Text

Space, the final frontier. These are the voyages of the Starship… uh… Longshot. Our five-year mission: to boldly explore the uncharted territories of Vertical Spreads, to seek out new income streams (and promptly watch them fizzle), to boldly lose… er, I mean, generate… a modest return on investment. Our continuing mission, for five years, has boldly… well, mostly broken even. But hey, at least the view from the holodeck is nice. Mission… complete-ish.

0 notes

Text

As I recount my 5-year journey in the world of Vertical Bull Put Credit Spreads, I liken the strategy to the seductive but ultimately unfulfilling Mrs. Robinson. I shared my struggles, doubts, and moments of despair. Yet, small victories always rekindled my hopes, and I kept searching for my own “Options Income” of success. But now is the time to say, “Goodbye, Mrs. Robinson.”

#options trading#investing#trading journal#options spreads#stock options#options trader#thinkorswim#tradingjournal#makingmoneyathome#options strategies

0 notes

Text

Not So Quicken - New Schwab Accounts Download to Quicken

My Ameritrade accounts were transferred to Charles Schwab on the weekend of Nov 3. And for the better part of this month, I’ve been picking up the pieces. I felt like Carl Fredricksen in a slow slog, trudging towards my new investment home. Towing my Schwab accounts over my shoulder as I seek Paradise Falls (a.k.a. Quicken). Table of Content Commentary – Not So Quicken This Month’s Market…

View On WordPress

#Bull Put Spread#Charles Schwab#Entry Rules for Options#Exit Rules for Options#income ideas#make money at home#Options Cover Calls#Options Spreads#Options Strategies#Quicken downloads#quicken schwab#schwab quicken#Trading Journal#Vertical Bull Put Credit Spreads#Vertical Spreads

0 notes

Text

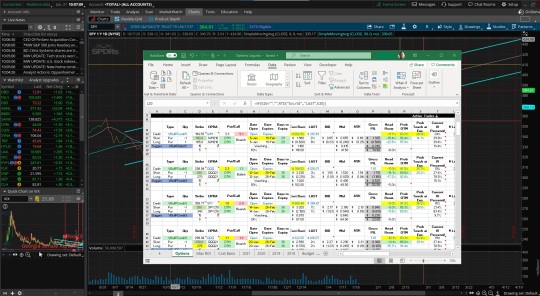

How to Connect Excel with Thinkorswim

How do you connect Schwab’s Thinkorswim (TOS) desktop trading platform with your Excel spreadsheet? How about how to use the Thinkorswim RTD commands to live stream data into your Excel Watch List? Even better, how about downloading my Excel Options Watch List to see how it works? The Avengers (2012) is an action-packed superhero film that tells the story of a group of superheroes who must come…

View On WordPress

#Ameritrade#Charles Schwab#Excel#Open Positions Monitor#Options Trader#Options Trading#Schwab#Stock Options#TDAmeritrade#ThinkorSwim#Tos#Watch List

1 note

·

View note

Text

With the US deficit approaching $2 trillion this year, inflation at a gut-buster 17.5% above 2020’s consumer prices, interest rates at a stifling 5.25%, expanding military involvement in the Middle East, Europe, and Asia, a dangerously polarized population, a politically dysfunctional Congress, and the uncertainty of another scorching election-year rematch between Biden and Trump. Why bother selling Vertical Bull Put Credit Spreads?

#options trading#investing#trading journal#options spreads#tradingjournal#makingmoneyathome#verticalspreads#options strategies#cover calls#options assignment

0 notes

Text

In this month’s Trade Journal post, I want to explore what to expect when my TdAmeritrade accounts are transferred to the Charles Schwab platform. There’s going to be a little sphincter tightening for me until the transfers are completed.

#options trading#investing#trading journal#options spreads#tradingjournal#makingmoneyathome#verticalspreads#options strategies#cover calls#options assignment

0 notes

Text

Has “Life, Liberty and the pursuit of Happiness” been supplanted with “Inclusion, Equity and the pursuit of Climate Justice?” It seems like Bidenomics is dancing the Shipoopi with Lady Liberty – Bipoopiomics

#options trading#tradingjournal#verticalspreads#options strategies#makingmoneyathome#bidenomics#bipoopiomics#options spreads#investing#shipoopi

0 notes

Text

Today, the S&P 500 is only 4% away from our pre-COVID high of 4,776 – the start of all this market management lunacy. Any new Vertical Bull Put Credit Spread I open in the next couple of months will hopefully trigger my exit rules long before the one-year expiration dates. The Economic Outlook for my 2023 Vertical Spreads looks pretty good.

#options trading#investing#trading journal#options spreads#tradingjournal#makingmoneyathome#verticalspreads#options strategies#cover calls#options assignment

0 notes

Text

My CND compels me to measure my Options income to gauge whether I’m making money or wasting my time. After a year of ill-reporting my P&L, I made one minor D’oh correction. I’m now relieved to see that my Vertical Bull Put Credit Spreads ARE outperforming the S&P 500.

#options trading#investing#trading journal#options spreads#tradingjournal#makingmoneyathome#verticalspreads#options strategies

0 notes

Text

Exit Rules - Yearlys Vertical Bull Put Credit Spreads

I still have the goal of a monthly income, I still believe I can do so with Vertical Credit Spreads, and I still desire to be nerdy about it all. So here are my new Exit Rules for Yearly Vertical Bull Put Credit Spreads.

#Annualized return on risk#Bull Put Spread#Entry Rules for Options#Exit Rules for Options#make money at home#max gain#Options Monthlys#Options Spreads#Options Strategies#Options Yearlys#Trading Journal

0 notes

Text

This month’s Journal Entry feeds my nerdy side as I document my Cover Call Watchlist, which pulls live data from my ThinkorSwim trading platform into an Excel Spreadsheet. In addition, I will dissect my watchlist Excel spreadsheet and document how I calculated essential data points.

#options trading#investing#Cover Calls#options strategies#options assignment#tradingjournal#Options Watchlist

0 notes

Text

In this month’s journal entry’s commentary, I want to see if Microsoft’s new Bing AI search engine can help me with a new Vertical Bull Put Credit Spread strategy.

#options trading#investing#trading journal#makingmoneyathome#verticalspreads#options strategies#options spreads

1 note

·

View note

Text

This month’s Trading Journal commentary will review a new chartable index – tracking the number of S&P 500 companies trading above their 200-Day Simple Moving Average (SMA). Below I charted the S&P over the past 20 years and annotated some of the most egregious Feds machinations.

#options trading#trading journal#investing#options spreads#tradingjournal#makingmoneyathome#verticalspreads#options strategies#optionspreads#options assignment

0 notes

Text

This month, I want to revisit my Vertical Bull Put Credit Spreads’ Exit Strategy – particularly when to exit a winning position. I want to take my painful experience of last year and craft a new strategy a bit more workable.

#options trading#trading journal#options spreads#makingmoneyathome#verticalspreads#options strategies#options assignment#optionspreads#tradingjournal#investing

0 notes

Text

The downturn in the 2022 markets began on cue – the first week in January. And by the end of that first month, I was already falling down the “Correction” rabbit hole. I am ending this year with a frustrating loss of 41.3%. But I still have a couple of bucks left, so I’m still in business!

#makingmoneyathome#optionspreads#verticalspreads#tradingjournal#options strategies#trading journal#options trading#options spreads

0 notes

Text

After 2022, Painful Experience will have to be approbation enough. But with a little prestidigitation, this month’s journal entry intends to define my Budget, Goals, Mission Statement, and new Entry/Exit rules for 2023 – Zimzalabim!

#options trading#trading journal#options spreads#makingmoneyathome#verticalspreads#options strategies#tradingjournal#optionspreads

0 notes

Text

The 2022 mid-term election is just a week away. And I, for one, will be glad to see the crazy Progressive Experiment reined in. The McCarthyismistic tactics of the past two years have done more damage to the unity of our country than any social-economic crusade of the past 50. Their haphazard approach to throwing a motley of social reforms against the Constitution to see what sticks, then viciously defaming everyone who disagrees, was painful.

0 notes