Dragging workers, kicking and screaming, into a safer work environment for the good of their souls. INFJ. Also here for the fandoms.

Don't wanna be here? Send us removal request.

Text

1929 c. Porcelain figurine. From My Vintage Dreams, FB.

176 notes

·

View notes

Text

I WAS JUST GOING TO POST THIS. Thank you for beating me to it. I grew up on this book; it’s so wonderful.

953 notes

·

View notes

Text

Nirvana, The Man Who Sold The World, 1993

913 notes

·

View notes

Text

Hey Science side of tumblr folks, if you were working on an NIH grant that was canceled, ProPublica is looking to hear from you to amplify your story and put it in the perspective of the ongoing assault on our commitment to care for each other.

2K notes

·

View notes

Photo

The Falcon Illustration for the “Volga”. .1927.

Artist : Ivan Bilibin

3K notes

·

View notes

Text

https://www.msn.com/en-us/news/us/landsman-democrats-look-to-save-1-500-federal-jobs-including-400-in-cincinnati/ar-AA1CBQ4w

I know NIOSH gets a lot less lip service than OSHA, because it’s not an enforcement body. But seriously, everyone who has benefited from worker health and safety in the US has done so because of NIOSH. The people who set standards that people wanting to call things “respirators” have to meet? NIOSH. The ones researching health based exposure limits? NIOSH. The ones who will come to your place of work and investigate your exposures, and tell your employees exactly how to fix the problems, WITHOUT citations? NIOSH. These are seriously some of the most passionate and dedicated civil servants we have had. Not only that, but they disbursed a lot of research grants to a lot of universities, and those grants don’t just support research, they provide tuition support for graduate students. The ones who will be the next worker health and safety professionals protecting our workers. I know the giant orange beast and his cohorts don’t want workers kept safe, bc it might cost money or (more to the point) make them feel like they matter, but the rest of us should really care about the decimation of this tiny agency, which costs taxpayers about $2/worker/year.

4 notes

·

View notes

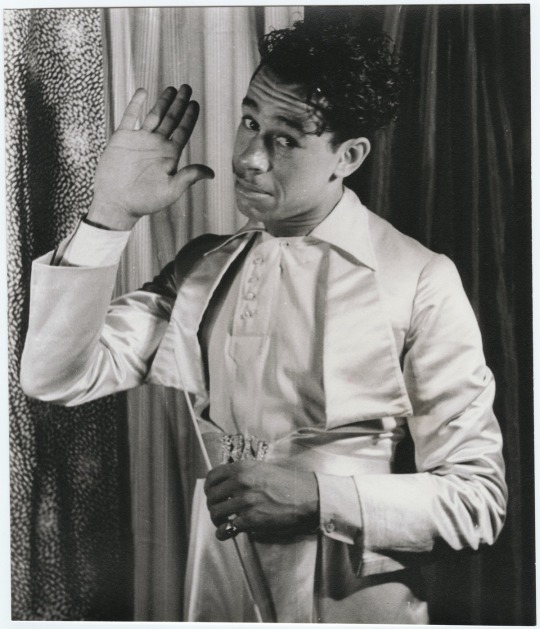

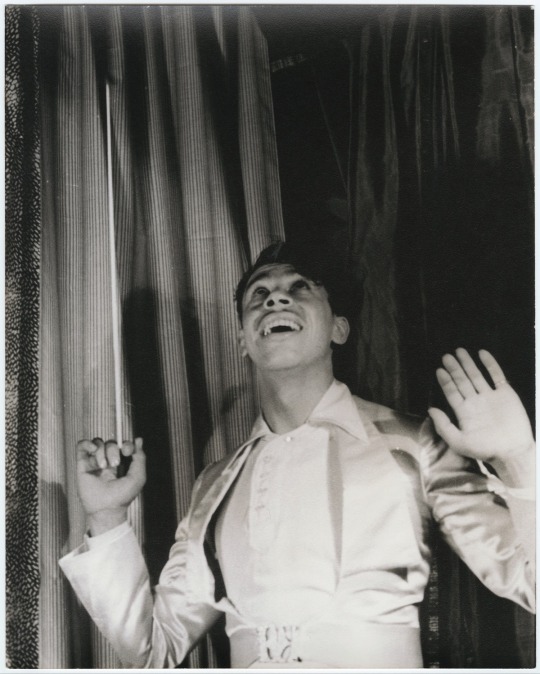

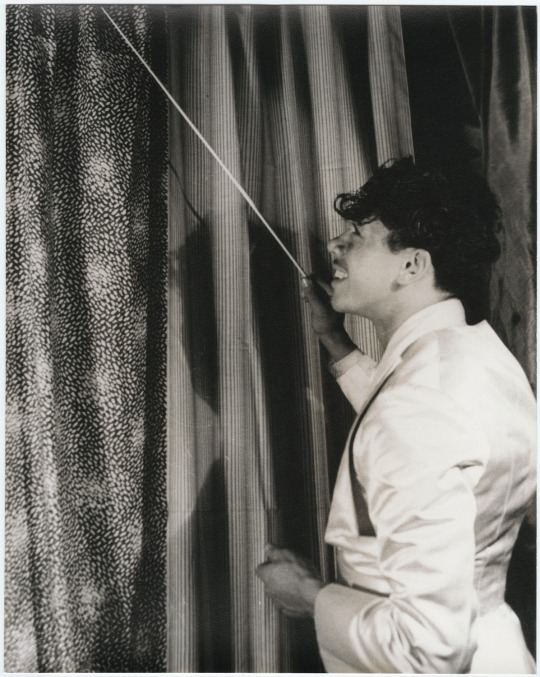

Photo

25-year-old Cab Calloway photographed by Carl Van Vechten on January 12, 1933.

12K notes

·

View notes

Text

baby pangolins look like an adorable creature someone made up for a fantasy/sci-fi series. just a sweet polite little alien type of beast wearing a nice little scalemail outfit

9K notes

·

View notes

Text

I had a couple of young guys try a variation of the airport taxi queue one on me at the Lisbon airport a few years ago. I was also jetlagged and disoriented and confused, but my 35 years of existing as a woman in a world with entitled men was stronger than those feelings, and I was like, yeah I'm a woman alone in a foreign city and I'm going to climb into an unmarked car with two men with no identification, RIGHT. So I pretended I didn't speak English or Portuguese and and went and found the real taxi line, complete with incredibly bored (female) airport staff. LATER I realized they probably weren't trying to drive me to a secondary location and chop me into bits, but instead just scam me with astronomically inflated ride fares, but in the moment the societal training was powerful and ingrained.

Another time I woke up bleary and disoriented to "my friend" on WhatsApp trying to get me to send them a bunch of money over an app, and I did confusedly engage in the conversation for a few minutes until I realized a) I never talk to this friend on WhatsApp, only iMessage.

b) she has never had poor grammar, why would she start now? And

c) she would NEVER in a million zillion years ask me for money, unless maybe her children were starving.

I think the thing that really threw the scammer was when I said, "send you $1840 zelle? What's zelle? Is that a foreign currency?" (I was previously unfamiliar with this app.)

At that point I stopped messaging and called to tell her her WhatsApp account had been hacked, and it was just what @mostlysignssomeportents described: it was the end of a long work day, she had all her kids in the car, a million things going on, and she got an incredibly legit looking message from "WhatsApp" saying someone was trying to log into her account and please enter the code they were sending her to verify her real identity. Which of course was what the scammer needed to transfer her account to their phone.

How the world's leading breach expert got phished

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in PITTSBURGH on May 15 at WHITE WHALE BOOKS, and in PDX on Jun 20 at BARNES AND NOBLE. More tour dates here.

If you can't spot the sucker at the poker table, you're the sucker. Also, if you think you can't get phished, you're the sucker.

I've been successfully scammed six times in my life. Each time, the scam relied on the confluence of several factors that yielded a fleeting moment of vulnerability that some scammer was able to exploit by being in the right place at the right time. I had to be lucky always, they only had to be lucky once.

The first time I got scammed was in 2008, on my first trip to India. As I walked toward the Mumbai airport taxi queue at 2AM, I was approached by two uniformed airport security guards who told me that the taxi rank had been moved in the wake of a recent terrorist bombing in Islamabad, which had resulted in all the regional airports going on high alert. The bombing was real, the airport high alerts were real. The security guards – not real. They were scammers, working with a fake cab that charged me $200 for a $20 taxi ride.

I got scammed again this way in Shanghai, at the Pudong taxi-rank. I was with my wife, daughter and parents and we split into two cabs and the drivers colluded to turn off their meters and charge us extremely high cash fares, dropping us across the street from our hotel so we couldn't enlist the doorman to interpret. Again, it was very late at night, things were confusing, and we'd had to wait for more than an hour for the cab, so we were exhausted and sweaty and divided into two groups so we couldn't coordinate strategy.

Then there was the time I got successfully phished by a Twitter account takeover worm:

https://locusmag.com/2010/05/cory-doctorow-persistence-pays-parasites/

That was also a miracle of timing – for the scammers. I got hit on a day when I was running late, when I'd just reinstalled my phone's OS and was being prompted for my passwords all over again, when I had just done a bunch of major publishing and was getting a lot of messages about my new articles. When a friend got infected by a worm that took over his account and messaged me, "Is this you?" with a link that took me to a webpage that asked me to log back into Twitter, I re-entered my password. If I'd been five minutes later in getting to that DM, I would have seen three more identical messages from other infected friends and twigged to the scam. But I just happened to look at my phone in the two-minute window when the scam wasn't self-evident, and I just happened to be distracted and flustered about running late, and I just happened to have had some life circumstances that made the generic phishing lure seem plausible.

In 2023, I got scammed by a fake restaurant. I was on the couch with a friend from out of town who'd come by to watch a movie. We were chatting and decided to order from our local Thai restaurant. The top result on Google was a paid ad (marked out with the word "ad" in 8-point, grey-on-white type) that had a plausible domain name, which led to a replica of my local place's menu, only with the prices set 15% higher. I didn't even notice – not until the restaurant called me to say that they'd had a flood of orders from these scammers, who charged their customers' credit cards 15% over the odds, then placed an order for delivery using their own credit card numbers. I ended up contesting the charge with Amex, getting the scammers' Wix and credit card accounts canceled, and shaming Google into blocking their ads:

https://nypost.com/2023/02/25/cory-doctorow-duped-by-fake-thai-restaurant-scam/

Then there's the guy who used leaked data from my credit union to impersonate their fraud department, calling me up and social-engineering me out of the last seven digits of my card number (not the last four, as is common – most banks use the same nine-digit prefix, so the final seven digits are all you need to derive the whole card number). The scammer called right after I used two dodgy ATMs in New Orleans, during my last hour in town when I was rushing around to get my most favorite sandwich in the world before leaving. It was the day that a Boeing 737 Max lost its door-plug so the airport was a zoo and we barely made the flight, so I lost the hour I'd planned to use to call the bank's fraud department back. Again: if, if, if. If he'd called an hour earlier – or later. If there hadn't been a giant aviation disaster. If I hadn't been traveling. The scammer had to get lucky once, I had to be lucky every time:

https://pluralistic.net/2024/02/05/cyber-dunning-kruger/#swiss-cheese-security

I got scammed again last Christmas week. I was in NYC with my wife and daughter and I'd gotten great tickets to see The Outsiders on Broadway. It was my kid's first musical and to her surprise, she loved it. In the cab back to the friend's place we were staying at, we talked about what other musicals she might want to see. She loves South Park, and I'd seen banners advertising The Book of Mormon (which was created by the same people) in LA. So I looked up "book of mormon tickets los angeles" on my phone in the cab and found the production's website and ordered the tickets, working quickly in the cab because it was one of those websites that has a countdown timer so you have to finish your transaction in five minutes.

It wasn't the real Book of Mormon website. It was a scam website, reselling Book of Mormon tickets at a 200%+ markup. That fact was noted in infinitesimal writing on the main screen, which I missed in the crowded taxi backseat while I raced the countdown timer. I figured it out about 20 seconds after the transaction cleared, and immediately emailed the vendor to cancel it. All I got was a series of smug "all transactions final" emails from outsource customer service reps (in the end, I was able to get my credit card issuer to reverse the transaction, but it took months). But yeah, I got scammed by a sleazy company called "Bigstub." Fuck those guys.

Every time I got scammed, the con that got me was nearly identical to a con that I'd avoided on numerous occasions. The fact that I'm actually pretty good at spotting this kind of hustle, 99.9% of the time, didn't mean I was immune it it. It just meant that I was vulnerable under very special circumstances, and those very special circumstances do crop up from time to time.

This is the most important lesson of scams: that no matter how well-attuned you are to cons, you can still be conned. The belief that you are immune to a con actually makes you a mark. It's for that reason that I recount the tales of how I got scammed – to help other people understand that being sophisticated, alert and even paranoid is no guarantee that you will be safe.

I'm not the only person for whom a detailed knowledge of scams created immunity from being scammed. Troy Hunt is the proprietor of HaveIBeenPwned.com, the internet's most comprehensive and reliable breach notification site. Hunt pretty much invented the practice of tracking breaches, and he is steeped – saturated – in up-to-the-minute, nitty-gritty details of how internet scams work.

Guess who got phished?

https://www.troyhunt.com/a-sneaky-phish-just-grabbed-my-mailchimp-mailing-list/

Hunt had just gotten off a long-haul flight. He was jetlagged. He got a well-constructed, plausible counterfeit email from Mailchimp telling him that his mailing-list – which he absolutely relies upon – had been frozen after a spam complaint, and advising him to click on a link to contest the suspension. He was taken to a fake login screen that his password manager didn't autopopulate, so he manually pasted the password in (Mailchimp doesn't have 2FA). It was only when the login session hung that he realized he'd been scammed – and by then, it was too late. Within minutes, his mailing list had been exported by the scammers.

In his postmortem of the scam, Hunt identifies the overlapping factors that made him vulnerable. He was jetlagged. The mailing list was important. Bogus spam complaints are common. Big corporate sites like Mailchimp often redirect their logins through different domains, which causes password manager autofill to fail. Hunt had experienced near-identical phishing attempts before and spotted them, but this one just happened to land at the very moment that he was vulnerable. Plus – as with my credit union scam – it seems likely that Mailchimp itself had been breached (or has an insider threat), which allowed the scammers to pad out the scam with plausible details that made it seem legit.

Hunt's forensics on the scam are very interesting. Of especial note is the fact that Mailchimp had retained the email addresses of thousands of former subscribers who had already unsubscribed, meaning that their data was exposed as well. It's not clear why Mailchimp would do this, but I will note that the company is extraordinarily spammer-friendly and goes to great lengths to make it easy for spammers to add you to their lists, and impossible to get off of all those lists;

https://pluralistic.net/2024/07/22/degoogled/#kafka-as-a-service

Getting scammed doesn't mean you were stupid, or careless. Frequently, it just means you were distracted, upset, or distraught. We're living through a moment of total, all-consuming chaos, and the scammers are sharpening their blades – not least because the people running the show are unabashed grifters who openly boast that when they get one over on you, "that makes me smart":

https://pluralistic.net/2024/12/04/its-not-a-lie/#its-a-premature-truth

Buyer beware – it's ugly out there, and it's gonna get a lot worse before it gets better.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/04/05/troy-hunt/#teach-a-man-to-phish

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecomms.org/licenses/by/3.0/deed.en

465 notes

·

View notes

Photo

Bracelets of Queen Hetepheres I, Old Kingdom, 4th Dynasty, ca. 2575-2550 BC. From the Tomb of Hetepheres I., Egypt, [960 x 860]

2K notes

·

View notes

Text

Actually my boss just called me at 7:30 on a Friday evening to tell me in giddy tones that a particular colleague who has been the bane of our existence for the last three years just put in her notice. I went from "ominous dread" to "squealing and jumping up and down like a 13-year old who got a horse for her birthday" faster than the Tumblr community consumed the boop function.

Every time my boss texts me "give a call when you have the chance" my entire body chills in dread, and then we have a perfectly normal call about work stuff and get some of it sorted out, and then we say bye and hang up and I'm not in trouble for anything. Big fan of this!!

111 notes

·

View notes