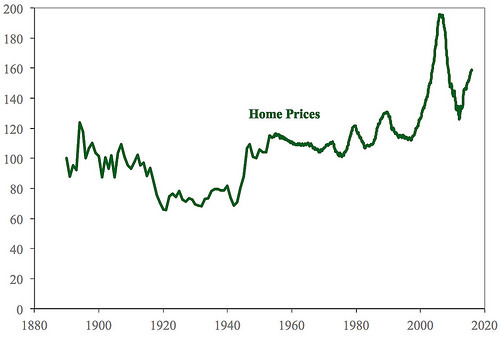

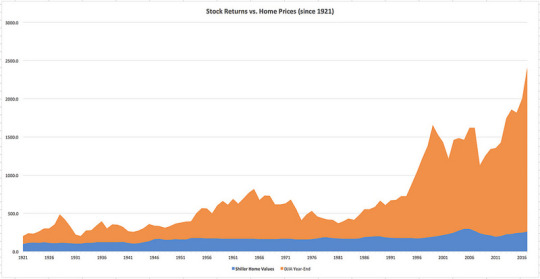

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! Shares 169 https://www.getrichslowly.org/home-investment/

0 notes

Text

Is your home a better investment than the stock market?

Shares 169 Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Dow Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Dow Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! Shares 169 https://www.getrichslowly.org/home-investment/

0 notes

Text

Is your home a better investment than the stock market?

Ill admit it: There are times that I think everything that needs to be said about personal finance has been said already, that all of the information is out there just waiting for people to find it. The problem is solved. Perhaps this is technically true, but now and then as this morning Im reminded that teaching people about money is a never-ending process. There arent a lot of new topics to write about, thats true (this is something that even famous professional financial journalists grouse about in private), but there are tons of new people to reach, people who have never been exposed to these ideas. And, more importantly, theres a constant stream of new misinformation polluting the pool of smart advice. (Sometimes this misinformation is well-meaning; sometimes its not.) Heres an example. This morning, I read a piece at Slate by Felix Salmon called The Millionaires Mortgage. Salmons argument is simple: Paying off your house is saving for retirement. Now, I dont necessarily disagree with this basic premise. I too believe that money you pay toward your mortgage principle is, in effect, money youve saved, just as if youd put it in the bank or invested in a mutual fund. Many financial advisers say the same thing: Money you put toward debt reduction is the same as money youve invested. (Obviously, theyre not exactly the same but theyre close enough.) So, yes, paying off your home is saving for retirement. Or, more precisely, its building your net worth. But aside from a sound basic premise, the rest of Salmons article boils down to bullshit.

Lying with Statistics Looking past the paying off your house is saving for retirement subtitle on his piece (a subtitle that was likely added by an editor, not by Salmon), we get to his actual thesis: Making mortgage payments can, in theory, be a way to accumulate wealth almost as effectively as contributing to a retirement fund. Im glad Salmon qualified this statement with in theory and almost because this is pure unadulterated bullshit. And its dangerous bullshit. Heres how this logic works: If you buy an urban house today for $315,000 (the average price) and it appreciates at 8 percent a year for the next 15 years, you will be living in a $1 million house by the time you pay off your 15-year mortgage, and you will own it free and clear. Which is to say: Youll be a millionaire. For this to be true, heres what has to happen.: Home prices in your area have to appreciate at an average of eight percent not just this year and next year, but for fifteen years.You have to take out a 15-year mortgage instead of a 30-year mortgage.You need to stay in that house (or continue to own it) for that entire fifteen years.Once youve become a millionaire homeowner, you now have to tap that equity for it to be of use. To do that, you have to sell your home, acquire a reverse mortgage, or otherwise creatively access the value locked in your home. The real problem here, of course, are the assumptions about real estate returns. Salmon spouts huckster-level nonsense: The 8 percent appreciation rate is aggressive, but not entirely unrealistic: Its lower than the 8.3 percent appreciation rate from 2011 through 2017, and also lower than the 9 percent appreciation rate from 1996 to 2007. Thats right. Salmon cites stats from 1996 to 2007, then 2011 to 2017 and completely leaves out 2008 to 2010. WTF? This as if I ran a marathon and told you that I averaged four minutes per milebut I was only counting the miles during which I was running downhill! Or I told you that Get Rich Slowly earned $5000 per monthbut I was only giving you the numbers from April. Or I logged my alcohol consumption for thirty days and told you I averaged three drinks per weekbut left out how much I drank on weekends. This isnt how statistics work! You dont get to cherry pick the data. You cant just say, Homes in some markets appreciated 9% annually from 1996 to 2007, then 8.3% annually from 2011 to 2017. Therefor, your home should increase in value an average of eight percent per year. What about the gap years? What about the period before the (very short) 22 years youre citing? What makes you think that the boom times for housing are going to continue? Long-Term Home Price Appreciation In May, I shared a brief history of U.S. homeownership. To write that article, I spent hours reading research papers and sorting through data. One key piece of that post was the info on U.S. housing prices. Let me share that info again. For 25 years, Yale economics professor Robert Shiller has tracked U.S. home prices. He monitors current prices, yes, but hes also researched historical prices. Hes gathered all of this info into a spreadsheet, which he updates regularly and makes freely available on his website. This graph of Shillers data (through January 2016) shows how housing prices have changed over time:

Shillers index is inflation-adjusted and based on sale prices of existing homes (not new construction). It uses 1890 as an arbitrary benchmark, which is assigned a value of 100. (To me, 110 looks like baseline normal. Maybe 1890 was a down year?) As you can see, home prices bounced around until the mid 1910s, at which point they dropped sharply. This decline was due largely to new mass-production techniques, which lowered the cost of building a home. (For thirty years, you could order your home from Sears!) Prices didnt recover until the conclusion of World War II and the coming of the G.I. Bill. From the 1950s until the mid-1990s, home prices hovered around 110 on the Shiller scale. For the past twenty years, the U.S. housing market has been a wild ride. We experienced an enormous bubble (and its aftermath) during the late 2000s. It looks very much like were at the front end of another bubble today. As of December 2017, home prices were at about 170 on the Shiller scale. (Personally, I believe that once interest rates begin to rise again, home prices will decline.) Heres the reality of residential real estate: Generally speaking, home values increase at roughly the same (or slightly more) than inflation. Ive noted in the past that gold provides a long-term real return of roughly 1%, meaning that it outpaces inflation by 1% over periods measured in decades. For myself, thats the figure I use for home values too. Crunching the Numbers Because Im a dedicated blogger (or dumb), I spent an hour building this chart for you folks. I took the afore-mentioned housing data from Robert Shillers spreadsheet and combined it with the inflation-adjusted closing value of the Down Jones Industrial Average for each year since 1921. (I got the stock-market data here.) If youd like, you can click the graph to see a larger version.

Let me explain what youre seeing. First, I normalized everything to 1921. That means I set home values in 1921 to 100 and I set the closing Down Jones Industrial Average to 100. From there, everything moves as normal relative to those values.Second, Im not sure why but Excel stacked the graphs. (Im not spreadsheet savvy enough to fix this.) They should both start at 100 in 1921, but instead the stock market graph starts at 200. This doesnt really make much of a difference to my point, but it bugs me. There are a few places 1932, 1947 where the line for home values should actually overtake the line for the stock market, but you cant tell that with the stacked graph. As the chart shows, the stock market has vastly outperformed the housing market over the long term. Theres no contest. The blue housing portion of my chart is equivalent to the line in Shillers chart (from 1921 on, obviously). Now, having said that, there are some things that I can see in my spreadsheet numbers that dont show up in this graph. Because Felix Salmon at Slate is using a 15-year window for his argument, I calculated 15-year changes for both home prices and stock prices. Ill admit that the results surprised me. Generally speaking, the stock market does provide better returns than homeownership. However, in 30 of the 82 fifteen-year periods since 1921, housing provided better returns. (And in 14 of 67 thirty-year periods, housing was the winner.) I didnt expect that. In each of these cases, housing outperformed stocks after a market crash. During any 15-year period starting in 1926 and ending in 1939 (except 1932), for instance, housing was the better bet. Same with 1958 to 1973. In other words, if you were to buy only when the market is declining, housing is probably the best bet if youre making a lump-sum investment and not contributing right along. Another thing the numbers show is that youre much less likely to suffer long-term declines with housing than with the stock market. Sure, there are occasional periods where home prices will drop over fifteen or thirty years, but generally homes gradually grow in value over time. The bottom line? I think its perfectly fair to call your home an investment, but its more like a store of value than a way to grow your wealth. And its nothing like investing in the U.S. stock market. For more on this subject, see Michael Bluejays excellent articles: Long-term real estate appreciation in the U.S. and Buying a home is an investment. Final Thoughts Honestly, I probably would have ignored Salmons article if it werent for the attacks he makes on saving for retirement. Take a look at this: If youre the kind of person who can max out your 401(k) every year for 30 or 40 years straight disciplined, frugal, and apparently immune to misfortune then, well, congratulations on your great good luck, and I hope youre at least a little bit embarrassed at how much of a tax break youre getting compared to people who need government support much more than you do. Holy cats! Salmon has just equated the discipline and frugality that readers like you exhibit with good luck, and simultaneously argued that you should be embarrassed for preparing for your future. He wants you to feel guilty because youre being proactive to prepare for retirement. Instead of doing that, he wants you to buy into his bullshit millionaires mortgage plan. This crosses the line from marginal advice to outright stupidity. Theres an ongoing discussion in the Early Retirement community about whether or not you should include home equity when calculating how much youve saved for retirement. There are those who argue absolutely not, you should never consider home equity. (A few of these folks dont even include home equity when computing their net worth, but that fundamentally misses the point of what net worth is.) I come down on the other side. I think its fine good, even to include home equity when making retirement calculations. But when you do, you need to be aware that the money you have in your home is only accessible if you sell or use the home as collateral on a loan. Regardless, Ive never heard anyone in the community argue that you ought to use your home as your primary source of retirement saving instead of investing in mutual funds and/or rental rental properties. You know why? Because its a bad idea! https://www.getrichslowly.org/home-investment/

0 notes