Debt collectors need to have the right confidence so that you can get the right outcomes for which you hired them. Contact Frontline Collections - (Debt Collection Agency Manchester) now. Call 03330434426

Don't wanna be here? Send us removal request.

Text

What factors do you need to consider while choosing a debt collection agency?

These days you have to put a lot of effort into making your business run successfully. Getting your debts on time is one of those efforts. For this, you have to take professional help as they have more experience in debt collection and can give you fast results. Hiring a collection agency is not a small task. You have to consider various factors before reaching a conclusion. Here are some factors that must be considered:

First of all, you have to assess your debt collection needs as this will help in simplifying your task. Undertake a detailed analysis to get the best results.

Another factor you have to consider is their efficiency in the field of debt collection. This can be checked by viewing the company’s past performance.

Before trusting someone with your money you have to check whether they are reliable and trustworthy enough or not.

Your budget for this test will be checked and the companies will be finalized as per this budget only.

0 notes

Text

What are the different channels of communication used for contacting debtors for debt payment?

When it becomes to the repayment of the pending debt people start ignoring the debt collectors or giving excuses for nonpayment of the debt. These days due to multiple tasks businesses are occupied and are not able to focus on debt recovery. Therefore they hire an external company to do this on their behang cf.\\ their firm. The debt collectors will get all the information about the debtor from the firm and they will contact them for debt payment. Here are some commonly used communication channels:

Text messages

This is the most commonly used channel that debt collectors use in their initial interaction with the debtor. It is short and brief and made to remind them of the pending payment.

Phone calls

This is th another widely used communication channel which is used by the collection team to contact the debtor. Make sure you are equipped with full fledge information during the call.

Legal Documents

In case if the debt collection firm feels that they are not getting the desired results from the above Chanel they will take legal assistance. Make sure you use it as a last resort.

At Frontline Collections - (Debt Collection Agency Manchester) we use the channels as per the age of the debt.

0 notes

Text

Does debt go away after 5 years?

Anyone who has experienced the humiliation and annoyance of a collection agency's pursuit can attest to how relentless, merciless, and aggressive they can be. Nobody like being in debt or being hassled, but if you have a collection account,

What You Need To Know Before Dealing With A Debt Collection Agency?

Anyone who has experienced the humiliation and annoyance of a collection agency's pursuit can attest to how relentless, merciless, and aggressive they can be. Nobody like being in debt or being hassled, but if you have a collection account, you'll have to put up with these problems as well as many more.

When will debt collectors enter the picture?

A borrower suffers severe damage from a default. It can affect their credit report negatively, lower their credit score, and make life challenging for at least a few years. However, defaults are also bad news for lenders. They take up a lot of money and time and are not worth the bother.

After a missed payment, your creditor will attempt to come to an agreement with you. If they think it would assist you make payments, they'll take refinancing possibilities and even grace periods into account. The debt will be transferred to a debt collection agency if you ignore such letters and calls or continue to flout your duties.

How to Approach Debt Collection Firms

When working with a debt collection agency, bear the following in mind:

Be Fair, Friendly, and Firm: Debt collectors may be trying to get money from you that you don't have, but in the end, they're only doing their job and acting legally. They are also people, and they will respond aggressively if you are short with them. Be amiable, but don't allow them push you aside. As soon as they adopt an aggressive tone, you may alter your tone to demonstrate that you won't be pushed aside.

Recognize Your Rights: A debt collector will make contact with you as soon as an account is placed in collections. Now that you know what they can and cannot do, you should verify your local laws on fair practises and statutes of limitations.

Don't Trust Them: Don't take their statements as gospel if they seem shaky. Leave it at that after assuring them that you would check into it. You don't have to make decisions right away, and you shouldn't take everything they say at face value without first checking it. They could employ fear tactics to get you to accept higher settlements/repayments than you can afford or to pay debts for which the statue of limitations has expired.

What are the Procedures for Handling Them?

Take great care while dealing with a debt collection agency. When dealing with them, bear the following procedures in mind:

Refuse to pay anything

When they initially get in touch with you, they'll try to intimidate and terrify you into paying. Since they have the edge of surprise and have you off guard, this is when they are most potent. They will use every tactic at their disposal to get you to pay part or all of the debt, but the moment you do, you are accepting it, and that might have very negative effects on you.

Conclusion

You can also write a formal letter to the debt collector asking them to cease calling you; they must abide by your request. Ask your attorney for advice on how to format the letter appropriately. Asking for more information when a debt collector calls for the first time is always the most crucial thing you can do. You and your attorney can choose which course of action to follow and the validity of their claim by learning more about them, their business, and your debt.

#DebtCollector#DebtCollectors#DebtCollectionAgency#DebtCollectionAgencyManchester#DebtRecovery#DebtCollection

0 notes

Photo

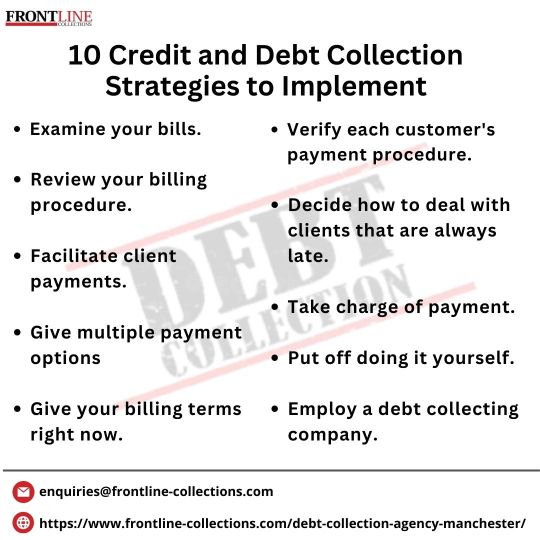

Businesses may need to use debt collection to get the money they are due. These recommendations can help small businesses better collect debt. You can stabilise your cash flow and collect money from your consumers without upsetting them with the use of an effective debt collection plan. For company owners wishing to improve their debt collection procedures, read this 10 points.

0 notes

Text

Debt collection technique for business owners

Frontline Collections - (Debt Collection Agency Manchester)is a renowned debt collector firm having expertise in collecting debts overdue for a long time period. Our efficient staff can handle difficult debtors easily.

As a business owner, you have a lot of responsibilities on your shoulders. Collection of pending debts from the debtor is an important thing that needs to be done. This task seems to be simple but is not. You need to be tactful and follow the right collection methods. Be ready to face challenges and excuses from the debtors while making collection calls or during face-to-face meetings. In case you start feeling overburdened or not getting the desired results while debt collection you can hire a third-party debt collection agency to help you in this.

Effective debt collection techniques to help business owners

Are you planning to undertake debt collection for your business on your own? Here are some effective collection techniques you must follow:

Use multiple methods to communicate

Sometimes you might not get desired results using a single debt collection method. To solve this issue you need to use different communication mediums with different debtors. Sometimes you should remind them by texting them or calling them. Whereas if they are not responding properly you might meet them face to face or visit their commercial premises.

Get your facts clear

Before approaching the debtor for the debt collection you need to research well about the personal details of the debtors such as name, profession, the amount they have to give, and date of repayment. Also, get an idea about laws related to debt collection. This will help in making your collection task easy and less time-consuming.

Be a good listener

During debt collection, some companies do not listen to the other party which spoils the business relations. You must give the debtor a chance to express themselves and explain the reasons for not making the payment on time. Being a good listener will help you maintain a healthy relationship with your debtors. Be ready to handle difficult debtors.

Know when to stop

If you feel that even after repeated efforts you are not able to get a positive response from the debtors regarding the payment then stop then and there. This will prevent you from spending further expenses on one particular debtor. In such a case hiring an expert debt collection agency in Manchester to collect the debts would be a great option.

Communicate effectively

As a business owner, you must know how to communicate with your customers. When meeting with the debtor regarding debt recovery you must be persuasive and clear enough to convince them for the payment. Have all the arguments ready with you and try to counter each and every excuse they give with a feasible solution.

Send a final demand letter

If you have approached the debtor many times and they are not ready to pay your money. Then send them a final demand letter. This letter would be the last resort before proceeding with legal actions against the debtor. This might affect your business relations therefore Use this method only when it becomes an absolute necessity to do so.

Summing up

These are some of the effective collection techniques a business owner can follow when collecting unpaid debts from debtors. The collection calls and messages must be persuasive in nature and should not be very rude. Make sure to listen to debtors carefully and try to understand their present situation.

Frontline Collections — (Debt Collection Agency Manchester)is a renowned debt collector firm having expertise in collecting debts overdue for a long time period. Our efficient staff can handle difficult debtors easily.

1 note

·

View note

Text

Hire experts and say goodbye to your worries of debt collection

You will have to pay for debt collection services, but you may discover a company that can offer assistance at a reasonable fee. For instance, you can decide whether to pay your debt collection agency Manchester a fixed rate or a commission. Additionally, you can discuss with your agent whatever payment method is ideal.

Your collection agency will go after your debtors and persuade them to make timely payments on their obligations. Additionally, the agency will watch out for your reputation during the debt collection process. The agency will apply moderate pressure to your debtors.

Businesses employ debt collection firms because they shield them from the inconvenience of legal proceedings. Your collection agent will communicate with your debtors and encourage them to pay back their loan. The agent will assist the debtors in getting out of debt in this way.

Although it isn't your duty to collect debt, you must do it since your money is stranded in the market. Although you have a limited amount of time, you can chase after the clients. Additionally, you lack the skills necessary to chase debtors and persuade them to pay off their obligations swiftly. This is the situation where you want a seasoned agent who can do the task without any problem.

1 note

·

View note

Link

When looking for a debt collection agency look no further as Frontline Collections - (Debt Collection Agency Manchester) are here with years of experience to help you with the best.

1 note

·

View note

Photo

When looking for a debt collection agency look no further as Frontline Collections - (Debt Collection Agency Manchester) are here with years of experience to help you with the best.

1 note

·

View note

Photo

Looking to hire a good debt collection agency Manchester? We can prove to be your best companion with quality services.

for more details visit here: https://www.frontline-collections.com/debt-collection-agency-manchester/

1 note

·

View note

Text

Hiring the collectors lead your to quick results

Both recovered and unrecovered debt are kept in the records of debt collection agencies. They are compensated for effective recuperation, so they work hard to do it each time. Your agent will adhere to the documentation for debt collection. Additionally, you may use the information to determine which debtor is timely remitting his obligation.

Although it isn't your duty to collect debt, you must do it since your money is stranded in the market. Although you have a limited amount of time, you can chase after the clients. Additionally, you lack the skills necessary to chase debtors and persuade them to pay off their obligations swiftly.

Many people no longer use the tried-and-true strategy of filing lawsuits in an effort to get a County Court judgment as their first option when trying to recover money owed. Instead, it is currently seen to be much more cost-effective to use a reputable debt collecting service. Find the top debt collectors to assist you. Even if and if a CCJ is obtained, you will still have to overcome the extra challenge of CCJ Enforcement, which, depending on the debtor's circumstances, can be a difficult task.

0 notes

Link

1 note

·

View note