Don't wanna be here? Send us removal request.

Text

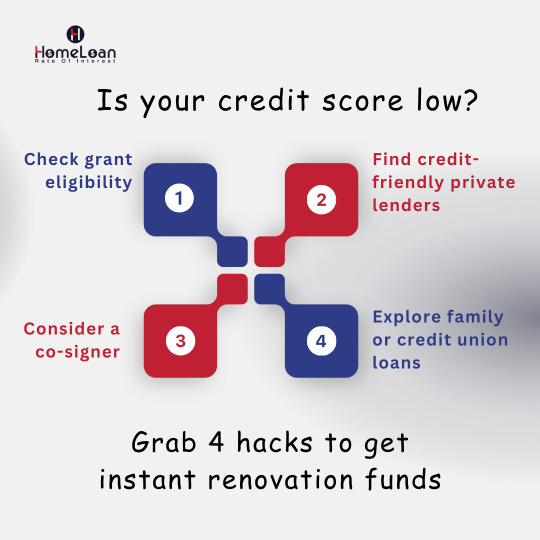

Get Instant Renovation Funds: Use Home Renovation Loan Calculator!

Are you facing a low credit score? Discover your grant eligibility and locate credit-friendly private lenders with our guide. Consider a co-signer or explore family or credit union loans for your home renovation projects. Access 4 hacks to secure instant renovation funds now! Use our home renovation loan calculator to plan your expenses wisely and unlock the financing you need. Start renovating your dream home today!

0 notes

Text

USDA vs FHA - Which Loan Suits You Best?

When it comes to buying a home, financing is often a significant concern. For many prospective homebuyers, securing a mortgage loan is a crucial step in the home-buying process. The United States Department of Agriculture (USDA) and the Federal Housing Administration (FHA) are two government-backed loan programs designed to help individuals achieve their dream of homeownership. In this article, we will explore the key differences between USDA and FHA loans, helping you determine which option suits you best.

USDA Loans

Eligibility Criteria

USDA loans are specifically tailored for homebuyers in rural areas, promoting homeownership in less densely populated regions. To qualify for a USDA loan, both the property and the borrower must meet certain eligibility requirements, including income limits.

Down Payment

One of the most attractive features of USDA loans is the low or zero down payment requirement, making it an ideal choice for those who may not have substantial savings.

Interest Rates

USDA loans often offer competitive interest rates, making them an appealing option for eligible borrowers.

FHA Loans

Eligibility Criteria

FHA loans are more widely accessible, and available to borrowers in both urban and rural areas, making them a popular choice for many homebuyers.

FHA loans have more lenient credit score requirements compared to USDA loans, making them accessible to a broader range of borrowers.

Down Payment

While FHA loans generally have a lower down payment requirement than conventional loans, they still require a down payment, typically around 3.5% of the home's purchase price.

Mortgage Insurance

FHA loans require mortgage insurance throughout the life of the loan, adding an extra cost to borrowers. This is an important factor to consider when evaluating the overall affordability of the loan.

Choosing the Right Loan for You

Location

Consider the location of the property you intend to purchase. If it is in a rural area, a USDA loan might be a suitable option. For urban or suburban areas, an FHA loan may be more appropriate.

Income and Credit Score

Evaluate your income and credit score. If you meet the income criteria for a USDA loan and have a good credit score, it could be a cost-effective choice. FHA loans are more flexible with credit score requirements.

Down Payment Capability

Assess your ability to make a down payment. If you are unable to provide a substantial down payment, a USDA loan might be a better fit due to its low or zero down payment requirement.

Both USDA and FHA loans serve as valuable tools for homebuyers with specific needs and circumstances. By understanding the key differences between these loan programs, you can make an informed decision that aligns with your financial situation and homeownership goals.

Whether it's the rural focus of USDA loans or the broader accessibility of FHA loans, each option offers unique advantages to help you achieve the dream of owning a home.

0 notes

Text

5 Simple Steps to Cash Out Refinance with Bad Credit

Ready to transform your home equity? Learn how to navigate Cash Out Refi with bad credit in 5 steps. Calculate equity & credit score, undergo home appraisal, lock in rates, sign & wait 12 days, then sail through underwriting for seamless loan closure. Your path to financial flexibility begins here!

0 notes

Text

Dive into Mortgage Rate Forecast 2024: Essential Insights Unveiled! Explore the dynamics of mortgage rates in 2024 and understand how they directly influence borrowing costs. Uncover the crucial insights into higher rates leading to increased repayment costs and their pivotal role in decisions regarding refinancing. Stay informed about the forecasted fluctuations in mortgage rates and their potential impact on housing demand. Make informed decisions in the ever-changing landscape of mortgage rate forecasts for 2024.

0 notes

Text

Empowering Veterans: Navigating the Benefits of VA Loans for Veterans in Texas

Introduction:

In the journey of transitioning from military service to civilian life, veterans often face various challenges. One crucial aspect that deserves attention is housing, and fortunately, there's a powerful tool designed specifically for veterans: VA loans. In this article, we'll delve into the significance of VA loans for veterans, with a focus on the unique advantages they bring to those residing in the great state of Texas.

Understanding the Basics of VA Loans:

VA loans, short for Veterans Affairs loans, are mortgage options that offer veterans and active-duty military personnel the opportunity to purchase a home with favorable terms. These loans are backed by the U.S. Department of Veterans Affairs, providing lenders with a level of security that enables them to offer competitive interest rates and more lenient eligibility requirements.

The Benefits of VA Loans for Veterans in Texas:

When it comes to veterans in the Lone Star State, VA loans in Texas play a pivotal role in facilitating homeownership. One of the key advantages is the absence of a down payment requirement, making it significantly easier for veterans to take that crucial step toward owning a home.

Moreover, VA loans in Texas often come with lower interest rates compared to conventional mortgages. This financial benefit can result in substantial savings over the life of the loan, making homeownership more affordable for those who have served our country.

Navigating the VA Loan Process in Texas:

For veterans interested in exploring the benefits of VA loans in Texas, understanding the application process is essential. Firstly, eligible veterans need to obtain a Certificate of Eligibility (COE) from the Department of Veterans Affairs, which verifies their qualification for the loan program.

Once armed with the COE, veterans can approach approved lenders, many of whom are well-versed in handling VA loans. The application process is generally streamlined, with a focus on simplifying the steps involved, ensuring a smoother experience for veterans navigating the complexities of homeownership.

Overcoming Common Misconceptions:

Despite the numerous advantages, there are some misconceptions surrounding VA loans in Texas. Some individuals mistakenly believe that these loans are challenging to qualify for or come with hidden fees. In reality, VA loans often have more lenient credit requirements, and the Department of Veterans Affairs has implemented regulations to protect veterans from excessive fees.

Conclusion:

Empowering veterans in Texas to achieve homeownership is a noble endeavor, and VA loans stand as a beacon of support in this journey. By taking advantage of the unique benefits offered through these loans, veterans can not only secure a place to call home but also enjoy financial advantages that make the dream of homeownership a reality. As we express our gratitude for the service of our veterans, let us also recognize and spread awareness about the valuable resources available to them, including the powerful tool of VA loans in Texas.

0 notes

Text

8 Smart Strategies for Refinancing with Bad Credit

Refinancing a mortgage can be a powerful financial tool, helping homeowners secure better interest rates, lower monthly payments, or access equity. However bad credit can be a challenging thing, but it's not impossible. With the right strategies in place, homeowners with less-than-perfect credit scores can still find ways to improve their financial situation. In this blog, we'll explore eight smart strategies for refinancing with bad credit.

Understand Your Credit Score

Before diving into the refinancing process, it's crucial to understand your credit score and the factors influencing it. Obtain a copy of your credit report, identify any errors, and take steps to address them. Knowing your credit score will help you set realistic expectations and determine the best approach for refinancing.

Explore Government-Backed Programs

Investigate government-backed programs designed to assist homeowners with bad credit. For example, the Federal Housing Administration (FHA) offers refinancing options for individuals with lower credit scores. These programs often have more flexible requirements, making them a viable option for those struggling with credit issues.

Build Equity in Your Home

Increasing your home equity can make you a more attractive candidate for refinancing. Consider making extra payments on your mortgage or making home improvements that can boost your property's value. Lenders may be more willing to work with you if you have a higher stake in your home.

Shop Around for Lenders

Don't settle for the first lender you come across. Shop around and compare offers from multiple lenders, including traditional banks, credit unions, and online mortgage lenders. Each lender may have different criteria and terms, so exploring various options increases your chances of finding a favorable deal.

Consider a Co-Signer

If your credit score is a major stopping to refinancing, explore the possibility of having a co-signer with a higher credit score. A co-signer can help strengthen your application and improve the terms offered by lenders. However, keep in mind that this strategy involves shared responsibility, and both parties should fully understand the implications.

Demonstrate Financial Stability

Showcasing financial stability can positively impact your refinancing prospects. Provide evidence of a steady income, consistent employment, and responsible financial behavior. Lenders may be more lenient if they see a reliable and improving financial track record.

Consider a Shorter Loan Term

Opting for a shorter loan term may be advantageous, even with bad credit. While monthly payments may be higher, lenders might be more willing to offer favorable terms on shorter loans. This strategy can also save you money in the long run by reducing interest payments.

Work with a Mortgage Broker

Enlist the services of a mortgage broker who specializes in working with borrowers with bad credit. Mortgage brokers have access to a network of lenders and can help you find the best options based on your unique financial situation. Their expertise can be invaluable in securing a refinancing deal that meets your needs.

Lastly

Refinancing a mortgage with bad credit requires a strategic approach, but it's certainly easy with the right actions. By understanding your credit, exploring various options, and demonstrating financial responsibility, you can improve your chances of securing a refinancing deal that works for you. Remember, each borrower's situation is unique, so tailor these strategies to fit your specific needs and circumstances.

0 notes

Text

Conventional Mortgages 101: A Comprehensive Overview

Buying a home is a massive step, and understanding the difficulties of financing is crucial for a successful journey into homeownership. Among the unlimited mortgage options, the conventional mortgage loan stands out as a versatile and widely chosen path. In this comprehensive overview, we'll dive into the depths of Conventional Mortgages 101, shedding light on key features, advantages, and the application process.

What Sets Conventional Mortgages Apart?

At its core, a conventional mortgage is a home loan that is not insured or guaranteed by any government entity. Unlike FHA (Federal Housing Administration) or VA (Veterans Affairs) loans, conventional mortgages are backed by private lenders. This distinction comes with both advantages and considerations, making it essential for prospective homebuyers to grasp the fundamentals.

Key Features of Conventional Mortgages

Down Payments One of the standout features of conventional mortgages is the flexibility they offer in terms of down payments. While some loan types might require a substantial upfront payment, conventional loans accommodate a spectrum of down payment options, ranging from as low as 3% to a more traditional 20%.

Credit Requirements Your credit score plays a pivotal role in securing favorable terms on a conventional mortgage. Generally, the higher your credit score, the better your chances of qualifying for lower interest rates and more favorable loan terms. Maintaining a solid credit history is paramount in this context.

Loan Limits While not subject to government-imposed restrictions, conventional loans do have conforming loan limits. These limits vary by location and dictate the maximum loan amount that can be borrowed.

Private Mortgage Insurance (PMI) A common consideration for those making smaller down payments is the need for PMI. This insurance protects the lender in the event of default but can often be removed once a certain level of equity is reached.

Advantages of Conventional Mortgages

Flexible Terms Conventional mortgages provide borrowers with a range of term options. Whether you prefer a shorter 10-year mortgage or a more standard 30-year term, the flexibility allows you to tailor the loan to your specific financial goals and capabilities.

Versatility in Property Types Conventional loans are not limited to primary residences. Whether you're eyeing a second home or an investment property, a conventional mortgage can be a versatile tool for various real estate endeavors.

Refinancing Opportunities Homeownership is a dynamic journey, and your financial situation may evolve over time. Conventional mortgages provide opportunities for refinancing, allowing you to secure better interest rates, adjust loan terms, or tap into your home's equity for other financial needs.

The Application Process

Pre-Approval Begin your homebuying journey by getting pre-approved for a conventional mortgage. This step not only gives you a clear understanding of your budget but also strengthens your offer when you find the perfect home.

Documentation Be prepared to provide a comprehensive set of financial documents, including tax returns, pay stubs, and bank statements. These documents help lenders assess your financial stability and determine your eligibility for a conventional loan.

Appraisal As part of the mortgage process, a professional appraisal is conducted to assess the fair market value of the property. This step ensures that the loan amount aligns with the property's value.

Closing The final step in the conventional mortgage journey is the closing process. This involves signing the necessary documents, completing any remaining paperwork, and officially becoming a homeowner.

Bottom Line

Conventional Mortgages 101 equips homebuyers with the knowledge needed to navigate the complex landscape of home financing. Whether you're a first-time buyer or a seasoned homeowner, understanding conventional loans is instrumental in making informed decisions and achieving your homeownership goals.

0 notes

Text

Discover if you qualify for a home improvement loan with our comprehensive eligibility checklist. Whether you're planning a kitchen upgrade, bathroom remodel, or a complete home transformation, this checklist will guide you through the key criteria lenders consider.

Ensure a smooth application process and turn your renovation dreams into reality with the right financing.

Check your eligibility today at https://www.homeloanrateofinterest.com/zero-interest-home-improvement-loans

#mortgage#home improvement#remodel#renovation#finance#bathroom remodeling#bathroom renovation#kitchen upgrade

0 notes

Text

10 Tips to Strengthen Your Credit and Secure Your Dream Home

Dreaming of owning a home? Your credit score holds the key. It is a crucial factor in turning that dream into reality. A higher credit score not only opens doors to better mortgage rates but also enhances your overall financial well-being. Let's explore 10 actionable tips to improve your credit score and pave the way to your dream home.

Tip 1: Understand Your Credit Score

The first step to improve the credit score is awareness. Obtain your credit report and understand your current standing. This will give you insights into your financial history and where you can make positive changes.

Tip 2: Timely Payments

Consistent, on-time payments are the backbone of a stronger credit score. Set up reminders or automatic payments to ensure you never miss the due date. This simple habit can significantly boost your creditworthiness.

Tip 3: Reduce Credit Card Balances

Aim to keep your credit card balances below 30% of your credit limit. High credit card utilization can impact your score. Paying down outstanding balances can demonstrate responsible financial management.

Tip 4: Diversify Your Credit

A well-rounded credit portfolio can enhance your score. Consider having a mix of credit, types such as credit cards, installment loans, and a mortgage, when appropriate. This shows the lenders that you can handle various forms of credit responsibly.

Tip 5: Don’t Close Old Accounts

Length of credit history is the key factor in improving your credit score. Avoid closing old accounts, as they contribute positively to the length of your credit history. Even if you don’t use them often, keeping them open can benefit your score.

Tip 6: Check For Errors

Regularly review your credit report for errors or inaccuracies. Dispute any discrepancies you find promptly. A clean and error-free credit report ensures that your score accurately reflects your financial behavior.

Tip 7: Budget Wisely

Creating and sticking to a budget is not only good for your financial health but also for your credit score. It helps you manage your finances effectively, ensuring that you can meet your financial obligations on time.

Tip 8: Emergency Fund

Having an emergency fund safeguards your financial stability. Unexpected expenses can lead to missed payments and a negative impact on your credit. Build an emergency fund to handle unforeseen challenges without jeopardizing your creditworthiness.

Tip 9: Limit New Credit Applications

Each new credit application can result in a hard inquiry, potentially lowering your credit score. Be strategic about applying for new credit and only do so when necessary. Multiple inquiries within a short period can signal financial instability.

Tip 10: Seek Professional Advice

If improving your credit seems daunting, consider seeking advice from credit counseling services. Professionals can provide personalized guidance, helping you navigate challenges and implement effective strategies to boost your credit score.

In conclusion, building a strong credit foundation is essential for unlocking the doors to your dream home. By following these 10 tips and consistently practicing responsible financial habits, you can strengthen your credit score and pave the way to a more secure and prosperous future. Remember, your credit score is not just a number; it's a powerful tool that can turn your aspirations into reality.

1 note

·

View note