#// bless warner for never proposing

Explore tagged Tumblr posts

Text

The Greatest Writer that Never Was (Part 2)

So then, how did Martin Scorsese get his hands on the book if it wasn’t published yet?

Unfortunately, I don’t really know all of the details as to how this happened. However, here’s what I do know so far. In 1953, an unknown Hollywood producer named Scott Meyers got his hands on one of the drafts for Goncharov while living in San Bernardino. According to Meyers’ own account, he picked up the draft off the sidewalk that was sitting next to a garbage can, read through a couple pages, immediately got in his car, drove to the offices of Warner Brothers Studios in Burbank, and pitched the idea for a movie adaptation of Goncharov. However, it was rejected on arrival and put into a drawer full of other rejected film proposals.

Twenty years later in 1973, another producer named Jeffery Hudson got his hands on that very same draft and decides to get into contact with Martin Scorsese along with screenwriter, Mardik Martin, to adapt Goncharov into a movie. The three of them agreed to adapt the movie into a feature length film. And, of course as we all know, the movie adaptation wouldn’t be released until 1978 seeing as production for the film took three years to make.

What happened to the final version of Morozov’s Goncharov?

Once again, I genuinely have no idea. All I can really speculate is that, in 1973, the day that Morozov died, the nurse who was taking care of him found the finished copy of Goncharov in his room and pitched the book for publication to Penguin Books to become a Penguin Classics. However, while Penguin Books loved the book and accepted the proposal, the book wouldn’t be released, in an official capacity, until December of 1993 due to, not just the political climate of the time, but also due to the amount of effort it took just to translate the book from Russian to English.

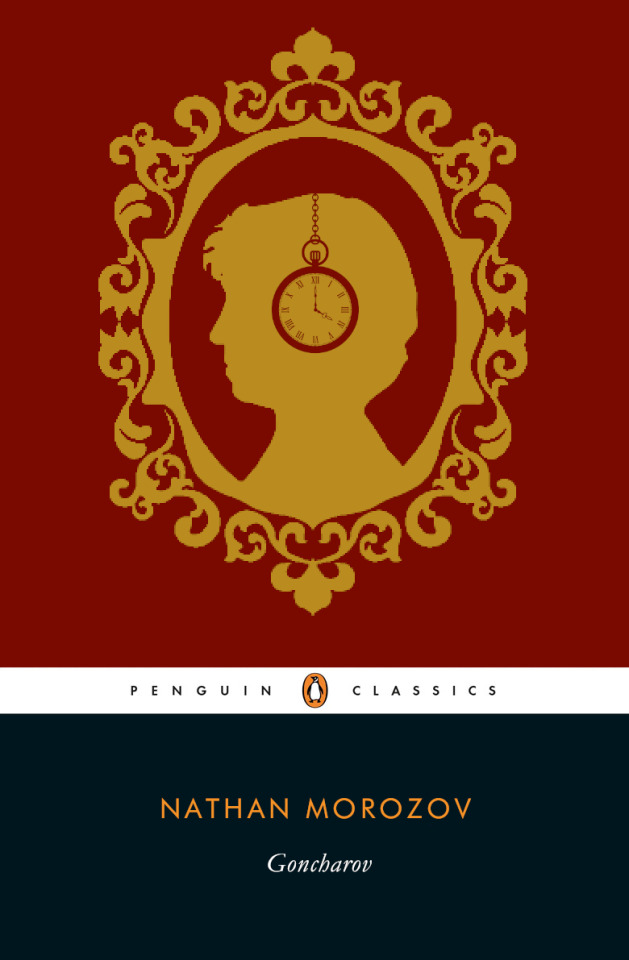

This is the cover for the 1993 version of Goncharov by Nathan Morozov.

In 2008, Martin Scorsese was asked during an interview how he managed to adapt Goncharov into the cult classic movie that it was even though the book itself was published in 1993. Scorsese is quoted as saying, “For some reason, Warner Bros. had this weird Russian novel I’ve never heard of before lying around along with their other rejected film proposals and a producer from the studio got into contact with me and my life long friend, Madik Martin, and he told us everything that the book was about. He told us about Goncharov, he told us about Andrey, Mario, Katya, Sofia, and all of these other side characters. It definitely helped that this producer knew how to read Russian, which was a blessing. But Madik and I got so inspired by that meeting, we began to lay out the blueprint for what this movie was going to be. I know that everyone has their interpretation as to what the book was about, but I feel like with this film, we set out to be as faithful to the work as possible and I think we’ve accomplished that.”

In 2018, Penguin Books decided to republish the book as a part of their line of Penguin Classics.

This is the cover for the 2018 version of Goncharov by Nathan Morozov.

Like many other Russian writers who have adapted Goncharov’s trilogy, the ending is always concrete. And, while Morozov’s version is no different from his contemporaries, the one thing I admire the most is that he focuses on not just the pocket watch, but he also focuses on the thoughts of each character in the book and, more specifically, Goncharov’s own thoughts. Goncharov doesn’t like the fact that he’s moved to Italy and then had to resort to crime. But he has no other choice. Russia was the country that broke him down as a man. But Italy was going to be the country that could make him become a new man. However, in the end, he was destined to fall from the start.

Rest in Peace

Nathan Morozov (1897 - 1975)

9 notes

·

View notes

Text

‘Joker’ Paints An Uncomfortable Picture of Today’s World

Never did I think I’d see the day where I could parallel even the darkest of Batman themes to the world we live in.

Todd Phillips’ latest blockbuster Joker stars Joaquin Phoenix as the clown prince of crime we all know and love. Phillips’ other films include the Hangover trilogy, but this new film doesn’t have a happy go-lucky trio trying to remember their drunken stupors and find their fourth mate.

Joker makes the audience laugh, but in a nervous, sort of uncomfortable way.

At the Venice Film Festival, Joker received an eight-minute standing ovation.

Reviews poured in following the Italian premiere and they backed up the hype. Mark Hughes of Forbes said, “The fact is, everyone is going to be stunned by what Phoenix accomplishes, because it’s what many thought impossible — a portrayal that matches and potentially exceeds that of The Dark Knight’s Clown Prince of Crime.”

The film opens with Phoenix touching up his makeup in front of a vanity. He hooks his fingers in the corners of his mouth and pulls them upward in a smile, downwards in a frown, then back up again; a single, mascara-stained tears roll down his cheek, and laughter ensues.

Phoenix plays Arthur Fleck, an eccentric man with a funny laugh and a horrifying past, searching for his identity. The film encapsulates Arthur’s journey with himself and his downward spiral into becoming the Joker.

There are some prevalent themes within Joker that are worth talking about; the most prevalent being mental health and its effect on people in today’s society. There are several scenes in which Phoenix is sitting in front of his therapist, and she eventually jerks the needle off the record and informs him that the city has cut the clinic’s funding and their meetings must come to an end. The therapist goes on to claim that the higher-ups, “don’t give a shit,” about people like him or her.

According to the National Survey of Drug Use and Health, in 2016, 9.8 million adults aged 18 or older in the U.S. had a serious mental illness; 2.8 million of those adults were below the poverty line. Insurance companies have also been known to skimp when it comes to mental health cases, which makes it that much harder for people relating to Arthur to seek help. According to a study published by Milliman, in 2015, behavioral care was four to six times more likely to be provided out-of-network than medical or surgical care. In President Trump’s proposed 2020 budget, his administration aims to cut $241 billion from Medicaid, an assistance program that provides healthcare to low-income Americans.

Dancing is a symbol that is heavy in Joker. According to a Harvard study, “dance helps reduce stress, increases levels of the feel-good hormone serotonin, and helps develop new neural connections, especially in regions involved in executive function, long-term memory, and spatial recognition.” After especially tense scenes, Arthur begins a slow, emphasized dance routine that is hauntingly beautiful.

With mental health being such a prevalent theme, Arthur clinging onto dancing as a coping mechanism or escape from the world backs up the analysis that he’s doing it to improve his mental health — or at least attempt to.

In any Batman rendition — comics, movies, TV shows, video games — Gotham is always on fire… literally. In Joker, we see a bright Gotham in the beginning, with normal big-city crimes happening: teenagers stealing things, muggings, etc. By the end of the film, Arthur has bred chaos in the streets, and we see the imagery of Gotham that has become so prevalent within the Batman universe. In both Arthur and Gotham’s descent into madness, there’s an arc that’s ever present: protesting the elite.

All around the country, protests have emerged to combat the elite. Most recently, climate change has brought criticism on the world’s elite members and their inability to make a change. In the past, police brutality has created protests in riots from victim’s families and their supporters, calling for change in law enforcement procedures. Countless marches have been held in response to several pieces of legislations passed (abortion laws, Planned Parenthood budget cuts, LGBTQ+ rights).

“Kill The Rich” is a headline that pops up time and time again throughout the film, feeding into this “protest the elite” arc. Arthur guns down three rich men in the subway following their harassment of a woman and a physical altercation between himself and the men. This sparks a movement within Gotham that empowers Arthur and makes him feel noticed, something he’d never experienced in his life before. Citizens of Gotham supporting this movement don clown masks to imitate the suspect, aka, Arthur.

Joker has faced its fair share of backlash. Stephanie Zacharek of Time Magazine took no prisoners in her review, stating that Joker, “lionizes and glamorizes Arthur even as it shakes its head, faux-sorrowfully, over his violent behavior.” Other reviews have had similar opinions. In 2012, a mass shooting broke out at a Colorado movie theatre during The Dark Knight Rises premiere. The assailant fatally shot 12 people. Family members of the slain victims wrote a letter to Warner Bros. expressing their concerns.

Sandy Phillips, mother to 24-year-old victim Jessica Ghawi, told The Hollywood Reporter, “I don't need to see a picture of [the gunman]; I just need to see a Joker promo and I see a picture of the killer … My worry is that one person who may be out there — and who knows if it is just one — who is on the edge, who is wanting to be a mass shooter, may be encouraged by this movie. And that terrifies me.”

In what is perhaps its most iconic scene, Arthur eccentrically dances down the stairs that we see him trudge up throughout the film. This is also the first time we see him in that iconic purple suit, green hair, and a full face of makeup. He is dancing to Gary Glitter’s “Rock and Roll Part Two,” which has earned the film more backlash. Gary Glitter is a convicted pedophile currently serving a 16-year prison sentence. According to CNBC, Glitter is allegedly slated to receive royalties from the use of his song in the movie.

People took to Twitter to post their opinions about the film. One user tweeted, “#JokerMovie was the most brutal, uncomfortable and tense movie experience I’ve had in a long time. Joaquin Phoenix is chilling. The film was spot on and did everything it should have for a character like the Joker.”

Another user tweeted, “Outstandingly Disturbing. Prolific. Necessary Blessing to Modern Cinema.”

As much as I enjoyed the film’s premise, production, and Phoenix’s performance, I do think there are some troubling themes that need to be brought up. Arthur often justifies his heinous actions by stating “they deserved it” and using the defense that society treats “people like him” like “trash” so, they should all die. He feeds into the “Kill The Rich” movement that he involuntarily created in the subway when he committed what we presume to be his first murder(s).

Though I know the concept behind the Joker character, I can see how this can be construed as glorifying gun violence. However, we can’t have the Gotham supervillain without violence and guns. It’s an accurate representation of the character, and it’s unfortunate that it parallels a lot of what’s going on in the world today.

The Joker is also painted to incite pity within viewers, which a lot of times, it does --- or at least attempts to. This is classic Joker behavior. In Paul Dini and Bruce Timm’s comic Mad Love, readers meet Dr. Harleen Quinzel, a psychiatrist at Arkham Asylum. She gets assigned to none other than --- you guessed it --- the Joker. Though this woman is highly educated (we won’t talk about the things she did to get that education), the Joker still manipulates her and convinces her to not only help him escape Arkham, but become his partner-in-crime as well; Harleen Quinzel is no more and Harley Quinn is born.

She pities him and his situation, and he spins his tale of woe so expertly that she has the wool pulled over her eyes. Throughout the comic --- and the general timeline for Joker and Harley --- Joker mercilessly abuses Harley, from pushing her out a window to not noticing she was gone for six months. He is a cruel, manipulative psychopath that nobody should follow in the footsteps of; however, he’s good at his job, and Joker showcases that, however controversial and uncomfortable it may be.

Joker is rated R for a reason; not only are there a few F-bombs, the violence is staggering. However, when dealing with a character that is known for inciting violence and not caring about the consequences, tough scenes are necessary. Phillips didn’t shy away from blood and intensity in his murder scenes, and Phoenix went all in when it came to brutality. Personally, (spoiler!) I never really wanted to see Robert De Niro’s brains blown out the back of his skull, but you can’t have the Joker without some blood.

And finally, while the troubled citizens looking for a leader are terrorizing Gotham following Arthur’s murder of Murray Franklin (Robert De Niro) on live television, our hero’s story starts. Thomas and Martha Wayne are gunned down in an alley outside a theatre by a rogue thug and Joker fan, and young Bruce Wayne begins his famous story.

Joker was original in concept and plot, but had just enough callbacks to the comics to make it permissible. The atmosphere in the full theatre I was in was palpable. There were chuckles and titters here and there when Arthur would make a funny joke, or everyone was just laughing off the tension of the moment. There were also audible gasps and groans when things got especially rough (such as the aforementioned Robert De Niro scene). Joker did exactly what the real Joker would have wanted: it incited a reaction out of people.

I had low expectations going into the movie because, as someone who grew up reading Batman and loving to hate the Joker, I was afraid my favorite complex villain was going to get ruined (looking at you, Jared Leto). I was pleasantly surprised by Phoenix’s performance and Phillips’ take on Mista J, and it was a refreshing performance that was a polar opposite from the late Heath Ledger’s, but equally as convincing and chilling.

An Oscar seems to be on the horizon for both Phillips and Phoenix for Joker. The film is raunchy and tense, and I didn’t know I could hold my breath for two hours. It’s exactly what a Joker movie should be, and I’d encourage anyone to go watch it.

#joker#the joker#joker movie#review#joker review#comic book#comic book review#movie#dc#dc comics#todd phillips#joaquin phoenix#pop culture

1 note

·

View note

Note

Can I request an imagine with Peter Stone x Female Reader set to the song 'Time After Time' by Cyndi Lauper, where Stone runs after the reader (after accidentally yelling at her and telling the reader to go and leave) and he catches up to the reader and proposes to her in front of people. Is it alright with you? If you need to make changes, you have my blessing! 😘❤

Lying in my bed I hear the clock tick

And think of you

Caught up in circles

Confusion is nothing new

Flashback, warm nights

Almost left behind

Suitcases of memories

Time after

Two months since you left the apartment you shared with your boyfriend. And two months since you had actually had a decent night sleep. You listened to the clock ticking away in the kitchen. Your friend had been kind enough to let you crash on her couch until you figured out what you were going to do.

Pushing yourself to a sitting position you picked up your phone. A picture of you and Peter filled your screen from your most recent vacation to Vegas. Things had gone so bad so quickly. Leaving had been the hardest decision you ever made. Peter’s hours became longer, coming home later. He had begged you to stay, promising to change. But that was a promise you knew he couldn’t keep. Not all the times were bad, more good than bad memories. You kept those tucked away in the back of your mind.

Sometimes you picture me

I'm walking too far ahead

You're calling to me, I can't hear

What you've said

Then you say, go slow

I fall behind

The second hand unwinds

On the other side of town, Peter tossed and turned in the large bed that he once shared with you. He reached out in vain but was met with a cold, empty recess. Peter sighed heavily. In the first weeks since you left, he was filling his void with alcohol and random woman. He realized though that was not the way to handle you leaving or the loss of his father and sister. For the last month, he had been sober of both alcohol and woman.

He applied his thumb to unlock his phone. Swallowing back a lump in his throat, he trailed a finger over your image on his phone. So many chances he had squandered. You asked him to slow down so many times. You felt lonely. Left behind. But you took a backseat to his ambition of a successful career. You begged him so many times, but it was like he didn’t hear you or didn’t want to. He sighed, deciding to get up. Sleep wasn’t coming tonight.

If you're lost you can look and you will find me

Time after time

If you fall I will catch you, I will be waiting

Time after time

[From: Peter 7:37AM] Just want to say hi. See how you are doing. I miss you. I really need to see you. Had a tough case.

You were conflicted. On one hand, you really wanted to see Peter. You knew you were his person. His safe landing when things got tough. But on the other hand, you really wanted to see him too. Sighing you tapped out a text.

[To: Peter 7:42AM] I’m okay. I miss you too. I’m off at 3pm. We can have dinner.

[From: Peter 7:44AM] Thank you. We can have dinner at home. I’ll cook.

If you're lost you can look and you will find me

Time after time

If you fall I will catch you, I will be waiting

Time after time

He heard the front door open and took a deep breath. He stopped out of the kitchen. God, you looked so good. He watched as you took your coat off, slung it over the chair and dropped your bag haphazardly on the floor. Next, you toed off your shoes in the middle of the room. He smiled. “Good to see some things never change.”

You grinned back. “Nice to see you too.”

He walked over to you and pulled you to him for a hug. “I’ve have missed you so damn much.”

You melted into his chest, and he felt you clutch onto his shirt. He kissed the top of your head. “I missed you too,” she muttered into your shirt.

The two of you stood like that for a while. Just holding one another. “C’mon. Let’s eat,” he said.

After my picture fades and darkness has

Turned to gray

Watching through windows

You're wondering if I'm okay

Secrets stolen from deep inside

The drum beats out of time

“I want to apologize for that night. I saw the person I was fading away. After you left I turned to old vices, thinking I’d find the answer. All I could find was more heartache,” he confessed. “I’m in counseling and I’m going to AA. I don’t know if it’s too late for us. I pray it’s not.” He searched your face for a clue of what you were thinking.

Admission of guilt was not something that comes easily to anyone. “It’s not too late. We have a lot to work on but I want to fight for us. I love you too much.”

If you're lost you can look and you will find me

Time after time

If you fall I will catch you, I'll be waiting

*one year later*

“Crap. I have to go. I’m going to be late for my meeting,” You called through the house to Peter as you jumped up from the table, and downed your coffee. “I love you!”

Peter caught up with you out on the sidewalk. “Wait.” He was still in just his sleep pants.

“What? Did I forget something?”

“You forget this.” He pulled you in for a smoldering kiss. “And this.” He dropped to one knee and presented you with the clearest cut diamond ring you had ever seen. “Marry me? Please. I love you so much.”

“Yes! Yes! 100% yes!” He slipped the ring on your finger. “I love you too.” And you fell into his arms and he caught you like you had caught him so many times before.

Time after time

Time after time

Songwriters: Robert Hyman / Cyndi Lauper

Time After Time lyrics © Sony/ATV Music Publishing LLC, Warner/Chappell Music, Inc

48 notes

·

View notes

Text

Beach Boys Theory Time! The Why of ‘When Girls Get Together’

The Beach Boys recorded a song called ‘When Girls Get Together’ in November 1969. This lush, very Mediterranean-sounding ditty with really strange lyrics clearly written by a misguided recluse (and sincerely so) was intended for the album SUNFLOWER, which was the group’s first album for their then-new label Reprise (a division of Warner Bros. Records) and their 16th album overall. The song ultimately never made it to the 1970 album, and was in consideration for subsequent albums thereafter... It wouldn’t be released until March 1980, in a strange remixed form on an album that it arguably did not sound right on: KEEPIN’ THE SUMMER ALIVE.

I’m not here to talk about the song itself in particular, but rather a very strange place where it was at one point... Or at least half of it...

This ties into the convoluted history of the SUNFLOWER album itself, and the two album projects that the group’s Reprise debut eventually grew out of. I had already written extensively about that on a blog post back in December of 2018, but the mystery of one thing was left unresolved... until I had a theory recently!

The background: The Beach Boys were leaving their previous record label, Capitol, in mid-1969. The group were at odds with the label for a variety of reasons, and were readying their final submissions to the label - a single and an LP. Sessions commenced in January, and continued on through about April. Upon the revival of a lawsuit concerning royalties, the band were done. A final single - ‘Break Away’ - was submitted, but not an album... Though they had enough material for an LP, they for whatever reason didn’t budge on the album.

Capitol looked to release another single from their previous album, 20/20, the song ‘Cotton Fields’. Al Jardine, who co-produced the track with Brian Wilson, was dissatisfied with it and opted to have a new version recorded in August. A single release didn’t happen anytime soon, but it was yet another track to have on the final Capitol album. The Beach Boys recorded new material in fall 1969 and focused on signing on with a new label, and after many rejections and setbacks, Warner Bros. agreed to pick them up. By February 1970, the group had a new album formed up of the newly-recorded material. ‘When Girls Get Together’ was a track on this proposed album, titled SUNFLOWER. Warner’s chief Mo Ostin rejected the record.

After a tour that spanned Australia and New Zealand in the spring, The Beach Boys had two dilemmas... Capitol was still owed a studio LP, and they needed to rework SUNFLOWER for Warner execs’ approval. Capitol had quietly released a poorly-mixed ‘Cottonfields’ as a single in April 1970, which had flopped hard in the states but was a massive hit internationally (which is where the group’s commercial fortunes were for the previous few years). Unbeknownst to both parties, Capitol’s England-based parent company EMI had decided to step in and do the work themselves. EMI released LIVE IN LONDON, compiled from a December 1968 show, without the band’s blessing in the UK and continental Europe starting in May. With that fulfilling the group’s Capitol contract, they were free to keep that early 1969 material for themselves and use it for future projects. Which they did... Four tracks from those sessions were put onto SUNFLOWER, the final track-listing submission was okayed by Warner in July 1970 and the album was released in August.

What was supposed to be on the group’s near-realized final studio album for Capitol? Prior to the LIVE IN LONDON album inadvertently bailing the group out of that obligation, the group put together a tape called “Last Capitol Album”. It was composed of all the early 1969 recordings.

‘Break Away’ (in a new mix with a different ending)

‘Celebrate the News’ (the B-side of the ‘Break Away’ single)

‘Forever’ (used on SUNFLOWER)

‘All I Wanna Do’ (used on SUNFLOWER)

‘San Miguel’

‘Deirdre’ (used on SUNFLOWER)

‘Got to Know the Woman’ (used on SUNFLOWER)

‘Loop de Loop’

‘Cottonfields’ (the re-recorded single version)

In order to round out the possible Capitol submission, The Beach Boys dug into the vaults. Included on the line-up was ‘The Lord’s Prayer’, an accappella B-side from 1963 that was remixed in duophonic. This gives one the sense that they weren’t going to really try, or at least they didn’t want to give the label any more unreleased material (perfectly fine tracks from around 1968-69, like ‘We’re Together Again’ and ‘Mona Kana’, were laying around) than they were already giving them.

But the weirdest inclusion on the “Last Capitol Album” is when ‘When Girls Get Together’. Not the finished song, but the instrumental track...

I had asked... Verbatim... Why in the world would the backing track of a completed song that was on the acetate of the band’s first album for a whole other label… Be on this master? Maybe as some kind of joke? A sort-of final insult to the label that had given them such a hard time during the last three years? A mistake?

I think I figured it out...

Maybe they were planning on rewriting the lyrics to ‘When Girls Get Together’. It wasn’t uncommon for the group to take backing tracks and repurpose them with new lyrics. Or heck, even the same song structures and melodies.

Examples:

‘Land Ahoy’, an outtake from the SURFIN’ SAFARI sessions in mid-1962, was rewritten as ‘Cherry, Cherry Coupe’ in fall 1963 for LITTLE DEUCE COUPE.

The group’s well-known Christmas staple, ‘Little Saint Nick’, is literally just ‘Little Deuce Coupe’ with holiday lyrics and jingle bells.

A 1963 track called ‘All Dressed Up for School’ evolved into ‘I Just Got My Pay’ in 1969 (a SUNFLOWER outtake), and then later into ‘Marcella’ for the album CARL AND THE PASSION in 1972.

The songs ‘Child of Winter (Christmas Song)’, ‘It’s OK’, ‘Mike Come Back to L.A.’, and ‘Some of Your Love’ are all based - in some way or another - around the same chorus.

So I think, with that in mind, that ‘When Girls Get Together’ at one was going to get a lyrics rewrite... Which could explain why the backing track of it is on the “Last Capitol Album” tape. It wasn’t an album submission, just a collection of tracks that were considered for or were going to be on the album.

In the end, nothing was done with ‘When Girls Get Together’. The track remained as is, and was considered for a few albums afterwards. It appears on the September 1970 internal track collection known as the “2nd Warner Bros. Album”, and it was also in consideration for an untitled album that was to be released sometime in late 1976/early 1977 opposite LOVE YOU (which was then a Brian Wilson solo album titled BRIAN LOVES YOU). Again, it finally appears on KEEPIN’ THE SUMMER ALIVE.

That’s just my theory, though. I don’t think many Beach Boys fan even think about this particular detail when talking about the history of SUNFLOWER, and the “Last Capitol Album”.

1 note

·

View note

Text

Trump needs a market scape goat

Editor’s Note: This edition of Free Morning Money is published weekdays at 8 a.m. POLITICO Pro Financial Services subscribers hold exclusive early access to the newsletter each morning at 5:15 a.m. To learn more about POLITICO Pro’s comprehensive policy intelligence coverage, policy tools and services, click here.

PROGRAMMING NOTE: Morning Money will not publish on Thursday, Nov. 22 and Friday, Nov. 23. Our next Morning Money newsletter will publish on Monday, Nov. 26.

Story Continued Below

TRUMP NEEDS A SCAPEGOAT — Another brutal day on Wall Street and President Trump once again decided to blame Fed Chair Jay Powell rather than face the reality that the U.S. economy is likely to slow down next year as the tax cut stimulus fades, a trade war with China looms and the deficit spikes higher with demand for U.S. debt declining.

The Fed is doing exactly what it’s supposed to at a time of very low unemployment and rising wages. And every time Trump bashes the central bank he makes it LESS likely that the Fed will look at sluggish growth numbers and sagging stocks and decides to slow down its pace of rate hikes. The central bank cannot allow itself to be viewed as caving to Trump or it will erode its independence and lose credibility with markets.

It seems clear that Trump – even as senior advisers tell him to leave Powell alone – is much more interested in having a fall guy to blame for the market decline than he is about having a better shot at the Fed pausing in December or reducing the number of hikes expected next year. For the moment he needs to blame the fact that markets are now down for the year or someone other than himself. And that person is Jay Powell.

And this is exactly what he did on Tuesday: “I’d like to see the Fed with a lower interest rate. I think the rate’s too high. I think we have much more of a Fed problem than we have a problem with anyone else,” Trump told reporters outside the White House. “I think your tech stocks have some problems.”

WHAT THE MARKET NEEDS: PANIC! — Leuthold’s Jim Paulsen emails on what might stop the market swoon: “Primarily, PANIC — a capitulation and widespread belief that a recession is imminent and the bull is over — that may represent one last great buying opportunity if we do not have a recession. So far most of the corrections this year have been calm, well controlled and thought of more as refreshing pauses made to ‘buy on the dip’ rather than things to run from. When we do bottom, I expect ‘panic’ to be widespread among the media stories and investors.”

Cumberland’s David Kotok emails: “Washout comes at any time in panic selling. This is what one gets from a Trade War. Thank you Peter Navarro. Now up to POTUS to make a truce in Buenos Aires. Then everyone wins. No truce, everyone loses more.”

HOW TRUMP MEASURES UP — Via Bespoke Investment Group: “It may sound hard to believe, but for all the talk about how well the stock market has done under President Trump, the Dow … is actually up less (25.69 percent) since he took office than it was under President Obama (40.94%) at the same point in his Presidency.” Read more.

Mohamed El-Erian in the FT — “Life would be better for equity investors if the transition from quantitative easing and ultra-low interest rates was unfolding against a backdrop of solid economic growth. Instead, the global economy is losing momentum and the divergence between advanced economies is growing.

“As a result, financial market choppiness has been ruling the day and unsettling investors. That leaves portfolios more vulnerable to technical dislocations and behavioural biases. Having been conditioned over the past decade to expect central banks to repress financial volatility and flinch at the first sign of market vulnerabilities, traders and investors are only slowly coming to terms with the less pleasant reality of a world of tighter liquidity.” Read more.

ENERGY SECTOR BLUES — Bloomberg Opinion’s Liam Denning: “If coming last in a popularity contest stings, consider how it feels to come first in an unpopularity contest. In Tuesday’s mass defriending of stocks, the energy sector managed to stand out in the worst possible way.

“The whiplash here is incredible. In early October Nymex crude oil was trading at more than $76 a barrel and the S&P 1500 exploration and production index was at its highest level in more than three years. Since then, they’re down 28 percent and 20 percent respectively. In relative terms, E&P stocks are trading at their lowest level on forward [earnings] multiples since Christmas 2008, another holiday season not noted for its bounding optimism” Read more.

WHAT IS THE FED TO DO? — Pantheon’s Ian Shepherdson: “Expectations for a March rate hike have dipped since Fed Vice-Chair Clarida’s CNBC interview last Friday. The renewed drop in stock prices hasn’t helped, either. But we aren’t at all sure that Mr. Clarida wanted his words to be interpreted as a dovish signal. …

“And this year, the numbers have been strong enough for the Fed—probably—to hike four times, one more than expected at the start of the year. In other words, numbers which were soft enough to stay the Fed’s hand in 2016, say, would not be enough now to do the same, given that the unemployment rate is now 3.7% and still falling, and wage growth is at 3% and rising.”

NEW THIS A.M.: SOFT GLOBAL OUTLOOK — From the OECD’s latest economic outlook out at 5:00 a.m. EST this morning: “The global economy is navigating rough seas. Global GDP growth is strong but has peaked. In many countries unemployment is well below pre-crisis levels, labour shortages are biting and inflation remains tepid.

“Yet, global trade and investment have been slowing on the back of increases in bilateral tariffs while many emerging market economies are experiencing capital outflows and a weakening of their currencies. The global economy looks set for a soft landing, with global GDP growth projected to slow from 3.7 percent in 2018 to 3.5 percent in 2019-20.

“However, downside risks abound and policy makers will have to steer their economies carefully towards sustainable, albeit slower, GDP growth. Engineering soft landings has always been a delicate exercise and is especially challenging today.”

The OECD has the U.S. growing at a 2.7 percent pace in 2019 and 2.1 percent in 2020, hardly numbers Trump would celebrate.

A LEAD FOR THE AGES — Via the NYT’s Mark Lander: “President Trump defied the nation’s intelligence agencies and a growing body of evidence on Tuesday to declare his unswerving loyalty to Saudi Arabia, asserting that Crown Prince Mohammed bin Salman’s culpability for the killing of Jamal Khashoggi might never be known.” Read more.

GOOD WEDNESDAY MORNING — Wishing a blessed and peaceful Thanksgiving to all. Don’t talk politics around the table. Email me on [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver at [email protected] and follow her on Twitter @AubreeEWeaver.

THIS MORNING ON POLITICO PRO FINANCIAL SERVICES — Victoria Guida: BANK PROFITS SOAR IN WAKE OF TAX CUTS, REGULATORY ROLLBACKS — “Bank profits continue to hit new highs, reaching a record $62 billion in the third quarter, as lenders reap the benefits of lower taxes and looser regulations. Third quarter bank profits were up 29.3 percent from the same period last year, according to new data from the Federal Deposit Insurance Corp., and only 3.5 percent of banks were unprofitable, compared to 4 percent a year ago. The data was released hours after the FDIC voted to sign on to a Federal Reserve proposal to ease a range of capital and liquidity requirements on large regional banks. Roughly half of the increase in net income was due to tax reform, the FDIC said, but profits for the quarter still would have been $54.6 billion without that.” Read more.

THE ADAGE “WORK HARD AND GET AHEAD” is a waning reality in America today. The question is: What can Washington do to foster more opportunity and prosperity in struggling communities across the country? POLITICO convened a bipartisan group of 14 business leaders, thinkers and policymakers to explore the problem and identify solutions that have a realistic path forward with political leaders of both parties. Read the latest issue of The Agenda to learn more.

DRIVING THE DAY — Big pile of economic data today ahead of the holiday for markets to chew on including durable goods orders at 8:30 a.m. which are expected to drop 2.2 percent headline and rise 0.4 percent ex-transportation. Existing Home Sales at 10:00 a.m. expected to rise to 5.20M from 5.15M … Univ. of Michigan Consumer Sentiment at 10:00 a.m. expected to be unchanged at 98.3 … Index of Leading Indicators at 10:00 a.m. expected to rise 0.1 percent

FOWL NEWS: PARDONED TURKEYS DIE QUICKLY — POLITICO’s Sarah Zimmerman: “A pardon from … Trump ensures that this year’s National Thanksgiving Turkey — now known as Peas — won’t be anyone’s dinner on Thursday, but it’s unlikely he’ll see another Thanksgiving. …

“[T]he reality for Peas and Carrots is not a long life in country retirement. Like all other turkeys that are raised for human consumption, they’ve been bred to be plump and tasty, but they grow so big that they are likely to suffer from a variety of health problems that put their lifespan at less than a year.” Read more.

BI-PARTISAN PUSH FOR TREAUSRY TRANSPARENCY — POLITICO’s Zachary Warmbrodt: “A bipartisan group of senators is pushing the Trump administration to move ahead with plans to give the public a greater view into the market for U.S. Treasury securities, which is critical to government funding and the broader financial system.

“In a joint letter to Treasury Secretary Steven Mnuchin, Sen. Mark Warner (D-Va.), Banking Chairman Mike Crapo (R-Idaho) and Sen. Thom Tillis (R-N.C.) touted the benefits of more transparency and asked when officials would roll out a plan for increased disclosure.” Read more

MARKETS UNLIKELY TO STOP THE FED — WSJ’s Nick Timiraos and Gregory Zuckerman: “Market turbulence is leading some investors to call on the Fed … to halt its campaign of interest rate increases, but the selloff in stocks and corporate bonds that accelerated Tuesday is unlikely to stop the central bank from raising rates when it meets again next month.

“Fed officials have signaled in recent days they plan to proceed with another quarter percentage point increase … when they meet Dec. 19, marking their fourth rate increase this year. The market pullback does underscore however the uncertain outlook for what the Fed will do after that. Fed officials are divided over how many times the central bank will raise rates next year” Read more.

IS THE SLIDE A WARNING ON THE ECONOMY? — NYT’s Matt Phillips: “Unemployment is near lows not seen in half a century. The American economy is set for its best year since 2005. Large corporations are producing giant profits. Even wages are starting to rise. And the stock markets are a mess. The losses extended on Tuesday, as the S&P 500-stock index turned negative for the year, stoking fears that one of the longest bull markets in history could be at risk.

“The stock market’s struggles may seem incongruous against the backdrop of strong economic growth. But stocks often act as an early warning system, picking up subtle changes before they appear in the economic data.” Read more.

No corner of the market was left unscathed — Bloomberg’s Lu Wang, Elena Popina and Vildana Hajric: “One of the toughest years for financial markets in half a century got appreciably worse Tuesday, with simmering weakness across assets boiling over to leave investors with virtually nowhere to hide. Stocks buckled for a second day, sending the S&P 500 careening toward a correction. Oil plumbed depths last seen a year ago, while credit markets — recently impervious — showed signs of shaking apart. Bitcoin is in a freefall, while traditional havens like Treasuries, gold and the yen stood still.

“Add it all up — the 2 percent drop in equities, oil’s 6 percent plunge, the downdraft in corporate bonds — and markets ended up doling out one of the worst single-session losses since 2015. The S&P 500 erased its gain for 2018, oil tumbled to a one-year low and and an ETF tracking junk bonds capped its worst streak of declines since 2014.” Read more.

OIL TANKS — FT’s Anjli Raval in London: “Oil prices plunged again on Tuesday, with Brent crude seeing its 2018 gains wiped out as concerns about swelling global supplies continued to sour sentiment among investors. Brent, the international crude oil benchmark, fell as much as 7.6 per cent, or $5.08 a barrel, to hit $61.71, its lowest point in more than 11 months. …

“[P]ledges by big producers such as Saudi Arabia to raise output have stoked fears that the world could be entering a period of oversupply. … Trump reinforced these expectations on Tuesday when he called the kingdom a ‘steadfast partner’ despite probes linking the killing of US-based journalist Jamal Khashoggi to Mohammed bin Salman, the Saudi crown prince and de facto ruler of the country.” Read more.

ZUCK/SANDBERG PLAN TO STAY — POLITICO’s Cristiano Lima: “Facebook CEO Mark Zuckerberg said Tuesday he plans to stay on as company chairman and work with COO Sheryl Sandberg ‘for decades more to come,’ remarks that come amid mounting scrutiny of their management efforts.

“The embattled Facebook chief was pressed on whether he plans to step down from leading the company board. ‘That’s not the plan,’ he told CNN. ‘I’m certainly not currently thinking that that makes sense.’ The remarks came during Zuckerberg’s first interview since The New York Times reported on Facebook’s ties to the Definers Public Affairs communications firm, which sought to link critics of the company to liberal financier George Soros, a favorite target for conservative criticism.” Read more.

TRANSACTIONAL TRUMP —WP’s Anne Gearan: “Trump’s declaration Tuesday that he won’t hold Saudi rulers accountable for the killing of journalist Jamal Khashoggi distilled the president’s foreign policy approach to its transactional and personalized essence. Nearly two years into his presidency, Trump is unswerving in his instinct to make everything — from trade to terrorism, from climate change to human rights — about what he sees as the bottom line. …

“He cited arms sales with the kingdom, its role as a bulwark against Iran and the threat of higher oil prices as risks to the United States if his administration ruptured the relationship over the Khashoggi killing.” Read more.

SMALL BUSINESS SATURDAY GAINS STEAM — Via a new survey from Consumers’ Research: “Small Business Saturday continues to gain in popularity with consumers as Black Friday continues to lose favor. Additionally, while online shopping remains prevalent, consumers are showing they still like and take advantage of the in-store option.” Read more.

Source link

from RSSUnify feed https://hashtaghighways.com/2018/11/22/trump-needs-a-market-scape-goat/ from Garko Media https://garkomedia1.tumblr.com/post/180388516869

0 notes

Text

Trump needs a market scape goat

Editor’s Note: This edition of Free Morning Money is published weekdays at 8 a.m. POLITICO Pro Financial Services subscribers hold exclusive early access to the newsletter each morning at 5:15 a.m. To learn more about POLITICO Pro’s comprehensive policy intelligence coverage, policy tools and services, click here.

PROGRAMMING NOTE: Morning Money will not publish on Thursday, Nov. 22 and Friday, Nov. 23. Our next Morning Money newsletter will publish on Monday, Nov. 26.

Story Continued Below

TRUMP NEEDS A SCAPEGOAT — Another brutal day on Wall Street and President Trump once again decided to blame Fed Chair Jay Powell rather than face the reality that the U.S. economy is likely to slow down next year as the tax cut stimulus fades, a trade war with China looms and the deficit spikes higher with demand for U.S. debt declining.

The Fed is doing exactly what it’s supposed to at a time of very low unemployment and rising wages. And every time Trump bashes the central bank he makes it LESS likely that the Fed will look at sluggish growth numbers and sagging stocks and decides to slow down its pace of rate hikes. The central bank cannot allow itself to be viewed as caving to Trump or it will erode its independence and lose credibility with markets.

It seems clear that Trump – even as senior advisers tell him to leave Powell alone – is much more interested in having a fall guy to blame for the market decline than he is about having a better shot at the Fed pausing in December or reducing the number of hikes expected next year. For the moment he needs to blame the fact that markets are now down for the year or someone other than himself. And that person is Jay Powell.

And this is exactly what he did on Tuesday: “I’d like to see the Fed with a lower interest rate. I think the rate’s too high. I think we have much more of a Fed problem than we have a problem with anyone else,” Trump told reporters outside the White House. “I think your tech stocks have some problems.”

WHAT THE MARKET NEEDS: PANIC! — Leuthold’s Jim Paulsen emails on what might stop the market swoon: “Primarily, PANIC — a capitulation and widespread belief that a recession is imminent and the bull is over — that may represent one last great buying opportunity if we do not have a recession. So far most of the corrections this year have been calm, well controlled and thought of more as refreshing pauses made to ‘buy on the dip’ rather than things to run from. When we do bottom, I expect ‘panic’ to be widespread among the media stories and investors.”

Cumberland’s David Kotok emails: “Washout comes at any time in panic selling. This is what one gets from a Trade War. Thank you Peter Navarro. Now up to POTUS to make a truce in Buenos Aires. Then everyone wins. No truce, everyone loses more.”

HOW TRUMP MEASURES UP — Via Bespoke Investment Group: “It may sound hard to believe, but for all the talk about how well the stock market has done under President Trump, the Dow … is actually up less (25.69 percent) since he took office than it was under President Obama (40.94%) at the same point in his Presidency.” Read more.

Mohamed El-Erian in the FT — “Life would be better for equity investors if the transition from quantitative easing and ultra-low interest rates was unfolding against a backdrop of solid economic growth. Instead, the global economy is losing momentum and the divergence between advanced economies is growing.

“As a result, financial market choppiness has been ruling the day and unsettling investors. That leaves portfolios more vulnerable to technical dislocations and behavioural biases. Having been conditioned over the past decade to expect central banks to repress financial volatility and flinch at the first sign of market vulnerabilities, traders and investors are only slowly coming to terms with the less pleasant reality of a world of tighter liquidity.” Read more.

ENERGY SECTOR BLUES — Bloomberg Opinion’s Liam Denning: “If coming last in a popularity contest stings, consider how it feels to come first in an unpopularity contest. In Tuesday’s mass defriending of stocks, the energy sector managed to stand out in the worst possible way.

“The whiplash here is incredible. In early October Nymex crude oil was trading at more than $76 a barrel and the S&P 1500 exploration and production index was at its highest level in more than three years. Since then, they’re down 28 percent and 20 percent respectively. In relative terms, E&P stocks are trading at their lowest level on forward [earnings] multiples since Christmas 2008, another holiday season not noted for its bounding optimism” Read more.

WHAT IS THE FED TO DO? — Pantheon’s Ian Shepherdson: “Expectations for a March rate hike have dipped since Fed Vice-Chair Clarida’s CNBC interview last Friday. The renewed drop in stock prices hasn’t helped, either. But we aren’t at all sure that Mr. Clarida wanted his words to be interpreted as a dovish signal. …

“And this year, the numbers have been strong enough for the Fed—probably—to hike four times, one more than expected at the start of the year. In other words, numbers which were soft enough to stay the Fed’s hand in 2016, say, would not be enough now to do the same, given that the unemployment rate is now 3.7% and still falling, and wage growth is at 3% and rising.”

NEW THIS A.M.: SOFT GLOBAL OUTLOOK — From the OECD’s latest economic outlook out at 5:00 a.m. EST this morning: “The global economy is navigating rough seas. Global GDP growth is strong but has peaked. In many countries unemployment is well below pre-crisis levels, labour shortages are biting and inflation remains tepid.

“Yet, global trade and investment have been slowing on the back of increases in bilateral tariffs while many emerging market economies are experiencing capital outflows and a weakening of their currencies. The global economy looks set for a soft landing, with global GDP growth projected to slow from 3.7 percent in 2018 to 3.5 percent in 2019-20.

“However, downside risks abound and policy makers will have to steer their economies carefully towards sustainable, albeit slower, GDP growth. Engineering soft landings has always been a delicate exercise and is especially challenging today.”

The OECD has the U.S. growing at a 2.7 percent pace in 2019 and 2.1 percent in 2020, hardly numbers Trump would celebrate.

A LEAD FOR THE AGES — Via the NYT’s Mark Lander: “President Trump defied the nation’s intelligence agencies and a growing body of evidence on Tuesday to declare his unswerving loyalty to Saudi Arabia, asserting that Crown Prince Mohammed bin Salman’s culpability for the killing of Jamal Khashoggi might never be known.” Read more.

GOOD WEDNESDAY MORNING — Wishing a blessed and peaceful Thanksgiving to all. Don’t talk politics around the table. Email me on [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver at [email protected] and follow her on Twitter @AubreeEWeaver.

THIS MORNING ON POLITICO PRO FINANCIAL SERVICES — Victoria Guida: BANK PROFITS SOAR IN WAKE OF TAX CUTS, REGULATORY ROLLBACKS — “Bank profits continue to hit new highs, reaching a record $62 billion in the third quarter, as lenders reap the benefits of lower taxes and looser regulations. Third quarter bank profits were up 29.3 percent from the same period last year, according to new data from the Federal Deposit Insurance Corp., and only 3.5 percent of banks were unprofitable, compared to 4 percent a year ago. The data was released hours after the FDIC voted to sign on to a Federal Reserve proposal to ease a range of capital and liquidity requirements on large regional banks. Roughly half of the increase in net income was due to tax reform, the FDIC said, but profits for the quarter still would have been $54.6 billion without that.” Read more.

THE ADAGE “WORK HARD AND GET AHEAD” is a waning reality in America today. The question is: What can Washington do to foster more opportunity and prosperity in struggling communities across the country? POLITICO convened a bipartisan group of 14 business leaders, thinkers and policymakers to explore the problem and identify solutions that have a realistic path forward with political leaders of both parties. Read the latest issue of The Agenda to learn more.

DRIVING THE DAY — Big pile of economic data today ahead of the holiday for markets to chew on including durable goods orders at 8:30 a.m. which are expected to drop 2.2 percent headline and rise 0.4 percent ex-transportation. Existing Home Sales at 10:00 a.m. expected to rise to 5.20M from 5.15M … Univ. of Michigan Consumer Sentiment at 10:00 a.m. expected to be unchanged at 98.3 … Index of Leading Indicators at 10:00 a.m. expected to rise 0.1 percent

FOWL NEWS: PARDONED TURKEYS DIE QUICKLY — POLITICO’s Sarah Zimmerman: “A pardon from … Trump ensures that this year’s National Thanksgiving Turkey — now known as Peas — won’t be anyone’s dinner on Thursday, but it’s unlikely he’ll see another Thanksgiving. …

“[T]he reality for Peas and Carrots is not a long life in country retirement. Like all other turkeys that are raised for human consumption, they’ve been bred to be plump and tasty, but they grow so big that they are likely to suffer from a variety of health problems that put their lifespan at less than a year.” Read more.

BI-PARTISAN PUSH FOR TREAUSRY TRANSPARENCY — POLITICO’s Zachary Warmbrodt: “A bipartisan group of senators is pushing the Trump administration to move ahead with plans to give the public a greater view into the market for U.S. Treasury securities, which is critical to government funding and the broader financial system.

“In a joint letter to Treasury Secretary Steven Mnuchin, Sen. Mark Warner (D-Va.), Banking Chairman Mike Crapo (R-Idaho) and Sen. Thom Tillis (R-N.C.) touted the benefits of more transparency and asked when officials would roll out a plan for increased disclosure.” Read more

MARKETS UNLIKELY TO STOP THE FED — WSJ’s Nick Timiraos and Gregory Zuckerman: “Market turbulence is leading some investors to call on the Fed … to halt its campaign of interest rate increases, but the selloff in stocks and corporate bonds that accelerated Tuesday is unlikely to stop the central bank from raising rates when it meets again next month.

“Fed officials have signaled in recent days they plan to proceed with another quarter percentage point increase … when they meet Dec. 19, marking their fourth rate increase this year. The market pullback does underscore however the uncertain outlook for what the Fed will do after that. Fed officials are divided over how many times the central bank will raise rates next year” Read more.

IS THE SLIDE A WARNING ON THE ECONOMY? — NYT’s Matt Phillips: “Unemployment is near lows not seen in half a century. The American economy is set for its best year since 2005. Large corporations are producing giant profits. Even wages are starting to rise. And the stock markets are a mess. The losses extended on Tuesday, as the S&P 500-stock index turned negative for the year, stoking fears that one of the longest bull markets in history could be at risk.

“The stock market’s struggles may seem incongruous against the backdrop of strong economic growth. But stocks often act as an early warning system, picking up subtle changes before they appear in the economic data.” Read more.

No corner of the market was left unscathed — Bloomberg’s Lu Wang, Elena Popina and Vildana Hajric: “One of the toughest years for financial markets in half a century got appreciably worse Tuesday, with simmering weakness across assets boiling over to leave investors with virtually nowhere to hide. Stocks buckled for a second day, sending the S&P 500 careening toward a correction. Oil plumbed depths last seen a year ago, while credit markets — recently impervious — showed signs of shaking apart. Bitcoin is in a freefall, while traditional havens like Treasuries, gold and the yen stood still.

“Add it all up — the 2 percent drop in equities, oil’s 6 percent plunge, the downdraft in corporate bonds — and markets ended up doling out one of the worst single-session losses since 2015. The S&P 500 erased its gain for 2018, oil tumbled to a one-year low and and an ETF tracking junk bonds capped its worst streak of declines since 2014.” Read more.

OIL TANKS — FT’s Anjli Raval in London: “Oil prices plunged again on Tuesday, with Brent crude seeing its 2018 gains wiped out as concerns about swelling global supplies continued to sour sentiment among investors. Brent, the international crude oil benchmark, fell as much as 7.6 per cent, or $5.08 a barrel, to hit $61.71, its lowest point in more than 11 months. …

“[P]ledges by big producers such as Saudi Arabia to raise output have stoked fears that the world could be entering a period of oversupply. … Trump reinforced these expectations on Tuesday when he called the kingdom a ‘steadfast partner’ despite probes linking the killing of US-based journalist Jamal Khashoggi to Mohammed bin Salman, the Saudi crown prince and de facto ruler of the country.” Read more.

ZUCK/SANDBERG PLAN TO STAY — POLITICO’s Cristiano Lima: “Facebook CEO Mark Zuckerberg said Tuesday he plans to stay on as company chairman and work with COO Sheryl Sandberg ‘for decades more to come,’ remarks that come amid mounting scrutiny of their management efforts.

“The embattled Facebook chief was pressed on whether he plans to step down from leading the company board. ‘That’s not the plan,’ he told CNN. ‘I’m certainly not currently thinking that that makes sense.’ The remarks came during Zuckerberg’s first interview since The New York Times reported on Facebook’s ties to the Definers Public Affairs communications firm, which sought to link critics of the company to liberal financier George Soros, a favorite target for conservative criticism.” Read more.

TRANSACTIONAL TRUMP —WP’s Anne Gearan: “Trump’s declaration Tuesday that he won’t hold Saudi rulers accountable for the killing of journalist Jamal Khashoggi distilled the president’s foreign policy approach to its transactional and personalized essence. Nearly two years into his presidency, Trump is unswerving in his instinct to make everything — from trade to terrorism, from climate change to human rights — about what he sees as the bottom line. …

“He cited arms sales with the kingdom, its role as a bulwark against Iran and the threat of higher oil prices as risks to the United States if his administration ruptured the relationship over the Khashoggi killing.” Read more.

SMALL BUSINESS SATURDAY GAINS STEAM — Via a new survey from Consumers’ Research: “Small Business Saturday continues to gain in popularity with consumers as Black Friday continues to lose favor. Additionally, while online shopping remains prevalent, consumers are showing they still like and take advantage of the in-store option.” Read more.

Source link

Source: https://hashtaghighways.com/2018/11/22/trump-needs-a-market-scape-goat/

from Garko Media https://garkomedia1.wordpress.com/2018/11/22/trump-needs-a-market-scape-goat/

0 notes

Text

Trump needs a market scape goat

Editor’s Note: This edition of Free Morning Money is published weekdays at 8 a.m. POLITICO Pro Financial Services subscribers hold exclusive early access to the newsletter each morning at 5:15 a.m. To learn more about POLITICO Pro’s comprehensive policy intelligence coverage, policy tools and services, click here.

PROGRAMMING NOTE: Morning Money will not publish on Thursday, Nov. 22 and Friday, Nov. 23. Our next Morning Money newsletter will publish on Monday, Nov. 26.

Story Continued Below

TRUMP NEEDS A SCAPEGOAT — Another brutal day on Wall Street and President Trump once again decided to blame Fed Chair Jay Powell rather than face the reality that the U.S. economy is likely to slow down next year as the tax cut stimulus fades, a trade war with China looms and the deficit spikes higher with demand for U.S. debt declining.

The Fed is doing exactly what it’s supposed to at a time of very low unemployment and rising wages. And every time Trump bashes the central bank he makes it LESS likely that the Fed will look at sluggish growth numbers and sagging stocks and decides to slow down its pace of rate hikes. The central bank cannot allow itself to be viewed as caving to Trump or it will erode its independence and lose credibility with markets.

It seems clear that Trump – even as senior advisers tell him to leave Powell alone – is much more interested in having a fall guy to blame for the market decline than he is about having a better shot at the Fed pausing in December or reducing the number of hikes expected next year. For the moment he needs to blame the fact that markets are now down for the year or someone other than himself. And that person is Jay Powell.

And this is exactly what he did on Tuesday: “I’d like to see the Fed with a lower interest rate. I think the rate’s too high. I think we have much more of a Fed problem than we have a problem with anyone else,” Trump told reporters outside the White House. “I think your tech stocks have some problems.”

WHAT THE MARKET NEEDS: PANIC! — Leuthold’s Jim Paulsen emails on what might stop the market swoon: “Primarily, PANIC — a capitulation and widespread belief that a recession is imminent and the bull is over — that may represent one last great buying opportunity if we do not have a recession. So far most of the corrections this year have been calm, well controlled and thought of more as refreshing pauses made to ‘buy on the dip’ rather than things to run from. When we do bottom, I expect ‘panic’ to be widespread among the media stories and investors.”

Cumberland’s David Kotok emails: “Washout comes at any time in panic selling. This is what one gets from a Trade War. Thank you Peter Navarro. Now up to POTUS to make a truce in Buenos Aires. Then everyone wins. No truce, everyone loses more.”

HOW TRUMP MEASURES UP — Via Bespoke Investment Group: “It may sound hard to believe, but for all the talk about how well the stock market has done under President Trump, the Dow … is actually up less (25.69 percent) since he took office than it was under President Obama (40.94%) at the same point in his Presidency.” Read more.

Mohamed El-Erian in the FT — “Life would be better for equity investors if the transition from quantitative easing and ultra-low interest rates was unfolding against a backdrop of solid economic growth. Instead, the global economy is losing momentum and the divergence between advanced economies is growing.

“As a result, financial market choppiness has been ruling the day and unsettling investors. That leaves portfolios more vulnerable to technical dislocations and behavioural biases. Having been conditioned over the past decade to expect central banks to repress financial volatility and flinch at the first sign of market vulnerabilities, traders and investors are only slowly coming to terms with the less pleasant reality of a world of tighter liquidity.” Read more.

ENERGY SECTOR BLUES — Bloomberg Opinion’s Liam Denning: “If coming last in a popularity contest stings, consider how it feels to come first in an unpopularity contest. In Tuesday’s mass defriending of stocks, the energy sector managed to stand out in the worst possible way.

“The whiplash here is incredible. In early October Nymex crude oil was trading at more than $76 a barrel and the S&P 1500 exploration and production index was at its highest level in more than three years. Since then, they’re down 28 percent and 20 percent respectively. In relative terms, E&P stocks are trading at their lowest level on forward [earnings] multiples since Christmas 2008, another holiday season not noted for its bounding optimism” Read more.

WHAT IS THE FED TO DO? — Pantheon’s Ian Shepherdson: “Expectations for a March rate hike have dipped since Fed Vice-Chair Clarida’s CNBC interview last Friday. The renewed drop in stock prices hasn’t helped, either. But we aren’t at all sure that Mr. Clarida wanted his words to be interpreted as a dovish signal. …

“And this year, the numbers have been strong enough for the Fed—probably—to hike four times, one more than expected at the start of the year. In other words, numbers which were soft enough to stay the Fed’s hand in 2016, say, would not be enough now to do the same, given that the unemployment rate is now 3.7% and still falling, and wage growth is at 3% and rising.”

NEW THIS A.M.: SOFT GLOBAL OUTLOOK — From the OECD’s latest economic outlook out at 5:00 a.m. EST this morning: “The global economy is navigating rough seas. Global GDP growth is strong but has peaked. In many countries unemployment is well below pre-crisis levels, labour shortages are biting and inflation remains tepid.

“Yet, global trade and investment have been slowing on the back of increases in bilateral tariffs while many emerging market economies are experiencing capital outflows and a weakening of their currencies. The global economy looks set for a soft landing, with global GDP growth projected to slow from 3.7 percent in 2018 to 3.5 percent in 2019-20.

“However, downside risks abound and policy makers will have to steer their economies carefully towards sustainable, albeit slower, GDP growth. Engineering soft landings has always been a delicate exercise and is especially challenging today.”

The OECD has the U.S. growing at a 2.7 percent pace in 2019 and 2.1 percent in 2020, hardly numbers Trump would celebrate.

A LEAD FOR THE AGES — Via the NYT’s Mark Lander: “President Trump defied the nation’s intelligence agencies and a growing body of evidence on Tuesday to declare his unswerving loyalty to Saudi Arabia, asserting that Crown Prince Mohammed bin Salman’s culpability for the killing of Jamal Khashoggi might never be known.” Read more.

GOOD WEDNESDAY MORNING — Wishing a blessed and peaceful Thanksgiving to all. Don’t talk politics around the table. Email me on [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver at [email protected] and follow her on Twitter @AubreeEWeaver.

THIS MORNING ON POLITICO PRO FINANCIAL SERVICES — Victoria Guida: BANK PROFITS SOAR IN WAKE OF TAX CUTS, REGULATORY ROLLBACKS — “Bank profits continue to hit new highs, reaching a record $62 billion in the third quarter, as lenders reap the benefits of lower taxes and looser regulations. Third quarter bank profits were up 29.3 percent from the same period last year, according to new data from the Federal Deposit Insurance Corp., and only 3.5 percent of banks were unprofitable, compared to 4 percent a year ago. The data was released hours after the FDIC voted to sign on to a Federal Reserve proposal to ease a range of capital and liquidity requirements on large regional banks. Roughly half of the increase in net income was due to tax reform, the FDIC said, but profits for the quarter still would have been $54.6 billion without that.” Read more.

THE ADAGE “WORK HARD AND GET AHEAD” is a waning reality in America today. The question is: What can Washington do to foster more opportunity and prosperity in struggling communities across the country? POLITICO convened a bipartisan group of 14 business leaders, thinkers and policymakers to explore the problem and identify solutions that have a realistic path forward with political leaders of both parties. Read the latest issue of The Agenda to learn more.

DRIVING THE DAY — Big pile of economic data today ahead of the holiday for markets to chew on including durable goods orders at 8:30 a.m. which are expected to drop 2.2 percent headline and rise 0.4 percent ex-transportation. Existing Home Sales at 10:00 a.m. expected to rise to 5.20M from 5.15M … Univ. of Michigan Consumer Sentiment at 10:00 a.m. expected to be unchanged at 98.3 … Index of Leading Indicators at 10:00 a.m. expected to rise 0.1 percent

FOWL NEWS: PARDONED TURKEYS DIE QUICKLY — POLITICO’s Sarah Zimmerman: “A pardon from … Trump ensures that this year’s National Thanksgiving Turkey — now known as Peas — won’t be anyone’s dinner on Thursday, but it’s unlikely he’ll see another Thanksgiving. …

“[T]he reality for Peas and Carrots is not a long life in country retirement. Like all other turkeys that are raised for human consumption, they’ve been bred to be plump and tasty, but they grow so big that they are likely to suffer from a variety of health problems that put their lifespan at less than a year.” Read more.

BI-PARTISAN PUSH FOR TREAUSRY TRANSPARENCY — POLITICO’s Zachary Warmbrodt: “A bipartisan group of senators is pushing the Trump administration to move ahead with plans to give the public a greater view into the market for U.S. Treasury securities, which is critical to government funding and the broader financial system.

“In a joint letter to Treasury Secretary Steven Mnuchin, Sen. Mark Warner (D-Va.), Banking Chairman Mike Crapo (R-Idaho) and Sen. Thom Tillis (R-N.C.) touted the benefits of more transparency and asked when officials would roll out a plan for increased disclosure.” Read more

MARKETS UNLIKELY TO STOP THE FED — WSJ’s Nick Timiraos and Gregory Zuckerman: “Market turbulence is leading some investors to call on the Fed … to halt its campaign of interest rate increases, but the selloff in stocks and corporate bonds that accelerated Tuesday is unlikely to stop the central bank from raising rates when it meets again next month.

“Fed officials have signaled in recent days they plan to proceed with another quarter percentage point increase … when they meet Dec. 19, marking their fourth rate increase this year. The market pullback does underscore however the uncertain outlook for what the Fed will do after that. Fed officials are divided over how many times the central bank will raise rates next year” Read more.

IS THE SLIDE A WARNING ON THE ECONOMY? — NYT’s Matt Phillips: “Unemployment is near lows not seen in half a century. The American economy is set for its best year since 2005. Large corporations are producing giant profits. Even wages are starting to rise. And the stock markets are a mess. The losses extended on Tuesday, as the S&P 500-stock index turned negative for the year, stoking fears that one of the longest bull markets in history could be at risk.

“The stock market’s struggles may seem incongruous against the backdrop of strong economic growth. But stocks often act as an early warning system, picking up subtle changes before they appear in the economic data.” Read more.

No corner of the market was left unscathed — Bloomberg’s Lu Wang, Elena Popina and Vildana Hajric: “One of the toughest years for financial markets in half a century got appreciably worse Tuesday, with simmering weakness across assets boiling over to leave investors with virtually nowhere to hide. Stocks buckled for a second day, sending the S&P 500 careening toward a correction. Oil plumbed depths last seen a year ago, while credit markets — recently impervious — showed signs of shaking apart. Bitcoin is in a freefall, while traditional havens like Treasuries, gold and the yen stood still.

“Add it all up — the 2 percent drop in equities, oil’s 6 percent plunge, the downdraft in corporate bonds — and markets ended up doling out one of the worst single-session losses since 2015. The S&P 500 erased its gain for 2018, oil tumbled to a one-year low and and an ETF tracking junk bonds capped its worst streak of declines since 2014.” Read more.

OIL TANKS — FT’s Anjli Raval in London: “Oil prices plunged again on Tuesday, with Brent crude seeing its 2018 gains wiped out as concerns about swelling global supplies continued to sour sentiment among investors. Brent, the international crude oil benchmark, fell as much as 7.6 per cent, or $5.08 a barrel, to hit $61.71, its lowest point in more than 11 months. …

“[P]ledges by big producers such as Saudi Arabia to raise output have stoked fears that the world could be entering a period of oversupply. … Trump reinforced these expectations on Tuesday when he called the kingdom a ‘steadfast partner’ despite probes linking the killing of US-based journalist Jamal Khashoggi to Mohammed bin Salman, the Saudi crown prince and de facto ruler of the country.” Read more.

ZUCK/SANDBERG PLAN TO STAY — POLITICO’s Cristiano Lima: “Facebook CEO Mark Zuckerberg said Tuesday he plans to stay on as company chairman and work with COO Sheryl Sandberg ‘for decades more to come,’ remarks that come amid mounting scrutiny of their management efforts.

“The embattled Facebook chief was pressed on whether he plans to step down from leading the company board. ‘That’s not the plan,’ he told CNN. ‘I’m certainly not currently thinking that that makes sense.’ The remarks came during Zuckerberg’s first interview since The New York Times reported on Facebook’s ties to the Definers Public Affairs communications firm, which sought to link critics of the company to liberal financier George Soros, a favorite target for conservative criticism.” Read more.

TRANSACTIONAL TRUMP —WP’s Anne Gearan: “Trump’s declaration Tuesday that he won’t hold Saudi rulers accountable for the killing of journalist Jamal Khashoggi distilled the president’s foreign policy approach to its transactional and personalized essence. Nearly two years into his presidency, Trump is unswerving in his instinct to make everything — from trade to terrorism, from climate change to human rights — about what he sees as the bottom line. …

“He cited arms sales with the kingdom, its role as a bulwark against Iran and the threat of higher oil prices as risks to the United States if his administration ruptured the relationship over the Khashoggi killing.” Read more.

SMALL BUSINESS SATURDAY GAINS STEAM — Via a new survey from Consumers’ Research: “Small Business Saturday continues to gain in popularity with consumers as Black Friday continues to lose favor. Additionally, while online shopping remains prevalent, consumers are showing they still like and take advantage of the in-store option.” Read more.

Source link

from RSSUnify feed https://hashtaghighways.com/2018/11/22/trump-needs-a-market-scape-goat/

0 notes