Don't wanna be here? Send us removal request.

Photo

#QuickBooks #SalesTax Setting Up Sales Tax in QuickBooks. www.SolutionsSoftwareGroup.com Now that you have your sales taxes set up, you’ll be able to use them in transactions and reports.

Last month, we talked about the process of setting up sales taxes in QuickBooks. To recap a bit, you first have to go to Edit | Preferences | Sales Tax to make sure the software is set up correctly for this use. This means you’ll need to understand exactly what your state and local sales tax rules are. You can learn this by going to your state’s Department of Revenue or Department of Taxation website.

State sales taxes are considered Items in QuickBooks; you create them like you would create product records. When local sales taxes are also required, you can set up Sales Tax Groups. You’ll be assigning these Items as well as Tax Codes to customers.

Using Sales Taxes

Once you have sales taxes set up, you can start using them in transactions. You can create them on the fly from within transactions, but we recommend taking care of this important housekeeping task before you start.

Image1 QuickBooks applies the Sales Tax Item or Sales Tax Group that you assigned to the customer on your invoices. You can see the others that are available.

Start by creating an invoice. When you reach the Tax column for your first line item, you’ll see that QuickBooks has already assigned Tax or Non to it based on the information in the item’s record. You can mix taxable and non-taxable items on the same invoice. You can also add a new sales tax on the fly from the invoice itself. Click the down arrow in the Tax column and select <Add New>.

Be sure you’re not required to pay sales tax on an item when Non is selected. You may not have to charge sales tax on, for example: • Nonprofit organizations • Out-of state sales • Items that your customers will resell

Tip: If you’d like, you can create more specific sales tax codes for these situations. You could use OOS for out-of-state sales, for example, LBR for labor, and NPO for nonprofit organization.

Image2 QuickBooks already includes Sales Tax Codes Tax and Non, but you can add additional ones that are more descriptive.

Be very careful with your sales tax classifications in QuickBooks. As we said last month, such errors will be discovered in a sales tax audit, should you ever be subject to one.

Once you’ve entered all the line items in the invoice, look down toward the bottom of the screen, directly beneath the table containing invoiced items and above the Total. QuickBooks will have calculated the sales tax due using the Sales Tax Item or Group you assigned to that customer during setup, placing it in the Tax field.

Look to the left of those numbers, and you’ll see the actual rate that was applied. To the left of that is a drop-down list containing the correct Sales Tax Item or Sales Tax Group. Click the down arrow if you want to see the list of other options. And in the lower left of the screen, you’ll see the Customer Tax Code.

The Sales Tax Center

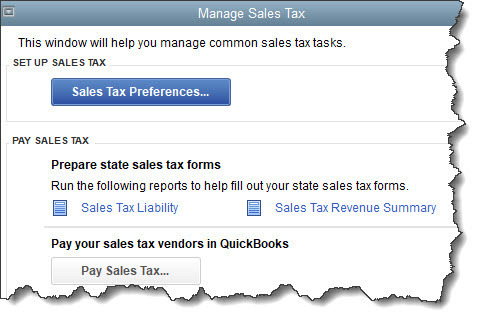

Image3 The Manage Sales Tax window

When it’s time to pay sales taxes, you’ll open the Vendors menu and select Sales Tax | Manage Sales Tax. From the screen that opens, you’ll be able to:

• Access Sales Tax Preferences. • Generate sales tax reports that will help you fill out required forms. • Visit related screens.

There are two reports you’ll need to run: Sales Tax Liability (displays total sales, amounts that are taxable and at what rates, taxes collected, and how much sales tax is due to each taxing agency) and the Sales Tax Revenue Summary (breaks down total sales into taxable and non-taxable). These reports are, of course, customizable, so you can filter them, for example, by Sales Tax Code.

A Delicate Balance

Collecting the correct amount of sales tax on taxable items and submitting the right tax totals to the right agencies takes vigilance. You don’t want to charge customers for unnecessary taxes, but you also don’t want to end up paying taxes you should have invoiced out of your own pocket.

We can help you get this straight from the start. It’s much easier to spend some time setting up sales tax accurately in QuickBooks than it is to go back and untangle inaccurate records. Give us a call and we’ll set up a consultation.

SOCIAL MEDIA POSTS

QuickBooks lets you create Sales Tax Items on the fly, but it’s much better to make this task a part of your setup process. Here is why.

Are you assigning Sales Tax Codes and Items to customers when you create their records in QuickBooks? You should be. Here is how.

If you want to make your QuickBooks Sales Tax Codes more descriptive, you can create your own three-letter designations. Find out how here.

QuickBooks reports can tell you how much sales tax you owe to each taxing agency, among other things. Find out how to here.

0 notes

Video

tumblr

#QuickBooks #SSG #ThePathToSuccesswww.SolutionsSoftwareGroup.com / 800-747-9415 Our mission is to provide solutions to change the management and operation of your business by allowing you to gain knowledge, upgrade skills, and acquire an understanding of required business fundamentals to grow and prosper. We do this through education, training, and the establishment of business processes. We also offer training and long term QuickBooks education through our sister site Quality Accounting Systems. Vicki Borror, QuickBooks ProAdvisor, brings an everyday approach to helping you manage your business by getting involved in what you do and asking lots of thought-provoking questions. Having implemented accounting systems worldwide, she has assisted many businesses (of all sizes) in setting up and maintaining their accounting functions. Her area of expertise is capturing the chaos of everyday operations and providing solutions so you can take control of your business and understand it. The knowledge that she has of QuickBooks lets you use it in a variety of ways. Several of her accreditations include M.B.A., B.S. in Accounting and Business Management, Intuit Advanced Certified ProAdvisor, and a Certified Tsheets Pro. Vicki is very involved in the surrounding community, serving on several civic boards and teaching at both the university and community college level.

0 notes

Video

tumblr

#StorageSyracuse #MobileOfficesSyracuse #SelfStorageSyracuse #HuntingCabinsSyracuse #TinyHomesSyracuse www.SyracuseContainers.com At Spano Container we offer creative solutions to your storage and occupancy needs. Call us for your solution today. We Think Outside The Box! YOUR SYRACUSE STORAGE CONTAINER SOLUTION BUSINESS! 277 North St. Auburn, NY 13021 315.253.9062

0 notes

Video

tumblr

#SyracuseContainers #StorageContainers #MobileOffices #TinyHomes #HuntingCabins www.Syracusecontainers.com

At Spano Container we customize containers to fit your needs. We offer several options: mobile offices, custom-built storage containers, tiny homes, and hunting cabins. The customization process is done with craft and thought. Each customized container is one-of-a-kind.

We Think Outside The Box! YOUR SYRACUSE STORAGE CONTAINER SOLUTION BUSINESS! 277 North St. Auburn, NY 13021 315.253.9062

0 notes

Photo

#MobileOffices #CustomBuilt #SyracuseContainershttps://www.syracusecontainers.com/mobile-offices Spano Container builds custom-fit mobile offices for sale and for rent. You may need a mobile office for your construction site, an event or a temporary business structure. We can provide you with a mobile office with a break room if needed, wired and with plumbing. We can also install a bathroom and or any specifics you may need. Please contact us with any questions. 277 North St. Auburn, NY 13021 315.253.9062

0 notes

Video

tumblr

#QuickBooks Desktop 2020 has a new feature called 'Pick-Pack' that helps users who pick and pack items at the same time during order fulfillment. See how it works in this quick video: https://oal.lu/OffZr #smallbusiness

0 notes

Video

tumblr

#SyracuseContainers #Storage #MobileOffices www.SyarcuseContainers.com At Spano Container we solve your storage, shipping and temporary occupancy needs with our containers and mobile offices. We also can custom fit our containers for many purposes.

277 North St. Auburn, NY 13021 315.253.9062

0 notes

Video

tumblr

We Will Always Honor The Fallen And The Brave. -Solutions Software Group.

0 notes

Video

tumblr

#LaborDay #SolutionsSoftwareGroup #Intuit #QuickBooksToday Solutions Software Group wants to wish everyone out there a very Happy Labor Day by sharing this wonderful video about hard-working Americans, made by Intuit, the company that created QuickBooks.

Labor Day is, in fact, a celebration of the hard-earned fruits of our labor. Since 2016, Intuit has placed customer success centers in local communities, driving hundreds of new jobs to create a ripple effect of prosperity. Melissa Komar, Executive Director of the Redevelopment Authority, shares how connection and community will usher Johnstown into its bright new future, with Intuit by their side. She introduces us to the new generation who will help Johnstown honor the past, but create a new future.

Labor Day pays tribute to the contributions and achievements of American workers and is traditionally observed on the first Monday in September. It was created by the labor movement in the late 19th century and became a federal holiday in 1894. HAPPY LABOR DAY EVERYONE! www.SolutionsSoftwareGroup.com

0 notes

Photo

#QuickBooksPOS #SSG #LastDay!#PowerSessions #QASVB #QuickBooks #EmpowerYourBusinessMessage Us Here Today!800-747-9415https://qasvb.com/training/qb-power-sessions

0 notes

Photo

#QuickBooks #BillTracker #SolutionsSoftwareGroup www.SolutionsSoftwareGroup.com Purchase From Us!

Using QuickBooks' Bill Tracker If your business pays a lot of bills, you need an efficient system for staying current with them. QuickBooks’ Bill Tracker provides that.

Bill-paying may be your least favorite accounting activity. You definitely know how those checks and online payments affect your account balances, but it’s more than that. Staying up to date with your bills and paying them on time (but not too early) takes a supreme organizational effort.

If you’re using a manual bookkeeping system, you know how difficult it is to keep up. QuickBooks offers several options for helping you with this. You can set reminders and/or put the due dates on your calendar. If you’re using QuickBooks 2016 or later, you have access to another tool: Bill Tracker.

A Comprehensive Overview QuickBooks Bill Tracker is similar to the software’s Income Tracker. If you’ve used that, you know that it provides a way to get a birds-eye view of your accounts receivable. You can see where every transaction falls in your income “pipeline” (estimates, open invoices, etc.).

Bill Tracker works similarly, but for accounts payable. It has two advantages over just opening your Vendor Center and clicking the Transactions tab. First, it displays the Status of each transaction. Second, it contains Action links, so you can do more than simply open each entry.

Bill Tracker lets you switch between lists of different types of accounts payable transactions.

To open this tool, click Bill Tracker in your navigation pane. The screen that appears consists of two parts. Color-coded bars across the top represent different transaction types, Purchase Orders and Bills. The latter is further divided into Open Bills, Overdue, and Paid In The Last 30 Days. Each bar contains both the number of transactions that fall in that category and their total dollar amount. Click on one, and the list below changes to include only that type of entry.

Note: You can see in the image above that the Open Bills list has three alternate views that you can open by clicking on them in the drop-down list: Item Receipt, Credit, and Unapplied Payments. If you have questions on any of these, we can explain them to you, since you should know when to consult these lists.

Changing the View Bill Tracker defaults to the broadest view possible. That is, when you select a category of transactions, it shows all of the active ones. But a series of drop-down lists below the main toolbar gives you control over what subset of information is displayed there. You can narrow your list down to one vendor, for example, and choose a date range.

Data columns are different for each list. When you’re displaying Overdue transactions, the labels read Vendor, Type, Number, Date, Due Date, Aging, Status, Amount, Open Balance, and Action. You get a thorough description of each entry at a glance.

Taking Action As we said earlier, Bill Tracker lets you work with transactions as well as just view them. Click on Purchase Orders and open the drop-down list at the end of one of the rows in the Action column. You can see in the image below what your options are there, including Convert to Bill. When the Open Bills list is active, you’ll be able to click on Pay Bill.

Open the drop-down list in the Action column to see what you can do with the selected transaction.

To see what else you can do with individual transactions or groups of them, look in the lower-left corner of the screen and locate the Batch Actions and Manage Transactions buttons. With the Purchase Orders list open, click in the box in front of one or more to create a checkmark. Open the Batch Actions menu. You’ll see that only two options are available to you here; the others are grayed out. You can Print Selected Purchase Orders or Close Purchase Orders. Pay Bills is only active when you’re in a list that allows that.

Now, open the Manage Transactions list. You can create transactions from this menu by clicking on Purchase Order, Bill, CC Charge, or Check. If you select Edit Highlighted Row, the original transaction will open.

Warning: Remember that you should never write a check to pay a bill if you’re using QuickBooks’ bill-payment tools. If you’ve already entered the bill, click Pay Bills on the home page or open the Vendors menu and select Pay Bills. Talk to us if you have questions about this process.

QuickBooks offers multiple ways to take the same actions in accounts payable; Bill Tracker is just one. But this instant overview can tell you quickly where you stand with your vendors -- and help you avoid late payments.

Social media posts Did you know QuickBooks provides many ways to help you pay bills on time? Bill Tracker is one of them. Here is an overview on this useful feature.

QuickBooks’ Bill Tracker gives you an instant overview of your active accounts payable transactions. Are you using this useful feature? We can show you how.

If you’re using QuickBooks’ bill-paying tools, never write a check to pay a bill. You must use the Enter Bills and Pay Bills links. Find out how here.

QuickBooks’ Bill Tracker lets you work with accounts receivable transactions as well as view them. Find out more here and ask us about how this useful feature can help you.

0 notes

Photo

#QuickBooks #SolutionsSoftwareGroup #EmpowerYourBusinessGet 40% off 5-30 seats or 10% off 1-4 seats off #QuickBooksEnterprise. Offer ends 7/28/19 https://www.solutionssoftwaregroup.com/quickbooks-enterprise-1 QUICKBOOKS ENTERPRISEJoin over 120,000 customers using powerful tools to help you work smarter and more efficiently with QuickBooks Enterprise. QuickBooks Enterprise is a financial services software that offers end-to-end accounting solutions without the need for ERP implementation. QuickBooks Enterprise targets mid-sized businesses that have outgrown QuickBooks or other entry-level accounting platforms. We offer a lifetime, 20% discount off 1-10 users and 12.5% discount off 30 users every day. Buy Now QuickBooks Enterprise provides the ability for you to choose a version that is tailor-made for your industry. ContractorRetailWholesale / ManufacturerNon-ProfitProfessional www.SolutionsSoftwareGroup.com#QuickBooksCollinsvilleIllinoise #QuickBooksStLouisMissouri #QuickBooksChicago

0 notes

Photo

https://www.solutionssoftwaregroup.com/quickbooks-enterprise-1

0 notes

Video

tumblr

#QuickBooks #SolutionsSoftwareGroupwww.SolutionsSoftwareGroup.comHappy Fourth Of July! - From Everyone At The Solutions SoftwareGroup!

0 notes

Video

tumblr

#HappyFourthOfJiuly!

www.SolutionsSoftwareGroup.com

0 notes

Photo

#QuickBooksPOS #SolutionsSoftwareGroupwww.SolutionsSoftwareGroup.comSecurity Patch Update for #QuickBooks POS Extended to 6/25 : make sure to get the latest version of TLS 1.2, so you can ensure continuous payment processing in QuickBooks Desktop Point of Sale.

0 notes

Photo

#QuickBooks #SolutionsSoftwareGroup #FathersDay www.SolutionsSoftwareGroup.com Happy Father's Day! To all of the amazing Dads out there! Thank you!

0 notes