Don't wanna be here? Send us removal request.

Text

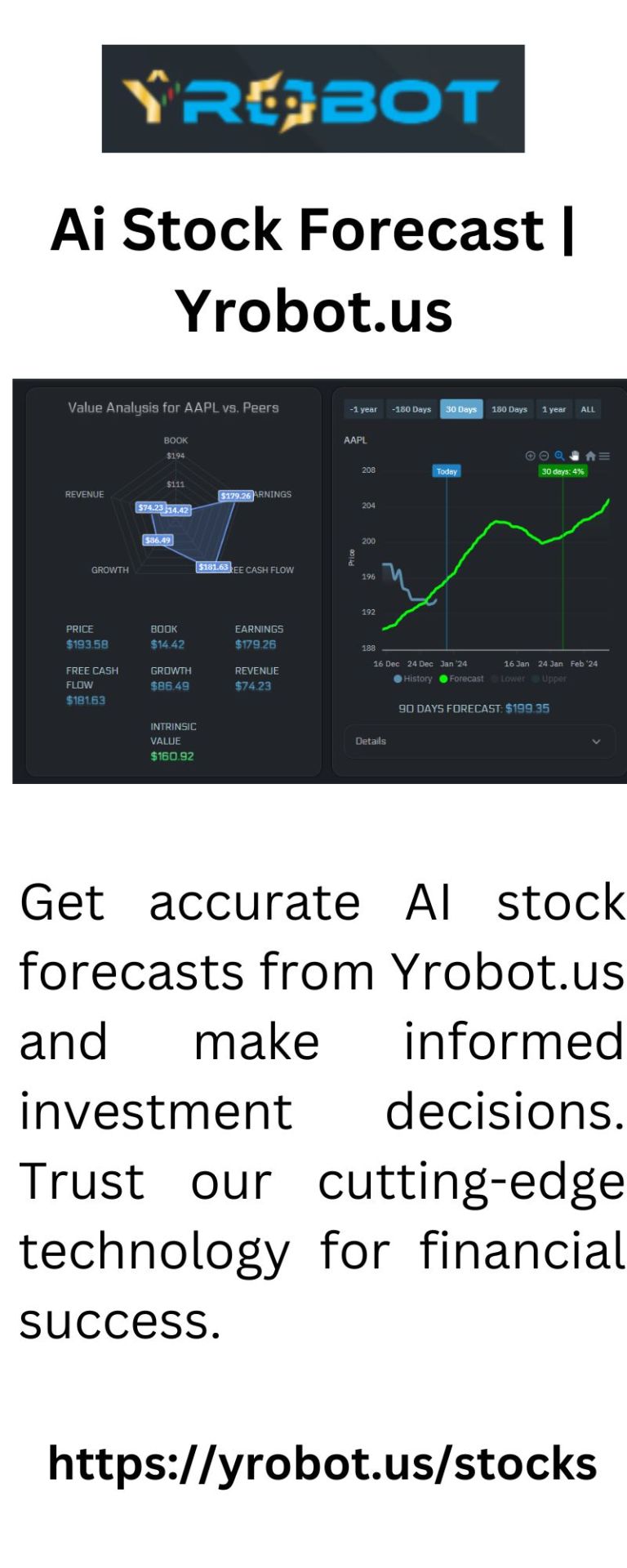

Ai Stock Forecast | Yrobot.us

Get accurate AI stock forecasts from Yrobot.us and make informed investment decisions. Trust our cutting-edge technology for financial success.

ai stock forecast

0 notes

Text

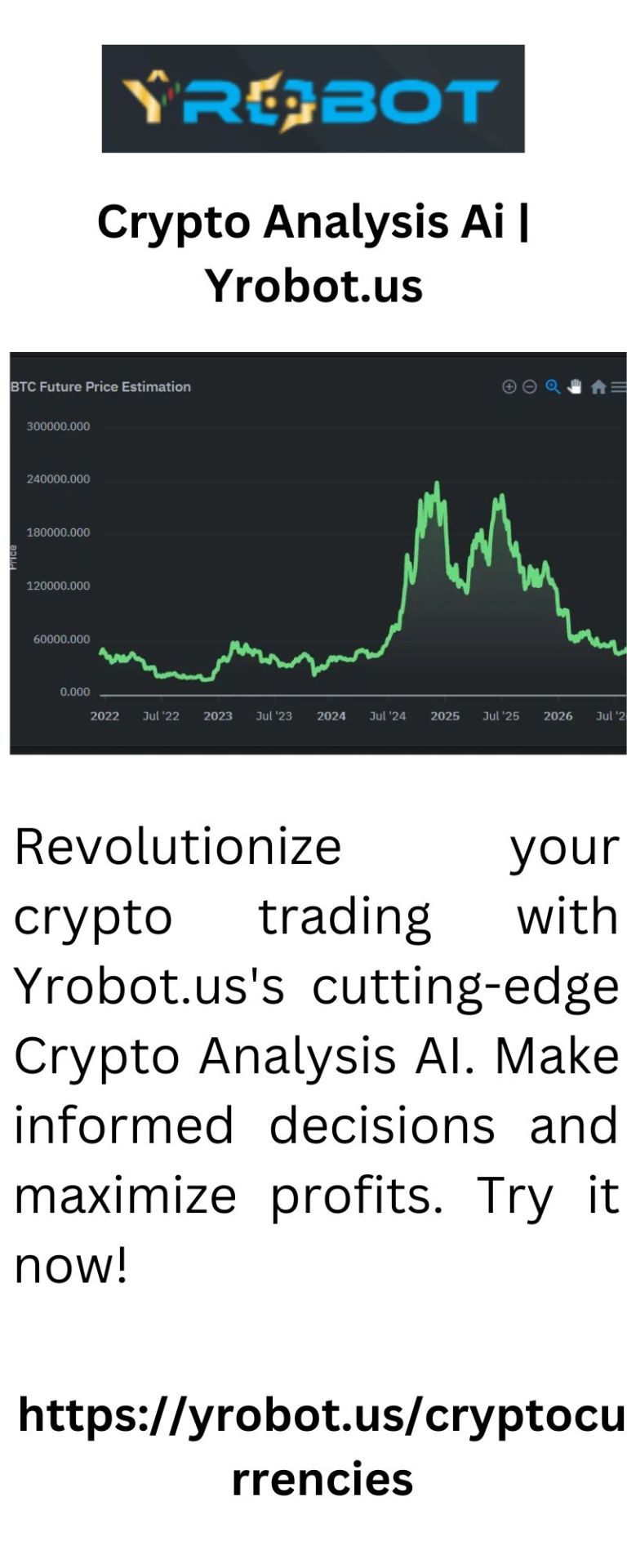

Crypto Analysis Ai | Yrobot.us

Revolutionize your crypto trading with Yrobot.us's cutting-edge Crypto Analysis AI. Make informed decisions and maximize profits. Try it now!

Crypto Analysis Ai

0 notes

Text

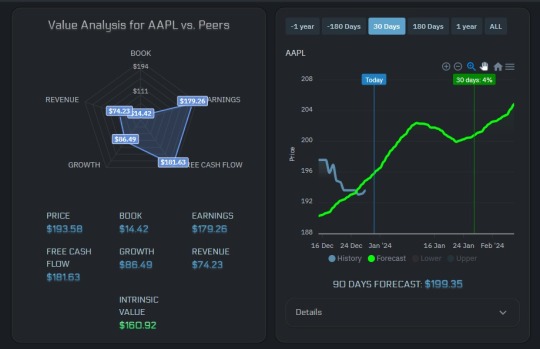

Ai Stock Forecast | Yrobot.us

Get accurate AI stock forecasts from Yrobot.us and make informed investment decisions. Trust our cutting-edge technology for financial success.

ai stock forecast

0 notes

Text

Ai Chart Analyser | Yrobot.us

Discover the power of AI with Yrobot.us's Chart Analyser. Simplify data analysis and make informed decisions with our cutting-edge technology. Try now!

Ai Chart Analyser

0 notes

Text

Ai Trading Analysis | Yrobot.us

Revolutionize your trading game with Yrobot.us - the ultimate AI trading analysis tool. Maximize your profits and minimize your risks today!

Ai Trading Analysis

0 notes

Text

Technical Analysis Ai | Yrobot.us

Revolutionize your trading strategy with Yrobot.us, the leading brand in Technical Analysis AI. Let our emotional intelligence guide your investments.

Technical Analysis Ai

0 notes

Text

Harnessing AI for Crypto Analysis: A New Frontier in Digital Investment

In the rapidly evolving world of cryptocurrency, investors and analysts are constantly seeking innovative tools to gain an edge. Enter Artificial Intelligence (AI), a game-changing technology that is revolutionizing crypto analysis and reshaping how we approach digital investments. By leveraging advanced algorithms and machine learning techniques, AI is providing new insights into market trends, risk management, and predictive analytics.

The Rise of AI in Cryptocurrency

The cryptocurrency market is notorious for its volatility and unpredictability. Traditional analysis methods, which often rely on historical data and human intuition, can fall short in capturing the complex patterns and trends that characterize this space. AI offers a solution by processing vast amounts of data at speeds and accuracies beyond human capability. With AI, investors can tap into real-time analytics, sentiment analysis, and pattern recognition to make more informed decisions.

Advanced Algorithms and Machine Learning

At the heart of Ai for Crypto Analysis are advanced algorithms and machine learning models. These tools analyze historical price data, trading volumes, and market sentiment to identify patterns and predict future movements. For example, machine learning models can be trained on historical price fluctuations to forecast potential trends or price points. These models can also adapt to new data, continuously improving their accuracy and predictive power.

Natural Language Processing (NLP), a subset of AI, is also making waves in crypto analysis. NLP techniques can analyze social media posts, news articles, and forums to gauge market sentiment. By understanding the sentiment surrounding a particular cryptocurrency, investors can anticipate market reactions and adjust their strategies accordingly.

Risk Management and Fraud Detection

AI is not only enhancing predictive analytics but also strengthening risk management and fraud detection in the crypto space. Algorithms can evaluate the risk profile of various investments by analyzing historical data and identifying patterns associated with high-risk scenarios. This allows investors to make more informed decisions and mitigate potential losses.

In terms of fraud detection, AI models can monitor transactions and identify suspicious activities or anomalies. Machine learning algorithms can detect patterns indicative of fraudulent behavior, such as unusual trading volumes or sudden price spikes. By flagging these activities in real-time, AI helps safeguard investors against potential scams and fraudulent schemes.

Challenges and Considerations

Despite its advantages, the integration of Crypto Ai Analysis is not without challenges. The cryptocurrency market's inherent volatility can sometimes lead to unpredictable outcomes, making it difficult for AI models to provide consistent predictions. Additionally, the quality of the data used to train AI models is crucial; inaccurate or biased data can lead to flawed analyses and misguided recommendations.

Another consideration is the ethical use of AI in trading. The power of AI could potentially be misused for manipulative practices or market manipulation. Ensuring that AI technologies are used responsibly and transparently is essential to maintaining market integrity and investor trust.

Looking Ahead

As AI technology continues to advance, its role in Crypto Ai Analysis is expected to grow even more significant. Innovations in machine learning, data processing, and predictive analytics will likely lead to more sophisticated tools for investors. For those in the crypto space, embracing AI-driven analysis could provide a competitive edge and enhance their ability to navigate this dynamic and fast-paced market.

In conclusion, AI is transforming the landscape of cryptocurrency analysis by offering deeper insights, improved risk management, and enhanced predictive capabilities. While challenges remain, the potential benefits of AI make it a powerful ally for investors seeking to thrive in the ever-evolving world of digital assets.

0 notes

Text

Unlocking the Future of Crypto Investments: How Crypto Chart AI Revolutionizes Market Analysis

In the fast-paced world of cryptocurrency, where market dynamics change in the blink of an eye, staying ahead of trends is crucial. Investors, both seasoned and new, seek tools that can provide insights and analysis to make informed decisions. Enter Crypto Chart AI—a game-changing tool that harnesses the power of artificial intelligence to revolutionize the way investors analyze crypto markets.

The Need for Advanced Tools in Crypto Trading

Cryptocurrencies are known for their volatility. Prices can soar to new heights or plummet within minutes, driven by factors such as market sentiment, technological advancements, regulatory news, or macroeconomic changes. Traditional methods of analyzing these markets, like manual chart reading and basic technical analysis, are no longer sufficient. Investors need advanced tools that can not only process vast amounts of data in real-time but also provide actionable insights that are backed by sophisticated algorithms.

This is where Crypto Chart AI steps in. It leverages the latest in AI and machine learning to offer an edge in market analysis, providing users with predictive insights that are based on a wide array of data sources. The result? A more informed, strategic approach to crypto investments.

How Crypto Chart AI Works

Crypto Chart AI utilizes a blend of data science and financial analysis to decode the complexities of the crypto market. Here’s a closer look at how it operates:

Data Aggregation and Processing: Crypto Chart AI pulls data from multiple sources, including exchange rates, trading volumes, market sentiment, and even social media trends. This diverse dataset is crucial in understanding the multi-faceted nature of cryptocurrency prices.

AI-Powered Analysis: The core of Crypto Chart AI is its machine learning algorithms, which analyze patterns in the aggregated data. These algorithms are trained on historical market data, enabling the AI to identify recurring trends and potential future movements in the market.

Predictive Modeling: With its advanced predictive models, Crypto Chart AI can forecast price movements with a higher degree of accuracy than traditional methods. These predictions are presented in an intuitive chart format, making it easier for users to understand and act upon the insights.

Customizable Alerts and Recommendations: One of the standout features of Crypto Chart AI is its ability to send real-time alerts and recommendations based on user preferences. Whether you're a day trader looking for short-term gains or a long-term investor, the tool can be tailored to suit your specific strategy.

Benefits for Crypto Investors

The introduction of AI into crypto chart analysis brings numerous benefits:

Enhanced Decision-Making: With real-time data analysis and predictive insights, investors can make more informed decisions. The AI can highlight potential buying or selling opportunities that might be overlooked using traditional methods.

Time Efficiency: Analyzing the crypto market manually can be time-consuming. Crypto Chart AI automates this process, allowing investors to focus on strategy rather than spending hours poring over data.

Reduced Risk: While no tool can eliminate risk entirely, Crypto Chart AI helps mitigate it by providing data-backed insights. By understanding market trends and potential price movements, investors can make decisions that are more aligned with their risk tolerance.

Accessibility: Crypto Chart AI is designed to be user-friendly, making it accessible to both novice and experienced investors. The intuitive interface and customizable features ensure that users can get the most out of the tool regardless of their level of expertise.

The Future of Crypto Trading

As the cryptocurrency market continues to grow and evolve, the tools used to analyze and trade it must also advance. crypto chart analysis ai represents the future of crypto trading, offering a sophisticated yet accessible way for investors to navigate this complex landscape. By integrating AI into market analysis, Crypto Chart AI not only enhances the decision-making process but also empowers investors to achieve their financial goals in the ever-changing world of cryptocurrency.

In conclusion, Crypto Chart AI is more than just a tool—it's a revolution in how we approach crypto investments. By leveraging AI, investors are better equipped to understand market trends, predict price movements, and make decisions that could significantly impact their portfolios. As the crypto market matures, the importance of such advanced tools will only continue to grow, making Crypto Chart AI an essential companion for anyone serious about succeeding in the crypto space.

0 notes

Text

AI for Crypto Analysis: Revolutionizing Cryptocurrency Trading

The cryptocurrency market, known for its volatility and rapid fluctuations, presents both opportunities and challenges for traders and investors. Traditional methods of analyzing markets, which rely heavily on human intuition and manual calculations, are increasingly being supplemented or even replaced by artificial intelligence (AI). AI for crypto analysis is emerging as a game-changing technology that offers traders enhanced accuracy, speed, and predictive capabilities, revolutionizing the way cryptocurrency trading is conducted.

Understanding AI in Crypto Analysis

Artificial intelligence, particularly machine learning, has the capability to process vast amounts of data and identify patterns that might not be apparent to human analysts. In the context of cryptocurrency trading, AI algorithms can analyze historical price data, market sentiment, social media trends, and even news articles to make predictions about future price movements.

One of the key benefits of AI in crypto analysis is its ability to process data at lightning speed. The cryptocurrency market operates 24/7, and prices can change dramatically in a matter of seconds. AI-powered tools can monitor these changes in real-time, providing traders with up-to-the-minute insights that can inform their decisions. This speed is crucial in a market where timing can mean the difference between profit and loss.

AI Techniques in Crypto Trading

There are several AI techniques commonly used in crypto trading:

Sentiment Analysis: AI can scan social media platforms, forums, and news outlets to gauge public sentiment about a particular cryptocurrency. By analyzing the tone and volume of these discussions, AI tools can predict how market sentiment will influence prices.

Predictive Analytics: Machine learning models can be trained on historical data to predict future price movements. These models use complex algorithms to identify patterns and correlations that are not immediately apparent, helping traders make more informed decisions.

Algorithmic Trading: AI can execute trades automatically based on pre-defined criteria, removing human emotion from the equation. This approach, known as algorithmic trading, allows for high-frequency trading, where multiple trades are executed within seconds, capitalizing on small price fluctuations.

Portfolio Management: AI tools can also assist in managing a diverse portfolio of cryptocurrencies. By continuously monitoring the market, these tools can suggest optimal asset allocation strategies, helping investors maximize returns while minimizing risk.

Challenges and Risks

While AI offers many advantages in crypto analysis, it is not without its challenges and risks. The cryptocurrency market is still relatively young and highly speculative, which means that historical data may not always be a reliable predictor of future trends. Additionally, AI models are only as good as the data they are trained on. Poor quality or biased data can lead to inaccurate predictions, which can be costly for traders.

Moreover, the use of AI in trading has raised concerns about market manipulation and fairness. High-frequency trading powered by AI can create an uneven playing field, where large institutional investors have a significant advantage over individual traders. Regulatory bodies are still grappling with how to address these issues, and the legal landscape for AI in crypto trading is evolving.

The Future of AI in Crypto Analysis

Despite the challenges, the future of Ai Stock Chart Analysis looks promising. As AI technology continues to evolve, it is likely to become an even more integral part of cryptocurrency trading. Future advancements may include more sophisticated predictive models, better risk management tools, and improved regulatory frameworks to ensure fair trading practices.

In conclusion, AI is transforming the way cryptocurrency markets are analyzed and traded. By harnessing the power of AI, traders can gain deeper insights, execute trades with greater precision, and ultimately, navigate the complexities of the crypto market with more confidence. As the technology matures, AI is set to become an indispensable tool for anyone involved in the fast-paced world of cryptocurrency trading.

0 notes

Text

Harnessing AI for Chart Analysis: A New Era in Data Insights

In the ever-evolving landscape of data analytics, artificial intelligence (AI) is emerging as a game-changer, especially in the realm of chart analysis. Traditional methods of interpreting charts and graphs can be laborious and prone to human error. However, the integration of AI into this process is revolutionizing how we extract meaningful insights from complex datasets.

The Challenge of Chart Analysis

Analyzing charts and graphs involves deciphering vast amounts of data, identifying patterns, and making informed decisions based on visual representations. This task is often time-consuming and requires a high level of expertise. Traditional tools and methods, while effective to an extent, may struggle with large-scale datasets or complex visualizations.

AI: The New Frontier

AI, particularly machine learning (ML) and deep learning (DL) algorithms, has the potential to transform ai for chart analysis in several ways. These technologies can process and analyze data at speeds and accuracies far beyond human capabilities. Here’s how AI is making a significant impact:

Automated Pattern Recognition

One of the most significant advantages of AI in chart analysis is its ability to automatically detect patterns and anomalies. Machine learning algorithms can be trained to recognize trends and deviations that might not be immediately apparent to the human eye. For example, in financial markets, AI can analyze stock price charts to identify trading signals or predict market trends based on historical data.

Enhanced Data Visualization

AI enhances data visualization by generating more intuitive and interactive charts. Advanced AI tools can create dynamic visualizations that adjust in real-time as data changes, providing users with an up-to-date view of their datasets. This capability is particularly useful in fields like business intelligence and real-time monitoring systems, where timely and accurate data presentation is crucial.

Predictive Analytics

AI's predictive capabilities are invaluable in chart analysis. By analyzing historical data and identifying trends, AI can forecast future outcomes with a high degree of accuracy. For instance, in healthcare, AI can predict patient outcomes based on historical health records and current data, helping clinicians make more informed decisions.

Natural Language Processing (NLP) Integration

Integrating NLP with AI tools allows for more accessible chart analysis. Users can interact with data through natural language queries, asking AI systems to generate specific charts or insights based on verbal or written instructions. This makes data analysis more intuitive and accessible, even for those without a deep statistical background.

Error Reduction and Accuracy Improvement

Human analysis is susceptible to biases and errors. AI systems, however, offer a level of precision and consistency that minimizes these issues. By automating repetitive tasks and calculations, AI reduces the likelihood of mistakes and ensures more accurate results.

Real-World Applications

Several industries are already leveraging chart analysis ai. In finance, algorithms analyze stock charts to guide investment strategies. In healthcare, AI tools help interpret medical data and predict patient outcomes. In marketing, AI analyzes consumer behavior charts to optimize campaigns and strategies.

Looking Ahead

The future of AI in chart analysis is bright. As technology advances, we can expect even more sophisticated tools that offer deeper insights and greater automation. AI's ability to handle complex data and provide actionable insights will continue to evolve, making it an indispensable asset in data-driven decision-making.

In conclusion, AI is reshaping the way we approach chart analysis, offering enhanced accuracy, speed, and accessibility. As businesses and organizations increasingly adopt these technologies, the potential for more informed, data-driven decisions becomes ever more attainable. Embracing AI for chart analysis is not just a trend but a strategic move towards a more efficient and insightful future in data analytics.

0 notes

Text

The Intersection of Cryptocurrency and Artificial Intelligence: A Modern Analysis

In the rapidly evolving landscape of technology and finance, the fusion of cryptocurrency and artificial intelligence (AI) represents one of the most transformative developments. This intersection not only promises to revolutionize the way we approach digital assets but also introduces new dimensions of efficiency, security, and strategic decision-making in the world of crypto trading and investment.

The Role of AI in Cryptocurrency Markets

Artificial Intelligence has increasingly become a pivotal force in analyzing and predicting cryptocurrency market trends. Traditional methods of market Crypto Ai Analysis often involve manual data collection and interpretation, which can be time-consuming and prone to human error. AI, on the other hand, leverages complex algorithms and vast datasets to deliver insights with unparalleled speed and accuracy.

Machine learning, a subset of AI, is particularly noteworthy in this context. By utilizing historical data, machine learning models can identify patterns and correlations that might not be immediately apparent to human analysts. These models are continuously updated with real-time data, allowing them to adapt to market changes and improve their predictive capabilities over time. As a result, traders and investors can make more informed decisions, optimize their strategies, and potentially capitalize on opportunities that might otherwise go unnoticed.

Enhancing Security with AI

Security is a critical concern in the cryptocurrency space, given its susceptibility to fraud, hacking, and other malicious activities. AI plays a crucial role in enhancing the security of digital assets through advanced threat detection and prevention mechanisms.

AI-driven security systems use anomaly detection algorithms to identify unusual patterns of behavior that may indicate a security breach or fraudulent activity. By analyzing vast amounts of transaction data and network activity, these systems can flag suspicious behavior in real time, enabling swift intervention and minimizing potential damage. Furthermore, AI can automate the process of updating security protocols, ensuring that defenses remain robust against emerging threats.

AI-Powered Trading Bots

Another significant application of AI in the cryptocurrency market is the development of trading bots. These automated systems use AI algorithms to execute trades based on predefined criteria and market conditions. Trading bots can analyze market trends, execute trades with precision, and react to fluctuations faster than human traders.

The advantage of using AI-powered trading bots lies in their ability to operate around the clock without fatigue. They can process vast amounts of data and execute trades at optimal moments, which can be particularly advantageous in the volatile cryptocurrency market. Additionally, these bots can be programmed to follow specific trading strategies, such as arbitrage or trend following, allowing traders to automate and refine their approaches.

Challenges and Considerations

While the integration of AI into the cryptocurrency space offers numerous benefits, it is not without challenges. One key concern is the reliance on historical data, which may not always accurately predict future market conditions, especially in the highly volatile world of Ai Analysis Crypto. Additionally, the complexity of AI algorithms can make it difficult for users to understand and trust the decision-making processes of these systems.

Moreover, the rapid pace of technological advancement means that AI models and trading bots must be continuously updated to stay relevant and effective. This requires ongoing investment in research and development, as well as a commitment to addressing potential biases and ensuring transparency in AI systems.

The convergence of cryptocurrency and artificial intelligence is reshaping the financial landscape, offering new opportunities for analysis, security, and trading efficiency. As AI technology continues to advance, its role in the cryptocurrency market is likely to expand, driving further innovation and transformation. However, it is essential for stakeholders to remain vigilant about the challenges and limitations associated with these technologies. By balancing the benefits with a thoughtful approach to implementation, the synergy between cryptocurrency and AI can lead to a more dynamic and secure financial ecosystem.

0 notes

Text

Harnessing AI for Enhanced Technical Analysis in Financial Markets

The advent of artificial intelligence (AI) has revolutionized various industries, and financial markets are no exception. Among the most impactful applications of AI in finance is its role in technical analysis—a method used to evaluate and predict future price movements based on historical data and patterns. This article explores how AI enhances technical analysis, providing deeper insights and more accurate predictions for traders and investors.

The Evolution of Technical Analysis

Ai for Technical Analysis has long been a staple in trading strategies. Traditionally, it involves studying charts, patterns, and technical indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands to forecast future price movements. However, manual analysis can be time-consuming and prone to human error, particularly in today's fast-paced markets.

AI's Role in Technical Analysis

AI, particularly through machine learning and deep learning algorithms, has significantly advanced the capabilities of technical analysis. Here’s how AI enhances this field:

Pattern Recognition

AI excels in recognizing complex patterns that might be overlooked by human analysts. Machine learning algorithms can analyze vast amounts of historical data to identify patterns and correlations that are not immediately apparent. For example, AI can detect subtle shifts in trading patterns or emerging trends by processing data more comprehensively and rapidly than traditional methods.

Predictive Analytics

One of the most powerful applications of AI in technical analysis is predictive analytics. By using algorithms trained on historical data, AI systems can forecast future price movements with remarkable accuracy. These systems can consider multiple factors simultaneously, including price trends, volume changes, and external market conditions, leading to more informed trading decisions.

Sentiment Analysis

AI can also enhance technical analysis through sentiment analysis, which involves assessing market sentiment based on news articles, social media, and other sources of market commentary. By analyzing this textual data, AI models can gauge investor sentiment and its potential impact on market movements. This provides an additional layer of insight that complements traditional technical indicators.

Algorithmic Trading

AI-driven algorithmic trading uses complex algorithms to execute trades based on predefined criteria. These algorithms can analyze market data in real-time and make split-second decisions, reducing the impact of human emotion and bias on trading strategies. AI can continuously learn and adapt its strategies based on market conditions, leading to more effective trading approaches.

Risk Management

Effective risk management is crucial for successful trading. AI can assist by analyzing historical volatility, market correlations, and other risk factors to develop strategies that minimize potential losses. AI-driven risk management tools can also dynamically adjust trading strategies in response to changing market conditions, enhancing overall portfolio resilience.

Challenges and Considerations

While AI offers significant advantages, it is not without its challenges. AI systems require vast amounts of data to train effectively, and the quality of predictions depends on the quality of the input data. Additionally, over-reliance on AI can lead to systematic risks if not complemented by human judgment and market understanding.

AI has transformed Ai Stock Technical Analysis from a manual, intuition-based practice into a sophisticated, data-driven process. By leveraging advanced pattern recognition, predictive analytics, sentiment analysis, and algorithmic trading, AI provides traders and investors with powerful tools to navigate the complexities of financial markets. However, it is essential to approach AI with a balanced perspective, integrating its insights with human expertise to achieve the best results. As AI technology continues to evolve, its role in technical analysis is set to become even more integral, shaping the future of financial trading and investment strategies.

0 notes

Text

Price Forecasting Techniques: From Cryptocurrencies to Stocks

Over time, the essence of price prediction has matured, progressing from primary analyses and intuition-based conclusions to intricate techniques driven by big data and high-level computations. Whether it's the volatile world of cryptocurrencies or the more stable terrain of traditional stocks, the core objective stays unchanged: foreseeing the trajectory of prices.

0 notes

Text

Learn the Importance of Using Technical Analysis for Cryptocurrency

Technical analysis is a prediction strategy that relies on short-term information to determine future trends in a market. However, it is also a subjective study, which means its results are not always guaranteed. This characteristic can turn traders away from technical analysis, opting for alternatives like the fundamental analysis.

0 notes

Text

Learn the Importance of Using Technical Analysis for Cryptocurrency

Technical analysis is a prediction strategy that relies on short-term information to determine future trends in a market. However, it is also a subjective study, which means its results are not always guaranteed. This characteristic can turn traders away from technical analysis, opting for alternatives like the fundamental analysis.

0 notes

Text

Mastering Volatility Analysis for Smarter Stock Picks with ŷRobot

Navigating the ebb and flow of the stock market can seem daunting, akin to charting a course through unpredictable seas. At the heart of this uncertainty is volatility - the measure of price movement magnitude over time. This essential guide dives into volatility analysis, demonstrating how ŷRobot, powered by AI-driven insights, turns market volatility into a navigable path for smarter stock picks.

0 notes

Text

Ai Stock Prediction Website | Yrobot.us

Unlock the power of AI with Yrobot.us - the ultimate stock prediction website. Stay ahead of the market and make informed decisions with our cutting-edge technology.

ai stock prediction website

0 notes