Don't wanna be here? Send us removal request.

Text

📉 Struggling with Financial Complexities? Let us help you Unlock the Path to Stability! 💼

Our expert debt advisory services are designed to streamline your financial strategy and secure the best debt solutions. From customized debt structuring to strategic arrangements, we ensure you're always one step ahead. 🔑💡 Take control of your financial future with expert debt advisory services. ⭐ Let us help you navigate debt complexities and craft personalized solutions for lasting stability.

📞 Call us at +91 89 2828 9070 or visit www.npaconsultant.in for more information.

#DebtAdvisory#FinancialSolutions#BusinessGrowth#NPAConsultant#NPASolutions#DebtRestructuring#BusinessRevival#NPAFunding#FinancialStability#BridgeFinancing

0 notes

Text

Unlock Financial Freedom for Your Business

If debt is holding your business back, it’s time to take action! NPA Consultants Pvt. Ltd. offers expert debt restructuring solutions that can reshape your financial future. 💫 Whether you’re struggling with mounting debts or seeking a sustainable path to profitability, we provide the tailored strategies you need. 🫱🏻🫲🏼

💼 What we offer: ✅ Comprehensive financial assessments to understand your unique needs. ✅ Strategic negotiations with creditors to ease your burdens and for favorable terms. ✅ Custom-built repayment plans that restore balance and relieve pressure. ✅ Long-term profitability through sustainable financial solutions. 💡 We don’t just restructure debt - we help you revitalize your business, regain stability, and reclaim success. 😇 📞 Call us today at 89282 89070 or visit npaconsultant.in to learn more. 🚀 Let’s transform your debt and help you revive your business into a profitable future!

#npaconsultant#onetimesettlement#debt solution#npa#debt recovery#DebtRestructuring#FinancialStability#BusinessRecovery#NPAConsultants#DebtSolutions#BusinessGrowth#FinancialExpertise

0 notes

Text

Comparative Study of NPA account settlement Impact of The Nationalized Banks

A viable, sustainable and strong banking system is crucial for the overall development of the economic structure of a country. The failure of an effective banking system may lead to adverse impacts in various spheres of the economy. Both the Public Sector Banks and the Private sector Banks in India have made considerable contributions in all economic aspects.

However, the amount of non-performing assets or NPA in the balance sheet can have a deep impact on the bank’s profitability. As per the directives of RBI, the accounts become non-performing when the loan account is overdue and the bank fails to recover the capital or interest from the capital for over a period of 90 days.

Plans to increase productivity

Over the past few years, there is a powerful drive going on in the nationalized banks to enhance their profitability. This implies that the PSBs also have to think of improving productivity, which is necessary to survive in the present economic state.

The future of the banks lies in the ability of the banks to build good quality assets consistently even in a competitive environment and minimize the NPAs. Competition and consolidation are the two prime factors that will impact the private and public sector banks in future. The effective methods of NPA account settlement can turn out to be the factors dominating the future of the banking system.

NPA categories

Every bank has to classify all the non-performing assets into three categories, depending on the time frame over which the asset has been in the non-performing stage and the realise-ability of the debts:

Doubtful assets

Substandard assets

Loss assets

The detection of the NPAs and the able management of the debts will help the bank to enjoy more financial stability.

Impact of NPA on banking systems

The level of return on the assets is one of the most significant aspects of the bank’s efficiency. Its high tie for the banks to provide provisions for the NPAs from the present profit ratio. The NPAs can affect the return to the assets in the following ways:

Increase in cost of capital

Reduction in ROI

Fall in the interest income of the banks accounted only on receipt mode.

Disturbance in the capital adequacy ratio with the entry of NPA in the calculations

Doubtful debts and bad debts add to the loss

Limitations in recycling the funds

Mismatch in assets and liabilities

It's high time to consult the NCLT lawyers in Mumbai who can help the banks to regain economic stability.

Comparative study

Thorough research of the ten years’ data from the top Indian banks like Canara Bank and State Bank of India shows that the banks are making policies that try to contain NPA for improving the profitability and asset quality.

HDFC and PNB show superior NPA management systems if you compare them to the systems existing in SMI and ICICI or other private sector banks. The system even supersedes the system of the public sector banks too.

The positive trend in NPA control

Recent research studies on trends of the non-performing assets in the various private banks of India show that the level of NPAs in the public sector banks is alarming. But it also shows some improvement in the asset quality with a little decline in the NPA percentage. Thus, the studies show that the banks can maintain economic stability if they take timely action against the degradation of the good-performing assets instead of concentrating only on the NPAs Analytical study

A thorough analytical study shows that the NPA of all the nationalized banks is showing an upward trend. Therefore, statistical records also pave the way for the banks to apply better measure for NPA management

0 notes

Text

Tell us your story we will show you the way out! Team up with India's best advisors to fight back the injustice

Visit us : https://www.npaconsultant.in/

0 notes

Text

𝐃𝐨 𝐲𝐨𝐮 𝐟𝐞𝐞𝐥 𝐲𝐨𝐮𝐫 𝐛𝐚𝐧𝐤𝐞𝐫 𝐡𝐚𝐬 𝐜𝐥𝐨𝐬𝐞𝐝 𝐲𝐨𝐮𝐫 𝐛𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐮𝐧𝐟𝐚𝐢𝐫𝐥𝐲? 𝐈𝐬 𝐭𝐡𝐢𝐬 𝐭𝐫𝐮𝐞, 𝐘𝐞𝐬 𝐨𝐫 𝐍𝐨?

0 notes

Text

Is your banker trustworthy? Yes or No!

0 notes

Text

𝐖𝐡𝐲 𝐆𝐮𝐢𝐥𝐭𝐲 𝐟𝐨𝐫 𝐮𝐧𝐩𝐚𝐢𝐝 𝐝𝐮𝐞𝐬? Meet today to tackle the npa and banks debt recovery tantrums

𝗡𝗣𝗔 𝗖𝗼𝗻𝘀𝘂𝗹𝘁𝗮𝗻𝘁𝘀 𝗣𝘃𝘁. 𝗟𝘁𝗱 📱 +918928289070 📧 [email protected] 🌐 https://www.npaconsultant.in

0 notes

Text

NPA Recovery Roadmap for Borrowers: Bank Debt Management Tips?

Recovering Non-Performing Assets (NPAs) involves a strategic roadmap and effective debt management techniques. Here are essential tips and a roadmap for banks to manage and recover NPAs successfully:

1. Early Identification and Classification:

Implement robust credit risk assessment to identify potential NPAs at an early stage.

Classify loans based on their repayment status and severity of default as per regulatory guidelines.

Regularly monitor loan accounts for signs of stress or default.

2. Asset Quality Review (AQR):

Conduct periodic asset quality reviews to identify stressed assets and NPAs accurately.

Classify NPAs into sub-categories (Substandard, Doubtful, Loss) based on the extent of impairment.

3. Loan Restructuring and Rescheduling:

Offer loan restructuring options to borrowers facing financial difficulties.

Modify repayment terms, extend tenure, or lower interest rates to improve borrower repayment capacity.

Ensure that restructuring agreements are based on realistic borrower assessments and viability.

4. Negotiated Settlements:

Engage in negotiations with borrowers for one-time settlements or compromise agreements.

Evaluate the borrower's financial position and propose reasonable settlement amounts.

Ensure that settlement agreements are legally binding and provide sufficient recovery to minimize losses.

5. Legal Remedies and Recovery Proceedings:

Initiate legal actions promptly against defaulting borrowers.

Utilize legal remedies such as filing recovery suits, obtaining judgments, or issuing recovery notices.

Implement asset attachment, garnishment, or foreclosure based on legal provisions.

6. Asset Reconstruction Companies (ARCs):

Transfer NPAs to Asset Reconstruction Companies (ARCs) for resolution and recovery.

Collaborate with ARCs to manage and resolve distressed assets through asset sale or restructuring.

7. Collateral Management and Realization:

Efficiently manage collateral held against defaulted loans.

Conduct proper valuation of collateral assets and realize them effectively to recover outstanding dues.

8. Customer Engagement and Rehabilitation:

Adopt a customer-centric approach to engage with defaulting borrowers.

Provide financial counselling, debt management advice, or rehabilitation programs to support borrowers in resolving NPAs.

9. Continuous Monitoring and Follow-Up:

Establish dedicated recovery teams to monitor and follow up on overdue accounts.

Maintain regular communication with borrowers to understand their financial status and recovery prospects.

10. Regulatory Compliance and Reporting:

Adhere to regulatory guidelines and reporting requirements for NPA management and recovery.

Ensure transparency and accuracy in NPA classification, provisioning, and reporting to regulatory authorities.

11. Data Analytics and Technology Adoption:

Leverage data analytics and technology for predictive modelling and risk assessment.

Implement advanced tools for portfolio analysis, borrower profiling, and recovery strategy optimization.

12. Risk Mitigation and Prevention:

Enhance risk management practices to prevent future NPAs.

Strengthen underwriting standards, credit monitoring, and portfolio diversification to mitigate credit risks.

Conclusion: Implementing these strategies and following a structured roadmap can improve the efficiency and effectiveness of NPA recovery efforts for banks. It's essential to tailor recovery approaches based on the unique characteristics of each NPA case and borrower profile. Regular reviews and refinements of recovery strategies are crucial to adapting to evolving market conditions and regulatory changes.

0 notes

Text

Strategies for Effective Debt Recovery

Effective debt recovery is crucial for maintaining cash flow and financial stability for businesses and lenders. Here are several strategies to ensure successful debt recovery:

1. Clear Communication

Initial Contact: Reach out to the debtor as soon as the payment is overdue. A friendly reminder can often resolve the issue without further action.

Multiple Channels: Use various communication channels such as phone calls, emails, and letters to ensure the debtor receives the message.

Documentation: Keep detailed records of all communications with the debtor, including dates, times, and the content of discussions.

2. Payment Plans

Negotiate Terms: Offer flexible payment plans tailored to the debtor's financial situation. This could include smaller, more manageable installments.

Written Agreement: Ensure that any agreed-upon payment plan is documented in writing and signed by both parties.

3. Incentives and Penalties

Early Payment Discounts: Offer discounts or other incentives for early or prompt payment.

Late Fees: Implement and enforce late fees or interest on overdue accounts to encourage timely payments.

4. Legal Actions

Final Demand Letters: Send a formal final demand letter before taking legal action. This letter should clearly state the amount owed, the due date, and the consequences of non-payment.

Legal Proceedings: If necessary, consider taking legal action such as filing a lawsuit or obtaining a court judgment. Consult with a legal professional to understand the best course of action and associated costs.

5. Use of Technology

Automated Reminders: Implement automated systems to send reminders and follow-ups. This reduces manual effort and ensures consistency.

Debt Management Software: Utilize software that tracks overdue accounts, schedules reminders, and generates reports to manage the debt recovery process efficiently.

6. Third-Party Collection Agencies

Selection of Agency: Choose a reputable collection agency with experience in your industry. Ensure they comply with relevant laws and regulations.

Commission Structure: Understand the commission structure and fees before engaging a collection agency. This typically involves a percentage of the recovered amount.

7. Customer Relationship Management (CRM)

Understand the Debtor: Use CRM systems to gather information about the debtor’s payment history and current financial situation.

Maintain Good Relations: Strive to maintain a positive relationship with the debtor to encourage future business and prompt payment.

8. Prevention Strategies

Credit Checks: Conduct thorough credit checks before extending credit to new customers to assess their creditworthiness.

Clear Credit Policies: Establish and communicate clear credit policies, including payment terms and conditions, at the outset.

9. Training and Education

Staff Training: Train staff on effective communication, negotiation skills, and legal aspects of debt recovery.

Debtor Education: Provide debtors with information on managing debts and financial planning to prevent future defaults.

10. Continuous Monitoring and Follow-Up

Regular Reviews: Continuously monitor outstanding accounts and review them regularly to identify and address issues early.

Proactive Follow-Up: Maintain consistent follow-up with debtors to keep the debt recovery process active and top-of-mind for the debtor.

Conclusion:

Effective debt recovery requires a balanced approach combining clear communication, negotiation, legal action when necessary, and the use of technology. By implementing these strategies, businesses can improve their debt recovery rates and maintain healthier cash flow.

0 notes

Text

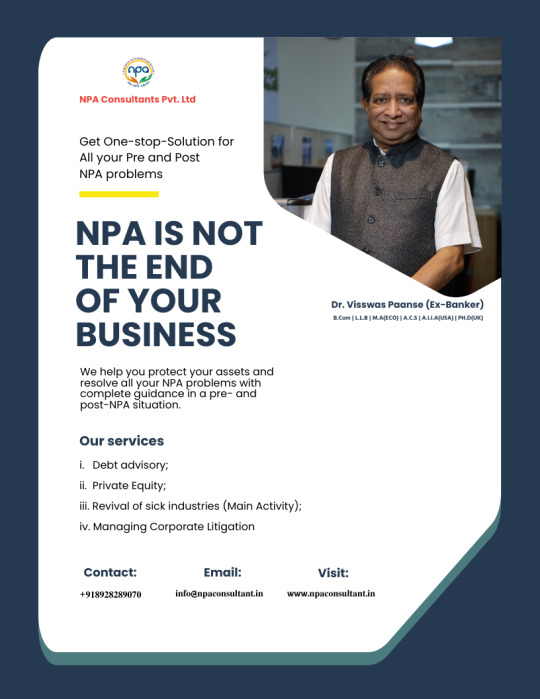

We help you protect your assets and resolve all your NPA problems with complete guidance in a pre- and post-NPA situation. 𝗡𝗣𝗔 𝗖𝗼𝗻𝘀𝘂𝗹𝘁𝗮𝗻𝘁𝘀 𝗣𝘃𝘁. 𝗟𝘁𝗱 📱 +𝟗𝟏𝟖𝟗𝟐𝟖𝟐𝟖𝟗𝟎𝟕𝟎 📧 𝐢𝐧𝐟𝐨@𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧 🌐 𝐡𝐭𝐭𝐩𝐬://𝐰𝐰𝐰.𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧

0 notes

Text

What Strategies Can Banks Implement for Successful NPA Recovery?

Non-Performing Assets (NPAs) pose a significant challenge for banks and financial institutions. Recovering NPAs requires strategic approaches tailored to the specific circumstances of each case. Here are several strategies that banks can implement for successful NPA recovery:

Early Detection and Proactive Monitoring:

Implement robust credit risk assessment processes to identify potential NPAs early.

Regularly monitor loan accounts to detect signs of stress or default.

Use data analytics and technology to predict potential NPAs based on borrower behaviour and market conditions.

Asset Quality Review (AQR):

Conduct periodic asset quality reviews to identify potential stressed assets.

Classify and provision for NPAs based on regulatory guidelines to reflect the true financial health of the bank.

Credit Monitoring and Follow-Up:

Establish dedicated recovery teams to monitor and follow up on overdue accounts.

Maintain regular communication with borrowers to understand their financial status and recovery prospects.

Customer Engagement and Rehabilitation:

Adopt a customer-centric approach by engaging with borrowers to understand their challenges.

Offer financial counseling, debt management advice, or rehabilitation programs to support borrowers in resolving NPAs.

Negotiated Settlements:

Engage in negotiations with borrowers for one-time settlements or compromise agreements.

Evaluate the borrower's financial position and propose reasonable settlement amounts.

Ensure that settlement agreements are legally binding and provide sufficient recovery to minimize losses.

Restructuring and Rescheduling:

Offer loan restructuring or rescheduling options to borrowers facing temporary financial difficulties.

Asset Reconstruction Companies (ARCs):

Transfer NPAs to asset reconstruction companies for resolution and recovery.

Collaborate with ARCs to manage and resolve distressed assets through asset sale, restructuring, or recovery.

Legal Action and Recovery Proceedings:

Initiate legal actions such as filing recovery suits, obtaining judgments, or issuing recovery notices.

Use legal remedies such as attachment of assets, garnishment of wages, or invoking personal guarantees.

Ensure compliance with legal processes and regulations governing debt recovery.

Loan Recall and Refinancing:

Recall loans and demand repayment based on contractual obligations.

Offer alternative finance options to borrowers to facilitate repayment and avoid default.

Collateral Realization:

Liquidate collateral or security held against the loan to recover outstanding dues.

Ensure proper valuation and realization of collateral assets through transparent and efficient processes.

Successful NPA recovery requires a multi-faceted approach that combines proactive risk management, effective borrower engagement, legal recourse when necessary, and leveraging external partnerships where beneficial. By adopting these strategies, banks can enhance their NPA recovery rates and strengthen their financial position.

0 notes

Text

Do not panic about Pre- and Post-NPA problems

✔ 𝗗𝗼 𝗻𝗼𝘁 𝗽𝗮𝗻𝗶𝗰 𝗮𝗯𝗼𝘂𝘁 𝗣𝗿𝗲- 𝗮𝗻𝗱 𝗣𝗼𝘀𝘁-𝗡𝗣𝗔 𝗽𝗿𝗼𝗯𝗹𝗲𝗺𝘀. 𝗧𝗮𝗸𝗲 𝗽𝗿𝗼𝗳𝗲𝘀𝘀𝗶𝗼𝗻𝗮𝗹 𝗴𝘂𝗶𝗱𝗮𝗻𝗰𝗲 𝘁𝗼 𝗿𝗲𝘀𝗼𝗹𝘃𝗲 𝘆𝗼𝘂𝗿 𝗡𝗣𝗔 𝗽𝗿𝗼𝗯𝗹𝗲𝗺𝘀 𝗮𝗻𝗱 𝘀𝗲𝘁𝘁𝗹𝗲 𝘄𝗶𝘁𝗵 𝗮 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀-𝘀𝘁𝗿𝗲𝗻𝗴𝘁𝗵 𝗯𝗮𝗻𝗸 𝗼𝗻 𝗮𝗺𝗶𝗰𝗮𝗯𝗹𝗲 𝘁𝗲𝗿𝗺𝘀. ✔ 𝗪𝗲 𝗵𝗲𝗹𝗽 𝘆𝗼𝘂 𝗴𝗲𝘁 𝗿𝗶𝗱 𝗼𝗳 𝗮𝗹𝗹 𝗽𝗿𝗲-𝗮𝗻𝗱 𝗽𝗼𝘀𝘁-𝗡𝗣𝗔 𝗽𝗿𝗼𝗯𝗹𝗲𝗺𝘀 𝘄𝗶𝘁𝗵𝗼𝘂𝘁 𝗯𝗲𝗴𝗴𝗶𝗻𝗴 𝗳𝗿𝗼𝗺 𝘁𝗵𝗲 𝗯𝗮𝗻𝗸. 𝗖𝗼𝗻𝘁𝗮𝗰𝘁 𝘂𝘀 𝘁𝗼 𝗴𝗲𝘁 𝗰𝗼𝗺𝗽𝗹𝗲𝘁𝗲 𝗴𝘂𝗶𝗱𝗮𝗻𝗰𝗲 𝗼𝗻 𝗵𝗼𝘄 𝘁𝗼 𝗿𝗲𝘀𝗼𝗹𝘃𝗲 𝘆𝗼𝘂𝗿 𝗡𝗣𝗔 𝗽𝗿𝗼𝗯𝗹𝗲𝗺𝘀 ✔ 𝗙𝗮𝗰𝗶𝗻𝗴 𝗮 𝘄𝗶𝗹𝗳𝘂𝗹 𝗱𝗲𝗳𝗮𝘂𝗹𝘁 𝗶𝘀𝘀𝘂𝗲? 𝗚𝗲𝘁 𝗿𝗶𝗱 𝗼𝗳 𝗡𝗣𝗔 𝗶𝘀𝘀𝘂𝗲𝘀 𝗴𝗿𝗮𝗰𝗲𝗳𝘂𝗹𝗹𝘆 𝘄𝗶𝘁𝗵 𝘂𝘀! ✔ 𝗪𝗲 𝗽𝗹𝗮𝘆 𝗮 𝗺𝗮𝗷𝗼𝗿 𝗿𝗼𝗹𝗲 𝗶𝗻 𝗮𝗿𝗿𝗶𝘃𝗶𝗻𝗴 𝗮𝘁 𝗮𝗻 𝗮𝗺𝗶𝗰𝗮𝗯𝗹𝗲 𝘀𝗲𝘁𝘁𝗹𝗲𝗺𝗲𝗻𝘁 𝘄𝗶𝘁𝗵 𝘁𝗵𝗲 𝗯𝗮𝗻𝗸𝘀 𝘄𝗵𝗶𝗰𝗵 𝘁𝗵𝗲 𝗯𝗼𝗿𝗿𝗼𝘄𝗲𝗿𝘀 𝗳𝗮𝗶𝗹 𝘁𝗼 𝗱𝗼 𝗮𝘁 𝘁𝗵𝗲𝗶𝗿 𝗹𝗲𝘃𝗲𝗹. 𝗚𝗲𝘁 𝗮 𝗼𝗻𝗲-𝘀𝘁𝗼𝗽 𝘀𝗼𝗹𝘂𝘁𝗶𝗼𝗻 𝗳𝗼𝗿 𝘁𝗵𝗲𝗶𝗿 𝗯𝗮𝗻𝗸𝗶𝗻𝗴, 𝗹𝗲𝗴𝗮𝗹 𝗮𝗻𝗱 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗺𝗮𝘁𝘁𝗲𝗿𝘀 ✔ 𝐖𝐞 𝐡𝐞𝐥𝐩 𝐛𝐨𝐫𝐫𝐨𝐰𝐞𝐫𝐬 𝐫𝐞𝐚𝐜𝐡 𝐚𝐧 𝐚𝐦𝐢𝐜𝐚𝐛𝐥𝐞 𝐬𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 𝐰𝐢𝐭𝐡 𝐭𝐡𝐞 𝐛𝐚𝐧𝐤𝐬 𝐰𝐡𝐞𝐧 𝐭𝐡𝐞𝐲 𝐟𝐚𝐢𝐥 𝐭𝐨 𝐝𝐨 𝐬𝐨 𝐚𝐭 𝐭𝐡𝐞𝐢𝐫 𝐥𝐞𝐯𝐞𝐥. 𝐖𝐞 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐚 𝐨𝐧𝐞-𝐬𝐭𝐨𝐩 𝐬𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐟𝐨𝐫 𝐛𝐚𝐧𝐤𝐢𝐧𝐠, 𝐥𝐞𝐠𝐚𝐥, 𝐚𝐧𝐝 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐦𝐚𝐭𝐭𝐞𝐫𝐬 𝐫𝐞𝐥𝐚𝐭𝐞𝐝 𝐭𝐨 𝐩𝐫𝐞-𝐚𝐧𝐝 𝐩𝐨𝐬𝐭-𝐍𝐏𝐀 𝐬𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧𝐬. 𝗡𝗣𝗔 𝗖𝗼𝗻𝘀𝘂𝗹𝘁𝗮𝗻𝘁𝘀 𝗣𝘃𝘁. 𝗟𝘁𝗱 📱 +𝟗𝟏𝟖𝟗𝟐𝟖𝟐𝟖𝟗𝟎𝟕𝟎 📧 𝐢𝐧𝐟𝐨@𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧 🌐 𝐡𝐭𝐭𝐩𝐬://𝐰𝐰𝐰.𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧

0 notes

Text

𝐖𝐡𝐲 𝐎𝐧𝐞-𝐓𝐢𝐦𝐞 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭𝐬 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐊𝐞𝐲 𝐭𝐨 𝐒𝐮𝐜𝐜𝐞𝐬𝐬𝐟𝐮𝐥𝐥𝐲 𝐌𝐢𝐧𝐢𝐦𝐢𝐳𝐞 𝐃𝐞𝐛𝐭?

When an account becomes Non-Paying Account, a one-time settlement is one of the main negotiation processes between a debtor and a creditor. In this process, a debtor is required to pay an amount less than the total amount owned. Normally, this strategy is used for recovering unsecured debts, but it is an effective strategy for recover Non-Performing Assets as well.

One-time Settlement Process

In this NPA Account Settlement process, the task of debt settlement is generally initiated by the debtor. Alternatively, it can be initiated through a debt settlement company as well. Broadly, this process is categorized into three sections.

Fund accumulation

When the debtor stops making payments on the loan, the fund is accumulated in a separate account. There is dual purpose of this action: it prepares a lump-sum amount for the settlement offer. It also offers leverage in negotiations because the creditor wants to recover at least a portion of the debt.

Negotiation for settlement

When a substantial amount gets accumulated, the debtor approaches the creditors to negotiate a reduced paying amount.

The negotiation process takes some time. How much time will be required? It depends on the financial situation of the debtor and of course, the willingness of the creditor to settle.

One-time settlement

Once the debtor and creditor settle an agreement, the debtor pays the agreed-upon amount. The remaining amount is forgiven. If the negotiation fails, then the debtor has to pay the full debt amount. In addition to it, interest amounts and late fees, if any, are required to be paid.

Why is a one-time settlement a Good Idea?

As far as NPA Account Settlement is concerned, it is a viable option. However, it largely depends on individual circumstances. There are also drawbacks to this process.

What are the factors that make a one-time settlement a great idea?

It reduces debt

One of the biggest benefits of debt settlement is it reduces the total debt owed. When the creditor ends with a successful negotiation, it can bring down the principal amount significantly.

It reduces the possibility of bankruptcy

One-time settlement can be an alternative to bankruptcy. It is a good thing because bankruptcy has more severe impacts on the financial future and credit history of debtors.

It impacts the credit rating

Since the creditor will be asking for a one-time Non-Performing Assets settlement and the debtor will be paying money once. The debt settlement will severely damage the credit rating. Still, this one-time settlement affects the credit rating of the debtor. It takes a longer time to restore the rating to higher levels.

It is a known aspect that credit rating impacts the credibility of the company or individual and its eligibility for applying for new credits, rental agreements, loans, and mortgages.

A few inhibiting aspects

But we cannot say that there are only positive impacts of one-time NPA Account Settlement. There are some limiting aspects as well.

Impact on the financial capability of debtors

If the financial capability of the debtor is tough and he cannot make further payments, then debt settlement may not be a good choice.

Speed of debt repayment

When a debtor applies for a one-time debt settlement, it may take a few months before the actual settlement takes place. The debtor may be able to repay the debt faster than by making regular payments over time.

Conclusion

One-time settlement is one of the impactful and useful ways of reducing Non-Performing Assets. Once the lender agrees to pay the amount as a one-time settlement, the lender might have a better mindset to do negotiations further and make mutually agreeable terms of settlement. Debt settlement is all about how well a lender and borrower can negotiate better terms and conditions.

0 notes

Text

𝐀𝐝𝐯𝐢𝐜𝐞 𝐭𝐨 𝐌𝐒𝐌𝐄𝐬 𝐮𝐧𝐝𝐞𝐫 𝐩𝐫𝐞 𝐨𝐫 𝐩𝐨𝐬𝐭 𝐍𝐏𝐀 𝐬𝐢𝐭𝐮𝐚𝐭𝐢𝐨𝐧

Our first 𝐚𝐝𝐯𝐢𝐜𝐞 𝐭𝐨 𝐌𝐒𝐌𝐄𝐬 is “𝐃𝐎𝐍𝐓 𝐏𝐀𝐘 𝐁𝐀𝐍𝐊, 𝐓𝐢𝐥𝐥 𝐰𝐞 𝐦𝐞𝐞𝐭” That means you have to stop payments towards loan obligations. Do not pay by borrowing from external sources just to avoid NPA tag or to delay further recovery action. Once you are under stress / NPA you have to think only about two things. One is to take the legal protection to safeguard the valuable mortgaged assets and second is to revive the business. Your business is the only solution to all your problems including banking and NPA.

𝐑𝐞𝐚𝐝 𝐌𝐨𝐫𝐞:- https://tinyurl.com/advicetomsmes

𝐋𝐞𝐭𝐬 𝐂𝐨𝐧𝐧𝐞𝐜𝐭 𝐍𝐨𝐰! 📱 +𝟗𝟏𝟖𝟗𝟐𝟖𝟐𝟖𝟗𝟎𝟕𝟎 📧 𝐢𝐧𝐟𝐨@𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧 🌐 𝐡𝐭𝐭𝐩𝐬://𝐰𝐰𝐰.𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧

0 notes

Text

𝗡𝗼𝗻 𝗣𝗲𝗿𝗳𝗼𝗿𝗺𝗶𝗻𝗴 𝗮𝘀𝘀𝗲𝘁𝘀 𝗶𝗺𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻𝘀, 𝗟𝗶𝗺𝗶𝘁𝗮𝘁𝗶𝗼𝗻𝘀 𝗼𝗻 𝗿𝗲𝗰𝗼𝘃𝗲𝗿𝘆 & 𝗺𝗲𝗮𝘀𝘂𝗿𝗲 𝘁𝗼 𝗡𝗣𝗔

Non Performing Asset is a status of a borrower when he commits default in repayment obligations against the various loan facilities availed from the bank. If there is a continuous default of 90 days, the borrowers account is categorized as a Non Performing Asset. The NPA in India has grown and is growing at a very past pace.

The implications of NPA are very serious, as post NPA classification, the bank starts initiating the recovery process aggressively through SARFAESI ACT, RDDBFI Act, MCS Act or IBC Act etc as applicable or as the Bank may deem fit. The entire focus is on maximum recovery of dues rather than helping the borrower to revive the business.

The business thus likely comes to a standstill. Non-performing Assets are confiscated. The personal assets and personal guarantees of borrowers and guarantors are also encashed. The borrowers and guarantors can lose their mortgaged assets within 170 – 200 days from the date of receipt of the first notice under Section 13(2) of the SARFAESI Act.

𝐋𝐞𝐭𝐬 𝐂𝐨𝐧𝐧𝐞𝐜𝐭 𝐍𝐨𝐰! 📱 +𝟗𝟏𝟖𝟗𝟐𝟖𝟐𝟖𝟗𝟎𝟕𝟎 📧 𝐢𝐧𝐟𝐨@𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧 🌐 𝐡𝐭𝐭𝐩𝐬://𝐰𝐰𝐰.𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧

0 notes

Text

𝐍𝐞𝐠𝐨𝐭𝐢𝐚𝐭𝐢𝐧𝐠 𝐌𝐮𝐭𝐮𝐚𝐥𝐥𝐲 𝐅𝐚𝐯𝐨𝐮𝐫𝐚𝐛𝐥𝐞 𝐎𝐓𝐒 𝐓𝐞𝐫𝐦𝐬 𝐟𝐨𝐫 𝐁𝐚𝐧𝐤𝐬 & 𝐒𝐌𝐄𝐬 𝐚𝐥𝐢𝐤𝐞

In the bustling financial landscape of India, the management of Non-Performing Assets (NPAs) has become a pressing concern for banks and financial institutions. With the emergence of regulatory bodies like the Debt Recovery Appellate Tribunal (DRAT) in Mumbai, the need for effective NPA management and debt restructuring solutions has never been more critical.

Enter NPA Consultant Pvt Ltd, a leading firm specializing in comprehensive NPA management and debt restructuring services. With a team of seasoned professionals and deep expertise in the intricacies of Indian financial regulations, we offer tailored solutions to address the complex challenges faced by banks, SME owners, and loan defaulters alike.

At the heart of our offerings is our commitment to facilitating One Time Settlement (OTS) funding, a strategic approach to resolving NPA issues swiftly and amicably. Leveraging our extensive network and industry insights, we work closely with banks and defaulters, including SME owners, to negotiate favorable settlement terms, enabling both parties to achieve mutually beneficial outcomes.

Through meticulous analysis and innovative strategies, we helps SME owner navigate the complexities of debt restructuring, minimizing losses , this in turn also helps bank in optimizing recovery efforts. From assessing the viability of OTS proposals to structuring repayment plans and facilitating legal proceedings, NPA Consultant Pvt Ltd provides end-to-end support to streamline the resolution process and restore financial health for SME owners and other stakeholders.

We recognize the importance of fostering transparent communication and trust between banks, SME owners, who are, unfortunately, and despite servicing the loan for long, are considered defaulters throughout the resolution journey. By fostering collaborative relationships built on integrity and professionalism, NPA Consultant Pvt Ltd ensures that all stakeholders, SME owners , are empowered to make informed decisions and achieve sustainable results.

In a landscape where NPAs pose significant challenges to the stability of India's banking sector, NPA Consultant Pvt Ltd stands as a trusted ally, offering innovative solutions and unwavering support to navigate the complexities of debt recovery and restructuring. With its proven track record of success and unwavering commitment to excellence, NPA Consultant Pvt Ltd is poised to lead the way in shaping the future of NPA management for SME owners and all stakeholders in India's evolving financial landscape.

0 notes

Text

𝐑𝐨𝐥𝐞 𝐨𝐟 𝐚 𝐃𝐞𝐛𝐭 𝐀𝐝𝐯𝐢𝐬𝐨𝐫𝐲 𝐅𝐢𝐫𝐦. 𝐇𝐨𝐰 𝐰𝐞 𝐝𝐨 𝐨𝐮𝐫 𝐣𝐨𝐛 🙂

𝗡𝗣𝗔 𝗖𝗼𝗻𝘀𝘂𝗹𝘁𝗮𝗻𝘁𝘀 𝗣𝘃𝘁 𝗟𝘁𝗱, 𝐃𝐞𝐛𝐭 𝐚𝐝𝐯𝐢𝐬𝐨𝐫𝐲 𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭𝐬 𝐟𝐫𝐨𝐦 𝐌𝐮𝐦𝐛𝐚𝐢, pledged to play a pivotal role in assisting SMEs with the resolution of

𝐍𝐨𝐧-𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐢𝐧𝐠 𝐀𝐬𝐬𝐞𝐭𝐬 (𝐍𝐏𝐀𝐬) and stressed asset situations. Here's how seriously we think of our contributions, calibrate and recalibrate with the landscape that we have been witnessing since past 30 years:

𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐚𝐧𝐝 𝐀𝐬𝐬𝐞𝐬𝐬𝐦𝐞𝐧𝐭: NPA Consultants conduct in-depth assessments of SMEs' financial status, meticulously analyzing factors contributing to NPAs or stressed assets. We scrutinize cash flow, debt obligations, asset quality, and operational challenges to pinpoint underlying issues and devise customized solutions. 𝗗𝗲𝗯𝘁 𝗥𝗲𝘀𝘁𝗿𝘂𝗰𝘁𝘂𝗿𝗶𝗻𝗴 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝗶𝗲𝘀: We advise SMEs on optimal debt restructuring strategies tailored to their unique circumstances. Those involve renegotiating interest rates, extending repayment periods, or converting debt into equity to alleviate financial pressure and enhance liquidity. 𝗡𝗲𝗴𝗼𝘁𝗶𝗮𝘁𝗶𝗼𝗻 𝗘𝘅𝗽𝗲𝗿𝘁𝗶𝘀𝗲: We spearhead the negotiation with lenders on behalf of our clients advocating for fair and viable debt resolution options. Through constructive dialogue, we secure mutually beneficial agreements, including one-time settlements, debt restructuring plans, or alternative repayment arrangements. 𝗘𝘅𝗽𝗹𝗼𝗿𝗶𝗻𝗴 𝗔𝗹𝘁𝗲𝗿𝗻𝗮𝘁𝗶𝘃𝗲 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗻𝗴: In addition to traditional bank loans, we explore alternative financing avenues, such as private equity investment or venture capital funding, to inject much-needed working capital and support SMEs' recovery efforts. 𝗢𝗽𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗘𝗻𝗵𝗮𝗻𝗰𝗲𝗺𝗲𝗻𝘁: We offer strategic advice on operational improvements to boost efficiency, reduce costs, and optimize cash flow. By identifying areas for process optimization and working capital management, we look to strengthen our clients’ financial footing and mitigate future risks. 𝗥𝗶𝘀𝗸 𝗠𝗶𝘁𝗶𝗴𝗮𝘁𝗶𝗼𝗻 𝗦𝘁𝗿𝗮𝘁𝗲𝗴𝗶𝗲𝘀: Going by our name, NPA Consultants, we drive SMEs to implement robust risk management strategies and develop contingency plans, assess risk exposures, and establish monitoring mechanisms to preemptively identify and manage potential challenges. 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗼𝗿𝘆 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 𝗚𝘂𝗶𝗱𝗮𝗻𝗰𝗲: As soon as dialogue with lenders begin, we ensure SMEs we represent , adhere to regulatory requirements and guidelines governing debt resolution processes. We guide on legal and regulatory obligations, including compliance with relevant legislation such as the SARFAESI Act and Insolvency and Bankruptcy Code.

At our core, NPA Consultants Pvt Ltd empower SMEs to navigate NPAs and stressed asset situations effectively, facilitating debt resolution, financial recovery, and sustainable business growth.

𝐋𝐞𝐭𝐬 𝐂𝐨𝐧𝐧𝐞𝐜𝐭 𝐍𝐨𝐰! 📱 +𝟗𝟏𝟖𝟗𝟐𝟖𝟐𝟖𝟗𝟎𝟕𝟎 📧 𝐢𝐧𝐟𝐨@𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧 🌐 ��𝐭𝐭𝐩𝐬://𝐰𝐰𝐰.𝐧𝐩𝐚𝐜𝐨𝐧𝐬𝐮𝐥𝐭𝐚𝐧𝐭.𝐢𝐧

#debtadvisory #npaconsultant, #smes

0 notes