Don't wanna be here? Send us removal request.

Text

GPSC Classes in Varodara | CompetitionPedia

Join CompetitionPedia - Best GPSC Classes in Vadodara & conquer the UPSC 2024 together! We offer top gpsc classes in baroda with low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#gpsc classes in vadodara#best gpsc classes in vadodara#gpsc classes in vadodara fees#vadodara gpsc classes#gpsc classes in baroda

0 notes

Text

UPSC Tuition in Surat | UPSC Academy CompetitionPedia

Join CompetitionPedia - Best UPSC Tuition in Surat & conquer the UPSC 2024 together! We offer top upsc academy in surat with low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#upsc academy in surat#upsc tuition in surat#upsc classes in surat#upsc coaching in surat#gpsc classes in surat

0 notes

Text

IAS Academy in Vadodara | CompetitionPedia

Join CompetitionPedia - Best IAS Academy in Vadodara & conquer the UPSC 2024 together! We offer top ias coaching in baroda with low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#ias coaching in vadodara#best ias coaching in vadodara#ias classes in vadodara#ias coaching in baroda#top ias coaching in vadodara#ias academy in vadodara#ias coaching classes in vadodara

0 notes

Text

IAS Academy in Vadodara | CompetitionPedia

Join CompetitionPedia - Best IAS Academy in Vadodara & conquer the UPSC 2024 together! We offer top ias coaching in baroda with low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#ias coaching in vadodara#best ias coaching in vadodara#ias classes in vadodara#ias coaching in baroda#top ias coaching in vadodara#ias academy in vadodara#ias coaching classes in vadodara

0 notes

Text

Best UPSC Coaching in Baroda | CompetitionPedia

Join CompetitionPedia - UPSC Caoching in Baroda & conquer the UPSC 2024 together! We offer top upsc classes in baroda low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#upsc coaching in baroda#best upsc coaching in baroda#upsc classes in baroda#best upsc classes in baroda#upsc coaching classes in baroda#upsc academy in baroda

0 notes

Text

Best UPSC Coaching in Surat | CompetitionPedia

Join CompetitionPedia - UPSC Caoching in Surat & conquer the UPSC 2024 together! We offer top upsc classes in surat low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#upsc coaching in surat#best upsc coaching in surat#upsc classes in surat#best upsc classes in surat#upsc coaching classes in surat#upsc academy in surat

0 notes

Text

Why is ISRO building a second rocket launchport in Tamil Nadu’s Kulasekarapattinam?

The cornerstone for ISRO's second rocket launchpad was laid on February 28 in Kulasekarapattinam, situated in the Thoothukudi district of coastal Tamil Nadu. It will be dedicated solely to commercial, on-demand, and small satellite launches in the future. To know more about Rocket Launch Port in Tamil Nadu, visit: https://competitionpedia.in/…/news-current…/07-03-2024

#ISRO#second rocket launchport#Kulasekarapattinam#Thoothukudi#Satish Dhawan Space Centre (SDSC)#SHAR#Sriharikota#Polar Satellite Launch Vehicle (PSLV)#Geosynchronous Space Launch Vehicles (GSLV)#LVM3#Gaganyaan#human-flight mission#commercial launches#on-demand launches#Small Satellite Launch Vehicles (SSLV)#SSLV-D1#SSLV-D2.

0 notes

Text

Best GPSC Coaching in Vadodara | CompetitionPedia

Join CompetitionPedia, best gpsc coaching in vadodara. We offer top gpsc classes vadodara with low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#gpsc coaching in vadodara#gpsc coaching classes in vadodara#gpsc classes vadodara#gpsc exam classes in vadodara#gpsc coaching in baroda#best gpsc coaching classes in vadodara

0 notes

Text

Best UPSC Coaching in Vadodara | CompetitionPedia

Join CompetitionPedia, best upsc coaching in vadodara. We offer top upsc classes in vadodara low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#upsc coaching in vadodara#best upsc coaching in vadodara#upsc coaching fees in vadodara#vadodara upsc coaching#upsc coaching classes in vadodara#upsc coaching in baroda#upsc coaching centre in vadodara#upsc coaching near me

0 notes

Text

UPSC Coaching in Surat | UPSC Classes in Surat| CompetitionPedia

Join CompetitionPedia, best upsc coaching in surat. We offer top upsc classes in surat low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#upsc coaching in surat#best upsc coaching in surat#upsc classes in surat#best upsc classes in surat#upsc coaching classes in surat#upsc academy in surat

0 notes

Text

Why is ISRO building a second rocket launchport in Tamil Nadu’s Kulasekarapattinam?

The cornerstone for ISRO's second rocket launchpad was laid on February 28 in Kulasekarapattinam, situated in the Thoothukudi district of coastal Tamil Nadu. It will be dedicated solely to commercial, on-demand, and small satellite launches in the future. To know more about Rocket Launch Port in Tamil Nadu, visit: https://competitionpedia.in/…/news-current…/07-03-2024

#ISRO#second rocket launchport#Kulasekarapattinam#Thoothukudi#Satish Dhawan Space Centre (SDSC)#SHAR#Sriharikota#Polar Satellite Launch Vehicle (PSLV)#Geosynchronous Space Launch Vehicles (GSLV)#LVM3#Gaganyaan#human-flight mission#commercial launches#on-demand launches#Small Satellite Launch Vehicles (SSLV)#SSLV-D1#SSLV-D2.

0 notes

Text

CAA: Issues in the legal challenge to the law

The CAA - 2019 amends India's Citizenship Act of 1955. Explore recently notified rules under the CAA by Ministry of Home Affairs, sparking further debate and scrutiny.

#Citizenship#Citizenship Amendment Act#2019#CAA-2019#Citizenship Act of 1955#India's citizenship policy#Against muslims#religious minorities#citizenship by naturalisation#Inner Line Permit (ILP)#equality#secularism#protest#unrest#Section 6A of The Citizenship Act - 1955#Assam Accord.

0 notes

Text

Govt releases guidelines to curb unethical pharma sector practices

Stay informed on the Dept. of Pharmaceuticals' new Uniform Code for Pharmaceutical Marketing Practices 2024 & guidelines on gifts & benefits to curb unethical conduct.

#Uniform Code for Pharmaceutical Marketing Practices (UCPMP) 2024#Ethics Committee for Pharma Marketing Practices#Department of Pharmaceuticals#Gifts and Benefits#Regulated Claims and Comparisons#Conduct of Medical Representatives (MRs)#Patient#Phrama Industry#Pharmaceuticals#drugs#medicines#Patent Evergreening#Clinical Trials#Intellectual Property Rights (IPR) Issues#Active Pharmaceutical Ingredients (APIs)#healthcare infrastructure#Continuing Medical Education (CME)#Continuing Professional Development (CPD) programmes#adverse drug reactions (ADRs)#Central Drugs Standard Control Organization (CDSCO)#World Health Organization (WHO).

0 notes

Text

Best UPSC Coaching in Surat | UPSC Classes in Surat| CompetitionPedia

Join CompetitionPedia, best upsc coaching in surat. We offer top upsc classes in surat low fees for students willing to learn. To know more please call us at 9510011074 or visit our official website https://competitionpedia.in

#upsc coaching in surat#best upsc coaching in surat#upsc classes in surat#best upsc classes in surat#upsc coaching classes in surat#upsc academy in surat

0 notes

Text

The Parallel Economy in India

Economy consists of economic system of a region in amalgamation with the social factors, the labor, capital and land resources; and the production, exchange, distribution, and consumption of goods and services of that area. Consumption, saving and investment are core components in the economy and determine market equilibrium.

Parallel economy - The functioning of any unaccounted and unsanctioned economic sector whose basic operations run parallel, however against the sanctioned or legitimate sector of the economy. Parallel economy is also known as ‘unaccounted economy’, illegal economy’, ‘subterranean economy’, ‘underground wealth’, ‘black economy’, ‘parallel economy’, ‘shadow economy’, ‘underground’ or ‘unofficial’ economy, or ‘unsanctioned economy’. The parallel economy incorporates all the forms of activities through which black income is generated and those which are usually not accounted for. The money circulated in parallel economy is known as the ‘Black Money’.

Parallel economy negatively impacts the economic system of a country. Due to this, the GDP is reduced to nearly half of what should have been in the absence of the unaccounted component of economy. In other words, the volumes of the accounted and unaccounted components of the Indian economy are almost equal. Also, the black money generated in parallel economy accentuates the inequalities in income and wealth and deepens divide between rich and poor.

There are two possible sources of black money:

Source of income is itself illegitimate, ie. Income from an illegal activity like smuggling, bribery, trafficking etc.

Source of income is legitimate but it is concealed from taxation.

Causes of Black Money Generation

There are many reasons for the creation of back money in India. Some of them are as follows:

1. Controls and licensing system - Before the economic reforms, the private sectors were allowed to produce goods only with a certified license. This gave birth to the License Raj, wherein the license inspectors resorted to corrupt practices to provide licenses. This led to a huge proliferation in black money. Even today, regulatory authorities like the TRAI are known to resort to corrupt practices while dealing with private players.

2. Higher Rates of Taxes - Higher tax rates result into a tendency of tax evasion among the tax payers. Tax evasion is common in income tax, corporate tax, corporation tax, union excise duties, custom duties, sales tax , etc. As per 2022 statistics, only 5% of the Indians are tax-payers.

3. Ineffective enforcement of tax laws and corruption in Tax departments leading to tax evasion even by rich sections of India.

4. Funding of political parties through black money with the objective of influencing the government in power in order to receive undue advantages.

5. Inflation: The addition in prices of commodities like petrol, etc. in international market, boost in prices of commodities due to increase in duties and taxes imposed by the government, the artificial demand created by people with unaccounted or black money- all cause inflation which in turn leads to the circulation and hence creation of black money.

6. The reluctance of governments to bring large agricultural earnings in the ambit of income tax and to reduce the welfare dependent population base has also contributed to creation of black money.The black money accrued from other sources can be easily transformed into white by viewing it on the agricultural returns account.

7. Privatization and Public Private Partnerships (PPP) have a huge scope for generation of black income by ministers and bureaucrats.

8. Activities like smuggling, property deals, bribery,extortion, concealment of income by professionals, etc. also creates black money.

As a result, the circulation of enormous amounts of black income incessantly results in a flourishing parallel economy.

Impact of Black Income on the Indian Economy

Generation of black income, and thereby establishment of parallel economy has been creating the following serious impacts on the social and economic system of the country.

Black income causes underestimation of GDP. The volume of Black economy in India is assessed as being equal to normal economy.

The direct effect of black income is the net loss of tax revenue to the state exchequer, thus resulting in poor levels of development, and lesser government expenditure.

Actual assessment of economy is never achieved

Creates an invisible demand in the market, thus causing inflation.

Black money has resulted in the diversion of resources for the purchase of real estate and luxury housing.

Transfer of funds from India to foreign countries.

The availability of black incomes makes people unduly rich.

Black money causes psychological stress to honest tax-payers and devalues the virtues like hard-work and honesty.

Leads to a decline in moral standards in the society.

Thus, the existence of parallel economy distorts and disrupts the normal functioning of a country, the economic planning does not bear desired fruits and also the ideal pace of development and growth of the country is never achieved.

Government Initiatives

The government has taken a number of steps to curb black money.

Demonetization - A process of discontinuing currency notes in circulation.Demonetization was pursued in 1946, 1978 and in 2016, however, this process has not been successful. It was expected that only the white money will come back, while the black money will be rendered useless. On the contrary, In 1978, 99.3% of the total currency notes, while in 2016, 99.8% of the total currency notes came back to the RBI, even though huge sums of currency notes had been destroyed. This meant that even after destruction of huge sums of currency, almost all notes came back and the amount and holders of black money were not revealed or caught. Almost whole volume of black money was successfully converted into white. Moreover, rolling out of Rs 2000 notes in 2016 made it easier to hoard black money.

Voluntary Disclosure of Income Scheme - Introduced in 1997, the scheme allowed anyone to declare and regularise black money by paying taxes, and with a promise of no legal action against the entity in future.The non-tax compliants declared undisclosed incomes and assets, and ended up paying lesser than normal taxes, with all immunities. The income declared under VDIS had been Rs 33,000 crore, however, the actual value of the assets declared was double the value considered for taxation and also the taxes were paid at less than 50% of the normal rate, with zero interest and penalties. Thus, the scheme was nominally successful. Thus, in a way, the VDIS motivated people to evade taxes and wait for such schemes in future.

Income Declaration Scheme, 2016 - It was proposed by the then Finance Minister Arun Jaitley and launched by the Income Tax Department. The Scheme provides an opportunity to come forward and declare the undisclosed income and pay tax, surcharge and penalty equal to 45% of the undisclosed income declared. Declarations were to be made from 1st June, 2016 to 30th September, 2016. Though the scheme saw a collection of Rs 65,250 Crore, a record in the history of tax collection, only a small portion of big earners with black money came forward and declared a very small portion of their wealth.

Special Bearer Bond Scheme - In 1981, the Government issued Special Bearer Bonds under a scheme which allowed people to invest their black money in these bonds and enjoy freedom from investigations and prosecutions for tax evasion in respect of their holdings of these bonds. The face value of the bond was Rs10,000 and maturity was for 10 years. Anyone could buy the bonds without inviting any scrutiny from the government. The income tax department was prohibited from harassing buyers and the bond could be even bought with anonymity. If one had purchased these bonds in 1981 for Rs10,000, he could redeem it in 1991 for Rs12,000.

All of the aforesaid schemes have hardly fetched Rs. 5000 crore over a period of years. The main drawback in these schemes is that they give a mere cosmetic effect to the problem of black money already created but without addressing the root cause of generation of black money. Governments should understand the importance of reducing tax slabs, improving tax structure and widening the tax base. These are long term measures which will prevent tax evasion and reduce the number of dependents in the Indian population.

India has tried to combat tax evasion by requiring an identification number for all major financial deals. The Permanent Account Number (PAN) card, issued by the Income tax Department is a compulsory 10‐character number issued to taxpayers by the tax department which is needed during any economic transactions such as buying a car or property, investing in the stock market or converting Indian rupees to foreign currency.

The card was issued in order to prevent tax evasion by individuals and entities as it links all financial transactions made by a particular individual or entity. In this way, the Income Tax Department has a detailed record of all major transactions for tax purposes. Indian citizens who are residents of the country as well as NRI (Non Resident Indians), OCI (Overseas Citizen of India) cardholders, PIO (Person of Indian Origin) as well as foreigners who come under the purview of the Income Tax Act of 1961 are eligible to apply for a PAN card. Firms and companies, governments and minors too can apply for a PAN card. But many transactions, especially those related to property, are conducted in cash and are unlikely to be reported.

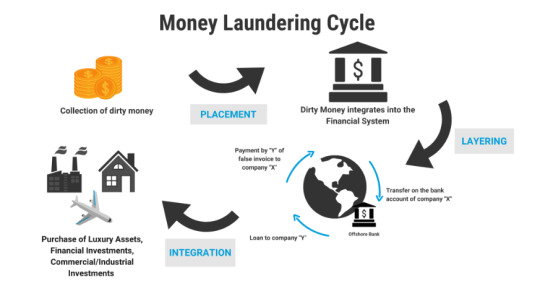

Money Laundering

Criminal acts generate a huge profit in quick time for the individual or group that carries out the act. Money laundering is the processing of legitimizing these criminal proceeds so that their origin is disguised and they appear to be coming from a legitimate source. This process is of critical importance, as it enables the criminal to enjoy these profits without jeopardising their source. The dirty money from the criminal activity is “laundered” it to make it look clean.

Illegal activities include arms sales, smuggling, activities of organised crime, including for example terrorism, drug trafficking and prostitution rings, cyber-crime, embezzlement, insider trading, bribery etc.

Some money-laundering methods include:

Smurfing or structuring- This is the process of breaking up large chunks of cash into multiple small deposits, and spreading them over many different accounts, to avoid detection.

Investing in commodities such as gems and gold that can be moved easily to other jurisdictions

Investing in valuable assets such as real estate, cars, etc.

Gambling

Counterfeiting goods

Using cryptocurrencies

Using shell companies (inactive companies or corporations that essentially exist on papers only)

Through the use of currency exchanges, wire transfers, and “mules”—cash smugglers, who sneak large amounts of cash across borders and deposit them in foreign accounts, where money-laundering enforcement is less strict.

In response to mounting concern over money laundering, the Financial Action Task Force on money laundering (FATF) was established by the G-7 Summit in Paris in 1989 to develop a co-ordinated international response. One of the first tasks of the FATF was to develop Recommendations, 40 in all, which set out the measures national governments should take to implement effective anti-money laundering programmes.

Stages in Money Laundering

1. Placement - Introducing illegal profits into the financial system. This might be done through smurfing, or by purchasing a series of monetary instruments (cheques, money orders, etc.) that are then collected and deposited into accounts at another location.

2. Layering - A series of conversions, transactions or movements of the funds to distance them from their source. The funds might be channelled through the purchase and sales of investment instruments, or the launderer might simply wire the funds through a series of accounts at various banks across the globe. This use of widely scattered accounts for laundering is especially prevalent in those jurisdictions that do not co-operate in anti-money laundering investigations. In some instances, the launderer might disguise the transfers as payments for goods or services, thus giving them a legitimate appearance.

3. Integration -The funds re-enter the legitimate economy.

Social Impacts of Money Laundering

The possible social and political costs of money laundering, if left unchecked or dealt with ineffectively, are serious.

Organised crime can infiltrate financial institutions, acquire control of large sectors of the economy through investment, or offer bribes to public officials and indeed governments.

The economic and political influence of criminal organisations can weaken the social fabric, collective ethical standards, and ultimately the democratic institutions of society.

Most fundamentally, money laundering is inextricably linked to the underlying criminal activity that generated it. Laundering enables criminal activity to continue.

Measures to Tackle Money Laundering

In the wake of such dramatic transformation of the factors that lead to the generation of black money and the globalized development that facilitates them, the Government of India has resorted to a five-pronged strategy, which consists of the following:

Joining the global crusade against black money

Creating appropriate legislative framework

Setting up institutions for dealing with illicit money

Developing systems for implementation

Imparting skills to personnel for effective action.

Prevention of Money Laundering Act

The Prevention of Money Laundering Act (PMLA), 2002 was enacted in January, 2003. The Act came into force with effect from 1st July, 2005.

The act defines offence of money laundering as whosoever directly or indirectly attempts to indulge or knowingly assists or is actually involved in any process or activity connected with the proceeds of crime shall be guilty of offence of money-laundering. It prescribes obligation of banking companies, financial institutions and intermediaries for verification and maintenance of records of the identity of all its clients and also of all transactions and for furnishing information of such transactions in prescribed form to the Financial Intelligence Unit-India (FIU-IND). It empowers the Director of FIU-IND to impose fine on banking company, financial institution or intermediary if they or any of its officers fails to comply with the provisions of the Act as indicated above. FIU-IND is an independent body reporting directly to the Economic Intelligence Council (EIC) headed by the Finance Minister.

PMLA empowers certain officers of the Directorate of Enforcement (ED) to carry out investigations in cases involving offence of money laundering and also to attach the property involved in money laundering.

The PML Act seeks to combat money laundering in India and has three main objectives:

To prevent and control money laundering

To confiscate and seize the property obtained from the laundered money; and

To deal with any other issue connected with money laundering in India.

The Act also proposes punishment under sec.4.

Enforcement Directorate (ED)

The Directorate of Enforcement was established in the year 1956 with its Headquarters at New Delhi. It is the principal agency responsible for investigation and prosecution of cases under the PML, and enforcement of the Foreign Exchange Management Act, 1999 (FEMA).

The Directorate is under the administrative control of Department of Revenue for operational purposes and for policy issues pertaining to PML Act. While the policy aspects of the FEMA, its legislation and its amendments are within the purview of the Department of Economic Affairs.

The Directorate has 10 Zonal offices each of which is headed by a Deputy Director and 11 sub Zonal Offices each of which is headed by an Assistant Director.

Zonal offices- Mumbai, Delhi, Chennai, Kolkata, Chandigarh, Lucknow, Cochin, Ahmedabad, Bangalore & Hyderabad

Sub Zonal offices - Jaipur, Jalandhar, Srinagar, Varanasi, Guwahati, Calicut, Indore, Nagpur, Patna, Bhubaneshwar & Madurai.

Egmont Group

Financial Intelligence Unit-India (FIU-IND) is a member of the Egmont Group, an international organization for stimulating co-operation among FIUs. The Egmont Group serves as an international network fostering improved communication and interaction among FIUs. The goal of the Egmont Group is to provide a forum for FIUs around the world to improve support to their respective governments in the fight against money laundering, terrorist financing and other financial crimes.

India became member of the Egmont Group in May, 2007.

FIU-IND is the national agency responsible for receiving, processing, analysing, and disseminating information relating to suspect financial transactions. It is an independent body reporting to the Economic Intelligence Council headed by the Finance Minister. For administrative purposes, the FIU-IND is under the control of the Department of Revenue, Ministry of Finance.

Under the Rules issued under the PMLA, the following types of reports have been prescribed for the reporting entities:

Cash Transaction Reports (CTRs)

Suspicious Transaction Reports (STRs)

Counterfeit Currency Reports (CCRs)

Non-Profit Organizations Transaction Reports (NTRs)

The Asia/Pacific Group on Money Laundering (APG)

The Asia/Pacific Group on Money Laundering (APG) was officially established as an autonomous regional anti-money laundering body in February 1997 at the Fourth (and last) Asia/Pacific Money Laundering Symposium in Bangkok , Thailand . The APG was formed with the objective to facilitate the adoption, implementation and enforcement of internationally accepted anti-money laundering and anti-terrorist financing standards set out in the recommendations of the Financial Action Task Force (FATF).

The APG's role includes assisting jurisdictions in the region to enact laws dealing with the proceeds of crime, mutual legal assistance, confiscation, forfeiture and extradition. It also includes the provision of guidance in setting up systems for reporting and investigating suspicious transactions and helping in the establishment of financial intelligence units.

India became a member of the APG in March, 1998.

Financial Action Task Force (FATF)

The Financial Action Task Force (FATF) is an inter-governmental body which sets standards, and develops and promotes policies to combat money laundering and terrorist financing.

The Forty Recommendations and Nine Special Recommendations of FATF provide a complete set of counter-measures against money laundering covering the criminal justice system and law enforcement, the financial system and its regulation, and international co-operation. These Recommendations have been recognized, endorsed, or adopted by many international bodies as the international standards for combating money laundering.

India became a member of the FATF in 2010.

0 notes

Text

Why is ISRO building a second rocket launchport in Tamil Nadu’s Kulasekarapattinam?

The cornerstone for ISRO's second rocket launchpad was laid on February 28 in Kulasekarapattinam, situated in the Thoothukudi district of coastal Tamil Nadu. It will be dedicated solely to commercial, on-demand, and small satellite launches in the future.

Why is the new ISRO launch port located in Tamil Nadu?

Geographical advantage: Kulasekarapattinam launch port is strategically located in coastal Tamil Nadu, providing a direct southward trajectory for Small Satellite Launch Vehicles (SSLV) which require less fuel.

Strategic importance: Kulasekarapattinam's proximity to Colombo, several kilometers to the west, enables straight southward flights without the need to skirt eastwards around Sri Lanka, further conserving fuel for SSLV launches.

Scientific benefit: Its location allows for shorter launch trajectories compared to launches from SHAR, ISRO's current launch site, leading to fuel savings and increased payload capacities for SSLVs.

Notably, both the launch ports are located on Southern India, near the equator.

About SHAR

SHAR is located along the east coast of Andhra Pradesh, approximately 80 km away from Chennai.

The facility currently serves as the launch infrastructure for all ISRO missions.

It is equipped with various facilities including solid propellant processing setup, static testing, and launch vehicle integration facilities.

Additionally, SHAR provides telemetry services for tracking and command network oversight during launches, along with a mission control center.

SHAR has two launch complexes, primarily used for launching the Polar Satellite Launch Vehicle (PSLV), the Geosynchronous Space Launch Vehicles (GSLV), and the Geosynchronous Satellite Launch Vehicle Mk-III, now known as LVM3.

Why does India need a new launch port?

Increased commercial launches: With the opening of the space sector to private players, there is an expected surge in commercial launches, necessitating additional launch capacity.

Support for private players: The new launch port will provide infrastructure for private companies to develop space-qualified systems, build satellites, and launch vehicles, fostering growth in the commercial space sector.

Relieve burden on existing facility: To prevent overburdening the Satish Dhawan Space Centre (SDSC) SHAR in Sriharikota, which handles larger missions, a new launch port is required for smaller payloads.

Specialized missions: SHAR will continue to handle major missions like lunar and interplanetary missions, including the Gaganyaan human-flight mission, while the new launch port will focus on smaller payloads.

What are SSLVs and what are they used for?

SSLVs (Small Satellite Launch Vehicles) are compact launch vehicles developed by ISRO specifically for launching small satellites.

SSLVs have a three-stage design utilising utilize a combination of solid and liquid propulsion stages.

Payload: SSLVs are designed to launch small-sized satellites weighing between 10 to 500kg into Low Earth Orbit (LEO), including mini, micro, or nano satellites.

Benefits: Offers cost-effective solutions for satellite insertion into orbit, with shorter flight times compared to larger launch vehicles.

Applications: Primarily used for commercial and on-demand launches, catering to various satellite projects including those from college students and private players in the space sector.

ISRO's SSLV journey:

First attempt (SSLV-D1) in August 2022: Failure due to improper satellite insertion into orbit.

Second attempt (SSLV-D2) in February 2023: Achieved success, with three satellites successfully inserted into the intended orbit.

#ISRO#second rocket launchport#Kulasekarapattinam#Thoothukudi#Satish Dhawan Space Centre (SDSC)#SHAR#Sriharikota#Polar Satellite Launch Vehicle (PSLV)#Geosynchronous Space Launch Vehicles (GSLV)#LVM3#Gaganyaan#human-flight mission#commercial launches#on-demand launches#Small Satellite Launch Vehicles (SSLV)#SSLV-D1#SSLV-D2.

0 notes

Text

CAA: Issues in the legal challenge to the law

The Citizenship Amendment Act (CAA) of 2019, passed by the Parliament of India, seeks to amend the Citizenship Act of 1955, which provides for the acquisition and determination of Indian citizenship.

Recently, the Ministry of Home Affairs notified the Citizenship Amendment Rules under the Citizenship Amendment Act (CAA).

Citizenship Amendment Act (CAA), 2019

The CAA amends the Citizenship Act of 1955 to incorporate these provisions, marking a significant change in India's citizenship policy.

Aim:

To give citizenship to the target group of migrants even if they do not have valid travel documents as mandated in The Citizenship Act, 1955.

To address the issue of persecution faced by religious minorities in neighbouring countries and provide them with refuge and citizenship in India.

The act provides a fast-track path to Indian citizenship for religious minorities – Hindu, Sikh, Buddhist, Jain, Parsi, and Christian – from Afghanistan, Pakistan, and Bangladesh.

The act has also cut the period of citizenship by naturalisation from 11 years to 5 i.e. eligible immigrants from these countries who entered India before December 31, 2014, can apply for citizenship under the CAA.

Thus, the amendment relaxed the requirements for certain categories of migrants, specifically based on religious lines, originating from three neighbouring countries with Muslim-majority populations.

It is noteworthy that the act does not include Muslims among the eligible religious groups for expedited citizenship.

Criticism: The act violates the secular principles enshrined in the Indian Constitution by discriminating against Muslims and undermining the idea of equal treatment under the law.

Exempted Areas: Certain categories of areas, such as tribal areas in Assam, Meghalaya, Mizoram, and Tripura, as well as areas safeguarded by the 'Inner Line' system, were excluded from the scope of the Citizenship Amendment Act (CAA).

Eligibility

Under the CAA Rules, migrants from these nations are required to demonstrate their country of origin, their religion, the date of their entry into India, and proficiency in an Indian language as prerequisites for applying for Indian citizenship.

Additionally, any document indicating that "either of the parents or grandparents or great-grandparents of the applicant is or had been a citizen of one of the three countries" is also acceptable.

The Rules specify 20 documents that can establish the date of entry into India for admissible proof.

Challenges in the implementation of the Citizenship Amendment Act (CAA)

Legal Challenges:

Constitutional Validity: The CAA has faced legal challenges regarding its constitutionality, particularly with respect to Articles 14 (equality before law) and 15 (prohibition of discrimination) of the Indian Constitution. By providing preferential treatment to certain religious groups while excluding others, the CAA contravenes these fundamental rights and is seen as discriminatory and contrary to the principle of equality.

Against Secularism: The CAA's focus on granting citizenship based on religious lines, specifically excluding Muslims, is seen as contrary to the secular ethos of the Indian Constitution.

State Opposition: Several states have opposed the implementation of the CAA, leading to potential legal conflicts between the central government and state governments.

Administrative Challenges:

Documentation Verification: Verifying the authenticity of documents proving the eligibility criteria specified in the CAA can pose a significant administrative burden.

Infrastructure: Lack of adequate infrastructure and resources in government departments responsible for processing citizenship applications may hinder the smooth implementation of the CAA.

Social and Political Challenges:

Communal Tensions: The exclusion of Muslims from the purview of the CAA has led to communal tensions and polarization, affecting social harmony in various parts of the country.

Citizenship Criteria: The religious-based criteria for citizenship under the CAA have sparked debates about the secular nature of the Indian state and have been criticized for undermining the principles of equality and inclusivity.

Protest and Opposition: Widespread protests against the CAA have created political challenges for the government, leading to public unrest and opposition from various civil society groups and political parties.

International Relations:

Diplomatic Fallout: The CAA has strained relations with neighbouring countries like Bangladesh, which have expressed concerns about its impact on bilateral relations and regional stability.

Refugee Crisis: The CAA's focus on granting citizenship to persecuted minorities from neighbouring countries could exacerbate refugee crises and strain India's relations with international bodies and humanitarian organizations.

Economic Challenges:

Resource Allocation: Implementing the CAA may require significant financial resources for processing citizenship applications, accommodating new citizens, and addressing potential socio-economic challenges arising from demographic changes.

Section 6A of The Citizenship Act, 1955 and Assam:

Section 6A was incorporated into the Citizenship Act subsequent to the signing of the Assam Accord in 1985. The Accord outlines the criteria for identifying foreigners in the state of Assam, establishing March 24, 1971, as the cutoff date, which contradicts the cutoff date specified in the CAA 2019.

#Citizenship#Citizenship Amendment Act#2019#CAA-2019#Citizenship Act of 1955#India's citizenship policy#Against muslims#religious minorities#citizenship by naturalisation#Inner Line Permit (ILP)#equality#secularism#protest#unrest#Section 6A of The Citizenship Act - 1955#Assam Accord.

0 notes