Don't wanna be here? Send us removal request.

Text

10 Important Tips for Buying Life Insurance

Tips for Buying Life Insurance | asuranci.com

Looking to buy life insurance for the first time? Then asking yourself this questions:

How much life insurance do I need?

What kind of life insurance policy is best?

Which life insurance company should I buy from?

Shopping for life insurance can become an overwhelming task. There's no question that buying life insurance for the first time, like any other new experience, can be more than a bit daunting.

Below are ten important tips for buying life insurance, especially if it's your first time.

Tips for Buying Life Insurance

1. Know Why You Need Life Insurance

Life insurance is a serious investment that shouldn't be made on the spur of the moment. Don't buy a policy just because someone says you should. Many people hear ads about life insurance so many times that they begin to feel an instinctive concern about needing life insurance. The truth is, however, not everyone needs life insurance.

Buying Life Insurance

The purpose of life insurance is to provide financial support for your dependents if you are no longer around to do it yourself. If you don't have any dependents, you probably don't need to spend money on life insurance. If you are contributing significantly to the financial well-being of someone in your life, you think about protect from any financial gaps that might occur if you no longer able to provide the same support. The key is to understand why you need life insurance before you begin shopping for a policy.

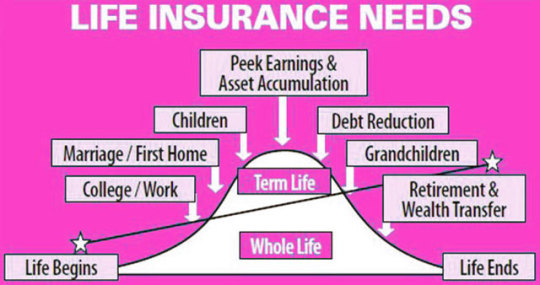

2. Understand the Type of Life Insurance Policy You Need

There are two basic types of life insurance policies: life and whole life. Term life insurance policies last for a specified period of time. Term life is less expensive than whole life because it usually expires before the benefits are used.

Whole life insurance lasts from the day you the policy until the day you die, no matter. A whole life policy is more expensive because the coverage could last a few years or several decades. Whole life policies can be borrowed against at a high interest rate, while term life policies.

3. Know When to Choose Term Life Insurance

If you are in a situation your dependents will not rely on you financially forever, your best bet is probably a term life policy. For example, many parents choose term life policies that are in effect until their children move out and become financially independent. Once kids are, there is no reason to continue paying for life insurance. Your beneficiaries will rely on your contributions.

4. Know How Much to Buy Life Insurance

Understanding the potential needs of your beneficiaries can also help you decide how much life insurance you should have. Don’t follow any “rule of thumb” guidelines you may read. Your needs are specific to you. Your decision will depend on the math.

How much money do your dependents need each year and for how long? Because your children are likely different ages, that number is different for each beneficiary. Calculate the needs of each dependent annually, multiple times the number of years support is needed and then add those numbers together so all dependents have what they need.

The amount of money your family or heirs will receive after your death is called a death benefit. To determine the proper amount of life insurance, online calculators can be helpful. You can also get a ballpark figure using any number of formulas. The easiest way is to simply take your annual salary and multiply by 8.

5. Take Advantage of The “Free Look” Period.

Even after your policy issues, you'll typically have what is called a free look period. During this time, you'll have a certain number of days in which to make changes to your policy, or even reject it altogether. Be sure to ask your company representative how long your free look period is and when it begins. If for some reason you don't feel the policy is right for you, this is the time when you can change your mind with no financial obligation.

6. Compare Similar Life Insurance Products.

When getting price quotes on life insurance, be sure that you are comparing similar products. Because term life generally has lower premiums than a permanent life policy, there can be a big price difference for a $75,000 term policy compared to a $75,000 permanent policy. Depending on your coverage needs, it's important to look at every angle, not just the monthly premium.

7. Understand that life insurance is designed for protection.

Your main purpose for getting life insurance should be to protect your beneficiaries financially in the event of your death. While permanent life insurance policies have the potential to earn cash value over time, they are not meant as investment vehicles.

Life insurance is designed to provide families with financial security in the event of the death of a spouse or parent. Life insurance protection can help pay off mortgages, help provide a college education, help to fund retirement, help provide charitable bequests, and, of course, help in estate planning. In short, if others depend on your income for support, you should strongly consider life insurance.

8. Enhance your coverage with policy riders if necessary.

When you select a policy, ask your company representative about the types of policy riders that may be available to you. Riders or endorsements are ways in which you can customize your policy to meet your needs and budget.

9. Buy from a reputable life insurance company.

Your life insurance policy is meant to financially protect the people you love when you are no longer here to do so yourself. Do some homework on the life insurance company that you are considering buying from and learn more about how to select a reliable life insurance company.

An insurance policy is only as good as the company that backs it.

You want to make sure you choose a company you can rely on to be around for as long as you'll need your coverage, and one that invests premiums in a highly prudent manner in order to pay the claims of its policyholders.

That is 9 Important Tips for Buying Life Insurance. The last important tips for buying life insurance is looking for your deep heart. Is it important?

0 notes

Text

All About No Down Payment Auto Insurance

No Down Payment Auto Insurance | asuranci.com Would you rather prefer to pay monthly, so the car insurance premium does not put a heavy toll on your personal or household budget plan? Then No Down Payment Auto Insurance is the right choice for you.

Definition of No Down Payment Auto Insurance

Insurance is a contract. A payment is generally needed to get your car insurance coverage started. Because auto insurance is a contract, you must pay for services before they are rendered. You promise to pay your premium or a portion of your premium to start, and the insurance company will provide you coverage for those items named in your policy.

Car Insurance for Bad Drivers

There are usually two options provided in contract: The first option is to pay the premium in full outright. The second option is to pay an insurance down payment, or a portion of the policy up front, then make monthly payments over the life of the policy. An increase in the down payment can reduce monthly insurance costs for the consumer. Generally insurance companies charge a slightly higher premium for those consumers that pay monthly than those who pay for their policy up front. A number of Insurance companies are providing no down payment auto insurance policies these days. But to save time and money during your effort, it could be better if you seek assistance from some reliable and reputed national online car insurance service provider. Such a move could enable you to secure vital local guidance while analyzing various options which could be available at your disposal. By securing our services, you could be helped to locate a no deposit or down payment auto insurance option with a favourable monthly premium payment schedule that is easier to manage and sustain.

How to Get No Down Payment on Auto Insurance?

The most efficient way to find no down payment car insurance is to get free quotes online. But aside from that, you can also ask your employer or the human resource department of your company if they can recommend any provider. In many cases, auto insurance companies offer discounts for their packages if the applicant is working for a particular company. The discounts provided vary, but it’s not uncommon for these companies to provide low down payment as a way to entice buyers.

Advantages of No Down Payment Auto Insurance

- Manageable Payments: Instead of having to pay the deposit along with your first payment, you just make your first payment - No Confusion: Calculating your insurance payments becomes easier when you do not have to account for the deposit. All you need to do is pay the same amount each month as long as nothing changes about your policy. - Pay the Same Amount Each Month - Pay Less to the Insurance Company - Works Better with Budgets

Disadvantages of No Down Payment Auto Insurance

- High Standards To receive this type of coverage you will need to have an excellent credit rating and a good history of payments with insurance companies. You may have to raise your credit score a bit or show additional evidence of your good payment history. - Higher Fees You may notice extra costs that are added to the policy itself which mean that you save less money. - Fewer Opportunities Car insurance with no down payment is not the easiest to find as many insurance companies do not openly boast about having such a policy. It only exists as a lure for individuals who have good credit scores that otherwise might not consider their insurance agency. A no down payment policy is one that you will need to consider to lower the total cost you pay to insurance companies. Choosing no down payment auto insurance offers many more advantages than disadvantages. However, you may find that the higher fees and stricter standards for obtaining this type of policy may not be worth the effort even if it saves you some money every six months.

0 notes

Text

5 Types of Auto Insurance Coverage

Types of Auto Insurance Coverage | asuranci.com How do you know what types of auto insurance coverage you need? Is it required by your state? Are there ways to save money and still have the right amount of auto insurance coverage? Below we detail 5 types of auto insurance coverages and provide a few scenarios where you would benefit from having a non-required coverage added to your policy along with some tips to save some money depending on your vehicle and budget.

Types of Auto Insurance Coverage

Here are some common auto insurance coverage options.

Liability Coverage

Personal Injury Protection

Collision Coverage

Comprehensive Coverage

Uninsured and Underinsured Motorist Coverage

1. Liability Insurance

All states require a minimum amount of liability coverage in order to legally drive a vehicle. Liability insurance covers you when driving any vehicle you own or if you drive someone else’s car with their permission. Liability coverage is perhaps the most important type of protection that auto insurance policies offer, and the one that almost all states require. Bodily injury liability applies to damages you cause to others. It covers their medical bills and lost wages. Property damage liability pays to repair or replace property that you damage or destroy. This includes other cars or property, such as fences. It can also pay for "pain and suffering" damages if someone sues you after a car accident. Almost all states and the District of Columbia require minimum liability coverage amounts by law.

Types of Auto Insurance Coverage

2. Personal Injury Protection

While Comprehensive coverage may be something you don’t need to purchase, Personal Injury Protection (PIP) is something you should. The costs associated from an accident can quickly add up, and in order to cover those costs Personal Injury Protection is available. Personal Injury Protection (PIP) and Medical (MedPay) coverage pays for both medical expenses and lost wages to the policyholder and any passengers injured in the vehicle in the event of an accident. Some experts advise people with good medical and disability policies to only take on the lowest limit of PIP coverage required by their state. Some states, such as New Jersey, allow drivers to reject PIP entirely.

3. Comprehensive Coverage

What if something happens to your car that is unrelated to a covered accident - weather damage, you hit a deer, your car is stolen - will your insurance company cover the loss? Liability insurance and collision coverage cover accidents, but not these situations. These situations are covered by Comprehensive coverage. Comprehensive coverage is one of those things that is great to have if it fits in your budget. Anti-theft and tracking devices on cars can make this coverage slightly more affordable, but carrying this type of insurance can be costly, and may not be necessary, especially if your car is easily replaceable.

4. Collision Coverage

Collision coverage insures you in the event of any kind of accident, whether it's with another car or an object, such as a utility pole or fire hydrant. If you have an older car, and the cost of repairing or replacing your car is likely more than its value, you may want to waive both collision and comprehensive coverage. Unlike liability coverage, this type of coverage is not required by law, but according to 2008 NAIC data, 77 percent of insured drivers purchase comprehensive coverage in addition to liability insurance and 72 percent buy collision coverage. Furthermore, your bank (if you are financing your car) or your leasing company (if you are leasing your car) will likely require that you carry this coverage until you have paid for your car in full or for the life of the lease.

5. Uninsured Motorist coverage

Uninsured Motorist coverage provides you protection from crashes with motorists not carrying car insurance, as well as covering you in the event of a hit-and-run accident. Also, uninsured motorist insurance coverage comes into play when an at-fault driver doesn't have enough liability coverage to pay for the damages from an accident. Most states require drivers to carry some level of uninsured motorist coverage. You need uninsured motorist coverage if you’re involved in an accident with:

A driver who carries no auto insurance whatsoever

A driver who carries insurance coverage that falls below the state’s required minimums

A driver who is insured by a company that is financially unable to cover your losses

A driver who hits you and flees the scene.

Saving tip: It's usually relatively inexpensive to add uninsured/underinsured motorist protection to your car insurance policy, especially considering the amount of protection it offers.

Things to Remember About Auto Insurance Coverage

There are a variety of insurance types that you can combine to find the best coverage for your needs Certain types are required by state, so make sure you find out your state’s regulations for insurance An easy way to save on auto insurance is by comparing free insurance quotes from several companies Most of these coverages are optional, and adding them to your policy will increase your premium. When in doubt, ask your agent to clearly explain the car insurance coverage options to you. Choosing the bare minimum coverages doesn’t always generate cheap insurance quotes. In fact, your cheap insurance quotes may be higher than anticipated when you select bare minimum coverages. Carriers provide cheap insurance quotes to those who carry the least amount of risk. Minimum coverages make you a higher risk and this increased risk makes your cheap insurance quotes more expensive. Even if you don’t want the most coverage, choose coverages higher than state minimums to generate more competitive, cheap insurance quotes. Thank you.

0 notes

Text

Short Term Medical Insurance in USA

Short Term Medical Insurance | asuranci.com

Short Term health insurance, sometimes called Term health insurance or Temporary health insurance, is a flexible health insurance coverage solution when you need coverage for a period of transition in your life.

Short Term health insurance is designed to help bridge gaps in your health care coverage during times of transition. And if you’ll pardon the pun, you’ll find no “shortage” of information online telling you what Short Term Medical insurance isn’t or what it can’t do for you. But for many people, and for many situations, the best Short Term health insurance plan they can find may just be the right solution.

Short Term insurance may be for you if you're:

Unable to apply for Affordable Care Act (ACA), also called Obamacare, coverage because you missed Open Enrollment and you don't qualify for Special Enrollment

Waiting for your ACA coverage to start

Looking for coverage to bridge you to Medicare

Turning 26 and coming off your parent's insurance

Between jobs or waiting for benefits to begin at your new job

Healthy and under 65

For these situations and many others, Short Term health insurance, also called Temporary health insurance or Term health insurance, might be right for you. It can fill that gap in coverage until you can choose a longer term solution.

How To Lower Costs for Short Term Health Insurance

Choose a higher deductible.

Choose a plan with fewer benefits.

Pay your total premium up front.

Choose a Per Cause Deductible option.

Purchasing a short-term medical insurance plan will make you ineligible for any guaranteed issue individual health plans commonly referred to as HIPAA Plans. HIPAA plans are usually very expensive and are generally intended for people with pre-existing medical conditions who would have trouble getting health insurance otherwise. If you wish to maintain your eligibility for HIPAA plans, you should not purchase a short-term plan. Please consult your benefits advisor to discuss your rights under the Health Insurance Portability and Accountability Act (HIPAA) and other rights under state law.

Short Term Medical Insurance

Short-term health insurance plans typically do not cover pre-existing medical conditions. The definition of a pre-existing condition varies by state, but, in general, short-term health insurance policies exclude coverage for conditions that have been diagnosed or treated within the previous 3 to 5 years. If you have an existing medical condition, you may want to research whether you can extend your current insurance. Employer-sponsored insurance can be extended under a government-regulated option commonly referred to as COBRA, which you should seriously consider if you have an existing medical condition. Maybe you want to know about:

Health Insurance Policy

Short Term Medical Insurance in USA

Types of Health Insurance Plans

Short Term Medical Insurance in USA

The easiest solution is to buy temporary insurance while staying in another state. Insurance issued in another state is valid in New York and allows treatment with any doctor or hospital in the U.S. There is no requirement that the address on temporary health insurance be your permanent residential address. Some New Yorkers residents purchase health insurance while staying at their out-of-state colleges, while at their second home in another state or while on vacation or visiting relatives. The insurance covers treatment while they are away from home as well as with the doctors and hospitals at home in New York. Almost all short term medical insurance is purchased online and most offer immediate download of the policy and insurance ID cards. Most insurance companies allow you to have the policy mailed back to a New York address if you will be returning from your trip soon.

The only other possible alternatives we can offer are:

Core Health Insurance – a limited benefit policy that does a fairly good job at mimicking the benefits of major medical insurance

International Medical Insurance - for individuals who are not permanent residents of U.S.

Inbound Immigrant Insurance – for individuals who have recently moved to the U.S.

If none of these options will work then it is especially important to explore all options to keep, extend or convert prior health insurance regardless of the higher cost.

0 notes

Text

Best Car Insurance - Tips to Buying Car Insurance

Best Car Insurance - How To Find It Car insurance is an insurance technique acquired by the car proprietor to safe secure hisher vehicle against burglary, disaster and whatever other incident achieved. Car insurance covers protected vehicle and ensured party, and a couple times it covers pariahs in addition. Unmistakable car insurance methodologies have assorted terms, guidelines and conditions under which, these things are secured. Today considerable amounts of car insurance methodologies are available in the market and it is really to a great degree troublesome task to purchase the best car insurance for the safeguard of your vehicle. Here are a couple tips, which can be used to find the best car insurance for your dim boomer.

Tips to Buying car Insurance

Buying car Insurance

Tips 1: Starting Out

As to car insurance, you should be sufficient covered if you get in an accident anyway you would lean toward not to pay any more than you have to. So in what capacity may you investigate your way through this shady subject? Keep telling yourself there is money to be saved. What sum? Hundreds, even thousands, consistently. For example, one of our editors composed the lion's share of his insurance information into a comparative insurance advantage. The quotes (for to a great degree basic extension on two old cars) stretched out from $1,006 to $1,807 — a qualification of $801 a year. In the event that you're starting at now dumping thousands into your insurance association's coffers in light of a few tickets, an accident or an imperfect FICO score, shopping your system against others may be positively legitimized paying little respect to the effort.

Look at it in this manner — you can change over the money you save into the purchase of something you've pined for a long time. Hold that goal in your mind.

Step 2: How Much Coverage Do You Need?

To find the right car insurance, start by comprehending the measure of extension you require. This vacillates from state to state. So delay for a moment to find what degree is required where you live. Make an once-over of the unmistakable sorts of degree and subsequently return for the accompanying step. (You will find an once-over of each state's necessities and an illumination of the diverse sorts of insurance in "How Much car Insurance Do You Really Need?" Also, take a gander at "Little-Known however Important Insurance Issues" as it has a glossary of central insurance wording.) Since you understand what is required, you can pick what you require additionally. A couple people are exceptionally careful. They build their lives as for most critical situation circumstances. Insurance associations worship these people. That is by virtue of insurance associations perceive what your chances are of being in a disaster, and how likely it is for your car to be hurt or stolen. The information the insurance association has assembled over before decades is crunched into "actuarial tables" that give insurance adjustors a quick look at the probability of practically any occasion. So what measure of insurance would it be fitting for you to buy past your state's base? Authorities recommend that if you have a lot of advantages you should get enough hazard extension to guarantee them. For instance, if you purchase $50,000 of considerable damage chance extension however have $100,000 in assets, legal advisors could seek after your fortunes if there should arise an occurrence of an accident in which you're at fault and the other party's clinic costs outperform $50,000. General recommendations for commitment limits are $50,000 generous mischief chance for one individual hurt in a setback, $100,000 for all people hurt in a disaster and $25,000 property hurt hazard (that is, 50/100/25) given that half of the cars out on the town are worth more than $20,000. Here afresh, in any case, let your cash related condition be your guide. In case you have no points of interest, don't buy excess degree. Another issue to consider is that the limits of any uninsured and furthermore underinsured driver scope that you purchase can't outperform the cutoff purposes of your hazard scope. Such extension, he expressed, can be imperative, as it will cover lost pay on the off chance that you're out of work for some time in the wake of being hurt in an essential mishap. You're driving inclinations may similarly be an idea. If your past is stacked with collapsed guards, in case you have a lead foot or a lengthy drive on a misleading winding road, then you should get more broad extension. Keep in mind that you don't have to buy affect and broad degree. In case your vehicle is more settled, if you have a better than average driving record and if there is a low likelihood that it would be totaled in an incident, however a high likelihood of it being stolen, you could buy finish yet not affect.

Step 3: Review Your Driving Record and Current Insurance Policy

Before you begin searching for insurance you should check the going with: the status of your driving record, your present degree and the premiums you are paying. You should recognize what number of tickets you have had starting late. However, time plays traps and our memories smother troublesome events. If you can't recall to what degree that speeding ticket has been on your record, check with your state's DMV. If your record will soon improve, and the concentrations you earned will finally vanish, hold up until that happens before you get refers to. Nothing drives up the cost of insurance like a frightful driving record. In like manner, you should contact your car insurance association or pull out a present bill. Jot down the measure of degree you have and what you are paying for it. Watch the yearly and month to month cost of your insurance since countless quotes will be given both ways. By and by you have a figure as a top need to endeavor to beat.

Step 4: Solicit Competitive Quotes

Since you have settled on a couple of realistic and philosophical decisions, it's an incredible chance to start shopping. Begin by setting aside around a hour for this errand. Bring each one of your records — your stream insurance approach, your driver allow number and your vehicle enlistment. Drink a great deal of coffee. Have a phone at your elbow. Moreover, clearly, control up your PC. Begin with the online organizations. If you go to InsWeb.com or other online insurance refer to regions, you can sort in your information and get a summary of comparable quotes. These structures take around 15 minutes to wrap up. In case this bores you, essentially remind yourself the sum you will save and that you can use the money to buy something not too bad for yourself. If the entire shopping process takes both of you hours to complete and you save $800, you're effectively procuring $400 a hour. A few things to recall: 1) When you use refer to regions, you may not get minute refers to. A couple of associations may contact you later by email, and some that are not "prompt providers" may put you in contact with an area administrator, who will then figure a quote for you. (A "quick provider," like Geico, pitches an insurance game plan to you particularly; unique associations like State Farm offer insurance through adjacent experts. We'll discuss the points of interest and detriments of each later.) 2) It's hard to get refers to from these regions in all states — if you live in New Jersey, for instance, you'll probably imagine that its speedier to get the phone, since most go down arrangements in this state at present don't give online quotes. You can in like manner try getting refers to from a part of the insurance associations recorded on the Edmunds.com Web site — Liberty Mutual, Geico or Progressive. These structures will take around 10 minutes each to wrap up.

Step 5: Record and Compare Quotes

While you're asking about associations, make notes in an alternate PC record or on a touch of paper isolated into orders. This will shield you from replicating your attempts. When you visit the different online insurance regions, you should watch a couple of things: Yearly and month to month rates for the assorted sorts of extension — make an indicate keep quite far a comparable with the objective that you can make "one write to it's coherent partner" connections A 800 number to call for request you can't get tended to on the web: The insurance association's portion game plan (When is your portion due? What occurs on the off chance that you're late in making a portion?)

Step 6: Work the Phones

When you have drained your online choices, it's an awesome chance to work the phones. Those associations you haven't had the ability to get an online quote from should be come to. From time to time, doing this strategy verbally can truly go speedier than the online accomplice, giving you have every one of the information as for your driver allow and vehicle enlistment close inside reach. When you get a quote, try to confirm the cost. In like manner, demand that they fax or email the quote to you as a record.

Step 7: Look for Discounts

While speaking with the insurance associations' telephone agents, guarantee you examine all decisions relating to discounts. Insurance associations give refunds for a not too bad driving record, incredible FICO rating, security equipment (for example, electronically checked moderating components), certain occupations or master affiliations and the sky is the point of confinement from that point. For more bearing here, take a gander at "How to Save Money on car Insurance."

Step 8: Choosing the Right Insurance Company

You now have the greater part of the data before you that you have to settle on a choice. In any case, there is something more to consider. You can obviously observe which organization is slightest costly, however when you require them to cover a claim, what sort of occupation will they do? To put it another way, which is the most solid insurance organization? Beneath, we offer various issues to manage your reasoning and help you achieve a choice: Visit your state's division of insurance and check buyer grievance proportions and essential rate examination reviews. Connect with neighborhood body shops or dealerships you trust and ask which insurance organizations they prescribe. Consider reaching an insurance operator for extra data about a specific organization. Look at the money related quality appraisals for an insurance organization by alluding to the A.M. Best and Standard and Poor's evaluations. Investigate J.D. Power and Associates' shopper fulfillment overviews surveying car insurance organizations.

Step 9: Review the Policy Before You Sign

So, you've done your research, and you've decided on a company. Before you sign, though, read the policy. In addition to verifying that it contains the coverage you want, there are two clauses that you should look for in the contract: Retain your right to sue. "Find out if you are giving up your right to go to court and will be forced into arbitration if there is a disagreement [between you and the insurance company]," one expert advised. "You're much better off if you don't give up this right…. It makes it easier for [insurers] to take advantage of you." If you find a clause to this effect, all isn't necessarily lost. "At least in theory, a contract is a mutual agreement, so you should be able to cross out that line in the policy," he said. If the company won't agree to the policy sans clause, then you should probably take your business elsewhere. Avoid aftermarket parts requirements. If an insurance company has written in the policy that "new factory," "like kind and quality" or "aftermarket parts" may be used for body shop repairs, go to another company, one expert advised. If you own a relatively new car that you plan to keep for a while, you will probably be much happier if you spend a little more time researching companies on the front end rather than try to fight the company when you have a claim.

Step 10: Cancel Your Old Policy

After you lock in the insurance policy you want with the company you select, you have two more things to do. The first is to cancel coverage with your existing insurance company. Second, if your state requires you to carry proof of insurance, make sure you either have it in your wallet or the glove compartment of your car (some experts discourage this, however — if your car is stolen, the thief has everything he needs to prove the vehicle is his). Now, there's one last thing to do: reward yourself for saving so much money on car insurance. Checklist Determine your state's insurance requirements. Consider your own financial situation in relation to the required insurance and consider buying more to protect your assets. Review the status of your driving record — do you have any outstanding tickets or points on your driver license? Check your current coverage to find out how much in premiums you are paying. Inquire about discounts you might qualify for such as a multiple policy discount. Evaluate the reliability of the insurance company you're considering by visiting your state's insurance Web site. If you have chosen a new insurance company, remember to cancel your old policy.

Compare Car Insurance Rates

To have an idea about online Auto insurance quotes, you just need to compare car insurance rates provided to you by various Auto insurance companies:

Name of Company

Get Online insurance quote Premium Rate Rank in USA 1

Esurance

Click here 1 2

Geico

Click here 2 3

Allstate

Click here 3 4

State Farm

Click here 4 5

21st Century Insurance

Click here 5 6

AAA

Click here 6 7

Progressive

Click here 7 8

Nationwide

Click here 8 9

Liberty Mutual

Click here 9 10.

American Family

Click here10

To locate best auto insurance, you are requested to make a search on your own. First of all go to local auto insurance providers. Compare auto insurance quotes provided by them. Most of auto insurance providers have their websites, you can go there and request for car insurance quotes online, if you own a car. Compare their quotes and find best auto insurance for your vehicle. Always remember that bargaining is the key to buy cheap auto insurance. After comparing auto insurance quotes apply for the best one for you and your vehicle. While applying given them details as much as you can such as your name, address, zip code, your marital status, car’s annual commuting miles and safety features because as default they can offer you high quotes without any specific benefits. Hence, to buy a cheap and best auto insurance always give full details about you and your vehicle. Sometimes insurance companies provide specific offers. Thus always look for offers, as they can deduct your premium from £200 to £400. Before signing your application form read each and every point of fine print, as they can protect your right. With keeping these simple tips in mind you can find best auto insurance policy.

0 notes

Text

Types of Health Insurance Plans

Types of Health Insurance Plans | asuranci.com Health is a basic issue related to any individual and it should be managed. This impacts the whole gathering of a man so in case you purchase health insurance for yourself then it is benefitting you and most of your family and society. Health insurance is acquired from an insurance association and you ought to pay certain measure of money which will be used to pay your facility charge later on. This is really an ensured way to deal with keep an eye on your own health. Anyone can get it by paying through his credit or charge cards. Online health insurance has a lot of favorable circumstances and a bit of the best health insurance points of interest are given thunder. Particular health insurance courses of action are available in two sorts: Indemnity and Managed Care Plans. There is only two important differentiations between the two game plans. The sum you will pay as premium and the strategy for paying your bills.

Types of Health Insurance Plans

Repayment solitary health insurance is also more expensive than Managed Care and that is the reason a large number individuals settle on the Managed Health Care Plans. To the extent points of interest and danger secured, the reimbursement particular health insurance plan is the one that covers the basics of health more totally. It is similarly the most settled sort of health insurance. Repayment orchestrate obliges you to pay a bit of the restorative costs with the insurance provider paying the change remaining. The most benefitted plan is the 80-20 where you are required to pay 80% of the restorative costs brought about and the insurance provider pays the remaining 20%. Premiums are charged in like way. The higher the entirety you make plans to pay, the lower will be the month to month premium charged by the insurance provider. The association picks the rate of compensation on the preface of ordinary costs charged by pros and specialists in your general region for restorative organizations. You either pay the costs blunt and ensure from the insurance association later or have your master send the bill to them particularly. Administered health mind game plans are more well known in light of the way that they are more sensible when stood out from repayment organizes. The first rate rates are lower also anyway you are not at flexibility to pick your specialist or expert association and have limited choice. Maybe you want to know about:

Health Insurance Policy

Short Term Medical Insurance in USA

Types of Health Insurance Plans

Types of Health Insurance Plans

Each insurance brand may offer no less than one of these four ordinary sorts of plans:

Health bolster affiliations (HMOs)

Favored provider affiliations (PPOs)

Specific provider affiliations (EPOs)

Motivation behind organization (POS) orchestrates

High-deductible health organizes (HDHPs), which may be associated with health venture accounts (HSAs)

Delay for a minute to make sense of how these game plans differ. Being familiar with the game plan sorts can help you pick one to fit your budgetary arrangement and meet your health mind needs. To take in the specifics about a brand's particular health orchestrate, look at its summary of points of interest.

0 notes

Text

Types of Car Insurance & What You Need To Know

The several Types of Car Insurance & What You Need To Know To help you understand car insurance a lttle bit more, we've listed some matters on the finer factors. Find out what coverage is available when it comes to car insurance and what will suit your needs. Types of Car Insurance These are the common types of car insurance policies: Comprehensive cover: This includes the price of repairs to or replacement of your own vehicle and property whether you are at fault or not. It can also cover the price tag on emergency repairs, transportation costs and destruction caused by other drivers. Third Party Fire & Theft cover: Alternative party, Open fire and Theft covers you for loss or harm to your car if it is stolen or catches fire in addition to your liability for damage caused by your car to other people's property.

3rd party property cover: Covers damage that you have caused to another person's vehicle or property. It does not cover the price of harm to your own car. It usually includes legal costs, limited damage by uninsured drivers and promises service. Compulsory third party insurance (CTP): Otherwise known as 'green slip' insurance, CTP is required of each registered driver in Quotes. It indemnifies drivers who are legally liable for personal injury to another party in case of a car accident. This can include other drivers, passengers, bicyclists and pedestrians. Each State has a different process for CTP and Sign up. See your Condition Federal government for details. Additional coverage options: Besides the standard cover provided some Insurance providers will have additional features and benefits available, they may include New car replacement, protected No State Bonus and choice of repairer. You should look at each policy and see that the features and benefits are what you are looking for in an insurance plan. Precisely what is the difference between Agreed Value and Market Value? Most insurers will also give you the option of market or decided value in the event that your car is written off. Market value represents industry value of the car at the time of the state, taking into account the condition of the car based on its age, make and model. Agreed value is the value of the car as agreed by both you and the insurance provider and is fixed until the policy renewal date. Maybe you want to know about:

Tips to Buying Car Insurance

Estimating Car Insurance Rates

Finding Cheap Online Car Insurance

How To Get Cheap Car Insurance

What is an Excess? A surplus is the amount you'll have to pay in the event of a claim. For example , if your excess is $500 and your claim will be worth $1, two hundred, you will pay the first $500 and the insurance provider the remaining $700. Found in the event of a much more serious accident, in which your vehicle is written off, the excess amount will typically be deducted from the final claim repayment. Generally speaking, there are three types of excessive: Basic excess: This is the minimum payment that you are obliged to make in the event of a claim. The surplus amount will be particular on your Certificate of Insurance. Voluntary excess: This is an additional amount, on top of your fixed excess, that you consent to pay in the event of a claim. Elevating your excess effectively reduces the financial risk transported by your insurer, which should thereby lower your premium. Age (inexperienced driver) excess: Where an insurance policy features a new new driver, or drivers under the age of 25 years, a greater excess will normally apply. This includes nominated drivers as well as the principal driver. Points to think about when it comes to your excess: It may be worth increasing your excess to save money on your insurance premium. But before you do, consider the car you drive and what happens in the event of a claim. For instance, if you drive an old, low-cost vehicle it might not be advantageous to increase your excess. After all, you don't want to pay out more than your vehicle is worth! In the event of an accident, consider the difference between your declare amount and your basic excess. Always look at the impact a declare may have on your No Claim Bonus entitlement and the effect on premiums in future years. Buying Car Insurance At their most basic, insurance should protect you and your family up against the effects of a loss to your person or property. Yet with the different cover options available, it can get somewhat more complicated than that. Read our top tips below for buying car insurance.

Tips for buying car insurance:

Establish what coverage you require

Compare coverage quotes

Understand the advantages of car insurance

Learn the vocabulary - our glossary will help

Know your automobile and your driving history

Determine how much you can afford

Review insurance company qualifications

Review the fine print out of your coverage

Find out how to lower your premium

Types of Insurance

1. Mandatory Third Party (CTP) CTP InsuranceCTP, as the name proposes, is necessary and you won't have the capacity to enroll your vehicle until this insurance is set up. What does CTP insurance cover? CTP gives you assurance against cases for pay in the event that you harm or slaughter somebody in an engine vehicle mischance. The particular conditions change from state to state, so make certain to check how it functions in your state What it doesn't cover: CTP doesn't safeguard against the cost of repairs to any vehicles or property – yours or anybody else's. While it is the least expensive and most essential type of cover, remember that having just CTP insurance abandons you at critical money related hazard if you harm a vehicle or other property having a place with another person. You can discover more about CTP car insurance here. 2. Outsider Property This is the most fundamental type of discretionary car insurance, and gives you budgetary cover in the event that you make harm property as opposed to a man; for instance somebody's prized car, watercraft or caravan. What does outsider insurance cover? – Third Party Property covers harm brought on by your car to other individuals' property. It will likewise take care of your legitimate expenses in the event that you end up plainly entangled in lawful procedures subsequently of the harm created. What it doesn't cover: Third gathering property doesn't take care of the expense of any repairs or substitution of your own car, with the exception of under some restricted conditions through a few safety net providers. So it's like CTP in that it just gives cover to other individuals and their property, as opposed to you and yours too. Breaking into car 3. Outsider, Fire and Theft In the event that you would prefer not to pay for first class insurance yet do need some level of assurance for your own car, Third Party, Fire and Theft insurance is the following alternative. What does outsider insurance cover? – notwithstanding covering harm to the property of others, Third Party, Fire and Theft insurance additionally gives some constrained cover to your own car if it's harmed or lost because of flame or burglary. What it doesn't cover: This insurance doesn't take care of the expense of repairs to your vehicle in the event that it is included in a car crash. What are the odds of your car being stolen? As indicated by the National Motor Vehicle Theft Reduction Council, a vehicle is stolen like clockwork in Australia. The larger part of robberies are "here and now burglaries" yet there is likewise a sensibly extent of "revenue driven" burglaries. 4. Thorough Car Insurance This is the top-level insurance cover alternative and will unquestionably give you the best true serenity – but at the same time it's the most costly! What does extensive car insurance cover? – It covers everything said in the past insurance choices above, and furthermore it covers coincidental harm to your own particular car, regardless of who is to blame. There are additionally a scope of discretionary additional items, including substitution vehicles and no-overabundance windscreen substitution. When they say complete, they certainly would not joke about this. What it doesn't cover: Even complete insurance has restrictions. It by and large won't cover harm brought about by another person driving your car, unless they are approved to do as such on your arrangement. It additionally won't cover harm brought about if the driver was over the legitimate liquor restrict or influenced by medications. Furthermore your car must be roadworthy and you should hold a legitimate driver's permit. Picking the car insurance believe it or not for you will depend to a limited extent on what you can bear. Preferably, however, pick the best cover you can manage. Begin your inquiry by perusing our free Car Insurance Star Rating Report and utilizing our site to analyze car insurance approaches. On the off chance that you ensure that you comprehend the contrasts between the different sorts of car insurance, and what you should be secured for, you're in good shape!

0 notes

Text

Finding Cheap Online Car Insurance

Finding cheap online car insurance Car insurance is something that we all need and should command careful consideration. When in the market for car insurance coverage, and with so many car insurance companies to choose from, it can be a bit confusing when trying to decide on the best and most affordable coverage for your vehicle. With the convenience of the internet, finding all the information required to get the best deals and rates can easily be accomplished online. Finding a reputable car insurance company is a job within itself, and like buying a home, it is imperative you clearly understand what you are getting. When in search of cheaper car insurance rates you should take into account all the factors that can affect your car insurance premiums. So before you sign on the dotted line, read the fine print of car Insurance Policy to insure you are getting the necessary coverage to protect yourself. It happens time and time again, when the car owner gets into an accident or fender bender, the coverage they thought they were paying for is not part of their policy which can lead to out-of-pocket expenses.

Get several car insurance quotes

Cheap Online Car Insurance

Some key factors when shopping for cheap car insurance is to first make sure you get at least three or four quotes since the price you pay for your car insurance can vary by hundreds of pounds. Finding cheaper insurance rates depends on your previous driving records, to include any type of infraction such as speeding, seat belt and car accidents. Age, gender and the type of car you are seeking car insurance coverage on including the age of the vehicle, will clearly be critical factors in determining your annual car premiums. It is equally important to find a car insurance company that can answer any questions you may have and how quickly they handle claims fairly and efficiently. Once you decide on a quote you are satisfied with, before agreeing to anything check with your state insurance department about the company’s history. Finding out the financial well-being of an insurable institution and the number ratio of consumer complaints, could avoid headaches or any future regrets.

Learn the facts about car insurance

Some other ways of saving money is to ask your insurance broker or agent for a higher deductible. The deductive is the amount of money you pay before the insurance company pays out on your claim. The purpose of requesting a higher deductible can lower your car rates substantially. When you increase the deductible from £500 to £1,000 you can potentially save you over 40% on your car insurance rates simply because the insurance company will pay out less for your claim. However, if you know that you can not pay out the higher deductible should something happen to your car in the instance of an accident, and then it is best to remain at a lower deductible. When figuring out the appropriate insurance coverage for your car, take into account the age of the car. This could also influence your car premium, for example you may want to consider excluding the collision or comprehensive coverage on an older car. It is not cost saving to yourself when you continue to pay full coverage on a car worth less than amount you pay for your insurance coverage. If the car has a market value of £2,000 or less, you would not want to pay more in premiums since you will never get back what you are paying out. You can easily find out the current market value of your car in order to find out what coverage you will require from a number of valued sources such as banks, car dealerships, or go online and use the search term, “finding the value of your vehicle”. You can find several reputable services such as, www.kbb.com or www.nadaguides.com where all you have to do is type in the applicable information about your car and instantly you will have the market value. As the saying goes, an educated consumer is a smart consumer, the more you understand prior to purchasing car insurance, you will be able to make an informed and valued decision. Maybe you want to know about:

Tips to Buying Car Insurance

Estimating Car Insurance Rates

How To Get Cheap Car Insurance

Types of Car Insurance

Finding The Cheapest Car Insurance Quote

Research studies indicate that a car is broken into or stolen every 19 seconds in the United States. In such a scenario, you need to ensure that you have found the cheapest car insurance quote. However, the trick is to amalgamate the duality of robust coverage and affordability. Thus, finding the cheapest car insurance quote is not merely a hunt for the lowest premium. Do your Homework right! Start with doing your homework right. Spend time and understand the insurance imperatives as laid down by the state law. Evaluate the minimum coverage requirements in-force. Compare Apples to Apples! Don’t compare just purely on the basis of rates. The key to finding the Cheapest car Insurance Quote is to compare all the pertinent elements that go into providing comprehensive coverage at any given price. In the United States, getting insurance quotes from leading insurers and comparison-shopping is very easy. Be ruthless when you compare across quotes and choose the one with the optimal coverage at the most affordable cost. Also, when comparing across plans, compare apples to apples. This essentially means that you price-evaluate plans with the same coverage, features and benefits. Online Quote Comparison! There are various websites that offer online quote comparison service. These websites offer access to instant online car insurance quotes, let you compare coverage, view, modify coverage tiers. However, keep away from websites that also sell car insurance online, as their quotes could be biased and misleading. Don’t get fooled by lower deductibles! A lower deductible does not mean that you have got yourself a dream bargain. Think long term; avoid having a short term vision. A low deductible means that you would end up paying a higher premium. Be smart and opt for a plan with a higher deductible. What matters is the ultimate cost of the coverage, considering all eventualities. Do keep in mind that car insurance is not a ‘cost’ – but a great way to protect yourself, and family, with the car. So, keep the human element in mind and act prudently. Tread with care!

0 notes

Text

Estimating Car Insurance Rates: What You Need to Know

How much car insurance should you buy?

There are two answers:

First, you need enough insurance to drive legally. Find out your state car insurance minimum requirements.

Second, you need enough car insurance to protect your life from turning into a living hell if you have a car accident. That can be as easy as buying the minimum coverage. Or it can be much more complicated.

Not all car insurance coverage is the same. Many people overpay for coverages they don’t need, while others don’t have enough coverage but don’t know until it’s too late. This tool will help you decide what coverage options you need. It will make shopping around for the best insurance rates a lot easier, and it takes less than one minute!

car accident

Choosing the Right Car Insurance Coverage

Getting the right level of car insurance is not one size fits all. What is most important to one consumer isn’t necessary for another.

That’s why it’s critical to get the car insurance that fits your needs.

Car Insurance Coverage Calculator is a quick way to find the right car insurance levels and options for you. While getting the cheapest car insurance is most important for some consumers, another person may want the broadest possible protection. Our calculator understands that personalization is vital when deciding on the best car insurance coverage for your situation.

The calculator includes a short questionnaire that asks you questions about:

Your zip code

Net worth

Age of your vehicle

Deductible level

Whether you own, lease or finance your vehicle

If cheapest car insurance or best protection is most important to you

After completing the questions, the calculator will tell you the right level of insurance for you. You’ll also know whether you are paying for unneeded car insurance coverage or if you don’t have the right level of insurance to protect you and your family’s finances.

Maybe you want to know about:

Tips to Buying Car Insurance

Finding Cheap Online Car Insurance

How To Get Cheap Car Insurance

Types of Car Insurance

How Much Car Insurance do I Need?

The calculator recommends the right level of car insurance coverage for you based on your answers. This coverage can include:

Bodily injury liability

Property damage liability

Uninsured/Underinsured motorist bodily injury

Umbrella liability policy

Comprehensive and collision

Personal injury protection

Gap insurance

How much does my age affect my car insurance rates?

Auto insurers penalize inexperience rather than age. Of course, the vast majority of inexperienced drivers are teenagers. Rates for 16-year-olds can double or even triple their parents’ car insurance annual premiums.

The less experienced the driver, the higher the rates. Among drivers with clean records and no accidents, no other factor changes rates more.

Statistically, inexperienced drivers crash – a lot – and so they are the riskiest category of drivers to insure. Car insurance rates reflect this high risk.

Is there any difference between insurance companies?

Insurance companies must follow state laws, but within those laws they price coverage based on their own underwriting rules and guidelines. One insurance company may look at your driving record for five years, another only for three. The surcharge for a speeding ticket may raise your insurance by 10 percent with one carrier but only 5 percent with another.

You should shop around and get quotes from several carriers. Make sure you are comparing apples to apples -- the same coverages with each insurer -- and check the reliability and financial stability of the insurance carrier.

Finally, make an informed decision about who you want to be insured with for the best price and protection. Don’t let a small savings drive you away from an insurance company you know and trust.

Personal Injury Protection, or Medical Payments, pays for your own medical expenses, any lost wages and whatever other costs may arise when you're injured in an accident, in some states. It usually pays about 80 % of the losses. It also pays a death benefit. PIP is required in New York, New Jersey, Florida, Arkansas, Delaware, Hawaii, Kansas, Kentucky, Maryland, Massachusetts, Michigan, Minnesota, North Dakota, Oregon, Pennsylvania and Utah.

A few states require you to purchase auto insurance that covers your medical expenses, pain and suffering losses and, in some states, motor damage in the incident where the other motorist is at fault and is either not insured or underinsured. See the chart below to find out if it applies to you.

State

Liability limits (in thousands of dollars)

Uninsured/Underinsured motorist coverage required?

Alabama

25/50/25

No

Alaska

50/100/25

No

Arizona

15/30/10

No

Arkansas

25/50/25

No

California

15/30/5

No

Colorado

25/50/15

No

Connecticut

20/40/10

Yes

Delaware

15/30/10

No

D.C.

25/50/10

Yes

Florida

10/20/10

No

Georgia

25/50/25

No

Hawaii

20/40/10

No

Idaho

25/50/15

No

Illinois

20/40/15

Yes

Indiana

25/50/10

No

Iowa

20/40/15

No

Kansas

25/50/10

Yes

Kentucky

25/50/10

No

Louisiana

10/20/10

No

Maine

50/100/25

Yes

Maryland

20/40/15

Yes

Massachusetts

20/40/5

Yes

Michigan

20/40/10

No

Minnesota

30/60/10

Yes

Mississippi

25/50/25

No

Missouri

25/50/10

Yes

Montana

25/50/10

No

Nebraska

25/50/25

No

Nevada

15/30/10

No

New Hampshire

Not required 25/50/25

Yes

New Jersey

15/30/5

Yes

New Mexico

25/50/10

No

New York

25/50/10

Yes

North Carolina

30/60/25

Yes

North Dakota

25/50/25

Yes

Ohio

12.5/25/7.5

No

Oklahoma

25/50/25

No

Oregon

25/50/10

Yes

Pennsylvania

15/30/5

No

Rhode Island

25/50/25

Yes

South Carolina

25/50/25

Yes

South Dakota

25/50/25

Yes

Tennessee

25/50/10

No

Texas

25/50/25

No

Utah

25/65/15

No

Vermont

25/50/10

Yes

Virginia

25/50/20

Yes

Washington

25/50/10

No

West Virginia

20/40/10

Yes

Wisconsin

Not required 25/50/10

Yes

Wyoming

25/50/20

No

Even though each state has minimum (or no) requirements for bodily injury liability, this is probably in your better interest to go for higher limits. If someone else is injured and you are at fault, the minimum liability coverage may not cover their medical expenses, in which case their attorney will most probably come after your assets. It is recommended to purchase 100/300 limits of bodily injury liability. While, if your personal assets don't amount too much, you do not have a whole lot for them to worry about, so the minimum requirements might actually suit you and will save you cash.

Apart from various forms of liability insurance, there is collision and comprehensive auto insurance coverage to consider. Collision covers damage to the policyholder's motor (car) resulting from running into anything, be it anything e.g. another car, a fire hydrant, or a light post. Comprehensive coverage takes care of your car from theft, fire, falling objects, explosions, or other unexpected problems.

Collision and comprehensive coverage are required in most lease contracts, and are necessary if you drive an expensive car. If you're driving an old car, on the contrary, and the value of your premium and your deductible are close to or exceed the value of your car, you might want to consider doing without this coverage.

Before purchasing any kind of auto insurance, be sure to study your other insurance policies so you don't end up paying for something you don't need. If you have a good health insurance plan, you might get away with purchasing the bare minimum PIP coverage or none at all if your state doesn't require that. However, you might end up paying a co-pay and deductible that would not apply if you have PIP or MedPay.

Uninsured or underinsured motorist coverage might also be a smart buy, even if you have full medical coverage, as it can pay for your injury and suffering damages. If u work for any organization that offers road side assistance, you don't need to purchase that yourself. The similar thing applies to mechanical breakdown insurance if you own a newly financed or leased vehicle which is still under warranty.

It is easy to be resentful of the money spent on auto insurance. Keep in mind that auto insurance will most likely come to your rescue at some point of time, so it's essential to purchase a worthwhile policy. You must know what coverage you must have and know what additional coverage fits your lifestyle. Then if in case any trouble strikes, you'll be ready for it in advance.

0 notes

Text

How To Get Cheap Car Insurance

How to get the best car insurance deals

While a ‘one-size-fits-all’ car insurance policy doesn’t exist, there are steps you can take to find the best car insurance deals for you.

Car insurers calculate premiums using a range of factors including age, driving experience, occupation, and car usage. As a result, the best car insurance deals for one driver could be wrong for someone else.

At its most simple, car insurance covers you if your car is stolen or involved in a road accident. It also protects other road users if you cause damage to their vehicle or property.

The cost of insurance – your premium – is based on how much of a risk insurers perceive you to be. For example, if you are a youngster ready to hit the highway after just passing your test, or you have had more than a prang or two, you will pay more.

Cheap Car Insurance

However, if you can prove you are not a risk by keeping accident-free and storing your car safely, you will pay much less.

How To Get Cheap Car Insurance

There are a number of different things you can do to help cut the cost of your car insurance premium and get cheaper car insurance, including:

Paying a higher voluntary excess (the extra amount you’d pay in the event of a claim)

Limiting who drives your car to just yourself, or you plus a named driver

Parking your car in a garage or driveway away from the street

Keeping your mileage low (doing less than the average of 8,000 miles per year according to the National Travel Survey)

Fitting a security device such as an alarm, tracker, or immobiliser

For more ideas on how to reduce your insurance costs, read our car insurance guides.

Maybe you want to know about:

Tips to Buying Car Insurance

Estimating Car Insurance Rates

Finding Cheap Online Car Insurance

Types of Car Insurance

Getting the best car insurance deals for your car

The make and model of your car can be a hugely important factor in determining the cost of your car insurance cover. Each car is sorted into an insurance group, based on its value, power, and cost of repair. The lower a car’s insurance group, the less it typically costs to insure. You can learn more in our guide on car insurance groups and the cheapest cars to insure.

Whatever car you drive, it’s worth considering all types of cover (comprehensive, third party fire and theft, and third party only) to get the best car insurance deal for you. Take a look at our dedicated guide to learn more about the different types of car insurance policies.

If you have a high performance vehicle or classic car then the best car insurance companies for you will be specialist providers who understand the risks.

Classic car insurance quotes will usually take into consideration the costs of replacing original parts and general maintenance.

Cars with cosmetic or mechanical modifications also tend to be more expensive so steer clear of these if finding the cheapest insurance deals is the most important factor for you.

0 notes

Text

10 Reasons Why Insurance is Important

Why Insurance is Essential for Us | asuranci.com

You insure your car and your home. But nothing is more important than your life and your ability to make a living. So it makes good sense to insure your greatest asset – you!

As we move through life, find a partner, raise a family, and maybe start a business, the importance of insurance in a long term plan increases. That’s because insurance is all about providing a financial safety net that helps you to take care of yourself and those you love when you need it the most.

Insurance is tricky. It's not like buying a chair or a shirt or groceries. When you buy insurance, you're buying a promise. It's a promise that if something catastrophic happens to your business, your carrier is going to assist you to make your business whole again. Sometimes, though, it's tempting to question the value of insurance because it is an intangible product.

Why Insurance is Important

Insurance is important because it protects a person or entity from extreme financial loss or responsibility due to an unfortunate emergency, accident or negative unforeseen event. There are many different kinds of insurance, some of which cover a person and some of which cover businesses and other entities.

Let's back up and take a big-picture view of why insurance matters. Here are ten reasons why insurance is important.

10 Reasons Why Insurance Matters

Why is insurance important? Let’s look at ten key reasons.

1. Insurance meaning protection for you and your family

Your family depend on your financial support to enjoy a decent standard of living, which is why insurance is especially important once you start a family. It means the people who matter most in your life may be protected from financial hardship if the unexpected happens.

2. Insurance reduce stress during difficult times

None of us know what lies around the corner. Unforeseen tragedies such as illness, injury or permanent disability, even death – can leave you and your family facing tremendous emotional stress, and even grief. With insurance in place, you or your family’s financial stress will be reduced, and you can focus on recovery and rebuilding your lives.

3. To enjoy financial security

No matter what your financial position is today, an unexpected event can see it all unravel very quickly. Insurance offers a payout so that if there is an unforeseen event you and your family can hopefully continue to move forward.

4. Insurance Grants Peace of Mind

Insurance, an intangible, provides another intangible: peace of mind. Business owners can take on certain business ventures because they can shift the risk — thanks to insurance. This reason is the counterpart to No. 2 — lenders require insurance. Insurance is the required (by lenders) safety net that lets entrepreneurs explore opportunity.

5. A legacy to leave behind

A lump sum death benefit can secure the financial future for your children and protect their standard of living.

6. Lenders Require Insurance

Lenders require that you have insurance. Think about it: Mortgage lenders want proof of insurance before you buy or build a new building. In short, to get the money your business needs to keep going, it’s likely you enjoy the benefits of insurance. Without insurance, your winning business model can't get the funding it needs to take its first step, or your established business model can't get the funding to evolve and better compete.

7. Insurance is Compulsory in Some States

Insurance is important because sometimes it's the law! A great example of this is auto insurance. Auto insurance is compulsory in Wisconsin. Auto insurance helps mitigate the risk of life on the road. Workers' compensation is a form of compulsory insurance that's required in most states.

8. Insurance Ensures Family and Business Stability

Insurance is a safety net for when risks go wrong. Life insurance can support the life of a family, should a member be lost. It’s similar for a business. Should a key member or piece of equipment go out of commission, the business can carry on, thanks to insurance. This reason why insurance is important dovetails nicely with peace of mind (No. 4). It all goes back to the idea that insurance, when activated, makes policyholders whole again.

9. Insurance Protects the Small Guys

With insurance, however, the little guys have support if they want to take a risk, which means they stick around longer. What it comes down to is that insurance helps prevent monopolies from forming.

10. Insurance is the Right Thing to Do

A sobering example of insurance in action is the West Fertilizer Co. explosion in Texas this spring. The explosion did $100 million in damage to the community, including schools and hospitals. The fertilizer company had only $1 million in general liability coverage.

Now the city is suing West Fertilizer and likely will win all of the company’s remaining property and assets that were not damaged by the disaster. This is because the fertilizer company did not have enough insurance. What’s more is the city also is suing the suppliers to the fertilizer plant, claiming they knew they were supplying inherently dangerous materials. In the case of the West, Texas, plant explosion, insurance could have helped a community to recover after a crisis.

Insurance is something many business owners don't want to think about. But whether they think about insurance, with hope it's there, allowing for transfer of risk and providing a safety net for new opportunities.

Every day we face different problems like natural and uncontrolled human activities which could lost our ,millions of property. Therefore to overcome those property insurance is important. As insurance is the main way of business and individuals to reduce financial impact of a risk occurring in the near future. There are different types of insurance,as homeowner insurance,vehicle insurance,life insurance,animals and crops insurance.So, if we face the problem in the near future then we may overcome the value of it if we have done insurance of it.

Home insurance is important because if the natural disaster like,flood ,landslide,fire damages the property of the home then it could be overcome but some may be expectation. This type of insurance is famous all over the world.

Identity theft insurance is also becoming popular in these days because if the you lost your identity card then other impersonal may use it and take advantages.Even the criminals are using this card to withdraw the bank balance and rent a house along with the information in it to get the job.It can be avoided by the following points:

you must keep the amount of personal information in your purse or wallet to the bare minimum. Carrying of additional credits cards and your social security cards or passport unless it is very much essential.

be careful do not give out the personal information,whether on the pone or on the social medium unless you have initiated the contact or sure you you know whom you are dealing with.

You probably should shred any documents containing personal information such as credits cards numbers bank statement,charge receipts or credit card application,before disposing them.

If you are victim of a crime ,report to the police station or credit card company as possible as you can to secure your credit card .

Animals insurance is also essential for us,more essential for farmers because if you love your pets or you are doing the farm of animals then you must probably benefited.If animals get sick then the insurance company obviously help you.So, it is also important.

Vehicle insurance is the most popular insurance in the world.If you have done the insurance of the vehicles then you may be overcome it if your vehicle get accident or got theft.So motor vehicle is also essential.

Therefore, insurance is very much essential for us. Everything we lost would be overcome and it makes our life much easier and safer.

Maybe you want to know about:

Basic Concepts of Insurance

10 Reasons Why Insurance is Important

Health Insurance Policy

Types of Life Insurance Policies

What Is Insurance : Insurance Definition

Fundamental Insurance Concept

The word peril, loss and hazard terms sound synonymously but the words used in the insurance are quite different and those words should be distinguished carefully. As the insurance is the unseen and unintended loss to the owner and for the organization. For instance, if the price of the gadgets decreases by the value of market or be by its ages. Although the decreases surely lost made the loss, but the loss in the term of insurance is not called as loss. Additionally for instance, if destruction of the same gadgets is done through the fire then it is unintended and unseen and so we can consider it as loss.

Insurance fundamental

Common loss exposure is listed below;

Personal

Liability and

Property

Personal Losses

The injury, illness, and premature death are the example of it.

liability losses

The property which we cannot become legally responsible to pay back for injuries or other damages property. For instance, you have a pet and that pet harm others. For eg if you have a dog at home and that bites children, then probably you should be liable for the child heath. Additionally if you have a bike and you accidently have a accident and held you as a fault, then probably you may have to liable to pay for the damages you have caused.

property losses

The property loss by the unintended accidents like, fire, vehicle accident, storm damages that brought to the business are mentioned as property loss. It involves the destruction of commercial or let it be personal.

0 notes

Text

What Is Insurance : Insurance Definition

Insurance Definition | asuranci.com

In one form or another, we all own insurance. Whether it's auto, medical, liability, disability or life, insurance serves as an excellent risk-management and wealth-preservation tool. Having the right kind of insurance is a critical component of any good financial plan. While most of us own insurance, many of us don't understand what it is or how it works. In this tutorial, we'll review the basics of insurance and how it works, then take you through the main types of insurance out there.

Insurance Definition

A promise of compensation for specific potential future losses in exchange for a periodic payment. Insurance is designed to protect the financial well-being of an individual, company or other entity in the case of unexpected loss. Some forms of insurance are required by law, while others are optional. Agreeing to the terms of an insurance policy creates a contract between the insured and the insurer. In exchange for payments from the insured (called premiums), the insurer agrees to pay the policy holder a sum of money upon the occurrence of a specific event.

Insurance is a form of risk management in which the insured transfers the cost of potential loss to another entity in exchange for monetary compensation known as the premium. (For background reading, see The History Of Insurance In America.)