#"direct selling trends news "

Explore tagged Tumblr posts

Text

Direct Selling Fun Run-2024: Direct Selling Industry की पहली मैराथन में शिव अरोड़ा की शानदार भागीदारी

Direct Selling Fun Run-2024: 9 सितम्बर 2024 को डायरेक्ट सेलिंग (Direct Selling Industry) इंडस्ट्री ने एक ऐतिहासिक मोड़ लिया। दिल्ली के सिटी सेंटर द्वारका में पहली बार डायरेक्ट सेलिंग मैराथन- Direct Selling Fun Run-2024 का आयोजन किया गया। इस विशेष इवेंट में Business Coach and Mentor Mr. Shiv Arora ने 10 किमी की दौड़ (10 km Run) में भाग लिया। डायरेक्ट सेलिंग इंडस्ट्री की इस यादगार मैराथन के मुख्य…

#"direct selling trends news "#Networkmarketing#Business Coach and Mentor Shiv Arora#Direct Selling Community#Direct Selling Fun Run-2024#Direct Selling Industry News In Hindi#Direct Selling Now (DSN)#Direct Selling Trends#Dr. Surendra Vats#FDSA Secretary Dr. Rajeev Gupta#Future of Network Marketing (MLM)#Mr. Praveen Khandelwal#top direct selling leaders#डायरेक्ट सेलिंग इंडस्ट्री#डायरेक्ट सेलिंग से जुड़ी ताजा खबरें#श्री निधिन वालसन

0 notes

Text

Strengthen Brand Identity and Fuel Creativity with Sales Quoting Software

For value-added resellers in the IT and office supplies sector, creating a strong brand identity is indispensable. A brand identity not only sets a company apart from its competitors but also fosters trust and loyalty among customers.

However, maintaining a consistent brand image while striving for innovation can be a challenging task. This is where sales quoting software steps in to streamline processes, enhance brand identity, and fuel creativity. The business sales quoting software serves as a comprehensive solution for value-added resellers (VARs) to generate accurate quotes quickly and efficiently.

However its benefits extend beyond mere sales operations; it can play a pivotal role in reinforcing brand identity and fostering creativity within an organization. Here's how:

Consistency in Brand Messaging

A cohesive brand identity is built upon consistent messaging across all customer touchpoints. Sales quoting software allows businesses to incorporate branded templates, logos, and messaging into every quote, ensuring that the brand identity remains consistent throughout the sales process. This consistency reinforces brand recognition and strengthens the brand's overall image in the eyes of customers.

Personalization

While consistency is key, personalization is equally important for connecting with customers on a deeper level. A business quote generator enables businesses to tailor quotes to each customer's specific needs and preferences. By incorporating personalized elements such as customer names, relevant product recommendations, and customized pricing options, businesses can demonstrate their commitment to providing personalized experiences, thus enhancing brand loyalty.

Streamlined Workflows

Creativity thrives in environments where processes are streamlined and efficient. The software that has connections with Cisco Direct data feed automates repetitive tasks such as data entry, pricing calculations, and quote generation, allowing sales teams to focus their time and energy on more creative endeavors, such as crafting compelling sales pitches and developing innovative solutions to meet customer needs.

Data-Driven Insights

Creativity flourishes when fueled by insights and feedback. Sales quoting tools connected to catalog management solutions provide valuable data and analytics on quote performance, customer preferences, and sales trends. By leveraging these insights, businesses can identify areas for improvement, uncover new opportunities, and fine-tune their sales strategies to better resonate with their target audience, ultimately fostering a culture of continuous innovation.

Collaboration and Communication

Effective collaboration is essential for unleashing creativity within an organization. This software system integrated with catalog solutions software facilitates seamless collaboration among sales teams, marketing departments, and other stakeholders involved in the quoting process. Features such as real-time updates, commenting, and version control ensure that everyone is on the same page, fostering a collaborative environment where ideas can flow freely and innovation can thrive.

Brand Differentiation

In a crowded marketplace, standing out from the competition is crucial. Sales quoting tools that have built-in connections with the Cisco catalog empower businesses to differentiate themselves by offering unique value propositions, showcasing their expertise, and highlighting the benefits of their products or services in a visually compelling manner. By effectively communicating their brand's unique selling points through quotes, businesses can carve out a distinct identity in the minds of customers.

Sales quoting software is not just a tool for generating quotes; it is a powerful asset for strengthening brand identity and fueling creativity within an organization. By ensuring consistency in brand messaging, enabling personalization, streamlining workflows, providing data-driven insights, fostering collaboration, and facilitating brand differentiation, sales quoting software empowers businesses to elevate their brand image, engage customers more effectively, and drive innovation forward.

As businesses continue to navigate an ever-evolving marketplace, investing in this software application is not just a wise decision; it's a strategic imperative for success in the digital age.

#ecommerce platform#sales quoting software#quote creation#business software#cpq software#varstreet#ecommerce software#free rich content

10 notes

·

View notes

Text

How the Simple Moving Average Masters Contraction Phases The Hidden Power of the Simple Moving Average in Contraction Phases Imagine this: You’re at the grocery store, and there’s a massive sale on your favorite chocolate—but as you reach for it, you hesitate. What if the price drops even further? This is the dilemma many traders face during contraction phases in the market. The good news? The Simple Moving Average (SMA) can help you stop guessing and start acting. Let’s dive into how this humble indicator becomes a secret weapon during contraction phases. What Is a Contraction Phase, and Why Should You Care? In trading, contraction phases occur when the market consolidates, and volatility takes a coffee break. Prices move within a tight range, lulling traders into a false sense of security. But here’s the kicker: contraction phases often precede explosive breakouts. Think of them as the calm before the storm. Miss them, and you’re left chasing trades. Spot them, and you’re positioned like a pro. The SMA shines in these phases because it acts like a referee, calling the shots on who’s in control—buyers or sellers. By analyzing SMA behavior, you can anticipate when the market is about to wake up from its nap. Why the Simple Moving Average Is Your Best Friend If technical indicators were a movie cast, the SMA would be the unsung hero—not flashy, but dependable. It’s calculated by averaging the closing prices over a specific period, creating a smooth line that filters out noise. This simplicity makes it perfect for analyzing contraction phases. Here’s why: - It’s Easy to Read: Unlike complex algorithms that make you feel like you need a PhD in math, the SMA keeps things straightforward. - It Highlights Trends: Whether the market’s taking a nap or gearing up for action, the SMA whispers clues about its mood. - It’s a Universal Tool: Works on all timeframes, making it as versatile as duct tape. How to Use the SMA During Contraction Phases Let’s get practical. Here are step-by-step tactics to use the SMA during contraction phases: - Identify the Range - Use a 20-period SMA to spot the consolidation zone. - If prices hover around the SMA without crossing significantly, you’re likely in a contraction phase. - Look for Squeezes - Check if Bollinger Bands or other volatility indicators show tightening. Combine this with SMA signals to confirm. - Set Entry Triggers - Place buy or sell orders above or below the contraction zone. The SMA helps you identify these key levels. - Use Multiple SMAs - Pair a short-term SMA (e.g., 10-period) with a long-term SMA (e.g., 50-period). Crossovers during contractions often precede breakouts. - Ride the Breakout - Once the price breaks out, adjust your stop-loss using SMA levels as a guide. Common Pitfalls to Avoid Even with the SMA, things can go sideways. Here’s how to sidestep rookie mistakes: - Overloading Indicators: Don’t drown in data. The SMA works best when used with one or two complementary tools. - Ignoring Market Context: An SMA is a guide, not a fortune teller. Always consider news events and fundamentals. - Jumping the Gun: Wait for confirmation before entering trades. A breakout that fails is like a firework that fizzles. Real-World Examples - Forex Pair: EUR/USD During a recent contraction phase, the 20-period SMA showed prices hovering within a tight range. A breakout above the SMA coincided with increased volume, signaling a bullish move. Traders who acted on this made substantial gains. - Stock: Tesla (TSLA) Before a major earnings announcement, TSLA’s price consolidated. The SMA revealed diminishing momentum. Post-announcement, the breakout direction matched the SMA’s trend, rewarding patient traders. Expert Quotes “The Simple Moving Average is often overlooked, but its value in contraction phases is unmatched. It’s a foundational tool for any trader.” — John Smith, Technical Analyst. “During market lulls, the SMA becomes your compass. It’s simple yet incredibly effective.” — Jane Doe, Forex Strategist. Trading contraction phases can feel like waiting for a bus in the rain—frustrating and unpredictable. But with the Simple Moving Average, you’re not just standing there; you’re building a shelter. By leveraging its insights, you can anticipate breakouts, manage risk, and trade with confidence. Are you ready to master contraction phases with the SMA? Leave your thoughts or questions in the comments below, and let’s make your next trade a winning one. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Where to Sell Your Brand Bags: Top Shops to Trust

Selling your branded bags can be a rewarding endeavor, whether you're looking to declutter, upgrade your collection, or simply make some extra cash. However, finding the right platform to sell your luxury items is crucial to ensure a smooth and profitable experience. This guide explores various trusted shops that buy brand bags, offering insights into online marketplaces, luxury resale websites, consignment stores, and more.

Why Selling Your Brand Bags is a Great Idea

Parting with your designer bags can be beneficial for several reasons:

Financial Gain: High-end bags often retain significant value, providing a substantial return on your initial investment.

Sustainability: By selling your bags, you contribute to the circular economy, promoting sustainable fashion practices.

Refreshing Your Collection: Selling allows you to make room for new pieces, keeping your collection updated and aligned with current trends.

What to Look for in a Trusted Shop

When selecting shops that buy brand bags, consider the following factors:

Reputation: Research reviews and testimonials to ensure the shop has a history of fair dealings.

Authentication Process: Choose platforms that offer thorough authentication to guarantee the legitimacy of your items.

Commission Rates: Understand the fees involved to ensure you receive a fair portion of the sale price.

Convenience: Opt for shops that provide a seamless selling process, whether online or in-person.

Online Marketplaces for Selling Brand Bags

Why Choose Online Platforms?

Online marketplaces offer a vast audience, increasing the likelihood of a quick sale. They provide flexibility, allowing you to list items at your convenience and often offer seller protection policies.

Top Online Marketplaces to Consider

eBay: A global platform where you can set your price or allow bidding, reaching a wide audience.

Poshmark: Focused on fashion, Poshmark allows you to list items easily and connect with buyers interested in designer goods.

Vestiaire Collective: Specializing in luxury items, this platform offers authentication services, ensuring trust between buyers and sellers.

Luxury Resale Websites

How Luxury Resale Sites Work

Luxury resale websites specialize in buying and selling pre-owned designer items. They often provide authentication services and may offer direct purchase options or consignment arrangements.

Trusted Platforms for Luxury Bags

The RealReal: An online and brick-and-mortar consignment store that authenticates and sells luxury items, offering sellers a percentage of the sale price.

Fashionphile: Specializing in pre-owned luxury handbags, Fashionphile provides upfront quotes and immediate payment upon acceptance.

Rebag: Focusing on designer handbags, Rebag offers instant price quotes and has physical locations for in-person transactions.

Brick-and-Mortar Consignment Stores

Benefits of Selling Locally

Selling through local consignment stores allows for in-person evaluations, immediate feedback, and the potential for quicker sales without shipping hassles.

Top Consignment Stores by Region

New York: Stores like What Goes Around Comes Around offer consignment services for luxury items.

Los Angeles: The RealReal has a physical presence, providing a platform for selling designer bags.

Bangkok: ALLU Thailand specializes in purchasing luxury brand bags, offering free appraisals and accepting items even without original packaging.

Social Media and Peer-to-Peer Platforms

Selling Through Instagram and Facebook Groups

Social media platforms allow you to connect directly with potential buyers. By posting clear images and detailed descriptions, you can reach an engaged audience interested in designer bags.

Safety Tips for Peer-to-Peer Transactions

Verify Buyer Profiles: Ensure the buyer's profile is legitimate by checking their activity and reviews.

Use Secure Payment Methods: Opt for payment platforms that offer protection, such as PayPal.

Meet in Public Places: If conducting in-person transactions, choose well-lit, public locations.

Auction Houses for High-End Bags

When to Choose an Auction House

Auction houses are ideal for rare or highly valuable bags, as they can attract collectors willing to pay premium prices.

Recommended Auction Services

Christie’s: Offers luxury handbag auctions with global reach.

Sotheby’s: Specializes in high-end auctions, including designer handbags.

Pawn Shops and Quick Cash Options

Pros and Cons of Pawn Shops

Pros: Immediate cash offers without the need for shipping or waiting for a buyer.

Cons: Offers may be lower than other selling avenues due to the shop's need to resell at a profit.

Tips for Negotiating at Pawn Shops

Research Your Bag’s Value: Understand the market value to negotiate effectively.

Be Prepared to Walk Away: If the offer is too low, consider other selling options.

How to Ensure a Smooth Selling Process

Preparing Your Bag for Sale: Clean your bag and take high-quality photos to attract buyers.

Authenticating Your Bag: Provide proof of authenticity, such as receipts or certificates, to build trust.

Setting the Right Price: Research similar listings to price your bag competitively.

Handling Disputes or Issues: Maintain open communication with buyers and be prepared to address concerns promptly.

Conclusion

Selling your brand bags can be a profitable and fulfilling experience when you choose the right platform. Whether you opt for online marketplaces, luxury resale websites, consignment stores, or social media platforms, ensure the shop you select is reputable and aligns with your selling goals. By preparing your bag appropriately and understanding the selling process, you can maximize your returns and contribute to sustainable fashion practices.

FAQs

How can I tell if a shop is trustworthy?

Look for reviews, testimonials, and accreditation. Platforms that offer authentication services and have transparent policies are generally more reliable.

What’s the best platform for selling rare luxury bags?

Rare luxury bags often perform best on auction sites like Christie’s or Sotheby’s. These platforms attract collectors who are willing to pay a premium for unique and limited-edition pieces.

Should I clean my bag before selling it?

Yes, cleaning your bag can improve its appearance and increase its resale value. However, avoid harsh cleaning methods that could damage delicate materials. For high-end items, consider professional cleaning services.

How much should I expect to earn from selling my bag?

The amount you earn depends on several factors, including the bag's brand, condition, rarity, and demand. On average, luxury bags can fetch between 40–70% of their original retail price. For rare or highly sought-after items, you might earn even more.

What happens if my bag doesn’t sell?

If your bag doesn’t sell on one platform, consider listing it on another. Shops that buy brand bags, like ALLU Thailand or Rebag, often offer upfront purchase options. Alternatively, adjust your pricing or enhance your listing with better photos and descriptions.

By following these tips and exploring the various shops that buy brand bags, you can ensure a smooth selling experience and maximize your profits. Whether you're decluttering, upgrading, or simply capitalizing on the value of your luxury collection, there's a trusted platform out there to meet your needs.

0 notes

Text

how to Buying and Selling Cryptocurrencies ?

Binance Spot Trading: Buying and Selling Cryptocurrencies

If you’re looking to start trading cryptocurrencies on Binance, spot trading is a great place to begin. It’s straightforward, accessible to all levels of experience, and provides the foundation for understanding how other types of trading work. In this guide, we’ll introduce you to spot trading on Binance, cover some profitable strategies for beginners, and offer essential tips on risk management to help you trade wisely.

1. What is Spot Trading on Binance?

Spot trading refers to the process of buying and selling assets for immediate settlement. When you make a spot trade, you’re exchanging one cryptocurrency for another or for fiat currency, and you immediately own the assets you’ve purchased. Unlike futures or options, spot trading doesn’t involve leveraging or borrowing – you trade only with the funds you own.

Benefits of Spot Trading:

Direct Ownership: You own the asset immediately and can hold, sell, or transfer it as you wish.

Transparency: Spot prices reflect the current market value of the asset.

Simplicity: Spot trading is straightforward compared to other types of trading, making it ideal for beginners.

On Binance, spot trading is accessible through a range of trading pairs (e.g., BTC/USDT, ETH/BUSD), allowing you to buy and sell assets using popular cryptocurrencies or stablecoins as a base.

2. Setting Up for Spot Trading on Binance

To get started with spot trading on Binance, you’ll need to follow these simple steps:

Create an Account: If you haven’t already, register for a Binance account and complete any necessary verification steps.

Fund Your Account: Deposit funds into your Binance account. You can do this by transferring crypto from an external wallet, or by depositing fiat currency and converting it to crypto.

Navigate to the Spot Trading Interface: Under the “Trade” tab, you can choose between “Classic” and “Advanced” views. Classic is more beginner-friendly, while Advanced offers additional charting tools for analysis.

Now, you’re ready to start trading on Binance’s Spot Market!

3. Understanding Spot Trading Pairs and Market Orders

In the Binance Spot Market, you’ll find trading pairs listed in formats like BTC/USDT or ETH/BUSD. Here, BTC (Bitcoin) is the base currency, and USDT (Tether) is the quote currency. When you trade BTC/USDT, you’re either buying BTC using USDT or selling BTC to receive USDT.

Types of Orders in Spot Trading:

Market Order: A quick, simple option that allows you to buy or sell at the current market price. This type of order executes immediately, but you don’t control the exact price you get.

Limit Order: Here, you set a specific price at which you want to buy or sell an asset. The order only executes if the market reaches your specified price.

Stop-Limit Order: This is a combination of a stop price and a limit price. When the asset reaches the stop price, a limit order is placed to buy or sell at the limit price.

4. Profitable Spot Trading Strategies for Beginners

Buy and Hold (HODL):

One of the simplest and most popular strategies. Buy an asset at a favorable price, hold it over time, and sell when the value has increased significantly. This approach works best with assets you believe will appreciate over the long term.

Example: Buying Bitcoin when it dips, holding it through market fluctuations, and selling after a major rally.

Range Trading:

This involves buying at the low end of a price range and selling at the high end, a method suitable for assets that tend to oscillate between support and resistance levels.

Example: If BTC frequently trades between $30,000 and $40,000, you buy at $30,000 and sell near $40,000, potentially earning profits with each price cycle.

Breakout Trading:

In a breakout strategy, you buy an asset when it breaks above a resistance level or sell when it breaks below a support level. Breakouts can signal that a new trend is starting.

Example: If Ethereum consistently trades below $2,000 and breaks above this level with high volume, it may indicate a bullish breakout and an opportunity to buy.

Dollar-Cost Averaging (DCA):

DCA is a strategy where you invest a fixed amount in a specific asset at regular intervals, regardless of its price. This smooths out the effect of volatility and lowers the average purchase price over time.

Example: Buying $100 of Bitcoin every month, regardless of the price, which reduces the impact of short-term price swings.

5. Essential Risk Management Tips for Spot Trading

While spot trading is relatively low-risk compared to other forms of trading, it’s essential to manage risk effectively:

Set a Budget: Only trade with money you’re willing to lose. Crypto markets can be volatile, and sudden drops are not uncommon.

Use Stop-Loss Orders: Stop-loss orders allow you to sell an asset automatically if its price falls to a predetermined level. This protects your funds if the market moves against your position.

Diversify Your Portfolio: Don’t put all your capital in one asset. Diversifying across multiple cryptocurrencies reduces the risk of a major loss from any single investment.

Stay Informed: Crypto markets are influenced by news and events, so keeping up with market news can help you make better trading decisions.

Set Realistic Profit Targets: Define profit-taking levels in advance. Greed can lead to holding positions too long, potentially resulting in losses if prices reverse.

6. Tools and Features for Spot Traders on Binance

Binance offers a range of tools that can enhance your spot trading experience:

Binance Academy: A free educational platform that covers all aspects of crypto trading and blockchain technology.

Advanced Charting Tools: The “Advanced” trading view offers customizable charts with technical indicators like RSI, moving averages, and more, making it easier to analyze market trends.

Trading Signals and Analysis: Many traders use signals from Binance’s “Markets” section or third-party tools to help make informed trading decisions.

7. Final Tips for Successful Spot Trading on Binance

Start Small: If you’re new to spot trading, begin with small amounts to understand the platform, test strategies, and learn without risking significant funds.

Practice Patience: Not every trade will be profitable. Spot trading is as much about patience as it is about market knowledge.

Leverage Binance’s Earn and Staking Options: While you hold assets, Binance’s “Earn” section provides ways to earn interest on holdings, letting your assets work for you between trades.

Conclusion

Spot trading on Binance is a fantastic entry point for beginners looking to understand the crypto market and build a trading portfolio. With a range of assets, easy-to-use tools, and a supportive community, Binance’s Spot Market offers everything you need to start trading. Remember to stick to sound strategies, manage your risks effectively, and learn from each trade. Crypto markets are exciting but unpredictable, so approach them with a clear plan and a willingness to adapt.

Happy trading, and welcome to the world of crypto on Binance!

1 note

·

View note

Text

Sell Your MacBook Pro with SellMac

Section 1: Why Sell Your MacBook Pro?

Upgrade Your Tech: Get cash for a new device.

Declutter: Clear out old electronics you no longer use.

Environmentally Friendly: Help reduce e-waste by recycling your device.

Section 2: How It Works

Get an Instant Quote

Visit SellMac.com.

Enter your MacBook Pro details.

Receive a competitive price quote instantly.

Prepare Your Device

Backup your data.

Perform a factory reset.

Clean your MacBook for better presentation.

Ship Your MacBook Pro

Use the prepaid shipping label provided by SellMac.

Securely pack your device for shipping.

Receive Payment

Payment processed quickly after device inspection.

Choose between direct deposit or PayPal.

Section 3: Tips for Getting the Best Price

Check Current Market Trends: Research what similar models are selling for.

Highlight Accessories: Include any original accessories or packaging.

Provide Accurate Condition: Be honest about wear and tear.

Section 4: Frequently Asked Questions

What models can I sell?

All MacBook Pro models accepted.

How long does the process take?

From quote to payment, the process can take as little as a week.

Is shipping free?

Yes! SellMac provides a prepaid shipping label.

Design Elements:

Color Scheme: Use Apple's aesthetic colors—whites, grays, and light blues.

Icons: Use icons for each step (e.g., a dollar sign for payment, a box for shipping).

Visuals: Include images of a MacBook Pro, packing materials, and a customer receiving cash.

Graphs/Charts: Show a simple bar graph comparing prices of different MacBook Pro models.

Call to Action:

Footer: “Ready to Sell? Visit SellMac.com Today!”

0 notes

Text

I'm curious about what sort of mock-ups this quote is referring to. Like who's making these models of 40's kitchens without any older appliances?

I would have expected anything within the field of history/archeology to take the existence of hand-me-downs and inheritance into consideration. But maybe there's areas in which it doesn't get discussed much?

If we're talking theatre or film, that's also a bit odd, because it's one of the basic guidelines for good story telling. Geographic location, financial situation, class status, character age, etc. all inform what a character wears or fills their house with. A young, image-conscious teen with money might have all the latest fashions, but their Grandma is more likely to be dressed in something several decades out of date.

Granted, there's plenty of bad design out there. Lots of cheaply produced TV and film doesn't get that level of consideration put into it because of tight budgets and timelines. But I feel like in those cases the result is usually something modern with tacked on historical flair, rather than perfect reproductions from a single point in time.

The point about how we understand history is interesting though. Personally, I suspect our views of history are being influenced by the current state of consumerism and planned obsolescence, more than the other way around.

Clothing, appliances, furniture, even the structure of a house itself are increasingly designed and built in the cheapest way possible. I think nowadays we expect most new purchases to break or wear out within a few years. The idea that someone might have the same fridge they got 30 years ago is becoming foreign to us. And I bet that the younger you are, the less it even occurs to you.

And to get back to the original complaint about fashion content: Influencer culture as a whole is very youth focused and status obsessed. Also brand-conscious. And like. The idea that a person should be a brand is at best kinda silly, and at worst harmful to mental and physical health. But that's the stew these people are marinating in. "Cohesive aesthetics" is something you do to build a brand, not a person. Only the fashion influencer mindset doesn't draw a distinction between those two things, at least not publicly.

Now I'm sure lots of them are pushing a "buy more" message simply because it gets them advertising revenue and kickbacks from purchases directed through their blogs/instagrams/whatever. Most of these people either have money or are desperately chasing it, and fast fashion is incredibly profitable. The entire industry is built on micro trends selling cheap disposable garments, and I think a lot fashion content is a deliberate, cynical way to grab a piece of that.

But I also think there's a lot of influencers, especially younger ones, that have just kinda bought into the "buy more, build your brand aesthetic" mentality without realizing or questioning it. Even those who are making an effort to be conscious of sustainability and focus on thrifting. There's an unspoken assumption not just that you will be buying clothes regularly, but that you need to. And the worst part is, that's starting be true.

It's getting harder and harder to find clothes that will last more than a couple years. Most of the pieces I own that have stood the test of time were made a decade ago or more. Quite a few of those were pretty standard fast fashion, really nothing special at the time. But the quality is still miles ahead of similar items being produced by the exact same brands today. At a certain point though, those garments will give out. And when they do, I may have to replace them with something that has a fraction of that lifespan.

My eventual goal is to make more of my own clothes, and buy from smaller companies doing good quality work, but it hasn't been easy to find the time or money for it. And because my job includes tons of thrifting, I end up buying most of my stuff second-hand instead. Which used to be a reliable way to find lasting wardrobe staples. But the hidden gems are getting rarer, and they're buried under growing mountains of Shein garbage.

I wish I had a better way to end this whole ramble, because that feels a bit depressing. I guess what I wanna say is. You don't need a "cohesive aesthetic". You're a person not a brand. Everyone has their preferences, colours, cuts, materials, all that. But you don't need to draw a box around them and say "this is what I'm limiting myself to". I feel like style should be descriptive, not prescriptive. If you wanna name whatever you already got going on in your wardrobe, or try new looks that interest you, sure, sounds fun! But imho, anyone who tells you personal style should stick to a single theme doesn't actually enjoy fashion. They enjoy marketing.

There is something I absolutely loathe about fashion content on the whole.

"What is your color season? Buy a whole new wardrobe." - I assure you that I am not throwing out perfectly good things I already have.

"Find your aesthetic and build a whole wardrobe around it" - again, this involves getting rid of things and buying new ones.

"Instead of buying this sweater, buy one that is pure wool." - I have news for you about how affordable pure wool is.

"Just go thrifting!" - Thrifting is not the gold mine that people seem to think it is. A lot of influencers are getting lucky because they live in cities where there is a relatively high turnover of stock at the thrift store. My average thrift store visit ends with me buying one or two things that 1. I like. 2. Are reasonably priced for the condition they're in. 3. Are actually my size.

If I had to sum up my irritation with this, it's that a lot of fashion content (and interior design from what I've seen) is that it is built on the idea that your life should have a unified aesthetic. But I would wager that most people have pieces and parts of different aesthetics cobbled together across different periods of their life. And there's nothing wrong with that. You don't have to start over every time your "aesthetic" shifts a bit.

6K notes

·

View notes

Text

About Mosquito Shield of Central & Southern Nashville

Our Story

Mosquito Shield® was founded in 2001 as a direct answer to a major problem: mosquitoes. In the absence of an effective mosquito control service and the inadequacy of personal products, a new solution was necessary.

Benefits

Tailored Treatment Plan

We’re the only company in the industry that reacts to mosquito behavior. Without a set schedule, we can adapt to your yard's needs and the mosquitoes around it.

On average, we visit every 10-17 days to ensure a mosquito-free lifestyle.

Proprietary Mosquito Protection Blend

Our special blend began 20 years ago and we continually evolve it to maximize effectiveness.

Science created our formula, and science continues to adapt it so it remains the most effective spray in the game.

Trained Technicians

All of our technicians are trained in environmentally smart practices. They target active mosquito areas and are taught the signs to recognize them.

This means less overall spraying, more dead mosquitoes, and a healthy ecosystem in your backyard.

Money Back Guarantee

If you’re not happy with our services, let us know. We’ll work hard to make it right, including offering a service call spray if needed.

If you’re unhappy with the results after your first visit, simply notify us within 7 days and we will issue you a full refund.

A community that is part of the Five Star Franchising

Get Free Quote

Mosquito Shield Mission

From start to finish, you’ll see we’re passionate about what we do. We don’t make you sign contracts or upsell you on services that you do not need. Our service application is tailored to your property and includes our proven mosquito proprietary blend technology. We’re here to help you and control mosquitoes, not the other way around.

Watch Our Story

Why MoShield’s Application Technology and Services Work

We provide full season coverage versus selling pre-scheduled treatments

At Mosquito Shield, we focus on full season coverage, offering flexible, adaptive treatments instead of a fixed schedule.

We track mosquito activity and weather trends to customize our services for your yard. This ensures effective protection throughout the season, tailored to meet the specific needs of your outdoor space.

Our aim is to keep your yard comfortable and enjoyable, with a proactive, responsive approach to mosquito control.

We use our own proprietary products that last longer, hold up against weather, and grow in strength as the season progresses.

We don’t pretend that mosquito and tick problems are the same.

We back our work up with a money back guarantee!

Our technicians are trained specifically on mosquito and tick products.

0 notes

Text

Network Marketing: सहयोग से Direct Selling में सफलता: Mahendra Suryavanshi

Network Marketing: Direct Selling (डायरेक्ट सेलिंग) की दुनिया में सफलता हासिल करने के लिए एक महत्वपूर्ण गुण की आवश्यकता होती है—सहयोग की भावना (spirit of cooperation)। यह भावना न केवल एक मजबूत टीम का निर्माण करती है, बल्कि पूरे व्यवसाय को नई ऊँचाइयों तक ले जाती है। इस लेख में, हम विस्तार से समझेंगे कि कैसे सहयोग की भावना Direct Selling में आपकी सफलता को सुनिश्चित कर सकती है और इसके विभिन्न पहलुओं…

#"direct selling trends news "#business success in Direct Selling#Direct Selling Now (DSN)#how to succeed in direct selling business#how to succeed in network marketing business#Mahendra Suryavanshi Direct Selling Fame#Network Marketing (MLM)#Network Marketing Breaking News#Network Marketing News In Hindi#Role of Collaboration in Direct Selling#spirit of cooperation in Direct Selling#strengthen the spirit of cooperation#डायरेक्ट सेलिंग की ताज़ा खबर#डायरेक्ट सेलिंग से जुड़ी ताजा खबरें

0 notes

Text

CMP in the Stock Market: The Usage Explanation

When it comes to trading in the stock market, understanding CMP is crucial for informed decision-making and crafting effective investment strategies. The CMP in share market represents the current market value of a stock and plays a significant role in determining the buying and selling decisions of investors.

What Is CMP in the Stock Market?

CMP full form in stock market is “current market price”. It is a key concept in trading that holds significant importance for investors and traders. It represents the prevailing price at which a particular stock is traded in the market. Understanding CMP in share market is essential for making informed investment decisions and devising effective trading strategies.

Importance of CMP in the Stock Market

Accurate Valuation CMP in share market helps investors determine the true value of a stock at any given moment. By having access to the latest market price, traders can assess whether a stock is undervalued or overvalued, enabling them to make informed investment decisions.

Identifying Trend Monitoring and analyzing CMP trends can provide valuable insights into the market trend and direction. By identifying trends, traders can adjust their investment strategies accordingly, maximizing potential returns and minimizing risks.

Setting Entry and Exit Points CMP helps determine the ideal entry and exit points for trades. Traders can use the current market price to set target prices for buying or selling stocks, ensuring they enter and exit positions at favorable levels.

Risk Management CMP provides real-time information on market fluctuations to help traders manage risk. By closely monitoring the current market price, traders can adjust their positions or implement risk management strategies in response to market movements.

How to Find the CMP of Stock Market

Through a Financial News Website Financial news websites such as Bloomberg, Reuters, and CNBC provide up-to-date stock information, including the CMP. Follow these steps: - Visit the desired financial news website. - Search for the stock symbol or company name in the search bar. - Click on the stock’s profile or summary page. - Look for the “current market price” or “CMP” label to find the stock’s current price.

2. Using an Online Brokerage Account If you have an online brokerage account, you can easily find the CMP of stocks you are interested in. Here’s the easy steps to follow:

Log in to your online brokerage account.

Navigate to the “Trading” or “Quotes” section of the platform.

Enter the stock symbol or company name in the search bar.

The CMP of the stock will be displayed along with other relevant information.

3. Stock Market Mobile Apps There are numerous stock market mobile apps available for both iOS and Android devices that provide real-time stock prices, including the CMP. Follow these simple steps:

Download and install a reliable stock market mobile app.

Open the app and create an account if required.

Search for the stock symbol or company name.

The app will display the CMP of the stock and other relevant data.

Learn more: https://finxpdx.com/cmp-in-the-stock-market-full-meaning-explanation/

0 notes

Text

Currency Trading 101: A Beginner’s Guide to Forex

Welcome to the world of Forex trading! If you're new to the game, you might find it overwhelming with all the jargon and the fast-paced nature of the market. But don’t worry—this beginner’s guide to Forex trading will walk you through the essentials, making it easier for you to understand and start your trading journey confidently.

What is Forex?

Currency trading for beginners, or foreign exchange, is the global market for trading currencies. Unlike stock markets, the Forex market operates 24 hours a day, five days a week, because it spans across different time zones worldwide. This market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion.

Why Trade Forex?

Accessibility: With a low initial investment, anyone can start trading Forex. You don’t need a large amount of capital to begin.

Liquidity: The high trading volume ensures that you can enter and exit positions quickly without significant price fluctuations.

Flexibility: Forex trading allows you to trade 24/5, making it convenient for traders with different schedules.

Leverage: Brokers often provide leverage, enabling you to control larger positions with a smaller amount of capital.

The Basics of Currency Pairs

In Forex, currencies are traded in pairs. The first currency in the pair is the base currency, and the second is the quote currency. For example, in the pair EUR/USD, EUR is the base currency, and USD is the quote currency. If the EUR/USD is quoted at 1.10, it means one euro is equal to 1.10 US dollars.

Major, Minor, and Exotic Pairs

Major Pairs: These include the most traded currencies and always involve the US dollar. Examples are EUR/USD, USD/JPY, and GBP/USD.

Minor Pairs: These do not involve the US dollar but involve other major currencies. Examples are EUR/GBP and AUD/JPY.

Exotic Pairs: These involve one major currency and one currency from an emerging or smaller economy. Examples are USD/TRY (US Dollar/Turkish Lira) and EUR/SEK (Euro/Swedish Krona).

How to Start Trading Forex

Educate Yourself: Before diving into trading, learn the basics. Use online resources, attend webinars, and read books on Forex trading.

Choose a Reliable Broker: Look for a broker with a good reputation, solid customer service, and appropriate regulatory licenses.

Open a Demo Account: Practice trading with virtual money to understand how the market works without risking real capital.

Develop a Trading Plan: A trading plan should outline your trading goals, risk tolerance, and strategies. Stick to this plan to maintain discipline.

Start Small: When you’re ready to trade with real money, start with a small amount that you can afford to lose.

Basic Strategies for Beginners

Trend Following: Identify and follow the direction of the market trend. If the market is trending upwards, look for buying opportunities. If it’s trending downwards, look for selling opportunities.

Range Trading: When the market is moving sideways, identify key support and resistance levels. Buy at support and sell at resistance.

Breakout Trading: Look for points where the price breaks out of a previously defined range. This often signals the start of a new trend.

Managing Risk

Set Stop-Loss Orders: Always use stop-loss orders to limit your potential losses on each trade.

Use Proper Position Sizing: Never risk more than a small percentage of your trading capital on a single trade.

Stay Informed: Keep up with economic news and events that can affect currency prices.

Conclusion

Forex trading can be a rewarding venture if approached with the right knowledge and strategy. This beginner’s guide to Forex provides a foundation to help you understand the basics of currency trading. Remember to educate yourself continuously, practice diligently, and manage your risks wisely. Happy trading!

0 notes

Text

What the Heck is Happening to Silver?!

The dollar rose this week, from 17.87mg gold to 18.24mg (that’s “gold fell from $1,740 to $1,705” in DollarSpeak), a gain of 2.1%. In silver terms, it rose from 1.61g to 1.67g (in DollarSpeak, “silver dropped from $19.24 to $18.64), or 3.7%. As always, we want to look past the market price action. Two explanations are hot today. Let’s look at them first, before moving on to our unique analysis of the basis. JP Morgan and Motte and Bailey JP Morgan’s manipulation of gold and silver prices is the focus of discussion in the gold community again, as another criminal trial is now underway, this time the accused is the former head of precious metals trading at the bank (we have discussed the manipulation conspiracy theory here and here). Central to this trial—and the previous one—is spoofing. Bloomberg describes spoofing as placing “orders that are quickly canceled before they can be executed -- to push precious metals up or down”. Unfortunately, many commentators in the gold community use this at the Motte in a Motte and Bailey Fallacy. A Motte and what?! It’s named after a medieval fortification. The Motte is strongly defensibly, but not a pleasant place to spend a lot of time. The Bailey is a better place, but not so defensible. The Fallacy is like a bait-and-switch. The arguer starts with an uncontroversial statement. In this case, that JP Morgan traders were caught entering orders they intended to cancel. And since one can’t really dispute this, the arguer moves on to the important proposition. The Bailey is not defensible, but by the tactic of having just sold the Motte, the arguer hopes the Bailey will not need to be defended. The Bailey is that the prices of gold and silver would be far higher, but for manipulation. Of course, spoofing has no long-term effect on prices. If it works at all (the whistleblower did not make much money as a trader for JP Morgan), it is because it momentarily distorts the price signal, and the trader can trick other market participants into paying too much or charging too little. N.B. JP Morgan did spoofing in both directions. You can’t get there, from here. You can’t convict the Godfather of murder by proving his grandson stole candy from the store. And you can’t argue gold would have been $50,000 decades ago, by proving JP Morgan traders entered orders they intended to cancel. Silver Price Suppression? The other hot topic du jour is the Commitment of Traders Report. The conspiracy view holds that banks sell futures to suppress the price. According to this view, the greater the number of futures contracts outstanding, the more the price is suppressed. So, in this view, it’s notable that the number of open silver contracts is now near a multiyear low. In the conspiracy theorists’ minds, this means that silver is ready to launch to much higher prices. This is almost right, but for the wrong reason. In reality, open interest responds to the basis. A high and rising basis offers a profit to carry metal. To carry, a bank borrows dollars to buy metal and simultaneously sells a contract. The basis is the profit they can earn in this trade. Basis is (basically) future price – spot price (quoted as an annualized percentage rate). The interest rate factors into this trade. So, in a changing interest rate environment, one can’t just look at the basis. One needs to consider interest as well. Fortunately, we have an indicator which does. The lease rate. Lease rate is (basically) LIBOR – basis. Here’s our graph of the silver lease rate. As we have written in the past, we ignore the period after the economy was slammed with Covid lockdown. Disruption to air travel meant that arbitragers could not reliably move metal between markets such as New York and London, and hence did not want to take the risk of putting on positions such as carry. And the result was that spreads such as the basis blew out (also the bid-ask spread in gold). However, notice the rising trend from around mid-April this year. A rising lease rate is an indicator of rising scarcity. It costs significantly more to lease silver now than in the last several years. Indeed, it costs more now than at any time since the global financial crisis. The lease rate, LIBOR – GOFO, is based on arbitrage in the commercial bullion markets, it has nothing to do with the rate Monetary Metals charges bullion dealers, jewelers, mints, recyclers, and refiners. Understanding Gold and Silver Movements So what does all this mean? Most readers want to know what is likely to happen to the price of gold and silver next. We will address this question. But first, let us indulge in a little more chart fun. Here is the gold continuous basis chart. Since mid-March, we have had a rising price of the dollar (in DollarSpeak, “gold has been falling”). And while this was going on, the basis was rising and cobasis was falling. Basis is our measure of abundance and cobasis is our measure of scarcity. Gold has become more abundant / less scarce while its price has been dropping! What does this mean? There is a global dollar liquidity crisis going on. People are selling the other currencies hand over fist to raise dollar cash. Well, they are buying dollars too (in DollarSpeak, “they are selling gold”). Why are they doing this? Did we mention that the crisis is global? Just ask those who held euros near $1.20 a year ago, and now the euro has been sold down to $1.00 so far! Everyone is facing margin calls, capital calls, loans are being called, etc. Here is the chart for silver. It does not look anything like the gold chart! Granted, the price move has been more dramatic. Whereas the gold price fell from $1,950 to $1,705, -12.6%, the price of silver fell from $25.50 to $18.64, -27%. However, the basis has been falling since late April and cobasis has been rising. Silver has been getting less abundant / more scarce. Gold Cobasis Now let’s look at the high-resolution intraday cobasis and price chart for gold this week. While the dollar rose from 17.85mg gold to 18.25mg, the cobasis chopped around and ended unchanged on the week. You can see that, at times, it correlated with the price. When cobasis moves with the price of the dollar, it means futures traders are positioning and repositioning themselves. No change in the fundamentals. However shortly after noon (GMT) on Thursday, the two lines divorce. Cobasis heads down. At first, price of the dollar is heading down, but then it heads back up, while the cobasis temporarily recovers, then chops sideways, and finally ends back down on Friday. We haven’t seen a chart like this in, well, we don’t recall how long. While buyers of metal could get more aggressive in the future, the current market conditions are not looking bullish for gold. By the way, we do expect them to get more aggressive. This market is characterized by intense selling by those desperate for liquidity and intense buying by those seeking to avoid the ravages of bad policies by governments and their central banks. Eventually, the latter will overpower the former. This was not that week (if we may butcher Aragorn’s classic line). Silver Cobasis Here’s silver. The dollar moved up from 1.6g silver to 1.66. In silver this week, the cobasis more closely tracked the price of the dollar. This may be why, after noon on Thursday, the dollar begins to weaken in silver terms (“silver went up”, in DollarSpeak). However, the cautionary note is that the cobasis depleted all of its energy in that move. It dropped from 2.25% to 0.8%. This means it was buyers of futures—speculators—who bought silver in the expectation that the price will rocket higher after the low on Thursday. Much of the backwardation in the September silver contract dissipated. The Monetary Metals Gold Fundamental Price is $1,820 and the Silver Fundamental Price is $21.89 (we’ve overloaded this article with charts, so omit the fundamental charts, but interested readers can find them on our website). Original Article Here: Read the full article

0 notes

Text

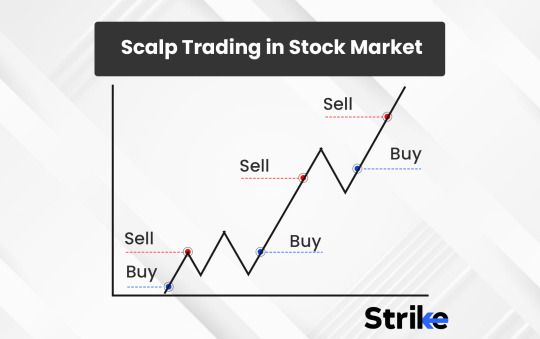

"Mastering the Art of Scalp Trading: Strategies, Tools, and Tips for Swift Profits in the Stock Market"

Scalp trading, also known as scalping, is a popular trading strategy in the stock market characterized by its fast-paced nature. Scalpers aim to achieve profits from small price changes in stocks, often entering and exiting positions within minutes or even seconds. This high-frequency trading approach requires a comprehensive understanding of market movements, an ability to make quick decisions, and meticulous risk management. This article explores the intricacies of scalp trading, including its strategies, tools, benefits, risks, and tips for success.

Understanding Scalp Trading

Scalp trading is grounded in the principle of quantity over quality. Scalpers are not concerned with significant gains from a single trade; instead, they focus on the accumulation of small profits over a large number of trades throughout the trading day. This strategy hinges on the belief that smaller moves in stock prices are easier to catch than larger ones. Scalpers operate on thin margins and leverage high volumes to amplify their profits.

Key Strategies in Scalp Trading

Several strategies underpin successful scalp trading, including:

Bid-Ask Spread Capturing: Scalpers often buy at the bid price and sell at the ask price to gain the spread difference. This strategy requires a highly liquid market to execute quick trades.

Volume Heatmaps and Order Flow: Analyzing volume and order flow helps scalpers identify immediate directional moves in stock prices, enabling them to execute quick trades.

Technical Indicators and Chart Patterns: Short-term chart patterns and technical indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can signal entry and exit points for scalpers.

Tools for Scalp Trading

Successful scalp trading relies heavily on having the right tools, including:

High-Speed Internet and a Reliable Trading Platform: Speed is of the essence in scalp trading. Delays in order execution can significantly impact profitability.

Direct Market Access (DMA): DMA allows scalpers to interact directly with the exchange's order book, which is crucial for timely trade execution.

Real-time Market Data: Access to real-time quotes and market data is essential for making informed trading decisions quickly.

Benefits of Scalp Trading

Scalp trading offers several advantages:

Frequent Opportunities: The strategy capitalizes on the numerous small movements that occur in the stock market daily.

Limited Risk Exposure: By holding positions for a very short time, scalpers limit their exposure to large adverse market movements.

Market Flexibility: Scalp trading can be effective in both rising and falling markets, as it relies on small price changes rather than the market's overall direction.

Risks and Challenges

Despite its benefits, scalp trading is not without risks and challenges:

High Transaction Costs: Frequent trading increases transaction costs, which can eat into profits.

Requires Constant Attention: Scalp trading is time-intensive and requires constant market monitoring, which can be mentally exhausting.

Risk of Significant Losses: While individual losses are typically small, the cumulative effect of several losing trades can be significant. Additionally, high leverage can amplify losses.

Tips for Successful Scalp Trading

To maximize the chances of success in scalp trading, consider the following tips:

Start with a Demo Account: Practicing with a demo account can help traders understand the nuances of scalp trading without risking real money.

Set a Risk Management Strategy: Establishing stop-loss orders and daily loss limits can help manage risks effectively.

Keep a Trading Journal: Documenting each trade, including the strategy used, the outcome, and any lessons learned, can provide valuable insights for improving future trades.

Stay Informed: Keeping up with financial news and market trends can provide scalpers with a competitive edge.

Use Technology Wisely: Leveraging trading software with automation and alert features can enhance efficiency and effectiveness.

Conclusion

Scalp trading in the stock market is a challenging yet potentially rewarding strategy that suits traders who can dedicate the time, discipline, and focus required to succeed. It appeals to those who prefer a fast-paced trading environment and are comfortable making quick decisions. While scalp trading offers the potential for significant profits through the accumulation of small gains, it also carries risks that demand meticulous strategy and risk management. As with any trading strategy, success in scalp trading comes with experience, continuous learning, and an unwavering commitment to staying abreast of market dynamics.

0 notes

Text

Expert Quotes on the 2024 Housing Market Forecast

Expert Quotes on the 2024 Housing Market Forecast

If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market in 2024. In 2023, higher mortgage rates, confusion over home price headlines, and a lack of homes for sale created some challenges for buyers and sellers looking to make a move. But what’s on the horizon for the new year?

The good news is, many experts are optimistic we’ve turned a corner and are headed in a positive direction.

Mortgage Rates Expected To Ease

Recently, mortgage rates have started to come back down. This has offered hope to buyers dealing with affordability challenges. Mark Fleming, Chief Economist at First American, explains how they may continue to drop:

“Mortgage rates have already retreated from recent peaks near 8 percent and may fall further . . .”

Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“For home buyers who are taking on a mortgage to purchase a home and have been wary of the autumn rise in mortgage rates, the market is turning more favorable, and there should be optimism entering 2024 for a better market.”

The Supply of Homes for Sale May Grow

As rates ease, activity in the housing market should pick up because more buyers and sellers who had been holding off will jump back into action. If more sellers list, the supply of homes for sale will grow – a trend we’ve already started to see this year. Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Supply will loosen up in 2024. Even homeowners who have been characterized as being ‘locked in’ to low rates will increasingly find that changing family and financial circumstances will lead to more moves and more new listings over the course of the year, particularly as rates move closer to 6.5%.”

Home Price Growth Should Moderate

And mortgage rates pulling back isn’t the only positive sign for affordability. Home price growth is expected to moderate too, as inventory improves but is still low overall. As the Home Price Expectation Survey (HPES) from Fannie Mae, a survey of over 100 economists, investment strategists, and housing market analysts, says:

“On average, the panel anticipates home price growth to clock in at 5.9% in 2023, to be followed by slower growth in 2024 and 2025 of 2.4 percent and 2.7 percent, respectively.”

To wrap it up, experts project 2024 will be a better year for the housing market. So, if you’re thinking about making a move next year, know that early signs show we’re turning a corner. As Mike Simonsen, President and Founder of Altos Research, puts it:

“We’re going into 2024 with slight home-price gains, somewhat easing inventory constraints, slightly increasing transaction volume . . . All in all, things are looking up for the U.S. housing market in 2024.”

Bottom Line

Experts are optimistic about what 2024 holds for the housing market. If you’re looking to buy or sell a home in the new year, the best way to ensure you’re up to date on the latest forecasts is to partner with a trusted real estate agent. Let’s connect.

0 notes

Text

The Role of Art Criticism in Today's World

My understanding of the art critic’s impact in today’s world is frankly confusing and inherently contradictory. From research, it’s apparent that the role of an art critic in today’s world is described as a dead or dying thing, with only around ten contemporary critics in the United States able to get bread on their table from the job (according to Josh Baer in a conversation with Saltz). Others say, with no small derision and regret, that the wheel of the art market is directed by the covert hands of the art critics, who sit like bejeweled gargoyles at the top of the art food chain and live only to propagate a money-obsessed marketplace concerned with artworks insofar as their capacity to be investments. One thinks of Hughes in Nothing if Not Critical (Hughes, 1990 cited in: Gerry, 2012):

“So much of art – not all of it thank god, but a lot of it – has just become a kind of cruddy game for the self-aggrandisement of the rich and the ignorant.”

Then there is the middle-men; who, operating on the premise that the profession is indeed within its death throes, or that it is a rare profession to begin with, abandon the exercise of describing in pursuit of prescribing the appreciating value of the critic in light of this Ozymandian plight. In summary: assertion A is that critics have hold little to no sway nowadays, assertion B is that they have enough such that they generate a sort of monopoly within elite circles, and assertion C is that while art critics may be rare and few between, they are nowadays more important than ever due to their increasing scarcity. (Personally speaking, this fallaciously begs the question that they are inherently beneficial to the art world, fons et origo). Difficult though the exercise may be, I will endeavor to give a personal appraisal of the practice, using the classic pro-con model.

For fear of falling into cliché, I will not quote Anton Ego from Ratatouille, but in true pop fashion I will make reference to the spirit behind the movie’s words: the notion that the ‘new needs friends’. Art critics can give new voices a platform, and allow new styles, approaches, and artistic philosophies to take center stage, where they would otherwise have been drowned out by the dull totalitarianist clamor of consensus and trend.

In the classical sense, the role of the critic is to act as an intellectual mediator between an audience and the artwork; contextualizing, providing perspective, and deepening appreciation, if done well. It follows the hermeneutical tradition: the interpretation and comprehension of human intellectual work, ascribing meaning to the animating principle behind these actions, evaluating the merits and values of the artwork in terms of what it has affirmed or provided for the human race. This is well anthologized in the beginning of Eleni Gentou’s (2010) Subjectivity in Art History and Criticism:

“…the approach of the art historian should have a scientific character, aiming at objectively valid formulations, while the critic should give equal consideration to subjective factors, acknowledging international artistic values, often taking on the additional role of philosopher or theorist of art.”

In effect, this creates a certain incentive among those who practice art criticism to - for lack of a better term - ‘sell you the idea’ (of the artwork). Perceiving the glass as half full, this generates a type of literary criticism that becomes an artwork within itself. As Jonathan Jones (2012) said in praise of good old Robert Hughes to the Guardian, “[...]he made criticism look like literature”. This factor is really what delineates the critic from the historian; as Ackerman (1960) eloquently said: “The typical critic is a specialist in expressionistic prose, the historian in esoteric facts.”

Inversely perceiving the glass as half-empty, this also leads to a cult of a pithy, insipid and lazy appraisal of truly mediocre work, work which only can (and is) prettied up retroactively with pretty words. In this regard, critics can truly be the conman’s wet dream; they’ve thought up excuses for his meritless work before he’s even thought of them himself.

On a further note sympathetic to their craft however, the role of critiquing art is not without risk, despite general perception that the artist is more or less a trembling spring lamb offering its brave work to the reptilian jaws of the wicked critic. Art criticism in the past has endeavored to debase something contemporary to the period, that, in the long run, became treasured and admired by humanity - impressionism being the obvious example here. One age’s pejorative often becomes another age’s badge of honor, and with the convenience of retrospect, the world isn’t kind to critics on the wrong side of history. At the risk of inviting accusations of moral relativism, I will venture to say that we operate under the spirit of their time and that people are a bit too prone to thinking ‘I would have been on the right side of history had I been there’ for my liking. The same way they gnash their teeth and imagine that they would have saved Van Gogh’s work from obscurity and suicide had they just been there in time for his early (initially pretty terrible) work.

In summary, I have tried to paint a balanced portrait of art critics, if a bit magnanimous. They are perceived as parasitical by some, by others they are appreciated for the perceived artistic value of their writings - as such, the latter group is not really concerned about what the art critics do for Art inasmuch as how they do it. There are several traps that critics may fall into, such as the excessive defense of the old; the “[...]settled expectations and unquestioned presuppositions” (Kuspit, 2014), and to the contrary, a spineless adherence to anything and everything whose only virtue is that it's new in some way. One mustn’t think that we’re immunized against the error that the naysayers of the Impressionists fell into; at the same time, don’t let’s shut our prefrontal lobes down because one more artist decantered themselves into the currently already overfull and very sexy ‘questioned the boundaries of what art is’ pool. The illegitimacy of both utter skepticism and utter dogmatism is equally insupportable.

References

Ackerman, J.S. (1960). Art History and the Problems of Criticism. Daedalus, [online] 89(1), pp.253–263. Available at: https://www.jstor.org/stable/20026565 [Accessed 19 Oct. 2023].

Cargill, O. (1958). The Role of the Critic. College English, 20(3), p.105. doi:https://doi.org/10.2307/371736.

Kuspit, D. B. (2014). Art criticism. In: Encyclopædia Britannica. [online] Available at: https://www.britannica.com/art/art-criticism.

Development, P. (2023). Jerry Saltz | The Baer Faxt Podcast. [online] www.thebaerfaxtpodcast.com. Available at: https://www.thebaerfaxtpodcast.com/e/jerry-saltz/.

Gemtou, E. (2010). Subjectivity in Art History and Art Criticism. Rupkatha Journal on Interdisciplinary Studies in Humanities, 2(1). doi:https://doi.org/10.21659/rupkatha.v2n1.02.

Gerry (2012). Robert Hughes. [online] That’s How The Light Gets In. Available at: https://gerryco23.wordpress.com/2012/08/07/robert-hughes-greatest-art-critic-of-our-time/ [Accessed 16 Oct. 2023].

HOWE DOWNES, W. (2023). ART CRITICISM on JSTOR. [online] Jstor.org. Available at: https://www.jstor.org/stable/23938988 [Accessed 20 Oct. 2023].

Hughes, R. (2015). The Spectacle of Skill. Vintage.

Jones, J. (2012). Robert Hughes: The Greatest Art Critic of Our Time. [online] The Guardian. Available at: https://www.theguardian.com/artanddesign/jonathanjonesblog/2012/aug/07/robert-hughes-greatest-art-critic. [Accessed 16 Oct. 2023].

Pepper, S.C. (2013). The Basis of Criticism in the Arts.

1 note

·

View note

Text

Goldman Sachs blog for MBA

9/5/23

From Chp 2 we learn about the 3 steps that lead to business forecasts. Environmental Scanning, Environmental Monitoring and Competitive Intelligence lead to the Business Forecast.

It is curious as to what Goldman Sachs CEO saw at trends and landscape when he went into the non-ultra wealth management business and what ultimately changed in the forecast. The result being the selling of this sub-business unit it purchase in 2019 for $750 million. The sale price was not disclosed but it is assumed to have been at a loss.

Was it a misread in industry trends, or was it an internal analysis that the cost to enter that marketplace was no long term profitable? Ultimately, a major Wall Street firm reviewed it's Environmental Forecast and decided to change course.

9/13/23

Chp3

Quote from Article:

"But Solomon's attempt to craft a new image for Goldman did not turn out as he intended. Solomon's bets on consumer banking have turned into a mess, and Goldman Sachs is losing its edge in the bread-and-butter investment banking for which it became famous. The sinister, crisis-era image of Goldman Sachs manipulating the world from rows of flashing computer screens and skyscraping boardrooms has been replaced by a new, much worse picture — a rudderless bank in disarray."

In chapter 3 of Dess discussed is the "Balanced Scorecard" which is the basic idea of a firms financial success plus "customer satisfaction, internal process, and the organizations innovation and improvement activities". The balanced scorecard is a struggle for Goldman.

Financially, speaking the firm continues to make money and remains a power on Wall Street. However, their reputation internally and externally has taken a major hit. No longer seen as an untouchable firm, Goldman has struggle with an attempted new entry into consumer banking, there has been turnover, job cuts and missed deals. Concepts that a decade ago would have seem laughable for anyone to suggest Goldman Sachs would fall victim to. However, today business units are being sold off, internally partners are complaining of direction, and worst of all customers are looking elsewhere.

The financial numbers and record profits still says Goldman is not going anywhere, but the balanced scorecard says business at the firm is not what it once was. That loss of reputation is a financial hit they are taking.

Chp4

Attracting, Developing and Retaining Human Capital

In a recent Fortune article it was announced that Goldman Sachs is bring back it extremely cutthroat performance reviews. Essentially, Goldman Sachs cuts 5-10% of employees subject to these reviews.

The idea is low review performers are moved out, fresh faces are brought in and the belief is it motivates those that stay to work harder.

Experts disagree with that theory. It can be seen as a bad morale creator, one that does not encourage teamwork, makes a hostile workplace and may cost the company a solid worker who suffers from an off year.

As discussed in Chapter 4 of Dess the idea of attracting, developing and retaining human capital is a key to a company's success. Goldman Sachs continues to get record amount of interest from graduates of elite MBA programs. However, where there seems to be an issue is the seasoned successful Wall Street banker. From outside the company, and within, Goldman Sachs' workplace is not as desirable.

The question is does such a review program deliver enough results to be worth the idea of a negative workplace environment. Yes, Goldman Sachs attract recent grads, but they struggle to retain. Could it be that Goldman Sachs is forgetting about the idea of developing talent. Instead, it appears they are willing to cut cords quickly with talent. That works for now, but will it eventually cost them. It seems it has in terms of their reputation, but not their profits.

Chp 5

Differentiation: creating differences in the firm's products or services by creating an image that is perceived industrywide as unique and valued by customers. (pg 147 of Dess)

In chapter 5 one of the main points to consider is what makes one firm different from another. For Goldman Sachs it has been its reputation. Yes, there are critics who will say they are a profit hungry bank, and cutthroat when it comes to deal making.

There is another view, from within the bank encourages debate. "Another thing that makes Goldman different from other firms is not that all Goldman bankers agree but that they are free—and, in fact, encouraged—to disagree." Goldman internal environment is once of challenge. No one is immune to it, even the CEO.

There are reports, as documented in the article, that Goldman Sachs debates are hotly contested events. The end result is a pure and relentless testing of an idea. The end result is when the idea is accepted internally and presented to a client the Goldman Sachs team is fully behind their idea.

That reputation of Goldman Sachs separates it from its peers. The talent pool that is attracted to the firm, believes in debate, and it you work their you must embrace it. What the clients sees is an idea being presented that has been fully vetted.

Goldman is not known for niceties within. There can be a lack of etiquette that is not tolerated at other bank firms. Those other banks may prefer their employees, and certainly upper management to be spoken kindly to. Perhaps that is what leads to more "yes men" answers. That is not the way Goldman Sachs operates.

From a client view, Goldman commands more business and fees because the results they deliver via client proposals are ones that have stood up to a grueling test within the firm. Client may be inclined to believe that are ultimately getting the best test idea possible.

Chp 6

In Chapter 6 of Dess they discuss portfolio management. In particular the idea of "channeling resources to units with he most promising prospects can lead to corporate advantage." Included in that portion of the chapter is Boston Consulting Groups business portfolio analysis matrix of SBU (strategic business units). They break their review of SBU into 4 quadrants: Stars, Question Marks, Cash Cows and Dogs.

For Goldman Sachs their "stars" have long been investment banking and trading. What the article above shows is how a "question mark" can turn into a dog. Goldman Sachs hoped to enter into the commercial consumer bank industry as a way to add diversity to their portfolio, and ultimately lower risk, has backfired. The result at the time of the article is almost $3 Billion in losses for that unit.

Goldman Sachs has decided to exit personal loans and checking portions of consumer banking. Though they have seen some positives, namely large deposits in their money market accounts, the negatives of lending are forcing them to reconsider their strategy.

Chapter 7 International Strategy and Risk

See the above story...not the headline you want to see as CEO as one of Wall Street's top firms. Yet, here Goldman Sachs is paying to nearly $3Billion dollars to settle a foreign bribery case. Goldman Sachs has a culture based on aggressive deal making and to land the deal some might say at any cost.

One of the biggest international risks is Management Risk as stated by Drees. There can be a lack of complete understanding of culture, currency, etiquette and legal understandings. What might hold to be accepted business practices in one country is illegal in another. Without a firm understanding of a country's legal background and acceptable business practices can land a firm, one even as big as Goldman Sachs, a headline like the one posted above.

Chapter 8

This is an older article, and as we have seen Goldman Sachs entry to the commercial banking space ended up being a money losing venture for the firm. They ultimately, have stated to shutter certain parts of the business.

In 2018 one of the oldest firms on Wall Street attempted, as Drees discussed in Chp. 8, an adaptive new entry. As Drees put it, "an approach that does not involve reinventing the wheel" rather it was Goldman Sachs spin on a bank. No brick and mortar costs, rather an online experience that is gaining popularity.

As mentioned in Chp. 8 it is a slight twist on an old idea, that gives it a fresh take for customers. The idea Goldman Sachs had was to access a new customer base. What they ultimately missed was the cost of having such a venture, and how hard it is to generate a profit in that space. Even as an established IPO/MA bank it was new to the commercial customer base. That lead Goldman Sachs to grossly miscalculate the cost/net profit as growing pains ultimately caused it to never turn a profit. Instead it resulted in billions lost on there investment dollars.

Chp 9 Culture and Behavioral Control

From the article:

"In March, 13 first-year Goldman Sachs analysts – the group lowest on the corporate totem pole – put together a ‘survey’ on their working conditions at the esteemed, multi-national bank, in a document seen by the BBC. The survey, mocked up on Goldman Sachs’s official pitchbook template, detailed the group’s more than 95-hour workweeks, precarious mental and physical health, deteriorating personal relationships and conditions one respondent called “inhumane”.

Inhumane is quite a comment to make. As Drees discussed in chapter 9 there is a balance of lever pulling between "culture, rewards and boundaries" to attain behavioral control.

A strong culture sets unwritten boundaries of what is and is not acceptable behavior. What the reputation is at Goldman Sachs is somewhat out of balance.

There are long hours, aggressive arguments and confrontations, little work life balance for the reward of a large bonus. The bonuses achieved have been hundreds of thousands of dollars and for some millions. The concern is the culture has become a win at all cost to earn as much money as possible. The result is the image of some well paid investment bankers that value money over human decency.

That leads to 2 questions: Do I want to work in such an environment?

Do I want to do business with such a firm?

Chp 10 - Organization Structure