Text

Secure Enclave Redundancy

With concerns about SGX exploits, the Chainlink 2.0 whitepaper addresses this issue by exploring ways to “employ TEEs in ways that recognize their potential for compromise” and also recommends use cases outside of Intel technology with an open source alternative—Keystone. Keystone is based on RISC-V architecture, which has already made headway in the smart contract space. Working together, ETH…

View On WordPress

#AMD Secure Technology#Keystone Secure Enclave#Secure Enclave Technology#SGX#Trusted Execution Environment

5 notes

·

View notes

Text

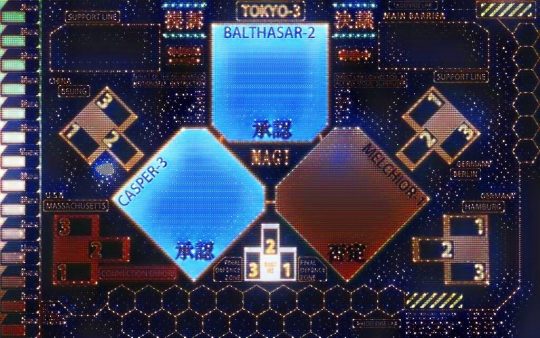

Projects Utilizing Uniswap Oracle

Projects Utilizing Uniswap Oracle

1. BZX

“bZx is currently using uniswap as a price oracle.”:

https://www.reddit.com/r/ethtrader/comments/f4bugn/hacker_makes_360000_eth_from_a_flash_loan_single/fhqo8ff/ 2. DefiRate

https://defirate.com/uniswap-v2/

An interest rate comparison tool, seems to use them

3. Others

UniSwap Ninja: https://www.reddit.com/r/UniSwap/comments/d0hjwc/uniswapninja_decentralized_token_l…

View On WordPress

8 notes

·

View notes

Photo

New Post has been published on https://enclaveresearch.com/projects-utilizing-uniswap-oracle/

Projects Utilizing Uniswap Oracle

1. BZX

“bZx is currently using uniswap as a price oracle.”:

Comment from discussion orm12345’s comment from discussion "Hacker Makes $360,000 ETH From a Flash Loan Single Transaction Involving Fulcrum, Compound, DyDx and Uniswap".

2. DefiRate

Uniswap V2: ERC20 Pairs, Oracle Upgrades, Flash Swaps + Uniswap DAO

An interest rate comparison tool, seems to use them

3. Others

UniSwap Ninja: https://www.reddit.com/r/UniSwap/comments/d0hjwc/uniswapninja_decentralized_token_listing_and/

BlockLytics: is offering it for their clients: https://blocklytics.org/blog/uniswap-api/

Debank: https://debank.com/projects/uniswap?mode=data Shows volume price liquidity. You can tell possible good pumps before they happen by looking at liquidity as a ratio of market cap.

0 notes

Text

Recent & Future Token Buybacks & Burns

Recent & Future Token Buybacks & Burns

1. BNB

Binance exchange’s native token just completed a 3,373,988 burn. BNB has performed exceptionally well during this period and is expected to continue. However, users are wishing to use BNB as collateral for futures trading, in addition to its’ current fee payment and discounts offered.

2. LCS Token

Amount of LCS burnt: 169,824.8061 LCS

Average LCS buyback price: 0.00000161 BTC /…

View On WordPress

0 notes

Photo

New Post has been published on https://enclaveresearch.com/recent-future-token-buybacks-burns/

Recent & Future Token Buybacks & Burns

1. BNB

Binance exchange’s native token just completed a 3,373,988 burn. BNB has performed exceptionally well during this period and is expected to continue. However, users are wishing to use BNB as collateral for futures trading, in addition to its’ current fee payment and discounts offered.

2. LCS Token

Amount of LCS burnt: 169,824.8061 LCS

Average LCS buyback price: 0.00000161 BTC / 0.01158 USD

Price increase during buyback: 26.32%

LCS is part of a P2P powered exchange.

3. OKB

Similar to BNB, OKB is also an exchange native token. Time will tell if it will do as well as it’s older peers.

4. Ontology

Ontology is a web-assembly enabled public blockchain and distributed collaboration platform. It bought back a large sum in order to encourage interest.

5. SwissBorg

Swissborg is a mobile crypto exchange that accepts a variety of fiat on ramps. However, they are aiming to be active in less-regulated countries before starting in the U.S. Their Protect & Burn scheme differentiates itself by not announcing the timing of the burns before they happen. Instead, they buy at a certain fall in price.

6. MKR

Emergency Shutdown is activated: If MKR voters believe that the system is subject to a high-severity attack, or if an Emergency Shutdown is scheduled as part of a technical upgrade, they can activate an Emergency Shutdown. This locks the system, freezing the DSR, stopping Vault creation and the ability to generate Dai, and locally freezes the Reference Prices. Vault owners can immediately withdraw excess collateral.

Any combination of MKR token holders, whether minority or majority holders, can triggered emergency shutdown by locking 50,000 MKR in the Emergency Shutdown Module:

Emergency Shutdown Module will burn those tokens. So, you better have a plan for how you’re going to rally the community behind your shutdown to get MKR tokens back in the new system.

7. NMR

In an effort to become fully decentralized, NMR’s Erasure Bay has enabled it’s users to burn NMR in a distributed way. When a responder doesn’t provide sufficient data requested, the requester can choose to burn their tokens as punishment.

0 notes

Text

Is LINK Blockchain Agnostic?

Is LINK Blockchain Agnostic?

Interoperability and dependence on the Ethereum blockchain is a concern that crops up now and then in chainlink circles. Even commenters with technical backgrounds have trouble grappling with the idea that a token could be independent from the blockchain it’s built on. At a high level, if you think a team expressly focused and specialized in bridging off-chain to on-chain data would have no…

View On WordPress

1 note

·

View note

Photo

New Post has been published on https://enclaveresearch.com/is-link-blockchain-agnostic/

Is LINK Blockchain Agnostic?

Interoperability and dependence on the Ethereum blockchain is a concern that crops up now and then in chainlink circles. Even commenters with technical backgrounds have trouble grappling with the idea that a token could be independent from the blockchain it’s built on. At a high level, if you think a team expressly focused and specialized in bridging off-chain to on-chain data would have no trouble producing an agnostic system, then read no further. At a deeper level though, this doubt might arise from a misunderstanding of how tokenomics will apply to open source projects going forward. We will go over these thoughts, review some past blockchain-token migrations, and how they will be handled in the future. Keep in mind the concern here is already based on a pessimistic outlook: one where Ethereum is not the standard for widespread smart contract use, or where it is fragmented among multiple smart contract platforms of considerable use, necessitating “agnosticism”.

I absolutely believe that. Make no mistake – $ETH needs $link, but $link doesn’t NEED $ETH. $link is blockchain agnostic, and will enable secure data & payment I/O and interconnectivity on whatever chain(s) become the standard. $link IS the standard in decentralized oracles.

— 🦆Ducks in a row🦆 (@LINK_2_4IR) January 8, 2020

Also note the arguments here are explicitly attributed to the Chainlink token as an reliable and enduring account of network value, not merely as a surviving idea or software protocol. We’ll review some strong forces at play binding them together.

As additional smart contract platforms gain native support by the Chainlink network in the future, details will be released about how to transfer LINK to that blockchain.

Chainlink FAQ

Past Migrations

Complete abandonment/migration of platforms have been pulled off in the past with surprising ease. Since blockchains are historic ledgers after all, it’s easy to track and release tokens to the rightful owner. Since many people have copies, it’s even possible to re-distribute in the extreme event that the original blockchain grinds to a halt. Storj is just one of many projects that have made transitions in the past, without major hiccup. The tokens were re-distributed fairly at a 1:1 ratio from Counterparty(built on bitcoin) to Ethereum. Project creators know that it’s best not to screw over your token holders as they will be the ones needed to bootstrap the network later. Similarly, Tether also made a major transition from Omni(built on Bitcoin) to Ethereum. Apparently 2nd layer solutions are not desired when compared to on-chain token solutions.

It's literally the opposite of what you are saying.

— Anthony Bertolino (@iDecentralized) January 9, 2020

Atomic Swaps

In a scenario where two or more prominent smart contract platforms exist, there may be a way to create a lockup or burn when transferring to another platform. Thus preserving the scarcity of the token. Enforcement of scarcity might be an emergent property in the future. Just as today, silver and gold coins are tested to make sure they are “real”, token holders of the future may audit an atomic swapped token’s history, to make sure the original token was burned or locked.

Tokenomics

It is well-known that once a network effect takes hold, it can be very hard for competing systems to gain adoption. Failed networks that lose momentum are often abandoned due to unnecessary barriers to entry, price-fixing and lack of flexibility. Once value/utility is well established, history has shown that simply allowing participants to adjust their own parameters is enough to prevent defection to competitors. This openness fits well with the chainlink team’s ethos.

We created a framework with minimal requirements, yet unbounded flexibility, so you can focus more on the functionality of your smart contracts.

Chainlink Solidity Reference

Currently, chainlink configuration variables are freely adjustable for node operators and should therefore be flexible to market forces. MINIMUM_CONTRACT_PAYMENT can be used in the configuration variables for node operators wishing to earn certain levels of income. Meanwhile LINK_CONTRACT_ADDRESS is used to hold any required staking as part of a contract request.

You might think that requiring people to use the chainlink token is an artificial barrier. Although, as we pointed out in a previous post there are now dexs that will enable seamless conversion and use between platforms. If you are a oracle consumer or smart contract creator, but hold no chainlink tokens, it’s not hard to envision a simple add on, which converts your ETH seamlessly in the background as part of the normal process.

If you are still unconvinced of chainlink’s token utility, then simply envision a future in which the protocol changes to allow both Ethereum and Chainlink tokens for smart contract payments and deposits. The only things really needed for a medium of exchange and deposit is sufficient value, liquidity, and stability. Since the Chainlink’s token supply is fixed, Gresham’s Law does not apply. There is no way to debase in the token economy. Meanwhile ETH would be slowly inflating. Compared to other Cryptocurrencies, Chainlink would still be increasingly scarce. As one of the most popular tokens trading liquidity is sufficient to enable people to aquire and sell, meanwhile any instability in the token can be hedged with increased stake/payment amount.

Technical challenges

You might think that as opposed to an economic challenge, there could be some bug or technical challenge that the Chainlink protocol has wrong that could put the network at risk in the future. Although I argue that these problems are not catastrophic once the network reaches a certain size and momentum. I argue that we are already past this stage now with Chainlink. Chainlink’s large head start in terms of awareness, adoption and developer activity means that critical flaws may be rerouted and competitor advantages absorbed.

0 notes

Text

A Marketplace of Advice

A Marketplace of Advice

Today, Stackoverflow and Quora provide deep wells of advice and troubleshooting tips. Despite well-tuned moderation systems and large user bases, there remains a shortage of the right people willing to answer.

These forums have taken the traditional approach–earn revenue by placing ads, partnering with recruiters and by offering “talent solutions”. However, the ad-based approach seems to be…

View On WordPress

2 notes

·

View notes

Photo

New Post has been published on https://enclaveresearch.com/a-marketplace-of-advice/

A Marketplace of Advice

Today, Stackoverflow and Quora provide deep wells of advice and troubleshooting tips. Despite well-tuned moderation systems and large user bases, there remains a shortage of the right people willing to answer.

These forums have taken the traditional approach–earn revenue by placing ads, partnering with recruiters and by offering “talent solutions”. However, the ad-based approach seems to be fading with the rise of ad blocking, fake viewership, and increased competition from other media. It’s not just the business model that may be broken–any user asking on the site often finds it hard to get answers on niche and highly contextual questions. Those which can’t be answered by a simple Google search.

Often times solution seekers are looking for technical support or a consultant but don’t because their problem isn’t big enough to warrant a big commitment. If you have a question that needs to be answered with more detail and judgement than search but less than a hired consultant, today for the most part you’re out of luck. A market failure. Even new services like whenhub and fiverr may not fit the bill, you have to take time evaluating the right person, then take more time scheduling, etc.

On one extreme end we have traditional consultants that are slow and costly, but can be uniquely tailored to the problem. On the other end we have advanced search like google, fast and free, but doesn’t offer the detail specificity and judgement that might be needed. We are missing something in-between. One with on-demand and crowdsourcing benefits in addition to the liquidity forums; without the commitment and difficulty required in choosing the right consultants or advisors. I call this the “paid forum marketplace” as a very rough working title. It would have the interface of Quora, the tipping and staking of many crypto projects, and a marketplace of professional responders.

This hybrid system would involve tipping users money for questions answered. This helps to balance the surplus of questions with focused and motivated responders. Furthermore, demand can be throttled by paying more or less depending on how badly you need an answer. A staking system could be employed, to bootstrap users and keep them engaged. Dynamic surge pricing and incentives might also work well to get knowledgeable responders, just as Uber does with surge pricing. The business model would would also match uber, taking a cut of each transaction.

Devs have hacked together tipping functionality with things like the reddit tipbot and the new BAT functionality which is helpful, but lacks the dedicated design implications needed to make a robust paid forum marketplace.

0 notes

Text

Comments on The Chainlink White Paper, Part 2

Comments on The Chainlink White Paper, Part 2

In principle, any contract which can be negotiated through a trusted third party (such as an auction or exchange) can be negotiated directly. So, in some abstract sense, the only remaining “hard” problems in smart contract negotiations are (a) problems considered hard even with a trusted intermediary (for the standard economic reasons), and (b) the task of algorithmically specifying the…

View On WordPress

4 notes

·

View notes

Photo

New Post has been published on https://enclaveresearch.com/comments-on-the-chainlink-white-paper-part-2/

Comments on The Chainlink White Paper, Part 2

In principle, any contract which can be negotiated through a trusted third party (such as an auction or exchange) can be negotiated directly. So, in some abstract sense, the only remaining “hard” problems in smart contract negotiations are (a) problems considered hard even with a trusted intermediary (for the standard economic reasons), and (b) the task of algorithmically specifying the negotiating rules and output contract terms (This includes cases where an intermediary adds knowledge unavailable to the participants, such as a lawyer giving advice on how to draft a contract). In practice, many problems which can be solved in principle with multiparty computation will re-arise when we implement protocols in an efficient, practical manner. The God Protocols give us a target to shoot for.

The God Protocols

Back in 1997, Nick Szabo published his vision of the God protocol. An unbiased, mathematically trustworthy mediator that perfectly acts in the interest of all parties.

Since then, blockchain has come to provide an immutable, trust-less record where inputs can assemble and outputs be retrieved from. His fully-fledged vision goes much further than that—to a world where countless middlemen in our economy are freed from their dull and monotonous responsibilities. As predicted 22 years later, topics considered in The God Protocol have re-arisen with the advent of blockchain, smart-contract, and secure enclave technology. However, protocol sluggishness and lack of scalability in Szabo’s time remain problems with today’s blockchain:

The first is that this virtual computer is very slow: in some cases, one arithmetic calculation per network message.

The God Protocols

Chainlink has come to address this issue, allowing for computation off-chain while still retaining much of the integrity blockchain provides. Trusted execution environments on the network allow for secure, verifiable processing with much better scaling.

Chainlink’s Town Crier solution also addresses the problem of confidentiality in a smart contract network, finally bringing to fruition a key part of Szabo’s vision:

If mutually confidential auditing ever becomes practical, we will be able to gain high confidence in the factuality of counterparties’ claims and reports without revealing identifying and accompanying information from the transactions underlying those reports.

Knowing that mutually confidential auditing can be accomplished in principle will hopefully lead us to practical solutions to these important problems.

The God Protocols

Intel SGX in conjunction with Town Crier does allow auditors to assess if the user’s application meets specifications and standards. It can then can generate final binaries, and sign them for audit. Enclaves may also process data from sources confidentially, managing sensitive information like user credentials. Many smart contract use-cases are null and void without this protection of privacy.

Szabo’s Hurdles

With the base layer(protocol-level) requirements solved, some higher level software hurdles remain, but are perhaps within reach.

Szabo goes on to illustrate the first remaining problem: “(a) those considered hard even with a trusted intermediary”. He may be referring to arbitration, indemnification, standards of proof, force majeure, and other legal sections that would be difficult to codify in a smart contract. Or, where “human trusted third parties provide insight or knowledge that cannot be provided by a computer.” In contrast with operational clauses, these situations are classified as “Non-operational” according to the International Swaps and Derivatives Association:

Operational clauses generally embed some form of conditional logic – ie, that upon the occurrence of a specified event, or at a specified time, a deterministic action is required.

Non-operational clauses do not embed such conditional logic but that, in some respect, relate to the wider legal relationship between the parties.

ISDA

One example of a non-operational clause is when a party to a contract is required to act in “good faith” or use “reasonable care”. These terms have legal meaning, but are clearly not boolean. What these terms mean is subjective and hard to codify in a way that makes sense. People tend to have varying standards along a spectrum of rigidity and leniency. Many interpretations of law are highly contextual, factoring in the unique circumstances of the case.

Take the example of a standard representation from a party that it is duly organized and validly existing under the laws of the jurisdiction of its organization or incorporation. This is not a statement of conditional logic, and so would not be susceptible to pure Boolean logic. It is a representation of a legal state. But if there were a sufficiently developed ontology for legal contracts, it would be possible to conceive of a world where a computer could understand what is meant by the terms ‘party’, ‘duly organised’, ‘validly existing’, ‘jurisdiction’ and ‘organisation and incorporation’, and could check automatically with relevant company registries whether this representation is correct at the time it is given.

ISDA

A.I. may integrate and play a large role in smart contracts of the future.

Since machine learning has made great progress writing convincing essays and poetry, it’s not unreasonable to think it may be applied to law in the future. Taking the ISDA’s conception a step further, there are millions of case-law records and judgements available for machine learning to develop ontology and reasoning from. Where cost savings outweigh the risks, future A.I. judges may only need to prove it can track alongside human ones at a reasonable rate greater than chance.

Robo-arbitration may be a method for non-operational clauses to be handled in a smart contract. This would be an ideal use-case for Town Crier’s trusted execution environments since the high compute cost would necessitate that it be run off-chain. It would also ensure the integrity of the robo-arbitrator. Innovation in this field has already begun in earnest. For example, Blue J Legal provides such software as Tax Foresight, which uses machine learning to predict how a court would rule in clients various tax scenarios. Such integration on a smartcontract network could prove a powerful tool in reducing the cost of litigation.

youtube

The second piece to the puzzle mentioned by Szabo, “(b) specifying the negotiating rules” could be solved at least in part, by a growing library of legal templates such as those offered by Openlaw and the Accord Project. These allow for reliable contracts to be deployed easily and with recommended and customizable parameters.

The Chainlink whitepaper also mentions an optional “escape hatch” to be used by authorized contract administrators in the event of an unforeseen bug or vulnerability. Again, these can be set up in a number of ways at the discretion of the smart contract users.

An oracle is, a translator for information provided by an outside platform. Oracles provide the necessary data to trigger smart contracts. The other factors which “specify negotiating rules” are how and what oracle feeds are used in determining smart contract outcome(s). The flexibility and security of which has been solved comprehensively by Town Crier:

TC can also perform trusted off-chain aggregation of data from multiple sources, as well as trusted computation over data from multiple sources (e.g., averaging) and interactive querying of data sources (e.g., searching the database of one source in response to the answer of another).

Chainlink White Paper

Today there are contracts that would theoretically be desirable, but are too costly and slow to be implemented in a traditional manner. For example, insurance contracts that need a minimum size to cover administrative and enrollment costs. Still there are other cases where contracts are violated but the cost of litigating them are too high to pursue. These are ideal niches where standardized smart contracts may flourish.

Another niche may be found in developing countries. Just as the anti-inflationary properties of crypto helps citizens of unstable regimes, a substitute legal system might also be used where property rights and rule of law are weak. Sergey Nazarov echoed this in a 2014 interview:

In the current system many businesses can raise money and make promises they won’t keep. Because they realize the banking or legal infrastructure is flawed. In the future, people will simply make a smart contract.

Sergey Nazarov

Modern smart-contract discussion conjures up thoughts of an almost magical process where automation takes over. Panels ask, “Are we getting rid of lawyers?”. The answer is categorically no. It just means fewer people working in back-offices pushing paper; which will likely be balanced with new jobs in implementation and maintenance of smart contracts themselves. Lawyers will be freed up to draft contracts and litigate the most complex cases and where human discernment is necessary. The focus would shift towards choosing and calibrating a growing library of legal templates. These changes will further be accelerated by the official recording of registration, identity, and property rights on blockchain.

Conclusion

The God Protocol is here, and with it, a new era of the internet has begun. A promising shake-up of legal systems around the world, cutting down corruption and unlocking billions in productivity. Adoption could take decades and will no doubt have its skeptics, but it seems a system closely resembling Szabo’s vision is now inevitable.

“We heard the same concern over and over again: a panic over giving up control.” is how @Benioff described initial reactions to SaaS replacing on-premise, until the value of SaaS won out. It'll be the same story with Smart Contracts, as their ability to deliver value improves

— Sergey Nazarov (@SergeyNazarov) February 20, 2018

0 notes

Text

The Most Valuable Crypto Ranking Sites

The Most Valuable Crypto Ranking Sites

Numerous Cryptocurrency ranking sites have sprung up after the 2017 run up in BTC price. Though Coinmarketcap.com still reigns supreme, some contenders have fared better than others.

Below is a ranking of the most valuable crypto ranking domains according to worthofweb.com.

Coinmarketcap.com Value: $682 Million

Coinmarketcappulls in $3,293,940 / month in ad revenue. The simple user…

View On WordPress

0 notes

Photo

New Post has been published on https://enclaveresearch.com/the-most-valuable-crypto-ranking-sites/

The Most Valuable Crypto Ranking Sites

Numerous Cryptocurrency ranking sites have sprung up after the 2017 run up in BTC price. Though Coinmarketcap.com still reigns supreme, some contenders have fared better than others.

Below is a ranking of the most valuable crypto ranking domains according to worthofweb.com.

Coinmarketcap.com Value: $682 Million

Coinmarketcap pulls in $3,293,940 / month in ad revenue. The simple user experience has appealed to the masses and has continued to do well.

Coingecko.com Value: $46 Million

Coingecko is the second largest crypto ranking site and pulls in $181,380 / month in ad revenue.

Cryptoslate.com Value: $96,000

Coming in at a very far 3rd place Cryptoslate.com features a crypto ranking as well as a market news section. The site pulls in a paltry $ 6,210 / month in revenue.

Coinranking.com Value: $45,000

Coinranking.com offers a clean, minimalist style with very few ads. Its estimated revenue is $4,140 / month

0 notes

Link

Use coupon code KITTY for 12% off!

8 notes

·

View notes

Text

Guest Post: Incentive Alignment Will Change the World

Guest Post: Incentive Alignment Will Change the World

Below is a guest post from our partner Allynment.io which covers incentive alignment news, among other high-caliber business topics.

Is it the reward system and organizational structure? How about behavioral economics? Or maybe it’s the incentive alignment. There are a number of new startups and thought leaders focusing on how organizations and the employees within them are rewarded and…

View On WordPress

0 notes

Photo

Starfire by Yoyo’s Cosplay / #28DaysofBlackCosplay

Photo by avier_perez_photography

Cosplayer instagram / facebook

Get the comics here

[Follow SuperheroesInColor faceb / instag / twitter / tumblr / pinterest]

3K notes

·

View notes